Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Roadrunner Transportation Systems, Inc. | rrts-20180402x8xkpressrele.htm |

| EX-99.1 - EXHIBIT 99.1 - Roadrunner Transportation Systems, Inc. | rrts-20180402xex991xpressr.htm |

First Three Quarters of 2017 Results

& Business Update

April 2, 2018

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which relate to future events or

performance. Forward-looking statements include, among others, statements regarding the anticipated filing of

Roadrunner’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and Form 10-Q for the

quarterly period ending March 31, 2018; Roadrunner’s strategies for long-term growth and shareholder value creation;

operating metric improvements within certain business units of Roadrunner’s TL and Ascent segments beginning in the

fourth quarter of 2017 and continuing into 2018; Roadrunner’s current plans to simplify operations and improve its go-

to-market strategy; Roadrunner’s other operational improvement strategies; Roadrunner’s investment in information

technology infrastructure to support its integration efforts, strengthen its internal controls and enable future growth;

Roadrunner’s expectation that its 2017 Adjusted EBITDA will exceed the reported amount for its 2016 Adjusted

EBITDA; and improvements in the rate environment. These statements are often, but not always, made through the use

of words or phrases such as “may,” “will,” “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,”

“believe,” “intend,” “predict,” “potential,” “opportunity,” and similar words or phrases or the negatives of these words or

phrases. These forward-looking statements are based on Roadrunner’s current assumptions, expectations and beliefs

and are subject to substantial risks, estimates, assumptions, uncertainties and changes in circumstances that may

cause Roadrunner’s actual results, performance or achievements, to differ materially from those expressed or implied in

any forward-looking statement. Such factors include, among others, risks related to the restatement of Roadrunner’s

previously issued financial statements, the remediation of Roadrunner’s identified material weaknesses in its internal

control over financial reporting, the litigation resulting from the restatement of Roadrunner’s previously issued financial

statements and the other risk factors contained in Roadrunner’s SEC filings, including Roadrunner’s Annual Report on

Form 10-K for the year ended December 31, 2016. Because the risks, estimates, assumptions and uncertainties

referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-

looking statements, you should not place undue reliance on any forward-looking statements. Any forward-looking

statement speaks only as of the date hereof, and, except as required by law, Roadrunner assumes no obligation and

does not intend to update any forward-looking statement to reflect events or circumstances after the date hereof.

Safe Harbor Statement

2

1. 2017 First Three Quarters Financial Results

2. Business Trends

3. Future Guideposts

4. Question & Answer Session

Agenda for Today’s Call

3

Financial Summary

• Revenues of $1,530.9 million vs. $1,482.0 million in 2016

• Net operating loss of $14.1 million vs. $352.5 million in 2016. 2017 operating loss includes:

– Increase in purchased transportation costs to $1,033.2 million in 2017 from $982.0 million in 2016

– Gain on sale of Unitrans of $35.4 million

– Restructuring and restatement costs of $23.6 million associated with legal, consulting and accounting matters,

including internal and external investigations, SEC and accounting compliance and restructuring

– Increase of $5.2 million in legal reserves related to recently settled independent contractor litigation and pre-

divestiture litigation related to Unitrans

– Non-cash impairment charges of $4.4 million in 2017 related to the revaluation of the goodwill of Ascent

segment following the sale of Unitrans, compared to non-cash impairment charges of $372.1 million in 2016

• Net loss of $67.9 million vs. $321.5 million in 2016. In addition to the items above, the 2017 net loss was

impacted by:

– Increased interest expense including issuance costs of $16.1 million associated with the sale of preferred stock

in May 2017 which was reflected as interest expense

– Loss from debt extinguishment of $15.9 million:

– $9.8 million loss from early debt repayment on the prior senior credit facility

– Early payment premiums on the redemption of preferred stock totaling $6.1 million using proceeds from

the ABL facility and the sale of Unitrans in Q3 of 2017

Summary of First Three Quarters 2017 Results

4

Segment Results

• TL revenues of $926.0 million vs. $890.8 million in 2016. Operating income of $0.1

million vs. operating loss of $143.4 million in 2016

– 2016 operating loss included goodwill impairment charges of $157.5 million

– 2017 operating income included increased equipment leasing and maintenance costs, fuel costs and insurance

claims than in 2016

• LTL revenues of $348.4 million vs. $355.6 million in 2016. Operating loss of $14.2

million vs. $194.1 million in 2016

– 2016 operating loss included goodwill impairment charges of $197.3 million

– 2017 operating loss included higher line-haul and other operating expenses than in 2016

• Ascent revenues of $261.5 million vs. $250.3 million in 2016. Operating income of

$15.9 million vs. $3.0 million in 2016

– Operating income included non-cash impairment charges of $4.4 million in 2017 and $17.2 million in 2016

Summary of First Three Quarters 2017 Results

5

2017 EBITDA

6

First Nine Months 2017 vs. 2016

2017 2016

Net loss (67,859)$ (321,457)$

Plus: Total interest expense 45,382 17,060

Plus: Benefit from income taxes (7,516) (48,092)

Plus: Depreciation and amortization 27,834 27,636

Plus: Impairment charges 4,402 372,081

Plus: Share-based compensation expense 1,647 1,653

Plus: Long-term incentive compensation 163 -

Plus: Adjustments to contingent purchase obligations - (2,458)

Plus: Gain on sale of Unitrans (35,440) -

Plus: Loss from debt extinguishments 15,876 -

Plus: Restructuring and restatement costs 23,591 -

Adjusted EBITDA 8,080$ 46,423$

Nine Months Ended

September 30,

(in thousands)

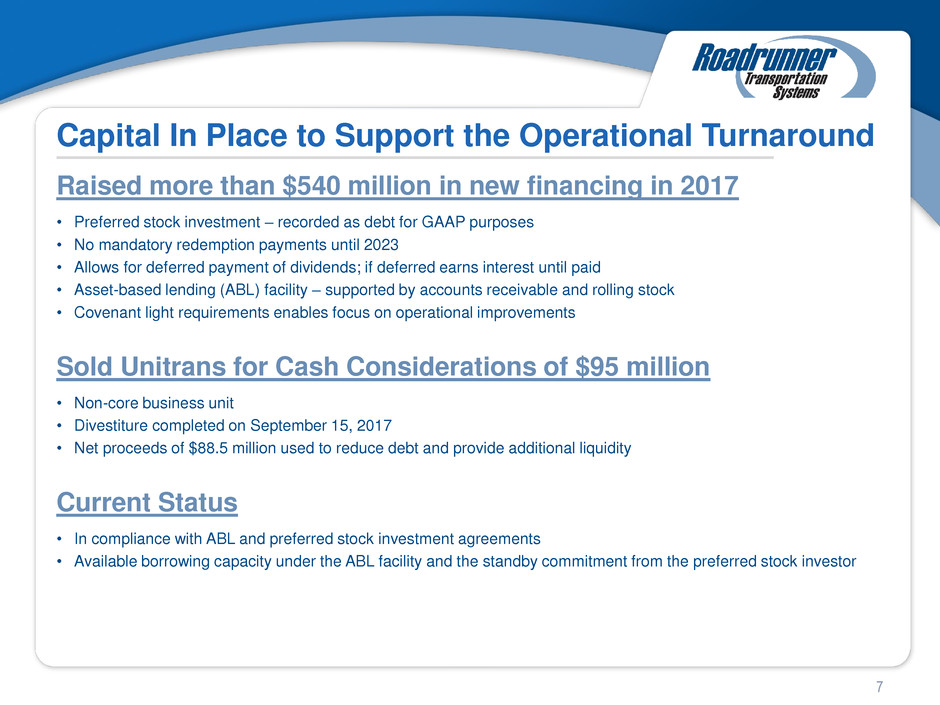

Raised more than $540 million in new financing in 2017

• Preferred stock investment – recorded as debt for GAAP purposes

• No mandatory redemption payments until 2023

• Allows for deferred payment of dividends; if deferred earns interest until paid

• Asset-based lending (ABL) facility – supported by accounts receivable and rolling stock

• Covenant light requirements enables focus on operational improvements

Sold Unitrans for Cash Considerations of $95 million

• Non-core business unit

• Divestiture completed on September 15, 2017

• Net proceeds of $88.5 million used to reduce debt and provide additional liquidity

Current Status

• In compliance with ABL and preferred stock investment agreements

• Available borrowing capacity under the ABL facility and the standby commitment from the preferred stock investor

Capital In Place to Support the Operational Turnaround

7

Business Trends

8

Business Trends

9

Truckload Logistics Less-Than-Truckload Ascent Global Logistics

• Difficult market conditions in first

three quarters of 2017,

particularly at Express Ground,

Intermodal and Temp Control

• Improving rate environment in

Q4 which has accelerated in

2018

• Favorable top and bottom line

trends in this segment driven by

rate and productivity

improvements, partially offset by

capacity decline

• Investment cycle focused on

customer experience and longer

term success vs short term financial

performance

• Use of purchased power a detriment

as truckload rate environment

improves

• Pleased with progress on capabilities

and customer experience

• Focused on improving yields and the

quality of revenue

• Patience required as financial

recovery will take time to take hold

• Sale of Unitrans in September with

$6.6 and $9.3 million of EBITDA in

2017 (thru 9/15) and 2016,

respectively

• Continuing top and bottom line

growth in this asset free segment

• New era launched on March 15 with

integration of Roadrunner Truckload

Plus with Ascent’s LTL, international

and retail consolidation capabilities

• Provides our teams and customers

with improved access to technology

enabled, asset-backed truckload,

LTL, flatbed, international

transportation and retail

consolidation capabilities

Future Guideposts

10

5 Key Phases – Tracking and Reporting our Progress

Business Improvement Guideposts

11

5. OPTIMIZATION

2018 Simplification & Integration

12

Key Initiatives

• Operations

– Improve operational performance in Truckload segment

– Integrate and expand Ascent Global Logistics segment

– Invest in longer-term recovery of LTL segment

– Simplify and combine operations and improve go-to-market approach in Express

Services (air and ground expedite) business platform

• Invest in our fleets and drivers

– New equipment and better control

– Increased driver/contractor pay and retention

• IT investments

– Improved system integration and customer-facing technology in each segment

– IT upgrades that will support integration, strengthen internal controls and enable

future growth

• Financial Goals

– Implement key operating and ROIC metrics across all business units

– Move EBITDA margins closer to industry norms

Future Communications

Topics for our Next Conference Call

• 2017 10-K and 2018 Q1 Results & Analysis

– Expect to file in Q2 2018 – will provide business updates

– Expect to remain current with quarterly and annual filings beginning in Q2

Other Communications

• Future announcements related to simplification and integration

13

Q&A

14