Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GSI COMMERCE INC | c91513e8vk.htm |

| EX-99.1 - EXHIBIT 99.1 - GSI COMMERCE INC | c91513exv99w1.htm |

Exhibit 99.2

| GSI Commerce + Retail Convergence = A Great Fit October 27, 2009 |

| Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements made in this, presentation other than statements of historical fact, are forward-looking statements, including statements regarding the expected timing of the closing of the acquisition of Retail Convergence, Inc ("RCI"), the ability of GSI Commerce Inc. and RCI to close the acquisition, the expected benefits of the acquisition, and the expected impact of the acquisition on GSI's financial results. In addition, the words "anticipate," "believe," "estimate," "expect," "intend," "may," "plan," "will," "would," "should," "guidance," "potential," "opportunity," "continue," "project," "forecast," "confident," "prospects," "schedule" and similar expressions typically are used to identify forward- looking statements. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business of GSI Commerce. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or implied by these forward-looking statements. Factors which may affect GSI Commerce's business, financial condition and operating results include the risk that the planned acquisition may not close on the terms agreed upon or at all, risks related to the acquisition, the effects of changes in the economy, consumer spending, the financial markets and the industries in which GSI Commerce and its clients operate, changes affecting the Internet and e-commerce, the ability of GSI Commerce and RCI to develop and maintain relationships with their strategic clients and suppliers and the timing of their establishment, extension or termination of relationships with strategic clients, the ability of GSI Commerce and RCI to timely and successfully develop, maintain and protect their technology, confidential and proprietary information, and product and service offerings and execute operationally, the ability of GSI Commerce and RCI to attract and retain qualified personnel, the ability of GSI Commerce to successfully integrate its acquisitions of other businesses and the performance of acquired businesses. More information about potential factors that could affect GSI Commerce can be found in its most recent Form 10-K, Form 10-Q and other reports and statements filed by GSI Commerce with the SEC. GSI Commerce expressly disclaims any intent or obligation to update these forward-looking statements. 2 |

| 3 Entrance to Rue La La is By Invitation Only We invite you to join Rue La La Please go to www.ruelala.com/gsi Pick a password and you are in! This exclusive access address is only valid for 48 hours |

| Acquisition Overview GSI enters the online private sale space, adding leading player Rue La La, a division of Retail Convergence, Inc. ("RCI") Acquisition of RCI also adds SmartBargains.com, a leading off-price marketplace Rue La La is a rapidly growing leader in the private sale space Revenues expected to grow almost five-fold to $28MM in 3Q09 from $5.8MM in 3Q08 Currently has 1.2 MM members and continues to grow rapidly Added more than 800,000 members in last 12 months RCI has trailing 12-month revenue of $135MM, an increase of 66% since September 2008, driven by significant growth in Rue La La Transaction expected to be accretive in 2010 Expect $230MM of net revenues and at least $15MM incremental NGIO* contribution in 2010 from RCI Deal valued at up to $350MM including up-front payment of $180MM (50% stock, 50% cash), and potential earn-out of $170MM based on achieving $51.9MM NGIO* in 2012 4 * See appendix for definition of NGIO |

| Acquisition Rationale: GSI & RCI a Great Fit Integration of Rue La La and SmartBargains.com furthers GSI's evolution as an innovative global e-commerce platform able to manage all aspects of online sales and interactive marketing for leading retailers and consumer brands GSI uniquely positioned to capture the value from the fast-growing private sale space by combining Rue La La's tremendous growth with GSI's assets, relationships with world-class brands and retailers, and large-scale operating infrastructure Rue La La provides GSI's clients with access to a new way of selling opportunistic inventory in a manner that enhances brand image and further drives consumer engagement Acquisition creates cross-sell opportunities between e-commerce services, interactive marketing services, private sale space and off-price consumer marketplace which will benefit both GSI and Rue La La clients 5 |

| 7 Retail Convergence, Inc. (RCI) at a Glance Based in Boston; 184 employees Seasoned management team led by CEO Ben Fischman Marketplace for the sale of off-price merchandise across a wide cross-section of categories 2009 Estimated Revenue: ~ $60MM Leader in the members-only private sale destination offering premier brands at discounts during two-day private sales Offers fashion, accessories, footwear, home, jewelry and other emerging categories Over one million members and 300+ brands acquired in 18 months of operation Effective, elegant solution for brands to move inventory and drive revenue while maintaining brand desirability 2009 Estimated Revenue: ~ $100MM ($20 MM in 2008) |

| Private Sale E-Commerce Business Overview |

| Private Sale Space Experiencing Remarkable Growth Rates 9 Online private sale model introduces a new way to shop and a sophisticated evolution of the well established, off-price retail model Online, members-only private sale model initially gained momentum in France by Vente-Privee in 2001 (2009 projected revenues of $900 million) Model first emerged in U.S. market in 2007 and has grown dramatically over the past two years Brings concept of "sample sale" online, creating an efficient and effective channel for premier brands to merchandise and sell excess inventory in a brand-protected environment Marketing centers on daily email alerts (e-Dialog powers Rue La La email) to members creating a sense of anticipation, urgency, and excitement to buy Highly viral nature of referral-based membership growth with nominal customer acquisition cost has contributed to the remarkable success of the online private sale model |

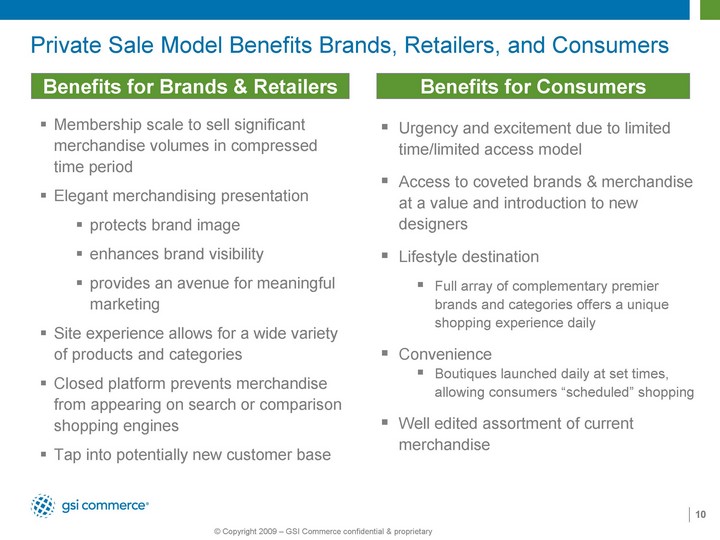

| Private Sale Model Benefits Brands, Retailers, and Consumers Membership scale to sell significant merchandise volumes in compressed time period Elegant merchandising presentation protects brand image enhances brand visibility provides an avenue for meaningful marketing Site experience allows for a wide variety of products and categories Closed platform prevents merchandise from appearing on search or comparison shopping engines Tap into potentially new customer base Benefits for Brands & Retailers Benefits for Consumers Urgency and excitement due to limited time/limited access model Access to coveted brands & merchandise at a value and introduction to new designers Lifestyle destination Full array of complementary premier brands and categories offers a unique shopping experience daily Convenience Boutiques launched daily at set times, allowing consumers "scheduled" shopping Well edited assortment of current merchandise 10 |

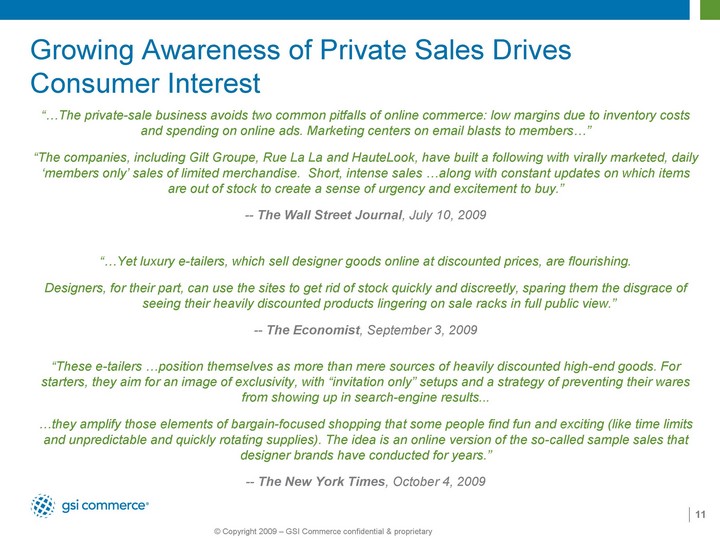

| 11 Growing Awareness of Private Sales Drives Consumer Interest "...The private-sale business avoids two common pitfalls of online commerce: low margins due to inventory costs and spending on online ads. Marketing centers on email blasts to members..." "The companies, including Gilt Groupe, Rue La La and HauteLook, have built a following with virally marketed, daily 'members only' sales of limited merchandise. Short, intense sales ...along with constant updates on which items are out of stock to create a sense of urgency and excitement to buy." -- The Wall Street Journal, July 10, 2009 "...Yet luxury e-tailers, which sell designer goods online at discounted prices, are flourishing. Designers, for their part, can use the sites to get rid of stock quickly and discreetly, sparing them the disgrace of seeing their heavily discounted products lingering on sale racks in full public view." -- The Economist, September 3, 2009 "These e-tailers ...position themselves as more than mere sources of heavily discounted high-end goods. For starters, they aim for an image of exclusivity, with "invitation only" setups and a strategy of preventing their wares from showing up in search-engine results... ...they amplify those elements of bargain-focused shopping that some people find fun and exciting (like time limits and unpredictable and quickly rotating supplies). The idea is an online version of the so-called sample sales that designer brands have conducted for years." -- The New York Times, October 4, 2009 |

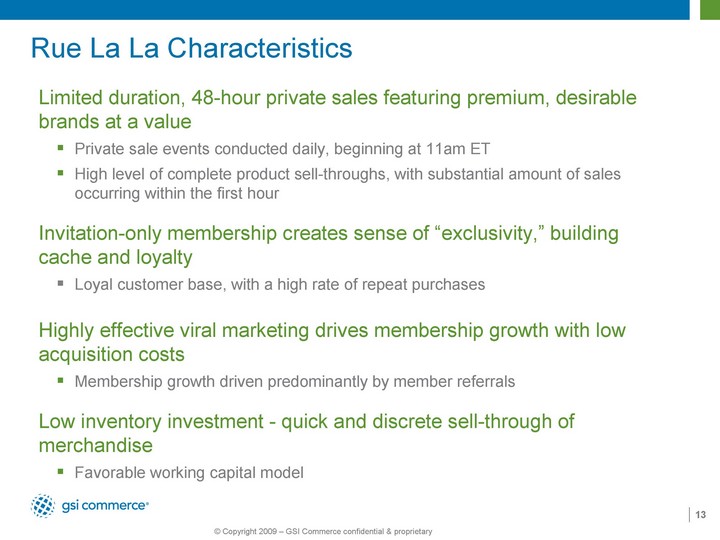

| Rue La La Characteristics Limited duration, 48-hour private sales featuring premium, desirable brands at a value Private sale events conducted daily, beginning at 11am ET High level of complete product sell-throughs, with substantial amount of sales occurring within the first hour Invitation-only membership creates sense of "exclusivity," building cache and loyalty Loyal customer base, with a high rate of repeat purchases Highly effective viral marketing drives membership growth with low acquisition costs Membership growth driven predominantly by member referrals Low inventory investment - quick and discrete sell-through of merchandise Favorable working capital model 13 |

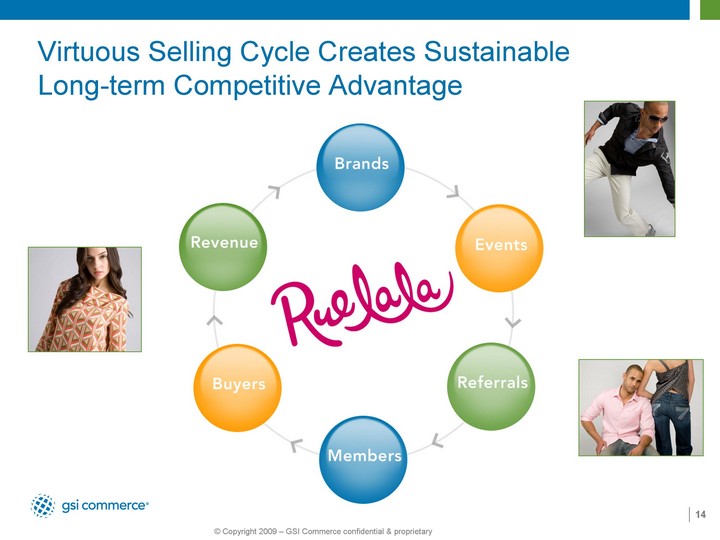

| 14 Virtuous Selling Cycle Creates Sustainable Long-term Competitive Advantage |

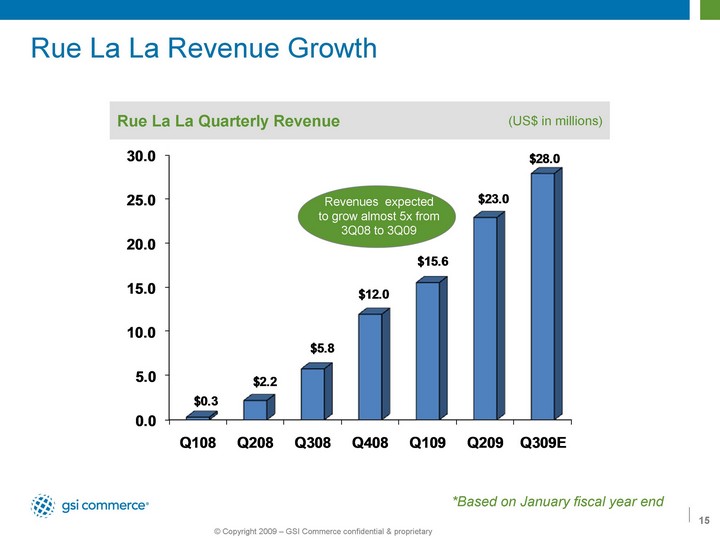

| Rue La La Revenue Growth 15 15 Revenues expected to grow almost 5x from 3Q08 to 3Q09 Rue La La Quarterly Revenue (US$ in millions) *Based on January fiscal year end |

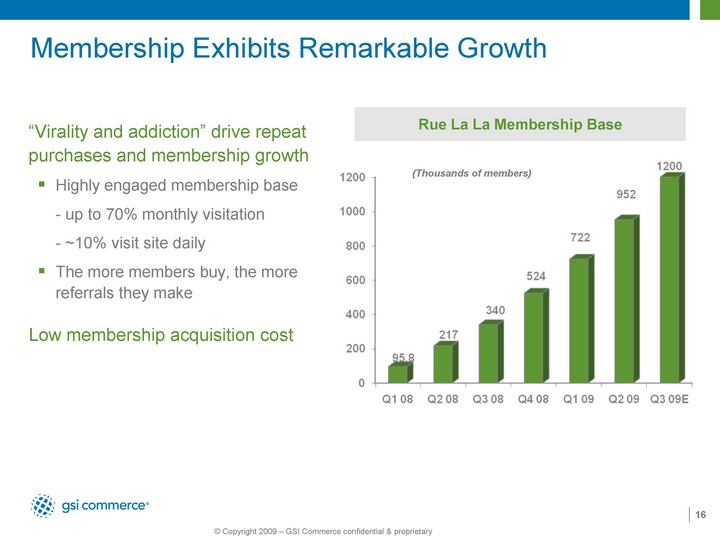

| 16 Membership Exhibits Remarkable Growth "Virality and addiction" drive repeat purchases and membership growth Highly engaged membership base - up to 70% monthly visitation - ~10% visit site daily The more members buy, the more referrals they make Low membership acquisition cost Rue La La Membership Base (Thousands of members) |

| Strategic Growth Pillar for GSI |

| 18 GSI Continues to Create Innovative Solutions for Brands, Retailers, and Consumers 1999 - 2001 2002 - 2006 2007 - Present E-commerce services to the sporting goods industry Category expansion (Apparel, Jewelry, Home, Health & Beauty, Toys & Baby, Electronics) Interactive Marketing Services added as new growth pillar International added as new growth pillar Adding Consumer Engagement as growth pillar with acquisition of Rue La La and Smart Bargains Addition of Rue La La provides another service for existing clients and provides opportunity to gain new clients |

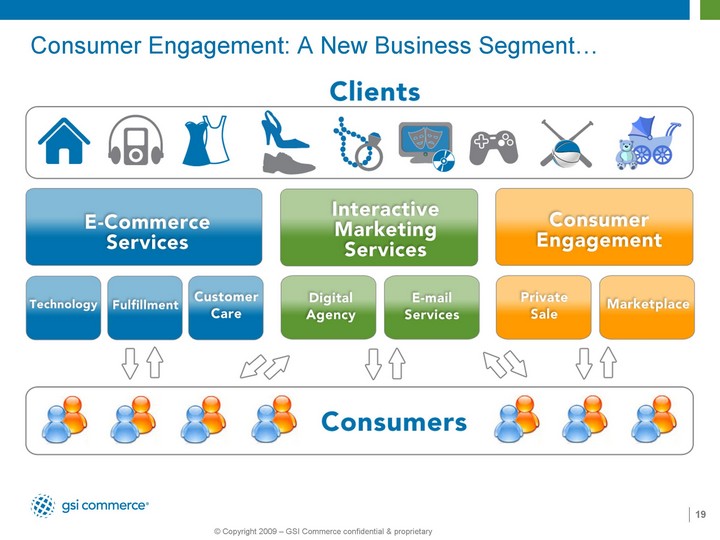

| Consumer Engagement: A New Business Segment... 19 |

| ...and a Key Pillar in GSI's Growth Strategy 20 |

| Synergies |

| Combination of GSI/RCI differentiates Rue La La to win in the private sale space GSI's extensive, proven infrastructure enhances Rue La La's consumer experience GSI client relationships strengthens Rue La La's expansion into new categories and new geographic markets Rue La La benefits from GSI's scale, purchasing efficiencies and best practices 22 GSI's Scale, Operational Expertise and Client Relationships Provide Meaningful Synergy Opportunities to Enhance Rue La La's Growth |

| 23 Opportunity to Sell E-Commerce and Marketing Services to Rue La La Clients* Common Clients *Slide shows selected clients |

| Financial Overview |

| Financial Highlights Expected to be accretive beginning in 2010 (NGIO/share basis) Earn-out tied to strong financial performance RCI delivering remarkable growth and healthy emerging profitability RCI has an attractive cash flow model GSI momentum remains strong 25 |

| 26 Transaction Overview Deal valued at up to $350MM $180MM at closing (50% cash and 50% stock) Earn-out potential of $170MM based on achieving $51.9MM NGIO* in 2012 Cash portion of consideration funded from available cash on hand HSR clearance and other customary closing conditions/closing expected within one month RCI had cash of $7.5MM at the end of September, 2009 GSI expects to record approximately $2.0MM of transaction related expenses in 4Q09 and approximately $2MM - $4MM of integration related expenses in 2010 *See appendix for definition of NGIO |

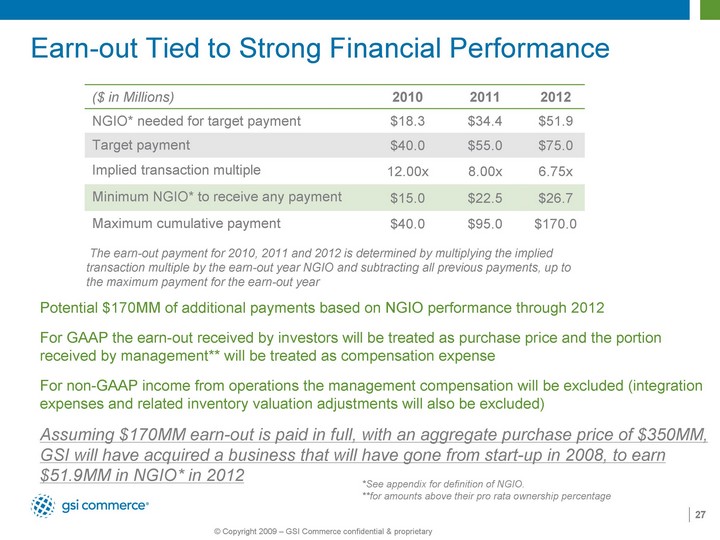

| Earn-out Tied to Strong Financial Performance Potential $170MM of additional payments based on NGIO performance through 2012 For GAAP the earn-out received by investors will be treated as purchase price and the portion received by management** will be treated as compensation expense For non-GAAP income from operations the management compensation will be excluded (integration expenses and related inventory valuation adjustments will also be excluded) Assuming $170MM earn-out is paid in full, with an aggregate purchase price of $350MM, GSI will have acquired a business that will have gone from start-up in 2008, to earn $51.9MM in NGIO* in 2012 27 ($ in Millions) 2010 2011 2012 NGIO* needed for target payment $18.3 $34.4 $51.9 Target payment $40.0 $55.0 $75.0 Implied transaction multiple 12.00x 8.00x 6.75x Minimum NGIO* to receive any payment $15.0 $22.5 $26.7 Maximum cumulative payment $40.0 $95.0 $170.0 The earn-out payment for 2010, 2011 and 2012 is determined by multiplying the implied transaction multiple by the earn-out year NGIO and subtracting all previous payments, up to the maximum payment for the earn-out year *See appendix for definition of NGIO. **for amounts above their pro rata ownership percentage |

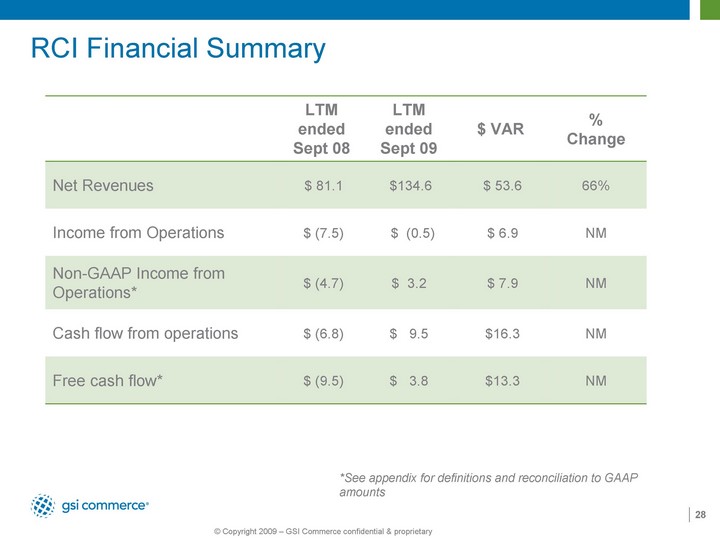

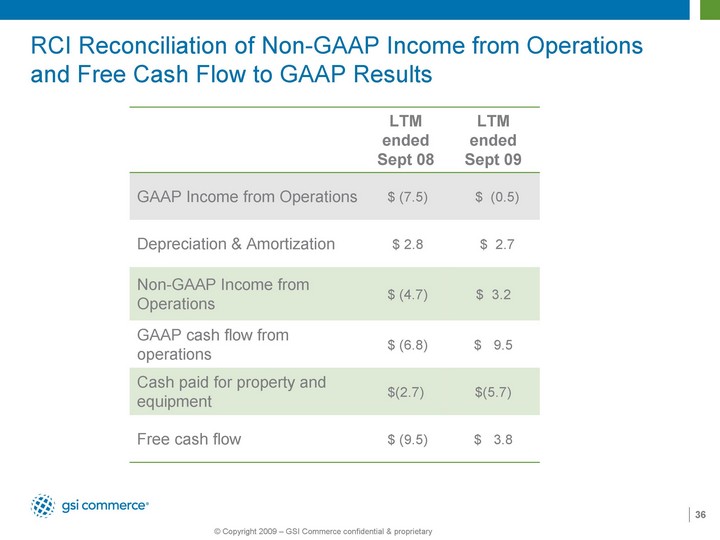

| 28 RCI Financial Summary LTM ended Sept 08 LTM ended Sept 09 $ VAR % Change Net Revenues $ 81.1 $134.6 $ 53.6 66% Income from Operations $ (7.5) $ (0.5) $ 6.9 NM Non-GAAP Income from Operations* $ (4.7) $ 3.2 $ 7.9 NM Cash flow from operations $ (6.8) $ 9.5 $16.3 NM Free cash flow* $ (9.5) $ 3.8 $13.3 NM *See appendix for definitions and reconciliation to GAAP amounts |

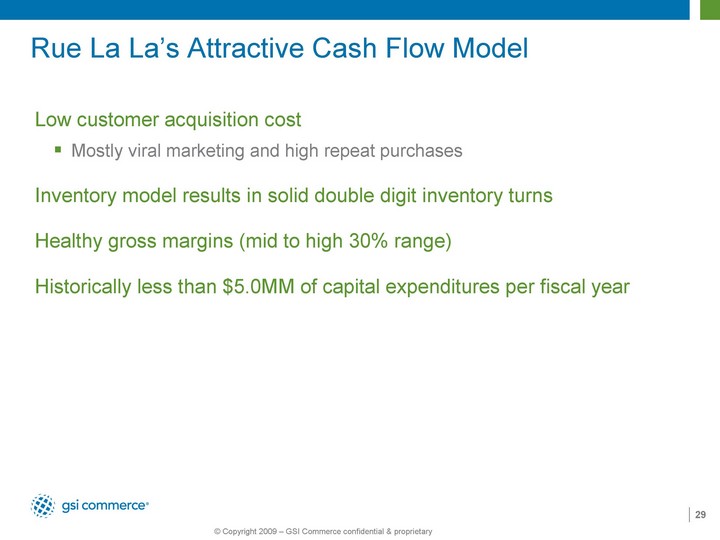

| Rue La La's Attractive Cash Flow Model Low customer acquisition cost Mostly viral marketing and high repeat purchases Inventory model results in solid double digit inventory turns Healthy gross margins (mid to high 30% range) Historically less than $5.0MM of capital expenditures per fiscal year 29 |

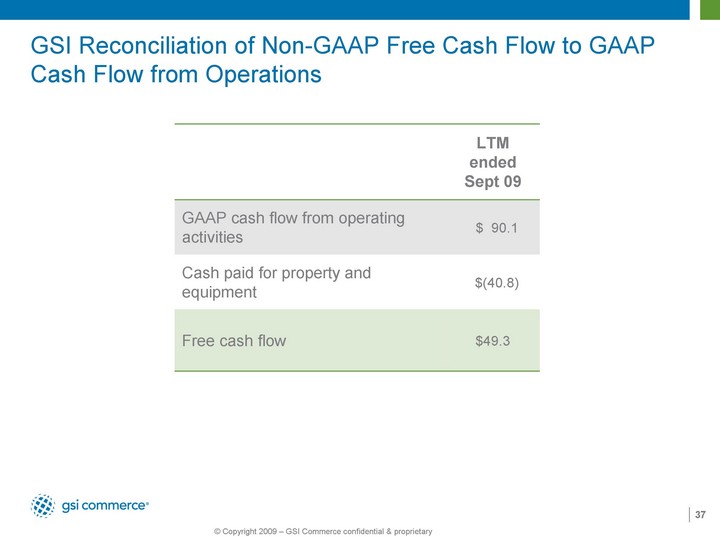

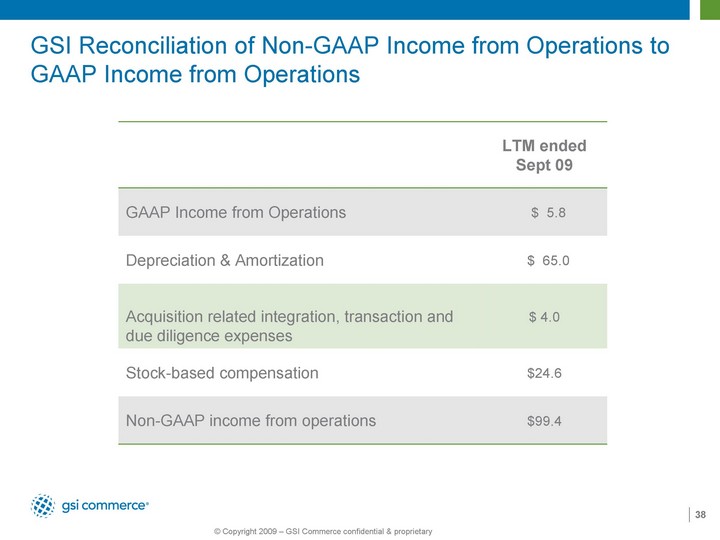

| GSI Momentum Remains Strong 3Q09 net revenue, income from operations and non-GAAP income from operations all exceeded the high end of our guidance ranges Trailing 12-month free cash flow was $49.3MM and trailing twelve month NGIO was $99.4MM* Quarter end cash was $135.3MM with nothing drawn on the company's line of credit On a pro forma basis assuming the cash portion of the purchase price was paid in the third quarter, GSI would have ended the quarter with $45.3MM in cash and nothing drawn on its $90MM line of credit Early 4Q09 revenue trends are positive RCI should provide modest incremental net revenues and NGIO in 4Q09 * see appendix for definitions and reconciliation to GAAP results 30 |

| GSI and Rue La La: A Great Fit 31 Integration of Rue La La and SmartBargains.com furthers GSI's evolution as an innovative e-commerce platform able to manage all aspects of online sales for leading retailers and global consumer brands GSI uniquely positioned to capture the value from the fast-growing private sale space by combining Rue La La's remarkable growth with GSI's assets, relationships with world-class brands and retailers and large-scale operating infrastructure Rue La La provides GSI's clients with access to a new and incremental way of selling opportunistic inventory in a manner that enhances brand image and further drives consumer engagement Acquisition creates cross-sell opportunities between e-commerce services, interactive marketing services, private sale space and consumer marketplace which will benefit of both GSI and Rue La La clients |

| Questions? 32 |

| Appendix |

| Non-GAAP Financial Measures Non-GAAP income from operations. We define non-GAAP income from operations as income from operations excluding stock-based compensation, depreciation and amortization expenses; transaction, due diligence and integration expenses relating to acquisitions. Beginning with this presentation, we are also excluding acquisition related non-cash inventory and deferred revenue valuation adjustments resulting from the step-up or step-down of acquired assets and liabilities and the cash portion of any acquisition earn-out payments recorded as compensation expense. We consider non-GAAP income from operations to be a useful metric for management and investors because it excludes certain non-cash and non-operating items. Because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use when valuing equity awards under SFAS 123R, we believe that viewing income from operations excluding stock-based compensation expense allows investors to make meaningful comparisons between our operating performance and those of other businesses. Because we are growing our business and operate in an emerging and changing industry, we believe that our level of capital expenditures and consequently the level of depreciation and amortization expense relative to our revenues could be meaningfully greater today than it will be over time. As a result, we believe it is useful supplemental information to view income from operations excluding depreciation and amortization expense as it provides a potential indicator of the future operating margin potential of the business. We believe the exclusion of acquisition-related integration, transaction and due diligence expenses, acquisition related non-cash inventory and deferred revenue valuation adjustments resulting from the step-up or step-down of acquired assets and liabilities, and the cash portion of any acquisition earn-out payments recorded as compensation expense permits evaluation and a comparison of results for on-going business operations, and it is on this basis that management internally assesses the company's performance 34 |

| Non-GAAP Financial Measures (cont'd) Free cash flow. We define free cash flow as net cash provided by operating activities minus cash paid for fixed assets, including internal use software. We consider free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that, after the acquisition of property and equipment, including information technology infrastructure, can be used for strategic opportunities, including investing in the business, making strategic acquisitions and strengthening the balance sheet. Analysis of free cash flow also facilitates management's comparisons of our operating results to the operating results of comparable companies. A limitation of using free cash flow as a means for evaluating our performance is that free cash flow reflects changes in working capital which is impacted by short-term changes in cash flow and the seasonality of our business which may not be indicative of long-term performance. Another limitation of free cash flow is that it excludes fixed assets purchased and placed in service, but not paid for during the applicable period. Our management compensates for this limitation by providing supplemental information about capital expenditures accrued, but not paid for during the applicable periods on the face of the cash flow statement in our Forms 10-K and 10-Q. 35 |

| 36 RCI Reconciliation of Non-GAAP Income from Operations and Free Cash Flow to GAAP Results LTM ended Sept 08 LTM ended Sept 09 GAAP Income from Operations $ (7.5) $ (0.5) Depreciation & Amortization $ 2.8 $ 2.7 Non-GAAP Income from Operations $ (4.7) $ 3.2 GAAP cash flow from operations $ (6.8) $ 9.5 Cash paid for property and equipment $(2.7) $(5.7) Free cash flow $ (9.5) $ 3.8 |

| 37 GSI Reconciliation of Non-GAAP Free Cash Flow to GAAP Cash Flow from Operations LTM ended Sept 09 GAAP cash flow from operating activities $ 90.1 Cash paid for property and equipment $(40.8) Free cash flow $49.3 |

| 38 GSI Reconciliation of Non-GAAP Income from Operations to GAAP Income from Operations LTM ended Sept 09 GAAP Income from Operations $ 5.8 Depreciation & Amortization $ 65.0 Acquisition related integration, transaction and due diligence expenses $ 4.0 Stock-based compensation $24.6 Non-GAAP income from operations $99.4 |