Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - HighPoint Resources Corp | hpr-05092018x8ka.htm |

| EX-23.1 - EXHIBIT 23.1 - HighPoint Resources Corp | hpr-05092018xex231.htm |

| EX-99.2 - EXHIBIT 99.2 - HighPoint Resources Corp | hpr-05092018xex992proforma.htm |

FIFTH CREEK ENERGY OPERATING COMPANY, LLC Financial Statements December 31, 2017, 2016 and 2015 (With Independent Auditors’ Report Thereon)

FIFTH CREEK ENERGY OPERATING COMPANY, LLC Table of Contents Page Independent Auditors’ Report 2 Balance Sheets – December 31, 2017, 2016 and 2015 3 Statements of Operations –Years ended December 31, 2017, 2016 and 2015 4 Statement of Member’s Equity – Years ended December 31, 2017, 2016 and 2015 5 Statements of Cash Flows – Years ended December 31, 2017, 2016 and 2015 6 Notes to the Financial Statements 7

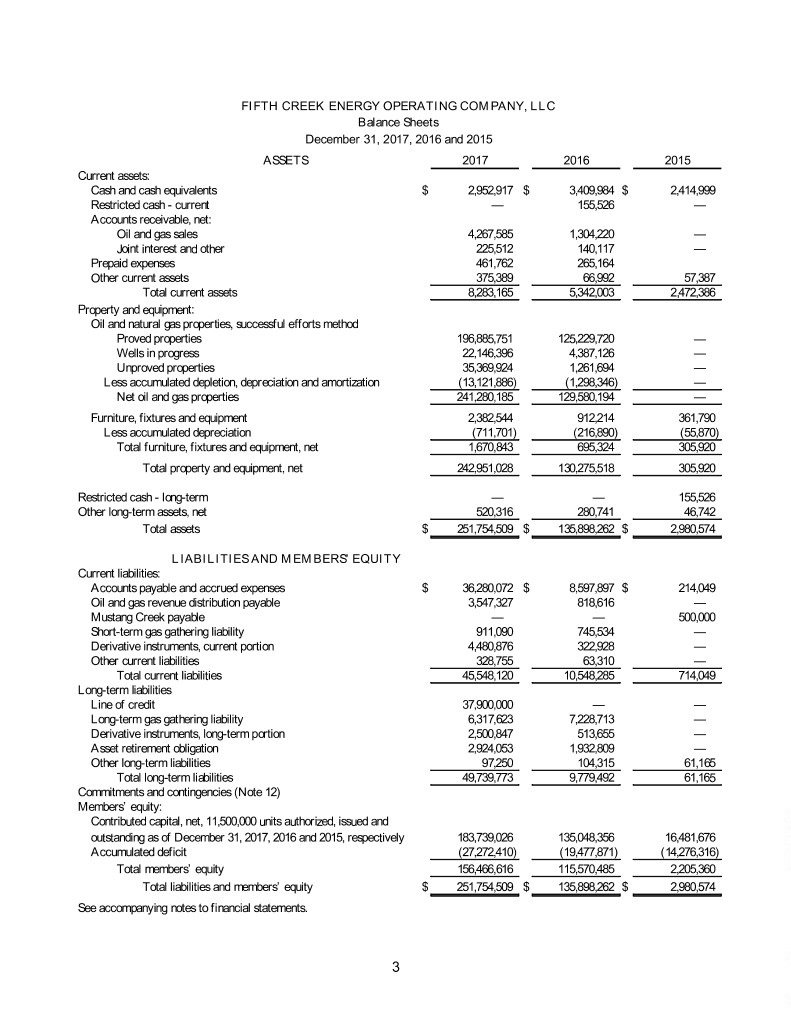

FIFTH CREEK ENERGY OPERATING COMPANY, LLC Balance Sheets December 31, 2017, 2016 and 2015 ASSETS 2017 2016 2015 Current assets: Cash and cash equivalents $ 2,952,917 $ 3,409,984 $ 2,414,999 Restricted cash - current — 155,526 — Accounts receivable, net: Oil and gas sales 4,267,585 1,304,220 — Joint interest and other 225,512 140,117 — Prepaid expenses 461,762 265,164 Other current assets 375,389 66,992 57,387 Total current assets 8,283,165 5,342,003 2,472,386 Property and equipment: Oil and natural gas properties, successful efforts method Proved properties 196,885,751 125,229,720 — Wells in progress 22,146,396 4,387,126 — Unproved properties 35,369,924 1,261,694 — Less accumulated depletion, depreciation and amortization (13,121,886) (1,298,346) — Net oil and gas properties 241,280,185 129,580,194 — Furniture, fixtures and equipment 2,382,544 912,214 361,790 Less accumulated depreciation (711,701) (216,890) (55,870) Total furniture, fixtures and equipment, net 1,670,843 695,324 305,920 Total property and equipment, net 242,951,028 130,275,518 305,920 Restricted cash - long-term — — 155,526 Other long-term assets, net 520,316 280,741 46,742 Total assets $ 251,754,509 $ 135,898,262 $ 2,980,574 LIABILITIES AND MEMBERS' EQUITY Current liabilities: Accounts payable and accrued expenses $ 36,280,072 $ 8,597,897 $ 214,049 Oil and gas revenue distribution payable 3,547,327 818,616 — Mustang Creek payable — — 500,000 Short-term gas gathering liability 911,090 745,534 — Derivative instruments, current portion 4,480,876 322,928 — Other current liabilities 328,755 63,310 — Total current liabilities 45,548,120 10,548,285 714,049 Long-term liabilities Line of credit 37,900,000 — — Long-term gas gathering liability 6,317,623 7,228,713 — Derivative instruments, long-term portion 2,500,847 513,655 — Asset retirement obligation 2,924,053 1,932,809 — Other long-term liabilities 97,250 104,315 61,165 Total long-term liabilities 49,739,773 9,779,492 61,165 Commitments and contingencies (Note 12) Members’ equity: Contributed capital, net, 11,500,000 units authorized, issued and outstanding as of December 31, 2017, 2016 and 2015, respectively 183,739,026 135,048,356 16,481,676 Accumulated deficit (27,272,410) (19,477,871) (14,276,316) Total members’ equity 156,466,616 115,570,485 2,205,360 Total liabilities and members’ equity $ 251,754,509 $ 135,898,262 $ 2,980,574 See accompanying notes to financial statements. 3

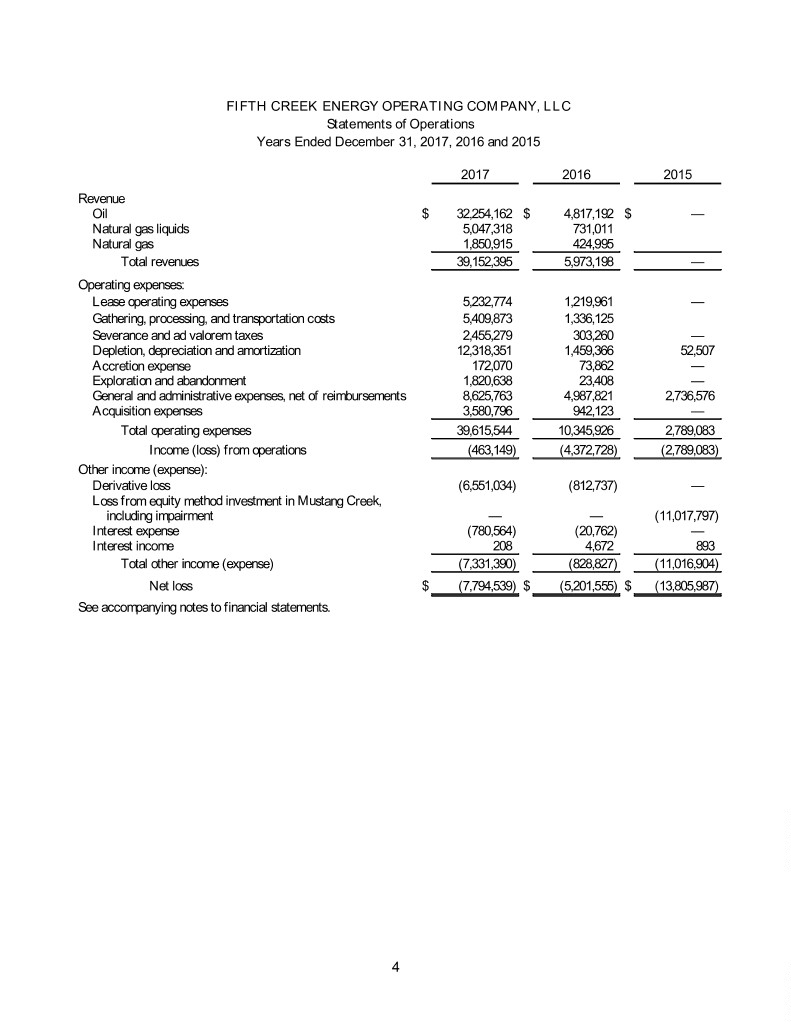

FIFTH CREEK ENERGY OPERATING COMPANY, LLC Statements of Operations Years Ended December 31, 2017, 2016 and 2015 2017 2016 2015 Revenue Oil $ 32,254,162 $ 4,817,192 $ — Natural gas liquids 5,047,318 731,011 Natural gas 1,850,915 424,995 Total revenues 39,152,395 5,973,198 — Operating expenses: Lease operating expenses 5,232,774 1,219,961 — Gathering, processing, and transportation costs 5,409,873 1,336,125 Severance and ad valorem taxes 2,455,279 303,260 — Depletion, depreciation and amortization 12,318,351 1,459,366 52,507 Accretion expense 172,070 73,862 — Exploration and abandonment 1,820,638 23,408 — General and administrative expenses, net of reimbursements 8,625,763 4,987,821 2,736,576 Acquisition expenses 3,580,796 942,123 — Total operating expenses 39,615,544 10,345,926 2,789,083 Income (loss) from operations (463,149) (4,372,728) (2,789,083) Other income (expense): Derivative loss (6,551,034) (812,737) — Loss from equity method investment in Mustang Creek, including impairment — — (11,017,797) Interest expense (780,564) (20,762) — Interest income 208 4,672 893 Total other income (expense) (7,331,390) (828,827) (11,016,904) Net loss $ (7,794,539) $ (5,201,555) $ (13,805,987) See accompanying notes to financial statements. 4

FIFTH CREEK ENERGY OPERATING COMPANY, LLC Statements of Member's Equity Years Ended December 31, 2017, 2016 and 2015 Contributed Accumulated capital deficit Total Balance, January 1, 2015 $ 1,000,000 $ (470,329) $ 529,671 Issuance of member's interest net of issuance costs 15,481,676 — 15,481,676 Net loss — (13,805,987) (13,805,987) Balance, December 31, 2015 $ 16,481,676 $ (14,276,316) $ 2,205,360 Issuance of member's interest net of issuance costs 118,566,680 — 118,566,680 Net loss — (5,201,555) (5,201,555) Balance, December 31, 2016 $ 135,048,356 $ (19,477,871) $ 115,570,485 Issuance of member's interest net of issuance costs 48,690,670 — 48,690,670 Net loss — (7,794,539) (7,794,539) Balance, December 31, 2017 $ 183,739,026 $ (27,272,410) $ 156,466,616 See accompanying notes to financial statements. 5

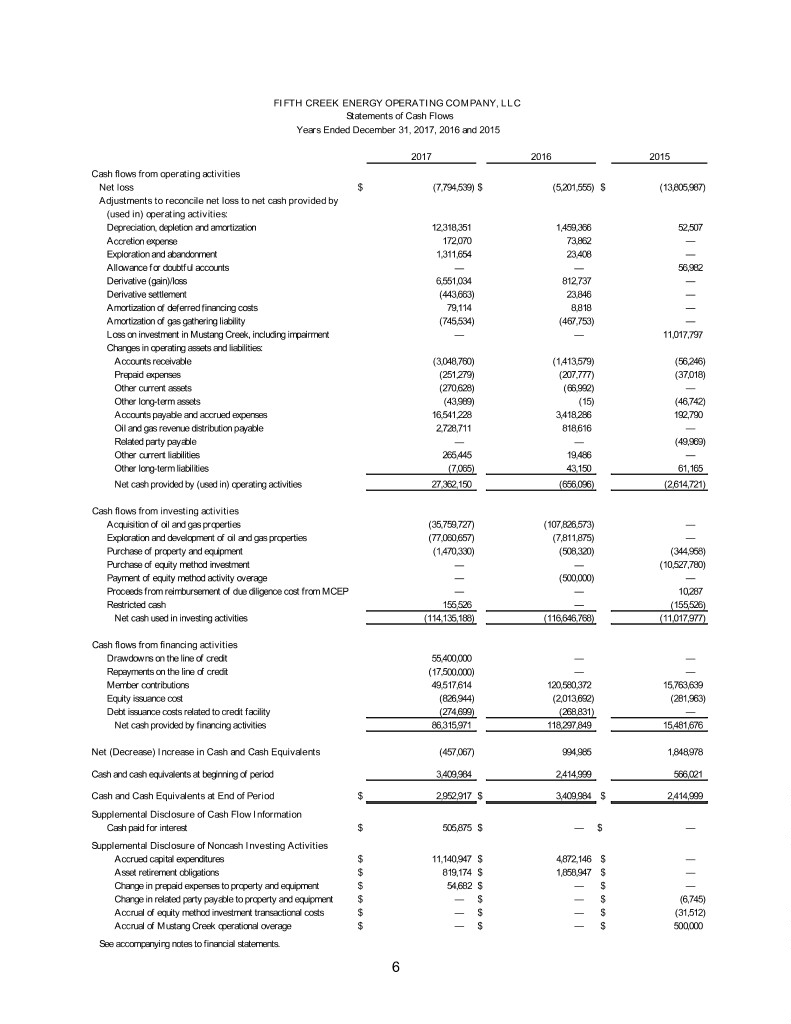

FIFTH CREEK ENERGY OPERATING COMPANY, LLC Statements of Cash Flows Years Ended December 31, 2017, 2016 and 2015 2017 2016 2015 Cash flows from operating activities Net loss $ (7,794,539) $ (5,201,555) $ (13,805,987) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation, depletion and amortization 12,318,351 1,459,366 52,507 Accretion expense 172,070 73,862 — Exploration and abandonment 1,311,654 23,408 — Allowance for doubtful accounts — — 56,982 Derivative (gain)/loss 6,551,034 812,737 — Derivative settlement (443,663) 23,846 — Amortization of deferred financing costs 79,114 8,818 — Amortization of gas gathering liability (745,534) (467,753) — Loss on investment in Mustang Creek, including impairment — — 11,017,797 Changes in operating assets and liabilities: Accounts receivable (3,048,760) (1,413,579) (56,246) Prepaid expenses (251,279) (207,777) (37,018) Other current assets (270,628) (66,992) — Other long-term assets (43,989) (15) (46,742) Accounts payable and accrued expenses 16,541,228 3,418,286 192,790 Oil and gas revenue distribution payable 2,728,711 818,616 — Related party payable — — (49,969) Other current liabilities 265,445 19,486 — Other long-term liabilities (7,065) 43,150 61,165 Net cash provided by (used in) operating activities 27,362,150 (656,096) (2,614,721) Cash flows from investing activities Acquisition of oil and gas properties (35,759,727) (107,826,573) — Exploration and development of oil and gas properties (77,060,657) (7,811,875) — Purchase of property and equipment (1,470,330) (508,320) (344,958) Purchase of equity method investment — — (10,527,780) Payment of equity method activity overage — (500,000) — Proceeds from reimbursement of due diligence cost from MCEP — — 10,287 Restricted cash 155,526 — (155,526) Net cash used in investing activities (114,135,188) (116,646,768) (11,017,977) Cash flows from financing activities Drawdowns on the line of credit 55,400,000 — — Repayments on the line of credit (17,500,000) — — Member contributions 49,517,614 120,580,372 15,763,639 Equity issuance cost (826,944) (2,013,692) (281,963) Debt issuance costs related to credit facility (274,699) (268,831) — Net cash provided by financing activities 86,315,971 118,297,849 15,481,676 Net (Decrease) Increase in Cash and Cash Equivalents (457,067) 994,985 1,848,978 Cash and cash equivalents at beginning of period 3,409,984 2,414,999 566,021 Cash and Cash Equivalents at End of Period $ 2,952,917 $ 3,409,984 $ 2,414,999 Supplemental Disclosure of Cash Flow Information Cash paid for interest $ 505,875 $ — $ — Supplemental Disclosure of Noncash Investing Activities Accrued capital expenditures $ 11,140,947 $ 4,872,146 $ — Asset retirement obligations $ 819,174 $ 1,858,947 $ — Change in prepaid expenses to property and equipment $ 54,682 $ — $ — Change in related party payable to property and equipment $ — $ — $ (6,745) Accrual of equity method investment transactional costs $ — $ — $ (31,512) Accrual of Mustang Creek operational overage $ — $ — $ 500,000 See accompanying notes to financial statements. 6

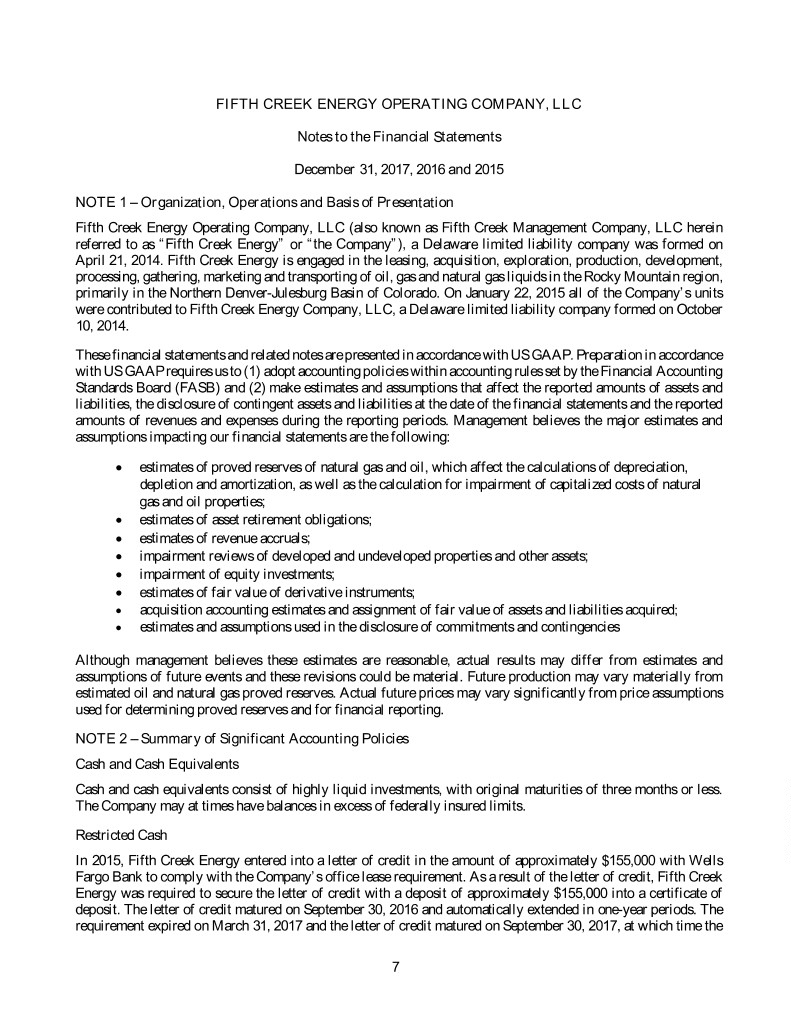

FIFTH CREEK ENERGY OPERATING COMPANY, LLC Notes to the Financial Statements December 31, 2017, 2016 and 2015 NOTE 1 – Organization, Operations and Basis of Presentation Fifth Creek Energy Operating Company, LLC (also known as Fifth Creek Management Company, LLC herein referred to as “Fifth Creek Energy” or “the Company”), a Delaware limited liability company was formed on April 21, 2014. Fifth Creek Energy is engaged in the leasing, acquisition, exploration, production, development, processing, gathering, marketing and transporting of oil, gas and natural gas liquids in the Rocky Mountain region, primarily in the Northern Denver-Julesburg Basin of Colorado. On January 22, 2015 all of the Company’s units were contributed to Fifth Creek Energy Company, LLC, a Delaware limited liability company formed on October 10, 2014. These financial statements and related notes are presented in accordance with US GAAP. Preparation in accordance with US GAAP requires us to (1) adopt accounting policies within accounting rules set by the Financial Accounting Standards Board (FASB) and (2) make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Management believes the major estimates and assumptions impacting our financial statements are the following: • estimates of proved reserves of natural gas and oil, which affect the calculations of depreciation, depletion and amortization, as well as the calculation for impairment of capitalized costs of natural gas and oil properties; • estimates of asset retirement obligations; • estimates of revenue accruals; • impairment reviews of developed and undeveloped properties and other assets; • impairment of equity investments; • estimates of fair value of derivative instruments; • acquisition accounting estimates and assignment of fair value of assets and liabilities acquired; • estimates and assumptions used in the disclosure of commitments and contingencies Although management believes these estimates are reasonable, actual results may differ from estimates and assumptions of future events and these revisions could be material. Future production may vary materially from estimated oil and natural gas proved reserves. Actual future prices may vary significantly from price assumptions used for determining proved reserves and for financial reporting. NOTE 2 – Summary of Significant Accounting Policies Cash and Cash Equivalents Cash and cash equivalents consist of highly liquid investments, with original maturities of three months or less. The Company may at times have balances in excess of federally insured limits. Restricted Cash In 2015, Fifth Creek Energy entered into a letter of credit in the amount of approximately $155,000 with Wells Fargo Bank to comply with the Company’s office lease requirement. As a result of the letter of credit, Fifth Creek Energy was required to secure the letter of credit with a deposit of approximately $155,000 into a certificate of deposit. The letter of credit matured on September 30, 2016 and automatically extended in one-year periods. The requirement expired on March 31, 2017 and the letter of credit matured on September 30, 2017, at which time the 7

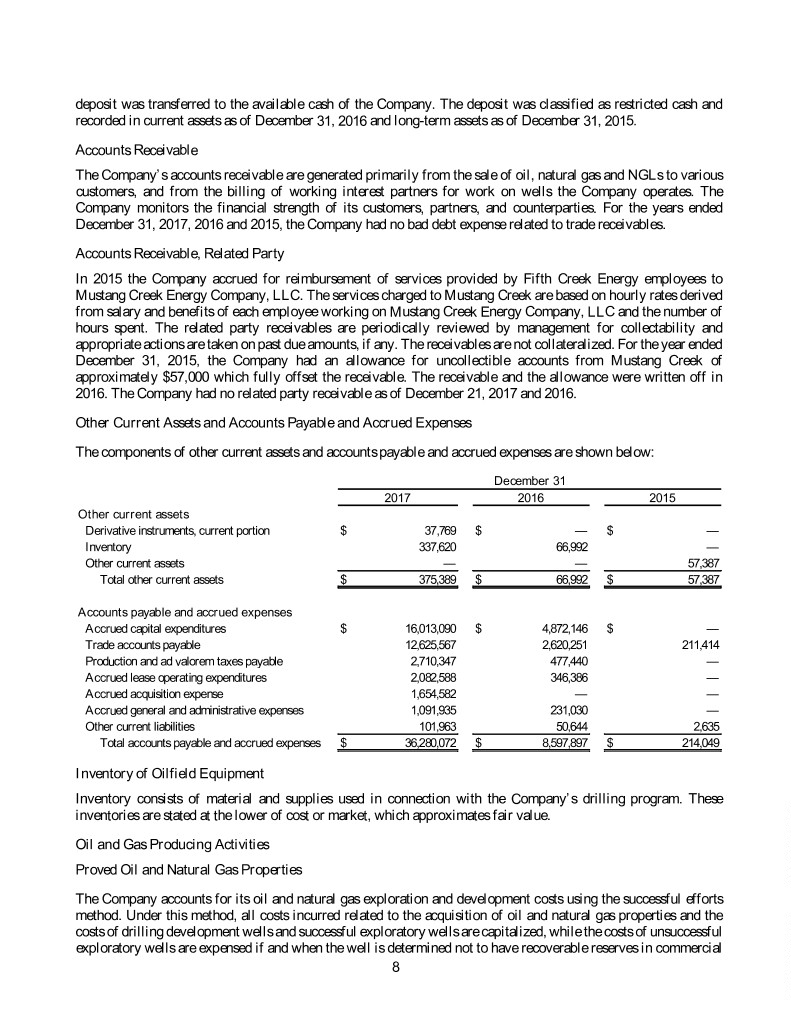

deposit was transferred to the available cash of the Company. The deposit was classified as restricted cash and recorded in current assets as of December 31, 2016 and long-term assets as of December 31, 2015. Accounts Receivable The Company’s accounts receivable are generated primarily from the sale of oil, natural gas and NGLs to various customers, and from the billing of working interest partners for work on wells the Company operates. The Company monitors the financial strength of its customers, partners, and counterparties. For the years ended December 31, 2017, 2016 and 2015, the Company had no bad debt expense related to trade receivables. Accounts Receivable, Related Party In 2015 the Company accrued for reimbursement of services provided by Fifth Creek Energy employees to Mustang Creek Energy Company, LLC. The services charged to Mustang Creek are based on hourly rates derived from salary and benefits of each employee working on Mustang Creek Energy Company, LLC and the number of hours spent. The related party receivables are periodically reviewed by management for collectability and appropriate actions are taken on past due amounts, if any. The receivables are not collateralized. For the year ended December 31, 2015, the Company had an allowance for uncollectible accounts from Mustang Creek of approximately $57,000 which fully offset the receivable. The receivable and the allowance were written off in 2016. The Company had no related party receivable as of December 21, 2017 and 2016. Other Current Assets and Accounts Payable and Accrued Expenses The components of other current assets and accounts payable and accrued expenses are shown below: December 31 2017 2016 2015 Othe r curre nt asse ts Derivative instruments, current portion $ 37,769 $ — $ — Inventory 337,620 66,992 — Other current assets — — 57,387 Total other current assets $ 375,389 $ 66,992 $ 57,387 Accounts payable and accrued expenses Accrued capital expenditures $ 16,013,090 $ 4,872,146 $ — Trade accounts payable 12,625,567 2,620,251 211,414 Production and ad valorem taxes payable 2,710,347 477,440 — Accrued lease operating expenditures 2,082,588 346,386 — Accrued acquisition expense 1,654,582 — — Accrued general and administrative expenses 1,091,935 231,030 — Other current liabilities 101,963 50,644 2,635 Total accounts payable and accrued expenses $ 36,280,072 $ 8,597,897 $ 214,049 Inventory of Oilfield Equipment Inventory consists of material and supplies used in connection with the Company’s drilling program. These inventories are stated at the lower of cost or market, which approximates fair value. Oil and Gas Producing Activities Proved Oil and Natural Gas Properties The Company accounts for its oil and natural gas exploration and development costs using the successful efforts method. Under this method, all costs incurred related to the acquisition of oil and natural gas properties and the costs of drilling development wells and successful exploratory wells are capitalized, while the costs of unsuccessful exploratory wells are expensed if and when the well is determined not to have recoverable reserves in commercial 8

quantities. Other items charged to expense generally include geological and geophysical costs, delay rentals and lease and well operating costs. At December 31, 2017, the Company had nine developmental wells in the process of being drilled or completed. At December 31, 2016, the Company had three exploratory wells in the process of being drilled or completed. Capitalized exploratory well costs are recorded in the wells in progress line on the accompanying balance sheets. At December 31, 2015, the Company did not have any oil and gas properties. Capitalized leasehold costs attributable to proved properties are depleted using the units-of-production method based on proved reserves on a field basis. Capitalized well costs, including asset retirement costs, are depleted based on proved developed reserves on a field basis. For the years ended December 31, 2017 and 2016, the Company recorded depletion for oil and natural gas properties of $11.8 million and $1.3 million, respectively. The Company recorded no depletion for the year ended December 31, 2015. Depletion expense is included in depletion, depreciation, and amortization expense on the accompanying statements of operations. Proved oil and natural gas properties are reviewed for impairment when facts and circumstances indicate their carrying value may not be recoverable. The Company estimates the expected future cash flows of oil and natural gas properties and compares these undiscounted cash flows to the carrying amount of the oil and natural gas properties to determine if the carrying amount is recoverable. If the carrying amount exceeds the estimated undiscounted future cash flows, the Company will write down the carrying amount of the oil and natural gas properties to estimated fair value. The factors used to determine fair value may include, but are not limited to, estimates of reserves, future commodity prices, future production estimates, estimated future capital expenditures and a commensurate discount rate. These assumptions and estimates represent Level 3 inputs. The Company did not record any impairment expenses associated with its proved properties during the years ended December 31, 2017 and 2016. The Company did not have any reserves prior to 2016. The Company records the fair value of an asset retirement obligation (“ARO”) as an asset and a liability when there is a legal obligation associated with the retirement of a long-lived asset and the amount can be reasonably estimated. The increase in carrying value is included in proved properties in the accompanying balance sheets. The Company depletes the amount added to proved properties and recognizes expense in connection with accretion of the discounted liability over the remaining estimated economic lives of the properties. The liability value recorded associated with the ARO is an estimate of the costs, based on today’s estimates of reclamation, inflated to a future value and then discounted to a present value utilizing an estimate of a credit-adjusted risk-free discount rate. For additional discussion, please refer to Note 5 - Asset Retirement Obligations. Unproved Oil and Natural Gas Properties Unproved oil and natural gas properties consist of costs to acquire undeveloped leases and unproved reserves, and are capitalized when incurred. When a successful well is drilled on an undeveloped leasehold or reserves are otherwise attributed to a property, unproved property costs are transferred to proved properties. Unproved properties are periodically assessed for impairment on a property-by-property basis. The Company evaluates significant unproved properties for impairment based on remaining lease term, drilling results, reservoir performance, seismic interpretation or future plans to develop acreage, and records impairment expense for any decline in value. The Company recorded impairment of unproved oil and gas properties resulting from lease expirations for the years ended December 31, 2017 and 2016 of $1.3 million and $23,408, respectively. The Company recorded no impairment of unproved oil and gas properties during the year ended December 31, 2015. Impairment expense is recorded in the exploration and abandonment line on the statement of operations. Furniture, Fixtures and Equipment Furniture, fixtures and equipment consists primarily of office furniture, vehicles, office equipment, field office equipment and leasehold improvements. Renewals and betterments, which substantially extend the useful lives of the assets, are capitalized. Maintenance and repairs are expensed when incurred. Property and equipment, vehicles, and software are depreciated using the straight-line method over 3 to 5 years. Leasehold improvements are depreciated using the straight-line method over the life of the office lease. Field office equipment is depreciated 9

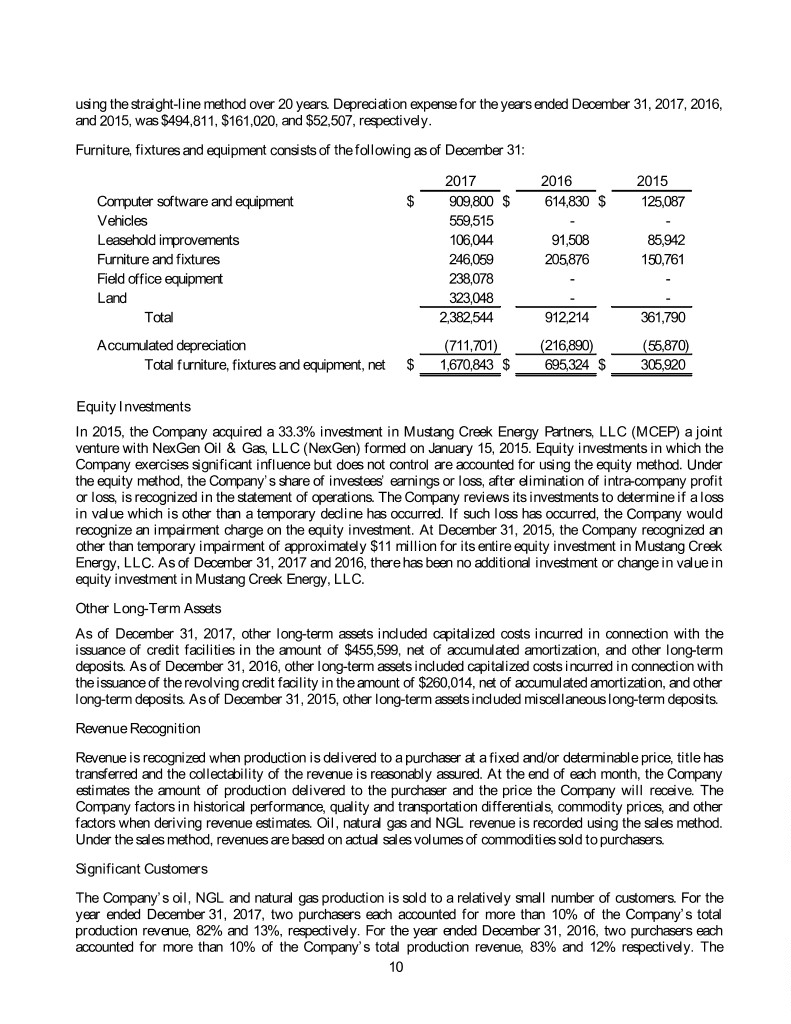

using the straight-line method over 20 years. Depreciation expense for the years ended December 31, 2017, 2016, and 2015, was $494,811, $161,020, and $52,507, respectively. Furniture, fixtures and equipment consists of the following as of December 31: 2017 2016 2015 Computer software and equipment $ 909,800 $ 614,830 $ 125,087 Vehicles 559,515 - - Leasehold improvements 106,044 91,508 85,942 Furniture and fixtures 246,059 205,876 150,761 Field office equipment 238,078 - - Land 323,048 - - Total 2,382,544 912,214 361,790 Accumulated depreciation (711,701) (216,890) (55,870) Total furniture, fixtures and equipment, net $ 1,670,843 $ 695,324 $ 305,920 Equity Investments In 2015, the Company acquired a 33.3% investment in Mustang Creek Energy Partners, LLC (MCEP) a joint venture with NexGen Oil & Gas, LLC (NexGen) formed on January 15, 2015. Equity investments in which the Company exercises significant influence but does not control are accounted for using the equity method. Under the equity method, the Company’s share of investees’ earnings or loss, after elimination of intra-company profit or loss, is recognized in the statement of operations. The Company reviews its investments to determine if a loss in value which is other than a temporary decline has occurred. If such loss has occurred, the Company would recognize an impairment charge on the equity investment. At December 31, 2015, the Company recognized an other than temporary impairment of approximately $11 million for its entire equity investment in Mustang Creek Energy, LLC. As of December 31, 2017 and 2016, there has been no additional investment or change in value in equity investment in Mustang Creek Energy, LLC. Other Long-Term Assets As of December 31, 2017, other long-term assets included capitalized costs incurred in connection with the issuance of credit facilities in the amount of $455,599, net of accumulated amortization, and other long-term deposits. As of December 31, 2016, other long-term assets included capitalized costs incurred in connection with the issuance of the revolving credit facility in the amount of $260,014, net of accumulated amortization, and other long-term deposits. As of December 31, 2015, other long-term assets included miscellaneous long-term deposits. Revenue Recognition Revenue is recognized when production is delivered to a purchaser at a fixed and/or determinable price, title has transferred and the collectability of the revenue is reasonably assured. At the end of each month, the Company estimates the amount of production delivered to the purchaser and the price the Company will receive. The Company factors in historical performance, quality and transportation differentials, commodity prices, and other factors when deriving revenue estimates. Oil, natural gas and NGL revenue is recorded using the sales method. Under the sales method, revenues are based on actual sales volumes of commodities sold to purchasers. Significant Customers The Company’s oil, NGL and natural gas production is sold to a relatively small number of customers. For the year ended December 31, 2017, two purchasers each accounted for more than 10% of the Company’s total production revenue, 82% and 13%, respectively. For the year ended December 31, 2016, two purchasers each accounted for more than 10% of the Company’s total production revenue, 83% and 12% respectively. The 10

Company had no oil and gas sales revenue in 2015. The loss of any single purchaser could materially and adversely affect our revenues in the short-term; however, the Company believes that the loss of any of its purchasers would not have a long-term material adverse effect on its financial condition and results of operations as oil and natural gas are fungible products with well-established markets and numerous purchasers. Income Taxes The Company is not a taxable entity for federal income tax purposes. As such, the Company does not directly pay federal income tax. Accordingly, the accompanying financial statements do not include a provision or liability for income taxes. The Company’s taxable income or loss, which may vary substantially from the net income or loss reported in the statement of operations, is includable in the federal income tax returns of each member based on their allocated share. The Company found no uncertain tax positions in 2017, 2016, or 2015, under the provisions of Accounting Standards Codification (ASC) 740, Accounting for Uncertainty in Income Taxes. The Company’s policy is to recognize accrued interest related to unrecognized tax benefits in interest expense, and to recognize tax penalties in operating expense. As of December 31, 2017, 2016, and 2015, the Company made no provision for interest or penalties related to uncertain tax positions. The Company files income tax returns in the U.S. federal jurisdiction and various states. There are currently no federal or state income tax examinations underway for these jurisdictions and tax returns for the periods from 2014 to 2017 are still open to examination. Derivative Instruments The Company uses commodity derivative instruments to manage its exposure to oil and natural gas price volatility. All of the commodity derivative instruments are utilized to manage price risk attributable to the Company’s expected oil and natural gas production, and the Company does not enter into such instruments for speculative trading purposes. The Company does not designate any derivative instruments as hedges for accounting purposes. The Company records all derivative instruments on the balance sheet as either assets or liabilities measured at their estimated fair value. The Company records gains and losses from the change in fair value of derivative instruments in current earnings as they occur. Fair Value of Financial Instruments The Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible. The Company determines fair value based on assumptions that market participants would use in pricing an asset or liability in the principal or most advantageous market. When considering market participant assumptions in fair value measurements, the fair value hierarchy distinguishes between observable and unobservable inputs, which are categorized in accordance with ASC Topic 820. The carrying amount of cash equivalents, receivables, other current assets, accounts payable and accrued expenses approximate fair value because of the short-term nature of those instruments. Comprehensive Income The Company has no elements of comprehensive income other than net income (loss). Recent Accounting Pronouncements Revenue from Contracts with Customers In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (Topic 606), which outlines a new, single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. This new revenue recognition model provides a five-step analysis in determining when and how revenue is recognized. The new guidance will require a company to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects 11

the consideration a company expects to receive in exchange for those goods or services. The new standards are effective for the Company on January 1, 2019. Early adoption is permitted for fiscal years beginning after December 15, 2016. The Company intends to adopt this standard on January 1, 2019, using the modified retrospective transition method. The Company expects that effective with the adoption, certain charges that are currently presented gross in the statement of operations will be presented net in revenue, and that additional disclosures will be made in accordance with the ASU. Leases On February 25, 2016, the FASB issued ASU 2016-02, Leases (ASU 2016-02). ASU 2016-02 will require lessees to present right-of-use assets and lease liabilities on their balance sheets. ASU 2016-02 is effective for annual and interim periods beginning January 1, 2020. Early adoption of ASU 2016-02 is permitted. Upon adoption of ASU 2016-02, the Company is required to recognize and measure leases at the beginning of the earliest period presented in Fifth Creek Energy’s financial statements using a modified retrospective approach. The modified retrospective approach includes a number of optional practical expedients that the Company may elect to apply. The Company has not yet decided when Fifth Creek Energy will adopt ASU 2016-02 or which practical expedient options we will elect. Fifth Creek Energy is currently evaluating and assessing the impact ASU 2016-02 will have on its financial statements. As of the date of this report, the Company cannot provide any estimate of the impact of adopting ASU 2016-02. Financial Instruments In January 2016, the FASB issued Update No. 2016-01 – Financial Instruments - Overall to require separate presentation of financial assets and financial liabilities by measurement category and form of financial asset on the balance sheet or the accompanying notes to the financial statements. This authoritative guidance is effective for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years. The Company is currently evaluating the provisions of this guidance and assessing its impact, but does not currently believe it will have a material effect on the Company’s financial statements or disclosures. Contingent Put and Call Options in Debt Instruments In March 2016, the FASB issued Update No. 2016-06 - Derivatives and Hedging (Topic 815): Contingent Put and Call Options in Debt Instruments (a consensus of the FASB Emerging Issues Task Force) to increase consistency in practice in applying guidance on determining if an embedded derivative is clearly and closely related to the economic characteristics of the host contract, specifically for assessing whether call (put) options that can accelerate the repayment of principal on a debt instrument meet the clearly and closely related criterion. This authoritative guidance is effective for fiscal years beginning after December 15, 2017 and interim periods within fiscal years beginning after December 15, 2018. The Company is currently evaluating the provisions of this guidance and assessing its impact. NOTE 3 – Merger On December 4, 2017, Fifth Creek Energy Operating Company, LLC entered into an Agreement and Plan of Merger with Bill Barrett Corporation (the “Merger Agreement”). Under the terms of the Merger Agreement, Bill Barrett and Fifth Creek will each become subsidiaries of a newly formed holding company, HighPoint Resources Corporation ("HighPoint Resources"), which will become the publicly listed and traded holding company for the combined Bill Barrett and Fifth Creek. In the transaction, Bill Barrett's stockholders will exchange their Bill Barrett common stock for HighPoint Resources common stock on a 1-for-1 basis, and Fifth Creek's current sole owner will receive 100 million shares of HighPoint Resources common stock. The merger will be accounted for as an acquisition under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 805, Business Combinations, with Bill Barrett being considered the acquirer of Fifth Creek for accounting purposes. The merger is subject to certain conditions to closing, including approval of Bill Barrett Corporation stockholders, effectiveness of the registration statement with the SEC, and approval of listing of HighPoint Resources Corporation common stock by the NYSE. 12

NOTE 4 – Acquisitions On July 17, 2017, the Company purchased an undivided 87.5% interest in oil and gas leases and associated assets comprising 16,372 net acres located in Weld County, Colorado, for $24.5 million. The acquisition was accounted for as an asset acquisition, since the properties acquired are substantially unproved leaseholds. The properties were recorded based on the fair value of the total consideration transferred on the acquisition date and transaction costs were capitalized as a component of the cost of the assets acquired. On July 19, 2017, the Company purchased certain additional interests in oil and gas leases and associated assets comprising 4,396 net acres located in Weld County, Colorado for $5.1 million. These interests acquired by the Company during 2017 were recorded at cost, which approximated fair value. The acquisition was accounted for as an asset acquisition, since the properties acquired are substantially unproved leaseholds. The properties were recorded based on the fair value of the total consideration transferred on the acquisition date and transaction costs were capitalized as a component of the cost of the assets acquired. On July 15, 2016, Fifth Creek Energy acquired proved and unproved oil, NGL, and natural gas properties from the Seller (the “Properties”). The oil, NGL, and natural gas properties are located in the DJ Basin located in Weld County in Colorado. The Properties acquired were approximately 51,641 net acres. The aggregate purchase price totaled approximately $108 million in cash. Transaction costs were $942,000 and were recorded as an operating expense in the statement of operations. Acquisitions are accounted for under the acquisition method of accounting in accordance with ASC Topic 805, Business Combinations (“ASC Topic 805”). An acquisition may result in the recognition of goodwill or a bargain purchase gain based on the measurement of the fair value of the assets acquired at the acquisition date as compared to the fair value of consideration transferred, adjusted for purchase price adjustments. Any such gain would be recognized in current period earnings and classified in other income and expense in the accompanying statement of operations. The Company did not recognize goodwill or a bargain purchase gain as a result of the acquisition of the Properties. The results of operations of the Properties acquired have been included in the financial statements since the Closing Date. The fair value measurements of oil, NGL and natural gas properties, other assets, and other liabilities are based upon inputs that are not observable in the market and therefore represent Level 3 inputs. The preliminary fair values of oil, NGL and natural gas properties, other assets and liabilities, and ARO were measured using valuation techniques that convert future cash flows to a single discounted amount. The estimated proved reserves and the associated future net revenues were discounted using a market-based weighted average cost of capital. Significant inputs to the valuation of oil, NGL and natural gas properties include estimates of reserves, future operating and development costs, future commodity prices, estimated future cash flows and a market-based weighted average cost of capital rate. ARO assumptions include inputs such as estimated plugging, abandonment and reclamation costs, assumptions about inflation factors, an estimate of a credit-adjusted risk-free interest rate and the expected economic recoveries of oil, NGLs and natural gas and time to abandonment. These inputs require significant judgments and estimates by management at the time of the preliminary valuation and are subject to change. The following table summarizes estimates of the fair value of identifiable assets acquired and liabilities assumed as of the Closing Date (rounded): 13

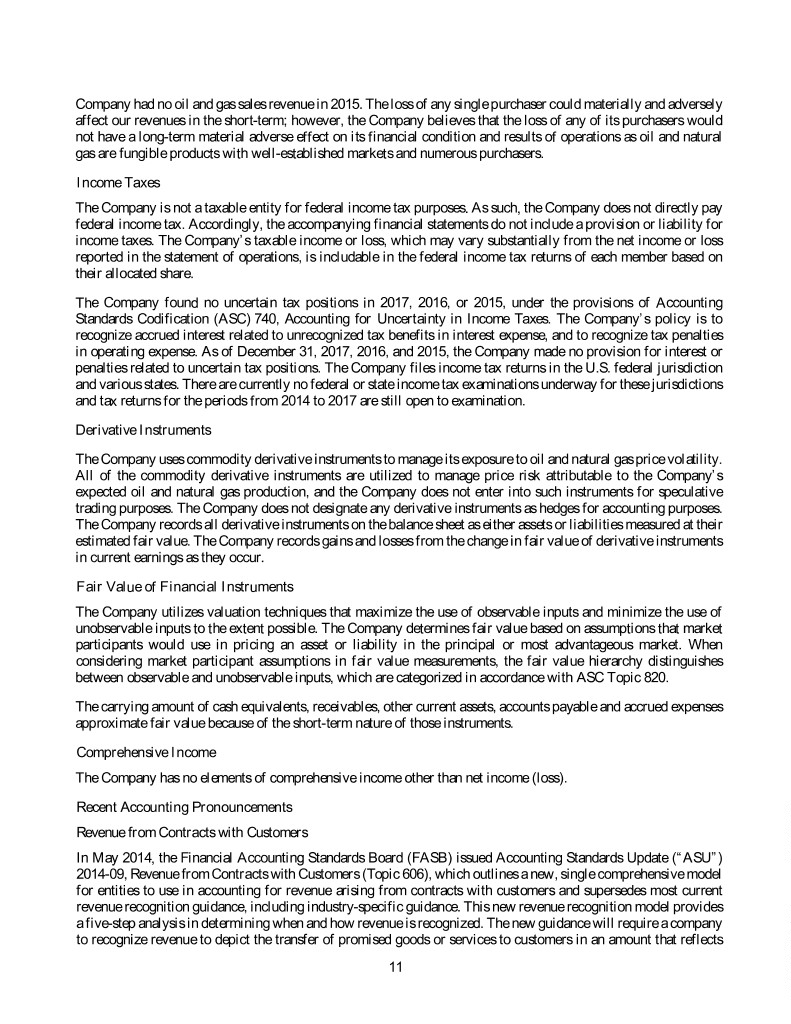

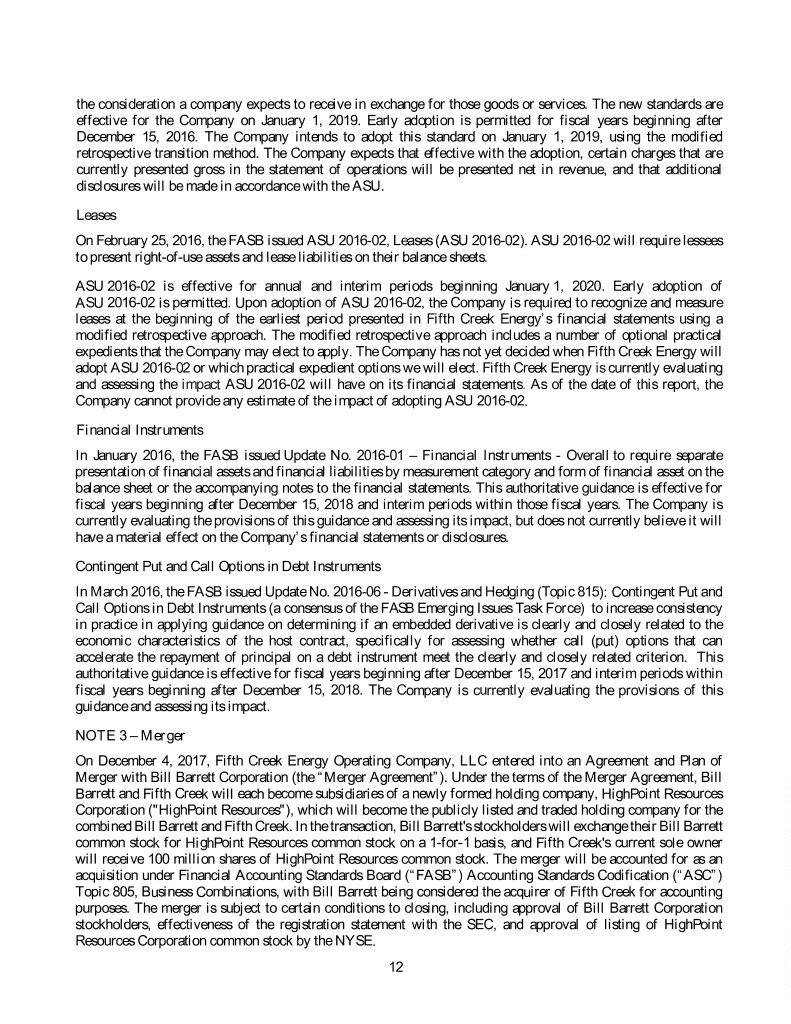

Purchase price Consideration given Cash $ 108,000,000 Total consideration given $ 108,000,000 Allocation of purchase price Proved oil and gas properties $ 117,665,000 Unproved properties 563,000 Asset retirement obligation (1,785,000) Total fair value of oil and gas properties acquired $ 116,443,000 Gas gathering liability (8,443,000) Fair value of net assets acquired $ 108,000,000 As part of the transaction, the Company also assumed an ARO liability related to the proved properties acquired of $1.8 million. The Company also acquired a gas gathering agreement with Summit Midstream Partners, LP (formerly Bear Tracker Energy, LLC) (the “Agreement”) as part of the above transaction. Under the provisions of the Agreement, the Company is committed to process its produced volumes at a predetermined fee, that as of the date of the Acquisition, was above market. Based on estimated future production, the Company estimates that, under the terms of the Agreement it will incur unfavorable expenses due to the current market conditions, therefore, we have accounted for this agreement under the accounting guidance in ASC Topic 805 as an unfavorable contract. The Company estimated the future payments over the term of the commitment period and discounted those payments using a market-based cost of debt rate and determined the fair value of $8.4 million. These inputs require significant judgments and estimates by management. The liability associated with the Agreement is referred to as the “gas gathering liability” throughout these financial statements and is presented as current and noncurrent accrued liabilities within the balance sheet and is being amortized ratably over the 11-year term of the remaining contract. NOTE 5 – Asset Retirement Obligations The Company recognizes an estimated liability for future costs to abandon its oil and gas properties. The time associated with the estimates of our ARO liability occur over the operating lives of the assets, estimated to range from less than one year to 30 years. For the years ended December 31, 2017 and December 31, 2016, estimated cash flows have been discounted at our credit-adjusted risk-free rate of 8.0% and adjusted for inflation using a rate of 2.25%. At December 31, 2017, the Company revised its inflation rate used in the calculation of the ARO liability to 2.38%. Our credit-adjusted risk-free rate is calculated based on our cost of borrowing adjusted for the effect of our credit standing and specific industry and business risk. The Company considers the inputs to the asset retirement obligation valuation to be Level 3, as fair value is determined using discounted cash flow methodologies based on standardized inputs that are not readily observable in public markets. The following table summarizes the changes in asset retirement obligations for the years ended December 31, 2017 and 2016: 14

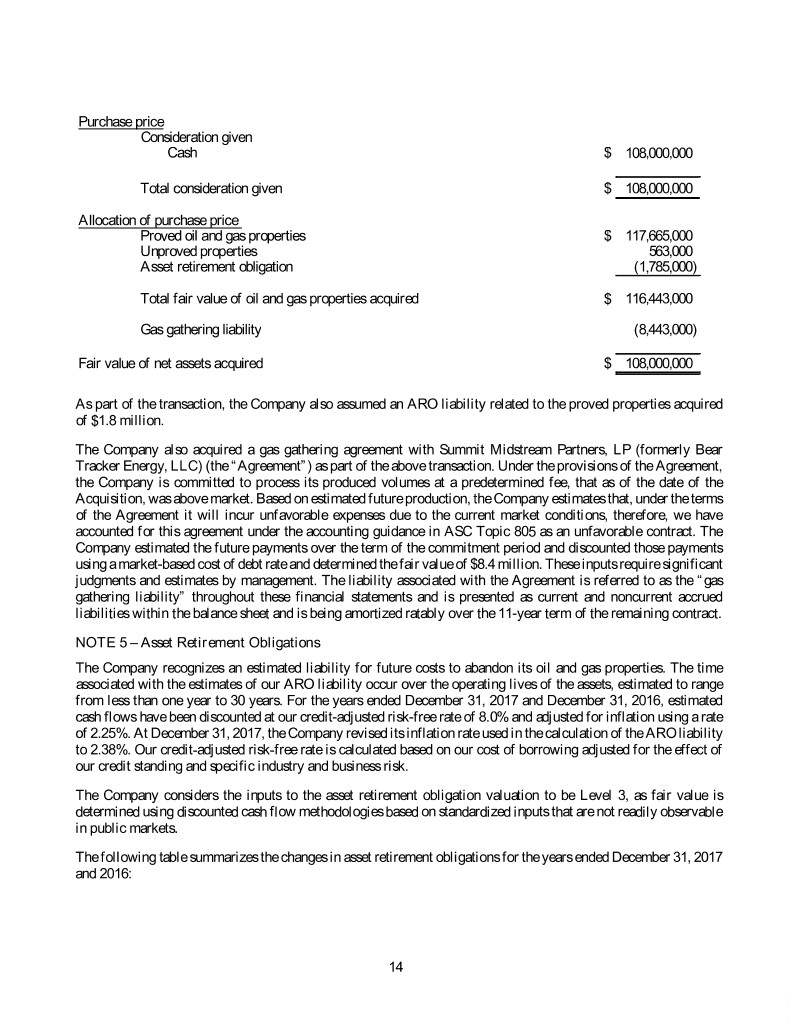

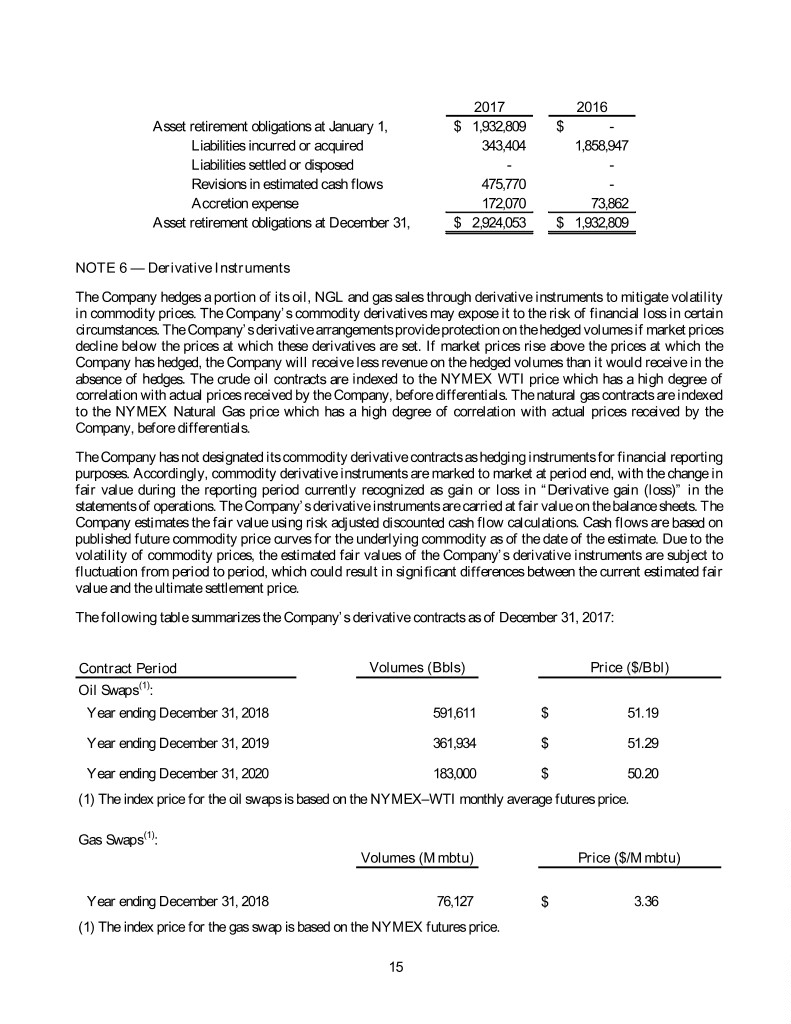

2017 2016 Asset retirement obligations at January 1, $ 1,932,809 $ - Liabilities incurred or acquired 343,404 1,858,947 Liabilities settled or disposed - - Revisions in estimated cash flows 475,770 - Accretion expense 172,070 73,862 Asset retirement obligations at December 31, $ 2,924,053 $ 1,932,809 NOTE 6 — Derivative Instruments The Company hedges a portion of its oil, NGL and gas sales through derivative instruments to mitigate volatility in commodity prices. The Company’s commodity derivatives may expose it to the risk of financial loss in certain circumstances. The Company’s derivative arrangements provide protection on the hedged volumes if market prices decline below the prices at which these derivatives are set. If market prices rise above the prices at which the Company has hedged, the Company will receive less revenue on the hedged volumes than it would receive in the absence of hedges. The crude oil contracts are indexed to the NYMEX WTI price which has a high degree of correlation with actual prices received by the Company, before differentials. The natural gas contracts are indexed to the NYMEX Natural Gas price which has a high degree of correlation with actual prices received by the Company, before differentials. The Company has not designated its commodity derivative contracts as hedging instruments for financial reporting purposes. Accordingly, commodity derivative instruments are marked to market at period end, with the change in fair value during the reporting period currently recognized as gain or loss in “Derivative gain (loss)” in the statements of operations. The Company’s derivative instruments are carried at fair value on the balance sheets. The Company estimates the fair value using risk adjusted discounted cash flow calculations. Cash flows are based on published future commodity price curves for the underlying commodity as of the date of the estimate. Due to the volatility of commodity prices, the estimated fair values of the Company’s derivative instruments are subject to fluctuation from period to period, which could result in significant differences between the current estimated fair value and the ultimate settlement price. The following table summarizes the Company’s derivative contracts as of December 31, 2017: Contract Pe riod Volumes (Bbls) Price ($/Bbl) Oil Swaps (1): Year ending December 31, 2018 591,611 $ 51.19 Year ending December 31, 2019 361,934 $ 51.29 Year ending December 31, 2020 183,000 $ 50.20 (1) The index price for the oil swaps is based on the NYMEX–WTI monthly average futures price. Gas Swaps (1): Volumes (Mmbtu) Price ($/Mmbtu) Year ending December 31, 2018 76,127 $ 3.36 (1) The index price for the gas swap is based on the NYMEX futures price. 15

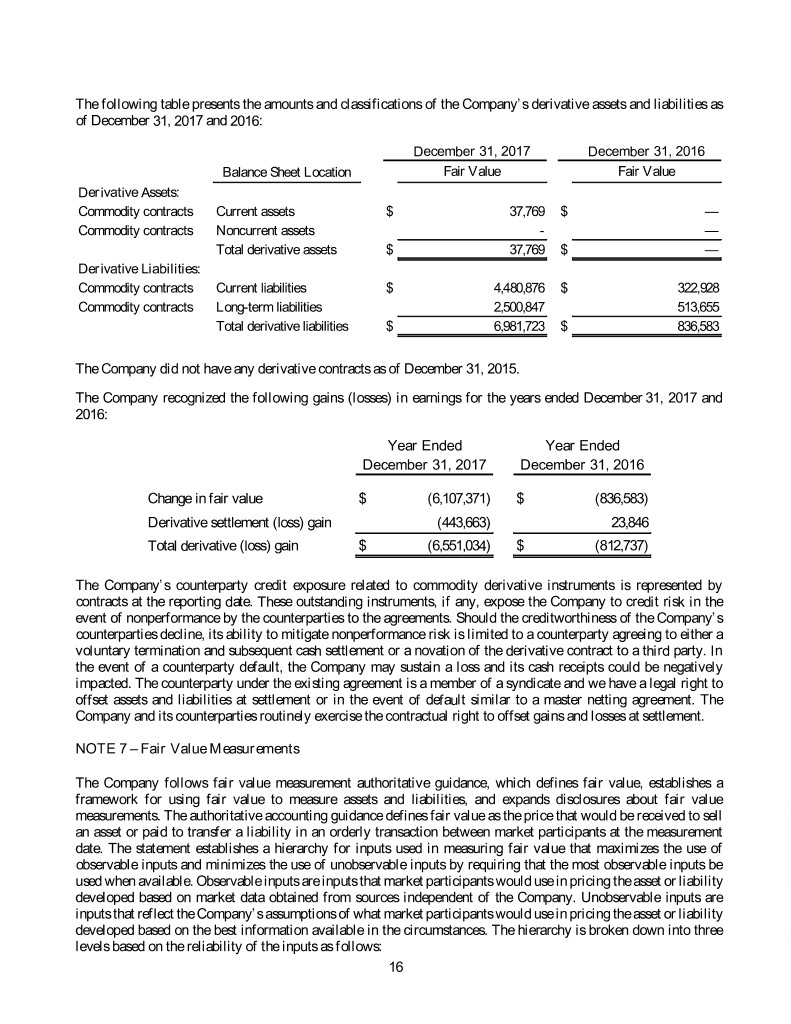

The following table presents the amounts and classifications of the Company’s derivative assets and liabilities as of December 31, 2017 and 2016: December 31, 2017 December 31, 2016 Balance Sheet Location Fair Value Fair Value Derivative Assets: Commodity contracts Current assets $ 37,769 $ — Commodity contracts Noncurrent assets - — Total derivative assets $ 37,769 $ — Derivative Liabilities: Commodity contracts Current liabilities $ 4,480,876 $ 322,928 Commodity contracts Long-term liabilities 2,500,847 513,655 Total derivative liabilities $ 6,981,723 $ 836,583 The Company did not have any derivative contracts as of December 31, 2015. The Company recognized the following gains (losses) in earnings for the years ended December 31, 2017 and 2016: Year Ended Year Ended December 31, 2017 December 31, 2016 Change in fair value $ (6,107,371) $ (836,583) Derivative settlement (loss) gain (443,663) 23,846 Total derivative (loss) gain $ (6,551,034) $ (812,737) The Company’s counterparty credit exposure related to commodity derivative instruments is represented by contracts at the reporting date. These outstanding instruments, if any, expose the Company to credit risk in the event of nonperformance by the counterparties to the agreements. Should the creditworthiness of the Company’s counterparties decline, its ability to mitigate nonperformance risk is limited to a counterparty agreeing to either a voluntary termination and subsequent cash settlement or a novation of the derivative contract to a third party. In the event of a counterparty default, the Company may sustain a loss and its cash receipts could be negatively impacted. The counterparty under the existing agreement is a member of a syndicate and we have a legal right to offset assets and liabilities at settlement or in the event of default similar to a master netting agreement. The Company and its counterparties routinely exercise the contractual right to offset gains and losses at settlement. NOTE 7 – Fair Value Measurements The Company follows fair value measurement authoritative guidance, which defines fair value, establishes a framework for using fair value to measure assets and liabilities, and expands disclosures about fair value measurements. The authoritative accounting guidance defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The statement establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions of what market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The hierarchy is broken down into three levels based on the reliability of the inputs as follows: 16

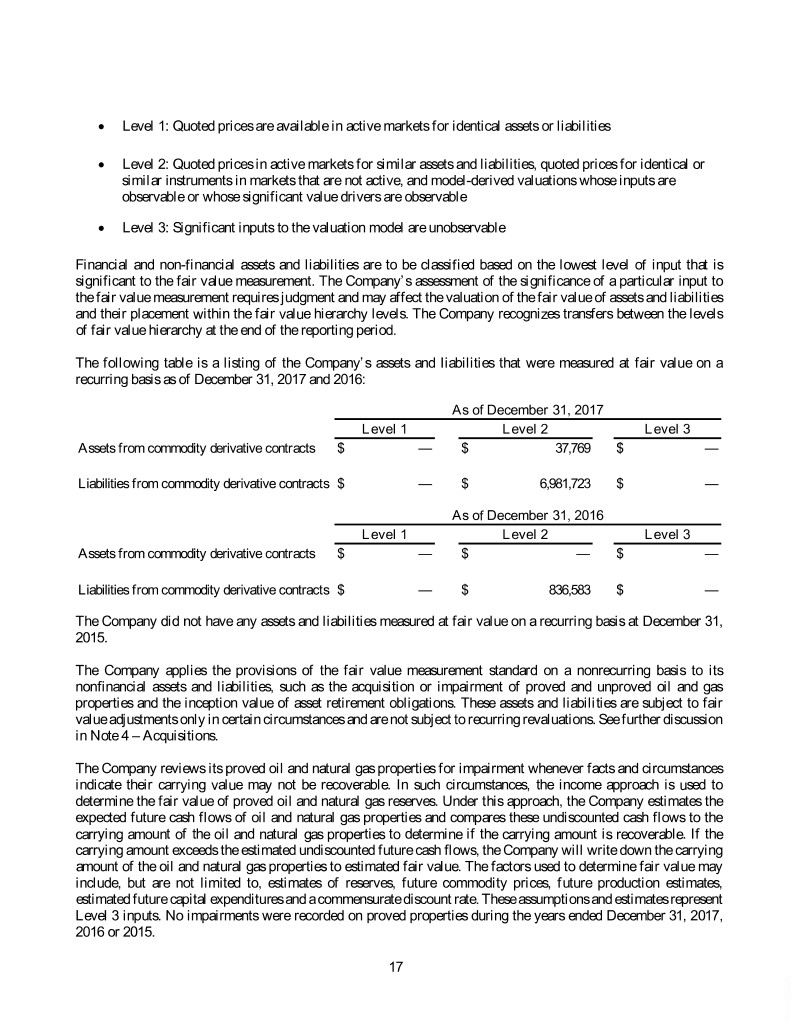

• Level 1: Quoted prices are available in active markets for identical assets or liabilities • Level 2: Quoted prices in active markets for similar assets and liabilities, quoted prices for identical or similar instruments in markets that are not active, and model-derived valuations whose inputs are observable or whose significant value drivers are observable • Level 3: Significant inputs to the valuation model are unobservable Financial and non-financial assets and liabilities are to be classified based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment and may affect the valuation of the fair value of assets and liabilities and their placement within the fair value hierarchy levels. The Company recognizes transfers between the levels of fair value hierarchy at the end of the reporting period. The following table is a listing of the Company’s assets and liabilities that were measured at fair value on a recurring basis as of December 31, 2017 and 2016: As of December 31, 2017 Level 1 Level 2 Level 3 Assets from commodity derivative contracts $ — $ 37,769 $ — Liabilities from commodity derivative contracts $ — $ 6,981,723 $ — As of December 31, 2016 Level 1 Level 2 Level 3 Assets from commodity derivative contracts $ — $ — $ — Liabilities from commodity derivative contracts $ — $ 836,583 $ — The Company did not have any assets and liabilities measured at fair value on a recurring basis at December 31, 2015. The Company applies the provisions of the fair value measurement standard on a nonrecurring basis to its nonfinancial assets and liabilities, such as the acquisition or impairment of proved and unproved oil and gas properties and the inception value of asset retirement obligations. These assets and liabilities are subject to fair value adjustments only in certain circumstances and are not subject to recurring revaluations. See further discussion in Note 4 – Acquisitions. The Company reviews its proved oil and natural gas properties for impairment whenever facts and circumstances indicate their carrying value may not be recoverable. In such circumstances, the income approach is used to determine the fair value of proved oil and natural gas reserves. Under this approach, the Company estimates the expected future cash flows of oil and natural gas properties and compares these undiscounted cash flows to the carrying amount of the oil and natural gas properties to determine if the carrying amount is recoverable. If the carrying amount exceeds the estimated undiscounted future cash flows, the Company will write down the carrying amount of the oil and natural gas properties to estimated fair value. The factors used to determine fair value may include, but are not limited to, estimates of reserves, future commodity prices, future production estimates, estimated future capital expenditures and a commensurate discount rate. These assumptions and estimates represent Level 3 inputs. No impairments were recorded on proved properties during the years ended December 31, 2017, 2016 or 2015. 17

Unproved oil and natural gas property costs are evaluated for impairment and reduced to fair value when there is an indication that the carrying costs may not be recoverable. To measure the fair value of the unproved properties, the Company uses a market approach, and takes into account future development plans, remaining lease term, drilling results, and reservoir performance. The Company recorded impairment of unproved oil and gas properties expense resulting from lease expirations for the years ended December 31, 2017 and 2016 of $1.3 million and $23,408, respectively. The Company recorded no impairment of unproved oil and gas properties during the year ended December 31, 2015. These assumptions and estimates represent Level 3 inputs. The inception value of the Company’s AROs and gas gathering liability are also measured at fair value on a nonrecurring basis. The inputs used to determine such fair value are based primarily on the present value of estimated future cash inflows and outflows. Given the unobservable nature of these inputs, they represent Level 3 inputs. There is no active, public market for the Revolving Credit Facility. The recorded value of the Revolving Credit Facility approximates its fair value due to its floating rate structure and the Company's borrowing base utilization. The fair value measurements for the Revolving Credit Facility represent Level 2 inputs. NOTE 8 – Revolving Credit Facility In November 2016, the Company entered into a five-year $250 million secured revolving credit facility (the “credit facility”). The credit facility has an initial borrowing base of $20.0 million and has semiannual borrowing base redeterminations by April 1 and October 1 each year. In April 2017, the Company entered into an amendment that increased the credit facility borrowing base to $32 million. In September 2017, the Company entered into an amendment that increased the credit facility borrowing base to $55 million. In November 2017, the Company entered into an amendment that increased the credit facility borrowing base to $70 million. Future borrowing bases will be determined at the discretion of the lending syndicate based on proved oil and natural gas reserves, hedge positions and estimated future cash flow from those reserves, as well as any other outstanding debt. Fifth Creek’s borrowings under the credit facility are subject to limitation under terms of the Merger Agreement, which requires the Company not to exceed $54 million on the line of credit at closing. At December 31, 2017, borrowings under the credit facility bore interest at the alternate base rate plus the applicable margin or at the adjusted London Interbank Offered Rate (“LIBOR”). The alternate base rate is defined as the greatest of (a) the prime rate in effect, (b) the federal funds rate in effect plus one half of 1.0%, or (c) the monthly LIBOR, plus 1%. The applicable margins associated with the prime rate or the federal funds rate vary based on the utilization percentage of the credit facility, and are 1.5% to 2.5% for base rate loans and 2.5% to 3.5% for LIBOR loans. The Company also pays an annual commitment fee of 0.5% based on the unused portion of the outstanding borrowing base. For the year ended December 31, 2017, the Company recorded $780,564 in interest expense comprised of $588,168 in interest on the outstanding balance, $79,114 in debt issuance amortization expense and $113,288 in commitment fees. For the year ended December 31, 2016, the Company recorded $20,762 in interest expense comprised of $8,818 in debt issuance amortization expense and $11,944 in commitment fees paid in 2017. The credit facility is secured by oil and natural gas properties representing at least 85% of the value of the Company’s proved reserves. The credit facility contains certain covenants, including among others, restrictions on indebtedness, restrictions on liens, restrictions on investments, restrictions on mergers, restrictions on sales of assets, restrictions on dividends and payments to the Company’s capital interest holders, and restrictions on the Company’s hedging activity. The financial covenants require the Company to maintain compliance with the following financial ratios: 18

• a current ratio, which is the ratio of the Company’s current assets (including unused commitments under the credit facility and excluding noncash assets related to asset retirement obligations and derivatives) to current liabilities (excluding the current portion of long-term debt under the credit agreement and noncash liabilities related to asset retirement obligations and derivatives), as of the last day of each fiscal quarter, of not less than 1.0 to 1.0; and • a leverage ratio, which is the ratio of debt (as defined in our credit agreement) as of the last day of any rolling period, to annualized EBITDAX for the rolling period (as defined in the credit agreement) ending on the last day of the rolling period, of not greater than 4.0 to 1.0. The financial covenants took effect on March 31, 2017. As of December 31, 2017, the Company was in compliance with the financial covenants of the credit facility. The credit facility requires that as of the last day of any fiscal quarter, our ratio of current assets, including the unused portion of our borrowing base, as of such day to current liabilities as of such day, must not be less than 1.0 to 1.0. Our current ratio as of December 31, 2017 was approximately 1.0 to 1.0. Due to the level of our current ratio being at the low end of the required minimum of 1.0 to 1.0, we received advanced confirmation of compliance with this metric from our credit facility syndicate. In the event of noncompliance with the covenants or other default by the Company, the lenders have the ability to call the credit facility due and payable, subject to certain cure provisions available to the Company. As of December 31, 2017, the Company’s outstanding balance under the credit facility was $37.9 million. The weighted-average interest rate on the outstanding balance for the year ended December 31, 2017 was 4.05%. As of December 31, 2016 and 2015, the Company’s outstanding balance under the credit facility was zero. NOTE 9 – Mustang Creek Energy Partners, LLC On January 27, 2015, Fifth Creek Energy agreed to purchase from MCEP 10,400,000 units, or 33.3% equity ownership, including a noncompensatory option to purchase additional units for $100,000 for a total of $10.5 million. MCEP is focused on the exploration and development in the southern Colorado DJ basin. Under FASB ASC 323, Investments-Equity Method and Joint Ventures, the Company uses the equity method of accounting for the investment in MCEP, with earnings or losses reported in the loss from equity investment line on the statements of operations. The funds received by MCEP from Fifth Creek Energy’s investment were used for an operational program including oil and gas exploration and lease acreage development operated by MCEP. During 2015, MCEP incurred operational costs that exceeded the initial $10.5 million funded by the Company. Due to the overage, Fifth Creek Energy agreed to pay for the first $500,000 of MCEP’s operational overage with the remainder being paid by the joint venture partner. The payment of $500,000 to MCEP did not result in additional units or an increase in ownership in MCEP for the Company. At December 31, 2015, Fifth Creek Energy had fully accrued the Company’s $500,000 funding of the overage to MCEP as a payable. The payable to MCEP was paid in 2016. Based on the results of MCEP’s operational program, Fifth Creek Energy determined to discontinue further investment in MCEP since the acreage did not fit the type of oil and gas play that the Company is looking to develop into a long-term asset. In addition, the acreage was not economical at current market prices. The Company determined the MCEP investment had an other than temporary loss and fully impaired the investment at December 31, 2015. The evaluation for the impairment was based on current market conditions, expiration of leases within the next 12 months and the results of the drilling program finding minimal resource play potential in the existing acreage. As a result, the Company incurred a noncash impairment charge of approximately $11 million to write off the carrying amount of the MCEP investment to zero at December 31, 2015. The Company has no remaining capital commitments to MCEP. 19

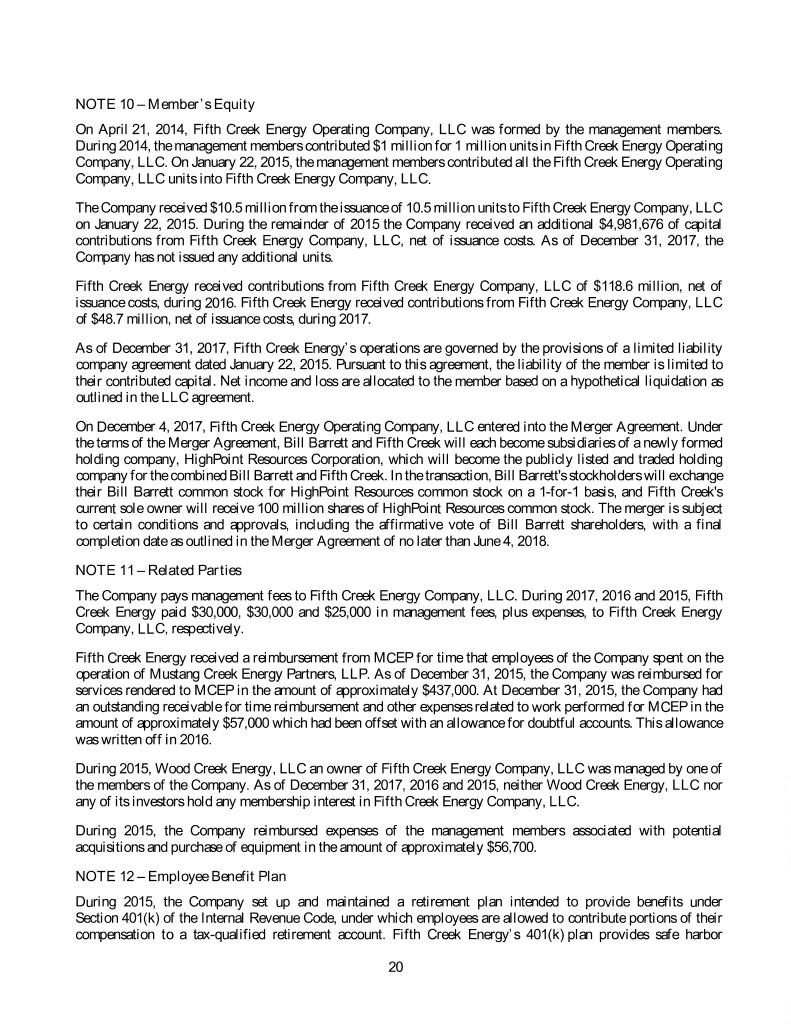

NOTE 10 – Member’s Equity On April 21, 2014, Fifth Creek Energy Operating Company, LLC was formed by the management members. During 2014, the management members contributed $1 million for 1 million units in Fifth Creek Energy Operating Company, LLC. On January 22, 2015, the management members contributed all the Fifth Creek Energy Operating Company, LLC units into Fifth Creek Energy Company, LLC. The Company received $10.5 million from the issuance of 10.5 million units to Fifth Creek Energy Company, LLC on January 22, 2015. During the remainder of 2015 the Company received an additional $4,981,676 of capital contributions from Fifth Creek Energy Company, LLC, net of issuance costs. As of December 31, 2017, the Company has not issued any additional units. Fifth Creek Energy received contributions from Fifth Creek Energy Company, LLC of $118.6 million, net of issuance costs, during 2016. Fifth Creek Energy received contributions from Fifth Creek Energy Company, LLC of $48.7 million, net of issuance costs, during 2017. As of December 31, 2017, Fifth Creek Energy’s operations are governed by the provisions of a limited liability company agreement dated January 22, 2015. Pursuant to this agreement, the liability of the member is limited to their contributed capital. Net income and loss are allocated to the member based on a hypothetical liquidation as outlined in the LLC agreement. On December 4, 2017, Fifth Creek Energy Operating Company, LLC entered into the Merger Agreement. Under the terms of the Merger Agreement, Bill Barrett and Fifth Creek will each become subsidiaries of a newly formed holding company, HighPoint Resources Corporation, which will become the publicly listed and traded holding company for the combined Bill Barrett and Fifth Creek. In the transaction, Bill Barrett's stockholders will exchange their Bill Barrett common stock for HighPoint Resources common stock on a 1-for-1 basis, and Fifth Creek's current sole owner will receive 100 million shares of HighPoint Resources common stock. The merger is subject to certain conditions and approvals, including the affirmative vote of Bill Barrett shareholders, with a final completion date as outlined in the Merger Agreement of no later than June 4, 2018. NOTE 11 – Related Parties The Company pays management fees to Fifth Creek Energy Company, LLC. During 2017, 2016 and 2015, Fifth Creek Energy paid $30,000, $30,000 and $25,000 in management fees, plus expenses, to Fifth Creek Energy Company, LLC, respectively. Fifth Creek Energy received a reimbursement from MCEP for time that employees of the Company spent on the operation of Mustang Creek Energy Partners, LLP. As of December 31, 2015, the Company was reimbursed for services rendered to MCEP in the amount of approximately $437,000. At December 31, 2015, the Company had an outstanding receivable for time reimbursement and other expenses related to work performed for MCEP in the amount of approximately $57,000 which had been offset with an allowance for doubtful accounts. This allowance was written off in 2016. During 2015, Wood Creek Energy, LLC an owner of Fifth Creek Energy Company, LLC was managed by one of the members of the Company. As of December 31, 2017, 2016 and 2015, neither Wood Creek Energy, LLC nor any of its investors hold any membership interest in Fifth Creek Energy Company, LLC. During 2015, the Company reimbursed expenses of the management members associated with potential acquisitions and purchase of equipment in the amount of approximately $56,700. NOTE 12 – Employee Benefit Plan During 2015, the Company set up and maintained a retirement plan intended to provide benefits under Section 401(k) of the Internal Revenue Code, under which employees are allowed to contribute portions of their compensation to a tax-qualified retirement account. Fifth Creek Energy’s 401(k) plan provides safe harbor 20

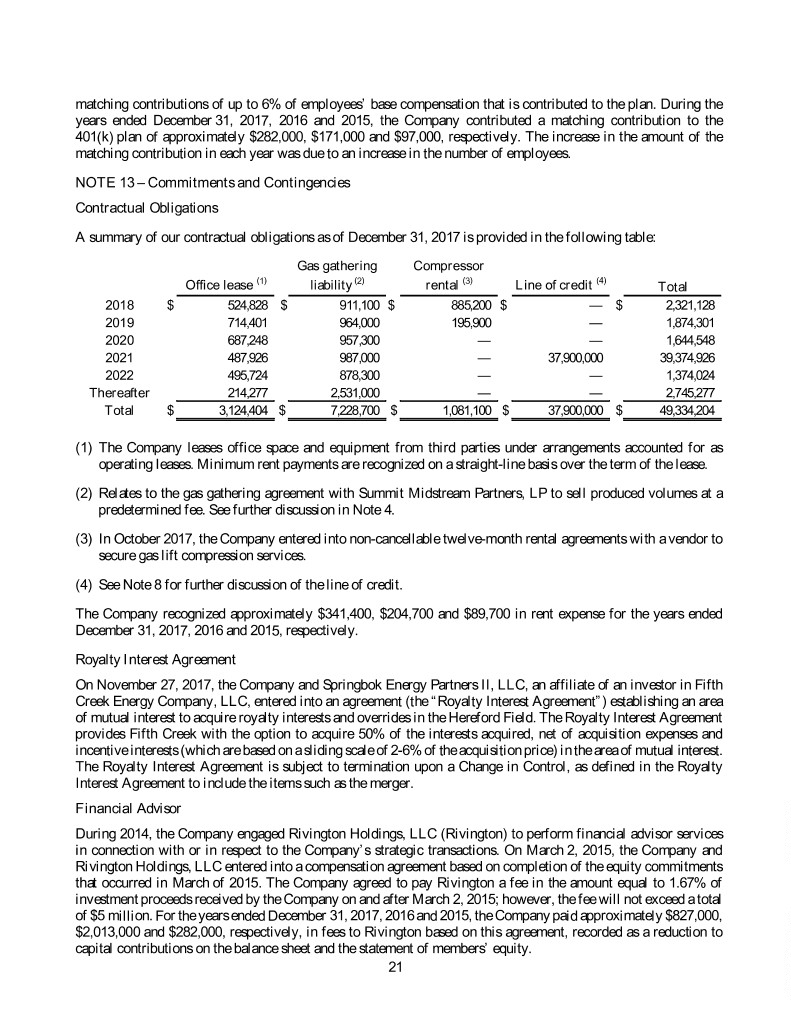

matching contributions of up to 6% of employees’ base compensation that is contributed to the plan. During the years ended December 31, 2017, 2016 and 2015, the Company contributed a matching contribution to the 401(k) plan of approximately $282,000, $171,000 and $97,000, respectively. The increase in the amount of the matching contribution in each year was due to an increase in the number of employees. NOTE 13 – Commitments and Contingencies Contractual Obligations A summary of our contractual obligations as of December 31, 2017 is provided in the following table: Gas gathe ring Compre ssor (1) (2) (3) (4) Office lease liability re ntal Line of credit Total 2018 $ 524,828 $ 911,100 $ 885,200 $ — $ 2,321,128 2019 714,401 964,000 195,900 — 1,874,301 2020 687,248 957,300 — — 1,644,548 2021 487,926 987,000 — 37,900,000 39,374,926 2022 495,724 878,300 — — 1,374,024 Thereafter 214,277 2,531,000 — — 2,745,277 Total $ 3,124,404 $ 7,228,700 $ 1,081,100 $ 37,900,000 $ 49,334,204 (1) The Company leases office space and equipment from third parties under arrangements accounted for as operating leases. Minimum rent payments are recognized on a straight-line basis over the term of the lease. (2) Relates to the gas gathering agreement with Summit Midstream Partners, LP to sell produced volumes at a predetermined fee. See further discussion in Note 4. (3) In October 2017, the Company entered into non-cancellable twelve-month rental agreements with a vendor to secure gas lift compression services. (4) See Note 8 for further discussion of the line of credit. The Company recognized approximately $341,400, $204,700 and $89,700 in rent expense for the years ended December 31, 2017, 2016 and 2015, respectively. Royalty Interest Agreement On November 27, 2017, the Company and Springbok Energy Partners II, LLC, an affiliate of an investor in Fifth Creek Energy Company, LLC, entered into an agreement (the “Royalty Interest Agreement”) establishing an area of mutual interest to acquire royalty interests and overrides in the Hereford Field. The Royalty Interest Agreement provides Fifth Creek with the option to acquire 50% of the interests acquired, net of acquisition expenses and incentive interests (which are based on a sliding scale of 2-6% of the acquisition price) in the area of mutual interest. The Royalty Interest Agreement is subject to termination upon a Change in Control, as defined in the Royalty Interest Agreement to include the items such as the merger. Financial Advisor During 2014, the Company engaged Rivington Holdings, LLC (Rivington) to perform financial advisor services in connection with or in respect to the Company’s strategic transactions. On March 2, 2015, the Company and Rivington Holdings, LLC entered into a compensation agreement based on completion of the equity commitments that occurred in March of 2015. The Company agreed to pay Rivington a fee in the amount equal to 1.67% of investment proceeds received by the Company on and after March 2, 2015; however, the fee will not exceed a total of $5 million. For the years ended December 31, 2017, 2016 and 2015, the Company paid approximately $827,000, $2,013,000 and $282,000, respectively, in fees to Rivington based on this agreement, recorded as a reduction to capital contributions on the balance sheet and the statement of members’ equity. 21

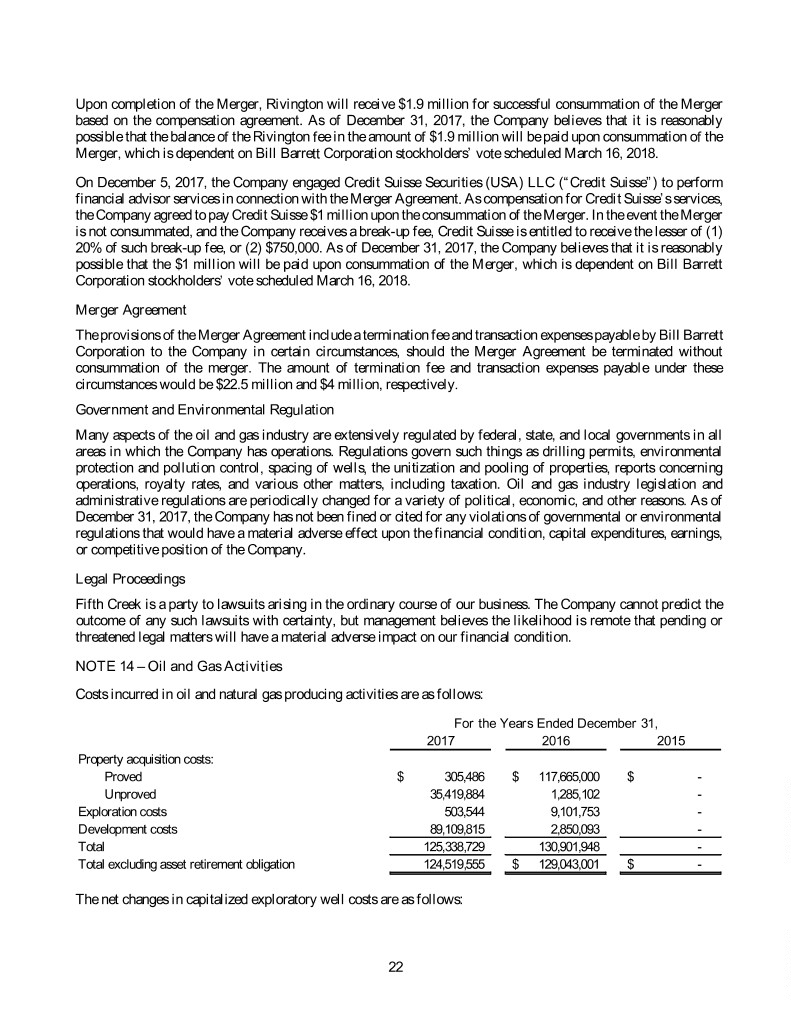

Upon completion of the Merger, Rivington will receive $1.9 million for successful consummation of the Merger based on the compensation agreement. As of December 31, 2017, the Company believes that it is reasonably possible that the balance of the Rivington fee in the amount of $1.9 million will be paid upon consummation of the Merger, which is dependent on Bill Barrett Corporation stockholders’ vote scheduled March 16, 2018. On December 5, 2017, the Company engaged Credit Suisse Securities (USA) LLC (“Credit Suisse”) to perform financial advisor services in connection with the Merger Agreement. As compensation for Credit Suisse’s services, the Company agreed to pay Credit Suisse $1 million upon the consummation of the Merger. In the event the Merger is not consummated, and the Company receives a break-up fee, Credit Suisse is entitled to receive the lesser of (1) 20% of such break-up fee, or (2) $750,000. As of December 31, 2017, the Company believes that it is reasonably possible that the $1 million will be paid upon consummation of the Merger, which is dependent on Bill Barrett Corporation stockholders’ vote scheduled March 16, 2018. Merger Agreement The provisions of the Merger Agreement include a termination fee and transaction expenses payable by Bill Barrett Corporation to the Company in certain circumstances, should the Merger Agreement be terminated without consummation of the merger. The amount of termination fee and transaction expenses payable under these circumstances would be $22.5 million and $4 million, respectively. Government and Environmental Regulation Many aspects of the oil and gas industry are extensively regulated by federal, state, and local governments in all areas in which the Company has operations. Regulations govern such things as drilling permits, environmental protection and pollution control, spacing of wells, the unitization and pooling of properties, reports concerning operations, royalty rates, and various other matters, including taxation. Oil and gas industry legislation and administrative regulations are periodically changed for a variety of political, economic, and other reasons. As of December 31, 2017, the Company has not been fined or cited for any violations of governmental or environmental regulations that would have a material adverse effect upon the financial condition, capital expenditures, earnings, or competitive position of the Company. Legal Proceedings Fifth Creek is a party to lawsuits arising in the ordinary course of our business. The Company cannot predict the outcome of any such lawsuits with certainty, but management believes the likelihood is remote that pending or threatened legal matters will have a material adverse impact on our financial condition. NOTE 14 – Oil and Gas Activities Costs incurred in oil and natural gas producing activities are as follows: For the Years Ended December 31, 2017 2016 2015 Property acquisition costs: Proved $ 305,486 $ 117,665,000 $ - Unproved 35,419,884 1,285,102 - Exploration costs 503,544 9,101,753 - Development costs 89,109,815 2,850,093 - Total 125,338,729 130,901,948 - Total excluding asset retirement obligation 124,519,555 $ 129,043,001 $ - The net changes in capitalized exploratory well costs are as follows: 22

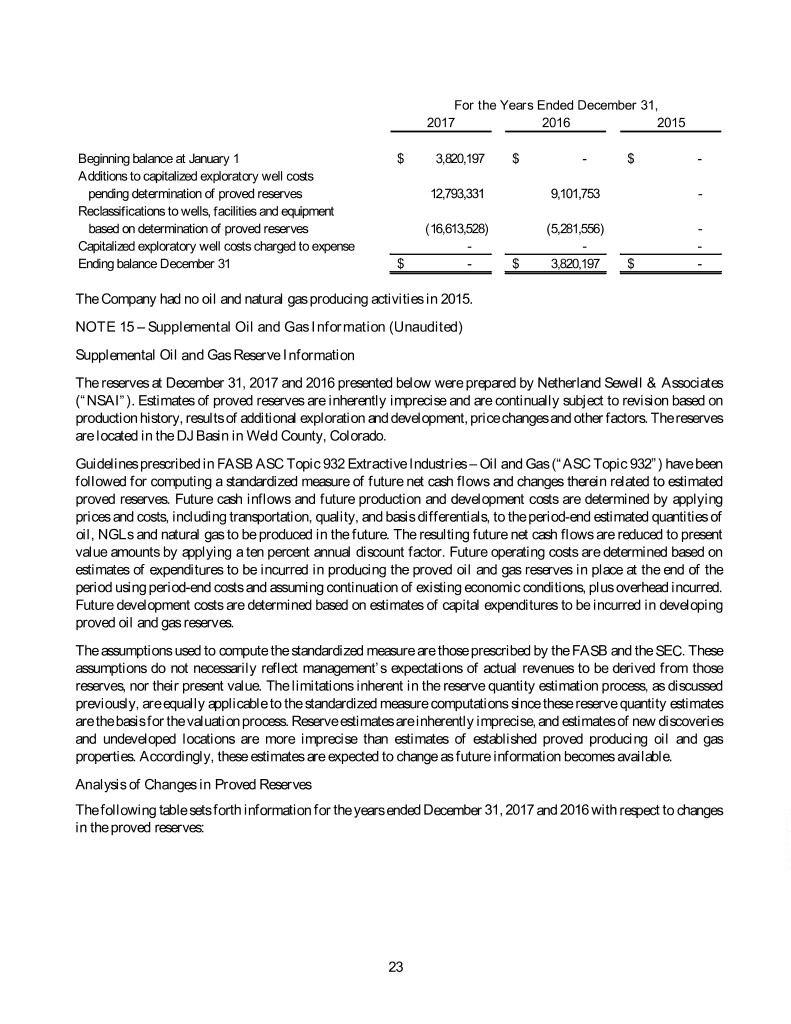

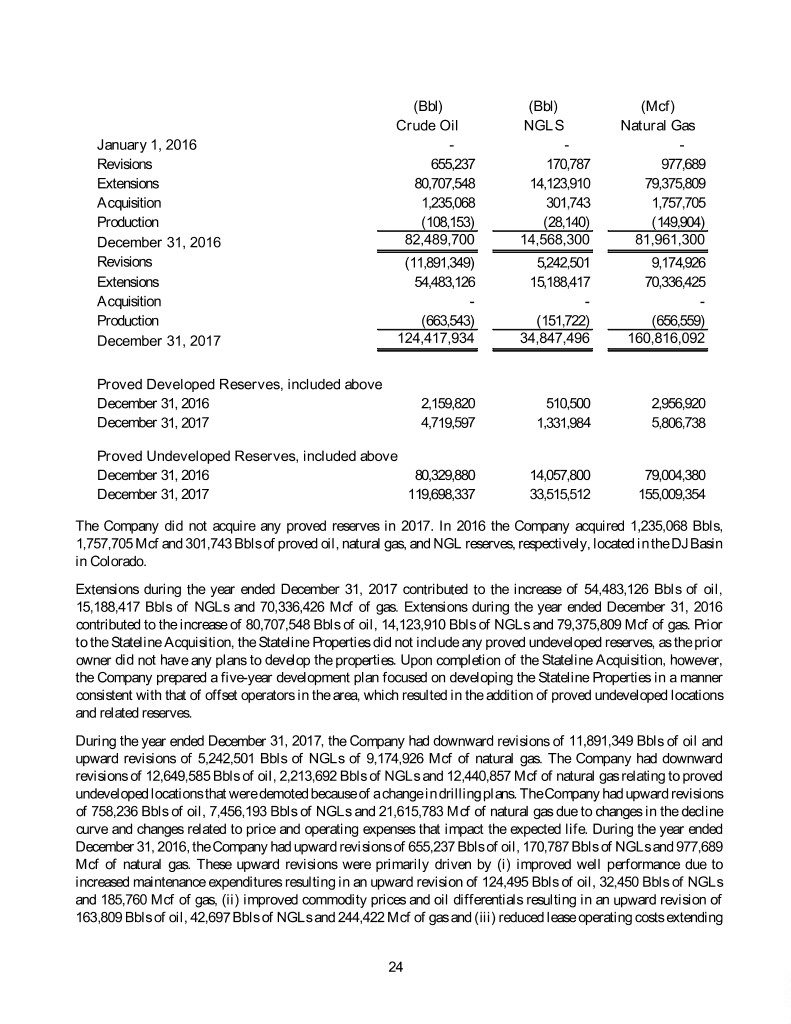

For the Years Ended December 31, 2017 2016 2015 Beginning balance at January 1 $ 3,820,197 $ - $ - Additions to capitalized exploratory well costs pending determination of proved reserves 12,793,331 9,101,753 - Reclassifications to wells, facilities and equipment based on determination of proved reserves (16,613,528) (5,281,556) - Capitalized exploratory well costs charged to expense - - - Ending balance December 31 $ - $ 3,820,197 $ - The Company had no oil and natural gas producing activities in 2015. NOTE 15 – Supplemental Oil and Gas Information (Unaudited) Supplemental Oil and Gas Reserve Information The reserves at December 31, 2017 and 2016 presented below were prepared by Netherland Sewell & Associates (“NSAI”). Estimates of proved reserves are inherently imprecise and are continually subject to revision based on production history, results of additional exploration and development, price changes and other factors. The reserves are located in the DJ Basin in Weld County, Colorado. Guidelines prescribed in FASB ASC Topic 932 Extractive Industries – Oil and Gas (“ASC Topic 932”) have been followed for computing a standardized measure of future net cash flows and changes therein related to estimated proved reserves. Future cash inflows and future production and development costs are determined by applying prices and costs, including transportation, quality, and basis differentials, to the period-end estimated quantities of oil, NGLs and natural gas to be produced in the future. The resulting future net cash flows are reduced to present value amounts by applying a ten percent annual discount factor. Future operating costs are determined based on estimates of expenditures to be incurred in producing the proved oil and gas reserves in place at the end of the period using period-end costs and assuming continuation of existing economic conditions, plus overhead incurred. Future development costs are determined based on estimates of capital expenditures to be incurred in developing proved oil and gas reserves. The assumptions used to compute the standardized measure are those prescribed by the FASB and the SEC. These assumptions do not necessarily reflect management’s expectations of actual revenues to be derived from those reserves, nor their present value. The limitations inherent in the reserve quantity estimation process, as discussed previously, are equally applicable to the standardized measure computations since these reserve quantity estimates are the basis for the valuation process. Reserve estimates are inherently imprecise, and estimates of new discoveries and undeveloped locations are more imprecise than estimates of established proved producing oil and gas properties. Accordingly, these estimates are expected to change as future information becomes available. Analysis of Changes in Proved Reserves The following table sets forth information for the years ended December 31, 2017 and 2016 with respect to changes in the proved reserves: 23

(Bbl) (Bbl) (Mcf) Crude Oil NGLS Natural Gas January 1, 2016 - - - Revisions 655,237 170,787 977,689 Extensions 80,707,548 14,123,910 79,375,809 Acquisition 1,235,068 301,743 1,757,705 Production (108,153) (28,140) (149,904) December 31, 2016 82,489,700 14,568,300 81,961,300 Revisions (11,891,349) 5,242,501 9,174,926 Extensions 54,483,126 15,188,417 70,336,425 Acquisition - - - Production (663,543) (151,722) (656,559) December 31, 2017 124,417,934 34,847,496 160,816,092 Proved Developed Reserves, included above December 31, 2016 2,159,820 510,500 2,956,920 December 31, 2017 4,719,597 1,331,984 5,806,738 Proved Undeveloped Reserves, included above December 31, 2016 80,329,880 14,057,800 79,004,380 December 31, 2017 119,698,337 33,515,512 155,009,354 The Company did not acquire any proved reserves in 2017. In 2016 the Company acquired 1,235,068 Bbls, 1,757,705 Mcf and 301,743 Bbls of proved oil, natural gas, and NGL reserves, respectively, located in the DJ Basin in Colorado. Extensions during the year ended December 31, 2017 contributed to the increase of 54,483,126 Bbls of oil, 15,188,417 Bbls of NGLs and 70,336,426 Mcf of gas. Extensions during the year ended December 31, 2016 contributed to the increase of 80,707,548 Bbls of oil, 14,123,910 Bbls of NGLs and 79,375,809 Mcf of gas. Prior to the Stateline Acquisition, the Stateline Properties did not include any proved undeveloped reserves, as the prior owner did not have any plans to develop the properties. Upon completion of the Stateline Acquisition, however, the Company prepared a five-year development plan focused on developing the Stateline Properties in a manner consistent with that of offset operators in the area, which resulted in the addition of proved undeveloped locations and related reserves. During the year ended December 31, 2017, the Company had downward revisions of 11,891,349 Bbls of oil and upward revisions of 5,242,501 Bbls of NGLs of 9,174,926 Mcf of natural gas. The Company had downward revisions of 12,649,585 Bbls of oil, 2,213,692 Bbls of NGLs and 12,440,857 Mcf of natural gas relating to proved undeveloped locations that were demoted because of a change in drilling plans. The Company had upward revisions of 758,236 Bbls of oil, 7,456,193 Bbls of NGLs and 21,615,783 Mcf of natural gas due to changes in the decline curve and changes related to price and operating expenses that impact the expected life. During the year ended December 31, 2016, the Company had upward revisions of 655,237 Bbls of oil, 170,787 Bbls of NGLs and 977,689 Mcf of natural gas. These upward revisions were primarily driven by (i) improved well performance due to increased maintenance expenditures resulting in an upward revision of 124,495 Bbls of oil, 32,450 Bbls of NGLs and 185,760 Mcf of gas, (ii) improved commodity prices and oil differentials resulting in an upward revision of 163,809 Bbls of oil, 42,697 Bbls of NGLs and 244,422 Mcf of gas and (iii) reduced lease operating costs extending 24

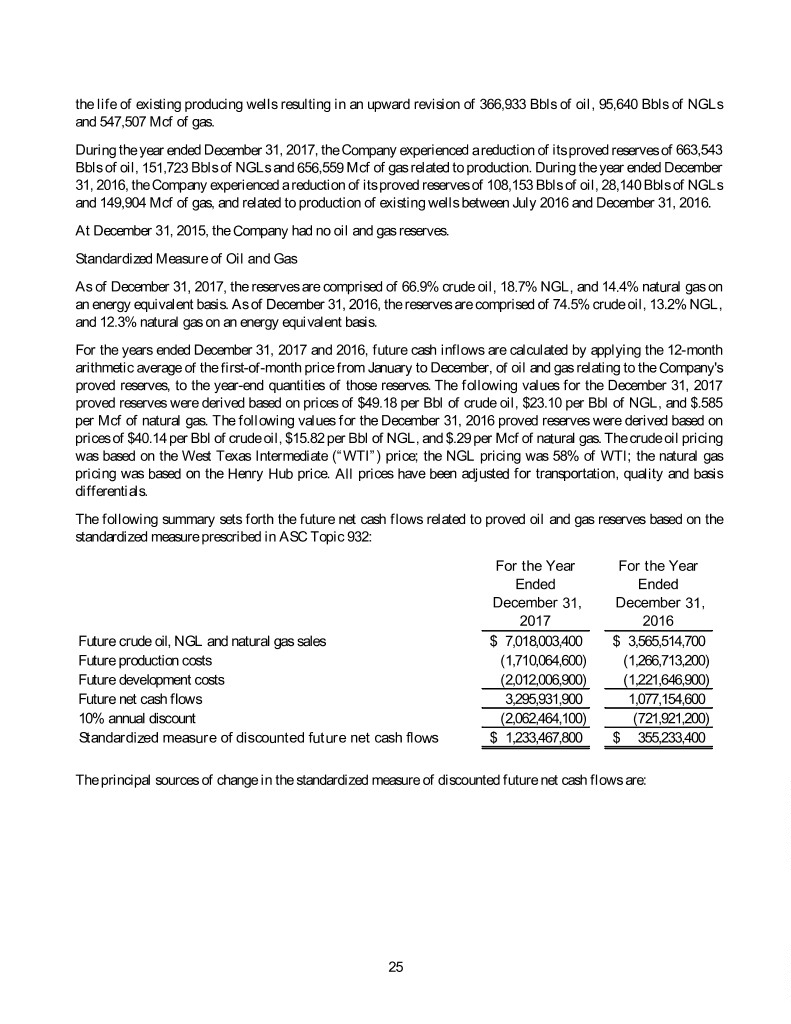

the life of existing producing wells resulting in an upward revision of 366,933 Bbls of oil, 95,640 Bbls of NGLs and 547,507 Mcf of gas. During the year ended December 31, 2017, the Company experienced a reduction of its proved reserves of 663,543 Bbls of oil, 151,723 Bbls of NGLs and 656,559 Mcf of gas related to production. During the year ended December 31, 2016, the Company experienced a reduction of its proved reserves of 108,153 Bbls of oil, 28,140 Bbls of NGLs and 149,904 Mcf of gas, and related to production of existing wells between July 2016 and December 31, 2016. At December 31, 2015, the Company had no oil and gas reserves. Standardized Measure of Oil and Gas As of December 31, 2017, the reserves are comprised of 66.9% crude oil, 18.7% NGL, and 14.4% natural gas on an energy equivalent basis. As of December 31, 2016, the reserves are comprised of 74.5% crude oil, 13.2% NGL, and 12.3% natural gas on an energy equivalent basis. For the years ended December 31, 2017 and 2016, future cash inflows are calculated by applying the 12-month arithmetic average of the first-of-month price from January to December, of oil and gas relating to the Company's proved reserves, to the year-end quantities of those reserves. The following values for the December 31, 2017 proved reserves were derived based on prices of $49.18 per Bbl of crude oil, $23.10 per Bbl of NGL, and $.585 per Mcf of natural gas. The following values for the December 31, 2016 proved reserves were derived based on prices of $40.14 per Bbl of crude oil, $15.82 per Bbl of NGL, and $.29 per Mcf of natural gas. The crude oil pricing was based on the West Texas Intermediate (“WTI”) price; the NGL pricing was 58% of WTI; the natural gas pricing was based on the Henry Hub price. All prices have been adjusted for transportation, quality and basis differentials. The following summary sets forth the future net cash flows related to proved oil and gas reserves based on the standardized measure prescribed in ASC Topic 932: For the Ye ar For the Ye ar Ended Ended December 31, December 31, 2017 2016 Future crude oil, NGL and natural gas sales $ 7,018,003,400 $ 3,565,514,700 Future production costs (1,710,064,600) (1,266,713,200) Future development costs (2,012,006,900) (1,221,646,900) Future net cash flows 3,295,931,900 1,077,154,600 10% annual discount (2,062,464,100) (721,921,200) Standardized measure of discounted future net cash flows $ 1,233,467,800 $ 355,233,400 The principal sources of change in the standardized measure of discounted future net cash flows are: 25

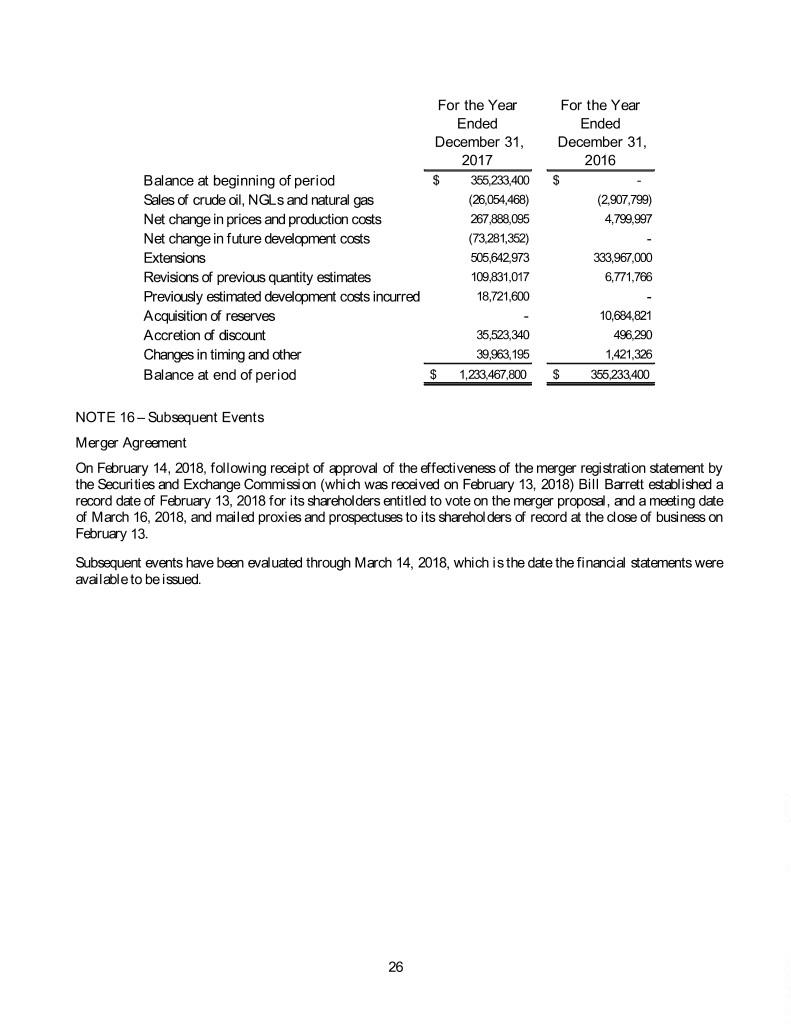

For the Ye ar For the Ye ar Ended Ended December 31, December 31, 2017 2016 Balance at beginning of period $ 355,233,400 $ - Sales of crude oil, NGLs and natural gas (26,054,468) (2,907,799) Net change in prices and production costs 267,888,095 4,799,997 Net change in future development costs (73,281,352) - Extensions 505,642,973 333,967,000 Revisions of previous quantity estimates 109,831,017 6,771,766 Previously estimated development costs incurred 18,721,600 - Acquisition of reserves - 10,684,821 Accretion of discount 35,523,340 496,290 Changes in timing and other 39,963,195 1,421,326 Balance at end of period $ 1,233,467,800 $ 355,233,400 NOTE 16 – Subsequent Events Merger Agreement On February 14, 2018, following receipt of approval of the effectiveness of the merger registration statement by the Securities and Exchange Commission (which was received on February 13, 2018) Bill Barrett established a record date of February 13, 2018 for its shareholders entitled to vote on the merger proposal, and a meeting date of March 16, 2018, and mailed proxies and prospectuses to its shareholders of record at the close of business on February 13. Subsequent events have been evaluated through March 14, 2018, which is the date the financial statements were available to be issued. 26