Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GAIN Capital Holdings, Inc. | form8-kq42017earnings.htm |

| EX-99.1 - EXHIBIT 99.1 - GAIN Capital Holdings, Inc. | ex99112-31x17earningsrelea.htm |

1

Q4 and Full Year 2017 Results

March 2018

2

SAFE HARBOR STATEMENT

Forward Looking Statements

In addition to historical information, this earnings presentation contains "forward-looking" statements that reflect management's expectations for the future. A variety of important factors

could cause results to differ materially from such statements. These factors are noted throughout GAIN Capital's annual report on Form 10-K for the year ended December 31, 2016, as filed

with the Securities and Exchange Commission on March 15, 2017, and include, but are not limited to, the actions of both current and potential new competitors, fluctuations in market

trading volumes, financial market volatility, evolving industry regulations, errors or malfunctions in GAIN Capital’s systems or technology, rapid changes in technology, effects of inflation,

customer trading patterns, the success of our products and service offerings, our ability to continue to innovate and meet the demands of our customers for new or enhanced products, our

ability to successfully integrate assets and companies we have acquired, our ability to effectively compete, changes in tax policy or accounting rules, fluctuations in foreign exchange rates

and commodity prices, adverse changes or volatility in interest rates, as well as general economic, business, credit and financial market conditions, internationally or nationally, and our

ability to continue paying a quarterly dividend in light of future financial performance and financing needs. The forward-looking statements included herein represent GAIN Capital’s views

as of the date of this release. GAIN Capital undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.

Non-GAAP Financial Measures

This presentation contains various non-GAAP financial measures, including adjusted EBITDA, adjusted net income, adjusted EPS and various “pro forma” non-GAAP measures. These non-

GAAP financial measures have certain limitations, including that they do not have a standardized meaning and, therefore, our definitions may be different from similar non-GAAP financial

measures used by other companies and/or analysts. Thus, it may be more difficult to compare our financial performance to that of other companies. We believe our reporting of these non-

GAAP financial measures assists investors in evaluating our historical and expected operating performance. However, because these are not measures of financial performance calculated in

accordance with GAAP, such measures should be considered in addition to, but not as a substitute for, other measures of our financial performance reported in accordance with GAAP, such as

net income.

3

2017 - A YEAR IN REVIEW

Ended year with retail client assets of $750 million, 25%

higher than prior year

• Focus on higher margin direct business

• Full year new funded direct accounts increased 12% y/y

Bolstered liquidity position and reduced fixed costs

• Completed $50 million revolving credit facility

• Executed a $92 million convertible debt offering in third

quarter of 2017

• Exceeded $15 million in targeted cost savings

Focus on organic growth by introducing new product and

service offerings

• Launched innovative digital advisory mobile app, GetGo

• Initiated global roll-out of Bitcoin trading, with UK/

Europe, Australia and Singapore live

Acquired FXCM’s U.S. client assets in February

• Highly accretive transaction, with total cost of $7.2

million and CTR of $15.5 million

• Continue to review strategic M&A opportunities

Growth in Retail Client Assets Expanded Product Offerings

Complementary M&AExecution of Financing and Cost Initiatives

4

2018 AND BEYOND – STRATEGIC PRIORITIES

Deliver Organic Growth Increase Operational

Excellence

• Focus on direct business vs lower

margin indirect business,

leveraging our brand assets &

existing global footprint

• Attractive proposition for two

distinct key customer segments:

experienced active trader &

retail investor

• Product innovation

• Increase automation and reduce

service costs

• Simplification of technology

“stack”

• Rationalize and refocus brands

• Insource vs. outsource

Reduce Revenue Volatility

• Increase efficiency of revenue

capture

• AI-driven hedging program

• Decrease cost of hedging

• Further optimize trade flow from

indirect business

5

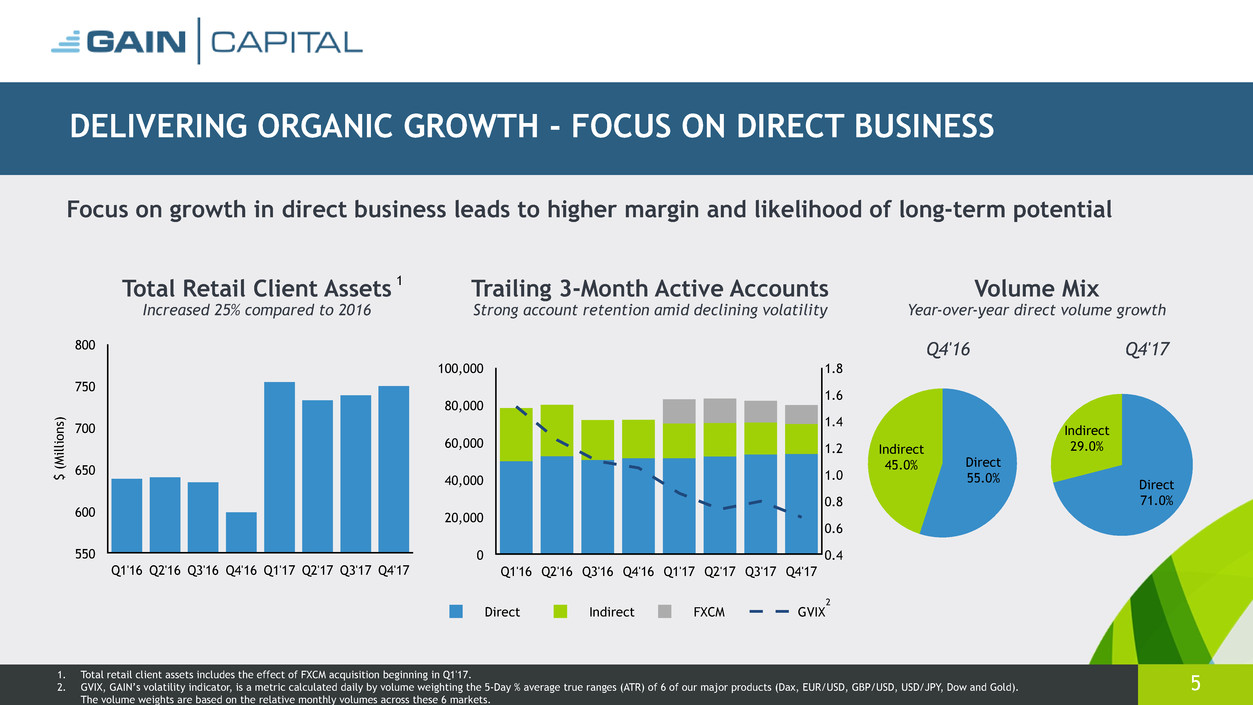

DELIVERING ORGANIC GROWTH - FOCUS ON DIRECT BUSINESS

Focus on growth in direct business leads to higher margin and likelihood of long-term potential

1. Total retail client assets includes the effect of FXCM acquisition beginning in Q1'17.

2. GVIX, GAIN’s volatility indicator, is a metric calculated daily by volume weighting the 5-Day % average true ranges (ATR) of 6 of our major products (Dax, EUR/USD, GBP/USD, USD/JPY, Dow and Gold).

The volume weights are based on the relative monthly volumes across these 6 markets.

Total Retail Client Assets

Increased 25% compared to 2016

Trailing 3-Month Active Accounts

Strong account retention amid declining volatility

Volume Mix

Year-over-year direct volume growth

Q4'16 Q4'17800

750

700

650

600

550

$

(M

ill

io

ns

)

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Direct Indirect FXCM GVIX

100,000

80,000

60,000

40,000

20,000

0

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Direct

55.0%

Indirect

45.0%

Direct

71.0%

Indirect

29.0%

2

1

6

DELIVERING ORGANIC GROWTH - TARGET TWO DISTINCT CUSTOMER SEGMENTS

EXPERIENCED ACTIVE TRADERS RETAIL INVESTORS

▪ Premium service for experienced active

traders

▪ Full range of 10k+ FX/CFD markets,

including equities and options

▪ Robust proposition for active traders –

tools, pricing, etc.

▪ Higher touch, personalized support

model

▪ Allows for future product extension to

attract wider investor audience

▪ User friendly experience for global

retail audience, emphasis on mobile

▪ Focus on FX, cryptos and most popular

global markets

▪ High volume, cost efficient customer

acquisition model via digital & affiliate

marketing channels

▪ Highly automated onboarding & funding

▪ Enhanced, AI-powered customer service

model

▪ Innovative, trade signals app for novice

traders

▪ Simplified trading experience for non-

‘self-directed’ investors

▪ Algo-generated signals across 40+

markets incl. FX, indices and gold

▪ Leverages existing offering / regulatory

licenses

▪ Launched in UK market in December;

global rollout planned in 2018

7

DELIVERING ORGANIC GROWTH - PRODUCT INNOVATION

Investing heavily in new products and services

P Next-gen trading platform

P Expanded cryptocurrency offering

P Enhanced service for high value clients

P Differentiated products to broaden appeal

of trading, such as GetGo

P Increased automation and ease of

onboarding

8

Financial Review

9

KEY FINANCIAL RESULTS & OPERATING METRICS

Note: Dollars in millions, except per share data. Columns may not add due to rounding.

(1) Adjusted EBITDA is a non-GAAP financial measure that represents our earnings before interest, taxes, depreciation, amortization and other one-time items. A reconciliation of net income/(loss) to adjusted EBITDA is available in the appendix to this presentation.

(2) Adjusted net income/(loss) is a non-GAAP financial measure that represents net income/(loss) excluding the impact of one-time items. A reconciliation of GAAP net income/(loss) to adjusted net income/(loss) is available in the appendix to this presentation.

(3) Adjusted EPS is a non-GAAP financial measure that represents net income/(loss) per share excluding the impact of one-time items. A reconciliation of GAAP EPS to adjusted EPS is available in the appendix to this presentation.

(4) Definitions for operating metrics are available in the appendix to this presentation.

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31, $ Change

2017 2016 2017 2016 Q4 Full Year

As Reported

Net Revenue $ 69.7 $ 115.8 $ 308.6 $ 411.8 $ (46.1) $ (103.2)

Operating Expenses (62.4) (78.9) (273.5) (312.2) 16.5 38.7

Adjusted EBITDA(1) $ 7.3 $ 36.9 $ 35.1 $ 99.6 $ (29.6) $ (64.5)

Adjusted EBITDA Margin % 10% 32% 11% 24% (22 pts) (13 pts)

Net (Loss)/Income $ (3.7) $ 20.8 $ (11.2) $ 35.3 $ (24.5) $ (46.5)

Adjusted Net (Loss)/Income(2) $ (4.5) $ 20.8 $ (9.4) $ 45.0 $ (25.3) $ (54.4)

GAAP Diluted EPS $ (0.08) $ 0.42 $ (0.20) $ 0.67 $ (0.50) $ (0.87)

Adjusted Diluted EPS(3) $ (0.10) $ 0.43 $ (0.20) $ 0.92 $ (0.53) $ (1.12)

Operating Metrics(4)

Retail OTC ADV (bns) $ 8.8 $ 9.8 $ 9.6 $ 10.9 $ (1.0) $ (1.3)

Institutional ADV (bns) $ 13.9 $ 12.8 $ 14.3 $ 11.4 $ 1.1 $ 2.9

ECN 11.5 9.4 11.5 8.4 2.1 3.1

Swap Dealer 2.4 3.3 2.8 3.0 (0.9) (0.2)

Avg. Daily Futures Contracts 25,772 29,117 27,322 32,954 (3,345) (5,632)

Adjusting for the impact of the

U.S. Tax Cuts and Jobs Act, net

income in Q4 would have been a

profit of $1.2 million or $0.03 per

share, while for the year it would

have been a loss of $6.3 million or

$0.10 per share

10

OPERATING SEGMENT RESULTS: RETAIL

Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

• Revenue and margin pressure due to low

volatility

• Active accounts and client assets increased

year-over-year on annual and quarterly

basis

• During first two months of 2018, seeing a

return to growth and profitability on both

top and bottom line as market volatility

increases

Retail Financial & Operating Results

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2017 2016 2017 2016

Trading Revenue $50.9 $96.2 $231.1 $330.7

Other Retail Revenue 1.9 1.3 6.3 5.6

Total Revenue $52.8 $97.5 $237.4 $336.3

Employee Comp & Ben 14.0 14.4 60.9 62.4

Marketing 7.5 9.9 29.9 27.7

Referral Fees 7.8 13.5 39.7 55.1

Other Operating Exp. 14.9 18.3 61.7 75.5

Segment Profit $8.6 $41.4 $45.2 $115.7

% Margin 16% 42% 19% 34%

Operating Metrics

ADV (bns) $8.8 $9.8 $9.6 $10.9

12 Month Trailing Active OTC Accounts 132,262 126,528 132,262 126,528

Client Assets $749.6 $599.4 $749.6 $599.4

PnL/mm $90 $151 $93 $117

11

OPERATING SEGMENT RESULTS: INSTITUTIONAL & FUTURES

Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

• Despite difficult market conditions, institutional

revenue and margins were relatively stable for Q4

and FY 2017

• ECN average daily volume increased as our GTX

platform continued to take market share

• VIX remained very low in Q417, down 27% from

Q416, while the average VIX level for FY 2017 was

at a multi-decade low

Institutional Financial & Operating Results Futures Financial & Operating Results

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 3 Months Ended Dec. 31, Fiscal Year Ended Dec.

2017 2016 2017 2016 2017 2016 2017 2016

ECN $ 5.3 $ 5.7 $ 23.0 $ 20.6 Revenue $ 9.5 $ 10.5 $ 40.3 $ 48.1

Swap Dealer 1.7 3.0 7.9 9.6

Other Revenue 0.2 — 0.2 — Employee Comp & Ben 2.0 2.6 9.4 12.0

Total Revenue $ 7.1 $ 8.7 $ 31.2 $ 30.2 Marketing 0.2 0.3 0.8 1.0

Referral Fees 3.2 3.8 14.0 15.7

Employee Comp & Ben 2.8 4.3 13.9 14.4 Other Operating Exp. 3.1 3.3 12.9 14.8

Marketing 0.0 0.0 0.1 0.0 Segment Profit $1.1 $ 0.6 $ 3.2 $ 4.7

Other Operating Exp. 3.0 3.0 12.3 10.4 % Margin 11% 6% 8% 10%

Segment Profit $ 1.2 $ 1.4 $ 4.9 $ 5.4

% Margin 17% 16% 16% 18% Operating Metrics

Avg. Daily Contracts 25,772 29,117 27,322 32,954

Operating Metrics 12 Month Trailing Active Futures Accounts 7,838 8,368 7,838 8,368

ECN ADV (bns) $ 11.5 $ 9.4 $ 11.5 $ 8.4 Client Assets $ 229.2 $ 346.1 $ 229.2 $ 346.1

Swap Dealer ADV (bns) $ 2.4 $ 3.3 $ 2.8 $ 3.0 Revenue/Contract $ 5.85 $ 5.72 $ 5.88 $ 5.79

12

FEBRUARY MONTHLY METRICS

Feb-18 Jan-18 Feb-17

Sequential

Change

Year-over-

year Change

Retail Segment

OTC Trading Volume (1) $ 283.5 $ 249.0 $ 170.2 13.9 % 66.6 %

OTC Average Daily Volume $ 14.2 $ 11.3 $ 8.5 25.7 % 67.1 %

12 Month Trailing Active OTC Accounts (2) 133,545 132,783 131,192 0.6 % 1.8 %

3 Month Trailing Active OTC Accounts (2) 80,681 81,034 76,513 (0.4)% 5.4 %

Institutional Segment

ECN Volume (1) $ 322.7 $ 305.0 $ 221.6 5.8 % 45.6 %

ECN Average Daily Volume $ 16.1 $ 13.9 $ 11.1 15.8 % 45.0 %

Swap Dealer Volume (1) $ 53.8 $ 56.0 $ 61.5 (3.9)% (12.5)%

Swap Dealer Average Daily Volume $ 2.7 $ 2.5 $ 3.1 8.0 % (12.9)%

Futures Segment

Number of Futures Contracts 714,322 674,160 589,538 6.0 % 21.2 %

Futures Average Daily Contracts 37,596 32,103 31,028 17.1 % 21.2 %

12 Month Trailing Active Futures Accounts (2) 7,972 7,924 8,221 0.6 % (3.0)%

All volume figures reported in billions.

1 US dollar equivalent of notional amounts traded.

2 Accounts that executed a transaction during the relevant period.

13

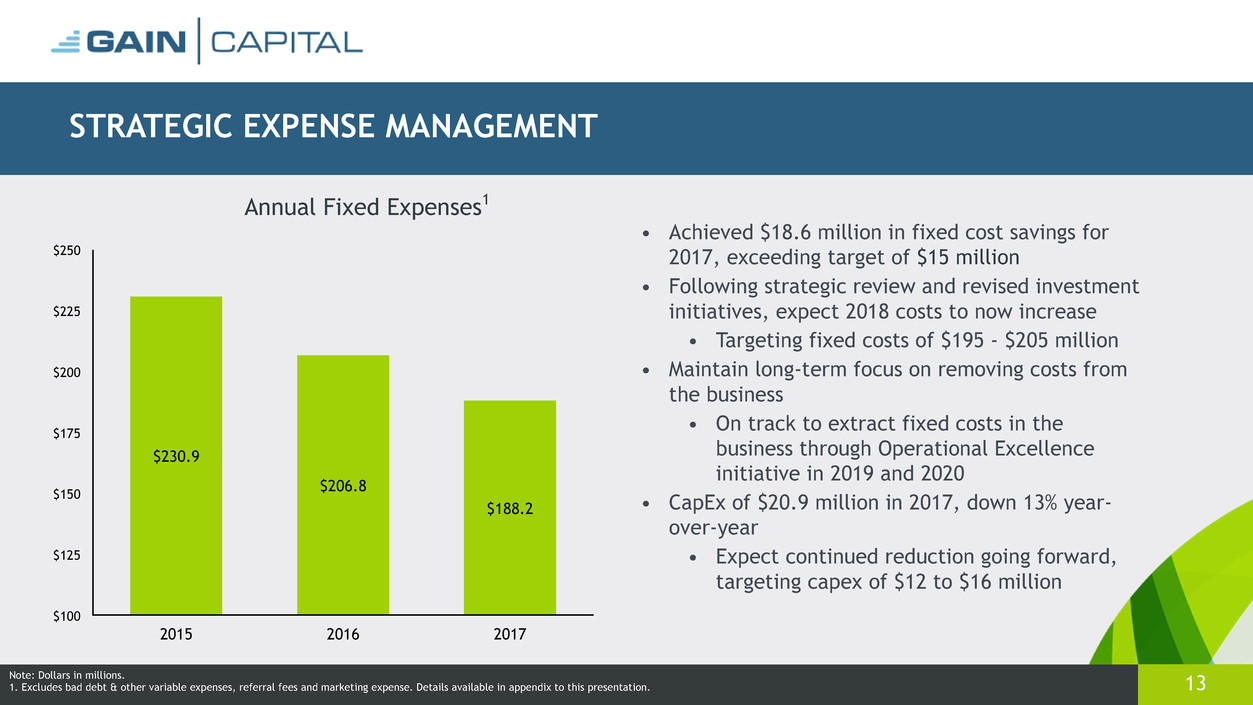

STRATEGIC EXPENSE MANAGEMENT

Note: Dollars in millions.

1. Excludes bad debt & other variable expenses, referral fees and marketing expense. Details available in appendix to this presentation.

• Achieved $18.6 million in fixed cost savings for

2017, exceeding target of $15 million

• Following strategic review and revised investment

initiatives, expect 2018 costs to now increase

• Targeting fixed costs of $195 - $205 million

• Maintain long-term focus on removing costs from

the business

• On track to extract fixed costs in the

business through Operational Excellence

initiative in 2019 and 2020

• CapEx of $20.9 million in 2017, down 13% year-

over-year

• Expect continued reduction going forward,

targeting capex of $12 to $16 million

$250

$225

$200

$175

$150

$125

$100

2015 2016 2017

$230.9

$206.8

$188.2

Annual Fixed Expenses1

14

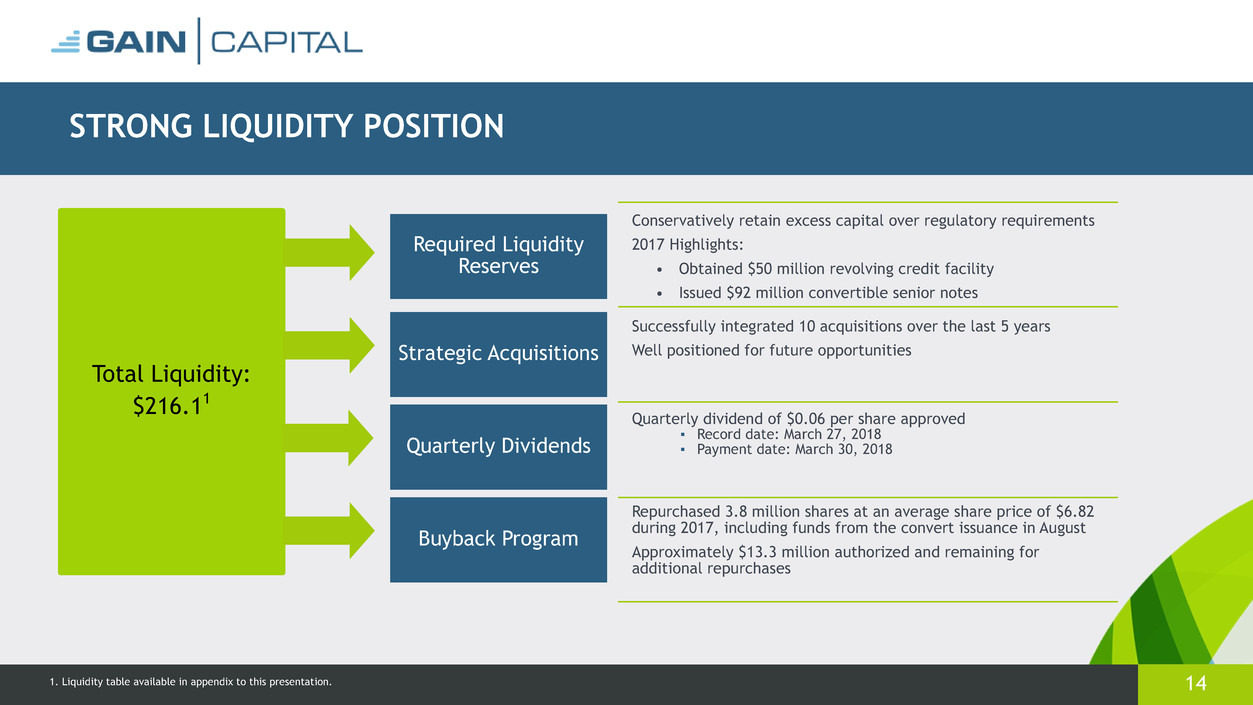

STRONG LIQUIDITY POSITION

Total Liquidity:

$216.11

Required Liquidity

Reserves

Strategic Acquisitions

Quarterly Dividends

Buyback Program

Conservatively retain excess capital over regulatory requirements

2017 Highlights:

• Obtained $50 million revolving credit facility

• Issued $92 million convertible senior notes

Successfully integrated 10 acquisitions over the last 5 years

Well positioned for future opportunities

Quarterly dividend of $0.06 per share approved

▪ Record date: March 27, 2018

▪ Payment date: March 30, 2018

Repurchased 3.8 million shares at an average share price of $6.82

during 2017, including funds from the convert issuance in August

Approximately $13.3 million authorized and remaining for

additional repurchases

1. Liquidity table available in appendix to this presentation.

15

POSITIONED TO DELIVER LONG-TERM VALUE

Proven Leader in a Large, Attractive and Growing Market

Strong Financial and Credit Profile

Multiple Levers to Drive Growth and

Operational Efficiency

Highly Diverse and Scalable Business Model

Risk Management Controls Limit

Market Volatility Headwinds

16

Appendix

17

CONSOLIDATED STATEMENT OF OPERATIONS

Note: Dollars in millions, except share and per share data. Columns may not add due to rounding.

(1) Earnings per share includes an adjustment for the redemption value of the NCI put option.

Three Months Ended Fiscal Year Ended

December 31, December 31,

2017 2016 2017 2016

Revenue

Retail revenue $ 50.9 $ 96.2 $ 231.1 $ 330.7

Institutional revenue 6.8 8.5 30.1 29.0

Futures revenue 8.8 10.3 38.0 47.4

Interest & Other revenue 3.1 0.8 9.4 4.6

Net revenue $ 69.7 $ 115.8 $ 308.6 $ 411.8

Expenses

Employee compensation and benefits 20.9 25.1 95.2 101.9

Selling and marketing 8.0 10.2 31.2 28.7

Referral Fees 11.0 17.3 53.7 70.8

Trading expenses 6.6 8.1 29.0 31.2

General and administrative 15.9 18.1 64.4 79.7

Depreciation and amortization 9.0 7.3 34.0 28.9

One-Time Expenses 1.4 0.3 1.4 13.0

Total expenses 72.9 86.4 308.9 354.2

Operating (loss)/profit $ (3.2) $ 29.4 $ (0.3) $ 57.7

Interest expense on long term borrowings 3.5 2.6 11.8 10.4

Loss on extinguishment of debt 0.0 0.0 4.9 0.0

(Loss)/income before income tax (benefit)/expense $ (6.7) $ 26.7 $ (17.1) $ 47.2

Income tax (benefit)/expense (3.4) 5.6 (6.9) 9.8

Equity in net loss of affiliate (0.2) 0.0 (0.3) (0.1)

Net (loss)/income $ (3.5) $ 21.1 $ (10.6) $ 37.4

Net income attributable to non-controlling interests 0.2 0.3 0.6 2.1

Net (loss)/income applicable to Gain Capital Holdings Inc. $ (3.7) $ 20.8 $ (11.2) $ 35.3

(Loss)/earnings per common share (1)

Basic $ (0.08) $ 0.42 $ (0.20) $ 0.67

Diluted $ (0.08) $ 0.42 $ (0.20) $ 0.67

Weighted average common shares outstanding used in

computing (loss)/earnings per common share:

Basic 45,090,984 48,535,293 46,740,097 48,588,917

Diluted 45,090,984 48,763,072 46,740,097 48,785,674

18

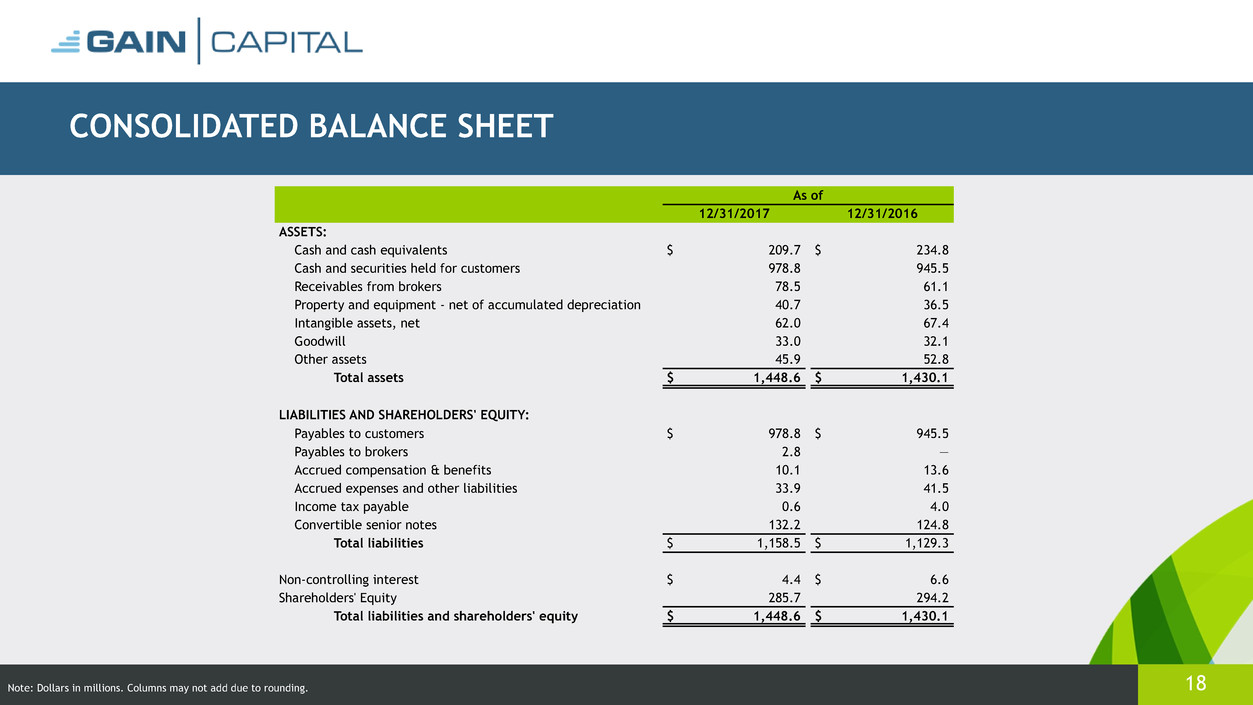

CONSOLIDATED BALANCE SHEET

Note: Dollars in millions. Columns may not add due to rounding.

As of

12/31/2017 12/31/2016

ASSETS:

Cash and cash equivalents $ 209.7 $ 234.8

Cash and securities held for customers 978.8 945.5

Receivables from brokers 78.5 61.1

Property and equipment - net of accumulated depreciation 40.7 36.5

Intangible assets, net 62.0 67.4

Goodwill 33.0 32.1

Other assets 45.9 52.8

Total assets $ 1,448.6 $ 1,430.1

LIABILITIES AND SHAREHOLDERS' EQUITY:

Payables to customers $ 978.8 $ 945.5

Payables to brokers 2.8 —

Accrued compensation & benefits 10.1 13.6

Accrued expenses and other liabilities 33.9 41.5

Income tax payable 0.6 4.0

Convertible senior notes 132.2 124.8

Total liabilities $ 1,158.5 $ 1,129.3

Non-controlling interest $ 4.4 $ 6.6

Shareholders' Equity 285.7 294.2

Total liabilities and shareholders' equity $ 1,448.6 $ 1,430.1

19

LIQUIDITY

Note: Dollars in millions. Columns may not add due to rounding.

(1) Reflects cash that would be received from brokers following the close-out of all open positions.

(2) Relates to regulatory capital requirements or capital charges, depending upon regulatory jurisdiction.

As of

12/31/2017 9/30/2017 6/30/2017 3/31/2017 12/31/2016

Cash and cash equivalents $ 209.7 $ 225.6 $ 193.1 $ 183.7 $ 234.8

Receivable from brokers (1) 78.5 56.0 80.7 75.9 61.1

Revolving credit facility (undrawn) 50.0 50.0 0.0 0.0 0.0

Net operating cash 338.2 331.6 273.8 259.6 295.9

Less: Regulatory capital requirements/charges (2) (112.9) (127.5) (138.0) (124.6) (113.0)

Less: Payables to brokers (2.8) 0.0 0.0 0.0 0.0

Less: Convertible senior notes due 2018 (6.4) 0.0 0.0 0.0 0.0

Liquidity $ 216.1 $ 204.1 $ 135.8 $ 134.9 $ 182.9

Regulatory Capital Requirements/Charges

US $ 37.4 $ 37.1 $ 36.2 $ 36.1 $ 28.7

UK 70.5 85.4 97.2 83.0 78.9

Other jurisdictions 5.0 5.0 4.6 5.5 5.4

Total Regulatory Capital Requirements/Charges (2) $ 112.9 $ 127.5 $ 138.0 $ 124.6 $ 113.0

20

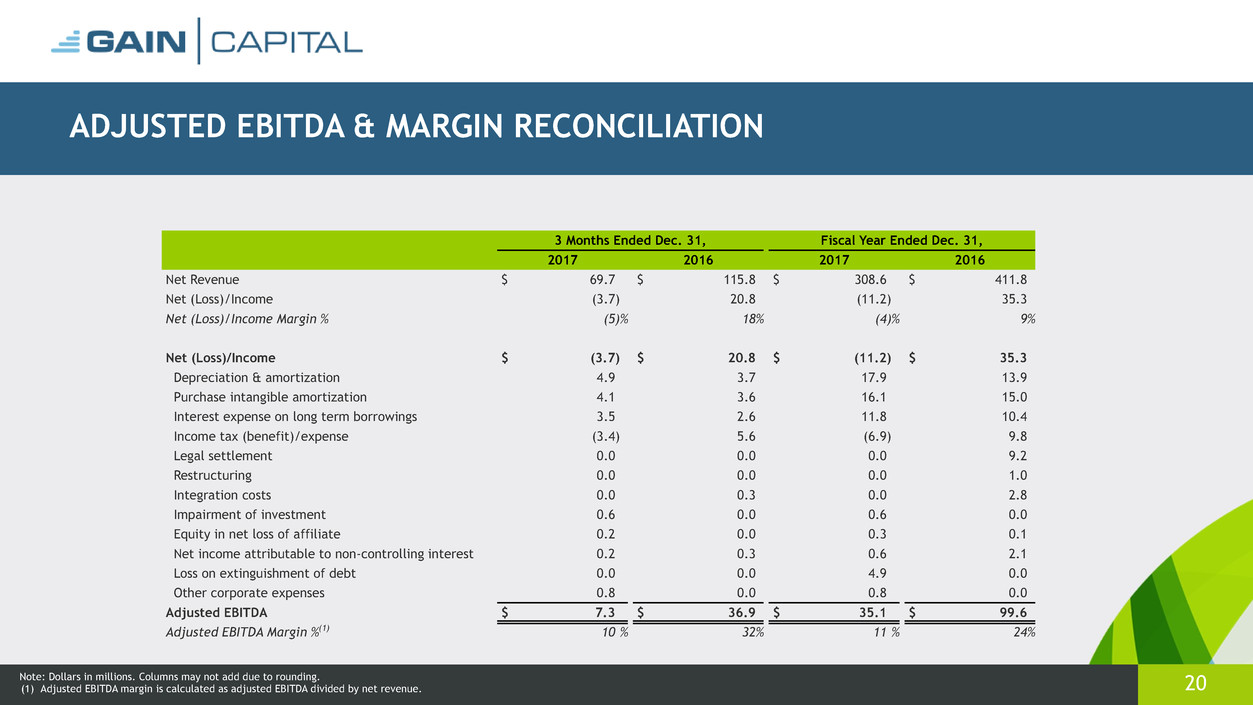

ADJUSTED EBITDA & MARGIN RECONCILIATION

Note: Dollars in millions. Columns may not add due to rounding.

(1) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue.

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2017 2016 2017 2016

Net Revenue $ 69.7 $ 115.8 $ 308.6 $ 411.8

Net (Loss)/Income (3.7) 20.8 (11.2) 35.3

Net (Loss)/Income Margin % (5)% 18% (4)% 9%

Net (Loss)/Income $ (3.7) $ 20.8 $ (11.2) $ 35.3

Depreciation & amortization 4.9 3.7 17.9 13.9

Purchase intangible amortization 4.1 3.6 16.1 15.0

Interest expense on long term borrowings 3.5 2.6 11.8 10.4

Income tax (benefit)/expense (3.4) 5.6 (6.9) 9.8

Legal settlement 0.0 0.0 0.0 9.2

Restructuring 0.0 0.0 0.0 1.0

Integration costs 0.0 0.3 0.0 2.8

Impairment of investment 0.6 0.0 0.6 0.0

Equity in net loss of affiliate 0.2 0.0 0.3 0.1

Net income attributable to non-controlling interest 0.2 0.3 0.6 2.1

Loss on extinguishment of debt 0.0 0.0 4.9 0.0

Other corporate expenses 0.8 0.0 0.8 0.0

Adjusted EBITDA $ 7.3 $ 36.9 $ 35.1 $ 99.6

Adjusted EBITDA Margin %(1) 10 % 32% 11 % 24%

21

ADJUSTED NET INCOME AND EPS RECONCILIATION

Note: Dollars in millions, except per share and share data. Columns may not add due to rounding.

(1) Assumes 21% tax rate following reduction in corporation tax rates in the UK from April 6 2017.

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2017 2016 2017 2016

Net (Loss)/Income $ (3.7) $ 20.8 $ (11.2) $ 35.3

Income Tax (Benefit)/Expense (3.4) 5.6 (6.9) 9.8

Equity in Net Loss of Affiliate 0.2 0.0 0.3 0.1

Non-Controlling Interest 0.2 0.3 0.6 2.1

Pre-Tax (Loss)/Income $ (6.7) $ 26.7 $ (17.1) $ 47.2

Plus: Adjustments 1.4 0.3 6.4 13.0

Adjusted Pre-Tax (Loss)/Income $ (5.2) $ 27.0 $ (10.7) $ 60.3

Normalized Income Tax(1) 1.1 (5.9) 2.2 (13.3)

Equity in Net Loss of Affiliate (0.2) 0.0 (0.3) (0.1)

Non-controlling interest (0.2) (0.3) (0.6) (2.1)

Adjusted Net (Loss)/Income $ (4.5) $ 20.8 $ (9.4) $ 45.0

Adjusted (Loss)/Earnings per Common Share:

Basic $ (0.10) $ 0.43 $ (0.20) $ 0.93

Diluted $ (0.10) $ 0.43 $ (0.20) $ 0.92

Weighted average common shares outstanding used

in computing adjusted (loss)/earnings per common

share:

Basic 45,090,984 48,535,293 46,740,097 48,588,917

Diluted 45,090,984 48,763,072 46,740,097 48,785,674

22

EPS COMPUTATION

Note: Dollars in millions, except per share and share data. Columns may not add due to rounding.

(1) The Company's redeemable non-controlling interests were less than its redemption value. The adjustment to increase carrying value reduces earnings available to the Company's shareholders.

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2017 2016 2017 2016

Net (loss)/income applicable to GAIN Capital Holdings Inc. $ (3.7) $ 20.8 $ (11.2) $ 35.3

Adjustment(1) (0.1) (0.4) 1.7 (2.7)

Net (loss)/income available to GAIN common shareholders $ (3.7) $ 20.4 $ (9.5) $ 32.6

(Loss)/earnings per common share

Basic ($0.08) $0.42 ($0.20) $0.67

Diluted ($0.08) $0.42 ($0.20) $0.67

Weighted average common shares outstanding used in

computing (loss)/earnings per common share:

Basic 45,090,984 48,535,293 46,740,097 48,588,917

Diluted 45,090,984 48,763,072 46,740,097 48,785,674

23

RECONCILATION OF SEGMENT PROFIT TO INCOME BEFORE INCOME TAX EXPENSE

Note: Dollars in millions. Columns may not add due to rounding.

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2017 2016 2017 2016

Retail segment $8.6 $41.4 $45.2 $115.7

Institutional segment 1.2 1.4 4.9 5.4

Futures segment 1.1 0.6 3.2 4.7

Corporate and other (3.6) (6.4) (18.1) (26.1)

Segment profit $7.3 $36.9 $35.1 $99.6

Depreciation and amortization $4.9 $3.7 $17.9 $13.9

Purchased intangible amortization 4.1 3.6 16.1 15.0

Restructuring expenses 0.0 0.0 0.0 1.0

Integration expenses 0.0 0.3 0.0 2.8

Legal settlement 0.0 0.0 0.0 9.2

Impairment of investment 0.6 0.0 0.6 0.0

Other corporate expenses 0.8 0.0 0.8 0.0

Operating (loss)/profit ($3.2) $29.4 ($0.3) $57.7

Interest expense on long term borrowings 3.5 2.6 11.8 10.4

Loss on extinguishment of debt 0.0 0.0 4.9 0.0

(Loss)/income before income tax (benefit)/expense ($6.7) $26.7 ($17.1) $47.2

24

OPERATING EXPENSES

Note: Dollars in millions. Columns may not add due to rounding.

2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Total Op. Expenses $ 83.9 $ 80.7 $ 68.9 $ 78.9 $ 73.0 $ 71.6 $ 66.6 $ 62.4

Bad Debt and other variable 1.8 1.7 0.2 2.2 0.1 (0.1) 0.3 0.1

Referral Fees 20.7 17.6 15.2 17.3 16.4 13.3 12.9 11.0

Marketing 6.4 6.8 5.3 10.2 9.3 7.5 6.4 8.0

Fixed Op. Expenses $ 55.0 $ 54.6 $ 48.2 $ 49.1 $ 47.2 $ 50.8 $ 47.0 $ 43.3

25

RETAIL REVENUE PER MILLION

Quarterly Trailing 12 Months - Pro Forma Trailing 12 Months

$160

$140

$120

$100

$80

$60

$40

$20

$0

Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17

$99

$151

$90

$89

$117

$86

$93

26

OPERATING SEGMENT RESULTS: CORPORATE & OTHER

Note: Dollars in millions, except where noted otherwise. Columns may not add due to rounding.

Corporate & Other Financial & Operating Results

3 Months Ended Dec. 31, Fiscal Year Ended Dec. 31,

2017 2016 2017 2016

Revenue $ 0.2 $ (1.0) $ (0.2) $ (2.8)

Employee Comp & Ben 2.0 3.8 11.1 13.1

Marketing 0.3 0.0 0.4 0.0

Other Operating Exp. 1.5 1.6 6.5 10.2

Loss $ (3.6) $ (6.4) $ (18.1) $ (26.1)

27

QUARTERLY OPERATING METRICS

Note: Volumes in billions; assets in millions. Definitions for all operating metrics are available on page 28

Three Months Ended,

Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17

Retail Segment

OTC Trading Volume (1)(2) $612.4 $637.0 $619.3 $646.4 $644.8 $563.1

OTC Average Daily Volume $9.3 $9.8 $9.5 $9.9 $9.9 $8.8

12 Month Trailing Active OTC Accounts (3) 129,921 126,528 136,829 134,120 133,813 132,262

3 Month Trailing Active OTC Accounts (3) 71,847 72,447 83,145 83,511 82,275 80,122

Institutional Segment

ECN Volume (1) $509.9 $612.2 $759.6 $715.7 $770.1 $734.3

ECN Average Daily Volume $7.7 $9.4 $11.7 $11.0 $11.8 $11.5

Swap Dealer Volume (1) $190.0 $216.6 $225.5 $141.5 $197.7 $155.8

Swap Dealer Average Daily Volume $2.9 $3.3 $3.5 $2.2 $3.0 $2.4

Futures Segment

Number of Futures Contracts 1,912,174 1,834,393 2,060,631 1,655,166 1,518,417 1,623,656

Futures Average Daily Contracts 29,878 29,117 33,236 26,272 24,102 25,772

12 Month Trailing Active Futures Accounts (3) 8,594 8,368 8,201 7,885 8,056 7,838

1 US dollar equivalent of notional amounts traded.

2 For the quarter, indirect volume represented 29% of total retail OTC trading volume.

3 Accounts that executed a transaction during the relevant period.

28

DEFINITION OF METRICS

• Active Accounts: Accounts that executed a transaction during the period

• Trading Volume: Represents the U.S. dollar equivalent of notional amounts traded

• Customer Assets: Represents amounts due to clients, including customer deposits and unrealized

gains or losses arising from open positions

29

FEBRUARY 2018 OPERATING METRICS

OTC Average Daily Volume ($ bns)

$14.0

$12.0

$10.0

$8.0

$6.0

$4.0

$2.0

$0.0

Feb

-17

Ma

r-1

7

Apr

-17

Ma

y-1

7

Jun

-17

Jul

-17

Aug

-17

Sep

-17

Oc

t-1

7

No

v-1

7

De

c-1

7

Jan

-18

Feb

-18

$8.5

$10.4

$9.3 $9.5

$11.0

$9.7 $10.3 $9.6 $8.8 $9.4 $8.2

$11.3

$14.2

ECN Average Daily Volume ($ bns)

$14.0

$12.0

$10.0

$8.0

$6.0

$4.0

$2.0

$0.0

Feb

-17

Ma

r-1

7

Apr

-17

Ma

y-1

7

Jun

-17

Jul

-17

Aug

-17

Sep

-17

Oc

t-1

7

No

v-1

7

De

c-1

7

Jan

-18

Feb

-18

$11.1 $11.8 $11.5 $10.7 $10.8 $10.1

$12.2

$13.3

11.4 12.2 10.8

13.9

16.1

TTM Active OTC Accounts (000s)

160.0

140.0

120.0

100.0

80.0

60.0

40.0

20.0

0.0

Feb

-17

Ma

r-1

7

Apr

-17

Ma

y-1

7

Jun

-17

Jul

-17

Aug

-17

Sep

-17

Oc

t-1

7

No

v-1

7

De

c-1

7

Jan

-18

Feb

-18

131.2 136.8 135.9 135.1 134.1 132.4 134.0 133.8 133.6 131.8 132.3 132.8 133.5

Swap Dealer Average Daily Volume ($ bns)

$5.0

$4.5

$4.0

$3.5

$3.0

$2.5

$2.0

$1.5

$1.0

$0.5

$0.0

Feb

-17

Ma

r-1

7

Apr

-17

Ma

y-1

7

Jun

-17

Jul

-17

Aug

-17

Sep

-17

Oc

t-1

7

No

v-1

7

De

c-1

7

Jan

-18

Feb

-18

$3.1 $2.9

$2.5 $2.6

$1.5

$2.7

$3.4

$3.0 $3.3

$2.4

$1.5

$2.5 $2.7

Futures Average Daily Contracts (000s)

$40.0

$35.0

$30.0

$25.0

$20.0

$15.0

$10.0

$5.0

$0.0

Feb

-17

Ma

r-1

7

Apr

-17

Ma

y-1

7

Jun

-17

Jul

-17

Aug

-17

Sep

-17

Oc

t-1

7

No

v-1

7

De

c-1

7

Jan

-18

Feb

-18

31.0

36.0

28.7

24.0 26.5 23.6 24.7 23.9 23.8

27.7 25.8

32.1

37.6

TTM Active Futures Account (000s)

$9.0

$8.0

$7.0

$6.0

$5.0

$4.0

$3.0

$2.0

$1.0

$0.0

Feb

-17

Ma

r-1

7

Apr

-17

Ma

y-1

7

Jun

-17

Jul

-17

Aug

-17

Sep

-17

Oc

t-1

7

No

v-1

7

De

c-1

7

Jan

-18

Feb

-18

8.2 8.2 8.1 8.0 7.9 8.0 8.1 8.1 8.0 7.9 7.8 7.9 8.0