Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Griffin Realty Trust, Inc. | gcear2form8-kinvestorupdat.htm |

INVESTOR UPDATE

FOURTH QUARTER 2017

ACQUISITION VALUE: Approximately $1.1 billion

SIZE OF PORTFOLIO: 7.3 million square feet

LEASED:(1) 100%

REMAINING AVERAGE LEASE TERM: Approximately 10.3 years

AVERAGE ANNUAL RENTAL INCREASE: (2) 2.4%

CURRENT AVERAGE DEBT RATE:(3) 3.13%

PORTFOLIO AT-A-GLANCE

AS OF DECEMBER 31, 2017

(1) There is no guarantee our properties will remain 100% leased.

(2) Weighted average rental increase is based on the remaining term of the lease at acquisition date. Rental increase may differ based on the full lease term, which is from the original commencement date.

(3) Current period debt rate includes the effect of interest rate swaps and excludes the effect of deferred financing costs.

NETGEAR | San Jose, CA

www.griffincapital.com

Logos shown are those of tenants, lease guarantors or non-guarantor parent companies at our properties.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. AN OFFERING IS MADE ONLY BY THE PROSPECTUS.

THIS MATERIAL MUST BE READ IN CONJUNCTION WITH THE PROSPECTUS IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING

OF SECURITIES TO WHICH IT RELATES. A COPY OF THE PROSPECTUS MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THIS OFFERING. NO OFFERING IS MADE

TO NEW YORK RESIDENTS EXCEPT BY A PROSPECTUS FILED WITH THE DEPARTMENT OF LAW OF THE STATE OF NEW YORK. NEITHER THE SECURITIES AND EXCHANGE

COMMISSION, THE ATTORNEY GENERAL OF THE STATE OF NEW YORK NOR ANY OTHER STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF THESE

SECURITIES OR DETERMINED IF THE PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. AN INVESTMENT IN

GRIFFIN CAPITAL ESSENTIAL ASSET REIT II, INC. INVOLVES A HIGH DEGREE OF RISK AND THERE CAN BE NO ASSURANCE THAT THE INVESTMENT OBJECTIVES OF THIS

PROGRAM WILL BE ATTAINED.

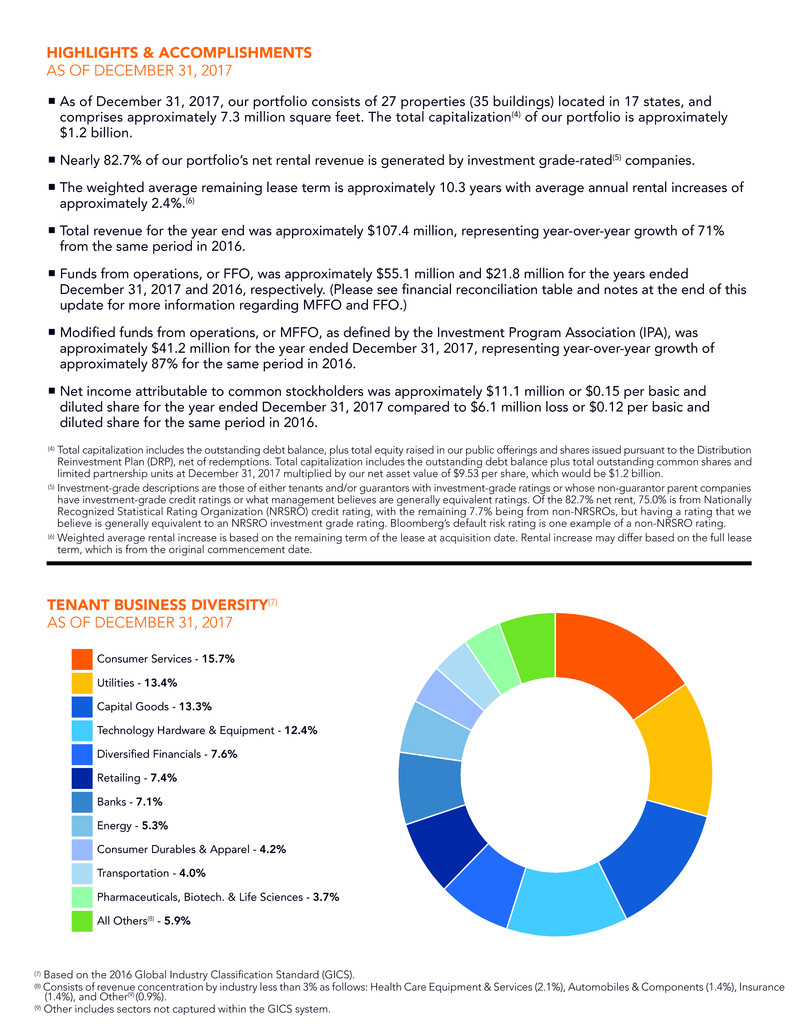

TENANT BUSINESS DIVERSITY(7)

AS OF DECEMBER 31, 2017

As of December 31, 2017, our portfolio consists of 27 properties (35 buildings) located in 17 states, and

comprises approximately 7.3 million square feet. The total capitalization(4) of our portfolio is approximately

$1.2 billion.

Nearly 82.7% of our portfolio’s net rental revenue is generated by investment grade-rated(5) companies.

The weighted average remaining lease term is approximately 10.3 years with average annual rental increases of

approximately 2.4%.(6)

Total revenue for the year end was approximately $107.4 million, representing year-over-year growth of 71%

from the same period in 2016.

Funds from operations, or FFO, was approximately $55.1 million and $21.8 million for the years ended

December 31, 2017 and 2016, respectively. (Please see financial reconciliation table and notes at the end of this

update for more information regarding MFFO and FFO.)

Modified funds from operations, or MFFO, as defined by the Investment Program Association (IPA), was

approximately $41.2 million for the year ended December 31, 2017, representing year-over-year growth of

approximately 87% for the same period in 2016.

Net income attributable to common stockholders was approximately $11.1 million or $0.15 per basic and

diluted share for the year ended December 31, 2017 compared to $6.1 million loss or $0.12 per basic and

diluted share for the same period in 2016.

HIGHLIGHTS & ACCOMPLISHMENTS

AS OF DECEMBER 31, 2017

(7) Based on the 2016 Global Industry Classification Standard (GICS).

(8) Consists of revenue concentration by industry less than 3% as follows: Health Care Equipment & Services (2.1%), Automobiles & Components (1.4%), Insurance

(1.4%), and Other(9) (0.9%).

(9) Other includes sectors not captured within the GICS system.

(4) Total capitalization includes the outstanding debt balance, plus total equity raised in our public offerings and shares issued pursuant to the Distribution

Reinvestment Plan (DRP), net of redemptions. Total capitalization includes the outstanding debt balance plus total outstanding common shares and

limited partnership units at December 31, 2017 multiplied by our net asset value of $9.53 per share, which would be $1.2 billion.

(5) Investment-grade descriptions are those of either tenants and/or guarantors with investment-grade ratings or whose non-guarantor parent companies

have investment-grade credit ratings or what management believes are generally equivalent ratings. Of the 82.7% net rent, 75.0% is from Nationally

Recognized Statistical Rating Organization (NRSRO) credit rating, with the remaining 7.7% being from non-NRSROs, but having a rating that we

believe is generally equivalent to an NRSRO investment grade rating. Bloomberg’s default risk rating is one example of a non-NRSRO rating.

(6) Weighted average rental increase is based on the remaining term of the lease at acquisition date. Rental increase may differ based on the full lease

term, which is from the original commencement date.

Consumer Services - 15.7%

Utilities - 13.4%

Capital Goods - 13.3%

Technology Hardware & Equipment - 12.4%

Diversified Financials - 7.6%

Retailing - 7.4%

Banks - 7.1%

Energy - 5.3%

Consumer Durables & Apparel - 4.2%

Transportation - 4.0%

Pharmaceuticals, Biotech. & Life Sciences - 3.7%

All Others(8) - 5.9%

9

10

5

4

2

1

3

8

7

611

12

13 14

PROPERTY MAP

AS OF DECEMBER 31, 2017

15

16

17

18

19

20

21

22

27

23

24

25

26

Owens Corning

Light Manufacturing

Building

Concord, NC

Acquisition Date:

03.09.15

Wood Group USA

Headquarters

Houston, TX

Acquisition Date:

04.01.15

Administrative Offices

of Pennsylvania Courts

Admin. Office Building

Mechanicsburg, PA

Acquisition Date: 04.22.15

American Express

Travel Related Services

Information &

Processing Technical

Resource Center

Phoenix, AZ

Acquisition Date: 05.11.15

Exel

Distribution Warehouse

Groveport, OH

Acquisition Date:

06.30.15

Rapiscan Systems

Office/R&D

Andover, MA

Acquisition Date: 07.01.15

FedEx Freight

Regional Hub

West Jefferson, OH

Acquisition Date: 07.22.15

Aetna Life Insurance

Company

Workers’ Compensation

Headquarters Building

Tucson, AZ

Acquisition Date:

07.29.15

NETGEAR

World Headquarters

San Jose, CA

Acquisition Date:

05.17.16

Nike, Inc.

Evergreen Technology

Campus

Hillsboro, OR

Acquisition Date: 06.16.16

Zebra Technologies

Corporate Headquarters

Lincolnshire, IL

Acquisition Date: 08.01.16

WABCO

Assembly & Distribution

Facility

North Charleston, SC

Acquisition Date:

09.14.16

Southern Company

Regional Office

Birmingham, AL

Acquisition Date: 12.22.16

Allstate Insurance

Company

Regional Office Building

Lone Tree, CO

Acquisition Date: 1.31.17

Midcontinent

Independent System

Operator, Inc. (MISO)

Headquarters Building

Carmel, IN

Acquisition Date: 5.15.17

1 2 3 4

9 10 11 12

17 18 19 20

25 26 27

MGM Resorts

International

Corporate Center

Las Vegas, NV

Acquisition Date:

05.27.15

American Showa

Assembly &

Distribution Warehouse

Columbus, OH

Acquisition Date:

05.28.15

Huntington Ingalls

Warehouse &

Distribution Center

Hampton, VA

Acquisition Date:

06.26.15

Wyndham

Worldwide Operations

Headquarters

Parsippany, NJ

Acquisition Date:

06.26.15

Bank of America

(450 American)

Office Building

Simi Valley, CA

Acquisition Date:

08.14.15

Bank of America

(1800 Tapo)

Office Building

Simi Valley, CA

Acquisition Date:

08.14.15

Atlas Copco

Office/R&D

Auburn Hills, MI

Acquisition Date:

10.01.15

Toshiba Global

Commerce Solutions

Corporate

Headquarters

Durham, NC

Acquisition Date:

01.21.16

IGT

North American

Gaming Headquarters

Las Vegas, NV

Acquisition Date:

09.27.16

3M

Distribution Facility

DeKalb, IL

Acquisition Date:

10.25.16

Amazon

Sortable Fulfillment

Center

Pataskala, OH

Acquisition Date:

11.18.16

Zoetis

Corporate

Headquarters

Parsippany, NJ

Acquisition Date:

12.16.16

5 6 7 8

13 14 15 16

21 22 23 24

(10) There is no guarantee our properties will remain 100% leased.

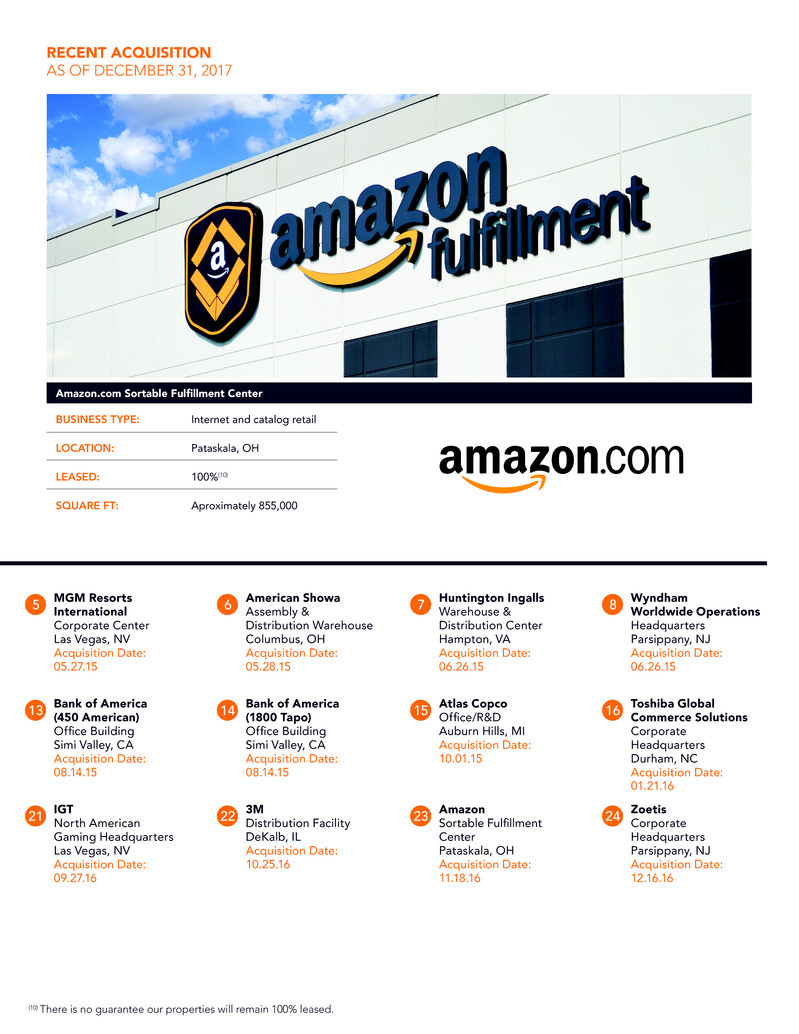

RECENT ACQUISITION

AS OF DECEMBER 31, 2017

Amazon.com Sortable Fulfillment Center

BUSINESS TYPE: Internet and catalog retail

LOCATION: Pataskala, OH

LEASED: 100%(10)

SQUARE FT: Aproximately 855,000

Owens Corning

Light Manufacturing

Building

Concord, NC

Acquisition Date:

03.09.15

Wood Group USA

Headquarters

Houston, TX

Acquisition Date:

04.01.15

Administrative Offices

of Pennsylvania Courts

Admin. Office Building

Mechanicsburg, PA

Acquisition Date: 04.22.15

American Express

Travel Related Services

Information &

Processing Technical

Resource Center

Phoenix, AZ

Acquisition Date: 05.11.15

Exel

Distribution Warehouse

Groveport, OH

Acquisition Date:

06.30.15

Rapiscan Systems

Office/R&D

Andover, MA

Acquisition Date: 07.01.15

FedEx Freight

Regional Hub

West Jefferson, OH

Acquisition Date: 07.22.15

Aetna Life Insurance

Company

Workers’ Compensation

Headquarters Building

Tucson, AZ

Acquisition Date:

07.29.15

NETGEAR

World Headquarters

San Jose, CA

Acquisition Date:

05.17.16

Nike, Inc.

Evergreen Technology

Campus

Hillsboro, OR

Acquisition Date: 06.16.16

Zebra Technologies

Corporate Headquarters

Lincolnshire, IL

Acquisition Date: 08.01.16

WABCO

Assembly & Distribution

Facility

North Charleston, SC

Acquisition Date:

09.14.16

Southern Company

Regional Office

Birmingham, AL

Acquisition Date: 12.22.16

Allstate Insurance

Company

Regional Office Building

Lone Tree, CO

Acquisition Date: 1.31.17

Midcontinent

Independent System

Operator, Inc. (MISO)

Headquarters Building

Carmel, IN

Acquisition Date: 5.15.17

1 2 3 4

9 10 11 12

17 18 19 20

25 26 27

$14.0M

$12.0M

$10.0M

$8.0M

$6.0M

$4.0M

$2.0M

0

$14.0M

$12.0M

$10.0M

$8.0M

$6.0M

$4.0M

$2.0M

0

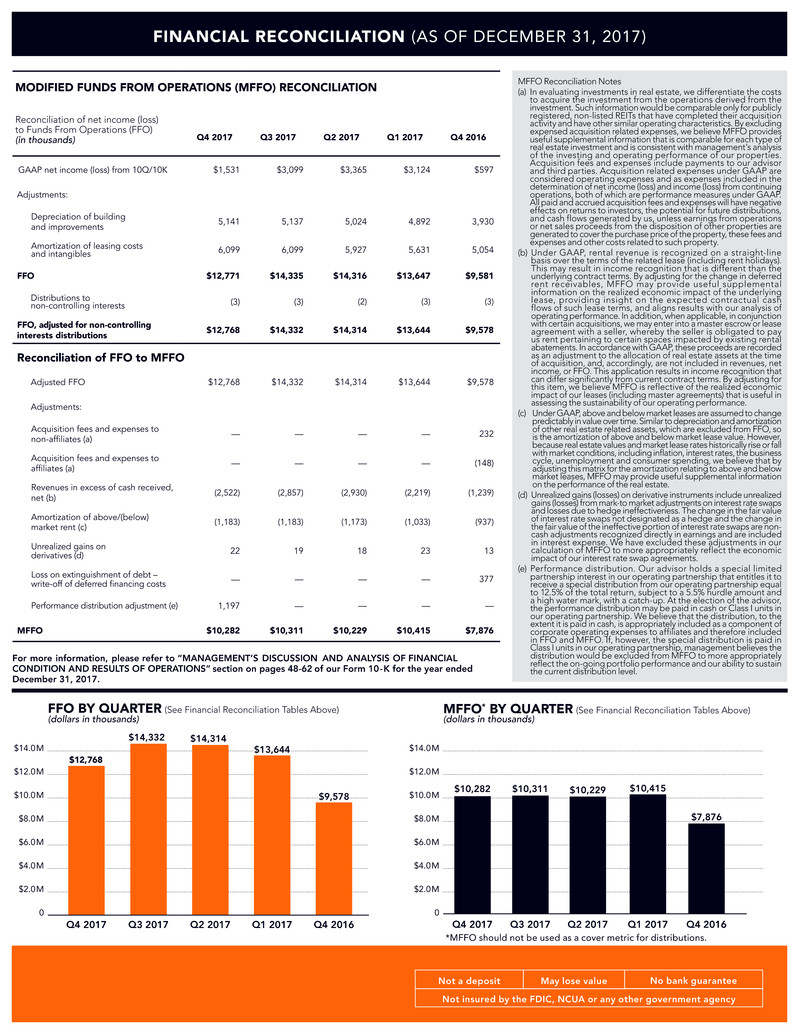

FINANCIAL RECONCILIATION (AS OF DECEMBER 31, 2017)

Not insured by the FDIC, NCUA or any other government agency

Not a deposit May lose value No bank guarantee

MODIFIED FUNDS FROM OPERATIONS (MFFO) RECONCILIATION

Reconciliation of net income (loss)

to Funds From Operations (FFO)

(in thousands) Q4 2017 Q3 2017 Q2 2017 Q1 2017 Q4 2016

GAAP net income (loss) from 10Q/10K $1,531 $3,099 $3,365 $3,124 $597

Adjustments:

Depreciation of building

and improvements 5,141 5,137 5,024 4,892 3,930

Amortization of leasing costs

and intangibles 6,099 6,099 5,927 5,631 5,054

FFO $12,771 $14,335 $14,316 $13,647 $9,581

Distributions to

non-controlling interests (3) (3) (2) (3) (3)

FFO, adjusted for non-controlling

interests distributions

$12,768 $14,332 $14,314 $13,644 $9,578

Reconciliation of FFO to MFFO

Adjusted FFO $12,768 $14,332 $14,314 $13,644 $9,578

Adjustments:

Acquisition fees and expenses to

non-affiliates (a) — — — — 232

Acquisition fees and expenses to

affiliates (a) — — — — (148)

Revenues in excess of cash received,

net (b) (2,522) (2,857) (2,930) (2,219) (1,239)

Amortization of above/(below)

market rent (c) (1,183) (1,183) (1,173) (1,033) (937)

Unrealized gains on

derivatives (d) 22 19 18 23 13

Loss on extinguishment of debt –

write-off of deferred financing costs — — — — 377

Performance distribution adjustment (e) 1,197 — — — —

MFFO $10,282 $10,311 $10,229 $10,415 $7,876

For more information, please refer to “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS” section on pages 48-62 of our Form 10-K for the year ended

December 31, 2017.

MFFO Reconciliation Notes

(a) In evaluating investments in real estate, we differentiate the costs

to acquire the investment from the operations derived from the

investment. Such information would be comparable only for publicly

registered, non-listed REITs that have completed their acquisition

activity and have other similar operating characteristics. By excluding

expensed acquisition related expenses, we believe MFFO provides

useful supplemental information that is comparable for each type of

real estate investment and is consistent with management’s analysis

of the investing and operating performance of our properties.

Acquisition fees and expenses include payments to our advisor

and third parties. Acquisition related expenses under GAAP are

considered operating expenses and as expenses included in the

determination of net income (loss) and income (loss) from continuing

operations, both of which are performance measures under GAAP.

All paid and accrued acquisition fees and expenses will have negative

effects on returns to investors, the potential for future distributions,

and cash flows generated by us, unless earnings from operations

or net sales proceeds from the disposition of other properties are

generated to cover the purchase price of the property, these fees and

expenses and other costs related to such property.

(b) Under GAAP, rental revenue is recognized on a straight-line

basis over the terms of the related lease (including rent holidays).

This may result in income recognition that is different than the

underlying contract terms. By adjusting for the change in deferred

rent receivables, MFFO may provide useful supplemental

information on the realized economic impact of the underlying

lease, providing insight on the expected contractual cash

flows of such lease terms, and aligns results with our analysis of

operating performance. In addition, when applicable, in conjunction

with certain acquisitions, we may enter into a master escrow or lease

agreement with a seller, whereby the seller is obligated to pay

us rent pertaining to certain spaces impacted by existing rental

abatements. In accordance with GAAP, these proceeds are recorded

as an adjustment to the allocation of real estate assets at the time

of acquisition, and, accordingly, are not included in revenues, net

income, or FFO. This application results in income recognition that

can differ significantly from current contract terms. By adjusting for

this item, we believe MFFO is reflective of the realized economic

impact of our leases (including master agreements) that is useful in

assessing the sustainability of our operating performance.

(c) Under GAAP, above and below market leases are assumed to change

predictably in value over time. Similar to depreciation and amortization

of other real estate related assets, which are excluded from FFO, so

is the amortization of above and below market lease value. However,

because real estate values and market lease rates historically rise or fall

with market conditions, including inflation, interest rates, the business

cycle, unemployment and consumer spending, we believe that by

adjusting this matrix for the amortization relating to above and below

market leases, MFFO may provide useful supplemental information

on the performance of the real estate.

(d) Unrealized gains (losses) on derivative instruments include unrealized

gains (losses) from mark-to market adjustments on interest rate swaps

and losses due to hedge ineffectiveness. The change in the fair value

of interest rate swaps not designated as a hedge and the change in

the fair value of the ineffective portion of interest rate swaps are non-

cash adjustments recognized directly in earnings and are included

in interest expense. We have excluded these adjustments in our

calculation of MFFO to more appropriately reflect the economic

impact of our interest rate swap agreements.

(e) Performance distribution. Our advisor holds a special limited

partnership interest in our operating partnership that entitles it to

receive a special distribution from our operating partnership equal

to 12.5% of the total return, subject to a 5.5% hurdle amount and

a high water mark, with a catch-up. At the election of the advisor,

the performance distribution may be paid in cash or Class I units in

our operating partnership. We believe that the distribution, to the

extent it is paid in cash, is appropriately included as a component of

corporate operating expenses to affiliates and therefore included

in FFO and MFFO. If, however, the special distribution is paid in

Class I units in our operating partnership, management believes the

distribution would be excluded from MFFO to more appropriately

reflect the on-going portfolio performance and our ability to sustain

the current distribution level.

*MFFO should not be used as a cover metric for distributions.

FFO BY QUARTER (See Financial Reconciliation Tables Above) MFFO* BY QUARTER (See Financial Reconciliation Tables Above)

Q4 2016

$13,644

$14,314

$9,578

Q4 2016

$7,876

Q1 2017Q2 2017 Q1 2017

$10,415

Q2 2017

$10,229

(dollars in thousands) (dollars in thousands)

$14,332

$12,768

Q3 2017Q4 2017 Q3 2017Q4 2017

$10,311$10,282

$10.0 M

$8.0 M

$6.0 M

$4.0 M

$2.0 M

0

IU-EA514(040418)

Griffin Capital Plaza

1520 E. Grand Avenue, El Segundo, CA 90245

949.270.9300 | www.griffincapital.com

EA2-IU4166(0418)

© 2018 Griffin Capital Essential Asset REIT II, Inc. All rights reserved.

Griffin Capital Securties, LLC, Member FINRA/SIPC, is the dealer

manager for the Griffin Capital Essential Asset REIT II, Inc. offering.

FINANCIAL RECONCILIATION (AS OF DECEMBER 31, 2017)

(11) Represents distributions paid to common shareholders in cash and through shares issued pursuant to the DRP.

(12) As monthly distributions are paid in arrears, the total distributions paid and declared include the portion of distributions which were not paid until the first month following quarter end, including

distributions paid to common shareholders. A portion of our distributions may be funded from the proceeds of our offerings or from borrowings in anticipation of future cash flow, some or all of which

may constitute a return of capital. Since our inception, cash distributions paid represented 44% of total distributions and shares issued pursuant to the DRP represented 56% of total distributions. In the

future, we may continue to pay distributions from net cash flow from property operations, the net proceeds of our public offerings, from borrowings in anticipation of future cash flows or from other

sources. We may be required to sell assets or issue new securities for cash in order to pay distributions. Any such action could reduce the amount of capital we ultimately invest in assets and negatively

impact the amount of income available for future distributions. For the quarter ended December 31, 2017, cash distributions paid represented 46% of total distributions and shares issued pursuant to

the DRP represented 54% of total distributions. For the period from October 1, 2017 through December 31, 2017, the board of directors declared a cash distribution rate of $0.55/share, which equates

to 5.5% (an annualized rate, declared quarterly, accrues daily and historically paid monthly) assuming a $10.00 purchase price.

(13) Through December 31, 2017, we funded 93% of our cash distributions from cash flow provided by operating activities and 7% from offering proceeds. Future distribution declarations are at the sole

discretion of the board and are not guaranteed. A portion of our distributions may be funded from the proceeds of our offerings or from borrowings in anticipation of future cash flow, some or all

of which may constitute a return of capital.

UNDERSTANDING INVESTMENT RISKS

An investment in Griffin Capital Essential Asset REIT II, Inc. is subject to risks, including the following:

n There is no public trading market for shares of our common stock, and we do not anticipate that there will be a public trading market for our shares, so redemption of shares by us will likely

be the only way to dispose of your shares.

n The purchase and redemption price for shares of our common stock is based on the NAV of each class of common stock and is not based on any public trading market. Our NAV does not

currently represent our enterprise value and may not accurately reflect the actual prices at which our assets could be liquidated on any given day, the value a third party would pay for all or

substantially all of our shares, or the price that our shares would trade at on a national stock exchange. Furthermore, our board of directors may amend our NAV procedures from time to time.

n Our new share redemption program generally imposes a quarterly cap on aggregate net redemptions of our new share classes equal to the amount of shares of such classes with a value of

up to 5% of the aggregate NAV of the outstanding shares of such classes as of the last day of the previous quarter. We may also amend, suspend or terminate our new share redemption

program at any time.

n A portion of the proceeds received in our offerings may be used to redeem or repurchase our shares, including our Class A, AA and AAA shares, which will reduce the net proceeds available

to acquire additional properties.

n We may pay distributions from sources other than our cash flows from operations, including from the net investment proceeds from our public offerings, and as a result, we would have less

cash available for investments and your overall return may be reduced. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use

an unlimited amount from any source to pay our distributions.

n There are substantial conflicts of interest among us and our sponsor, advisor, property manager and dealer manager.

n Our advisor will face conflicts of interest relating to the purchase of properties, including conflicts with Griffin Capital Essential Asset REIT, Inc., and such conflicts may not be resolved in our

favor, which could adversely affect our investment opportunities.

n We have no employees and must depend on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources

to us.

n We will pay substantial fees and expenses to our advisor, its affiliates and participating broker-dealers, which will reduce cash available for investment and distribution.

n We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment, and our board of directors may authorize

us to exceed our charter limit on leverage of 300% of net assets.

n If we fail to maintain our status as a Real Estate Investment Trust (“REIT”), it could adversely affect our operations and our ability to make distributions.

n We have incurred net losses in the past and may incur net losses in the future, and we have an accumulated deficit and may continue to do so in the future.

DISTRIBUTIONS PAID AND DECLARED BY QUARTER (12)(13)DISTRIBUTIONS PAID BY QUARTER (11)

$10.0 M

$8.0 M

$6.0 M

$4.0 M

$2.0 M

0

Certain statements contained in this material, other than historical facts, may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by

the applicable safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include,

in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to

differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can

generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are

cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date originally made. We cannot guarantee the accuracy of any such forward-looking

statements contained in this material, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Q3 2017

$10,556

Q4 2017

$10,653

(dollars in thousands) (dollars in thousands)

Q3 2017

$10,543

Q4 2017

$10,576

Q2 2017

$10,398

Q4 2016

$8,921

Q1 2017

$9,924

Q2 2017

$10,361

Q4 2016

$9,165

Q1 2017

$10,067