Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - MassRoots, Inc. | ea126477-8k_massroots.htm |

| EX-10.2 - FORM OF SEPTEMBER NOTE - MassRoots, Inc. | ea126477ex10-2_massroots.htm |

| EX-10.1 - FORM OF NOTES - MassRoots, Inc. | ea126477ex10-1_massroots.htm |

Exhibit 99.1

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 1 OTC: MSRT SEPTEMBER 2020 INVESTOR UPDATE

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 2 SAFE HARBOR STATEMENT This presentation is being provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any of MassRoots, Inc.’s (the “Company” or “MassRoots”) securities. This presentation is not intended, nor should it be distributed, for advertising purposes, nor is it intended for broadcast or publication to the general public. Any such offer of the Company’s securities will only be made in compliance with applicable state and federal securities laws pursuant to a prospectus or an offering memorandum and related offering documents which will be provided to qualified prospective investors upon request. This presentation contains certain forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are identified by the use of the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions that are intended to identify forward - looking statements. All forward - looking statements speak only as of the date of this presentation. You should not place undue reliance on these forward - looking statements. Although we believe that our plans, objectives, expectations and intentions reflected in or suggested by the forward - looking statements are reasonable, we can give no assurance that these plans, objectives, expectations or intentions will be achieved. Forward - looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from historical experience and present expectations or projections. Actual results may differ materially from those in the forward - looking statements and the trading price for our common stock may fluctuate significantly. Forward - looking statements also are affected by the risk factors described in our filings with the U.S. Securities and Exchange Commission. Except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 3 We are a widely - recognized brand with a significant following across multiple platforms: ● 387,000 Followers on Instagram; ● 265,000 Subscribers on YouTube; ● 920,000 Opt - In Email Subscribers; ● 172,500 Followers on Twitter; and ● 200,000+ Monthly Website Visitors. MASSROOTS IS A MEDIA COMPANY FOCUSED ON THE CANNABIS INDUSTRY

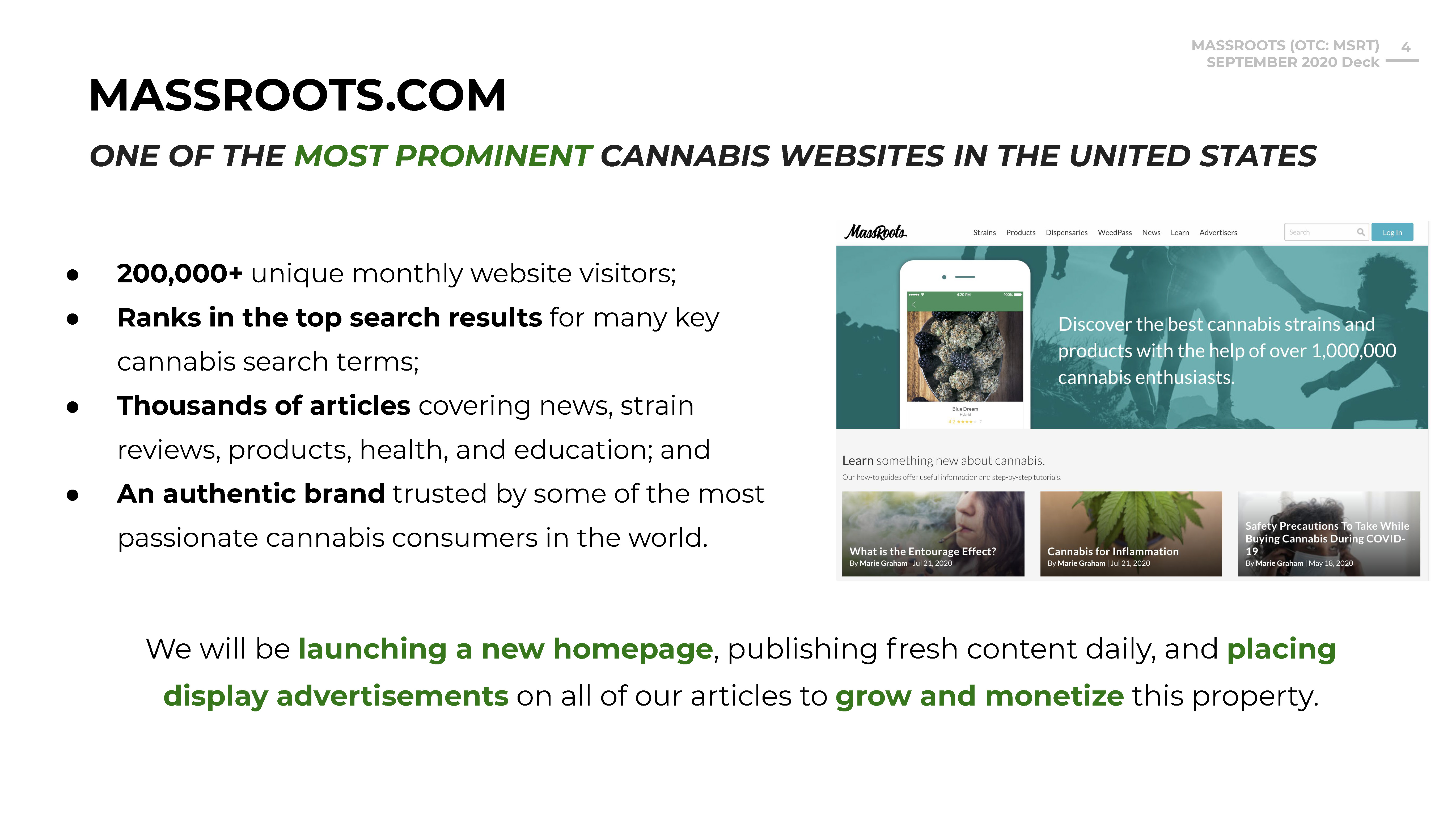

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 4 ● 200,000+ unique monthly website visitors; ● Ranks in the top search results for many key cannabis search terms; ● Thousands of articles covering news, strain reviews, products, health, and education; and ● An authentic brand trusted by some of the most passionate cannabis consumers in the world. We will be launching a new homepage , publishing fresh content daily, and placing display advertisements on all of our articles to grow and monetize this property. MASSROOTS.COM ONE OF THE MOST PROMINENT CANNABIS WEBSITES IN THE UNITED STATES

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 5 MASSROOTS HAS ONE OF THE LEADING CANNABIS CHANNELS ● 18.2+ million video views; ● 265,000 subscribers; and ● Our videos are ranked in the top search results for many key cannabis - related terms. YOUTUBE CHANNEL We are publishing fresh content on a weekly - basis , charging brands for product - placement in videos, and are planning to place Google Ads on our videos to grow and monetize this channel.

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 6 SOCIAL MEDIA AND EMAIL NEWSLETTER INSTAGRAM TWITTER EMAIL NEWSLETTER ● 390,000 followers; ● Highly - engaged audience; and ● Relationships with many of the most widely - followed cannabis influencers. We have significantly lowered the costs associated with operating these channels by having content remotely - produced. MassRoots plans to charge brands for product - placement , display advertising , and daily - deal newsletters to monetize these channels. ● 172,500 followers; ● Verified by Twitter; and ● Have been retweeted and followed by numerous news organizations and celebrities. ● 920,000 opt - in email subscribers; ● Above - average open and click - through rates; and ● Is one of the largest email newsletters in the industry.

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 7 For much of our history, MassRoots has focused on building a technology platform for the cannabis industry. As part of our marketing strategy, we garnered a significant following across web, social media, and email channels that was highly successful at driving users to our platform. While our long - term goal remains building the leading technology platform for the cannabis industry, we believe it will likely take significant capital to do so . Therefore, we believe it’s in the best interests of our shareholders to focus on monetizing our existing media channels over the coming months with the goal of generating positive cash - flows from operations. OUR GOAL IS TO GENERATE POSITIVE CASH - FLOWS FROM OPERATIONS

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 8 During the week of September 21, 2020, the House of Representatives is scheduled to vote on the Marijuana Opportunity Reinvestment and Expungement Act (“MORE Act”), which, if passed, would legalize cannabis at the federal level . In May 2020, the House of Representatives passed the Secure and Fair Enforcement Banking Act (“SAFE Banking Act”) as part of their Coronavirus Stimulus Package, in addition to passing it as a stand - alone bill. We believe the passage of one or both of these bills would eliminate the industry’s strongest headwinds and could: ● Lead to national, well - capitalized banks accepting and making traditional loans to cannabis companies; ● Enable dispensaries and ancillary brands to accept credit cards as a form of payment ; ● Permit cannabis companies with U.S. operations to list on national exchanges ; and ● Improve the perception of the cannabis industry amongst investors in a meaningful way. If the SAFE Banking Act and/or MORE Act becomes law, we believe there will likely be an influx of capital into the industry which, in turn, could lead to cannabis companies substantially increasing their spending on advertising. ON THE VERGE OF POTENTIAL FEDERAL ACCEPTANCE

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 9 Our Chairman and Chief Executive Officer, Isaac Dietrich, is one of the most well - connected and seasoned executives in the regulated cannabis industry. Since founding MassRoots seven years ago, Mr. Dietrich has: ● Raised $35 million across 15+ public and private offerings; ● Built a base of 30,000+ shareholders and garnered widespread support for multiple shareholder votes and proxy proposals; ● Led the Company through numerous challenges, refinancings, and high - pressure situations; ● Earned MassRoots coverage by CNBC, CNN, Financial Times, Wall Street Journal, New York Times, Reuters, Associated Press, and Forbes. CORPORATE LEADERSHIP MassRoots’ leadership is focused on growing revenues from its existing media channels with the goal of generating positive cash - flows from operations . If successful, we believe MassRoots could become one of the greatest comeback stories in the cannabis space and we believe Mr. Dietrich is uniquely qualified to get it done.

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 10 We have taken significant action that we believe will benefit all of MassRoots’ shareholders in the long - run : ● Built a distributed, remote content production and sales organization that has significantly reduced our operating costs ; ● Closed $700,000 in bridge financing in 2020 from institutional and accredited investors in addition to a $50,000 loan under the Paycheck Protection Program; ● Renegotiated terms, pricing, and balances with our key vendors in light of the COVID - 19 pandemic; and ● Adopted a plan that, we believe, could produce positive cash - flows from operations in the coming months. RECENT D E V E L O P MEN T S

MASSROOTS (OTC: MSRT) SEPTEMBER 2020 Deck 11 By focusing on monetizing our existing media channels and minimizing expenses, we believe MassRoots could generate positive cash - flows from operations in the coming months. We believe we are positioned to benefit from the likely passage of the SAFE Banking and MORE Acts and are committed to making MassRoots one of the greatest comeback stories in the cannabis industry. 2020 OUTLOOK