Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRIPLE-S MANAGEMENT CORP | form8k.htm |

Exhibit 99.1

Investor Presentation September 2018

*This document contains forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information about possible or assumed future sales, results of operations, developments, regulatory approvals or other circumstances. Sentences that include "believe", "expect", "plan", "intend", "estimate", "anticipate", "project", "may", "will", "shall", "should" and similar expressions, whether in the positive or negative, are intended to identify forward-looking statements. All forward-looking statements in this news release reflect management's current views about future events and are based on assumptions and subject to risks and uncertainties. Consequently, actual results may differ materially from those expressed here as a result of various factors, including all the risks discussed and identified in public filings with the U.S. Securities and Exchange Commission (SEC). In addition, the Company operates in a highly competitive, constantly changing environment, influenced by very large organizations that have resulted from business combinations, aggressive marketing and pricing practices of competitors, and regulatory oversight. The following factors, if markedly different from the Company's planning assumptions (either individually or in combination), could cause Triple-S Management's results to differ materially from those expressed in any forward-looking statements shared here: Trends in health care costs and utilization rates Ability to secure sufficient premium rate increases Competitor pricing below market trends of increasing costs Re-estimates of policy and contract liabilities Changes in government laws and regulations of managed care, life insurance or property and casualty insurance Significant acquisitions or divestitures by major competitors Introduction and use of new prescription drugs and technologies A downgrade in the Company's financial strength ratings A downgrade in the Government of Puerto Rico's debt Litigation or legislation targeted at managed care, life insurance or property and casualty insurance companies Ability to contract with providers consistent with past practice Ability to successfully implement the Company's disease management, utilization management and Star ratings programs Ability to maintain Federal Employees, Medicare and Medicaid contracts Volatility in the securities markets and investment losses and defaults General economic downturns, major disasters, and epidemics This list is not exhaustive. Management believes the forward-looking statements in this release are reasonable. However, there is no assurance that the actions, events or results anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on the Company's results of operations or financial condition. In view of these uncertainties, investors should not place undue reliance on any forward-looking statements, which are based on current expectations. In addition, forward-looking statements are based on information available the day they are made, and (other than as required by applicable law, including the securities laws of the United States) the Company does not intend to update or revise any of them in light of new information or future events. Readers are advised to carefully review and consider the various disclosures in the Company's SEC reports. Safe Harbor Statement

Introduction to Triple-S Who we are Largest and most experienced managed care organization (MCO) in Puerto RicoExclusive BCBS licensee for Puerto Rico, Costa Rica and U.S. Virgin IslandsNYSE: GTS Premiums earned 4-year CAGR of 6.4%2017 medical loss ratio (MLR) of 85.6%As of June 30, 2018, approximately $256 million in cash and $30 million of debt on balance sheet Solid Financials Recent Developments Received 4-star Medicare Advantage designation in our HMO productPartnering with Optum to modernize and enhance infrastructureEstablished and expanding ambulatory clinic network in Puerto RicoExpanded share repurchase program in February 2018 by $25 million

Investment Highlights Strong balance sheet and robust repurchase program in place Well regulated market = strong barrier to entry Upgrading infrastructure/technology to improve service, lower costs and enhance long-term margins Rebuilt management team with deep managed care expertise leveraging 50+ year experience and brand equity Well positioned to grow business as Puerto Rico recovers

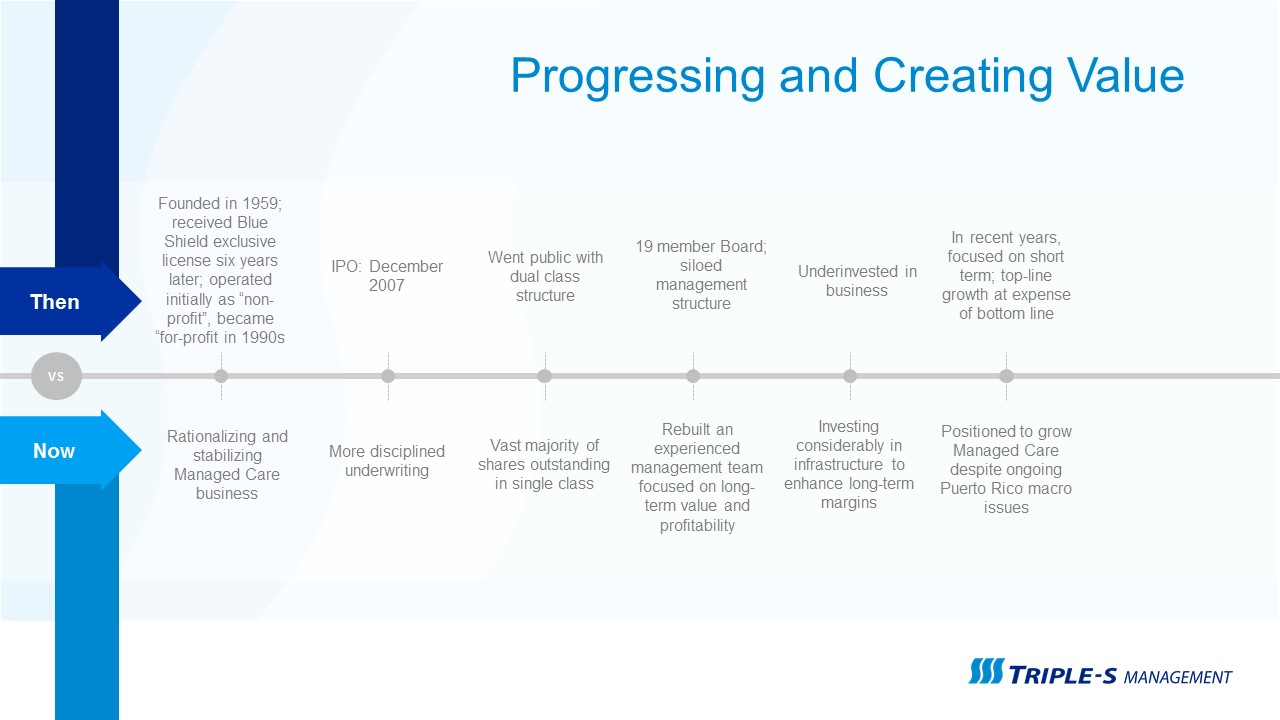

Progressing and Creating Value Now Then VS Founded in 1959; received Blue Shield exclusive license six years later; operated initially as “non-profit”, became “for-profit in 1990s IPO: December 2007 Went public with dual class structure 19 member Board; siloed management structure In recent years, focused on short term; top-line growth at expense of bottom line Underinvested in business Rebuilt an experienced management team focused on long-term value and profitability Rationalizing and stabilizing Managed Care business More disciplined underwriting Vast majority of shares outstanding in single class Investing considerably in infrastructure to enhance long-term margins Positioned to grow Managed Care despite ongoing Puerto Rico macro issues

Deep Senior Management Expertise Roberto García-RodríguezPresident & CEO25+ years of health care / legal industry experienceHas held various roles since joining Triple-S in 2008, including COO from 2013-2016Member of the Board of Directors of the Blue Cross Blue Shield Association Juan José Román-JiménezExecutive VP & CFO30+ years of financial and health care industry experience, CPAPrior to rejoining Triple-S, was CFO of EVERTEC, a NYSE-listed payments services companyPreviously spent 15 years at Triple-S and its subsidiaries in various positions Madeline Hernández-UrquizaExecutive VP & COOPresident - Triple-S Salud and Triple-S Advantage30+ years of health care and financial industry experienceHeld various positions at Triple-S, including Chief Risk Officer for Commercial and Medicaid businessesSuccessfully reorganized company’s Medicare Advantage subsidiary, leading to upgraded 4-Star HMO rating in late 2016 Arturo Carrión-Crespo President – Triple-S Vida30+ years of life/health insurance industry experiencePresident of Triple-S Vida since 1998Also spent 11 years at Great American Life Assurance Company of Puerto Rico

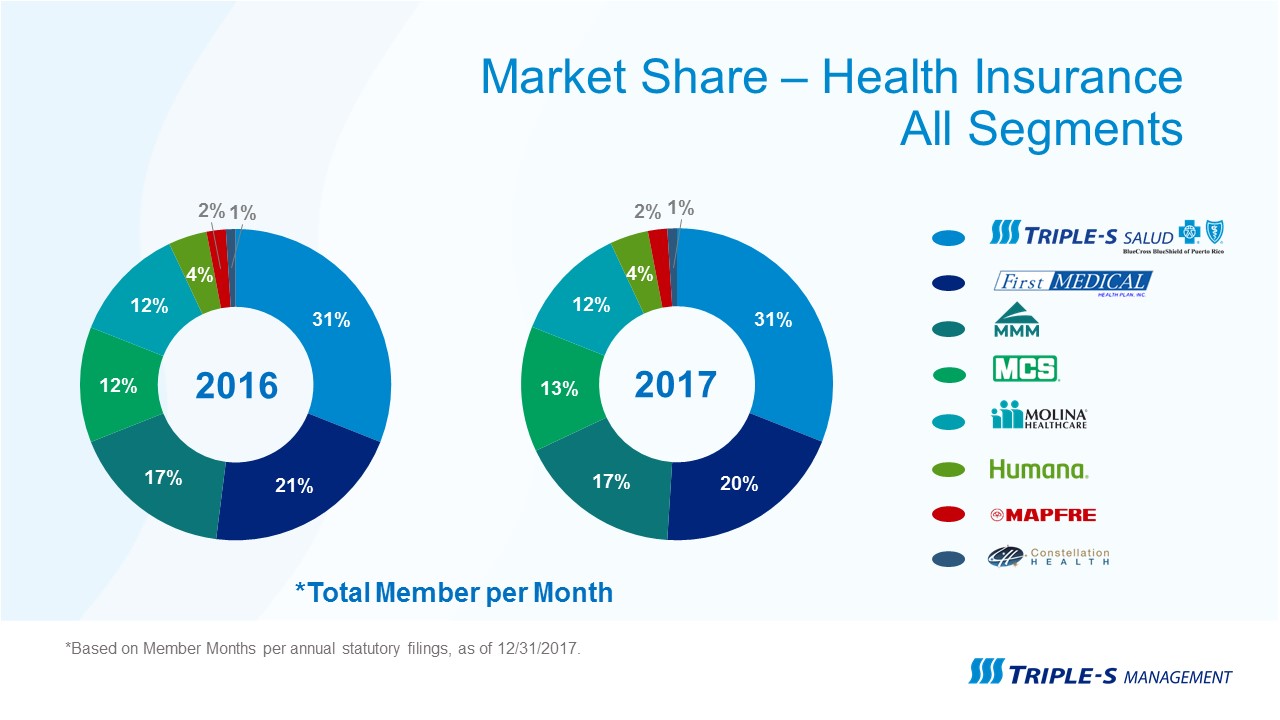

Market Share – Health InsuranceAll Segments 2016 2017 *Total Member per Month *Based on Member Months per annual statutory filings, as of 12/31/2017.

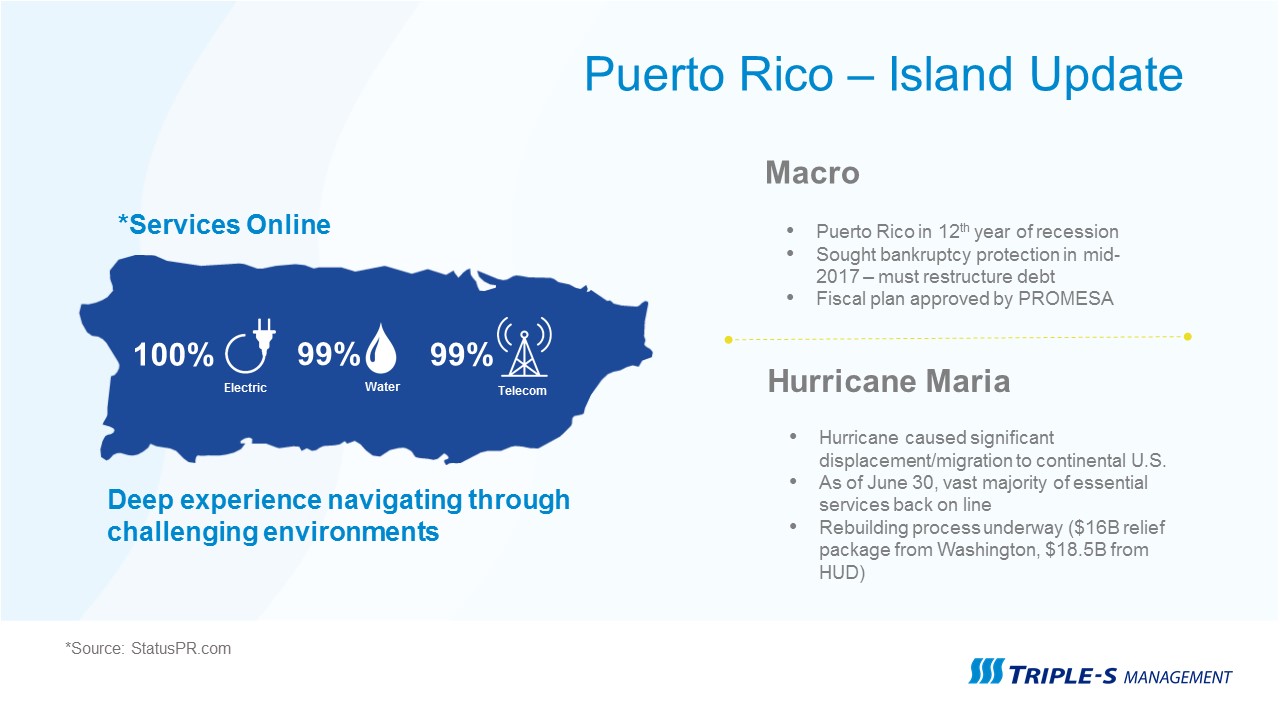

Puerto Rico – Island Update Macro Puerto Rico in 12th year of recessionSought bankruptcy protection in mid-2017 – must restructure debtFiscal plan approved by PROMESA Hurricane Maria Hurricane caused significant displacement/migration to continental U.S.As of June 30, vast majority of essential services back on lineRebuilding process underway ($16B relief package from Washington, $18.5B from HUD) *Services Online Electric Water Telecom 100% 99% 99% Deep experience navigating through challenging environments *Source: StatusPR.com

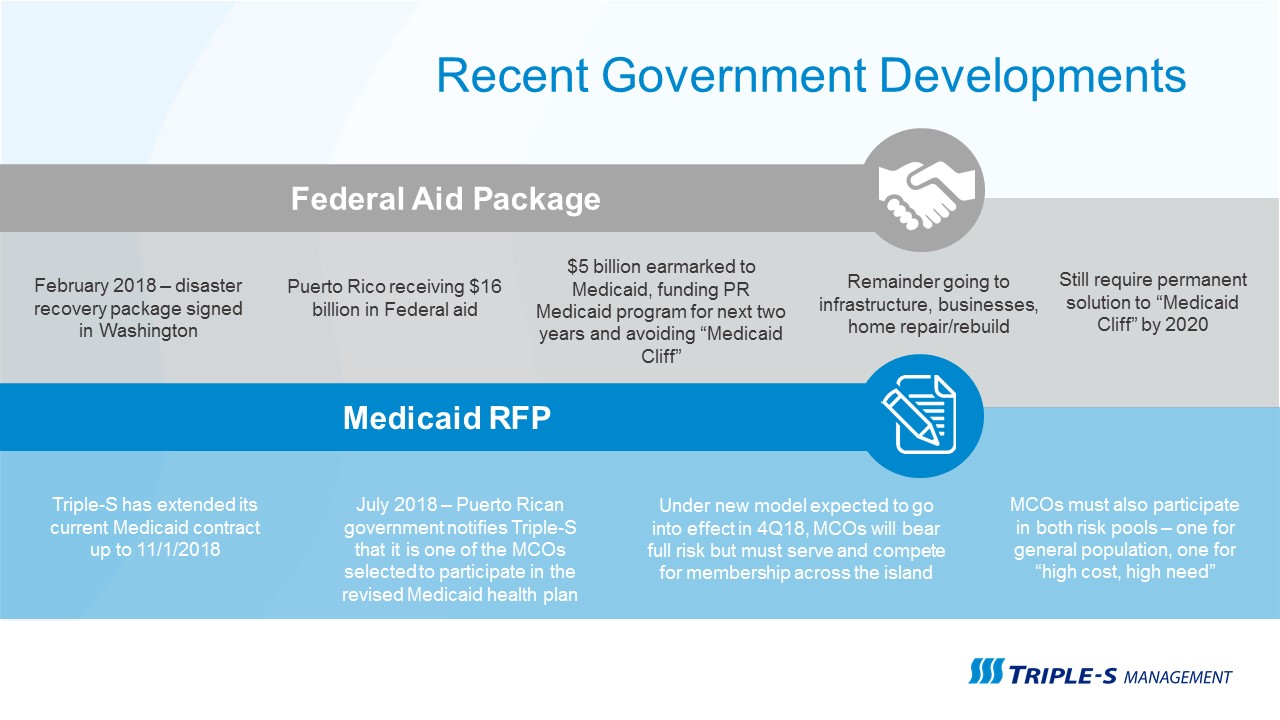

Recent Government Developments Medicaid RFP February 2018 – disaster recovery package signed in Washington Puerto Rico receiving $16 billion in Federal aid $5 billion earmarked to Medicaid, funding PR Medicaid program for next two years and avoiding “Medicaid Cliff” Remainder going to infrastructure, businesses, home repair/rebuild Still require permanent solution to “Medicaid Cliff” by 2020 July 2018 – Puerto Rican government notifies Triple-S that it is one of the MCOs selected to participate in the revised Medicaid health plan Under new model expected to go into effect in 4Q18, MCOs will bear full risk but must serve and compete for membership across the island MCOs must also participate in both risk pools – one for general population, one for “high cost, high need” Triple-S has extended its current Medicaid contract up to 11/1/2018 Federal Aid Package

Consolidation of Pharmacy Benefits Management (PBM) Triple-S recently entered into a three-year strategic agreement with Abarca Health to consolidate the management of pharmacy benefits of its Commercial and Medicare Advantage businesses Abarca is Triple-S’s current Medicare Advantage PBM – the collaboration has achieved a 5-star rating in the Part D component of Triple-S’s PPO product, and has also contributed to the product’s overall 4-star ratingAbarca will provide prescription drug claim processing, pharmacy network management, and delivery of clinical programsAbarca was chosen for its innovative technology, products and services, analytic rigor, and customer focusThe integration of medical care with clinical and pharmacy programs under the agreement is expected to improve Triple-S’s care management and create operational efficiencies, ultimately reducing expenses and generating long-term value for our customers and shareholders Transition expected by January 2019

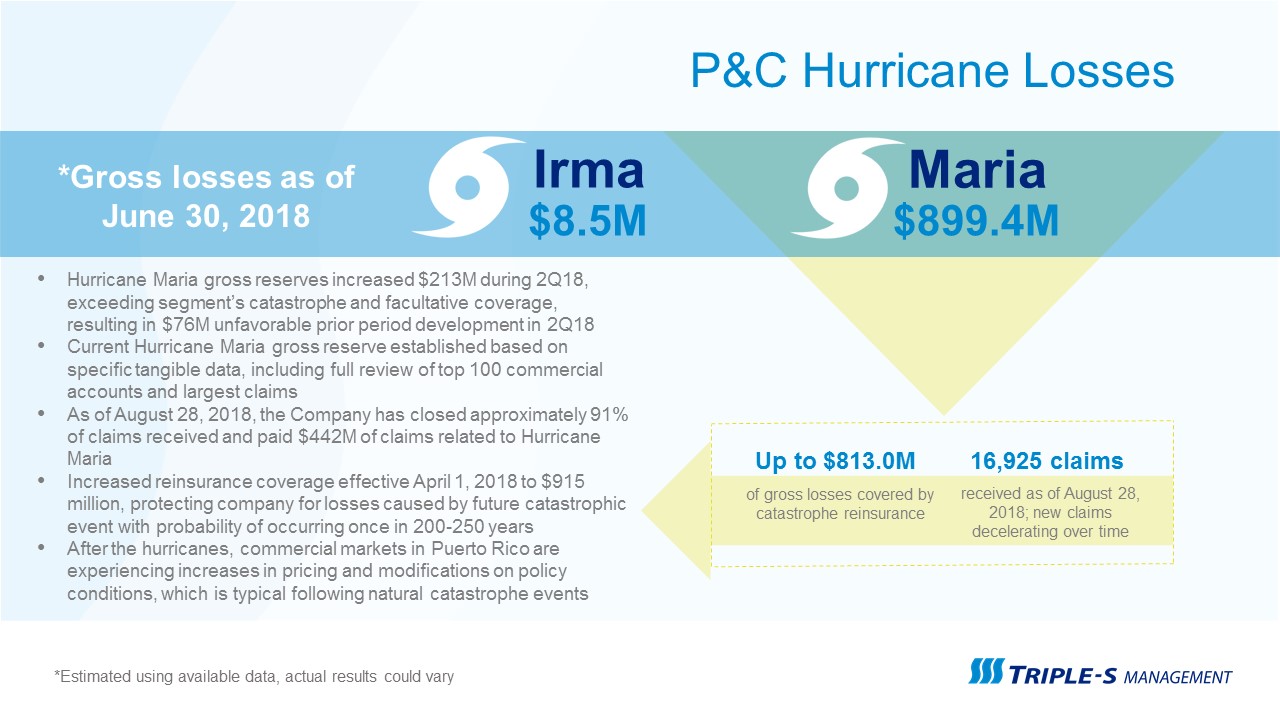

P&C Hurricane Losses $8.5M Irma $899.4M Maria *Gross losses as of June 30, 2018 of gross losses covered by catastrophe reinsurance received as of August 28, 2018; new claims decelerating over time Up to $813.0M 16,925 claims Hurricane Maria gross reserves increased $213M during 2Q18, exceeding segment’s catastrophe and facultative coverage, resulting in $76M unfavorable prior period development in 2Q18Current Hurricane Maria gross reserve established based on specific tangible data, including full review of top 100 commercial accounts and largest claimsAs of August 28, 2018, the Company has closed approximately 91% of claims received and paid $442M of claims related to Hurricane MariaIncreased reinsurance coverage effective April 1, 2018 to $915 million, protecting company for losses caused by future catastrophic event with probability of occurring once in 200-250 yearsAfter the hurricanes, commercial markets in Puerto Rico are experiencing increases in pricing and modifications on policy conditions, which is typical following natural catastrophe events *Estimated using available data, actual results could vary

Strong and Stable Balance Sheet Continuing to prudently allocate capital Expanded existing $30 million share repurchase program by an additional $25 million in February 2018; as of August 1, 2018, $18.5 million of availability remained As of June 30, 2018:Investment portfolio of $1.6 billion; generated net investment income of $51.6 million in 2017, an increase of 5.5% from prior yearLimited exposure to Puerto Rico devaluations; PR government obligation has fair value of $8 million, representing <1% of portfolioApproximately $256 million in cash and cash equivalentsLong-term debt of $30 million, no near-term maturities

Upgraded Medicare Advantage Product Inconsistent productLack of cost control HMO Plan Receives 4-star Designation Reposition Reorganize Retention Legacy 2013 - 2016 Late 2016

Competitive MA Offering Expands Growth Opportunities Consistency MA product conservative with benefits Choice 75% of eligible consumers choose an MA plan Cash Designation provides 8-9% increase in rates Continuing to optimize costs in segment to drive improving bottom line Can price premiums more competitively than in prior years Four-star designation provides company with growth engine

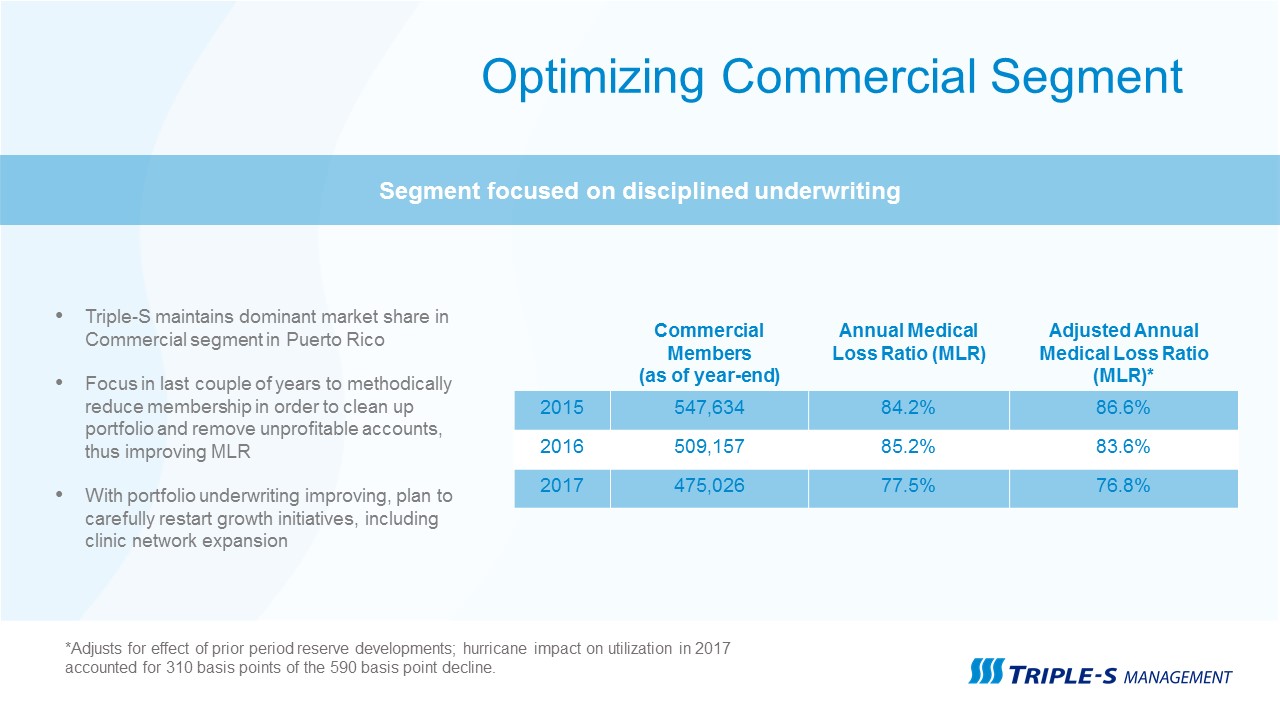

Optimizing Commercial Segment *Adjusts for effect of prior period reserve developments; hurricane impact on utilization in 2017 accounted for 310 basis points of the 590 basis point decline. Segment focused on disciplined underwriting Triple-S maintains dominant market share in Commercial segment in Puerto RicoFocus in last couple of years to methodically reduce membership in order to clean up portfolio and remove unprofitable accounts, thus improving MLRWith portfolio underwriting improving, plan to carefully restart growth initiatives, including clinic network expansion Commercial Members(as of year-end) Annual Medical Loss Ratio (MLR) Adjusted Annual Medical Loss Ratio (MLR)* 2015 547,634 84.2% 86.6% 2016 509,157 85.2% 83.6% 2017 475,026 77.5% 76.8%

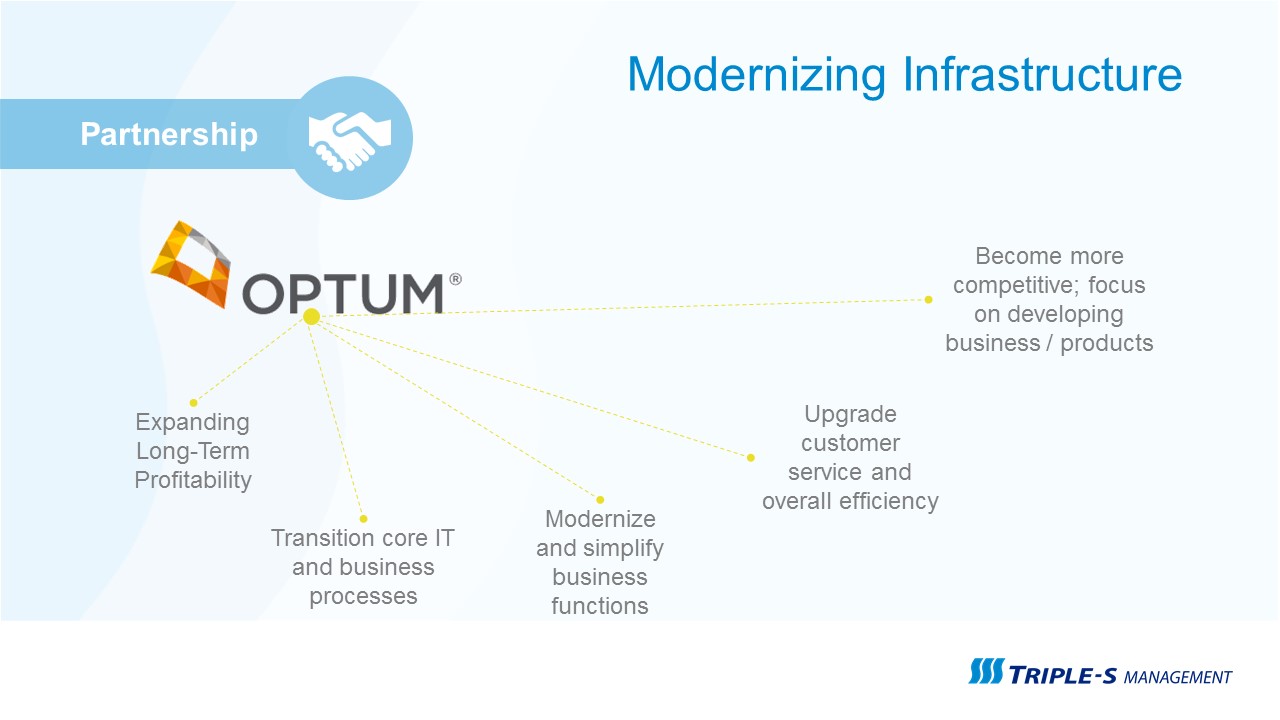

Modernizing Infrastructure Expanding Long-Term Profitability Transition core IT and business processes Modernize and simplify business functions Upgrade customer service and overall efficiency Become more competitive; focus on developing business / products Partnership

Well-Positioned to Grow Long-Term Creating long-term value by growing within Puerto Rico – can be accomplished despite migration Focus on retaining current Medicare Advantage client base and using more competitive offering to win new business and capture additional market shareContinue modernizing infrastructure to further improve level of service while creating additional efficiencies to reduce costsExpand ambulatory clinic network – leverage as additional platform to provide better medical access, cost, quality, and build into additional competitive advantage

Investment Highlights Strong balance sheet and robust repurchase program in place Well regulated market = strong barrier to entry Upgrading infrastructure/technology to improve service, lower costs and enhance long-term margins Rebuilt management team with deep managed care expertise leveraging 50+ year experience and brand equity Well positioned to grow business as Puerto Rico recovers

Appendix

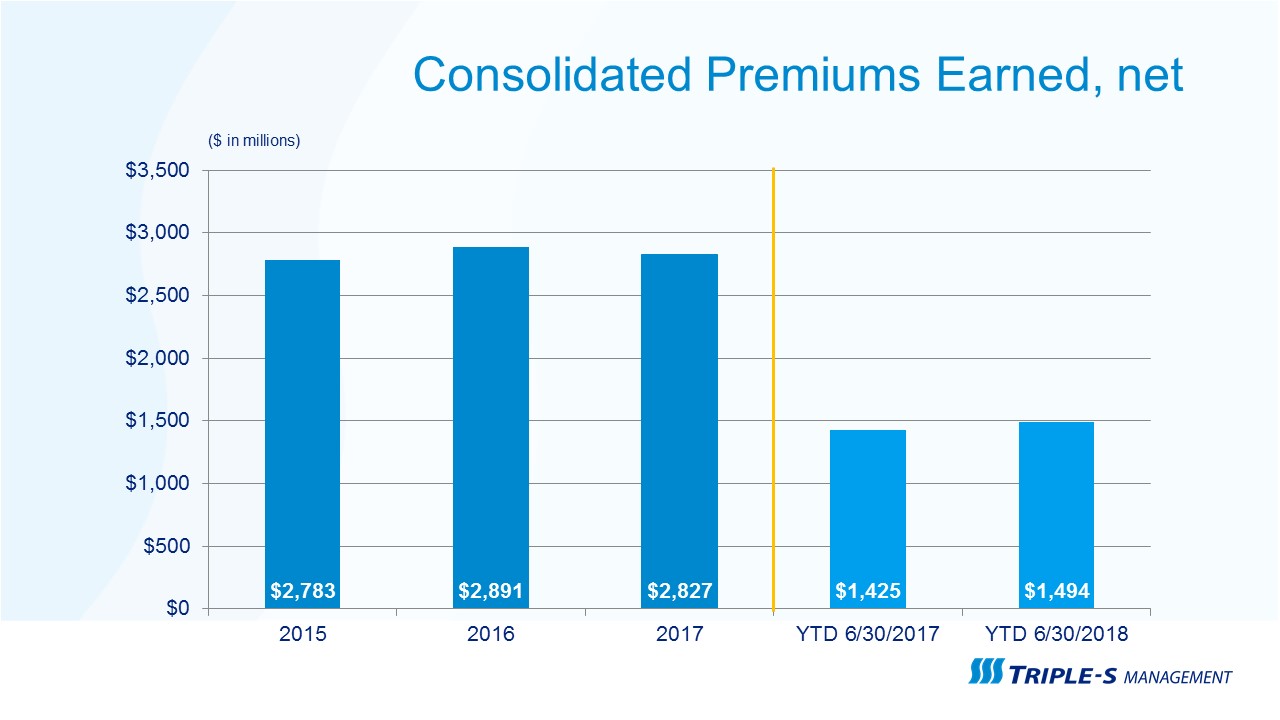

Consolidated Premiums Earned, net ($ in millions)

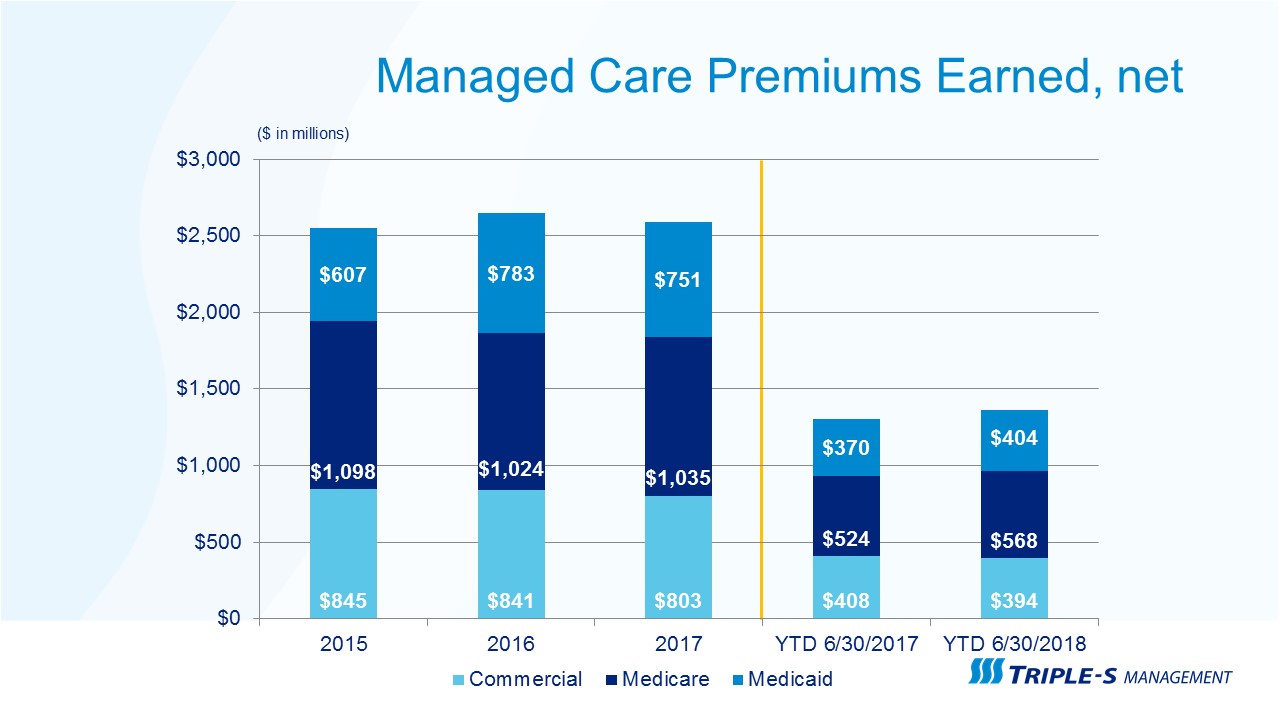

Managed Care Premiums Earned, net ($ in millions)

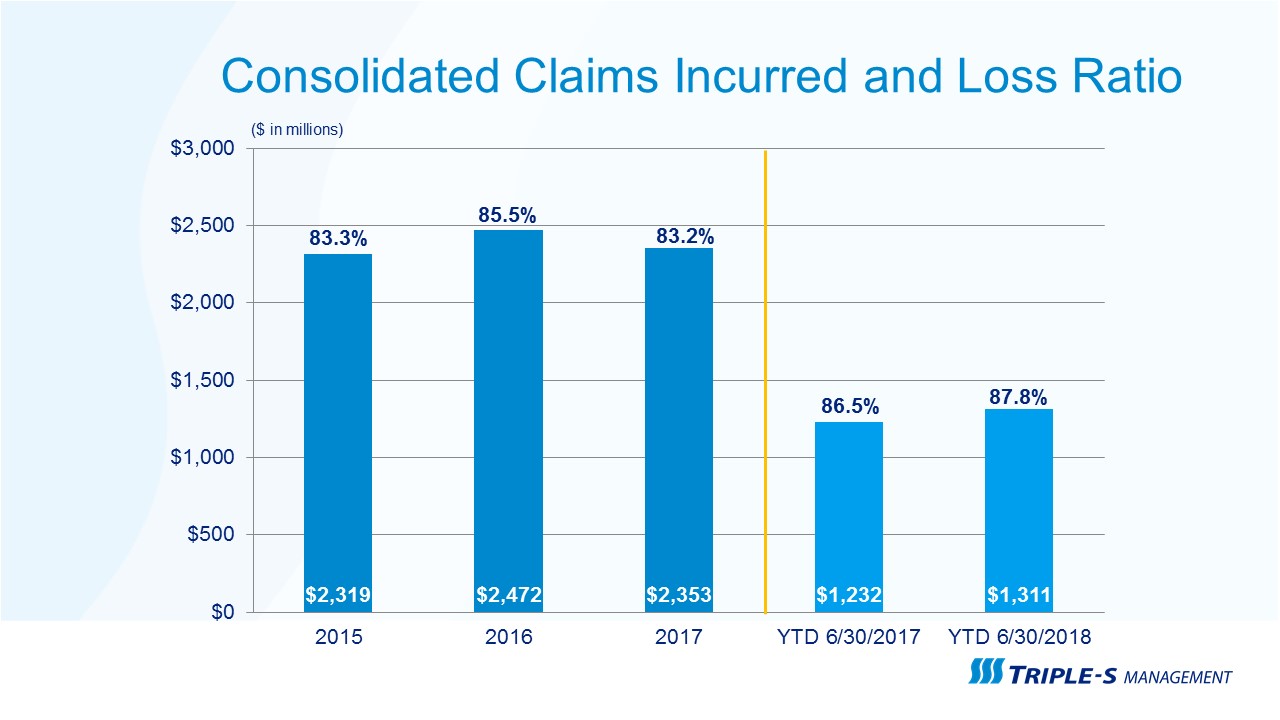

Consolidated Claims Incurred and Loss Ratio ($ in millions)

Consolidated Operating Expenses and Expense Ratio ($ in millions)