Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ALLIANCE DATA SYSTEMS CORP | exhibit_99-1.htm |

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | form_8k.htm |

Alliance DataKBW Virtual Fintech Payments ConferenceFebruary 23, 2021Ralph Andretta – President &

CEOTammy McConnaughey – EVP, Card Ops & Credit RiskTim King – EVP & CFO Exhibit 99.2

Forward-Looking StatementsThis presentation contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our expectations or forecasts of future events and can generally be identified by the use of words such as

“believe,” “expect,” “anticipate,” “estimate,” “intend,” “project,” “plan,” “likely,” “may,” “should” or other words or phrases of similar import. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions

or goals also are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements we make regarding, and the guidance we give with respect to, our anticipated operating or financial results,

initiation or completion of strategic initiatives, future dividend declarations, and future economic conditions, including, but not limited to, fluctuation in currency exchange rates, market conditions and COVID-19 impacts related to relief

measures for impacted borrowers and depositors, labor shortages due to quarantine, reduction in demand from clients, supply chain disruption for our reward suppliers and disruptions in the airline or travel industries.We believe that our

expectations are based on reasonable assumptions. Forward-looking statements, however, are subject to a number of risks and uncertainties that could cause actual results to differ materially from the projections, anticipated results or other

expectations expressed in this presentation, and no assurances can be given that our expectations will prove to have been correct. These risks and uncertainties include, but are not limited to, factors set forth in the Risk Factors section in

our Annual Report on Form 10-K for the most recently ended fiscal year, which may be updated in Item 1A of, or elsewhere in, our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K. Our forward-looking statements speak

only as of the date made, and we undertake no obligation, other than as required by applicable law, to update or revise any forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated

circumstances or otherwise.

Agenda Presentation Ralph Andretta – President & CEO Opening Remarks A Year in Review (Ralph’s one

year anniversary with ADS) Business Updates Areas of FocusTammy McConnaughey – EVP, Card Services Operations & Credit Risk Macroeconomic Impacts on Credit Lending Philosophy & Underwriting Portfolio MixFireside chat with Ralph, Tammy,

and Tim 3

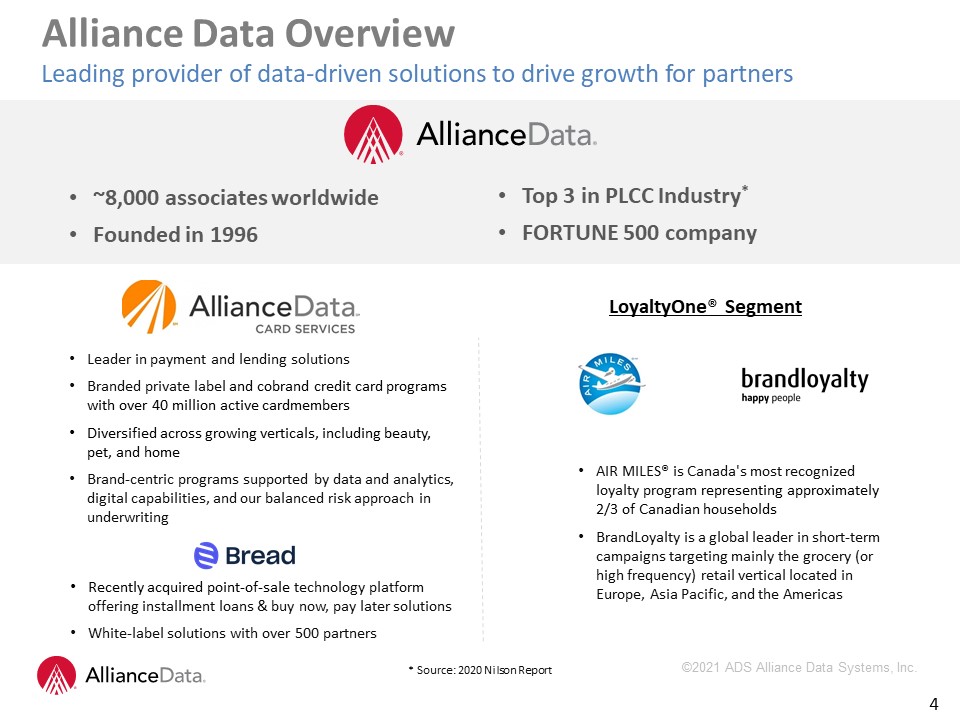

Leader in payment and lending solutions Branded private label and cobrand credit card programs with over

40 million active cardmembersDiversified across growing verticals, including beauty, pet, and homeBrand-centric programs supported by data and analytics, digital capabilities, and our balanced risk approach in underwriting 4 Alliance Data

OverviewLeading provider of data-driven solutions to drive growth for partners ~8,000 associates worldwideFounded in 1996 LoyaltyOne® Segment Recently acquired point-of-sale technology platform offering installment loans & buy now, pay

later solutions White-label solutions with over 500 partners AIR MILES® is Canada's most recognized loyalty program representing approximately 2/3 of Canadian householdsBrandLoyalty is a global leader in short-term campaigns targeting mainly

the grocery (or high frequency) retail vertical located in Europe, Asia Pacific, and the Americas Top 3 in PLCC Industry*FORTUNE 500 company * Source: 2020 Nilson Report

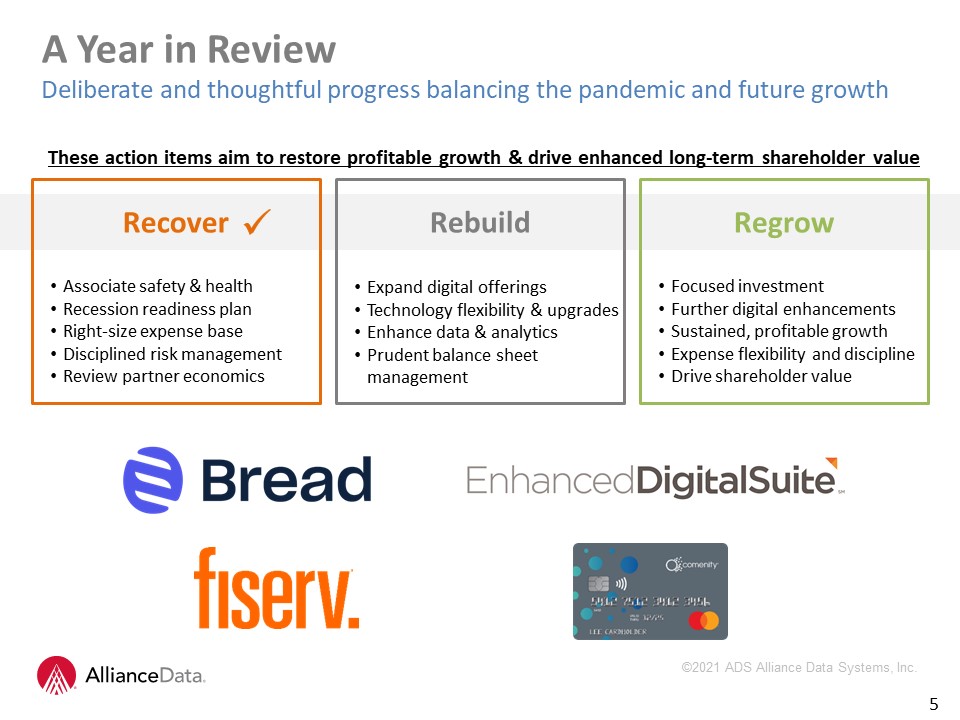

Expand digital offeringsTechnology flexibility & upgradesEnhance data & analyticsPrudent balance

sheet management Associate safety & healthRecession readiness planRight-size expense baseDisciplined risk management Review partner economics 5 A Year in ReviewDeliberate and thoughtful progress balancing the pandemic and future

growth Rebuild Recover These action items aim to restore profitable growth & drive enhanced long-term shareholder value Focused investmentFurther digital enhancementsSustained, profitable growthExpense flexibility and

disciplineDrive shareholder value Regrow

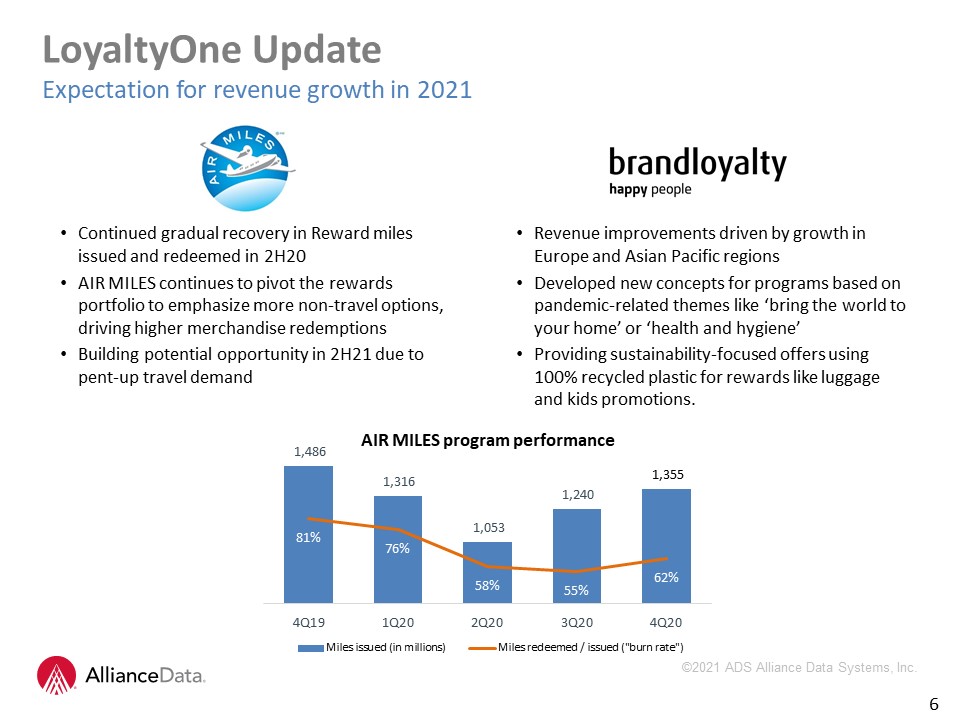

LoyaltyOne UpdateExpectation for revenue growth in 2021 Continued gradual recovery in Reward miles

issued and redeemed in 2H20AIR MILES continues to pivot the rewards portfolio to emphasize more non-travel options, driving higher merchandise redemptionsBuilding potential opportunity in 2H21 due to pent-up travel demand 6 AIR MILES program

performance Revenue improvements driven by growth in Europe and Asian Pacific regionsDeveloped new concepts for programs based on pandemic-related themes like ‘bring the world to your home’ or ‘health and hygiene’Providing

sustainability-focused offers using 100% recycled plastic for rewards like luggage and kids promotions.

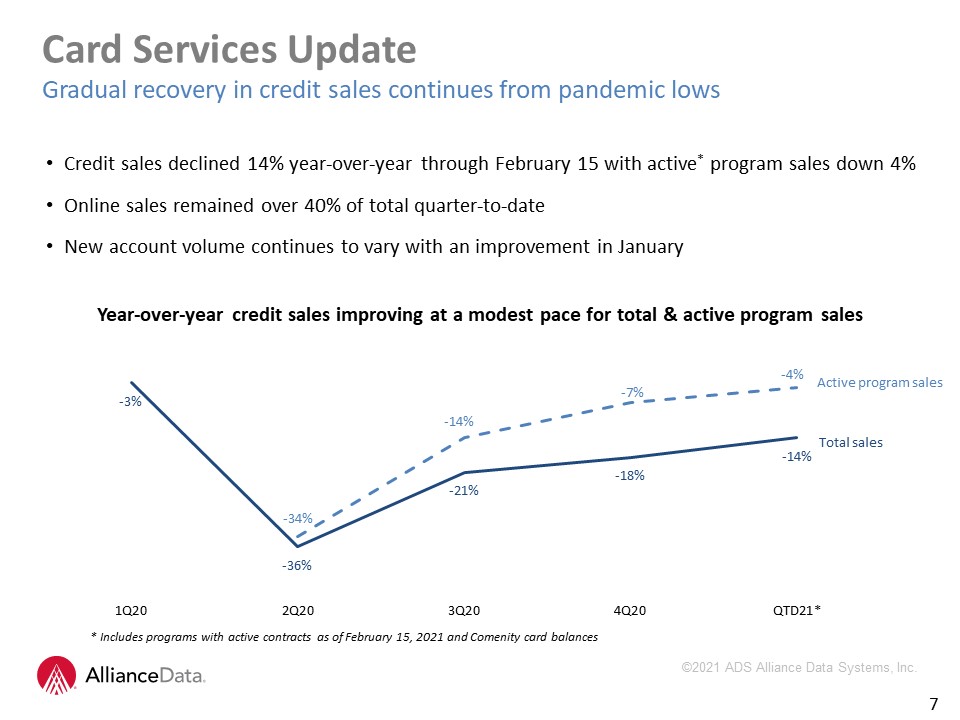

Card Services Update Gradual recovery in credit sales continues from pandemic lows 7 Active program

sales Total sales Year-over-year credit sales improving at a modest pace for total & active program sales Credit sales declined 14% year-over-year through February 15 with active* program sales down 4%Online sales remained over 40% of

total quarter-to-dateNew account volume continues to vary with an improvement in January * Includes programs with active contracts as of February 15, 2021 and Comenity card balances

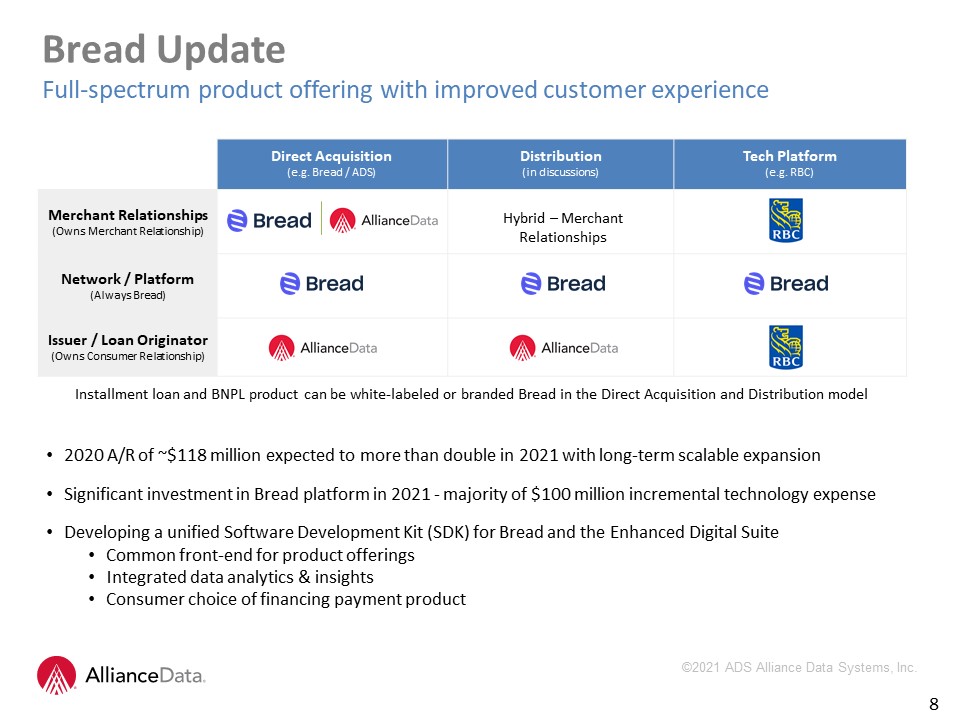

Bread UpdateFull-spectrum product offering with improved customer experience 8 Installment loan and

BNPL product can be white-labeled or branded Bread in the Direct Acquisition and Distribution model Direct Acquisition(e.g. Bread / ADS) Distribution(in discussions) Tech Platform(e.g. RBC) Merchant Relationships(Owns Merchant

Relationship) Network / Platform(Always Bread) Issuer / Loan Originator(Owns Consumer Relationship) Hybrid – Merchant Relationships 2020 A/R of ~$118 million expected to more than double in 2021 with long-term scalable

expansionSignificant investment in Bread platform in 2021 - majority of $100 million incremental technology expenseDeveloping a unified Software Development Kit (SDK) for Bread and the Enhanced Digital Suite Common front-end for product

offerings Integrated data analytics & insights Consumer choice of financing payment product

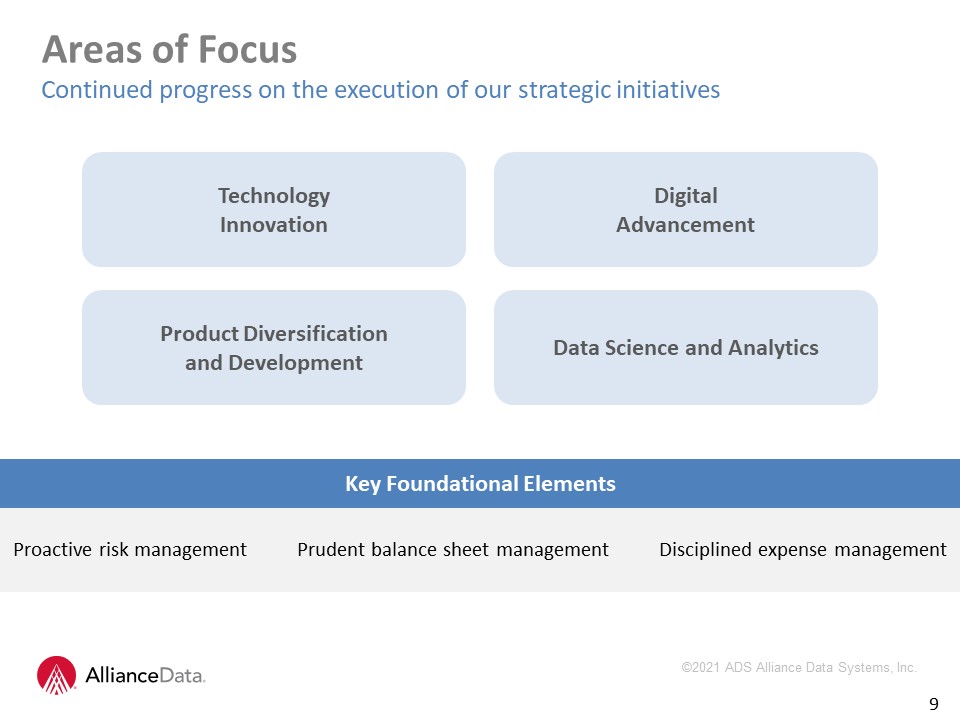

9 Areas of FocusContinued progress on the execution of our strategic initiatives

TechnologyInnovation Product Diversification and Development DigitalAdvancement Data Science and Analytics Proactive risk management Prudent balance sheet management Disciplined expense management Key Foundational Elements

Tammy McConnaughey EVP, Card Services Operations & Credit Risk

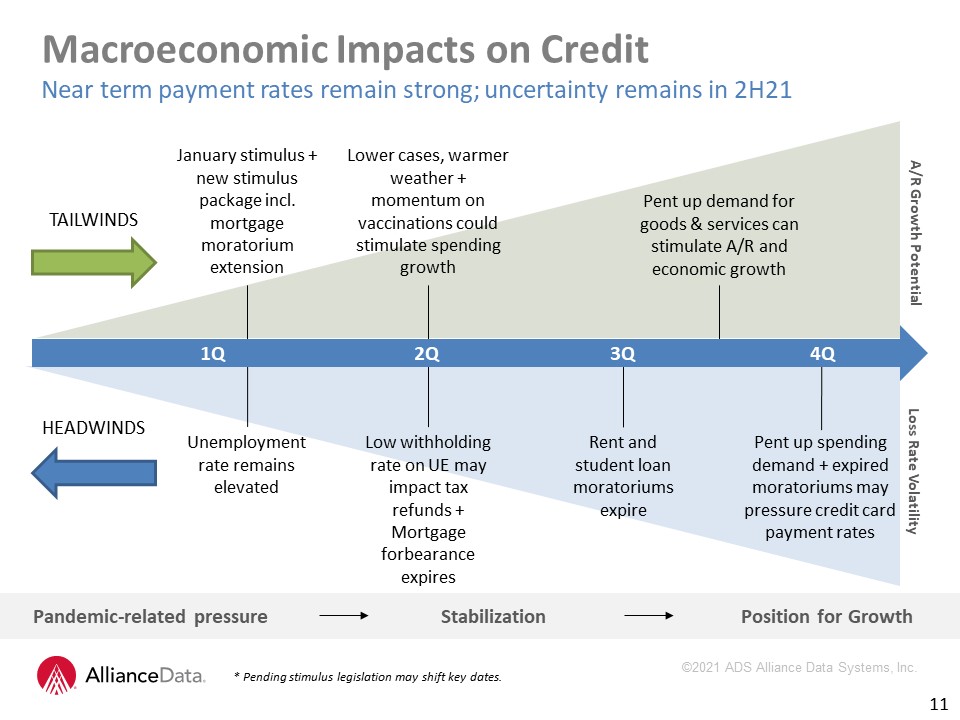

11 Macroeconomic Impacts on CreditNear term payment rates remain strong; uncertainty remains in

2H21 Position for Growth Stabilization Unemployment rate remains elevated Low withholding rate on UE may impact tax refunds +Mortgage forbearance expires January stimulus + new stimulus package incl. mortgage moratorium

extension 2021 Pandemic-related pressure TAILWINDS HEADWINDS Lower cases, warmer weather + momentum on vaccinations could stimulate spending growth Rent and student loan moratoriums expire Pent up spending demand + expired

moratoriums may pressure credit card payment rates Pent up demand for goods & services can stimulate A/R and economic growth Loss Rate Volatility A/R Growth Potential 1Q 2Q 3Q 4Q * Pending stimulus legislation may shift key

dates.

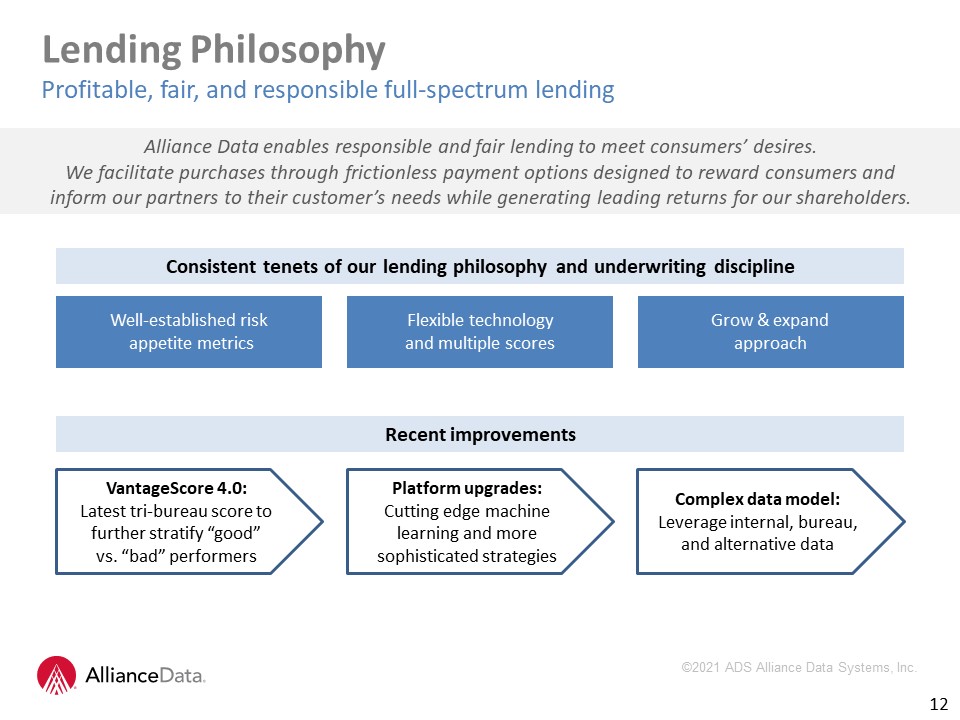

12 Lending PhilosophyProfitable, fair, and responsible full-spectrum lending Alliance Data enables

responsible and fair lending to meet consumers’ desires. We facilitate purchases through frictionless payment options designed to reward consumers and inform our partners to their customer’s needs while generating leading returns for our

shareholders. Platform upgrades:Cutting edge machine learning and more sophisticated strategies VantageScore 4.0:Latest tri-bureau score to further stratify “good” vs. “bad” performers Complex data model:Leverage internal, bureau, and

alternative data Recent improvements Flexible technology and multiple scores Consistent tenets of our lending philosophy and underwriting discipline Well-established risk appetite metrics Grow & expand approach

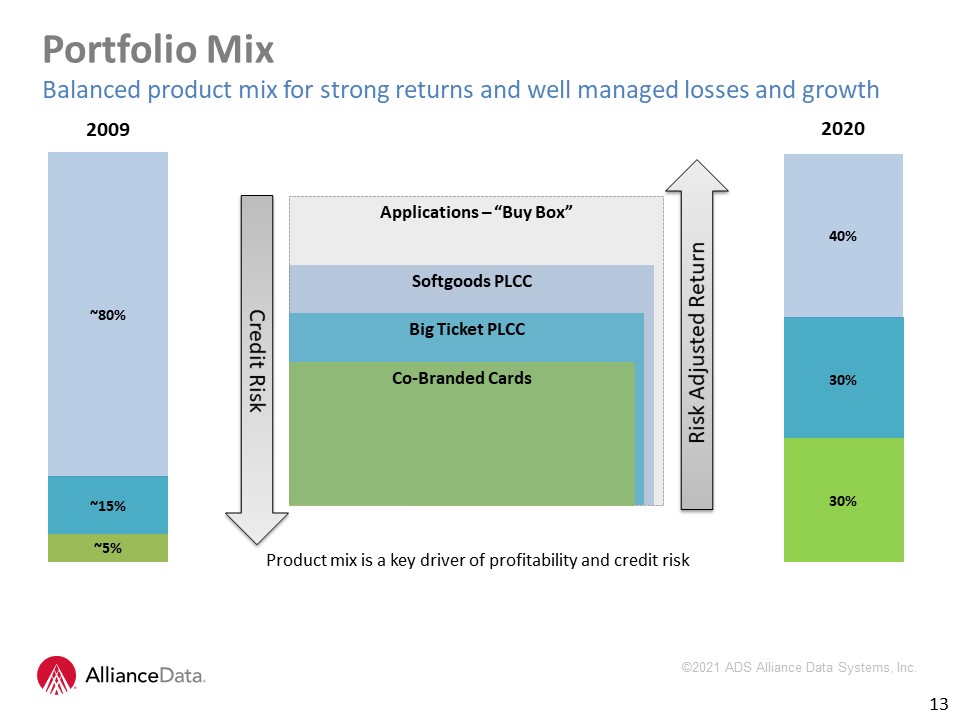

Portfolio MixBalanced product mix for strong returns and well managed losses and growth 13 Applications

– “Buy Box” Softgoods PLCC Big Ticket PLCC Co-Branded Cards Credit Risk ~5% ~15% ~80% 2009 2020 Product mix is a key driver of profitability and credit risk Risk Adjusted Return 30% 40% 30%

Questions & Answers