Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Zendesk, Inc. | zen_8-kxq1x2018xex991.htm |

| 8-K - 8-K - Zendesk, Inc. | zen_8-kxq1x2018.htm |

| EX-99.3 - EXHIBIT 99.3 - Zendesk, Inc. | q1tweetanimationv3final.htm |

| EX-10.1 - EXHIBIT 10.1 - Zendesk, Inc. | amendedandrestatednon-empl.htm |

Zendesk Shareholder Letter Q1 2018 - 1

Shareholder Letter

Q1 2018

M

a

y

1

, 2018

Exhibit 99.2

Zendesk Shareholder Letter Q1 2018 - 2

Mikkel Svane

CEO

Elena Gomez

CFO

Marc Cabi

Strategy & IR

Q1 2018 Revenue

Q1 Y/Y Revenue Growth

Paid Customer Accounts

Introduction

We achieved a major milestone during the first quarter by surpassing a

$500 million annual revenue run rate, making Zendesk the fastest-growing

dedicated customer service and engagement platform. How did we get

there? By staying true to our origins while also growing entirely new areas

of our business. We have extended our reach with small and midsized

organizations, while also building our enterprise business—focused on larger

companies—which represents a significant part of our revenue today.

We believe that our success in both areas is a reflection of the broad appeal

of our products. Over the four years since our IPO, our annual revenue run

rate has grown at a compounded annual growth rate of 50% from the $100

million that we reported in May 2014 to more than $500 million today. We

now have more than 125,000 paid customer accounts that are using Zendesk

to offer service and support in more than 30 languages.

$129.8M

38%

125,000

Note: All results and guidance in this letter are based on the new revenue recognition standard ASC 606.

Zendesk Shareholder Letter Q1 2018 - 3

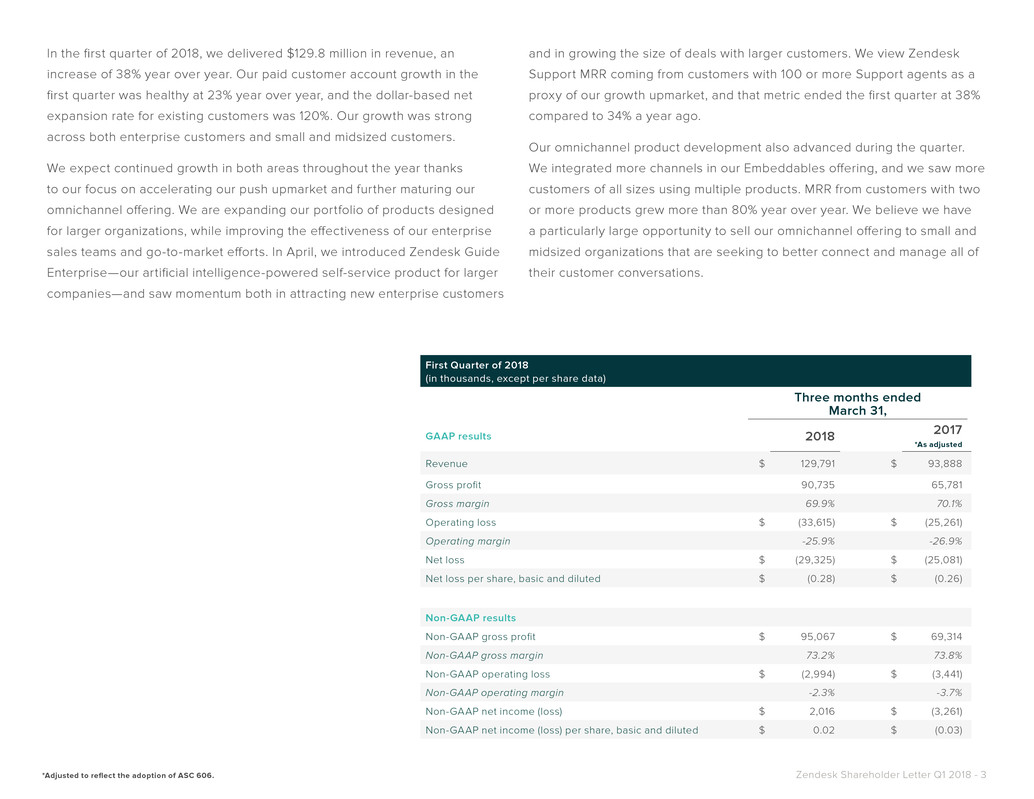

First Quarter of 2018

(in thousands, except per share data)

Three months ended

March 31,

GAAP results 2018 2017

*As adjusted

Revenue $ 129,791 $ 93,888

Gross profit 90,735 65,781

Gross margin 69.9% 70.1%

Operating loss $ (33,615) $ (25,261)

Operating margin -25.9% -26.9%

Net loss $ (29,325) $ (25,081)

Net loss per share, basic and diluted $ (0.28) $ (0.26)

Non-GAAP results

Non-GAAP gross profit $ 95,067 $ 69,314

Non-GAAP gross margin 73.2% 73.8%

Non-GAAP operating loss $ (2,994) $ (3,441)

Non-GAAP operating margin -2.3% -3.7%

Non-GAAP net income (loss) $ 2,016 $ (3,261)

Non-GAAP net income (loss) per share, basic and diluted $ 0.02 $ (0.03)

In the first quarter of 2018, we delivered $129.8 million in revenue, an

increase of 38% year over year. Our paid customer account growth in the

first quarter was healthy at 23% year over year, and the dollar-based net

expansion rate for existing customers was 120%. Our growth was strong

across both enterprise customers and small and midsized customers.

We expect continued growth in both areas throughout the year thanks

to our focus on accelerating our push upmarket and further maturing our

omnichannel offering. We are expanding our portfolio of products designed

for larger organizations, while improving the effectiveness of our enterprise

sales teams and go-to-market efforts. In April, we introduced Zendesk Guide

Enterprise—our artificial intelligence-powered self-service product for larger

companies—and saw momentum both in attracting new enterprise customers

and in growing the size of deals with larger customers. We view Zendesk

Support MRR coming from customers with 100 or more Support agents as a

proxy of our growth upmarket, and that metric ended the first quarter at 38%

compared to 34% a year ago.

Our omnichannel product development also advanced during the quarter.

We integrated more channels in our Embeddables offering, and we saw more

customers of all sizes using multiple products. MRR from customers with two

or more products grew more than 80% year over year. We believe we have

a particularly large opportunity to sell our omnichannel offering to small and

midsized organizations that are seeking to better connect and manage all of

their customer conversations.

*Adjusted to reflect the adoption of ASC 606.

Zendesk Shareholder Letter Q1 2018 - 4

Enterprise Momentum

We continue to accelerate our push upmarket with investments in

broadening our go-to-market capabilities and evolving our products for

more complex use cases. Given our solid growth in revenue during the first

quarter and a healthy portfolio of larger customer opportunities, we believe

we are off to a strong start for 2018.

A big part of our go-to-market investments remains focused on hiring sales

expertise to pursue new opportunities with larger enterprises. In addition,

we already serve a large population of enterprise companies in which we

can expand into new use cases. With a new SVP of worldwide sales in

place and a focus on sales team stability as we grow, we have seen positive

results both in sales execution and productivity.

Supporting our efforts to increase success with enterprise customers, we

have further expanded our capabilities in both pre-sales technical consulting

as well as a broader set of professional services. During the first quarter of

2018, our revenue from professional services continued to grow at a faster

rate than overall revenue growth, although professional services revenue

remains less than 5% of our total revenue.

Founded in 1966, Peet’s Coffee has more than 400

retail locations and sells its specialty coffee and tea

products in more than 15,000 grocery stores in the

United States. A Zendesk customer for three years,

Peet’s uses Zendesk for several internal teams—

including IT, sales operations, and accounting—and

manages its online customer interactions with

Zendesk Support and Chat. In 2017, customer

service and internal teams solved almost 100,000

tickets in Support. Thanks to Zendesk’s ease of use,

Peet’s can easily roll out Zendesk to new teams to

be administered and managed by business users,

without burdening its IT team.

Products Used

Zendesk Shareholder Letter Q1 2018 - 5

Zendesk Guide and Artificial Intelligence (AI)

As part of our enterprise expansion initiatives, we have focused on enhancing our family of products

with capabilities and features aimed at larger organizations and complex use cases. In April, we

launched our third enterprise-focused product in the past nine months: Guide Enterprise, which joins

Chat Enterprise and Talk Enterprise. Guide Enterprise helps our largest customers identify knowledge

gaps in customer service content and collaborate more easily across their extended teams.

With Guide Enterprise, we released our newest AI-powered feature: Content Cues, which works

in conjunction with Answer Bot to help businesses create robust self-service experiences. While

Answer Bot automates responses to customers, the Content Cues algorithm reviews questions from

customers and existing help center articles to suggest topics that are missing or need improvement.

With this guidance, content teams can be more proactive and efficient in optimizing the quality and

comprehensiveness of their help center content.

Guide Enterprise’s advanced workflow and approvals feature, called Team Publishing, makes it

easy for large organizations to collaborate on knowledge base content by getting their agents and

team members more involved in the process. Customers found that Team Publishing increased the

percentage of support agents who contribute to their organization’s knowledge base by approximately

three times.

Zendesk Shareholder Letter Q1 2018 - 6

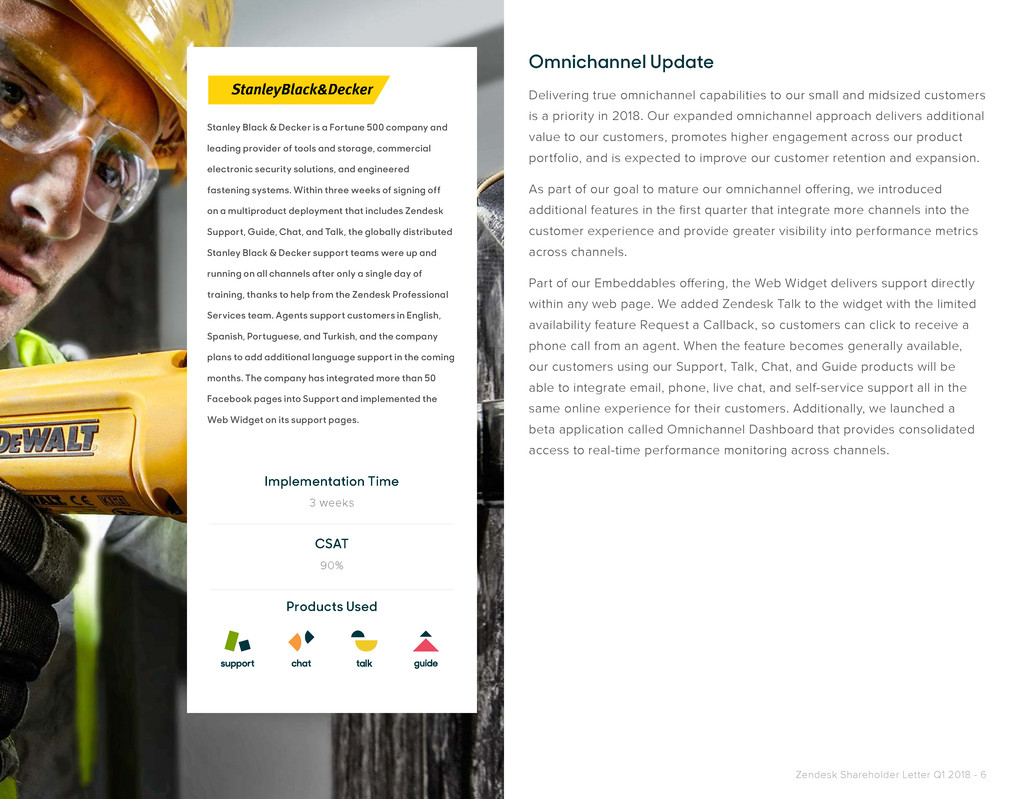

Stanley Black & Decker is a Fortune 500 company and

leading provider of tools and storage, commercial

electronic security solutions, and engineered

fastening systems. Within three weeks of signing off

on a multiproduct deployment that includes Zendesk

Support, Guide, Chat, and Talk, the globally distributed

Stanley Black & Decker support teams were up and

running on all channels after only a single day of

training, thanks to help from the Zendesk Professional

Services team. Agents support customers in English,

Spanish, Portuguese, and Turkish, and the company

plans to add additional language support in the coming

months. The company has integrated more than 50

Facebook pages into Support and implemented the

Web Widget on its support pages.

Implementation Time

3 weeks

CSAT

90%

Products Used

Omnichannel Update

Delivering true omnichannel capabilities to our small and midsized customers

is a priority in 2018. Our expanded omnichannel approach delivers additional

value to our customers, promotes higher engagement across our product

portfolio, and is expected to improve our customer retention and expansion.

As part of our goal to mature our omnichannel offering, we introduced

additional features in the first quarter that integrate more channels into the

customer experience and provide greater visibility into performance metrics

across channels.

Part of our Embeddables offering, the Web Widget delivers support directly

within any web page. We added Zendesk Talk to the widget with the limited

availability feature Request a Callback, so customers can click to receive a

phone call from an agent. When the feature becomes generally available,

our customers using our Support, Talk, Chat, and Guide products will be

able to integrate email, phone, live chat, and self-service support all in the

same online experience for their customers. Additionally, we launched a

beta application called Omnichannel Dashboard that provides consolidated

access to real-time performance monitoring across channels.

Zendesk Shareholder Letter Q1 2018 - 7

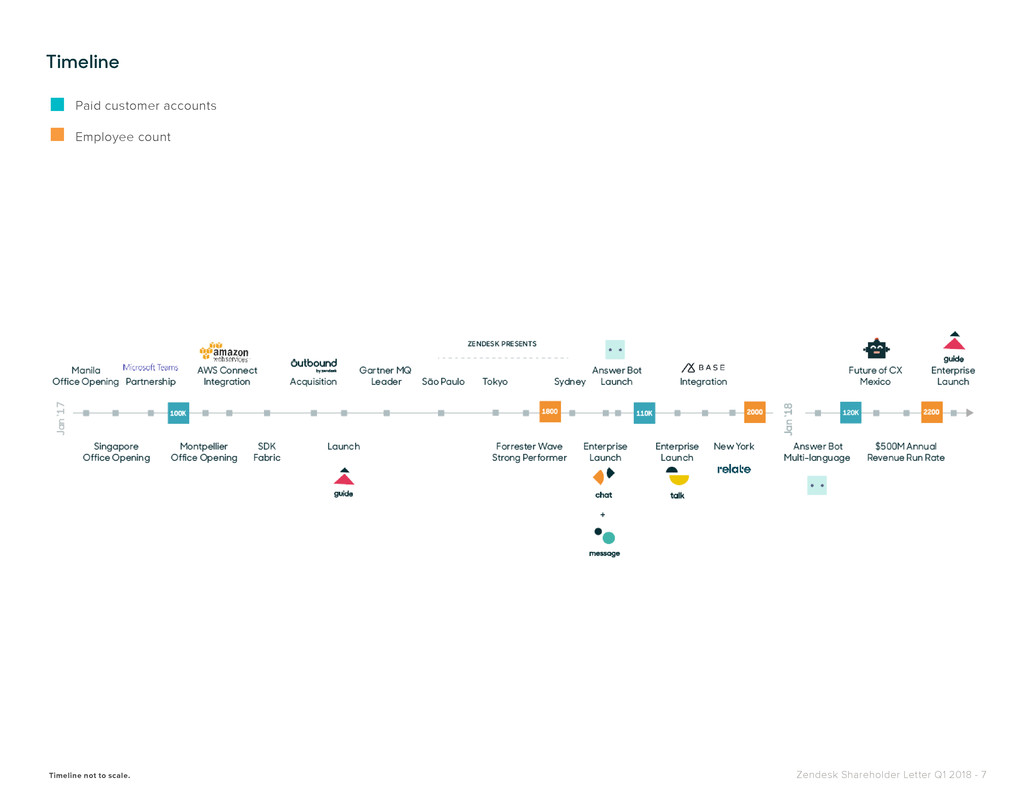

Timeline

Paid customer accounts

Employee count

Timeline not to scale.

Zendesk Shareholder Letter Q1 2018 - 8

Infrastructure Investments

Our transition from co-located data centers to cloud infrastructure is

progressing as planned. Throughout 2017, we made investments to ensure

each of our customers has a successful outcome as they are transitioned

to cloud infrastructure. As of the end of the first quarter of 2018, we have

moved nearly 75% of our customers to Amazon Web Services. We anticipate

completing the full transition by the end of the fourth quarter of this year.

Our investments in cloud services-based infrastructure ensure Zendesk

maintains flexibility and agility as it scales to meet the requirements of our

largest customers.

GDPR

As we prepare for the EU General Data Protection Regulation (GDPR) to take

effect on May 25, 2018, we have continued to reap the benefits of our earlier

data privacy investments, including the approval of our binding corporate

rules for data processors and data controllers and the certification of compli-

ance with the EU-U.S. and Swiss-U.S. Privacy Shield Frameworks. In prepa-

ration for the GDPR, we have built upon these investments by increasing our

efforts to ensure that our products have the functionality necessary to allow

our customers to comply with the GDPR. Additionally, we have delivered

regional webinars for our customers, provided a detailed EU Data Protec-

tion microsite to explain the product features with which our customers can

support their GDPR compliance programs, and developed extensive internal

and external resources. Following the effective date of the GDPR, we look

forward to the continued opportunity to ensure that our customer base has

the tools necessary within our products to serve their global end users.

Established in 1954, Relais & Châteaux is an

association of more than 560 landmark hotels and

restaurants operated by independent innkeepers,

chefs, and owners, who share a passion for their

businesses and a desire for authenticity in their

relationships with their clientele. Last year, they

sought a new partner to optimize their customer

service and operations. “We have a luxury image,

and we absolutely wanted to improve the quality

of service of our call centers and to monitor each

request with a real, personalized answer,” explains

Arnaud Wielgus, Chief Commercial and Marketing

Officer. “Zendesk will align us with the new digital

standards of the industry.”

Products Used

Zendesk Shareholder Letter Q1 2018 - 9

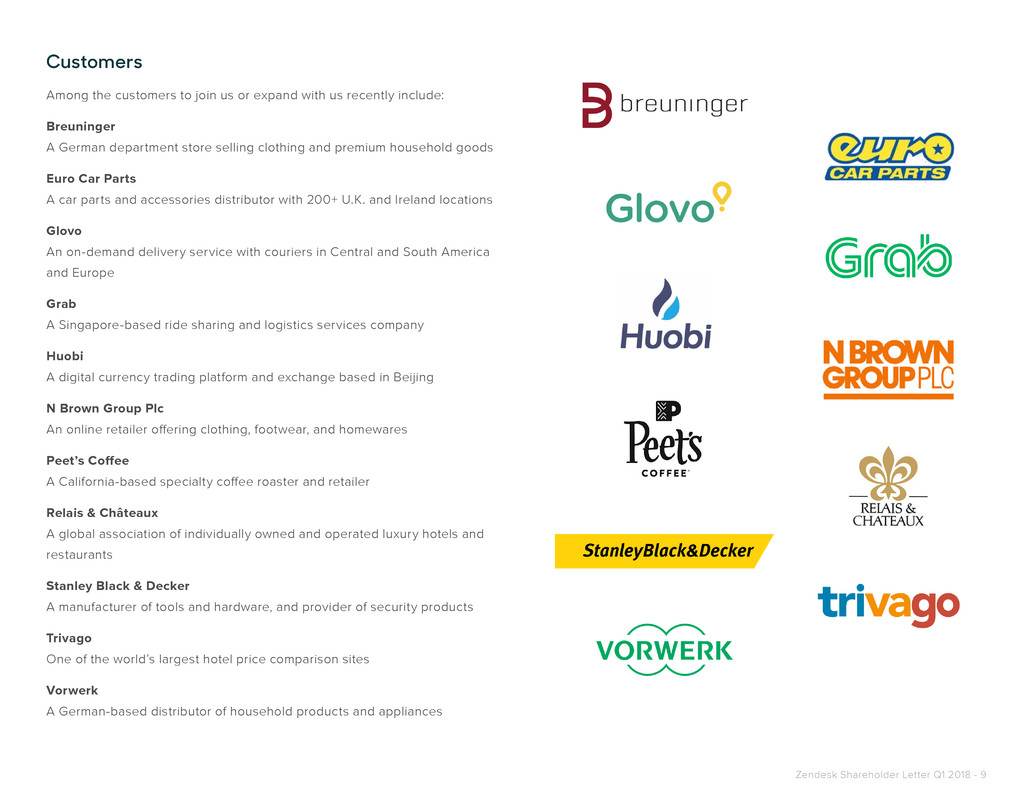

Customers

Among the customers to join us or expand with us recently include:

Breuninger

A German department store selling clothing and premium household goods

Euro Car Parts

A car parts and accessories distributor with 200+ U.K. and Ireland locations

Glovo

An on-demand delivery service with couriers in Central and South America

and Europe

Grab

A Singapore-based ride sharing and logistics services company

Huobi

A digital currency trading platform and exchange based in Beijing

N Brown Group Plc

An online retailer offering clothing, footwear, and homewares

Peet’s Coffee

A California-based specialty coffee roaster and retailer

Relais & Châteaux

A global association of individually owned and operated luxury hotels and

restaurants

Stanley Black & Decker

A manufacturer of tools and hardware, and provider of security products

Trivago

One of the world’s largest hotel price comparison sites

Vorwerk

A German-based distributor of household products and appliances

Zendesk Shareholder Letter Q1 2018 - 10

% of total quarter-ending Support MRR

from paid customer accounts with 100+ Support agents

38%

100+ agents

Q1 2018

Operating Metrics

A key metric we use to gauge our penetration

within larger organizations is represented by

the percentage of Support MRR generated by

customers with 100 or more Support agents. That

percentage remained strong at 38% at the end of

the first quarter of 2018, compared to 38% at the

end of the fourth quarter of 2017 and 34% at the

end of the first quarter of 2017.

As a proxy of our success with upmarket

opportunities, we measure our number of

contracts signed with an annual value of $50,000

or greater. In the first quarter of 2018, the number

of these contracts we closed was over 60%

greater than in the first quarter of 2017, while the

average size of those transactions was larger as

compared to the same period last year.

Our dollar-based net expansion rate, which we

use to quantify our annual expansion within

existing customers, increased by one percentage

point to end the first quarter at 120%, compared

to 119% at the end of the fourth quarter of 2017.

Our dollar-based net expansion rate was 115%

at the end of the first quarter of 2017. Consistent

with expectations in prior quarters, we expect our

dollar-based net expansion rate to remain in the

110% - 120% range over the next several quarters.

Zendesk Shareholder Letter Q1 2018 - 11

Corporate Social Responsibilty

Corporate social responsibility (CSR) has long been an

important part of Zendesk’s culture and brand, and we believe

it is gaining even more significance to our business. We view

CSR as a critical way to build greater empathy among our

employees and increase their engagement both with our

community and their work.

We previously shared results of a study we sponsored with

Drexel University, which found that our customer advocates

who volunteered at least once every two months were three

times more likely to be rated in the top third of the company

for empathy. We believe this result is significant because of

the growing importance of empathy in business generally. As

automation increases across industries, it is leading to an even

bigger expectation from customers that the companies they do

business with act more human than ever before. Meeting this

expectation requires empathetic employees who are engaged

with one another and their work.

Within our own company, we continue to see strong interest in

volunteerism among our employees and believe it helps both

engage and retain current employees while attracting new

talent. In the first quarter of 2018 alone, Zendesk employees

invested more than 3,100 hours in community engagement and

volunteering through Zendesk programs.

Zendesk Shareholder Letter Q1 2018 - 12

Select Financial Measures

(in millions, except per share data)

Three months ended

March 31, 2018

December 31, 2017

*As adjusted

March 31, 2017

*As adjusted

Comments

GAAP results

Revenue $ 129.8 $ 121.9 $93.9 Up 6.5% q/q and 38.2% y/y largely due to a strong dollar-based net expansion rate and growth in paid customer accounts

Gross margin 69.9% 71.3% 70.1%

Declined 140 basis points (bps) q/q and 20 bps y/y largely due to additional

costs to migrate customers from co-located data centers to cloud

infrastructure

We expect to incur up to approximately 100 bps of additional depreciation

and related costs in each quarter until all customers have been transitioned

Operating loss $ (33.6) $ (26.9) $ (25.3)

Operating margin -25.9% -22.0% -26.9%

Declined 390 bps q/q largely due to higher headcount and additonal costs

to migrate customers from co-located data centers to cloud infrastructure

Improved 100 bps y/y largely due to scale as revenue growth outpaced

operating expenses growth

Non-GAAP results

Non-GAAP gross margin 73.2% 74.2% 73.8%

Declined 100 bps q/q and 60 bps y/y largely due to additional costs to

migrate customers from co-located data centers to cloud infrastructure

We expect to incur up to approximately 100 bps of additional depreciation

and related costs in each quarter until all customers have been transitioned

Non-GAAP operating loss $ (3.0) $ (0.9) $ (3.4)

Non-GAAP operating margin -2.3% -0.7% -3.7%

Declined 160 bps q/q largely due to higher headcount and additonal costs

to migrate customers from co-located data centers to cloud infrastructure

Improved 140 bps y/y largely due to scale as revenue growth outpaced

operating expenses growth

Other financial measures

Net cash provided by operating activities $ 16.2 $ 17.3 $ 7.3

Free cash flow (non-GAAP) $ 7.1 $ 12.0 $ 0.6 Net cash provided by operating activities, less purchases of property and equipment and internal-use software development costs

Cash and cash equivalents $ 609.2 $ 109.4 $ 109.3 Increased largely due to issuance of $575 million in convertible senior notes, offset by the cost of the capped call and issuance costs

Marketable securities $ 250.5 $ 235.0 $ 206.8

Non-GAAP results exclude the following

Share-based compensation and related expenses $ 29.2 $ 24.5 $ 20.9 Increased q/q and y/y largely due to higher headcount, higher share price, and timing of awards

Amortization of purchased intangibles $ 0.7 $ 0.7 $ 0.9

Acquisition-related expenses $ 0.7 $ 0.7 —

*Adjusted to reflect the adoption of ASC 606.

*Quarter-over-quarter comparisons (q/q) are for the three months ended March 31, 2018, compared to the three months ended December 31, 2017.

*Year-over-year comparisons (y/y) are for the three months ended March 31, 2018, compared to the three months ended March 31, 2017.

Zendesk Shareholder Letter Q1 2018 - 13

Guidance

For the quarter ending June 30, 2018, we expect to report:

• Revenue in the range of $136.0 - 138.0 million

• GAAP operating income (loss) in the range of $(34.0) - (32.0) million,

which includes share-based compensation and related expenses of

approximately $30.7 million, amortization of purchased intangibles

of approximately $0.7 million, and acquisition-related expenses of

approximately $0.6 million

• Non-GAAP operating income (loss) in the range of $(2.0) - 0.0 million,

which excludes share-based compensation and related expenses of

approximately $30.7 million, amortization of purchased intangibles

of approximately $0.7 million, and acquisition-related expenses of

approximately $0.6 million

• Approximately 105.2 million weighted average shares outstanding (basic)

• Approximately 109.9 million weighted average shares outstanding (diluted)

For the full year 2018, we expect to report:

• Revenue in the range of $565.0 - 572.0 million

• GAAP operating income (loss) in the range of $(132.0) - (127.0) million,

which includes share-based compensation and related expenses of

approximately $126.8 million, amortization of purchased intangibles of

approximately $2.7 million, and acquisition-related expenses of

approximately $2.5 million

• Non-GAAP operating income (loss) in the range of $0.0 - 5.0 million,

which excludes share-based compensation and related expenses of

approximately $126.8 million, amortization of purchased intangibles

of approximately $2.7 million, and acquisition-related expenses of

approximately $2.5 million

• Approximately 106.0 million weighted average shares outstanding (basic)

• Approximately 111.8 million weighted average shares outstanding (diluted)

• Free cash flow in the range of $25.0 - 30.0 million

We have not reconciled free cash flow guidance to net cash from operating

activities for the full year of 2018 because we do not provide guidance on

the reconciling items between net cash from operating activities and free

cash flow as a result of the uncertainty regarding, and the potential variability

of, these items. The actual amount of such reconciling items will have a

significant impact on our free cash flow and, accordingly, a reconciliation of

net cash from operating activities to free cash flow for the full year of 2018 is

not available without unreasonable effort.

Zendesk’s estimates of share-based compensation and related expenses,

amortization of purchased intangibles, and acquisition-related expenses in

future periods assume, among other things, the occurrence of no additional

acquisitions, investments or restructurings, and no further revisions to share-

based compensation and related expenses.

Zendesk Shareholder Letter Q1 2018 - 14

Condensed consolidated

statements of operations

(In thousands, except per

share data; unaudited)

Three months ended

March 31,

2018

2017

*As adjusted

Revenue $129,791 $93,888

Cost of revenue 39,056 28,107

Gross profit 90,735 65,781

Operating expenses:

Research and development 37,085 26,456

Sales and marketing 65,058 46,269

General and administrative 22,207 18,317

Total operating expenses 124,350 91,042

Operating loss (33,615) (25,261)

Other income, net 1,000 218

Loss before provision for (benefit from) income taxes (32,615) (25,043)

Provision for (benefit from) income taxes (3,290) 38

Net loss $(29,325) $(25,081)

Net loss per share, basic and diluted $(0.28) $(0.26)

Weighted-average shares used to compute net loss per share, basic and diluted 103,692 97,475

*Adjusted to reflect the adoption of ASC 606.

Zendesk Shareholder Letter Q1 2018 - 15

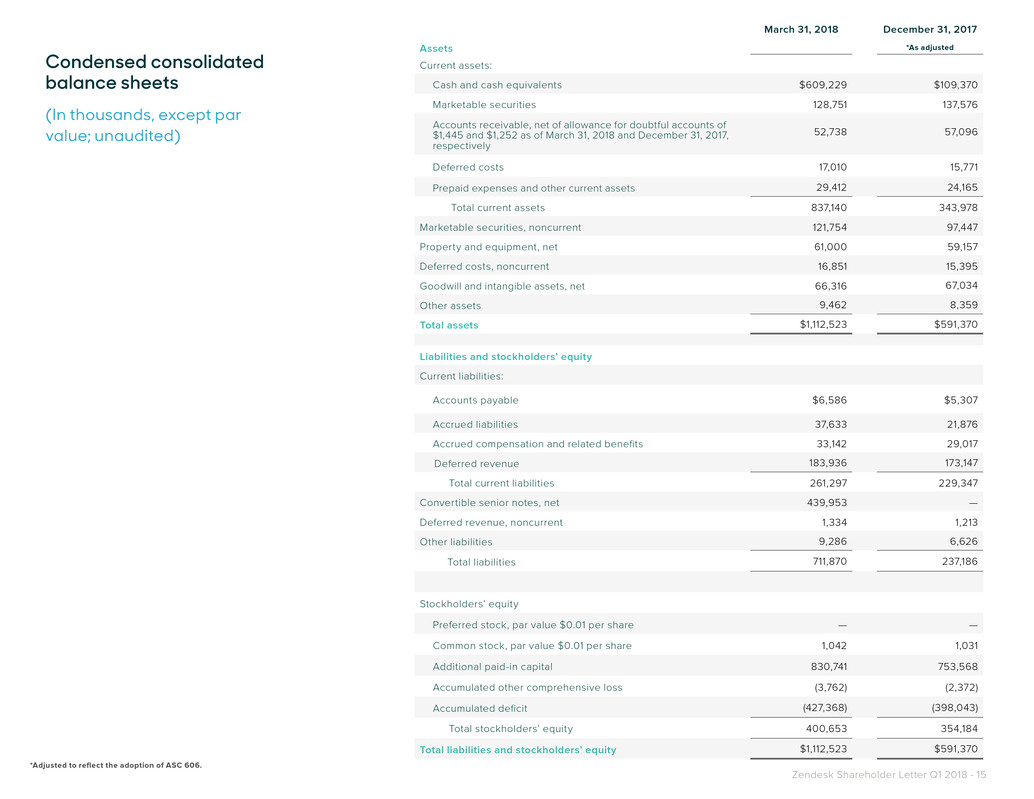

Condensed consolidated

balance sheets

(In thousands, except par

value; unaudited)

March 31, 2018 December 31, 2017

Assets *As adjusted

Current assets:

Cash and cash equivalents $609,229 $109,370

Marketable securities 128,751 137,576

Accounts receivable, net of allowance for doubtful accounts of

$1,445 and $1,252 as of March 31, 2018 and December 31, 2017,

respectively

52,738 57,096

Deferred costs 17,010 15,771

Prepaid expenses and other current assets 29,412 24,165

Total current assets 837,140 343,978

Marketable securities, noncurrent 121,754 97,447

Property and equipment, net 61,000 59,157

Deferred costs, noncurrent 16,851 15,395

Goodwill and intangible assets, net 66,316 67,034

Other assets 9,462 8,359

Total assets $1,112,523 $591,370

Liabilities and stockholders’ equity

Current liabilities:

Accounts payable $6,586 $5,307

Accrued liabilities 37,633 21,876

Accrued compensation and related benefits 33,142 29,017

Deferred revenue 183,936 173,147

Total current liabilities 261,297 229,347

Convertible senior notes, net 439,953 —

Deferred revenue, noncurrent 1,334 1,213

Other liabilities 9,286 6,626

Total liabilities 711,870 237,186

Stockholders’ equity

Preferred stock, par value $0.01 per share — —

Common stock, par value $0.01 per share 1,042 1,031

Additional paid-in capital 830,741 753,568

Accumulated other comprehensive loss (3,762) (2,372)

Accumulated deficit (427,368) (398,043)

Total stockholders’ equity 400,653 354,184

Total liabilities and stockholders’ equity $1,112,523 $591,370

*Adjusted to reflect the adoption of ASC 606.

Zendesk Shareholder Letter Q1 2018 - 16

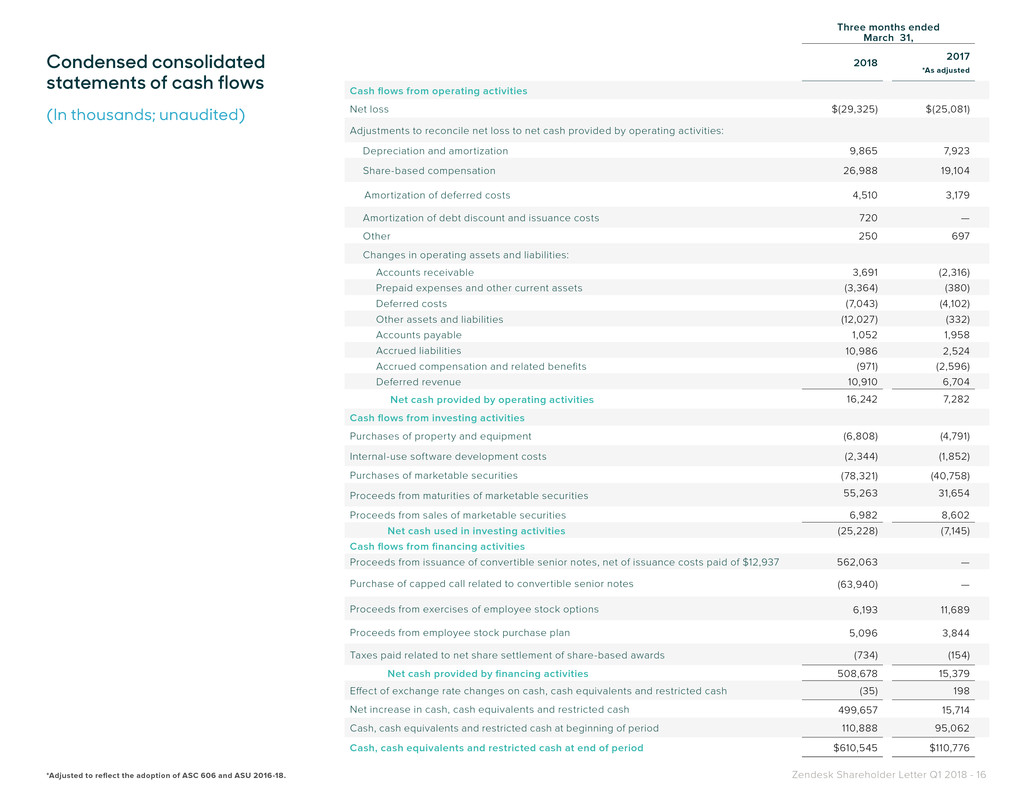

Condensed consolidated

statements of cash flows

(In thousands; unaudited)

Three months ended

March 31,

2018

2017

*As adjusted

Cash flows from operating activities

Net loss $(29,325) $(25,081)

Adjustments to reconcile net loss to net cash provided by operating activities:

Depreciation and amortization 9,865 7,923

Share-based compensation 26,988 19,104

Amortization of deferred costs 4,510 3,179

Amortization of debt discount and issuance costs 720 —

Other 250 697

Changes in operating assets and liabilities:

Accounts receivable 3,691 (2,316)

Prepaid expenses and other current assets (3,364) (380)

Deferred costs (7,043) (4,102)

Other assets and liabilities (12,027) (332)

Accounts payable 1,052 1,958

Accrued liabilities 10,986 2,524

Accrued compensation and related benefits (971) (2,596)

Deferred revenue 10,910 6,704

Net cash provided by operating activities 16,242 7,282

Cash flows from investing activities

Purchases of property and equipment (6,808) (4,791)

Internal-use software development costs (2,344) (1,852)

Purchases of marketable securities (78,321) (40,758)

Proceeds from maturities of marketable securities 55,263 31,654

Proceeds from sales of marketable securities 6,982 8,602

Net cash used in investing activities (25,228) (7,145)

Cash flows from financing activities

Proceeds from issuance of convertible senior notes, net of issuance costs paid of $12,937 562,063 —

Purchase of capped call related to convertible senior notes (63,940) —

Proceeds from exercises of employee stock options 6,193 11,689

Proceeds from employee stock purchase plan 5,096 3,844

Taxes paid related to net share settlement of share-based awards (734) (154)

Net cash provided by financing activities 508,678 15,379

Effect of exchange rate changes on cash, cash equivalents and restricted cash (35) 198

Net increase in cash, cash equivalents and restricted cash 499,657 15,714

Cash, cash equivalents and restricted cash at beginning of period 110,888 95,062

Cash, cash equivalents and restricted cash at end of period $610,545 $110,776

*Adjusted to reflect the adoption of ASC 606 and ASU 2016-18.

Zendesk Shareholder Letter Q1 2018 - 17

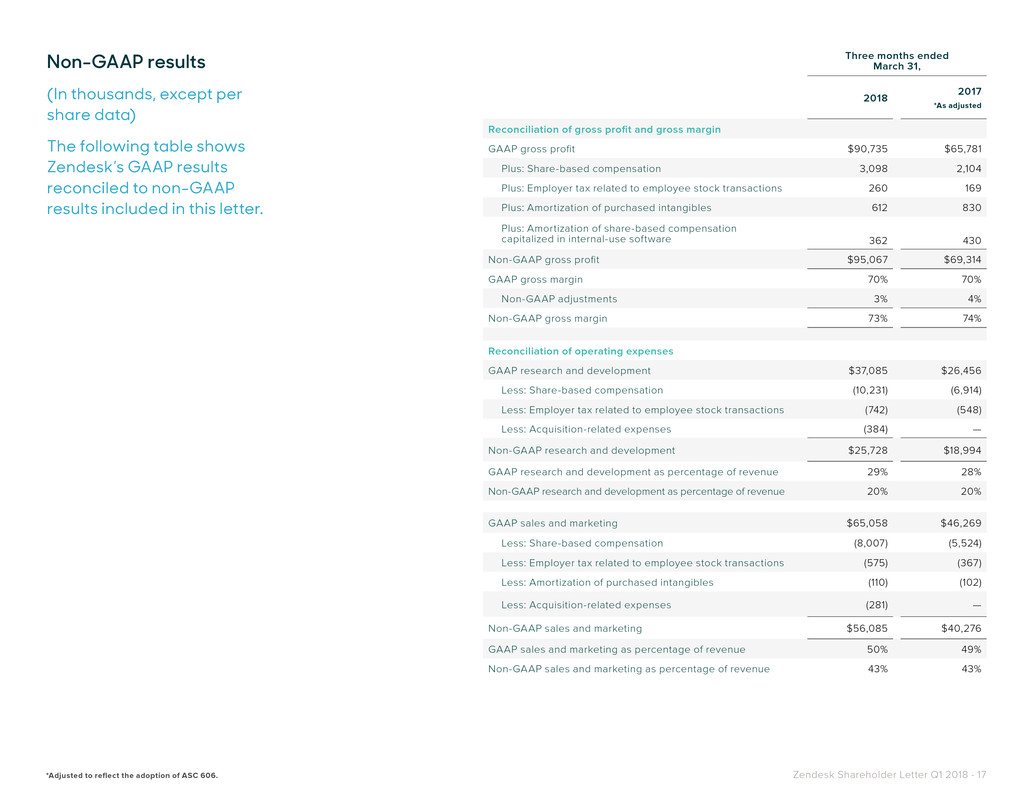

Non-GAAP results

(In thousands, except per

share data)

The following table shows

Zendesk’s GAAP results

reconciled to non-GAAP

results included in this letter.

Three months ended

March 31,

2018

2017

*As adjusted

Reconciliation of gross profit and gross margin

GAAP gross profit $90,735 $65,781

Plus: Share-based compensation 3,098 2,104

Plus: Employer tax related to employee stock transactions 260 169

Plus: Amortization of purchased intangibles 612 830

Plus: Amortization of share-based compensation

capitalized in internal-use software 362 430

Non-GAAP gross profit $95,067 $69,314

GAAP gross margin 70% 70%

Non-GAAP adjustments 3% 4%

Non-GAAP gross margin 73% 74%

Reconciliation of operating expenses

GAAP research and development $37,085 $26,456

Less: Share-based compensation (10,231) (6,914)

Less: Employer tax related to employee stock transactions (742) (548)

Less: Acquisition-related expenses (384) —

Non-GAAP research and development $25,728 $18,994

GAAP research and development as percentage of revenue 29% 28%

Non-GAAP research and development as percentage of revenue 20% 20%

GAAP sales and marketing $65,058 $46,269

Less: Share-based compensation (8,007) (5,524)

Less: Employer tax related to employee stock transactions (575) (367)

Less: Amortization of purchased intangibles (110) (102)

Less: Acquisition-related expenses (281) —

Non-GAAP sales and marketing $56,085 $40,276

GAAP sales and marketing as percentage of revenue 50% 49%

Non-GAAP sales and marketing as percentage of revenue 43% 43%

*Adjusted to reflect the adoption of ASC 606.

Zendesk Shareholder Letter Q1 2018 - 18

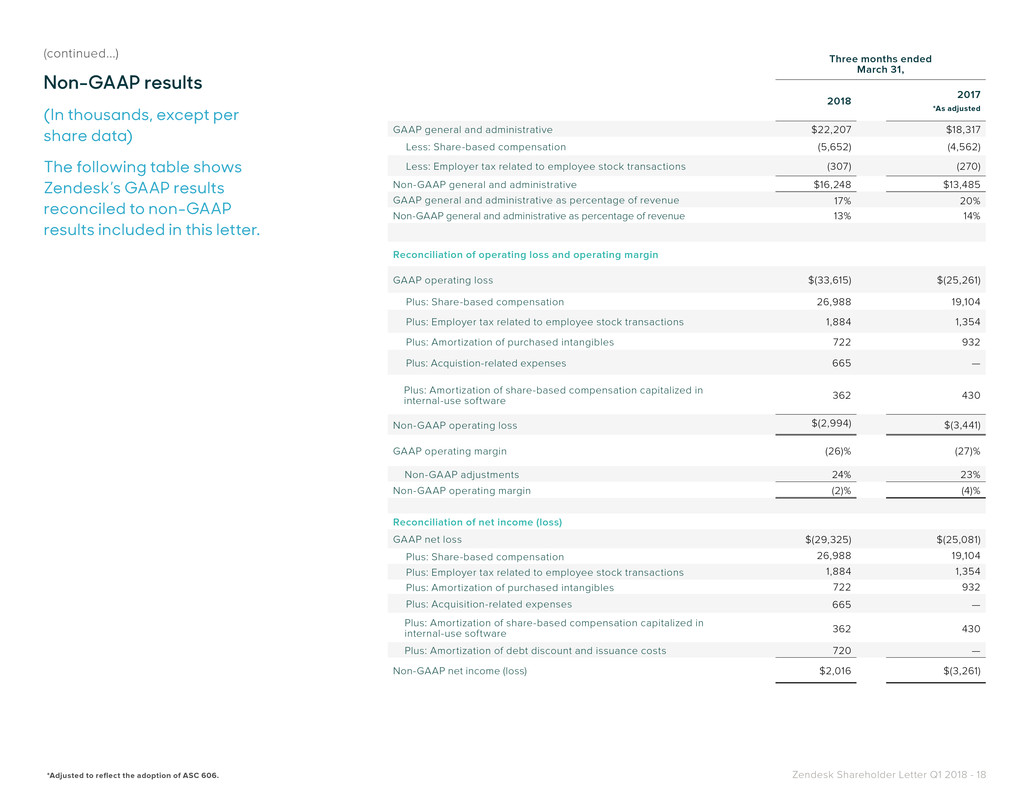

(continued...)

Non-GAAP results

(In thousands, except per

share data)

The following table shows

Zendesk’s GAAP results

reconciled to non-GAAP

results included in this letter.

Three months ended

March 31,

2018

2017

*As adjusted

GAAP general and administrative $22,207 $18,317

Less: Share-based compensation (5,652) (4,562)

Less: Employer tax related to employee stock transactions (307) (270)

Non-GAAP general and administrative $16,248 $13,485

GAAP general and administrative as percentage of revenue 17% 20%

Non-GAAP general and administrative as percentage of revenue 13% 14%

Reconciliation of operating loss and operating margin

GAAP operating loss $(33,615) $(25,261)

Plus: Share-based compensation 26,988 19,104

Plus: Employer tax related to employee stock transactions 1,884 1,354

Plus: Amortization of purchased intangibles 722 932

Plus: Acquistion-related expenses 665 —

Plus: Amortization of share-based compensation capitalized in

internal-use software 362 430

Non-GAAP operating loss $(2,994) $(3,441)

GAAP operating margin (26)% (27)%

Non-GAAP adjustments 24% 23%

Non-GAAP operating margin (2)% (4)%

Reconciliation of net income (loss)

GAAP net loss $(29,325) $(25,081)

Plus: Share-based compensation 26,988 19,104

Plus: Employer tax related to employee stock transactions 1,884 1,354

Plus: Amortization of purchased intangibles 722 932

Plus: Acquisition-related expenses 665 —

Plus: Amortization of share-based compensation capitalized in

internal-use software 362 430

Plus: Amortization of debt discount and issuance costs 720 —

Non-GAAP net income (loss) $2,016 $(3,261)

*Adjusted to reflect the adoption of ASC 606.

Zendesk Shareholder Letter Q1 2018 - 19

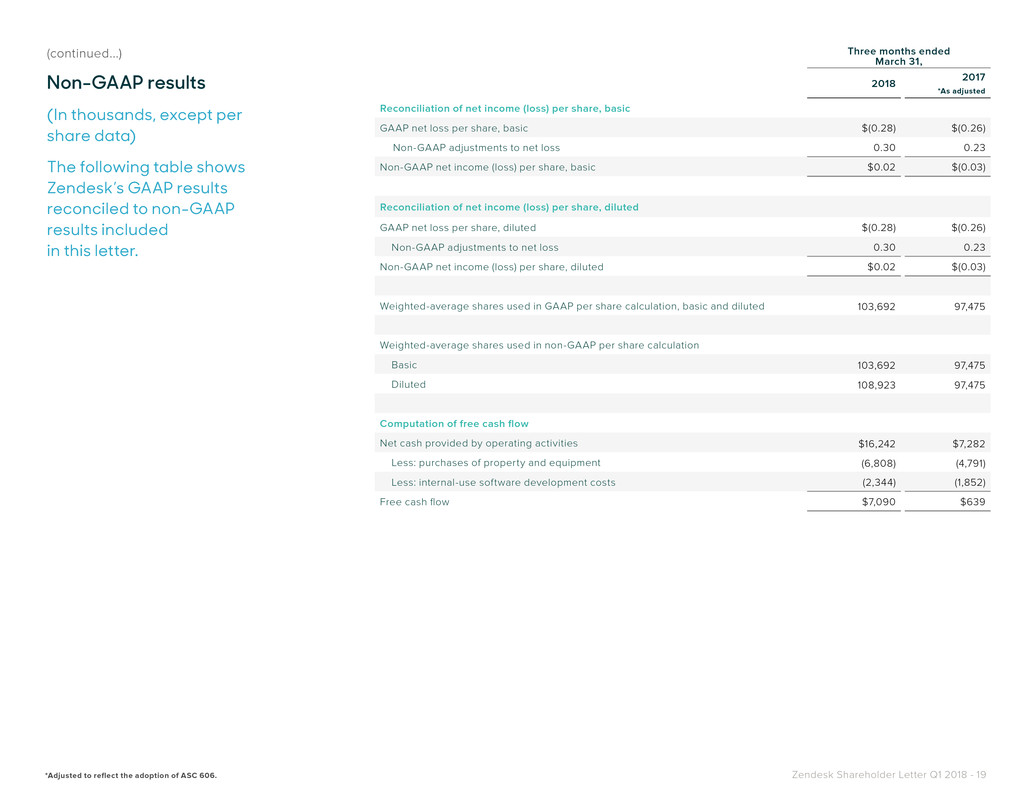

Three months ended

March 31,

2018

2017

*As adjusted

Reconciliation of net income (loss) per share, basic

GAAP net loss per share, basic $(0.28) $(0.26)

Non-GAAP adjustments to net loss 0.30 0.23

Non-GAAP net income (loss) per share, basic $0.02 $(0.03)

Reconciliation of net income (loss) per share, diluted

GAAP net loss per share, diluted $(0.28) $(0.26)

Non-GAAP adjustments to net loss 0.30 0.23

Non-GAAP net income (loss) per share, diluted $0.02 $(0.03)

Weighted-average shares used in GAAP per share calculation, basic and diluted 103,692 97,475

Weighted-average shares used in non-GAAP per share calculation

Basic 103,692 97,475

Diluted 108,923 97,475

Computation of free cash flow

Net cash provided by operating activities $16,242 $7,282

Less: purchases of property and equipment (6,808) (4,791)

Less: internal-use software development costs (2,344) (1,852)

Free cash flow $7,090 $639

(continued...)

Non-GAAP results

(In thousands, except per

share data)

The following table shows

Zendesk’s GAAP results

reconciled to non-GAAP

results included

in this letter.

*Adjusted to reflect the adoption of ASC 606.

Zendesk Shareholder Letter Q1 2018 - 20

About Zendesk

The best customer experiences are built with Zendesk. Zendesk’s powerful and flexible

customer service and engagement platform scales to meet the needs of any business,

from startups and small businesses to growth companies and enterprises. Zendesk serves

businesses across a multitude of industries, with more than 100,000 paid customer accounts

offering service and support in more than 30 languages. Headquartered in San Francisco,

Zendesk operates worldwide with 15 offices in North America, Europe, Asia, Australia, and

South America. Learn more at www.zendesk.com.

Forward-Looking Statements

This press release contains forward-looking statements, including, among other things,

statements regarding Zendesk’s future financial performance, its continued investment to

grow its business, and progress towards its long-term financial objectives. The words such as

“may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases

that denote future expectation or intent regarding Zendesk’s financial results, operations, and

other matters are intended to identify forward-looking statements. You should not rely upon

forward-looking statements as predictions of future events.

The outcome of the events described in these forward-looking statements is subject to

known and unknown risks, uncertainties, and other factors that may cause Zendesk’s actual

results, performance, or achievements to differ materially, including (i) adverse changes in

general economic or market conditions; (ii) Zendesk’s ability to adapt its products to chang-

ing market dynamics and customer preferences or achieve increased market acceptance of

its products; (iii) Zendesk’s ability to effectively expand its sales capabilities, (iv) Zendesk’s

ability to effectively market and sell its products to larger enterprises, (v) Zendesk’s expec-

tation that the future growth rate of its revenues will decline, and that, as its costs increase,

Zendesk may not be able to generate sufficient revenues to achieve or sustain profitability;

(vi) the market in which Zendesk operates is intensely competitive, and Zendesk may not

compete effectively; (vii) the development of the market for software as a service business

software applications; (viii) Zendesk’s ability to introduce and market new products and to

support its products on a shared services platform; (ix) Zendesk’s ability to integrate acquired

businesses and technologies successfully or achieve the expected benefits of such acqui-

sitions; (x) Zendesk’s ability to effectively manage its growth and organizational change; (xi)

breaches in Zendesk’s security measures or unauthorized access to its customers’ data; (xii)

service interruptions or performance problems associated with Zendesk’s technology and in-

frastructure; (xiii) real or perceived errors, failures, or bugs in its products; and (xiv) Zendesk’s

substantial reliance on its customers renewing their subscriptions and purchasing additional

subscriptions.

The forward-looking statements contained in this press release are also subject to additional

risks, uncertainties, and factors, including those more fully described in Zendesk’s filings with

the Securities and Exchange Commission, including its Annual Report on Form 10-K for the

year ended December 31, 2017. Further information on potential risks that could affect actual

results will be included in the subsequent periodic and current reports and other filings that

Zendesk makes with the Securities and Exchange Commission from time to time, including its

Quarterly Report on Form 10-Q for the quarter ended March 31, 2018.

Forward-looking statements represent Zendesk’s management’s beliefs and assumptions

only as of the date such statements are made. Zendesk undertakes no obligation to update

any forward-looking statements made in this press release to reflect events or circumstances

after the date of this press release or to reflect new information or the occurrence of unantici-

pated events, except as required by law.

About Non-GAAP Financial Measures

To provide investors and others with additional information regarding Zendesk’s results, the

following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross

margin, non-GAAP operating expenses, non-GAAP operating income (loss) and operating

margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, basic and

diluted, and free cash flow.

Specifically, Zendesk excludes the following from its historical and prospective non-GAAP

financial measures, as applicable:

Share-based Compensation and Amortization of Share-based Compensation Capitalized

in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain

employees. It is principally aimed at aligning their interests with those of its stockholders

and at long-term retention, rather than to address operational performance for any particular

period. As a result, share-based compensation expenses vary for reasons that are generally

unrelated to financial and operational performance in any particular period.

Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of

employer taxes related to its employee stock transactions as an expense that is dependent

on its stock price, employee exercise and other award disposition activity, and other factors

that are beyond Zendesk’s control. As a result, employer taxes related to its employee stock

transactions vary for reasons that are generally unrelated to financial and operational perfor-

mance in any particular period.

Amortization of Purchased Intangibles: Zendesk views amortization of purchased intangible

assets, including the amortization of the cost associated with an acquired entity’s developed

technology, as items arising from pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are evaluated for impairment regularly, amortization

of the cost of purchased intangibles is an expense that is not typically affected by operations

during any particular period.

Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as transac-

tion costs, integration costs, restructuring costs, and acquisition-related retention payments,

including amortization of acquisition-related retention payments capitalized in internal-use

software, as events that are not necessarily reflective of operational performance during

a period. In particular, Zendesk believes the consideration of measures that exclude such

expenses can assist in the comparison of operational performance in different periods which

may or may not include such expenses.

Amortization of Debt Discount and Issuance Costs: In March 2018, Zendesk issued $575

million of convertible senior notes due in 2023, which bear interest at an annual fixed rate of

0.25%. The imputed interest rate of the convertible senior notes was approximately 5.26%.

This is a result of the debt discount recorded for the conversion feature that is required to

be separately accounted for as equity, and debt issuance costs, which reduce the carrying

value of the convertible debt instrument. The debt discount is amortized as interest expense

together with the issuance costs of the debt. The expense for the amortization of debt

discount and debt issuance costs is a non-cash item, and we believe the exclusion of this

interest expense will provide for a more useful comparison of our operational performance in

different periods.

Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from

operating activities, less purchases of property and equipment and internal-use software

development costs. Zendesk uses free cash flow, among other measures, to evaluate the

ability of its operations to generate cash that is available for purposes other than capital

expenditures and capitalized software development costs. Zendesk believes that informa-

tion regarding free cash flow provides investors with an important perspective on the cash

available to fund ongoing operations.

Zendesk Shareholder Letter Q1 2018 - 21

Zendesk has not reconciled free cash flow guidance to net cash from operating activities for

the year ending December 31, 2018 because Zendesk does not provide guidance on the

reconciling items between net cash from operating activities and free cash flow, as a result

of the uncertainty regarding, and the potential variability of, these items. The actual amount

of such reconciling items will have a significant impact on Zendesk’s free cash flow and,

accordingly, a reconciliation of net cash from operating activities to free cash flow for the year

ending December 31, 2018 is not available without unreasonable effort.

Zendesk’s disclosures regarding its expectations for its non-GAAP operating margin include

adjustments to its expectations for its GAAP operating margin that exclude the expected

share-based compensation and related expenses, amortization of purchased intangibles,

and acquisition-related expenses excluded from its expectations for non-GAAP operating

income (loss) as compared to its expectation for GAAP operating income (loss) for the same

period.

Zendesk does not provide a reconciliation of its non-GAAP operating margin guidance to

GAAP operating margin for future periods beyond the current fiscal year because Zendesk

does not provide guidance on the reconciling items between GAAP operating margin and

non-GAAP operating margin for such periods, as a result of the uncertainty regarding, and

the potential variability of, these items. The actual amount of such reconciling items will have

a significant impact on Zendesk’s non-GAAP operating margin and, accordingly, a reconcili-

ation of GAAP operating margin to non-GAAP operating margin guidance for such periods is

not available without unreasonable effort.

Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include

adjustments to its expectations for its GAAP gross margin that exclude share-based com-

pensation and related expenses in Zendesk’s cost of revenue and amortization of purchased

intangibles related to developed technology. The share-based compensation and related

expenses excluded due to such adjustments are primarily comprised of the share-based

compensation and related expenses for employees associated with Zendesk’s infrastructure

and customer experience organization.

Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP

gross margin for future periods because Zendesk does not provide guidance on the rec-

onciling items between GAAP gross margin and non-GAAP gross margin, as a result of the

uncertainty regarding, and the potential variability of, these items. The actual amount of such

reconciling items will have a significant impact on Zendesk’s non-GAAP gross margin and,

accordingly, a reconciliation of GAAP gross margin to non-GAAP gross margin guidance for

the period is not available without unreasonable effort.

Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for

internal planning and forecasting purposes. Zendesk’s management does not itself, nor does

it suggest that investors should, consider such non-GAAP financial measures in isolation

from, or as a substitute for, financial information prepared in accordance with GAAP. Zendesk

presents such non-GAAP financial measures in reporting its financial results to provide inves-

tors with an additional tool to evaluate Zendesk’s operating results. Zendesk believes these

non-GAAP financial measures are useful because they allow for greater transparency with

respect to key metrics used by management in its financial and operational decision-making.

This allows investors and others to better understand and evaluate Zendesk’s operating

results and future prospects in the same manner as management.

Zendesk’s management believes it is useful for itself and investors to review, as applicable,

both GAAP information that may include items such as share-based compensation and relat-

ed expenses, amortization of purchased intangibles, and acquisition-related expenses, and

the non-GAAP measures that exclude such information in order to assess the performance

of Zendesk’s business and for planning and forecasting in subsequent periods. When

Zendesk uses such a non-GAAP financial measure with respect to historical periods, it

provides a reconciliation of the non-GAAP financial measure to the most closely compara-

ble GAAP financial measure. When Zendesk uses such a non-GAAP financial measure in a

forward-looking manner for future periods, and a reconciliation is not determinable without

unreasonable effort, Zendesk provides the reconciling information that is determinable

without unreasonable effort and identifies the information that would need to be added or

subtracted from the non-GAAP measure to arrive at the most directly comparable GAAP

measure. Investors are encouraged to review the related GAAP financial measures and the

reconciliation of these non-GAAP financial measures to their most directly comparable GAAP

financial measure as detailed above.

Non-GAAP gross margin for the fourth quarter of 2017 excludes $2.9 million in share-based

compensation and related expenses (including $0.1 million of employer tax related to em-

ployee stock transactions and $0.4 million of amortization of share-based compensation

capitalized in internal-use software), and $0.6 million of amortization of purchased intangi-

bles. Non-GAAP operating loss and non-GAAP operating margin for the fourth quarter of

2017 excludes $24.5 million in share-based compensation and related expenses (including

$2.0 million of employer tax related to employee stock transactions and $0.4 million of amor-

tization of share-based compensation capitalized in internal-use software), $0.7 million of

acquisition-related expenses, and $0.7 million of amortization of purchased intangibles. Free

cash flow for the fourth quarter of 2017 includes cash used for purchases of property and

equipment of $3.1 million and internal-use software development costs of $2.3 million.

About Operating Metrics

Zendesk reviews a number of operating metrics to evaluate its business, measure per-

formance, identify trends, formulate business plans, and make strategic decisions. These

include the number of paid customer accounts on Zendesk Support, Zendesk Chat, and its

other products, dollar-based net expansion rate, monthly recurring revenue represented by

its churned customers, and the percentage of its monthly recurring revenue from Support

originating from customers with 100 or more agents on Support.

Zendesk defines the number of paid customer accounts at the end of any particular period

as the sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free

trials, or other free services, (ii) the number of accounts using Chat, exclusive of free trials

or other free services, and (iii) the number of accounts on all of its other products, exclusive

of free trials and other free services, each as of the end of the period and as identified by

a unique account identifier. Use of Support, Chat, and Zendesk’s other products requires

separate subscriptions and each of these accounts are treated as a separate paid custom-

er account. Existing customers may also expand their utilization of Zendesk’s products by

adding new accounts and a single consolidated organization or customer may have multiple

accounts across each of Zendesk’s products to service separate subsidiaries, divisions, or

work processes. Each of these accounts is also treated as a separate paid customer account.

Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase

revenue across its existing customer base through expansion of authorized agents asso-

ciated with a paid customer account, upgrades in subscription plans, and the purchase of

additional products as offset by churn, contraction in authorized agents associated with a

paid customer account, and downgrades in subscription plans. Zendesk’s dollar-based net

expansion rate is based upon monthly recurring revenue for a set of paid customer accounts

on its products. Monthly recurring revenue for a paid customer account is a legal and con-

tractual determination made by assessing the contractual terms of each paid customer ac-

count, as of the date of determination, as to the revenue Zendesk expects to generate in the

next monthly period for that paid customer account, assuming no changes to the subscrip-

tion and without taking into account any one-time discounts or any platform usage above

the subscription base, if any, that may be applicable to such subscription. Monthly recurring

revenue is not determined by reference to historical revenue, deferred revenue, or any other

GAAP financial measure over any period. It is forward-looking and contractually derived as of

the date of determination.

Zendesk Shareholder Letter Q1 2018 - 22

Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net

of contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue

as the aggregate monthly recurring revenue across its products for customers with paid

customer accounts on Support or Chat as of the date one year prior to the date of calcula-

tion. Zendesk defines the retained revenue net of contraction and churn as the aggregate

monthly recurring revenue across its products for the same customer base included in the

measure of base revenue at the end of the annual period being measured. The dollar-based

net expansion rate is also adjusted to eliminate the effect of certain activities that Zendesk

identifies involving the transfer of agents between paid customer accounts, consolidation of

customer accounts, or the split of a single paid customer account into multiple paid customer

accounts. In addition, the dollar-based net expansion rate is adjusted to include paid cus-

tomer accounts in the customer base used to determine retained revenue net of contraction

and churn that share common corporate information with customers in the customer base

that are used to determine the base revenue. Giving effect to this consolidation results in

Zendesk’s dollar-based net expansion rate being calculated across approximately 95,800

customers, as compared to the approximately 125,500 total paid customer accounts as of

March 31, 2018.

To the extent that Zendesk can determine that the underlying customers do not share com-

mon corporate information, Zendesk does not aggregate paid customer accounts associated

with reseller and other similar channel arrangements for the purposes of determining its

dollar-based net expansion rate. While not material, Zendesk believes the failure to account

for these activities would otherwise skew the dollar-based net expansion metrics associated

with customers that maintain multiple paid customer accounts across its products and paid

customer accounts associated with reseller and other similar channel arrangements.

Zendesk does not currently incorporate operating metrics associated with its analytics prod-

uct or its Outbound product into its measurement of dollar-based net expansion rate.

For a more detailed description of how Zendesk calculates its dollar-based net expansion

rate, please refer to Zendesk’s periodic reports filed with the Securities and Exchange Com-

mission.

Zendesk’s percentage of monthly recurring revenue from Support that is generated by cus-

tomers with 100 or more agents on Support is determined by dividing the monthly recurring

revenue from Support for paid customer accounts with 100 or more agents on Support as of

the measurement date by the monthly recurring revenue from Support for all paid customer

accounts on Support as of the measurement date. Zendesk determines the customers with

100 or more agents on Support as of the measurement date based on the number of activat-

ed agents on Support at the measurement date and includes adjustments to aggregate paid

customer accounts that share common corporate information.

Zendesk determines the annualized value of a contract by annualizing the monthly recurring

revenue for such contract.

Zendesk does not currently incorporate operating metrics associated with products other

than Support into its measurement of the percentage of monthly recurring revenue from

Support that is generated by customers with 100 or more agents on Support.

March 31,

2017

June 30,

2017

September 30,

2017

December 31,

2017

March 31,

2018

Paid customer accounts on

Zendesk Support (approx.) 54,900 57,800 61,200 64,100 67,800

+ Paid customer accounts on

Zendesk Chat (approx.) 44,000 45,300 46,600 47,000 47,700

+ Paid customer accounts on

other Zendesk products (approx.) 2,900 4,300 6,100 7,800 10,000

= Approximate number of

paid customer accounts 101,800 107,400 113,900 118,900 125,500

Source: Zendesk, Inc.

Contact:

Investor Contact

Marc Cabi, +1 415-852-3877

ir@zendesk.com

Media Contact

Tian Lee, +1 415-231-0847

press@zendesk.com

Customer Metrics

Geographic Information

United States

EMEA

Other

Q1’18

52.7%

29.2%

18.1%

Revenue by geography: