Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Manitex International, Inc. | d376270d8k.htm |

Exhibit 99.1

MANITEX INTERNATIONAL, INC.

(NASDAQ: MNTX)

Corporate Presentation

August 2017

FORWARD-LOOKING STATEMENT

& NON-GAAP MEASURES

Safe Harbor Statement under

the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains

statements that are forward-looking in nature which express the beliefs and

expectations of management including

statements regarding the Company’s expected results of operations or liquidity; statements concerning projections,

predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic

performance; and statements of management’s goals and objectives and other similar expressions concerning matters that

are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,”

“estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,”

“may,” “will,” “should,” “could,”

and similar expressions. Such statements are based on current plans, estimates and

expectations and involve a number of

known and unknown risks, uncertainties and other factors that could cause the Company’s future results, performance or

achievements to differ significantly from the results, performance or achievements expressed or implied by such forwardlooking

statements. These factors and additional information are discussed in the Company’s filings with the Securities and

Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although

we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forwardlooking

statements speak only as of the date on which they are made, and the Company undertakes no obligation to update

publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Non-GAAP Measures: Manitex International from time to time refers to various non-GAAP (generally

accepted accounting

principles) financial measures in this presentation. Manitex believes that this information is useful to understanding its

operating results without the impact of special items. See Manitex’s Q2 2017 earnings release on the Investor Relations

section of our website www.manitexinternational.com for a description and/or reconciliation of these measures. NASDAQ : MNTX2

MANITEX INTERNATIONAL:

OVERVIEW

Manitex International is a leading provider of straight- mast and knuckle boom

cranes and other specialized equipment for niche industrial applications;

Manitex has its assembly facilities located in North America and Europe and

products are sold through independent dealers, worldwide. NASDAQ : MNTX 3

Our Primary Products-

Straight-mast a n d “Knuckleboom”

Cranes NASDAQ : MNTX 4

Why We are Here Today-Investment

Considerations

IMPROVING OUTLOOK for 2017 financials as recovery begins to accelerate:

Announced backlog of 47.6 million, growth of 52.1% over 12/31/16

Finished Q2 2017 with book to bill of .93, indicative of higher order activity than in previous

years

Achieved Q2 2017 adjusted gross margin of 21.5 percent

Production is expected to steadily increase along with revenues, margins, and EBITDA

throughout the year and into next

• DELEVERAGING, including ASV partial

sale, has brought net debt down below $90M

• Steady increase in MARKET SHARE in straight-mast cranes last 5 years; potential to take marke

share for knuckle boom cranes via PM—Last Peak PM and Manitex was OVER $350M in net sales

• Potential EARNINGS POWER now exceeds prior peak level; product mix has changed the margin

profile away from low-margin materials handling businesses to primarily crane businesses NASDAQ : MNTX5

Sales Increase and Margin

Expansion in 2017 and Beyond

Sales:

• Crane backlog growth should add gradually to sales throughout 2017

• Peak level

for remaining businesses* was > $350M

• Run rate sales for remaining businesses* of just over $200M

* Remaining businesses = Manitex, PM, C&M, Badger, Sabre, and Valla

Margin Profile

Improves in 2017 from non-crane divestitures with <4% EBITDA margin:

• Sales reduction $90M

• EBITDA reduction $4M

Over $15 million in cost reductions achieved through sourcing

and operating efficiency

initiatives 2015-2017

10% EBITDA margin goal with

economic recovery and execution NASDAQ : MNTX 6

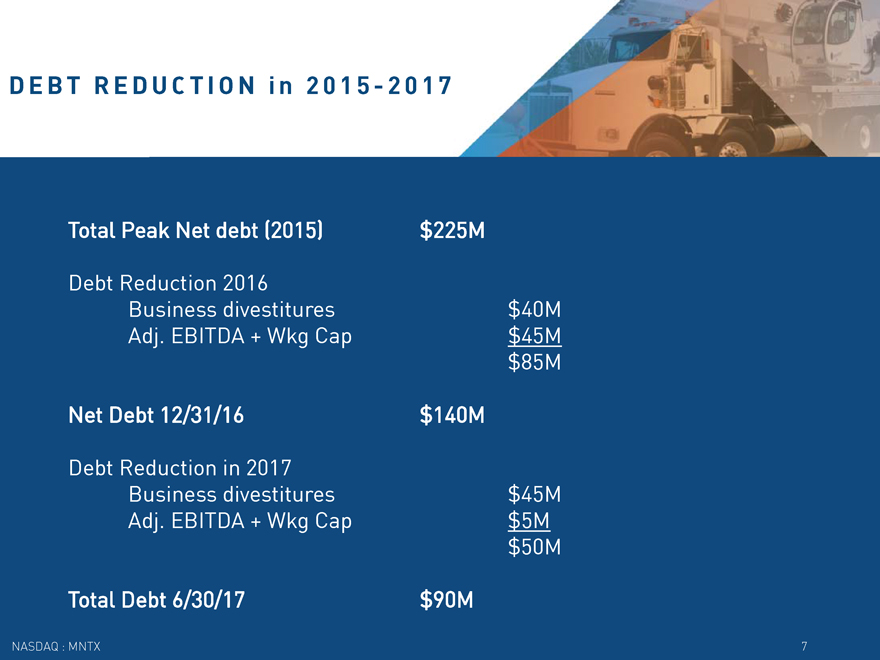

DEBT REDUCTION in 2015-2017

Total Peak Net debt (2015) $225M

Debt Reduction 2016

Business divestitures $40M

Adj. EBITDA + Wkg Cap $45M

$85M

Net Debt 12/31/16 $140M

Debt Reduction in 2017

Business divestitures $45M

Adj. EBITDA + Wkg Cap $5M

$50M

Total Debt 6/30/17 $90M NASDAQ : MNTX 7

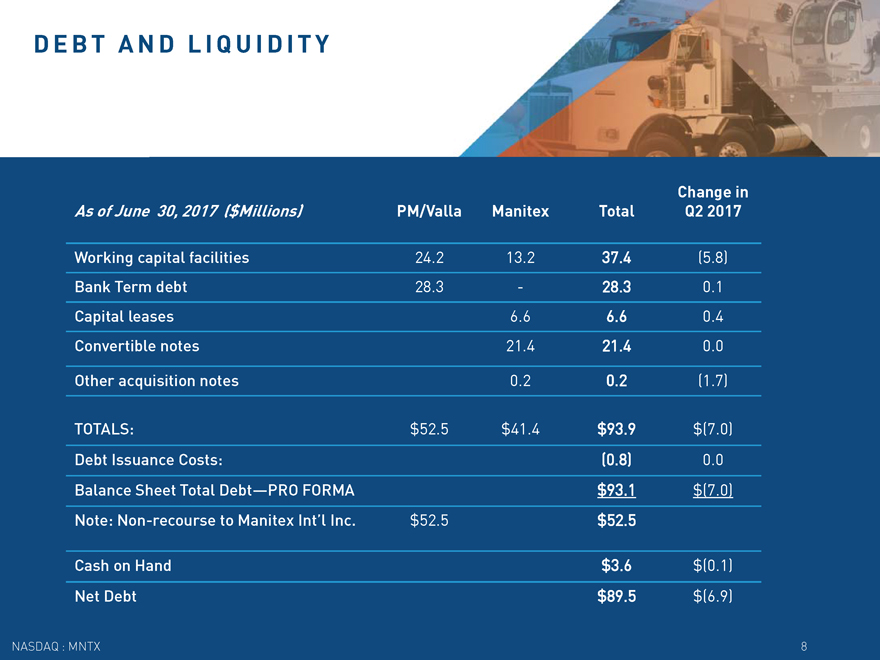

DEBT AND LIQUIDITY

As of June 30, 2017 ($Millions) PM/Valla Manitex Total

Change in

Q2 2017

Working capital facilities 24.2 13.2 37.4 (5.8)

Bank Term debt 28.3 - 28.3 0.1

Capital leases 6.6 6.6 0.4

Convertible notes 21.4 21.4 0.0

Other acquisition notes 0.2 0.2 (1.7)

TOTALS: $52.5 $41.4 $93.9 $(7.0)

Debt Issuance Costs: (0.8) 0.0

Balance Sheet Total Debt—PRO FORMA $93.1 $(7.0)

Note:

Non-recourse to Manitex Int’l Inc. $52.5 $52.5

Cash on Hand $3.6 $(0.1)

Net Debt $89.5 $(6.9)

NASDAQ : MNTX 8

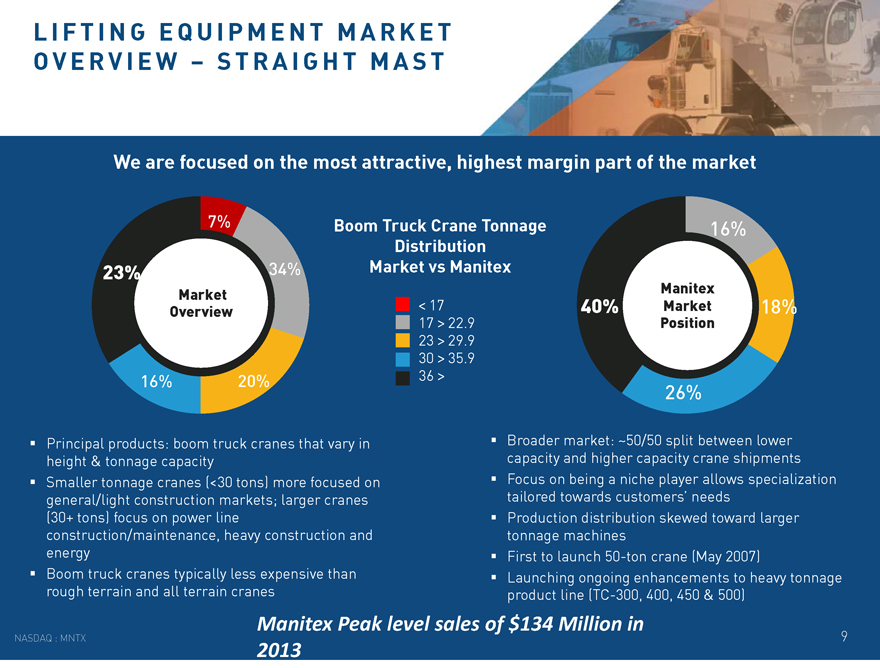

LIFTING EQUIPMENT MARKET

OVERVIEW – STRAIGHT MAST

7%

23% 34%

Market Overview

16% 20%

We are focused on the most attractive, highest margin part of the market

Boom Truck Crane Tonnage Distribution Market vs Manitex

< 17

17 > 22.9

23 > 29.9

30 > 35.9

36 >

16%

Manitex

40% Market 18%

Position

26%

Principal products: boom truck cranes that vary in height & tonnage capacity

Smaller tonnage cranes (<30 tons) more focused on general/light construction markets; larger cranes (30+ tons) focus on power line construction/maintenance, heavy construction and energy Boom truck cranes typically less expensive than rough

terrain and all terrain cranes

Broader market: ~50/50 split between lower capacity and higher capacity crane shipments Focus on being a niche player allows

specialization tailored towards customers’ needs Production distribution skewed toward larger tonnage machines First to launch 50-ton crane (May 2007) Launching ongoing enhancements to heavy tonnage

product line (TC-300, 400, 450 & 500)

NASDAQ : MNTX

Manitex Peak level sales of $134 Million in 2013

9

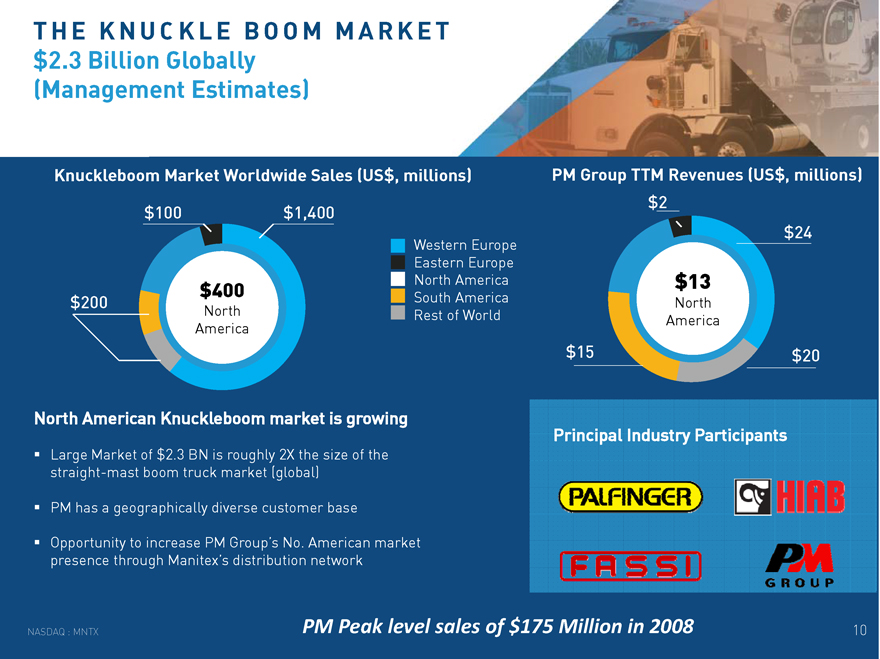

THE KNUCKLE BOOM MARKET $2.3 Billion Globally (Management Estimates)

Knuckleboom Market Worldwide Sales (US$, millions)

$100 $1,400

Western Europe Eastern Europe North America $400 South America $200 North Rest of World America

North American Knuckleboom market is growing

Large Market of $2.3 BN is

roughly 2X the size of the straight-mast boom truck market (global)

PM has a geographically diverse customer base

Opportunity to increase PM Group’s No. American market presence through Manitex’s distribution network

PM Group TTM Revenues (US$, millions) $2 $24

$13

North America

$15 $20

Principal Industry Participants

NASDAQ : MNTX

PM Peak level sales of $175 Million in 2008

10

REPLACEMENTS PARTS & SERVICE

Consistent recurring revenue stream throughout the cycle

Typically generates 10%-20% of net sales in a quarter/year Typically carry 2x gross margin of core equipment business

Spares relate to swing drives,

rotating components, & booms among others, many of which are proprietary

Serve additional brands

Service team for crane equipment

Automated proprietary system implemented in principal

operations

NASDAQ : MNTX

11

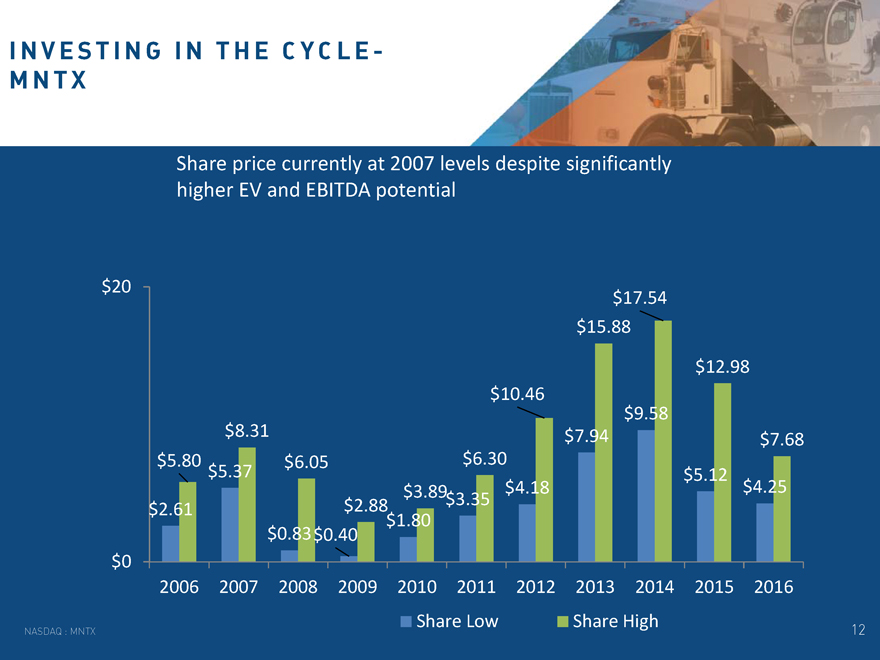

INVESTING IN THE CYCLE-MNTX

Share price currently at 2007 levels despite significantly higher EV and EBITDA potential

$20

$17.54

$15.88

$12.98

$10.46 $9.58 $8.31 $7.94 $7.68 $5.80 $6.05 $6.30 $5.37 $5.12 $3.89 $4.18 $4.25 $2.88 $3.35 $2.61 $1.80 $0.83$0.40 $0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

NASDAQ : MNTX

Share Low

Share High

12

Valuation – Equity Holders to Benefit as we move debt to equity

($, Millions)

Implied Implied EBITDA EV Debt Equity Share Price

20 200 85 115 $ 6.93

20 250 70 180 $ 10.84

25 250 85 165 $ 9.94

25 250 70 180 $ 10.84

35 350 70 280 $ 16.87

35 350 55 295 $ 17.77

40 400 55 345 $ 20.78

MNTX holders retain 21% ownership of ASV-at current market price, worth

~ $16M

NASDAQ : MNTX

13

OPERATING COMPANIES Products, End Market, Drivers

Straight-mast boomtrucks and Power transmission Strong end market demand for specialized, cranes Industrial projects competitively differentiated products for oil, Sign cranes

Infrastructure development gas, and energy sectors Parts Product development

Knuckle boom cranes Construction Growing acceptance of knucklebooms in Truck-mounted

Aerial Infrastructure North American markets Platforms Utilities Oil and gas exploration creating demand Product development

Specialized equipment for Energy

Reputation for quality & innovation liquid storage & containment Petrochemical Serves a market of over $1B annually 8,000-21,000 gallon capacities Waste management

Precision pick & carry cranes Automotive Strong end market demand for specialized, Chemical / petrochemical competitively differentiated products Infrastructure

development Environmental (electric) or hazardous (spark Aerospace free) developments Construction Product development

Rough terrain cranes Railroad Equipment

replacement cycle in small Specialized construction Construction tonnage flexible cranes for refinery market equipment Refineries More efficient product offering across end Parts Municipality markets

NASDAQ : MNTX

14

EXPERIENCED MANAGEMENT TEAM

David Langevin, Chairman & CEO 20+ years principally with Terex

Michael Schneider,

CFO

Formerly with Ernst & Young, 20+ years in financial operations

Scott Rolston, SVP Strategic Planning

13+ years principally with Manitowoc

Steve Kiefer, SVP Sales and Marketing

25+ years principally with Eaton Corp.

and Hendrickson International

Jim Peterson, SVP Operations 35+ years in manufacturing operations

Luigi Fucili, CEO PM Group

10+ years principally with PM Group

NASDAQ : MNTX

15

MANITEX INTERNATIONAL, INC.

FINANCIAL OVERVIEW

August 2017

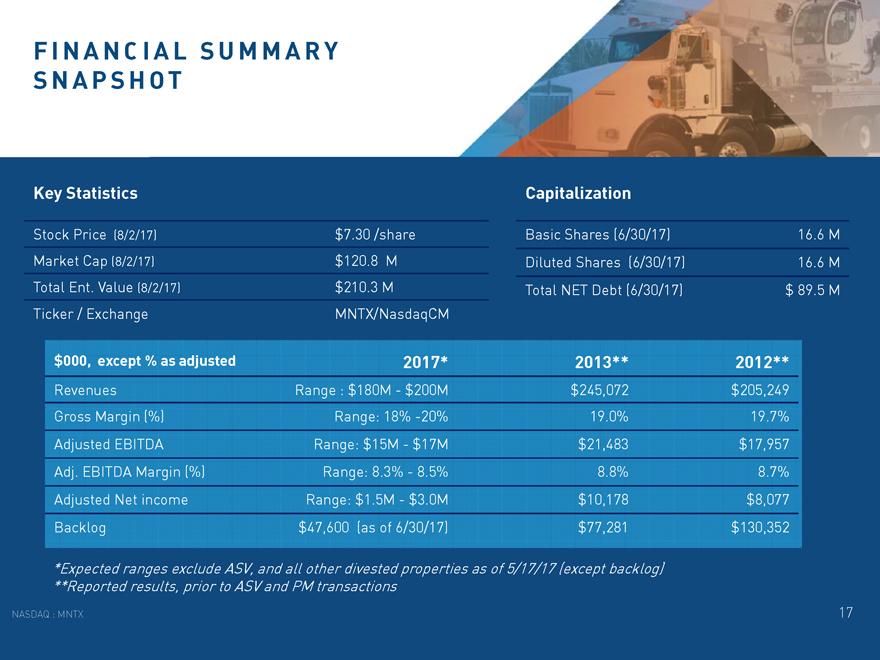

FINANCIAL SUMMARY SNAPSHOT

Key Statistics Capitalization

Stock Price (8/2/17) $7.30 /share Basic Shares (6/30/17) 16.6 M

Market Cap (8/2/17) $120.8 M Diluted Shares (6/30/17) 16.6 M Total Ent. Value (8/2/17) $210.3 M Total NET Debt (6/30/17) $ 89.5 M Ticker / Exchange MNTX/NasdaqCM

$000, except % as adjusted 2017* 2013** 2012**

Revenues Range : $180M - $200M

$245,072 $205,249 Gross Margin (%) Range: 18% -20% 19.0% 19.7% Adjusted EBITDA Range: $15M - $17M $21,483 $17,957 Adj. EBITDA Margin (%) Range: 8.3% - 8.5% 8.8% 8.7% Adjusted Net income Range: $1.5M - $3.0M

$10,178 $8,077 Backlog $47,600 (as of 6/30/17) $77,281 $130,352

*Expected ranges exclude ASV, and all other divested properties as of 5/17/17 (except backlog)

**Reported results, prior to ASV and PM transactions

NASDAQ : MNTX

17

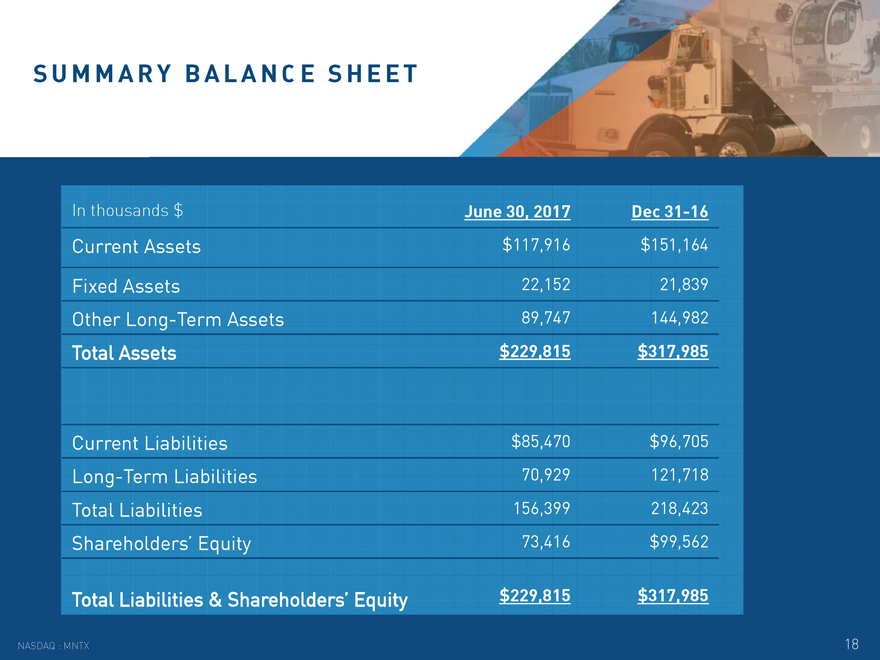

SUMMARY BALANCE SHEET

In thousands $ June 30, 2017 Dec 31-16

Current

Assets $117,916 $151,164

Fixed Assets 22,152 21,839 Other Long-Term Assets 89,747 144,982

Total Assets $229,815 $317,985

Current Liabilities $85,470 $96,705 Long-Term Liabilities

70,929 121,718 Total Liabilities 156,399 218,423 Shareholders’ Equity 73,416 $99,562

Total Liabilities & Shareholders’ Equity $229,815 $317,985

NASDAQ : MNTX

18

MANITEX INTERNATIONAL, INC.

(NASDAQ : MNTX) August 2017

David Langevin, CEO

708 - 237 - 2060 dlangevin@manitex.com

Peter Seltzberg , IRD arrow Associates, Inc.

516 - 419 - 9915 pseltzberg@darrowir.com