Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIRST MIDWEST BANCORP INC | ex-99d1.htm |

| 8-K - 8-K - FIRST MIDWEST BANCORP INC | f8-k.htm |

Exhibit 99.2

| 1 Acquisition by First Midwest Bancorp, Inc. of Bridgeview Bancorp, Inc. |

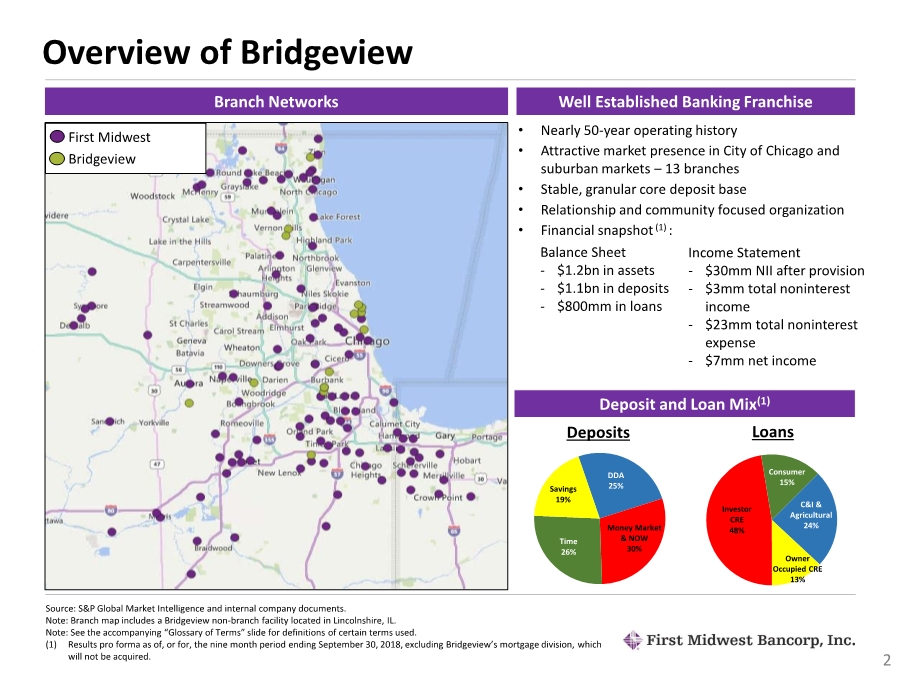

| 2 Investor CRE 48% • Nearly 50-year operating history • Attractive market presence in City of Chicago and suburban markets – 13 branches • Stable, granular core deposit base • Relationship and community focused organization • Financial snapshot (1) : Source: S&P Global Market Intelligence and internal company documents. Note: Branch map includes a Bridgeview non-branch facility located in Lincolnshire, IL. Note: See the accompanying “Glossary of Terms” slide for definitions of certain terms used. (1) Results pro forma as of, or for, the nine month period ending September 30, 2018, excluding Bridgeview’s mortgage division, which will not be acquired. First Midwest Bridgeview Well Established Banking FranchiseBranch Networks 1 Overview of Bridgeview Deposit and Loan Mix(1) Deposits Loans Time 26% Savings 19% DDA 25% Money Market & NOW 30% Owner Occupied CRE 13% C&I & Agricultural 24% Consumer 15% Balance Sheet - $1.2bn in assets - $1.1bn in deposits - $800mm in loans Income Statement - $30mm NII after provision - $3mm total noninterest income - $23mm total noninterest expense - $7mm net income |

| 3 Strategic Rationale Key Strategic Elements • Expands Chicagoland presence in attractive Cook, DuPage, Kendall, Lake and Will county marketplaces - Desirable locations within the City of Chicago - DuPage, Kendall, Lake and Will are ranked as the top 4 counties in Illinois based on median household income • Advances First Midwest to top 10 deposit market share in Chicago MSA(1) - Adds over $1bn of high-quality deposits, strengthening an existing funding base that is well- positioned for a rising rate environment - Average deposits per Bridgeview Bank branch exceeds $80mm • Complementary customer mix and relationship focus on clients and communities • Opportunity to cross-sell broader products and services • Achievable operating efficiencies through combined scale Financially Attractive • Full year EPS accretion estimated at approximately 5%, or $0.11, in 2020(2) • Tangible book value earn back of ~3 years using “crossover” or “simple” method(3) • Internal rate of return in excess of 20% • Pro forma capital ratios remain strong Low-Risk Opportunity • In-market, low-risk integration • Experienced acquiror with management and integration teams in place to facilitate a smooth transition Note: See the accompanying “Glossary of Terms” slide for definitions of certain terms used. (1) Ranking for deposit market share pro forma for any announced and pending acquisitions. (2) Based on First Midwest’s 2020 analyst consensus earnings estimates on a standalone basis. (3) “Crossover” earn back period defined as the number of years for pro forma tangible book value per share to exceed projected standalone tangible book value per share. “Simple” earn back period defined as dilution to tangible book value per share at close divided by EPS accretion in 2020. Calculations include expected transaction expenses. |

| 4 Key Transaction Terms Purchase Price • 0.2767 shares of First Midwest common stock and $1.79 in cash for each share of Bridgeview common stock(1) • $145 million implied aggregate consideration(1) Valuation Multiples(2) • ~1.3x tangible book value • Core deposit premium of 4.0%(3) • 9.4x LTM earnings including fully phased-in after-tax cost savings Transaction Assumptions • ~40% reduction in Bridgeview’s total noninterest expense base, excluding Bridgeview Bank’s mortgage division (phased-in 75% in 2019 and 100% in 2020) • Credit mark exceeds loan loss reserve as of September 30, 2018 Bridgeview Bank Mortgage Division • First Midwest will not acquire Bridgeview Bank’s mortgage division • Third-party buyer has executed an agreement to acquire the mortgage division and is in the process of completing the transaction • Mortgage division sale expected to close by December 31, 2018 Closing • Targeting Q2 2019 close, subject to regulatory approvals, Bridgeview stockholder approval and customary closing conditions Note: See the accompanying “Glossary of Terms” slide for definitions of certain terms used. (1) Subject to certain adjustments as described in the definitive agreement. (2) Based on First Midwest’s December 4, 2018 closing stock price of $22.03. (3) ~75% of Bridgeview’s deposits considered to be core. |

| 5 Glossary of Terms bn – Billion Bridgeview – Bridgeview Bancorp, Inc. C&I – Commercial and industrial Core deposits – Includes DDA, savings, money market, and NOW accounts CRE – Commercial real estate DDA – Demand deposit account EPS – Earnings per share the Company or First Midwest Bancorp, Inc. – First Midwest Bancorp, Inc. mm – Million MSA – Metropolitan statistical area NII – Net interest income NOW – Negotiable order of withdrawal deposit account |

| 6 This presentation, as well as any oral statements made by or on behalf of First Midwest, may contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those relating to First Midwest’s proposed acquisition of Bridgeview including the projected costs and benefits associated therewith and the timing thereof. Forward-looking statements are not historical facts or guarantees of future performance or outcomes, but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and events may differ, possibly materially, from the anticipated results or events indicated in these forward-looking statements. First Midwest cautions you not to place undue reliance on these statements. Forward- looking statements are made only as of the date of this presentation, and First Midwest undertakes no obligation to update any forward- looking statements to reflect new information or events or conditions after the date hereof. Forward-looking statements are subject to certain risks, uncertainties and assumptions. For a discussion of these risks, uncertainties and assumptions, please see the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in First Midwest’s annual report on Form 10-K for the year ended December 31, 2017, as well as subsequent filings made with the Securities and Exchange Commission (the “SEC”). However, these risks and uncertainties are not exhaustive. Other sections of such reports describe additional factors that could adversely impact First Midwest’s business, financial performance and pending or consummated acquisition transactions, including the proposed acquisition of Bridgeview. Projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. Forward-Looking Statements |

| 7 Additional Information The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger of First Midwest and Bridgeview, First Midwest will file a registration statement on Form S-4 with the SEC. The registration statement will include a proxy statement of Bridgeview, which also will constitute a prospectus of First Midwest, that will be sent to Bridgeview’s stockholders. Investors and stockholders are advised to read the registration statement and proxy statement/prospectus when it becomes available because it will contain important information about First Midwest, Bridgeview and the proposed transaction. When filed, this document and other documents relating to the transaction filed by First Midwest can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing First Midwest’s website at www.firstmidwest.com under the tab “Investor Relations” and then under “SEC Filings.” Alternatively, these documents can be obtained free of charge from First Midwest upon written request to First Midwest Bancorp, Inc., Attn: Corporate Secretary, 8750 West Bryn Mawr Avenue, Suite 1300, Chicago, Illinois 60631 or by calling (708) 831-7483, or from Bridgeview upon written request to Bridgeview Bancorp, Inc., Attn: William Conaghan, President and Chief Executive Officer, 4753 North Broadway, Chicago, Illinois 60640 or by calling (773) 989-5728. Participants in this Transaction First Midwest, Bridgeview and certain of their respective directors and executive officers may be deemed under the rules of the SEC to be participants in the solicitation of proxies from Bridgeview’s stockholders in connection with the proposed transaction. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about First Midwest and its directors and certain of its officers may be found in First Midwest’s definitive proxy statement relating to its 2018 Annual Meeting of Stockholders filed with the SEC on April 11, 2018 and First Midwest’s annual report on Form 10-K for the year ended December 31, 2017 filed with the SEC on February 28, 2018. The definitive proxy statement and annual report can be obtained free of charge from the SEC’s website at www.sec.gov. |