Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | kra022120188-k.htm |

February 21, 2018

Kraton Corporation

Fourth Quarter 2017

Earnings Presentation

Kraton Fourth Quarter 2017 Earnings Call 2

Disclaimers

Forward Looking Statements

Some of the statements and information in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. This presentation includes forward-looking statements that reflect our plans, beliefs, expectations, and current views with respect

to, among other things, future events and financial performance. Forward-looking statements are often identified by words such as “outlook,” “believes,”

“estimates,” “expects,” “projects,” “may,” “intends,” “plans”, “on track” “on trend”, or “anticipates,” or by discussions of strategy, plans or intentions,

including all matters described on the slide titled “2018 Modeling Assumptions” and our expectations for targeted debt reduction..

All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and

unknown risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed in forward-looking

statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A.

Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other

filings with the Securities and Exchange Commission, and include, but are not limited to, risks related to: Kraton's ability to repay its indebtedness;

Kraton's reliance on third parties for the provision of significant operating and other services; conditions in the global economy and capital markets;

fluctuations in raw material costs; limitations in the availability of raw materials; competition in Kraton's end-use markets; and other factors of which we

are currently unaware or deem immaterial. Readers are cautioned not to place undue reliance on our forward-looking statements. Forward-looking

statements speak only as of the date they are made, and we assume no obligation to update such information in light of new information or future

events.

Kraton Fourth Quarter 2017 Earnings Call 3

GAAP Disclaimer

This presentation includes the use of non-GAAP financial measures, as defined below. Tables included in this presentation reconcile each of these non-

GAAP financial measures with the most directly comparable GAAP financial measure. For additional information on the impact of the spread between the

FIFO basis of accounting and estimated current replacement cost (“ECRC”), see our Annual Report on Form 10-K for the fiscal year ended December

31, 2017.

We consider these non-GAAP financial measures to be important supplemental measures in the evaluation of our absolute and relative performance.

However, we caution that these non-GAAP financial measures have limitations as analytical tools and may vary substantially from other measures of our

performance. You should not consider them in isolation, or as a substitute for analysis of our results under GAAP in the United States.

EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin: For our consolidated results, EBITDA represents net income (loss) before interest, taxes,

depreciation and amortization. For each reporting segment, EBITDA represents operating income before depreciation and amortization, disposition and

exit of business activities and earnings of unconsolidated joint ventures. Among other limitations, EBITDA does not: reflect the significant interest

expense on our debt or reflect the significant depreciation and amortization expense associated with our long-lived assets; and EBITDA included herein

should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements since it calculation

differs in such agreements. Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative

measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from

EBITDA the impact of a number of items we do not consider indicative of our on-going performance but you should be aware that in the future we may

incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our

future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often

does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP. We define

Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue (for each reporting segment or on a consolidated bases, as applicable).

Adjusted Gross Profit and Adjusted Gross Profit Per Ton: We define Adjusted Gross Profit Per Ton as Adjusted Gross Profit divided by total sales volume

(for each reporting segment or on a consolidated basis, as applicable). We define Adjusted Gross Profit as gross profit excluding certain charges and

expenses. Adjusted Gross Profit is limited because it often varies substantially from gross profit calculated in accordance with U.S. GAAP due to volatility

in raw material prices.

Adjusted Diluted Earnings Per Share: Adjusted Diluted Earnings Per Share is Diluted Earnings (Loss) Per Share excluding the impact of a number of

non-recurring items we do not consider indicative of our on-going performance.

Net Debt: Net debt for Kraton is total debt (excluding debt of KFPC due to its own capital structure) less cash and cash equivalents. Consolidated net

debt is Kraton net debt plus debt of KFPC less KFPC’s cash and cash equivalents. Management believes that net debt is useful to investors in

determining our leverage since we could choose to use cash and cash equivalents to satisfy our debt obligations.

Disclaimers

Kraton Fourth Quarter 2017 Earnings Call 4

2017 Highlights

Full-year 2017 net income of $97.5 million and Adjusted EBITDA(1) of $374.2 million compared to net income of

$107.3 million and Adjusted EBITDA(1) of $354.1 million in 2016

▪ Adjusted EBITDA(1) up $20 million or 5.7% compared to 2016

Polymer segment operating income of $117.4 million and Adjusted EBITDA(1) of $223.0 million compared to

operating income of $77.9 million and Adjusted EBITDA(1) of $183.1 million in 2016

▪ Adjusted EBITDA(1) up $40 million or 21.8% compared to 2016

▪ 2017 Adjusted EBITDA margin(2) of 19%

Chemical segment operating income of $84.7 million and Adjusted EBITDA(1) of $151.2 million compared to

operating income of $58.4 million and Adjusted EBITDA(1) (3) of $171.0 million in 2016

▪ 2017 Adjusted EBITDA margin(2) of 20%

▪ Improving trends for TOFA and TOR drove 9.5% growth in Adjusted EBITDA(1) in 2H’17 vs. 1H’17

Adjusted earnings of $2.85 per diluted share(1) in 2017, up 21% compared to $2.36 per diluted share in 2016

Delivered Chemical segment synergies and operational cost improvements of $65 million, one year ahead of plan

Delivered an incremental $13 million of cost reductions in the Polymer segment in 2017

Reduced Kraton net debt(1) by $163 million, exceeding high end of expected range

▪ Net debt(1) reduced by $281 million since the date of the Arizona Chemical Acquisition

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

(3) Chemical segment results for the period January 6, 2016 (the date of the Arizona Chemical Acquisition) through December 31, 2016.

Kraton Fourth Quarter 2017 Earnings Call 5

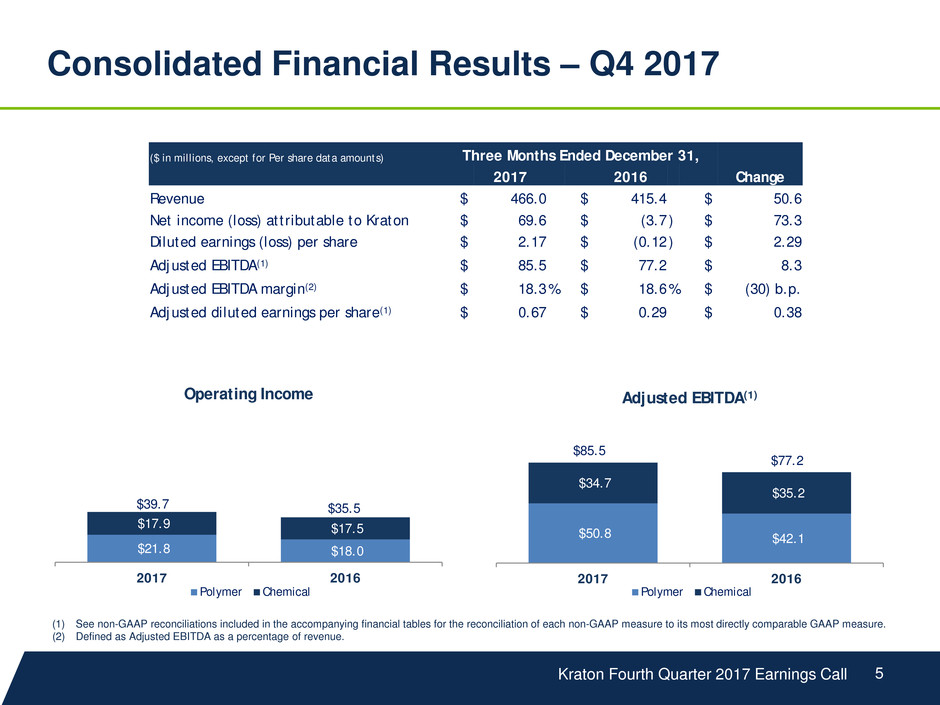

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

Consolidated Financial Results – Q4 2017

$50.8 $42.1

$34.7

$35.2

2017 2016

Adjusted EBITDA(1)

Polymer Chemical

$85.5

$77.2

($ in millions, except for Per share data amounts) Three Months Ended December 31,

2017 2016 Change

Revenue $ 466.0 $ 415.4 $ 50.6

Net income (loss) attributable to Kraton $ 69.6 $ (3.7 ) $ 73.3

Diluted earnings (loss) per share $ 2.17 $ (0.12 ) $ 2.29

Adjusted EBITDA(1) $ 85.5 $ 77.2 $ 8.3

Adjusted EBITDA margin(2) $ 18.3 % $ 18.6 % $ (30) b.p.

Adjusted diluted earnings per share(1) $ 0.67 $ 0.29 $ 0.38

$21.8 $18.0

$17.9 $17.5

2017 2016

Operating Income

Polymer Chemical

$39.7 $35.5

Kraton Fourth Quarter 2017 Earnings Call 6

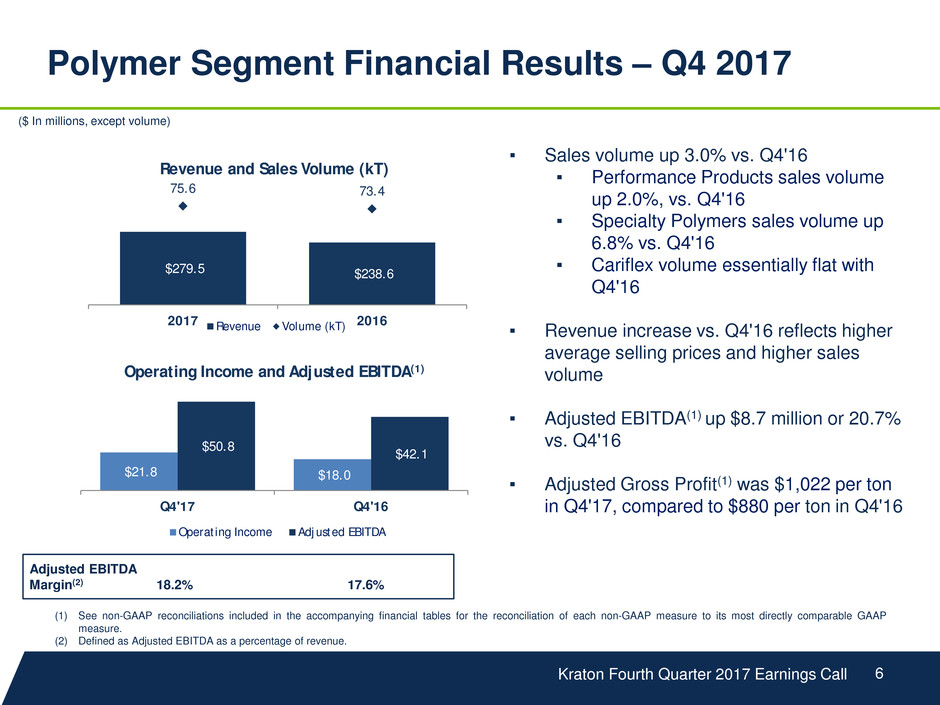

Polymer Segment Financial Results – Q4 2017

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP

measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

▪ Sales volume up 3.0% vs. Q4'16

▪ Performance Products sales volume

up 2.0%, vs. Q4'16

▪ Specialty Polymers sales volume up

6.8% vs. Q4'16

▪ Cariflex volume essentially flat with

Q4'16

▪ Revenue increase vs. Q4'16 reflects higher

average selling prices and higher sales

volume

▪ Adjusted EBITDA(1) up $8.7 million or 20.7%

vs. Q4'16

▪ Adjusted Gross Profit(1) was $1,022 per ton

in Q4'17, compared to $880 per ton in Q4'16

Adjusted EBITDA

Margin(2) 18.2% 17.6%

($ In millions, except volume)

$279.5 $238.6

75.6 73.4

0.0

10.0

20.0

30.0

40.0

50.0

60.0

70.0

80.0

$-

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

$400.0

2017 2016

Revenue and Sales Volume (kT)

Revenue Volume (kT)

$21.8 $18.0

$50.8 $42.1

Q4'17 Q4'16

Operating Income and Adjusted EBITDA(1)

Operating Income Adjusted EBITDA

Kraton Fourth Quarter 2017 Earnings Call 7

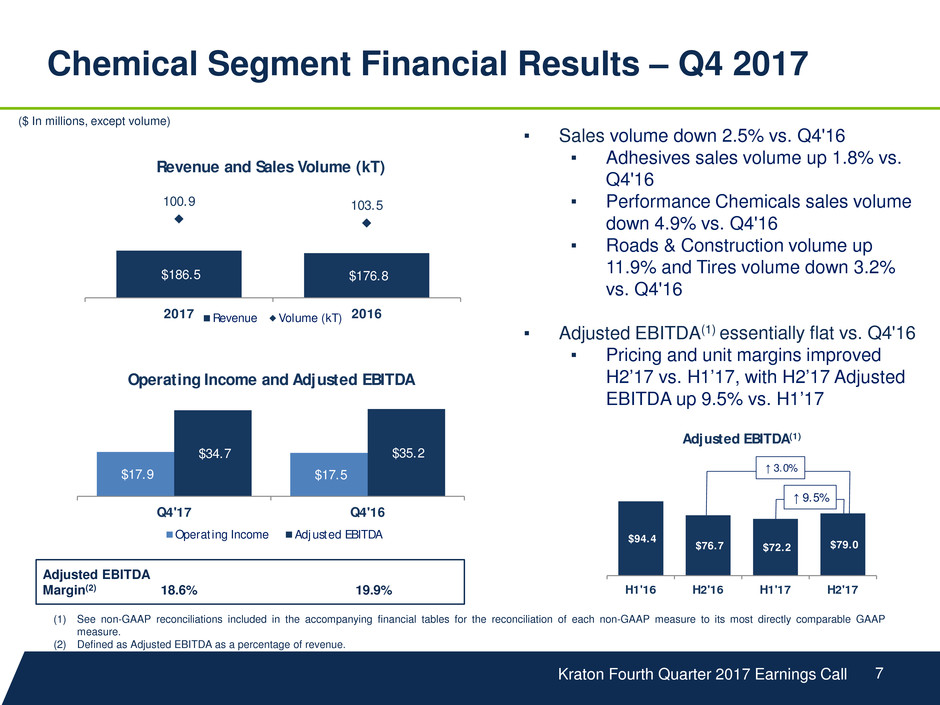

$94.4

$76.7 $72.2 $79.0

H1'16 H2'16 H1'17 H2'17

Adjusted EBITDA(1)

$186.5 $176.8

100.9 103.5

0.0

20.0

40.0

60.0

80.0

100.0

120.0

140.0

$-

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

$400.0

2017 2016

Revenue and Sales Volume (kT)

Revenue Volume (kT)

$17.9 $17.5

$34.7 $35.2

Q4'17 Q4'16

Operating Income and Adjusted EBITDA

Operating Income Adjusted EBITDA

Chemical Segment Financial Results – Q4 2017

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP

measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

Adjusted EBITDA

Margin(2) 18.6% 19.9%

($ In millions, except volume)

▪ Sales volume down 2.5% vs. Q4'16

▪ Adhesives sales volume up 1.8% vs.

Q4'16

▪ Performance Chemicals sales volume

down 4.9% vs. Q4'16

▪ Roads & Construction volume up

11.9% and Tires volume down 3.2%

vs. Q4'16

▪ Adjusted EBITDA(1) essentially flat vs. Q4'16

▪ Pricing and unit margins improved

H2’17 vs. H1’17, with H2’17 Adjusted

EBITDA up 9.5% vs. H1’17

↑ 9.5%

↑ 3.0%

Kraton Fourth Quarter 2017 Earnings Call 8

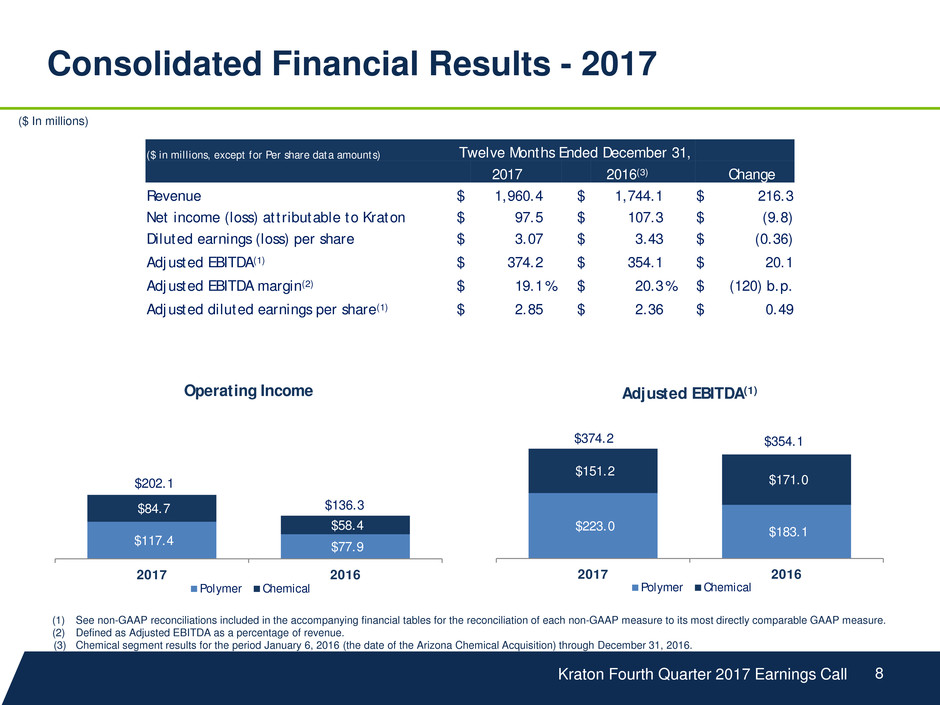

$117.4 $77.9

$84.7

$58.4

2017 2016

Operating Income

Polymer Chemical

$202.1

$136.3

($ in millions, except for Per share data amounts) Twelve Months Ended December 31,

2017 2016(3) Change

Revenue $ 1,960.4 $ 1,744.1 $ 216.3

Net income (loss) attributable to Kraton $ 97.5 $ 107.3 $ (9.8)

Diluted earnings (loss) per share $ 3.07 $ 3.43 $ (0.36)

Adjusted EBITDA(1) $ 374.2 $ 354.1 $ 20.1

Adjusted EBITDA margin(2) $ 19.1 % $ 20.3 % $ (120) b.p.

Adjusted diluted earnings per share(1) $ 2.85 $ 2.36 $ 0.49

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

(3) Chemical segment results for the period January 6, 2016 (the date of the Arizona Chemical Acquisition) through December 31, 2016.

Consolidated Financial Results - 2017

($ In millions)

$223.0 $183.1

$151.2

$171.0

2017 2016

Adjusted EBITDA(1)

Polymer Chemical

$374.2 $354.1

Kraton Fourth Quarter 2017 Earnings Call 9

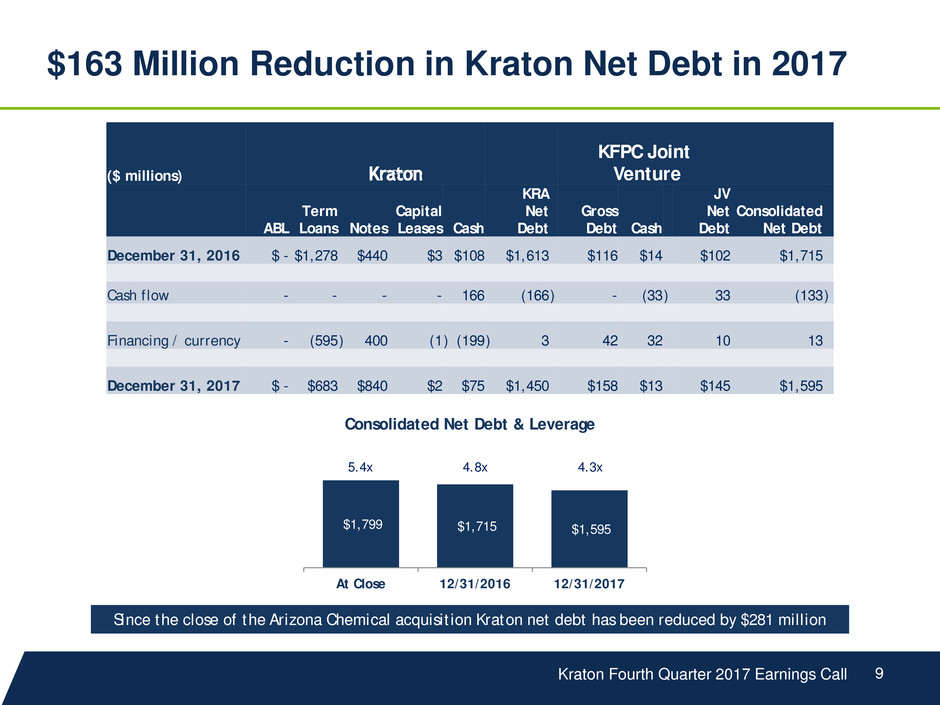

($ millions)

KFPC Joint

Venture

ABL

Term

Loans Notes

Capital

Leases Cash

KRA

Net

Debt

Gross

Debt Cash

JV

Net

Debt

Consolidated

Net Debt

December 31, 2016 $ - $1,278 $440 $3 $108 $1,613 $116 $14 $102 $1,715

Cash flow - - - - 166 (166 ) - (33 ) 33 (133 )

Financing / currency - (595 ) 400 (1 ) (199 ) 3 42 32 10 13

December 31, 2017 $ - $683 $840 $2 $75 $1,450 $158 $13 $145 $1,595

Since the close of the Arizona Chemical acquisition Kraton net debt has been reduced by $281 million

$163 Million Reduction in Kraton Net Debt in 2017

$1,799 $1,715 $1,595

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

At Close 12/31/2016 12/31/2017

Consolidated Net Debt & Leverage

5.4x 4.8x 4.3x

Kraton Fourth Quarter 2017 Earnings Call 10

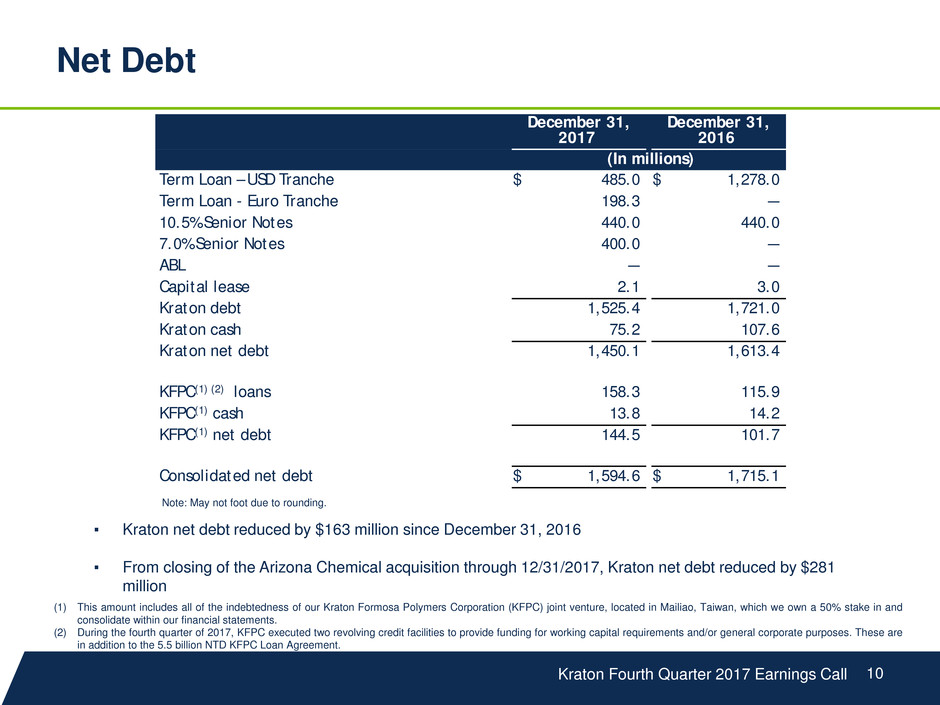

Net Debt

December 31,

2017

December 31,

2016

(In millions)

Term Loan – USD Tranche $ 485.0 $ 1,278.0

Term Loan - Euro Tranche 198.3 —

10.5% Senior Notes 440.0 440.0

7.0% Senior Notes 400.0 —

ABL — —

Capital lease 2.1 3.0

Kraton debt 1,525.4 1,721.0

Kraton cash 75.2 107.6

Kraton net debt 1,450.1 1,613.4

KFPC(1) (2) loans 158.3 115.9

KFPC(1) cash 13.8 14.2

KFPC(1) net debt 144.5 101.7

Consolidated net debt $ 1,594.6 $ 1,715.1

(1) This amount includes all of the indebtedness of our Kraton Formosa Polymers Corporation (KFPC) joint venture, located in Mailiao, Taiwan, which we own a 50% stake in and

consolidate within our financial statements.

(2) During the fourth quarter of 2017, KFPC executed two revolving credit facilities to provide funding for working capital requirements and/or general corporate purposes. These are

in addition to the 5.5 billion NTD KFPC Loan Agreement.

Note: May not foot due to rounding.

▪ Kraton net debt reduced by $163 million since December 31, 2016

▪ From closing of the Arizona Chemical acquisition through 12/31/2017, Kraton net debt reduced by $281

million

Appendix

Kraton Fourth Quarter 2017 Earnings Call 12

2018 Modeling Assumptions(1)

($ in millions)

Non-cash compensation expense $10

Depreciation & amortization $140

Interest expense

Cash interest of approximately $108 million

$117

Effective tax rate

Non-GAAP basis 20%-25%

20% - 25%

Capex (includes capitalized interest) $110

Reduction in net debt(2) Approximately $125

(1) Management's estimates. These estimates are forward-looking statements and speak only as of February 21, 2018. Management assumes no obligation to update or confirm

these estimates in light of new information or future events.

(2) We have not reconciled net debt guidance to debt due to high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and

actions. The actual amount of such reconciling items will have a significant impact if they were included in our net debt. Accordingly, a reconciliation of the non-GAAP financial

measure guidance to the corresponding GAAP measures is not available without unreasonable effort.

Note: Non-cash compensation expense is excluded in determining Adjusted EBITDA and included in determining Adjusted EPS.

Kraton Fourth Quarter 2017 Earnings Call 13

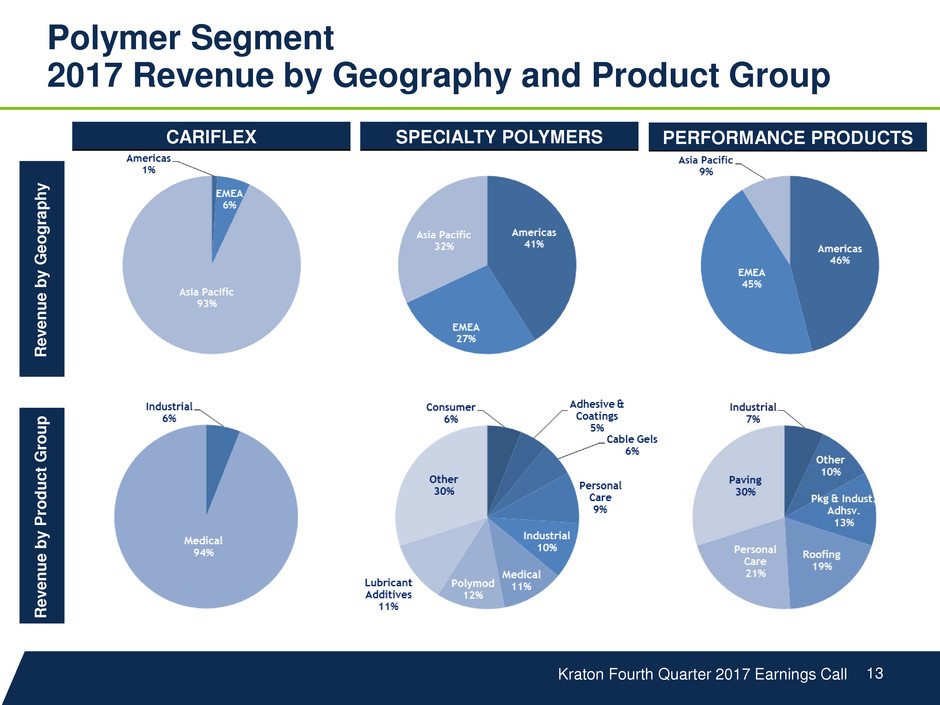

Polymer Segment

2017 Revenue by Geography and Product Group

R

ev

en

ue

b

y

G

eo

gr

ap

hy

R

ev

en

ue

b

y

P

ro

du

ct

G

ro

up

CARIFLEX PERFORMANCE PRODUCTS SPECIALTY POLYMERS

Kraton Fourth Quarter 2017 Earnings Call 14

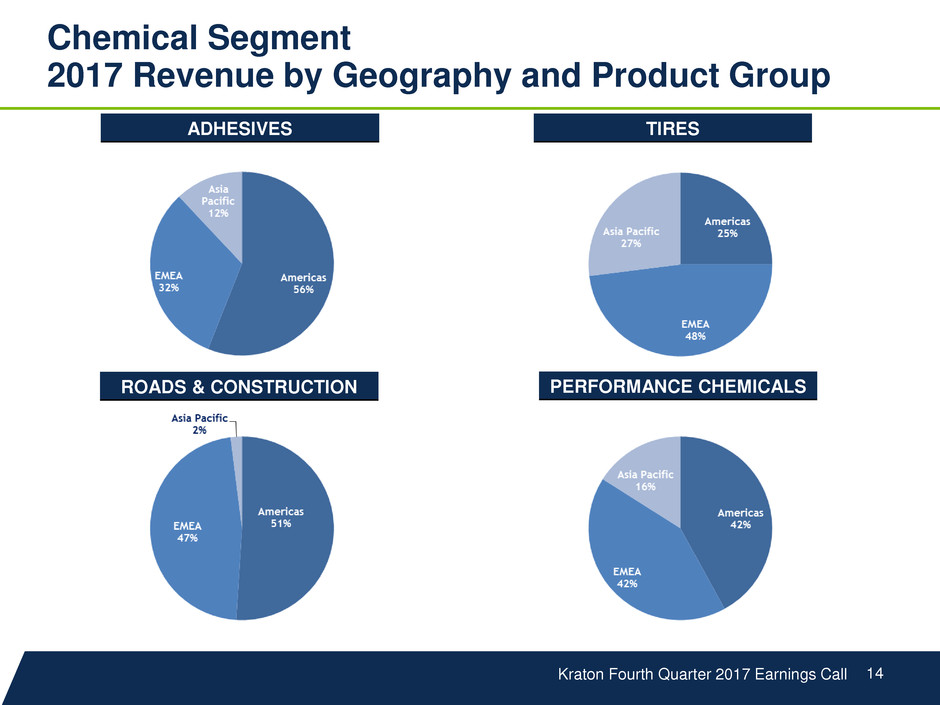

ADHESIVES TIRES

ROADS & CONSTRUCTION PERFORMANCE CHEMICALS

Chemical Segment

2017 Revenue by Geography and Product Group

Kraton Fourth Quarter 2017 Earnings Call 15

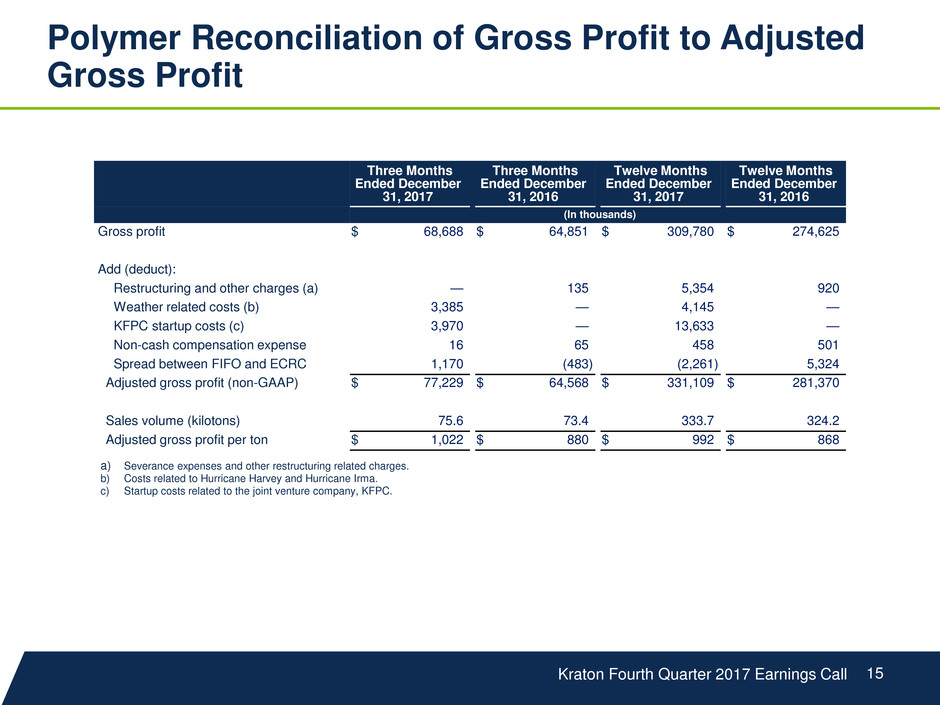

Polymer Reconciliation of Gross Profit to Adjusted

Gross Profit

Three Months

Ended December

31, 2017

Three Months

Ended December

31, 2016

Twelve Months

Ended December

31, 2017

Twelve Months

Ended December

31, 2016

(In thousands)

Gross profit $ 68,688 $ 64,851 $ 309,780 $ 274,625

Add (deduct):

Restructuring and other charges (a) — 135 5,354 920

Weather related costs (b) 3,385 — 4,145 —

KFPC startup costs (c) 3,970 — 13,633 —

Non-cash compensation expense 16 65 458 501

Spread between FIFO and ECRC 1,170 (483 ) (2,261 ) 5,324

Adjusted gross profit (non-GAAP) $ 77,229 $ 64,568 $ 331,109 $ 281,370

Sales volume (kilotons) 75.6 73.4 333.7 324.2

Adjusted gross profit per ton $ 1,022 $ 880 $ 992 $ 868

a) Severance expenses and other restructuring related charges.

b) Costs related to Hurricane Harvey and Hurricane Irma.

c) Startup costs related to the joint venture company, KFPC.

Kraton Fourth Quarter 2017 Earnings Call 16

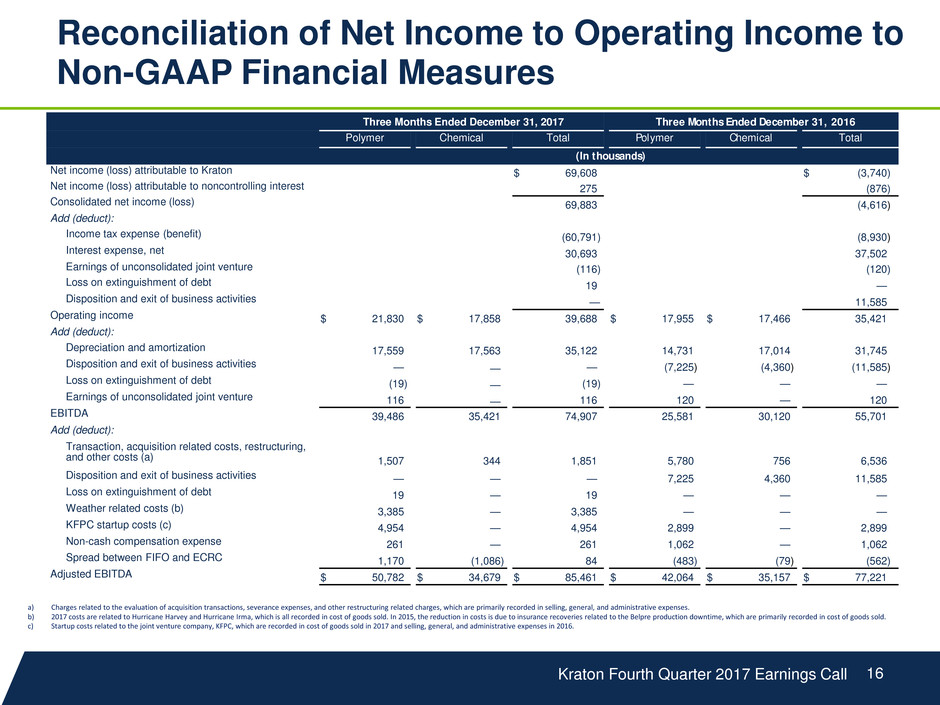

Reconciliation of Net Income to Operating Income to

Non-GAAP Financial Measures

Three Months Ended December 31, 2017 Three Months Ended December 31, 2016

Polymer Chemical Total Polymer Chemical Total

(In thousands)

Net income (loss) attributable to Kraton $ 69,608 $ (3,740 )

Net income (loss) attributable to noncontrolling interest 275 (876 )

Consolidated net income (loss) 69,883 (4,616 )

Add (deduct):

Income tax expense (benefit) (60,791 ) (8,930 )

Interest expense, net 30,693 37,502

Earnings of unconsolidated joint venture (116 ) (120 )

Loss on extinguishment of debt 19 —

Disposition and exit of business activities — 11,585

Operating income $ 21,830 $ 17,858 39,688 $ 17,955 $ 17,466 35,421

Add (deduct):

Depreciation and amortization 17,559 17,563 35,122 14,731 17,014 31,745

Disposition and exit of business activities — — — (7,225 ) (4,360 ) (11,585 )

Loss on extinguishment of debt (19 ) — (19 ) — — —

Earnings of unconsolidated joint venture 116 — 116 120 — 120

EBITDA 39,486 35,421 74,907 25,581 30,120 55,701

Add (deduct):

Transaction, acquisition related costs, restructuring,

and other costs (a) 1,507 344 1,851 5,780 756 6,536

Disposition and exit of business activities — — — 7,225 4,360 11,585

Loss on extinguishment of debt 19 — 19 — — —

Weather related costs (b) 3,385 — 3,385 — — —

KFPC startup costs (c) 4,954 — 4,954 2,899 — 2,899

Non-cash compensation expense 261 — 261 1,062 — 1,062

Spread between FIFO and ECRC 1,170 (1,086 ) 84 (483 ) (79 ) (562 )

Adjusted EBITDA $ 50,782 $ 34,679 $ 85,461 $ 42,064 $ 35,157 $ 77,221

a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges, which are primarily recorded in selling, general, and administrative expenses.

b) 2017 costs are related to Hurricane Harvey and Hurricane Irma, which is all recorded in cost of goods sold. In 2015, the reduction in costs is due to insurance recoveries related to the Belpre production downtime, which are primarily recorded in cost of goods sold.

c) Startup costs related to the joint venture company, KFPC, which are recorded in cost of goods sold in 2017 and selling, general, and administrative expenses in 2016.

Kraton Fourth Quarter 2017 Earnings Call 17

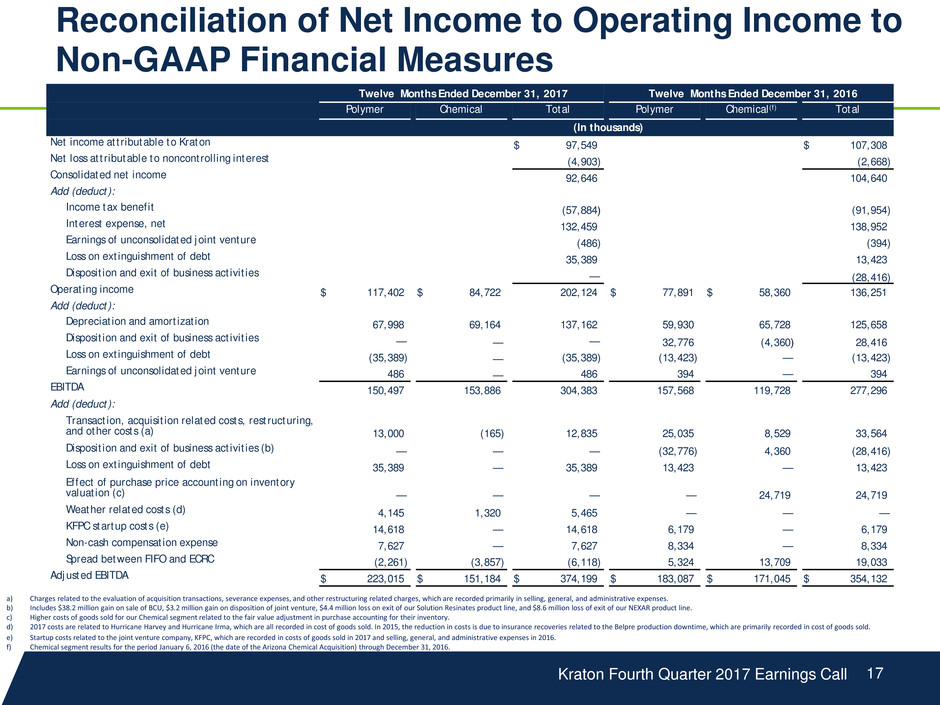

Reconciliation of Net Income to Operating Income to

Non-GAAP Financial Measures

Twelve Months Ended December 31, 2017 Twelve Months Ended December 31, 2016

Polymer Chemical Total Polymer Chemical(f) Total

(In thousands)

Net income attributable to Kraton $ 97,549 $ 107,308

Net loss attributable to noncontrolling interest (4,903 ) (2,668 )

Consolidated net income 92,646 104,640

Add (deduct):

Income tax benefit (57,884 ) (91,954 )

Interest expense, net 132,459 138,952

Earnings of unconsolidated joint venture (486 ) (394 )

Loss on extinguishment of debt 35,389 13,423

Disposition and exit of business activities — (28,416 )

Operating income $ 117,402 $ 84,722 202,124 $ 77,891 $ 58,360 136,251

Add (deduct):

Depreciation and amortization 67,998 69,164 137,162 59,930 65,728 125,658

Disposition and exit of business activities — — — 32,776 (4,360 ) 28,416

Loss on extinguishment of debt (35,389 ) — (35,389 ) (13,423 ) — (13,423 )

Earnings of unconsolidated joint venture 486 — 486 394 — 394

EBITDA 150,497 153,886 304,383 157,568 119,728 277,296

Add (deduct):

Transaction, acquisition related costs, restructuring,

and other costs (a) 13,000 (165 ) 12,835 25,035 8,529 33,564

Disposition and exit of business activities (b) — — — (32,776 ) 4,360 (28,416 )

Loss on extinguishment of debt 35,389 — 35,389 13,423 — 13,423

Effect of purchase price accounting on inventory

valuation (c) — — — — 24,719 24,719

Weather related costs (d) 4,145 1,320 5,465 — — —

KFPC startup costs (e) 14,618 — 14,618 6,179 — 6,179

Non-cash compensation expense 7,627 — 7,627 8,334 — 8,334

Spread between FIFO and ECRC (2,261 ) (3,857 ) (6,118 ) 5,324 13,709 19,033

Adjusted EBITDA $ 223,015 $ 151,184 $ 374,199 $ 183,087 $ 171,045 $ 354,132

a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges, which are recorded primarily in selling, general, and administrative expenses.

b) Includes $38.2 million gain on sale of BCU, $3.2 million gain on disposition of joint venture, $4.4 million loss on exit of our Solution Resinates product line, and $8.6 million loss of exit of our NEXAR product line.

c) Higher costs of goods sold for our Chemical segment related to the fair value adjustment in purchase accounting for their inventory.

d) 2017 costs are related to Hurricane Harvey and Hurricane Irma, which are all recorded in cost of goods sold. In 2015, the reduction in costs is due to insurance recoveries related to the Belpre production downtime, which are primarily recorded in cost of goods sold.

e) Startup costs related to the joint venture company, KFPC, which are recorded in costs of goods sold in 2017 and selling, general, and administrative expenses in 2016.

f) Chemical segment results for the period January 6, 2016 (the date of the Arizona Chemical Acquisition) through December 31, 2016.

Kraton Fourth Quarter 2017 Earnings Call 18

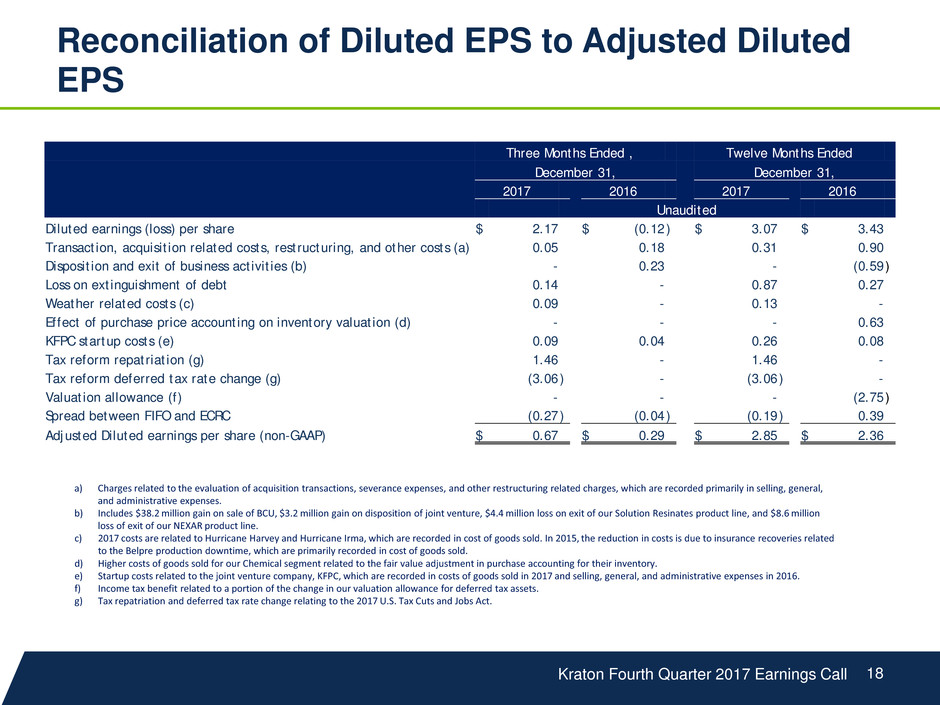

Reconciliation of Diluted EPS to Adjusted Diluted

EPS

a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges, which are recorded primarily in selling, general,

and administrative expenses.

b) Includes $38.2 million gain on sale of BCU, $3.2 million gain on disposition of joint venture, $4.4 million loss on exit of our Solution Resinates product line, and $8.6 million

loss of exit of our NEXAR product line.

c) 2017 costs are related to Hurricane Harvey and Hurricane Irma, which are recorded in cost of goods sold. In 2015, the reduction in costs is due to insurance recoveries related

to the Belpre production downtime, which are primarily recorded in cost of goods sold.

d) Higher costs of goods sold for our Chemical segment related to the fair value adjustment in purchase accounting for their inventory.

e) Startup costs related to the joint venture company, KFPC, which are recorded in costs of goods sold in 2017 and selling, general, and administrative expenses in 2016.

f) Income tax benefit related to a portion of the change in our valuation allowance for deferred tax assets.

g) Tax repatriation and deferred tax rate change relating to the 2017 U.S. Tax Cuts and Jobs Act.

Three Months Ended , Twelve Months Ended

December 31, December 31,

2017 2016 2017 2016

Unaudited

Diluted earnings (loss) per share $ 2.17 $ (0.12 ) $ 3.07 $ 3.43

Transaction, acquisition related costs, restructuring, and other costs (a) 0.05 0.18 0.31 0.90

Disposition and exit of business activities (b) - 0.23 - (0.59 )

Loss on extinguishment of debt 0.14 - 0.87 0.27

Weather related costs (c) 0.09 - 0.13 -

Effect of purchase price accounting on inventory valuation (d) - - - 0.63

KFPC startup costs (e) 0.09 0.04 0.26 0.08

Tax reform repatriation (g) 1.46 - 1.46 -

Tax reform deferred tax rate change (g) (3.06 ) - (3.06 ) -

Valuation allowance (f) - - - (2.75 )

Spread between FIFO and ECRC (0.27 ) (0.04 ) (0.19 ) 0.39

Adjusted Diluted earnings per share (non-GAAP) $ 0.67 $ 0.29 $ 2.85 $ 2.36