Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - SJW GROUP | d526512dex993.htm |

| EX-99.1 - EX-99.1 - SJW GROUP | d526512dex991.htm |

| EX-2.1 - EX-2.1 - SJW GROUP | d526512dex21.htm |

| 8-K - 8-K - SJW GROUP | d526512d8k.htm |

Exhibit 99.2

Creating a Leading National Water Utility: R e v i s e d M e rg e r Term s August 6, 2018

Safe Harbor Statement Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the proposed transaction between SJW and CTWS may not be satisfied or waived, including the risk that required approvals from the security holders of CTWS to the proposed transaction are not obtained; (2) the risk that the regulatory approvals required for the proposed transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the effect of water, utility, environmental and other governmental policies and regulations; (4) litigation relating to the proposed transaction; (5) uncertainties as to the timing of the consummation of the proposed transaction and the ability of each party to consummate the proposed transaction; (6) risks that the proposed transaction disrupts the current plans and operations of SJW or CTWS; (7) the ability of SJW and CTWS to retain and hire key personnel; (8) competitive responses to the proposed transaction; (9) unexpected costs, charges or expenses resulting from the proposed transaction, including, without limitation, related to SJW’s financing plans in connection with the proposed transaction; (10) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; (11) the combined company’s ability to achieve the growth prospects and synergies expected from the proposed transaction, as well as delays, challenges and expenses associated with integrating SJW’s and CTWS’s existing businesses; and (12) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement filed by CTWS in connection with the proposed transaction, and are more fully discussed in SJW’s quarterly report on Form 10-Q for the period ended June 30, 2018 filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 27, 2018 and CTWS’s quarterly report on Form 10-Q for the period ended March 31, 2018 filed with the SEC on May 9, 2018. In addition, actual results are subject to other risks and uncertainties that relate more broadly to SJW’s overall business, including those more fully described in its filings with the SEC including, without limitation, its annual report on Form 10-K for the fiscal year ended December 31, 2017 and CTWS’s overall business and financial condition, including those more fully described in its filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2017. Forward looking statements are not guarantees of performance, and speak only as of the date made, and none of SJW, its management, CTWS or its management undertakes any obligation to update or revise any forward-looking statements except as required by law. 2

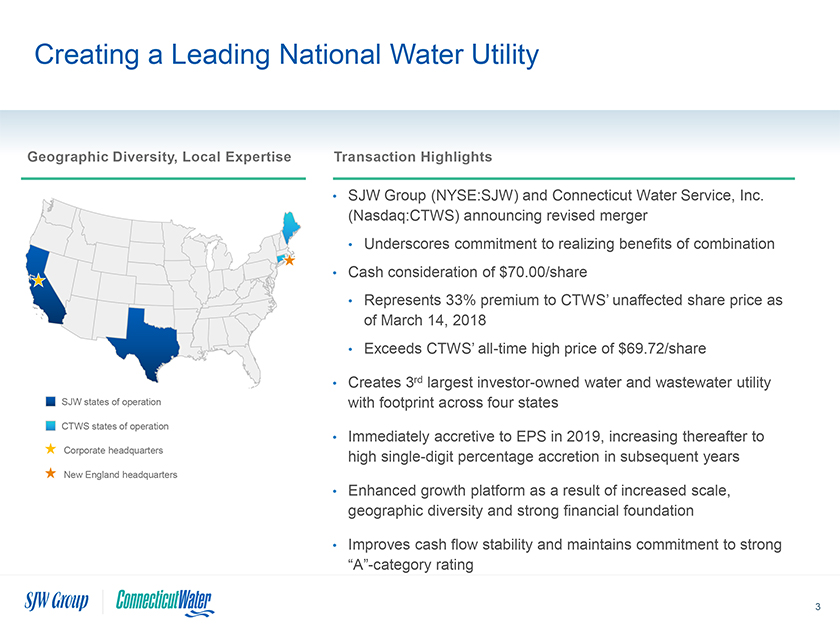

Creating a Leading National Water Utility Geographic Diversity, Local Expertise Transaction Highlights SJW Group (NYSE:SJW) and Connecticut Water Service, Inc. (Nasdaq:CTWS) announcing revised merger Underscores commitment to realizing benefits of combination Cash consideration of $70.00/share Represents 33% premium to CTWS’ unaffected share price as of March 14, 2018 Exceeds CTWS’ all-time high price of $69.72/share Creates 3rd largest investor-owned water and wastewater utility SJW states of operation with footprint across four states CTWS states of operation Immediately accretive to EPS in 2019, increasing thereafter to Corporate headquarters high single-digit percentage accretion in subsequent years New England headquarters Enhanced growth platform as a result of increased scale, geographic diversity and strong financial foundation Improves cash flow stability and maintains commitment to strong “A”-category rating 3

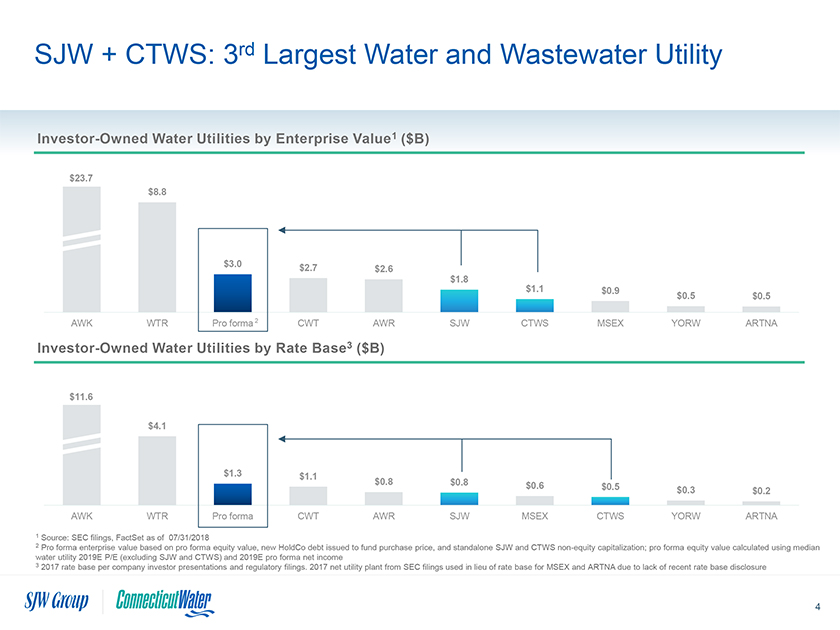

SJW + CTWS: 3rd Largest Water and Wastewater Utility Investor-Owned Water Utilities by Enterprise Value1 ($B) $23.7 $8.8 $3.0 $2.7 $2.6 $1.8 $1.1 $0.9 $0.5 $0.5 AWK WTR Pro forma 2 CWT AWR SJW CTWS MSEX YORW ARTNA Investor-Owned Water Utilities by Rate Base3 ($B) $11.6 $4.1 $1.3 $1.1 $0.8 $0.8 $0.6 $0.5 $0.3 $0.2 AWK WTR Pro forma CWT AWR SJW MSEX CTWS YORW ARTNA 1 Source: SEC filings, FactSet as of 07/31/2018 2 Pro forma enterprise value based on pro forma equity value, new HoldCo debt issued to fund purchase price, and standalone SJW and CTWS non-equity capitalization; pro forma equity value calculated using median water utility 2019E P/E (excluding SJW and CTWS) and 2019E pro forma net income 3 2017 rate base per company investor presentations and regulatory filings. 2017 net utility plant from SEC filings used in lieu of rate base for MSEX and ARTNA due to lack of recent rate base disclosure 4

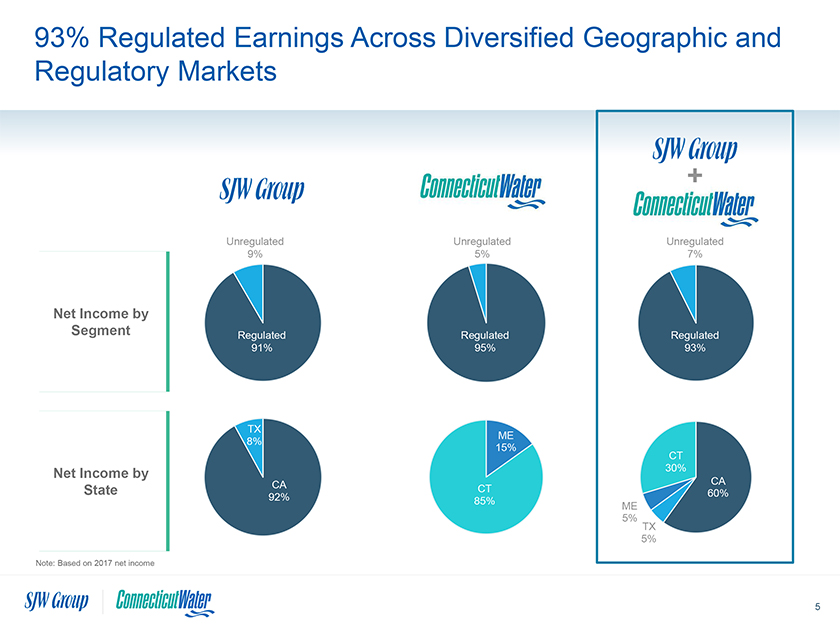

93% Regulated Earnings Across Diversified Geographic and Regulatory Markets + Unregulated Unregulated Unregulated 9% 5% 7% Net Income by Segment Regulated Regulated Regulated 91% 95% 93% TX ME 8% 15% CT Net Income by 30% CA CA State CT 60% 92% 85% ME 5% TX 5% Note: Based on 2017 net income 5

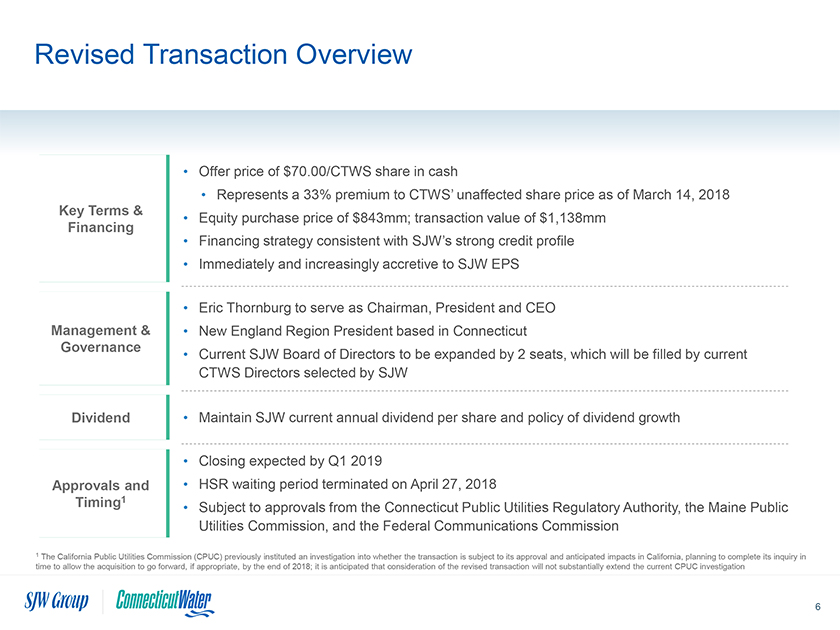

Revised Transaction Overview Offer price of $70.00/CTWS share in cash Represents a 33% premium to CTWS’ unaffected share price as of March 14, 2018 Key Terms & Equity purchase price of $843mm; transaction value of $1,138mm Financing Financing strategy consistent with SJW’s strong credit profile Immediately and increasingly accretive to SJW EPS Eric Thornburg to serve as Chairman, President and CEO Management & New England Region President based in Connecticut Governance Current SJW Board of Directors to be expanded by 2 seats, which will be filled by current CTWS Directors selected by SJW Dividend Maintain SJW current annual dividend per share and policy of dividend growth Closing expected by Q1 2019 Approvals and HSR waiting period terminated on April 27, 2018 Timing1 Subject to approvals from the Connecticut Public Utilities Regulatory Authority, the Maine Public Utilities Commission, and the Federal Communications Commission 1 The California Public Utilities Commission (CPUC) previously instituted an investigation into whether the transaction is subject to its approval and anticipated impacts in California, planning to complete its inquiry in time to allow the acquisition to go forward, if appropriate, by the end of 2018; it is anticipated that consideration of the revised transaction will not substantially extend the current CPUC investigation 6

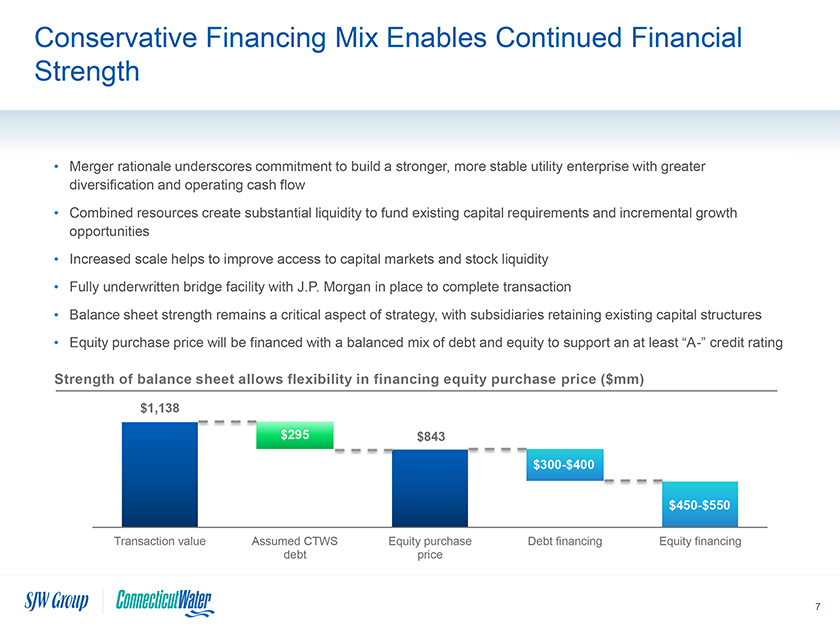

Conservative Financing Mix Enables Continued Financial Strength Merger rationale underscores commitment to build a stronger, more stable utility enterprise with greater diversification and operating cash flow Combined resources create substantial liquidity to fund existing capital requirements and incremental growth opportunities Increased scale helps to improve access to capital markets and stock liquidity Fully underwritten bridge facility with J.P. Morgan in place to complete transaction Balance sheet strength remains a critical aspect of strategy, with subsidiaries retaining existing capital structures Equity purchase price will be financed with a balanced mix of debt and equity to support an at least “A-” credit rating Strength of balance sheet allows flexibility in financing equity purchase price ($mm) $1,138 $295 $843 $300-$400 $450-$550 Transaction value Assumed CTWS Equity purchase Debt financing Equity financing debt price 7

Clear Path to Close in Q1 2019 Q3 2018 Q4 2018 Q1 2019 Revised Merger CTWS Shareholder Approval Announcement File Revised Proxy Statement CT PURA, ME PUC, and FCC Develop and Initiate Transition / Integration Plans Expected Transaction Close Note: The California Public Utilities Commission (CPUC) previously instituted an investigation into whether the transaction is subject to its approval and anticipated impacts in California, planning to complete its inquiry in time to allow the acquisition to go forward, if appropriate, by the end of 2018; it is anticipated that consideration of the revised transaction will not substantially extend the current CPUC investigation; transaction is not subject to SJW shareholder vote 8

Creating a Leading Water Utility Company Well positioned to deliver continued superior shareholder returns and best-in-class customer service More diverse, stable and higher earnings growth profile than could be achieved standalone Ability to leverage nationwide footprint to pursue attractive capital deployment opportunities Robust dividend growth supported by solid investment grade balance sheet Experienced management teams with proven track records of success Advantages of geographic diversity, while maintaining local focus and expertise 9

Additional Information IMPORTANT INFORMATION FOR INVESTORS AND SHAREHOLDERS In response to the tender offer for all the outstanding shares of common stock of SJW commenced by California Water Service Group (“California Water”) through its wholly owned subsidiary, Waltz Acquisition Sub, Inc., SJW has filed a solicitation/recommendation statement on Schedule 14D-9 with the SEC on June 15, 2018, as amended by that Amendment No. 1 to Schedule 14D-9 filed with the SEC on June 26, 2018. Investors and stockholders of SJW are urged to read the solicitation/recommendation statement on Schedule 14D-9 and other documents that are filed or will be filed with the SEC carefully and in their entirety because they contain important information. Investors and stockholders of SJW may obtain a copy of these documents free of charge at the SEC’s website at www.sec.gov. These materials are also available free of charge at SJW’s investor relations website at https://sjwgroup.com/investor_relations. In addition, copies of these materials may be requested free of charge from SJW’s information agent, Georgeson LLC, toll-free at (866) 357-4029. 10