Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Hi-Crush Inc. | exhibit991-earningsrelease.htm |

| 8-K - 8-K - Hi-Crush Inc. | q42017-earningsrelease8xk.htm |

INVESTOR PRESENTATION – Q4 2017 EARNINGS

FEBRUARY 2018

Forward Looking Statements

Some of the information included herein may contain forward-looking statements within the meaning of the federal securities

laws. Forward-looking statements give our current expectations and may contain projections of results of operations or of

financial condition, or forecasts of future events. Words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,”

“expect,” “intend,” “plan,” “estimate,” “anticipate,” “could,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar

expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or

unknown risks or uncertainties. Consequently, no expected results of operations or financial condition or other forward-looking

statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors

and other cautionary statements in Hi-Crush Partners LP’s (“Hi-Crush”) reports filed with the Securities and Exchange

Commission (“SEC”), including those described under Item 1A, “Risk Factors” of Hi-Crush’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2017. Actual results may vary materially. You are cautioned not to place undue reliance on any

forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should

not consider the risk factors in our reports filed with the SEC or the following list to be a complete statement of all potential risks

and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-

looking statements include: the volume of frac sand we are able to sell; the price at which we are able to sell frac sand; the

outcome of any litigation, claims or assessments, including unasserted claims; changes in the price and availability of natural

gas or electricity; changes in prevailing economic conditions; and difficulty collecting receivables. All forward-looking statements

are expressly qualified in their entirety by the foregoing cautionary statements. Hi-Crush’s forward-looking statements speak

only as of the date made and Hi-Crush undertakes no obligation to update or revise its forward-looking statements, whether as a

result of new information, future events or otherwise.

2

Business Update

Investor Presentation | September, 2013 3

4

Creating a Stable and Diverse Platform for Growth

We provide our customers with the high-quality, cost-effective proppant and

logistics services they desire and require, when and where they are needed

• 13.4mm TPY annual

production capacity

• High quality Northern White

and in-basin Permian

reserves

• Diverse grade mix

• Industry-leading production

cost profile

• Largest owned and operated

terminal network in the U.S.

• Cost-effective service to all

major U.S. oil and gas basins

• Unit train origins and

destinations; efficient and

proactive railcar management

• Partnering with a national

trucking company for logistics to

mitigate trucking bottlenecks

• Most vertically-integrated

supplier of proppant and

logistics services

• PropStreamTM delivers sand

from the mine to the wellsite

• Industry’s highest quality

customer service

MOVE. MINE. MANAGE.

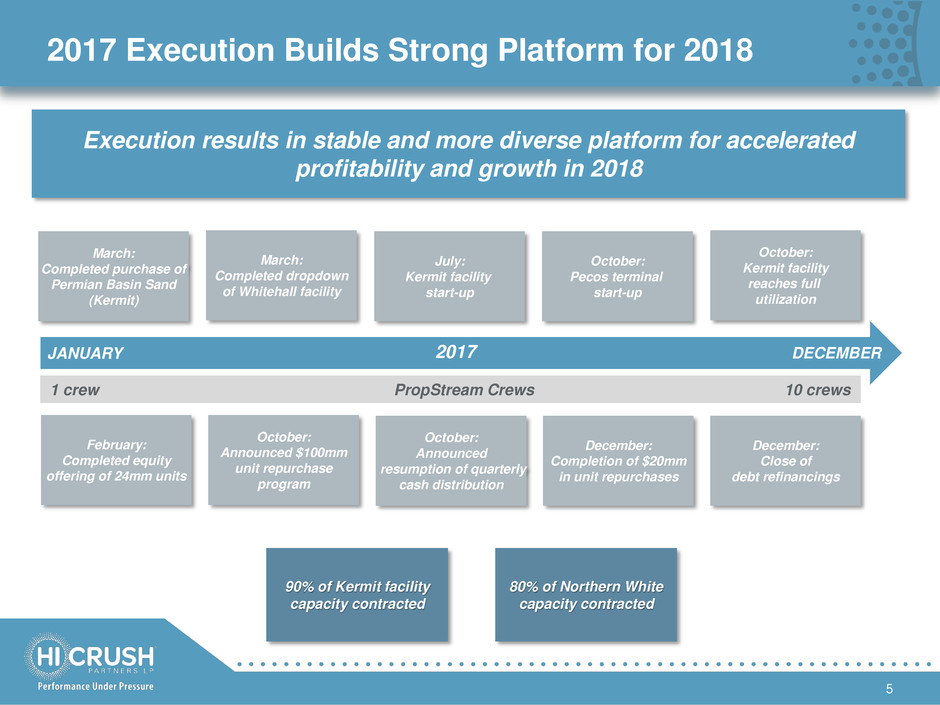

2017 Execution Builds Strong Platform for 2018

5

Execution results in stable and more diverse platform for accelerated

profitability and growth in 2018

March:

Completed purchase of

Permian Basin Sand

(Kermit)

JANUARY DECEMBER

March:

Completed dropdown

of Whitehall facility

July:

Kermit facility

start-up

2017

October:

Pecos terminal

start-up

October:

Kermit facility

reaches full

utilization

October:

Announced

resumption of quarterly

cash distribution

December:

Close of

debt refinancings

December:

Completion of $20mm

in unit repurchases

1 crew PropStream Crews 10 crews

February:

Completed equity

offering of 24mm units

90% of Kermit facility

capacity contracted

80% of Northern White

capacity contracted

October:

Announced $100mm

unit repurchase

program

Network Ownership Provides Logistics Advantage

6

Note: Map does not reflect all third party terminals utilized by Hi-Crush to deliver sand to customers

• Owned and operated logistics

network provides flexibility to

address changing demand

dynamics; proactively mitigates

impacts of potential bottlenecks

• Priority at owned and operated

terminals ensures quality

customer service and fast turn

times

• Unit train capabilities at majority

of 100+ origination / destination

pairings

• Moved 43% of Q4 2017

volumes sold through point of

sale at our terminals

• Managed logistics to the wellsite

for 15% of volumes sold via our

10 PropStream crews in Q4

2017

• Access to multiple third party

terminals

Bakken

DJ Basin

Permian SCOOP /

STACK

Eagle

Ford

Marcellus /

Utica

Logistics Network

Rail-served Sand Facility

Existing Terminal (HCLP owned)

Pecos Terminal (HCLP owned)

Mine-to-Well Sand Facility

Existing Terminal (Third party)

Wisconsin

Augusta

Wyeville

Whitehall

Blair

Haynesville

Kermit facility

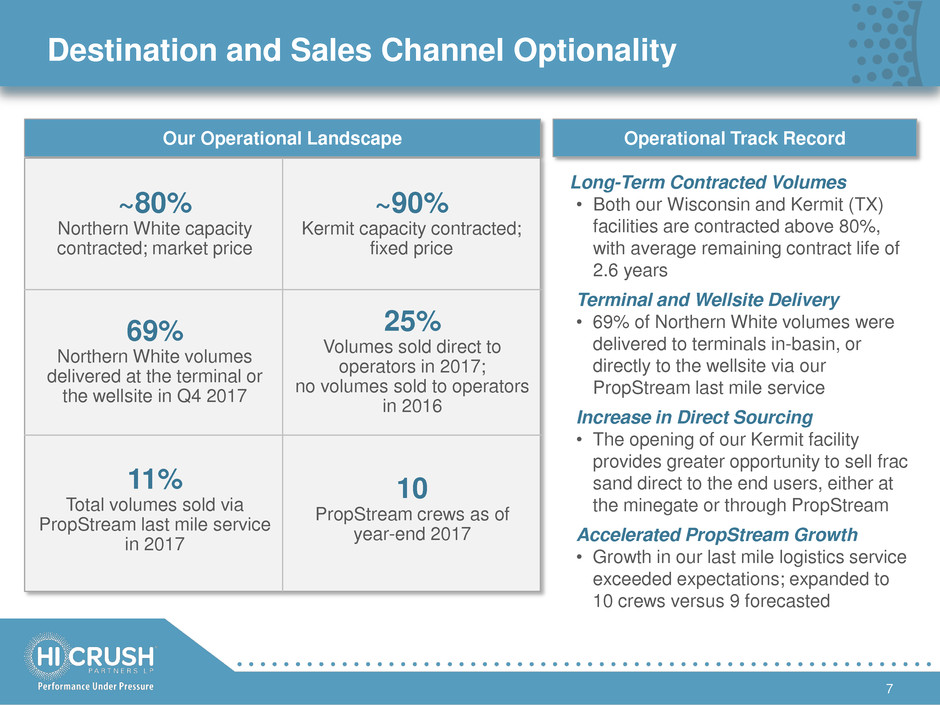

Operational Track Record Our Operational Landscape

~80%

Northern White capacity

contracted; market price

~90%

Kermit capacity contracted;

fixed price

69%

Northern White volumes

delivered at the terminal or

the wellsite in Q4 2017

25%

Volumes sold direct to

operators in 2017;

no volumes sold to operators

in 2016

11%

Total volumes sold via

PropStream last mile service

in 2017

Destination and Sales Channel Optionality

7

Long-Term Contracted Volumes

• Both our Wisconsin and Kermit (TX)

facilities are contracted above 80%,

with average remaining contract life of

2.6 years

Terminal and Wellsite Delivery

• 69% of Northern White volumes were

delivered to terminals in-basin, or

directly to the wellsite via our

PropStream last mile service

Increase in Direct Sourcing

• The opening of our Kermit facility

provides greater opportunity to sell frac

sand direct to the end users, either at

the minegate or through PropStream

Accelerated PropStream Growth

• Growth in our last mile logistics service

exceeded expectations; expanded to

10 crews versus 9 forecasted

10

PropStream crews as of

year-end 2017

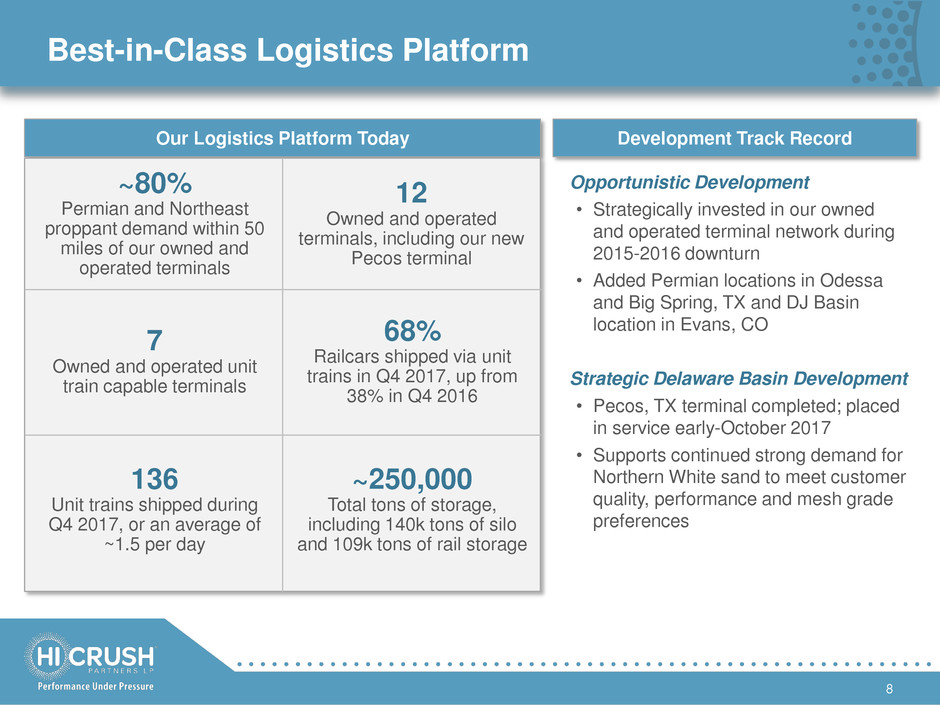

Development Track Record Our Logistics Platform Today

~250,000

Total tons of storage,

including 140k tons of silo

and 109k tons of rail storage

~80%

Permian and Northeast

proppant demand within 50

miles of our owned and

operated terminals

12

Owned and operated

terminals, including our new

Pecos terminal

7

Owned and operated unit

train capable terminals

68%

Railcars shipped via unit

trains in Q4 2017, up from

38% in Q4 2016

136

Unit trains shipped during

Q4 2017, or an average of

~1.5 per day

Best-in-Class Logistics Platform

8

Opportunistic Development

• Strategically invested in our owned

and operated terminal network during

2015-2016 downturn

• Added Permian locations in Odessa

and Big Spring, TX and DJ Basin

location in Evans, CO

Strategic Delaware Basin Development

• Pecos, TX terminal completed; placed

in service early-October 2017

• Supports continued strong demand for

Northern White sand to meet customer

quality, performance and mesh grade

preferences

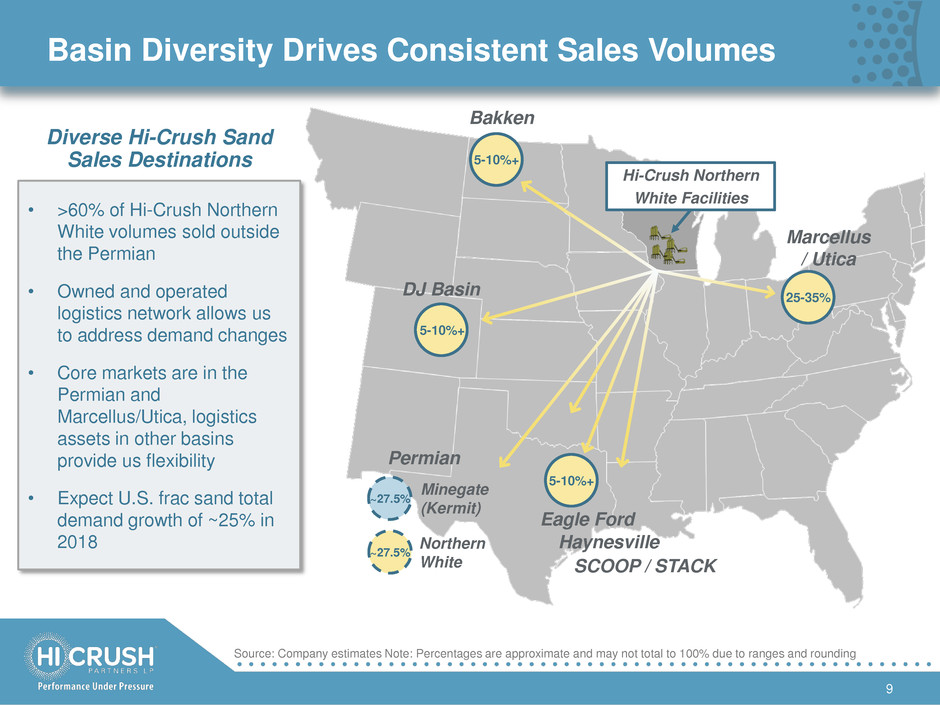

Basin Diversity Drives Consistent Sales Volumes

9

Bakken

DJ Basin

Permian

SCOOP / STACK

Eagle Ford

Marcellus

/ Utica

Haynesville

25-35%

5-10%+

5-10%+

5-10%+

~27.5%

~27.5%

Minegate

(Kermit)

Northern

White

• >60% of Hi-Crush Northern

White volumes sold outside

the Permian

• Owned and operated

logistics network allows us

to address demand changes

• Core markets are in the

Permian and

Marcellus/Utica, logistics

assets in other basins

provide us flexibility

• Expect U.S. frac sand total

demand growth of ~25% in

2018

Diverse Hi-Crush Sand

Sales Destinations

Hi-Crush Northern

White Facilities

Source: Company estimates Note: Percentages are approximate and may not total to 100% due to ranges and rounding

Permian Footprint Provides Multiple Delivery Points

10

• Hi-Crush operates multiple types

of facilities, in diverse locations

strategically positioned to serve

the Midland and Delaware Basins

• ~80% of activity in the Permian

region within a 50-mile radius of a

Hi-Crush facility1

• Optionality provided by Hi-Crush’s

facility locations, as well as

integration with our last mile

PropStream service, minimizes

trucking distances and reduces

logistics costs per well

• Partnership with a national

trucking company for last mile

logistics mitigates trucking

bottlenecks

Permian Service Footprint

50-mile radius of Pecos terminal Delaware Basin counties

Midland Basin counties

Proppant consumption heat map

50-mile radius of Kermit facility

50-mile radius of Odessa terminal

50-mile radius of Big Spring terminal

1) Estimate based on NavPort 2017/2018 YTD reported proppant volumes as of 2/13/18

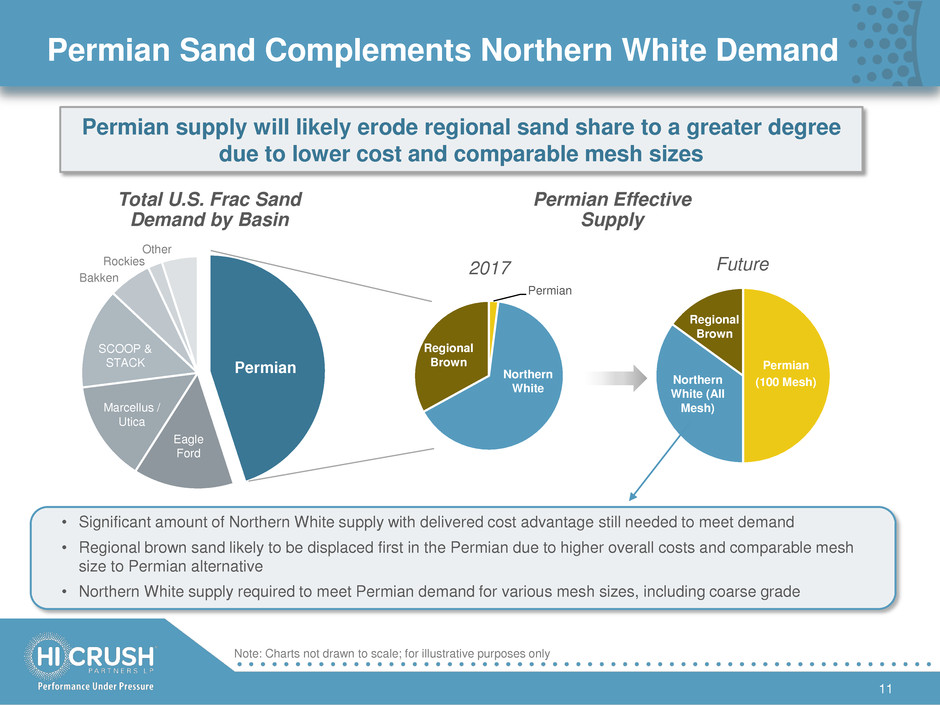

Permian Sand Complements Northern White Demand

11

Permian

(100 Mesh) Northern

White (All

Mesh)

Total U.S. Frac Sand

Demand by Basin

Permian Effective

Supply

Regional

Brown

2017 Future

Permian supply will likely erode regional sand share to a greater degree

due to lower cost and comparable mesh sizes

• Significant amount of Northern White supply with delivered cost advantage still needed to meet demand

• Regional brown sand likely to be displaced first in the Permian due to higher overall costs and comparable mesh

size to Permian alternative

• Northern White supply required to meet Permian demand for various mesh sizes, including coarse grade

Permian

Permian

Regional

Brown

Northern

White

Eagle

Ford

Marcellus /

Utica

SCOOP &

STACK

Bakken

Rockies

Other

Note: Charts not drawn to scale; for illustrative purposes only

Well-Positioned in Dynamic Demand Environment

12

1) Company estimates. Note: Charts not drawn to scale; for illustrative purposes only

0% 50% 100% 0% 50% 100%

Future Supply Sources Mesh Split (Demand)

15%

5%

10%

0% 25% 50%

Other

Rockies

Bakken

Marcellus / Utica

PermianPermian

Marcellus/Utica

Bakken

Rockies

Other

Demand (Future)

0% 50% 100% 0% 50% 100%

Total U.S.1 ~[VA

LUE]

0 40 80 120

Permian

Strong base of Northern White (“NW”)

demand in Permian due to mesh preferences

Majority of 2018 demand from regions

only economically supplied by NW

A

B

A B

20/40 30/50 40/70 100m Northern White Permian Regional

MM TPY

% of Total Demand

45-50%

20-25%

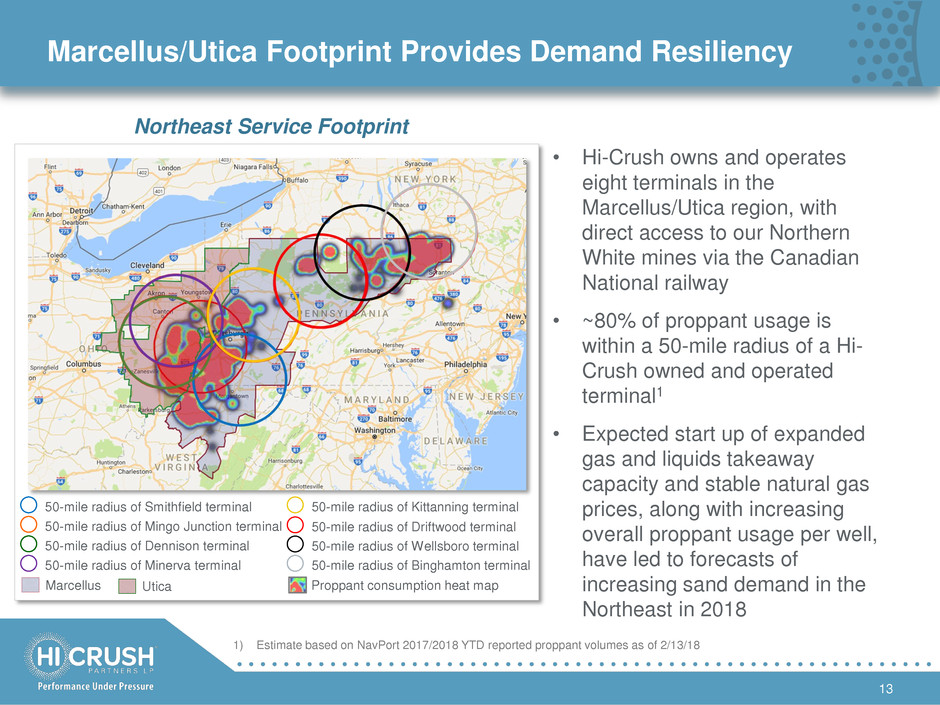

Marcellus/Utica Footprint Provides Demand Resiliency

13

• Hi-Crush owns and operates

eight terminals in the

Marcellus/Utica region, with

direct access to our Northern

White mines via the Canadian

National railway

• ~80% of proppant usage is

within a 50-mile radius of a Hi-

Crush owned and operated

terminal1

• Expected start up of expanded

gas and liquids takeaway

capacity and stable natural gas

prices, along with increasing

overall proppant usage per well,

have led to forecasts of

increasing sand demand in the

Northeast in 2018

50-mile radius of Smithfield terminal

50-mile radius of Mingo Junction terminal

50-mile radius of Dennison terminal

50-mile radius of Minerva terminal

50-mile radius of Kittanning terminal

50-mile radius of Driftwood terminal

50-mile radius of Wellsboro terminal

50-mile radius of Binghamton terminal

Proppant consumption heat map Marcellus Utica

1) Estimate based on NavPort 2017/2018 YTD reported proppant volumes as of 2/13/18

Northeast Service Footprint

PropStream Integrated Logistics Service

14

Safe. Efficient. Effective.

• Unique last mile proppant logistics solution reduces

costs and environmental impact by simplifying the

proppant delivery process through a fully flexible

service

• PropStream has to-date scored a perfect 100% on five

separate on-site safety audits conducted by a major

operator customer in the Permian Basin

• Reduces operator’s respirable silica exposures by more

than 96% vs. pneumatic alternative and complies with June

2018 OSHA standards

• Greater operating efficiency reduces non-productive time

and demurrage costs, improves truck cycle times and

enhances inventory management

• Superior accuracy and reliability through highly precise

sand delivery and greater than 99% uptime efficiency

• Gravity fed loading/unloading accelerates load times and

provides more consistent fills

• Container size and mobility enhances operational flexibility

Strategy & Outlook

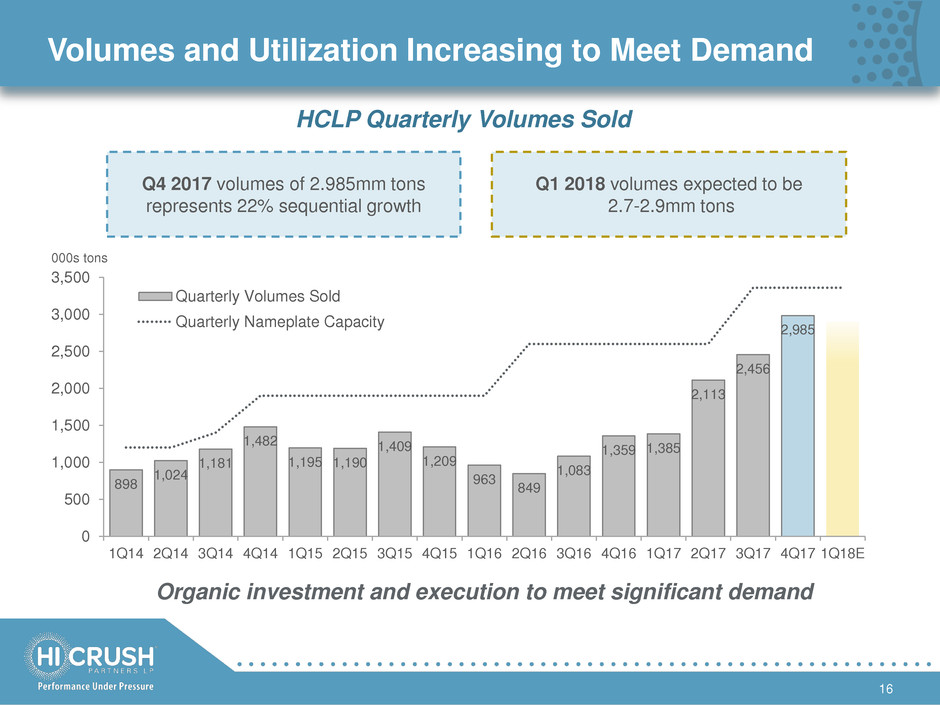

Volumes and Utilization Increasing to Meet Demand

16

898

1,024

1,181

1,482

1,195 1,190

1,409

1,209

963

849

1,083

1,359 1,385

2,113

2,456

2,985

0

500

1,000

1,500

2,000

2,500

3,000

3,500

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18E

000s tons

Quarterly Volumes Sold

Quarterly Nameplate Capacity

Q1 2018 volumes expected to be

2.7-2.9mm tons

Q4 2017 volumes of 2.985mm tons

represents 22% sequential growth

HCLP Quarterly Volumes Sold

Organic investment and execution to meet significant demand

Our Outlook – 2018 and Beyond

17

Advantage

to Integrated

Frac Sand

Companies

Direct

Sourcing by

End Users

Importance of

Controlling

Logistics

Range of Last

Mile Needs

We see the evolution of the frac sand industry

in 2018 and beyond building on three themes:

self sourcing, logistics excellence, and site-

specific last mile solutions

Direct Sourcing by End Users

• Direct sourcing creates a reliance on vendors

who can provide a reliable mine-to-wellsite

solution

Importance of Controlling Logistics

• We believe that this will advantage companies,

like Hi-Crush, with scale of operations,

geographic diversity, owned and operated

transportation networks, and trucking efficiency

• Increased activity will lead to logistics

bottlenecks that will advantage companies like

Hi-Crush that control access to a range of

logistics solutions

Range of Last Mile Needs

• Not all last mile needs will be met by one

system; vendors will target customer base that

will see the most value from their particular

solution

Sand Market Forces of Change

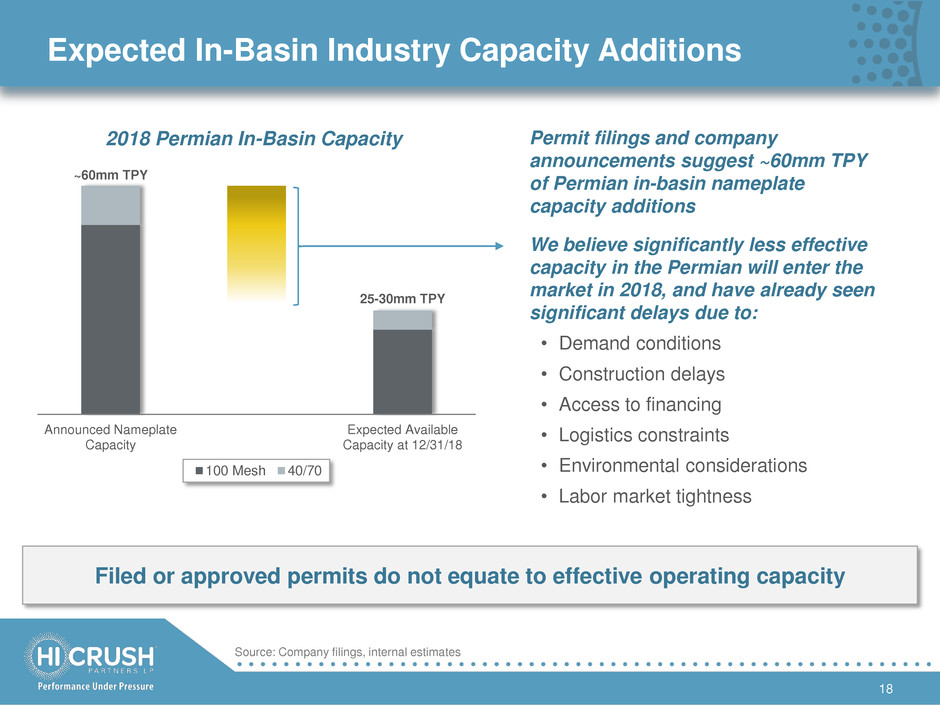

Expected In-Basin Industry Capacity Additions

18

Announced Nameplate

Capacity

Expected Available

Capacity at 12/31/18

100 Mesh 40/70

~60mm TPY

25-30mm TPY

Permit filings and company

announcements suggest ~60mm TPY

of Permian in-basin nameplate

capacity additions

We believe significantly less effective

capacity in the Permian will enter the

market in 2018, and have already seen

significant delays due to:

• Demand conditions

• Construction delays

• Access to financing

• Logistics constraints

• Environmental considerations

• Labor market tightness

2018 Permian In-Basin Capacity

Filed or approved permits do not equate to effective operating capacity

Source: Company filings, internal estimates

PropStream

Kermit

Strong Financial Outlook Using Modest Assumptions

19

$mm $5.0 $10.0 $15.0 $20.0 $25.0

75% 39 78 117 156 195

80% 42 83 125 166 208

85% 44 88 133 177 221

90% 47 94 140 187 234

95% 49 99 148 198 247

3.0mm TPY

~$35/ton

Kermit: ~$105mm

10 crews

~$1.5mm/crew

PropStream: ~$15mm

Northern White Contribution Margin Matrix

$mm $5.0 $10.0 $15.0 $20.0 $25.0

75% 158 197 236 275 314

80% 160 202 243 285 327

85% 163 207 251 295 340

90% 165 212 259 306 353

95% 168 217 267 316 366 --

-

N

W

Ut

ili

zat

ion

-

--

------------- Northern White Contribution Margin per Ton ----------

--

-

N

W

Ut

ili

zat

ion

-

--

Pre-G&A Margin Potential

Northern White Contribution Margin

Note: Northern White contribution margin based on total capacity of 10.4mm TPY

------------- Northern White Contribution Margin per Ton ----------

Historical Average

Contribution Margin

• 3Q14 - $44.00/ton

• 4Q16 - $3.51/ton

• 3Q17 - $19.39/ton

• 4Q17 - $23.46/ton

Leveraging Our Competitive Advantages

20

Factor Our Position The Hi-Crush Advantage

Size and

Scale

Five facilities, 13.4mm tons

of annual capacity

Premier supplier with operational flexibility and ability

to meet dynamic customer needs

Supply

Diversity

Leading supplier of Northern

White and Permian Basin

frac sand

13.4mm TPY of low-cost, high-quality frac sand

production with diversity of grades, geography and

mesh sizes

Best-in-Class

Assets

Market-leading cost structure

Best-in-class cost structure provides competitive,

financial and operational advantages from mine to

wellsite

Distribution

Network

Class-1 rail origins; strategic

owned terminal network;

Permian Basin production

Direct access to UP and CN railroads combined with

Kermit facility and PropStream last mile solution

extends competitive advantages to the wellsite

Customer

Relationships

Strong, long-term

relationships

Increasing profitable market share through extending

relationships with key customers and expanding direct

sourcing; benefiting from supply source consolidation

Balance

Sheet

Ample liquidity and

significant capital flexibility

Maintain and improve conservative position; strong

ability to pursue potential attractive growth

opportunities

Capital

Return

Balanced approach to

returning value to unitholders

Flexibility to return capital to unitholders through

meaningful and sustainable distribution growth and

disciplined buyback program

21

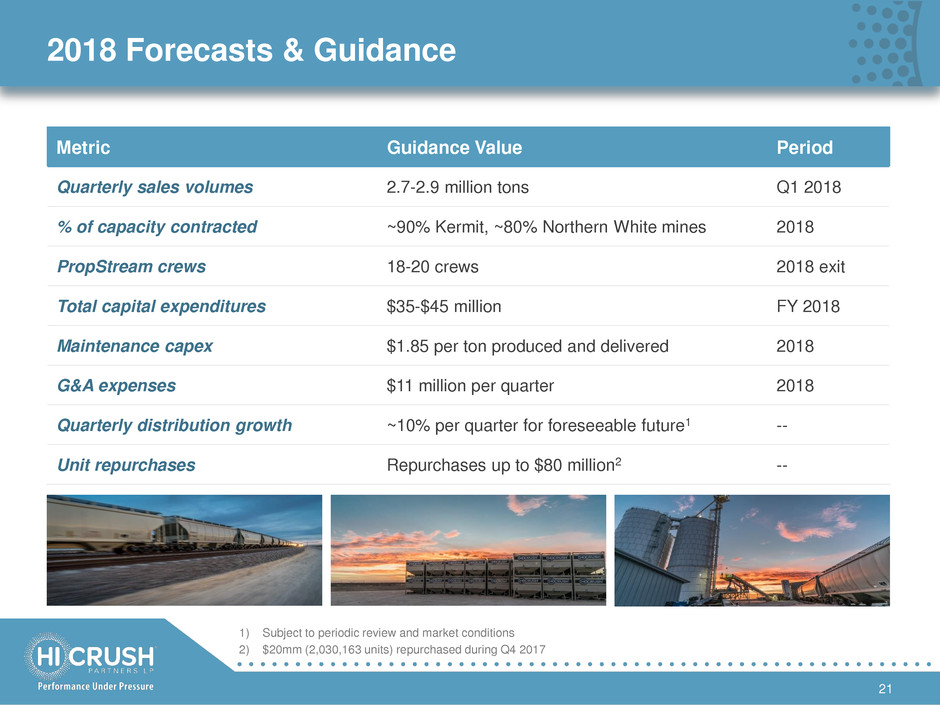

2018 Forecasts & Guidance

Metric Guidance Value Period

Quarterly sales volumes 2.7-2.9 million tons Q1 2018

% of capacity contracted ~90% Kermit, ~80% Northern White mines 2018

PropStream crews 18-20 crews 2018 exit

Total capital expenditures $35-$45 million FY 2018

Maintenance capex $1.85 per ton produced and delivered 2018

G&A expenses $11 million per quarter 2018

Quarterly distribution growth ~10% per quarter for foreseeable future1 --

Unit repurchases Repurchases up to $80 million2 --

1) Subject to periodic review and market conditions

2) $20mm (2,030,163 units) repurchased during Q4 2017

Financial Results

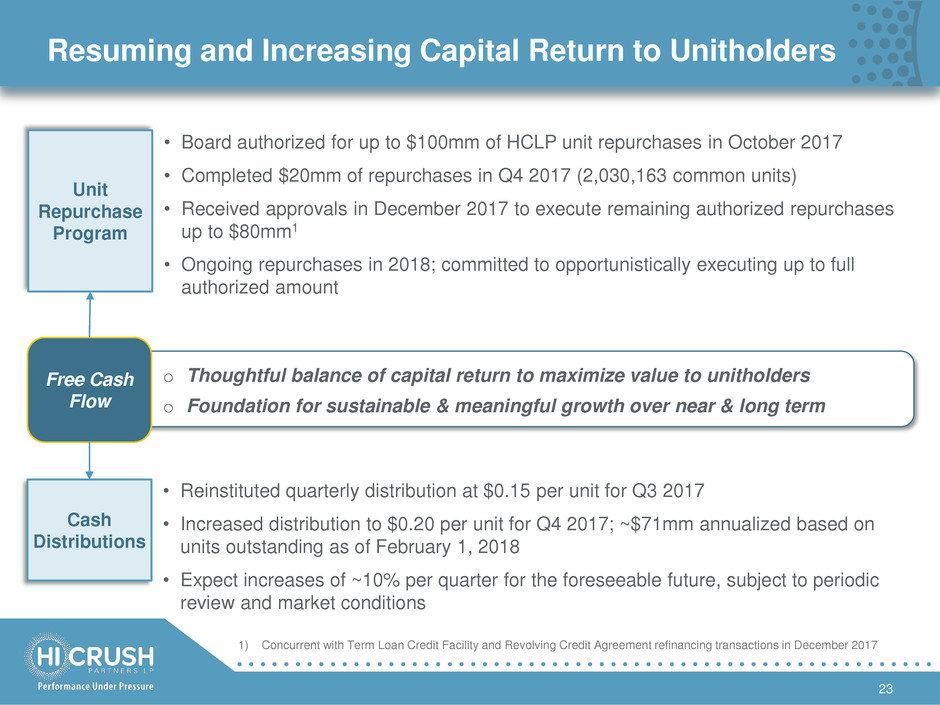

Resuming and Increasing Capital Return to Unitholders

• Reinstituted quarterly distribution at $0.15 per unit for Q3 2017

• Increased distribution to $0.20 per unit for Q4 2017; ~$71mm annualized based on

units outstanding as of February 1, 2018

• Expect increases of ~10% per quarter for the foreseeable future, subject to periodic

review and market conditions

• Board authorized for up to $100mm of HCLP unit repurchases in October 2017

• Completed $20mm of repurchases in Q4 2017 (2,030,163 common units)

• Received approvals in December 2017 to execute remaining authorized repurchases

up to $80mm1

• Ongoing repurchases in 2018; committed to opportunistically executing up to full

authorized amount

23

Unit

Repurchase

Program

Free Cash

Flow

Cash

Distributions

1) Concurrent with Term Loan Credit Facility and Revolving Credit Agreement refinancing transactions in December 2017

o Thoughtful balance of capital return to maximize value to unitholders

o Foundation for sustainable & meaningful growth over near & long term

24

Extended Maturity Profile and Enhanced Flexibility

Revolver Refinancing Term Loan Refinancing

• In December 2017, entered into new 7-year

$200mm Term Loan Credit Facility

• Extends maturity by 3+ years to December 2024

• Bears interest at (a) base rate + 2.75%, or (b)

Eurodollar + 3.75%, subject to a 1.00% LIBOR

floor1

• Term Loan rated B3 by Moody’s and B- by S&P

• No limitation on unit repurchases or cash

distributions

• In December 2017, entered into new 5-year

$125mm Revolving Credit Agreement

• Upsized from previous capacity of $75mm

• Extends maturity by 3+ years to December 2022

• No outstanding borrowings on revolver as of

December 31, 2017

• No limitation on unit repurchases or cash

distributions

• Maximum leverage ratio of 3.25x2

1) Subject to a 0.25% rate increase during any period the Partnership does not have a public corporate family rating of

B2 or higher from Moody’s.

2) Financial covenants also include minimum asset coverage ratio of 1.5x and minimum interest coverage ratio of 2.5x.

75

200

125

200

0

50

100

150

200

250

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

$

M

M

Old

Revolver

New

Revolver

Old Term

Loan

New Term

Loan

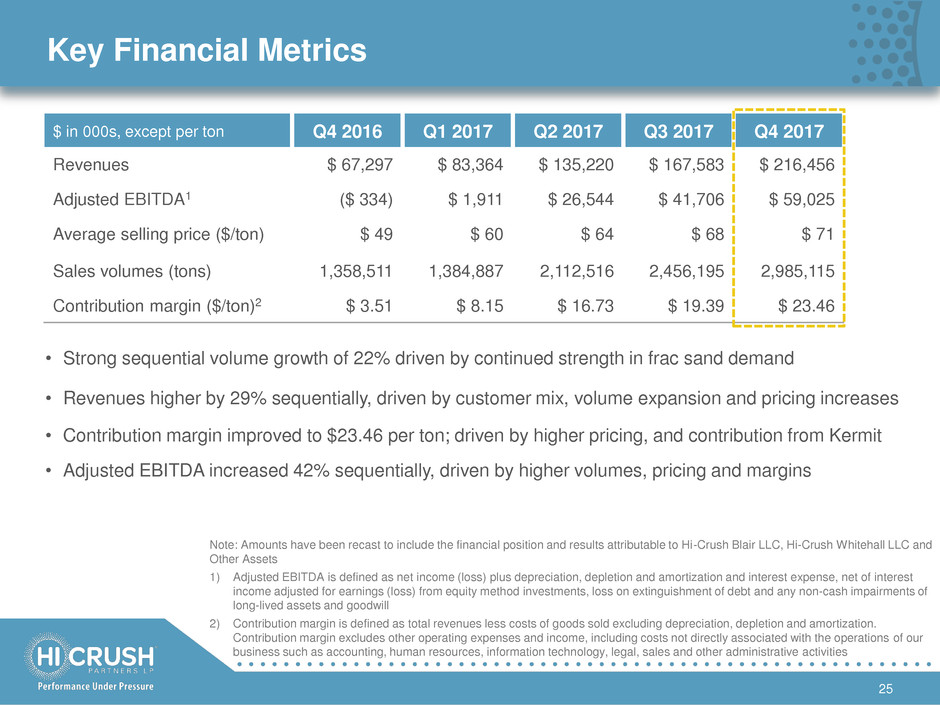

Key Financial Metrics

25

$ in 000s, except per ton Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Revenues $ 67,297 $ 83,364 $ 135,220 $ 167,583 $ 216,456

Adjusted EBITDA1 ($ 334) $ 1,911 $ 26,544 $ 41,706 $ 59,025

Average selling price ($/ton) $ 49 $ 60 $ 64 $ 68 $ 71

Sales volumes (tons) 1,358,511 1,384,887 2,112,516 2,456,195 2,985,115

Contribution margin ($/ton)2 $ 3.51 $ 8.15 $ 16.73 $ 19.39 $ 23.46

Note: Amounts have been recast to include the financial position and results attributable to Hi-Crush Blair LLC, Hi-Crush Whitehall LLC and

Other Assets

1) Adjusted EBITDA is defined as net income (loss) plus depreciation, depletion and amortization and interest expense, net of interest

income adjusted for earnings (loss) from equity method investments, loss on extinguishment of debt and any non-cash impairments of

long-lived assets and goodwill

2) Contribution margin is defined as total revenues less costs of goods sold excluding depreciation, depletion and amortization.

Contribution margin excludes other operating expenses and income, including costs not directly associated with the operations of our

business such as accounting, human resources, information technology, legal, sales and other administrative activities

• Strong sequential volume growth of 22% driven by continued strength in frac sand demand

• Revenues higher by 29% sequentially, driven by customer mix, volume expansion and pricing increases

• Contribution margin improved to $23.46 per ton; driven by higher pricing, and contribution from Kermit

• Adjusted EBITDA increased 42% sequentially, driven by higher volumes, pricing and margins

Strong Liquidity and Financial Flexibility

26

1) Senior secured term loan: $200mm original face value at L+3.75%; rated B3 and B- by Moody’s and Standard &

Poor’s, respectively; includes accordion feature to increase capacity to $300mm. Presented net of discounts and

issuance costs.

2) Revolving credit agreement at 12/31/17: $104.3mm available at L+2.75% ($125mm capacity less $20.7mm of LCs).

Revolver facility capacity increased to $125mm in December 2017.

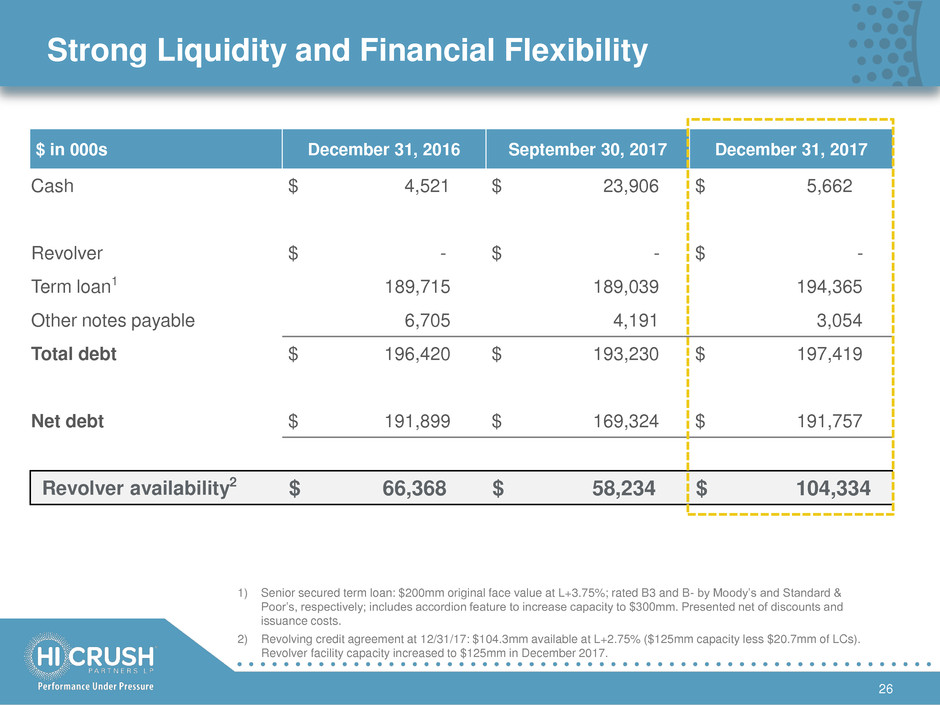

$ in 000s December 31, 2016 September 30, 2017 December 31, 2017

Cash $ 4,521 $ 23,906 $ 5,662

Revolver $ - $ - $ -

Term loan1 189,715 189,039 194,365

Other notes payable 6,705 4,191 3,054

Total debt $ 196,420 $ 193,230 $ 197,419

Net debt $ 191,899 $ 169,324 $ 191,757

Revolver availability2 $ 66,368 $ 58,234 $ 104,334

Q4 2017 Summary – Statements of Operations

27

1) Financial information has been recast to include the financial position and results attributable to Hi-Crush Whitehall

LLC, 2.0% equity interest in Hi-Crush Augusta LLC and PDQ Properties LLC (together the "Other Assets")

Unaudited Quarterly Consolidated Statements of Operations

(Amounts in thousands, except per unit amounts)

28

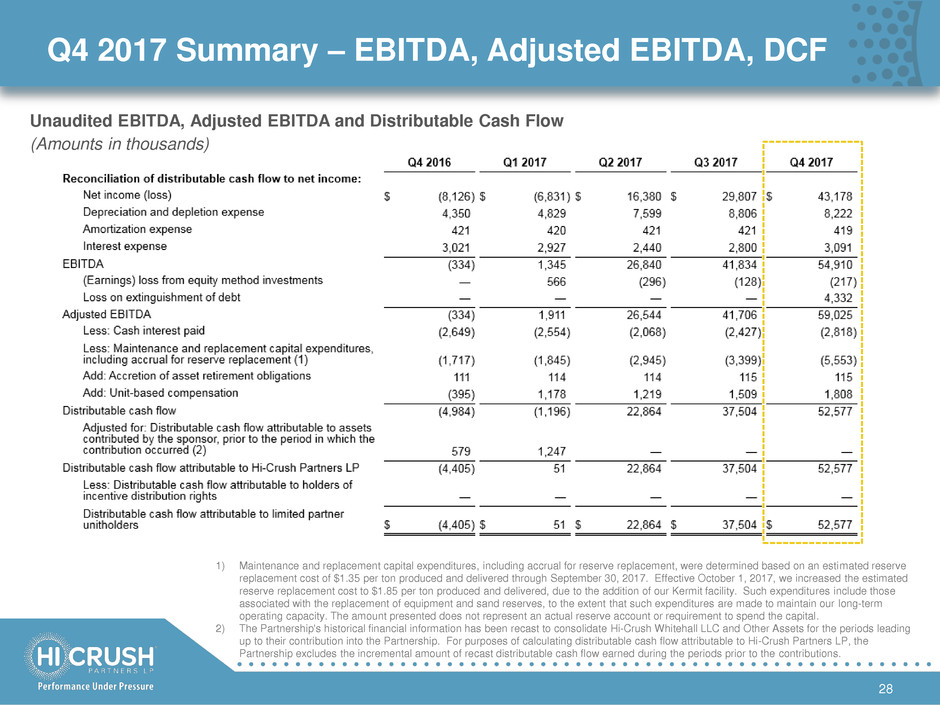

Q4 2017 Summary – EBITDA, Adjusted EBITDA, DCF

Unaudited EBITDA, Adjusted EBITDA and Distributable Cash Flow

(Amounts in thousands)

1) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated reserve

replacement cost of $1.35 per ton produced and delivered through September 30, 2017. Effective October 1, 2017, we increased the estimated

reserve replacement cost to $1.85 per ton produced and delivered, due to the addition of our Kermit facility. Such expenditures include those

associated with the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term

operating capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital.

2) The Partnership's historical financial information has been recast to consolidate Hi-Crush Whitehall LLC and Other Assets for the periods leading

up to their contribution into the Partnership. For purposes of calculating distributable cash flow attributable to Hi-Crush Partners LP, the

Partnership excludes the incremental amount of recast distributable cash flow earned during the periods prior to the contributions.

Appendix

Investor Presentation | September, 2013 29

Hi-Crush’s Production Portfolio

30

Wyeville Blair Augusta Whitehall Kermit

Capacity 1.85mm TPY 2.86mm TPY 2.86mm TPY 2.86mm TPY 3.00mm TPY

Type

Northern

White

Northern

White

Northern

White

Northern

White

Permian

Pearl

Reserve Life1 40 years 40 years 13 years 27 years 35 years

Takeaway

Union

Pacific

Canadian

National

Union

Pacific

Canadian

National

Direct to

Truck

Location Wisconsin Wisconsin Wisconsin Wisconsin West Texas

Site

1) Reserve life estimates based on reserve reports prepared by JT Boyd

Efficient Railcar Management

31

Railcar Fleet1 FY 2016 Q3 2017 Q4 2017 FY 2017

Leased or Owned 4,200 4,172 4,253 4,253

Customer or System 1,358 2,228 2,404 2,404

Total 5,558 6,400 6,657 6,657

In Storage 605 None None None

Lease Costs (for the period ending) $28.9mm $6.8mm $6.8mm $27.4mm

Unit trains 138 126 136 436

% of railcars shipped via unit

trains

39% 65% 68% 63%

• All railcars remobilized from storage in early 2017 to meet increasing demand

• 63% of railcars shipped via unit train in 2017 vs. 39% in 2016

• Effective management reduces costs and enhances customer service

Railcar

Management

Update

Efficiently managing our railcar fleet; well-positioned to service increased activity

1) As of end of period