Attached files

| file | filename |

|---|---|

| EX-10.3 - EX-10.3 - Priority Technology Holdings, Inc. | priority-arespreferredcomm.htm |

| 8-K - 8-K - Priority Technology Holdings, Inc. | a8k-3821.htm |

| EX-10.1 - EX-10.1 - Priority Technology Holdings, Inc. | exhibith-supportagreemente.htm |

| EX-10.2 - EX-10.2 - Priority Technology Holdings, Inc. | priorityprojectwarrior-tru.htm |

| EX-99.1 - EX-99.1 - Priority Technology Holdings, Inc. | prthfinxerapressrelease-fi.htm |

| EX-2.1 - EX-2.1 - Priority Technology Holdings, Inc. | projectwarriorfinxera-merg.htm |

mc PRTH Acquisition of Finxera Leading the Convergence of Payments and Banking March 2021

Disclaimer 2 Important Notice Regarding Forward-Looking Statements and Non-GAAP Measures This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services, and other statements identified by words such as “may,” “will,” “should,” “anticipates,” “believes,” “expects,” “plans,” “future,” “intends,” “could,” “estimate,” “predict,” “projects,” “targeting,” “potential” or “contingent,” “guidance,” “anticipates,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited to, expected timing of the closing of Priority Technology Holdings, Inc.’s (“Priority”, “we”, “our” or “us”) merger with Finxera Holdings, Inc. (“Finxera”), the expected returns and other benefits of the merger to shareholders, expected improvement in operating efficiency resulting from the merger, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, our 2021 outlook and statements regarding our market and growth opportunities. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive risks, trends and uncertainties that could cause actual results to differ materially from those projected, expressed, or implied by such forward-looking statements. These forward-looking statements may include, but are not limited to, statements about the effects of the COVID-19 pandemic on our revenues and financial operating results. Our actual results could differ materially, and potentially adversely, from those discussed or implied herein. We caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in our Securities and Exchange Commission (“SEC”) filings, including our Annual Report on Form 10-K and our Quarterly Report on Form 10-Q filed with the SEC on March 30, 2020 and November 13, 2020, respectively. These filings are available online at www.sec.gov or www.PRTH.com. We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences we anticipate or affect us or our operations in the way we expect. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance. The forward-looking statements included in this presentation are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements. Statements included in this presentation include non-GAAP financial measures, including: (i) Revenue Growth, (ii) EBITDA Growth Acceleration, (iii) Run-Rate PF Net Revenue, (iv) Run-Rate Organic PF Net Revenue Growth, (v) Integrated Revenue, (vi) Run-Rate PF Adj. EBITDA, (vii) PF Adj. EBITDA Growth, (viii) PF Adj. EBITDA Margins, (ix) PF Annual Free Cash Flow. Priority does not provide a reconciliation for projected non- GAAP financial measures to their comparable GAAP financial measures because it could not do so without unreasonable effort due to the unavailability of the information needed to calculate reconciling items. Priority does not believe that a GAAP reconciliation would provide meaningful supplemental information about the Priority’s outlook. Management believes that non-GAAP financial measures provide a greater understanding of ongoing performance and operations, and enhance comparability with prior periods. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as determined in accordance with GAAP, and investors should consider Priority’s performance and financial condition as reported under GAAP and all other relevant information when assessing its performance or financial condition. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP. Non-GAAP financial measures may not be comparable to non-GAAP financial measures presented by other companies.

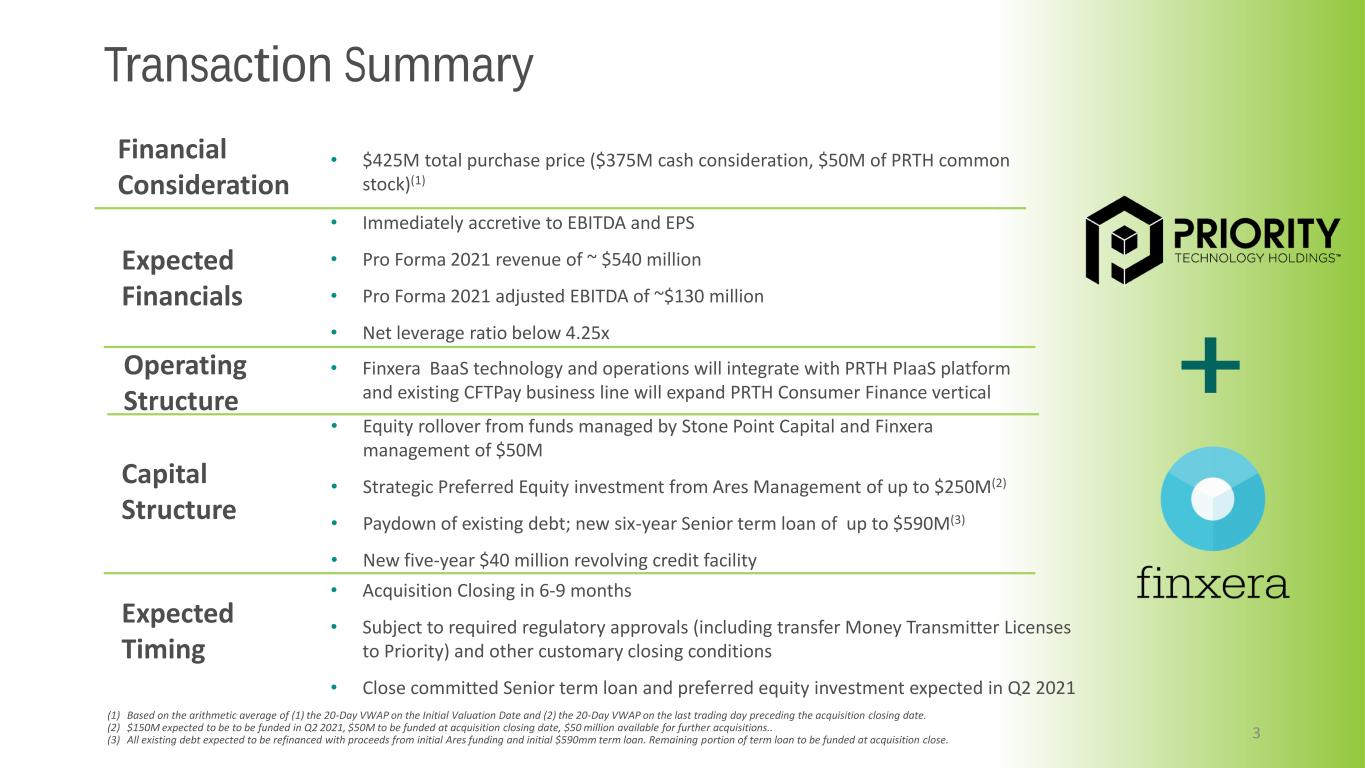

Transaction Summary 3 • $425M total purchase price ($375M cash consideration, $50M of PRTH common stock)(1) Financial Consideration • Immediately accretive to EBITDA and EPS • Pro Forma 2021 revenue of ~ $540 million • Pro Forma 2021 adjusted EBITDA of ~$130 million • Net leverage ratio below 4.25x Expected Financials • Finxera BaaS technology and operations will integrate with PRTH PIaaS platform and existing CFTPay business line will expand PRTH Consumer Finance vertical Operating Structure • Equity rollover from funds managed by Stone Point Capital and Finxera management of $50M • Strategic Preferred Equity investment from Ares Management of up to $250M(2) • Paydown of existing debt; new six-year Senior term loan of up to $590M(3) • New five-year $40 million revolving credit facility Capital Structure • Acquisition Closing in 6-9 months • Subject to required regulatory approvals (including transfer Money Transmitter Licenses to Priority) and other customary closing conditions • Close committed Senior term loan and preferred equity investment expected in Q2 2021 Expected Timing (1) Based on the arithmetic average of (1) the 20-Day VWAP on the Initial Valuation Date and (2) the 20-Day VWAP on the last trading day preceding the acquisition closing date. (2) $150M expected to be to be funded in Q2 2021, $50M to be funded at acquisition closing date, $50 million available for further acquisitions.. (3) All existing debt expected to be refinanced with proceeds from initial Ares funding and initial $590mm term loan. Remaining portion of term loan to be funded at acquisition close.

Strategic Rationale 4 PayFac and Banking-as-a-Service Capabilities • Scalable payment aggregation and sub-ledger system • Deposit and e-wallet account solutions coupled with robust compliance and money transmission capabilities opens up fintech / neobank opportunity Highly Scalable Technology Platform • Outstanding technology development talent, including scalable India Development Center (IDC) Excellent Financial Profile • Recurring, highly predictable and countercyclical revenue • High operating margins, minimal capex fuels stellar free cash flow Strong, Highly Complementary Management Team • Existing Finxera Management will continue in their roles and expand PRTH’s management team Leading Provider of Payment & Financial Technology Solutions • Integrated account administrator to burgeoning, counter-cyclical debt settlement market • Digital banking and account ledgering solutions leverageable across integrated payment verticals

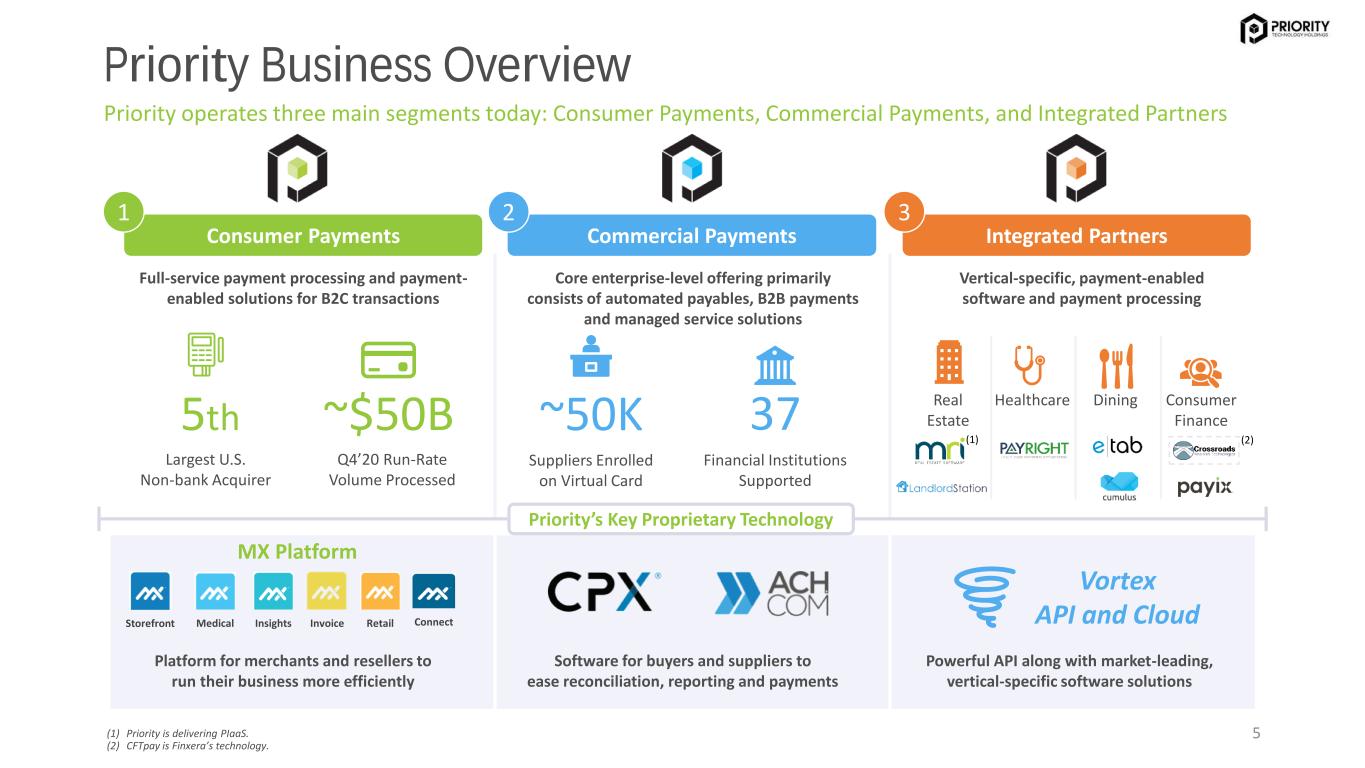

MX Platform Storefront Medical Insights Invoice Retail Connect Consumer Payments Full-service payment processing and payment- enabled solutions for B2C transactions Platform for merchants and resellers to run their business more efficiently Integrated Partners Vertical-specific, payment-enabled software and payment processing Commercial Payments Core enterprise-level offering primarily consists of automated payables, B2B payments and managed service solutions Priority Business Overview Priority operates three main segments today: Consumer Payments, Commercial Payments, and Integrated Partners 5 Priority’s Key Proprietary Technology 1 2 3 Software for buyers and suppliers to ease reconciliation, reporting and payments Powerful API along with market-leading, vertical-specific software solutions 5th Largest U.S. Non-bank Acquirer ~$50B Q4’20 Run-Rate Volume Processed ~50K Suppliers Enrolled on Virtual Card 37 Financial Institutions Supported Vortex API and Cloud Real Estate (1) Healthcare Dining Consumer Finance (2) (1) Priority is delivering PIaaS. (2) CFTpay is Finxera’s technology.

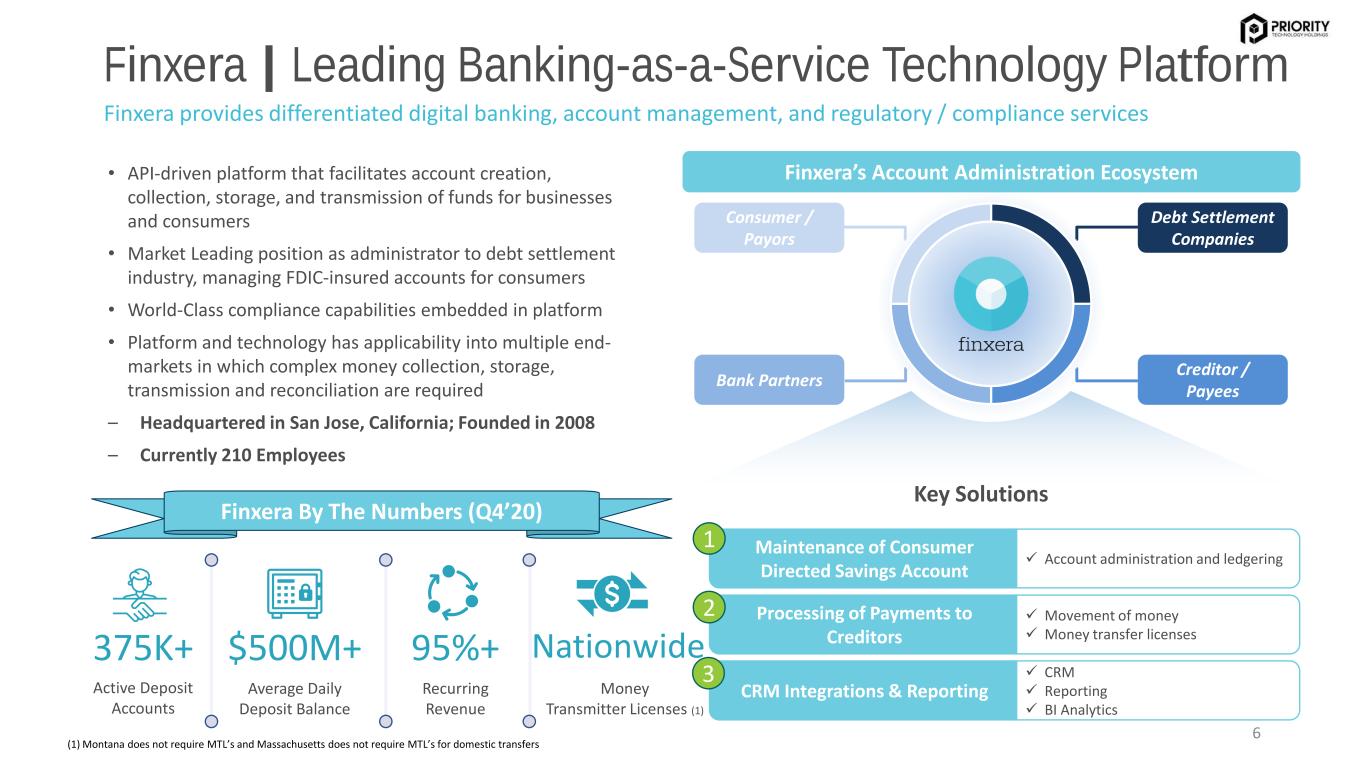

✓ Account administration and ledgering 6 Finxera | Leading Banking-as-a-Service Technology Platform Finxera provides differentiated digital banking, account management, and regulatory / compliance services • API-driven platform that facilitates account creation, collection, storage, and transmission of funds for businesses and consumers • Market Leading position as administrator to debt settlement industry, managing FDIC-insured accounts for consumers • World-Class compliance capabilities embedded in platform • Platform and technology has applicability into multiple end- markets in which complex money collection, storage, transmission and reconciliation are required – Headquartered in San Jose, California; Founded in 2008 – Currently 210 Employees 375K+ Active Deposit Accounts $500M+ Average Daily Deposit Balance Consumer / Payors Debt Settlement Companies Bank Partners Creditor / Payees Finxera’s Account Administration Ecosystem 95%+ Recurring Revenue Nationwide Money Transmitter Licenses (1) Key Solutions Maintenance of Consumer Directed Savings Account Processing of Payments to Creditors CRM Integrations & Reporting 1 2 3 Finxera By The Numbers (Q4’20) ✓ Movement of money ✓ Money transfer licenses ✓ CRM ✓ Reporting ✓ BI Analytics (1) Montana does not require MTL’s and Massachusetts does not require MTL’s for domestic transfers

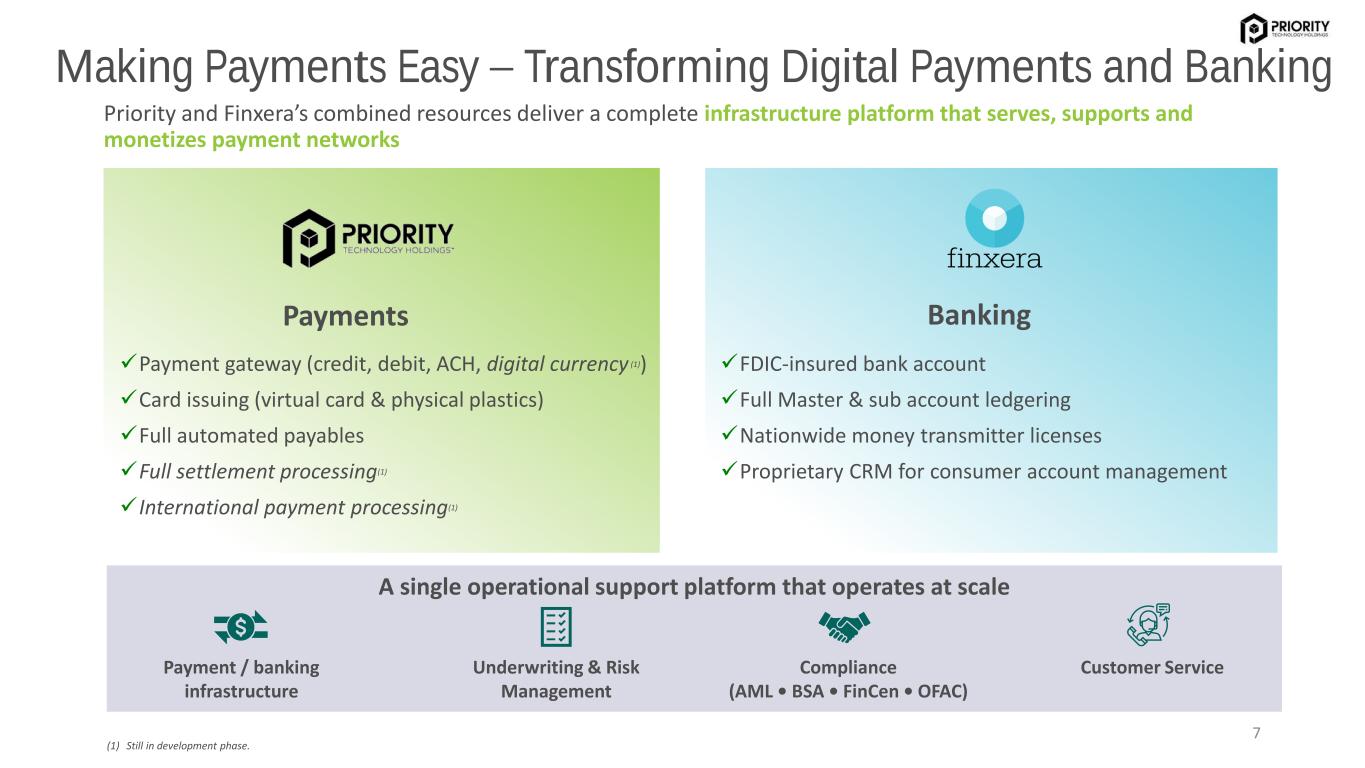

A single operational support platform that operates at scale Making Payments Easy – Transforming Digital Payments and Banking 7 Priority and Finxera’s combined resources deliver a complete infrastructure platform that serves, supports and monetizes payment networks ✓Payment gateway (credit, debit, ACH, digital currency (1)) ✓Card issuing (virtual card & physical plastics) ✓Full automated payables ✓Full settlement processing(1) ✓International payment processing(1) BankingPayments ✓FDIC-insured bank account ✓Full Master & sub account ledgering ✓Nationwide money transmitter licenses ✓Proprietary CRM for consumer account management (1) Still in development phase. Payment / banking infrastructure Underwriting & Risk Management Compliance (AML • BSA • FinCen • OFAC) Customer Service

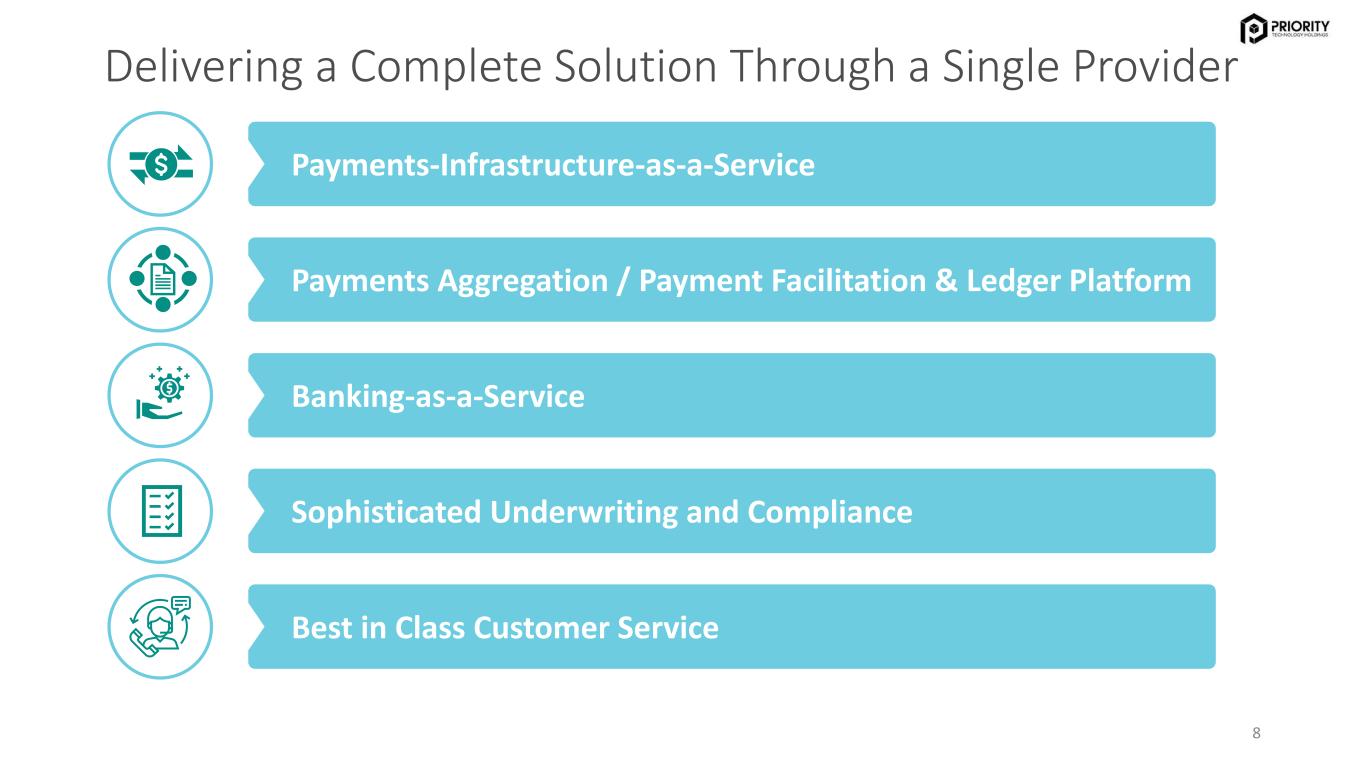

Delivering a Complete Solution Through a Single Provider 8 Payments-Infrastructure-as-a-Service Payments Aggregation / Payment Facilitation & Ledger Platform Banking-as-a-Service Sophisticated Underwriting and Compliance Best in Class Customer Service

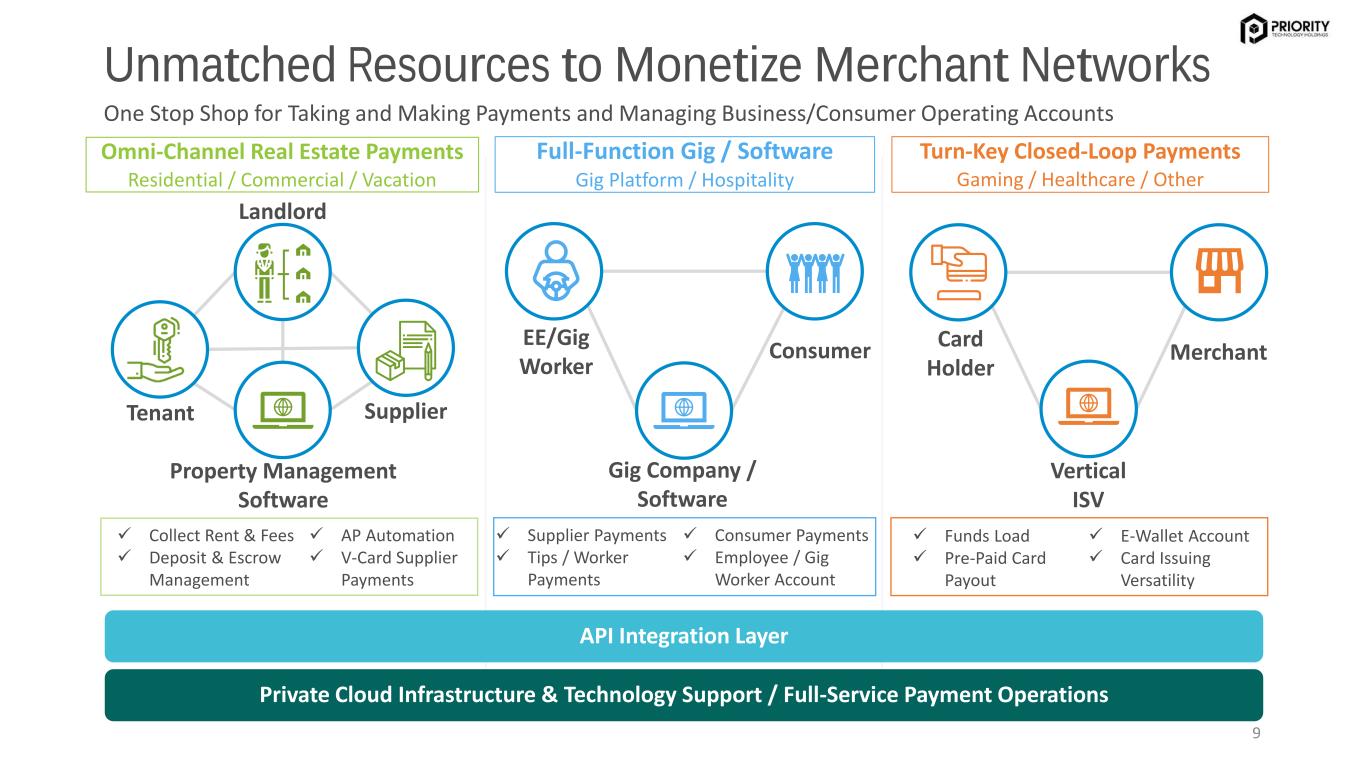

One Stop Shop for Taking and Making Payments and Managing Business/Consumer Operating Accounts Unmatched Resources to Monetize Merchant Networks Tenant Landlord Supplier Property Management Software 9 Omni-Channel Real Estate Payments Residential / Commercial / Vacation Gig Company / Software EE/Gig Worker Consumer Full-Function Gig / Software Gig Platform / Hospitality Turn-Key Closed-Loop Payments Gaming / Healthcare / Other Private Cloud Infrastructure & Technology Support / Full-Service Payment Operations API Integration Layer ✓ Collect Rent & Fees ✓ Deposit & Escrow Management ✓ AP Automation ✓ V-Card Supplier Payments ✓ Supplier Payments ✓ Tips / Worker Payments ✓ Consumer Payments ✓ Employee / Gig Worker Account ✓ Funds Load ✓ Pre-Paid Card Payout ✓ E-Wallet Account ✓ Card Issuing Versatility Card Holder Merchant Vertical ISV

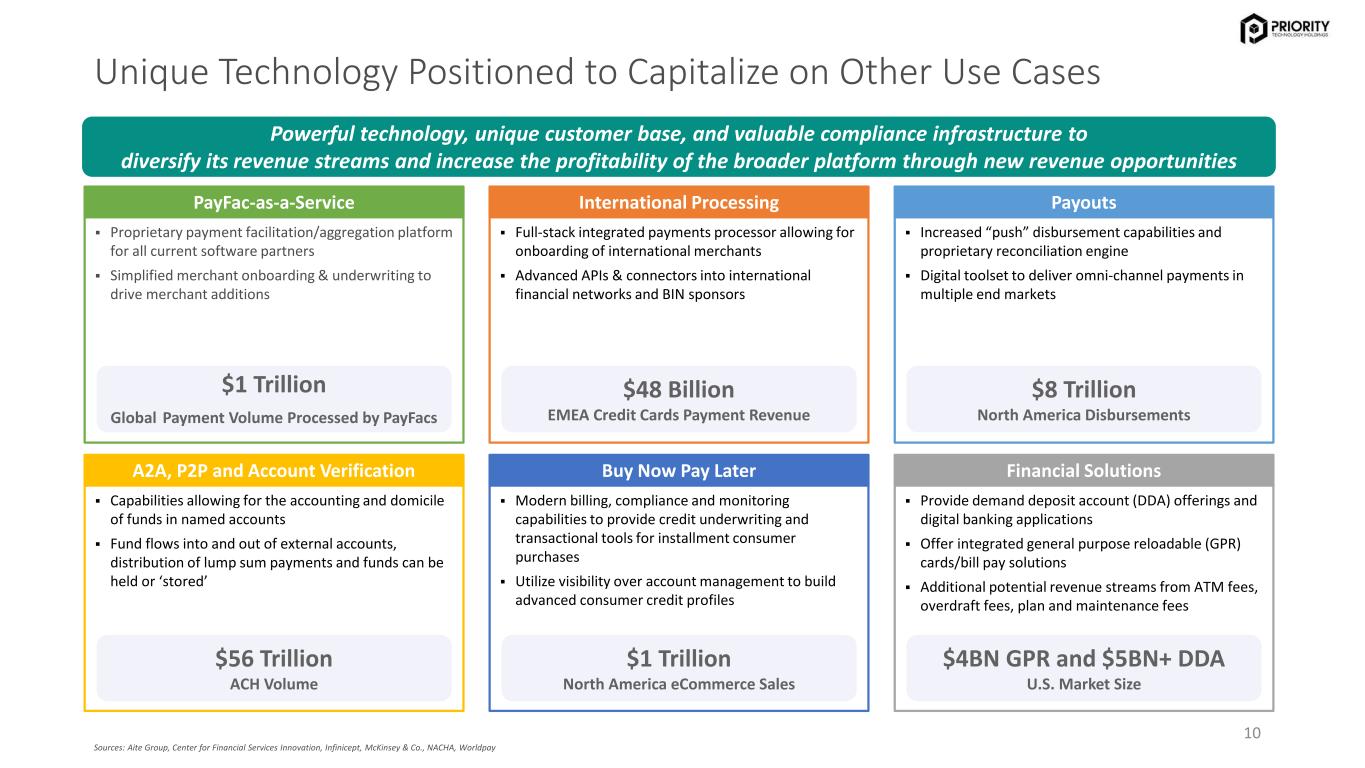

Unique Technology Positioned to Capitalize on Other Use Cases 10 ▪ Proprietary payment facilitation/aggregation platform for all current software partners ▪ Simplified merchant onboarding & underwriting to drive merchant additions PayFac-as-a-Service $1 Trillion Global Payment Volume Processed by PayFacs ▪ Full-stack integrated payments processor allowing for onboarding of international merchants ▪ Advanced APIs & connectors into international financial networks and BIN sponsors International Processing $48 Billion EMEA Credit Cards Payment Revenue ▪ Increased “push” disbursement capabilities and proprietary reconciliation engine ▪ Digital toolset to deliver omni-channel payments in multiple end markets Payouts $8 Trillion North America Disbursements ▪ Provide demand deposit account (DDA) offerings and digital banking applications ▪ Offer integrated general purpose reloadable (GPR) cards/bill pay solutions ▪ Additional potential revenue streams from ATM fees, overdraft fees, plan and maintenance fees Financial Solutions $4BN GPR and $5BN+ DDA U.S. Market Size ▪ Modern billing, compliance and monitoring capabilities to provide credit underwriting and transactional tools for installment consumer purchases ▪ Utilize visibility over account management to build advanced consumer credit profiles Buy Now Pay Later $1 Trillion North America eCommerce Sales ▪ Capabilities allowing for the accounting and domicile of funds in named accounts ▪ Fund flows into and out of external accounts, distribution of lump sum payments and funds can be held or ‘stored’ A2A, P2P and Account Verification Powerful technology, unique customer base, and valuable compliance infrastructure to diversify its revenue streams and increase the profitability of the broader platform through new revenue opportunities $56 Trillion ACH Volume Sources: Aite Group, Center for Financial Services Innovation, Infinicept, McKinsey & Co., NACHA, Worldpay

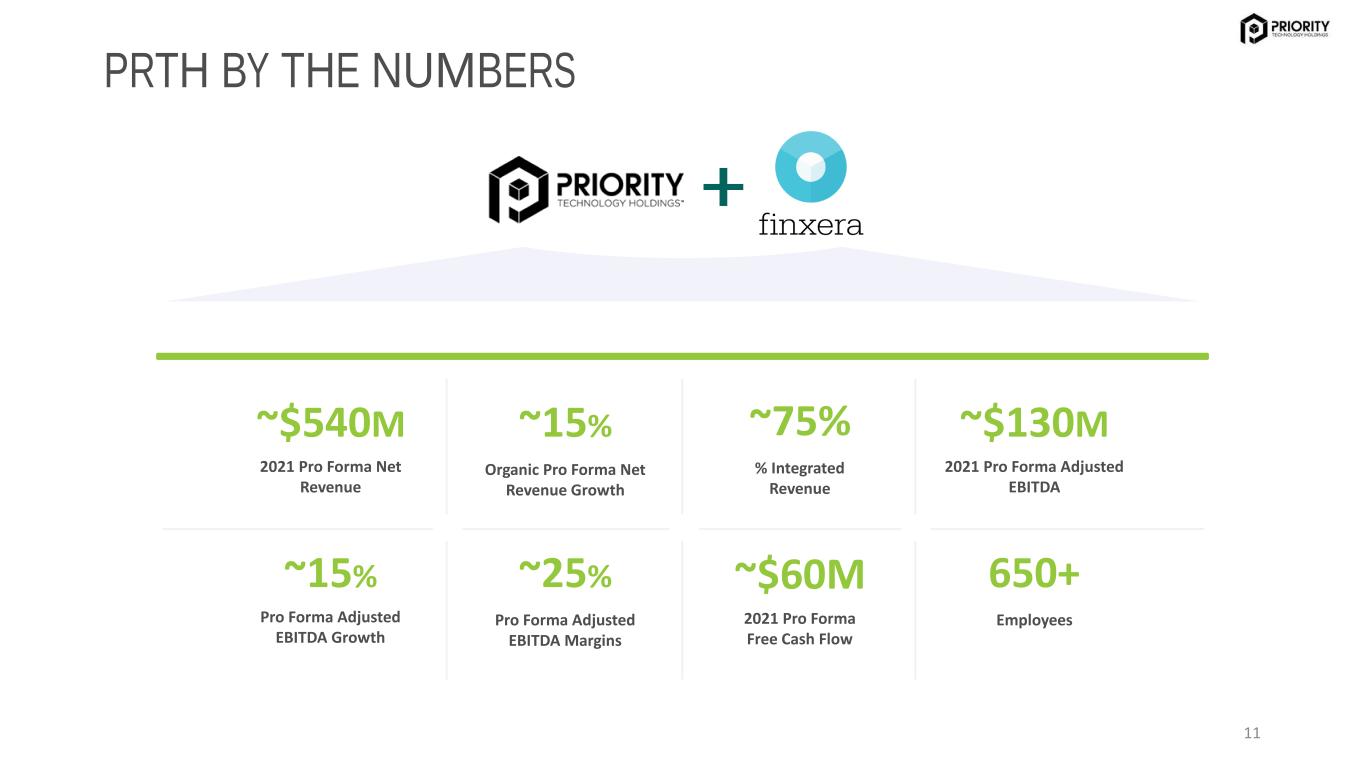

PRTH BY THE NUMBERS 11 ~75% % Integrated Revenue ~$130M 2021 Pro Forma Adjusted EBITDA ~15% Organic Pro Forma Net Revenue Growth ~25% Pro Forma Adjusted EBITDA Margins ~$540M 2021 Pro Forma Net Revenue 650+ Employees ~15% Pro Forma Adjusted EBITDA Growth ~$60M 2021 Pro Forma Free Cash Flow

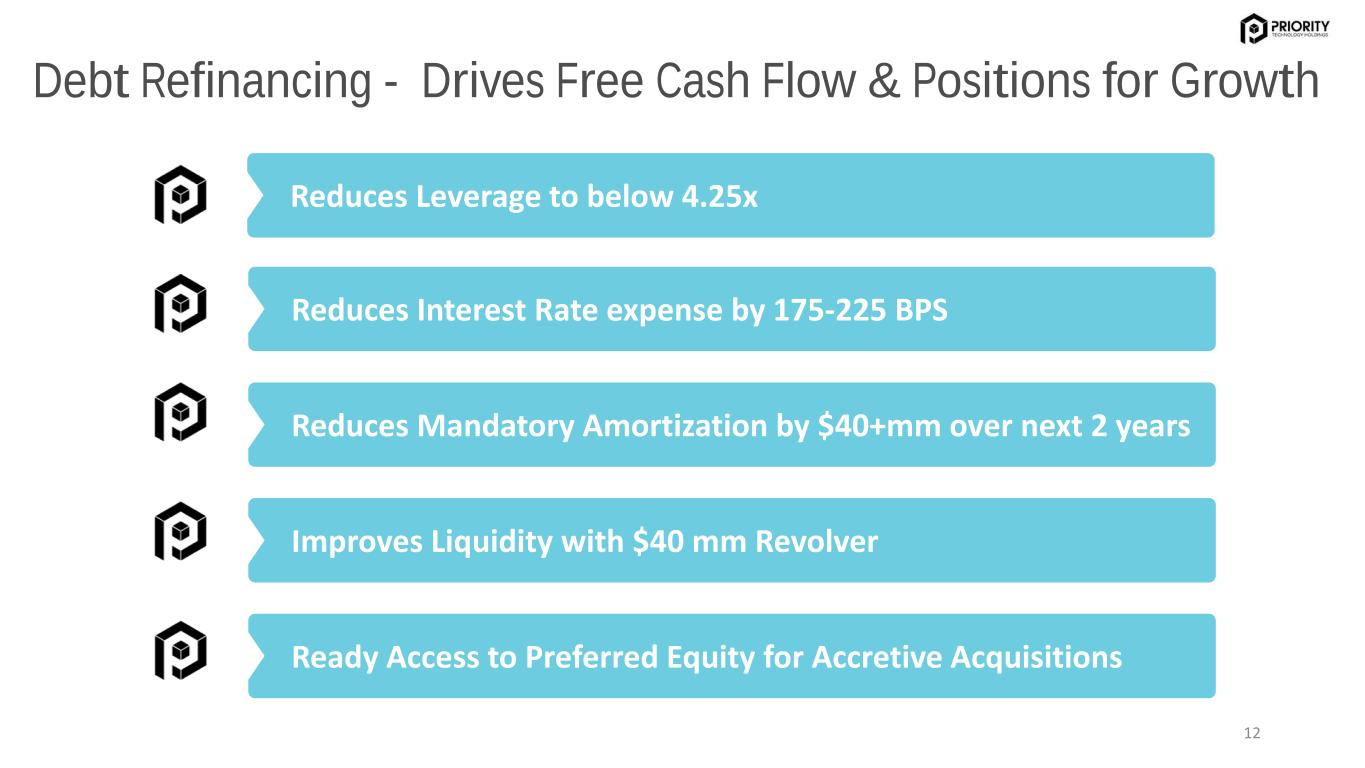

Debt Refinancing - Drives Free Cash Flow & Positions for Growth 12 Reduces Leverage to below 4.25x Reduces Interest Rate expense by 175-225 BPS Reduces Mandatory Amortization by $40+mm over next 2 years Improves Liquidity with $40 mm Revolver Ready Access to Preferred Equity for Accretive Acquisitions