Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Monogram Residential Trust, Inc. | a17-14780_18k.htm |

Exhibit 99.1

Monogram Residential Trust Company Presentation June 2017 OLUME– San Francisco, CA

Forward-Looking Statements 2 Certain statements made in this presentation and other written or oral statements made by or on behalf of Monogram Residential Trust, Inc. (“Monogram”), may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements regarding future events and developments and Monogram’s future performance, as well as management’s expectations, beliefs, plans, estimates or projections relating to the future, are forward-looking statements within the meaning of these laws. Examples of such statements in this presentation and in Monogram’s outlook include, expectations regarding apartment market conditions and expectations regarding future operating conditions, including Monogram’s current outlook as to expected funds from operations, core funds from operations, adjusted funds from operations, revenue, operating expenses, net operating income, capital expenditures, lease-up activities and timeline, redeployment of capital from sold properties, depreciation, gains on sales and net income and anticipated development activities (including projected construction expenditures and timing). We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement for purposes of complying with those safe harbor provisions. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this presentation. Such factors include the risk that we may not meet our expected funds from operations, net operating income or other performance metrics, and other factors described in the Risk Factors section of Monogram’s Annual Report on Form 10-K for the year ended December 31, 2016 and in subsequent filings with the Securities and Exchange Commission. Management believes that these forward-looking statements are reasonable; however, you should not place undue reliance on such statements. These statements are based on current expectations and speak only as of the date of such statements. Monogram undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise.

Monogram Overview Owner, operator, and developer of luxury apartment communities Young, highly amenitized class A portfolio drives premium average monthly rent of $1,967 per unit(1) Significant and growing presence in select coastal markets The Mile – Miami, FL Proven track record of Value Creation(2) and strong operational performance Significantly completed development program which continues to fuel meaningful embedded NOI(2) growth as remaining properties stabilize Verge – San Diego, CA Notes 1)Data based on total stabilized portfolio as of 3/31/17 2)See Appendix for Definitions and Reconciliations of Non-GAAP Measurements 3

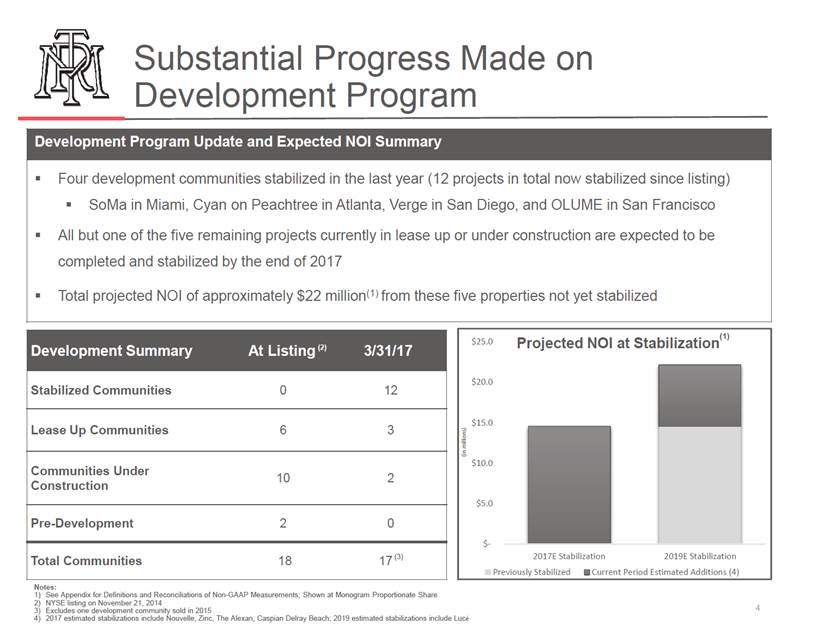

Substantial Progress Made on Development Program (1) Projected NOI at Stabilization $25.0 $20.0 $15.0 $10.0 10 2 Construction $5.0 $-2017E Stabilization 2019E Stabilization Previously Stabilized Current Period Estimated Additions (4) Notes: 1) See Appendix for Definitions and Reconciliations of Non-GAAP Measurements; Shown at Monogram Proportionate Share 2) NYSE listing on November 21, 2014 3) Excludes one development community sold in 2015 4) 2017 estimated stabilizations include Nouvelle, Zinc, The Alexan, Caspian Delray Beach; 2019 estimated stabilizations include Lucé 4 (in millions) Development SummaryAt Listing (2) 3/31/17 Stabilized Communities012 Lease Up Communities63 Communities Under Pre-Development20 Total Communities1817 (3) Development Program Update and Expected NOI Summary Four development communities stabilized in the last year (12 projects in total now stabilized since listing) SoMa in Miami, Cyan on Peachtree in Atlanta, Verge in San Diego, and OLUME in San Francisco All but one of the five remaining projects currently in lease up or under construction are expected to be completed and stabilized by the end of 2017 Total projected NOI of approximately $22 million(1) from these five properties not yet stabilized

Development Program Continues to Drive Accretive Growth Strategic Growth Allocation of capital to accretive investments in core markets that enhance portfolio quality - Value Creation Spread between projected stabilized yields and market cap rates drives growth in NAV over time - Efficiency In addition to in-house development expertise, partner with best-in-class development partners, which provides access to a wider variety of investment opportunities - Nouvelle – Tysons Corner, VA Risk Mitigation Cost-overrun and completion guarantees secured from development partners - 5

Proven Track Record of Value Creation Stabilized 12 communities since listing at average NOI Yields at Stabilization(1) of approximately 6.8% Results largely above pro forma - Attractive returns on cost: spreads over market cap rates in excess of 150 – 200 basis points - SOMA – Miami, FL Total Value Creation of approximately $160 million(2), or $0.95 per share, on stabilized properties 12 Notes 1) See Appendix for Definitions and Reconciliations of Non-GAAP Measurements 2) Shown at Monogram Proportionate Share. See Appendix for Definitions and Reconciliations of Non-GAAP Measurements 6

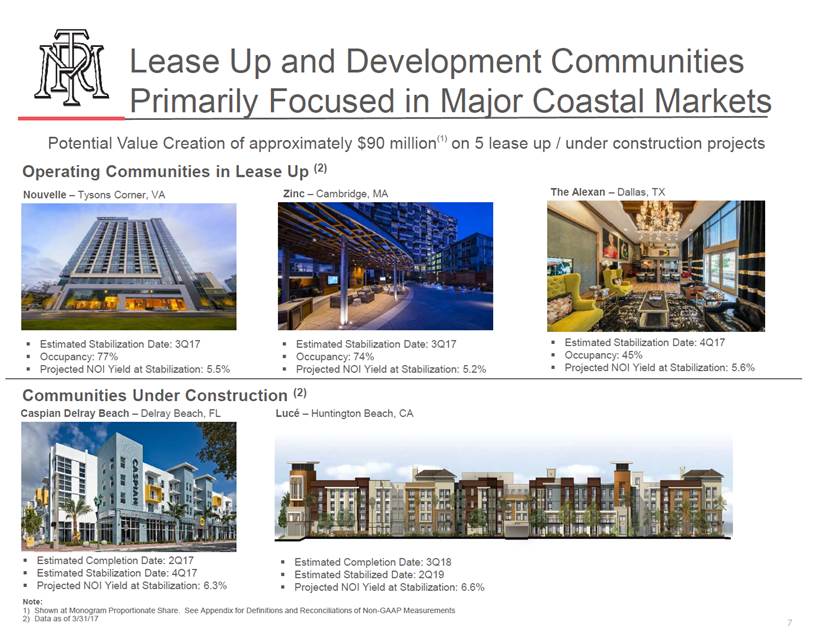

Lease Up and Development Communities Primarily Focused in Major Coastal Markets Potential Value Creation of approximately $90 million(1) on 5 lease up / under construction projects Operating Communities in Lease Up (2) The Alexan – Dallas, TX Zinc – Cambridge, MA Nouvelle – Tysons Corner, VA Estimated Stabilization Date: 4Q17 Occupancy: 45% Projected NOI Yield at Stabilization: 5.6% Estimated Stabilization Date: 3Q17 Occupancy: 77% Projected NOI Yield at Stabilization: 5.5% Estimated Stabilization Date: 3Q17 Occupancy: 74% Projected NOI Yield at Stabilization: 5.2% Communities Under Construction (2) Caspian Delray Beach – Delray Beach, FL Lucé – Huntington Beach, CA Estimated Completion Date: 2Q17 Estimated Stabilization Date: 4Q17 Projected NOI Yield at Stabilization: 6.3% Estimated Completion Date: 3Q18 Estimated Stabilized Date: 2Q19 Projected NOI Yield at Stabilization: 6.6% Note: 1) Shown at Monogram Proportionate Share. See Appendix for Definitions and Reconciliations of Non-GAAP Measurements 2) Data as of 3/31/17 7

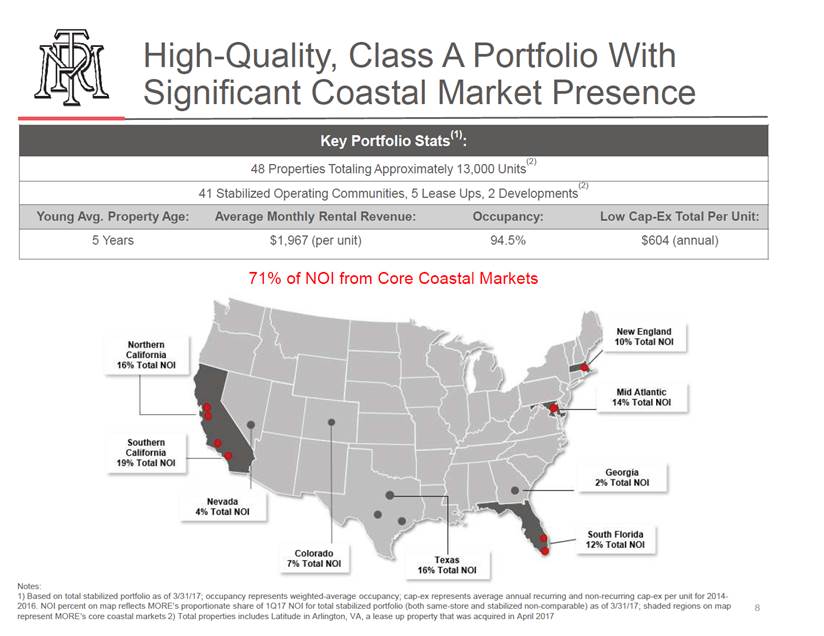

High-Quality, Class A Portfolio With Significant Coastal Market Presence 48 Properties Totaling Approximately 13,000 Units 41 Stabilized Operating Communities, 5 Lease Ups, 2 Developments 71% of NOI from Core Coastal Markets Notes: 1) Based on total stabilized portfolio as of 3/31/17; occupancy represents weighted-average occupancy; cap-ex represents average annual recurring and non-recurring cap-ex per unit for 2014-2016. NOI percent on map reflects MORE’s proportionate share of 1Q17 NOI for total stabilized portfolio (both same-store and stabilized non-comparable) as of 3/31/17; shaded regions on map represent MORE’s core coastal markets 2) Total properties includes Latitude in Arlington, VA, a lease up property that was acquired in April 2017 8 Key Portfolio Stats(1): (2) (2) Young Avg. Property Age:Average Monthly Rental Revenue:Occupancy:Low Cap-Ex Total Per Unit: 5 Years$1,967 (per unit)94.5%$604 (annual)

Long Term Portfolio Strategy Premier owner, operator, developer of luxury apartment communities Young, modern, and highly-amenitized assets that achieve premium average monthly rents Work-play-live locations Low capex requirements - - - Opportunity to create value by Rationalizing portfolio to focus on existing coastal markets with stronger growth prospects due to: - EV - San Diego, CA • • • • Low land availability Barrier to entry locations High cost of single family housing Strong economic growth Increasing operating efficiencies - 9

Opportunity to Rationalize Markets… A More Concentrated Portfolio in Existing Coastal Markets with Better Expected Long Term NOI Growth and Total Return Prospects Reposition portfolio primarily through sales of low barrier, volatile, and / or single asset markets and acquisitions of assets in high barrier, stable, existing coastal markets RECYCLE PROCEEDS Unique opportunity to recycle capital from non-core markets to core coastal markets with a historically tight cap rate differential and at an IRR premium 10 Markets Exited Orlando (2017) Chicago (2015) Markets Identified to Exit Over Time New Jersey (1 property) Atlanta (1 property) Las Vegas (2 properties) Opportunistically Reduce Market Exposure Over Time Austin Denver Houston Dallas Existing Coastal Markets to Increase Concentrations Northern California •SF Bay Area Southern California •Los Angeles, Orange and San Diego Counties South Florida •Broward, Dade and Palm Beach Counties Washington DC Metro Area Boston Metro Area

…And Increase Operating Efficiency A More Concentrated Portfolio in Existing Coastal Markets with Fewer Total Markets Expected to Increase Operating Efficiency Current portfolio is located in thirteen different markets Three non-coastal markets each have just one asset - One non-coastal market has just two assets - A more focused geographic and market footprint allows for G&A efficiencies / savings and a more streamlined corporate organization The Mark – Boca Raton, FL Opportunity to enhance property operating margins - 11

Opportunity to Simplify and Structure Operations Strategic focus to reduce joint venture ownership of portfolio over the long term Simplify strategy - Increase Control - Enhance Flexibility - Buy / sell provisions which may allow for future wholly owned growth JV property interests represent potential attractive acquisition opportunities with minimal transaction costs if Monogram determines they would be accretive - Opportunity to buy-out interests in existing coastal markets and / or buy-out interests in non-core markets and redeploy through 1031 exchanges into coastal markets - Argenta – San Francisco, CA 12

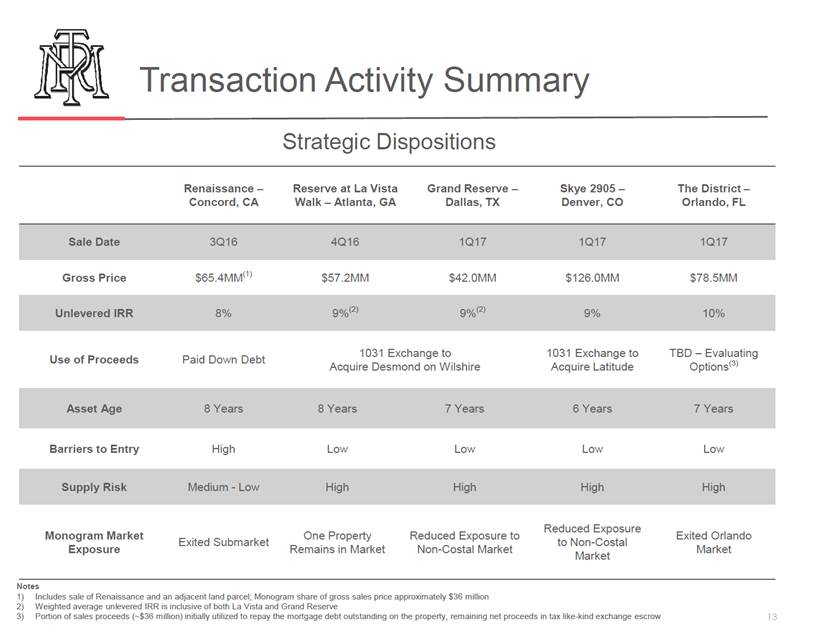

Transaction Activity Summary Strategic Dispositions Renaissance – Concord, CA Reserve at La Vista Walk – Atlanta, GA Grand Reserve – Dallas, TX Skye 2905 – Denver, CO The District – Orlando, FL $65.4MM(1) Gross Price $57.2MM $42.0MM $126.0MM $78.5MM 1031 Exchange to Acquire Desmond on Wilshire 1031 Exchange to Acquire Latitude TBD – Evaluating Options(3) Use of Proceeds Paid Down Debt Barriers to Entry High Low Low Low Low Reduced Exposure to Non-Costal Market Monogram Market Exposure One Property Remains in Market Reduced Exposure to Non-Costal Market Exited Orlando Market Exited Submarket Notes 1) 2) 3) Includes sale of Renaissance and an adjacent land parcel; Monogram share of gross sales price approximately $36 million Weighted average unlevered IRR is inclusive of both La Vista and Grand Reserve Portion of sales proceeds (~$36 million) initially utilized to repay the mortgage debt outstanding on the property, remaining net proceeds in tax like-kind exchange escrow 13 Supply RiskMedium - LowHighHighHighHigh Asset Age8 Years8 Years7 Years6 Years7 Years Unlevered IRR8%9%(2) 9%(2) 9%10% Sale Date3Q164Q161Q171Q171Q17

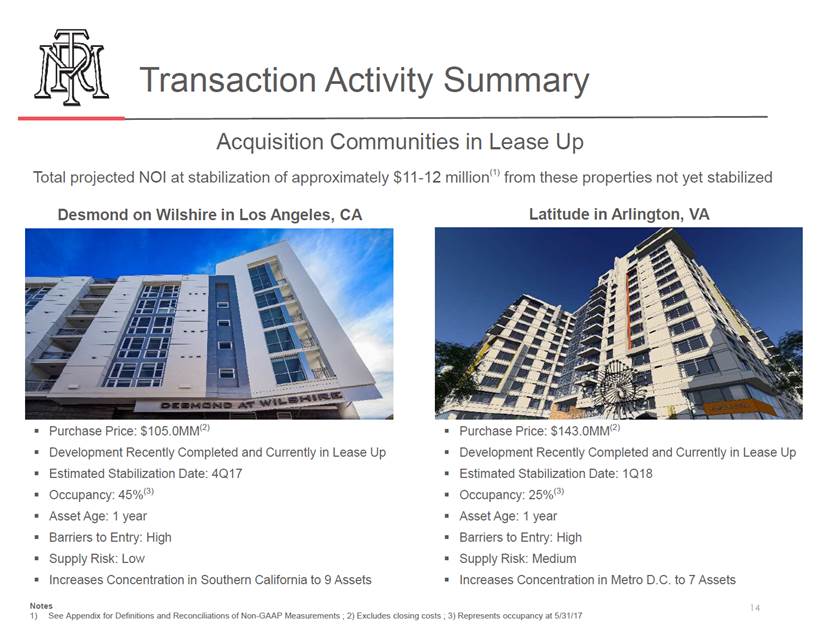

Transaction Activity Summary Acquisition Communities in Lease Up Total projected NOI at stabilization of approximately $11-12 million(1) from these properties not yet stabilized Desmond on Wilshire in Los Angeles, CA Latitude in Arlington, VA Purchase Price: $105.0MM(2) Development Recently Completed and Currently in Lease Up Estimated Stabilization Date: 4Q17 Occupancy: 45%(3) Asset Age: 1 year Barriers to Entry: High Supply Risk: Low Increases Concentration in Southern California to 9 Assets Purchase Price: $143.0MM(2) Development Recently Completed and Currently in Lease Up Estimated Stabilization Date: 1Q18 Occupancy: 25%(3) Asset Age: 1 year Barriers to Entry: High Supply Risk: Medium Increases Concentration in Metro D.C. to 7 Assets Notes 1)See Appendix for Definitions and Reconciliations of Non-GAAP Measurements ; 2) Excludes closing costs ; 3) Represents occupancy at 5/31/17 14

Operating Portfolio Results Summary Total portfolio NOI growth of 12.2%(1) Continue to capture significant embedded NOI from lease-up properties - Same Store NOI of (0.3)%(1) Vara – San Francisco, CA - 2017 full-year outlook: 0.0% - 2.0% Achieved occupancy of 94.5% and average monthly rental revenue per unit of $1,967(2) - Average rents expected to continue to increase upon stabilization of high quality development and acquisition communities Blue Sol – Costa Mesa, CA Notes 1)As of 3/31/17 and as compared to 3/31/16 2)Metrics based on total stabilized portfolio as of 3/31/17; occupancy represents weighted average occupancy; figures shown represent consolidated operating metrics 15

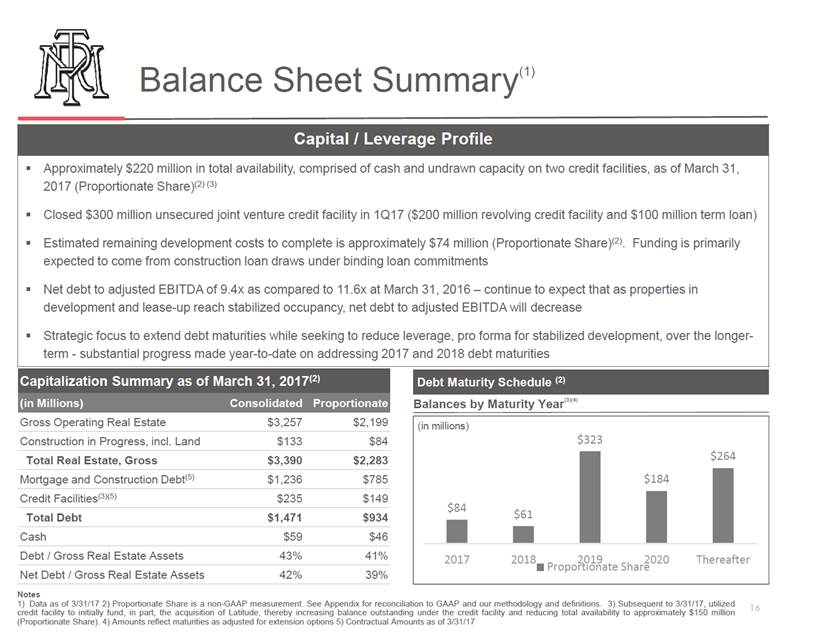

Balance Sheet Summary(1) Gross Operating Real Estate $3,257 $2,199 Construction in Progress, incl. Land $133 $84 Total Real Estate, Gross $3,390 $2,283 Mortgage and Construction Debt(5) $1,236 $785 Credit Facilities(3)(5) $235 $149 Total Debt $1,471 $934 Cash $59 $46 Debt / Gross Real Estate Assets 43% 41% Net Debt / Gross Real Estate Assets 42% 39% Notes 1) Data as of 3/31/17 2) Proportionate Share is a non-GAAP measurement. See Appendix for reconciliation to GAAP and our methodology and definitions. 3) Subsequent to 3/31/17, utilized 16 credit facility to initially fund, in part, the acquisition of Latitude, thereby increasing balance outstanding under the credit facility and reducing total availability to approximately $150 million (Proportionate Share). 4) Amounts reflect maturities as adjusted for extension options 5) Contractual Amounts as of 3/31/17 (in millions) $323 2017 2018 2019 2020 Thereafter Proportionate Share $84 $61 $264 $184 Capital / Leverage Profile Approximately $220 million in total availability, comprised of cash and undrawn capacity on two credit facilities, as of March 31, 2017 (Proportionate Share)(2) (3) Closed $300 million unsecured joint venture credit facility in 1Q17 ($200 million revolving credit facility and $100 million term loan) Estimated remaining development costs to complete is approximately $74 million (Proportionate Share)(2). Funding is primarily expected to come from construction loan draws under binding loan commitments Net debt to adjusted EBITDA of 9.4x as compared to 11.6x at March 31, 2016 – continue to expect that as properties in development and lease-up reach stabilized occupancy, net debt to adjusted EBITDA will decrease Strategic focus to extend debt maturities while seeking to reduce leverage, pro forma for stabilized development, over the longer-term - substantial progress made year-to-date on addressing 2017 and 2018 debt maturities Capitalization Summary as of March 31, 2017(2) Balances by Maturity Year(3)(4) (in Millions)ConsolidatedProportionate Debt Maturity Schedule (2)

Appendix Definitions and Reconciliations of Non-GAAP Measurements (continued on following pages) Economic Costs represents costs for all on-site development and construction costs for GAAP, but including certain items expensed for GAAP (primarily specific financing and operating expenses incurred during lease up) and excluding certain GAAP costs related to consolidated allocated costs, former sponsor-related fees and other non-cash capitalized cost items. Capital Expenditures are amounts capitalized in accordance with GAAP related to recurring and non-recurring improvements to the community (such as appliances, HVAC equipment, etc.), but excluding revenue producing improvements, major renovations and rehabilitations of units and common areas. NOI Yield at Stabilization is calculated as 12 months of projected NOI subsequent to stabilization divided by total Economic Costs. Unlevered IRR is calculated based on the timing and amounts of inception-to-date net cash flows of the property (primarily including the net sales proceeds, revenues and other operating cash receipts) less cash outflows of the property (primarily including direct operating expenses, capital expenditures and other operating cash expenses). The unlevered IRR excludes any cash flows related to mortgages and debt service. Our calculation of unlevered IRR is based on our Proportionate Share during the period owned. Value Creation represents estimates of value less estimated total Economic Cost, before any selling expenses. 17

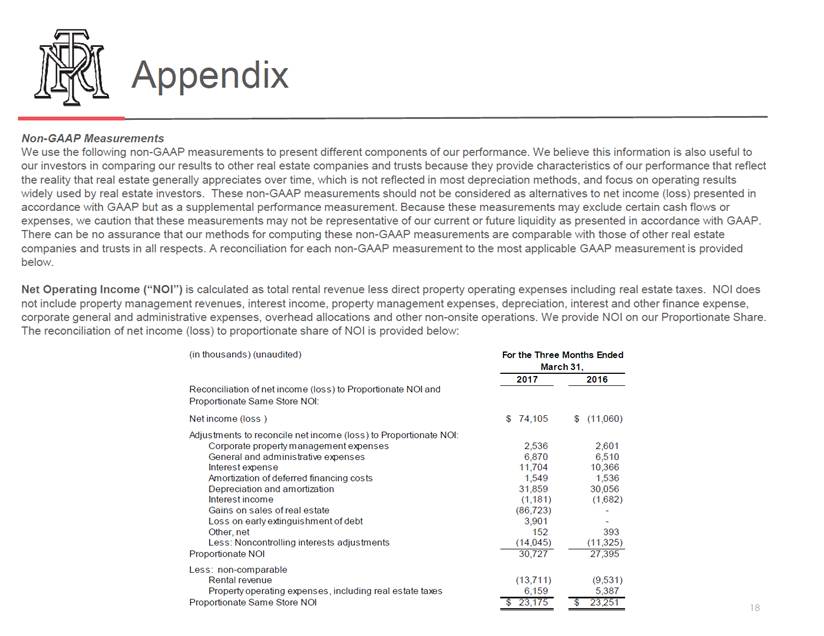

Appendix Non-GAAP Measurements We use the following non-GAAP measurements to present different components of our performance. We believe this information is also useful to our investors in comparing our results to other real estate companies and trusts because they provide characteristics of our performance that reflect the reality that real estate generally appreciates over time, which is not reflected in most depreciation methods, and focus on operating results widely used by real estate investors. These non-GAAP measurements should not be considered as alternatives to net income (loss) presented in accordance with GAAP but as a supplemental performance measurement. Because these measurements may exclude certain cash flows or expenses, we caution that these measurements may not be representative of our current or future liquidity as presented in accordance with GAAP. There can be no assurance that our methods for computing these non-GAAP measurements are comparable with those of other real estate companies and trusts in all respects. A reconciliation for each non-GAAP measurement to the most applicable GAAP measurement is provided below. Net Operating Income (“NOI”) is calculated as total rental revenue less direct property operating expenses including real estate taxes. NOI does not include property management revenues, interest income, property management expenses, depreciation, interest and other finance expense, corporate general and administrative expenses, overhead allocations and other non-onsite operations. We provide NOI on our Proportionate Share. The reconciliation of net income (loss) to proportionate share of NOI is provided below: (in thous ands ) (unaudited) For the Three Months Ended March 31, 2017 2016 Reconciliation of net incom e (los s ) to Proportionate NOI and Proportionate Sam e Store NOI: Net incom e (los s ) Adjus tm ents to reconcile net incom e (los s ) to Proportionate NOI: Corporate property m anagem ent expens es General and adm inis trative expens es Interes t expens e Am ortization of deferred financing cos ts Depreciation and am ortization Interes t incom e Gains on s ales of real es tate Los s on early extinguis hm ent of debt Other, net Les s : Noncontrolling interes ts adjus tm ents Proportionate NOI Les s : non-com parable Rental revenue Property operating expens es , including real es tate taxes Proportionate Sam e Store NOI $ 74,105 $ (11,060) 2,536 6,870 11,704 1,549 31,859 (1,181) (86,723) 3,901 152 (14,045) 2,601 6,510 10,366 1,536 30,056 (1,682) - - 393 (11,325) 30,727 27,395 (13,711) 6,159 (9,531) 5,387 $ 23,175 $ 23,251 18

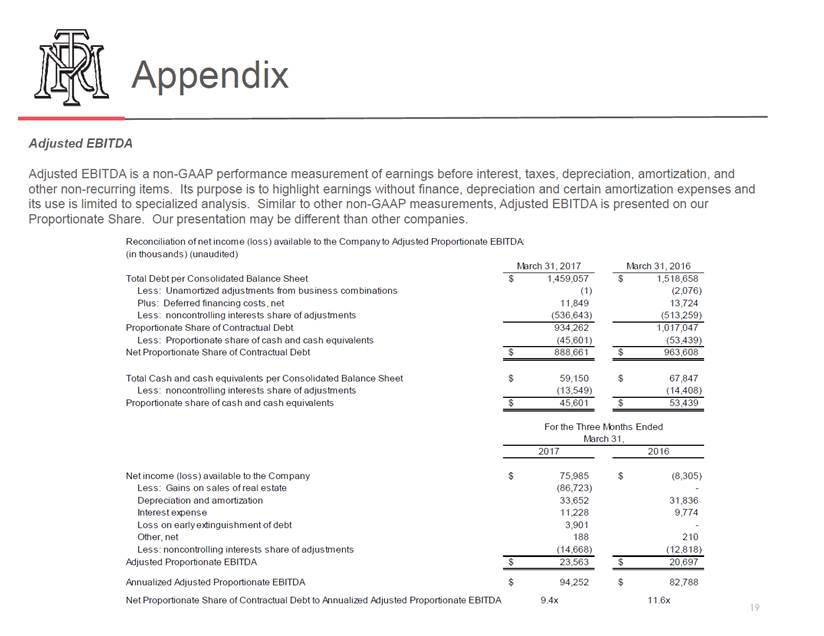

Appendix Adjusted EBITDA Adjusted EBITDA is a non-GAAP performance measurement of earnings before interest, taxes, depreciation, amortization, and other non-recurring items. Its purpose is to highlight earnings without finance, depreciation and certain amortization expenses and its use is limited to specialized analysis. Similar to other non-GAAP measurements, Adjusted EBITDA is presented on our Proportionate Share. Our presentation may be different than other companies. Reconciliation of net incom e (los s ) available to the Com pany to Adjus ted Proportionate EBITDA: (in thous ands ) (unaudited) March 31, 2017 March 31, 2016 Total Debt per Cons olidated Balance Sheet Les s : Unam ortized adjus tm ents from bus ines s com binations Plus : Deferred financing cos ts , net Les s : noncontrolling interes ts s hare of adjus tm ents Proportionate Share of Contractual Debt Les s : Proportionate s hare of cas h and cas h equivalents Net Proportionate Share of Contractual Debt $ 1,459,057 (1) 11,849 (536,643) $ 1,518,658 (2,076) 13,724 (513,259) 934,262 (45,601) 1,017,047 (53,439) $ 888,661 $ 963,608 Total Cas h and cas h equivalents per Cons olidated Balance Sheet Les s : noncontrolling interes ts s hare of adjus tm ents Proportionate s hare of cas h and cas h equivalents $ 59,150 (13,549) $ 67,847 (14,408) $ 45,601 $ 53,439 For the Three Months Ended March 31, 2017 2016 Net incom e (los s ) available to the Com pany Les s : Gains on s ales of real es tate Depreciation and am ortization Interes t expens e Los s on early extinguis hm ent of debt Other, net Les s : noncontrolling interes ts s hare of adjus tm ents Adjus ted Proportionate EBITDA $ 75,985 (86,723) 33,652 11,228 3,901 188 (14,668) $ (8,305) - 31,836 9,774 - 210 (12,818) $ 23,563 $ 20,697 Annualized Adjus ted Proportionate EBITDA Net Proportionate Share of Contractual Debt to Annualized Adjus ted Proportionate EBITDA $ 94,252 $ 82,788 11.6x 9.4x 19

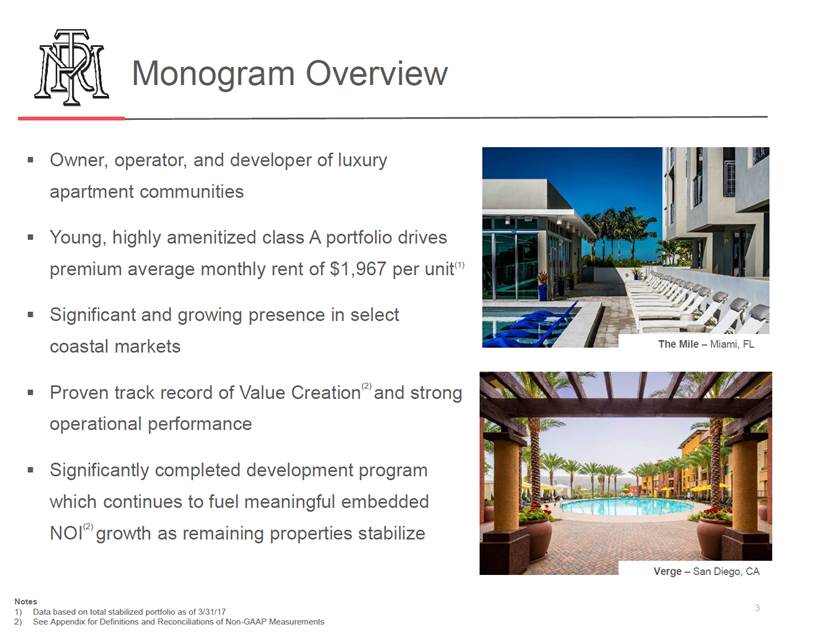

Appendix Proportionate Share is a non-GAAP presentation of financial amounts at our effective cash share based on our current participation in distributable operating cash. The amounts exclude noncontrolling interests in consolidated joint ventures. All interests are consolidated, where we are the controlling interest. Proportionate Share presentations may be useful in analyzing our financial information by providing revenues, expenses, assets and liabilities attributable only to our shareholders. Management uses this information to allocate resources and evaluate investments. Proportionate Share presentations are also relevant to our investors and lenders as it highlights operations and capital available for our lenders and investors and is the basis used for several of our loan covenants. However, our Proportionate Share does not include amounts related to our consolidated operations and should not be considered a replacement for corresponding GAAP amounts presented on a consolidated basis. Investors are cautioned that our Proportionate Share amounts should only be used to assess financial information in the limited context of evaluating amounts attributable to shareholders. We may describe as Proportionate Share, Monogram share or our share. The consolidated GAAP balances and noncontrolling interests adjustments related to certain balance sheet amounts are provided below: (i n mi l l i ons ) (una u di te d) Amounts a s of Ma rch 31, 2017 Noncontrol l i ng I nte re s ts Ad jus tme nts Cons ol i da te d GAAP Gros s Ope ra ti ng Re a l Es ta te Cons tructi o n i n Progre s s , i ncl ud i ng La nd Tota l Re a l Es ta te , Gros s $ 3,257 133 $ (1,058) (49) 3,390 Mo rtga ge a nd Cons tructi on De b t (1) Cre di t Fa ci l i ti e s (1) Tota l De bt $ 1,236 235 (451) (86) 1,471 Ca s h $ 59 (13) 20 (1) Contractual Amounts as of March 31, 2017