Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ares Management Corp | a2017q2-form8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - Ares Management Corp | a2017q2-ex991.htm |

Second Quarter 2017

Earnings Presentation

Exhibit 99.2

2

Important Notice

This presentation contains “forward looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to

risks and uncertainties. Actual outcomes and results could differ materially from those suggested by this presentation due to the impact of many factors beyond the

control of Ares Management, L.P. (“Ares”), including those listed in the “Risk Factors” section of our filings with the Securities and Exchange Commission (“SEC”). Any

such forward-looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and Ares assumes no obligation to update

or revise any such forward-looking statements.

Certain information discussed in this presentation was derived from third party sources and has not been independently verified and, accordingly, Ares makes no

representation or warranty in respect of this information.

The following slides contain summaries of certain financial and statistical information about Ares. The information contained in this presentation is summary

information that is intended to be considered in the context of Ares’ SEC filings and other public announcements that Ares may make, by press release or otherwise,

from time to time. Ares undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this

presentation. In addition, this presentation contains information about Ares, its affiliated funds and certain of their respective personnel and affiliates, and their

respective historical performance. You should not view information related to the past performance of Ares and its affiliated funds, as indicative of future results.

Certain information set forth herein includes estimates and targets and involves significant elements of subjective judgment and analysis. Further, such information,

unless otherwise stated, is before giving effect to management and incentive fees and deductions for taxes. No representations are made as to the accuracy of such

estimates or targets or that all assumptions relating to such estimates or targets have been considered or stated or that such estimates or targets will be realized.

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of Ares.

Management uses certain non-GAAP financial measures, including assets under management, fee paying assets under management, economic net income and

distributable earnings, to evaluate Ares’ performance and that of its business segments. Management believes that these measures provide investors with a greater

understanding of Ares’ business and that investors should review the same supplemental non-GAAP financial measures that management uses to analyze Ares’

performance. The measures described herein represent those non-GAAP measures used by management, in each case, before giving effect to the consolidation of

certain funds that the company consolidates with its results in accordance with GAAP. These measures should be considered in addition to, and not in lieu of, Ares’

financial statements prepared in accordance with GAAP. The definitions and reconciliations of these measures to the most directly comparable GAAP measures, as well

as an explanation of why we use these measures, are included in the Appendix. Amounts and percentages may reflect rounding adjustments and consequently totals

may not appear to sum.

3

Second Quarter Highlights

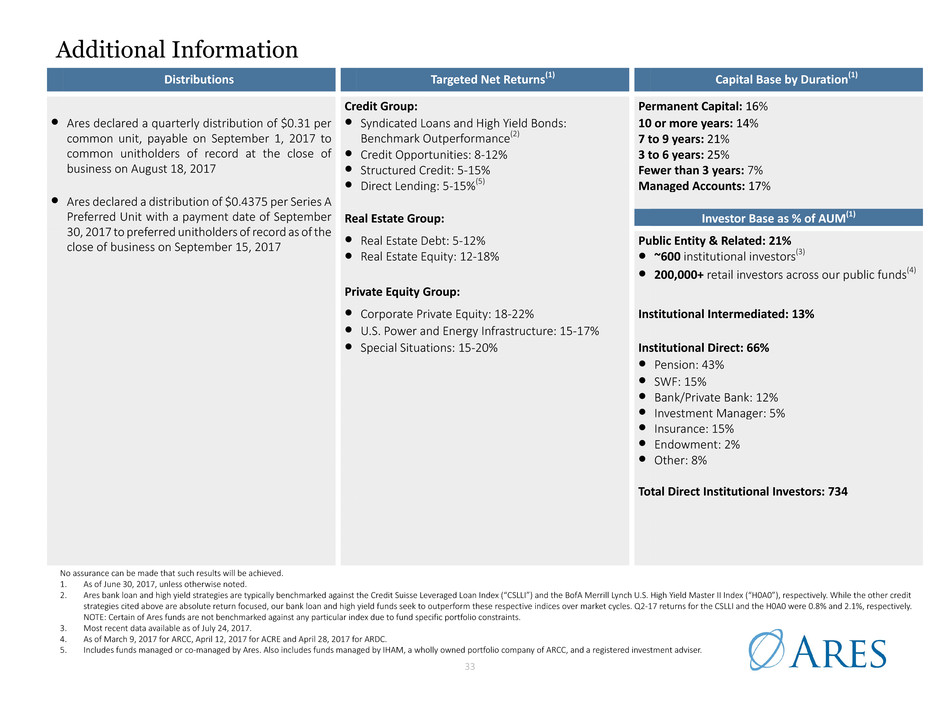

1. Net inflows represents gross commitments less redemptions.

2. Includes ARCC Part I Fees of $19.1 million for the three months ended June 30, 2017. Difference between GAAP and Unconsolidated management fees represents $4.8 million from Consolidated Funds that is

eliminated upon consolidation.

3. Total pro forma units of 214,569,211 includes the sum of common units, Ares Operating Group Units that are exchangeable for common units on a one-for-one basis and the dilutive effects of the Company’s equity-

based awards. Please refer to slides 18 and 32 in this presentation for further information. After-tax Economic Net Income per unit is net of the preferred unit distribution.

4. After-tax Distributable Earnings per common unit is net of the preferred unit distribution.

5. Payable on September 1, 2017 to unitholders of record as of August 18, 2017.

6. Payable on September 30, 2017 to unitholders of record as of September 15, 2017.

Assets Under

Management

• Assets Under Management of $104.0 billion

• Fee Paying AUM of $70.5 billion

• Available Capital of $24.8 billion

• AUM Not Yet Earning Fees that is available for future deployment of $10.6 billion

• Raised $5.5 billion in gross new capital with net inflows of $4.9 billion(1) for the quarter ended June 30, 2017

• Capital deployment of $3.9 billion for the quarter ended June 30, 2017, of which $3.6 billion was related to our drawdown funds for the period

Financial Results

Distributable

Earnings and

Distributions

• Q2-17 GAAP net income attributable to Ares Management, L.P. of $49.9 million

• Q2-17 GAAP basic earnings per common unit of $0.54 and diluted earnings per common unit of $0.53

• Q2-17 GAAP management fees of $180.8 million(2)

• Q2-17 Unconsolidated management and other fees of $191.6 million(2)

• Q2-17 Fee Related Earnings of $53.4 million

• Q2-17 Performance Related Earnings of $104.7 million

• Q2-17 Economic Net Income of $158.1 million and after-tax Economic Net Income of $0.69 per unit(3)

• Q2-17 Distributable Earnings of $69.7 million

• Q2-17 after-tax Distributable Earnings of $0.33 per common unit(4)

• Declared Q2-17 distributions of $0.31 per common unit(5) and $0.4375 per preferred unit(6)

4

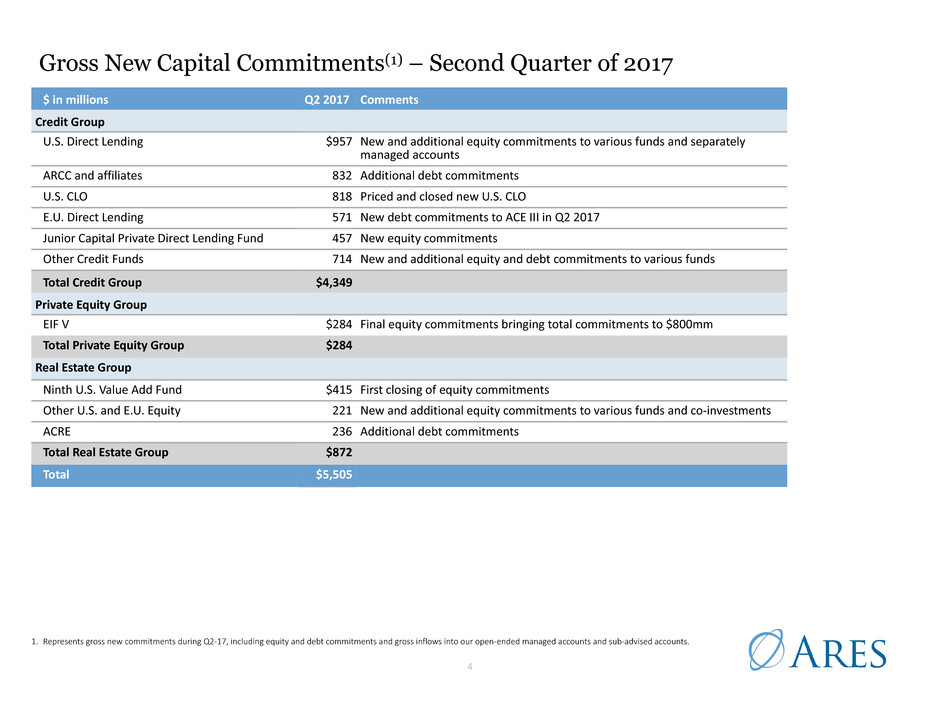

Gross New Capital Commitments(1) – Second Quarter of 2017

1. Represents gross new commitments during Q2-17, including equity and debt commitments and gross inflows into our open-ended managed accounts and sub-advised accounts.

$ in millions Q2 2017 Comments

Credit Group

U.S. Direct Lending $957 New and additional equity commitments to various funds and separately

managed accounts

ARCC and affiliates 832 Additional debt commitments

U.S. CLO 818 Priced and closed new U.S. CLO

E.U. Direct Lending 571 New debt commitments to ACE III in Q2 2017

Junior Capital Private Direct Lending Fund 457 New equity commitments

Other Credit Funds 714 New and additional equity and debt commitments to various funds

Total Credit Group $4,349

Private Equity Group

EIF V $284 Final equity commitments bringing total commitments to $800mm

Total Private Equity Group $284

Real Estate Group

Ninth U.S. Value Add Fund $415 First closing of equity commitments

Other U.S. and E.U. Equity 221 New and additional equity commitments to various funds and co-investments

ACRE 236 Additional debt commitments

Total Real Estate Group $872

Total $5,505

#679FD1

#49749B

#225070

#1E3154

#75B8F4

#DBE6EF

#A7D1EA

#ACACAC

#828282

#D2D2D2

5

Assets Under Management

Note: For definitions of AUM and FPAUM please refer to the “Glossary” slide in the appendix.

1. As of June 30, 2017, AUM amounts include funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital Corporation and a registered

investment adviser.

2. For Q2-17, distributions totaled approximately $1.2 billion and redemptions totaled approximately $0.6 billion.

AUM of $104.0 billion as of June 30, 2017 increased 9.2% year over year(1)

• Q2-17 net new capital commitments of $5.4 billion, including $2.9 billion in equity commitments and $2.5 billion in debt commitments

◦ Of the $5.5 billion in gross new capital commitments raised during the quarter, $2.0 billion is already earning fees and another $1.5 billion is expected to

become FPAUM upon deployment

• AUM growth was partially offset by distributions/redemptions of $1.8 billion(2), primarily in funds past their reinvestment periods in the Private Equity and Credit

Groups, and by reduction in leverage of $2.5 billion, primarily due to paydowns in CLOs and loans in ARCC's SSLP program

FPAUM of $70.5 billion as of June 30, 2017 increased 19.1% year over year

• Increase in FPAUM was primarily attributable to management fees turning on for ACOF V (effective March 3, 2017), which includes $7.6 billion of fee paying AUM

and ARCC's acquistion of ACAS which included $2.8 billion of fee paying AUM

AUM ($ in billions) FPAUM ($ in billions)

Q2-16 Q1-17 Q2-17

$60.3 $65.2 $67.4

$24.8

$24.7 $25.8

$10.1

$95.2

$9.9

$99.8

$10.8

$104.0

Q2-16 Q1-17 Q2-17

$40.6 $45.7

$46.5

$11.9

$17.2 $17.3$6.6

$59.1 $6.4

$69.3

$6.7

$70.5

Credit Private Equity Real Estate Credit Private Equity Real Estate

6

AUM, FPAUM and Management Fees Duration

As of June 30, 2017, approximately 76% of AUM and 72% of FPAUM had a duration longer than 3 years, from which FPAUM generated 82% of

management fees in Q2 2017

◦ Within our Managed Accounts category, 56% of AUM and 64% of FPAUM has been with the firm longer than 3 years as of June 30, 2017

14%

24%

7%

17%

7

%

30%

6%

22%

6%

20%

Permanent Capital 10 or more years 7 to 9 years 3 to 6 years Fewer Than 3 years Managed Accounts

76%

15%

72%

FPAUM: $70.5 billionAUM: $104.0 billion Management Fees: $185.6 million

82%

36%

16%

15%

15%

9%

9%

18%

16%

20%

18%

8%

20%16%

14%

21%

25%

7%

17%

7

Q2-16 Q1-17 Q2-17

$23,044

$29,637 $31,518

$19,291

$19,652 $20,710

$7,087

$49,422 $6,610

$55,899

$7,241

$59,469

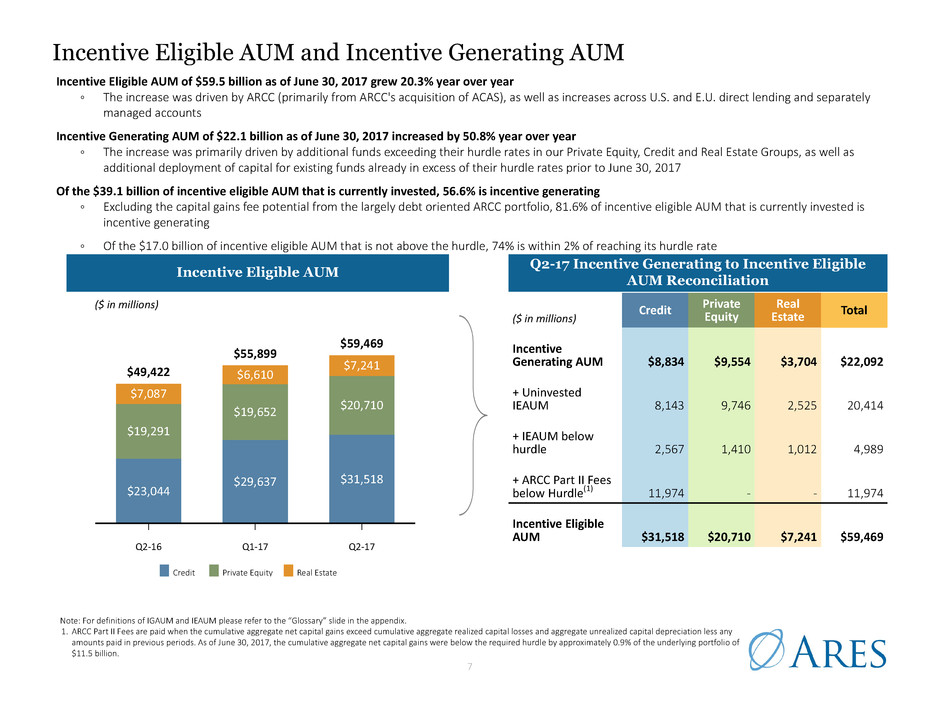

Incentive Eligible AUM and Incentive Generating AUM

Note: For definitions of IGAUM and IEAUM please refer to the “Glossary” slide in the appendix.

1. ARCC Part II Fees are paid when the cumulative aggregate net capital gains exceed cumulative aggregate realized capital losses and aggregate unrealized capital depreciation less any

amounts paid in previous periods. As of June 30, 2017, the cumulative aggregate net capital gains were below the required hurdle by approximately 0.9% of the underlying portfolio of

$11.5 billion.

Incentive Eligible AUM

Incentive Eligible AUM of $59.5 billion as of June 30, 2017 grew 20.3% year over year

◦ The increase was driven by ARCC (primarily from ARCC's acquisition of ACAS), as well as increases across U.S. and E.U. direct lending and separately

managed accounts

Incentive Generating AUM of $22.1 billion as of June 30, 2017 increased by 50.8% year over year

◦ The increase was primarily driven by additional funds exceeding their hurdle rates in our Private Equity, Credit and Real Estate Groups, as well as

additional deployment of capital for existing funds already in excess of their hurdle rates prior to June 30, 2017

Of the $39.1 billion of incentive eligible AUM that is currently invested, 56.6% is incentive generating

◦ Excluding the capital gains fee potential from the largely debt oriented ARCC portfolio, 81.6% of incentive eligible AUM that is currently invested is

incentive generating

◦ Of the $17.0 billion of incentive eligible AUM that is not above the hurdle, 74% is within 2% of reaching its hurdle rate

($ in millions)

Credit Private Equity Real Estate

($ in millions)

Credit PrivateEquity

Real

Estate Total

Incentive

Generating AUM $8,834 $9,554 $3,704 $22,092

+ Uninvested

IEAUM 8,143 9,746 2,525 20,414

+ IEAUM below

hurdle 2,567 1,410 1,012 4,989

+ ARCC Part II Fees

below Hurdle(1) 11,974 - - 11,974

Incentive Eligible

AUM $31,518 $20,710 $7,241 $59,469

Q2-17 Incentive Generating to Incentive Eligible

AUM Reconciliation

8

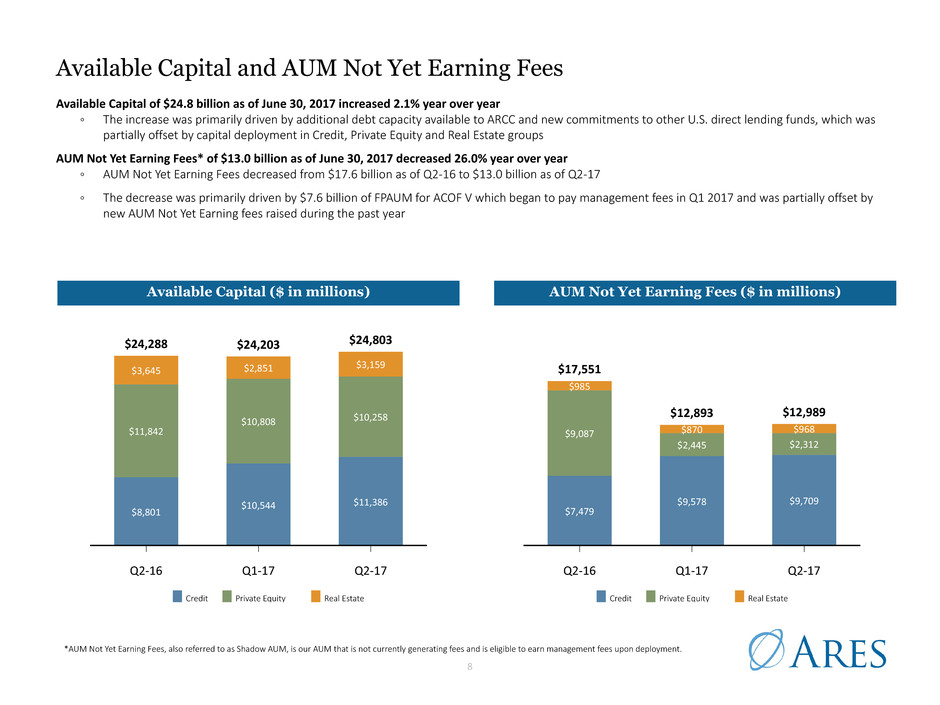

Available Capital and AUM Not Yet Earning Fees

Available Capital of $24.8 billion as of June 30, 2017 increased 2.1% year over year

◦ The increase was primarily driven by additional debt capacity available to ARCC and new commitments to other U.S. direct lending funds, which was

partially offset by capital deployment in Credit, Private Equity and Real Estate groups

AUM Not Yet Earning Fees* of $13.0 billion as of June 30, 2017 decreased 26.0% year over year

◦ AUM Not Yet Earning Fees decreased from $17.6 billion as of Q2-16 to $13.0 billion as of Q2-17

◦ The decrease was primarily driven by $7.6 billion of FPAUM for ACOF V which began to pay management fees in Q1 2017 and was partially offset by

new AUM Not Yet Earning fees raised during the past year

Available Capital ($ in millions) AUM Not Yet Earning Fees ($ in millions)

*AUM Not Yet Earning Fees, also referred to as Shadow AUM, is our AUM that is not currently generating fees and is eligible to earn management fees upon deployment.

Q2-16 Q1-17 Q2-17

$8,801

$10,544 $11,386

$11,842

$10,808 $10,258

$3,645

$24,288

$2,851

$24,203

$3,159

$24,803

Credit Private Equity Real EstateCredit Private Equity Real Estate

Q2-16 Q1-17 Q2-17

$7,479

$9,578 $9,709

$9,087

$2,445 $2,312

$985

$17,551

$870

$12,893

$968

$12,989

9

$7,820

$1,932

$879

AUM Not Yet Earning Fees Available for Future

Deployment: $10.6 billion

AUM Not Yet Earning Fees

As of June 30, 2017, AUM not yet earning fees of $13.0 billion could generate approximately $136.0 million in potential incremental annual management

fees, of which $109.4 million relates to the $10.6 billion of AUM available for future deployment*

$10.6 billion of AUM not yet earning fees was available for future deployment as of June 30, 2017

◦ The $10.6 billion includes approximately $6.1 billion relating to U.S. and E.U. direct lending funds, $1.9 billion in private equity funds, and $1.0

billion in structured credit funds, among other funds

*No assurance can be made that such results will be achieved. Assumes the AUM not yet paying fees as of June 30, 2017 is invested and such fees are paid on an annual basis. Does not reflect any associated reductions in

management fees from certain funds, some of which may be material. Reference to $136.0 million includes approximately $21.4 million in potential incremental management fees from deploying undrawn/available credit

facilities at ARCC (in excess of 0.75X leverage), which may not be drawn due to leverage target limitations and restrictions. Excludes any potential ARCC Part I Fees.

1. Capital available for deployment for follow-on investments represents capital committed to funds that are past their investment periods but for which capital is available to be called for follow-on investments in existing

portfolio companies. There is no assurance such capital will be invested.

$10.6 billion of AUM not yet earning

fees was available for future

deployment as of June 30, 2017

($ in millions)($ in millions)

Capital Available for Future Deployment

Capital Available for Deployment for Follow-on Investments (1)

Available Capital Currently in Funds Unlikely to Be Drawn Due to Leverage Targets and

Restrictions

Funds in or Expected to Be in Wind-down

Credit Private Equity Real Estate

$10,631

$524

$1,430

$404

AUM Not Yet Earning Fees: $13.0 billion

10

$2,813

$911

$208

Q2-17 Capital Deployment Breakdown: $3.9 billion

Capital Deployment(1)

• Total gross invested capital during Q2-17 of $3.9 billion compared to

$3.4 billion in Q2-16

◦ Of the total amount, $3.6 billion was related to deployment in our

drawdown funds compared to $2.4 billion for the same period in

2016

◦ Of our drawdown funds, the most active investment strategies were

U.S. and E.U. direct lending and corporate private equity

• Total gross invested capital for the six months ended June 30, 2017 of

$7.5 billion compared to $4.8 billion for the six months ended June 30,

2016

◦ Of the total amount, $6.1 billion was related to deployment in

drawdown funds compared to $3.5 billion for the same period in

2016

($ in millions)

(2)

1. Capital deployment figures exclude deployment from permanent capital vehicles.

2. Non-drawdown funds includes new capital deployed by managed accounts and CLOs but excludes recycled capital.

$3,563

$369

Drawdown Funds Non-drawdown Funds(2) Credit Private Equity Real Estate

Credit Private Equity Real Estate

Q2-17 Capital Deployment in Drawdown Funds:

$3.6 billion

Q2-17 Strategies

• U.S. Direct Lending

• E.U. Direct Lending

• Corporate Private Equity

• U.S. Real Estate Equity

• E.U. Real Estate Equity

• Structured Credit

Q2-16 Q2-17

$1,616

$2,444

$135

$911

$689

$2,440

$208

$3,563

Q2-17 Capital Deployment by Type: $3.9 billion

($ in millions) ($ in millions)

11

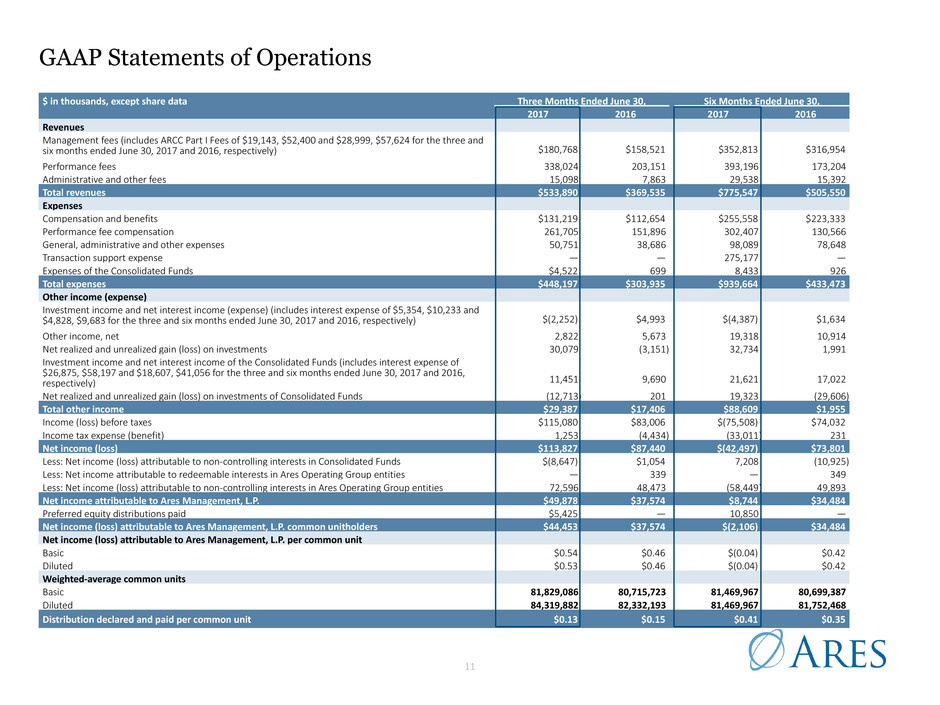

$ in thousands, except share data Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

Revenues

Management fees (includes ARCC Part I Fees of $19,143, $52,400 and $28,999, $57,624 for the three and

six months ended June 30, 2017 and 2016, respectively) $180,768 $158,521 $352,813 $316,954

Performance fees 338,024 203,151 393,196 173,204

Administrative and other fees 15,098 7,863 29,538 15,392

Total revenues $533,890 $369,535 $775,547 $505,550

Expenses

Compensation and benefits $131,219 $112,654 $255,558 $223,333

Performance fee compensation 261,705 151,896 302,407 130,566

General, administrative and other expenses 50,751 38,686 98,089 78,648

Transaction support expense — — 275,177 —

Expenses of the Consolidated Funds $4,522 699 8,433 926

Total expenses $448,197 $303,935 $939,664 $433,473

Other income (expense)

Investment income and net interest income (expense) (includes interest expense of $5,354, $10,233 and

$4,828, $9,683 for the three and six months ended June 30, 2017 and 2016, respectively) $(2,252) $4,993 $(4,387) $1,634

Other income, net 2,822 5,673 19,318 10,914

Net realized and unrealized gain (loss) on investments 30,079 (3,151) 32,734 1,991

Investment income and net interest income of the Consolidated Funds (includes interest expense of

$26,875, $58,197 and $18,607, $41,056 for the three and six months ended June 30, 2017 and 2016,

respectively) 11,451 9,690 21,621 17,022

Net realized and unrealized gain (loss) on investments of Consolidated Funds (12,713) 201 19,323 (29,606)

Total other income $29,387 $17,406 $88,609 $1,955

Income (loss) before taxes $115,080 $83,006 $(75,508) $74,032

Income tax expense (benefit) 1,253 (4,434) (33,011) 231

Net income (loss) $113,827 $87,440 $(42,497) $73,801

Less: Net income (loss) attributable to non-controlling interests in Consolidated Funds $(8,647) $1,054 7,208 (10,925)

Less: Net income attributable to redeemable interests in Ares Operating Group entities — 339 — 349

Less: Net income (loss) attributable to non-controlling interests in Ares Operating Group entities 72,596 48,473 (58,449) 49,893

Net income attributable to Ares Management, L.P. $49,878 $37,574 $8,744 $34,484

Preferred equity distributions paid $5,425 — 10,850 —

Net income (loss) attributable to Ares Management, L.P. common unitholders $44,453 $37,574 $(2,106) $34,484

Net income (loss) attributable to Ares Management, L.P. per common unit

Basic $0.54 $0.46 $(0.04) $0.42

Diluted $0.53 $0.46 $(0.04) $0.42

Weighted-average common units

Basic 81,829,086 80,715,723 81,469,967 80,699,387

Diluted 84,319,882 82,332,193 81,469,967 81,752,468

Distribution declared and paid per common unit $0.13 $0.15 $0.41 $0.35

GAAP Statements of Operations

12

ENI and Other Measures Financial Summary

1.Includes ARCC Part I Fees of $19.1 million and $29.0 million for the three months ended June 30, 2017 and 2016, respectively, and $52.4 million and $57.6 million for the six months ended June 30, 2017 and 2016, respectively.

2.Includes compensation and benefits expenses attributable to OMG of $31.0 million and $25.0 million for the three months ended June 30, 2017 and 2016, respectively, and $57.3 million and $51.3 million for six months ended June 30,

2017 and 2016, respectively.

3.Includes G&A expenses attributable to OMG of $19.0 million and $14.7 million for the three months ended June 30, 2017 and 2016, respectively, and $38.3 million and $31.2 million for the six months ended June 30, 2017 and 2016,

respectively, which are not allocated to an operating segment.

4.Non-core/non-recurring other cash uses includes one-time acquisition costs, non-cash depreciation and amortization and placement fees and underwriting costs associated with selected strategies. See slide 13 in this presentation for

additional details.

5.After income tax Distributable Earnings attributable to common unitholders per unit calculation uses total common units outstanding, assuming no exchange of Ares Operating Group Units.

6.Units of 214,569,211 includes the sum of common units, Ares Operating Group Units that are exchangeable for common units on a one-for-one basis and the dilutive effects of the Company’s equity-based awards.

7.Total fee revenue is calculated as management fees plus net performance fees.

8.Effective management fee rate represents the quotient of management fees and the aggregate fee bases for the quarters presented. The effective rate shown excludes the effect of one-time catch-up fees.

$ in thousands, except share data (unless otherwise noted) Three Months Ended June 30, Six Months Ended June 30,

2017 2016 % Change 2017 2016 % Change

Management fees(1) $185,560 $162,612 14% $362,341 $325,280 11%

Other fees 6,020 1,319 NM 10,854 2,026 NM

Compensation and benefits expenses(2) (103,846) (97,053) 7% (204,456) (192,838) 6%

General, administrative and other expenses(3) (34,346) (27,313) 26% (68,629) (55,855) 23%

Fee Related Earnings $53,388 $39,565 35% $100,110 $78,613 27%

Net performance fees $76,054 $53,022 43% $93,418 $43,353 115%

Net investment income 28,611 9,764 193% 40,381 4,533 NM

Performance Related Earnings $104,665 $62,786 67% $133,799 $47,886 179%

Economic Net Income $158,053 $102,351 54% $233,909 $126,499 85%

(-) Unrealized net performance fees $54,897 $22,449 145% $68,757 $8,414 NM

(-) Unrealized net investment income (loss) 22,987 (4,157) NM 31,310 (12,725) NM

(-) Non-core/non-recurring other cash uses(4) 10,477 7,239 45% 23,241 12,709 83%

Distributable Earnings $69,692 $76,820 (9)% $110,601 $118,101 (6)%

Preferred unit distribution $(5,425) $0 NM $(10,850) $0 NM

Distributable Earnings, net of preferred unit distribution $64,267 $76,820 (16)% $99,751 $118,101 (16)%

After-tax Distributable Earnings per common unit, net of preferred unit

distribution(5) $0.33 $0.31 6% $0.47 $0.46 2%

After-tax Economic Net Income, net of preferred unit distribution $147,837 $93,698 58% $211,635 $110,281 92%

After-tax Economic Net Income per unit, net of preferred unit distribution(6) $0.69 $0.44 57% $0.99 $0.52 90%

Other Data

Total fee revenue(7) $261,614 $215,634 21% $455,759 $368,633 24%

Effective management fee rate(8) 1.06% 1.06% 1.08% 1.09%

13

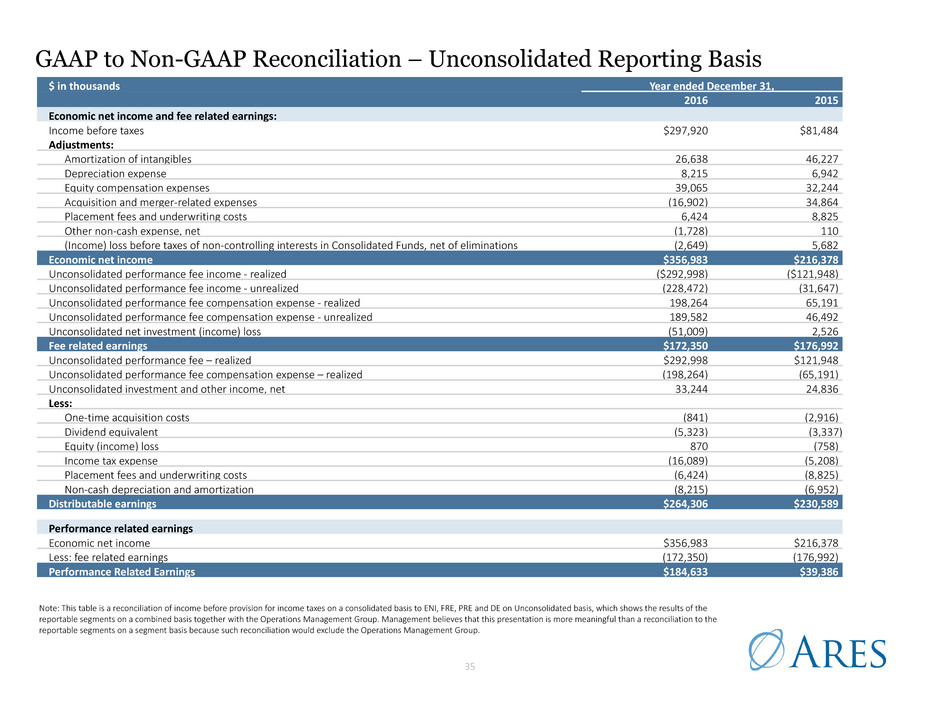

GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis

Note: This table is a reconciliation of income (loss) before provision for income taxes on a consolidated basis to ENI, FRE, PRE and DE on Unconsolidated basis, which shows the results of the

reportable segments on a combined basis together with the Operations Management Group. Management believes that this presentation is more meaningful than a reconciliation to the

reportable segments on a segment basis because such reconciliation would exclude the Operations Management Group. Differences may arise due to rounding.

1. Adjustments to eliminate costs being borne by certain of our joint venture partners.

$ in thousands Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

Economic Net Income and Fee Related Earnings:

Income (loss) before taxes $115,080 $83,006 $(75,508) $74,032

Adjustments:

Amortization of intangibles 5,274 7,121 10,549 14,384

Depreciation expense 2,774 1,934 5,990 3,792

Equity compensation expenses 18,917 9,536 34,006 18,709

Acquisition and merger-related expenses 756 61 255,844 557

Placement fees and underwriting costs 6,383 1,754 9,822 2,684

Offering costs (5) — 655 —

(Income) loss before taxes of non-controlling interests in Consolidated subsidiaries(1) 623 — 623 —

(Income) loss before taxes of non-controlling interests in Consolidated Funds, net of eliminations 8,251 (1,061) (8,072) 12,341

Economic Net Income $158,053 $102,351 $233,909 $126,499

Unconsolidated performance fee income - realized $(74,130) $(81,604) $(82,935) $(87,953)

Unconsolidated performance fee income - unrealized (263,629) (123,314) (312,890) (85,966)

Unconsolidated performance fee compensation expense - realized 52,973 51,031 58,274 53,014

Unconsolidated performance fee compensation expense - unrealized 208,732 100,865 244,133 77,552

Unconsolidated net investment (income) loss (28,611) (9,764) (40,381) (4,533)

Fee Related Earnings $53,388 $39,565 $100,110 $78,613

Unconsolidated performance fee – realized $74,130 $81,604 $82,935 $87,953

Unconsolidated performance fee compensation expense – realized (52,973) (51,031) (58,274) (53,014)

Unconsolidated investment and other income realized, net 5,620 13,921 9,067 17,258

Adjustments:

One-time acquisition costs (724) (84) (883) (344)

Dividend equivalent (1,744) (783) (5,205) (1,754)

Equity income 322 683 136 847

Income tax (expense) benefit 825 (3,367) (818) (4,982)

Placement fees and underwriting costs (6,383) (1,754) (9,822) (2,684)

Non-cash depreciation and amortization (2,774) (1,934) (5,990) (3,792)

Offering costs 5 — (655) —

Distributable Earnings $69,692 $76,820 $110,601 $118,101

Performance Related Earnings

Economic Net Income $158,053 $102,351 $233,909 $126,499

Less: Fee Related Earnings (53,388) (39,565) (100,110) (78,613)

Performance Related Earnings $104,665 $62,786 $133,799 $47,886

14

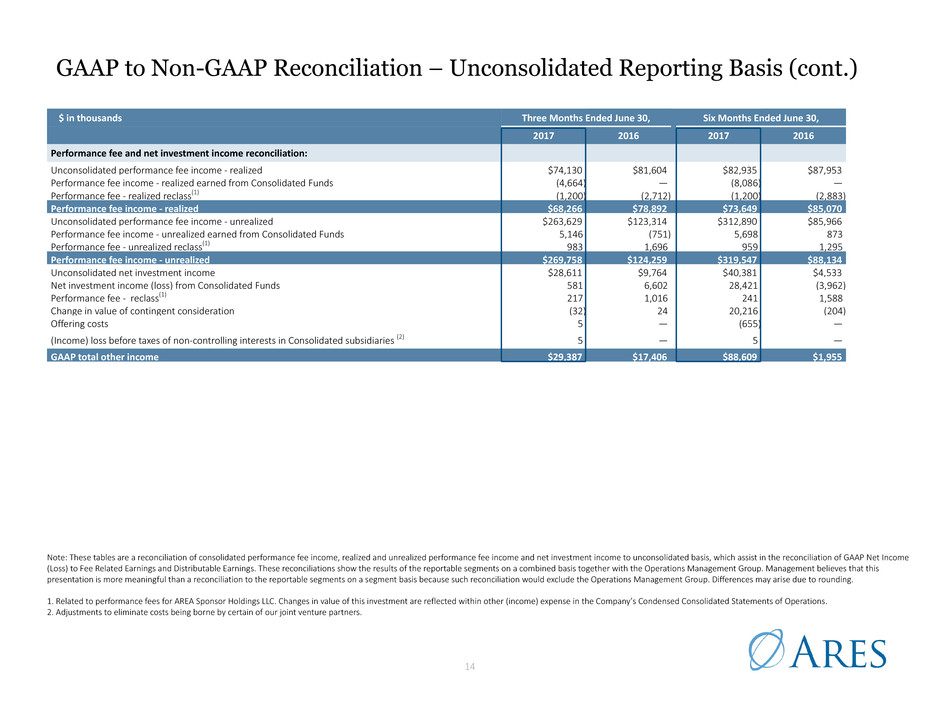

GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis (cont.)

Note: These tables are a reconciliation of consolidated performance fee income, realized and unrealized performance fee income and net investment income to unconsolidated basis, which assist in the reconciliation of GAAP Net Income

(Loss) to Fee Related Earnings and Distributable Earnings. These reconciliations show the results of the reportable segments on a combined basis together with the Operations Management Group. Management believes that this

presentation is more meaningful than a reconciliation to the reportable segments on a segment basis because such reconciliation would exclude the Operations Management Group. Differences may arise due to rounding.

1. Related to performance fees for AREA Sponsor Holdings LLC. Changes in value of this investment are reflected within other (income) expense in the Company’s Condensed Consolidated Statements of Operations.

2. Adjustments to eliminate costs being borne by certain of our joint venture partners.

$ in thousands Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

Performance fee and net investment income reconciliation:

Unconsolidated performance fee income - realized $74,130 $81,604 $82,935 $87,953

Performance fee income - realized earned from Consolidated Funds (4,664) — (8,086) —

Performance fee - realized reclass(1) (1,200) (2,712) (1,200) (2,883)

Performance fee income - realized $68,266 $78,892 $73,649 $85,070

Unconsolidated performance fee income - unrealized $263,629 $123,314 $312,890 $85,966

Performance fee income - unrealized earned from Consolidated Funds 5,146 (751) 5,698 873

Performance fee - unrealized reclass(1) 983 1,696 959 1,295

Performance fee income - unrealized $269,758 $124,259 $319,547 $88,134

Unconsolidated net investment income $28,611 $9,764 $40,381 $4,533

Net investment income (loss) from Consolidated Funds 581 6,602 28,421 (3,962)

Performance fee - reclass(1) 217 1,016 241 1,588

Change in value of contingent consideration (32) 24 20,216 (204)

Offering costs 5 — (655) —

(Income) loss before taxes of non-controlling interests in Consolidated subsidiaries (2) 5 — 5 —

GAAP total other income $29,387 $17,406 $88,609 $1,955

15

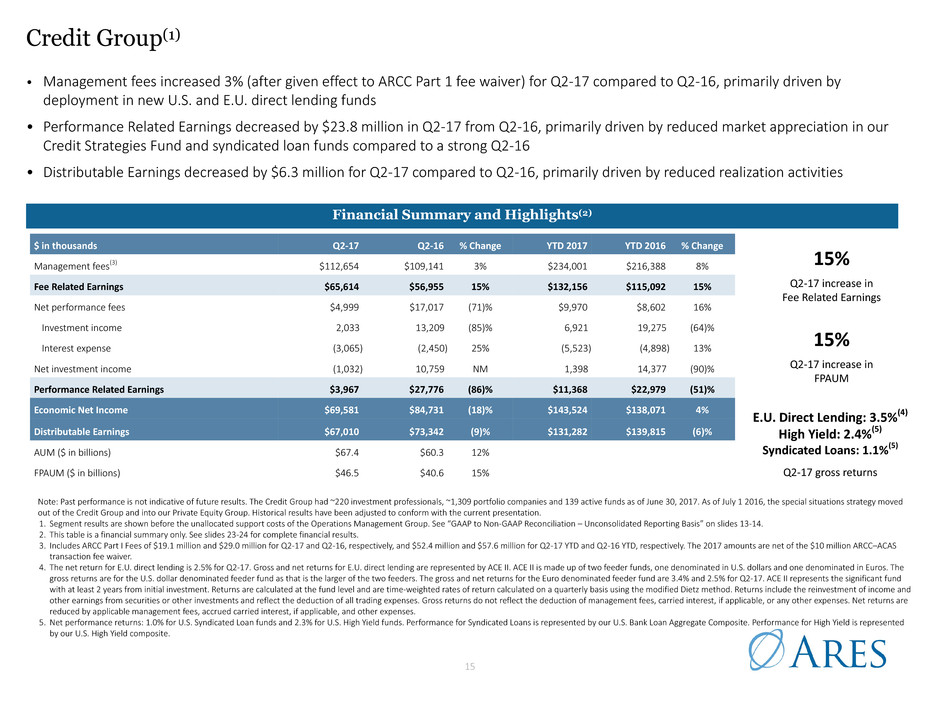

Credit Group(1)

Note: Past performance is not indicative of future results. The Credit Group had ~220 investment professionals, ~1,309 portfolio companies and 139 active funds as of June 30, 2017. As of July 1 2016, the special situations strategy moved

out of the Credit Group and into our Private Equity Group. Historical results have been adjusted to conform with the current presentation.

1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis” on slides 13-14.

2. This table is a financial summary only. See slides 23-24 for complete financial results.

3. Includes ARCC Part I Fees of $19.1 million and $29.0 million for Q2-17 and Q2-16, respectively, and $52.4 million and $57.6 million for Q2-17 YTD and Q2-16 YTD, respectively. The 2017 amounts are net of the $10 million ARCC–ACAS

transaction fee waiver.

4. The net return for E.U. direct lending is 2.5% for Q2-17. Gross and net returns for E.U. direct lending are represented by ACE II. ACE II is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The

gross returns are for the U.S. dollar denominated feeder fund as that is the larger of the two feeders. The gross and net returns for the Euro denominated feeder fund are 3.4% and 2.5% for Q2-17. ACE II represents the significant fund

with at least 2 years from initial investment. Returns are calculated at the fund level and are time-weighted rates of return calculated on a quarterly basis using the modified Dietz method. Returns include the reinvestment of income and

other earnings from securities or other investments and reflect the deduction of all trading expenses. Gross returns do not reflect the deduction of management fees, carried interest, if applicable, or any other expenses. Net returns are

reduced by applicable management fees, accrued carried interest, if applicable, and other expenses.

5. Net performance returns: 1.0% for U.S. Syndicated Loan funds and 2.3% for U.S. High Yield funds. Performance for Syndicated Loans is represented by our U.S. Bank Loan Aggregate Composite. Performance for High Yield is represented

by our U.S. High Yield composite.

• Management fees increased 3% (after given effect to ARCC Part 1 fee waiver) for Q2-17 compared to Q2-16, primarily driven by

deployment in new U.S. and E.U. direct lending funds

• Performance Related Earnings decreased by $23.8 million in Q2-17 from Q2-16, primarily driven by reduced market appreciation in our

Credit Strategies Fund and syndicated loan funds compared to a strong Q2-16

• Distributable Earnings decreased by $6.3 million for Q2-17 compared to Q2-16, primarily driven by reduced realization activities

Financial Summary and Highlights(2)

15%

Q2-17 increase in

FPAUM

15%

Q2-17 increase in

Fee Related Earnings

E.U. Direct Lending: 3.5%(4)

High Yield: 2.4%(5)

Syndicated Loans: 1.1%(5)

Q2-17 gross returns

$ in thousands Q2-17 Q2-16 % Change YTD 2017 YTD 2016 % Change

Management fees(3) $112,654 $109,141 3% $234,001 $216,388 8%

Fee Related Earnings $65,614 $56,955 15% $132,156 $115,092 15%

Net performance fees $4,999 $17,017 (71)% $9,970 $8,602 16%

Investment income 2,033 13,209 (85)% 6,921 19,275 (64)%

Interest expense (3,065) (2,450) 25% (5,523) (4,898) 13%

Net investment income (1,032) 10,759 NM 1,398 14,377 (90)%

Performance Related Earnings $3,967 $27,776 (86)% $11,368 $22,979 (51)%

Economic Net Income $69,581 $84,731 (18)% $143,524 $138,071 4%

Distributable Earnings $67,010 $73,342 (9)% $131,282 $139,815 (6)%

AUM ($ in billions) $67.4 $60.3 12%

FPAUM ($ in billions) $46.5 $40.6 15%

16

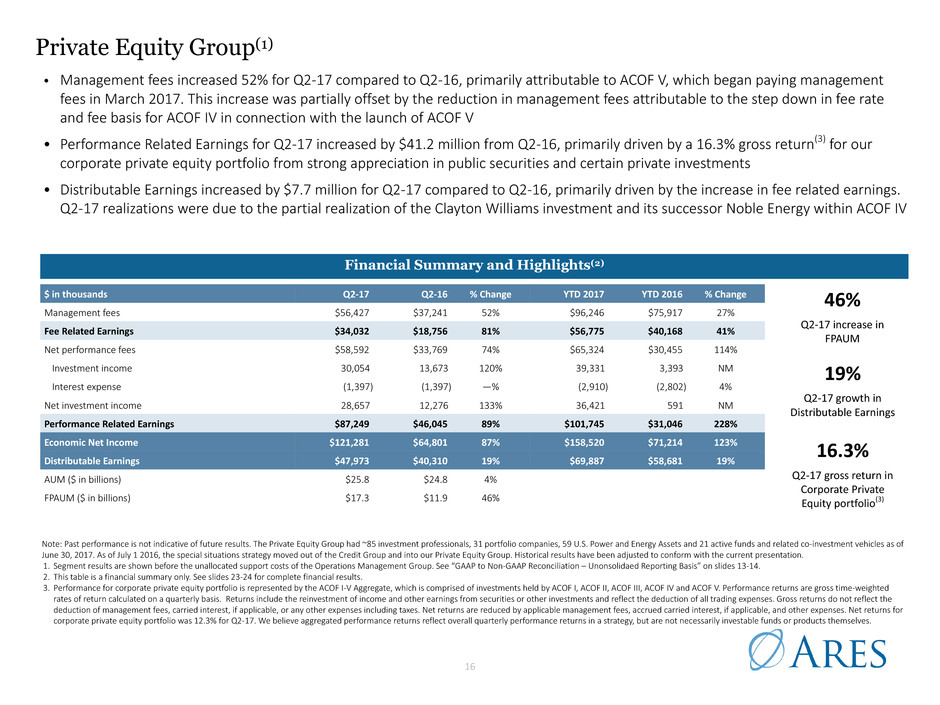

Private Equity Group(1)

Note: Past performance is not indicative of future results. The Private Equity Group had ~85 investment professionals, 31 portfolio companies, 59 U.S. Power and Energy Assets and 21 active funds and related co-investment vehicles as of

June 30, 2017. As of July 1 2016, the special situations strategy moved out of the Credit Group and into our Private Equity Group. Historical results have been adjusted to conform with the current presentation.

1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Unonsolidaed Reporting Basis” on slides 13-14.

2. This table is a financial summary only. See slides 23-24 for complete financial results.

3. Performance for corporate private equity portfolio is represented by the ACOF I-V Aggregate, which is comprised of investments held by ACOF I, ACOF II, ACOF III, ACOF IV and ACOF V. Performance returns are gross time-weighted

rates of return calculated on a quarterly basis. Returns include the reinvestment of income and other earnings from securities or other investments and reflect the deduction of all trading expenses. Gross returns do not reflect the

deduction of management fees, carried interest, if applicable, or any other expenses including taxes. Net returns are reduced by applicable management fees, accrued carried interest, if applicable, and other expenses. Net returns for

corporate private equity portfolio was 12.3% for Q2-17. We believe aggregated performance returns reflect overall quarterly performance returns in a strategy, but are not necessarily investable funds or products themselves.

• Management fees increased 52% for Q2-17 compared to Q2-16, primarily attributable to ACOF V, which began paying management

fees in March 2017. This increase was partially offset by the reduction in management fees attributable to the step down in fee rate

and fee basis for ACOF IV in connection with the launch of ACOF V

• Performance Related Earnings for Q2-17 increased by $41.2 million from Q2-16, primarily driven by a 16.3% gross return(3) for our

corporate private equity portfolio from strong appreciation in public securities and certain private investments

• Distributable Earnings increased by $7.7 million for Q2-17 compared to Q2-16, primarily driven by the increase in fee related earnings.

Q2-17 realizations were due to the partial realization of the Clayton Williams investment and its successor Noble Energy within ACOF IV

Financial Summary and Highlights(2)

19%

Q2-17 growth in

Distributable Earnings

46%

Q2-17 increase in

FPAUM

16.3%

Q2-17 gross return in

Corporate Private

Equity portfolio(3)

$ in thousands Q2-17 Q2-16 % Change YTD 2017 YTD 2016 % Change

Management fees $56,427 $37,241 52% $96,246 $75,917 27%

Fee Related Earnings $34,032 $18,756 81% $56,775 $40,168 41%

Net performance fees $58,592 $33,769 74% $65,324 $30,455 114%

Investment income 30,054 13,673 120% 39,331 3,393 NM

Interest expense (1,397) (1,397) —% (2,910) (2,802) 4%

Net investment income 28,657 12,276 133% 36,421 591 NM

Performance Related Earnings $87,249 $46,045 89% $101,745 $31,046 228%

Economic Net Income $121,281 $64,801 87% $158,520 $71,214 123%

Distributable Earnings $47,973 $40,310 19% $69,887 $58,681 19%

AUM ($ in billions) $25.8 $24.8 4%

FPAUM ($ in billions) $17.3 $11.9 46%

17

Real Estate Group(1)

Note: Past performance is not indicative of future results. The Real Estate Group had ~70 investment professionals, ~175 properties and 43 active funds as of June 30, 2017.

1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis” on slides 13-14.

2. This table is a financial summary only. See slides 23-24 for complete financial results.

3. Returns are gross time-weighted rates of return and do not reflect the deduction of management fees or carried interest, or fund expenses, if applicable. Gross return for U.S. equity is represented by U.S. Fund VIII and gross

return for E.U. equity is represented by EF IV. EF IV is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross returns are for the U.S. dollar denominated feeder fund as that is

the larger of the two feeders. Gross returns do not reflect the deduction of management fees, carried interest, if applicable, or any other expenses including taxes. The funds shown represent the significant funds with at least

2 years from initial investment. Net returns are reduced by applicable management fees, accrued carried interest, if applicable, and other expenses. Net returns for U.S. equity and E.U. equity were 2.7% and 6.5% for Q2-17.

The gross and net returns for the Euro denominated feeder fund were 6.3% and 4.8% for Q2-17.

• Management fees increased 2% for Q2-17 compared to Q2-16, primarily driven by new fundraising for E.U. and U.S. equity

strategies and partially offset by run-off and liquidation in vintage funds in the U.S. equity strategy

• Performance Related Earnings increased by $13.4 million for Q2-17 compared to Q2-16, primarily driven by strong appreciation in

E.F. IV and a smaller contribution from other equity strategies in the U.S. and Europe

• Distributable Earnings decreased by $3.0 million for Q2-17 compared to Q2-16, primarily driven by a decline in realized net

incentive income and realized investment income compared to a year ago

Financial Summary and Highlights(2)

7%

Q2-17 growth in

AUM

5%

Q2-17 increase in Fee

Related Earnings

U.S. Equity: 3.7%

E.U. Equity: 8.9%

Q2-17 Gross Returns(3)

$ in thousands Q2-17 Q2-16 % Change YTD 2017 YTD 2016 % Change

Management fees $16,479 $16,230 2% $32,094 $32,975 (3)%

Fee Related Earnings $3,693 $3,521 5% $6,832 $5,848 17%

Net performance fees $12,463 $2,236 NM $18,124 $4,296 NM

Investment income 3,041 (336) NM 4,199 3,223 30%

Interest expense (429) (272) 58% (861) (546) 58%

Net investment income 2,612 (608) NM 3,338 2,677 25%

Performance Related Earnings $15,075 $1,628 NM $21,462 $6,973 208%

Economic Net Income $18,768 $5,149 264% $28,294 $12,821 121%

Distributable Earnings $4,747 $7,781 (39)% $7,860 $10,459 (25)%

AUM ($ in billions) $10.8 $10.1 7%

FPAUM ($ in billions) $6.7 $6.6 —%

18

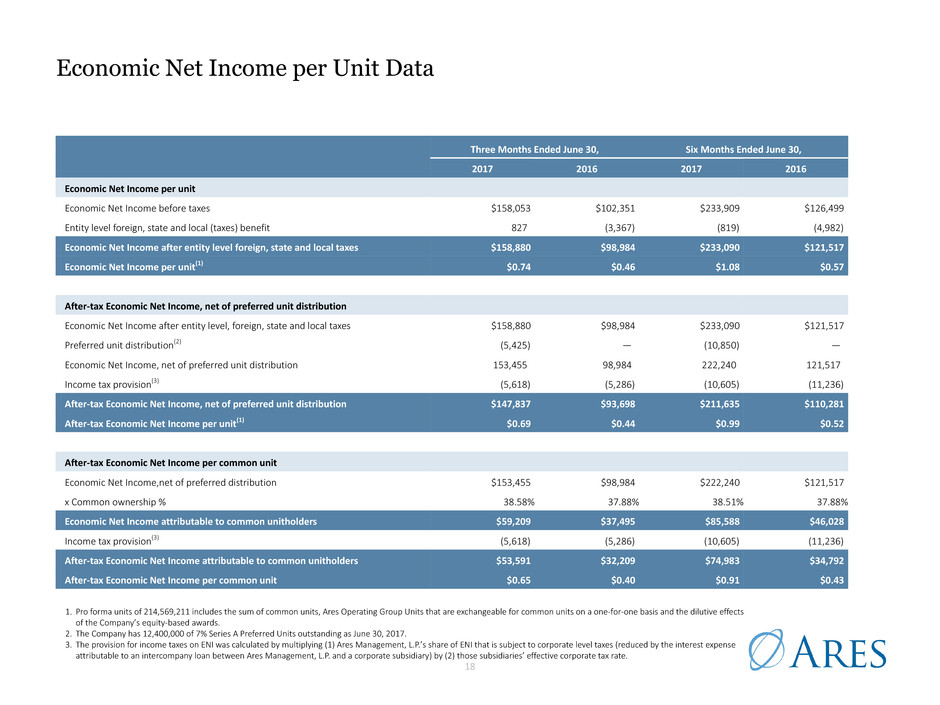

Economic Net Income per Unit Data

1. Pro forma units of 214,569,211 includes the sum of common units, Ares Operating Group Units that are exchangeable for common units on a one-for-one basis and the dilutive effects

of the Company’s equity-based awards.

2. The Company has 12,400,000 of 7% Series A Preferred Units outstanding as June 30, 2017.

3. The provision for income taxes on ENI was calculated by multiplying (1) Ares Management, L.P.’s share of ENI that is subject to corporate level taxes (reduced by the interest expense

attributable to an intercompany loan between Ares Management, L.P. and a corporate subsidiary) by (2) those subsidiaries’ effective corporate tax rate.

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

Economic Net Income per unit

Economic Net Income before taxes $158,053 $102,351 $233,909 $126,499

Entity level foreign, state and local (taxes) benefit 827 (3,367) (819) (4,982)

Economic Net Income after entity level foreign, state and local taxes $158,880 $98,984 $233,090 $121,517

Economic Net Income per unit(1) $0.74 $0.46 $1.08 $0.57

After-tax Economic Net Income, net of preferred unit distribution

Economic Net Income after entity level, foreign, state and local taxes $158,880 $98,984 $233,090 $121,517

Preferred unit distribution(2) (5,425) — (10,850) —

Economic Net Income, net of preferred unit distribution 153,455 98,984 222,240 121,517

Income tax provision(3) (5,618) (5,286) (10,605) (11,236)

After-tax Economic Net Income, net of preferred unit distribution $147,837 $93,698 $211,635 $110,281

After-tax Economic Net Income per unit(1) $0.69 $0.44 $0.99 $0.52

After-tax Economic Net Income per common unit

Economic Net Income,net of preferred distribution $153,455 $98,984 $222,240 $121,517

x Common ownership % 38.58% 37.88% 38.51% 37.88%

Economic Net Income attributable to common unitholders $59,209 $37,495 $85,588 $46,028

Income tax provision(3) (5,618) (5,286) (10,605) (11,236)

After-tax Economic Net Income attributable to common unitholders $53,591 $32,209 $74,983 $34,792

After-tax Economic Net Income per common unit $0.65 $0.40 $0.91 $0.43

19

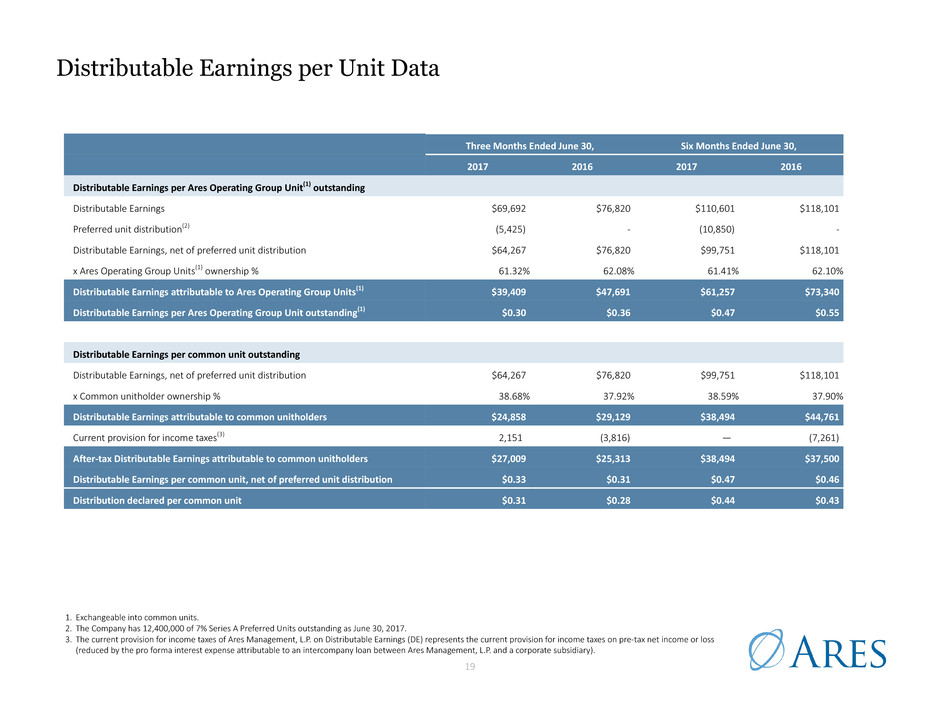

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

Distributable Earnings per Ares Operating Group Unit(1) outstanding

Distributable Earnings $69,692 $76,820 $110,601 $118,101

Preferred unit distribution(2) (5,425) - (10,850) -

Distributable Earnings, net of preferred unit distribution $64,267 $76,820 $99,751 $118,101

x Ares Operating Group Units(1) ownership % 61.32% 62.08% 61.41% 62.10%

Distributable Earnings attributable to Ares Operating Group Units(1) $39,409 $47,691 $61,257 $73,340

Distributable Earnings per Ares Operating Group Unit outstanding(1) $0.30 $0.36 $0.47 $0.55

Distributable Earnings per common unit outstanding

Distributable Earnings, net of preferred unit distribution $64,267 $76,820 $99,751 $118,101

x Common unitholder ownership % 38.68% 37.92% 38.59% 37.90%

Distributable Earnings attributable to common unitholders $24,858 $29,129 $38,494 $44,761

Current provision for income taxes(3) 2,151 (3,816) — (7,261)

After-tax Distributable Earnings attributable to common unitholders $27,009 $25,313 $38,494 $37,500

Distributable Earnings per common unit, net of preferred unit distribution $0.33 $0.31 $0.47 $0.46

Distribution declared per common unit $0.31 $0.28 $0.44 $0.43

Distributable Earnings per Unit Data

1. Exchangeable into common units.

2. The Company has 12,400,000 of 7% Series A Preferred Units outstanding as June 30, 2017.

3. The current provision for income taxes of Ares Management, L.P. on Distributable Earnings (DE) represents the current provision for income taxes on pre-tax net income or loss

(reduced by the pro forma interest expense attributable to an intercompany loan between Ares Management, L.P. and a corporate subsidiary).

20

• Substantial balance sheet value related to investments in Ares managed vehicles and net performance fees receivable

◦ $137.3 million in cash and cash equivalents, $510.9 million in debt obligations with $135.0 million drawn against our $1.04 billion revolving credit

facility as of June 30, 2017

◦ As of June 30, 2017, investments reported on a GAAP basis were $598.7 million. On an unconsolidated basis, investments were $739.2 million(1)

◦ As of June 30, 2017, gross performance fees receivable reported on a GAAP basis were $1,082.8 million. On an unconsolidated basis, performance

fees receivable were $1,085.4 million(2)

▪ As of June 30, 2017, net performance fees receivable reported on a GAAP basis were $238.0 million. On an unconsolidated basis, performance

fees receivable were $240.6 million(2)

▪ As of June 30, 2017, net performance fees receivable reported on a GAAP basis increased 47.8% compared to the fourth quarter of 2016. On an

unconsolidated basis, net performance fees receivable increased 42.1% compared to the fourth quarter of 2016.

20%

66%

14%19%

67%

14%

Balance Sheet

1. As of June 30, 2017, $51.9 million was invested in non-Ares managed vehicles. Difference between GAAP and unconsolidated investments represents investments of $140.5 million in Consolidated Funds that

are eliminated upon consolidation.

2. Difference between GAAP and unconsolidated gross and net performance fees receivable of $2.6 million represents fees earned from Consolidated Funds that are eliminated upon consolidation.

Q2 2017: $240.6 million

Net Performance Fees Receivable by Group –

Unconsolidated Net Performance Fees Receivable by Group – GAAP

Q2 2017: $238.0 million

Credit Private Equity Real Estate Credit Private Equity Real Estate

21

Corporate Data

Board of Directors

Michael Arougheti

Co-Founder and President of Ares

Paul G. Joubert

Founding Partner of EdgeAdvisors and

Investing Partner in Common Angels

Ventures

David Kaplan

Co-Founder and Partner of Ares, Co-Head

of Private Equity Group

John Kissick

Co-Founder and Former Partner of Ares

Michael Lynton

Former Chief Executive Officer of Sony

Entertainment

Dr. Judy D. Olian

Dean of UCLA Anderson School of

Management and the John E. Anderson

Chair in Management

Antony P. Ressler

Co-Founder, Chairman and Chief Executive

Officer of Ares

Bennett Rosenthal

Co-Founder and Partner of Ares, Co-Head

of Private Equity Group

Executive Officers

Michael Arougheti

Co-Founder and President

Kipp deVeer

Partner

David Kaplan

Co-Founder and Partner

Michael McFerran

Executive Vice President, Chief Financial

Officer

Antony P. Ressler

Co-Founder and Chief Executive Officer

Bennett Rosenthal

Co-Founder and Partner

Michael Weiner

Executive Vice President, Chief Legal Officer

of Ares

Research Coverage

Autonomous

Patrick Davitt

(646) 561-6254

Bank of America Merrill Lynch

Michael Carrier

(646) 855-5004

Credit Suisse

Craig Sigenthaler

(212) 325-3104

Goldman Sachs

Alexander Blostein

(212) 357-9976

JP Morgan

Kenneth Worthington

(212) 622-6613

Keefe, Bruyette & Woods

Robert Lee

(212) 887-7732

Morgan Stanley

Michael Cyprys

(212) 761-7619

RBC Capital Markets

Kenneth Lee

(212) 905-5995

SunTrust Robinson Humphrey

Douglas Mewhirter

(404) 926-5745

Wells Fargo Securities

Christopher Harris

(443) 263-6513

Corporate Counsel

Proskauer Rose LLP

Los Angeles, CA

Corporate Headquarters

2000 Avenue of the Stars

12th Floor

Los Angeles, CA 90067

Tel: (310) 201-4100

Fax: (310) 201-4170

Independent Registered Public Accounting

Firm

Ernst & Young LLP

Los Angeles, CA

Securities Listing

NYSE: ARES

NYSE: ARES PR A

Transfer Agent

American Stock Transfer & Trust Company,

LLC

6201 15th Avenue

Brooklyn, NY 11210

Tel: (877) 681-8121

Fax: (718) 236-2641

info@amstock.com

www.amstock.com

Investor Relations Contacts

Carl Drake

Partner/Head of Ares Management, LLC

Public Investor Relations and

Communications

Tel: (678) 538-1981

cdrake@aresmgmt.com

Veronica Mendiola

Vice President

Tel: (212) 808-1150

General IR Contact

Tel (U.S.):

(800) 340-6597

Tel (International):

(212) 808-1101

IRARES@aresmgmt.com

Please visit our website at:

www.aresmgmt.com

Appendix

23

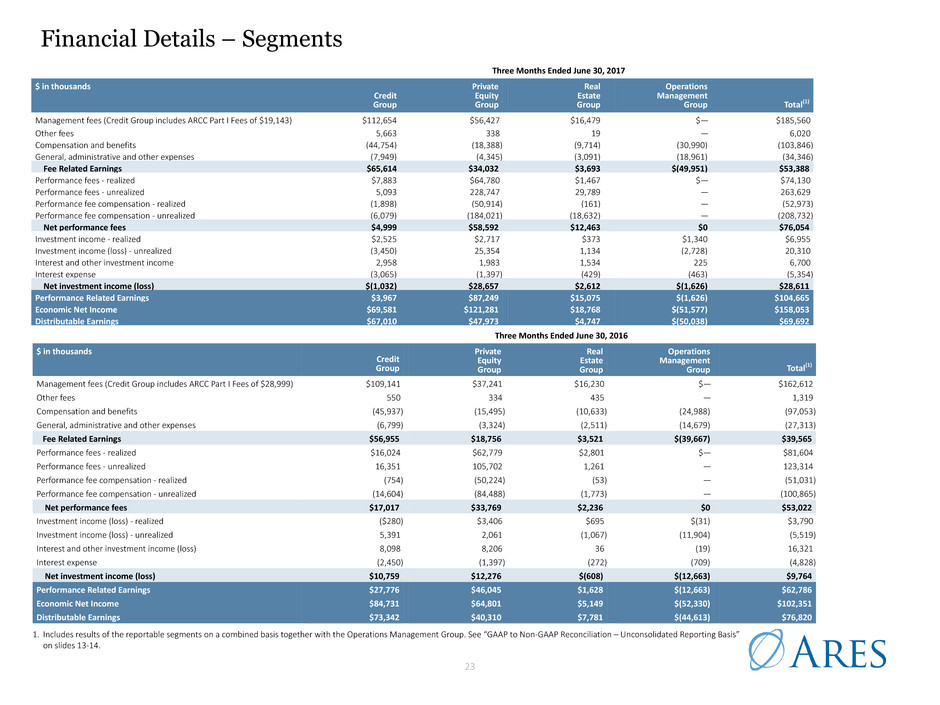

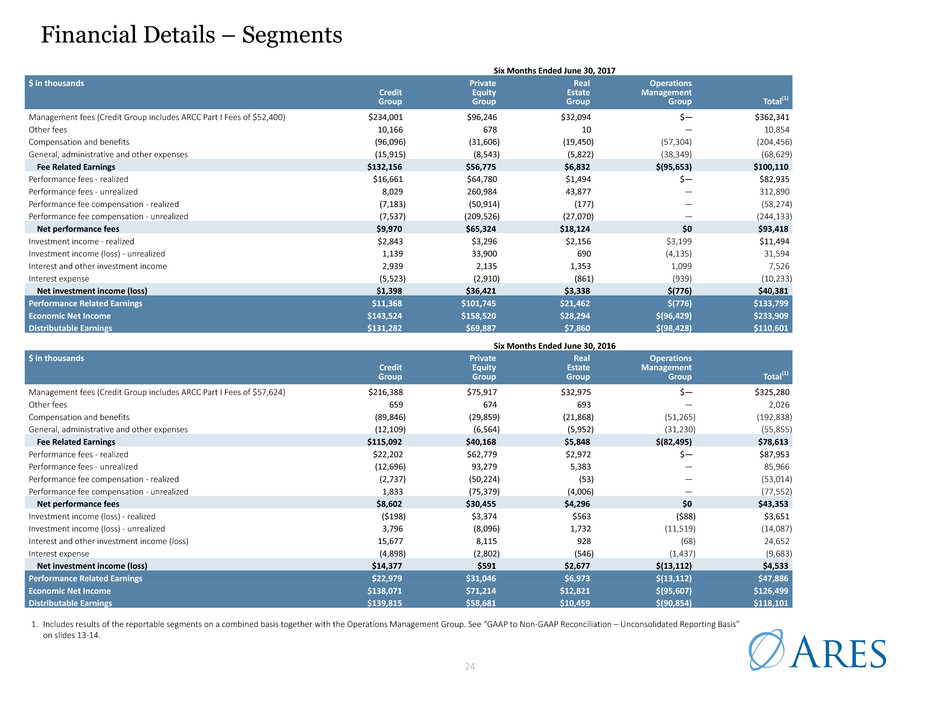

Financial Details – Segments

1. Includes results of the reportable segments on a combined basis together with the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis”

on slides 13-14.

Three Months Ended June 30, 2017

$ in thousands

Credit

Group

Private

Equity

Group

Real

Estate

Group

Operations

Management

Group Total(1)

Management fees (Credit Group includes ARCC Part I Fees of $19,143) $112,654 $56,427 $16,479 $— $185,560

Other fees 5,663 338 19 — 6,020

Compensation and benefits (44,754) (18,388) (9,714) (30,990) (103,846)

General, administrative and other expenses (7,949) (4,345) (3,091) (18,961) (34,346)

Fee Related Earnings $65,614 $34,032 $3,693 $(49,951) $53,388

Performance fees - realized $7,883 $64,780 $1,467 $— $74,130

Performance fees - unrealized 5,093 228,747 29,789 — 263,629

Performance fee compensation - realized (1,898) (50,914) (161) — (52,973)

Performance fee compensation - unrealized (6,079) (184,021) (18,632) — (208,732)

Net performance fees $4,999 $58,592 $12,463 $0 $76,054

Investment income - realized $2,525 $2,717 $373 $1,340 $6,955

Investment income (loss) - unrealized (3,450) 25,354 1,134 (2,728) 20,310

Interest and other investment income 2,958 1,983 1,534 225 6,700

Interest expense (3,065) (1,397) (429) (463) (5,354)

Net investment income (loss) $(1,032) $28,657 $2,612 $(1,626) $28,611

Performance Related Earnings $3,967 $87,249 $15,075 $(1,626) $104,665

Economic Net Income $69,581 $121,281 $18,768 $(51,577) $158,053

Distributable Earnings $67,010 $47,973 $4,747 $(50,038) $69,692

Three Months Ended June 30, 2016

$ in thousands

Credit

Group

Private

Equity

Group

Real

Estate

Group

Operations

Management

Group Total(1)

Management fees (Credit Group includes ARCC Part I Fees of $28,999) $109,141 $37,241 $16,230 $— $162,612

Other fees 550 334 435 — 1,319

Compensation and benefits (45,937) (15,495) (10,633) (24,988) (97,053)

General, administrative and other expenses (6,799) (3,324) (2,511) (14,679) (27,313)

Fee Related Earnings $56,955 $18,756 $3,521 $(39,667) $39,565

Performance fees - realized $16,024 $62,779 $2,801 $— $81,604

Performance fees - unrealized 16,351 105,702 1,261 — 123,314

Performance fee compensation - realized (754) (50,224) (53) — (51,031)

Performance fee compensation - unrealized (14,604) (84,488) (1,773) — (100,865)

Net performance fees $17,017 $33,769 $2,236 $0 $53,022

Investment income (loss) - realized ($280) $3,406 $695 $(31) $3,790

Investment income (loss) - unrealized 5,391 2,061 (1,067) (11,904) (5,519)

Interest and other investment income (loss) 8,098 8,206 36 (19) 16,321

Interest expense (2,450) (1,397) (272) (709) (4,828)

Net investment income (loss) $10,759 $12,276 $(608) $(12,663) $9,764

Performance Related Earnings $27,776 $46,045 $1,628 $(12,663) $62,786

Economic Net Income $84,731 $64,801 $5,149 $(52,330) $102,351

Distributable Earnings $73,342 $40,310 $7,781 $(44,613) $76,820

24

1. Includes results of the reportable segments on a combined basis together with the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis”

on slides 13-14.

Six Months Ended June 30, 2017

$ in thousands

Credit

Group

Private

Equity

Group

Real

Estate

Group

Operations

Management

Group Total(1)

Management fees (Credit Group includes ARCC Part I Fees of $52,400) $234,001 $96,246 $32,094 $— $362,341

Other fees 10,166 678 10 — 10,854

Compensation and benefits (96,096) (31,606) (19,450) (57,304) (204,456)

General, administrative and other expenses (15,915) (8,543) (5,822) (38,349) (68,629)

Fee Related Earnings $132,156 $56,775 $6,832 $(95,653) $100,110

Performance fees - realized $16,661 $64,780 $1,494 $— $82,935

Performance fees - unrealized 8,029 260,984 43,877 — 312,890

Performance fee compensation - realized (7,183) (50,914) (177) — (58,274)

Performance fee compensation - unrealized (7,537) (209,526) (27,070) — (244,133)

Net performance fees $9,970 $65,324 $18,124 $0 $93,418

Investment income - realized $2,843 $3,296 $2,156 $3,199 $11,494

Investment income (loss) - unrealized 1,139 33,900 690 (4,135) 31,594

Interest and other investment income 2,939 2,135 1,353 1,099 7,526

Interest expense (5,523) (2,910) (861) (939) (10,233)

Net investment income (loss) $1,398 $36,421 $3,338 $(776) $40,381

Performance Related Earnings $11,368 $101,745 $21,462 $(776) $133,799

Economic Net Income $143,524 $158,520 $28,294 $(96,429) $233,909

Distributable Earnings $131,282 $69,887 $7,860 $(98,428) $110,601

Six Months Ended June 30, 2016

$ in thousands

Credit

Group

Private

Equity

Group

Real

Estate

Group

Operations

Management

Group Total(1)

Management fees (Credit Group includes ARCC Part I Fees of $57,624) $216,388 $75,917 $32,975 $— $325,280

Other fees 659 674 693 — 2,026

Compensation and benefits (89,846) (29,859) (21,868) (51,265) (192,838)

General, administrative and other expenses (12,109) (6,564) (5,952) (31,230) (55,855)

Fee Related Earnings $115,092 $40,168 $5,848 $(82,495) $78,613

Performance fees - realized $22,202 $62,779 $2,972 $— $87,953

Performance fees - unrealized (12,696) 93,279 5,383 — 85,966

Performance fee compensation - realized (2,737) (50,224) (53) — (53,014)

Performance fee compensation - unrealized 1,833 (75,379) (4,006) — (77,552)

Net performance fees $8,602 $30,455 $4,296 $0 $43,353

Investment income (loss) - realized ($198) $3,374 $563 ($88) $3,651

Investment income (loss) - unrealized 3,796 (8,096) 1,732 (11,519) (14,087)

Interest and other investment income (loss) 15,677 8,115 928 (68) 24,652

Interest expense (4,898) (2,802) (546) (1,437) (9,683)

Net investment income (loss) $14,377 $591 $2,677 $(13,112) $4,533

Performance Related Earnings $22,979 $31,046 $6,973 $(13,112) $47,886

Economic Net Income $138,071 $71,214 $12,821 $(95,607) $126,499

Distributable Earnings $139,815 $58,681 $10,459 $(90,854) $118,101

Financial Details – Segments

25

AUM and FPAUM Rollforward

Note: For definitions of AUM and FPAUM please refer to the “Glossary” slide in the appendix.

Credit

l AUM increased by 3.4% from Q1-17, primarily driven by new capital commitments to syndicated loans and direct lending strategies, partially offset by paydowns in U.S.

syndicated loans (within CLOs) and other credit funds

l FPAUM increased by 1.8% from Q1-17, primarily driven by new commitments to syndicated loans strategy and deployment in direct lending funds paid on invested capital,

largely offset by paydowns in U.S. syndicated loans (within CLOs) and other credit funds

Private Equity

l AUM increased by 4.5% from Q1-17 primarily due to appreciation in ACOF III and ACOF IV and additional equity commitments to EIF V, partially offset by distributions in

various Private Equity funds

l FPAUM increased slightly by 0.6% from Q1-17, primarily driven by new commitments and deployment, largely offset by exits in various Private Equity funds

Real Estate

l AUM increased by 8.6% from Q1-17, primarily driven by fundraising of new U.S. equity funds and new debt commitments to ACRE, offset by distributions in our U.S. and E.U.

equity strategies

l FPAUM increased by 4.7% from Q1-17, primarily driven by fundraising of new U.S. equity funds, offset by change in fee basis in U.S. Real Estate Fund VIII and distributions in

our U.S. and E.U. equity strategies

Q2-17 Total AUM Rollforward ($ in millions) LTM Total AUM Rollforward ($ in millions)

Credit Private Equity Real Estate Total Credit Private Equity Real Estate Total

Q1-17 Ending Balance $65,231 $24,653 $9,941 $99,825 Q2-16 Ending Balance $60,325 $24,814 $10,124 $95,263

Acquisitions — — — — Acquisitions 3,605 — — 3,605

Commitments 4,350 281 738 5,369 Commitments 12,907 483 1,481 14,871

Capital reductions (2,527) (1) — (2,528) Capital reductions (8,835) (5) (105) (8,945)

Distributions/redemptions (919) (659) (168) (1,746) Distributions/redemptions (3,183) (2,920) (1,216) (7,319)

Changes in fund value 1,312 1,496 281 3,089 Changes in fund value 2,628 3,398 508 6,534

Q2-17 Ending Balance $67,447 $25,770 $10,792 $104,009 Q2-17 Ending Balance $67,447 $25,770 $10,792 $104,009

QoQ change $2,216 $1,117 $851 $4,184 YoY change $7,122 $956 $668 $8,746

Q2-17 Total FPAUM Rollforward ($ in millions) LTM Total FPAUM Rollforward ($ in millions)

Credit Private Equity Real Estate Total Credit Private Equity Real Estate Total

Q1-17 Ending Balance $45,696 $17,182 $6,357 $69,235 Q2-16 Ending Balance $40,586 $11,853 $6,644 $59,083

Acquisitions — — — — Acquisitions 2,789 — — 2,789

Commitments 1,251 281 390 1,922 Commitments 4,143 8,081 680 12,904

Subscriptions/deployment/increase in leverage 1,265 456 154 1,875 Subscriptions/deployment/increase in leverage 4,164 908 573 5,645

Distributions/redemptions/decrease in leverage (2,684) (570) (96) (3,350) Distributions/redemptions/decrease in leverage (7,337) (1,422) (902) (9,661)

Changes in fund value 756 (57) 85 784 Changes in fund value 1,939 (337) 51 1,653

Change in fee basis 225 — (236) (11) Change in fee basis 225 (1,791) (392) (1,958)

Q2-17 Ending Balance $46,509 $17,292 $6,654 $70,455 Q2-17 Ending Balance $46,509 $17,292 $6,654 $70,455

QoQ change $813 $110 $297 $1,220 YoY change $5,923 $5,439 $10 $11,372

26

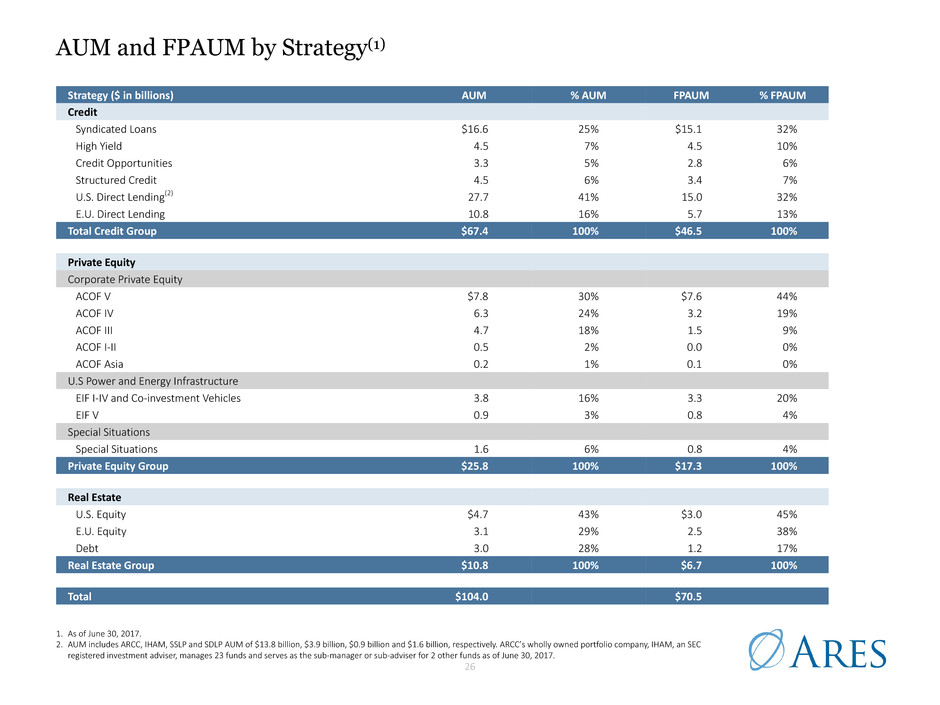

AUM and FPAUM by Strategy(1)

1. As of June 30, 2017.

2. AUM includes ARCC, IHAM, SSLP and SDLP AUM of $13.8 billion, $3.9 billion, $0.9 billion and $1.6 billion, respectively. ARCC’s wholly owned portfolio company, IHAM, an SEC

registered investment adviser, manages 23 funds and serves as the sub-manager or sub-adviser for 2 other funds as of June 30, 2017.

Strategy ($ in billions) AUM % AUM FPAUM % FPAUM

Credit

Syndicated Loans $16.6 25% $15.1 32%

High Yield 4.5 7% 4.5 10%

Credit Opportunities 3.3 5% 2.8 6%

Structured Credit 4.5 6% 3.4 7%

U.S. Direct Lending(2) 27.7 41% 15.0 32%

E.U. Direct Lending 10.8 16% 5.7 13%

Total Credit Group $67.4 100% $46.5 100%

Private Equity

Corporate Private Equity

ACOF V $7.8 30% $7.6 44%

ACOF IV 6.3 24% 3.2 19%

ACOF III 4.7 18% 1.5 9%

ACOF I-II 0.5 2% 0.0 0%

ACOF Asia 0.2 1% 0.1 0%

U.S Power and Energy Infrastructure

EIF I-IV and Co-investment Vehicles 3.8 16% 3.3 20%

EIF V 0.9 3% 0.8 4%

Special Situations

Special Situations 1.6 6% 0.8 4%

Private Equity Group $25.8 100% $17.3 100%

Real Estate

U.S. Equity $4.7 43% $3.0 45%

E.U. Equity 3.1 29% 2.5 38%

Debt 3.0 28% 1.2 17%

Real Estate Group $10.8 100% $6.7 100%

Total $104.0 $70.5

27

Balance Sheet Investments by Strategy

Note: Reflects the balance sheet of Ares Management, L.P. and its consolidated subsidiaries, excluding the effect of Consolidation.

*Through investments in Ares CLOs.

$ in thousands June 30, 2017 December 31, 2016

Credit

Syndicated Loans* $212,389 $140,667

Credit Opportunities 4,256 4,035

Structured Credit 9,805 9,004

U.S. Direct Lending 45,474 37,696

E.U. Direct Lending 45,314 44,882

Credit Group $317,238 $236,284

Private Equity

ACOF I - II $4,166 $5,503

ACOF III 125,097 97,549

ACOF IV 43,443 37,308

ACOF V 9,470 —

ACOF Asia 69,891 71,769

U.S. Power & Energy Infrastructure 11,894 17,361

Special Situations 23,585 27,927

Private Equity $287,546 $257,417

Real Estate

U.S. Equity $67,354 $62,208

E.U. Equity 15,154 13,077

Real Estate $82,508 $75,285

Operations Management Group

Other $51,867 $53,229

Other $51,867 $53,229

Total $739,159 $622,215

28

Significant Fund Performance Metrics*

The following table presents the performance data for significant funds in the Credit Group that are not drawdown funds:

Note: Past performance is not indicative of future results. AUM and Net Returns as of June 30, 2017 unless otherwise noted. The above table includes fund performance metrics for significant funds which includes

those that contributed at least 1% of total management fees for the six months ended June 30, 2017 or comprised 1% or more of the Company’s total FPAUM as of June 30, 2017, and for which we have sole

discretion for investment decisions within the fund. Please see significant fund performance endnotes on slides 30-31 for additional information. Return information presented may not reflect actual returns earned

by investors in the applicable fund. ARCC is a publicly traded vehicle.

* Returns are not shown for funds until at least 2 years from initial investment and the fund is either 50% through its investing period or 50% of committed capital has been deployed.

As of June 30, 2017

Returns (%)(1)

Current Quarter Year-To-Date Since Inception(2)

Year of

Inception

AUM

(in millions) Gross Net Gross Net Gross Net

Primary

Investment Strategy

Credit

ARCC(3) 2004 $13,766 N/A 2.6% N/A 5.3% N/A 11.8% U.S. Direct Lending

Sub-advised Client A(4) 2007 709 2.4% 2.3% 4.4% 4.2% 8.0% 7.6% High Yield

Sub-advised Client B(4) 2009 677 1.0% 0.9% 2.0% 1.7% 6.5% 5.9% Syndicated Loans

ELIS XI(4) 2013 682 1.2% 1.1% 2.3% 2.1% 3.4% 2.9% Syndicated Loans

Separately Managed Account Client A(4) 2015 1,120 1.8% 1.8% 6.6% 6.4% 6.7% 6.4% Structured Credit

Separately Managed Account Client B* 2016 811 N/A N/A N/A N/A N/A N/A High Yield

29

Significant Fund Performance Metrics*

Note: Past performance is not indicative of future results. AUM and Net Returns as of June 30, 2017 unless otherwise noted. The above table includes fund performance metrics for significant funds which

includes those that contributed at least 1% of total management fees for the six months ended June 30, 2017 or comprised 1% or more of the Company’s total FPAUM as of June 30, 2017, and for which we have

sole discretion for investment decisions within the fund. Please see significant fund performance endnotes on slides 30-31 for additional information. Return information presented may not reflect actual returns

earned by investors in the applicable fund.

* IRRs are not shown for funds until at least 2 years from initial investment and the fund is either 50% through its investing period or 50% of committed capital has been deployed.

The following table presents the performance data for our significant funds, all of which are drawdown funds:

As of June 30, 2017

Credit

Year of

Inception

Original

Capital

Commitment

s

Cumulative

Invested

Capital

Realized

Proceeds(5)

Unrealized

Value(6) Total Value

MOIC IRR

Primary Investment Strategy($ in millions) AUM Gross(7) Net(8) Gross(9) Net(10)

ACE II

(11)

2013 $1,502 $1,216 $962 $327 $876 $1,202 1.3x 1.2x 10.3% 7.4% E.U. Direct Lending

ACE III

(12)

* 2015 4,862 2,822 1,414 49 1,485 1,534 1.1x 1.1x N/A N/A E.U. Direct Lending

Private Equity

Year of

Inception

Original

Capital

Commitment

s

Cumulative

Invested

Capital

Realized

Proceeds(1)

Unrealized

Value(2) Total Value

MOIC IRR

Primary Investment Strategy($ in millions) AUM Gross(3) Net(4) Gross(5) Net(6)

USPF III 2007 $926 $1,350 $1,807 $1,732 $912 $2,644 1.5x 1.4x 8.5% 5.9% U.S. Power and Energy Infrastructure

ACOF III 2008 4,709 3,510 3,867 5,671 4,363 10,034 2.6x 2.2x 31.7% 23.7% Corporate Private Equity

USPF IV 2010 1,953 1,688 1,772 742 1,724 2,466 1.4x 1.3x 12.7% 9.5% U.S. Power and Energy Infrastructure

ACOF IV 2012 6,278 4,700 3,733 1,324 5,093 6,417 1.7x 1.5x 24.9% 16.8% Corporate Private Equity

ACOF V* 2017 7,794 7,850 716 9 707 716 1.0x 0.9x N/A N/A Corporate Private Equity

EIF V

(7)

* 2015 875 801 264 75 299 375 1.4x 1.5x N/A N/A U.S. Power and Energy Infrastructure

Real Estate

Year of

Inception

Original

Capital

Commitment

s

Cumulative

Invested

Capital

Realized

Proceeds(1)

Unrealized

Value(2) Total Value

MOIC IRR

Primary Investment Strategy($ in millions) AUM Gross(3) Net(4) Gross(5) Net(6)

EF IV

(7)

2014 $1,304 $1,302 $875 $94 $1,082 $1,176 1.3x 1.2x 21.0% 13.0% E.U. Real Estate Equity

EPEP II

(8)

* 2015 766 747 228 16 257 273 1.2x 1.1x N/A N/A E.U. Real Estate Equity

30

Significant Fund Performance Metrics Endnotes

Credit

1. Returns are time-weighted rates of return and include the reinvestment of income and other earnings from securities or other investments and reflect the deduction of all trading expenses.

2. Since inception returns are annualized.

3. Net returns are calculated using the fund's NAV and assume dividends are reinvested at the closest quarter-end NAV to the relevant quarterly ex-dividend dates. Additional information related to ARCC can be

found in its financial statements filed with the SEC, which are not part of this presentation.

4. Gross returns do not reflect the deduction of management fees or any other expenses. Net returns are calculated by subtracting the applicable management fee from the gross returns on a monthly basis.

5. Realized proceeds represent the sum of all cash distributions to all partners and if applicable, exclude tax and incentive distributions made to the general partner.

6. Unrealized value represents the fund's NAV reduced by the accrued incentive allocation, if applicable. There can be no assurance that unrealized values will be realized at the valuations indicated.

7. The gross multiple of invested capital (“MoIC”) is calculated at the fund-level and is based on the interests of the fee-paying limited partners and if applicable, excludes interests attributable to the non-fee paying

limited partners and/or the general partner which does not pay management fees or performance fees. The gross MoIC is before giving effect to management fees, performance fees as applicable and other

expenses.

8. The net MoIC is calculated at the fund-level and is based on the interests of the fee-paying limited partners and if applicable, excludes those interests attributable to the non-fee paying limited partners and/or the

general partner which does not pay management fees or performance fees. The net MoIC is after giving effect to management fees, performance fees as applicable and other expenses.

9. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Gross IRR reflects returns to the

fee-paying limited partners and if applicable, excludes interests attributable to the non-fee paying limited partners and/or the general partner which does not pay management fees or performance fees. The cash

flow dates used in the gross IRR calculation are based on the actual dates of the cash flows. Gross IRRs are calculated before giving effect to management fees, performance fees as applicable, and other expenses.

10. The net IRR is an annualized since inception net internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Net IRRs reflect returns to the fee-

paying limited partners and if applicable, exclude interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or performance fees. The cash flow

dates used in the net IRR calculations are based on the actual dates of the cash flows. The net IRRs are calculated after giving effect to management fees, performance fees as applicable, and other expenses.

11. ACE II is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net IRR and gross and net MoIC presented in the chart are for the U.S. dollar denominated

feeder fund as that is the larger of the two feeders. The gross and net IRR for the Euro denominated feeder fund are 12.9% and 9.7%, respectively. The gross and net MoIC for the Euro denominated feeder fund

are 1.4x and 1.3x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of the fund's closing. All other values for ACE II are for the combined fund and

are converted to U.S. dollars at the prevailing quarter-end exchange rate. The variance between the gross and net MoICs and the net IRRs for the U.S. dollar denominated and Euro denominated feeder funds is

driven by the U.S. GAAP mark-to-market reporting of the foreign currency hedging program in the U.S. dollar denominated feeder fund. The feeder fund will be holding the foreign currency hedges until maturity,

and therefore is expected to ultimately recognize a gain while mitigating the currency risk associated with the initial principal investments.

12. ACE III is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net MoIC presented in the chart are for the Euro denominated feeder fund as that is the

larger of the two feeders. The gross and net MoIC for the U.S. dollar denominated feeder fund are 1.1x and 1.1x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange

rate at the time of the fund's closing. All other values for ACE III are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate.

Private Equity

1. Realized proceeds represent the sum of all cash dividends, interest income, other fees and cash proceeds from realizations of interests in portfolio investments.

2. Unrealized value represents the fair market value of remaining investments. There can be no assurance that unrealized investments will be realized at the valuations indicated.

3. The gross MoIC is calculated at the investment-level and is based on the interests of all partners. The gross MoIC is before giving effect to management fees, performance fees as applicable and other expenses.

4. The net MoIC for the U.S. power and energy infrastructure funds is calculated at the fund-level. The net MoIC for the corporate private equity funds is calculated at the investment-level. For all funds, the net MoIC

is based on the interests of the fee-paying limited partners and if applicable, excludes those interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management

fees or performance fees. The net MoIC is after giving effect to management fees, performance fees as applicable and other expenses.

5. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from investments and the residual value of the investments at the end of the measurement period. Gross IRRs reflect

returns to all partners. Cash flows used in the gross IRR calculation are assumed to occur at month-end. The gross IRRs are calculated before giving effect to management fees, performance fees as applicable, and

other expenses.

6. The net IRR for the U.S. power and energy infrastructure funds is an annualized since inception net internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the

measurement period. The cash flow dates used in the net IRR calculations are based on the actual dates of the cash flows. The net IRR for the corporate private equity funds is an annualized since inception net

internal rate of return of cash flows to and from investments and the residual value of the investments at the end of the measurement period. Cash flows used in the net IRR calculations are assumed to occur at

month end. For all funds, the net IRRs reflect returns to the fee-paying limited partners and if applicable, exclude interests attributable to the non-fee paying limited partners and/or the general partner who does

not pay management fees or performance fees. The net IRRs are calculated after giving effect to management fees, performance fees as applicable, and other expenses.

7. The Gross MoIC is lower than the Net MoIC due to the fund's utilization of a credit facility to fund an investment that is currently under construction and not generating cash flow.

31

Significant Fund Performance Metrics Endnotes (cont’d)

Real Estate

1. Realized proceeds include distributions of operating income, sales and financing proceeds received.

2. Unrealized value represents the fair market value of remaining investments. There can be no assurance that unrealized investments will be realized at the valuations indicated.

3. The gross MoIC is calculated at the investment level and is based on the interests of all partners. The gross MoIC for all funds is before giving effect to management fees, performance fees as applicable and other

expenses.

4. The net MoIC is calculated at the fund-level and is based on the interests of the fee-paying partners and, if applicable, excludes interests attributable to the non fee-paying partners and/or the general partner who does

not pay management fees or performance fees or has such fees rebated outside of the fund. The net MoIC is after giving effect to management fees, performance fees as applicable and other expenses.

5. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from investments and the residual value of the investments at the end of the measurement period. Gross IRRs reflect returns

to all partners. Cash flows used in the gross IRR calculation are assumed to occur at quarter-end. The gross IRRs are calculated before giving effect to management fees, performance fees as applicable, and other

expenses.

6. The net IRR is an annualized since inception net internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Net IRRs reflect returns to the fee-paying

partners and, if applicable, excludes interests attributable to the non fee-paying partners and/or the general partner who does not pay management fees or performance fees or has such fees rebated outside of the fund.

The cash flow dates used in the net IRR calculation are based on the actual dates of the cash flows. The net IRRs are calculated after giving effect to management fees, performance fees as applicable, and other expenses.

7. EF IV is made up of two parallel funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net MoIC and gross and net IRR presented in the chart are for the U.S. dollar denominated parallel

fund as that is the larger of the two funds. The gross and net IRRs for the Euro denominated parallel fund are 21.3% and 13.5%, respectively. The gross and net MoIC for the Euro denominated parallel fund are 1.3x and

1.2x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of fund's closing. All other values for EF IV are for the combined fund and are converted to U.S.

dollars at the prevailing quarter-end exchange rate.

8. EPEP II is made up of dual currency investors and Euro currency investors. The gross and net MoIC presented in the chart are for dual currency investors as dual currency investors represent the largest group of investors

in the fund. Multiples exclude foreign currency gains and losses since dual currency investors fund capital contributions and receive distributions in local deal currency (GBP or EUR) and therefore, do not realize foreign

currency gains or losses. The gross and net MoIC for the Euro currency investors, which include foreign currency gains and losses, are 1.2x and 1.1x, respectively. Original capital commitments are converted to U.S. dollars

at the prevailing exchange rate at the time of fund's closing. All other values for EPEP II are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate.

32

Weighted Average Unit Information

1. Represents units exchangeable for Ares Management, L.P. common units on a one-for-one basis.