Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - ZAGG Inc | a201703078kex102.htm |

| EX-99.2 - EXHIBIT 99.2 - ZAGG Inc | a201703078kex992.htm |

| 8-K - ZAGG Inc | a201703078kcover.htm |

| EX-10.4 - EXHIBIT 10.4 - ZAGG Inc | a201703078kex104.htm |

| EX-10.1 - EXHIBIT 10.1 - ZAGG Inc | a201703078kex101.htm |

| EX-99.5 - EXHIBIT 99.5 - ZAGG Inc | a201703078kex995.htm |

| EX-99.1 - EXHIBIT 99.1 - ZAGG Inc | a201703078kex991.htm |

| EX-10.3 - EXHIBIT 10.3 - ZAGG Inc | a201703078kex103.htm |

| EX-99.3 - EXHIBIT 99.3 - ZAGG Inc | a201703078kex993.htm |

0

Investor Presentation

March 2018

1

Cautionary note regarding forward-looking statements

Forward-Looking Statements

This presentation of ZAGG Inc (“ZAGG,” the “Company,” “we” or “us”) contains (and oral communications made by us may contain) “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "predict," "project," "target," “future,” “seek,” “likely,” “strategy,”

“may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our guidance for the Company and statements that estimate or

project future results of operations or the performance of the Company. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to

the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from

those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from

those indicated in the forward-looking statements include, among others, the following: (a) the ability to design, produce, and distribute the creative product solutions required to retain existing customers and to attract new

customers; (b) building and maintaining marketing and distribution functions sufficient to gain meaningful international market share for our products; (c) the ability to respond quickly with appropriate products after the adoption

and introduction of new mobile devices by major manufacturers like Apple, Samsung, and Google; (d) changes or delays in announced launch schedules for (or recalls or withdrawals of) new mobile devices by major

manufacturers like Apple, Samsung, and Google; (e) the ability to successfully integrate new operations or acquisitions, (f) the impact of inconsistent quality or reliability of new product offerings; (g) the impact of lower profit

margins in certain new and existing product categories, including certain mophie products; (h) the impacts of changes in economic conditions, including on customer demand; (i) managing inventory in light of constantly shifting

consumer demand; (j) the failure of information systems or technology solutions or the failure to secure information system data, failure to comply with privacy laws, security breaches, or the effect on the company from cyber-

attacks, terrorist incidents, or the threat of terrorist incidents; (k) adoption of or changes in accounting policies, principles, or estimates; and (l) changes in tax laws and regulations. Any forward-looking statement made by us in this

presentation speaks only as of the date of this presentation. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or

the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Readers should also review the risks and uncertainties listed in our most recent

Annual Report on Form 10-K and other reports we file with the U.S. Securities and Exchange Commission, including (but not limited to) Item 1A - "Risk Factors" in the Form 10-K and Management's Discussion and Analysis of Financial

Condition and Results of Operations and the risks described therein from time to time. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or otherwise. The forward-looking statements contained in this presentation are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

This presentation also contains estimates and other statistical data made by independent parties and by ZAGG relating to market share, growth and other industry data. This data involves a number of assumptions and limitations,

and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent parties and contained in this presentation and,

accordingly, cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we compete are necessarily

subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results or outcomes to differ materially from those expressed in the estimates made by the independent parties and

by ZAGG.

Non-GAAP Financial Measures

This presentation also includes certain non-GAAP financial measures, Adjusted EBITDA and Adjusted EBITDA Margin. Readers are cautioned that Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization, stock-

based compensation expense, other income (expense), mophie transaction expenses, mophie fair value inventory write-up related to acquisition, mophie restructuring charges, mophie employee retention bonus, loss on disputed

mophie purchase price (2016 only), and impairment of intangible asset) and Adjusted EBITDA Margin (Adjusted EBITDA stated as a percentage of revenue) are not financial measures under US generally accepted accounting

principles (“GAAP”). In addition, this financial information should not be construed as an alternative to any other measure of performance determined in accordance with GAAP, or as an indicator of operating performance,

liquidity or cash flows generated by operating, investing and financing activities, as there may be significant factors or trends that it fails to address. As such, it should be read only in conjunction with our consolidated financial

statements prepared in accordance with GAAP. We present Adjusted EBITDA and Adjusted EBITDA Margin because we believe that they are helpful to some investors as measures of performance. We caution readers that non-

GAAP financial information, by its nature, departs from traditional accounting conventions. Accordingly, its use can make it difficult to compare current results with results from other reporting periods and with the financial results of

other companies. We have provided a reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin to the most directly comparable GAAP measures, which is available in the appendix.

2

Corporate objectives & values

3

$-

$100

$200

$300

$400

$500

$600

Screen Protection Power Cases Power Management Keyboards, Cases, and Other Audio

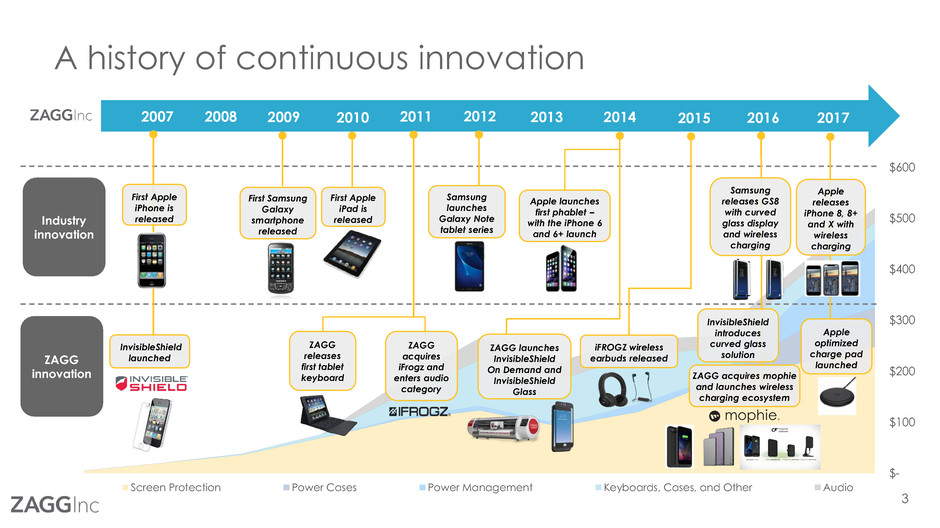

A history of continuous innovation

Industry

innovation

201620092008 20152012 2017

ZAGG

innovation

2010

First Apple

iPad is

released

2007

InvisibleShield

launched

First Apple

iPhone is

released

20142011

First Samsung

Galaxy

smartphone

released

ZAGG

releases

first tablet

keyboard

ZAGG

acquires

iFrogz and

enters audio

category

Samsung

launches

Galaxy Note

tablet series

ZAGG launches

InvisibleShield

On Demand and

InvisibleShield

Glass

Apple launches

first phablet –

with the iPhone 6

and 6+ launch

2013

iFROGZ wireless

earbuds released

Samsung

releases GS8

with curved

glass display

and wireless

charging

InvisibleShield

introduces

curved glass

solution

ZAGG acquires mophie

and launches wireless

charging ecosystem

Apple

releases

iPhone 8, 8+

and X with

wireless

charging

Apple

optimized

charge pad

launched

4

Power

Management

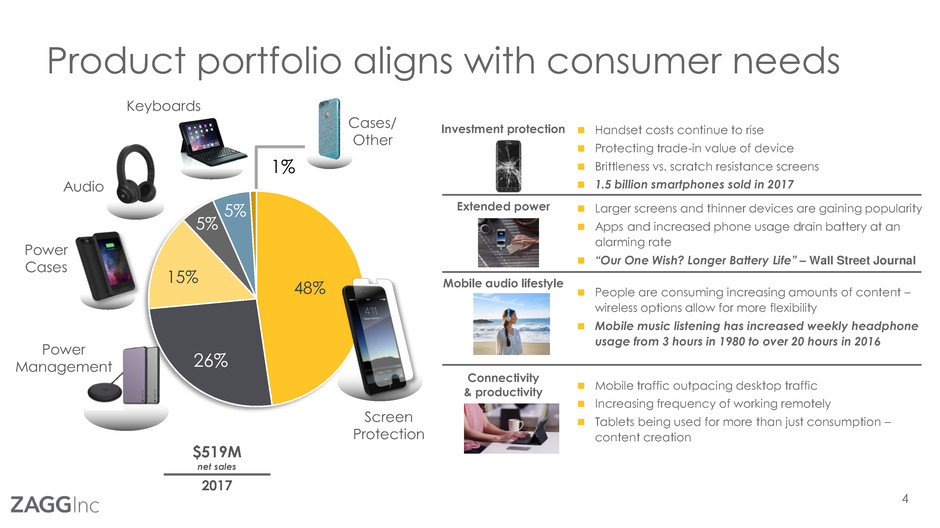

Product portfolio aligns with consumer needs

48%

15%

5%

5%

Power

Cases

Audio

Cases/

Other

Screen

Protection

Keyboards

1%

2017

$519M

net sales

Mobile audio lifestyle

Connectivity

& productivity

Investment protection

Extended power

Handset costs continue to rise

Protecting trade-in value of device

Brittleness vs. scratch resistance screens

1.5 billion smartphones sold in 2017

Mobile traffic outpacing desktop traffic

Increasing frequency of working remotely

Tablets being used for more than just consumption –

content creation

Larger screens and thinner devices are gaining popularity

Apps and increased phone usage drain battery at an

alarming rate

“Our One Wish? Longer Battery Life” – Wall Street Journal

People are consuming increasing amounts of content –

wireless options allow for more flexibility

Mobile music listening has increased weekly headphone

usage from 3 hours in 1980 to over 20 hours in 2016

26%

5

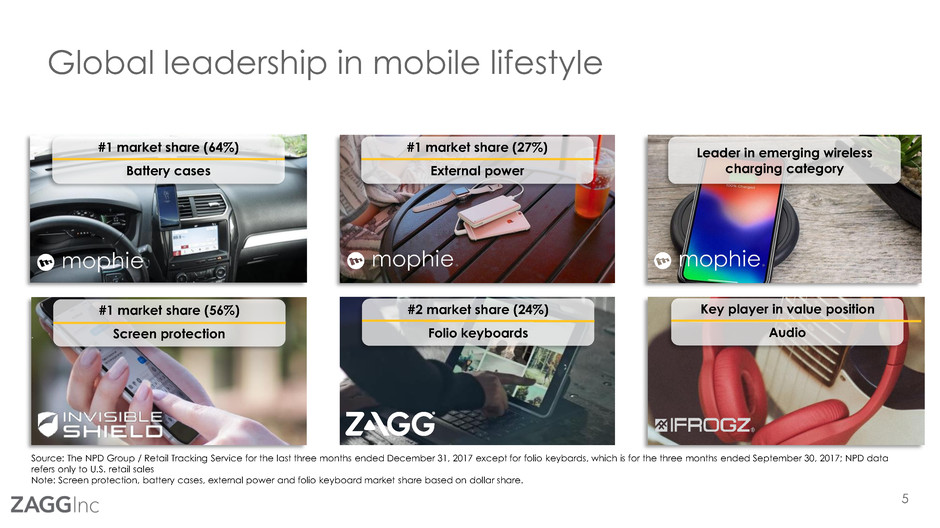

Global leadership in mobile lifestyle

#1 market share (56%)

Screen protection

#1 market share (64%)

Battery cases

#2 market share (24%)

Folio keyboards

Source: The NPD Group / Retail Tracking Service for the last three months ended December 31, 2017 except for folio keybards, which is for the three months ended September 30, 2017; NPD data

refers only to U.S. retail sales

Note: Screen protection, battery cases, external power and folio keyboard market share based on dollar share.

Leader in emerging wireless

charging category

#1 market share (27%)

External power

Key player in value position

Audio

6

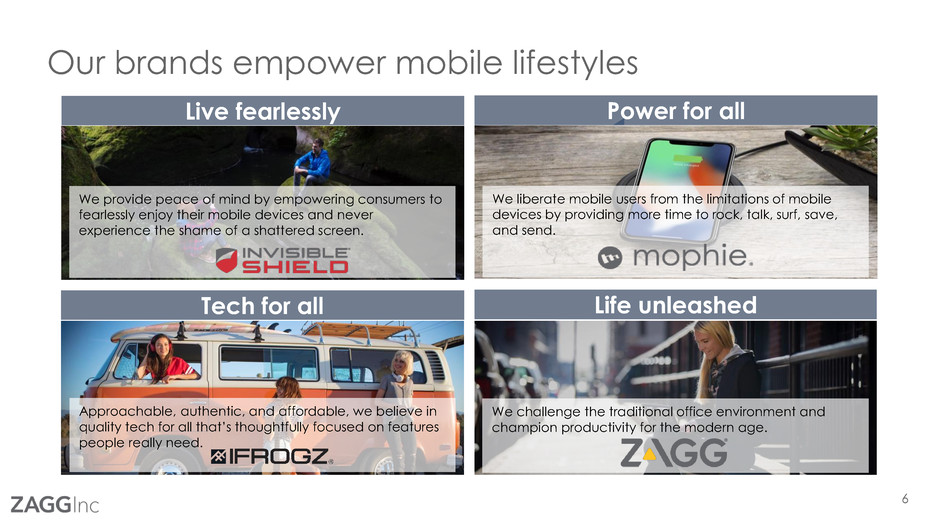

Our brands empower mobile lifestyles

We challenge the traditional office environment and

champion productivity for the modern age.

We liberate mobile users from the limitations of mobile

devices by providing more time to rock, talk, surf, save,

and send.

Approachable, authentic, and affordable, we believe in

quality tech for all that’s thoughtfully focused on features

people really need.

Power for allLive fearlessly

We provide peace of mind by empowering consumers to

fearlessly enjoy their mobile devices and never

experience the shame of a shattered screen.

Tech for all Life unleashed

7

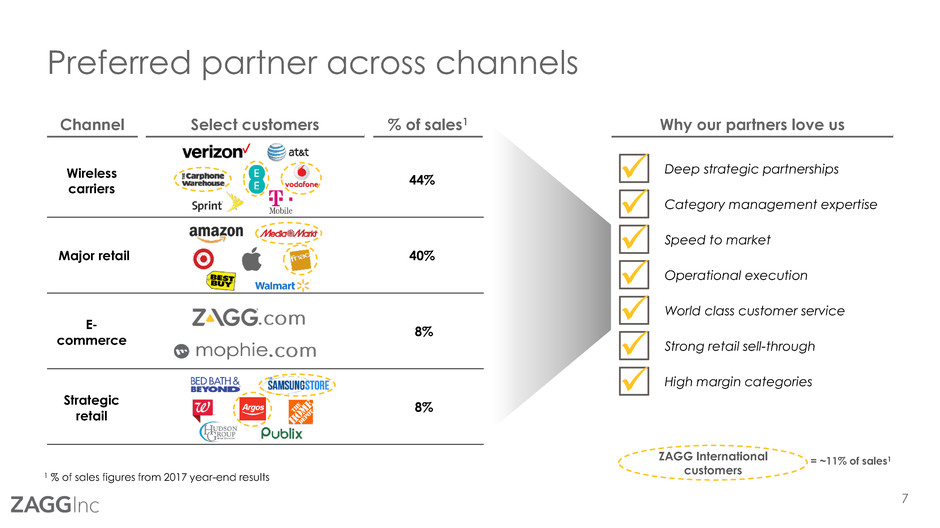

Preferred partner across channels

Wireless

carriers

44%

Major retail 40%

E-

commerce

8%

Strategic

retail

8%

Category management expertise

Speed to market

Operational execution

Strong retail sell-through

High margin categories

World class customer service

Deep strategic partnerships✓

✓

✓

✓

✓

Channel Select customers % of sales1

ZAGG International

customers

✓

✓

= ~11% of sales1

1 % of sales figures from 2017 year-end results

Why our partners love us

8

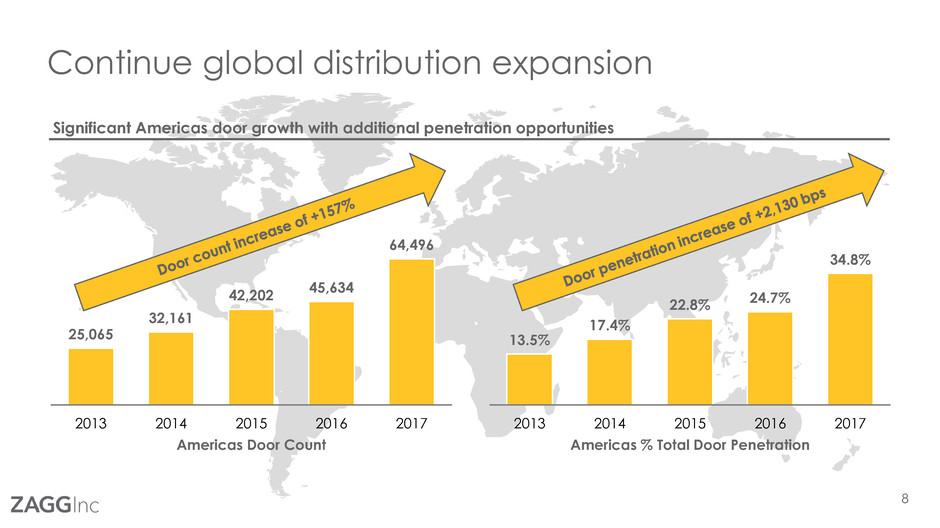

Continue global distribution expansion

Significant Americas door growth with additional penetration opportunities

25,065

32,161

42,202

45,634

64,496

2013 2014 2015 2016 2017

Americas Door Count

13.5%

17.4%

22.8% 24.7%

34.8%

2013 2014 2015 2016 2017

Americas % Total Door Penetration

9

Operational excellence

9%

14%

2016 2017

Adjusted EBITDA margin (%)

StageGate – new product development process

S&OP – Sales and Operations Planning process

Planning Edge and other tools in place

globally

Weekly sales forecast and input to supply chain

Annual cost savings initiatives impacting

operating expense and cost of goods sold

Inventory turns improved from 5.1x (March 2016)

to 6.9x (December 2017)

mophie in-channel inventory improved from 52

weeks (March 2016) to 8 weeks (December

2017)

Commentary

10

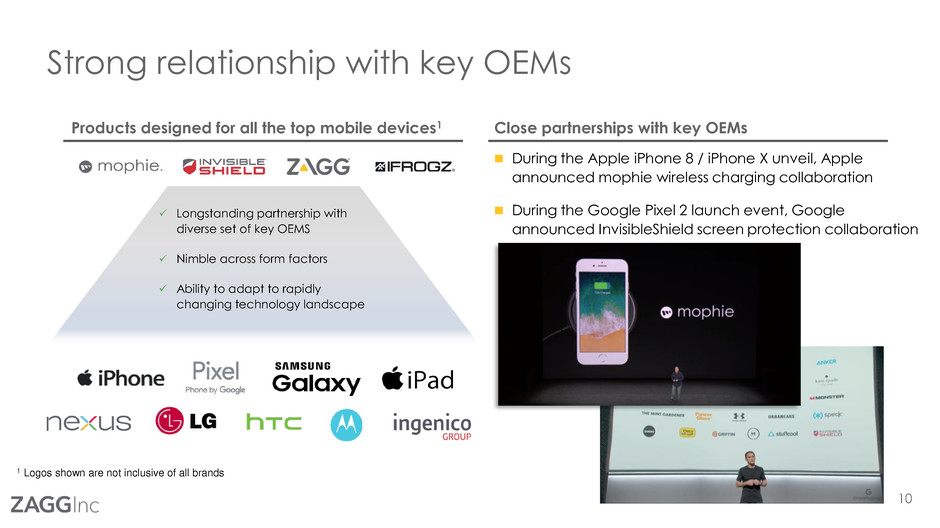

Strong relationship with key OEMs

During the Apple iPhone 8 / iPhone X unveil, Apple

announced mophie wireless charging collaboration

During the Google Pixel 2 launch event, Google

announced InvisibleShield screen protection collaboration

Close partnerships with key OEMsProducts designed for all the top mobile devices1

1 Logos shown are not inclusive of all brands

✓ Longstanding partnership with

diverse set of key OEMS

✓ Nimble across form factors

✓ Ability to adapt to rapidly

changing technology landscape

11

34%

42%

51%

54%

20%

30%

40%

50%

60%

2014 2015 2016 2017

Dollar Market Share

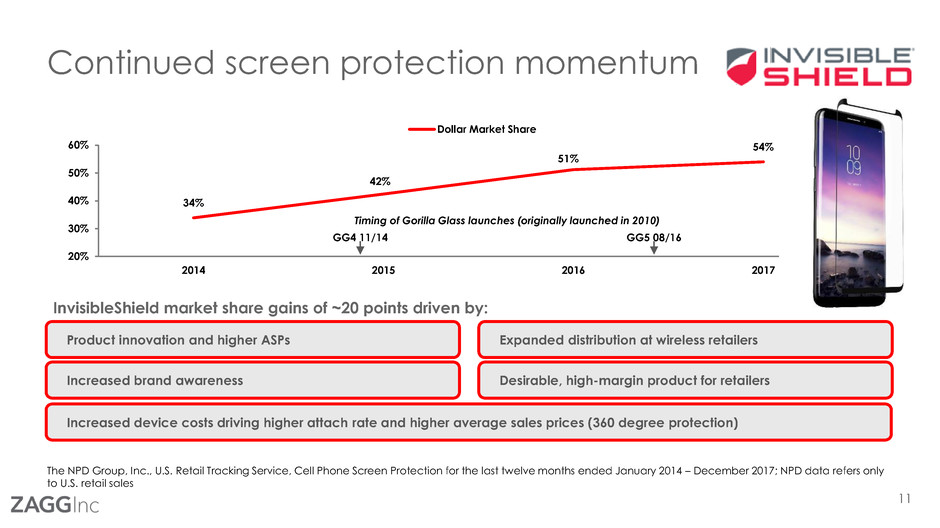

Continued screen protection momentum

InvisibleShield market share gains of ~20 points driven by:

Product innovation and higher ASPs Expanded distribution at wireless retailers

Increased brand awareness Desirable, high-margin product for retailers

Increased device costs driving higher attach rate and higher average sales prices (360 degree protection)

The NPD Group, Inc., U.S. Retail Tracking Service, Cell Phone Screen Protection for the last twelve months ended January 2014 – December 2017; NPD data refers only

to U.S. retail sales

GG4 11/14 GG5 08/16

Timing of Gorilla Glass launches (originally launched in 2010)

12

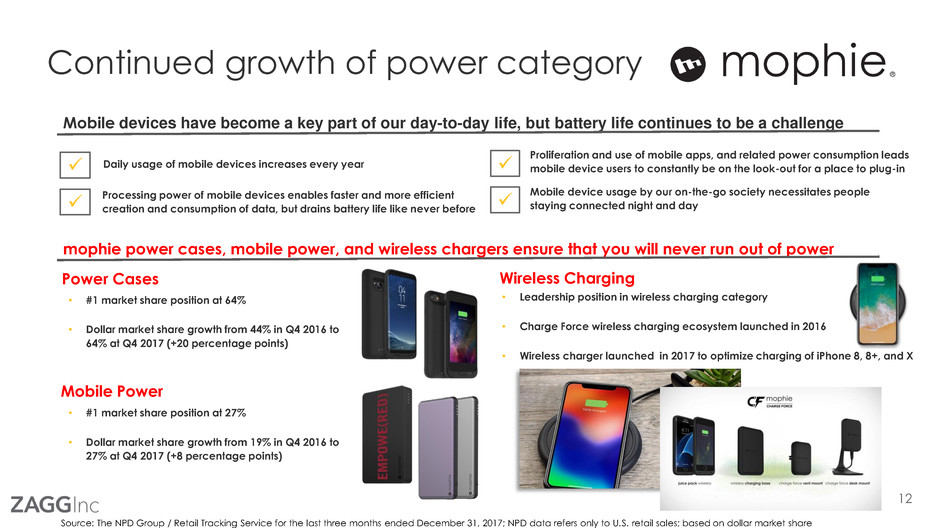

Continued growth of power category

Mobile devices have become a key part of our day-to-day life, but battery life continues to be a challenge

✓ Daily usage of mobile devices increases every year

Mobile device usage by our on-the-go society necessitates people

staying connected night and day✓

Processing power of mobile devices enables faster and more efficient

creation and consumption of data, but drains battery life like never before✓

Proliferation and use of mobile apps, and related power consumption leads

mobile device users to constantly be on the look-out for a place to plug-in✓

mophie power cases, mobile power, and wireless chargers ensure that you will never run out of power

Power Cases

Mobile Power

Wireless Charging

• Leadership position in wireless charging category

• Charge Force wireless charging ecosystem launched in 2016

• Wireless charger launched in 2017 to optimize charging of iPhone 8, 8+, and X

• #1 market share position at 64%

• Dollar market share growth from 44% in Q4 2016 to

64% at Q4 2017 (+20 percentage points)

Source: The NPD Group / Retail Tracking Service for the last three months ended December 31, 2017; NPD data refers only to U.S. retail sales; based on dollar market share

• #1 market share position at 27%

• Dollar market share growth from 19% in Q4 2016 to

27% at Q4 2017 (+8 percentage points)

Financial overview

14

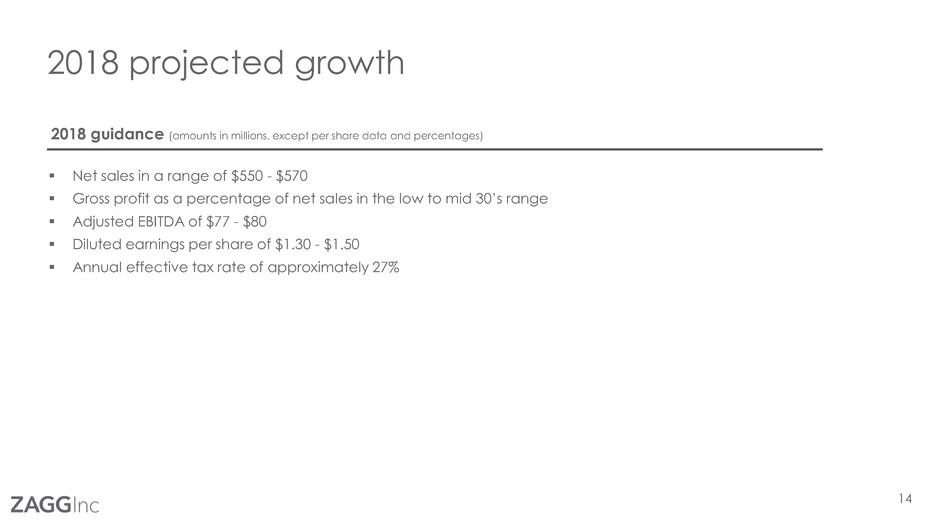

2018 projected growth

2018 guidance (amounts in millions, except per share data and percentages)

▪ Net sales in a range of $550 - $570

▪ Gross profit as a percentage of net sales in the low to mid 30’s range

▪ Adjusted EBITDA of $77 - $80

▪ Diluted earnings per share of $1.30 - $1.50

▪ Annual effective tax rate of approximately 27%

15

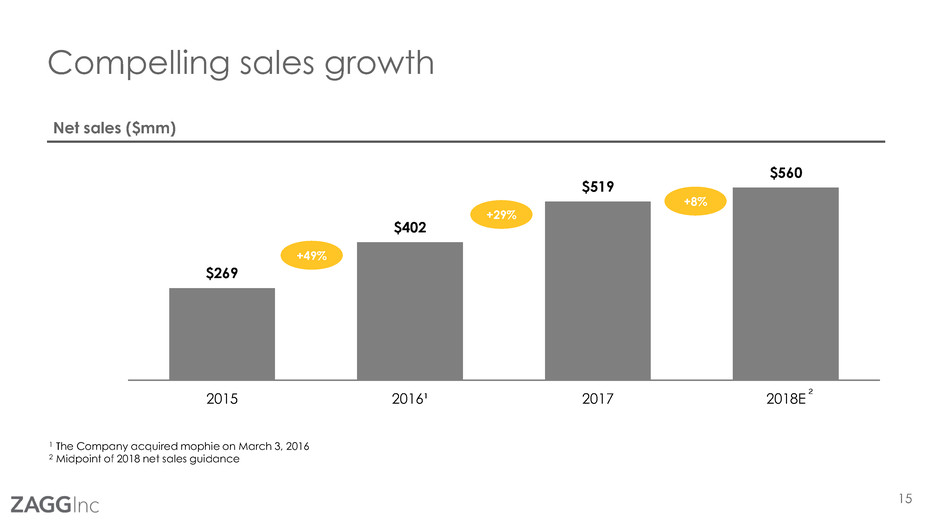

Compelling sales growth

Net sales ($mm)

$269

$402

$519

$560

2015 2016¹ 2017 2018E

+8%

+29%

+49%

1 The Company acquired mophie on March 3, 2016

2 Midpoint of 2018 net sales guidance

2

16

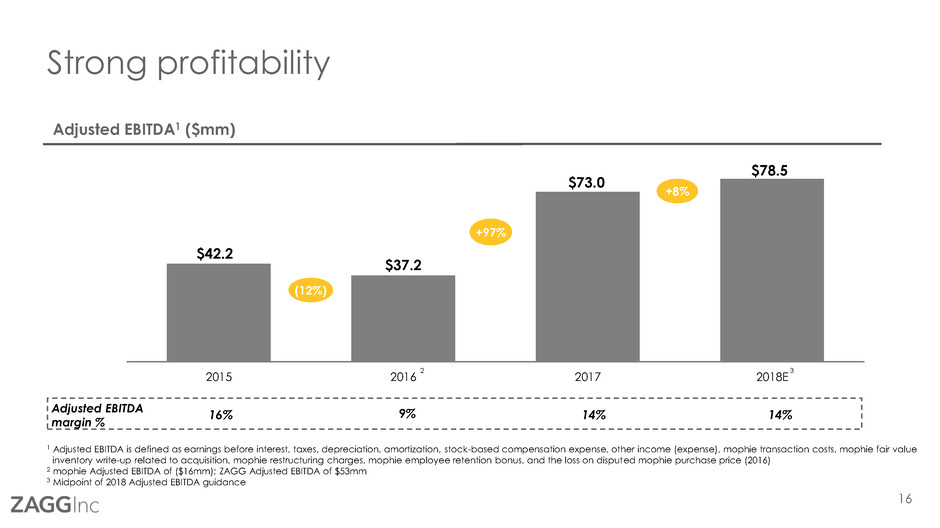

Strong profitability

$42.2

$37.2

$73.0

$78.5

2015 2016 2017 2018E

Adjusted EBITDA1 ($mm)

Adjusted EBITDA

margin %

16% 14%9%

1 Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation expense, other income (expense), mophie transaction costs, mophie fair value

inventory write-up related to acquisition, mophie restructuring charges, mophie employee retention bonus, and the loss on disputed mophie purchase price (2016)

2 mophie Adjusted EBITDA of ($16mm); ZAGG Adjusted EBITDA of $53mm

3 Midpoint of 2018 Adjusted EBITDA guidance

+97%

+8%

(12%)

2 3

14%

17

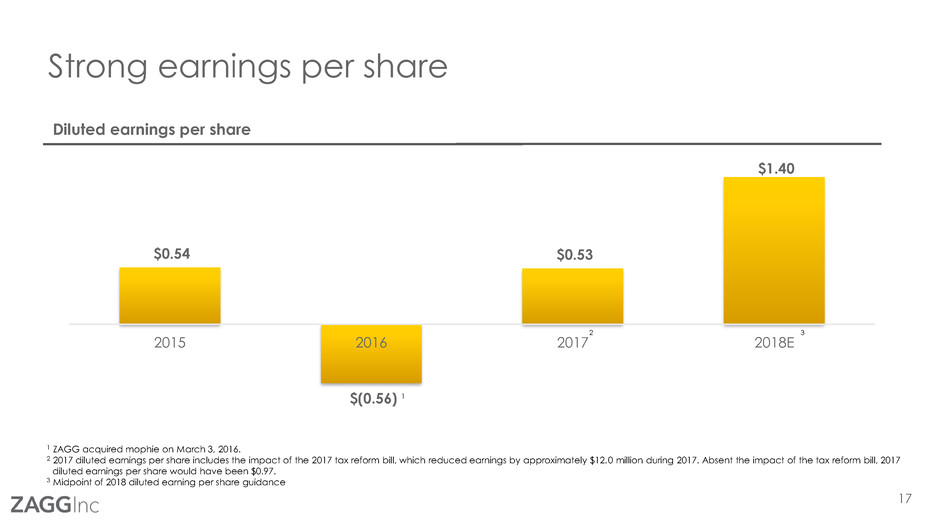

Strong earnings per share

Diluted earnings per share

1 ZAGG acquired mophie on March 3, 2016.

2 2017 diluted earnings per share includes the impact of the 2017 tax reform bill, which reduced earnings by approximately $12.0 million during 2017. Absent the impact of the tax reform bill, 2017

diluted earnings per share would have been $0.97.

3 Midpoint of 2018 diluted earning per share guidance

1

3

$0.54

$(0.56)

$0.53

$1.40

2015 2016 2017 2018E

2

18

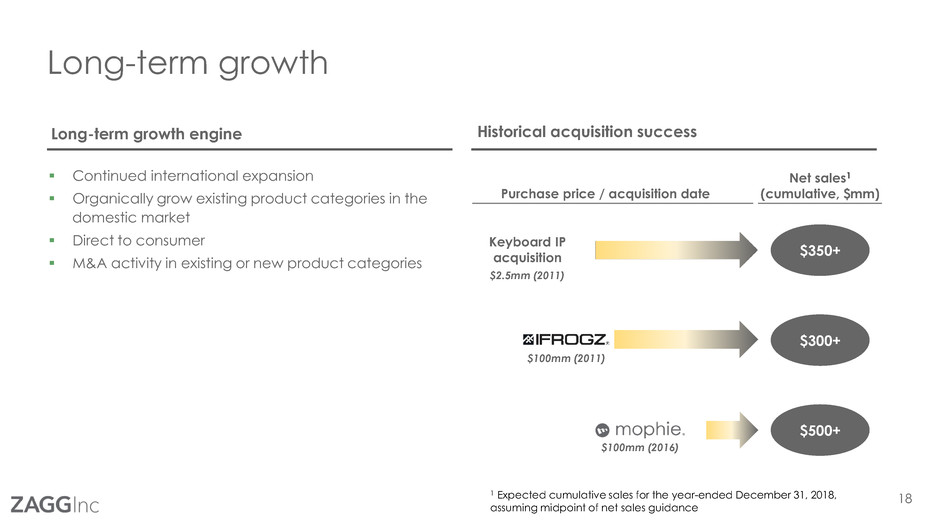

Long-term growth

Long-term growth engine

▪ Continued international expansion

▪ Organically grow existing product categories in the

domestic market

▪ Direct to consumer

▪ M&A activity in existing or new product categories

Historical acquisition success

$350+

$300+

$500+

Purchase price / acquisition date

Net sales1

(cumulative, $mm)

Keyboard IP

acquisition

$2.5mm (2011)

$100mm (2011)

$100mm (2016)

1 Expected cumulative sales for the year-ended December 31, 2018,

assuming midpoint of net sales guidance

19

Appendix

20

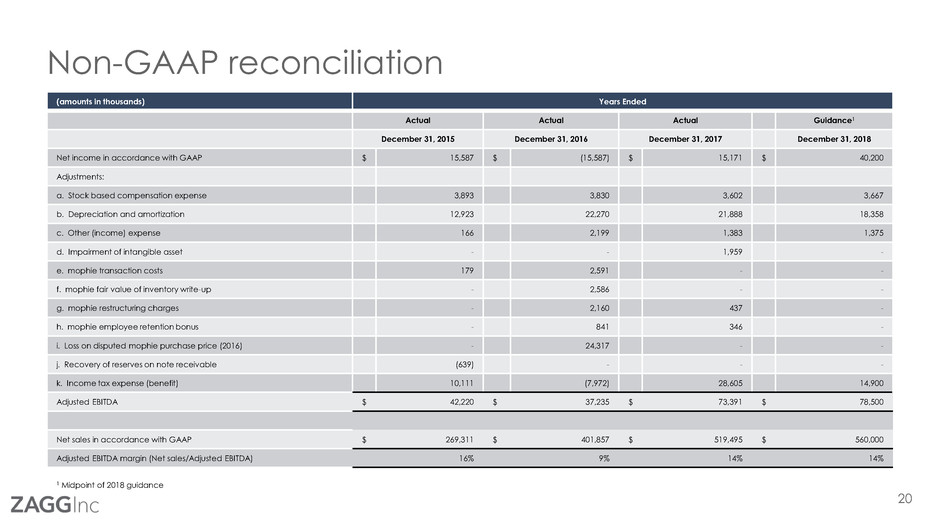

Non-GAAP reconciliation

(amounts in thousands) Years Ended

Actual Actual Actual Guidance1

December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018

Net income in accordance with GAAP $ 15,587 $ (15,587) $ 15,171 $ 40,200

Adjustments:

a. Stock based compensation expense 3,893 3,830 3,602 3,667

b. Depreciation and amortization 12,923 22,270 21,888 18,358

c. Other (income) expense 166 2,199 1,383 1,375

d. Impairment of intangible asset - - 1,959 -

e. mophie transaction costs 179 2,591 - -

f. mophie fair value of inventory write-up - 2,586 - -

g. mophie restructuring charges - 2,160 437 -

h. mophie employee retention bonus - 841 346 -

i. Loss on disputed mophie purchase price (2016) - 24,317 - -

j. Recovery of reserves on note receivable (639) - - -

k. Income tax expense (benefit) 10,111 (7,972) 28,605 14,900

Adjusted EBITDA $ 42,220 $ 37,235 $ 73,391 $ 78,500

Net sales in accordance with GAAP $ 269,311 $ 401,857 $ 519,495 $ 560,000

Adjusted EBITDA margin (Net sales/Adjusted EBITDA) 16% 9% 14% 14%

1 Midpoint of 2018 guidance

21

The NPD Group, Inc. references

References to the market shares information on slide #5 from The NPD Group Retail Tracking Services cited below:

1. The NPD Group Inc., U.S. Retail Tracking Service, Cell Phone Screen Protection, based on dollar sales, October 2017 – December 2017.

2. The NPD Group Inc., U.S. Retail Tracking Service, Cell Phone Device Protection, Charging Case, based on dollar sales, October 2017 – December 2017.

3. The NPD Group Inc., U.S. Retail Tracking Service, Mobile Power, Charge Type: Portable Power Packs, based on dollar sales, October 2017 – December 2017.

4. The NPD Group Inc., U.S. Retail Tracking Service, Tablet and e-readers – Cases, Keyboard Included, based on dollar sales, October 2017 – September 2017.

References to the market shares information on slide #11 from The NPD Group Retail Tracking Services cited below:

1. The NPD Group Inc., U.S. Retail Tracking Service, Cell Phone Screen Protection, based on dollar sales, January 2014 – December 2017.

References to the market shares information on slide #12 from The NPD Group Retail Tracking Services cited below:

1. The NPD Group Inc., U.S. Retail Tracking Service, Cell Phone Device Protection, Charging Case, based on dollar sales, October 2017 – December 2017.

2. The NPD Group Inc., U.S. Retail Tracking Service, Mobile Power, Charge Type: Portable Power Packs, based on dollar sales, October 2017 – December 2017.

22

Investor Presentation

March 2018