Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - FORD MOTOR CO | exhibit992todeutschebank.htm |

| 8-K - 8-K - FORD MOTOR CO | deutschebankconference8-kd.htm |

NEWS

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

www.twitter.com/ford

www.facebook.com/ford

Ford Details Plans to Improve Fitness, Refocus Model Lineup

and Accelerate Introduction of Smart Vehicles and Services

• Operational fitness, portfolio rationalization and increased investments in electrification,

autonomy and mobility at core of company strategy

• Company increases planned investments in electrification to $11 billion by 2022

• Expanded electrified portfolio to include 40 electrified vehicles globally, including 16 full

battery electric vehicles by 2022

• Announces preliminary results for full-year 2017 of $1.95 earnings-per-share (EPS) and

$1.78 adjusted EPS, in line with most recent guidance range

• Declares first quarter regular dividend of $0.15 per share and a $500 million

supplemental cash dividend – or $0.13 per share – for a combined $0.28 per share

• Company issues guidance for 2018 of adjusted EPS of $1.45 to $1.70

DEARBORN, Mich., Jan. 16, 2018 – Ford Motor Company (NYSE: F) today detailed plans to

improve operational fitness, refocus capital allocation and accelerate the introduction of smart

vehicles and services.

Presenting at the Deutsche Bank Global Auto Industry Conference in Detroit, the company

provided preliminary results for full-year 2017, issued guidance for 2018 and outlined plans to

accelerate investment in electric vehicles and sport utility vehicles.

“In 2017, F-Series extended its streak as America's best-selling pickup for the 41st straight year,

we set a new company high for U.S. SUV sales and Lincoln had its best year since the turn of

the millennium thanks to accelerated growth in China,” said Jim Farley, Ford executive vice

president and president, Global Markets. “We have a rock solid foundation and we have seen

growth in key areas, but we know we must evolve to be even more competitive, and narrow our

full line of nameplates in all markets, to a more focused lineup that delivers stronger, more

profitable growth, with better returns.”

Bob Shanks, executive vice president and chief financial officer, said Ford is working rapidly to

improve its operational fitness and reallocate capital to higher-return opportunities that is

expected to fuel profitable growth in the future.

“Since we reinstated a dividend in 2012, we have generated $31 billion in cumulative

automotive cash flow, and returned $15.4 billion to shareholders via dividends and share

repurchase,” said Bob Shanks, executive vice president and chief financial officer.

“Notwithstanding this discipline of returning value to shareholders, we know we can better

capture opportunities for growth, profitability and liquidity.”

The full slide deck of Ford’s presentation can be found at www.shareholder.ford.com.

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

2

Ford is further detailing its fitness initiatives first outlined at a presentation to analysts last fall.

This includes making changes to products in production today and dramatically improving the

efficiency of the business.

For example, the company is reducing the number of orderable combinations on Escape,

Fusion and EcoSport from thousands, to just 10 to 20 combinations for each vehicle. This will

improve costs by reducing manufacturing expense, lowering inventory and logistics expense

and improve quality, while growing revenue by ensuring customers can get what they want

faster and at the dealer of their choosing.

The company said it would continue to pursue partnerships, alliances, and acquisitions as a key

component to enhance its competitiveness. Ford is pursuing partnerships, alliances, and

acquisitions where doing so provides access to technology and capabilities that will enhance its

competitive position, including with Mahindra in India and Zotye in China to develop vehicles

and services uniquely suited to compete in those markets.

In addition, Ford said it will shift toward a lower volume passenger car lineup in North America

and Europe, while competing in more profitable sub-segments of the utilities market, as

demonstrated by vehicles such as the new Edge ST and the upcoming Bronco. In North

America, for example, over the next couple of years, Ford’s SUV mix will increase 10

percentage points, while its car portfolio will shrink about 10 percentage points.

Ford also will expand its electrified vehicle lineup with a total of 40 vehicles globally, which will

include 16 full battery electric vehicles by 2022. To support this, the company announced that it

now plans to invest more than $11 billion in electrification from 2015 to 2022. The company also

reiterated that it is on track to deliver a full battery electric performance SUV that offers at least

a 300-mile range, for launch in 2020.

“We are actively evolving our position to be more competitive,” Farley said. “At the highest level,

we need to narrow our full lineup of nameplates to a more focused lineup that delivers stronger

growth, less risk and better returns. We are repositioning the company to offer best-in-class,

human-centered vehicles and mobility services. That’s our vision.”

Regarding self-driving vehicles, Ford is focused on building an autonomous vehicle business,

including a purpose-built vehicle, the self-driving technology and the operational infrastructure in

parallel, which will allow it to scale quickly as it enters production in 2021. Collaborations with

Dominos, Lyft and Postmates will help validate its self-driving services business beginning this

quarter though a series of pilot programs in a new city to be identified soon.

2017 Preliminary Results and 2018 Guidance*

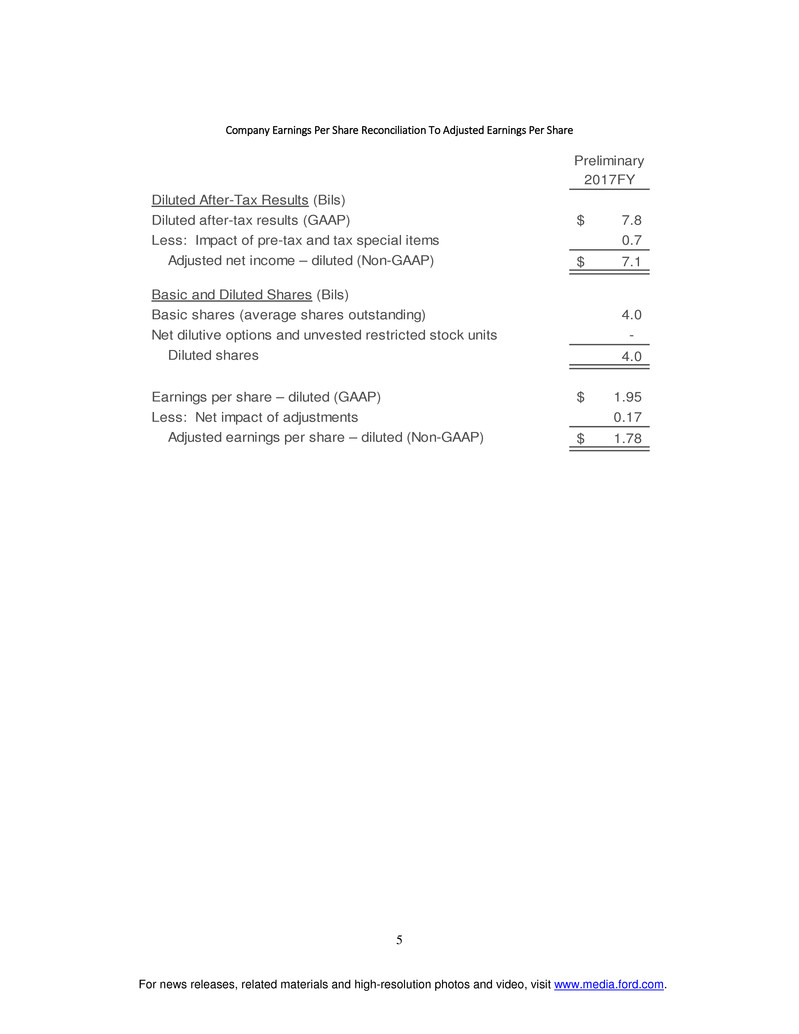

For full-year 2017, the company is announcing preliminary results of $1.95 EPS, an increase of

80 cents from a year ago, and adjusted EPS of $1.78, an increase of 2 cents from a year ago

and in line with the company’s most recent guidance. The company also anticipates ending the

year with a strong balance sheet with automotive cash of $26.5 billion and automotive liquidity

of nearly $37 billion.

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

3

2017 results will also include the impact of a non-cash pre-tax remeasurement loss of about

$150 million related to the year-end revaluation of global pension and other postretirement

employee benefits (OPEB) plans, also known as pension mark-to-market adjustment.

As a result of the company’s performance in 2017, Ford’s Board of Directors declared a first

quarter regular dividend of $0.15 per share and a $500 million supplemental cash dividend that

is equal to $0.13 per share. This provides a combined total of $0.28 per share of dividends on

the company’s outstanding Class B and common stock.

The first quarter regular dividend maintains the same level as the dividends paid in 2017. The

first quarter regular and supplemental dividends are payable on March 1, 2018 to shareholders

of record at the close of business on Jan. 30, 2018. Subject to the approval of the Board of

Directors, the company expects to make distributions totaling about $3.1 billion in 2018. By

year-end, cumulative distributions to shareholders will total more than $18 billion since the

company’s regular dividend was restored in 2012.

For 2018, the company is guiding to an adjusted EPS in the range of $1.45 to $1.70. This

guidance reflects higher commodity costs and further adverse exchange, offset in varying

degrees by actions the company is taking to mitigate their effect.

Ford’s presentation at the Deutsche Bank Global Auto Industry Conference will begin at

approximately 6:30 p.m. EST today. To access the presentation materials and a listen-only

audio webcast, visit www.shareholder.ford.com.

*This release include Ford’s preliminary view of 2017 results. Ford’s actual results could differ materially from the preliminary results

included in this release. Ford will provide additional detail on 2017 results in its earnings presentation on January 24, 2018. Ford’s

Annual Report on Form 10-K, which will be filed in February, will included Ford’s audited financial results.

Note: See table later in this release for reconciliation of the non-GAAP financial measure designated as “adjusted earnings per

share” to “earnings per share,” the most comparable financial measure calculated in accordance with U.S. generally accepted

accounting principles (“GAAP”). Adjusted earnings per share is a non-GAAP financial measure because it excludes special items.

The measure provides investors with useful information to evaluate the performance of Ford’s business excluding items not

indicative of the underlying run rate. When Ford provides guidance for adjusted earnings per share, Ford does not provide guidance

on an earnings per share basis because the GAAP measure will include potentially significant special items that have not yet

occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains

and losses.

About Ford Motor Company

Ford Motor Company is a global company based in Dearborn, Michigan. The company designs,

manufactures, markets and services a full line of Ford cars, trucks, SUVs, electrified vehicles and Lincoln

luxury vehicles, provides financial services through Ford Motor Credit Company and is pursuing leadership

positions in electrification, autonomous vehicles and mobility solutions. Ford employs approximately

203,000 people worldwide. For more information regarding Ford, its products and Ford Motor Credit

Company, please visit www.corporate.ford.com.

Contact(s): Media: Equity Investment Fixed Income Shareholder

Brad Carroll

Community:

Sabrina McKee

Investment

Community:

Karen Rocoff

Inquiries:

1.800.555.5259 or

313.390.5565 313.845.4601 313.621.0965 313.845.8540

bcarro37@ford.com

fordir@ford.com fixedinc@ford.com stockinf@ford.com

# # #

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

4

Cautionary Note On Forward-Looking Statements

Statements included or incorporated by reference herein may constitute “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on

expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other

factors that could cause actual results to differ materially from those stated, including, without limitation:

• Decline in industry sales volume, particularly in the United States, Europe, or China, due to financial crisis,

recession, geopolitical events, or other factors;

• Lower-than-anticipated market acceptance of Ford’s new or existing products or services, or failure to

achieve expected growth;

• Market shift away from sales of larger, more profitable vehicles beyond Ford’s current planning assumption,

particularly in the United States;

• Continued or increased price competition resulting from industry excess capacity, currency fluctuations, or

other factors;

• Fluctuations in foreign currency exchange rates, commodity prices, and interest rates;

• Adverse effects resulting from economic, geopolitical, protectionist trade policies, or other events;

• Work stoppages at Ford or supplier facilities or other limitations on production (whether as a result of labor

disputes, natural or man-made disasters, tight credit markets or other financial distress, production

constraints or difficulties, or other factors);

• Single-source supply of components or materials;

• Labor or other constraints on Ford’s ability to maintain competitive cost structure;

• Substantial pension and other postretirement liabilities impairing liquidity or financial condition;

• Worse-than-assumed economic and demographic experience for pension and other postretirement benefit

plans (e.g., discount rates or investment returns);

• Restriction on use of tax attributes from tax law “ownership change;”

• The discovery of defects in vehicles resulting in delays in new model launches, recall campaigns, or

increased warranty costs;

• Increased safety, emissions, fuel economy, or other regulations resulting in higher costs, cash expenditures,

and/or sales restrictions;

• Unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged

defects in products, perceived environmental impacts, or otherwise;

• Adverse effects on results from a decrease in or cessation or claw back of government incentives related to

investments;

• Cybersecurity risks to operational systems, security systems, or infrastructure owned by Ford, Ford Credit,

or a third party vendor or supplier;

• Failure of financial institutions to fulfill commitments under committed credit and liquidity facilities;

• Inability of Ford Credit to access debt, securitization, or derivative markets around the world at competitive

rates or in sufficient amounts, due to credit rating downgrades, market volatility, market disruption,

regulatory requirements, or other factors;

• Higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return

volumes for leased vehicles;

• Increased competition from banks, financial institutions, or other third parties seeking to increase their share

of financing Ford vehicles; and

• New or increased credit regulations, consumer or data protection regulations, or other regulations resulting

in higher costs and/or additional financing restrictions.

We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will

prove accurate, or that any projection will be realized. It is to be expected that there may be differences between

projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and

we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of

new information, future events, or otherwise. For additional discussion, see "Item 1A. Risk Factors" in our Annual

Report on Form 10-K for the year ended December 31, 2016, as updated by subsequent Quarterly Reports on Form

10-Q and Current Reports on Form 8-K.

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

5

Company Earnings Per Share Reconciliation To Adjusted Earnings Per Share

Preliminary

2017FY

Diluted After-Tax Results (Bils)

Diluted after-tax results (GAAP) 7.8$

Less: Impact of pre-tax and tax special items 0.7

Adjusted net income – diluted (Non-GAAP) 7.1$

Basic and Diluted Shares (Bils)

Basic shares (average shares outstanding) 4.0

Net dilutive options and unvested restricted stock units -

Diluted shares 4.0

Earnings per share – diluted (GAAP) 1.95$

Less: Net impact of adjustments 0.17

Adjusted earnings per share – diluted (Non-GAAP) 1.78$