Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CRU PHOSPHATES 2017 (MARCH 2017) - MOSAIC CO | a8-kcrupresentationmarch20.htm |

Walt Precourt

Senior Vice President – Phosphates

CRU Phosphates 2017

Tampa, FL

March 14, 2017

The Global Outlook:

A View From Florida

Exhibit 99.1

2

Safe Harbor

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but

are not limited to, statements about our proposed acquisition of the global phosphate and potash operations of Vale S.A. (“Vale”) conducted through Vale

Fertilizantes S.A. (the “Transaction”) and the anticipated benefits and synergies of the proposed Transaction, other proposed or pending future transactions

or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of

The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks

and uncertainties arising from the possibility that the closing of the proposed Transaction may be delayed or may not occur, including delays or risks arising

from any inability to obtain governmental approvals of the Transaction on the proposed terms and schedule, any inability of Vale to achieve certain other

specified regulatory and operational milestones or to successfully complete the transfer of the Cubatão business to Vale and its affiliates in a timely manner,

and the ability to satisfy any of the other closing conditions; our ability to secure financing, or financing on satisfactory terms and in amounts sufficient to

fund the cash portion of the purchase price without the need for additional funds from other liquidity sources; difficulties with realization of the benefits of the

proposed Transaction, including the risks that the acquired business may not be integrated successfully or that the anticipated synergies or cost or capital

expenditure savings from the Transaction may not be fully realized or may take longer to realize than expected, including because of political and economic

instability in Brazil or changes in government policy in Brazil; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw

material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of

inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our

products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and

those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski

Mayo mine, the ability of the Wa’ad Al Shamal Phosphate Company (also known as MWSPC) to obtain additional planned funding in acceptable amounts

and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future

success of current plans for MWSPC and any future changes in those plans; difficulties with realization of the benefits of our long term natural gas based

pricing ammonia supply agreement with CF Industries, Inc., including the risk that the cost savings initially anticipated from the agreement may not be fully

realized over its term or that the price of natural gas or ammonia during the term are at levels at which the pricing is disadvantageous to Mosaic; customer

defaults; the effects of Mosaic’s decisions to exit business operations or locations; changes in government policy; changes in environmental and other

governmental regulation, including expansion of the types and extent of water resources regulated under federal law, carbon taxes or other greenhouse gas

regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess

nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that

Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or

challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the

effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi

River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of

various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other

environmental regulation, Canadian resources taxes and royalties, or the costs of the MWSPC, its existing or future funding and Mosaic’s commitments in

support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to

fund financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft

mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events, sinkholes or

releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties

reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set

forth in the forward-looking statements.

3

Topics

▪ What’s Driving the Current Rally

▪ A Look Beyond 2017

▪ The Evolution of the North American Industry

▪ What’s New at Mosaic

4

What’s Driving the Current Rally

5

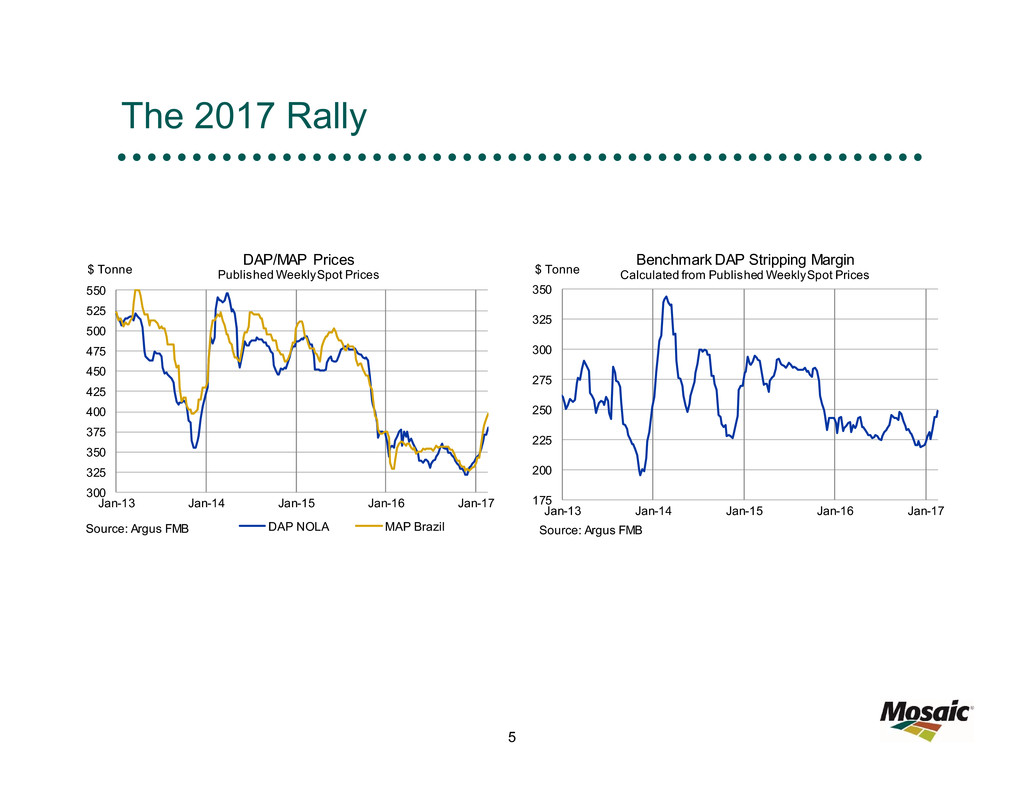

The 2017 Rally

300

325

350

375

400

425

450

475

500

525

550

Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

$ Tonne

DAP/MAP Prices

Published Weekly Spot Prices

DAP NOLA MAP BrazilSource: Argus FMB

175

200

225

250

275

300

325

350

Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

$ Tonne

Benchmark DAP Stripping Margin

Calculated from Published Weekly Spot Prices

Source: Argus FMB

6

Fundamental Drivers

▪ Buying rush in a rising market

− Continued positive agronomic and economic demand drivers

− Low channel inventories worldwide

− Large uncovered commitments for upcoming application season

▪ Decline in Chinese export availability

− Peak domestic shipments (part of the demand story)

− Lower domestic production

• Unprofitable production economics

• More stringent environmental regulations (Blue Skies)

▪ Jumps in raw materials costs

▪ Loading delays in Morocco

7

First Half Outlook – Key Features

▪ Momentum expected to continue

− More upside than downside risk

• Strong shipment prospects

• Lower Chinese exports

• Little raw materials cost relief

• Ongoing shipping delays from Jorf Lasfar

• No material production from new capacity

8

Second Half Outlook – Key Features

▪ Tilting toward continued tight S/D balance

− Several uncertainties, but . . .

− Key swing factors at this point look positive

• Shipments expected to remain strong in the second half

• Chinese exports projected to drop to ~8.0 million tonnes

• Raw materials costs forecast to ease later this year

• Output from new facilities likely less than current expectations

9

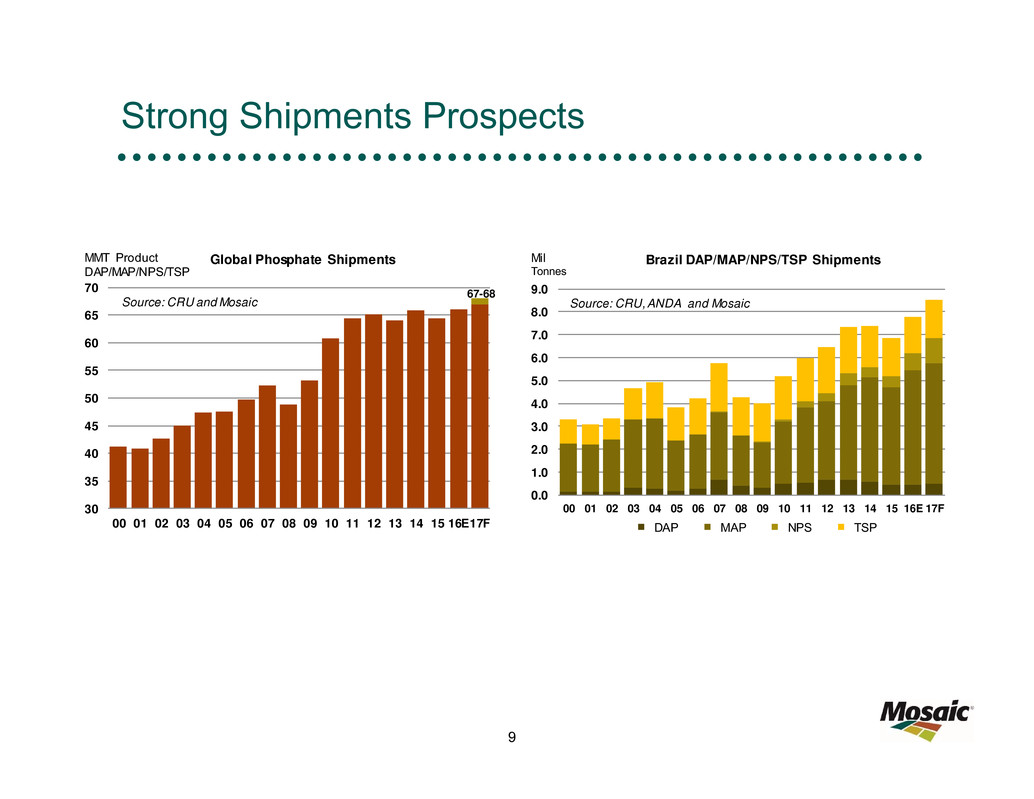

Strong Shipments Prospects

67-68

30

35

40

45

50

55

60

65

70

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16E17F

Global Phosphate ShipmentsMMT Product

DAP/MAP/NPS/TSP

Source: CRU and Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16E 17F

Brazil DAP/MAP/NPS/TSP Shipments

DAP MAP NPS TSP

Mil

Tonnes

Source: CRU, ANDA and Mosaic

10

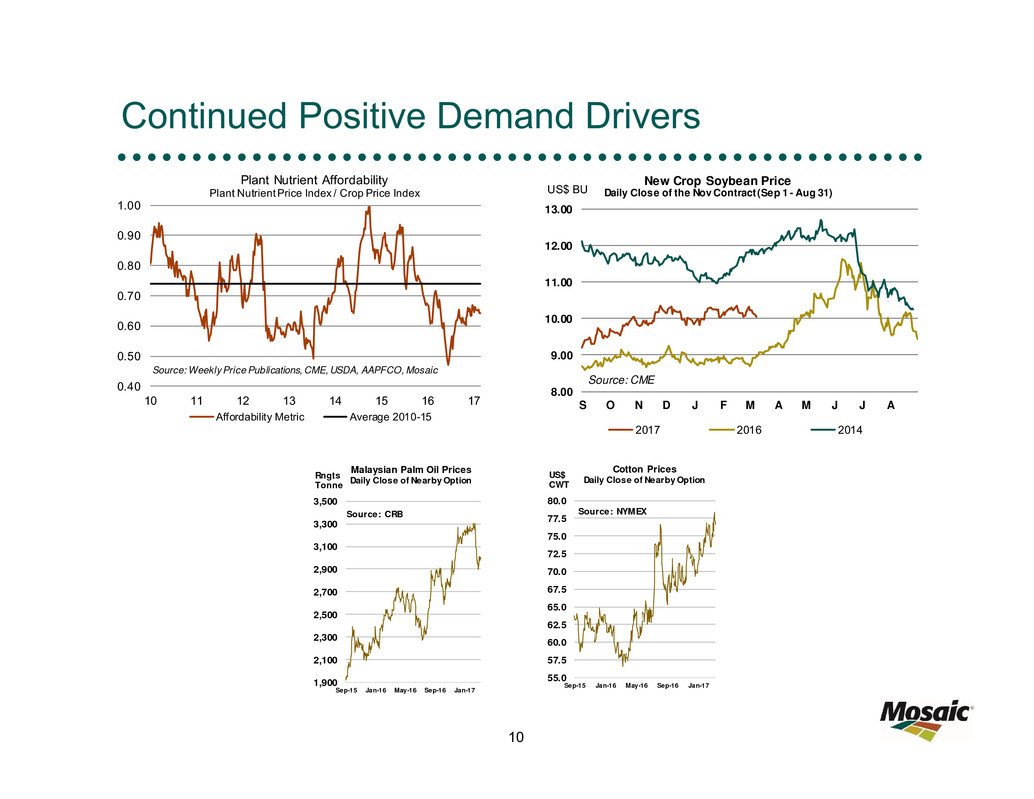

Continued Positive Demand Drivers

0.40

0.50

0.60

0.70

0.80

0.90

1.00

10 11 12 13 14 15 16 17

Plant Nutrient Affordability

Plant Nutrient Price Index / Crop Price Index

Affordability Metric Average 2010-15

Source: WeeklyPrice Publications, CME, USDA, AAPFCO, Mosaic

8.00

9.00

10.00

11.00

12.00

13.00

S O N D J F M A M J J A

US$ BU

New Crop Soybean Price

Daily Close of the Nov Contract (Sep 1 - Aug 31)

2017 2016 2014

Source: CME

1,900

2,100

2,300

2,500

2,700

2,900

3,100

3,300

3,500

Sep-15 Jan-16 May-16 Sep-16 Jan-17

Rngts

Tonne

Source: CRB

Malaysian Palm Oil Prices

Daily Close of Nearby Option

55.0

57.5

60.0

62.5

65.0

67.5

70.0

72.5

75.0

77.5

80.0

Sep-15 Jan-16 May-16 Sep-16 Jan-17

US$

CWT

Source: NYMEX

Cotton Prices

Daily Close of Nearby Option

11

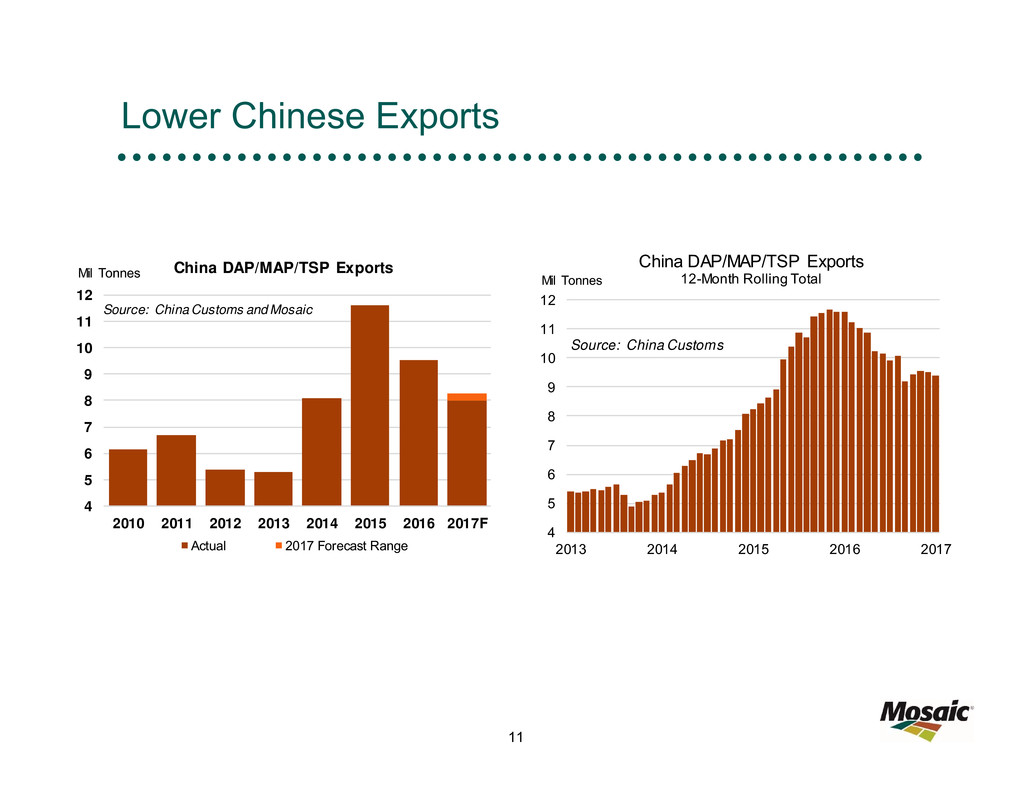

Lower Chinese Exports

4

5

6

7

8

9

10

11

12

2010 2011 2012 2013 2014 2015 2016 2017F

Mil Tonnes

Source: China Customs and Mosaic

China DAP/MAP/TSP Exports

Actual 2017 Forecast Range

4

5

6

7

8

9

10

11

12

2013 2014 2015 2016 2017

Mil Tonnes

Source: China Customs

China DAP/MAP/TSP Exports

12-Month Rolling Total

12

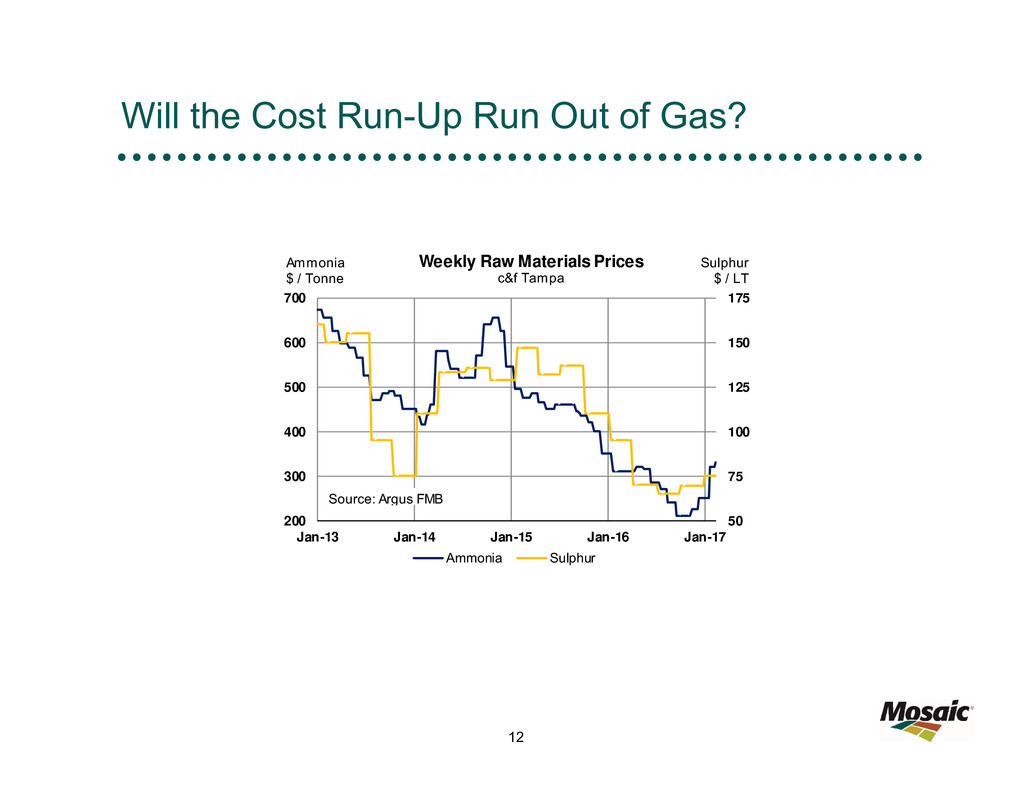

Will the Cost Run-Up Run Out of Gas?

50

75

100

125

150

175

200

300

400

500

600

700

Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

Sulphur

$ / LT

Ammonia

$ / Tonne

Weekly Raw Materials Prices

c&f Tampa

Ammonia Sulphur

Source: Argus FMB

13

2017 Outlook Topic of March Issue of Market Mosaic

Available at:

www.mosaicco.com/resources/market_mosaic.htm

14

A Look Beyond 2017

15

Five-Year Outlook – Key Features

▪ A positive demand outlook

− Underpinned by constructive long term agricultural fundamentals

− Global phosphate demand forecast to increase ~2% per year

− More consistent and broad-based growth expected

▪ Few new projects expected after 2018

− Little in the pipeline outside Morocco and Saudi Arabia

− Next wave of OCP and Ma’aden capacity on line after 2021

▪ A restructuring of the Chinese industry

− Central planners likely asking:

Why are we depleting our non-renewable phosphate rock resources, upgrading them into final products at a

loss, disrupting our environment in the process, and supplying India and others with cheap phosphate?

− Production and exports expected to stabilize at lower levels

− A focus on profitability and sustainability

16

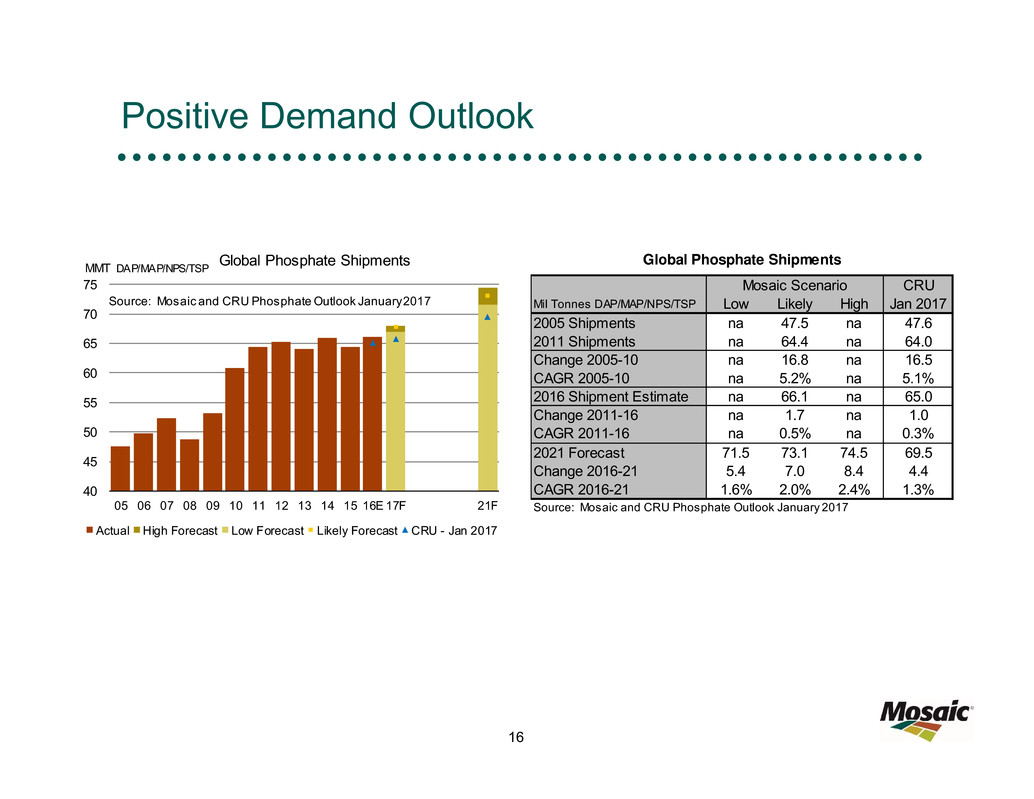

Positive Demand Outlook

40

45

50

55

60

65

70

75

05 06 07 08 09 10 11 12 13 14 15 16E 17F 21F

Global Phosphate Shipments

Actual High Forecast Low Forecast Likely Forecast CRU - Jan 2017

MMT DAP/MAP/NPS/TSP

Source: Mosaic and CRU Phosphate Outlook January 2017

Global Phosphate Shipments

Mosaic Scenario CRU

Mil Tonnes DAP/MAP/NPS/TSP Low Likely High Jan 2017

2005 Shipments na 47.5 na 47.6

2011 Shipments na 64.4 na 64.0

Change 2005-10 na 16.8 na 16.5

CAGR 2005-10 na 5.2% na 5.1%

2016 Shipment Estimate na 66.1 na 65.0

Change 2011-16 na 1.7 na 1.0

CAGR 2011-16 na 0.5% na 0.3%

2021 Forecast 71.5 73.1 74.5 69.5

Change 2016-21 5.4 7.0 8.4 4.4

CAGR 2016-21 1.6% 2.0% 2.4% 1.3%

Source: Mosaic and CRU Phosphate Outlook January 2017

17

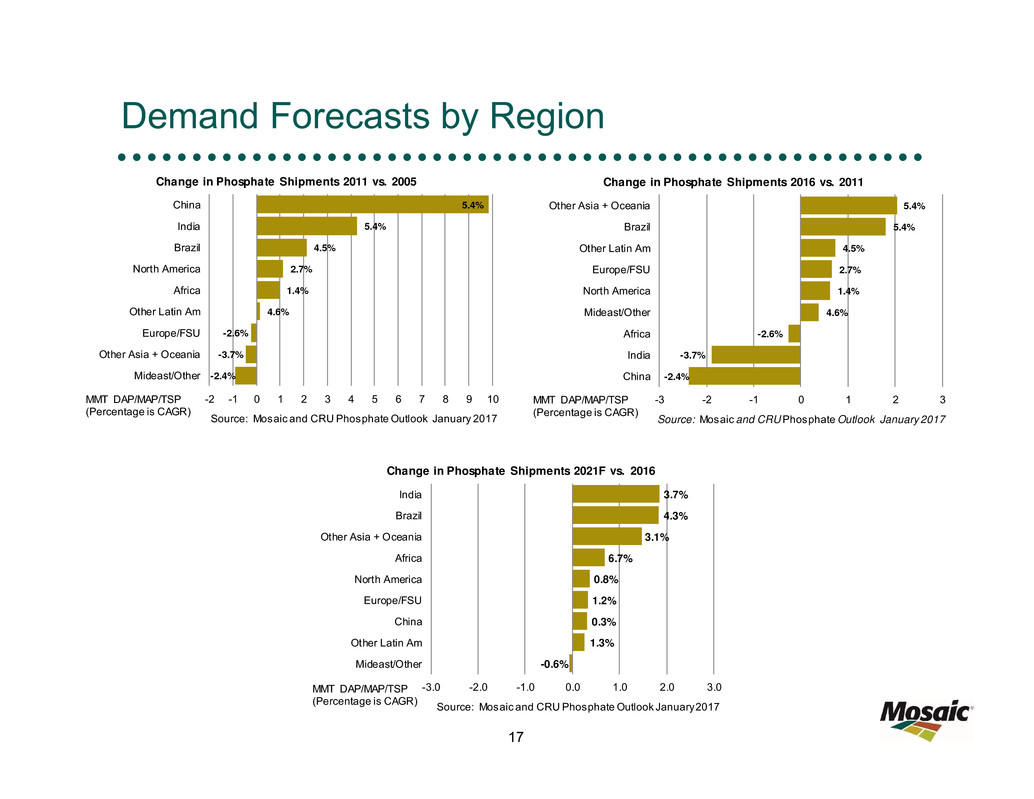

Demand Forecasts by Region

-2.4%

-3.7%

-2.6%

4.6%

1.4%

2.7%

4.5%

5.4%

5.4%

-3 -2 -1 0 1 2 3

China

India

Africa

Mideast/Other

North America

Europe/FSU

Other Latin Am

Brazil

Other Asia + Oceania

MMT DAP/MAP/TSP

(Percentage is CAGR)

Change in Phosphate Shipments 2016 vs. 2011

Source: Mosaic and CRU Phosphate Outlook January 2017

-0.6%

1.3%

0.3%

1.2%

0.8%

6.7%

3.1%

4.3%

3.7%

-3.0 -2.0 -1.0 0.0 1.0 2.0 3.0

Mideast/Other

Other Latin Am

China

Europe/FSU

North America

Africa

Other Asia + Oceania

Brazil

India

MMT DAP/MAP/TSP

(Percentage is CAGR)

Change in Phosphate Shipments 2021F vs. 2016

Source: Mosaic and CRU Phosphate Outlook January 2017

-2.4%

-3.7%

-2.6%

4.6%

1.4%

2.7%

4.5%

5.4%

5.4%

-2 -1 0 1 2 3 4 5 6 7 8 9 10

Mideast/Other

Other Asia + Oceania

Europe/FSU

Other Latin Am

Africa

North America

Brazil

India

China

MMT DAP/MAP/TSP

(Percentage is CAGR)

Change in Phosphate Shipments 2011 vs. 2005

Source: Mosaic and CRU Phosphate Outlook January 2017

18

Supply/Demand Balance

-3.0

-2.0

-1.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

16 17 18 19 20 21

Mil Tonnes

DAP/MAP/NPS/TSP

Source: CRU and Mosaic

Cumulative Change in Capacity by Region

2016-21

China Rest of World Morocco Saudi Arabia

-2.0

-1.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

16 17 18 19 20 21

Mil Tonnes

DAP/MAP/NPS/TSP

Source: CRU and Mosaic

Cumulative Change in Capacity vs. Demand

2016-21

Capacity Demand - Mosaic Demand - CRU

19

The Evolution of the North American Industry

20

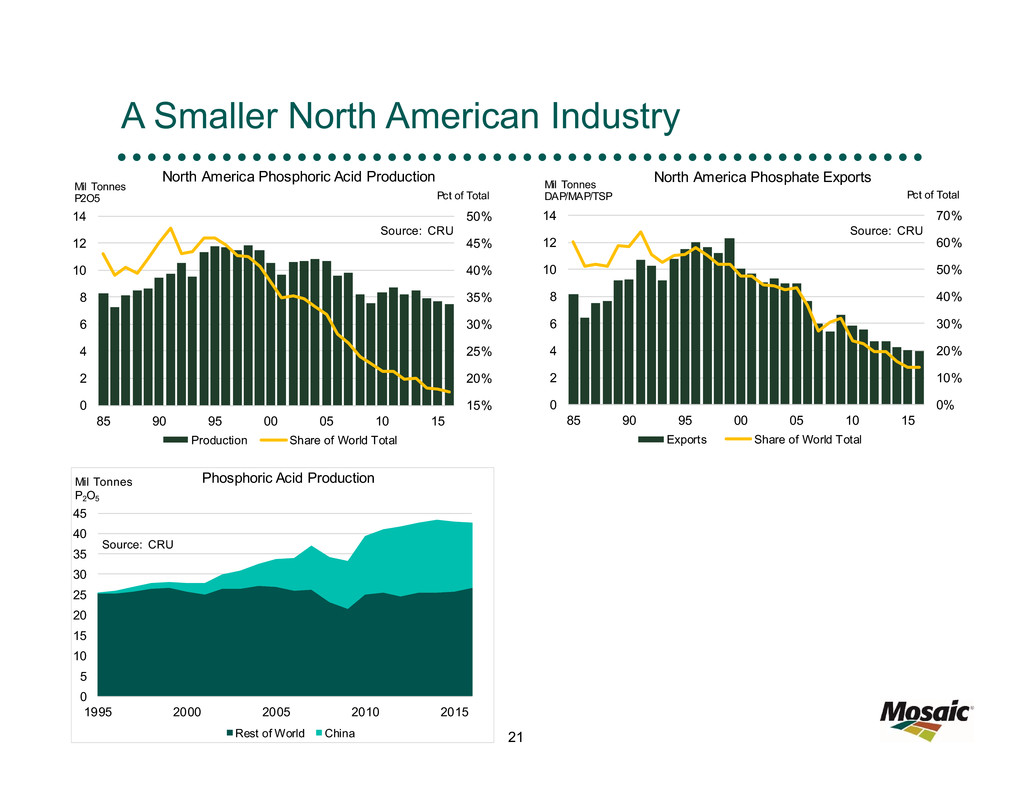

The Evolution of the North American Industry

▪ A smaller but still large industry today

▪ A less important role in the growing global market

▪ A regional focus on the freight-advantaged Americas

▪ A product focus on innovative premium products

▪ Continuous efforts to enhance productivity/efficiency

21

A Smaller North American Industry

15%

20%

25%

30%

35%

40%

45%

50%

0

2

4

6

8

10

12

14

85 90 95 00 05 10 15

Pct of Total

Mil Tonnes

P2O5

Source: CRU

North America Phosphoric Acid Production

Production Share of World Total

0%

10%

20%

30%

40%

50%

60%

70%

0

2

4

6

8

10

12

14

85 90 95 00 05 10 15

Pct of Total

Mil Tonnes

DAP/MAP/TSP

Source: CRU

North America Phosphate Exports

Exports Share of World Total

0

5

10

15

20

25

30

35

40

45

1995 2000 2005 2010 2015

Mil Tonnes

P2O5

Source: CRU

Phosphoric Acid Production

Rest of World China

22

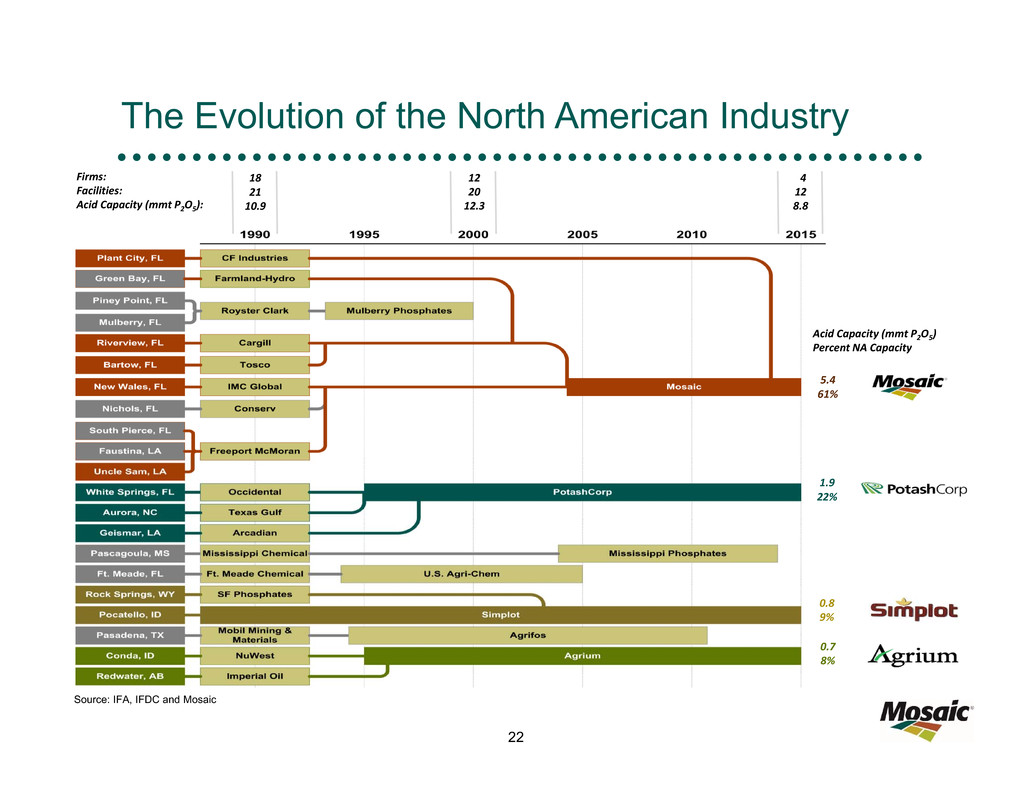

The Evolution of the North American Industry

Acid Capacity (mmt P2O5)

Percent NA Capacity

12

20

12.3

4

12

8.8

5.4

61%

1.9

22%

0.8

9%

0.7

8%

18

21

10.9

Firms:

Facilities:

Acid Capacity (mmt P2O5):

Source: IFA, IFDC and Mosaic

23

What’s New at Mosaic

24

A Long List of Exciting Initiatives

▪ Completed the integration of the CF phosphate operations

▪ Enhancing efficiencies and optimizing operations

▪ Obtaining permits for our next generation rock mines

▪ Harvesting value from our ADM Brazil acquisition

▪ Ramping up MicroEssentials® capacity at New Wales

▪ Commissioned our new sulphur melter at New Wales in 2016

▪ Awaiting the launch of a tug/barge to transport ammonia from CF

Industries Louisiana facilities to our Florida phosphate operations

▪ Working to close the Vale Fertilizantes acquisition

▪ Planning to capture synergies from the Vale acquisition

Walt Precourt

Senior Vice President – Phosphate Operations

CRU Phosphates 2017

Tampa, FL

March 14, 2017

The Global Outlook:

A View From Florida

Thank You!