Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WASHINGTON FEDERAL INC | wfsl-20200722.htm |

| EX-99.1 - EX-99.1 - WASHINGTON FEDERAL INC | exhibit991june2020earn.htm |

| EX-99.2 - EX-99.2 - WASHINGTON FEDERAL INC | exhibit992june2020fact.htm |

July 2020 Earnings Release Supplemental Information 1

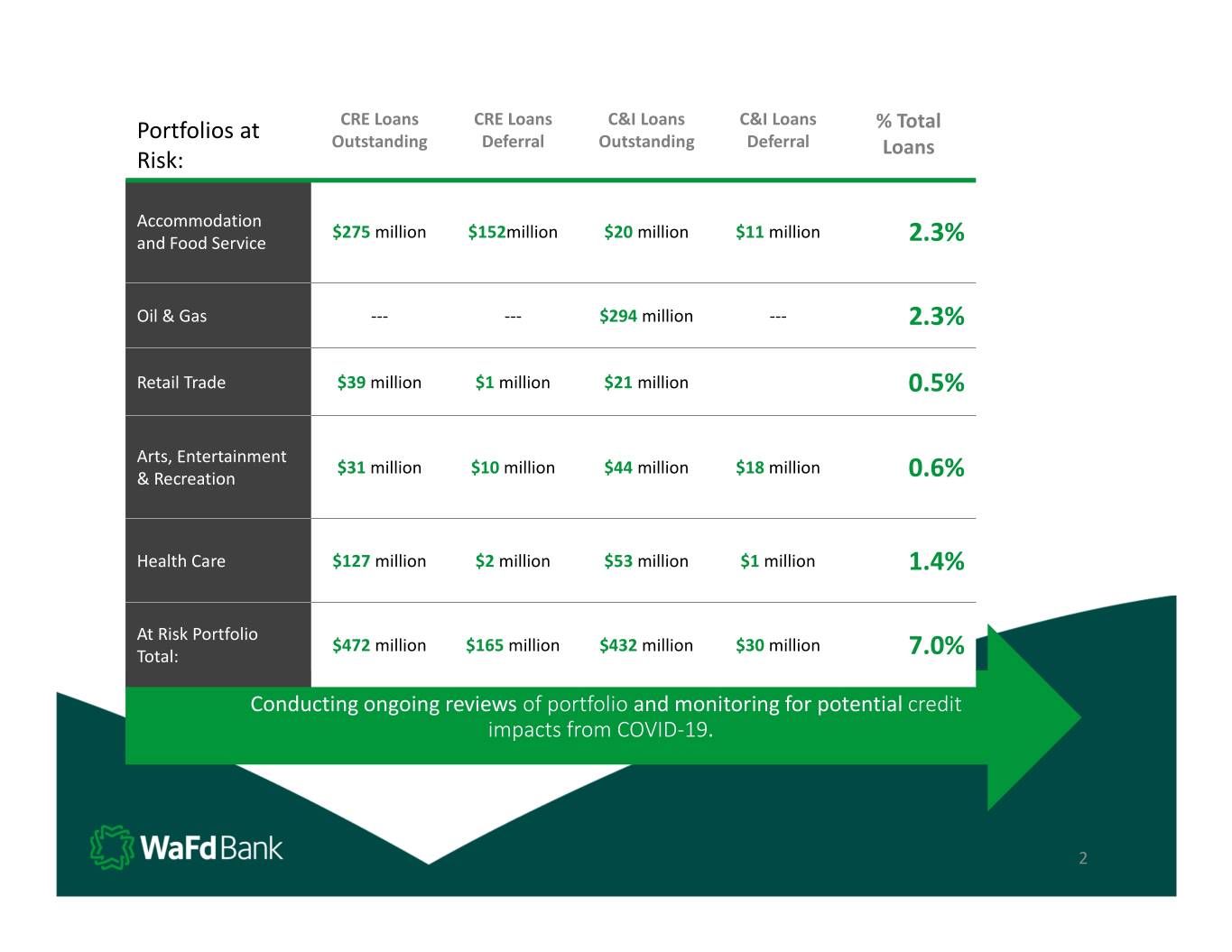

Portfolios at CRE Loans CRE Loans C&I Loans C&I Loans % Total Outstanding Deferral Outstanding Deferral Loans Risk: Accommodation $275 million $152 million $20 million $11 million and Food Service 2.3% Oil & Gas --- --- $294 million --- 2.3% Retail Trade $39 million $1 million $21 million 0.5% Arts, Entertainment $31 million $10 million $44 million $18 million & Recreation 0.6% Health Care $127 million $2 million $53 million $1 million 1.4% At Risk Portfolio $472 million $165 million $432 million $30 million Total: 7.0% Conducting ongoing reviews of portfolio and monitoring for potential credit impacts from COVID-19 . 2

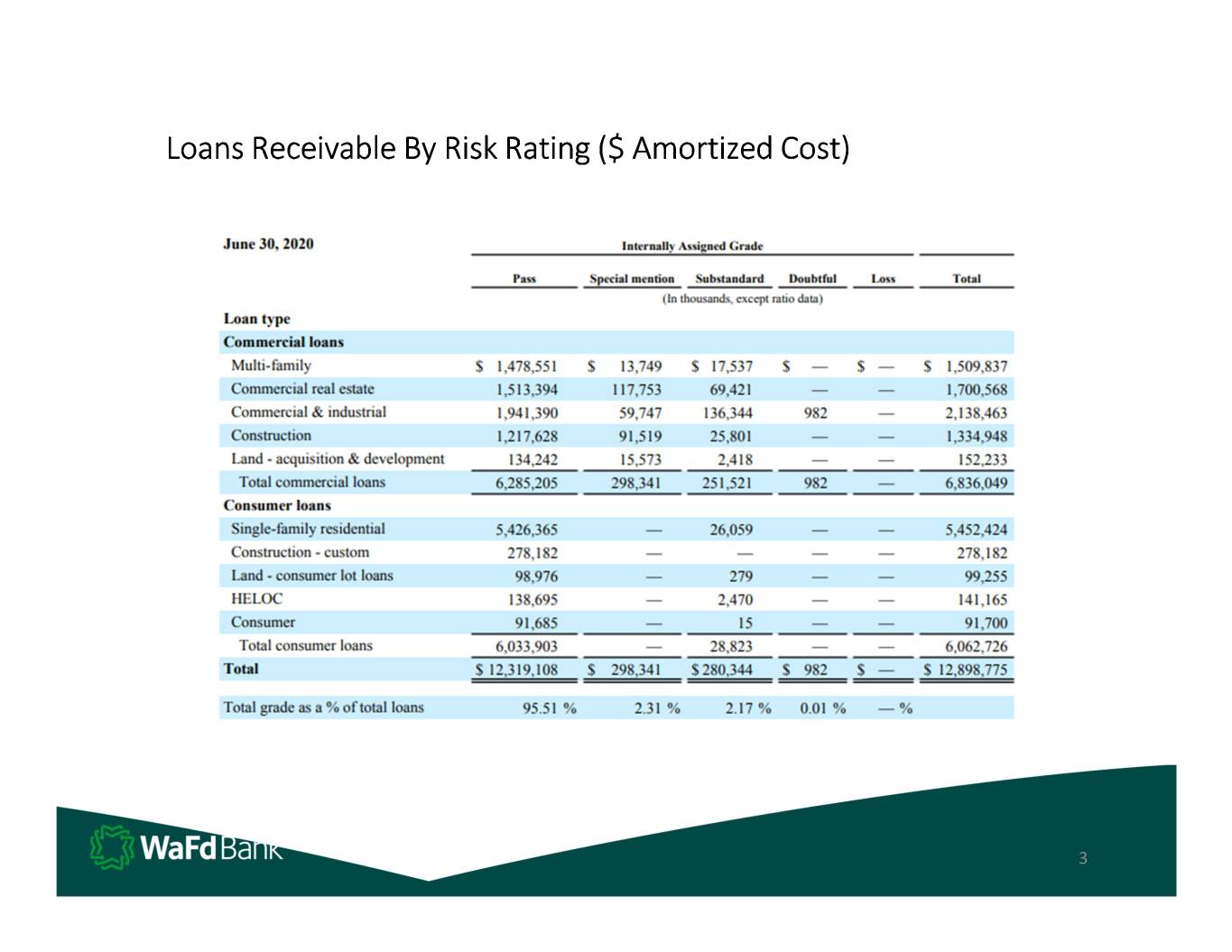

Loans Receivable By Risk Rating ($ Amortized Cost) 3

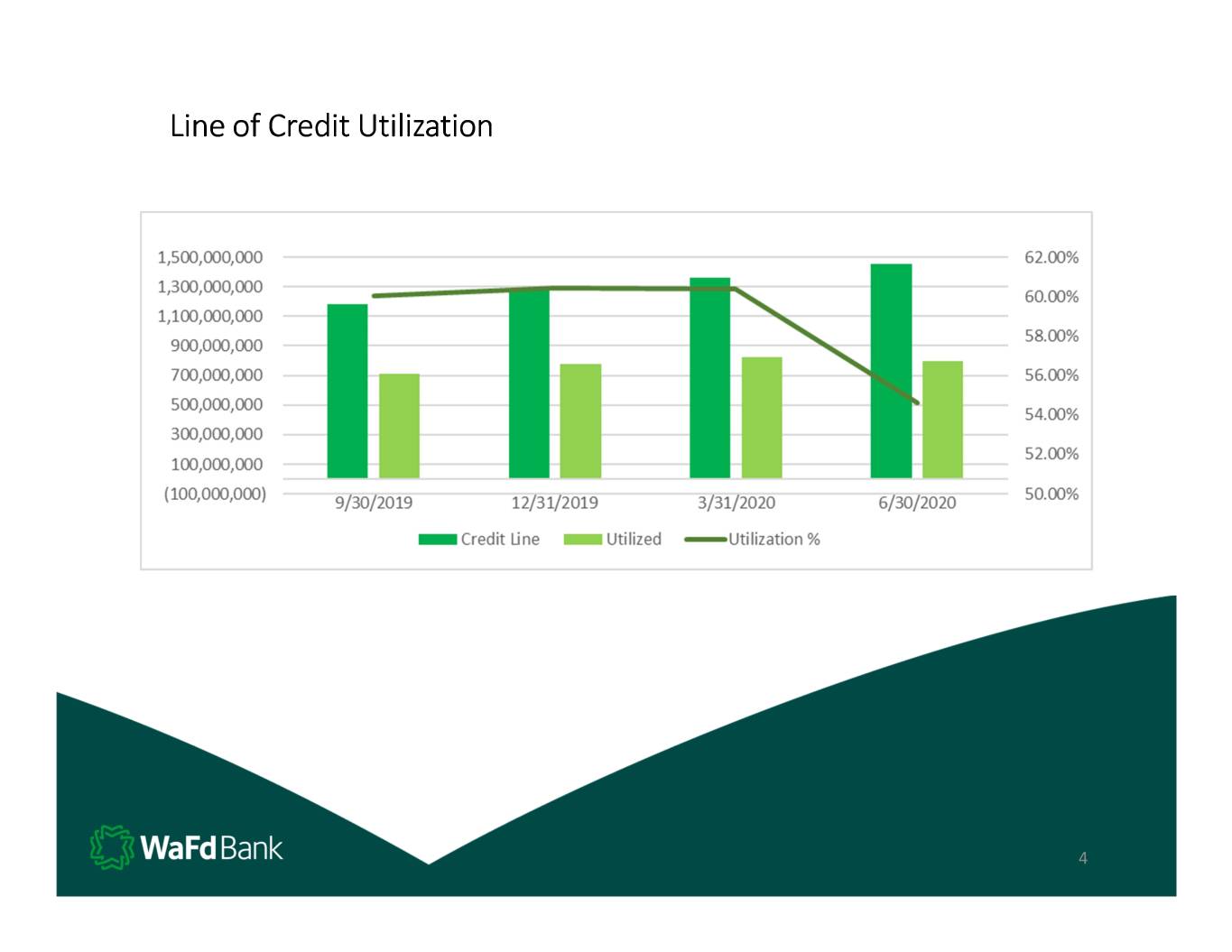

Line of Credit Utilization 4

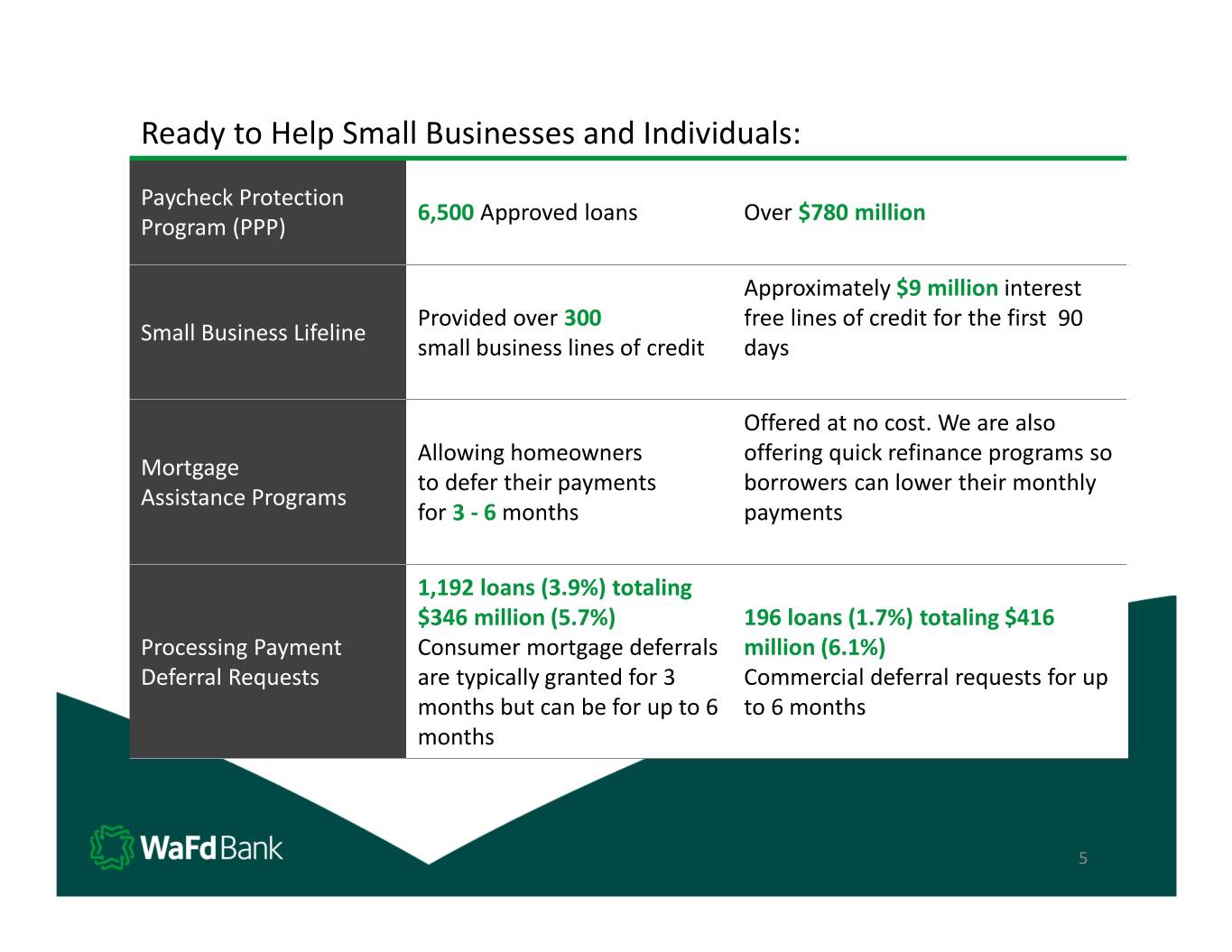

Ready to Help Small Businesses and Individuals: Paycheck Protection 6,500 Approved loans Over $780 million Program (PPP) Approximately $9 million interest Provided over 300 free lines of credit for the first 90 Small Business Lifeline small business lines of credit days Offered at no cost. We are also Allowing homeowners offering quick refinance programs so Mortgage to defer their payments borrowers can lower their monthly Assistance Programs for 3 - 6 months payments 1,192 loans (3.9%) totaling $346 million (5.7%) 196 loans (1.7%) totaling $416 Processing Payment Consumer mortgage deferrals million (6.1%) Deferral Requests are typically granted for 3 Commercial deferral requests for up months but can be for up to 6 to 6 months months 5

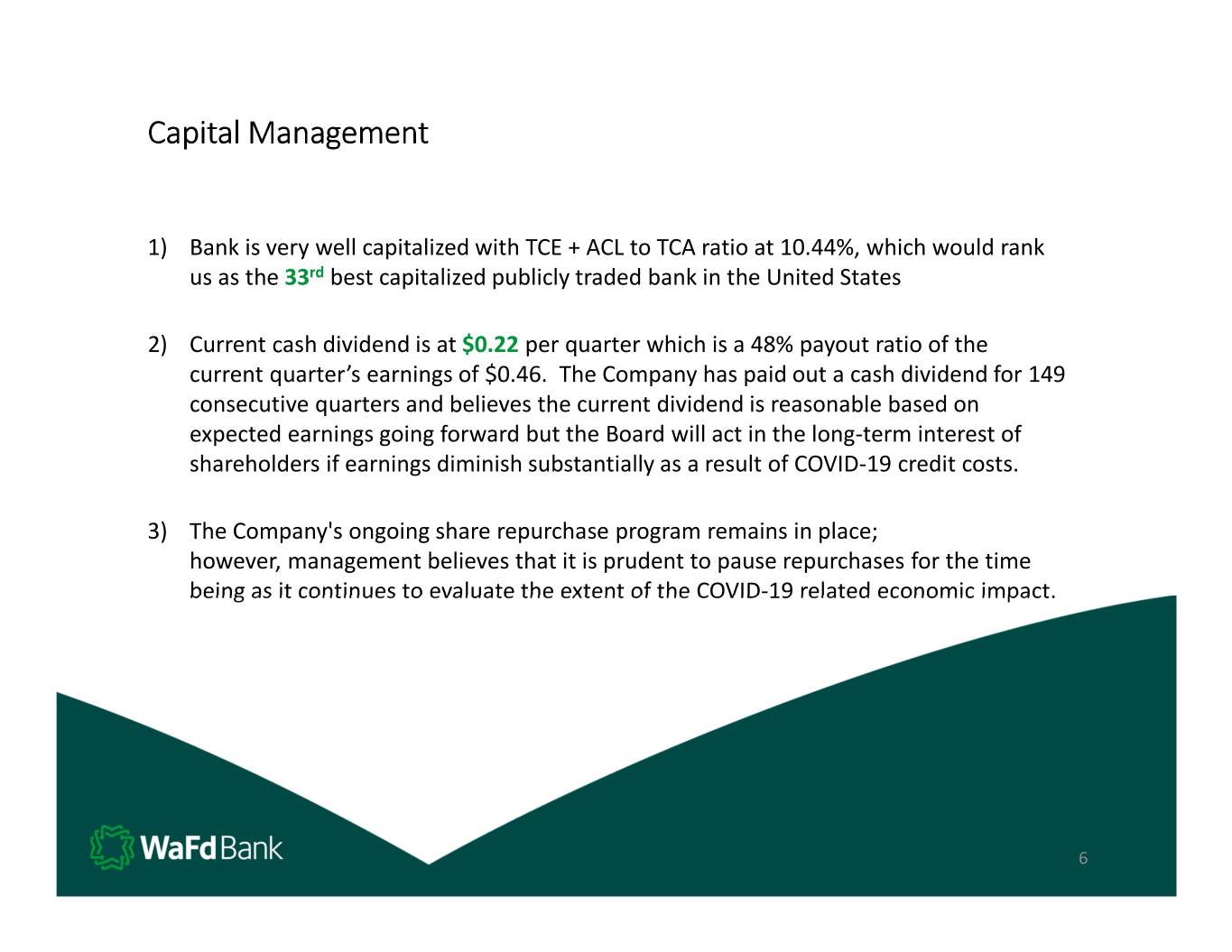

Capital Management 1) Bank is very well capitalized with TCE + ACL to TCA ratio at 10.44%, which would rank us as the 33 rd best capitalized publicly traded bank in the United States 2) Current cash dividend is at $0.22 per quarter which is a 48% payout ratio of the current quarter’s earnings of $0.46. The Company has paid out a cash dividend for 149 consecutive quarters and believes the current dividend is reasonable based on expected earnings going forward but the Board will act in the long-term interest of shareholders if earnings diminish substantially as a result of COVID-19 credit costs. 3) The Company's ongoing share repurchase program remains in place; however, management believes that it is prudent to pause repurchases for the time being as it continues to evaluate the extent of the COVID-19 related economic impact. 6

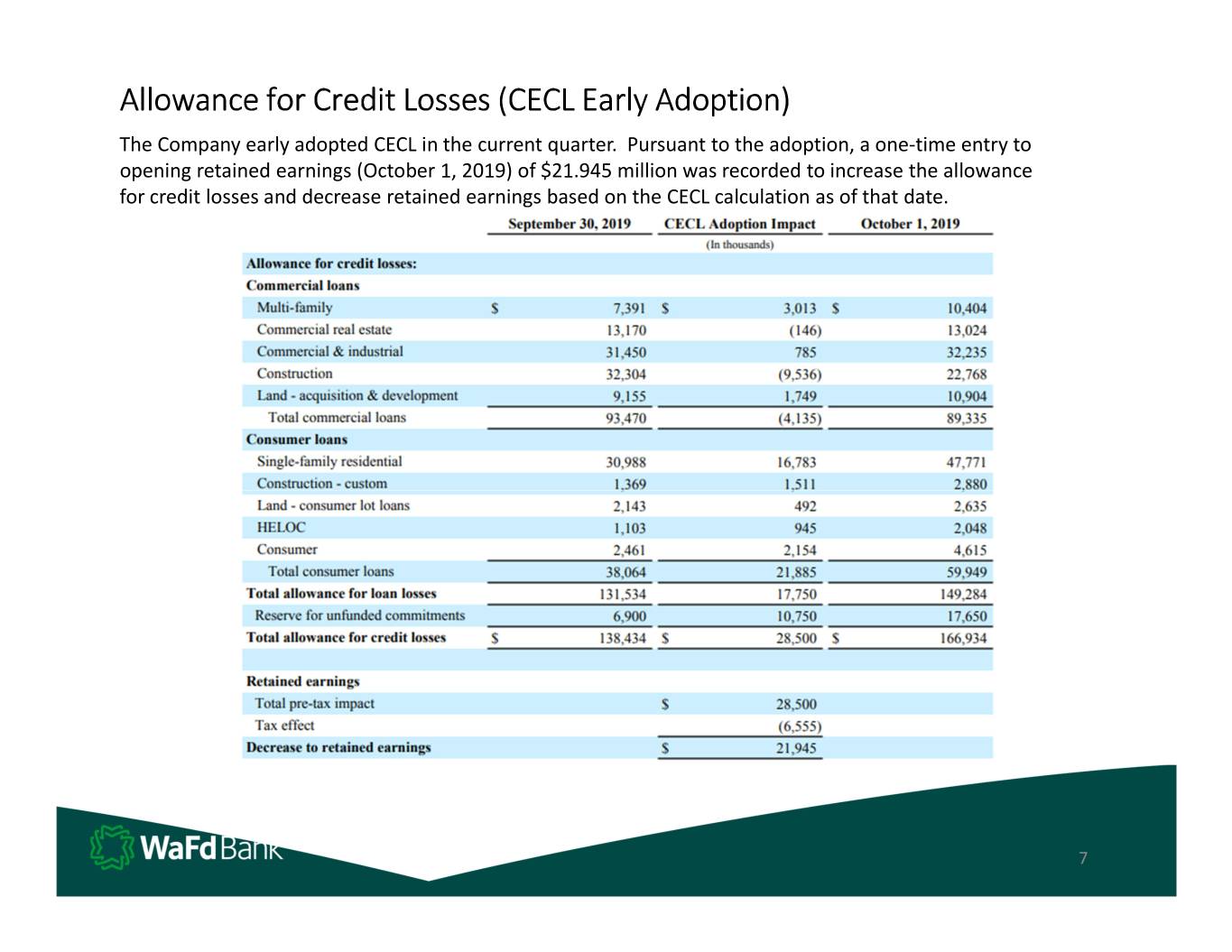

Allowance for Credit Losses (CECL Early Adoption) The Company early adopted CECL in the current quarter. Pursuant to the adoption, a one-time entry to opening retained earnings (October 1, 2019) of $21.945 million was recorded to increase the allowance for credit losses and decrease retained earnings based on the CECL calculation as of that date. 7

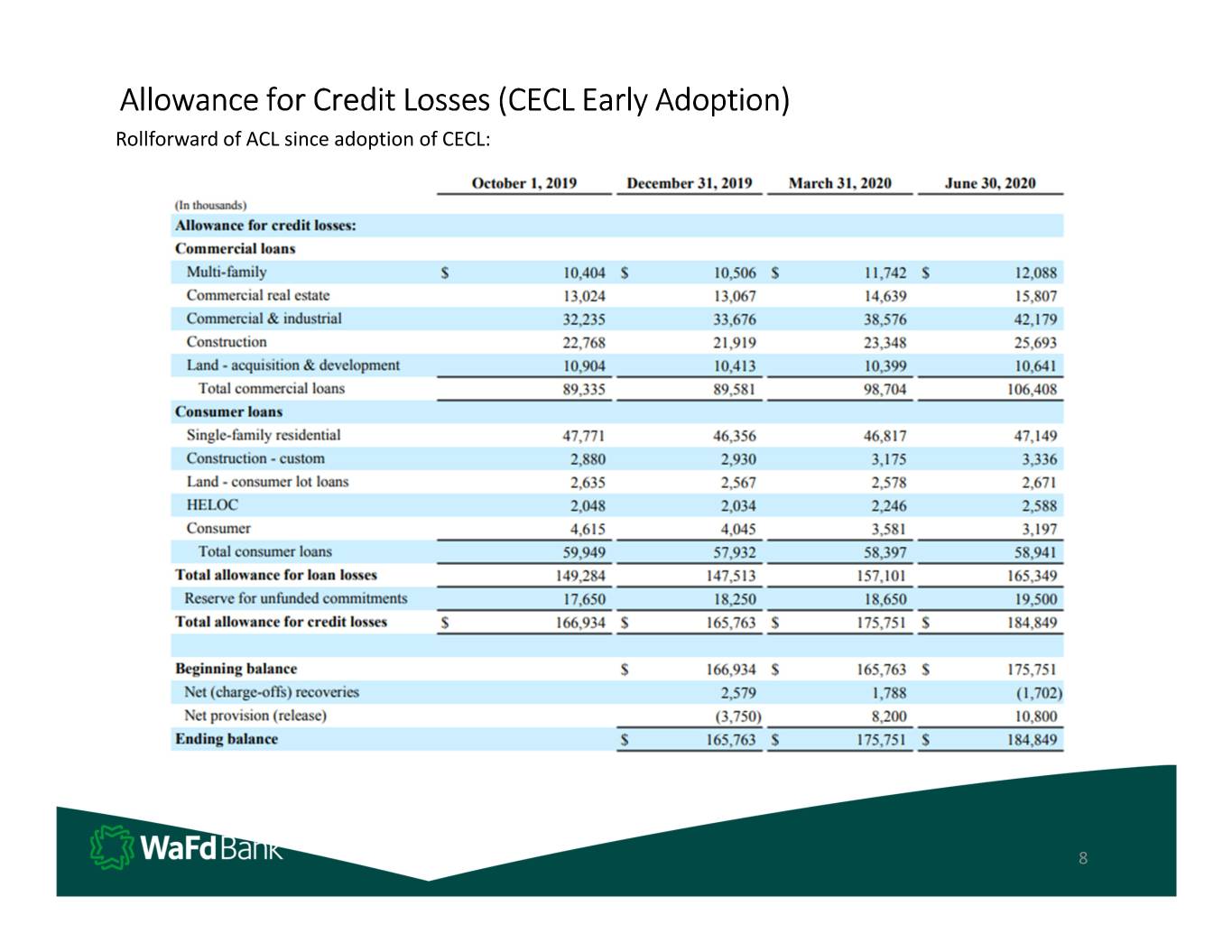

Allowance for Credit Losses (CECL Early Adoption) Rollforward of ACL since adoption of CECL: 8

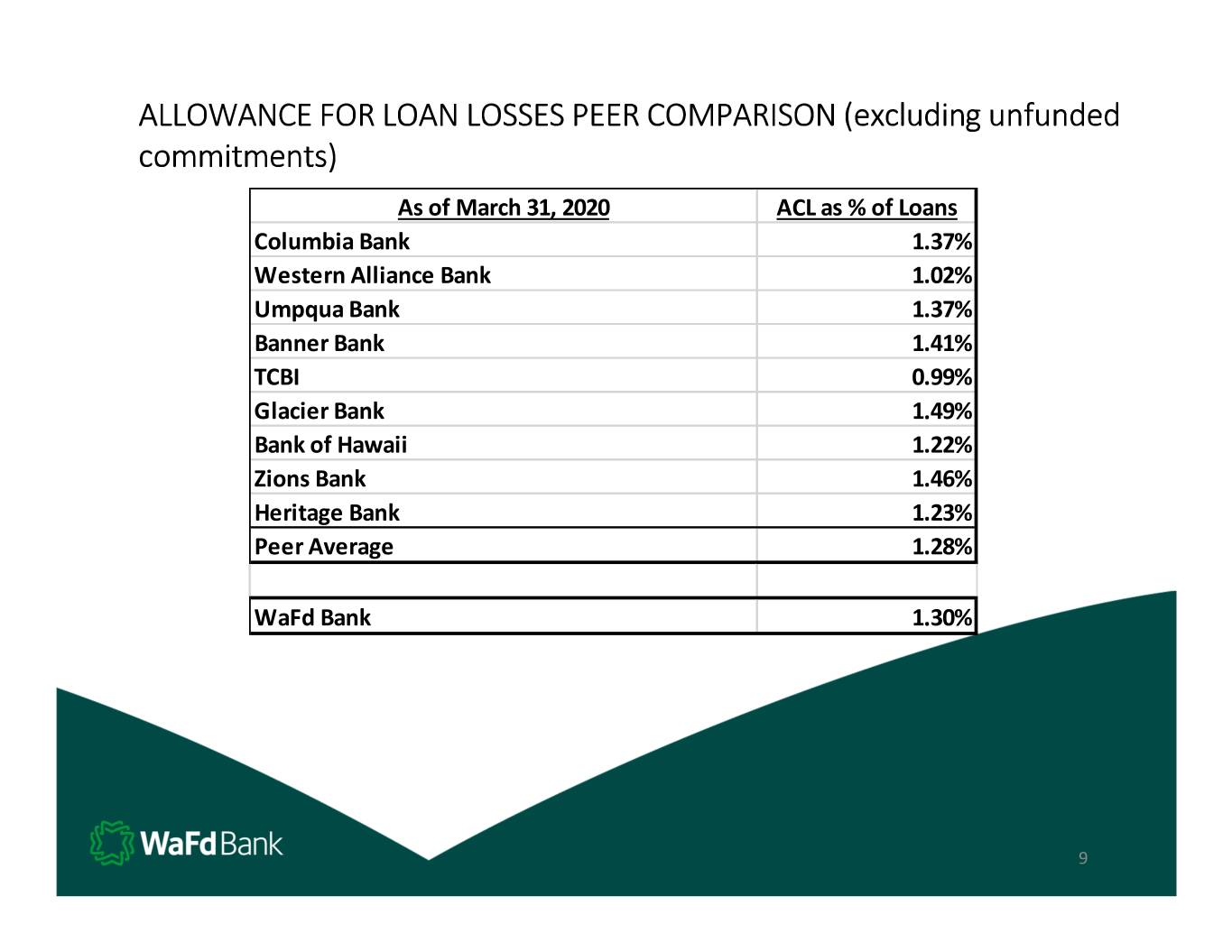

ALLOWANCE FOR LOAN LOSSES PEER COMPARISON (excluding unfunded commitments) As of March 31, 2020 ACL as % of Loans Columbia Bank 1.37% Western Alliance Bank 1.02% Umpqua Bank 1.37% Banner Bank 1.41% TCBI 0.99% Glacier Bank 1.49% Bank of Hawaii 1.22% Zions Bank 1.46% Heritage Bank 1.23% Peer Average 1.28% WaFd Bank 1.30% 9