Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SCANSOURCE, INC. | a2019-q1form8xk09302018.htm |

| EX-99.1 - EXHIBIT 99.1 - SCANSOURCE, INC. | a2019-q1exhibit99109302018.htm |

Exhibit 99.2 ScanSource, Inc. CFO COMMENTARY Q1 FY2019 CFO COMMENTARY Q1 FY 2019 FINANCIAL INFORMATION AND CONFERENCE CALL Please see the accompanying earnings press release available at Q1 FY19 Results: www.scansource.com in the Investor Relations section. The information included in this CFO commentary is unaudited and should be read in NET SALES conjunction with the Company’s SEC filings on Form 10-Q for the quarter ended September 30, 2018. ScanSource will present additional information about its financial results and outlook in a conference call on $ 973 million Tuesday, November 06, 2018 at 5:00 pm ET. A webcast of the call is available and can be accessed at www.scansource.com (Investor Forecast: Relations section). The webcast will be available for replay for 60 days. $950 million to $1.01 billion FIRST QUARTER SUMMARY GAAP We had a strong start to fiscal year 2019 with operating results that DILUTED EPS included 5% net sales growth, 6% gross profit growth, and 7% non- GAAP operating income growth. Our first quarter gross profit and non- $0.56 GAAP operating income grew faster than sales. Both Worldwide Forecast: $0.56 to $0.62 segments and all of our geographic regions increased net sales year- over-year. Operating results tracked our expectations with 6.5% year- over-year organic sales growth and a gross margin of 11.5%. First NON-GAAP quarter 2019 GAAP diluted EPS increased 250% year-over-year, and DILUTED EPS non-GAAP diluted EPS increased 17% year-over-year. GAAP diluted EPS of $0.56 includes a higher than expected expense for the change $0.89 in fair value of contingent consideration for Intelisys as a result of Forecast: $0.83 to $0.89 better than expected actual results. Non-GAAP diluted EPS was at the upper end of our forecast range, and net sales were near the midpoint. Please see Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. scansource.com 1 November 06, 2018

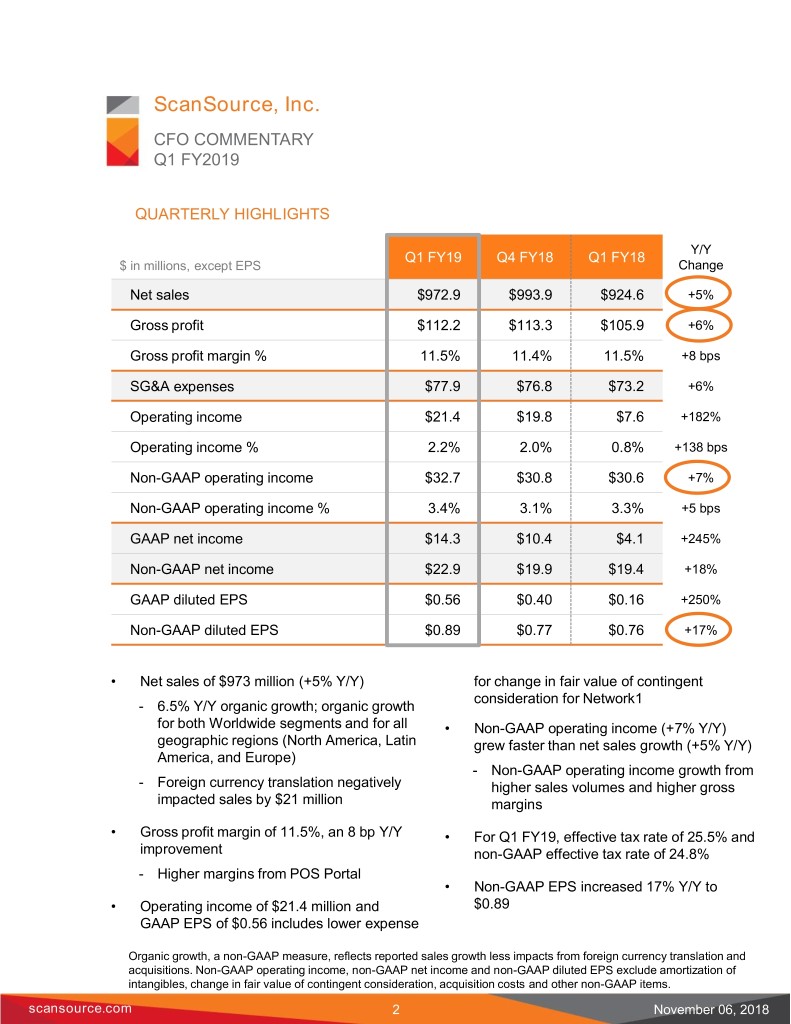

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 QUARTERLY HIGHLIGHTS Y/Y Q1 FY19 Q4 FY18 Q1 FY18 $ in millions, except EPS Change Net sales $972.9 $993.9 $924.6 +5% Gross profit $112.2 $113.3 $105.9 +6% Gross profit margin % 11.5% 11.4% 11.5% +8 bps SG&A expenses $77.9 $76.8 $73.2 +6% Operating income $21.4 $19.8 $7.6 +182% Operating income % 2.2% 2.0% 0.8% +138 bps Non-GAAP operating income $32.7 $30.8 $30.6 +7% Non-GAAP operating income % 3.4% 3.1% 3.3% +5 bps GAAP net income $14.3 $10.4 $4.1 +245% Non-GAAP net income $22.9 $19.9 $19.4 +18% GAAP diluted EPS $0.56 $0.40 $0.16 +250% Non-GAAP diluted EPS $0.89 $0.77 $0.76 +17% • Net sales of $973 million (+5% Y/Y) for change in fair value of contingent consideration for Network1 - 6.5% Y/Y organic growth; organic growth for both Worldwide segments and for all • Non-GAAP operating income (+7% Y/Y) geographic regions (North America, Latin grew faster than net sales growth (+5% Y/Y) America, and Europe) - Non-GAAP operating income growth from - Foreign currency translation negatively higher sales volumes and higher gross impacted sales by $21 million margins • Gross profit margin of 11.5%, an 8 bp Y/Y • For Q1 FY19, effective tax rate of 25.5% and improvement non-GAAP effective tax rate of 24.8% - Higher margins from POS Portal • Non-GAAP EPS increased 17% Y/Y to • Operating income of $21.4 million and $0.89 GAAP EPS of $0.56 includes lower expense Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and acquisitions. Non-GAAP operating income, non-GAAP net income and non-GAAP diluted EPS exclude amortization of intangibles, change in fair value of contingent consideration, acquisition costs and other non-GAAP items. scansource.com 2 November 06, 2018

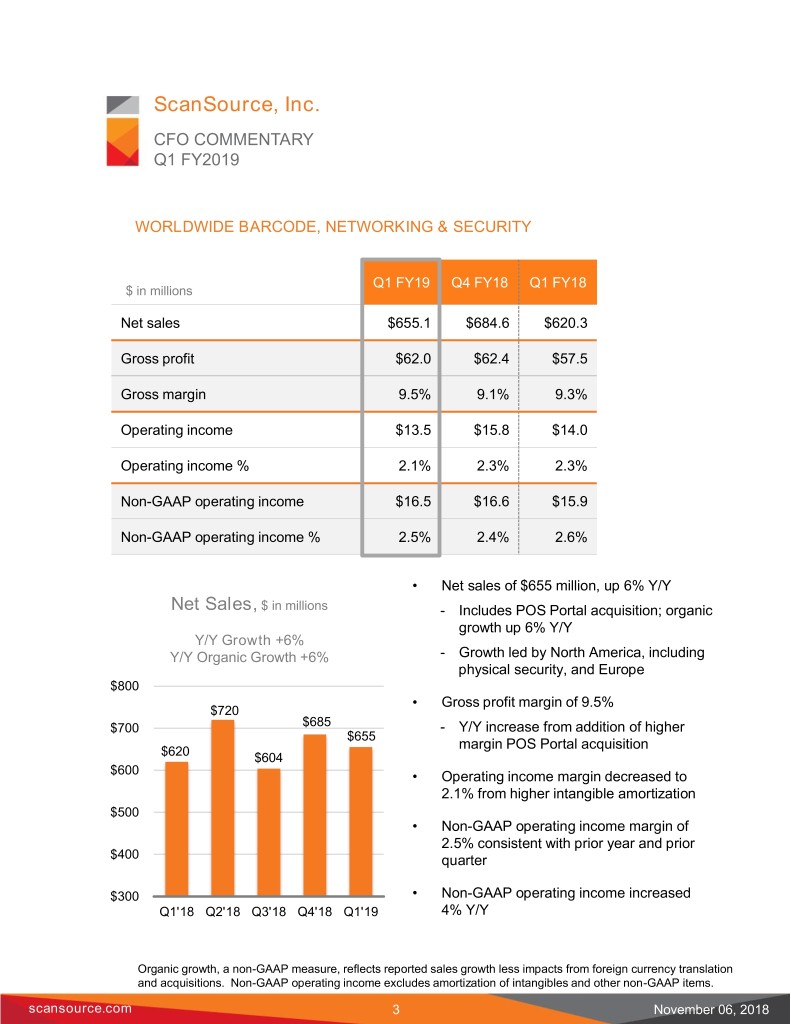

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 WORLDWIDE BARCODE, NETWORKING & SECURITY Q1 FY19 Q4 FY18 Q1 FY18 $ in millions Net sales $655.1 $684.6 $620.3 Gross profit $62.0 $62.4 $57.5 Gross margin 9.5% 9.1% 9.3% Operating income $13.5 $15.8 $14.0 Operating income % 2.1% 2.3% 2.3% Non-GAAP operating income $16.5 $16.6 $15.9 Non-GAAP operating income % 2.5% 2.4% 2.6% • Net sales of $655 million, up 6% Y/Y Net Sales, $ in millions - Includes POS Portal acquisition; organic growth up 6% Y/Y Y/Y Growth +6% Y/Y Organic Growth +6% - Growth led by North America, including physical security, and Europe $800 • Gross profit margin of 9.5% $720 $700 $685 - Y/Y increase from addition of higher $655 margin POS Portal acquisition $620 $604 $600 • Operating income margin decreased to 2.1% from higher intangible amortization $500 • Non-GAAP operating income margin of 2.5% consistent with prior year and prior $400 quarter $300 • Non-GAAP operating income increased Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 4% Y/Y Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and acquisitions. Non-GAAP operating income excludes amortization of intangibles and other non-GAAP items. scansource.com 3 November 06, 2018

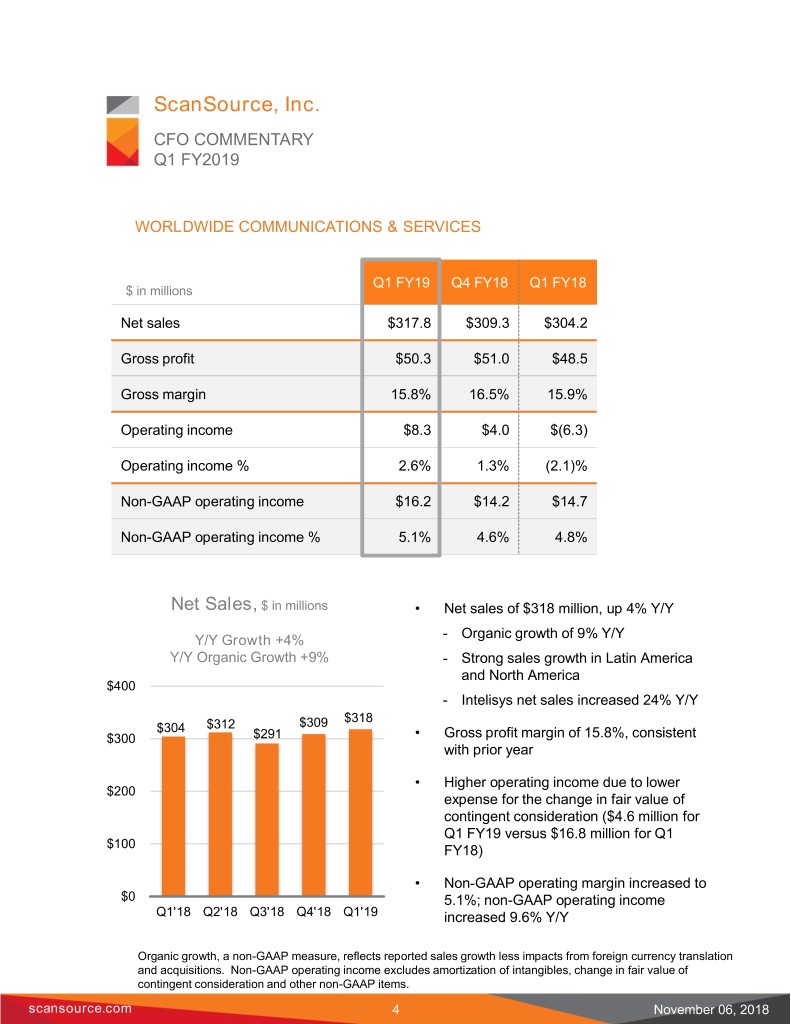

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 WORLDWIDE COMMUNICATIONS & SERVICES Q1 FY19 Q4 FY18 Q1 FY18 $ in millions Net sales $317.8 $309.3 $304.2 Gross profit $50.3 $51.0 $48.5 Gross margin 15.8% 16.5% 15.9% Operating income $8.3 $4.0 $(6.3) Operating income % 2.6% 1.3% (2.1)% Non-GAAP operating income $16.2 $14.2 $14.7 Non-GAAP operating income % 5.1% 4.6% 4.8% Net Sales, $ in millions • Net sales of $318 million, up 4% Y/Y Y/Y Growth +4% - Organic growth of 9% Y/Y Y/Y Organic Growth +9% - Strong sales growth in Latin America and North America $400 - Intelisys net sales increased 24% Y/Y $318 $304 $312 $309 $300 $291 • Gross profit margin of 15.8%, consistent with prior year • Higher operating income due to lower $200 expense for the change in fair value of contingent consideration ($4.6 million for Q1 FY19 versus $16.8 million for Q1 $100 FY18) • Non-GAAP operating margin increased to $0 5.1%; non-GAAP operating income Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 increased 9.6% Y/Y Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and acquisitions. Non-GAAP operating income excludes amortization of intangibles, change in fair value of contingent consideration and other non-GAAP items. scansource.com 4 November 06, 2018

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 WORKING CAPITAL Q1 FY19 Q4 FY18 Q1 FY18 $ in millions Accounts receivable (Q/E) $677.5 $678.9 $661.4 Days sales outstanding in receivables* 60 59 63 Inventory (Q/E) $672.7 $595.9 $597.3 Inventory turns 5.4 6.0 5.8 Accounts payable (Q/E) $629.2 $562.6 $534.9 Paid for inventory days* 8.1 6.8 10.1 Working capital (Q/E) (AR+INV–AP) $721.0 $712.3 $723.8 * Excludes the impact of Intelisys for all periods; paid for inventory days represent Q/E inventory days less Q/E accounts payable days • Working capital of $721.0, down 0.4% Y/Y • Inventory turns of 5.4x with inventory up and up 1% Q/Q 13% Y/Y and Q/Q • Working capital investment to support • Paid for inventory days of 8.1 reflect growth timing of accounts payable • Days sales outstanding in receivables of 60 days, closer to recent trends - Aging of accounts receivable portfolio, primarily in Latin America scansource.com 5 November 06, 2018

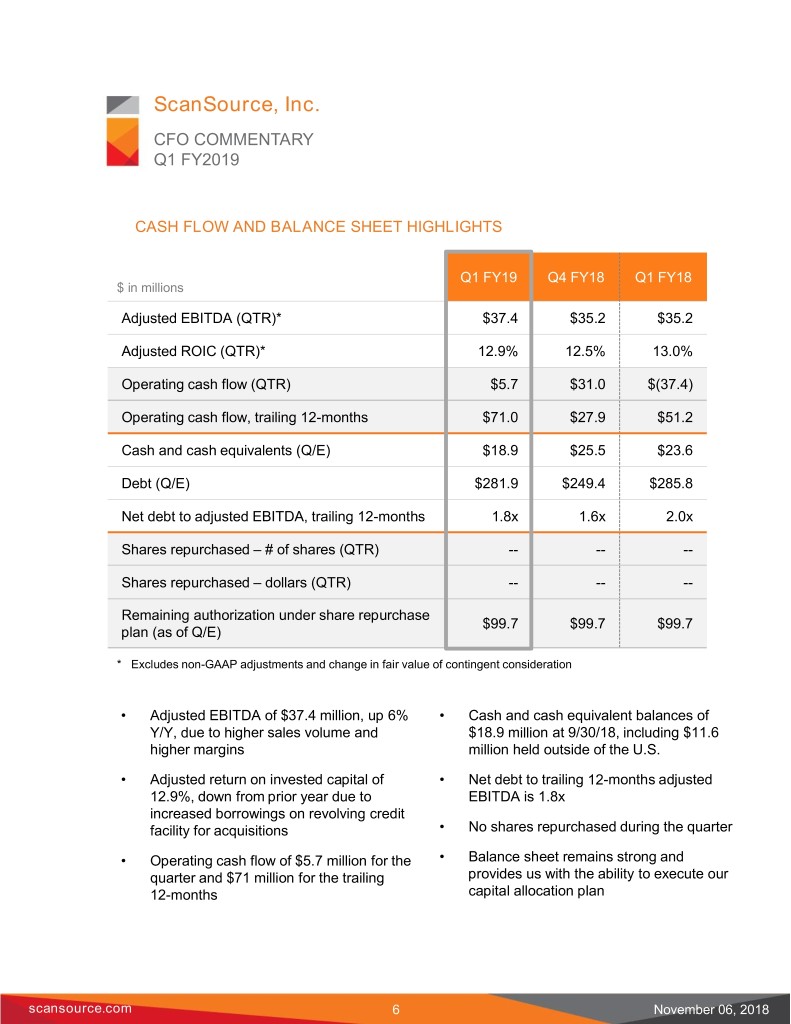

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 CASH FLOW AND BALANCE SHEET HIGHLIGHTS Q1 FY19 Q4 FY18 Q1 FY18 $ in millions Adjusted EBITDA (QTR)* $37.4 $35.2 $35.2 Adjusted ROIC (QTR)* 12.9% 12.5% 13.0% Operating cash flow (QTR) $5.7 $31.0 $(37.4) Operating cash flow, trailing 12-months $71.0 $27.9 $51.2 Cash and cash equivalents (Q/E) $18.9 $25.5 $23.6 Debt (Q/E) $281.9 $249.4 $285.8 Net debt to adjusted EBITDA, trailing 12-months 1.8x 1.6x 2.0x Shares repurchased – # of shares (QTR) -- -- -- Shares repurchased – dollars (QTR) -- -- -- Remaining authorization under share repurchase $99.7 $99.7 $99.7 plan (as of Q/E) * Excludes non-GAAP adjustments and change in fair value of contingent consideration • Adjusted EBITDA of $37.4 million, up 6% • Cash and cash equivalent balances of Y/Y, due to higher sales volume and $18.9 million at 9/30/18, including $11.6 higher margins million held outside of the U.S. • Adjusted return on invested capital of • Net debt to trailing 12-months adjusted 12.9%, down from prior year due to EBITDA is 1.8x increased borrowings on revolving credit facility for acquisitions • No shares repurchased during the quarter • Operating cash flow of $5.7 million for the • Balance sheet remains strong and quarter and $71 million for the trailing provides us with the ability to execute our 12-months capital allocation plan scansource.com 6 November 06, 2018

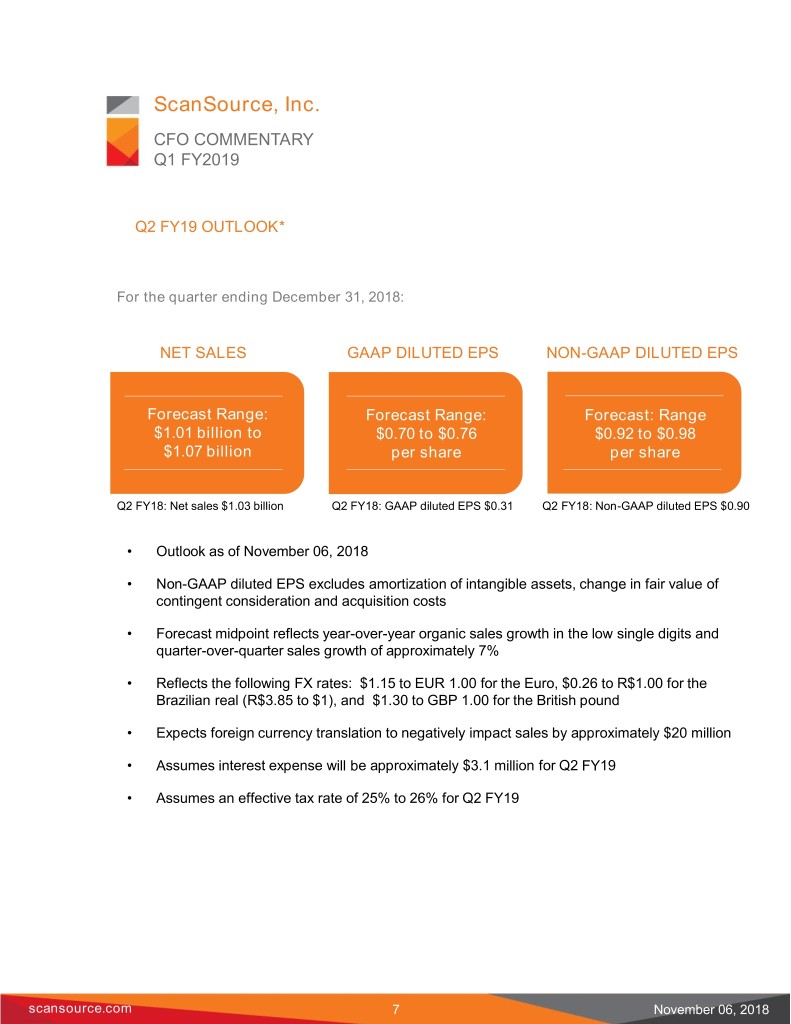

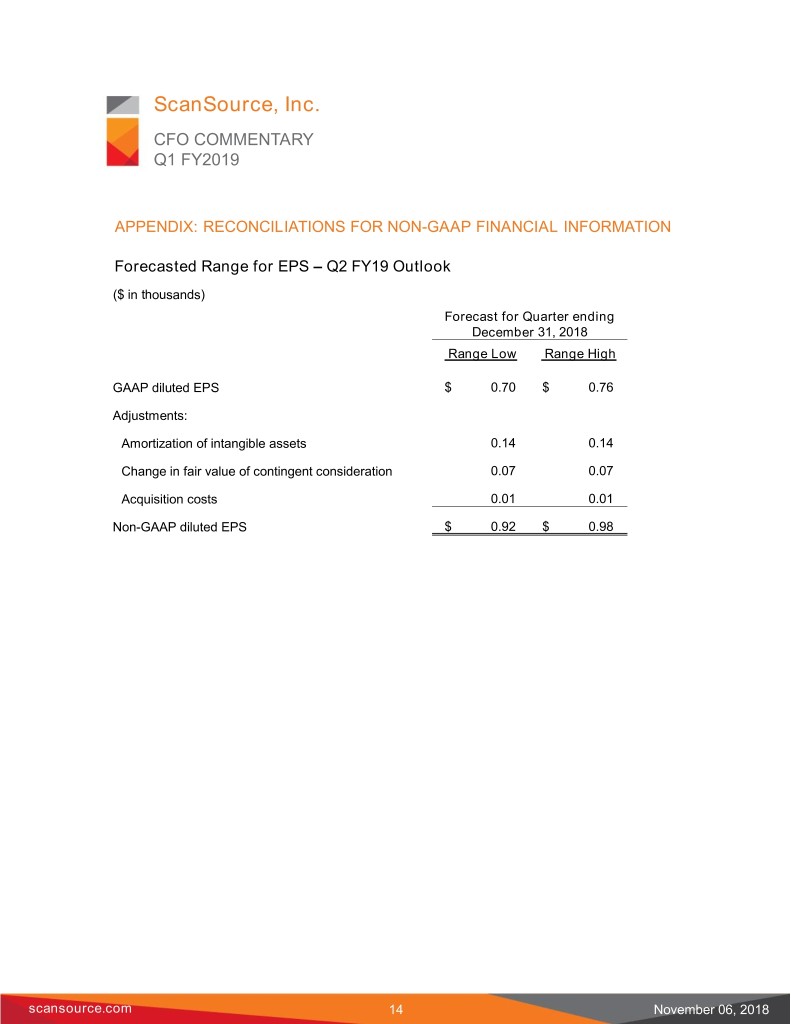

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 Q2 FY19 OUTLOOK* For the quarter ending December 31, 2018: NET SALES GAAP DILUTED EPS NON-GAAP DILUTED EPS Forecast Range: Forecast Range: Forecast: Range $1.01 billion to $0.70 to $0.76 $0.92 to $0.98 $1.07 billion per share per share Q2 FY18: Net sales $1.03 billion Q2 FY18: GAAP diluted EPS $0.31 Q2 FY18: Non-GAAP diluted EPS $0.90 • Outlook as of November 06, 2018 • Non-GAAP diluted EPS excludes amortization of intangible assets, change in fair value of contingent consideration and acquisition costs • Forecast midpoint reflects year-over-year organic sales growth in the low single digits and quarter-over-quarter sales growth of approximately 7% • Reflects the following FX rates: $1.15 to EUR 1.00 for the Euro, $0.26 to R$1.00 for the Brazilian real (R$3.85 to $1), and $1.30 to GBP 1.00 for the British pound • Expects foreign currency translation to negatively impact sales by approximately $20 million • Assumes interest expense will be approximately $3.1 million for Q2 FY19 • Assumes an effective tax rate of 25% to 26% for Q2 FY19 scansource.com 7 November 06, 2018

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 FORWARD-LOOKING STATEMENTS Although ScanSource believes the expectations in its forward-looking statements This CFO Commentary contains certain are reasonable, it cannot guarantee future comments that are “forward-looking” results, levels of activity, performance or statements, including statements about achievement. ScanSource disclaims any expected EBITDA, return on invested capital obligation to update or revise any forward- (“ROIC”), sales, GAAP diluted earnings per looking statements, whether as a result of new share (“EPS”), non-GAAP diluted EPS, foreign information, future events, or otherwise, currency rates, tax rates and interest expense except as may be required by law. that involve plans, strategies, economic performance and trends, projections, expectations, costs or beliefs about future NON-GAAP FINANCIAL INFORMATION events and other statements that are not In addition to disclosing results that are descriptions of historical facts. Forward- determined in accordance with United States looking information is inherently subject to Generally Accepted Accounting Principles risks and uncertainties. (“GAAP”), the Company also discloses certain non-GAAP measures, including non-GAAP Any number of factors could cause actual operating income, non-GAAP operating results to differ materially from anticipated or income margin, non-GAAP net income, non- forecasted results, including but not limited to, GAAP diluted EPS, adjusted EBITDA, ROIC changes in interest and exchange rates and and net sales excluding the impact of foreign regulatory regimes impacting our international currency translation and acquisitions (organic operations, the impact of tax reform laws, the growth). A reconciliation of the Company's failure of acquisitions to meet our non-GAAP financial information to GAAP expectations, the failure to manage and financial information is provided in the implement our organic growth strategy, credit Appendix and in the Company’s Form 8-K, risks involving our larger customers and filed with the SEC, with the quarterly earnings vendors, termination of our relationship with press release for the period indicated. key vendors or a significant modification of the terms under which we operate with a key vendor, the decline in demand for the products and services that we provide, reduced prices for the products and services that we provide due both to competitor and customer actions, and other factors set forth in the “Risk Factors” contained in our annual report on Form 10-K for the year ended June 30, 2018, filed with the Securities and Exchange Commission (“SEC”). scansource.com 8 November 06, 2018

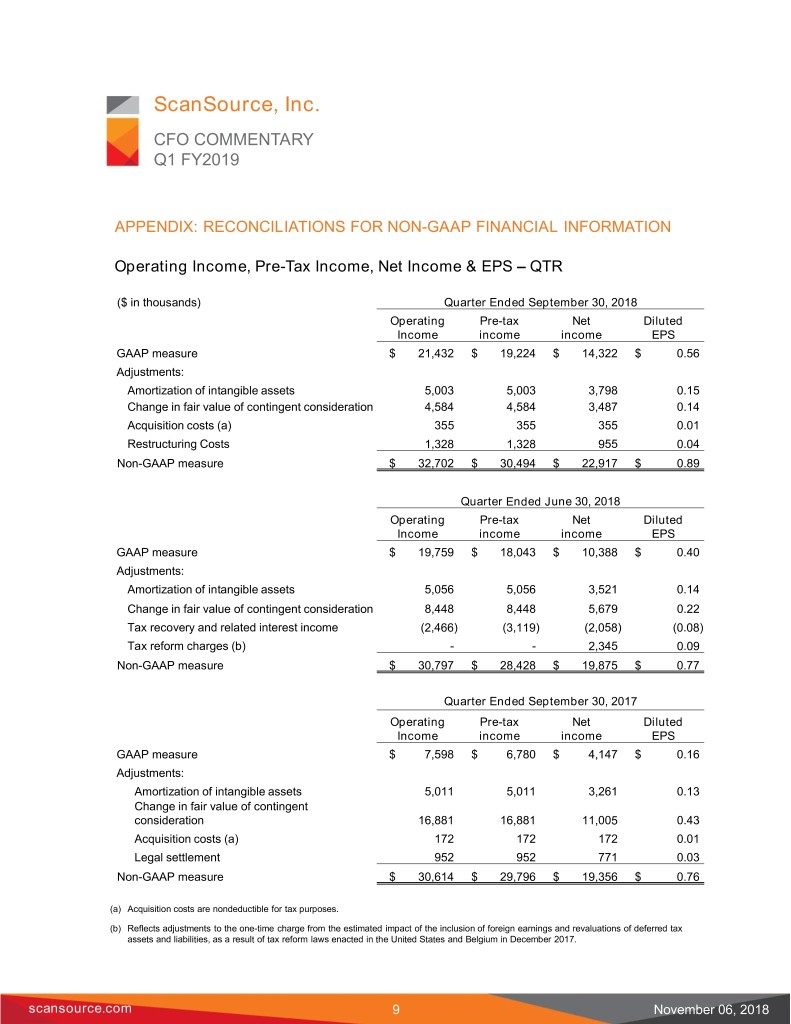

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Operating Income, Pre-Tax Income, Net Income & EPS – QTR ($ in thousands) Quarter Ended September 30, 2018 Operating Pre-tax Net Diluted Income income income EPS GAAP measure $ 21,432 $ 19,224 $ 14,322 $ 0.56 Adjustments: Amortization of intangible assets 5,003 5,003 3,798 0.15 Change in fair value of contingent consideration 4,584 4,584 3,487 0.14 Acquisition costs (a) 355 355 355 0.01 Restructuring Costs 1,328 1,328 955 0.04 Non-GAAP measure $ 32,702 $ 30,494 $ 22,917 $ 0.89 Quarter Ended June 30, 2018 Operating Pre-tax Net Diluted Income income income EPS GAAP measure $ 19,759 $ 18,043 $ 10,388 $ 0.40 Adjustments: Amortization of intangible assets 5,056 5,056 3,521 0.14 Change in fair value of contingent consideration 8,448 8,448 5,679 0.22 Tax recovery and related interest income (2,466) (3,119) (2,058) (0.08) Tax reform charges (b) - - 2,345 0.09 Non-GAAP measure $ 30,797 $ 28,428 $ 19,875 $ 0.77 Quarter Ended September 30, 2017 Operating Pre-tax Net Diluted Income income income EPS GAAP measure $ 7,598 $ 6,780 $ 4,147 $ 0.16 Adjustments: Amortization of intangible assets 5,011 5,011 3,261 0.13 Change in fair value of contingent consideration 16,881 16,881 11,005 0.43 Acquisition costs (a) 172 172 172 0.01 Legal settlement 952 952 771 0.03 Non-GAAP measure $ 30,614 $ 29,796 $ 19,356 $ 0.76 (a) Acquisition costs are nondeductible for tax purposes. (b) Reflects adjustments to the one-time charge from the estimated impact of the inclusion of foreign earnings and revaluations of deferred tax assets and liabilities, as a result of tax reform laws enacted in the United States and Belgium in December 2017. scansource.com 9 November 06, 2018

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Net Sales, Constant Currency and Excluding Acquisitions (Organic Growth) – QTR ($ in thousands) WW Barcode, WW Comms. NW & Security & Services Consolidated For the quarter ended September 30, 2018: Q1 FY19 net sales, as reported $ 655,113 $ 317,787 $ 972,900 Foreign exchange impact (a) 7,513 13,307 20,820 Q1 FY19 net sales, constant currency 662,626 331,094 993,720 Less: Acquisitions (23,465) (964) (24,429) Q1 FY19 net sales, constant currency excluding acquisitions $ 639,161 $ 330,130 $ 969,291 Q1 FY18 net sales, as reported $ 620,329 $ 304,230 $ 924,559 Less: Acquisitions (14,553) - (14,553) Q1 FY18 net sales, excluding acquisitions $ 605,776 $ 304,230 $ 910,006 Y/Y % Change: As reported 5.6% 4.5% 5.2% Constant currency 6.8% 8.8% 7.5% Constant currency, excluding acquisitions (organic growth) 5.5% 8.5% 6.5% (a) Year-over-year sales growth excluding the translation impact of changes in foreign currency rates. Calculated by translating net sales for the quarter ended September 30, 2018 into U.S. dollars using the weighted average foreign exchange rates for the quarter ended September 30, 2017. scansource.com 10 November 06, 2018

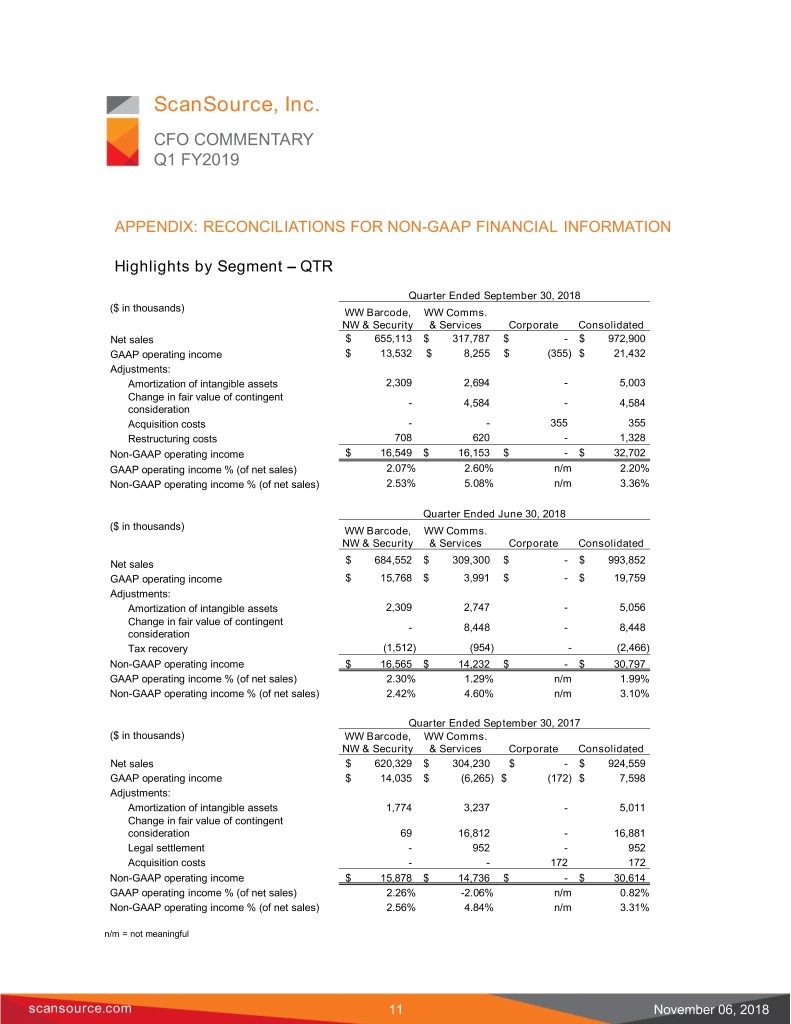

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Highlights by Segment – QTR Quarter Ended September 30, 2018 ($ in thousands) WW Barcode, WW Comms. NW & Security & Services Corporate Consolidated Net sales $ 655,113 $ 317,787 $ - $ 972,900 GAAP operating income $ 13,532 $ 8,255 $ (355) $ 21,432 Adjustments: Amortization of intangible assets 2,309 2,694 - 5,003 Change in fair value of contingent - 4,584 - 4,584 consideration Acquisition costs - - 355 355 Restructuring costs 708 620 - 1,328 Non-GAAP operating income $ 16,549 $ 16,153 $ - $ 32,702 GAAP operating income % (of net sales) 2.07% 2.60% n/m 2.20% Non-GAAP operating income % (of net sales) 2.53% 5.08% n/m 3.36% Quarter Ended June 30, 2018 ($ in thousands) WW Barcode, WW Comms. NW & Security & Services Corporate Consolidated Net sales $ 684,552 $ 309,300 $ - $ 993,852 GAAP operating income $ 15,768 $ 3,991 $ - $ 19,759 Adjustments: Amortization of intangible assets 2,309 2,747 - 5,056 Change in fair value of contingent - 8,448 - 8,448 consideration Tax recovery (1,512) (954) - (2,466) Non-GAAP operating income $ 16,565 $ 14,232 $ - $ 30,797 GAAP operating income % (of net sales) 2.30% 1.29% n/m 1.99% Non-GAAP operating income % (of net sales) 2.42% 4.60% n/m 3.10% Quarter Ended September 30, 2017 ($ in thousands) WW Barcode, WW Comms. NW & Security & Services Corporate Consolidated Net sales $ 620,329 $ 304,230 $ - $ 924,559 GAAP operating income $ 14,035 $ (6,265) $ (172) $ 7,598 Adjustments: Amortization of intangible assets 1,774 3,237 - 5,011 Change in fair value of contingent consideration 69 16,812 - 16,881 Legal settlement - 952 - 952 Acquisition costs - - 172 172 Non-GAAP operating income $ 15,878 $ 14,736 $ - $ 30,614 GAAP operating income % (of net sales) 2.26% -2.06% n/m 0.82% Non-GAAP operating income % (of net sales) 2.56% 4.84% n/m 3.31% n/m = not meaningful scansource.com 11 November 06, 2018

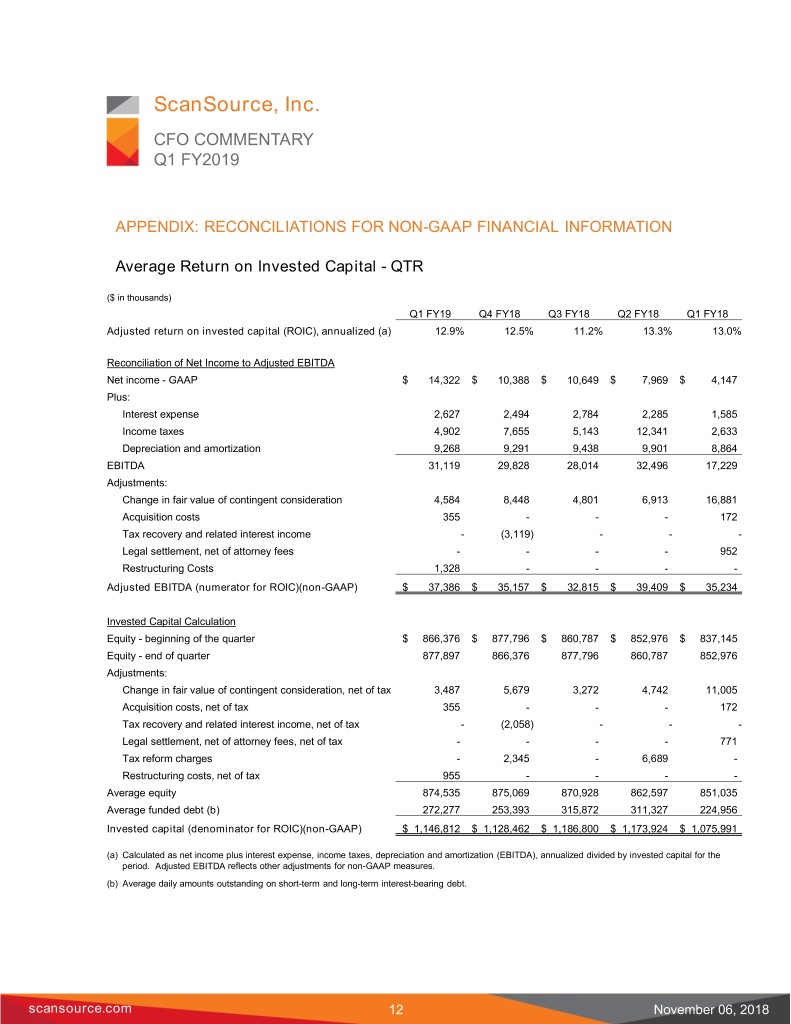

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Average Return on Invested Capital - QTR ($ in thousands) Q1 FY19 Q4 FY18 Q3 FY18 Q2 FY18 Q1 FY18 Adjusted return on invested capital (ROIC), annualized (a) 12.9% 12.5% 11.2% 13.3% 13.0% Reconciliation of Net Income to Adjusted EBITDA Net income - GAAP $ 14,322 $ 10,388 $ 10,649 $ 7,969 $ 4,147 Plus: Interest expense 2,627 2,494 2,784 2,285 1,585 Income taxes 4,902 7,655 5,143 12,341 2,633 Depreciation and amortization 9,268 9,291 9,438 9,901 8,864 EBITDA 31,119 29,828 28,014 32,496 17,229 Adjustments: Change in fair value of contingent consideration 4,584 8,448 4,801 6,913 16,881 Acquisition costs 355 - - - 172 Tax recovery and related interest income - (3,119) - - - Legal settlement, net of attorney fees - - - - 952 Restructuring Costs 1,328 - - - - Adjusted EBITDA (numerator for ROIC)(non-GAAP) $ 37,386 $ 35,157 $ 32,815 $ 39,409 $ 35,234 Invested Capital Calculation Equity - beginning of the quarter $ 866,376 $ 877,796 $ 860,787 $ 852,976 $ 837,145 Equity - end of quarter 877,897 866,376 877,796 860,787 852,976 Adjustments: Change in fair value of contingent consideration, net of tax 3,487 5,679 3,272 4,742 11,005 Acquisition costs, net of tax 355 - - - 172 Tax recovery and related interest income, net of tax - (2,058) - - - Legal settlement, net of attorney fees, net of tax - - - - 771 Tax reform charges - 2,345 - 6,689 - Restructuring costs, net of tax 955 - - - - Average equity 874,535 875,069 870,928 862,597 851,035 Average funded debt (b) 272,277 253,393 315,872 311,327 224,956 Invested capital (denominator for ROIC)(non-GAAP) $ 1,146,812 $ 1,128,462 $ 1,186,800 $ 1,173,924 $ 1,075,991 (a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital for the period. Adjusted EBITDA reflects other adjustments for non-GAAP measures. (b) Average daily amounts outstanding on short-term and long-term interest-bearing debt. scansource.com 12 November 06, 2018

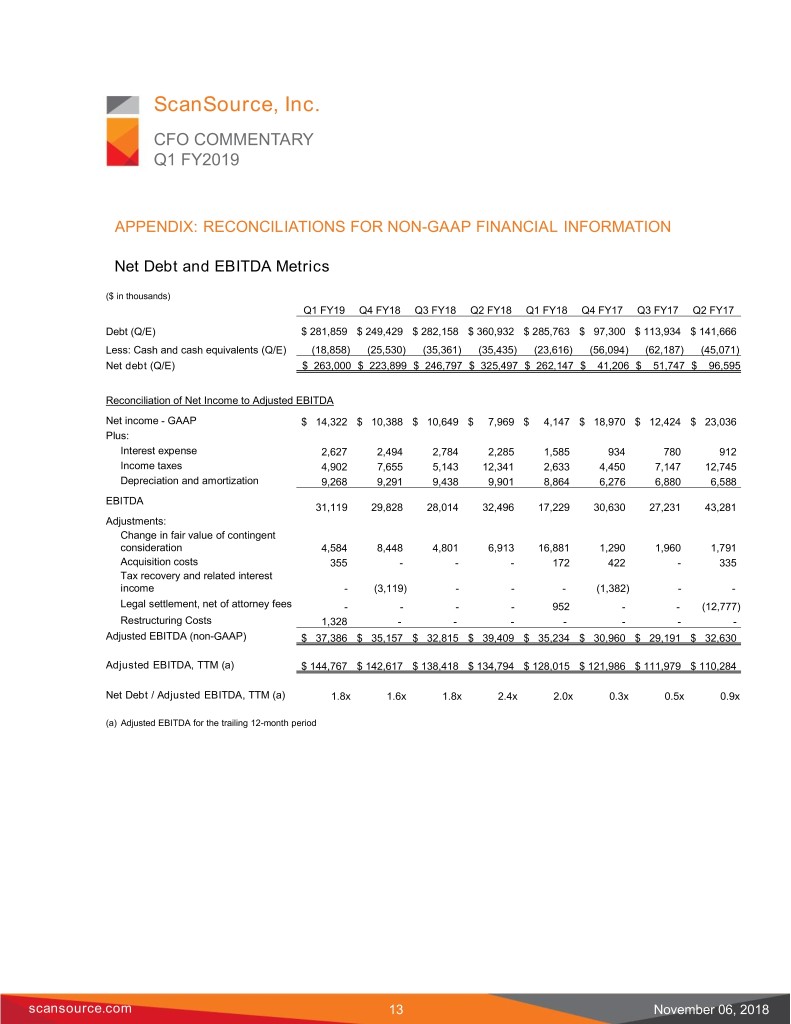

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Net Debt and EBITDA Metrics ($ in thousands) Q1 FY19 Q4 FY18 Q3 FY18 Q2 FY18 Q1 FY18 Q4 FY17 Q3 FY17 Q2 FY17 Debt (Q/E) $ 281,859 $ 249,429 $ 282,158 $ 360,932 $ 285,763 $ 97,300 $ 113,934 $ 141,666 Less: Cash and cash equivalents (Q/E) (18,858) (25,530) (35,361) (35,435) (23,616) (56,094) (62,187) (45,071) Net debt (Q/E) $ 263,000 $ 223,899 $ 246,797 $ 325,497 $ 262,147 $ 41,206 $ 51,747 $ 96,595 Reconciliation of Net Income to Adjusted EBITDA Net income - GAAP $ 14,322 $ 10,388 $ 10,649 $ 7,969 $ 4,147 $ 18,970 $ 12,424 $ 23,036 Plus: Interest expense 2,627 2,494 2,784 2,285 1,585 934 780 912 Income taxes 4,902 7,655 5,143 12,341 2,633 4,450 7,147 12,745 Depreciation and amortization 9,268 9,291 9,438 9,901 8,864 6,276 6,880 6,588 EBITDA 31,119 29,828 28,014 32,496 17,229 30,630 27,231 43,281 Adjustments: Change in fair value of contingent consideration 4,584 8,448 4,801 6,913 16,881 1,290 1,960 1,791 Acquisition costs 355 - - - 172 422 - 335 Tax recovery and related interest income - (3,119) - - - (1,382) - - Legal settlement, net of attorney fees - - - - 952 - - (12,777) Restructuring Costs 1,328 - - - - - - - Adjusted EBITDA (non-GAAP) $ 37,386 $ 35,157 $ 32,815 $ 39,409 $ 35,234 $ 30,960 $ 29,191 $ 32,630 Adjusted EBITDA, TTM (a) $ 144,767 $ 142,617 $ 138,418 $ 134,794 $ 128,015 $ 121,986 $ 111,979 $ 110,284 Net Debt / Adjusted EBITDA, TTM (a) 1.8x 1.6x 1.8x 2.4x 2.0x 0.3x 0.5x 0.9x (a) Adjusted EBITDA for the trailing 12-month period scansource.com 13 November 06, 2018

ScanSource, Inc. CFO COMMENTARY Q1 FY2019 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Forecasted Range for EPS – Q2 FY19 Outlook ($ in thousands) Forecast for Quarter ending December 31, 2018 Range Low Range High GAAP diluted EPS $ 0.70 $ 0.76 Adjustments: Amortization of intangible assets 0.14 0.14 Change in fair value of contingent consideration 0.07 0.07 Acquisition costs 0.01 0.01 Non-GAAP diluted EPS $ 0.92 $ 0.98 scansource.com 14 November 06, 2018