Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE BANK FINANCIAL CORP | a8kcoverpage061517.htm |

| EX-2.1 - EXHIBIT 2.1 - STATE BANK FINANCIAL CORP | mergeragreement6152017.htm |

| EX-99.1 - EXHIBIT 99.1 - STATE BANK FINANCIAL CORP | alostarpressrelease.htm |

June 15, 2017

State Bank Financial Corporation

Announces Merger with AloStar

Bank of Commerce

2

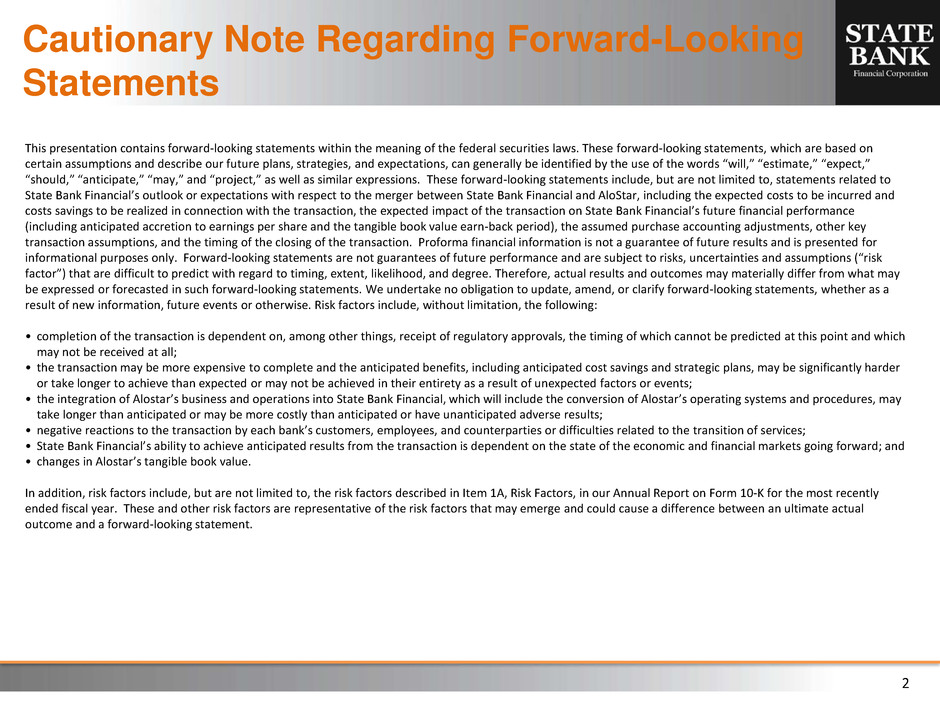

Cautionary Note Regarding Forward-Looking

Statements

This presentation contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements, which are based on

certain assumptions and describe our future plans, strategies, and expectations, can generally be identified by the use of the words “will,” “estimate,” “expect,”

“should,” “anticipate,” “may,” and “project,” as well as similar expressions. These forward-looking statements include, but are not limited to, statements related to

State Bank Financial’s outlook or expectations with respect to the merger between State Bank Financial and AloStar, including the expected costs to be incurred and

costs savings to be realized in connection with the transaction, the expected impact of the transaction on State Bank Financial’s future financial performance

(including anticipated accretion to earnings per share and the tangible book value earn-back period), the assumed purchase accounting adjustments, other key

transaction assumptions, and the timing of the closing of the transaction. Proforma financial information is not a guarantee of future results and is presented for

informational purposes only. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions (“risk

factor”) that are difficult to predict with regard to timing, extent, likelihood, and degree. Therefore, actual results and outcomes may materially differ from what may

be expressed or forecasted in such forward-looking statements. We undertake no obligation to update, amend, or clarify forward-looking statements, whether as a

result of new information, future events or otherwise. Risk factors include, without limitation, the following:

• completion of the transaction is dependent on, among other things, receipt of regulatory approvals, the timing of which cannot be predicted at this point and which

may not be received at all;

• the transaction may be more expensive to complete and the anticipated benefits, including anticipated cost savings and strategic plans, may be significantly harder

or take longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events;

• the integration of Alostar’s business and operations into State Bank Financial, which will include the conversion of Alostar’s operating systems and procedures, may

take longer than anticipated or may be more costly than anticipated or have unanticipated adverse results;

• negative reactions to the transaction by each bank’s customers, employees, and counterparties or difficulties related to the transition of services;

• State Bank Financial’s ability to achieve anticipated results from the transaction is dependent on the state of the economic and financial markets going forward; and

• changes in Alostar’s tangible book value.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently

ended fiscal year. These and other risk factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual

outcome and a forward-looking statement.

3

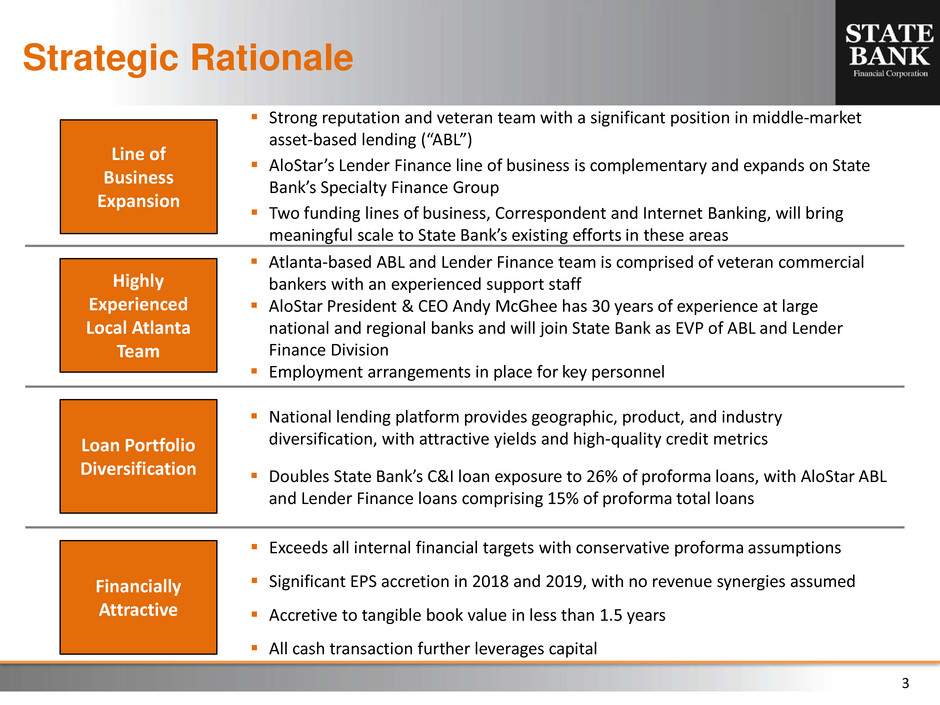

Strategic Rationale

Financially

Attractive

Highly

Experienced

Local Atlanta

Team

Exceeds all internal financial targets with conservative proforma assumptions

Significant EPS accretion in 2018 and 2019, with no revenue synergies assumed

Accretive to tangible book value in less than 1.5 years

All cash transaction further leverages capital

Atlanta-based ABL and Lender Finance team is comprised of veteran commercial

bankers with an experienced support staff

AloStar President & CEO Andy McGhee has 30 years of experience at large

national and regional banks and will join State Bank as EVP of ABL and Lender

Finance Division

Employment arrangements in place for key personnel

Line of

Business

Expansion

Strong reputation and veteran team with a significant position in middle-market

asset-based lending (“ABL”)

AloStar’s Lender Finance line of business is complementary and expands on State

Bank’s Specialty Finance Group

Two funding lines of business, Correspondent and Internet Banking, will bring

meaningful scale to State Bank’s existing efforts in these areas

Loan Portfolio

Diversification

National lending platform provides geographic, product, and industry

diversification, with attractive yields and high-quality credit metrics

Doubles State Bank’s C&I loan exposure to 26% of proforma loans, with AloStar ABL

and Lender Finance loans comprising 15% of proforma total loans

4

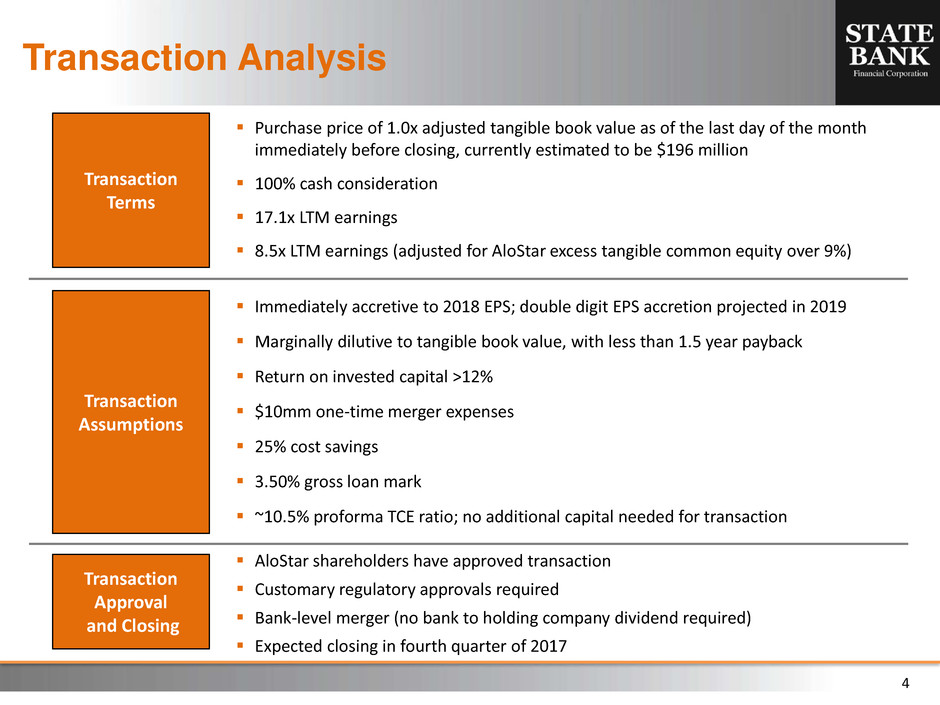

Transaction Analysis

Transaction

Assumptions

Immediately accretive to 2018 EPS; double digit EPS accretion projected in 2019

Marginally dilutive to tangible book value, with less than 1.5 year payback

Return on invested capital >12%

$10mm one-time merger expenses

25% cost savings

3.50% gross loan mark

~10.5% proforma TCE ratio; no additional capital needed for transaction

Transaction

Terms

Purchase price of 1.0x adjusted tangible book value as of the last day of the month

immediately before closing, currently estimated to be $196 million

100% cash consideration

17.1x LTM earnings

8.5x LTM earnings (adjusted for AloStar excess tangible common equity over 9%)

AloStar shareholders have approved transaction

Customary regulatory approvals required

Bank-level merger (no bank to holding company dividend required)

Expected closing in fourth quarter of 2017

Transaction

Approval

and Closing

5

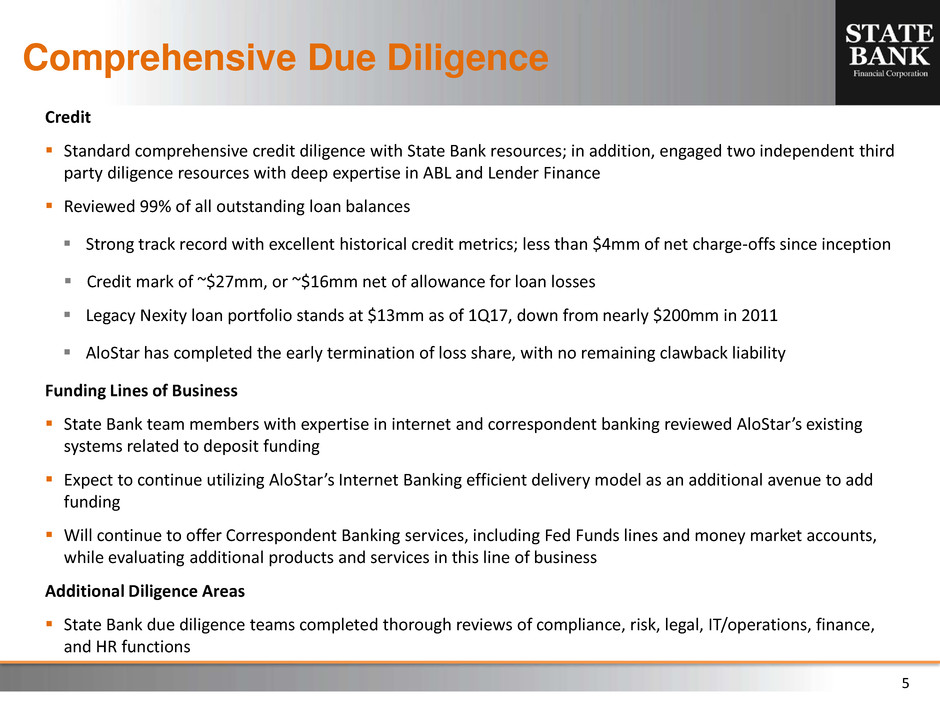

Comprehensive Due Diligence

Credit

Standard comprehensive credit diligence with State Bank resources; in addition, engaged two independent third

party diligence resources with deep expertise in ABL and Lender Finance

Reviewed 99% of all outstanding loan balances

Strong track record with excellent historical credit metrics; less than $4mm of net charge-offs since inception

Credit mark of ~$27mm, or ~$16mm net of allowance for loan losses

Legacy Nexity loan portfolio stands at $13mm as of 1Q17, down from nearly $200mm in 2011

AloStar has completed the early termination of loss share, with no remaining clawback liability

Funding Lines of Business

State Bank team members with expertise in internet and correspondent banking reviewed AloStar’s existing

systems related to deposit funding

Expect to continue utilizing AloStar’s Internet Banking efficient delivery model as an additional avenue to add

funding

Will continue to offer Correspondent Banking services, including Fed Funds lines and money market accounts,

while evaluating additional products and services in this line of business

Additional Diligence Areas

State Bank due diligence teams completed thorough reviews of compliance, risk, legal, IT/operations, finance,

and HR functions

6

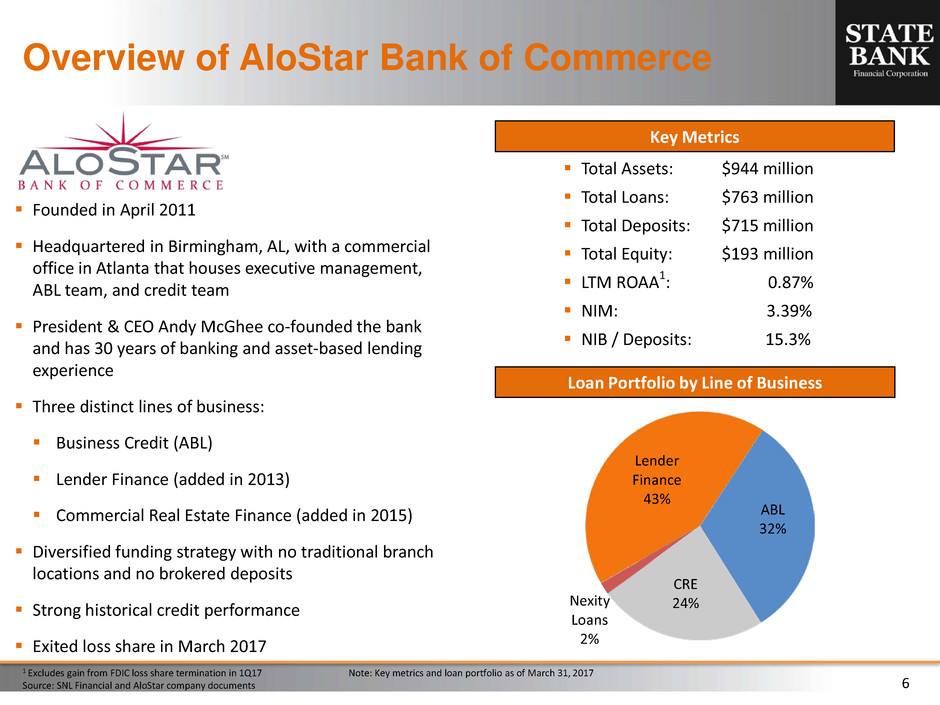

1 Excludes gain from FDIC loss share termination in 1Q17 Note: Key metrics and loan portfolio as of March 31, 2017

Source: SNL Financial and AloStar company documents

Founded in April 2011

Headquartered in Birmingham, AL, with a commercial

office in Atlanta that houses executive management,

ABL team, and credit team

President & CEO Andy McGhee co-founded the bank

and has 30 years of banking and asset-based lending

experience

Three distinct lines of business:

Business Credit (ABL)

Lender Finance (added in 2013)

Commercial Real Estate Finance (added in 2015)

Diversified funding strategy with no traditional branch

locations and no brokered deposits

Strong historical credit performance

Exited loss share in March 2017

Total Assets: $944 million

Total Loans: $763 million

Total Deposits: $715 million

Total Equity: $193 million

LTM ROAA1: 0.87%

NIM: 3.39%

NIB / Deposits: 15.3%

Key Metrics

Overview of AloStar Bank of Commerce

Loan Portfolio by Line of Business

Lender

Finance

43%

ABL

32%

CRE

24% Nexity

Loans

2%

7

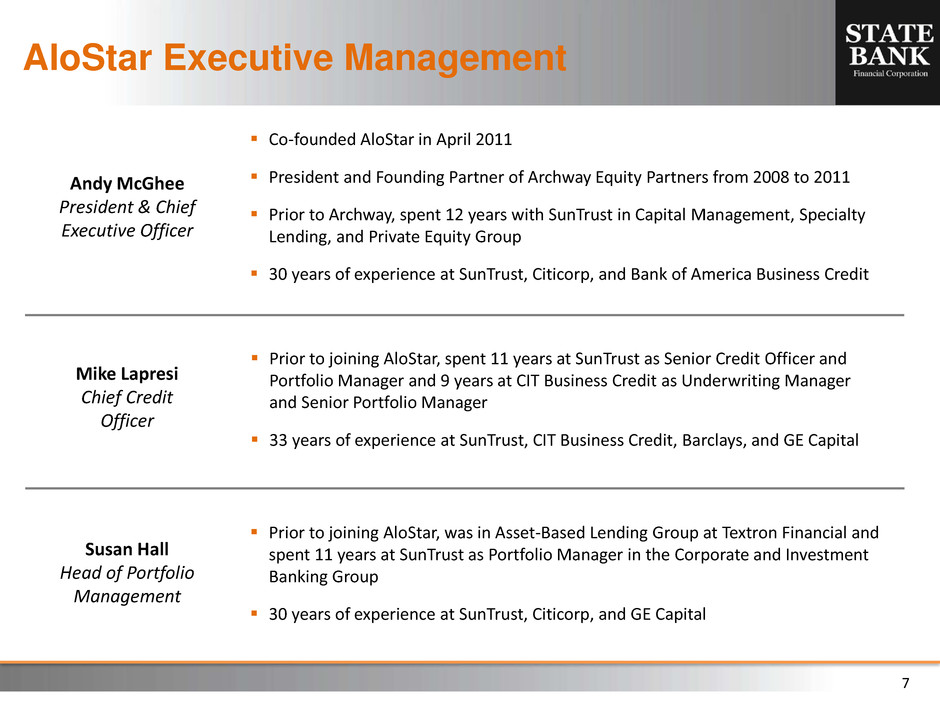

AloStar Executive Management

Prior to joining AloStar, spent 11 years at SunTrust as Senior Credit Officer and

Portfolio Manager and 9 years at CIT Business Credit as Underwriting Manager

and Senior Portfolio Manager

33 years of experience at SunTrust, CIT Business Credit, Barclays, and GE Capital

Andy McGhee

President & Chief

Executive Officer

Co-founded AloStar in April 2011

President and Founding Partner of Archway Equity Partners from 2008 to 2011

Prior to Archway, spent 12 years with SunTrust in Capital Management, Specialty

Lending, and Private Equity Group

30 years of experience at SunTrust, Citicorp, and Bank of America Business Credit

Prior to joining AloStar, was in Asset-Based Lending Group at Textron Financial and

spent 11 years at SunTrust as Portfolio Manager in the Corporate and Investment

Banking Group

30 years of experience at SunTrust, Citicorp, and GE Capital

Mike Lapresi

Chief Credit

Officer

Susan Hall

Head of Portfolio

Management

8

Represents 43% of total loans

Additional sub-limits for 12 individual asset

classes within the Lender Finance portfolio

Transactions are sourced through AloStar’s

national lending platform

ABL and Lender Finance Overview

Lender Finance

Business Credit (ABL)

Represents 32% of total loans

AloStar Business Credit has a strong reputation

and is a significant player in the middle-market

ABL business

Business Credit provides financial solutions for

growth, leverage buyouts, turnarounds,

recapitalizations, and restructurings

National footprint and broad industry experience,

including manufacturing, distribution, service

industries, and retail

Typical Transaction Characteristics

• $5mm – $20mm transaction size

• 70% – 90% advance rate structures on

borrower’s advance

• 3 – 5 year commitments

• Minimum tangible net worth of $3.5mm+

• Asset classes include: Non-bank

factoring/ABL/SBA, merchant cash advance,

insurance premium finance, BDC’s, tax liens,

and other specialty segments

Typical Transaction Characteristics

• $5mm – $20mm committed facilities

• 3 – 5 year commitments (majority are 3 years)

• Revolving lines of credit secured by accounts

receivable and inventory

• Term loans secured by machinery and

equipment, real estate, and other assets

9

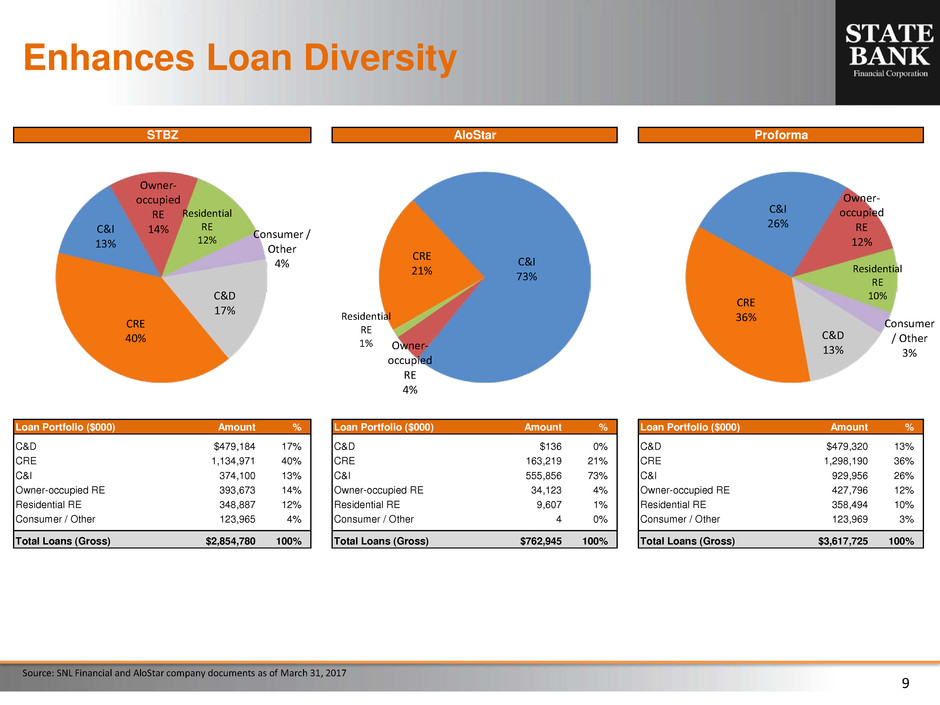

Enhances Loan Diversity

Source: SNL Financial and AloStar company documents as of March 31, 2017

Loan Portfolio ($000) Amount % Loan Portfolio ($000) Amount % Loan Portfolio ($000) Amount %

C&D $479,184 17% C&D $136 0% C&D $479,320 13%

CRE 1,134,971 40% CRE 163,219 21% CRE 1,298,190 36%

C&I 374,100 13% C&I 555,856 73% C&I 929,956 26%

Owner-occupied RE 393,673 14% Owner-occupied RE 34,123 4% Owner-occupied RE 427,796 12%

Residential RE 348,887 12% Residential RE 9,607 1% Residential RE 358,494 10%

Consumer / Other 123,965 4% Consumer / Other 4 0% Consumer / Other 123,969 3%

Total Loans (Gross) $2,854,780 100% Total Loans (Gross) $762,945 100% Total Loans (Gross) $3,617,725 100%

STBZ AloStar Proforma

CRE

21%

C&I

73%

Owner-

occupied

RE

4%

Residential

RE

1%

C&D

17%

CRE

40%

C&I

13%

Owner-

occupied

RE

14%

Residential

RE

12% Consumer /

Other

4%

C&D

13%

CRE

36%

C&I

26%

Owner-

occupied

RE

12%

Residential

RE

10%

Consumer

/ Other

3%

10

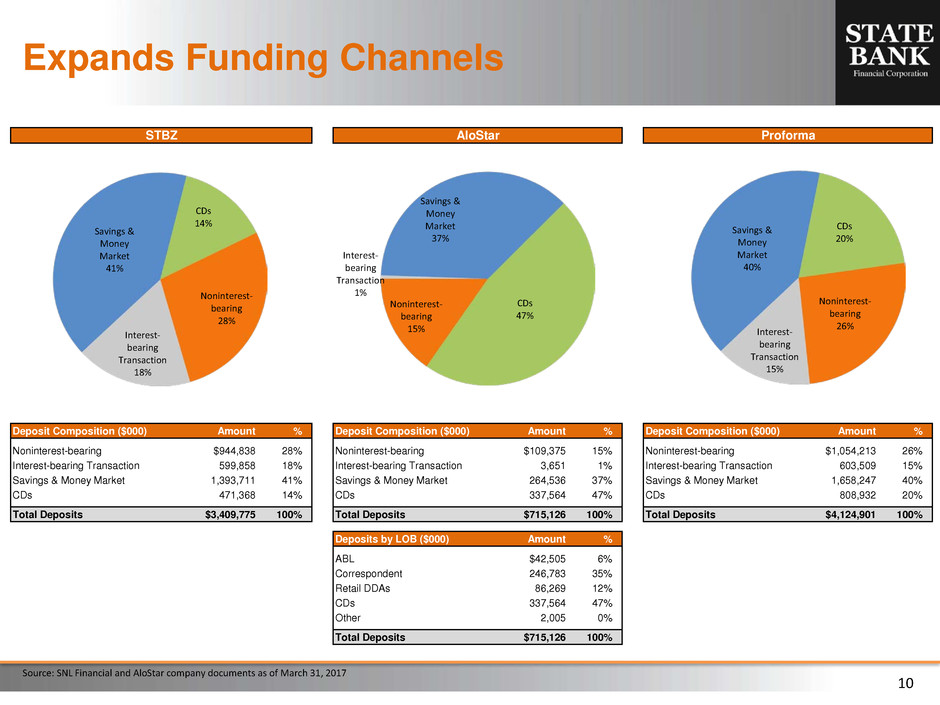

Expands Funding Channels

Source: SNL Financial and AloStar company documents as of March 31, 2017

Deposit Composition ($000) Amount % Deposit Composition ($000) Amount % Deposit Composition ($000) Amount %

Noninterest-bearing $944,838 28% Noninterest-bearing $109,375 15% Noninterest-bearing $1,054,213 26%

Interest-bearing Transaction 599,858 18% Interest-bearing Transaction 3,651 1% Interest-bearing Transaction 603,509 15%

Savings & Money Market 1,393,711 41% Savings & Money Market 264,536 37% Savings & Money Market 1,658,247 40%

CDs 471,368 14% CDs 337,564 47% CDs 808,932 20%

Total Deposits $3,409,775 100% Total Deposits $715,126 100% Total Deposits $4,124,901 100%

Deposits by LOB ($000) Amount %

ABL $42,505 6%

Correspondent 246,783 35%

Retail DDAs 86,269 12%

CDs 337,564 47%

Other 2,005 0%

Total Deposits $715,126 100%

STBZ AloStar Proforma

Noninterest-

bearing

26%

Interest-

bearing

Transaction

15%

Savings &

Money

Market

40%

CDs

20%

Noninterest-

bearing

15%

Interest-

bearing

Transaction

1%

Savings &

Money

Market

37%

CDs

47%

Noninterest-

bearing

28%

Interest-

bearing

Transaction

18%

Savings &

Money

Market

41%

CDs

14%

11

Summary

Strategically compelling position in ABL market, with executive management

and lending team based in Atlanta

Executing on strategy of adding scalable asset-generating lines of business

Diversifies loan portfolio

Accretive to EPS and net interest margin

Efficient deployment of capital

Proven track record of successful acquisitions/integrations at State Bank