Attached files

| file | filename |

|---|---|

| 8-K - CTBI 2018 SHAREHOLDERS' PRESENTATION 8-K - COMMUNITY TRUST BANCORP INC /KY/ | ctbi2018sharepres8-k.htm |

Exhibit 99.1

2018 Annual Shareholders’ Presentation

Cautionary Statement Information provided herein by CTBI contains “forward-looking” information. CTBI cautions that any forward-looking statements made are not guarantees of future performance and that actual results may differ materially from those in the forward-looking statements. Please refer to CTBI’s 2017 Annual Report on Form 10-K, Cautionary Statement Regarding Forward Looking Statements for additional information. 2

2017 Key Metrics 3 Total Assets $4.1 billionMarket Capitalization $833.3 millionCash Dividend Yield 2.80%P/E Ratio 16.1xPrice to Book Value 1.6xPrice to Tangible Book Value 1.8xTangible Common Equity Ratio 11.43%Competitive Position2nd largest Kentucky domiciled bank holding company #1 in Kentucky in deposit market share of all Kentucky domiciled FDIC insured institutions 6th largest bank in Kentucky in terms of deposit market share of all FDIC insured institutions Financial data as of December 31, 2017

Our Banking Franchise Central Region Eastern Region Northeastern RegionLoans - $678 million Loans - $949 million Loans - $365 millionDeposits - $822 million Deposits - $1.3 billion Deposits - $527 million• Danville • Floyd/Knott/Johnson • Advantage Valley• Lexington • Hazard • Ashland• Mt. Sterling • Pikeville • Flemingsburg• Richmond • Tug Valley • Summersville• Versailles • Whitesburg• Winchester South Central Region Indirect LendingLoans - $638 million Loans - $490 million Deposits - $711 million• Campbellsville CTIC• LaFollette Assets Under Management - $2.2 billion (including $0.6 billion CTB)• Middlesboro Revenues - $14.2 million• Mt. Vernon • Ashland• Williamsburg • LaFollette • Lexington • Pikeville • Versailles Financial data as of December 31, 2017 4

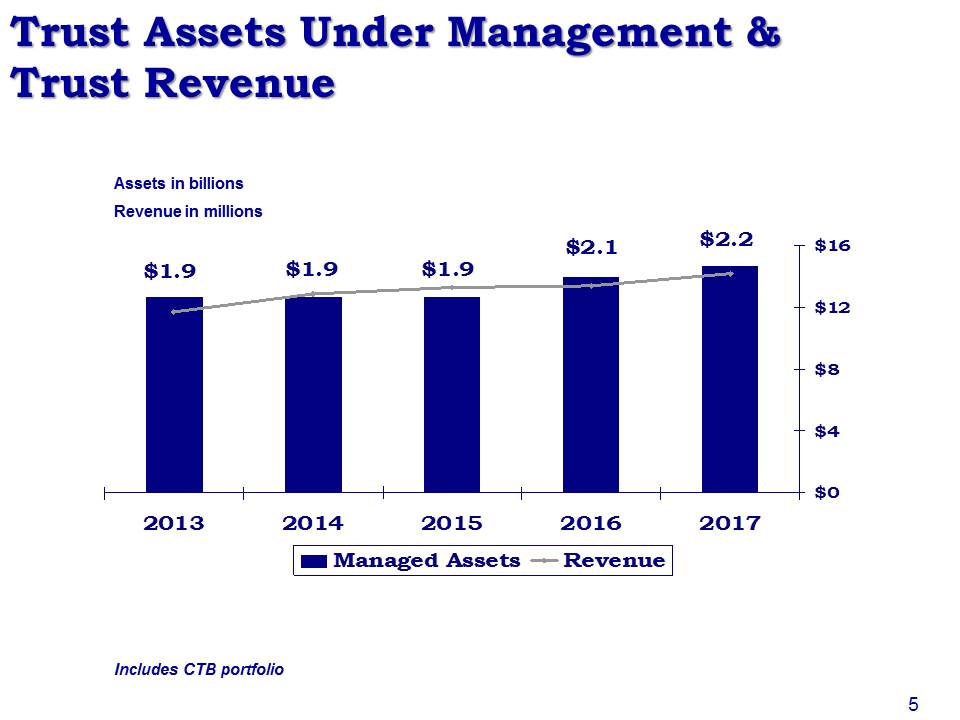

Trust Assets Under Management &Trust Revenue Assets in billionsRevenue in millions 5 Includes CTB portfolio

2017 Performance

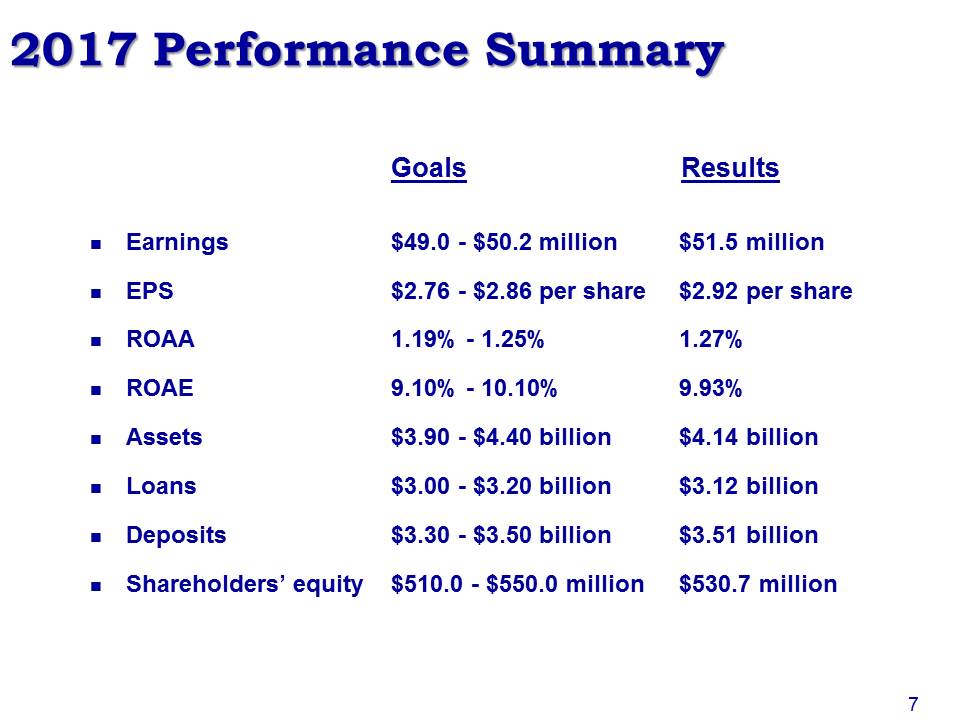

2017 Performance Summary Goals ResultsEarnings $49.0 - $50.2 million $51.5 millionEPS $2.76 - $2.86 per share $2.92 per shareROAA 1.19% - 1.25% 1.27%ROAE 9.10% - 10.10% 9.93%Assets $3.90 - $4.40 billion $4.14 billionLoans $3.00 - $3.20 billion $3.12 billionDeposits $3.30 - $3.50 billion $3.51 billionShareholders’ equity $510.0 - $550.0 million $530.7 million 7

Shareholder Value

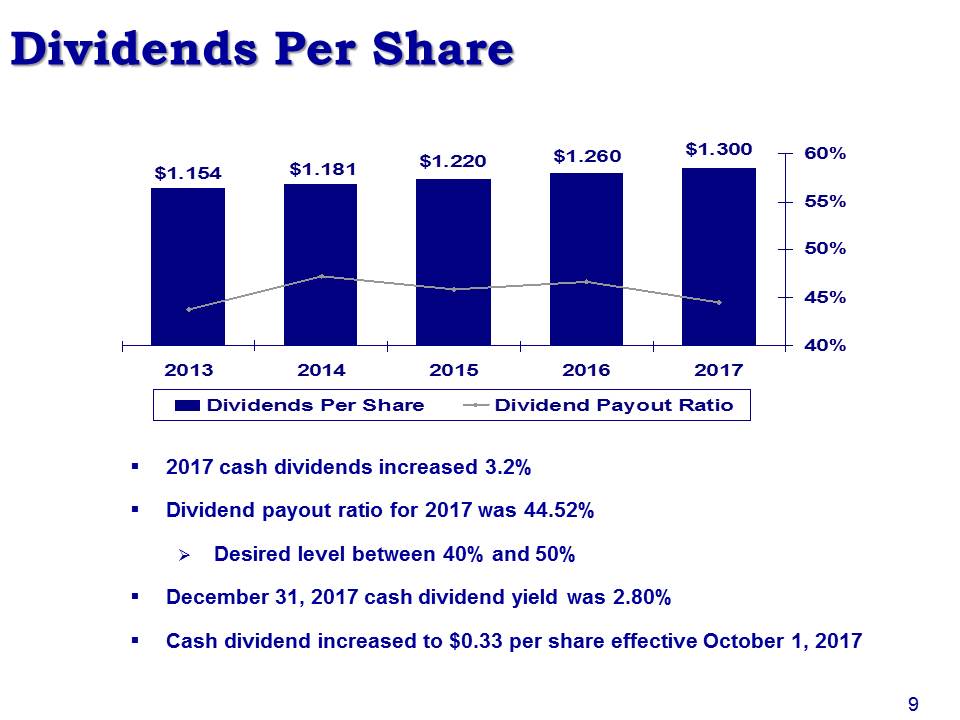

2017 cash dividends increased 3.2%Dividend payout ratio for 2017 was 44.52%Desired level between 40% and 50%December 31, 2017 cash dividend yield was 2.80%Cash dividend increased to $0.33 per share effective October 1, 2017 Dividends Per Share 9

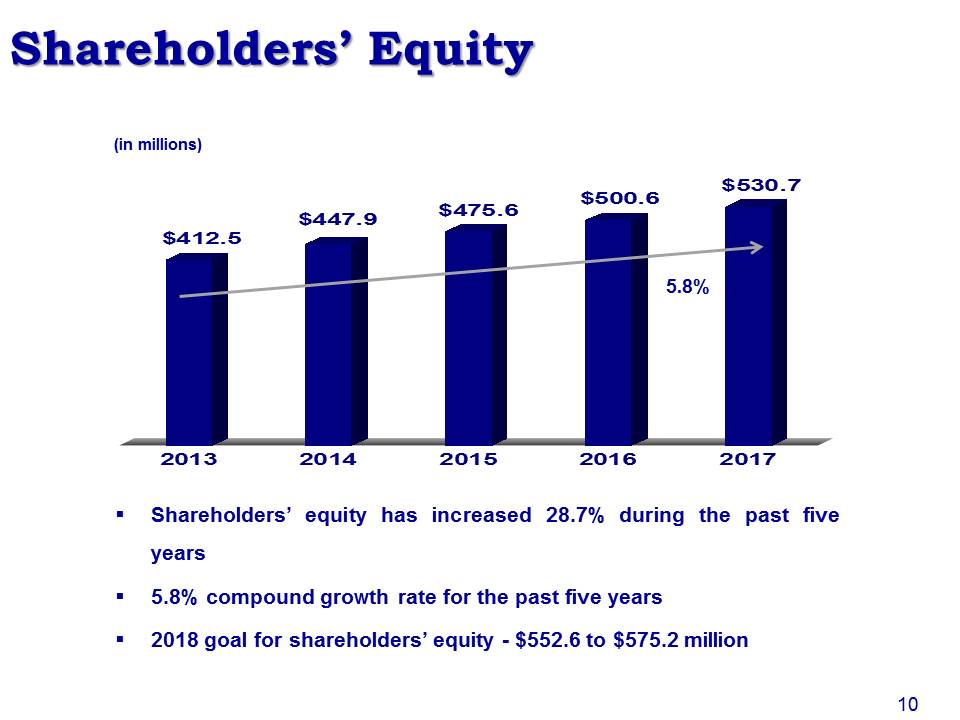

Shareholders’ Equity (in millions) Shareholders’ equity has increased 28.7% during the past five years5.8% compound growth rate for the past five years2018 goal for shareholders’ equity - $552.6 to $575.2 million 5.8% 10

Book ValuePer Share Tangible Common Equity/Assets 11

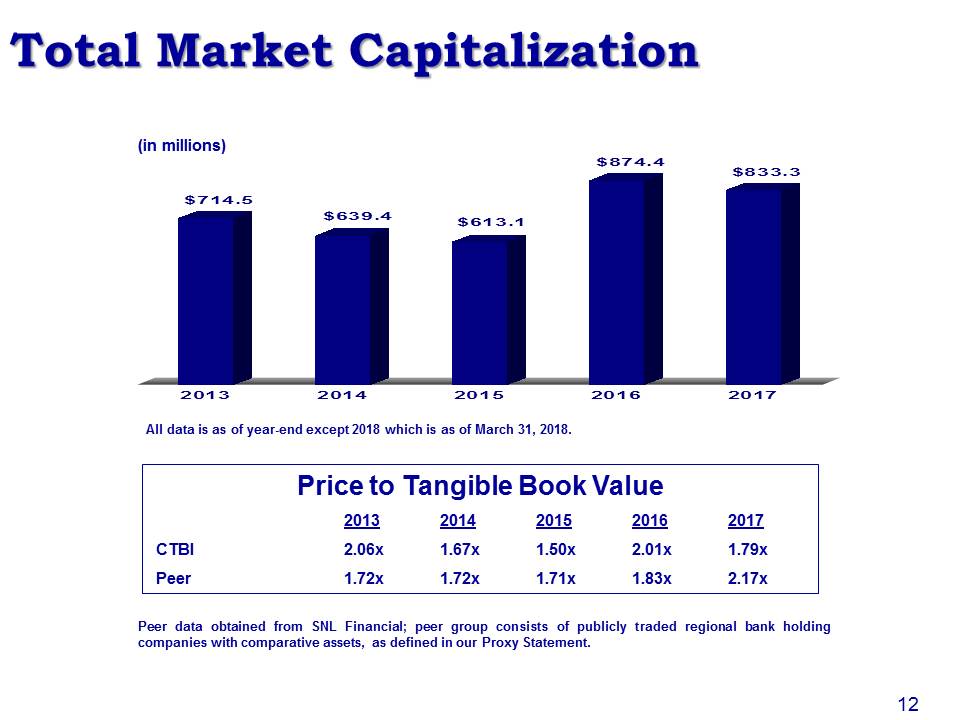

Total Market Capitalization Peer data obtained from SNL Financial; peer group consists of publicly traded regional bank holding companies with comparative assets, as defined in our Proxy Statement. (in millions) Price to Tangible Book Value 2013 2014 2015 2016 2017 CTBI 2.06x 1.67x 1.50x 2.01x 1.79x Peer 1.72x 1.72x 1.71x 1.83x 2.17x 12 All data is as of year-end except 2018 which is as of March 31, 2018.

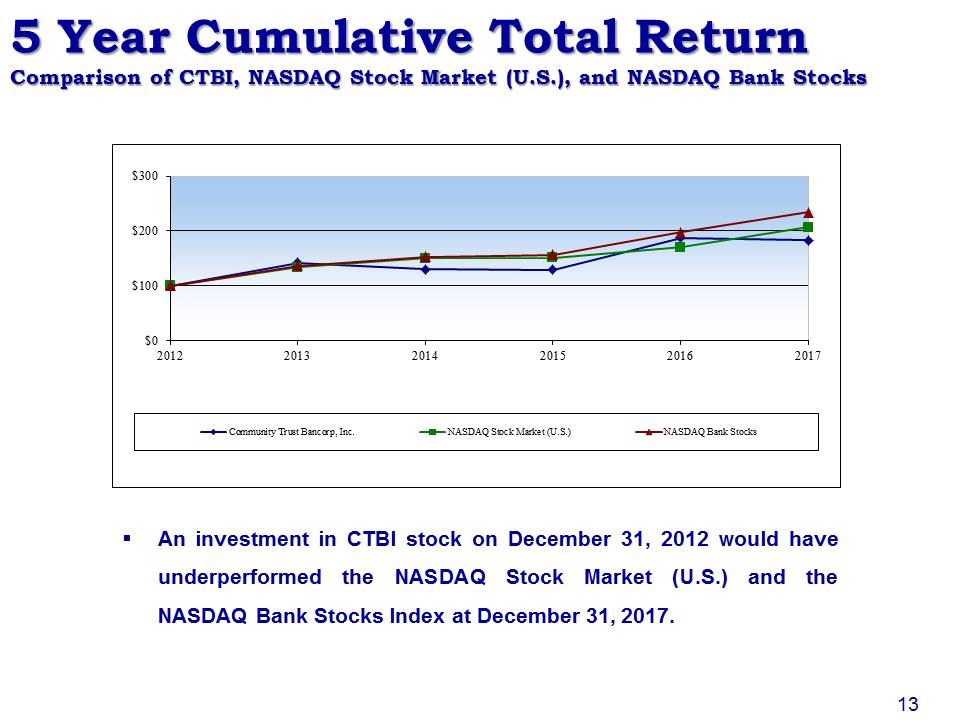

5 Year Cumulative Total ReturnComparison of CTBI, NASDAQ Stock Market (U.S.), and NASDAQ Bank Stocks An investment in CTBI stock on December 31, 2012 would have underperformed the NASDAQ Stock Market (U.S.) and the NASDAQ Bank Stocks Index at December 31, 2017. 13

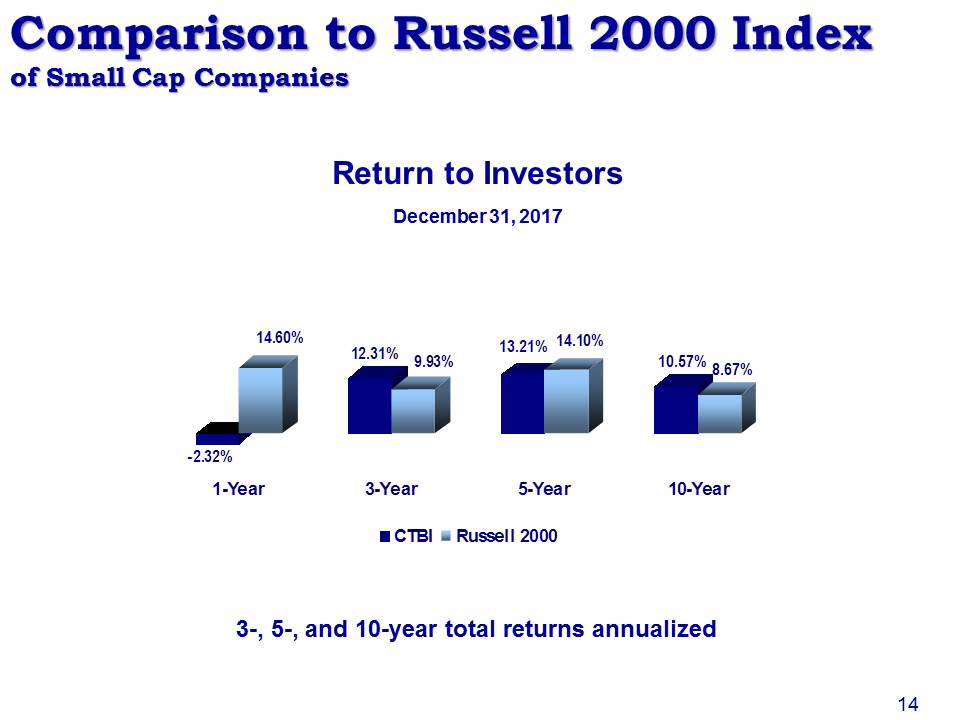

Comparison to Russell 2000 Indexof Small Cap Companies Return to Investors 3-, 5-, and 10-year total returns annualized December 31, 2017 14

Core Value Long-Term Investment 12 stock splits and 10 stock dividends37 years of consecutive increases in cash dividends5-year compound growth rate of cash dividends 2.7%Stock included in the NASDAQ Global Select Market, NASDAQ Dividend Achievers Index, and NASDAQ Bank Stock IndexRecognized as one of “America’s 50 Most Trustworthy Financial Companies” for four consecutive years and ranked 1st and 2nd in the “Small Cap” category in the years 2014 and 2015, respectively, and tied for 1st in the years 2016 and 2017CTBI shareholders include169 institutional investors (including CTIC – 9.8%) hold 10.2 million shares (56.3%)241 mutual funds hold 4.6 million shares (26.2%) Data as of December 31, 2017 15

CTBI’s Franchise Value History of solid investor returnsHistorically strong capital positionInvestor focused dividend policyDividend Achievers IndexConsistent financial performanceCommunity banking strategyEconomic diversity in the markets we serveStrong experienced management team and over 1,000 dedicated employeesOur shareholders 16

Earnings Review

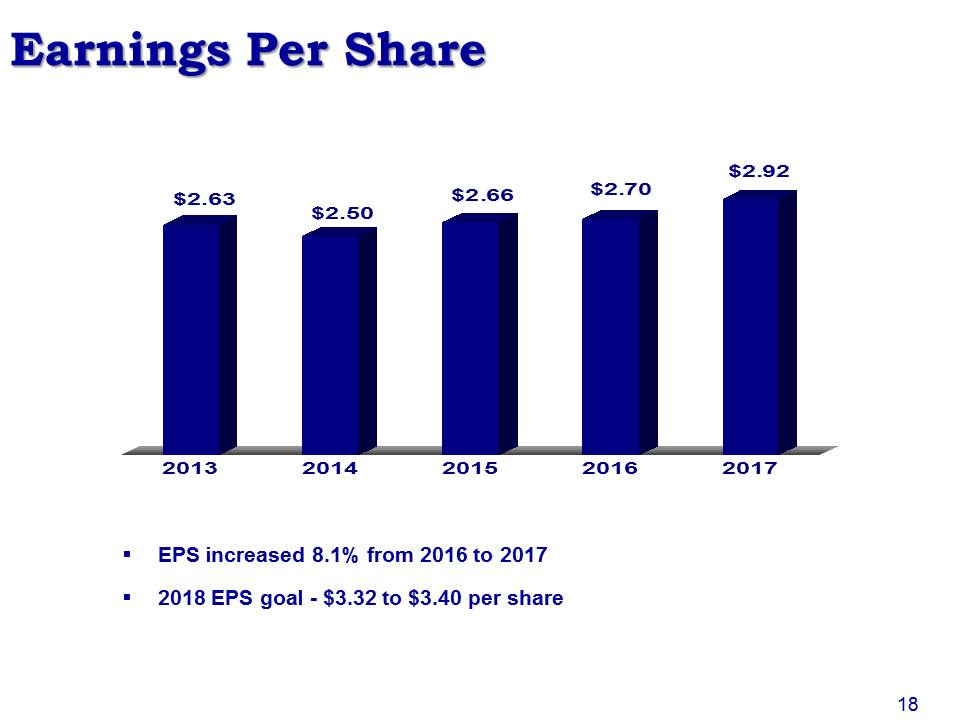

EPS increased 8.1% from 2016 to 20172018 EPS goal - $3.32 to $3.40 per share Earnings Per Share 18

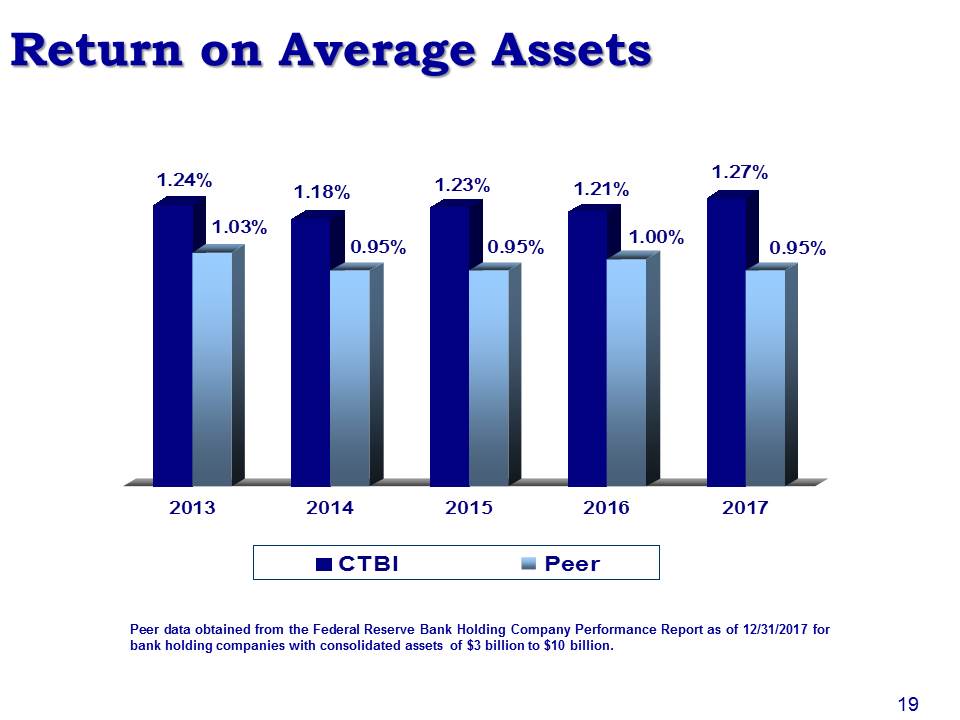

Return on Average Assets Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 12/31/2017 for bank holding companies with consolidated assets of $3 billion to $10 billion. 19

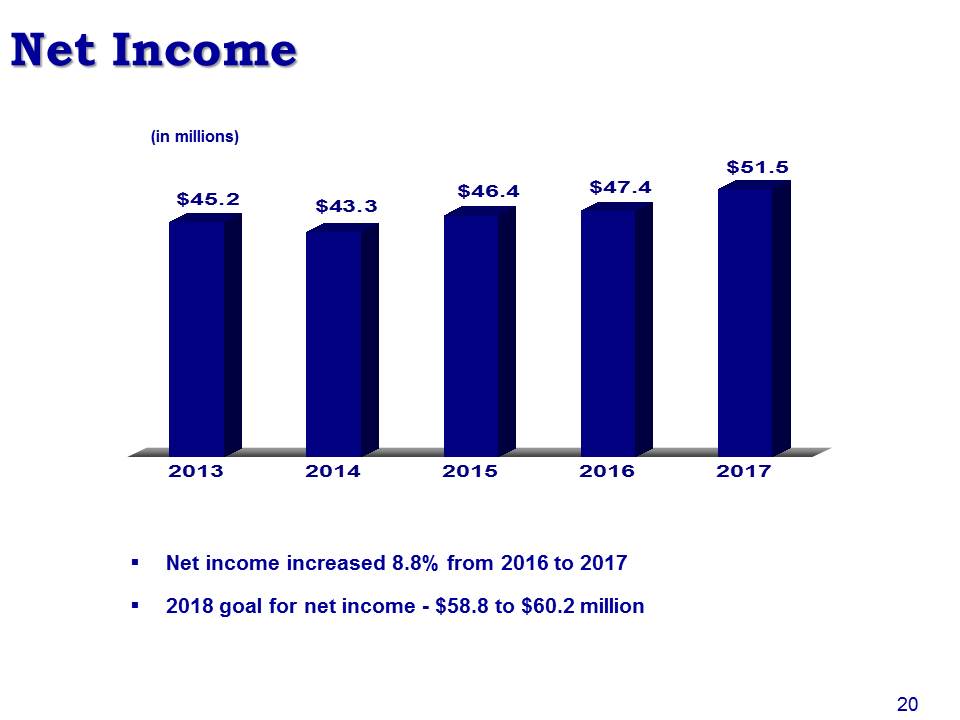

(in millions) Net Income Net income increased 8.8% from 2016 to 20172018 goal for net income - $58.8 to $60.2 million 20

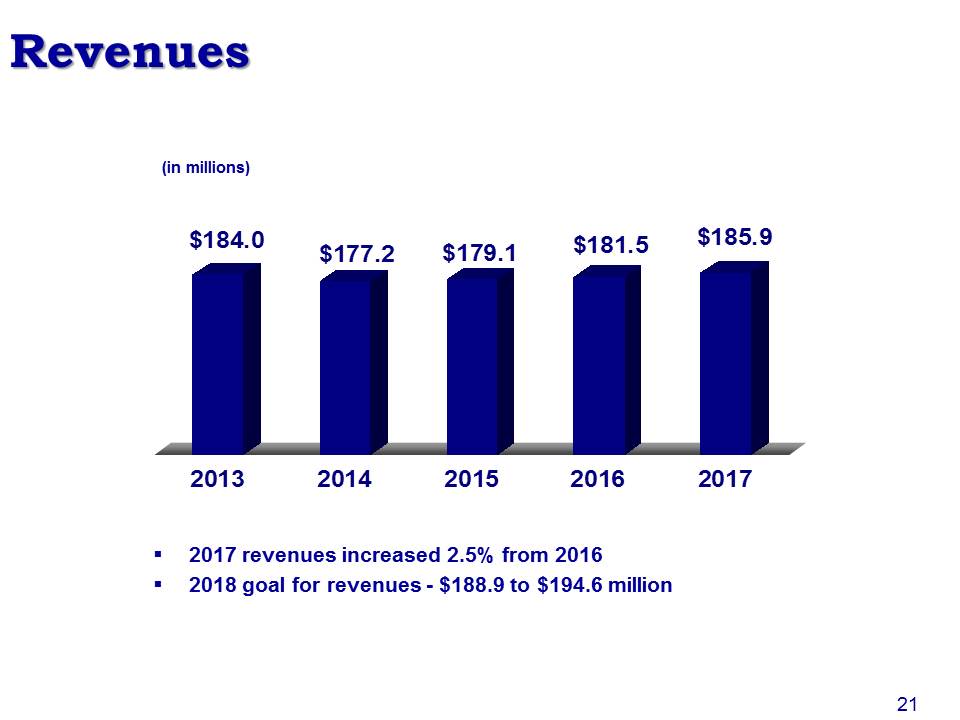

Revenues (in millions) 2017 revenues increased 2.5% from 20162018 goal for revenues - $188.9 to $194.6 million 21

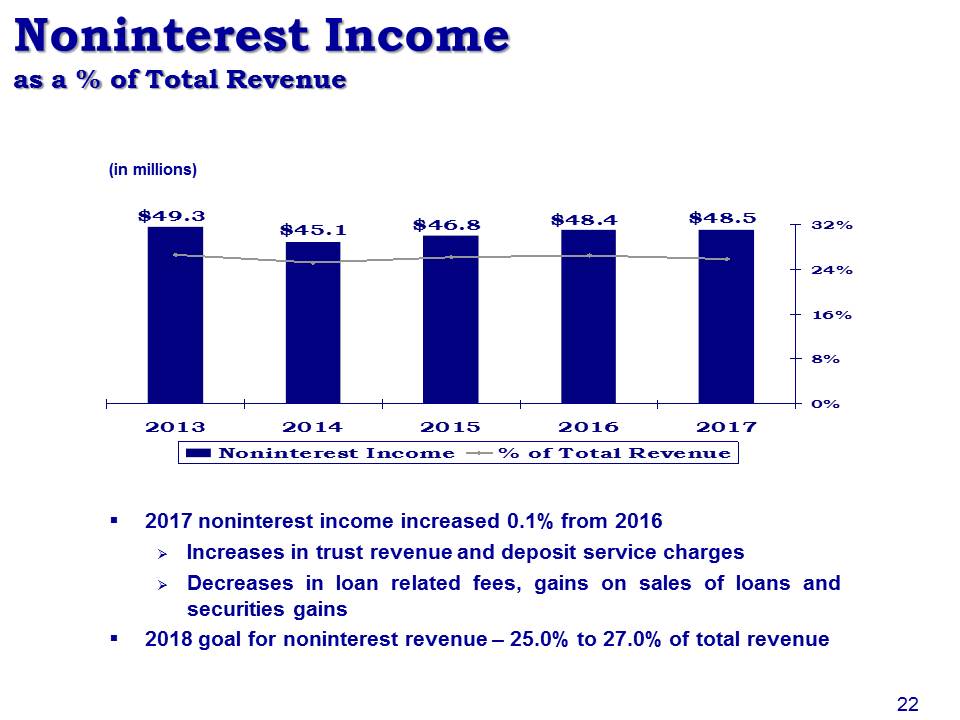

2017 noninterest income increased 0.1% from 2016Increases in trust revenue and deposit service chargesDecreases in loan related fees, gains on sales of loans and securities gains2018 goal for noninterest revenue – 25.0% to 27.0% of total revenue Noninterest Incomeas a % of Total Revenue (in millions) 22

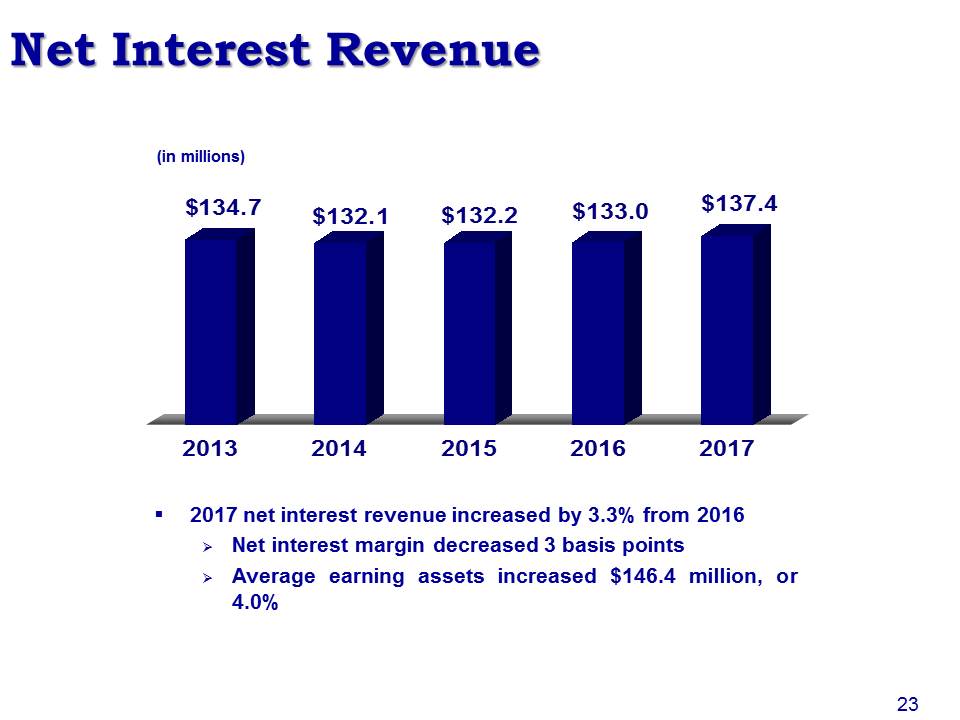

2017 net interest revenue increased by 3.3% from 2016Net interest margin decreased 3 basis pointsAverage earning assets increased $146.4 million, or 4.0% (in millions) Net Interest Revenue 23

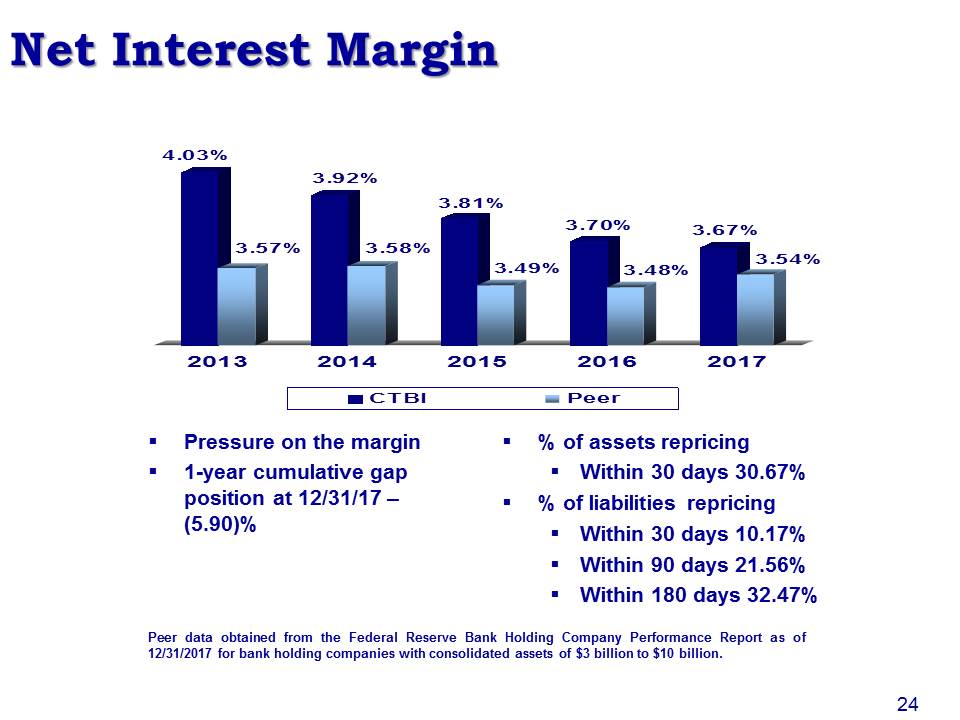

Net Interest Margin Pressure on the margin1-year cumulative gap position at 12/31/17 – (5.90)% % of assets repricingWithin 30 days 30.67%% of liabilities repricing Within 30 days 10.17%Within 90 days 21.56%Within 180 days 32.47% Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 12/31/2017 for bank holding companies with consolidated assets of $3 billion to $10 billion. 24

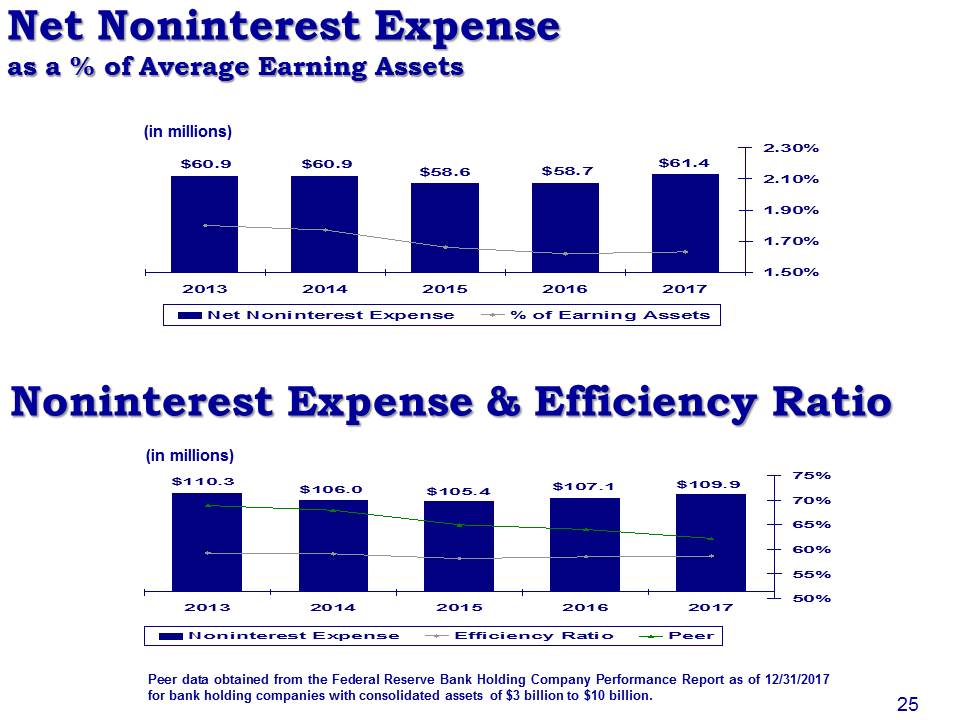

Net Noninterest Expenseas a % of Average Earning Assets Noninterest Expense & Efficiency Ratio (in millions) (in millions) Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 12/31/2017 for bank holding companies with consolidated assets of $3 billion to $10 billion. 25

Balance Sheet Review

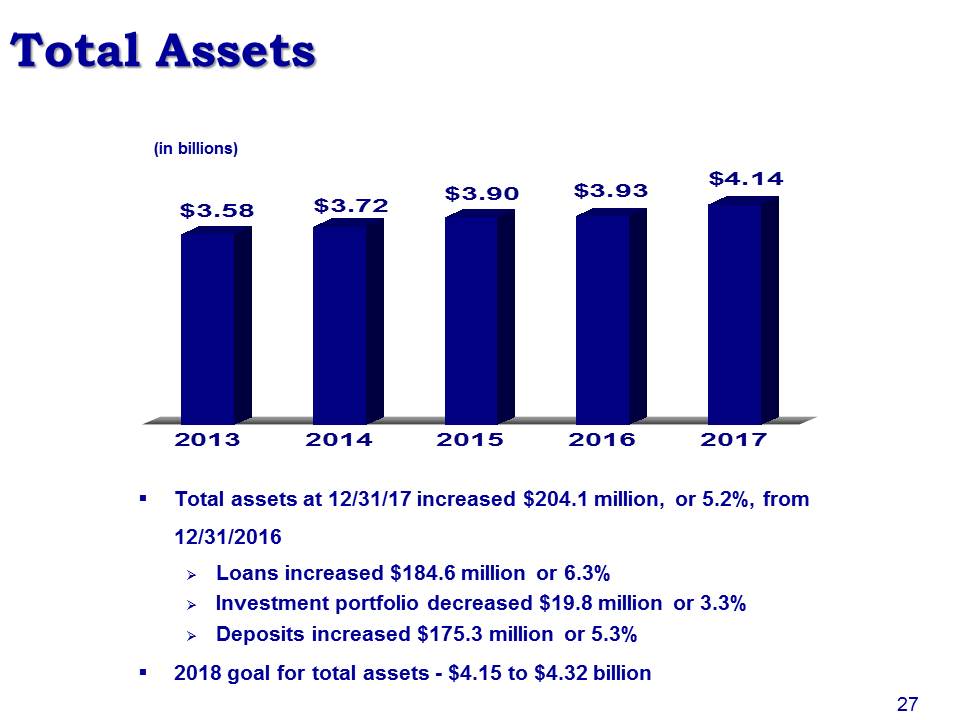

Total assets at 12/31/17 increased $204.1 million, or 5.2%, from 12/31/2016Loans increased $184.6 million or 6.3%Investment portfolio decreased $19.8 million or 3.3%Deposits increased $175.3 million or 5.3%2018 goal for total assets - $4.15 to $4.32 billion (in billions) Total Assets 27

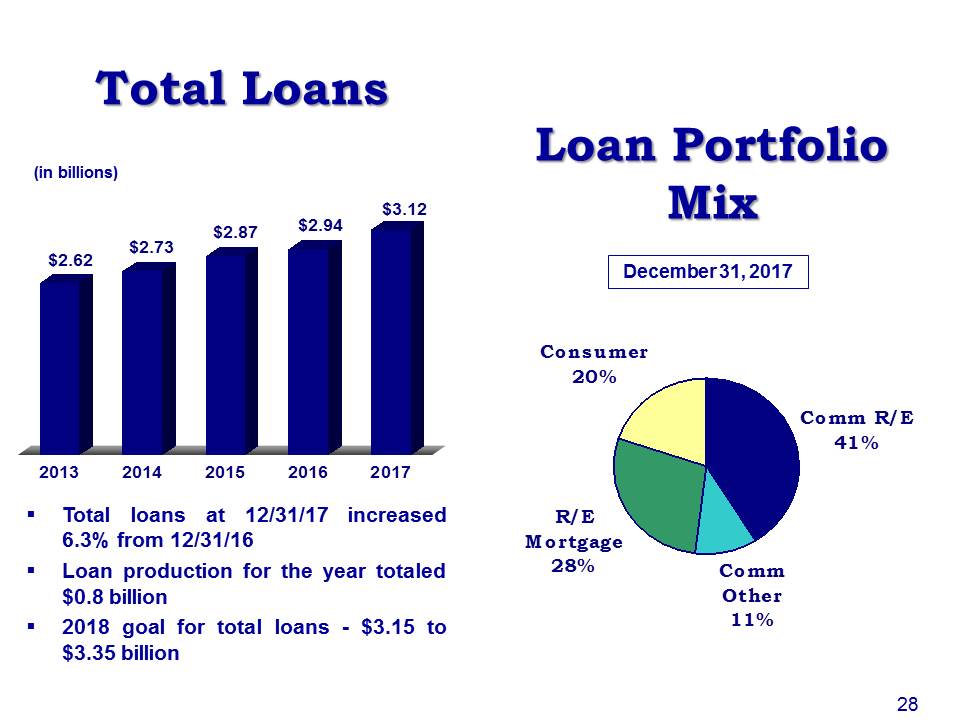

(in billions) Total Loans Total loans at 12/31/17 increased 6.3% from 12/31/16Loan production for the year totaled $0.8 billion2018 goal for total loans - $3.15 to $3.35 billion December 31, 2017 Loan PortfolioMix 28

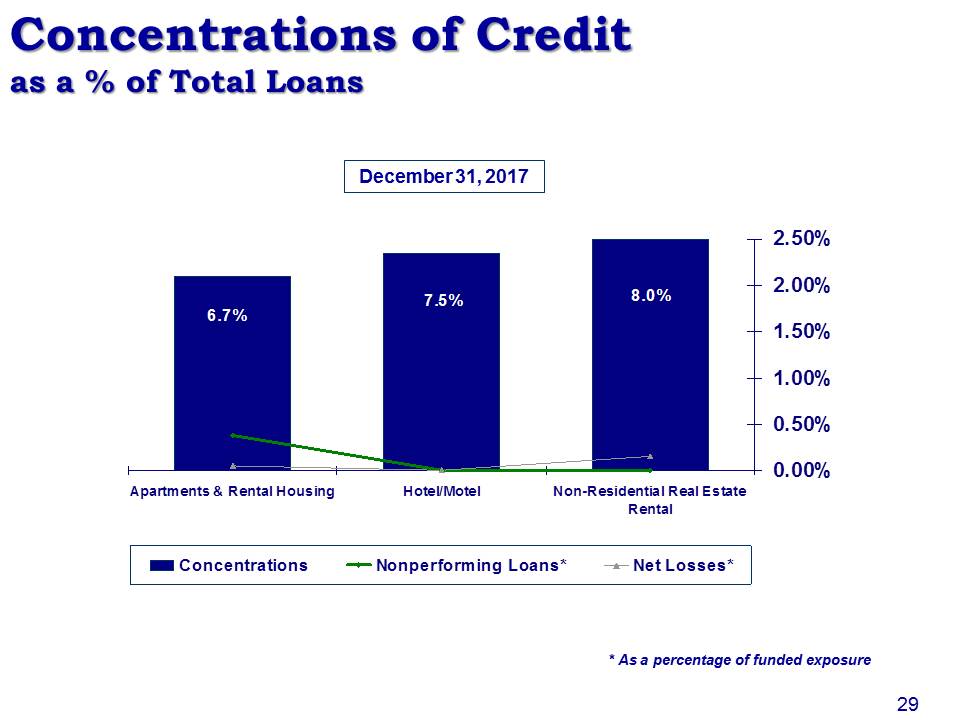

Concentrations of Creditas a % of Total Loans December 31, 2017 * As a percentage of funded exposure 29

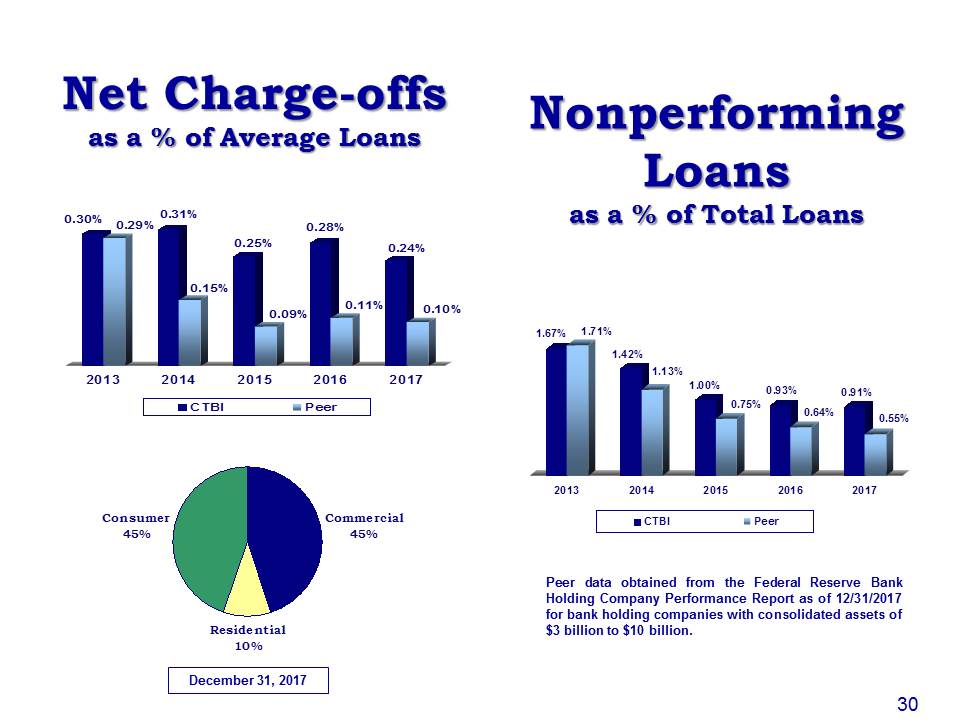

Net Charge-offsas a % of Average Loans NonperformingLoansas a % of Total Loans Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 12/31/2017 for bank holding companies with consolidated assets of $3 billion to $10 billion. December 31, 2017 30

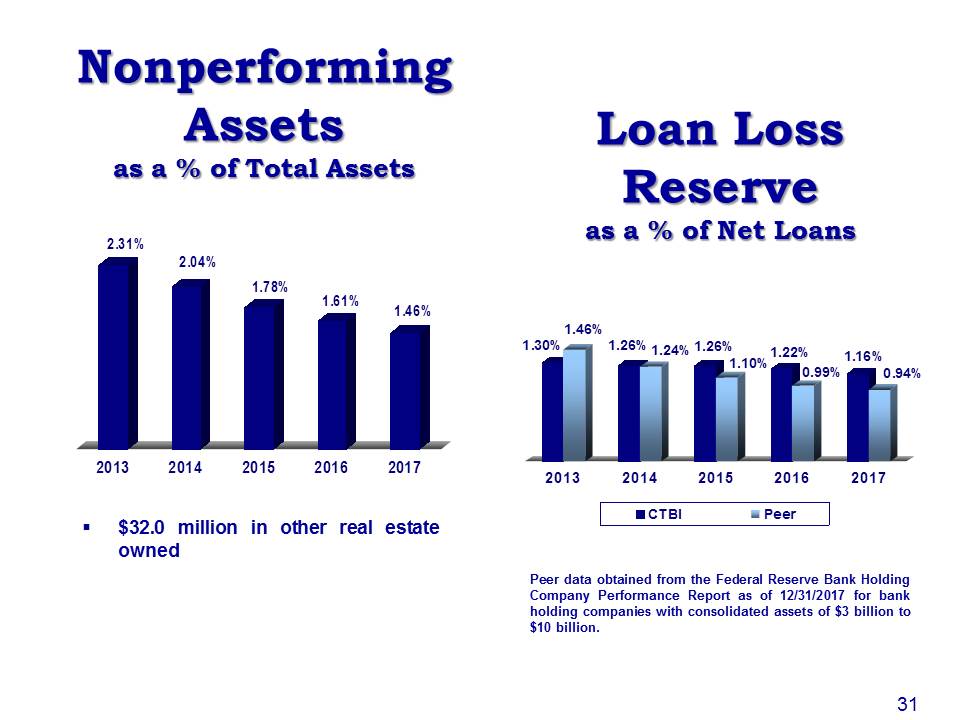

Nonperforming Assetsas a % of Total Assets Loan Loss Reserveas a % of Net Loans $32.0 million in other real estate owned Peer data obtained from the Federal Reserve Bank Holding Company Performance Report as of 12/31/2017 for bank holding companies with consolidated assets of $3 billion to $10 billion. 31

Total Other Real Estate Owned Sales of foreclosed properties for the year ended 12/31/17 $6.1 millionNew bookings in 2017 $5.4 millionProperties under contract to sell $2.2 million (in millions) 32

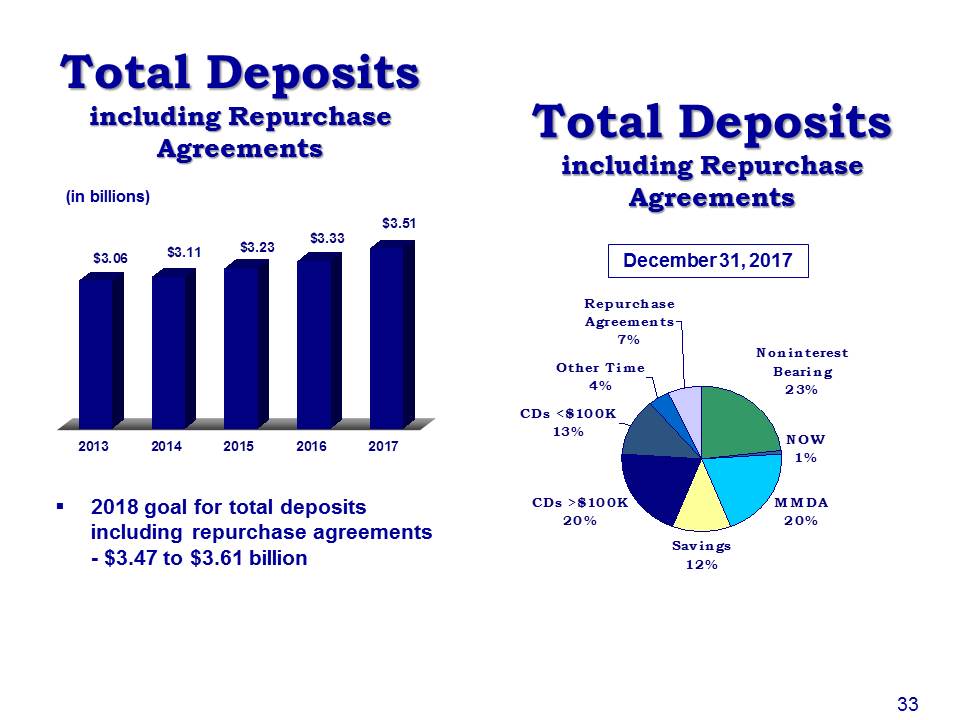

(in billions) Total Depositsincluding Repurchase Agreements 2018 goal for total deposits including repurchase agreements - $3.47 to $3.61 billion Total Depositsincluding Repurchase Agreements December 31, 2017 33

1st Quarter 2018Review

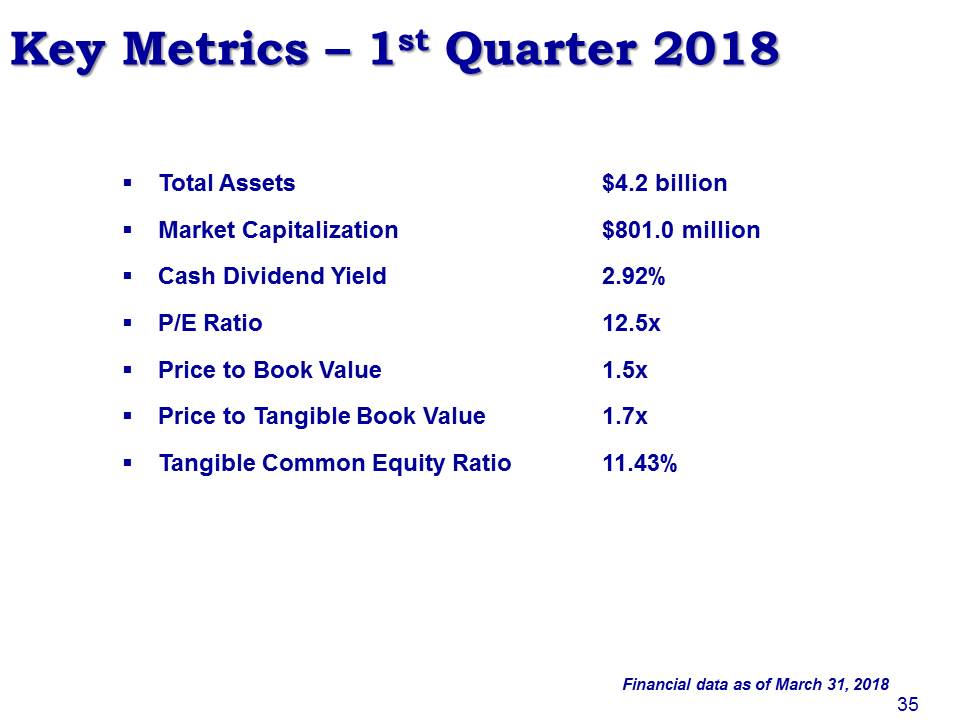

35 Key Metrics – 1st Quarter 2018 Total Assets $4.2 billionMarket Capitalization $801.0 millionCash Dividend Yield 2.92%P/E Ratio 12.5xPrice to Book Value 1.5xPrice to Tangible Book Value 1.7xTangible Common Equity Ratio 11.43% Financial data as of March 31, 2018

Earnings Per Share 36

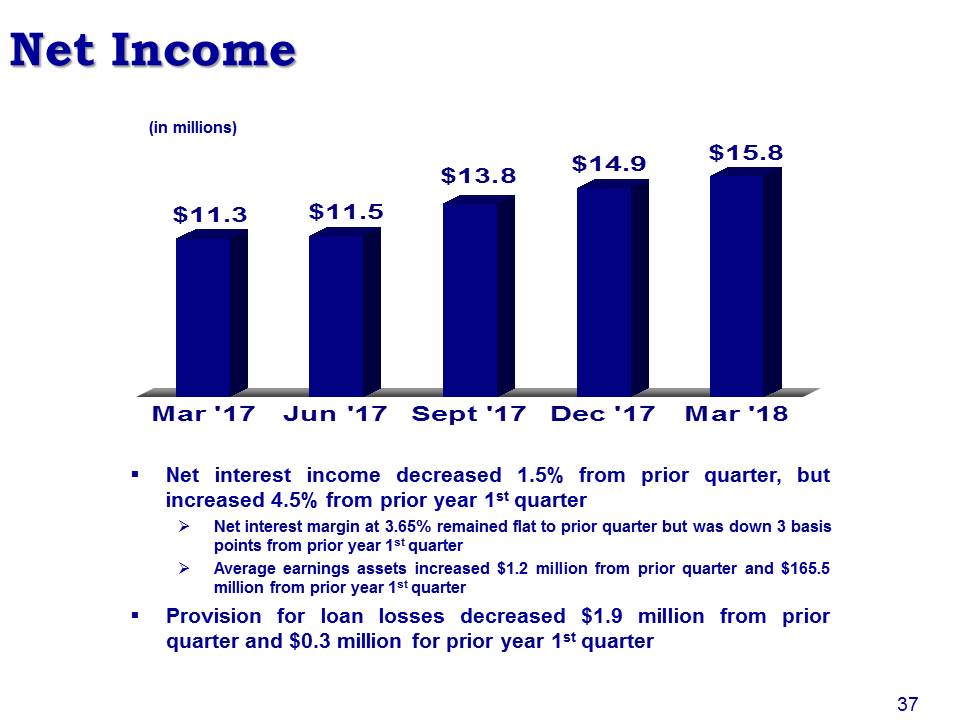

(in millions) Net Income 37 Net interest income decreased 1.5% from prior quarter, but increased 4.5% from prior year 1st quarterNet interest margin at 3.65% remained flat to prior quarter but was down 3 basis points from prior year 1st quarterAverage earnings assets increased $1.2 million from prior quarter and $165.5 million from prior year 1st quarterProvision for loan losses decreased $1.9 million from prior quarter and $0.3 million for prior year 1st quarter

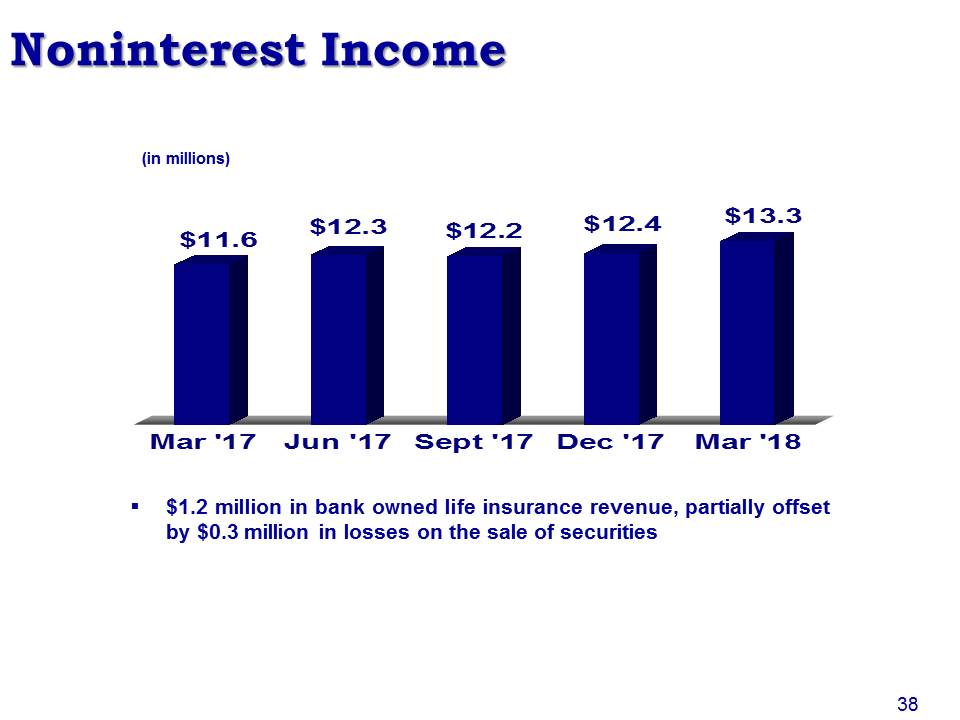

(in millions) Noninterest Income $1.2 million in bank owned life insurance revenue, partially offset by $0.3 million in losses on the sale of securities 38

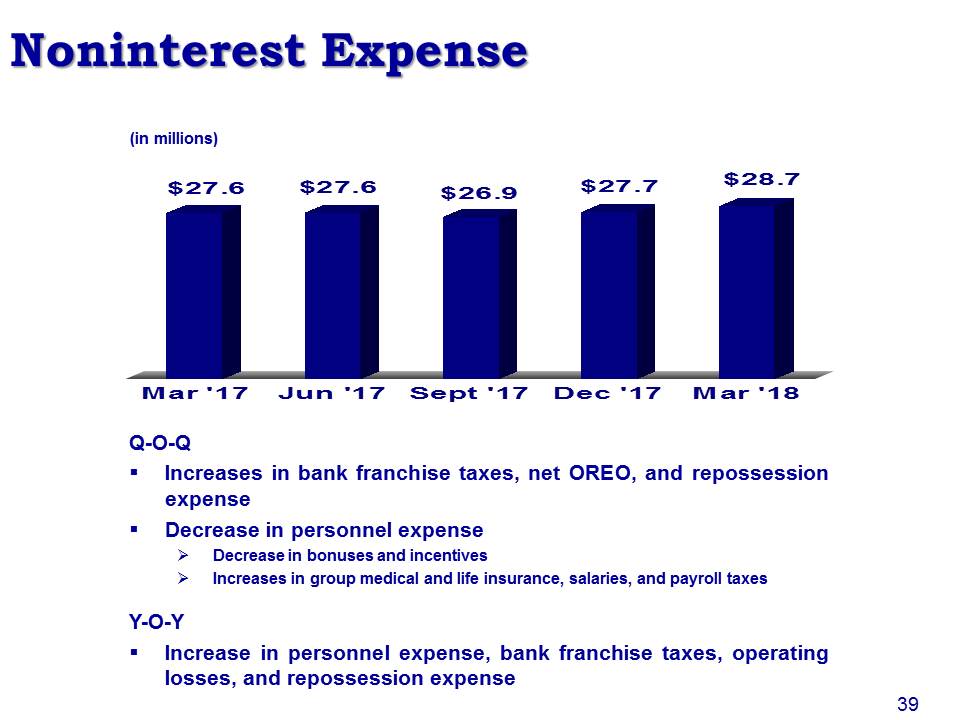

(in millions) Noninterest Expense Q-O-QIncreases in bank franchise taxes, net OREO, and repossession expenseDecrease in personnel expenseDecrease in bonuses and incentivesIncreases in group medical and life insurance, salaries, and payroll taxesY-O-YIncrease in personnel expense, bank franchise taxes, operating losses, and repossession expense 39

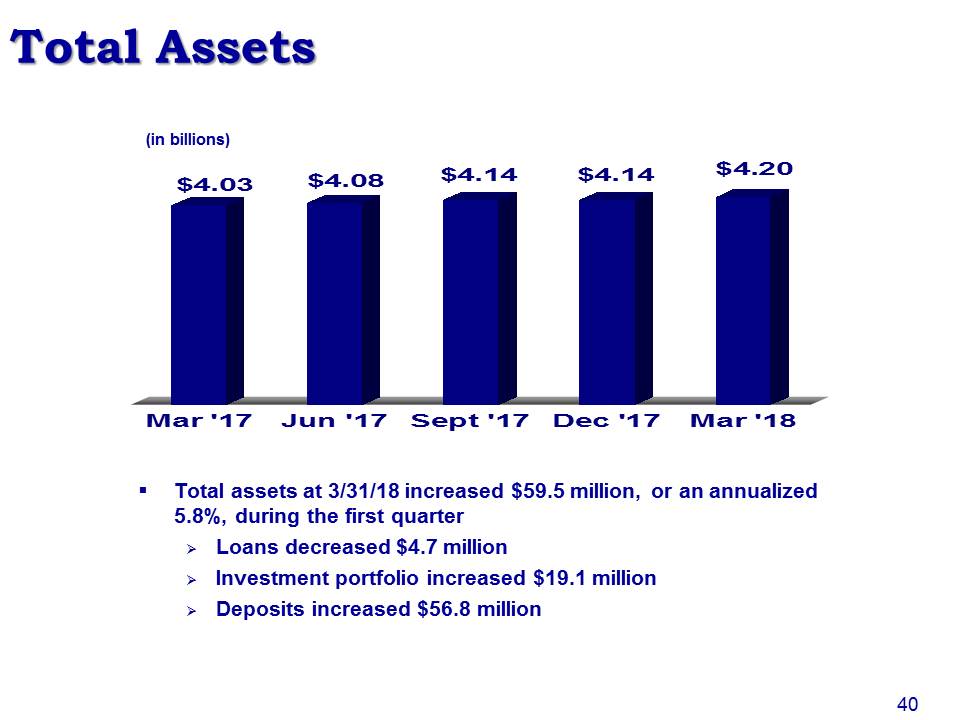

40 (in billions) Total Assets Total assets at 3/31/18 increased $59.5 million, or an annualized 5.8%, during the first quarterLoans decreased $4.7 millionInvestment portfolio increased $19.1 millionDeposits increased $56.8 million

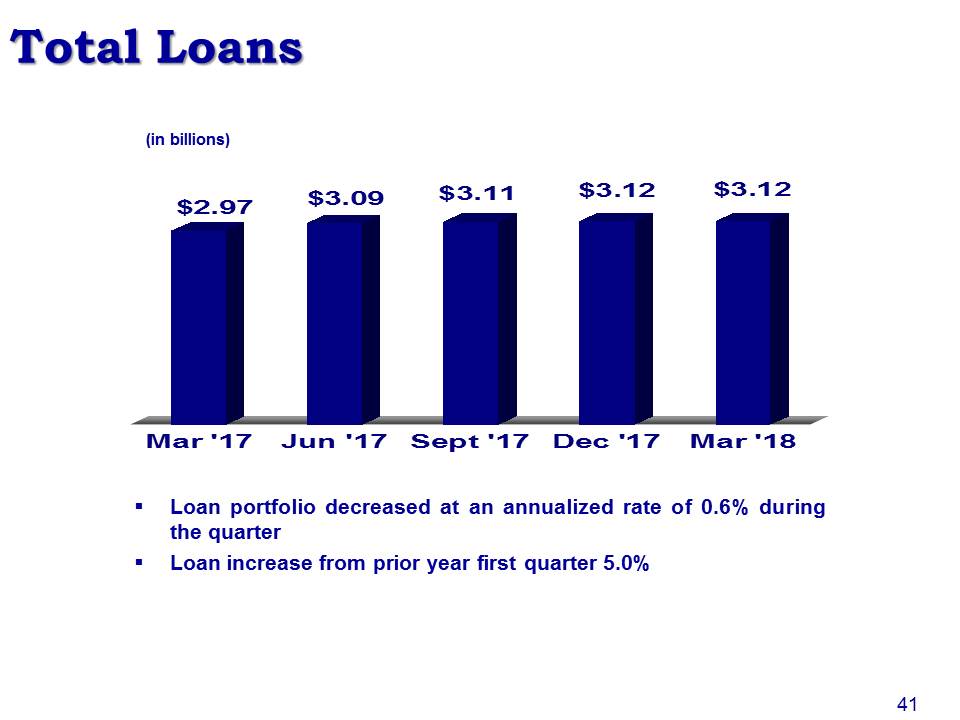

Loan portfolio decreased at an annualized rate of 0.6% during the quarterLoan increase from prior year first quarter 5.0% (in billions) Total Loans 41

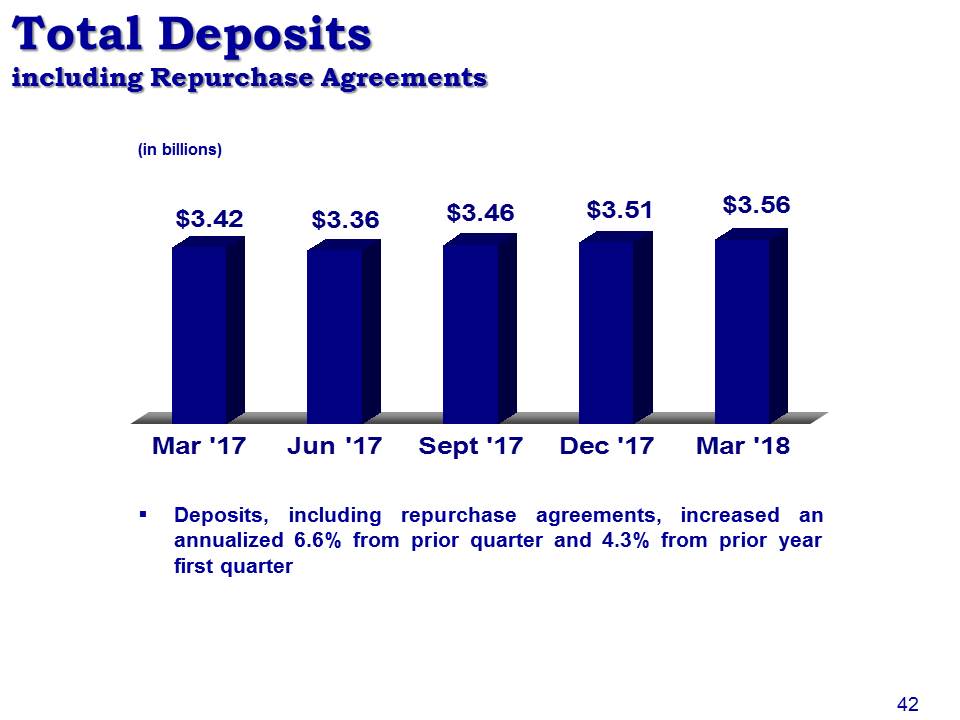

Deposits, including repurchase agreements, increased an annualized 6.6% from prior quarter and 4.3% from prior year first quarter (in billions) Total Depositsincluding Repurchase Agreements 42

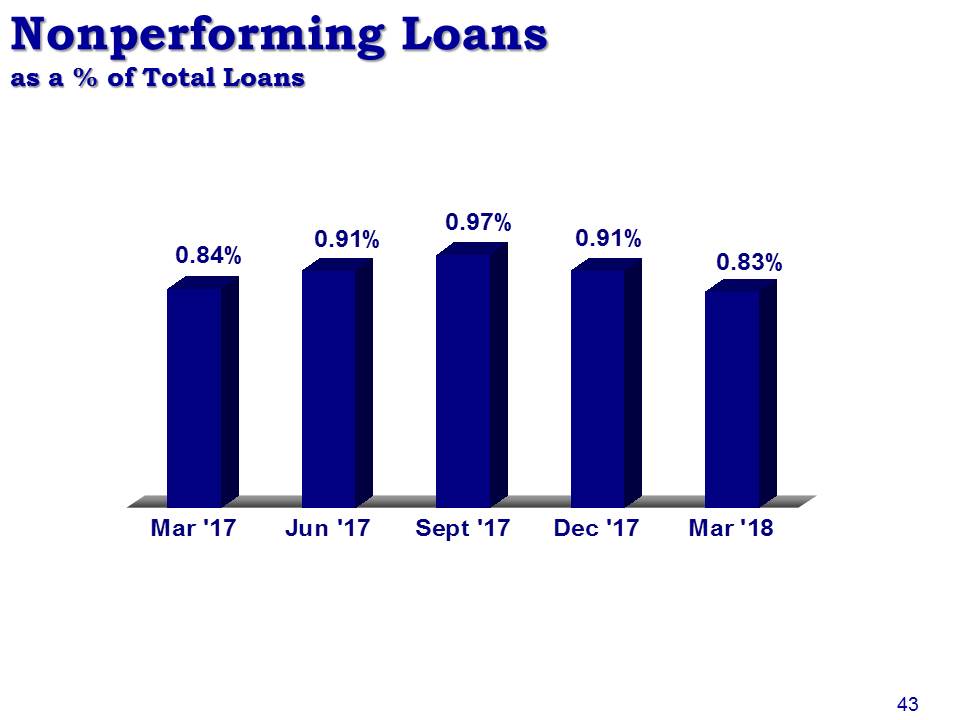

Nonperforming Loansas a % of Total Loans 43

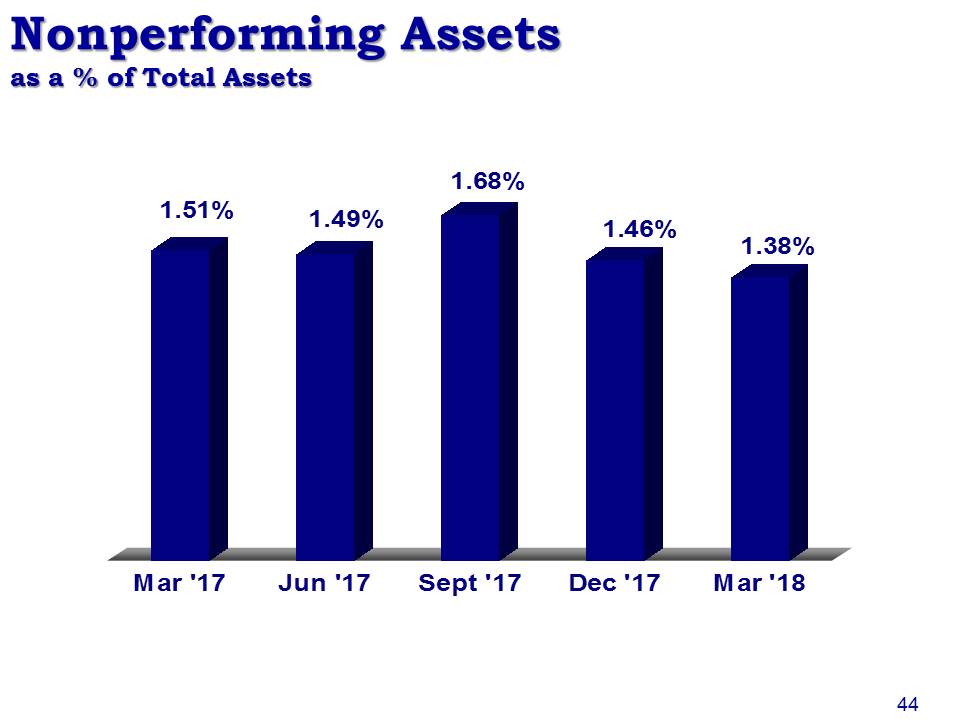

Nonperforming Assetsas a % of Total Assets 44

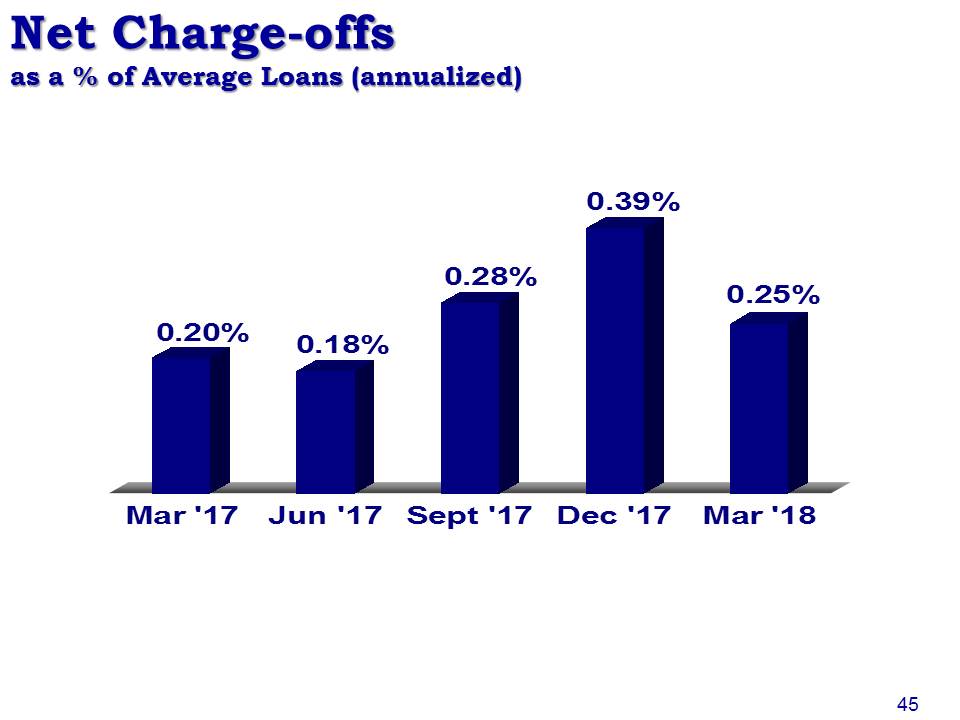

Net Charge-offsas a % of Average Loans (annualized) 45

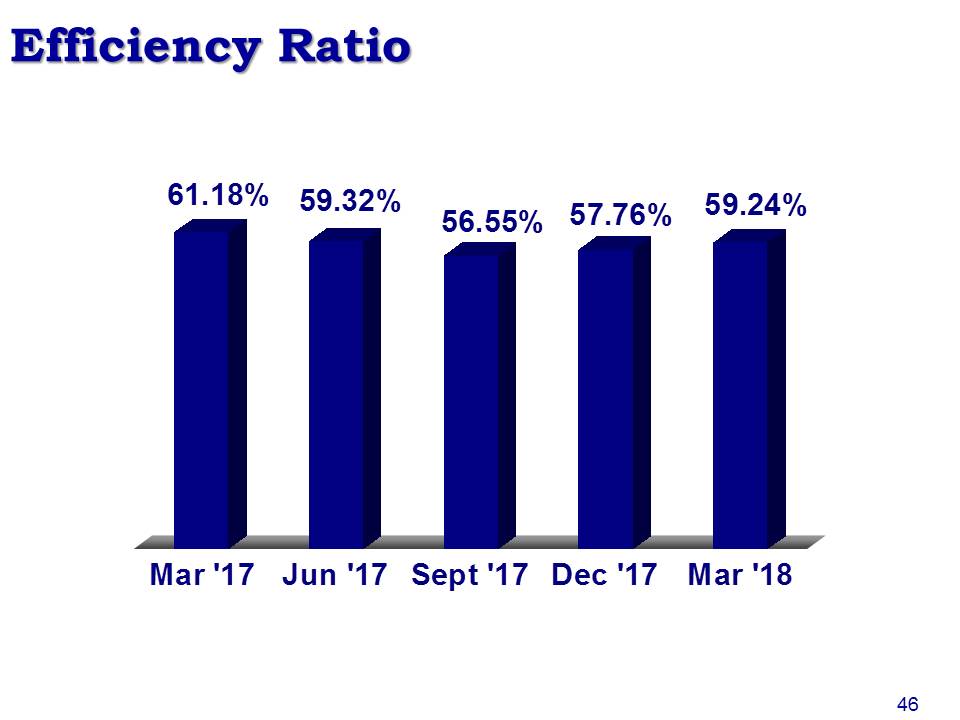

Efficiency Ratio 46

Key Strategic Initiatives

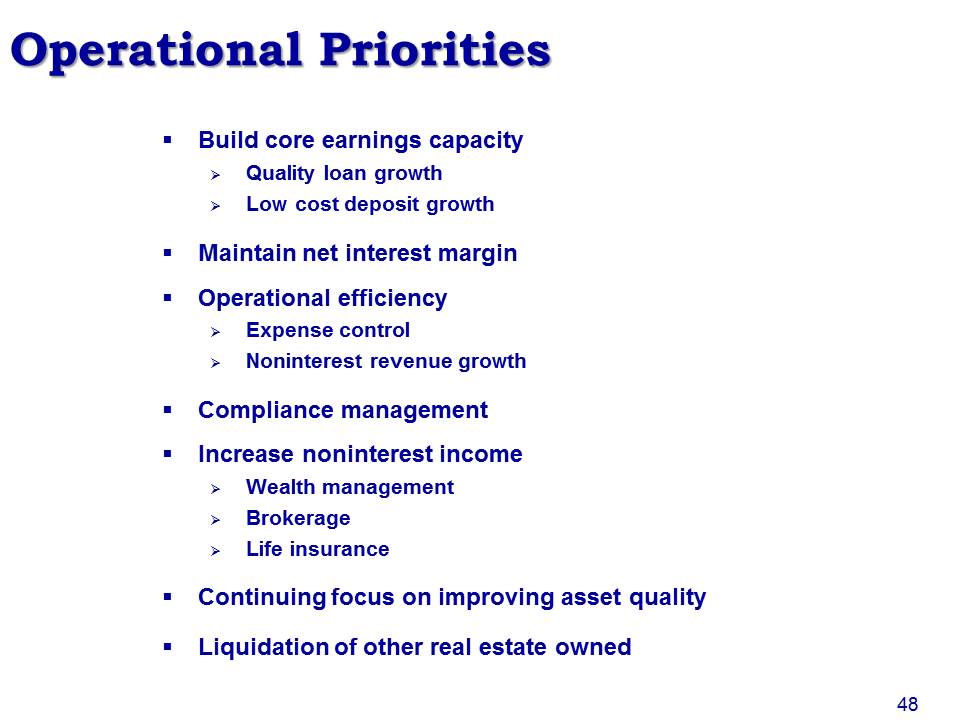

Operational Priorities 48 Build core earnings capacityQuality loan growthLow cost deposit growthMaintain net interest margin Operational efficiencyExpense controlNoninterest revenue growthCompliance managementIncrease noninterest incomeWealth managementBrokerageLife insuranceContinuing focus on improving asset quality Liquidation of other real estate owned

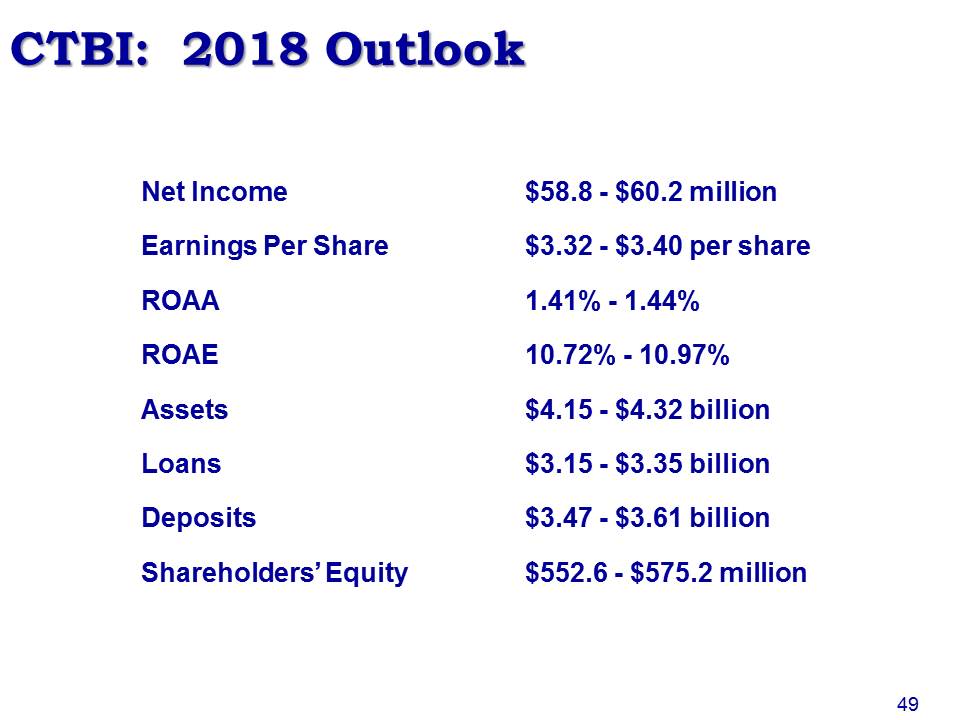

CTBI: 2018 Outlook Net Income $58.8 - $60.2 millionEarnings Per Share $3.32 - $3.40 per shareROAA 1.41% - 1.44% ROAE 10.72% - 10.97% Assets $4.15 - $4.32 billionLoans $3.15 - $3.35 billionDeposits $3.47 - $3.61 billionShareholders’ Equity $552.6 - $575.2 million 49

To Our Shareholders Your management has a Strategic Plan for the performance and operations of your company. Success will be attained by the execution of this plan, not just by management, but by approximately 1,000 employees. The continuing support by you, our shareholders, by referring your friends, neighbors, and business associates to do business with your bank, is invaluable to the execution of our plans for the performance of your Company. 50