Attached files

| file | filename |

|---|---|

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - ANDEAVOR LOGISTICS LP | ex21-agreementandplanofmer.htm |

| EX-99.1 - PRESS RELEASE - ANDEAVOR LOGISTICS LP | ex991-pressrelease.htm |

| 8-K - 8-K - ANDEAVOR LOGISTICS LP | form8-kandxmergerandx.htm |

| EX-10.2 - SPONSOR EQUITY RESTRUCTURING AGREEMENT - ANDEAVOR LOGISTICS LP | ex102-sponsorequityrestruc.htm |

| EX-10.1 - SUPPORT AGREEMENT - ANDEAVOR LOGISTICS LP | ex101-supportagreement.htm |

MLP Merger and

Financial

Repositioning of

Andeavor Logistics

August 14, 2017

Forward Looking Statements

This communication contains certain statements that are “forward-looking” statements within the meaning of Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act of 1934. Words such as “may,” “will,” “could,” “anticipate,” “estimate,”

“expect,” “predict,” “project,” “future,” “potential,” “intend,” “plan,” “assume,” “believe,” “forecast,” “look,” “build,” “focus,” “create,” “work”

“continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any

discussion of future plans, actions, or events identify forward-looking statements. These forward-looking statements include, but are not

limited to, statements regarding the proposed acquisition by Andeavor Logistics of WNRL, synergies and the shareholder value to result

from the combined company, and the proposed buy-in of Andeavor Logistics’ incentive distribution rights by Andeavor in exchange for

common units of Andeavor. There are a number of risks and uncertainties that could cause actual results to differ materially from the

forward-looking statements included in this communication. For example, the risk that the proposed transactions do not occur, expected

timing and likelihood of completion of the proposed transactions, including the timing, receipt and terms and conditions of any required

governmental and regulatory approvals of the proposed acquisition that could reduce anticipated benefits or cause the parties to

abandon the transactions, the ability to successfully integrate the businesses, the occurrence of any event, change or other

circumstances that could cause the parties to abandon the transactions, risks related to disruption of management time from ongoing

business operations due to the proposed transactions, the risk that any announcements relating to the proposed transaction could have

adverse effects on the market price of Andeavor Logistics’ common units, WNRL’s common units or Andeavor’s common stock, the risk

that the proposed transaction and its announcement could have an adverse effect on the ability of Andeavor Logistics, WNRL and

Andeavor to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on

their operating results and businesses generally, the risk that problems may arise in successfully integrating the businesses of the

companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the

combined company may be unable to achieve cost-cutting synergies or it may take longer than expected to achieve those synergies, the

risk of the amount of any future distribution Andeavor Logistics may pay, and other factors. All such factors are difficult to predict and are

beyond Andeavor Logistics’ or Andeavor’s control, including those detailed in Andeavor Logistics’ annual reports on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K that are available on its website at http://andeavorlogistics.com/ and on the SEC’s

website at http://www.sec.gov, those detailed in WNRL’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K that are available on WNRL’s website at http://www.wnrl.com and on the SEC website at http://www.sec.gov and

those detailed in Andeavor’s website at http://andeavor.com and on the SEC’s website at http://www.sec.gov. Andeavor Logistics’,

WNRL’s and Andeavor’s forward-looking statements are based on assumptions that Andeavor Logistics, WNRL and Andeavor believe to

be reasonable but that may not prove to be accurate. Andeavor Logistics, WNRL and Andeavor undertake no obligation to publicly

release the result of any revisions to any such forward-looking statements that may be made to reflect events or circumstances that

occur, or which we become aware of, except as required by applicable law or regulation. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as of the date hereof.

1

• Growth-oriented, full-service and diversified midstream

company

• Targets at least $1 billion of annual growth investments, with

exposure to the highly attractive Permian Basin

• Enhances capital structure and improves cost of capital to

support sustainable, long-term growth

– Targets metrics of:

Annual distribution growth rate of 6% or greater

Distribution coverage of approximately 1.1x

Debt-to-EBITDA at or below 4.0x by end of 2017

– Significantly reduces need for new public equity issuances

– Expected to be accretive to distributable cash flow by

second half 2019

• Transparent value for Andeavor, who will own approximately

59% of Andeavor Logistics valued at $6.1 billion1

2

Andeavor Logistics Repositioned for

Long-Term, Sustainable Growth

1. Assumes 34 million current ANDX common units owned by Andeavor, 78 million newly issued units from IDR

Buy-In and approximately 15 million newly issued units from the Merger for a total ownership of approximately

127 million ANDX common units. Based on Andeavor Logistics closing price on August 11, 2017

3

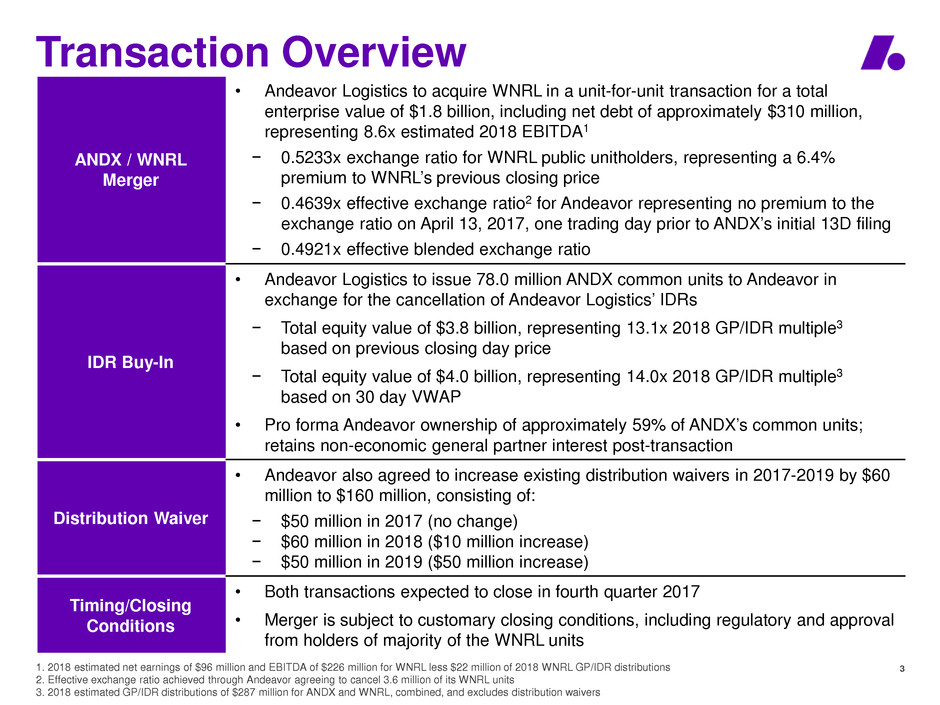

Transaction Overview

ANDX / WNRL

Merger

• Andeavor Logistics to acquire WNRL in a unit-for-unit transaction for a total

enterprise value of $1.8 billion, including net debt of approximately $310 million,

representing 8.6x estimated 2018 EBITDA1

− 0.5233x exchange ratio for WNRL public unitholders, representing a 6.4%

premium to WNRL’s previous closing price

− 0.4639x effective exchange ratio2 for Andeavor representing no premium to the

exchange ratio on April 13, 2017, one trading day prior to ANDX’s initial 13D filing

− 0.4921x effective blended exchange ratio

IDR Buy-In

• Andeavor Logistics to issue 78.0 million ANDX common units to Andeavor in

exchange for the cancellation of Andeavor Logistics’ IDRs

− Total equity value of $3.8 billion, representing 13.1x 2018 GP/IDR multiple3

based on previous closing day price

− Total equity value of $4.0 billion, representing 14.0x 2018 GP/IDR multiple3

based on 30 day VWAP

• Pro forma Andeavor ownership of approximately 59% of ANDX’s common units;

retains non-economic general partner interest post-transaction

Distribution Waiver

• Andeavor also agreed to increase existing distribution waivers in 2017-2019 by $60

million to $160 million, consisting of:

− $50 million in 2017 (no change)

− $60 million in 2018 ($10 million increase)

− $50 million in 2019 ($50 million increase)

Timing/Closing

Conditions

• Both transactions expected to close in fourth quarter 2017

• Merger is subject to customary closing conditions, including regulatory and approval

from holders of majority of the WNRL units

1. 2018 estimated net earnings of $96 million and EBITDA of $226 million for WNRL less $22 million of 2018 WNRL GP/IDR distributions

2. Effective exchange ratio achieved through Andeavor agreeing to cancel 3.6 million of its WNRL units

3. 2018 estimated GP/IDR distributions of $287 million for ANDX and WNRL, combined, and excludes distribution waivers

4

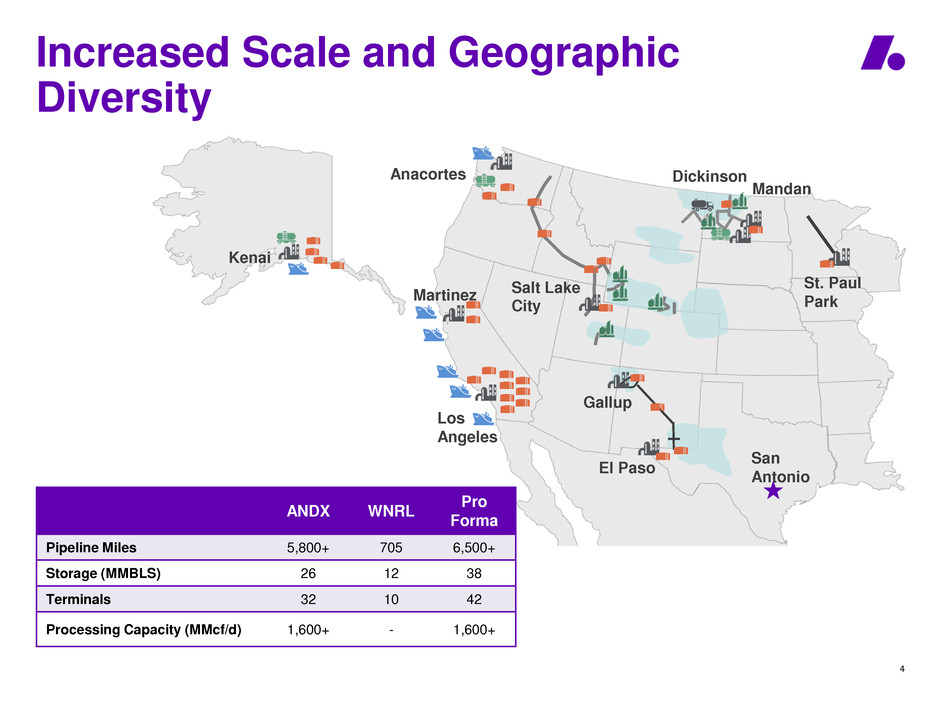

Increased Scale and Geographic

Diversity

Martinez

Kenai

Anacortes Dickinson

Mandan

St. Paul

Park

Los

Angeles

Salt Lake

City

Gallup

El Paso

San

Antonio

Kenai

ANDX WNRL Pro Forma

Pipeline Miles 5,800+ 705 6,500+

Storage (MMBLS) 26 12 38

Terminals 32 10 42

Processing Capacity (MMcf/d) 1,600+ - 1,600+

5

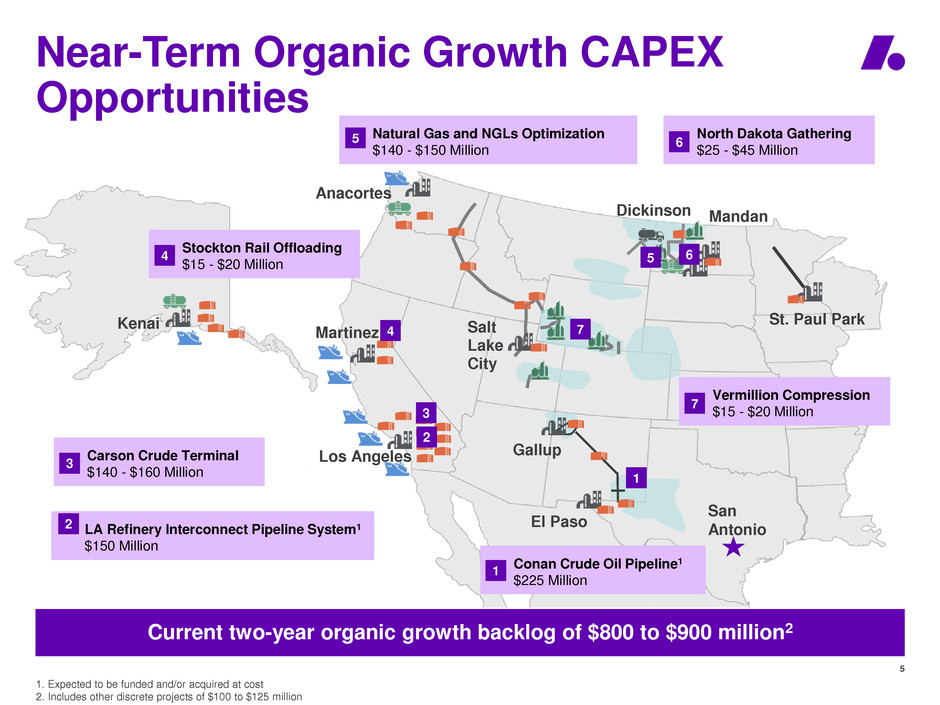

Near-Term Organic Growth CAPEX

Opportunities

Current two-year organic growth backlog of $800 to $900 million2

Martinez

Kenai

Anacortes

Dickinson Mandan

St. Paul Park

Los Angeles

Salt

Lake

City

Gallup

El Paso

San

Antonio

Kenai

4

Vermillion Compression

$15 - $20 Million 7

Conan Crude Oil Pipeline1

$225 Million

1

North Dakota Gathering

$25 - $45 Million 6

LA Refinery Interconnect Pipeline System1

$150 Million

2

1

2

Carson Crude Terminal

$140 - $160 Million

3

3

6

Natural Gas and NGLs Optimization

$140 - $150 Million

5

5

7

Stockton Rail Offloading

$15 - $20 Million

4

1. Expected to be funded and/or acquired at cost

2. Includes other discrete projects of $100 to $125 million

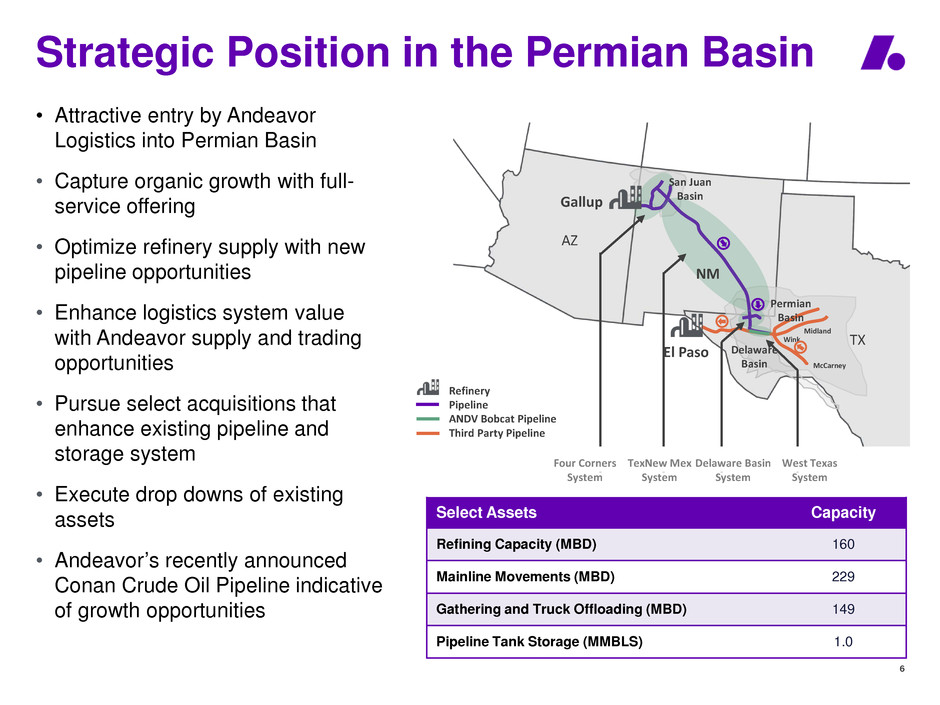

Strategic Position in the Permian Basin

6

• Attractive entry by Andeavor

Logistics into Permian Basin

• Capture organic growth with full-

service offering

• Optimize refinery supply with new

pipeline opportunities

• Enhance logistics system value

with Andeavor supply and trading

opportunities

• Pursue select acquisitions that

enhance existing pipeline and

storage system

• Execute drop downs of existing

assets

• Andeavor’s recently announced

Conan Crude Oil Pipeline indicative

of growth opportunities

Four Corners

System

TexNew Mex

System

Delaware Basin

System

West Texas

System

Refinery

Pipeline

ANDV Bobcat Pipeline

Third Party Pipeline

Permian

Basin

Delaware

Basin

Gallup

El Paso

NM

AZ

TX

Midland

McCarney

Wink

San Juan

Basin

Select Assets Capacity

Refining Capacity (MBD) 160

Mainline Movements (MBD) 229

Gathering and Truck Offloading (MBD) 149

Pipeline Tank Storage (MMBLS) 1.0

7

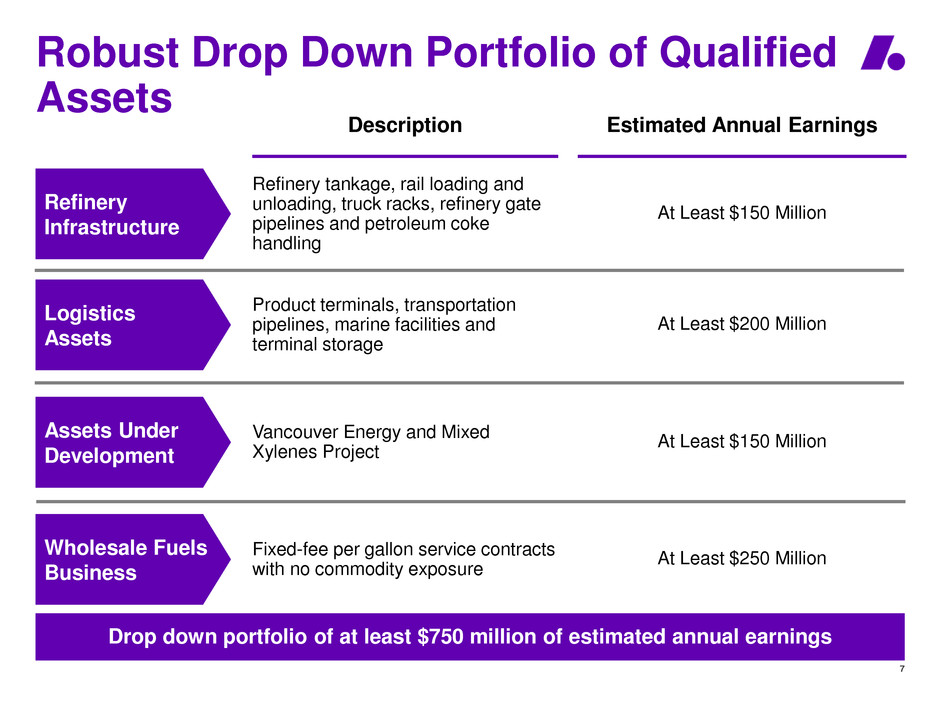

Robust Drop Down Portfolio of Qualified

Assets

Drop down portfolio of at least $750 million of estimated annual earnings

Refinery tankage, rail loading and

unloading, truck racks, refinery gate

pipelines and petroleum coke

handling

Assets Under

Development

Wholesale Fuels

Business

Refinery

Infrastructure

Logistics

Assets

Product terminals, transportation

pipelines, marine facilities and

terminal storage

Vancouver Energy and Mixed

Xylenes Project

Fixed-fee per gallon service contracts

with no commodity exposure

Description

At Least $150 Million

Estimated Annual Earnings

At Least $200 Million

At Least $150 Million

At Least $250 Million

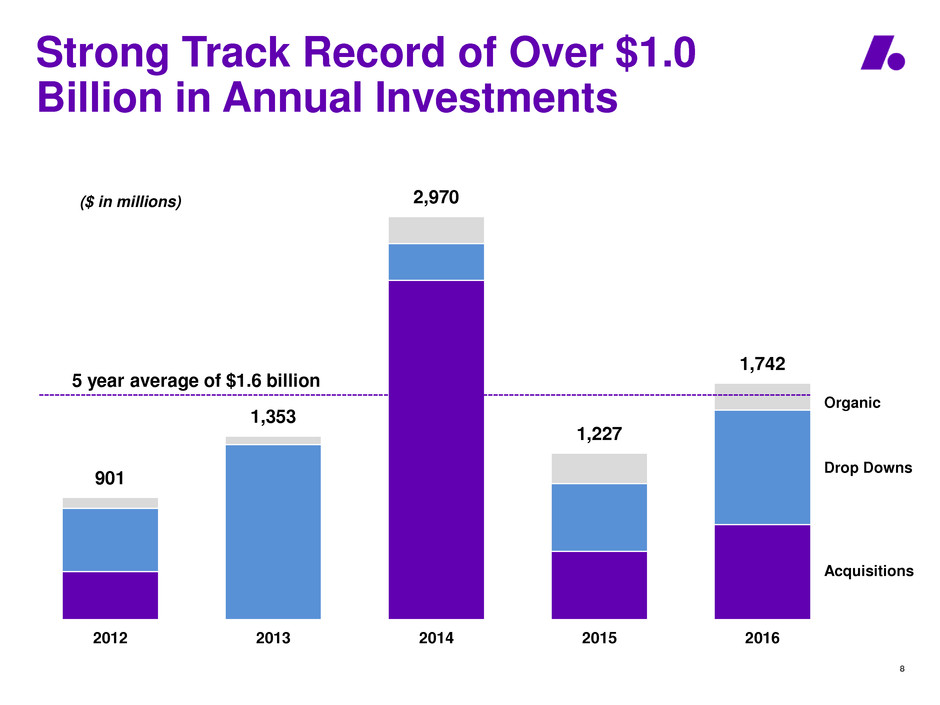

901

1,353

2,970

1,227

1,742

2012 2013 2014 2015 2016

($ in millions)

5 year average of $1.6 billion

8

Strong Track Record of Over $1.0

Billion in Annual Investments

Acquisitions

Drop Downs

Organic

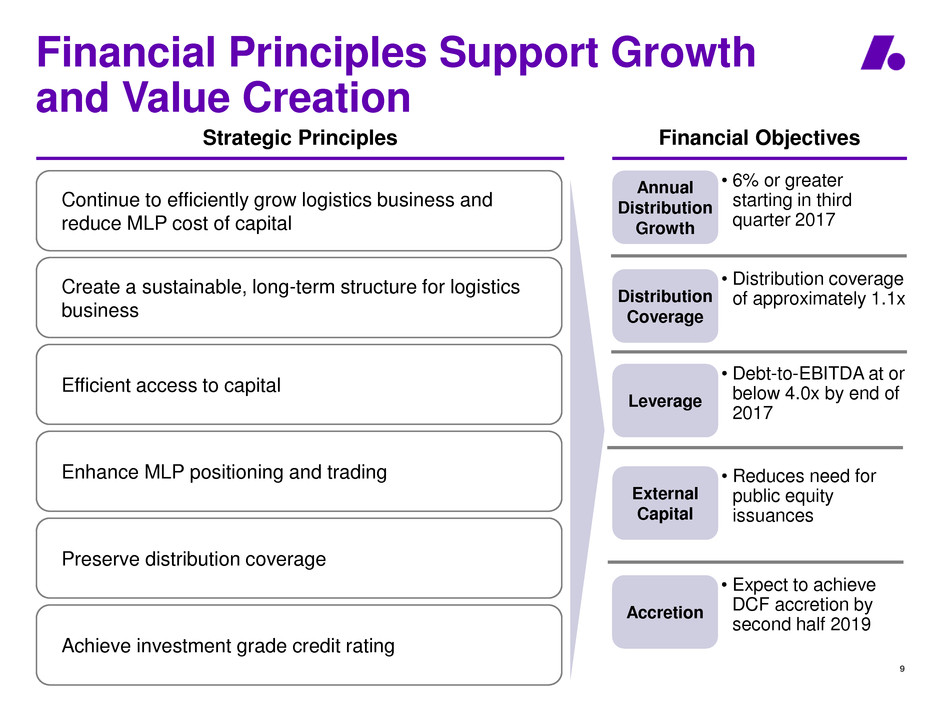

Continue to efficiently grow logistics business and

reduce MLP cost of capital

• 6% or greater

starting in third

quarter 2017

Create a sustainable, long-term structure for logistics

business

Annual

Distribution

Growth

Efficient access to capital

Enhance MLP positioning and trading

Preserve distribution coverage

Achieve investment grade credit rating

Distribution

Coverage

External

Capital

• Distribution coverage

of approximately 1.1x

Leverage

• Debt-to-EBITDA at or

below 4.0x by end of

2017

• Reduces need for

public equity

issuances

Strategic Principles Financial Objectives

9

Financial Principles Support Growth

and Value Creation

Accretion

• Expect to achieve

DCF accretion by

second half 2019

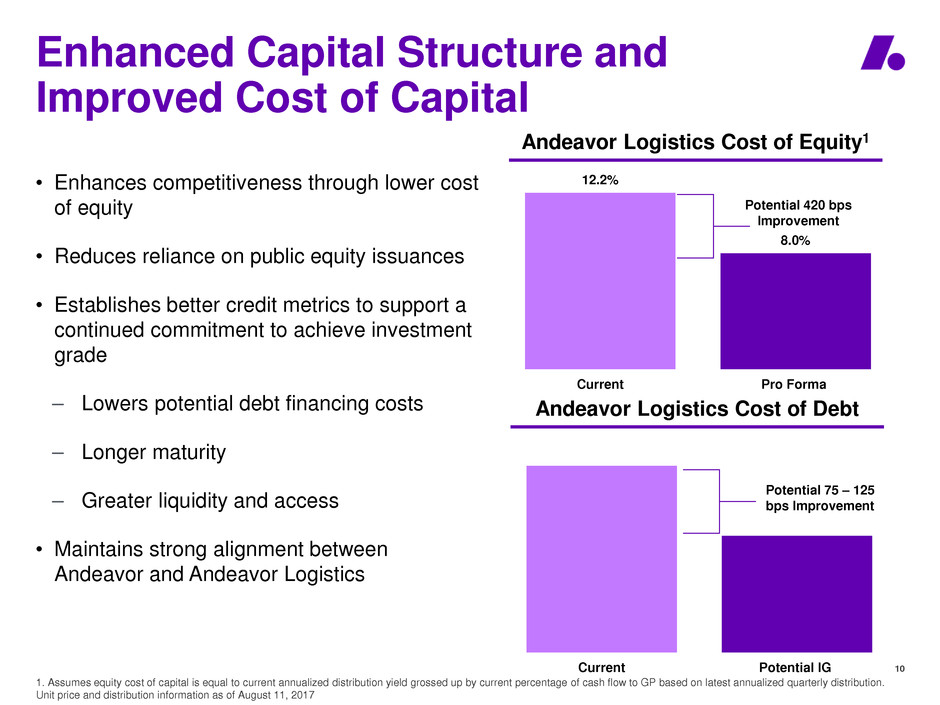

• Enhances competitiveness through lower cost

of equity

• Reduces reliance on public equity issuances

• Establishes better credit metrics to support a

continued commitment to achieve investment

grade

– Lowers potential debt financing costs

– Longer maturity

– Greater liquidity and access

• Maintains strong alignment between

Andeavor and Andeavor Logistics

12.2%

8.0%

Current Pro Forma

Andeavor Logistics Cost of Equity1

1. Assumes equity cost of capital is equal to current annualized distribution yield grossed up by current percentage of cash flow to GP based on latest annualized quarterly distribution.

Unit price and distribution information as of August 11, 2017

Potential 420 bps

Improvement

10

Enhanced Capital Structure and

Improved Cost of Capital

Current Potential IG

Andeavor Logistics Cost of Debt

Potential 75 – 125

bps Improvement

11

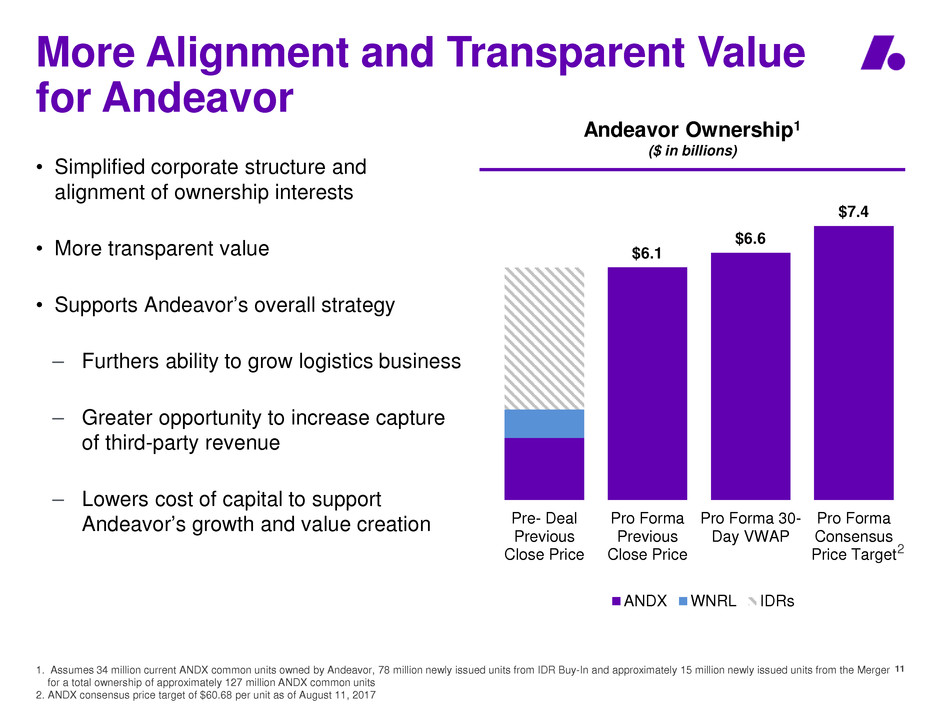

• Simplified corporate structure and

alignment of ownership interests

• More transparent value

• Supports Andeavor’s overall strategy

– Furthers ability to grow logistics business

– Greater opportunity to increase capture

of third-party revenue

– Lowers cost of capital to support

Andeavor’s growth and value creation

Andeavor Ownership1

($ in billions)

More Alignment and Transparent Value

for Andeavor

1. Assumes 34 million current ANDX common units owned by Andeavor, 78 million newly issued units from IDR Buy-In and approximately 15 million newly issued units from the Merger

for a total ownership of approximately 127 million ANDX common units

2. ANDX consensus price target of $60.68 per unit as of August 11, 2017

$6.1

$6.6

$7.4

Pre- Deal

Previous

Close Price

Pro Forma

Previous

Close Price

Pro Forma 30-

Day VWAP

Pro Forma

Consensus

Price Target

ANDX WNRL IDRs

2

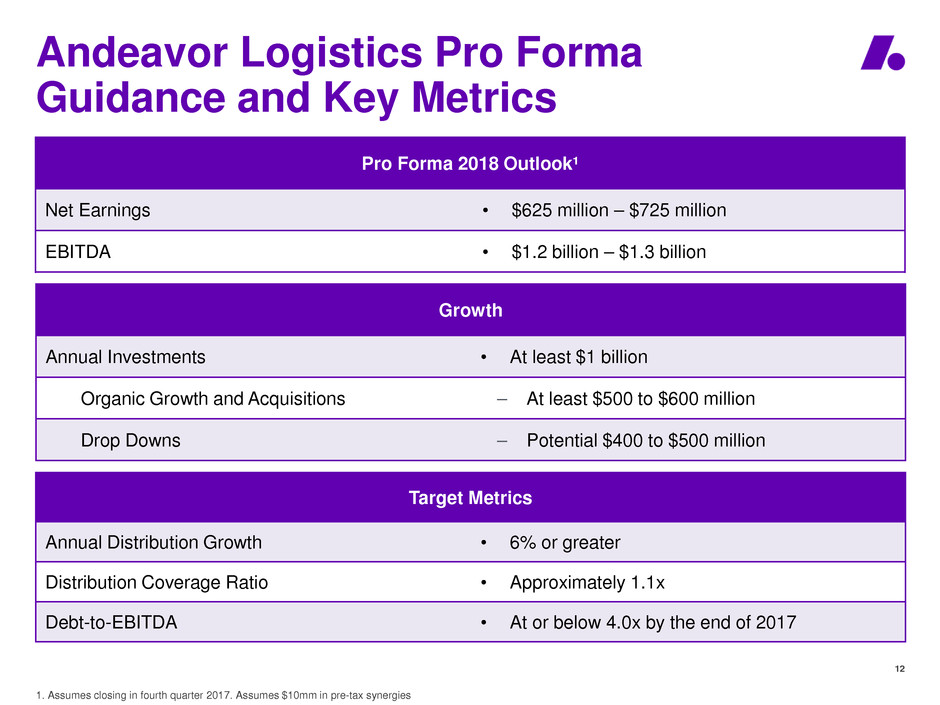

Andeavor Logistics Pro Forma

Guidance and Key Metrics

12

Target Metrics

Annual Distribution Growth • 6% or greater

Distribution Coverage Ratio • Approximately 1.1x

Debt-to-EBITDA • At or below 4.0x by the end of 2017

Pro Forma 2018 Outlook¹

Net Earnings • $625 million – $725 million

EBITDA • $1.2 billion – $1.3 billion

1. Assumes closing in fourth quarter 2017. Assumes $10mm in pre-tax synergies

Growth

Annual Investments • At least $1 billion

Organic Growth and Acquisitions – At least $500 to $600 million

Drop Downs – Potential $400 to $500 million

13

Delivering Significant Value

• Significant value proposition for all stakeholders

• Greater organic growth opportunities across the

combined geographic footprint

• Robust drop down portfolio of qualified assets

• Enhanced distribution growth, distribution

coverage and credit metrics

• Simplified capital structure and improved cost of

capital

• Better alignment and more transparent value of

all ownership interests

Andeavor

Appendix

14

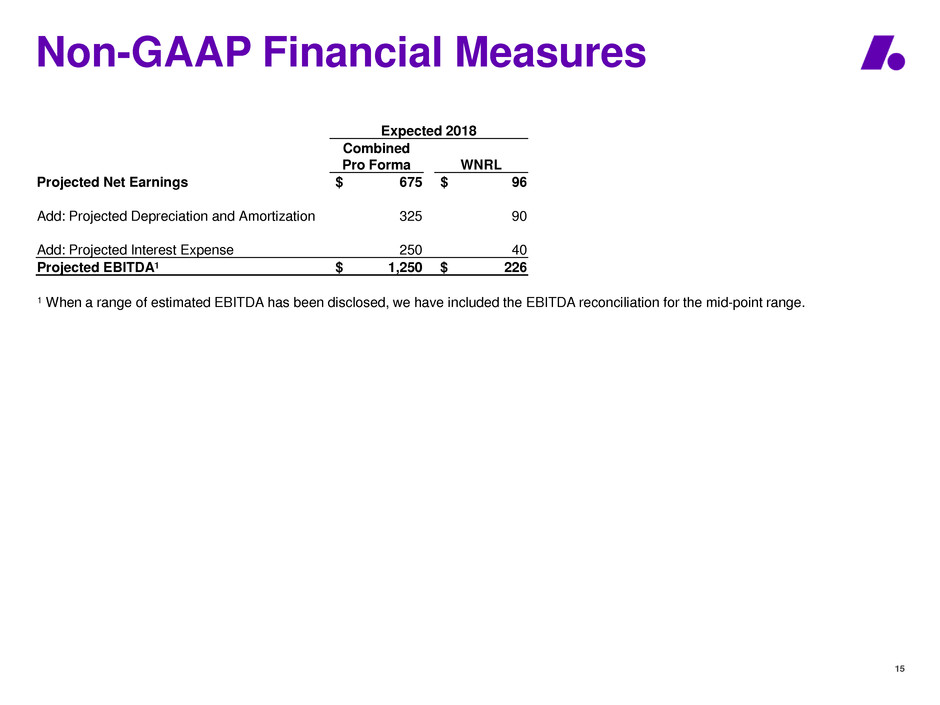

Non-GAAP Financial Measures

15

Expected 2018

Combined

Pro Forma WNRL

Projected Net Earnings $ 675 $ 96

Add: Projected Depreciation and Amortization

325

90

Add: Projected Interest Expense

250

40

Projected EBITDA1 $ 1,250 $ 226

1 When a range of estimated EBITDA has been disclosed, we have included the EBITDA reconciliation for the mid-point range.

Important Information

No Offer or Solicitation:

This communication relates to a proposed business combination between WNRL and Andeavor Logistics and a proposed transaction between

Andeavor Logistics and Andeavor. This communication is for informational purposes only and is neither an offer to purchase, nor a solicitation

of an offer to sell, any securities in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or

transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information and Where to Find It:

Andeavor Logistics and WNRL intend to file a registration statement on Form S-4, containing a consent statement/prospectus (the “S-4”) with

the SEC. This communication is not a substitute for the registration statement, definitive consent statement/prospectus or any other documents

that Andeavor Logistics, WNRL or Andeavor may file with the SEC or send to unitholders in connection with the proposed transaction.

UNITHOLDERS OF ANDEAVOR LOGISTICS AND WNRL AND SHAREHOLDERS OF ANDEAVOR ARE URGED TO READ ALL RELEVANT

DOCUMENTS FILED WITH THE SEC, INCLUDING THE FORM S-4 AND THE DEFINITIVE CONSENT STATEMENT/PROSPECTUS

INCLUDED THEREIN IF AND WHEN FILED, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. When available, investors and security holders will be

able to obtain copies of these documents, including the consent statement/prospectus, and any other documents that may be filed with the

SEC with respect to the proposed transactions free of charge at the SEC’s website, http://www.sec.gov. Copies of documents filed with the

SEC by Andeavor Logistics will be made available free of charge on Andeavor Logistics’ website at http://andeavorlogistics.com/ or by

contacting Andeavor Logistics’ Investor Relations Department by phone at (210) 626-7202. Copies of documents filed with the SEC by WNRL

will be made available free of charge on WNRL’s website at http://www.wnrl.com or by contacting WNRL’s Investor Relations Department by

phone at (602) 286-1533. Copies of documents filed with the SEC by ANDV will be made available free of charge on ANDV’s website at

http://www.andeavor.com or by contacting ANDV’s Investor Relations Department by phone at (210) 626-4757.

Participants in the Solicitation Relating to the Merger

Andeavor Logistics, WNRL, Andeavor and certain of their respective directors and executive officers may be deemed to be participants in the

solicitation of consent from the unitholders of WNRL in connection with the proposed transaction. Information about the directors and executive

officers of the general partner of Andeavor Logistics is set forth in Andeavor Logistics’ Annual Report on Form 10-K for the year ended

December 31, 2016, which was filed with the SEC on February 21, 2017. Information about the directors and executive officers of the general

partner of WNRL is set forth in WNRL’s Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the SEC on

March 1, 2017. Information about the executive officers of Andeavor is set forth in Andeavor’s Annual Report on Form 10-K for the year ended

December 31, 2016, which was filed with the SEC on February 21, 2017. Information about the directors of Andeavor is set forth in Andeavor’s

Definitive Proxy Statement on Schedule 14A for its 2017 Annual Meeting of Stockholders, which was filed with the SEC on March 22, 2017.

These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the consent

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the consent

statement/prospectus and other relevant materials to be filed with the SEC when they become available. 16