Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED NOVEMBER 2, 2009 - Aegion Corp | form8k11022009.htm |

Investor

Update - November 2009

Energy

& Mining

Wastewater

Sustainable

Pipeline Solutions

2

Forward-Looking

Statements

The

Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for

forward-looking

statements. The Company makes forward-looking statements in this document that represent the

Company’s beliefs or expectations about future events or financial performance. These forward-looking

statements are based on information currently available to the Company and on management’s beliefs,

assumptions, estimates and projections and are not guarantees of future events or results. When used in

this document, the words “anticipate,” “estimate,” “believe,” “plan,” “intend,” “may,” “will” and similar

expressions are intended to identify forward-looking statements, but are not the exclusive means of

identifying such statements. Such statements are subject to known and unknown risks, uncertainties

and assumptions, including those referred to in the “Risk Factors” section of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2008, as filed with the Securities and Exchange

Commission on March 2, 2009. In light of these risks, uncertainties and assumptions, the forward-

looking events discussed may not occur. In addition, our actual results may vary materially from those

anticipated, estimated, suggested or projected. Except as required by law, we do not assume a duty to

update forward-looking statements, whether as a result of new information, future events or otherwise.

Investors should, however, review additional disclosures made by the Company from time to time in its

periodic filings with the Securities and Exchange Commission. Please use caution and do not place

reliance on forward-looking statements. All forward-looking statements made by the Company in this

document are qualified by these cautionary statements.

statements. The Company makes forward-looking statements in this document that represent the

Company’s beliefs or expectations about future events or financial performance. These forward-looking

statements are based on information currently available to the Company and on management’s beliefs,

assumptions, estimates and projections and are not guarantees of future events or results. When used in

this document, the words “anticipate,” “estimate,” “believe,” “plan,” “intend,” “may,” “will” and similar

expressions are intended to identify forward-looking statements, but are not the exclusive means of

identifying such statements. Such statements are subject to known and unknown risks, uncertainties

and assumptions, including those referred to in the “Risk Factors” section of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2008, as filed with the Securities and Exchange

Commission on March 2, 2009. In light of these risks, uncertainties and assumptions, the forward-

looking events discussed may not occur. In addition, our actual results may vary materially from those

anticipated, estimated, suggested or projected. Except as required by law, we do not assume a duty to

update forward-looking statements, whether as a result of new information, future events or otherwise.

Investors should, however, review additional disclosures made by the Company from time to time in its

periodic filings with the Securities and Exchange Commission. Please use caution and do not place

reliance on forward-looking statements. All forward-looking statements made by the Company in this

document are qualified by these cautionary statements.

In

addition, some of the market and industry data and forecasts included in this

Investor Presentation

are based upon independent industry sources. Although we believe that these independent sources are

reliable we have not independently verified the accuracy and completeness of this information.

are based upon independent industry sources. Although we believe that these independent sources are

reliable we have not independently verified the accuracy and completeness of this information.

Insituform®,

the Insituform® logo, Insitumain™, United Pipeline Systems®, Bayou

Companies™,

Corrpro®, Insituform Blue® and our other trademarks referenced herein are the registered and

unregistered trademarks of Insituform Technologies, Inc. and its affiliates.

Corrpro®, Insituform Blue® and our other trademarks referenced herein are the registered and

unregistered trademarks of Insituform Technologies, Inc. and its affiliates.

3

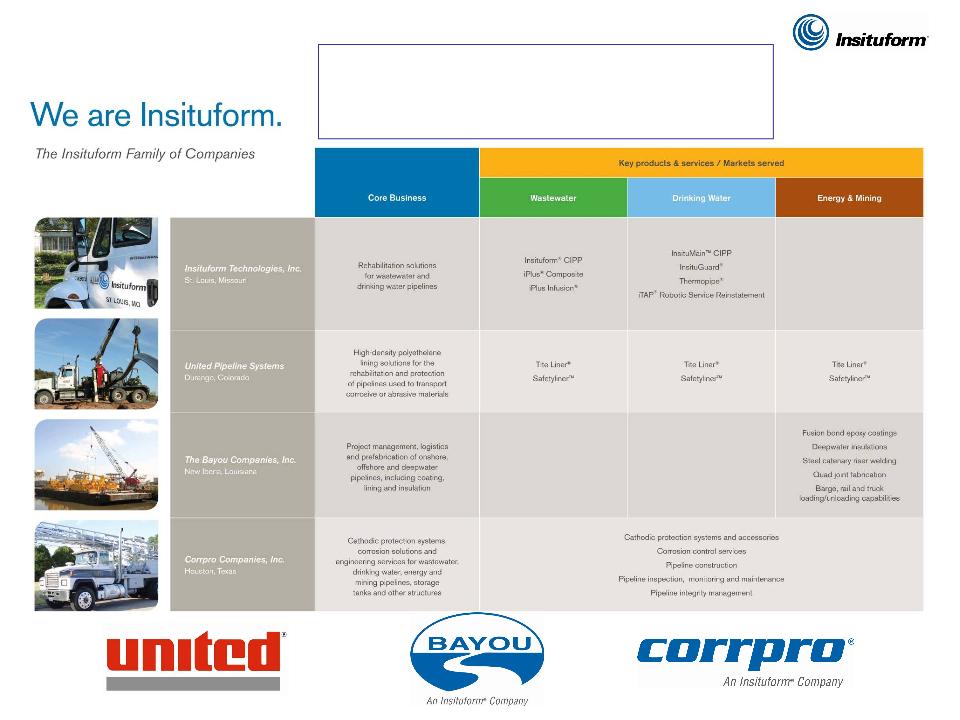

Insituform

is a leading global provider of proprietary

technologies and services for rehabilitating and maintaining

sewer, water and energy and mining piping systems and the

corrosion protection of industrial pipelines

technologies and services for rehabilitating and maintaining

sewer, water and energy and mining piping systems and the

corrosion protection of industrial pipelines

4

§ Sewer

Rehabilitation

§ Europe - Focus on

improving profitability through right-sizing installation businesses, expanding

third party tube

sales, optimizing German joint venture and lowering fixed operating expenses

sales, optimizing German joint venture and lowering fixed operating expenses

§ Asia/Pacific - Growth in India,

Hong Kong and Australia, expansion into Singapore and China, growth of

third

party tube sales through development of certified installer program throughout Asia

party tube sales through development of certified installer program throughout Asia

§ Water

Rehabilitation

§ Focus on successful

implementation of Insitumain®

§ Development of

broader water platform to capitalize on growing water infrastructure needs

globally

§ Energy

and Mining

§ Continued

integration of recent acquisitions of Bayou and Corrpro under common platform

leadership group

§ Investing in

building business development opportunities for comprehensive service

platform

§ Focus on selective

geographic expansion (Asia, Middle East) coordinated with current Insituform

theatre

management

management

Our

Vision

5

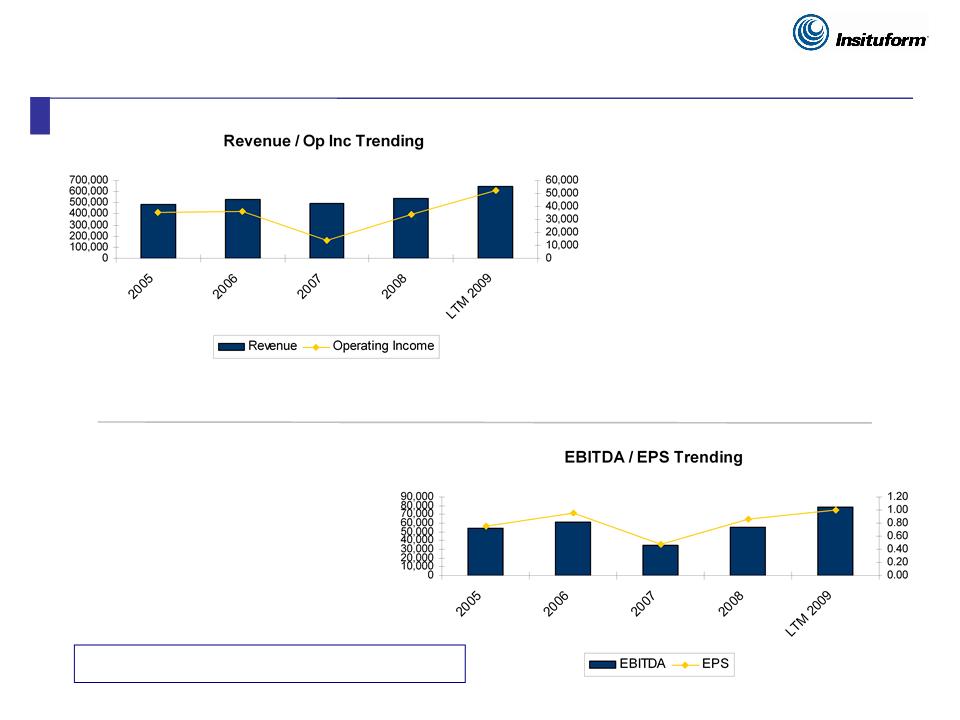

Financial

Snapshot

NOTE: LTM 2009

as of September 30, excluding Acquisition-

Related Transaction and Severance Costs

Related Transaction and Severance Costs

Ø LTM

revenue growth of 21% and

operating income growth of 54% with

margin increasing from 6.3% to 8.0%

operating income growth of 54% with

margin increasing from 6.3% to 8.0%

Ø Significant

revenue growth expected

in near term:

in near term:

• Economic

recovery in NA Market

• Stimulus

funding

• Insitumain™

momentum

• Increasing

Asia / Pacific

infrastructure

infrastructure

• Oil

and Gas pricing recovery

• Geographic

expansion across

service segments

service segments

Ø Growth

increases earnings potential

Ø Geographic

expansion and expanded

Energy and Mining platform

dramatically increased addressable

market size / organic growth

opportunities

Energy and Mining platform

dramatically increased addressable

market size / organic growth

opportunities

Ø Additional

cost synergies as

companies integrate / achieve

additional scale

companies integrate / achieve

additional scale

6

Financial Snapshot

(Continued)

NOTE: LTM 2009

as of September 30, excluding Acquisition-

Related Transaction and Severance Costs

Related Transaction and Severance Costs

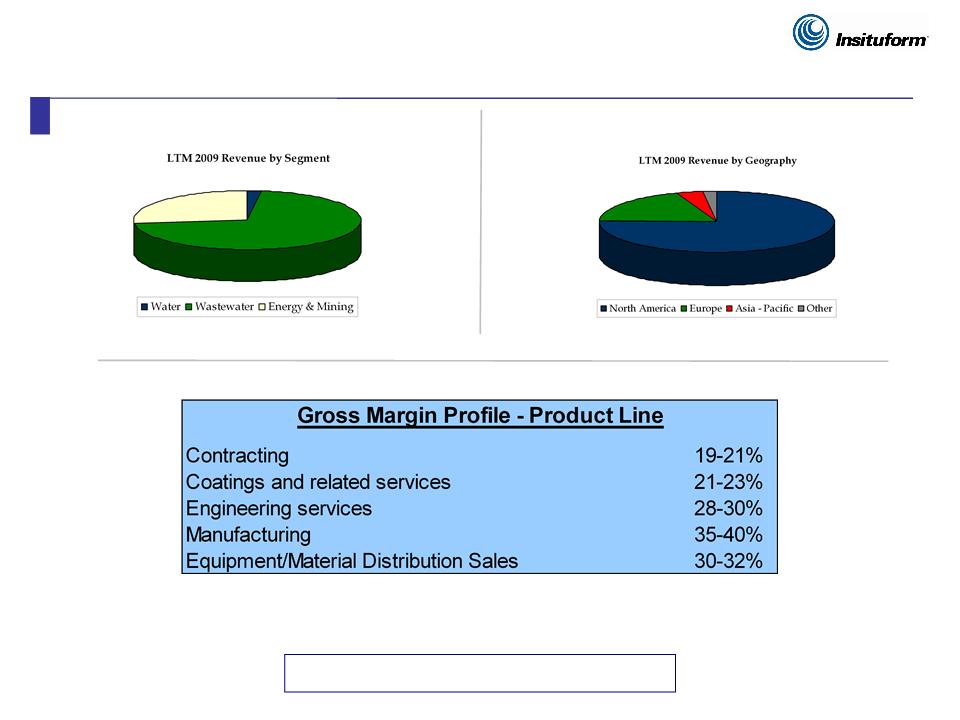

7

PERFORMANCE

§ Gross margin %

increased to 24.6% (LTM Sept 2009) from 22.2% in 2008, primarily resulting

from:

- Cost of quality

reductions

- Crew efficiency /

Manufacturing efficiency

- Implementation of

improved installation techniques (IPlus® Infusion (steam cure small diameter

technique))

- Lower fuel / resin

prices

- Lower fixed costs

for equipment

§ Win rate by $

increasing as we focus on large projects:

- Win rate increased

to 55% for first nine months of 2009, from 45% for full year of

2008

- Won 7 of 9 projects

over $6 million in 2009

§ Market pricing for

CIPP tube contributing to increased margin - dollars and margin %

§ Contract backlog

$183.8 million at September, up 3% from $178.5 million in Sept 2008

OUTLOOK

§ Continue to optimize

market share

§ Capture of stimulus

work in 2010-2011

§ Continuous

improvement in project management capability

§ Increase operating

expense efficiency

§ Grow third party

tube sales business

NOTE: LTM 2009

as of September 30

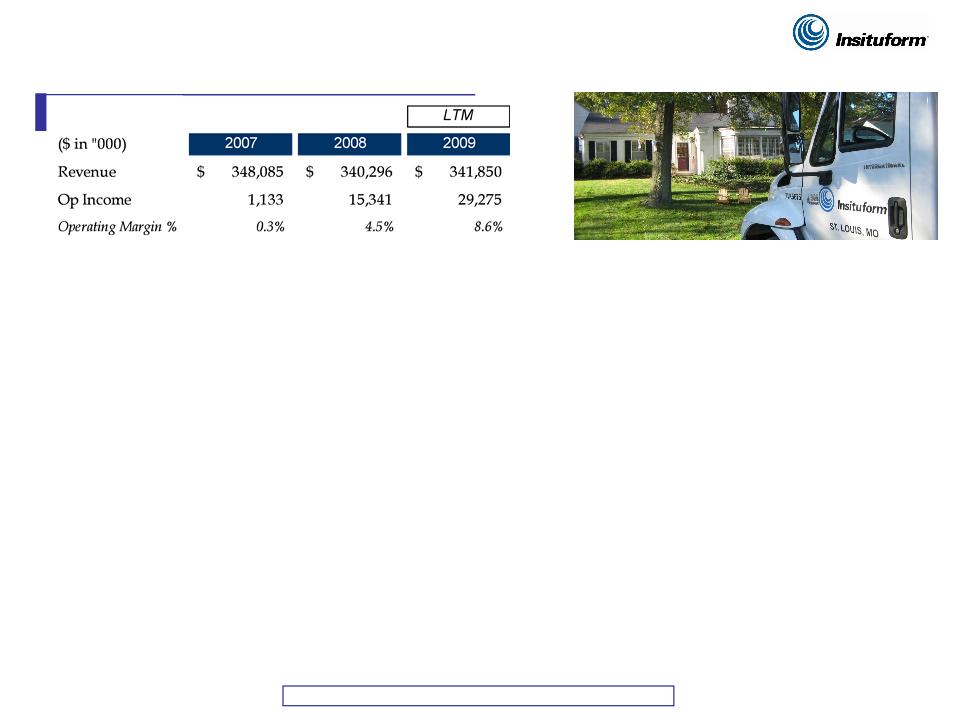

North

American Sewer Rehabilitation

8

PERFORMANCE

§ Gross margin trends

very positive - 27.2%¹ (LTM Sept 2009) versus 22.3% for 2008

§ Quality improvements

- large improvement on project execution (fewer project write-

downs)

downs)

§ Backlog growing -

$40.7 million at September 2009 versus $30.7 million at September

2008, a 32.6% improvement

2008, a 32.6% improvement

§ German JV

performance improving - Insituform’s equity earnings improved to $1.0

million (LTM Sept 2009) versus $0.8 million in 2008, a 29% improvement

million (LTM Sept 2009) versus $0.8 million in 2008, a 29% improvement

¹ Excludes

fourth quarter 2008 one-time gain from litigation settlement of $8 million

recorded as revenues

NOTE: LTM 2009

as of September 30

European Sewer

Rehabilitation

9

PERFORMANCE

/ OUTLOOK

§ Creating a capable

execution organization on a market specific basis

§ India - strong

relationship with SPML, opening new regional markets

§ Using recent Sydney

award to grow share in Australian market

§ Certified installer

program to promote tube sales in small diameter

markets (Singapore, China)

markets (Singapore, China)

NOTE: LTM 2009

as of September 30

Asia-Pacific Sewer

Rehabilitation

10

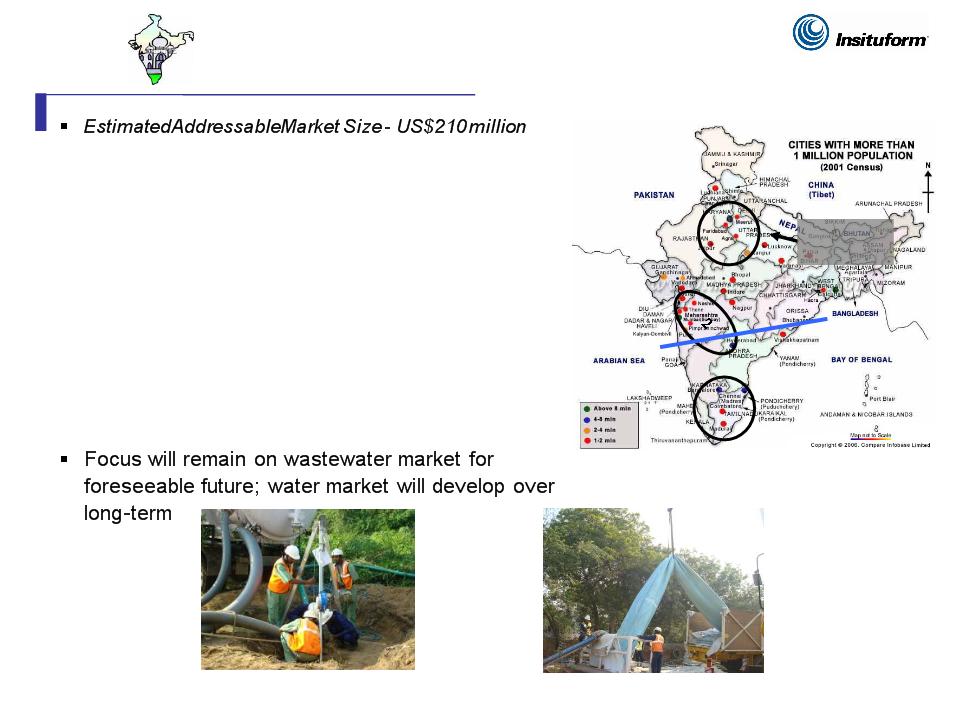

§ Cities

over 1 million people - 56

§ Structure

- 50.5% owned JV with SPML

Overview

/ Outlook:

§ Established solid

base of operations in Delhi

§ Recently

successfully expanded outside of Delhi

with contract win in Uttar Pradesh

with contract win in Uttar Pradesh

§ Actively marketing

to other major cities - Mumbai,

Hyderabad

Hyderabad

§ Chennai efforts

important as they will establish

operations outside of monsoon belt

operations outside of monsoon belt

1

3

Current

capability

India

11

Overview

/ Outlook:

§ Hong Kong is the

springboard into China

§ Acquired remaining

50% of joint venture with

VSL in June

VSL in June

§ Significant recent

project wins direct with the

client will enable operational efficiencies

client will enable operational efficiencies

§ Currently

identifying potential CIPP installers in

China to become certified Insituform installers in

greater Guangzhou, Shanghai, Beijing, Wuhan

and Chongqing areas

China to become certified Insituform installers in

greater Guangzhou, Shanghai, Beijing, Wuhan

and Chongqing areas

1

Hong

Kong / China

12

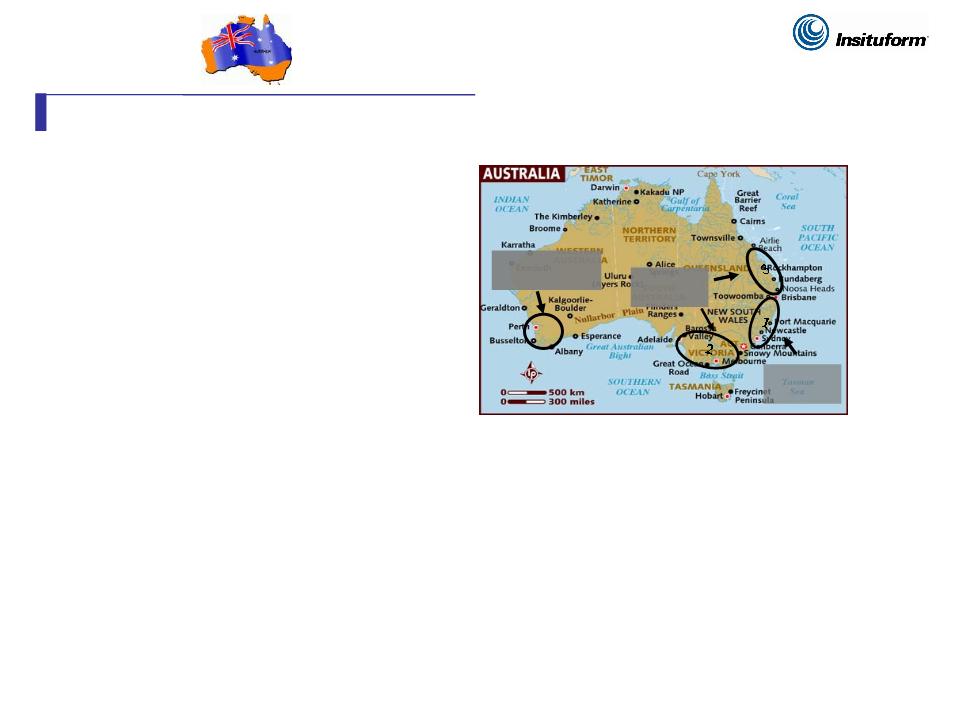

§ Estimated

Addressable Market Size - $US195 million

§ Cities

over 1 million people - 4

§ Overview

/ Outlook:

§ Sydney represents

largest trenchless rehabilitation market in Australia

§ Focus on scaling up

to establish fully-functional business platform

throughout Australia (specialized roles, crew productivity, etc.)

throughout Australia (specialized roles, crew productivity, etc.)

§ During 2010 will

establish service platform in Victoria

§ During 2011 will

establish service platform in Queensland

Current

capability

Planned

Expansion

Expansion

Water

Opportunities

Opportunities

Australia

13

§ Estimated

Addressable Market - $110 M (per annum)

Overview

/ Outlook

§ Insituform

purchasing former licensee to have execution capability

§ Plan to bid on large

diameter projects and institute a certified installer

program to sell tube and technical services for small diameter projects

(one already agreed upon)

program to sell tube and technical services for small diameter projects

(one already agreed upon)

§ Opportunity -

Approximately $300 million in sewer rehabilitation projects

to be tendered over next three years

to be tendered over next three years

Singapore

14

CONSIDERATIONS

§ Introduced

Insitumain in March 2009 -

- Fully Structural

CIPP water product

- Current

capability -

diameters from 6” to 12”, operating pressures up to 150 psi (working on

developing capability up to 24”), and any type of host pipe material - very important as it can

addresses 65-70% of market issues

developing capability up to 24”), and any type of host pipe material - very important as it can

addresses 65-70% of market issues

- Epoxy resin system

allows adhesive seal of connections (versus mechanical seal)

§ Began pilot testing

in the 3rd quarter

with success

§ Will continue pilot

tests in the 4th

quarter

§ Already secured

approximately $2 million in project awards, with more pending

NOTE: LTM 2009

as of September 30

Water

Rehabilitation

15

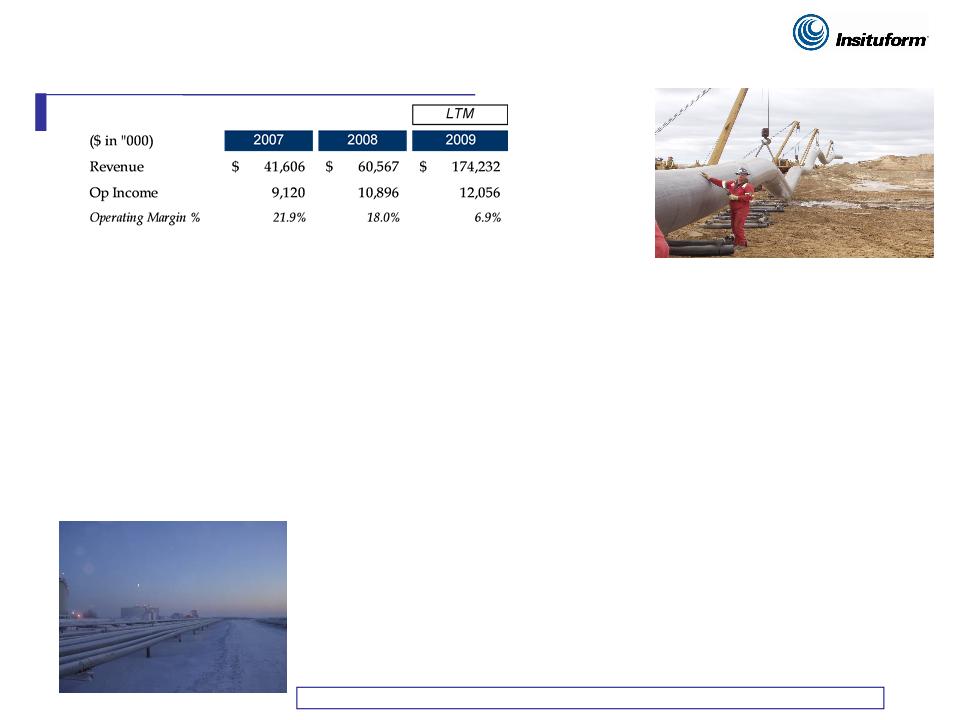

PERFORMANCE

§ Integration

completed with run rate savings > $6.5M (2010)

§ Corrpro has

performed as planned

§ Bayou has performed

well despite depressed natural gas pricing

- >30% drop in

ancillary businesses (CCSI, BWW, Baton Rouge Coating JV)

- Virtually no work in

small diameter gas market in 2009

- Oil market

rebounding, leading to increased quote activity late in the year

§ UPS downturn related

to lower copper and gas pricing - significant backlog growth in second half

of

2009

2009

§ Platform sales

momentum created by recent Mexican project awards (see next slide)

STRATEGIC

OUTLOOK

§ Strengthening bid

table as commodity pricing recovers - Chile,

Australia, Canada, Middle East

Australia, Canada, Middle East

§ Target capital

“light:” geographic expansions - Garneau (Canada)

§ Platform momentum

creates value added opportunities in key markets -

Oil Sands, Gulf of Mexico

Oil Sands, Gulf of Mexico

§ Concrete /

Insulation expansion

NOTE: LTM 2009

as of September 30, excluding Acquisition-Related Transaction and Severance

Costs

Energy

and Mining

16

§ First significant

cross E&M platform sale - total value $13 million

§ Scope - oil and

water line replacement, which includes elements for

TiteLiner®, CCSI, Corrpro, Bayou Welding Works

TiteLiner®, CCSI, Corrpro, Bayou Welding Works

§ Direct relationship

with Petróleos Mexicanos (“Pemex”) (versus

contractors)

contractors)

§ Creates future

opportunities for work with Pemex and well field

developers (Schlumberger, etc.)

developers (Schlumberger, etc.)

§ Robust bid

table:

§ Mexico - >$100

million in first half 2010

§ Canadian Oil

Sands

§ North

Sea

Project

Summary - Poza Rico, Mexico

17

§ Will look for

opportunities to expand capability:

Ø Pipeline inspection

/ leak detection - complementary

Corrpro capabilities on industrial side

Corrpro capabilities on industrial side

Ø Front-end

development of maintenance programs -

complement our execution capability

complement our execution capability

Ø Flexible pipe

opportunities to access markets where dig

and replace will remain dominant

and replace will remain dominant

Ø Pipeline integrity

services

Focus

on Water for Future Growth

18

Technology

Innovator

Premier

Brand / Long

Standing Customer

Relationships

Standing Customer

Relationships

Experience

with Complex

Regulatory Environment

Regulatory Environment

Project

Management and

Execution Capability

Execution Capability

Leader

in Large and

Growing Markets

Growing Markets

Energy

& Mining

Wastewater

Our

Business

19

Appendix

20

§ The

following is a reconciliation of Insituform's income from continuing operations

to EBITDA:

(1)

9/30/09 Pro Forma EBITDA excludes all acquisition transaction costs incurred by

Insituform, Bayou and Corrpro

EBITDA

Reconciliation