Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASHFORD HOSPITALITY TRUST INC | ahtinvestorpresentation8-k.htm |

Company Presentation – April 2017

Safe Harbor

2

In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be

considered forward-looking and subject to certain risks and uncertainties that could cause results to differ

materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate,"

"should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements.

Such forward-looking statements include, but are not limited to, our business and investment strategy, our

understanding of our competition, current market trends and opportunities, projected operating results, and

projected capital expenditures.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause

actual results to differ materially from those anticipated including, without limitation: general volatility of the

capital markets and the market price of our common stock; changes in our business or investment strategy;

availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the

market in which we operate, interest rates or the general economy, and the degree and nature of our

competition. These and other risk factors are more fully discussed in the Company's filings with the Securities

and Exchange Commission.

EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as

trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the

property's net operating income by the purchase price. Net operating income is the property's funds from

operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the

change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are

non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the

SEC.

This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell,

any securities of Ashford Hospitality Trust, Inc. or any of its respective affiliates, and may not be relied upon in

connection with the purchase or sale of any such security.

Strategic Overview

3

Opportunistic platform focused

on upper-upscale, full-service

hotels

Superior long-term total

shareholder return performance

Targets moderate debt levels of

55-60% net debt/gross assets

Attractive dividend yield

Targets cash level of 25-35% of

total equity market cap

Highly-aligned management

team & advisory structure

Recent Developments

4

Q4 2016 Earnings Release:

Q4 RevPAR growth for all hotels not under renovation of 3.2%

Q4 Hotel EBITDA margin for all hotels not under renovation increased 46 bps

Q4 Hotel EBITDA flow-through for all hotels not under renovation of 51%

In February 2017, the Company announced a non-binding proposal to acquire

FelCor Lodging Trust Incorporated (NYSE: FCH) ("FelCor") for 1.192 shares of

Ashford Trust and securities in Ashford Inc. in exchange for each share of FelCor

In February 2017, the Company announced the appointment of Douglas A.

Kessler as Chief Executive Officer effective immediately

Announced enhancements to corporate governance policies

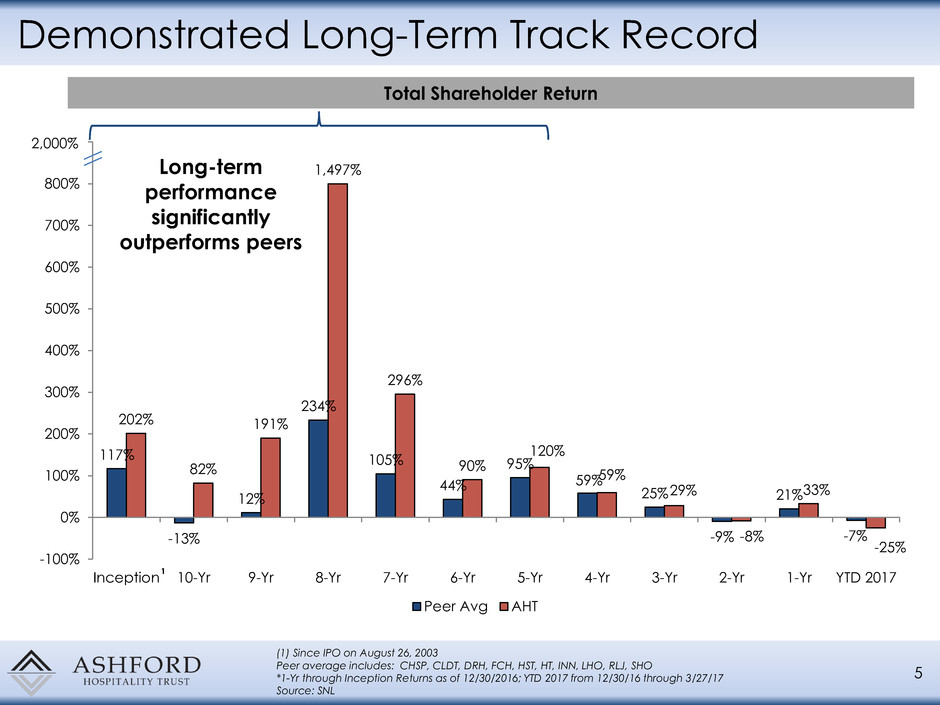

117%

-13%

12%

234%

105%

44%

95%

59%

25%

-9%

21%

-7%

202%

82%

191%

1,497%

296%

90%

120%

59%

29%

-8%

33%

-25%

-100%

0%

100%

200%

300%

400%

500%

600%

700%

800%

900%

Inception 10-Yr 9-Yr 8-Yr 7-Yr 6-Yr 5-Yr 4-Yr 3-Yr 2-Yr 1-Yr YTD 2017

Peer Avg AHT

Demonstrated Long-Term Track Record

5

(1) Since IPO on August 26, 2003

Peer average includes: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, RLJ, SHO

*1-Yr through Inception Returns as of 12/30/2016; YTD 2017 from 12/30/16 through 3/27/17

Source: SNL

Total Shareholder Return

Long-term

performance

significantly

outperforms peers

1

2,000

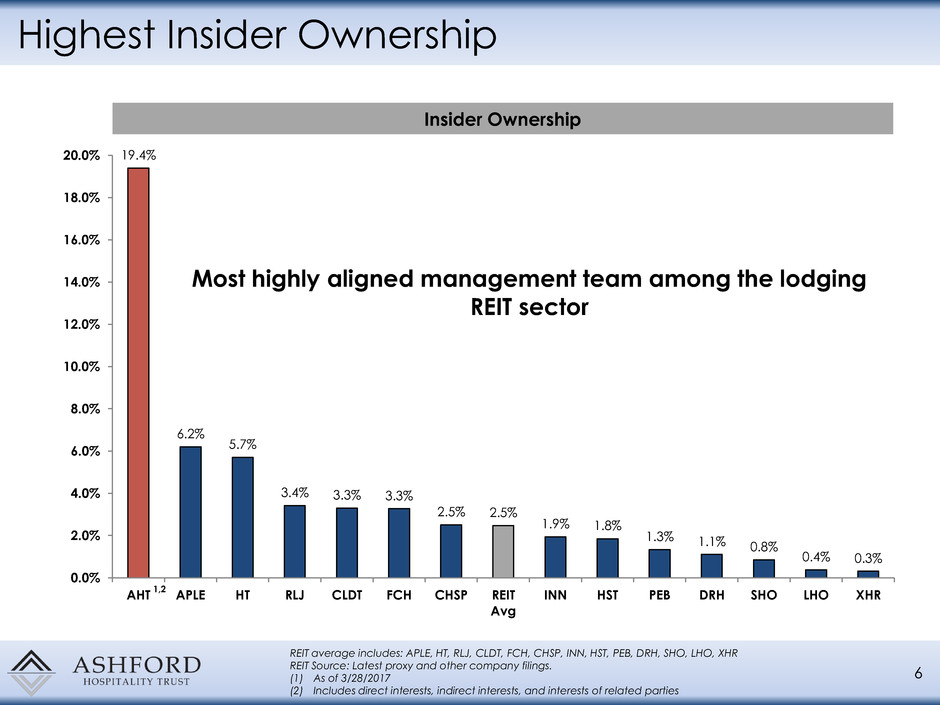

19.4%

6.2%

5.7%

3.4% 3.3% 3.3%

2.5% 2.5%

1.9% 1.8%

1.3% 1.1% 0.8%

0.4% 0.3%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

AHT APLE HT RLJ CLDT FCH CHSP REIT

Avg

INN HST PEB DRH SHO LHO XHR

Highest Insider Ownership

6

REIT average includes: APLE, HT, RLJ, CLDT, FCH, CHSP, INN, HST, PEB, DRH, SHO, LHO, XHR

REIT Source: Latest proxy and other company filings.

(1) As of 3/28/2017

(2) Includes direct interests, indirect interests, and interests of related parties

Insider Ownership

Most highly aligned management team among the lodging

REIT sector

1,2

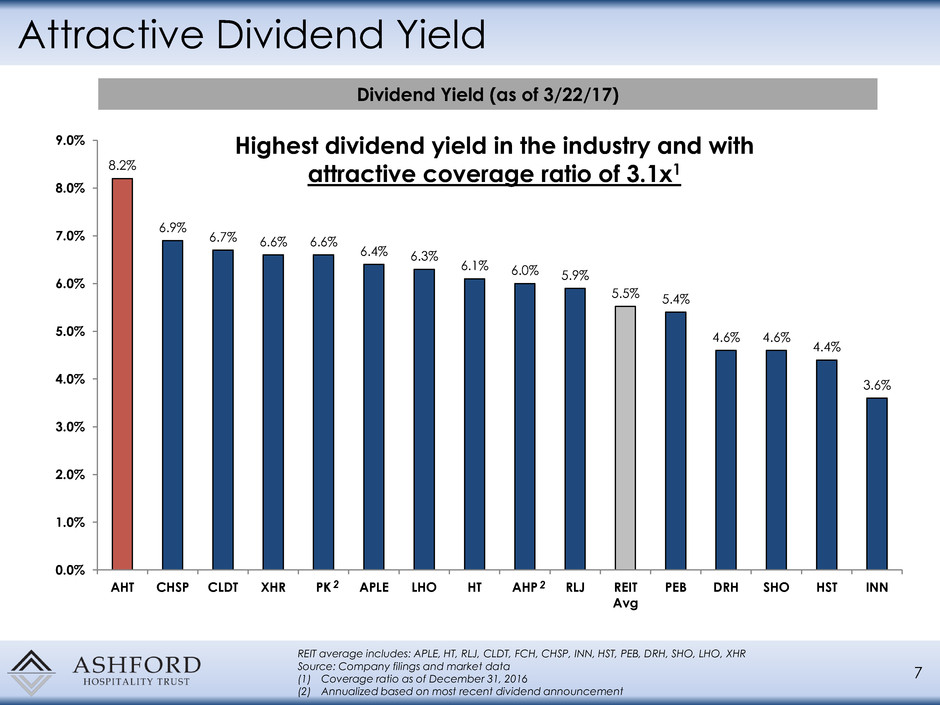

8.2%

6.9%

6.7% 6.6% 6.6%

6.4% 6.3%

6.1% 6.0% 5.9%

5.5% 5.4%

4.6% 4.6%

4.4%

3.6%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

AHT CHSP CLDT XHR PK APLE LHO HT AHP RLJ REIT

Avg

PEB DRH SHO HST INN

Attractive Dividend Yield

7

REIT average includes: APLE, HT, RLJ, CLDT, FCH, CHSP, INN, HST, PEB, DRH, SHO, LHO, XHR

Source: Company filings and market data

(1) Coverage ratio as of December 31, 2016

(2) Annualized based on most recent dividend announcement

Dividend Yield (as of 3/22/17)

Highest dividend yield in the industry and with

attractive coverage ratio of 3.1x1

2 2

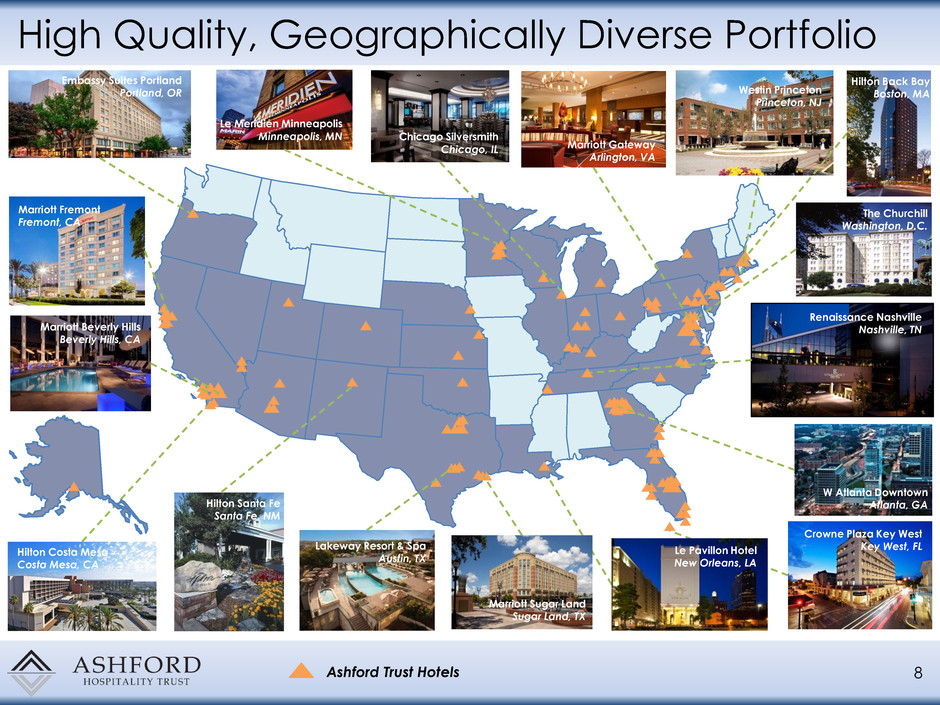

8 Ashford Trust Hotels

High Quality, Geographically Diverse Portfolio

Le Pavillon Hotel

New Orleans, LA

Lakeway Resort & Spa

Austin, TX

Hilton Costa Mesa

Costa Mesa, CA

Marriott Fremont

Fremont, CA

Le Meridien Minneapolis

Minneapolis, MN Chicago Silversmith

Chicago, IL

Hilton Back Bay

Boston, MA

The Churchill

Washington, D.C.

W Atlanta Downtown

Atlanta, GA

Crowne Plaza Key West

Key West, FL

Marriott Sugar Land

Sugar Land, TX

Hilton Santa Fe

Santa Fe, NM

Renaissance Nashville

Nashville, TN

Westin Princeton

Princeton, NJ

Marriott Beverly Hills

Beverly Hills, CA

Embassy Suites Portland

Portland, OR

Marriott Gateway

Arlington, VA

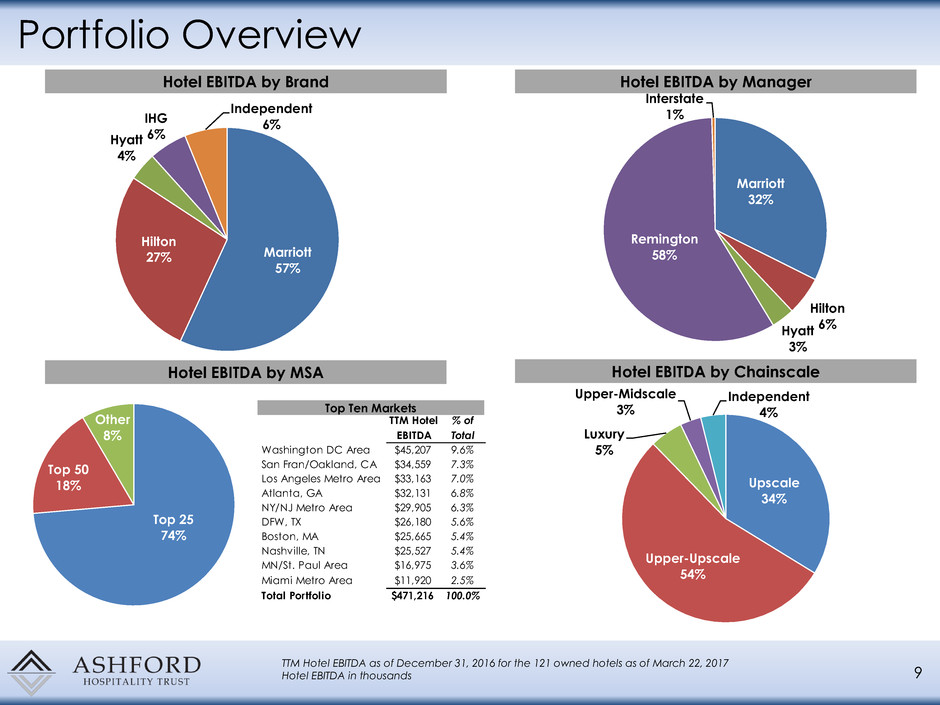

Top 25

74%

Top 50

18%

Other

8%

Portfolio Overview

9

TTM Hotel EBITDA as of December 31, 2016 for the 121 owned hotels as of March 22, 2017

Hotel EBITDA in thousands

Hotel EBITDA by Brand Hotel EBITDA by Manager

Hotel EBITDA by MSA Hotel EBITDA by Chainscale

Top Ten Markets

Marriott

57%

Hilton

27%

Hyatt

4%

IHG

6%

Independent

6%

Marriott

32%

Hilton

6%

Hyatt

3%

Remington

58%

Interstate

1%

Upscale

34%

Upper-Upscale

54%

Luxury

5%

Upper-Midscale

3%

Independent

4%

TTM Hotel % of

EBITDA Total

Washington DC Area $45,207 9.6%

San Fran/Oakland, CA $34,559 7.3%

Los Angeles Metro Area $33,163 7.0%

Atlanta, GA $32,131 6.8%

NY/NJ Metro Area $29,905 6.3%

DFW, TX $26,180 5.6%

Boston, MA $25,665 5.4%

Nashville, TN $25,527 5.4%

MN/St. Paul Area $16,975 3.6%

Miami Metro Area $11,920 2.5%

Total Portfolio $471,216 100.0%

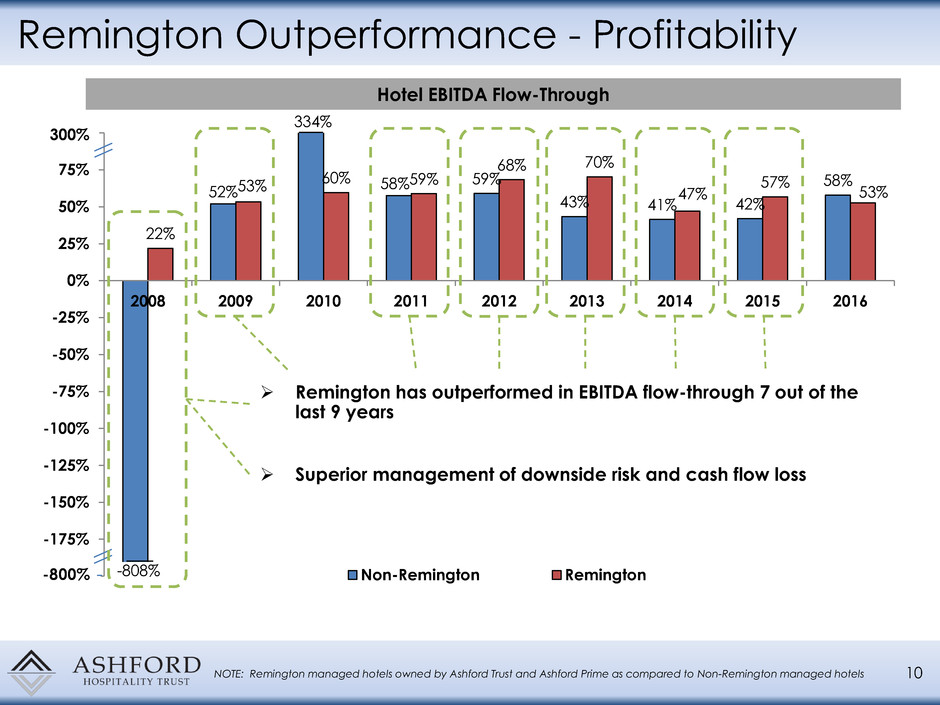

52%

58% 59%

43% 41% 42%

58%

22%

53%

60% 59%

68% 70%

47%

57%

53%

-200%

-175%

-150%

-125%

-100%

-75%

-50%

-25%

0%

25%

50%

75%

100%

2008 2009 2010 2011 2012 2013 2014 2015 2016

Non-Remington Remington

Remington Outperformance - Profitability

Remington has outperformed in EBITDA flow-through 7 out of the

last 9 years

10 NOTE: Remington managed hotels owned by Ashford Trust and Ashford Prime as compared to Non-Remington managed hotels

Hotel EBITDA Flow-Through

Superior management of downside risk and cash flow loss

-800 -808%

334%

300

Embassy Suites Portland: Secured a new, high quality restaurant tenant, upgrading TV and Wi-Fi to

improve guest experience

Ritz Carlton Atlanta: Completed restaurant renovation, extensive guestroom renovation scheduled for Q4

($21M), expanding Ritz Carlton Club Lounge, expanded/updated gift shop into upscale retail market

Marriott Beverly Hills: 55% 2016 RevPAR growth (first full year since $28M conversion from Crowne Plaza)

Hyatt Regency Savannah: Completed extensive room renovation with shower conversions and Increased

premium rooms inventory by 70 rooms to drive ADR

Marriott Bridgewater: Converted 30 king rooms to double/double rooms to capture more group business;

increase premium room type by 43.5% to capture higher ADR. Recently completed a lobby and

restaurant renovation

W Hotel Atlanta Downtown: Terminated existing BLT Steak outlet management agreement and brought

the operation in-house with a projected annual positive GOP impact of almost $300k

Courtyard Denver Airport: Secured two significant pieces of airline crew business that will drive significant

share growth in 2017

W & LeMeridien Minneapolis: Worked with existing restaurant tenant at LM to extend lease under more

favorable terms. Leased underutilized lobby space at W MPLS to Manny’s for a Private Dining Room

11

Asset Management Initiatives - Recent

Renaissance Nashville: Partnering with developer to redevelop Nashville Convention Center resulting in new,

premium meeting space, extending meeting space lease from 11 years to 99 years with no upfront or ongoing

lease payments

Marriott Crystal Gateway: Spending $30M on major renovations: all guestrooms, lobby & restaurant, addition of

M Club, new and expanded fitness center, adding 6 keys and additional meeting space

Hilton Boston Back Bay: Shifted revenue strategies to increase off-season occupancy to add significant

incremental revenue, spending $11.3M in 2017 on guestroom and lobby renovation

Hyatt Regency Savannah: Extensive food and beverage outlet repositioning and full lobby renovation nearly

complete. New Meeting space created as well. Opening new retail market

Marriott Dallas DFW: Converting from brand to franchise managed (Remington) on May 24th. Comprehensive

ballroom and meeting space renovation in summer 2017

Embassy Suites Santa Clara: Spending $10.4M on 2017 guestrooms and lobby renovation to include larger

market and fitness area

Engaged expense consultant: Charged with examining all contracted services in select hotels and negotiating

improved terms to drive profit at existing operations

Exploring Outdoor Advertising: Working with several consultants to explore outdoor advertising (Wall wraps,

video boards, and free-standing) to monetize underutilized outdoor space

Time/Motion studies: Engaged a consultant to analyze current work habits in several hotels and propose labor

savings initiatives

12

Asset Management Initiatives - Upcoming

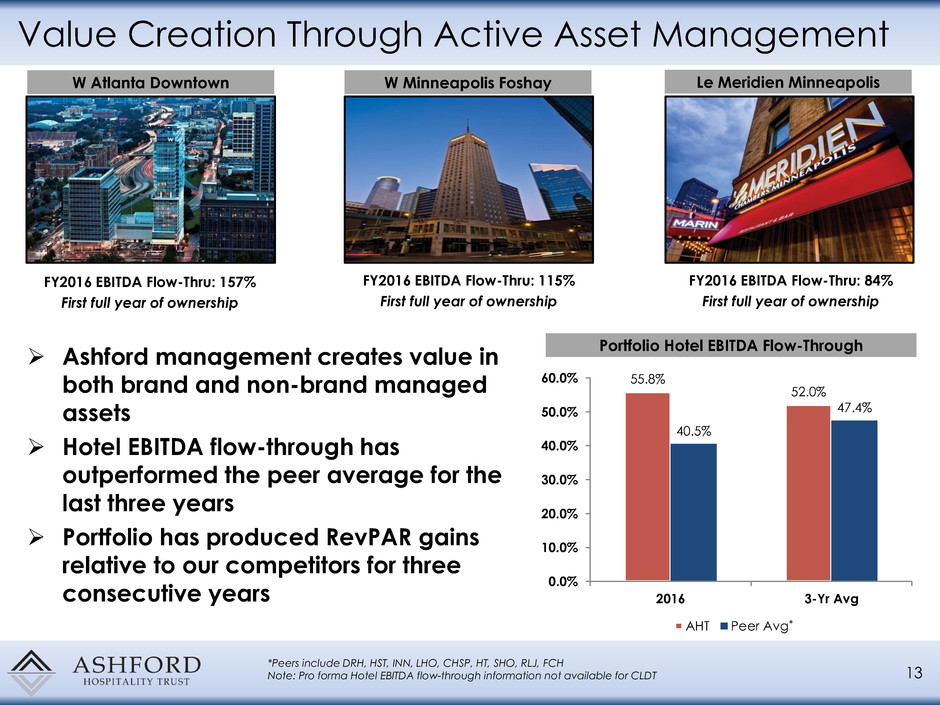

13

Value Creation Through Active Asset Management

55.8%

52.0%

40.5%

47.4%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

2016 3-Yr Avg

AHT Peer Avg

Portfolio Hotel EBITDA Flow-Through

*Peers include DRH, HST, INN, LHO, CHSP, HT, SHO, RLJ, FCH

Note: Pro forma Hotel EBITDA flow-through information not available for CLDT

*

Ashford management creates value in

both brand and non-brand managed

assets

Hotel EBITDA flow-through has

outperformed the peer average for the

last three years

Portfolio has produced RevPAR gains

relative to our competitors for three

consecutive years

W Atlanta Downtown W Minneapolis Foshay Le Meridien Minneapolis

FY2016 EBITDA Flow-Thru: 157%

First full year of ownership

FY2016 EBITDA Flow-Thru: 115%

First full year of ownership

FY2016 EBITDA Flow-Thru: 84%

First full year of ownership

Case Study – Conversion to Remington Managed

14

Implemented Strategies:

Increased club room premium pricing from

$30 to $45

Increased corporate group room nights to 25%

mid-week to ensure sell-outs and push rate

Improved pattern management and business

mix to increase higher rated retail contribution

Moved to premium pricing, allowing restriction

of premium rooms and preferred business

management

Aggressively priced preferred rooms rates 25%-

30% YOY

Marriott Fremont – Fremont, CA

*$ in Thousands

(1) As of December 31, 2016

Announced forward cap rate and EBITDA multiple of 8.1% and 10.0x, respectively

Actual cap rate and EBITDA multiple of 10.9% and 7.9x, respectively

Current cap rate and EBITDA multiple of 15.6% and 5.7x, respectively (1)

Acquired for $50 million in Aug 2014; Oct 2016 refi had allocated loan amount of $61 million

TTM

Pre-Takeover

TTM

Post-Takeover

Increase

(%, BPs)

Total Revenue* $19,140 $22,153 15.7%

RevPAR $107.1 $130.5 21.8%

GOP margin 27.0% 38.1% +1,116

EBITDA margin 20.9% 30.0% +916

Marriott Fremont

Case Study – Marriott Beverly Hills Conversion

15

16

Case Study – Marriott Beverly Hills Conversion (cont.)

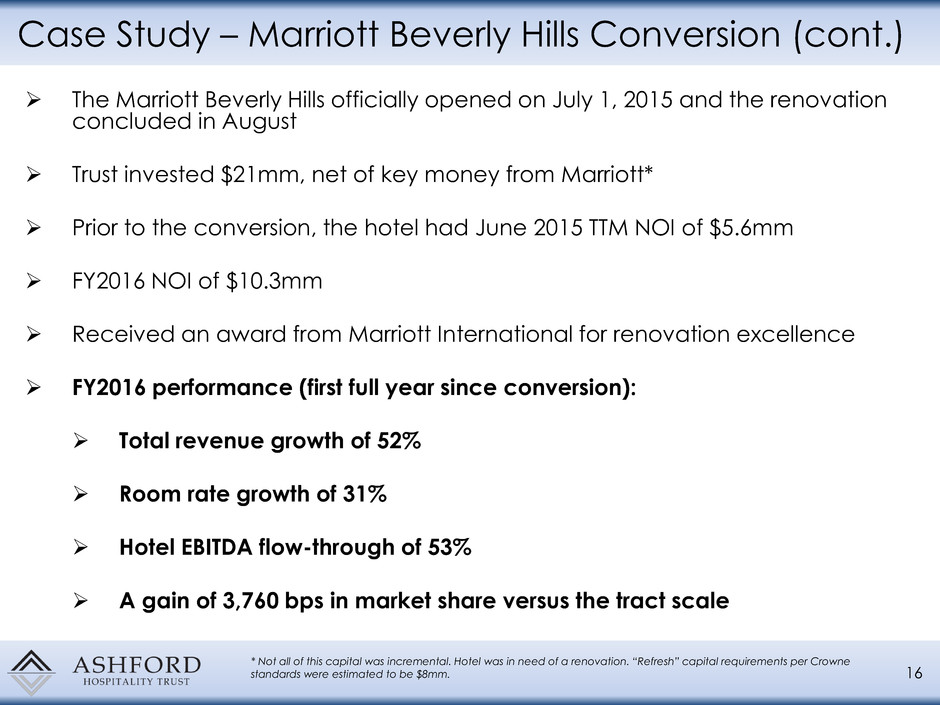

The Marriott Beverly Hills officially opened on July 1, 2015 and the renovation

concluded in August

Trust invested $21mm, net of key money from Marriott*

Prior to the conversion, the hotel had June 2015 TTM NOI of $5.6mm

FY2016 NOI of $10.3mm

Received an award from Marriott International for renovation excellence

FY2016 performance (first full year since conversion):

Total revenue growth of 52%

Room rate growth of 31%

Hotel EBITDA flow-through of 53%

A gain of 3,760 bps in market share versus the tract scale

* Not all of this capital was incremental. Hotel was in need of a renovation. “Refresh” capital requirements per Crowne

standards were estimated to be $8mm.

17

Case Study – Marriott Beverly Hills Conversion (cont.)

Lobby Bar Restaurant

Front Desk

Lobby

18

Case Study – Marriott Beverly Hills Conversion (cont.)

Guestroom

Boardroom Guestroom

Club Lounge

Aggressive Asset Management – W Atlanta Downtown

19

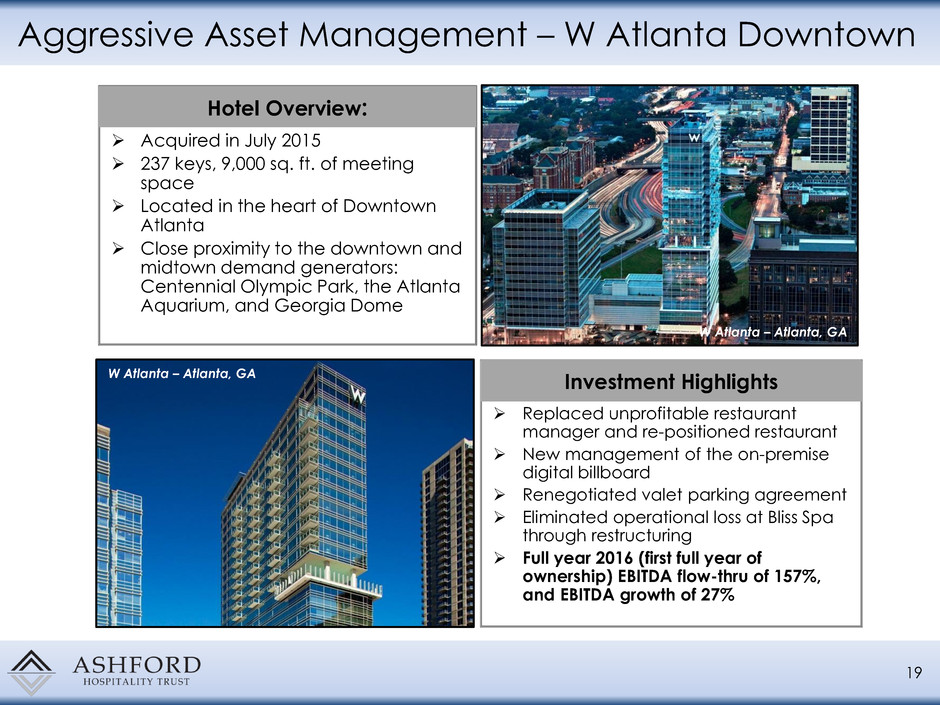

Acquired in July 2015

237 keys, 9,000 sq. ft. of meeting

space

Located in the heart of Downtown

Atlanta

Close proximity to the downtown and

midtown demand generators:

Centennial Olympic Park, the Atlanta

Aquarium, and Georgia Dome

Replaced unprofitable restaurant

manager and re-positioned restaurant

New management of the on-premise

digital billboard

Renegotiated valet parking agreement

Eliminated operational loss at Bliss Spa

through restructuring

Full year 2016 (first full year of

ownership) EBITDA flow-thru of 157%,

and EBITDA growth of 27%

W Atlanta – Atlanta, GA

W Atlanta – Atlanta, GA

Hotel Overview:

Investment Highlights

Capital Structure and Net Working Capital

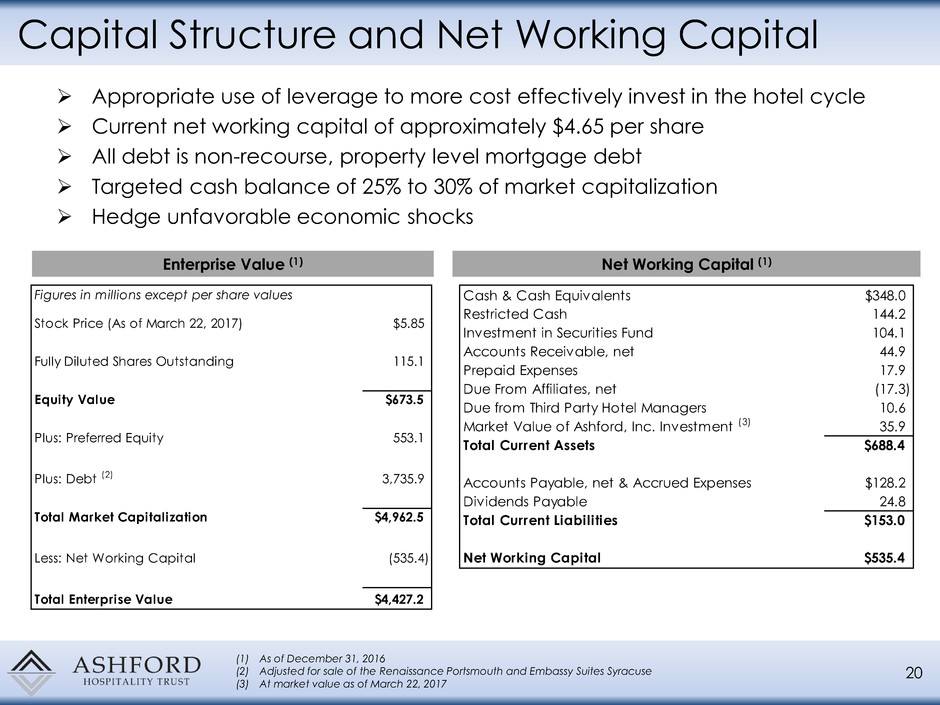

Appropriate use of leverage to more cost effectively invest in the hotel cycle

Current net working capital of approximately $4.65 per share

All debt is non-recourse, property level mortgage debt

Targeted cash balance of 25% to 30% of market capitalization

Hedge unfavorable economic shocks

20

(1) As of December 31, 2016

(2) Adjusted for sale of the Renaissance Portsmouth and Embassy Suites Syracuse

(3) At market value as of March 22, 2017

Enterprise Value (1) Net Working Capital (1)

Figures in millions except per share values

Stock Price (As of March 22, 2017) $5.85

Fully Diluted Shares Outstanding 115.1

Equity Value $673.5

Plus: Preferred Equity 553.1

Plus: Debt (2) 3,735.9

Total Market Capitalization $4,962.5

Less: Net Working Capital (535.4)

Total Enterprise Value $4,427.2

Cash & Cash Equivalents $348.0

Restricted Cash 144.2

Investment in Securities Fund 104.1

Accounts Receivable, net 44.9

Prepaid Expenses 17.9

Due From Affiliates, net (17.3)

Due from Third Party Hotel Managers 10.6

M rket Value of Ashford, Inc. Investment (3) 35.9

Total Current Assets $688.4

Accounts Payable, net & Accrued Expenses $128.2

Dividends Payable 24.8

Total Current Liabilities $153.0

Net Working Capital $535.4

Debt Maturities and Leverage

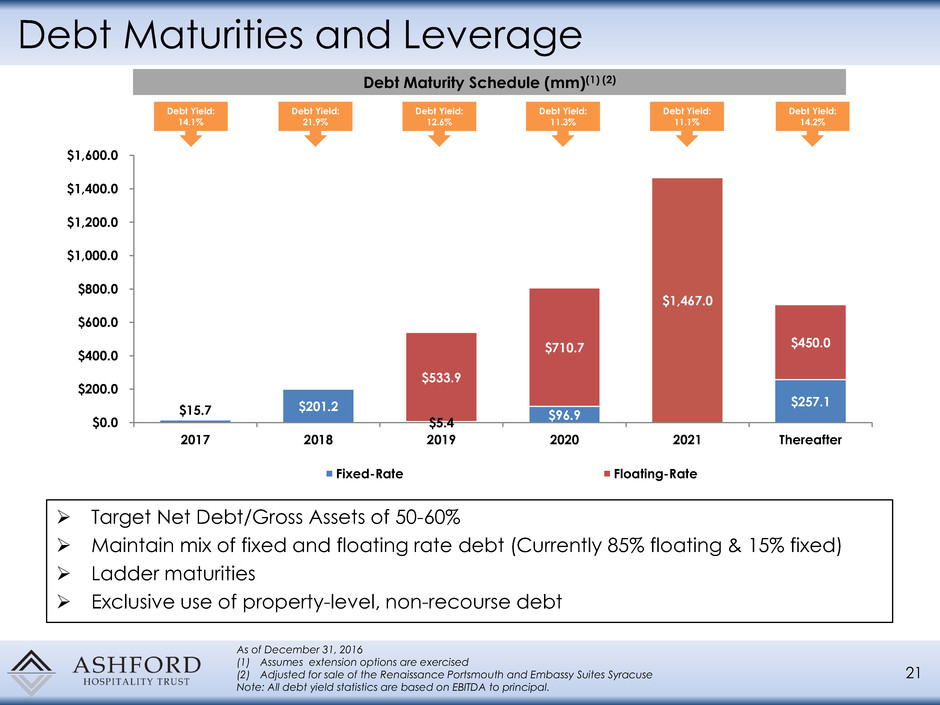

Target Net Debt/Gross Assets of 50-60%

Maintain mix of fixed and floating rate debt (Currently 85% floating & 15% fixed)

Ladder maturities

Exclusive use of property-level, non-recourse debt

21

As of December 31, 2016

(1) Assumes extension options are exercised

(2) Adjusted for sale of the Renaissance Portsmouth and Embassy Suites Syracuse

Note: All debt yield statistics are based on EBITDA to principal.

Debt Maturity Schedule (mm)(1) (2)

Debt Yield:

14.2%

Debt Yield:

12.6%

Debt Yield:

21.9%

Debt Yield:

14.1%

Debt Yield:

11.3%

Debt Yield:

11.1%

$15.7 $201.2

$5.4

$96.9

$257.1

$533.9

$710.7

$1,467.0

$450.0

$0.0

$200.0

$400.0

$600.0

$800.0

$1,000.0

$1,200.0

$1,400.0

$1,600.0

2017 2018 2019 2020 2021 Thereafter

Fixed-Rate Floating-Rate

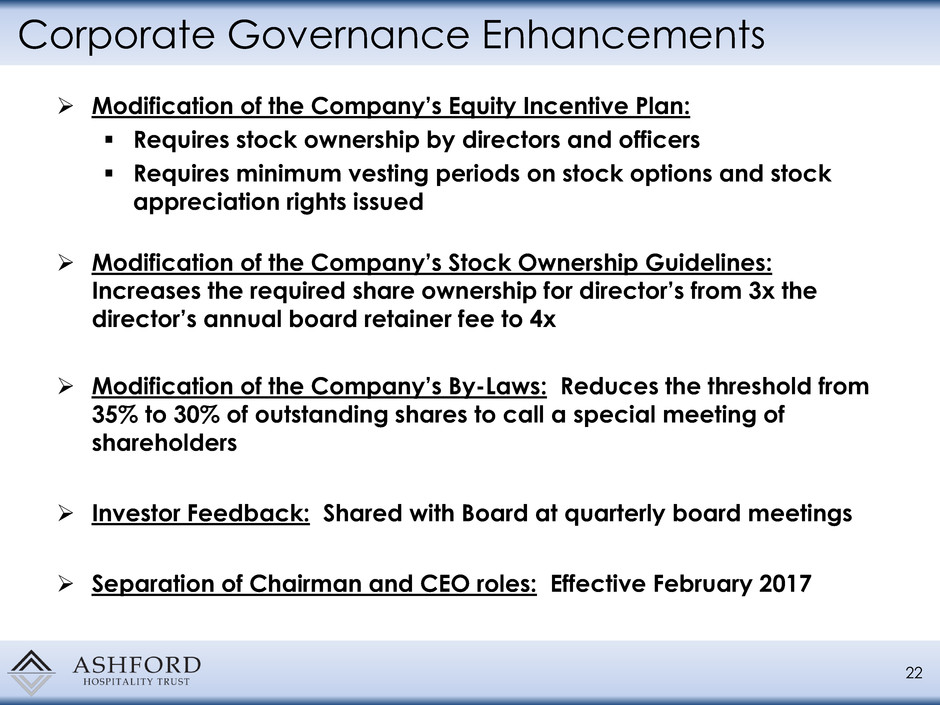

Corporate Governance Enhancements

22

Modification of the Company’s Equity Incentive Plan:

Requires stock ownership by directors and officers

Requires minimum vesting periods on stock options and stock

appreciation rights issued

Modification of the Company’s By-Laws: Reduces the threshold from

35% to 30% of outstanding shares to call a special meeting of

shareholders

Modification of the Company’s Stock Ownership Guidelines:

Increases the required share ownership for director’s from 3x the

director’s annual board retainer fee to 4x

Investor Feedback: Shared with Board at quarterly board meetings

Separation of Chairman and CEO roles: Effective February 2017

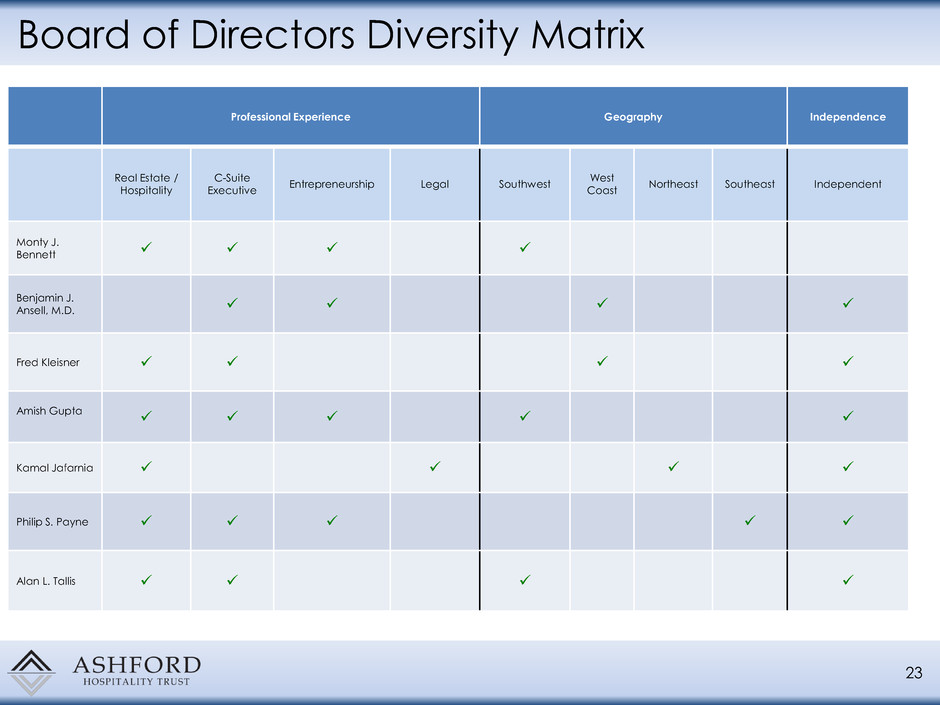

Board of Directors Diversity Matrix

Professional Experience Geography Independence

Real Estate /

Hospitality

C-Suite

Executive

Entrepreneurship Legal Southwest

West

Coast

Northeast Southeast Independent

Monty J.

Bennett

Benjamin J.

Ansell, M.D.

Fred Kleisner

Amish Gupta

Kamal Jafarnia

Philip S. Payne

Alan L. Tallis

23

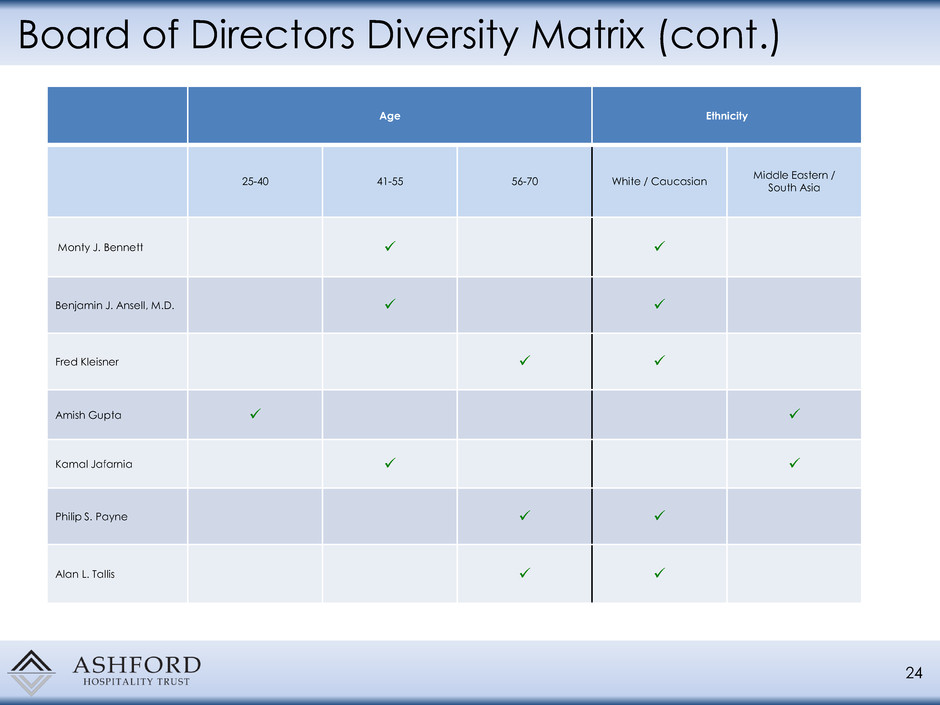

Board of Directors Diversity Matrix (cont.)

Age Ethnicity

25-40 41-55 56-70 White / Caucasian

Middle Eastern /

South Asia

Monty J. Bennett

Benjamin J. Ansell, M.D.

Fred Kleisner

Amish Gupta

Kamal Jafarnia

Philip S. Payne

Alan L. Tallis

24

Key Takeaways

25

Focused on increasing shareholder value through

simplifying strategy and improving portfolio quality

Strong management team with a long track record of

creating shareholder value

Highest dividend yield in the industry

Highly-aligned platform through management structure

and high insider ownership

Company Presentation – April 2017