Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HEADWATERS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE DATED OCTOBER 13, 2009 - HEADWATERS INC | dex991.htm |

Exhibit 99.2

HEADWATERS INCORPORATED

SUPPLEMENTAL REGULATION FD DISCLOSURE STATEMENT

DATED OCTOBER 13, 2009

SUMMARY

You should read the following summary together with the more detailed information and consolidated financial statements and their notes included in Headwaters Incorporated’s Annual Report filed on Form 10-K for the year ended September 30, 2009, referred to as the 2008 Form 10-K, and in Headwaters Incorporated’s Quarterly Report filed on Form 10-Q for the three months ended June 30, 2009, referred to as the June 2009 Form 10-Q. The press release dated October 13, 2009 describing the offering of Headwaters’ senior secured notes (the “Secured Notes”) included in Exhibit 99.1 to Headwaters’ Form 8-K filed with the Securities Exchange Commission on October 13, 2009 is referred to in this disclosure statement as the “Secured Notes Offering Press Release.” In this disclosure statement, unless otherwise indicated or the context otherwise requires, the terms “Headwaters,” “we,” “us,” and “our” refer to Headwaters Incorporated and its subsidiaries. Certain other capitalized terms used in this disclosure statement are defined in the 2008 Form 10-K, the June 2009 Form 10-Q or elsewhere in this disclosure statement.

Non GAAP Financial Data

EBITDA and Adjusted EBITDA presented in this disclosure statement are supplemental measures that are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income, operating income or any other performance measures derived in accordance with GAAP or as a measure of our liquidity. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for management’s discretionary use, as they do not consider certain cash requirements such as interest payments, tax payments and debt service requirements. In addition, our method of calculating EBITDA and Adjusted EBITDA may vary from the method used by other companies. We have used the method for calculating EBITDA set forth in our historical debt arrangements and pursuant to the offering of the Secured Notes. Although Adjusted EBITDA contains certain additional adjustments, our management considers Adjusted EBITDA to be a key indicator of financial performance. Adjusted EBITDA contains certain adjustments that do not comply with the SEC’s rules governing the use of non-GAAP financial measures in registration statements or other filings.

In addition to EBITDA being used for purposes of our debt arrangements, we believe EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. In addition, we believe that investors, analysts and rating agencies consider EBITDA and Adjusted EBITDA useful means of measuring our ability to meet our debt service obligations and evaluating our financial performance, and management uses these measurements for one or more of these purposes. Our presentation of EBITDA and Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items. EBITDA and Adjusted EBITDA have important limitations as analytical tools and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to service our indebtedness or invest in our business.

Our Company

Headwaters is a diversified company providing products, technologies and services to the building products, construction materials and energy industries. We have leadership positions in many of the product categories in which we compete. We generate revenue by selling building products such as manufactured architectural stone, siding accessory products and concrete blocks; managing and marketing coal combustion products (“CCPs”), which are used as a replacement for cement in concrete; and reclaiming waste coal. Headwaters intends to continue expanding its business through growth of existing operations and commercialization of new technologies and products.

We conduct our business primarily through the following three reporting segments: light building products (“Headwaters Building Products,” or “HBP”); heavy construction materials (“Headwaters Resources,” or “HRI”); and energy technology (“Headwaters Energy Services,” or “HES”).

Headwaters Building Products

HBP competes in the light building products industry and is currently our largest reporting segment based on revenue. HBP generated approximately $368.6 million in revenue for the twelve months ended June 30, 2009. HBP has leading positions in several light building products categories and is comprised of the following key businesses: Tapco, Eldorado Stone and Southwest Concrete Products (“SCP”).

Tapco is a leading designer, manufacturer and marketer of siding accessories as well as professional tools used in residential home improvement and construction. Tapco’s siding accessories include decorative window shutters, gable vents, and mounting blocks for exterior fixtures, roof ventilation, window and door trim products. Tapco also markets functional shutters and storm protection systems, specialty siding products, specialty roofing products and window wells. In addition, Tapco recently introduced an innovative cellular foam polyvinyl chloride, or PVC, trim board product. Tapco’s sales are primarily driven by the residential repair and remodeling construction market and, to a lesser extent, by the new residential construction market.

Eldorado Stone is a leading producer of manufactured architectural stone. Our Eldorado Stone product line is designed and manufactured to be one of the most realistic manufactured architectural stone products in the world. We utilize two additional brands to segment the manufactured architectural stone market and sell at lower price points than the Eldorado Stone

2

product line, allowing us to compete across a broad spectrum of customer profiles. Eldorado Stone’s sales are primarily driven by new residential construction demand and, to a lesser extent, by the residential repair and remodeling, as well as commercial construction markets.

SCP is the largest manufacturer of concrete block in the Texas market, which we believe to be one of the largest concrete block markets in the United States. We offer a variety of concrete based masonry unit products and employ a regional branding and distribution strategy. A large portion of SCP’s sales are generated from the institutional construction markets in Texas, including school construction, allowing SCP to benefit from positive demographic trends.

We have a large customer base for our building products, represented by approximately 4,000 non-retail ship-to locations and approximately 4,600 retail ship-to locations across the country. Sales are broadly diversified by serving a large variety of customers in various distribution channels. We believe we attract a large base of customers because we continually upgrade our product offerings through product extensions and new products and brands.

Headwaters Resources

HRI competes in the heavy construction materials industry and generated approximately $272.0 million in revenue for the twelve months ending June 30, 2009. HRI is the national leader in the management and marketing of CCPs, procuring CCPs from coal-fueled electric generating utilities and supplying them to our customers in a variety of concrete infrastructure and building projects. CCPs, such as fly ash and bottom ash, are the non-carbon components of coal that remain after coal is burned. CCPs have traditionally been an environmental and economic burden for power generators but can be a source of value when properly managed.

Fly ash is principally used as a substitute for a portion of the portland cement used in concrete. Concrete made with fly ash has better performance characteristics than concrete made only from portland cement, including improved durability, decreased permeability and enhanced corrosion-resistance. Further, concrete made with CCPs is easier to work with than concrete made only with portland cement, due in part to its better pumping and forming properties. Because fly ash is generally less expensive per ton than portland cement, the manufacturing cost of concrete made with fly ash can be lower than the manufacturing cost of concrete made with portland cement.

In order to ensure a steady and reliable supply of CCPs, we have entered into numerous long-term and exclusive management contracts with coal-fueled electric generating utilities, maintain 22 stand-alone CCP distribution terminals across North America and support approximately 100 plant-site supply facilities. We own or lease approximately 1,500 rail cars and more than 200 trucks, in addition to contracting with other carriers in order to meet transportation needs for the marketing and disposal of CCPs. Our extensive distribution network allows us to transport CCPs across the nation, including into states that represent important construction markets but that have a low production of CCPs.

HRI has grown with the expanded commercial use of CCPs and continues to support market recognition of the performance, economic and environmental benefits of CCPs. According to American Coal Ash Association (“ACAA”) 2008 estimates, fly ash replaced approximately 15.5% of the portland cement used in concrete manufactured in the United States.

3

Headwaters Energy Services

HES is a leader in coal cleaning and coal upgrading and generated approximately $73.5 million in revenue for the twelve months ended June 30, 2009. HES primarily owns and operates coal cleaning facilities that separate ash from waste coal to provide a refined coal product that is higher in Btu value and lower in impurities than the feedstock coal. The cleaned coal is sold primarily to electric power plants and other industrial users. This clean coal technology allows mining companies to reclaim waste coal sites and return them to a state of beneficial use. By December 2008, we had completed construction and operation of eleven coal cleaning facilities. In response to current market conditions, we are currently operating seven of these facilities. These facilities reduce sulfur oxides, nitrogen oxides and mercury emissions from waste coal, greatly increasing its cleanliness and usability. The cleaned coal product is comparable in energy content and ash to run-of-mine coal products. We anticipate the sale of cleaned coal products will generate refined coal tax credits under Section 45 of the Internal Revenue Code (“Section 45”) when coal is sold into the steam market. In addition to coal cleaning, we are also involved in heavy oil upgrading processes, liquefaction of coal into liquid fuels as well as production of hydrogen peroxide and ethanol.

Our Strengths

Market Leadership Positions in Diversified End Markets. HBP has leading market positions in multiple categories of both residential and non-residential building products that are used primarily in exterior siding applications. Tapco is the number one national provider of siding accessories, which are principally used for residential repair and remodeling projects and to a lesser extent for new residential construction. Eldorado Stone is a leading national producer of manufactured architectural stone siding, which is used in both residential and commercial construction. SCP is the number one producer of concrete block in the Texas market, which is used for institutional and commercial construction applications. HRI is the number one national supplier of CCPs. HRI’s market share for high value CCPs in concrete products has steadily increased from 38% to over 48% from fiscal 2001 through fiscal 2008. We believe our market leadership positions help us generate profit margins at the top of our light building products and heavy construction materials peer groups. We also believe our diversification within various construction end markets, along with our energy markets, provide more business stability than we would otherwise experience by participating in just one end market.

Strong Brand Recognition. Headwaters has strong brand recognition in the building products industry. Tapco is widely recognized for its siding accessories that enhance the appearance of homes while delivering durability at a lower cost compared to similar aluminum, wood and plastic products. Tapco leverages a multi-brand strategy to market similar products through various distribution channels. For example, Tapco distributes its Builders Edge brand of shutters through The Home Depot and its Mid-America brand of shutters through the wholesale channel. Tapco is able to capture a larger percentage of the market with this segmentation strategy. We believe Tapco and its various product brands are among the most recognized brands in the siding accessory market and that these brands are recognized for quality, performance and aesthetics. Under our Eldorado Stone, StoneCraft and Dutch Quality Stone brands we market a wide variety of manufactured architectural stone products that offer high aesthetic quality, ease of installation, durability and reasonable cost to meet a variety of design needs. We market our manufactured architectural stone products under these three different brands to avoid any potential channel conflict and to offer different price points within the market. SCP has a strong regional brand in the Texas concrete block market. We believe our strong brand recognition helps us increase demand for our building products and maintain our market leadership positions, and gives us the flexibility to further segment the market by customer type and by distribution channel.

4

Extensive and Established National Distribution Networks. We maintain sophisticated distribution systems in both our light building products and heavy construction materials segments. Tapco and Eldorado Stone have extensive distribution networks that provide national marketing and sales opportunities for our diversified portfolio of light building products. Tapco maintains an extensive distribution network that consists of substantially all of the major vinyl siding, roofing and window distributors in the United States. We believe Tapco’s penetration of these channels is due to contractor loyalty to Tapco instilled by the quality and breadth of Tapco’s products and Tapco’s high level of services to distributors, including rapid order fulfillment. Eldorado primarily distributes its manufactured architectural stone products on a wholesale basis through a network of distributors, including masonry and stone suppliers, roofing and siding materials distributors, fireplace suppliers and other specialty contractor stores.

In addition, we believe we have the most extensive CCP infrastructure in the United States with 22 stand-alone CCP distribution terminals across North America, as well as approximately 100 plant site supply facilities. We believe our extensive distribution network across all our businesses has been a key factor in our growth because it allows us to add other products which we have developed internally or acquired through strategic acquisitions, rapidly increasing sales opportunities.

Long-Term Customer Relationships and Exclusive Supply Contracts. Headwaters has developed attractive, long-term relationships with numerous important customers. HBP enjoys a large customer base with 4,000 non-retail ship-to-locations and more than 4,600 retail ship-to-locations. The non-retail channel consists of wholesale distributors, with some of these customer relationships in effect for more than 30 years. The wholesale distribution customers are very attractive to HBP due to the relationships they develop and maintain with the contractors who install the building products. Contractors have tended to continue using the products that they have grown accustomed to installing and the manufacturers upon whom they have come to rely for excellent product quality and customer service. Because HBP has consistently delivered high quality products on a timely basis for contractors, the wholesale channel has rewarded HBP with relationships that have grown and strengthened over the years. HBP has also developed relationships within the retail distribution channel. HBP has been supplying products to The Home Depot and Lowe’s for more than 15 years. In particular, Tapco is the national vendor of choice to The Home Depot for shutters, mounting blocks and gable vents and the national vendor of choice to Lowe’s for mounting blocks and gable vents.

Our HRI segment has established long-term relationships and exclusive CCP management contracts with many of the nation’s major coal-fueled electric generating utilities. We contract with these utilities to manage and market CCPs, including high-value CCPs that are used as a replacement for portland cement and can also be used in many products manufactured in our light building products segment. We currently provide CCP management services to more than 100 power plants.

Well Positioned to Benefit from the Rebound in Housing Markets. As a result of the challenging housing market environment, we have taken significant actions to rightsize our manufacturing capacity and reduce our segment and corporate overhead. Since 2005 peak levels, combined headcount at HBP has been reduced by approximately 50%, and we have

5

reduced our manufacturing footprint for Tapco and Eldorado Stone. Given our market leadership positions and reduced cost structure, we believe that we are well positioned to benefit from a rebound in the housing market. We believe the residential housing market is in the early stages of a broad recovery and that the long-term growth prospects in the industry are strong. According to the U.S. Census Bureau, seasonally-adjusted annualized housing starts in August 2009 are up 25% from their lows experienced earlier this year, but current seasonally-adjusted annualized housing starts are still well below the 50-year average. According to the Harvard Joint Center for Housing Studies, the nation’s housing stock will have to accommodate approximately 12.5 million to 14.8 million additional households due to population growth over the next decade.

Well Positioned to Benefit from Increased Infrastructure Spending. We believe our construction materials business has been negatively affected by recent weakness in infrastructure spending as federal, state and local funding available for infrastructure projects has declined. The recently passed American Recovery and Reinvestment Act (“ARRA”) sets aside $130.8 billion for infrastructure spending, including $49.3 billion for transportation construction projects. We expect to benefit from the infrastructure spending under the ARRA because HRI sells fly ash for the partial replacement of portland cement in the manufacture of concrete used in many of these construction projects.

Our Strategy

Introduce New Products and Brands to Leverage our Distribution System. We have a longstanding tradition of developing and commercializing innovative building products and technologies to better serve our customers. For example, Tapco was the first company to introduce injection-molded shutters, vents and mounting blocks. In addition, we enhance existing products and introduce new brands in response to specific customer needs and market demand. HBP has one of the most extensive distribution networks in the building products industry, allowing us to reach most of the major vinyl siding, roofing, window and masonry distributors in the United States. This extensive distribution network provides us with an existing outlet for our newly developed or acquired products to quickly expand sales of such products. For example, during 2009 we introduced the first color cellular PVC trim board product into what we believe is a significant market growth opportunity. Our manufacturing capacity was quickly sold out to a small number of distributors in our network, and in 2010 we will expand our manufacturing capacity and increase the number of distributors commensurate with our expanded capacity. We have expanded our new products and brands organically and through small acquisitions by introducing them into our national distribution system. We estimate that our sales of internally-developed and acquired new products and new brands within our HBP segment grew from approximately $15 million in fiscal 2004 to $92 million in fiscal 2008. Included in this growth are sales from specialty siding, architectural brick, synthetic slate roofing, trim board, and sales of our Dutch Quality and Stonecraft branded manufactured architectural stone.

Grow Headwaters Resources Through Optimizing Our Distribution System, Increasing Supply and Expanding Services. HRI has the most extensive CCP infrastructure in the U.S., and is the only distributor of fly ash with national reach. This infrastructure allows us to pursue CCP supply contracts throughout the nation and gives us an advantage when competing for supply contracts. We believe our industry-leading distribution network has been a significant factor in our historical growth and positions us well for future growth. We continue to grow our supply of high quality fly ash through extension of our distribution and storage system, blending fly ash to achieve a desired level of quality, and extending our existing exclusive supply agreements. Further, we have undertaken to increase our service work provided to utilities as our service revenue has been stable and provides additional interaction with utilities which could be suppliers of fly ash. As noted below under the heading “Risk Factors”, the EPA has announced an intention to propose new rules potentially regulating the storage and/or usage of fly ash. Depending on the scope and nature of any rules actually adopted, there may be additional opportunities for us to increase the revenue we generate from advising utilities on the management of their CCPs. Service revenue has grown from 18% to 26% of HRI’s revenues from fiscal 2007 to the nine months ended June 30, 2009.

6

Expand the Use of CCPs. We undertake a variety of marketing efforts to expand the use of CCPs and emphasize the performance value of CCPs, as well as the attendant benefits such as conserving landfill space and reducing greenhouse gases. These activities include professional outreach, technical publications, relationships with industry organizations, and involvement in legislative initiatives leading to greater use of CCPs. In addition, we have developed several specialty products that increase market penetration of CCPs and name recognition for our products for road bases, structural fills and industrial fillers. We have also developed new products that utilize high volumes of CCPs. For example, through research and development activities, we developed two products to utilize the fly ash generated at fluidized bed combustion (“FBC”) power plants, which is generally unsuitable for use in traditional concrete applications. We have also developed technologies that maintain or improve the quality of CCPs, further expanding and enhancing their marketability. To date, the value of utilizing CCPs in concrete has been recognized by federal and many state agencies. The EPA has historically encouraged CCP utilization in federal and state transportation projects because of improved concrete characteristics, reduced landfill usage and an indirect reduction in carbon dioxide. However, the EPA has announced its intention to propose new rules potentially regulating the storage or use of fly ash. See “Risk Factors—Risks Relating to Our Business—If the EPA adopts regulations designating coal ash as a hazardous solid waste for some or all purposes, this action would likely have an adverse effect on the cost, beneficial use and sales of CCPs.”

Commercialize Sustainable Business Opportunities. Consistent with our mission to develop valuable products from under-utilized resources, we are continually expanding our business as we identify new opportunities. Recently, we entered into the coal cleaning business, converting waste coal and low-value coal into high-quality coal. This high-quality coal has lower levels of sulfur oxides, nitrogen oxides and mercury emissions than the feedstock coal. We believe that we are also nearing commercialization of our heavy oil upgrading technology, enhancing the value of low-value heavy oil. In both the coal cleaning and the heavy oil upgrading technologies, we upgrade the quality of the material and transform it into a valuable product. We continue to look for future opportunities to further upgrade low-value resources for their reuse.

Continue Focus on Reducing Costs to Position our Business for Macroeconomic Recovery. We have identified cost reduction opportunities across all of our business segments. When fully implemented, we believe these initiatives will generate approximately $52 million in annualized cost savings. Within our HBP segment, we expect to realize annualized cost savings of approximately $20 million from cost reduction initiatives that have already been implemented, including advertising expense reductions, employee headcount reductions and transportation cost reductions. Within our HRI segment, we expect to realize annualized cost savings of approximately $9 million from cost reduction initiatives that have already been implemented, including process improvements, employee headcount reductions, lower maintenance spending and improved terms on operating leases. Further, we have recently consolidated management of our HRI and clean coal businesses to reduce overhead. Within our HES segment we expect to realize annualized cost savings of approximately $20 million from cost reduction initiatives that have already been implemented, including reduced research and development spending, reduced labor costs, and improved capacity utilization. Other corporate level cost reduction initiatives implemented in fiscal 2009 are expected to result in annual cost savings of approximately $3 million. We believe that reducing our overall cost structure positions us well for market recoveries across all of our businesses.

7

The Refinancing Transactions

The offering of the Secured Notes described in the Secured Notes Offering Press Release is one of a series of financing transactions undertaken by us since June 30, 2009, in an effort to improve our capital structure and to refinance certain of our indebtedness that has near-term maturities. In this disclosure statement, we refer to the refinancing transactions which have occurred and will occur in connection with the offering of the Secured Notes and as otherwise described below collectively as the “Refinancing.” No assurances can be given that we will be able to close the ABL Revolver or successfully complete the offering of the Secured Notes.

New Senior Secured Asset-Based Revolving Credit Facility. At or prior to the closing of the offering of the Secured Notes, we expect to enter into an asset-based revolving credit facility (the “ABL Revolver”) to replace the revolving credit facility (the “Existing Revolver”) under our existing senior secured credit facilities, which would otherwise expire on October 30, 2009. We expect the ABL Revolver initially will provide up to $70.0 million of revolving loans, subject to borrowing base limitations, and will have a four year maturity.

Tender Offer for 2-7/8% Convertible Senior Notes due 2016. On September 24, 2009, we commenced a tender offer to purchase for cash any and all of our outstanding 2-7/8% Convertible Senior Subordinated Notes due 2016 (the “2.875% Convertible Notes”). As of October 9, 2009, approximately $6.3 million of the 2.875% Convertible Notes were tendered pursuant to the tender offer. The tender offer will expire on October 22, 2009, unless extended by us. Any 2.875% Convertible Notes not tendered may be put to us by the holders for repayment in June 2011. We intend to use part of the net proceeds from the offering of the Secured Notes described in the Secured Notes Offering Press Release to pay the purchase price for such tendered notes and to repay in the future any 2.875% Convertible Notes not tendered.

Repayment of Term Loan and Existing Revolver. Our senior secured credit facilities contain a senior secured first lien term loan (the “Term Loan”). As of the date hereof, there is $163.0 million outstanding under the Term Loan (which reflects a reduction of $34.5 million in principal amount since June 30, 2009 from the proceeds of the Equity Offering described below). The maturity of the Term Loan is April 30, 2011. We intend to use part of the net proceeds from the offering of the Secured Notes described in the Secured Notes Offering Press Release to repay the Term Loan in its entirety. We repaid $5.0 million of our Existing Revolver in September 2009 and made no additional borrowings under the Existing Revolver in the quarter ended September 30, 2009.

Registered Direct Offering of Common Stock. On September 22, 2009, we completed a registered direct offering of 9.6 million shares of our common stock (the “Equity Offering”) for net proceeds of approximately $34.5 million. We used all of the net proceeds from the Equity Offering to repay $34.5 million of our Term Loan in September 2009.

Convertible Note Exchange. In July 2009, we exchanged approximately $19.8 million of our 2.875% Convertible Notes for approximately 4.8 million shares of our common stock and approximately $15.0 million of our 16% convertible senior subordinated notes for approximately 3.5 million shares of our common stock.

8

Corporate Structure

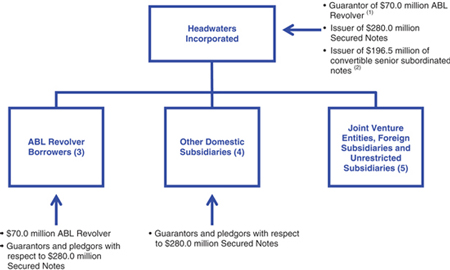

The chart below is a summary of our organizational structure and illustrates the long-term debt that will be outstanding following the Refinancing.

| (1) | At or prior to the closing of the offering of the Secured Notes, we will enter into the ABL Revolver. Headwaters will be a guarantor under the ABL Revolver. |

| (2) | Consists of 16% Convertible Senior Subordinated Notes due 2016, 2.50% Convertible Senior Subordinated Notes due 2014, and 14.75% Convertible Senior Subordinated Notes due 2014, assuming all of the 2.875% Convertible Senior Subordinated Notes are tendered. |

| (3) | Headwaters Construction Materials, Inc. and Tapco International Corporation and their operating subsidiaries and Headwaters Resources Inc. and its operating subsidiaries will be borrowers under the ABL Revolver. |

| (4) | At the closing of the offering of the Secured Notes, Headwaters Energy Services and its subsidiaries. After the closing of the offering of the Secured Notes, HES and its subsidiaries may become borrowers under the ABL Revolver. |

| (5) | Evonik Headwaters Korea Co., Ltd. (foreign, 50% owned), Evonik Headwaters LLP (foreign, 50% owned), HES Ethanol Holdings LLC (owner of 51% interest in ethanol plant), Flexcrete Building Systems, LC (90% owned), Headwaters Clean Carbon Services LLC (51% owned) and American Lignite Energy, LLC (50% owned). |

9

Summary Financial and Operating Data

The following table sets forth a summary of our consolidated financial data. We derived the summary consolidated financial data as of and for the years ended September 30, 2007 and 2008 and for the year ended September 30, 2006 from the audited consolidated financial statements and related notes included in the 2008 Form 10-K. We derived the financial information as of September 30, 2006 from our audited consolidated financial statements that are included in our Annual Report filed on Form 10-K for the year ended September 30, 2006. We derived the summary consolidated financial data as of June 30, 2009 and for the nine month periods ended June 30, 2008 and 2009 from the unaudited condensed financial statements included in the June 2009 Form 10-Q, which, in the opinion of our management, have been prepared on the same basis as the audited financial statements and reflect all adjustments, consisting only of normal recurring adjustments, except for the adjustments related to goodwill impairment and the debt exchange transactions, necessary for a fair presentation of our results of operations and financial position for such periods. We derived the financial information as of June 30, 2008 from our unaudited condensed financial statements that are included in our Quarterly Report filed on Form 10-Q for the three months ended June 30, 2008. Results for the nine month periods ended June 30, 2008 and 2009 are not indicative of results that may be expected for the entire fiscal year or any future period. We have derived the summary consolidated financial data for the twelve months ended June 30, 2009 by adding the financial data from our audited consolidated financial statements for the year ended September 30, 2008 to the financial data from our unaudited condensed financial statements for the nine months ended June 30, 2009 and subtracting the financial data from our unaudited condensed financial statements for the nine months ended June 30, 2008. Results for the twelve months ended June 30, 2009 are not indicative of results that may be expected in the future. The summary consolidated financial data set forth below should be read in conjunction with, and is qualified by reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in the 2008 Form 10-K and the June 2009 Form 10-Q and the audited consolidated financial statements and unaudited condensed interim financial statements and accompanying notes described above.

| Year ended September 30, | Nine months ended June 30, | Twelve months ended June 30, 2009 |

|||||||||||||||||||

| 2006 | 2007 | 2008 | 2008 | 2009 | |||||||||||||||||

| (unaudited) | (unaudited) | ||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||

| Statement of Operations Data: |

|||||||||||||||||||||

| Revenue: |

|||||||||||||||||||||

| Light building products |

$ | 573,390 | $ | 544,087 | $ | 457,008 | $ | 337,609 | $ | 249,205 | $ | 368,604 | |||||||||

| Heavy construction materials |

281,213 | 306,394 | 313,373 | 221,048 | 179,721 | 272,046 | |||||||||||||||

| Energy technology |

266,784 | 357,363 | 116,023 | 92,675 | 50,139 | 73,487 | |||||||||||||||

| Total revenue |

1,121,387 | 1,207,844 | 886,404 | 651,332 | 479,065 | 714,137 | |||||||||||||||

| Cost of revenue: |

|||||||||||||||||||||

| Light building products |

394,141 | 383,505 | 337,315 | 248,639 | 193,321 | 281,997 | |||||||||||||||

| Heavy construction materials |

206,372 | 217,619 | 226,077 | 161,676 | 129,998 | 194,399 | |||||||||||||||

| Energy technology |

163,352 | 212,152 | 90,201 | 72,334 | 59,331 | 77,198 | |||||||||||||||

| Total cost of revenue |

763,865 | 813,276 | 653,593 | 482,649 | 382,650 | 553,594 | |||||||||||||||

| Gross profit |

357,522 | 394,568 | 232,811 | 168,683 | 96,415 | 160,543 | |||||||||||||||

| Operating expenses: |

|||||||||||||||||||||

| Amortization |

24,273 | 22,885 | 22,396 | 16,412 | 17,674 | 23,658 | |||||||||||||||

| Research and development |

13,478 | 17,744 | 14,996 | 11,448 | 7,466 | 11,014 | |||||||||||||||

| Selling, general and administrative |

137,968 | 155,597 | 143,300 | 110,278 | 87,773 | 120,795 | |||||||||||||||

| Goodwill impairment |

— | 98,000 | 205,000 | — | 465,656 | 670,656 | |||||||||||||||

| Total operating expenses |

175,719 | 294,226 | 385,692 | 138,138 | 578,569 | 826,123 | |||||||||||||||

| Operating income (loss) |

181,803 | 100,342 | (152,881 | ) | 30,545 | (482,154 | ) | (665,580 | ) | ||||||||||||

10

| Year ended September 30, | Nine months ended June 30, | Twelve months ended June 30, 2009 |

||||||||||||||||||||||

| 2006 | 2007 | 2008 | 2008 | 2009 | ||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||

| Net interest expense |

$ | (34,049 | ) | $ | (31,061 | ) | $ | (23,801 | ) | $ | (17,607 | ) | $ | (27,224 | ) | $ | (33,418 | ) | ||||||

| Other income (expense), net |

(9,938 | ) | (10,940 | ) | 6,499 | 7,498 | 29,922 | 28,923 | ||||||||||||||||

| Income (loss) before income taxes |

137,816 | 58,341 | (170,183 | ) | 20,436 | (479,456 | ) | (670,075 | ) | |||||||||||||||

| Income tax benefit (provision) |

(35,758 | ) | (38,287 | ) | 503 | (6,030 | ) | 83,600 | 90,133 | |||||||||||||||

| Net income (loss) |

$ | 102,058 | $ | 20,054 | $ | (169,680 | ) | $ | 14,406 | $ | (395,856 | ) | $ | (579,942 | ) | |||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| Operating income (loss) without goodwill impairment |

$ | 181,803 | $ | 198,342 | $ | 52,119 | $ | 30,545 | $ | (16,498 | ) | $ | 5,076 | |||||||||||

| EBITDA(1) |

269,053 | 301,155 | 142,121 | 99,468 | 75,639 | 118,292 | ||||||||||||||||||

| Adjusted EDITDA(1) |

145,097 | 129,656 | 110,065 | 72,284 | 48,994 | 95,618 | ||||||||||||||||||

| Adjusted EBITDA margin(2) |

16.8 | % | 15.1 | % | 13.4 | % | 12.3 | % | 10.2 | % | 13.5 | % | ||||||||||||

| Capital expenditures |

59,935 | 54,986 | 116,201 | 86,052 | 55,255 | 85,404 | ||||||||||||||||||

| Cash paid for interest |

34,998 | 31,430 | 26,113 | 20,262 | 22,458 | 28,309 | ||||||||||||||||||

| Total secured debt(3) |

415,319 | 210,000 | 200,000 | 245,000 | 227,500 | 227,500 | ||||||||||||||||||

| Total secured debt / Adjusted EBITDA(4) |

2.4 | x | ||||||||||||||||||||||

| Adjusted EBITDA / cash paid for interest |

3.4 | x | ||||||||||||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 79,151 | $ | 55,787 | $ | 21,637 | $ | 33,536 | $ | 14,016 | ||||||||||||||

| Working capital(5) |

145,296 | 163,394 | 124,657 | 139,748 | 80,056 | |||||||||||||||||||

| Total assets |

1,661,729 | 1,655,889 | 1,401,986 | 1,636,130 | 902,572 | |||||||||||||||||||

| Total liabilities |

860,771 | 825,639 | 770,434 | 821,987 | 661,235 | |||||||||||||||||||

| Total stockholders’ equity |

800,958 | 830,250 | 631,552 | 814,143 | 241,337 | |||||||||||||||||||

| (1) | EBITDA is defined as net income (loss) plus net interest expense, income taxes (as defined), depreciation and amortization, stock-based compensation, foreign currency translation gain or loss and goodwill and other impairments, as these items are defined in our Term Loan and the notes offered hereby. EBITDA is a measure used by management to monitor compliance with debt covenants and to measure operating performance. EBITDA is also used by investors to measure a company’s ability to service its debt and meet its other cash needs. Management believes EBITDA is helpful in highlighting trends because EBITDA excludes the results of decisions that are outside the control of operating management and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate and capital investments. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. |

| Adjusted EBITDA is defined to exclude the impact of our former Section 45K business which was not conducted after December 31, 2007, a one-time gain on the sale of our mortars and stuccos business, one-time gains on convertible debt exchanges and severance costs. In addition, Adjusted EBITDA for the twelve months ended June 30, 2009 includes the estimated amount of incremental annualized cost savings relating to operational cost savings which we began to implement in fiscal 2009 as if such measures had been in effect for the entire period. Management believes that these adjustments applied in presenting Adjusted EBITDA are appropriate to provide additional information to investors about our discontinued Section 45K business, one-time gains which are unusual items that we do not expect in the future, and in the case of estimated incremental annualized cost savings, the impact of workforce reductions in fiscal 2009 which are expected to be continued in future periods. |

| EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income, operating income or any other performance measure derived in accordance with GAAP or as a measure of our liquidity. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for management’s discretionary use, as they do not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Our presentations of EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly-titled measures used by other companies. Our presentations of EBITDA and Adjusted EBITDA may not be in accordance with current SEC practice or with regulations adopted by the SEC that apply to registration statements filed under the Securities Act and periodic reports presented under the Exchange Act. |

11

EBITDA and Adjusted EBITDA are calculated as follows:

| Year ended September 30, | Nine months ended June 30, | Twelve months ended June 30, 2009 |

||||||||||||||||||||||

| 2006 | 2007 | 2008 | 2008 | 2009 | ||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Net income (loss) |

$ | 102,058 | $ | 20,054 | $ | (169,680 | ) | $ | 14,406 | $ | (395,856 | ) | $ | (579,942 | ) | |||||||||

| Goodwill impairment |

— | 98,000 | 205,000 | — | 465,656 | 670,656 | ||||||||||||||||||

| Income taxes(a) |

62,265 | 69,781 | 2,196 | 7,111 | (77,390 | ) | (82,305 | ) | ||||||||||||||||

| Net interest expense |

34,049 | 31,061 | 23,801 | 17,607 | 27,224 | 33,418 | ||||||||||||||||||

| Depreciation and amortization |

63,669 | 72,199 | 68,884 | 50,791 | 51,853 | 69,946 | ||||||||||||||||||

| Stock-based compensation and foreign currency translation gain/ loss |

7,012 | 10,060 | 11,920 | 9,553 | 4,152 | 6,519 | ||||||||||||||||||

| EBITDA |

$ | 269,053 | $ | 301,155 | $ | 142,121 | $ | 99,468 | $ | 75,639 | $ | 118,292 | ||||||||||||

| Section 45K(b) |

(123,956 | ) | (172,714 | ) | (25,276 | ) | (20,365 | ) | — | (4,911 | ) | |||||||||||||

| Gain on sale of mortars and stuccos business(c) |

— | — | (7,612 | ) | (7,612 | ) | — | — | ||||||||||||||||

| Gain on convertible debt exchanges(d) |

— | — | — | — | (29,304 | ) | (29,304 | ) | ||||||||||||||||

| Severance costs |

— | 1,215 | 832 | 793 | 2,659 | 2,698 | ||||||||||||||||||

| Additional cost savings(e) |

— | — | — | — | — | 8,843 | ||||||||||||||||||

| Adjusted EBITDA |

$ | 145,097 | $ | 129,656 | $ | 110,065 | $ | 72,284 | $ | 48,994 | $ | 95,618 | ||||||||||||

| (a) | Income taxes differ from income tax benefit (provision) primarily due to income tax credits that are already included in Net income (loss). |

| (b) | Represents our Section 45K business. By law, Section 45K tax credits for synthetic fuel produced from coal expired for synthetic fuel sold after December 31, 2007. With the expiration of Section 45K at the end of calendar 2007, our licensees’ synthetic fuel facilities and the facilities we owned were closed because production of synthetic fuel was not profitable absent the tax credits. |

| (c) | Represents the gain recognized in fiscal 2008 on the sale of our non-strategic mortar/stucco assets in our light building products segment. |

| (d) | Represents the gains recognized on the extinguishments of convertible debt in fiscal 2009. |

| (e) | Represents the estimated amount of incremental annualized cost savings from the elimination of 185 employee positions during fiscal year 2009. This amount reflects the incremental amount of salary, bonuses and benefits costs incurred during this period that would have been eliminated had all of such workforce reductions occurred on July 1, 2008. In future periods, the actual amount of costs savings we may achieve because of these 2009 workforce reductions may be greater or less than the estimates set forth above. |

| (2) | Adjusted EBITDA margin is calculated by dividing Adjusted revenue by Adjusted EDITDA. Adjusted revenue is calculated by subtracting Section 45K revenue from total revenue. |

| (3) | Total secured debt is the aggregate principal amount of debt outstanding that is secured by some or all of our assets. |

| (4) | On a pro forma basis after giving effect to the Refinancing, our ratio of Total secured debt / Adjusted EBITDA on June 30, 2009 would have been 2.9x. |

| (5) | Working Capital is total current assets less total current liabilities. |

12

RISK FACTORS

Risks relating to our business and our common stock are described in Item 1A of the 2008 Form 10-K. The following information supplements the information contained therein.

Risks Relating to Our Business

The building products industry is experiencing a severe downturn that may continue for an indefinite period into the future. Because the markets for our building products are heavily dependent on the residential construction and remodeling market, our revenues could decrease as a result of events outside our control that impact home construction and home improvement activity, including economic factors specific to the building products industry.

Since 2006, there has been a severe slowing of new housing starts and in home sales generally. Bank foreclosures have put a large number of homes into the market for sale, effectively limiting some of the incentives to build new homes. The homebuilding industry continues to experience a significant and sustained decrease in demand for new homes and an oversupply of new and existing homes available for sale since 2006. While our residential building products business relies upon the home improvement and remodeling markets as well as new construction, we have experienced a slowdown in sales activity beginning in fiscal 2007, and continuing in 2008 and 2009. Interest rate increases, limits on credit availability, further foreclosures, home price depreciation, and an oversupply of homes for sale in the market may adversely affect homeowners’ and/or homebuilders’ ability or desire to engage in construction or remodeling, resulting in a continued or further slowdown in new construction or remodeling and repair activities. The federal government’s program to provide an $8,000 credit for certain new homebuyers, which encouraged home purchases, is scheduled for termination on December 1, 2009. Termination of this program may have an adverse effect on home sales generally and negatively affect our building products business.

We, like many others in the building products industry, experienced a large drop in orders and a reduction in our margins in 2008 and 2009, relative to prior years. For the past three years, we have recorded significant goodwill impairments associated with our building products business. We can provide no assurances that the building products market will improve in the near future. To the extent weakness continues into 2010, it will have an adverse effect on our business and our results of operations.

The construction markets are seasonal. The majority of our building products sales are in the residential construction market, which tends to slow down in the winter months. If there is more severe weather than normal, or other events outside of our control, there may be a negative effect on our revenues if we are not able to increase market share. For the winter months of 2009 and 2010, we expect that our decreased seasonal revenues from HBP and HRI will result in negative cash flow.

The recent financial crisis could negatively affect our business, results of operations, and financial condition. Market conditions in the mortgage lending and mortgage finance industries deteriorated significantly in 2008 and 2009, which adversely affected the availability of credit for home purchasers and remodelers.

The recent financial crisis affecting the banking system and financial markets and the going concern threats to banks and other financial institutions have resulted in a tightening in the credit markets, a low level of liquidity in many financial markets, including mortgages and home equity loans, and extreme volatility in credit and equity markets. Further tightening of mortgage lending or mortgage financing requirements could adversely affect the availability of credit for purchasers of our products and thereby reduce our sales.

13

There could be a number of follow-on effects from the credit crisis on our business, including the inability of prospective homebuyers or remodelers to obtain credit to finance the purchase of our building products. These and other similar factors could:

| • | cause delay or decisions to not undertake new home construction or improvement projects, |

| • | cause our customers to delay or decide not to purchase our building products, |

| • | lead to a decline in customer transactions and our financial performance. |

Our building products business has been strengthened by the sales growth of new products. If we are unable to continue to successfully expand our new product sales, our revenue growth may be adversely affected.

Our growth strategy includes the introduction of new building products by our light building products business. Part of our revenues has come from sales in new product categories. New products require capital for development, manufacturing, and acquisition activities. If we are unable to sustain new product sales growth, whether for lack of access to adequate capital or for other reasons, sales will follow the general industry slowdown in new residential construction and remodeling activity, which will negatively affect our revenue and growth.

Demand for our building products may decrease because of changes in customer preferences or because competing products gain price advantages. If demand for our products declines, our revenues will decrease.

Our building products are subject to reductions in customer demand for reasons such as changes in preferred home styles and appearances. Many of our resin-based siding accessory products are complementary to an owner’s choice of vinyl as a siding material. If sales of vinyl siding decrease, sale of our accessories will also decrease. Similarly, sales of our manufactured architectural stone products are dependent on the continuing popularity of stone finishes.

Demand for our building products can also decline if competing products become relatively less expensive. For example, if costs of petroleum-based resins that are used to make vinyl siding and accessories increase faster than the costs of stucco, then stucco products, which we do not sell, will become more attractive from a price standpoint, and our vinyl siding and accessory sales may decrease. If demand for our building products declines because of changes in the popularity or price advantages of our products, our revenues will be adversely affected.

A significant increase in the price of materials used in the production of our building products that cannot be passed on to customers could have a significant adverse effect on our operating income. Furthermore, we depend upon limited sources for certain key production materials, the interruption of which would materially disrupt our ability to manufacture and supply products, resulting in lost revenues and the potential loss of customers.

Our manufactured architectural stone and concrete block manufacturing processes require key production materials including cement, man made and natural aggregates, oxides, packaging materials, and certain types of rubber-based products. The suppliers of these materials may experience capacity or supply constraints in meeting market demand that limit our ability to obtain needed production materials on a timely basis or at expected prices. We have no long-term contracts with such suppliers. We do not currently maintain large inventories of production materials and alternative sources meeting our requirements could be difficult to arrange in the short term. A significant increase in the price of these materials that cannot be passed on to customers could have a significant adverse effect on our cost of sales and operating income. Additionally, our manufacturing and ability to provide products to its customers could be materially disrupted if this supply of materials was interrupted for any reason. Such an interruption and the resulting inability to supply our manufactured architectural stone customers with products could adversely impact our revenues and our relationships with our customers.

14

Certain of our home siding accessory products are manufactured from polypropylene, which material is sold to us by a single supplier. The price of polypropylene is primarily a function of manufacturing capacity, demand and the prices of petrochemical feedstocks, crude oil and natural gas liquids. Historically, the market price of polypropylene has fluctuated, and significantly increased in 2008. A significant increase in the price of polypropylene that cannot be passed on to customers could have a significant adverse effect on our cost of sales and operating income. We do not have a long-term contract with our polypropylene supplier. We do not maintain large inventories of polypropylene and alternative sources of polypropylene could be difficult to arrange in the short term. Therefore, our manufacturing and ability to provide products to our customers could be materially disrupted if this supply of polypropylene was interrupted for any reason. Such an interruption and the resulting inability to supply our resin-based siding accessory customers with products could adversely impact our revenues and potentially our relationships with our customers.

Interruption of our ability to immediately ship individual or custom product orders could harm our reputation and result in lost revenues if customers turn to other sources for products.

Our building products business is highly dependent upon rapid shipments to contractors and distributors throughout the United States of individual orders, a large portion of which orders are manufactured upon demand to meet customer specifications. If there is significant interruption of business at any of our manufacturing plants or with our computer systems that track customer orders and production, we are at risk of harming its reputation for speed and reliability with important customers and losing short-term and long-term revenues if these customers turn to other sources.

Tapco’s revenues would be materially adversely affected if it lost one or more of its three major customers.

Three customers of our resin-based siding accessory products together accounted for approximately 29% of Tapco’s revenues for such products in the fiscal year ended September 30, 2008, and approximately 6.0% of our total revenues as of such date. There are no long-term contracts in place with these customers. Accordingly, a loss of or significant decrease in demand from these customers would have a material adverse effect on our business.

Our construction materials business has been severely affected by recent downturns in governmental infrastructure spending.

Our fly ash and concrete block products, and to a much lesser extent, our other building products, are used in public infrastructure projects, which include the construction, maintenance, and improvement of highways, bridges, schools, prisons and similar projects. Our business is dependent on the level of federal, state, and local spending on these projects. We cannot be assured of the existence, amount, and timing of appropriations for government spending on these projects.

Federal and state budget limitations may continue to decrease severely the funding available for infrastructure spending. The lack of available credit has limited the ability of states to issue bonds to finance construction projects. In addition, infrastructure spending continues to be adversely affected by the overall weakness in the economy, which leads to lower tax revenues and state government budget deficits. Shortages in state tax revenues can reduce the amounts spent on state infrastructure projects, even below amounts awarded by the legislatures. Delays in state infrastructure spending can hurt our business. Further, rising construction and material prices constrain infrastructure construction budgets.

The American Recovery and Reinvestment Act (“ARRA”) enacted in early 2009 provided billions of dollars in new stimulus funding for transportation infrastructure. However, there has been a time delay in Congressional appropriation of such funds and each state’s actions to take advantage of such funding. In addition, each state must approve various infrastructure projects to be funded through the new federal stimulus plan. So while management believes the ARRA will increase our sales in fiscal 2010, we cannot be assured of the amount of funds to be expended and the timing of expenditures under the stimulus plan.

15

If HRI’s coal-fueled electric utility industry suppliers fail to provide it with high-value coal combustion products (“CCPs”) due to environmental regulations or otherwise, HRI’s costs could increase and supply could fail to meet production needs, potentially negatively impacting our profitability or hindering growth.

Headwaters Resources relies on the production of CCPs by coal-fueled electric utilities. HRI has occasionally experienced delays and other problems in obtaining high-value CCPs from its suppliers and may in the future be unable to obtain high-value CCPs on the scale and within the time frames required by HRI to meet customers’ needs. Following the judicial invalidation in 2008 of the EPA’s Clean Air Mercury Rule under the 1990 Clean Air Act Amendments, additional technologies at power plants may be required by future regulation or legislation, in order to achieve reductions in mercury emissions that could negatively affect fly ash quality. For example, future regulations could require activated carbon to be injected into power plant exhaust gases to capture mercury. This process may increase the carbon collected with the fly ash and may make the fly ash undesirable for concrete. Carbon removal processes for fly ash are technically challenging and expensive. The EPA has announced that new regulations to control mercury emissions from power plants may be proposed in 2010. Further, as the price of natural gas has decreased to current prices, coal-fueled electric utilities have in some instances switched from coal to natural gas. A reduction in the use of coal as fuel causes a decline in the production and availability of fly ash. To the extent the price of natural gas continues to decrease, more coal-fueled electric utilities may explore the feasibility of switching from coal to natural gas.

Increasing concerns about greenhouse gases (“GHG”) or other emissions from burning coal at electricity generation plants could lead to federal or state regulations that encourage or require utilities to burn less or eliminate coal in the production of electricity. Congress and the Obama administration are currently engaged in developing federal legislation to reduce GHG emissions which, among other things, could establish a cap and trade system for GHG, including carbon dioxide emitted by coal burning power plants and requirements for electric utilities to increase their use of renewable energy, such as wind and solar power. Also, the EPA has taken several recent actions which signal the start of regulatory efforts to reduce GHG, including its April 2009 proposed finding of “endangerment” to public health and welfare from GHG, its issuance on September 22, 2009 of the Final Mandatory Reporting of Greenhouse Gases Rule which requires large sources, including coal burning power plants, to report GHG emissions to the EPA annually starting in 2011, and its publication on September 30, 2009, of its proposed Prevention of Significant Deterioration and Title V Greenhouse Gas Tailoring Rule, which would require large industrial facilities, including coal burning power plants, to obtain permits to emit, and to use best available control technology to control GHG. Some states have also adopted or are developing climate change legislation and/or regulations as well. Such legislation and/or regulations could reduce the supply of fly ash and other CCPs. If HRI is unable to obtain CCPs or if it experiences a delay in the delivery of high-value or quality CCPs, HRI will have a reduced supply of CCPs to sell or may be forced to incur significant unanticipated expenses to secure alternative sources or to otherwise maintain supply to customers. Moreover, revenues could be adversely affected if CCP sales volumes cannot be maintained or if customers choose to find alternatives to HRI’s products.

16

If the EPA adopts regulations designating coal ash as a hazardous solid waste for some or all purposes, this action would likely have an adverse effect on the cost, beneficial use and sales of CCPs.

Headwaters’ coal ash business is dependent upon the management, recovery, processing and beneficial use of coal combustion products and coal combustion wastes received from its clients, typically coal-burning power plants. The EPA has announced its intention, by the end of 2009, to propose new regulations governing management and storage of coal ash wastes, and to determine whether to designate coal ash as a non-hazardous solid waste (Subtitle D) or as a hazardous solid waste (Subtitle C) under the Resource Conservation and Recovery Act. Following a major spill of coal ash from a surface impoundment at a coal burning power plant in Tennessee in December 2008, there is mounting pressure on the EPA to regulate coal ash as a hazardous waste. If the EPA does so, coal ash would become subject to a variety of hazardous waste regulations and the cost of handling, transporting, storing and disposing of the material would increase, thus increasing regulatory obligations and costs of coal ash management for the utility industry and for Headwaters. Such regulations could directly or indirectly limit, as well as impose regulatory requirements for, existing or proposed beneficial uses of coal ash, including its use as a substitute for portland cement. They could also cause state and other regulators responsible for approving beneficial uses of coal ash to restrict its use, and potential users of products containing coal ash to seek alternatives in light of its designation as a “hazardous waste.” These potential increased regulatory obligations and costs, limitations on beneficial uses, the stigma associated with products labeled as hazardous and potential increased liabilities could result in reduced use of coal ash in products. For example, it is possible that there may be restrictions on incorporating coal ash in products that are placed in contact with the ground owing to a risk of potential leaching of metals into the environment. It is also possible that the EPA could exempt from regulation certain coal combustion wastes used for beneficial purposes, including certain construction applications such as use in concrete and concrete products, cement, road base and wall board. In light of the current uncertainty concerning the scope and details of any final EPA regulations for coal ash, we are not in a position at this time to assess their impact, but there can be no guarantee that such regulation would not have a material adverse impact on our operations and financial condition.

In addition, environmental groups have filed a notice of intent to sue the EPA for failing to update effluent limitation guidelines under the Clean Water Act for coal-fired power plants, to limit discharges of toxic metals in waste water from handling of coal combustion waste. The EPA subsequently announced its intention to revise its existing effluent limitation guidelines before 2012 to address toxic pollutants discharged from power plants, including discharges from coal ash ponds. If the EPA adopts new Clean Water Act requirements, the regulatory obligations and cost of managing coal combustion waste would likely increase, which could make coal burning more expensive or less attractive to HRI’s utility clients.

HRI primarily sells fly ash for use in concrete; if use of fly ash does not increase, HRI may not grow.

HRI’s growth has been and continues to be dependent upon the increased use of fly ash in the production of concrete. HRI’s marketing initiatives emphasize the environmental, cost and performance advantages of replacing portland cement with fly ash in the production of concrete. If HRI’s marketing initiatives are not successful, HRI may not be able to sustain its growth.

Further, utilities are switching fuel sources, changing boiler operations and introducing activated carbon and ammonia into the exhaust gas stream in an effort to decrease costs and/or to meet increasingly stringent emissions control regulations. All of these factors can have a negative effect on fly ash quality, including an increase in the amount of unburned carbon in fly ash and the presence of ammonia slip. We are attempting to address these challenges with the development and/or commercialization of two technologies: carbon fixation, which pre-treats unburned carbon particles in fly ash in order to minimize the particles’ adverse effects, and ammonia slip mitigation, which counteracts the impact of ammonia contaminants in fly ash. Decreased quality of fly ash may impede the use of fly ash in the production of concrete, which would adversely affect HRI’s revenue.

17

If portland cement or competing replacement products are available at lower prices than fly ash, our sales of fly ash as a replacement for portland cement in concrete products could suffer, causing a decline in HRI’s revenues and net income.

An estimated 80% of HRI’s revenues for the fiscal year ended September 30, 2008 were derived from the sale of fly ash as a replacement for portland cement in concrete products. At times, there may be an overcapacity of cement in regional markets, causing potential price decreases. The markets for HRI’s products are regional, in part because of the costs of transporting CCPs, and HRI’s business is affected by the availability and cost of competing products in the specific regions where it conducts business. If competing products become available at prices equal to or less than fly ash, HRI’s revenues and net income could decrease.

Because demand for CCPs sold by HRI is affected by fluctuations in weather and construction cycles, HRI’s revenues and net income could decrease significantly as a result of unexpected or severe weather.

HRI manages and markets CCPs and uses CCPs to produce building products. Utilities produce CCPs year-round. In comparison, sales of CCPs are generally keyed to construction market demands that tend to follow national trends in construction with predictable increases during temperate seasons and decreases during periods of severe weather. HRI’s CCP sales have historically reflected these seasonal trends, with the largest percentage of total annual revenues being realized in the quarters ended June 30 and September 30. Low seasonal demand normally results in reduced shipments and revenues in the quarters ended December 31 and March 31. We expect the seasonal impact on HRI’s revenue, together with the seasonal impact on Tapco and HBP revenues to result in negative cash flows for the winter months of 2009 and 2010.

The profitability of HES depends upon the operational success of our new coal cleaning business, which has been adversely affected by decreased demand for coal.

Because of the end of HES legacy alternative fuel licensing and chemical reagent sales business as of December 31, 2007, HES began development of its new coal cleaning business. By December 2008, HES had acquired or completed construction on eleven coal cleaning facilities. To successfully operate its facilities, HES must produce and market a quality fuel, addressing operational issues including feedstock availability and cost, construction and operability of equipment, successful separation of minerals including ash, sulfur, and mercury, product moisture and Btu content, overall costs of operations, as well as marketing and sales of the finished product, which is generally of smaller particle size (called fines) and which may be more difficult to sell than run-of-mine coal. This is a new business for HES, and we have experienced difficulty in receiving or extracting our full requirements of feedstock at some facilities and softness in the price of our products. Because of decreased demand for coal, we have curtailed operations at four facilities, leaving seven in operation at this time. The profitability of HES depends on the ability of HES to increase production and sales of cleaned coal. If these facilities operate at low production levels or cannot produce fuel satisfactory to customers, revenues will be materially adversely affected.

Regulatory changes could reduce the demand for coal which may decrease the price for which HES can sell its clean coal product. In addition, a slowing economy may reduce demand for coal, adversely affecting our revenues.

Our clean coal revenues are dependent upon the demand for coal, particularly as a fuel for the production of electricity. Increasing concerns about greenhouse gas or other air emissions, toxic materials in wastewater discharges and the hazardousness of coal combustion waste from burning coal at power generation plants could lead to federal or state regulations that encourage or require utilities to burn less or eliminate coal in the production of electricity. Such regulations could reduce the demand for coal, which would adversely affect the prices at which HES could sell its clean coal product and decrease our revenues.

18

Coal is a commodity that can be produced and shipped worldwide. As the U.S. and worldwide economies slow, demand for coal as an energy source may decrease. In addition, some of our clean coal revenues come from the sale of metallurgical grade coal used in steel making. As economic growth slows, so will the demand for steel. Slower economic growth can therefore reduce the overall demand for coal, including metallurgical grade coal. This could reduce the prices for which we can sell clean coal, adversely affecting our revenues.

HES may not qualify for tax credits under Section 45, which will adversely affect our profitability.

Section 45 provides a tax credit for the production and sale of refined coal. Based on the language of Section 45, HES believes that the coal cleaning facilities are eligible for Section 45 refined coal tax credits. However, the ability to claim tax credits is dependent upon a number of conditions, including, but not limited to:

| • | Placing facilities in service on or before December 31, 2008; |

| • | Producing a fuel from coal that is lower in NOx and either SO2 or mercury emissions by the specified amount as compared to the emissions of the feedstock; |

| • | Producing a fuel at least 50% more valuable than the feedstock; and |

| • | Sale of the fuel to a third-party for the purpose of producing steam. |

To date, the Internal Revenue Service (“IRS”) has issued very little public guidance about how this tax credit program will be administered and the restrictions on the availability of such credits. We understand that the IRS may be providing guidance in the near future, but we do not know how any such guidance will affect our ability to take tax credits.

The IRS may challenge Section 45 tax credits claimed by HES, under which we have recognized a total benefit of approximately $8.2 million through June 30, 2009, based on any one of the above or other conditions. In addition, Congress may modify or repeal Section 45 so that these tax credits may not be available in the future. If HES is not successful in claiming Section 45 credits from our coal cleaning facilities, our profitability will be materially adversely affected.

If the IRS is successful in its challenges of Section 45K tax credits claimed by us, we may be subject to increased tax liabilities which will materially adversely affect our income and accounting reserves.

Section 45K (formerly Section 29) of the Internal Revenue Code (“Section 45K”) provides a tax credit for the production and sale of alternative fuels from coal. The IRS is challenging by audit whether HES satisfied the requirements of Section 45K, including placed-in-service requirements, and is seeking to disallow Section 45K tax credits claimed by us. The outcome of such audits, appeals, and any tax litigation is uncertain. In the event that the IRS is ultimately successful in sustaining its challenge to tax credits claimed by us, we will have an increased tax liability which will materially adversely affect our income and accounting reserves. The IRS has recently concluded its field review of our 2005-2006 tax years and issued a Revenue Agent’s report, or RAR, on September 9, 2009, disallowing approximately $21.5 million in tax credits relating to synthetic coal facilities owned by us, which, if sustained in full, could result in payment of up to $15.1 million of additional taxes, plus any penalties and interest. We have filed a protest letter challenging the proposed adjustments contained in the RAR. However, we may not be successful in our challenge, which, as noted above, could result in a material tax liability and could adversely affect our results of operation and financial condition. In addition, should the IRS prevail with respect to its assertions relating to the 2005-2006 tax years, it is also possible that Section 45K tax credits that we have claimed for our 2007-2008 tax years will also be disallowed, which could result in a payment of $4.2 million of additional taxes for the 2007-2008 tax years, plus any penalties and interest.

19

The availability and price of corn purchased by Blue Flint Ethanol, LLC (“BFE”) can be affected by weather, disease, demand from other users of corn, government programs and other factors beyond BFE’s control. In addition, fluctuations in ethanol prices could adversely affect BFE’s ethanol revenues.

The availability and price of corn, the primary feedstock for BFE’s ethanol production, is subject to wide fluctuations due to unpredictable factors such as weather, plantings, crop disease, demand for corn from other users, government farm programs and policies, changes in demand resulting from population growth, and production of similar and competitive crops. There were wide fluctuations in the pricing of ethanol and corn in 2008. Ethanol pricing currently tracks corn pricing which tends to limit the upside price potential of ethanol. Increased demand and/or reduced supply of corn adversely affects our profitability by increasing the cost of raw materials used in BFE’s operations.

The ethanol and biodiesel industry in the U.S. has grown rapidly and our success will depend on whether demand for ethanol increases proportionately or if the increased production results in excess capacity. As of the end of 2008, it appears that the ethanol industry is producing product in excess of the market’s ability to blend, store, transport, sell and deliver ethanol-based fuels. This excess supply is putting downward pressure on the sales prices for ethanol to producers, and could adversely affect BFE’s revenues and operating results.

Environmental regulations aimed at reducing greenhouse gas emissions may also affect the market for ethanol-based fuel derived from corn. The EPA’s low carbon fuel standard proposal contains a new biofuel lifecycle emissions analysis that, if the proposal is finalized, could adversely impact the production of ethanol-based fuel derived from corn. In addition, California has adopted a new low carbon fuel standard with a lifecycle fuel analysis that could adversely impact the sources of ethanol in fuel distributed in California.

Our new businesses, processes and technologies may not be successfully developed, operated and marketed, which could affect our future profitability.

Although we have developed or acquired many new businesses, processes and technologies (e.g., ethanol, heavy oil upgrading and coal cleaning), commercialization of these businesses and technologies is in early stages. Commercial success of these new businesses and technologies will depend on our ability to enter into agreements with customers, licensees and/or joint ventures to further develop and provide adequate funding to commercialize the new businesses and technologies, as well as to develop markets for the products and technologies. We may not be able to enter into these agreements and adequate funding may not be available to fully develop and successfully commercialize our new businesses and technologies. Further, we may not be able to profitably operate our new businesses or market our technologies or products produced from them. These processes (e.g., heavy oil upgrading) and technologies also may become less competitive and more costly as a result of increasing efforts to reduce use of fossil fuels and more stringent environmental regulation, including efforts to control greenhouse gas emissions.

Our growth requires continued investment of capital. If we cannot invest additional capital into new and existing businesses, we may not be able to sustain or increase our growth.