Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TCF FINANCIAL CORP | chfc8-kfebruary2018confere.htm |

Realizing our Ever Greater

Potential

Thomas C. Shafer

Vice Chairman, Chief Executive

Officer of Chemical Bank

Dennis Klaeser

Chief Financial Officer

Katie Wendt

Chief Accounting Officer

February 2017

KBW Winter Financial Services Symposium

This presentation and the accompanying presentation by management may contain forward-looking statements that are based on management's beliefs, assumptions, current

expectations, estimates and projections about the financial services industry, the economy and Chemical Financial Corporation ("Chemical"). Words and phrases such as "anticipates,"

"believes," “focus,” "continue," "estimates," "expects," "forecasts," "future," "intends," "is likely," "opinion," "opportunity," "plans," "potential," "predicts," "probable," "projects,"

"should," "strategic," "trend," "will," and variations of such words and phrases or similar expressions are intended to identify such forward-looking statements. These statements

include, among others, that Chemical is well-positioned to build market share and enhance revenue growth, plans to invest in commercial lending and banking teams, make key

operational staff additions and enhance core operating systems, the strength of our loans pipeline, including expected first quarter loan originations, our focus and expectations around

building shareholder value, including organic revenue growth, and cost discipline and expanding our market presence and product lines. All statements referencing future time periods

are forward-looking. Management's determination of the provision and allowance for loan losses; the carrying value of acquired loans, goodwill and mortgage servicing rights; the fair

value of investment securities (including whether any impairment on any investment security is temporary or other-than-temporary and the amount of any impairment); and

management's assumptions concerning pension and other postretirement benefit plans involve judgments that are inherently forward-looking. There can be no assurance that future

loan losses will be limited to the amounts estimated. All of the information concerning interest rate sensitivity is forward-looking. The future effect of changes in the financial and

credit markets and the national and regional economies on the banking industry, generally, and on Chemical, specifically, are also inherently uncertain.

Forward-looking statements are based upon current beliefs and expectations and involve substantial risks and uncertainties that could cause actual results to differ materially from

those expressed or implied by such forward-looking statements. Accordingly, such statements are not guarantees of future performance and involve certain risks, uncertainties and

assumptions ("risk factors") that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ

from what may be expressed or forecasted in such forward-looking statements. Chemical undertakes no obligation to update, amend or clarify forward-looking statements, whether as

a result of new information, future events or otherwise. Risk factors including, without limitation:

• Chemical’s ability to attract and retain new commercial lenders and other bankers as well as key operations staff in light of competition for experienced employees in the banking

industry;

• Chemical’s ability to grow its deposits while reducing the number of physical branches that it operates;

• Chemical’s ability to control operational expenses;

• Negative reactions to the branch closures by Chemical Bank’s customers, employees and other counterparties;

• Economic conditions (both generally and in Chemical’s markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a

reduction in demand for credit and a decline in real estate values;

• A general decline in the real estate and lending markets, particularly in Chemical’s market areas, could negatively affect Chemical’s financial results;

• Increased cybersecurity risk, including potential network breaches, business disruptions, or financial losses;

• Restrictions or conditions imposed by Chemical’s or Chemical Bank’s regulators on Chemical’s or Chemical Bank’s operations may make it more difficult for Chemical to

achieve its goals;

• Legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect Chemical;

• Changes in the interest rate environment may reduce margins or the volumes or values of the loans Chemical makes or has acquired; and

• Economic, governmental, or other factors may prevent the projected population, residential, and commercial growth in the markets in which Chemical operates.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A of Chemical’s most recent Annual Report on Form 10-K or disclosed in documents filed or

furnished by the Company with or to the SEC after the filing of such Annual Report on Form 10-K. These and other factors are representative of the risk factors that may emerge and

could cause a difference between an ultimate actual outcome and a preceding forward-looking statement.

Forward-Looking Statements

2

Non-GAAP Financial Measures

This presentation and the accompanying presentation by management contain certain non-GAAP financial disclosures that are not in accordance with U.S. generally accepted

accounting principles ("GAAP"). Such non-GAAP financial measures include Chemical’s tangible shareholders' equity to tangible assets ratio, tangible book value per share,

presentation of net interest income and net interest margin on a fully taxable equivalent basis, operating expenses-core (which excludes merger and restructuring expenses and

impairment of income tax credits), operating expenses-efficiency ratio (which excludes merger and restructuring expenses, impairment of income tax credits and amortization of

intangibles), the adjusted efficiency ratio (which excludes significant items, impairment of income tax credits, loan servicing rights change in fair value gains (losses), amortization of

intangibles, net interest income FTE adjustments, (losses) gains from sale of investment securities and closed branch locations) and other information presented excluding significant

items, including net income, diluted earnings per share, return on average assets and return on average shareholders' equity. Chemical uses non-GAAP financial measures to provide

meaningful, supplemental information regarding its operational results and to enhance investors’ overall understanding of Chemical’s financial performance. The limitations associated

with non-GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might

calculate these measures differently. These disclosures should not be considered an alternative to Chemical’s GAAP results. See the Appendix included with this presentation for a

reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

Non-GAAP Financial Measures

3

Emphasize our strategy of

being the Premier Midwest

Community Bank

4

1

Demonstrated track record of

organic growth2

Strong performance metrics and

profitability should drive upside3

Realizing our ever greater potential

The largest banking company headquartered in Michigan

Scalable core strategies and disciplines

Proven organic growth initiatives

Leadership in EPS growth among peers (1)

Total Return out-performans (peers and indices) (1)

ROAA(2) 1.3%, ROAE(2) 9.4%, ROATCE(2) 16.5%, low efficiency ratio

Delivering on projected merger benefits

Consistent EPS growth performance

Market share growth

Revenue enhancements

Concentrate on achieving cost savings and exploiting business synergy opportunities

Continue to build out and enhance risk management practices

(1) Source: S&P Global Market Intelligence

(2) ROAA, ROAE and ROATCE, excluding significant items, are non-GAAP financial measure. “Significant items” are defined as merger expenses, restructuring expenses

and the fourth quarter of 2017 losses on sales of investment securities as part of the Corporation’s treasury and tax management objectives. Refer to the Appendix for a

reconciliation of non-GAAP financial measures.

Overview

4

“Local” community bank

Strong belief in the community banking concept

Community-driven leadership, rapid local response

Emphasis on building relationships

We know our markets; what works, and what does not work

Strong credit culture

Diversification

In-depth knowledge of our customers and markets

Underwriting discipline

Low cost, stable, core funding – starts at relationship level

Expense management and control

Clean balance sheet, solid capital ratios and intense focus on effective capital deployment

Identify, hire, motivate and retain talented individuals to carry out our relationship strategies

Sustain long-term growth through combination of organic and acquisitive growth

Higher lending limits provide enhanced middle market lending growth opportunities

Opportunities for fee income growth from Wealth Management and Mortgage Banking synergies

Enhancing preparedness for future acquisitive growth opportunities in Michigan, Ohio, and Indiana

Scalable Core Strategies & Disciplines

Core Values

5

6

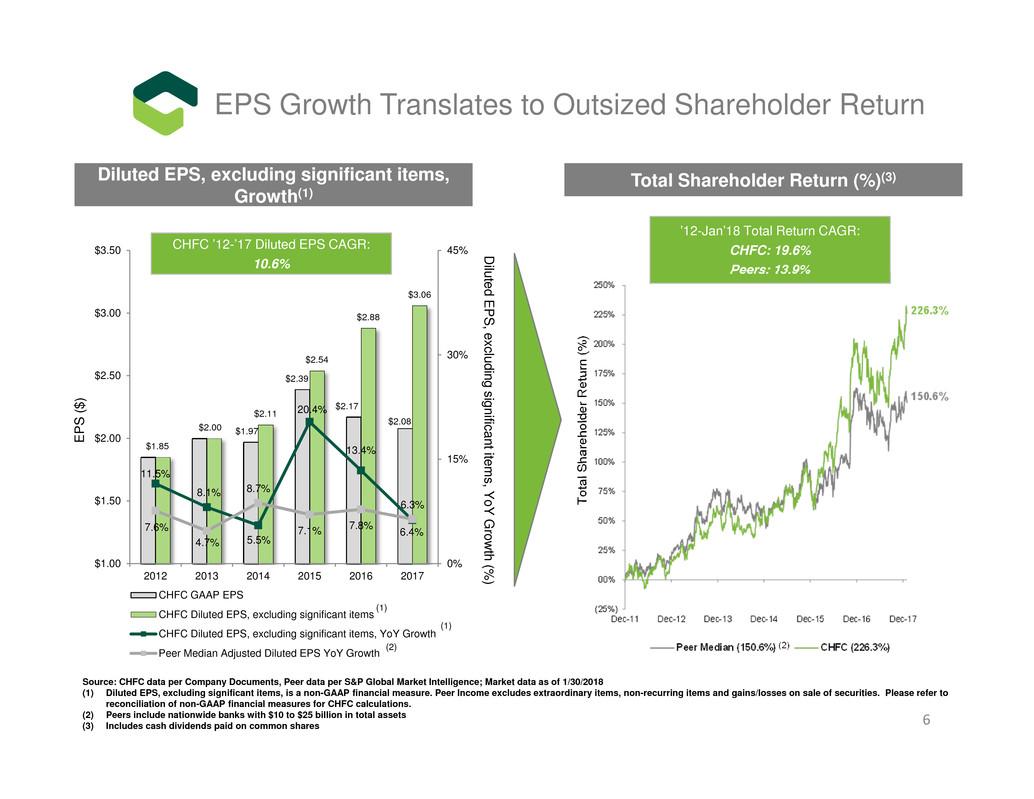

EPS Growth Translates to Outsized Shareholder Return

Source: CHFC data per Company Documents, Peer data per S&P Global Market Intelligence; Market data as of 1/30/2018

(1) Diluted EPS, excluding significant items, is a non-GAAP financial measure. Peer Income excludes extraordinary items, non-recurring items and gains/losses on sale of securities. Please refer to

reconciliation of non-GAAP financial measures for CHFC calculations.

(2) Peers include nationwide banks with $10 to $25 billion in total assets

(3) Includes cash dividends paid on common shares

Diluted EPS, excluding significant items,

Growth(1)

Total Shareholder Return (%)(3)

(2)

E

P

S

(

$

)

D

iluted E

P

S

, excluding significant item

s, Y

oY

G

row

th (%

)

T

o

t

a

l

S

h

a

r

e

h

o

l

d

e

r

R

e

t

u

r

n

(

%

)

(2)

CHFC ’12-’17 Diluted EPS CAGR:

10.6%

(1)

(1)

’12-Jan’18 Total Return CAGR:

CHFC: 19.6%

Peers: 13.9%

$1.97

$2.39

$2.17

$2.08

$1.85

$2.00

$2.11

$2.54

$2.88

$3.06

11.5%

8.1%

5.5%

20.4%

13.4%

6.3%

7.6%

4.7%

8.7%

7.1% 7.8% 6.4%

0%

15%

30%

45%

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2012 2013 2014 2015 2016 2017

CHFC GAAP EPS

CHFC Diluted EPS, excluding significant items

CHFC Diluted EPS, excluding significant items, YoY Growth

Peer Median Adjusted Diluted EPS YoY Growth

$19.3 billion in assets

Largest banking company headquartered and

operating branches in Michigan

Operates 212 banking offices primarily in Michigan,

Northeast Ohio and Northern Indiana

Local market knowledge and business development

opportunities led by community-based advisory

boards

One of the largest trust and wealth management

operations of a Michigan-headquartered bank with

$5.1 billion in assets under management or custody

and another $1.3 billion in assets within the Chemical

Financial Advisors Program

Focused on realizing operating and business synergies

from Chemical/Talmer merger, enhancing organic growth

potential and growing market share in key urban

markets

$4.1 billion Market Capitalization(1)

(1) Based upon CHFC shares outstanding of 71.3 million and the CHFC stock price of $58.09 on January 30, 2018.

About Chemical Financial Corporation

7

8

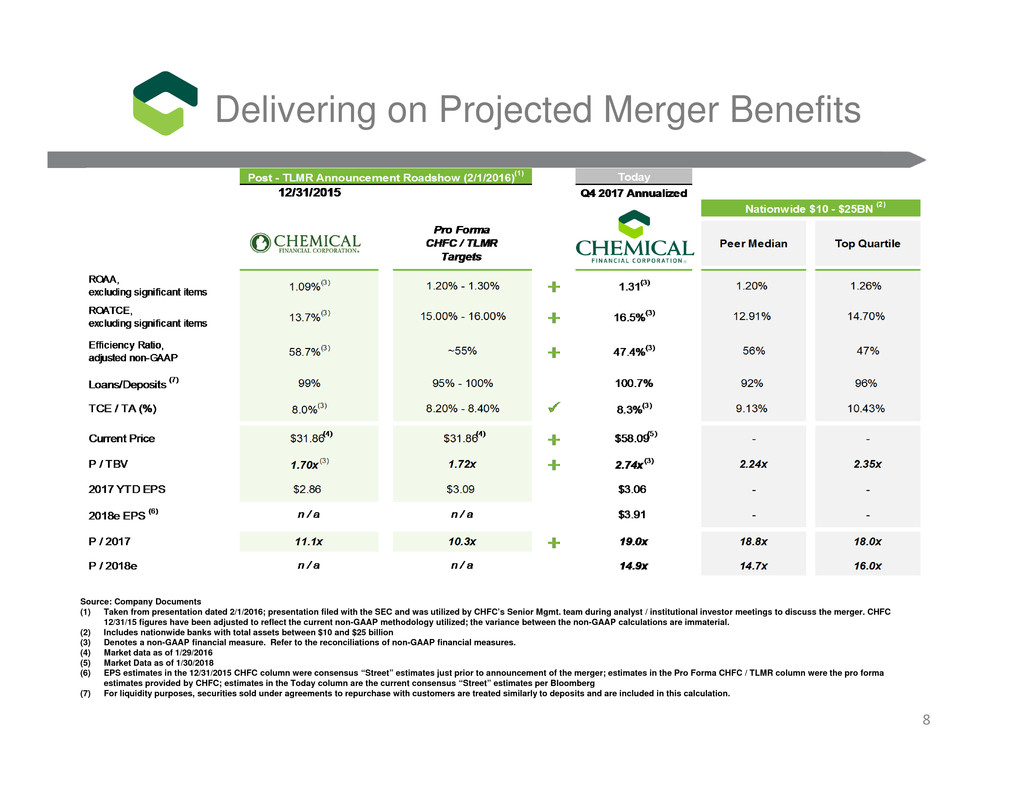

Delivering on Projected Merger Benefits

Source: Company Documents

(1) Taken from presentation dated 2/1/2016; presentation filed with the SEC and was utilized by CHFC’s Senior Mgmt. team during analyst / institutional investor meetings to discuss the merger. CHFC

12/31/15 figures have been adjusted to reflect the current non-GAAP methodology utilized; the variance between the non-GAAP calculations are immaterial.

(2) Includes nationwide banks with total assets between $10 and $25 billion

(3) Denotes a non-GAAP financial measure. Refer to the reconciliations of non-GAAP financial measures.

(4) Market data as of 1/29/2016

(5) Market Data as of 1/30/2018

(6) EPS estimates in the 12/31/2015 CHFC column were consensus “Street” estimates just prior to announcement of the merger; estimates in the Pro Forma CHFC / TLMR column were the pro forma

estimates provided by CHFC; estimates in the Today column are the current consensus “Street” estimates per Bloomberg

(7) For liquidity purposes, securities sold under agreements to repurchase with customers are treated similarly to deposits and are included in this calculation.

62.7%

64.2%

65.3%

63.2%

67.2%

60.1%60.8%

63.1%

61.6%

58.7%

54.4%

51.9%

59.5%

63.0%

61.2%

59.4%

57.5%

59.6%

50.0%

53.0%

56.0%

59.0%

62.0%

65.0%

68.0%

2012 2013 2014 2015 2016 2017

CHFC, GAAP CHFC, adjusted Peer Median

11.2%

11.4%

10.3%

12.8%

11.2%

10.2%

11.2%

11.4% 11.2%

13.7%

14.6%

15.2%

10.9%

11.8% 11.5% 11.5% 11.4%

13.4%

8.00%

10.00%

12.00%

14.00%

16.00%

2012 2013 2014 2015 2016 2017

CHFC CHFC, adjusted Peer Median

0.9% 1.0%

1.0%

1.0%

0.9%

0.8%

0.9% 0.9%

1.0%

1.1%

1.2% 1.2%

0.9%

1.1% 1.1% 1.1%

1.1%

1.0%

0.7%

0.8%

0.9%

1.0%

1.1%

1.2%

1.3%

2012 2013 2014 2015 2016 2017

CHFC, GAAP CHFC, adjusted Peer Median

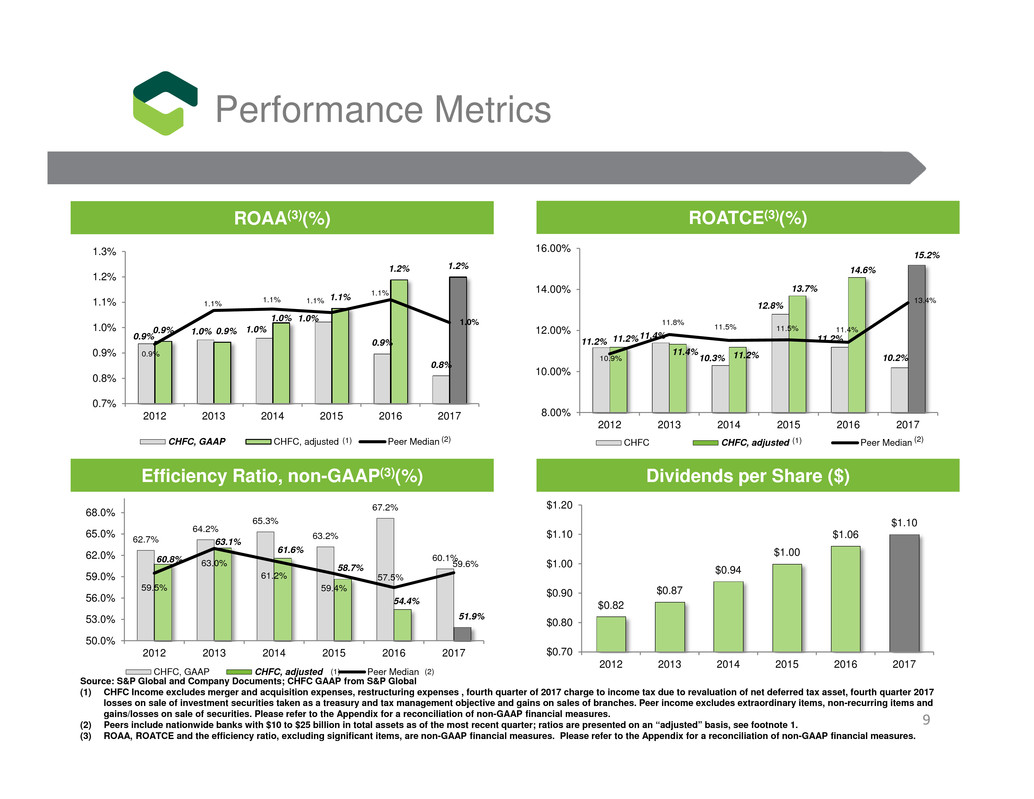

ROAA(3)(%)

Performance Metrics

Source: S&P Global and Company Documents; CHFC GAAP from S&P Global

(1) CHFC Income excludes merger and acquisition expenses, restructuring expenses , fourth quarter of 2017 charge to income tax due to revaluation of net deferred tax asset, fourth quarter 2017

losses on sale of investment securities taken as a treasury and tax management objective and gains on sales of branches. Peer income excludes extraordinary items, non-recurring items and

gains/losses on sale of securities. Please refer to the Appendix for a reconciliation of non-GAAP financial measures.

(2) Peers include nationwide banks with $10 to $25 billion in total assets as of the most recent quarter; ratios are presented on an “adjusted” basis, see footnote 1.

(3) ROAA, ROATCE and the efficiency ratio, excluding significant items, are non-GAAP financial measures. Please refer to the Appendix for a reconciliation of non-GAAP financial measures.

ROATCE(3)(%)

Efficiency Ratio, non-GAAP(3)(%)

(2) (2)

(2)

Dividends per Share ($)

(1) (1)

$0.82

$0.87

$0.94

$1.00

$1.06

$1.10

$0.70

$0.80

$0.90

$1.00

$1.10

$1.20

2012 2013 2014 2015 2016 2017

(1)

9

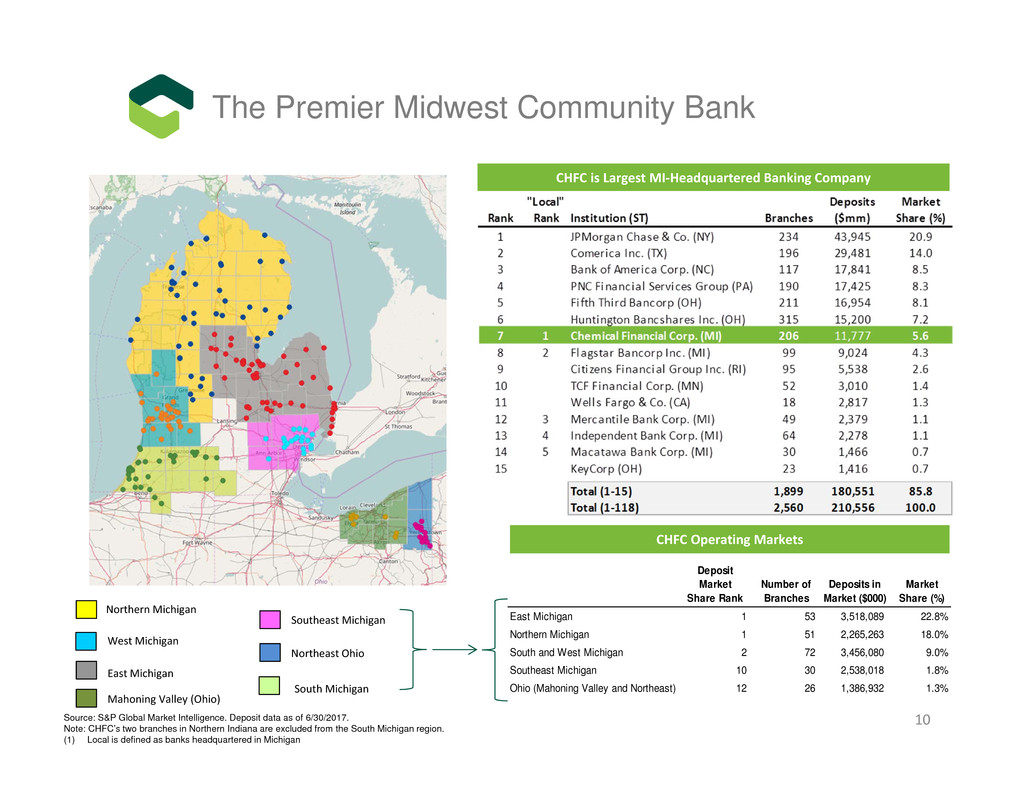

CHFC is Largest MI‐Headquartered Banking Company

CHFC Operating Markets

Source: S&P Global Market Intelligence. Deposit data as of 6/30/2017.

Note: CHFC’s two branches in Northern Indiana are excluded from the South Michigan region.

(1) Local is defined as banks headquartered in Michigan

Northern Michigan

Southeast Michigan

West Michigan

East Michigan

Northeast Ohio

The Premier Midwest Community Bank

South Michigan

Mahoning Valley (Ohio)

Deposit

Market

Share Rank

Number of

Branches

Deposits in

Market ($000)

Market

Share (%)

East Michigan 1 53 3,518,089 22.8%

Northern Michigan 1 51 2,265,263 18.0%

South and West Michigan 2 72 3,456,080 9.0%

Southeast Michigan 10 30 2,538,018 1.8%

Ohio (Mahoning Valley and Northeast) 12 26 1,386,932 1.3%

10

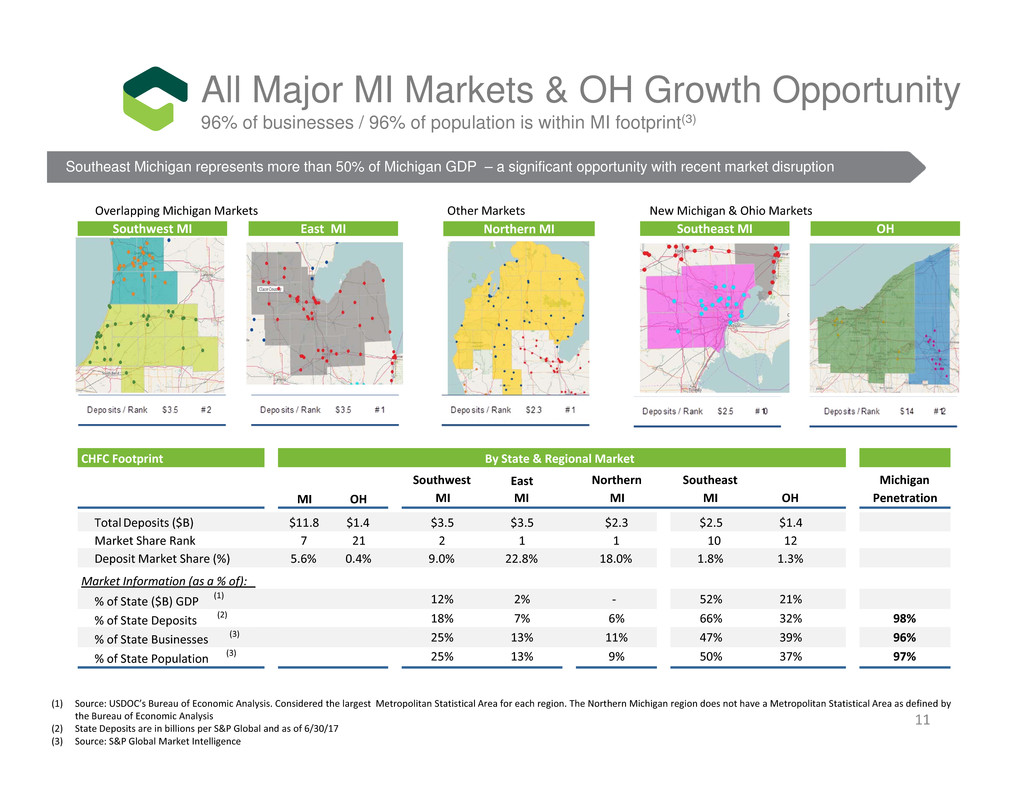

Overlapping Michigan Markets New Michigan & Ohio MarketsOther Markets

Southwest MI East MI Southeast MI OHNorthern MI

(1) Source: USDOC’s Bureau of Economic Analysis. Considered the largest Metropolitan Statistical Area for each region. The Northern Michigan region does not have a Metropolitan Statistical Area as defined by

the Bureau of Economic Analysis

(2) State Deposits are in billions per S&P Global and as of 6/30/17

(3) Source: S&P Global Market Intelligence

All Major MI Markets & OH Growth Opportunity

96% of businesses / 96% of population is within MI footprint(3)

Southeast Michigan represents more than 50% of Michigan GDP – a significant opportunity with recent market disruption

CHFC Footprint By State & Regional Market

MI OH

Southwest

MI

East

MI

Northern

MI

Southeast

MI OH

Michigan

Penetration

TotalDeposits ($B) $11.8 $1.4 $3.5 $3.5 $2.3 $2.5 $1.4

Market Share Rank 7 21 2 1 1 10 12

Deposit Market Share (%) 5.6% 0.4% 9.0% 22.8% 18.0% 1.8% 1.3%

Market Information (as a % of):

% of State ($B) GDP (1) 12% 2% ‐ 52% 21%

% of State Deposits (2) 18% 7% 6% 66% 32% 98%

% of State Businesses (3) 25% 13% 11% 47% 39% 96%

% of State Population (3) 25% 13% 9% 50% 37% 97%

11

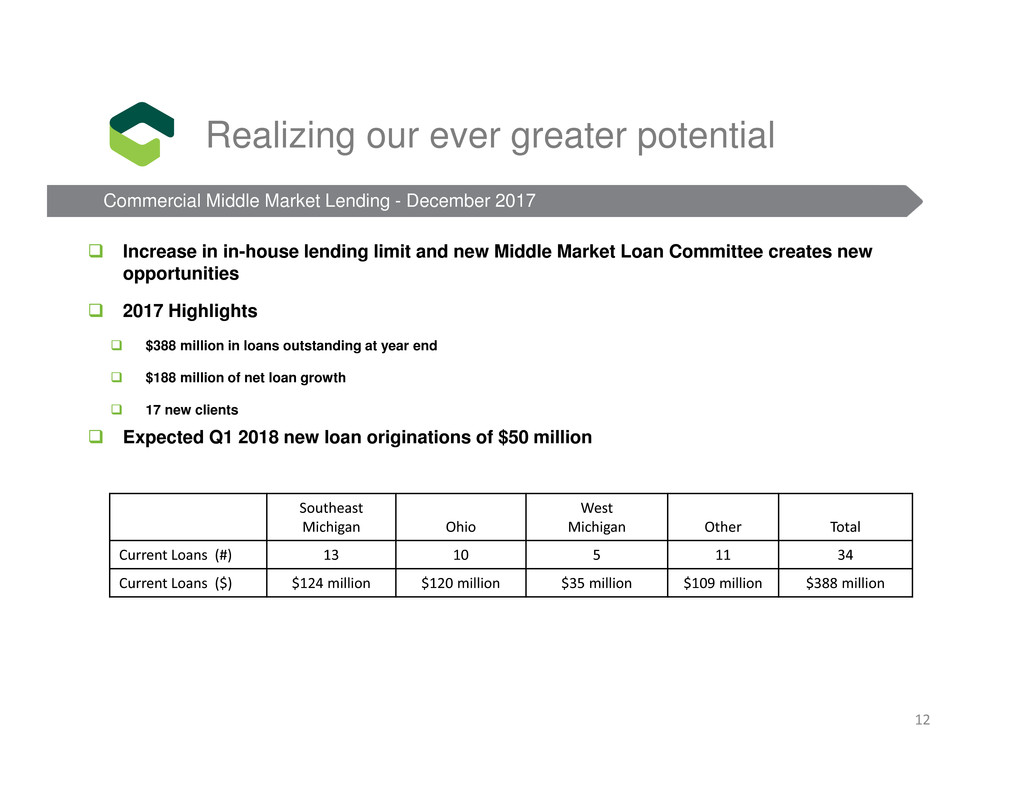

Increase in in-house lending limit and new Middle Market Loan Committee creates new

opportunities

2017 Highlights

$388 million in loans outstanding at year end

$188 million of net loan growth

17 new clients

Expected Q1 2018 new loan originations of $50 million

Realizing our ever greater potential

Commercial Middle Market Lending - December 2017

Southeast

Michigan Ohio

West

Michigan Other Total

Current Loans (#) 13 10 5 11 34

Current Loans ($) $124 million $120 million $35 million $109 million $388 million

12

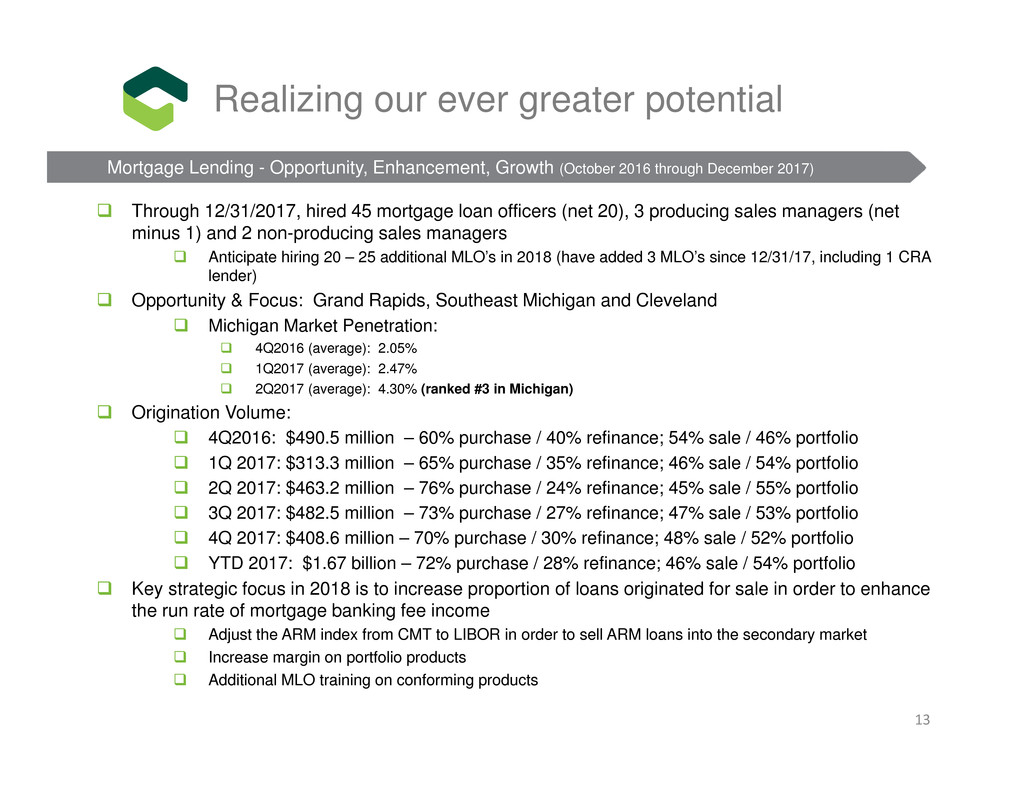

Through 12/31/2017, hired 45 mortgage loan officers (net 20), 3 producing sales managers (net

minus 1) and 2 non-producing sales managers

Anticipate hiring 20 – 25 additional MLO’s in 2018 (have added 3 MLO’s since 12/31/17, including 1 CRA

lender)

Opportunity & Focus: Grand Rapids, Southeast Michigan and Cleveland

Michigan Market Penetration:

4Q2016 (average): 2.05%

1Q2017 (average): 2.47%

2Q2017 (average): 4.30% (ranked #3 in Michigan)

Origination Volume:

4Q2016: $490.5 million – 60% purchase / 40% refinance; 54% sale / 46% portfolio

1Q 2017: $313.3 million – 65% purchase / 35% refinance; 46% sale / 54% portfolio

2Q 2017: $463.2 million – 76% purchase / 24% refinance; 45% sale / 55% portfolio

3Q 2017: $482.5 million – 73% purchase / 27% refinance; 47% sale / 53% portfolio

4Q 2017: $408.6 million – 70% purchase / 30% refinance; 48% sale / 52% portfolio

YTD 2017: $1.67 billion – 72% purchase / 28% refinance; 46% sale / 54% portfolio

Key strategic focus in 2018 is to increase proportion of loans originated for sale in order to enhance

the run rate of mortgage banking fee income

Adjust the ARM index from CMT to LIBOR in order to sell ARM loans into the secondary market

Increase margin on portfolio products

Additional MLO training on conforming products

Realizing our ever greater potential

Mortgage Lending - Opportunity, Enhancement, Growth (October 2016 through December 2017)

13

Emphasize our strategy of being the Premier Midwest Community Bank

Focus on what will build shareholder value

• Organic revenue growth and cost discipline

• Concentrate on controlling costs while reinvesting in our people and

systems

• Expand our market presence and product lines where additional value

can be created

• Rationalization of branch locations

Closing Comments

14

Supplemental Information

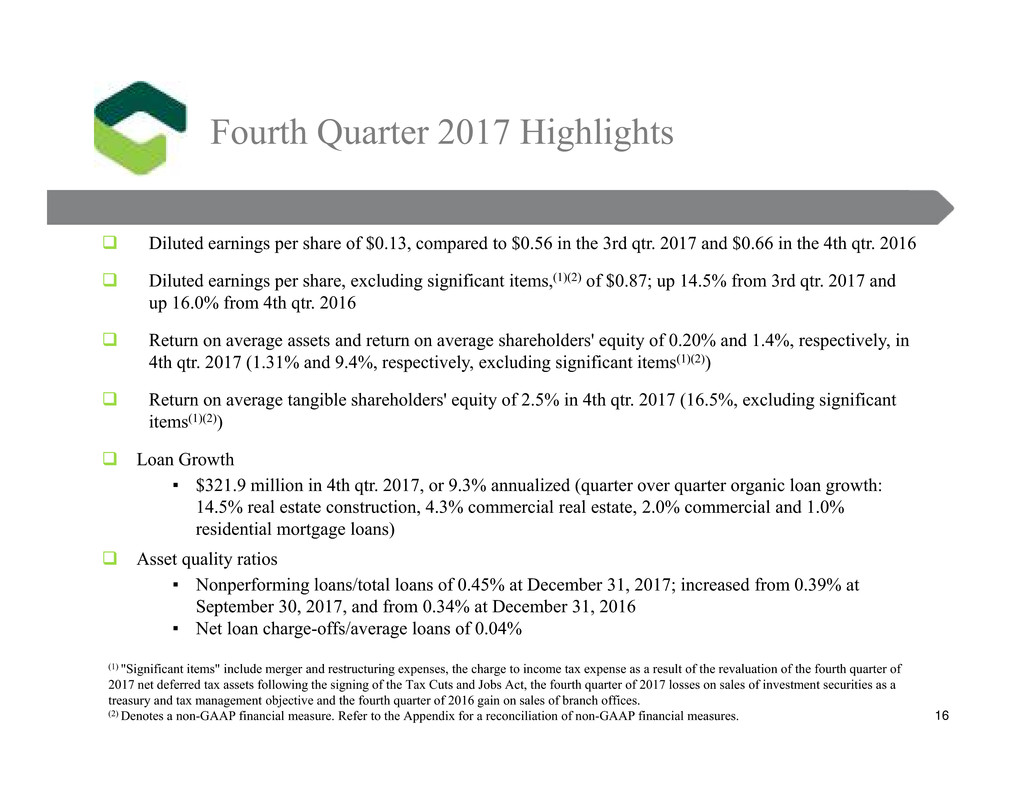

Fourth Quarter 2017 Highlights

Diluted earnings per share of $0.13, compared to $0.56 in the 3rd qtr. 2017 and $0.66 in the 4th qtr. 2016

Diluted earnings per share, excluding significant items,(1)(2) of $0.87; up 14.5% from 3rd qtr. 2017 and

up 16.0% from 4th qtr. 2016

Return on average assets and return on average shareholders' equity of 0.20% and 1.4%, respectively, in

4th qtr. 2017 (1.31% and 9.4%, respectively, excluding significant items(1)(2))

Return on average tangible shareholders' equity of 2.5% in 4th qtr. 2017 (16.5%, excluding significant

items(1)(2))

Loan Growth

▪ $321.9 million in 4th qtr. 2017, or 9.3% annualized (quarter over quarter organic loan growth:

14.5% real estate construction, 4.3% commercial real estate, 2.0% commercial and 1.0%

residential mortgage loans)

Asset quality ratios

▪ Nonperforming loans/total loans of 0.45% at December 31, 2017; increased from 0.39% at

September 30, 2017, and from 0.34% at December 31, 2016

▪ Net loan charge-offs/average loans of 0.04%

(1) "Significant items" include merger and restructuring expenses, the charge to income tax expense as a result of the revaluation of the fourth quarter of

2017 net deferred tax assets following the signing of the Tax Cuts and Jobs Act, the fourth quarter of 2017 losses on sales of investment securities as a

treasury and tax management objective and the fourth quarter of 2016 gain on sales of branch offices.

(2) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. 16

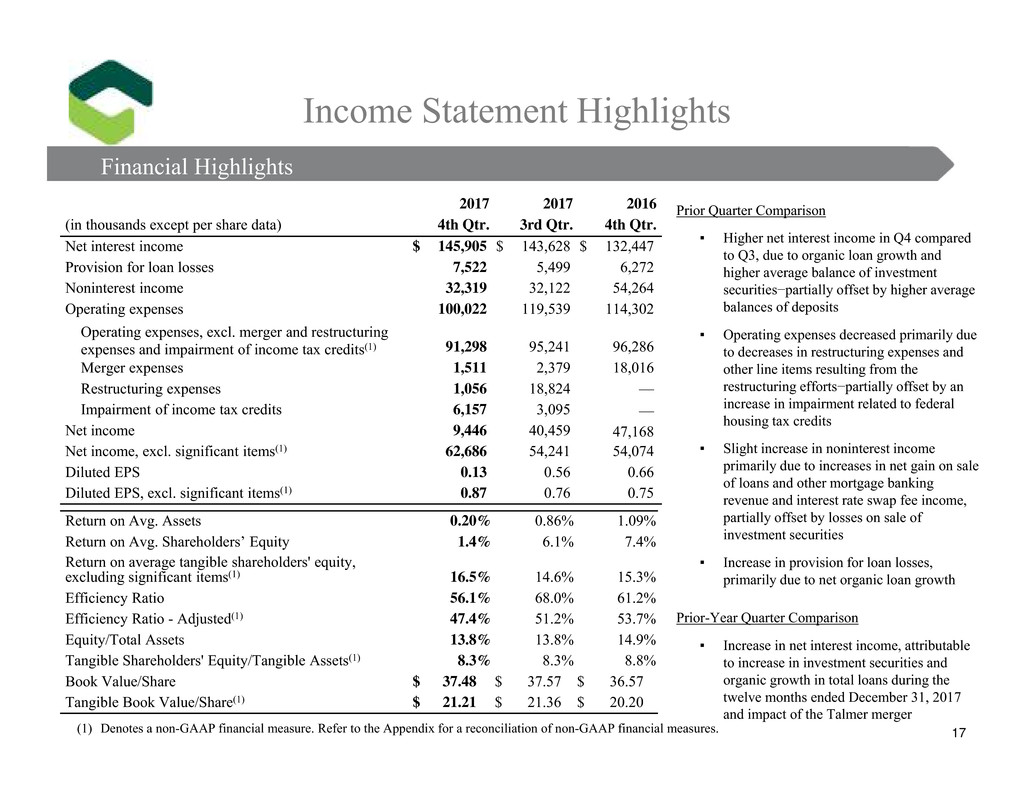

2017 2017 2016

(in thousands except per share data) 4th Qtr. 3rd Qtr. 4th Qtr.

Net interest income $ 145,905 $ 143,628 $ 132,447

Provision for loan losses 7,522 5,499 6,272

Noninterest income 32,319 32,122 54,264

Operating expenses 100,022 119,539 114,302

Operating expenses, excl. merger and restructuring

expenses and impairment of income tax credits(1) 91,298 95,241 96,286

Merger expenses 1,511 2,379 18,016

Restructuring expenses 1,056 18,824 —

Impairment of income tax credits 6,157 3,095 —

Net income 9,446 40,459 47,168

Net income, excl. significant items(1) 62,686 54,241 54,074

Diluted EPS 0.13 0.56 0.66

Diluted EPS, excl. significant items(1) 0.87 0.76 0.75

Return on Avg. Assets 0.20% 0.86% 1.09%

Return on Avg. Shareholders’ Equity 1.4% 6.1% 7.4%

Return on average tangible shareholders' equity,

excluding significant items(1) 16.5% 14.6% 15.3%

Efficiency Ratio 56.1% 68.0% 61.2%

Efficiency Ratio - Adjusted(1) 47.4% 51.2% 53.7%

Equity/Total Assets 13.8% 13.8% 14.9%

Tangible Shareholders' Equity/Tangible Assets(1) 8.3% 8.3% 8.8%

Book Value/Share $ 37.48 $ 37.57 $ 36.57

Tangible Book Value/Share(1) $ 21.21 $ 21.36 $ 20.20

Prior Quarter Comparison

▪ Higher net interest income in Q4 compared

to Q3, due to organic loan growth and

higher average balance of investment

securities−partially offset by higher average

balances of deposits

▪ Operating expenses decreased primarily due

to decreases in restructuring expenses and

other line items resulting from the

restructuring efforts−partially offset by an

increase in impairment related to federal

housing tax credits

▪ Slight increase in noninterest income

primarily due to increases in net gain on sale

of loans and other mortgage banking

revenue and interest rate swap fee income,

partially offset by losses on sale of

investment securities

▪ Increase in provision for loan losses,

primarily due to net organic loan growth

Prior-Year Quarter Comparison

▪ Increase in net interest income, attributable

to increase in investment securities and

organic growth in total loans during the

twelve months ended December 31, 2017

and impact of the Talmer merger

(1) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

Financial Highlights

Income Statement Highlights

17

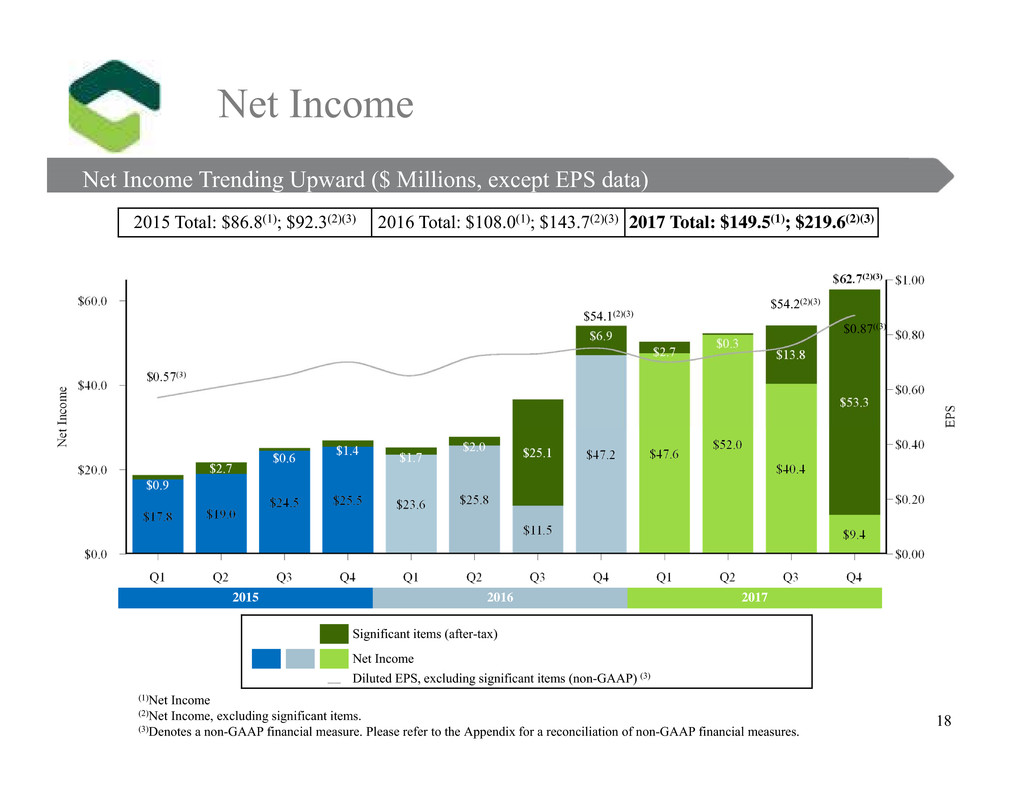

Financial Highlights

2015 Total: $86.8(1); $92.3(2)(3) 2016 Total: $108.0(1); $143.7(2)(3) 2017 Total: $149.5(1); $219.6(2)(3)

(1)Net Income

(2)Net Income, excluding significant items.

(3)Denotes a non-GAAP financial measure. Please refer to the Appendix for a reconciliation of non-GAAP financial measures.

$62.7(2)(3)

Net Income Trending Upward ($ Millions, except EPS data)

Net Income

$0.57(3)

Net Income Trending Upward ($ Millions, except EPS data)

2015 2016 2017

$54.2(2)(3)

18

$54.1(2)(3)

Significant items (after-tax)

Net Income

__ Diluted EPS, excluding significant items (non-GAAP) (3)

$0.87((3)

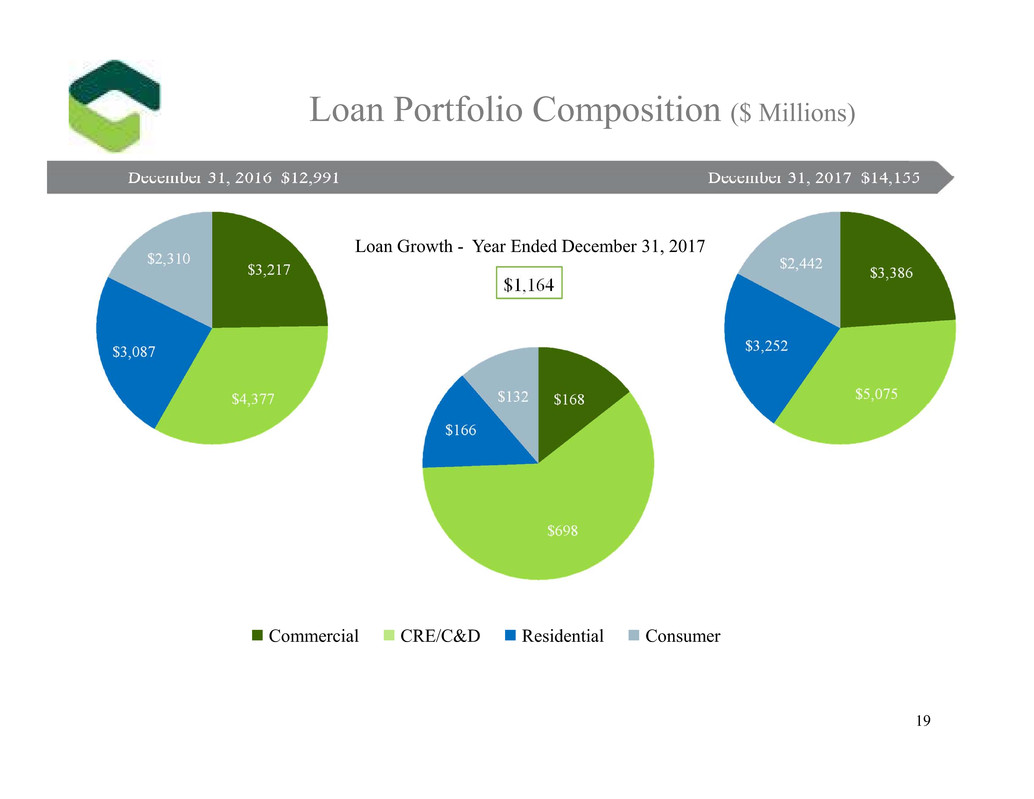

Loan Portfolio Composition ($ Millions)

$1,164

19

December 31, 2016 $12,991 December 31, 2017 $14,155

Total Loan Growth -

Commercial CRE/C&D Residential Consumer

Loan Growth - Year Ended December 31, 2017

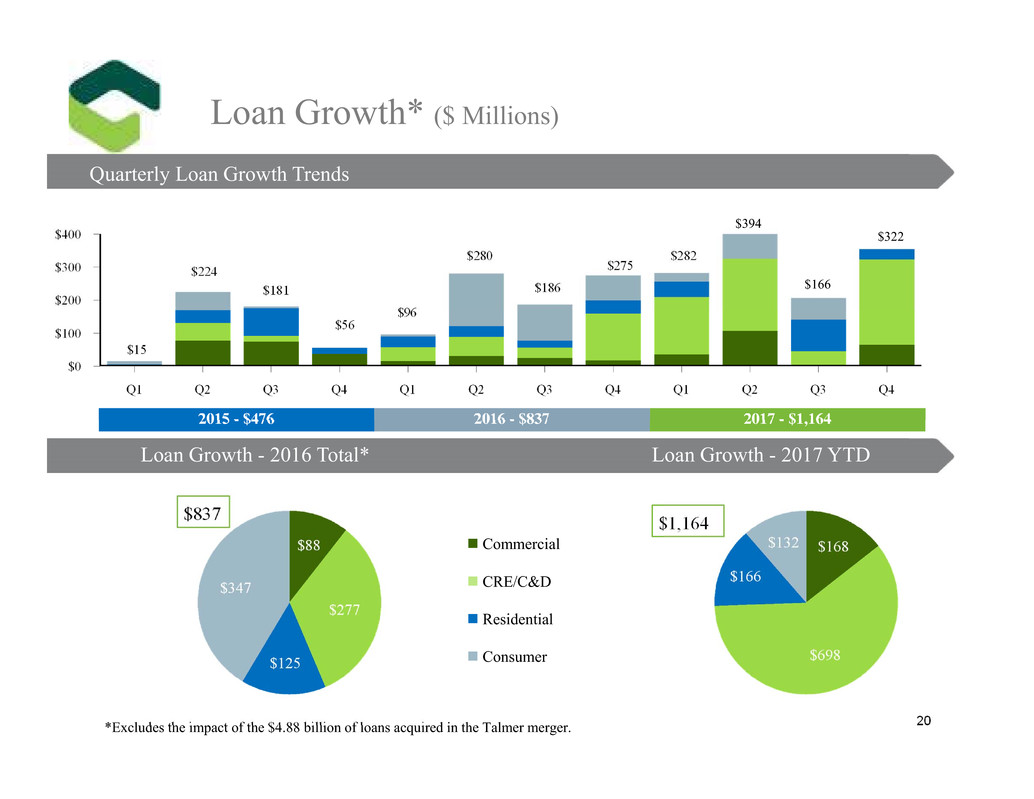

2015 - $476 2016 - $837 2017 - $1,164

$15

$224

$181

$280

$56

$1,164 $837

$96

$186

Loan Growth* ($ Millions)

$275

*Excludes the impact of the $4.88 billion of loans acquired in the Talmer merger.

$282

20

Commercial

CRE/C&D

Residential

Consumer

Loan Growth - 2016 Total* Loan Growth - 2017 YTD

$166

$394

Quarterly Loan Growth Trends

$322

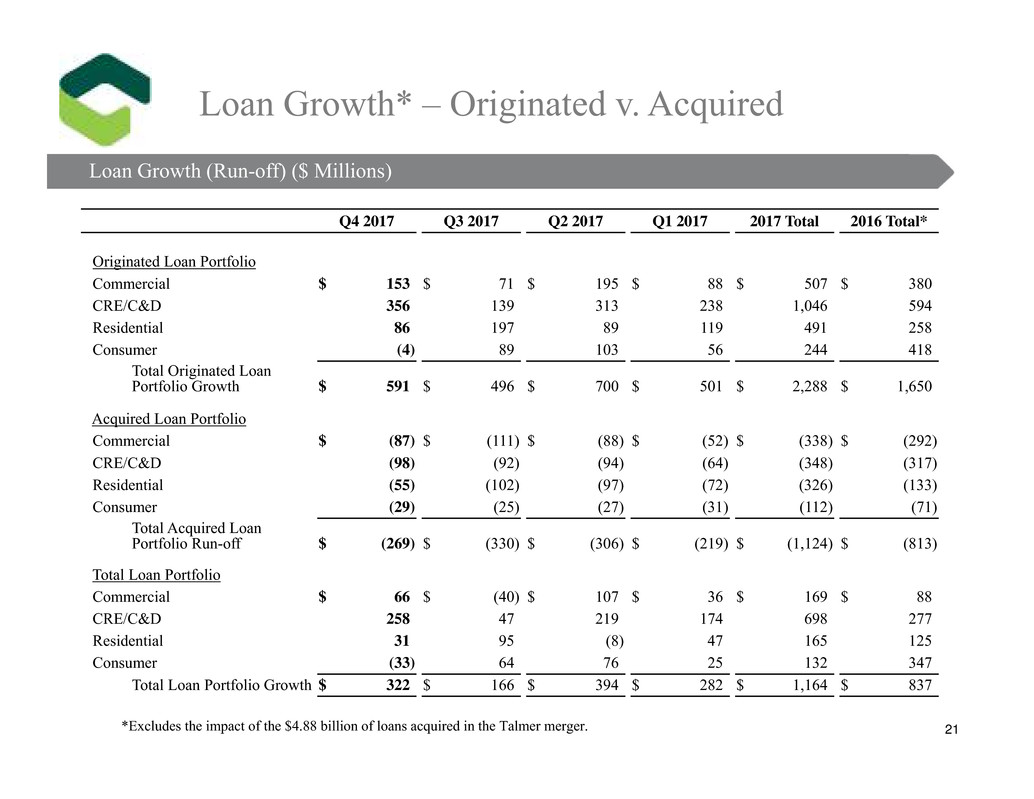

Q4 2017 Q3 2017 Q2 2017 Q1 2017 2017 Total 2016 Total*

Originated Loan Portfolio

Commercial $ 153 $ 71 $ 195 $ 88 $ 507 $ 380

CRE/C&D 356 139 313 238 1,046 594

Residential 86 197 89 119 491 258

Consumer (4) 89 103 56 244 418

Total Originated Loan

Portfolio Growth $ 591 $ 496 $ 700 $ 501 $ 2,288 $ 1,650

Acquired Loan Portfolio

Commercial $ (87) $ (111) $ (88) $ (52) $ (338) $ (292)

CRE/C&D (98) (92) (94) (64) (348) (317)

Residential (55) (102) (97) (72) (326) (133)

Consumer (29) (25) (27) (31) (112) (71)

Total Acquired Loan

Portfolio Run-off $ (269) $ (330) $ (306) $ (219) $ (1,124) $ (813)

Total Loan Portfolio

Commercial $ 66 $ (40) $ 107 $ 36 $ 169 $ 88

CRE/C&D 258 47 219 174 698 277

Residential 31 95 (8) 47 165 125

Consumer (33) 64 76 25 132 347

Total Loan Portfolio Growth $ 322 $ 166 $ 394 $ 282 $ 1,164 $ 837

Loan Growth (Run-off) ($ Millions)

Loan Growth* – Originated v. Acquired

*Excludes the impact of the $4.88 billion of loans acquired in the Talmer merger. 21

Loan Growth (Run-off) ($ Millions)

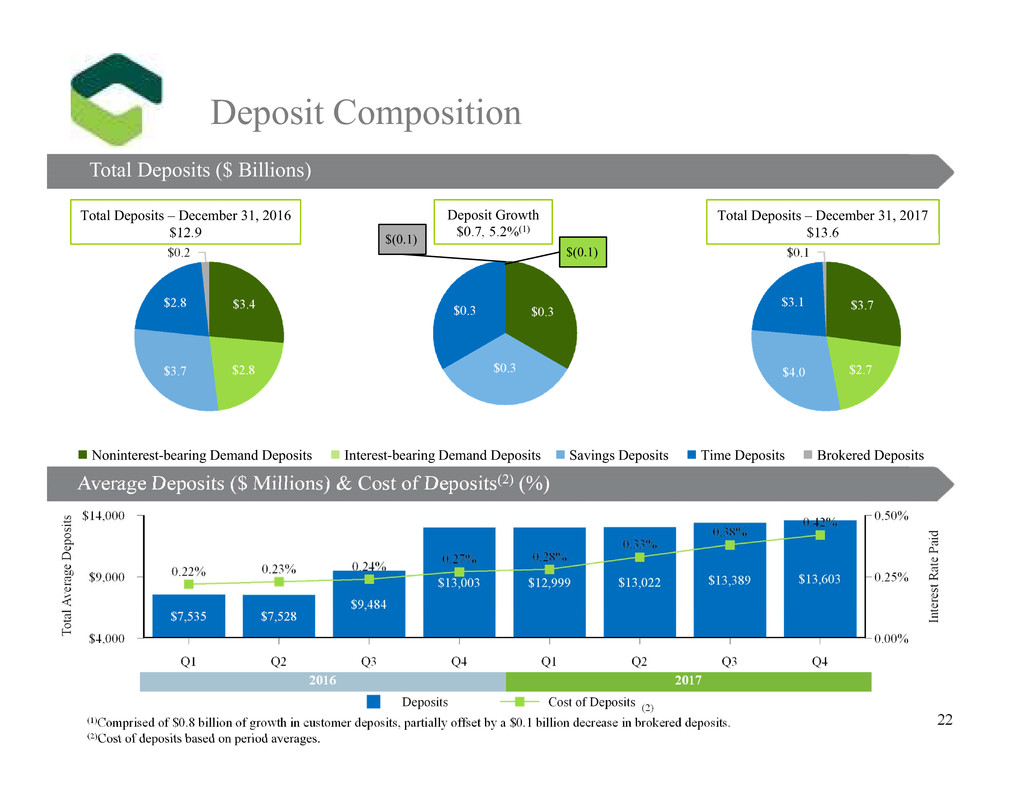

(1)Comprised of $0.8 billion of growth in customer deposits, partially offset by a $0.1 billion decrease in brokered deposits.

(2)Cost of deposits based on period averages.

Total Deposits – December 31, 2016

$12.9

Total Deposits – December 31, 2017

$13.6

Deposit Growth

$0.7, 5.2%(1)

Total Deposits ($ Billions)

Deposit Composition

(2)

2016 2017

22

Total Deposits ($ Billions)

Average Deposits ($ Millions) & Cost of Deposits(2) (%)

Noninterest-bearing Demand Deposits Interest-bearing Demand Deposits Savings Deposits Time Deposits Brokered Deposits

$(0.1)

$(0.1)

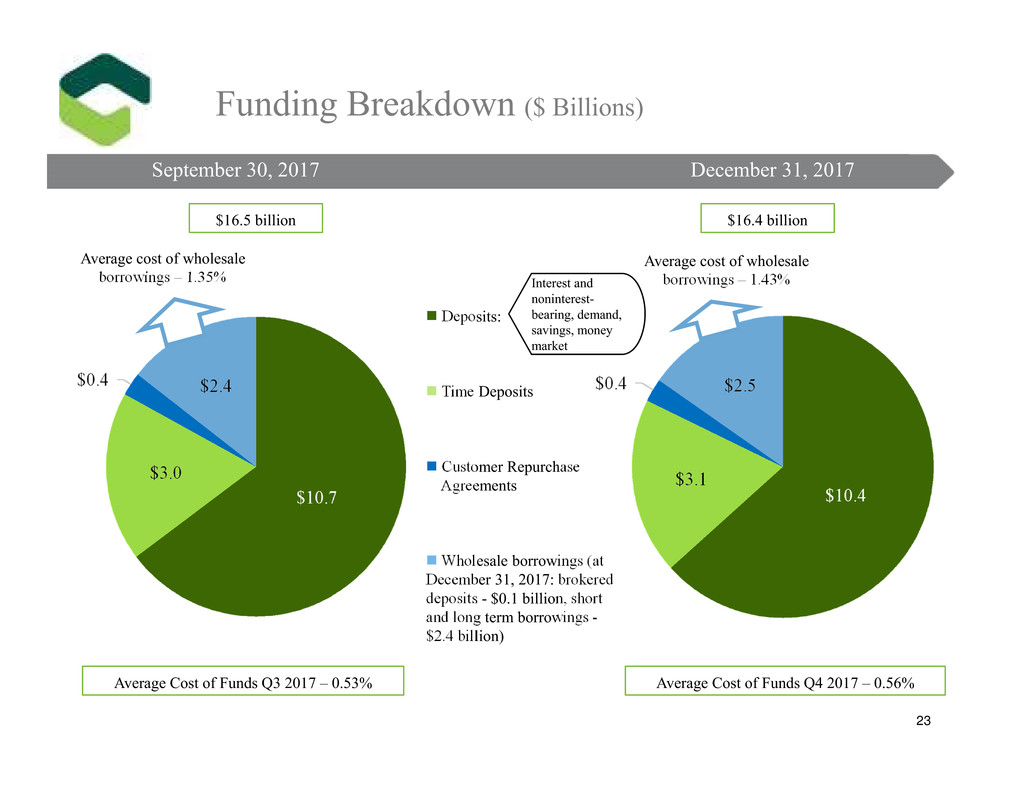

Average Cost of Funds Q4 2017 – 0.56% Average Cost of Funds Q3 2017 – 0.53%

$16.5 billion $16.4 billion

Average cost of wholesale

borrowings – 1.43%

Average cost of wholesale

borrowings – 1.35%

Funding Breakdown ($ Billions)

23

September 30, 2017 December 31, 2017

Deposits:

Time Deposits

Customer Repurchase

Agreements

Wholesale borrowings (at

December 31, 2017: brokered

deposits - $0.1 billion, short

and long term borrowings -

$2.4 billion)

Interest and

noninterest-

bearing, demand,

savings, money

market

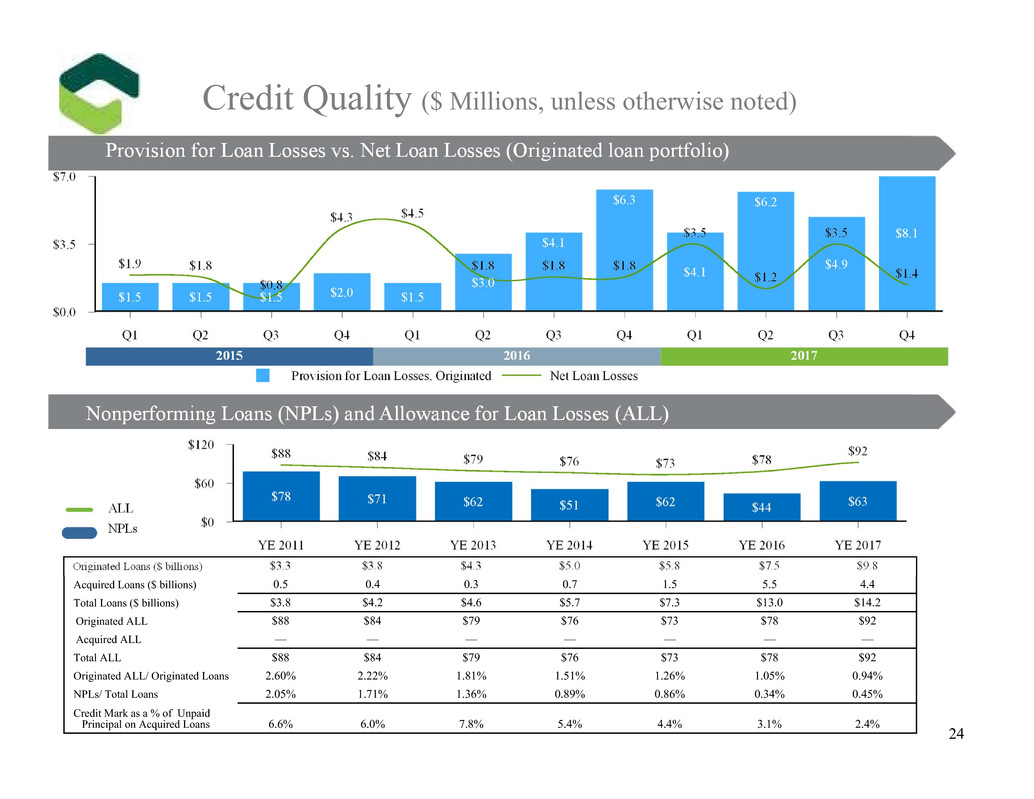

ALL

NPLs

2015 2016 2017

Originated Loans ($ billions) $3.3 $3.8 $4.3 $5.0 $5.8 $7.5 $9.8

Acquired Loans ($ billions) 0.5 0.4 0.3 0.7 1.5 5.5 4.4

Total Loans ($ billions) $3.8 $4.2 $4.6 $5.7 $7.3 $13.0 $14.2

Originated ALL $88 $84 $79 $76 $73 $78 $92

Acquired ALL — — — — — — —

Total ALL $88 $84 $79 $76 $73 $78 $92

Originated ALL/ Originated Loans 2.60% 2.22% 1.81% 1.51% 1.26% 1.05% 0.94%

NPLs/ Total Loans 2.05% 1.71% 1.36% 0.89% 0.86% 0.34% 0.45%

Credit Mark as a % of Unpaid

Principal on Acquired Loans 6.6% 6.0% 7.8% 5.4% 4.4% 3.1% 2.4%

Provision for Loan Losses vs. Net Loan Losses

Credit Quality ($ Millions, unless otherwise noted)

Provision for Loan Losses vs. Net Loan Losses (Originated loan portfolio)

Nonperforming Loans (NPLs) and Allowance for Loan Losses (ALL)

24

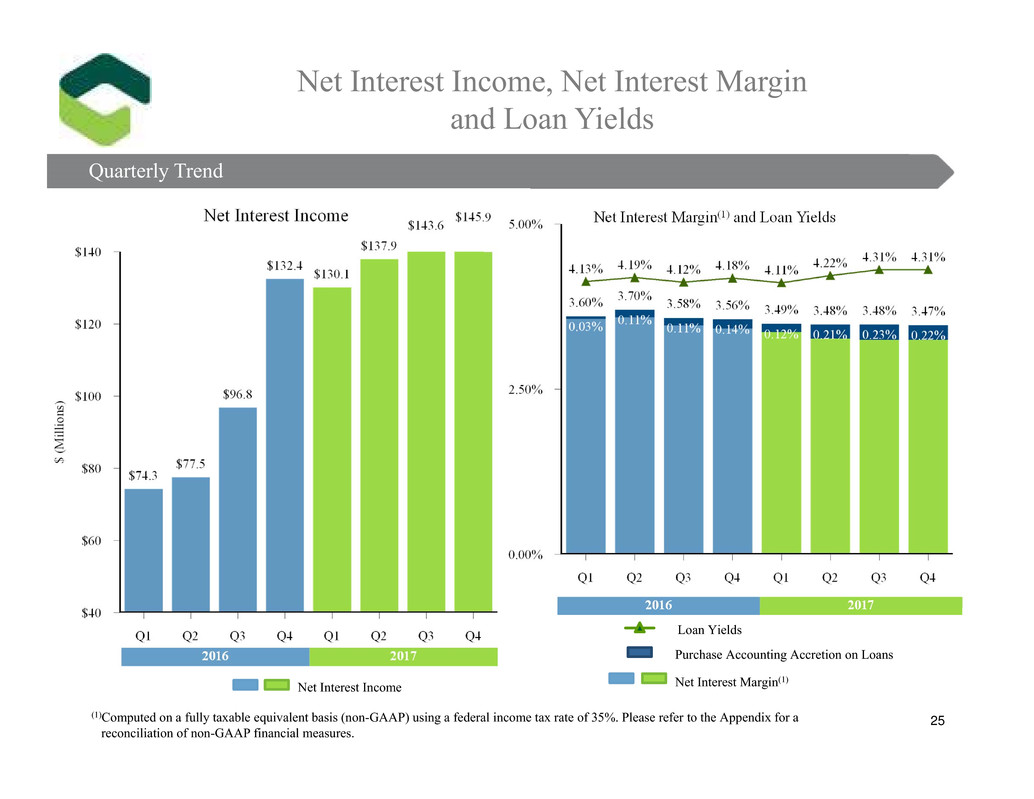

Net Interest Margin(1) and Loan Yields

Net Interest Margin(1)

Purchase Accounting Accretion on Loans

Loan Yields

Net Interest Income

(Quarterly Trend)

Net Interest Income, Net Interest Margin

and Loan Yields

(1)Computed on a fully taxable equivalent basis (non-GAAP) using a federal income tax rate of 35%. Please refer to the Appendix for a

reconciliation of non-GAAP financial measures.

25

Quarterly Tre

2016 2017

2016 2017

$20.9

$32.1

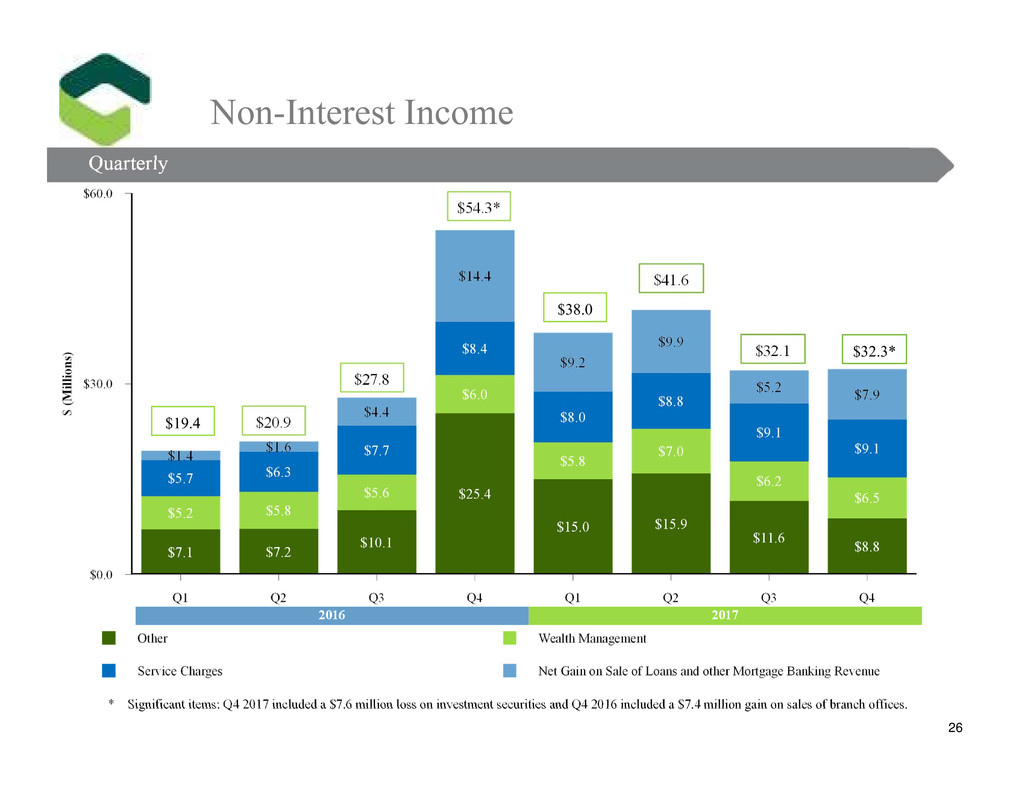

Quarterly

Non-Interest Income

* Significant items: Q4 2017 included a $7.6 million loss on investment securities and Q4 2016 included a $7.4 million gain on sales of branch offices.

$41.6

$27.8

$54.3*

26

Quarterly

2016 2017

$38.0

$19.4

$32.3*

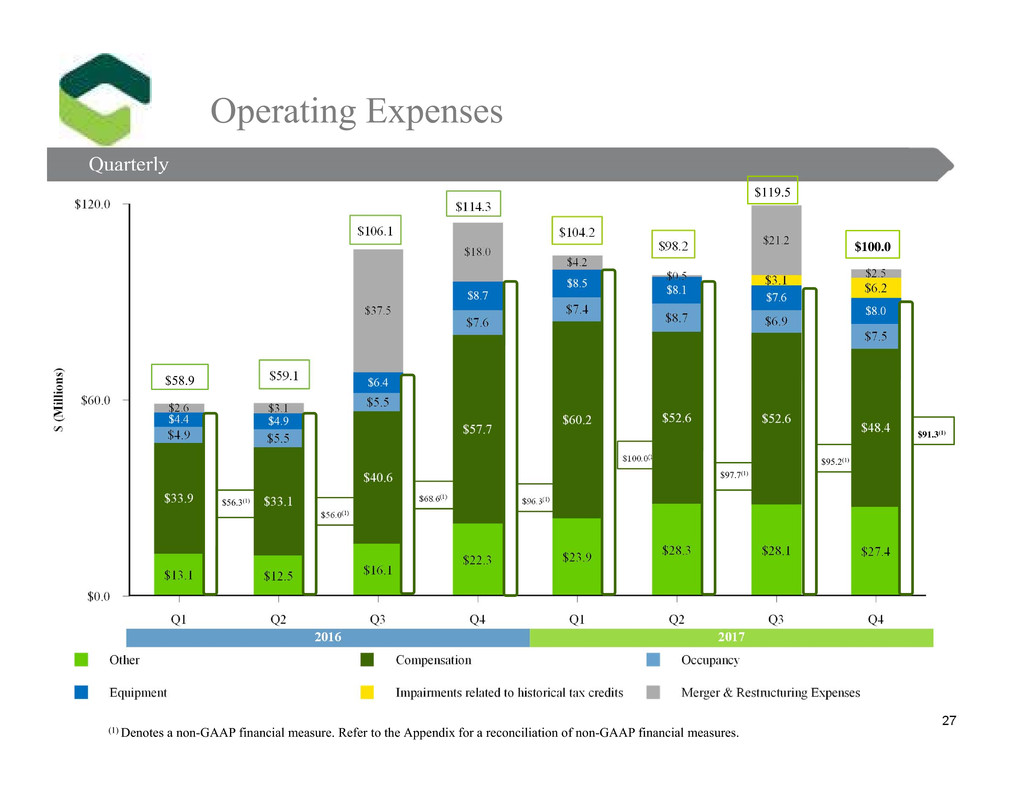

$68.6(1)

$106.1

$56.0(1)

$59.1

$96.3(1)

$114.3

Quarterly

Operating Expenses

$98.2

$100.0(1)

27

Quarterly

2016 2017

$104.2

$97.7(1)

$95.2(1)

$119.5

(1) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

$56.3(1)

$58.9

$100.0

$91.3(1)

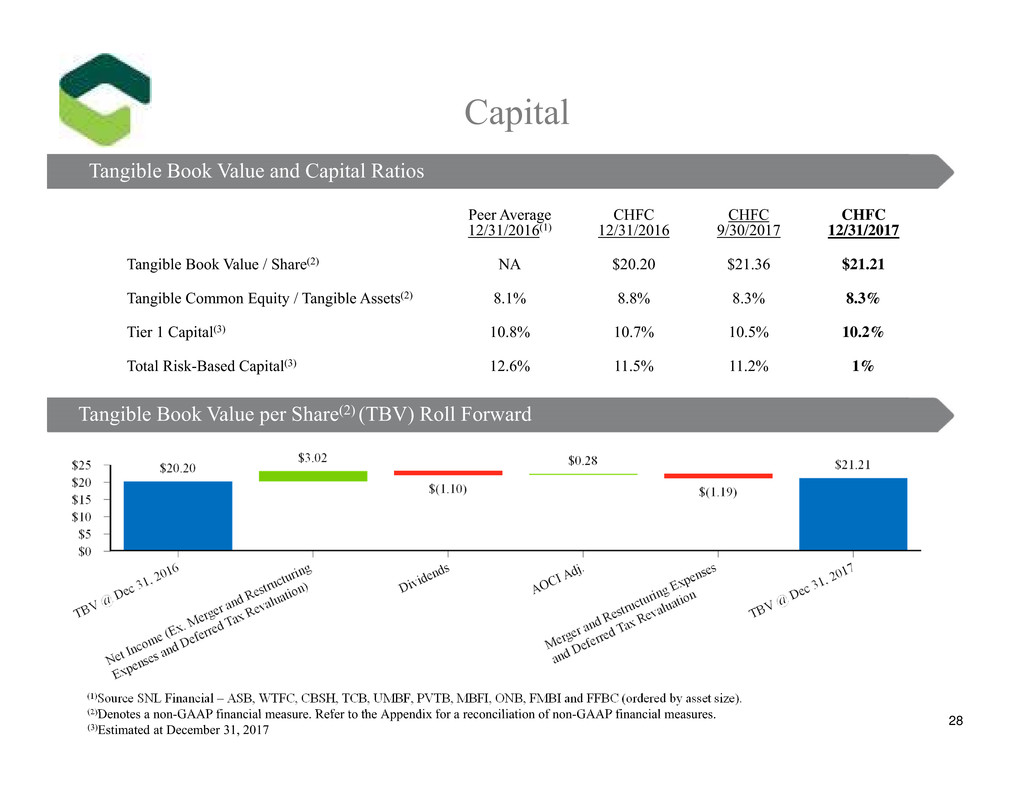

Peer Average

12/31/2016(1)

CHFC

12/31/2016

CHFC

9/30/2017

CHFC

12/31/2017

Tangible Book Value / Share(2) NA $20.20 $21.36 $21.21

Tangible Common Equity / Tangible Assets(2) 8.1% 8.8% 8.3% 8.3%

Tier 1 Capital(3) 10.8% 10.7% 10.5% 10.2%

Total Risk-Based Capital(3) 12.6% 11.5% 11.2% 1%

Capital

(1)Source SNL Financial – ASB, WTFC, CBSH, TCB, UMBF, PVTB, MBFI, ONB, FMBI and FFBC (ordered by asset size).

(2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

(3)Estimated at December 31, 2017

Tangible Book Value and Capital Ratios

Tangible Book Value per Share(2) (TBV) Roll Forward

28

0.00

0.20

0.40

0.60

0.80

1.00

1.20

$

P

e

r

S

h

a

r

e

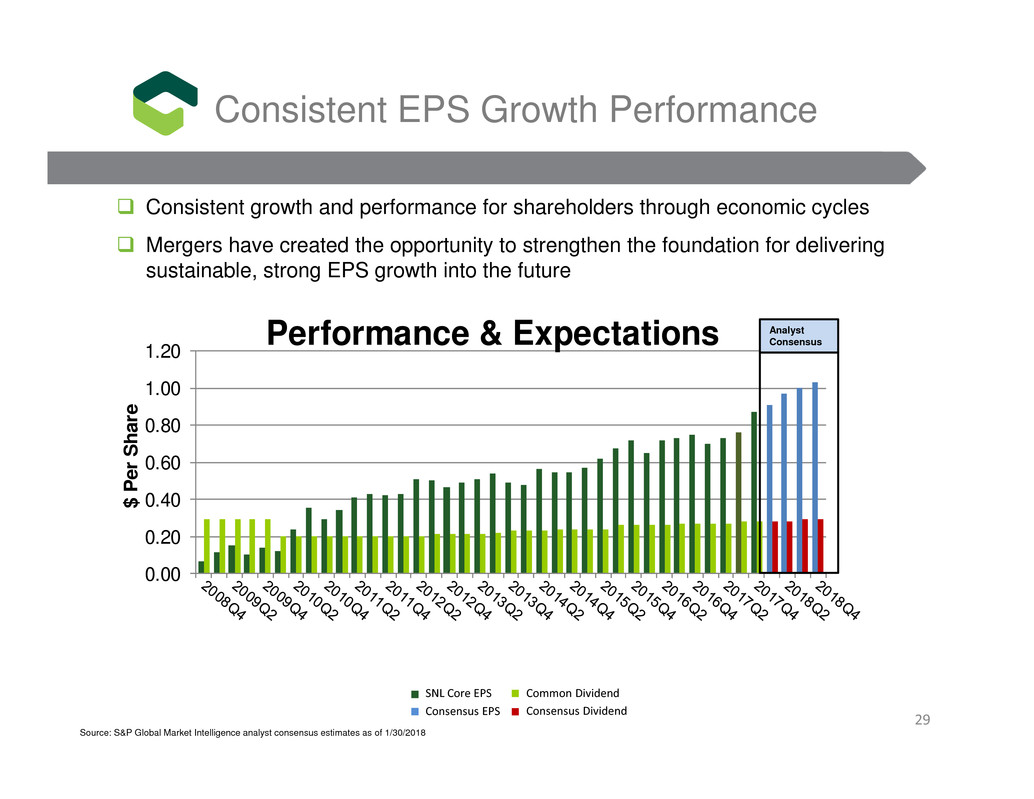

Performance & Expectations Analyst Consensus

Consistent growth and performance for shareholders through economic cycles

Mergers have created the opportunity to strengthen the foundation for delivering

sustainable, strong EPS growth into the future

Consensus EPS Consensus Dividend

SNL Core EPS Common Dividend

29

Consistent EPS Growth Performance

Source: S&P Global Market Intelligence analyst consensus estimates as of 1/30/2018

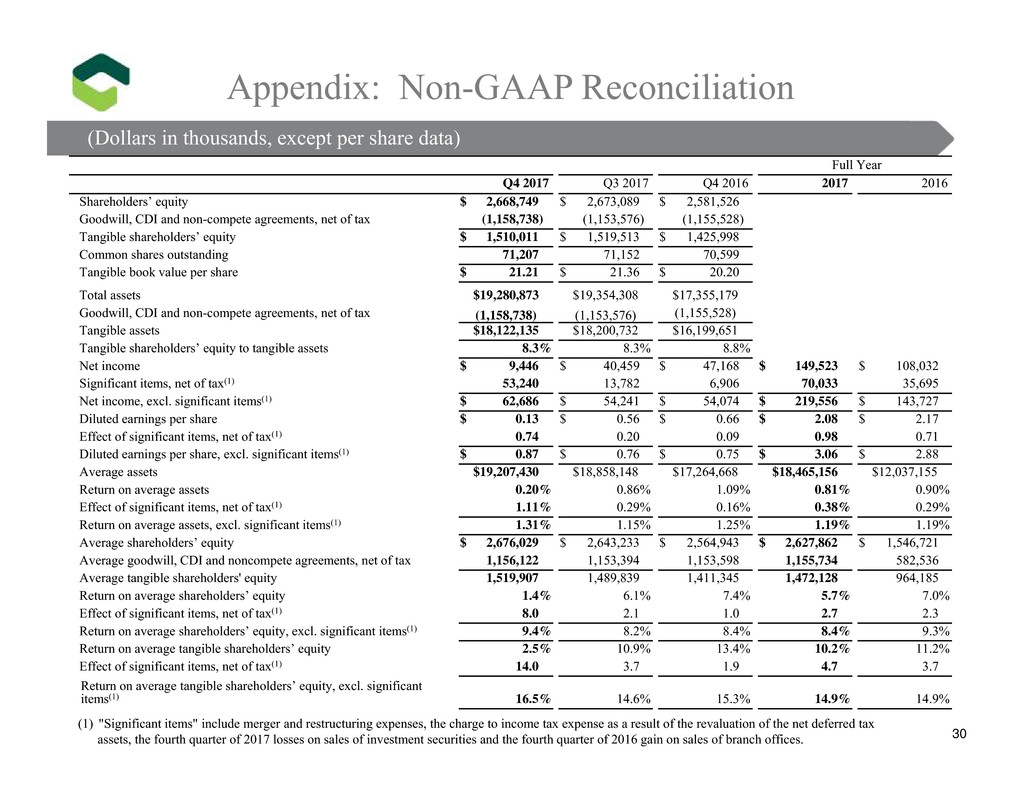

Full Year

Q4 2017 Q3 2017 Q4 2016 2017 2016

Shareholders’ equity $ 2,668,749 $ 2,673,089 $ 2,581,526

Goodwill, CDI and non-compete agreements, net of tax (1,158,738) (1,153,576) (1,155,528)

Tangible shareholders’ equity $ 1,510,011 $ 1,519,513 $ 1,425,998

Common shares outstanding 71,207 71,152 70,599

Tangible book value per share $ 21.21 $ 21.36 $ 20.20

Total assets $19,280,873 $19,354,308 $17,355,179

Goodwill, CDI and non-compete agreements, net of tax (1,158,738) (1,153,576) (1,155,528)

Tangible assets $18,122,135 $18,200,732 $16,199,651

Tangible shareholders’ equity to tangible assets 8.3% 8.3% 8.8%

Net income $ 9,446 $ 40,459 $ 47,168 $ 149,523 $ 108,032

Significant items, net of tax(1) 53,240 13,782 6,906 70,033 35,695

Net income, excl. significant items(1) $ 62,686 $ 54,241 $ 54,074 $ 219,556 $ 143,727

Diluted earnings per share $ 0.13 $ 0.56 $ 0.66 $ 2.08 $ 2.17

Effect of significant items, net of tax(1) 0.74 0.20 0.09 0.98 0.71

Diluted earnings per share, excl. significant items(1) $ 0.87 $ 0.76 $ 0.75 $ 3.06 $ 2.88

Average assets $19,207,430 $18,858,148 $17,264,668 $18,465,156 $12,037,155

Return on average assets 0.20% 0.86% 1.09% 0.81% 0.90%

Effect of significant items, net of tax(1) 1.11% 0.29% 0.16% 0.38% 0.29%

Return on average assets, excl. significant items(1) 1.31% 1.15% 1.25% 1.19% 1.19%

Average shareholders’ equity $ 2,676,029 $ 2,643,233 $ 2,564,943 $ 2,627,862 $ 1,546,721

Average goodwill, CDI and noncompete agreements, net of tax 1,156,122 1,153,394 1,153,598 1,155,734 582,536

Average tangible shareholders' equity 1,519,907 1,489,839 1,411,345 1,472,128 964,185

Return on average shareholders’ equity 1.4% 6.1% 7.4% 5.7% 7.0%

Effect of significant items, net of tax(1) 8.0 2.1 1.0 2.7 2.3

Return on average shareholders’ equity, excl. significant items(1) 9.4% 8.2% 8.4% 8.4% 9.3%

Return on average tangible shareholders’ equity 2.5% 10.9% 13.4% 10.2% 11.2%

Effect of significant items, net of tax(1) 14.0 3.7 1.9 4.7 3.7

Return on average tangible shareholders’ equity, excl. significant

items(1) 16.5% 14.6% 15.3% 14.9% 14.9%

(Dollars in thousands, except per share data)

Appendix: Non-GAAP Reconciliation

30

lars in thousands, exce t per share data)

(1) "Significant items" include merger and restructuring expenses, the charge to income tax expense as a result of the revaluation of the net deferred tax

assets, the fourth quarter of 2017 losses on sales of investment securities and the fourth quarter of 2016 gain on sales of branch offices.

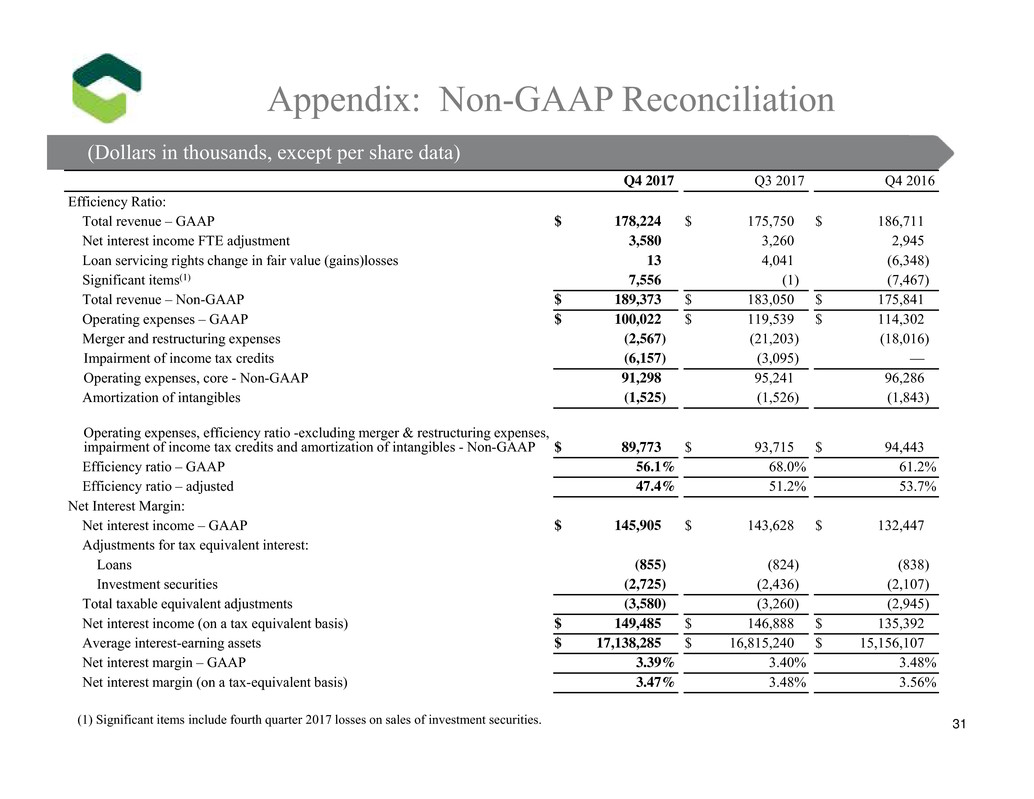

Q4 2017 Q3 2017 Q4 2016

Efficiency Ratio:

Total revenue – GAAP $ 178,224 $ 175,750 $ 186,711

Net interest income FTE adjustment 3,580 3,260 2,945

Loan servicing rights change in fair value (gains)losses 13 4,041 (6,348)

Significant items(1) 7,556 (1) (7,467)

Total revenue – Non-GAAP $ 189,373 $ 183,050 $ 175,841

Operating expenses – GAAP $ 100,022 $ 119,539 $ 114,302

Merger and restructuring expenses (2,567) (21,203) (18,016)

Impairment of income tax credits (6,157) (3,095) —

Operating expenses, core - Non-GAAP 91,298 95,241 96,286

Amortization of intangibles (1,525) (1,526) (1,843)

Operating expenses, efficiency ratio -excluding merger & restructuring expenses,

impairment of income tax credits and amortization of intangibles - Non-GAAP $ 89,773 $ 93,715 $ 94,443

Efficiency ratio – GAAP 56.1% 68.0% 61.2%

Efficiency ratio – adjusted 47.4% 51.2% 53.7%

Net Interest Margin:

Net interest income – GAAP $ 145,905 $ 143,628 $ 132,447

Adjustments for tax equivalent interest:

Loans (855) (824) (838)

Investment securities (2,725) (2,436) (2,107)

Total taxable equivalent adjustments (3,580) (3,260) (2,945)

Net interest income (on a tax equivalent basis) $ 149,485 $ 146,888 $ 135,392

Average interest-earning assets $ 17,138,285 $ 16,815,240 $ 15,156,107

Net interest margin – GAAP 3.39% 3.40% 3.48%

Net interest margin (on a tax-equivalent basis) 3.47% 3.48% 3.56%

(Dollars in thousands, except per share data)

Appendix: Non-GAAP Reconciliation

31

lars in thousands, exce t per share data)

(1) Significant items include fourth quarter 2017 losses on sales of investment securities.

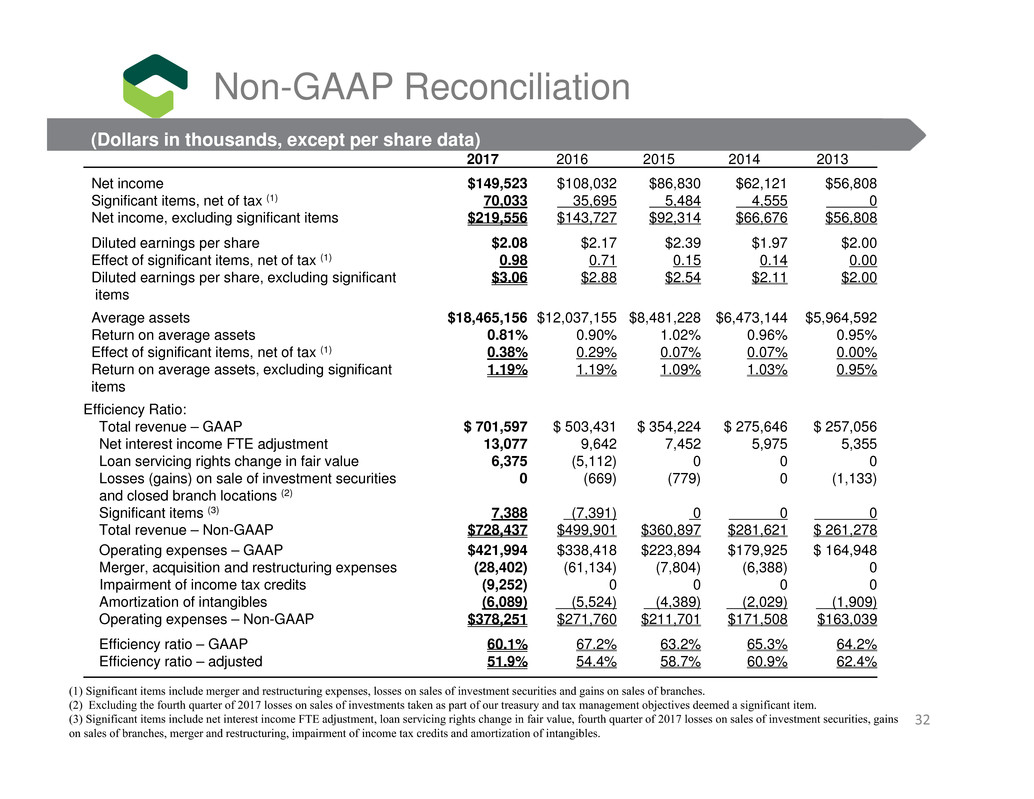

2017 2016 2015 2014 2013

Net income $149,523 $108,032 $86,830 $62,121 $56,808

Significant items, net of tax (1) 70,033 35,695 5,484 4,555 0

Net income, excluding significant items $219,556 $143,727 $92,314 $66,676 $56,808

Diluted earnings per share $2.08 $2.17 $2.39 $1.97 $2.00

Effect of significant items, net of tax (1) 0.98 0.71 0.15 0.14 0.00

Diluted earnings per share, excluding significant

items

$3.06 $2.88 $2.54 $2.11 $2.00

Average assets $18,465,156 $12,037,155 $8,481,228 $6,473,144 $5,964,592

Return on average assets 0.81% 0.90% 1.02% 0.96% 0.95%

Effect of significant items, net of tax (1) 0.38% 0.29% 0.07% 0.07% 0.00%

Return on average assets, excluding significant

items

1.19% 1.19% 1.09% 1.03% 0.95%

Efficiency Ratio:

Total revenue – GAAP $ 701,597 $ 503,431 $ 354,224 $ 275,646 $ 257,056

Net interest income FTE adjustment 13,077 9,642 7,452 5,975 5,355

Loan servicing rights change in fair value 6,375 (5,112) 0 0 0

Losses (gains) on sale of investment securities

and closed branch locations (2)

0 (669) (779) 0 (1,133)

Significant items (3) 7,388 (7,391) 0 0 0

Total revenue – Non-GAAP $728,437 $499,901 $360,897 $281,621 $ 261,278

Operating expenses – GAAP $421,994 $338,418 $223,894 $179,925 $ 164,948

Merger, acquisition and restructuring expenses (28,402) (61,134) (7,804) (6,388) 0

Impairment of income tax credits (9,252) 0 0 0 0

Amortization of intangibles (6,089) (5,524) (4,389) (2,029) (1,909)

Operating expenses – Non-GAAP $378,251 $271,760 $211,701 $171,508 $163,039

Efficiency ratio – GAAP 60.1% 67.2% 63.2% 65.3% 64.2%

Efficiency ratio – adjusted 51.9% 54.4% 58.7% 60.9% 62.4%

Non-GAAP Reconciliation

(Dollars in thousands, except per share data)

(1) Significant items include merger and restructuring expenses, losses on sales of investment securities and gains on sales of branches.

(2) Excluding the fourth quarter of 2017 losses on sales of investments taken as part of our treasury and tax management objectives deemed a significant item.

(3) Significant items include net interest income FTE adjustment, loan servicing rights change in fair value, fourth quarter of 2017 losses on sales of investment securities, gains

on sales of branches, merger and restructuring, impairment of income tax credits and amortization of intangibles.

32

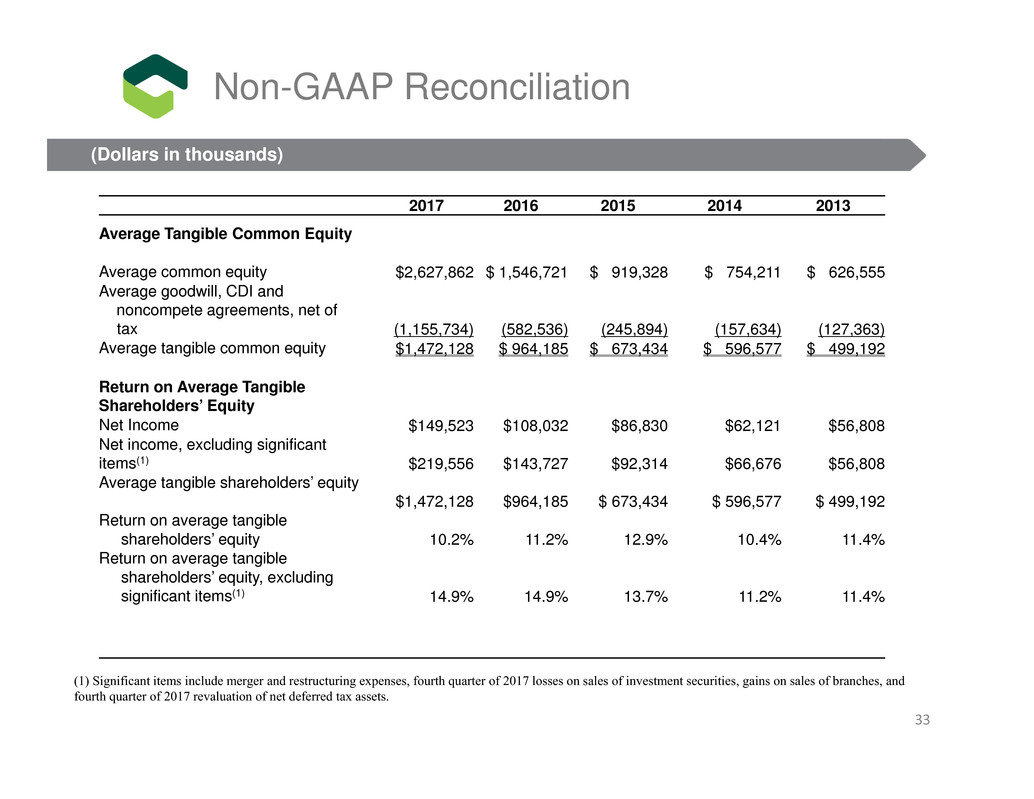

2017 2016 2015 2014 2013

Average Tangible Common Equity

Average common equity $2,627,862 $ 1,546,721 $ 919,328 $ 754,211 $ 626,555

Average goodwill, CDI and

noncompete agreements, net of

tax (1,155,734) (582,536) (245,894) (157,634) (127,363)

Average tangible common equity $1,472,128 $ 964,185 $ 673,434 $ 596,577 $ 499,192

Return on Average Tangible

Shareholders’ Equity

Net Income $149,523 $108,032 $86,830 $62,121 $56,808

Net income, excluding significant

items(1) $219,556 $143,727 $92,314 $66,676 $56,808

Average tangible shareholders’ equity

$1,472,128 $964,185 $ 673,434 $ 596,577 $ 499,192

Return on average tangible

shareholders’ equity 10.2% 11.2% 12.9% 10.4% 11.4%

Return on average tangible

shareholders’ equity, excluding

significant items(1) 14.9% 14.9% 13.7% 11.2% 11.4%

Non-GAAP Reconciliation

(Dollars in thousands)

(1) Significant items include merger and restructuring expenses, fourth quarter of 2017 losses on sales of investment securities, gains on sales of branches, and

fourth quarter of 2017 revaluation of net deferred tax assets.

33