Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - JOHN WILEY & SONS, INC. | exhibit99_1.htm |

| 8-K - FORM 8K - JOHN WILEY & SONS, INC. | form8k.htm |

Learning House AcquisitionTech-enabled education services for universities, corporations, students and professionals October 9, 2018

Safe Harbor StatementThis presentation contains certain forward-looking statements concerning the Company's operations, performance, and financial condition. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements. Any such forward-looking statements are based upon a number of assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond the control of the Company, and are subject to change based on many important factors. Such factors include, but are not limited to (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for the Company's journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key online retailers; (vi) the seasonal nature of the Company's educational business and the impact of the used book market; (vii) worldwide economic and political conditions; (viii) the Company's ability to protect its copyrights and other intellectual property worldwide (ix) the ability of the Company to successfully integrate acquired operations and realize expected opportunities, (x) Learning House’s forecasted fiscal year 2018 revenues and (xi) other factors detailed from time to time in the Company's filings with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances. About WileyWiley is a global leader in research and education. Our online scientific, technical, medical, and scholarly journals, combined with our digital learning, assessment and certification solutions help universities, academic societies, businesses, governments and individuals increase the academic and professional impact of their work. For more than 200 years, we have delivered consistent performance to our stakeholders. The Company's website can be accessed at www.wiley.com.

Learning House extends Wiley’s leadership position in tech-enabled education services that help universities and students to succeed Combination makes Wiley a leader in rapidly-growing $2.3B OPM* market space Unmatched portfolio of partners (60+) and programs (800+) – the “Wiley network effect” Unprecedented diversity and range - large, medium, and small institutions – grad and undergrad - international Unrivaled brand, relationships and reach across education ecosystem – Wiley uniquely positioned inside university Exceptional outcomes – high student retention, high student satisfaction scores, job placement opportunities Adds a dynamic, well-managed growth company that strongly complements our Wiley Education Services (WES) business and adds to Wiley’s global education position Learning House - 10% EBITDA margin; pathway to 15-20% operating margin in combination with WES at mature state Strong focus on underpenetrated and attractive regional school segment and undergraduate opportunity Strong operating efficiencies to leverage across Wiley Education Services business Cost synergies in marketing, technology, and other areas Entrepreneurial culture and capabilities Expands our footprint in the rapidly-growing $10B+ tech-enabled education services market Short courses, bootcamps, and other skills credentialing for students and professionals Pathway services for international students Teacher advancement and credentialing for K-12 instructors Enterprise learning solutions Job placement network of over 450 corporate partners *Services that support universities in the delivery of academic degree programs Sources for market opportunities: Internal estimates, BMO/Course Reports (Bootcamps), Eduventures (OPM), Statistica (Teacher Advancement), Pathways (Cambridge and Studyportals)

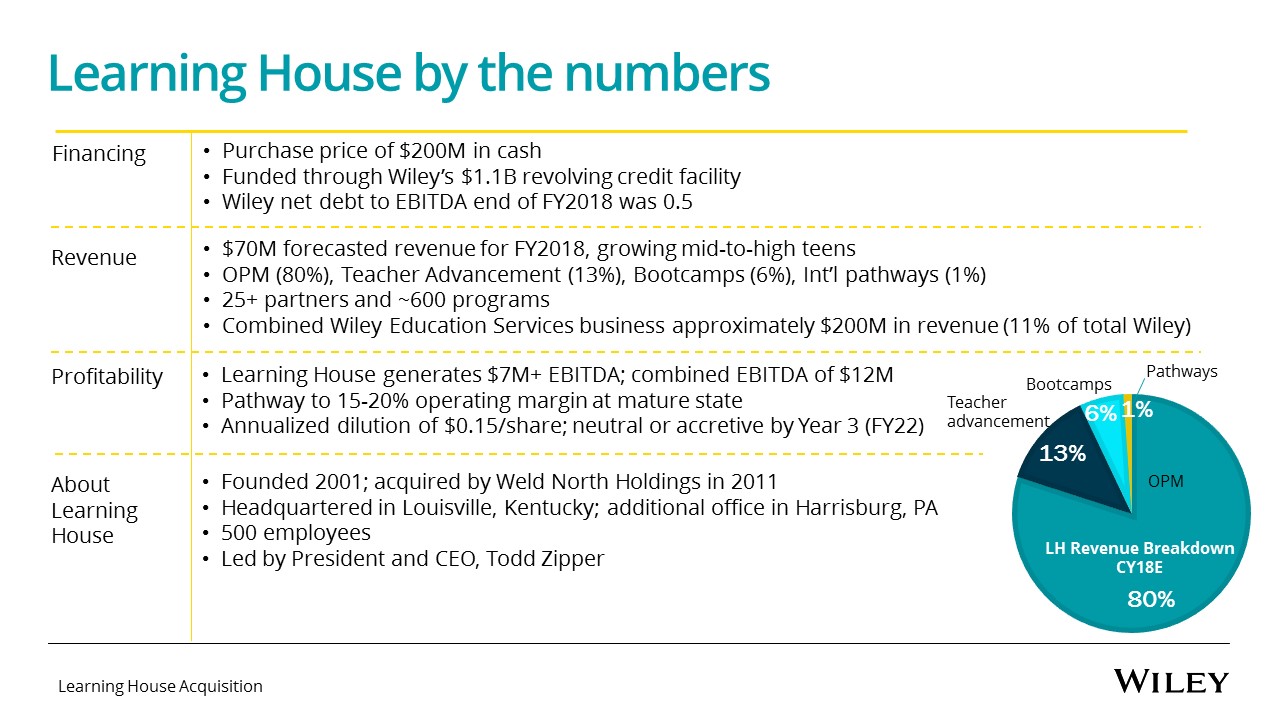

Learning House by the numbers Revenue Purchase price of $200M in cashFunded through Wiley’s $1.1B revolving credit facility Wiley net debt to EBITDA end of FY2018 was 0.5 Financing $70M forecasted revenue for FY2018, growing mid-to-high teensOPM (80%), Teacher Advancement (13%), Bootcamps (6%), Int’l pathways (1%)25+ partners and ~600 programsCombined Wiley Education Services business approximately $200M in revenue (11% of total Wiley) Learning House generates $7M+ EBITDA; combined EBITDA of $12MPathway to 15-20% operating margin at mature stateAnnualized dilution of $0.15/share; neutral or accretive by Year 3 (FY22) Profitability OPM Teacher advancement Bootcamps Pathways LH Revenue BreakdownCY18E About Learning House Founded 2001; acquired by Weld North Holdings in 2011Headquartered in Louisville, Kentucky; additional office in Harrisburg, PA500 employeesLed by President and CEO, Todd Zipper

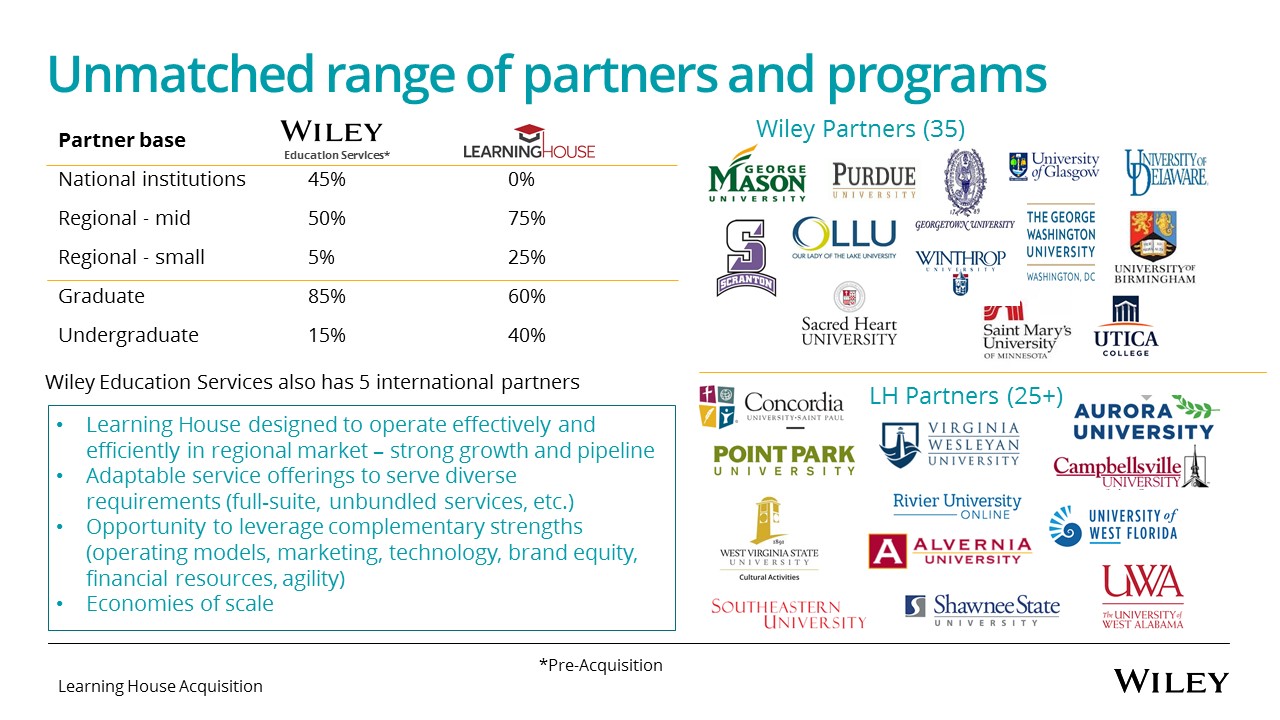

Unmatched range of partners and programs Wiley Partners (35) Partner base National institutions 45% 0% Regional - mid 50% 75% Regional - small 5% 25% Graduate 85% 60% Undergraduate 15% 40% Wiley Education Services also has 5 international partners Learning House designed to operate effectively and efficiently in regional market – strong growth and pipelineAdaptable service offerings to serve diverse requirements (full-suite, unbundled services, etc.)Opportunity to leverage complementary strengths (operating models, marketing, technology, brand equity, financial resources, agility)Economies of scale LH Partners (25+) Education Services* *Pre-Acquisition

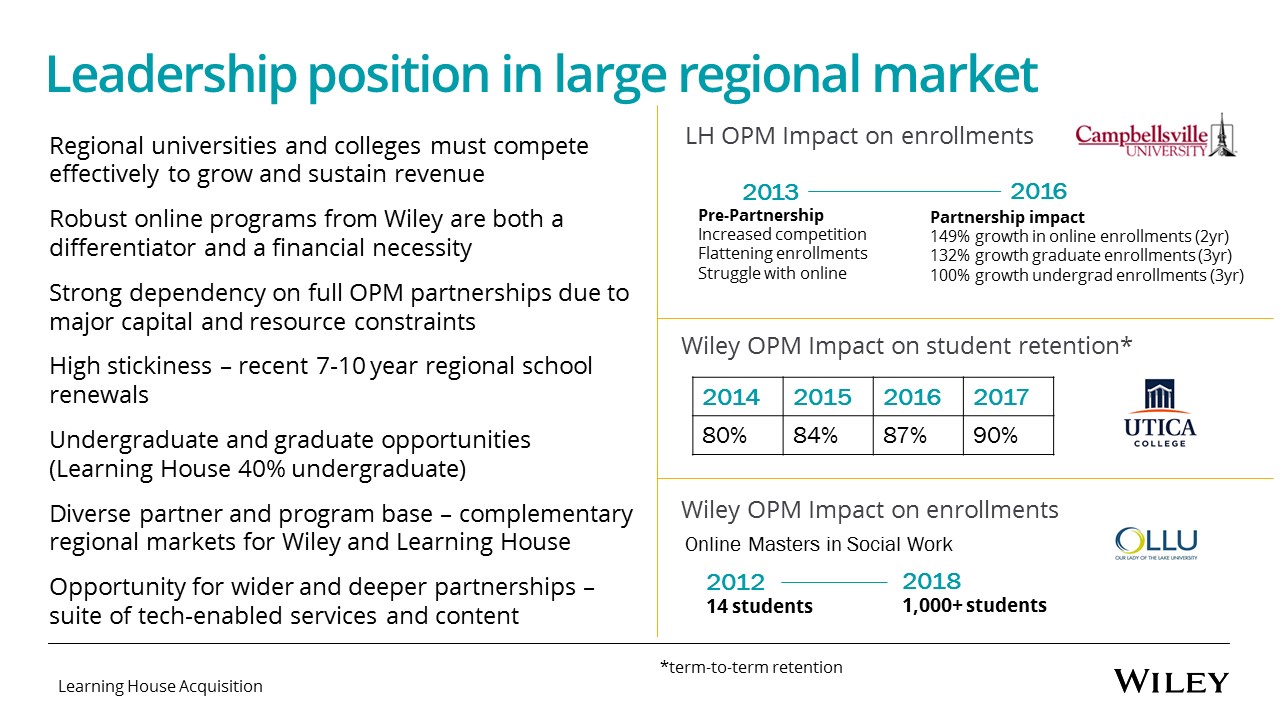

Leadership position in large regional market Regional universities and colleges must compete effectively to grow and sustain revenueRobust online programs from Wiley are both a differentiator and a financial necessityStrong dependency on full OPM partnerships due to major capital and resource constraints High stickiness – recent 7-10 year regional school renewals Undergraduate and graduate opportunities (Learning House 40% undergraduate) Diverse partner and program base – complementary regional markets for Wiley and Learning House Opportunity for wider and deeper partnerships – suite of tech-enabled services and content Pre-PartnershipIncreased competitionFlattening enrollmentsStruggle with online 2014 2015 2016 2017 80% 84% 87% 90% Wiley OPM Impact on student retention* 2016 2013 LH OPM Impact on enrollments Partnership impact149% growth in online enrollments (2yr)132% growth graduate enrollments (3yr)100% growth undergrad enrollments (3yr) Wiley OPM Impact on enrollments Online Masters in Social Work 201214 students 20181,000+ students *term-to-term retention

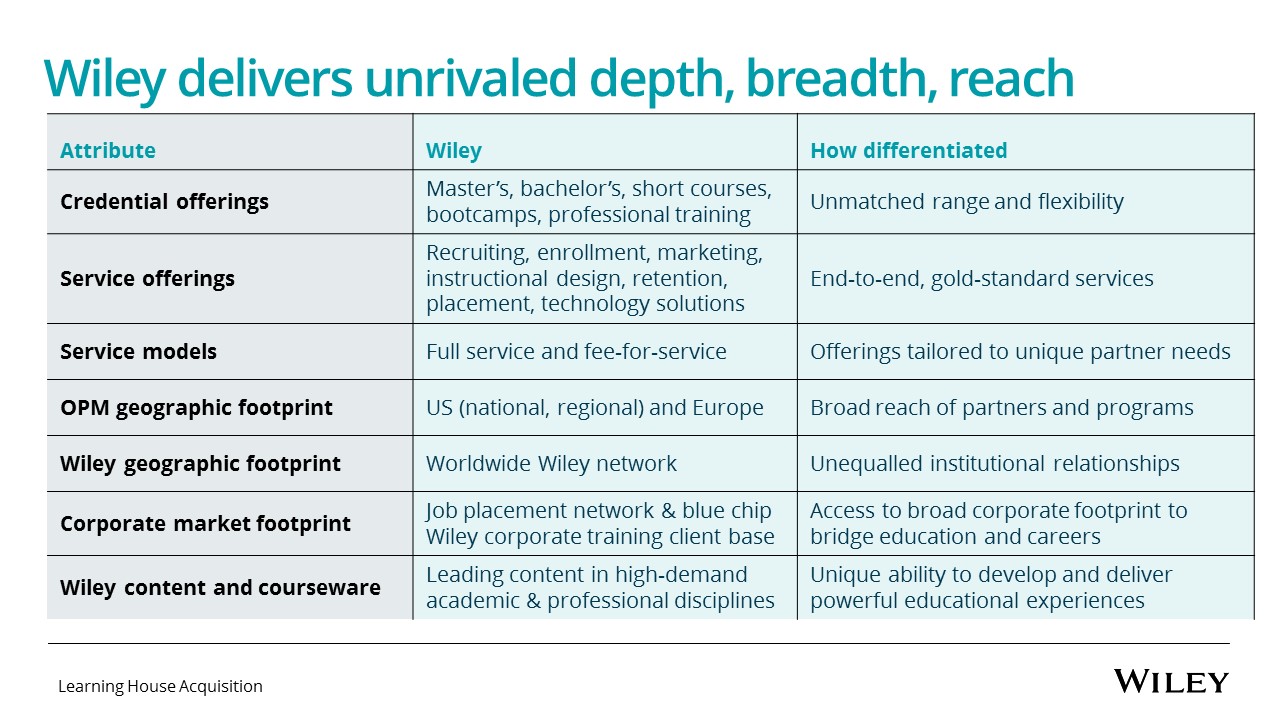

Wiley delivers unrivaled depth, breadth, reach Attribute Wiley How differentiated Credential offerings Master’s, bachelor’s, short courses, bootcamps, professional training Unmatched range and flexibility Service offerings Recruiting, enrollment, marketing, instructional design, retention, placement, technology solutions End-to-end, gold-standard services Service models Full service and fee-for-service Offerings tailored to unique partner needs OPM geographic footprint US (national, regional) and Europe Broad reach of partners and programs Wiley geographic footprint Worldwide Wiley network Unequalled institutional relationships Corporate market footprint Job placement network & blue chip Wiley corporate training client base Access to broad corporate footprint to bridge education and careers Wiley content and courseware Leading content in high-demand academic & professional disciplines Unique ability to develop and deliver powerful educational experiences

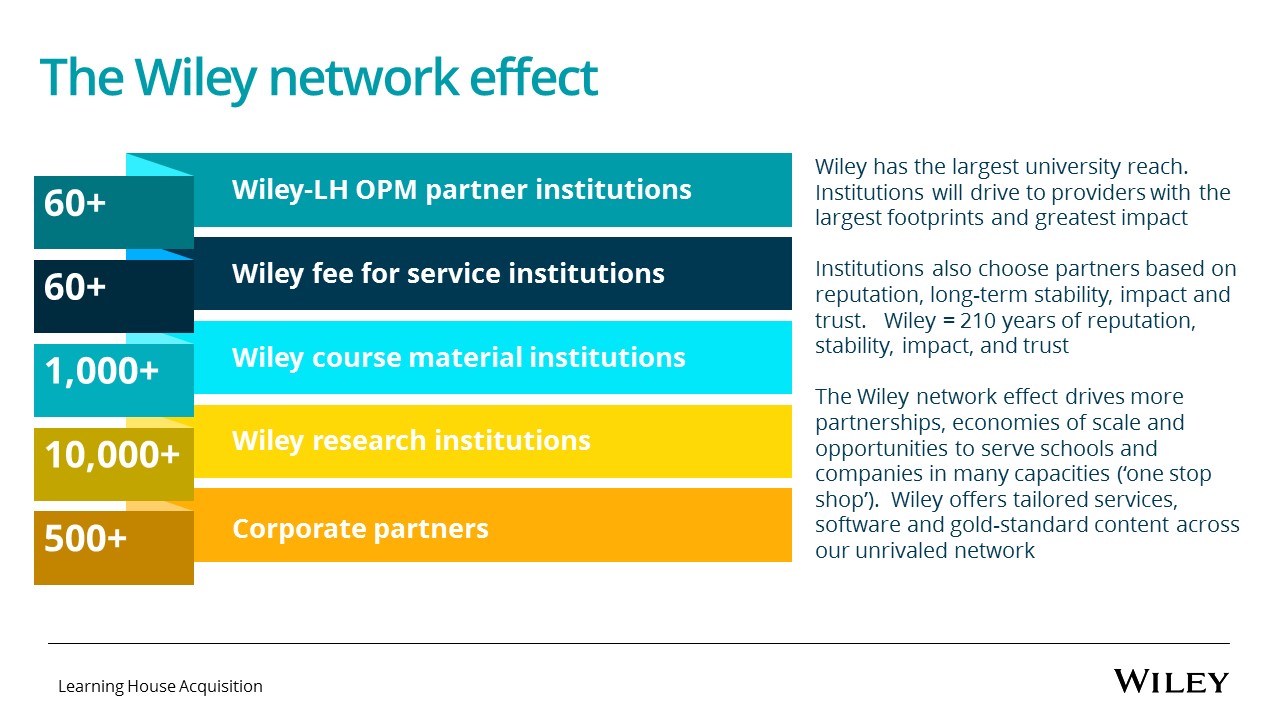

The Wiley network effect Corporate partners 500+ Wiley research institutions 10,000+ Wiley course material institutions 1,000+ Wiley fee for service institutions 60+ Wiley-LH OPM partner institutions 60+ Wiley has the largest university reach. Institutions will drive to providers with the largest footprints and greatest impactInstitutions also choose partners based on reputation, long-term stability, impact and trust. Wiley = 210 years of reputation, stability, impact, and trustThe Wiley network effect drives more partnerships, economies of scale and opportunities to serve schools and companies in many capacities (‘one stop shop’). Wiley offers tailored services, software and gold-standard content across our unrivaled network

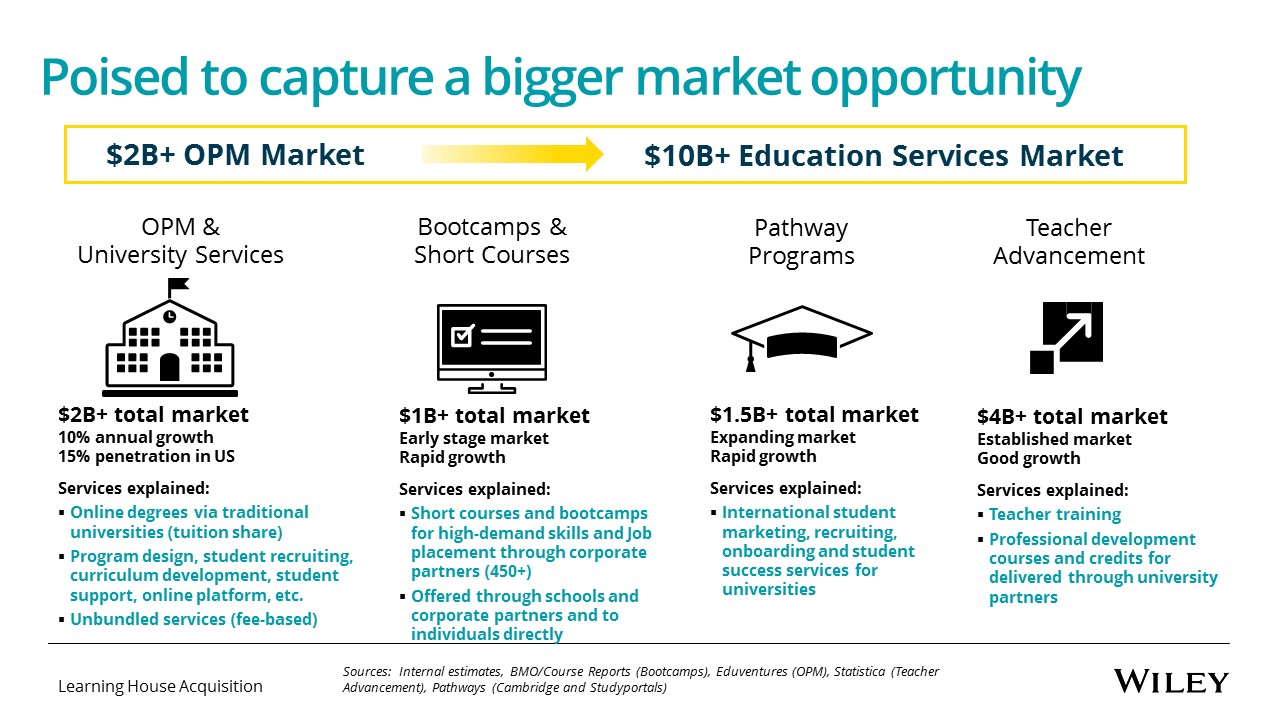

$2B+ total market10% annual growth15% penetration in USServices explained: Online degrees via traditional universities (tuition share)Program design, student recruiting, curriculum development, student support, online platform, etc.Unbundled services (fee-based) OPM & University Services Bootcamps & Short Courses $1B+ total marketEarly stage marketRapid growthServices explained: Short courses and bootcamps for high-demand skills and Job placement through corporate partners (450+)Offered through schools and corporate partners and to individuals directly Teacher Advancement $4B+ total marketEstablished marketGood growthServices explained: Teacher trainingProfessional development courses and credits for delivered through university partners $2B+ OPM Market $10B+ Education Services Market Pathway Programs $1.5B+ total marketExpanding marketRapid growthServices explained: International student marketing, recruiting, onboarding and student success services for universities Sources: Internal estimates, BMO/Course Reports (Bootcamps), Eduventures (OPM), Statistica (Teacher Advancement), Pathways (Cambridge and Studyportals) Poised to capture a bigger market opportunity

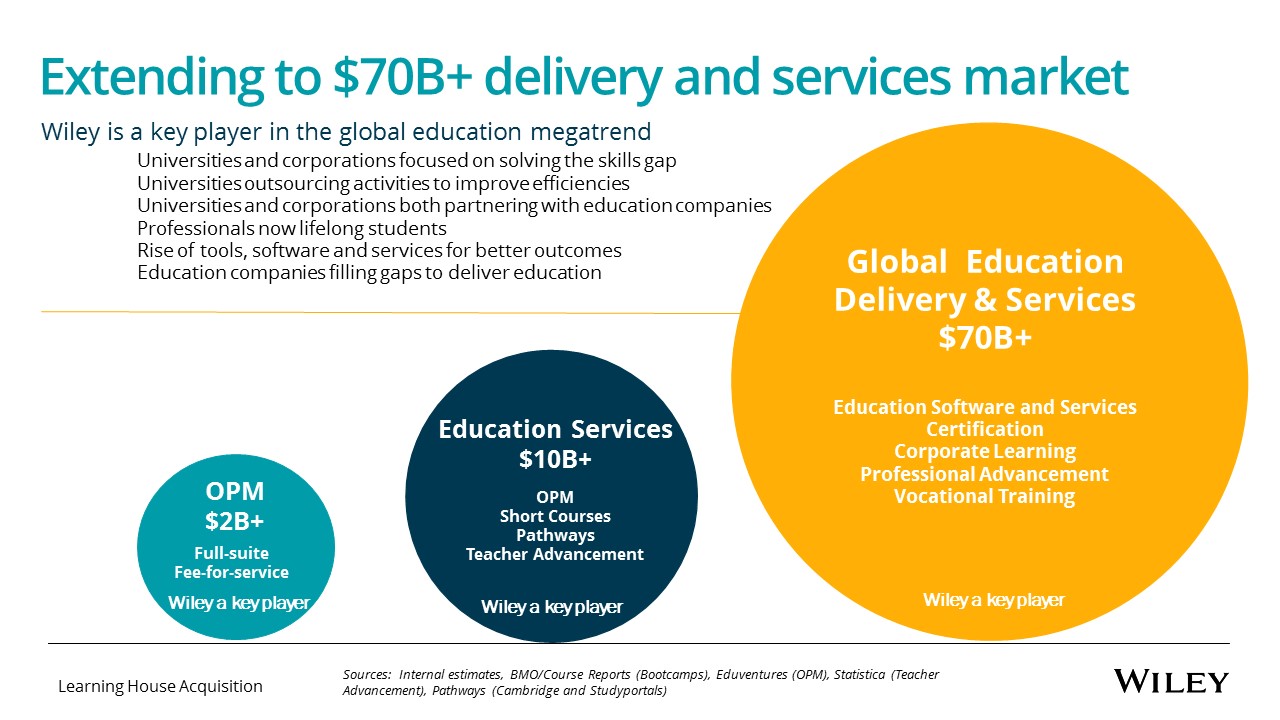

Extending to $70B+ delivery and services market OPM$2B+ Wiley is a key player in the global education megatrend Universities and corporations focused on solving the skills gap Universities outsourcing activities to improve efficiencies Universities and corporations both partnering with education companies Professionals now lifelong students Rise of tools, software and services for better outcomes Education companies filling gaps to deliver education Global EducationDelivery & Services $70B+Education Software and ServicesCertificationCorporate LearningProfessional AdvancementVocational Training Wiley a key player Wiley a key player Sources: Internal estimates, BMO/Course Reports (Bootcamps), Eduventures (OPM), Statistica (Teacher Advancement), Pathways (Cambridge and Studyportals) Education Services$10B+OPMShort CoursesPathwaysTeacher Advancement Wiley a key player Full-suiteFee-for-service

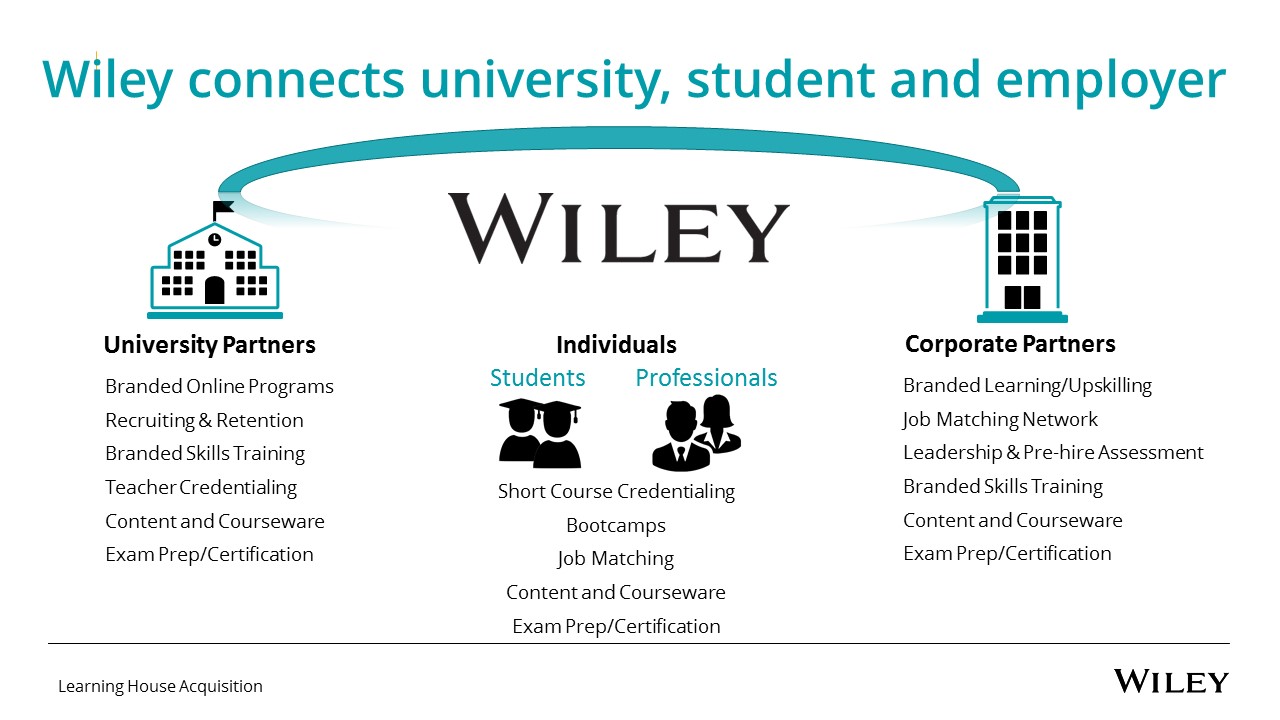

University Partners Individuals Corporate Partners Professionals Students Branded Online ProgramsRecruiting & RetentionBranded Skills TrainingTeacher CredentialingContent and CoursewareExam Prep/Certification Short Course CredentialingBootcampsJob MatchingContent and CoursewareExam Prep/Certification Branded Learning/UpskillingJob Matching NetworkLeadership & Pre-hire AssessmentBranded Skills TrainingContent and CoursewareExam Prep/Certification Wiley connects university, student and employer

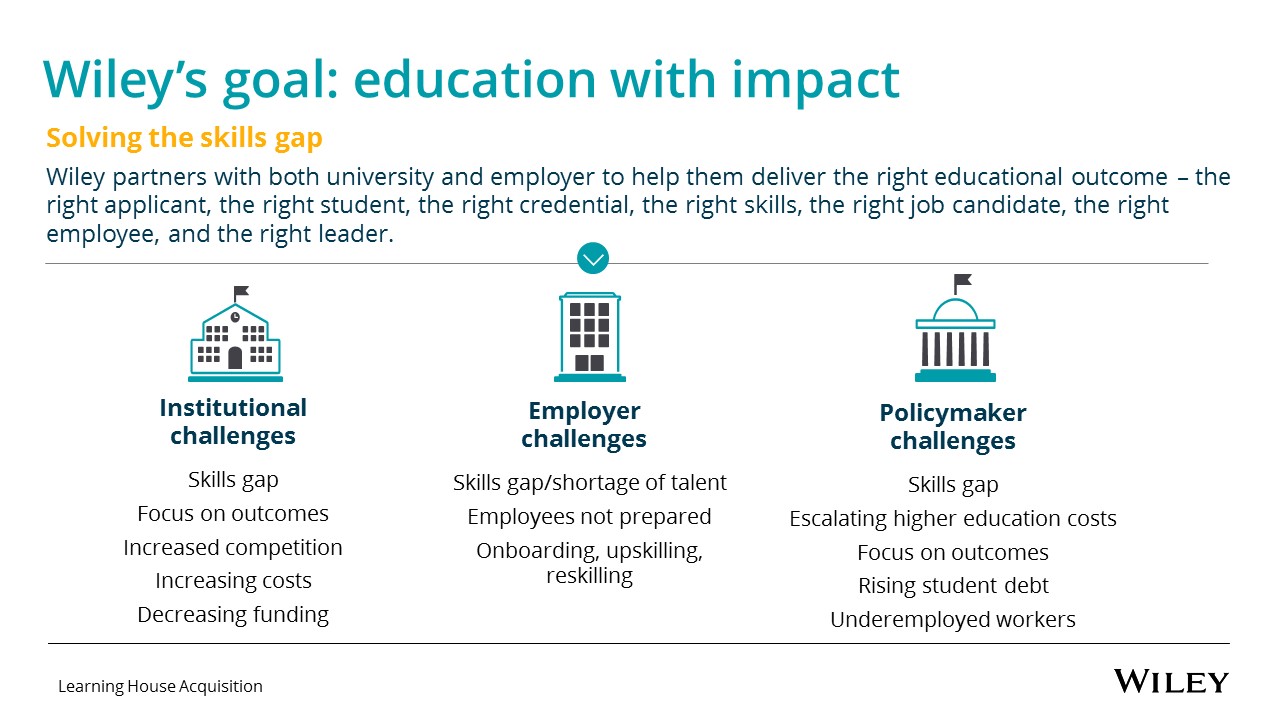

Wiley’s goal: education with impact Summary Employer challengesSkills gap/shortage of talent Employees not prepared Onboarding, upskilling, reskilling Institutional challengesSkills gapFocus on outcomesIncreased competitionIncreasing costsDecreasing funding Policymaker challengesSkills gapEscalating higher education costsFocus on outcomesRising student debtUnderemployed workers Solving the skills gap Wiley partners with both university and employer to help them deliver the right educational outcome – the right applicant, the right student, the right credential, the right skills, the right job candidate, the right employee, and the right leader.

Summary Combination makes Wiley a leader in rapidly-growing $2.3B OPM* market space Unmatched portfolio of partners (60+) and programs (800+) – the “Wiley network effect” Unprecedented diversity and range - large, medium, and small institutions – grad and undergrad - international Unrivaled brand, relationships and reach across education ecosystem – Wiley uniquely positioned inside university Exceptional outcomes – high student retention, high student satisfaction scores, job placement opportunities Adds a dynamic, well-managed growth company that strongly complements our Wiley Education Services (WES) business and adds to Wiley’s global education position Learning House - 10% EBITDA margin; pathway to 15-20% operating margin in combination with WES at mature state Strong focus on underpenetrated and attractive regional school segment and undergraduate opportunity Strong operating efficiencies to leverage across Wiley Education Services business Cost synergies in marketing, technology, and other areas Entrepreneurial culture and capabilities Expands our footprint in the rapidly-growing $10B+ tech-enabled education services market Short courses, bootcamps, and other skills credentialing for students and professionals Pathway services for international students Teacher advancement and credentialing for K-12 instructors Enterprise learning solutions Job placement network of over 450 corporate partners *Services that support universities in the delivery of academic degree programs Sources for market opportunities: Internal estimates, BMO/Course Reports (Bootcamps), Eduventures (OPM), Statistica (Teacher Advancement), Pathways (Cambridge and Studyportals)