Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InterDigital, Inc. | brhc10015411_8k.htm |

Exhibit 99.1

© 2020 InterDigital, Inc. All Rights Reserved. InterDigital Q3 2020 Investor Presentation

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding InterDigital, Inc.’s current beliefs, plans and expectations, as to: (i) future results, projections and trends; (ii) our strategy and

business plan; (iii) our future revenues and expenses, including our expectations with respect to full year 2020 revenues; (iv) future recurring revenue levels and the timelines for achieving such levels; (v) investments; (vi) partnerships,

commercial initiatives and other potential business and revenue opportunities, including through new markets; (vii) technology development timelines; (viii) future global mobile, video, IoT and consumer electronics device shipments and market

opportunities; and (ix) our plans to expand our footprint and engagement strategy. Such statements are subject to the safe harbor created by those sections.Words such as “anticipate,” “believe,” “estimate,” “expect,” “project,” “intend,”

“plan,” “forecast,” “will,” variations of any such words or similar expressions, and graphical timelines representing future estimates or events are intended to identify such forward-looking statements. Forward-looking statements are subject to

risks and uncertainties. Actual outcomes could differ materially from those expressed in or anticipated by such forward-looking statements due to a variety of factors, including, without limitation: (i) the market relevance of our technologies;

(ii) changes in the needs, availability, pricing and features of competitive technologies as well as those of strategic partners or consumers; (iii) unanticipated technical or resource difficulties or delays related to further development of

our technologies; (iv) the entry into additional patent license, patent sales or technology solutions agreements; (v) our ability to successfully identify and launch new commercial businesses; (vi) our ability to successfully identify and

expand into new markets; (vii) our ability to enter into partnerships, strategic relationships or complementary investment opportunities on acceptable terms; (viii) the accuracy of market sales projections of our licensees, changes in our

estimates of 2020 sales by our per-unit licensees, delays in payments from our licensees and related matters, in each case, including as a result of the COVID-19 pandemic; (ix) the resolution of current legal proceedings, including any awards

or judgments relating to such proceedings, additional legal proceedings, changes in the schedules or costs associated with legal proceedings or adverse rulings in such legal proceedings; (x) unanticipated costs or expenses; (xi) changes in our

strategy going forward; and (xii) changes or inaccuracies in our market projections or technology development timelines, as well as other risks and uncertainties, including those detailed in our Annual Report on Form 10-K for the year ended

December 31, 2019, and from time to time in our other Securities and Exchange Commission filings. We undertake no duty to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise, except

as may be required by applicable law, regulation or other competent legal authority. Forward-Looking Statements © 2020 InterDigital, Inc. All Rights Reserved. 2

© 2020 InterDigital, Inc. All Rights Reserved. Why InterDigital, More than Ever 3 One of the Largest

Pure Research, Innovation and Licensing Companies in the World Our Strength: Over four decades of pioneeringwireless and visual technologies innovationOur Business Model: Bring core technology to the market though substantial technical

contributions to the global standardsThe Result: Licensing access to billions of consumer electronics products, including mobile phones, TVs, set top boxes, and laptops Our Competitive Edge. One of the largest patent portfolios in the world

related to wireless and video technologies

© 2020 InterDigital, Inc. All Rights Reserved. Unquestioned Research Leadership in Wireless and Visual

Technologies 4 Contributing Technology Worldwideon Two Major Fronts ~5,000 contributions to 3GPP & IETF in past 20 years >100 leadership roles in standards, external boards and invited speaking opportunities in 2019

alone 20%+ of revenue invested in R&D since 2000 ~290 engineers, approx. 90% with advanced degrees, including 107 PhDs >100/yr contributions to video standards bodies 25+ years of experience in video compression

solutions >50/yr journal and conference papers published

© 2020 InterDigital, Inc. All Rights Reserved. In Our Labs Today 5 \ A world-class R&D lab that

drives InterDigital’s technology development and is a respected participant in international standards & industry activities 5G & 6G Cellular StandardsMobile Edge ComputingSpectrum Sharing & Unlicensed SpectrumAdvanced Video

Standards & PlatformsImmersive and Volumetric VideoArtificial Intelligence / Machine LearningIoT Standards & PlatformsIntelligent & Autonomous VehiclesDrones / UAVs / Robotics VideoTechnology IoT

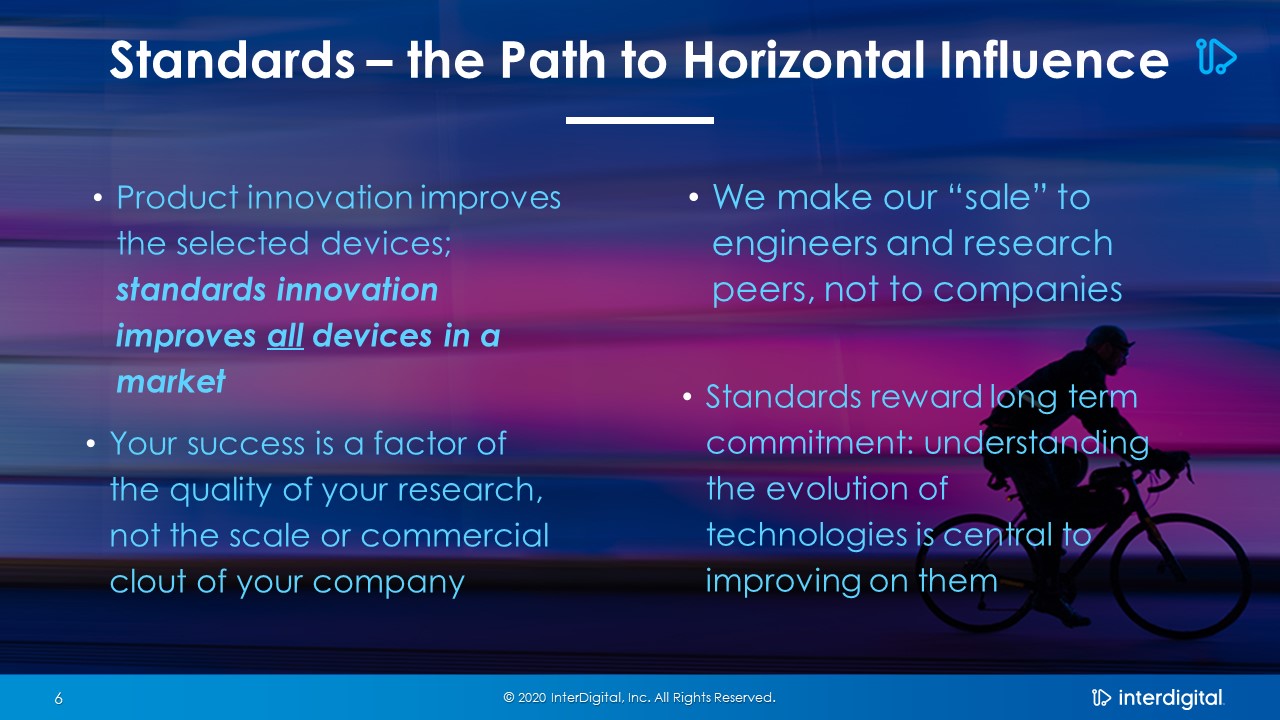

© 2020 InterDigital, Inc. All Rights Reserved. 6 Standards – the Path to Horizontal Influence Product

innovation improves the selected devices; standards innovation improves all devices in a market We make our “sale” to engineers and research peers, not to companies Your success is a factor of the quality of your research, not the scale or

commercial clout of your company Standards reward long term commitment: understanding the evolution of technologies is central to improving on them

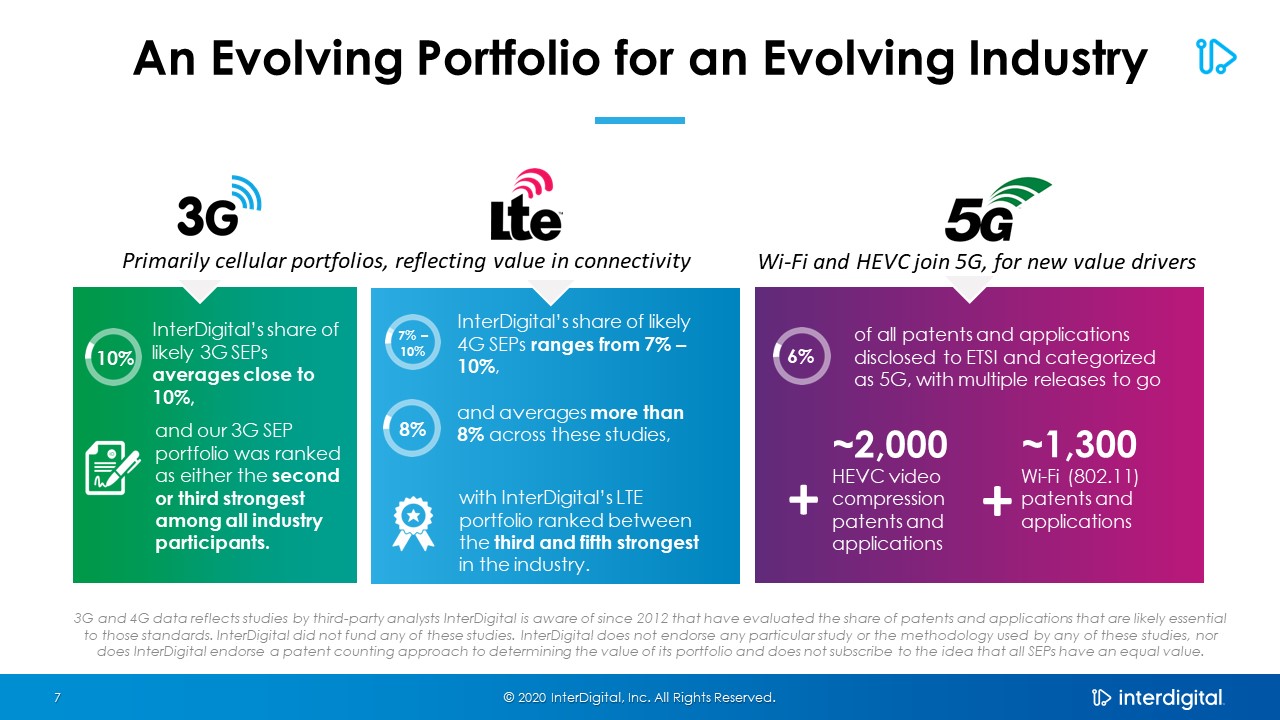

10% InterDigital’s share of likely 3G SEPs averages close to 10%, and our 3G SEP portfolio was

ranked as either the second or third strongest among all industry participants. © 2020 InterDigital, Inc. All Rights Reserved. An Evolving Portfolio for an Evolving Industry 7 7% –10% InterDigital’s share of likely 4G SEPs ranges from

7% – 10%, and averages more than 8% across these studies, with InterDigital’s LTE portfolio ranked between the third and fifth strongest in the industry. 10% InterDigital’s share of likely 3G SEPs averages close to 10%, and our 3G SEP

portfolio was ranked as either the second or third strongest among all industry participants. 7% –10% 10% 7% –10% InterDigital’s share of likely 4G SEPs ranges from 7% – 10%, and averages more than 8% across these studies, with

InterDigital’s LTE portfolio ranked between the third and fifth strongest in the industry. 3G and 4G data reflects studies by third-party analysts InterDigital is aware of since 2012 that have evaluated the share of patents and applications

that are likely essential to those standards. InterDigital did not fund any of these studies. InterDigital does not endorse any particular study or the methodology used by any of these studies, nor does InterDigital endorse a patent counting

approach to determining the value of its portfolio and does not subscribe to the idea that all SEPs have an equal value. Primarily cellular portfolios, reflecting value in connectivity Wi-Fi and HEVC join 5G, for new value

drivers 6% of all patents and applications disclosed to ETSI and categorized as 5G, with multiple releases to go ~2,000HEVC video compression patents and applications ~1,300Wi-Fi (802.11) patents and applications 8% + +

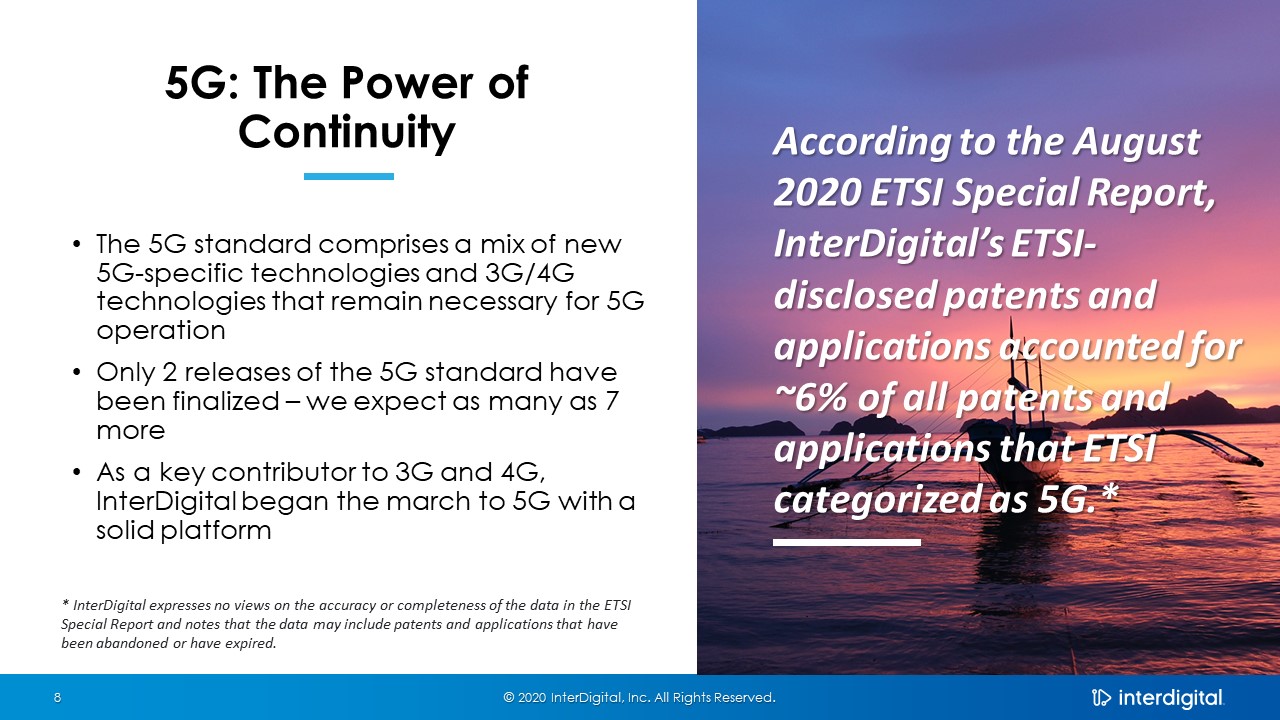

© 2020 InterDigital, Inc. All Rights Reserved. 8 5G: The Power of Continuity The 5G standard comprises

a mix of new 5G-specific technologies and 3G/4G technologies that remain necessary for 5G operationOnly 2 releases of the 5G standard have been finalized – we expect as many as 7 moreAs a key contributor to 3G and 4G, InterDigital began the

march to 5G with a solid platform * InterDigital expresses no views on the accuracy or completeness of the data in the ETSI Special Report and notes that the data may include patents and applications that have been abandoned or have

expired. According to the August 2020 ETSI Special Report, InterDigital’s ETSI-disclosed patents and applications accounted for ~6% of all patents and applications that ETSI categorized as 5G.*

© 2020 InterDigital, Inc. All Rights Reserved. A Portfolio that Combines Depth and Breadth Across

Technologies 9 The InterDigital portfolio now brings together >32,000 patent assets that show enormous strength in key wireless and video technologies but also broad diversity across the entire gamut of technology needs. Data as of

9/11/2020

A History of Long-Term Customers © 2020 InterDigital, Inc. All Rights Reserved. 10 Shipments Years

as InterDigital Licensee 10+ Years >10 others Some companies – among them Samsung, Panasonic, NEC, Kyocera and Sharp – have been customers / under license for 20+ years.Apple and Samsung have been licensed since before they started

shipping iPhones and GalaxiesEvery handset customer that has ever signed a license and remains in the industry is still a customer

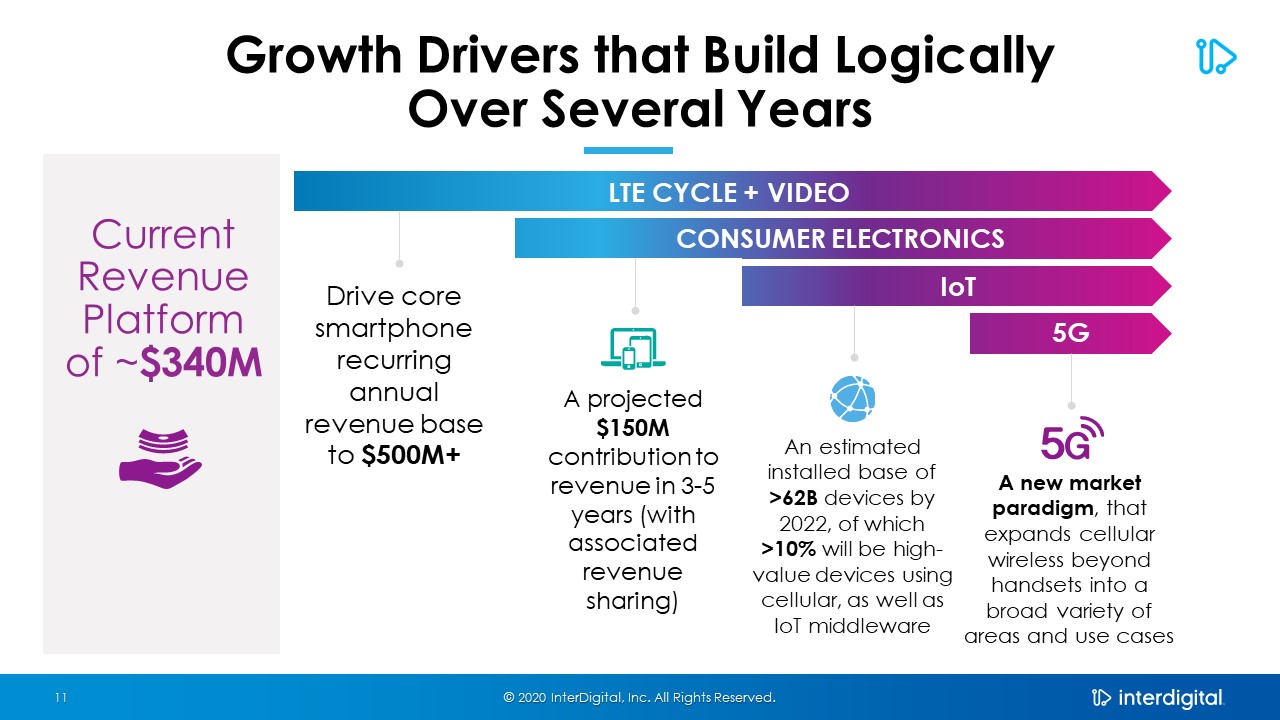

© 2020 InterDigital, Inc. All Rights Reserved. Growth Drivers that Build LogicallyOver Several

Years 11 Current Revenue Platform of ~$340M A projected $150M contribution to revenue in 3-5 years (with associated revenue sharing) An estimated installed base of >62B devices by 2022, of which >10% will be high-value devices

using cellular, as well as IoT middleware A new market paradigm, that expands cellular wireless beyond handsets into a broad variety of areas and use cases LTE CYCLE + VIDEO CONSUMER ELECTRONICS IoT 5G Drive core

smartphone recurring annual revenue base to $500M+

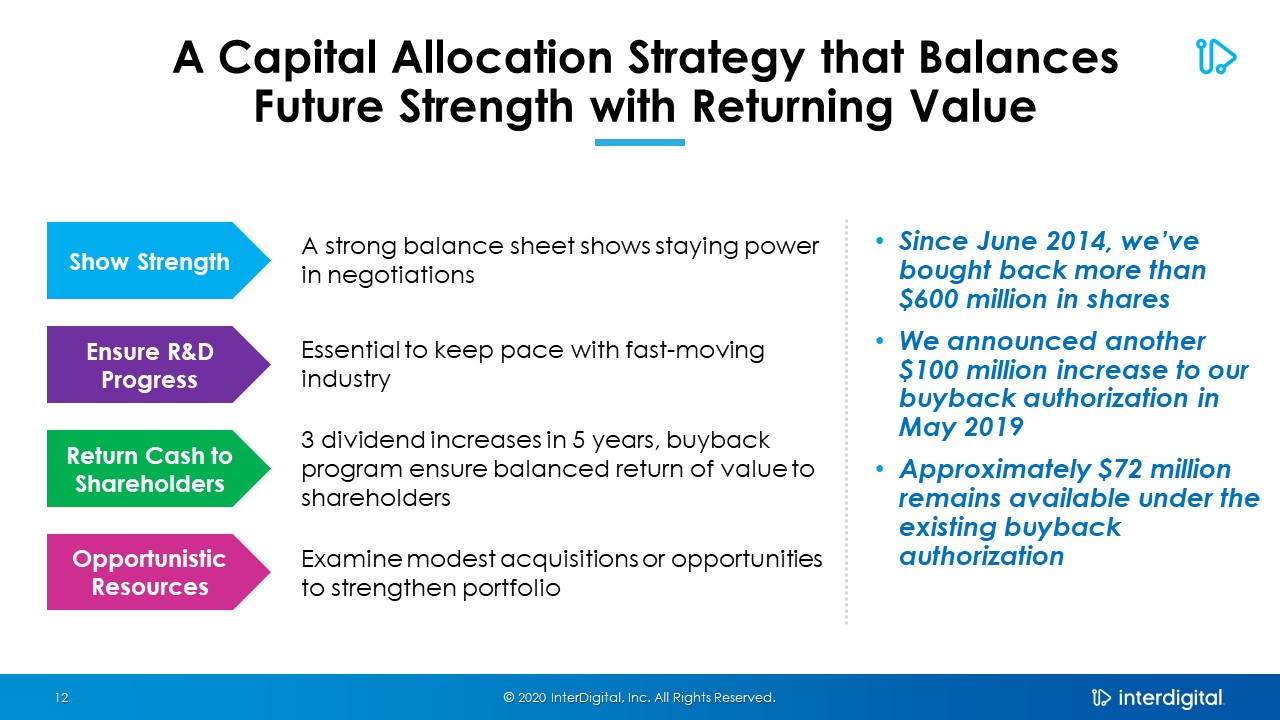

© 2020 InterDigital, Inc. All Rights Reserved. 12 Since June 2014, we’ve bought back more than $600

million in sharesWe announced another $100 million increase to our buyback authorization in May 2019Approximately $72 million remains available under the existing buyback authorization A Capital Allocation Strategy that Balances Future

Strength with Returning Value Show Strength Ensure R&D Progress Return Cash to Shareholders Opportunistic Resources A strong balance sheet shows staying power in negotiations Essential to keep pace with fast-moving industry 3

dividend increases in 5 years, buyback program ensure balanced return of value to shareholders Examine modest acquisitions or opportunities to strengthen portfolio

© 2020 InterDigital, Inc. All Rights Reserved.