Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COGNIZANT TECHNOLOGY SOLUTIONS CORP | earningsrelease123116.htm |

| EX-99.1 - EXHIBIT 99.1 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | exhibit991123116.htm |

| EX-99.2 - EXHIBIT 99.2 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | exhibit992123116.htm |

| EX-10.1 - EXHIBIT 10.1 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | exhibit101123116.htm |

© 2017 Cognizant

© 2017 Cognizant

Investor Presentation

Accelerating the Shift to Digital

February 8, 2017

© 2017 Cognizant

Forward Looking Statements and Non-GAAP Financial Measures

1

This investor presentation includes statements which may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, including, but not limited to, express or implied forward-looking statements relating to our expectations regarding

opportunities in the marketplace, our anticipated financial performance, our plan to return capital to shareholders, our plan to increase non-GAAP operating

margins, our expectations concerning the impact of the agreement with Elliott Management, management's plans, objectives and strategies and the

upcoming 2017 Annual Meeting of Stockholders, the accuracy of which are necessarily subject to risks, uncertainties, and assumptions as to future events

that may not prove to be accurate. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of

which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing

and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors

that could cause actual results to differ materially from those expressed or implied include general economic conditions, changes in the regulatory

environment, including with respect to immigration and taxes, and the other factors discussed in our most recent Annual Report on Form 10-K and other

filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a

result of new information, future events, or otherwise, except as may be required under applicable securities law.

This investor presentation includes discussion of non-GAAP operating margin and U.S. free cash flow. Non-GAAP operating margin and U.S. free cash

flow are measures defined by the Securities and Exchange Commission as non-GAAP financial measures. A non-GAAP measure is not based on any

comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, a financial measure calculated in

accordance with GAAP, and may be different from non-GAAP measures used by other companies. In addition, a non-GAAP measure should be read in

conjunction with our financial statements prepared in accordance with GAAP.

Our non-GAAP operating margin excludes stock-based compensation costs and acquisition-related charges. Acquisition-related charges include, when

applicable, amortization of purchased intangible assets included in the depreciation and amortization expense line on our condensed consolidated

statements of operations, external deal costs, acquisition-related retention bonuses, integration costs, changes in the fair value of contingent consideration

liabilities, charges for impairment of acquired intangible assets and other acquisition-related costs. Investors should refer to our earnings release, dated

February 8, 2017, for a reconciliation of our non-GAAP operating margin to our GAAP operating margin.

We define U.S. free cash flow as net cash provided from operating activities of our U.S. operating subsidiaries less cash purchases of property and

equipment by our U.S. operating subsidiaries.

© 2017 Cognizant

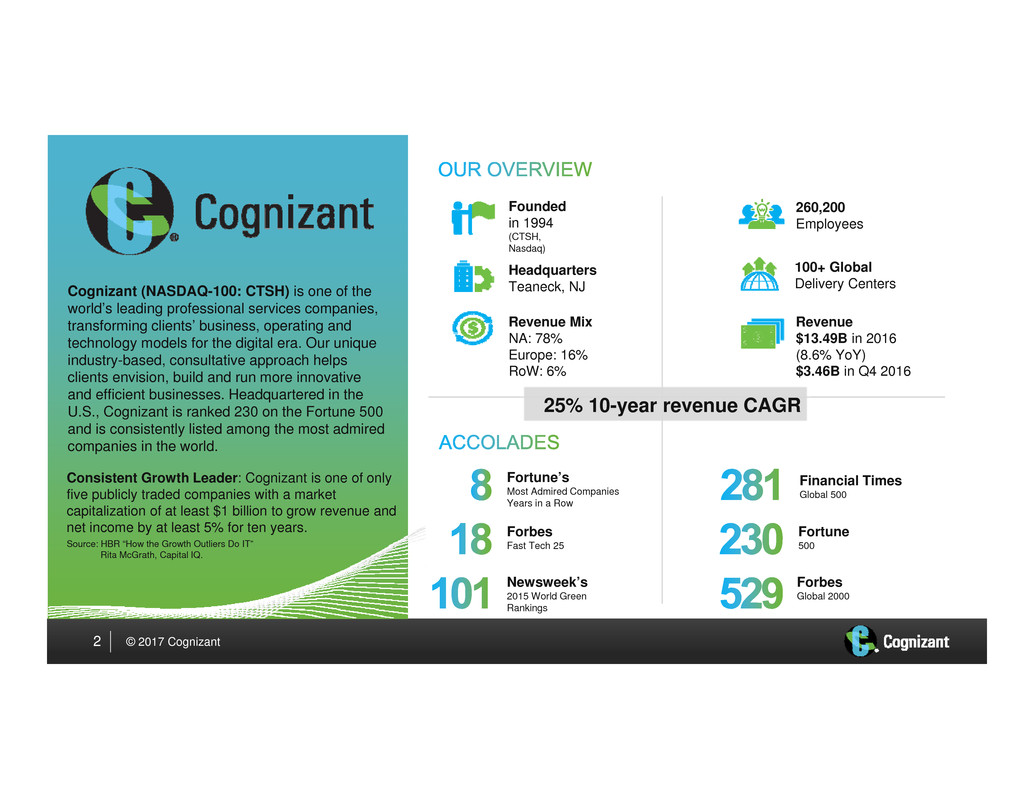

Founded

in 1994

(CTSH,

Nasdaq)

Headquarters

Teaneck, NJ

100+ Global

Delivery Centers

260,200

Employees

Revenue

$13.49B in 2016

(8.6% YoY)

$3.46B in Q4 2016

Revenue Mix

NA: 78%

Europe: 16%

RoW: 6%

Newsweek’s

2015 World Green

Rankings

Forbes

Fast Tech 25

Fortune’s

Most Admired Companies

Years in a Row

Forbes

Global 2000

Fortune

500

Financial Times

Global 500

2

Consistent Growth Leader: Cognizant is one of only

five publicly traded companies with a market

capitalization of at least $1 billion to grow revenue and

net income by at least 5% for ten years.

Source: HBR “How the Growth Outliers Do IT”

Rita McGrath, Capital IQ.

Cognizant (NASDAQ-100: CTSH) is one of the

world’s leading professional services companies,

transforming clients’ business, operating and

technology models for the digital era. Our unique

industry-based, consultative approach helps

clients envision, build and run more innovative

and efficient businesses. Headquartered in the

U.S., Cognizant is ranked 230 on the Fortune 500

and is consistently listed among the most admired

companies in the world.

25% 10-year revenue CAGR

© 2017 Cognizant

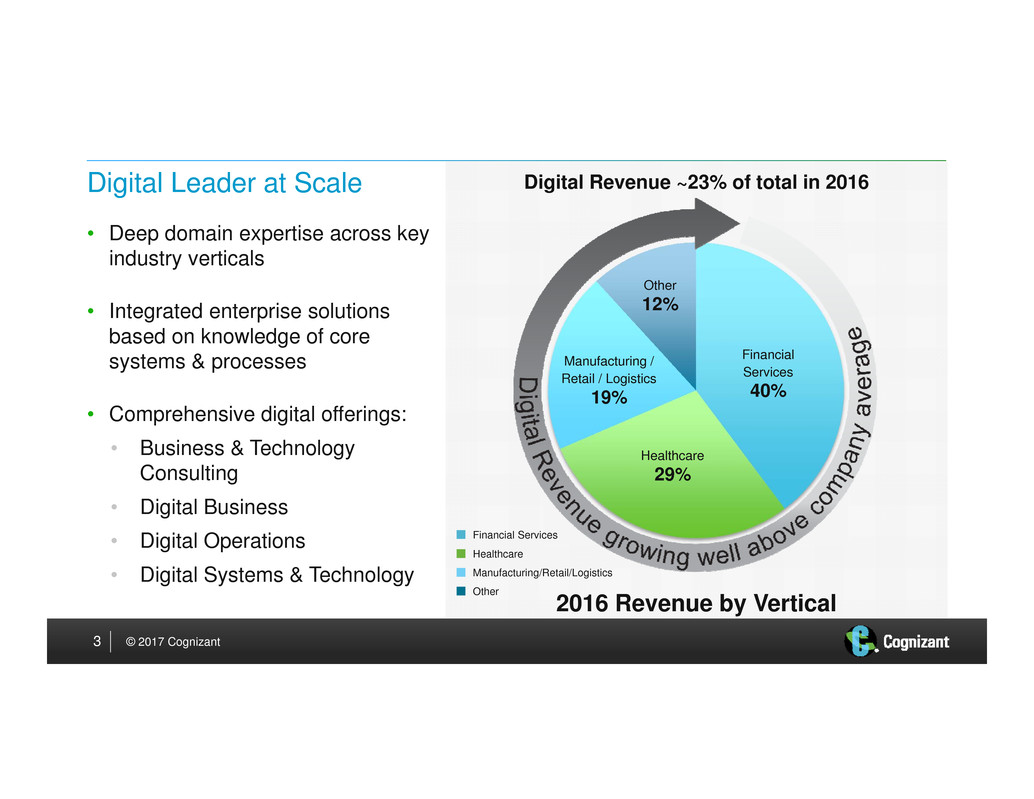

Financial

Services

40%

Healthcare

29%

Manufacturing /

Retail / Logistics

19%

Other

12%

• Deep domain expertise across key

industry verticals

• Integrated enterprise solutions

based on knowledge of core

systems & processes

• Comprehensive digital offerings:

• Business & Technology

Consulting

• Digital Business

• Digital Operations

• Digital Systems & Technology

Digital Leader at Scale

3

2016 Revenue by Vertical

Financial Services

Healthcare

Manufacturing/Retail/Logistics

Other

Digital Revenue ~23% of total in 2016

© 2017 Cognizant

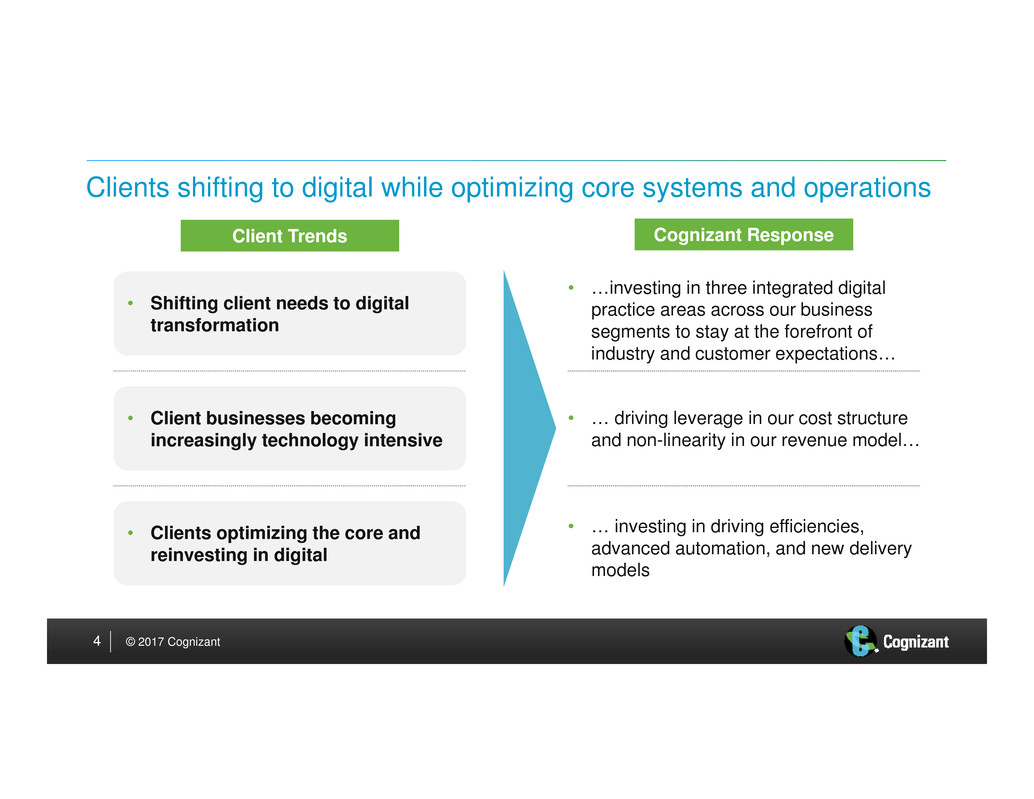

Clients shifting to digital while optimizing core systems and operations

• Shifting client needs to digital

transformation

• Client businesses becoming

increasingly technology intensive

• Clients optimizing the core and

reinvesting in digital

• …investing in three integrated digital

practice areas across our business

segments to stay at the forefront of

industry and customer expectations…

• … driving leverage in our cost structure

and non-linearity in our revenue model…

• … investing in driving efficiencies,

advanced automation, and new delivery

models

Client Trends Cognizant Response

4

© 2017 Cognizant

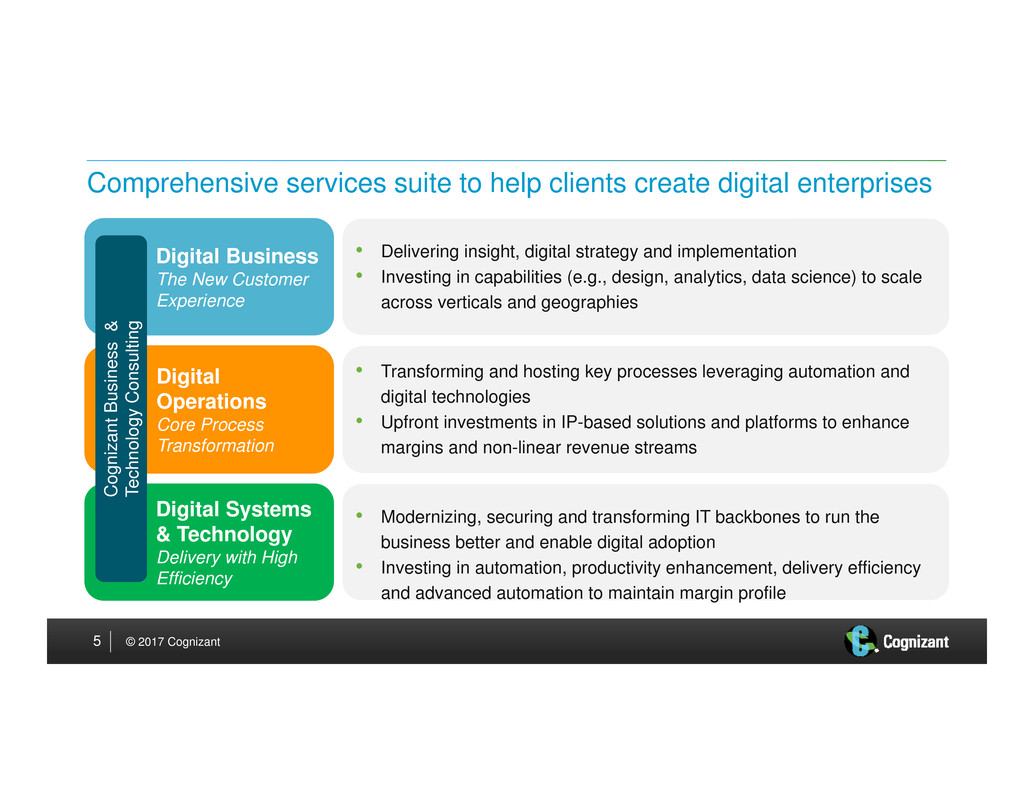

• Delivering insight, digital strategy and implementation

• Investing in capabilities (e.g., design, analytics, data science) to scale

across verticals and geographies

• Transforming and hosting key processes leveraging automation and

digital technologies

• Upfront investments in IP-based solutions and platforms to enhance

margins and non-linear revenue streams

• Modernizing, securing and transforming IT backbones to run the

business better and enable digital adoption

• Investing in automation, productivity enhancement, delivery efficiency

and advanced automation to maintain margin profile

Digital Business

The New Customer

Experience

Digital

Operations

Core Process

Transformation

Digital Systems

& Technology

Delivery with High

Efficiency

C

o

g

n

i

z

a

n

t

B

u

s

i

n

e

s

s

&

T

e

c

h

n

o

l

o

g

y

C

o

n

s

u

l

t

i

n

g

C

o

g

n

i

z

a

n

t

B

u

s

i

n

e

s

s

&

T

e

c

h

n

o

l

o

g

y

C

o

n

s

u

l

t

i

n

g

Comprehensive services suite to help clients create digital enterprises

5

© 2017 Cognizant

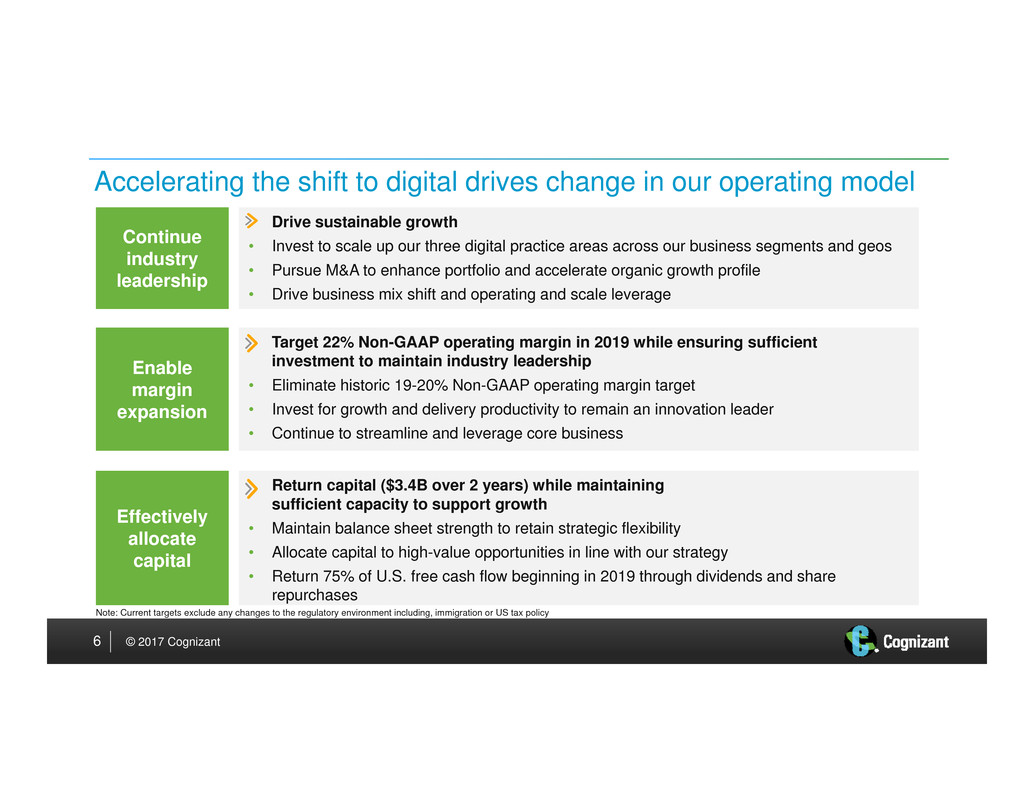

Accelerating the shift to digital drives change in our operating model

Drive sustainable growth

• Invest to scale up our three digital practice areas across our business segments and geos

• Pursue M&A to enhance portfolio and accelerate organic growth profile

• Drive business mix shift and operating and scale leverage

Continue

industry

leadership

Enable

margin

expansion

Target 22% Non-GAAP operating margin in 2019 while ensuring sufficient

investment to maintain industry leadership

• Eliminate historic 19-20% Non-GAAP operating margin target

• Invest for growth and delivery productivity to remain an innovation leader

• Continue to streamline and leverage core business

Effectively

allocate

capital

Return capital ($3.4B over 2 years) while maintaining

sufficient capacity to support growth

• Maintain balance sheet strength to retain strategic flexibility

• Allocate capital to high-value opportunities in line with our strategy

• Return 75% of U.S. free cash flow beginning in 2019 through dividends and share

repurchases

6

Note: Current targets exclude any changes to the regulatory environment including, immigration or US tax policy

© 2017 Cognizant

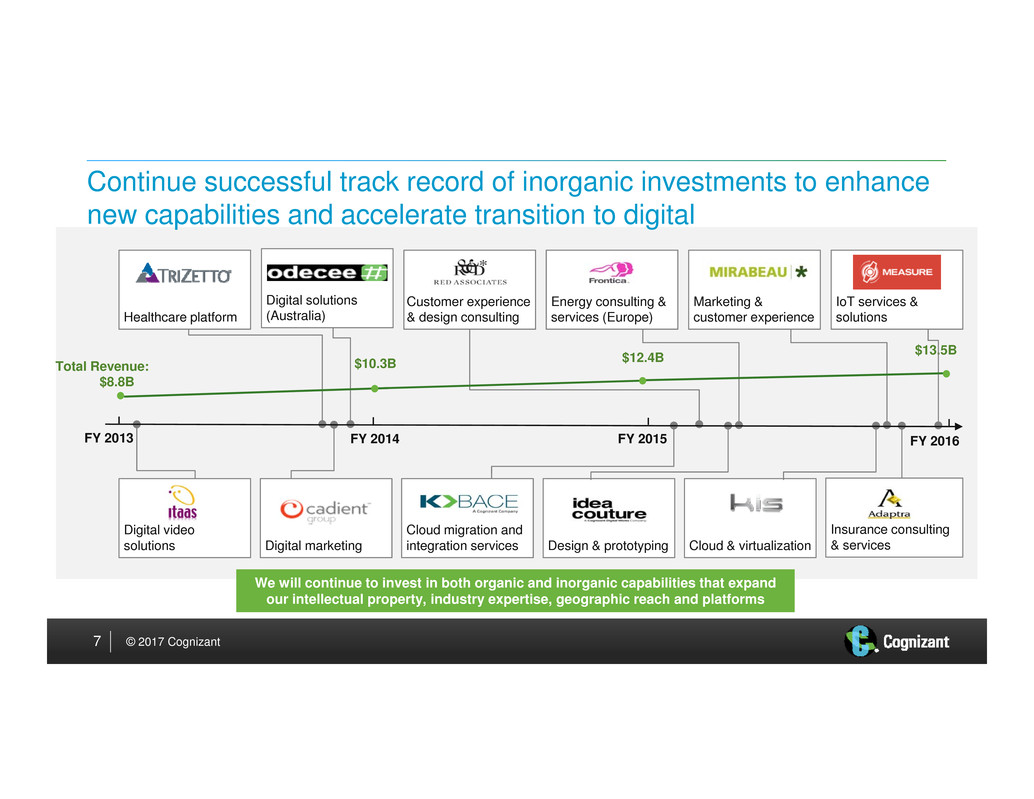

Continue successful track record of inorganic investments to enhance

new capabilities and accelerate transition to digital

FY 2013

Total Revenue:

$13.5B$12.4B

FY 2015 FY 2016FY 2014

$10.3B

Digital video

solutions Digital marketing Design & prototyping

Insurance consulting

& services Cloud & virtualization

We will continue to invest in both organic and inorganic capabilities that expand

our intellectual property, industry expertise, geographic reach and platforms

Cloud migration and

integration services

Digital solutions

(Australia)Healthcare platform

Energy consulting &

services (Europe)

Marketing &

customer experience

Customer experience

& design consulting

IoT services &

solutions

7

$8.8B

© 2017 Cognizant

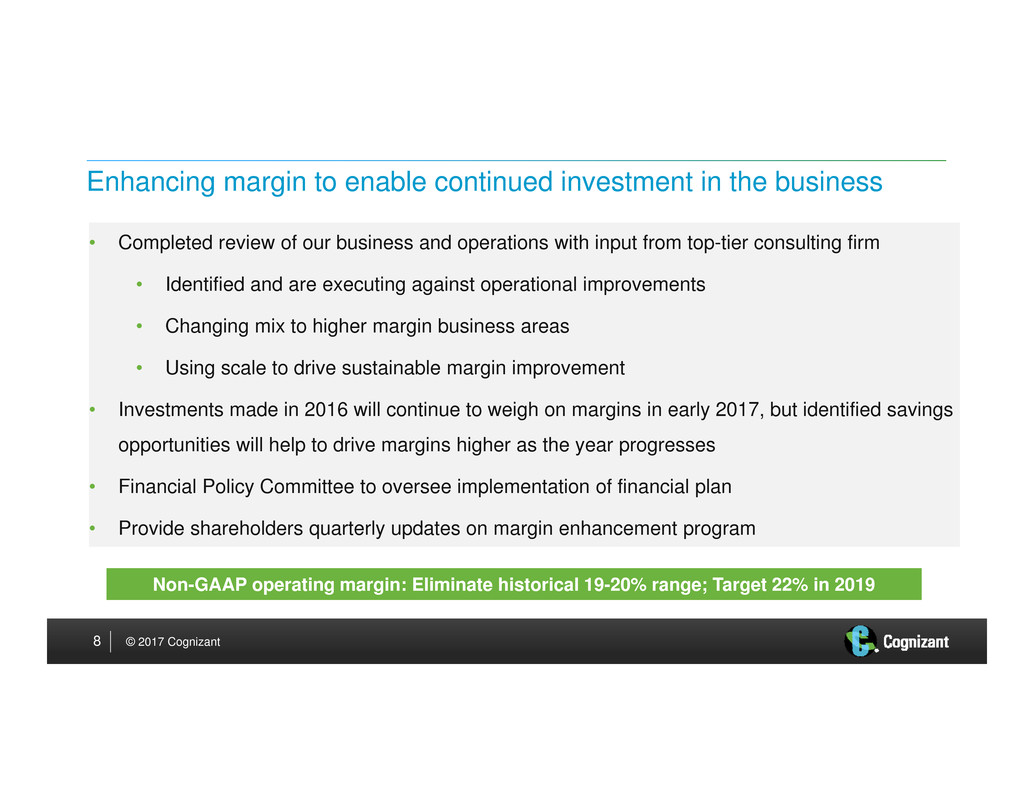

Enhancing margin to enable continued investment in the business

• Completed review of our business and operations with input from top-tier consulting firm

• Identified and are executing against operational improvements

• Changing mix to higher margin business areas

• Using scale to drive sustainable margin improvement

• Investments made in 2016 will continue to weigh on margins in early 2017, but identified savings

opportunities will help to drive margins higher as the year progresses

• Financial Policy Committee to oversee implementation of financial plan

• Provide shareholders quarterly updates on margin enhancement program

8

Non-GAAP operating margin: Eliminate historical 19-20% range; Target 22% in 2019

© 2017 Cognizant

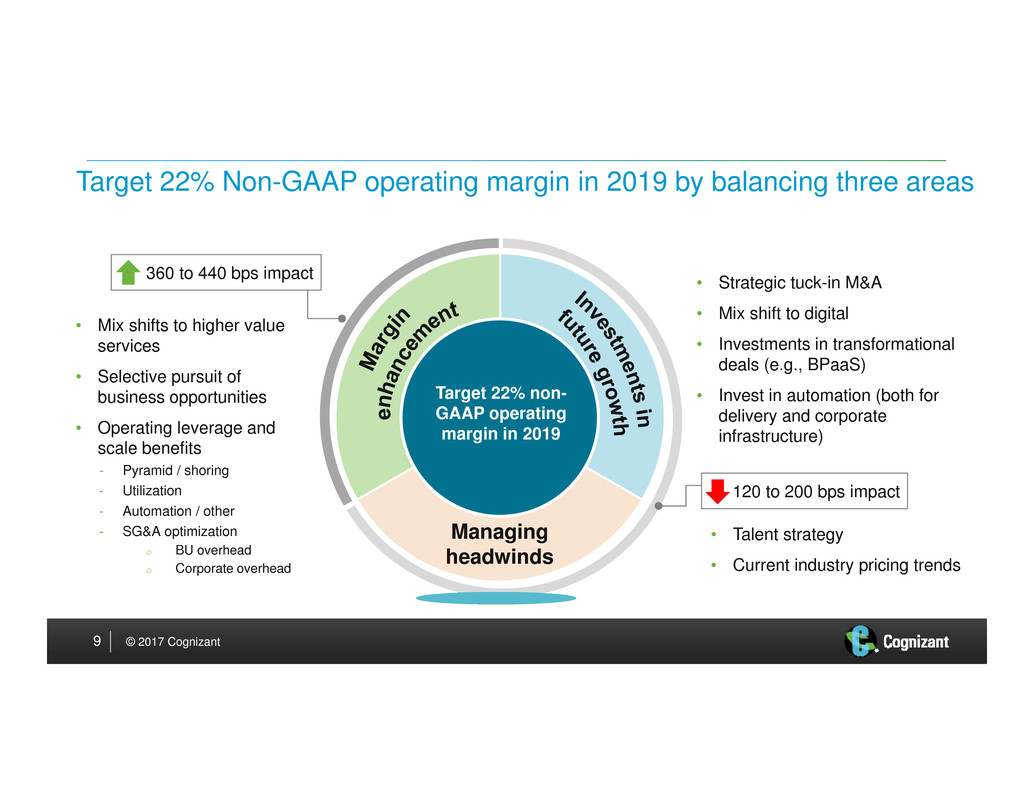

Target 22% Non-GAAP operating margin in 2019 by balancing three areas

Managing

headwinds

Target 22% non-

GAAP operating

margin in 2019

• Strategic tuck-in M&A

• Mix shift to digital

• Investments in transformational

deals (e.g., BPaaS)

• Invest in automation (both for

delivery and corporate

infrastructure)

• Talent strategy

• Current industry pricing trends

• Mix shifts to higher value

services

• Selective pursuit of

business opportunities

• Operating leverage and

scale benefits

- Pyramid / shoring

- Utilization

- Automation / other

- SG&A optimization

o BU overhead

o Corporate overhead

120 to 200 bps impact

360 to 440 bps impact

9

© 2017 Cognizant

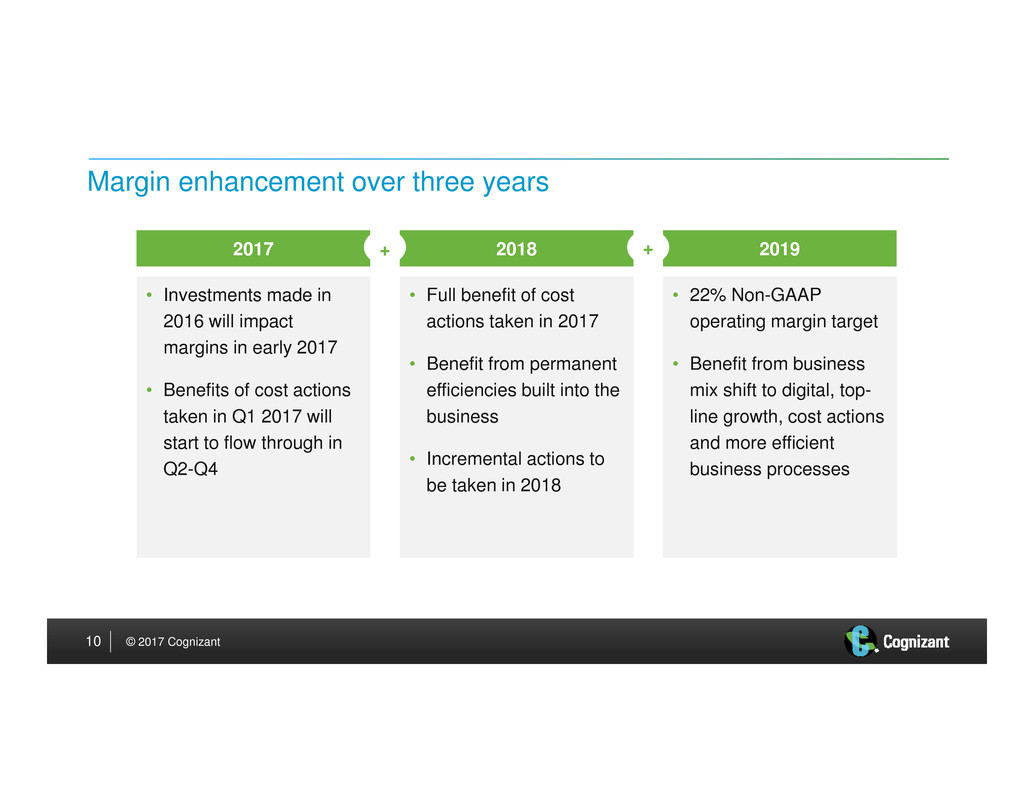

Margin enhancement over three years

• Investments made in

2016 will impact

margins in early 2017

• Benefits of cost actions

taken in Q1 2017 will

start to flow through in

Q2-Q4

2017

• Full benefit of cost

actions taken in 2017

• Benefit from permanent

efficiencies built into the

business

• Incremental actions to

be taken in 2018

2018

• 22% Non-GAAP

operating margin target

• Benefit from business

mix shift to digital, top-

line growth, cost actions

and more efficient

business processes

2019

10

+ +

© 2017 Cognizant

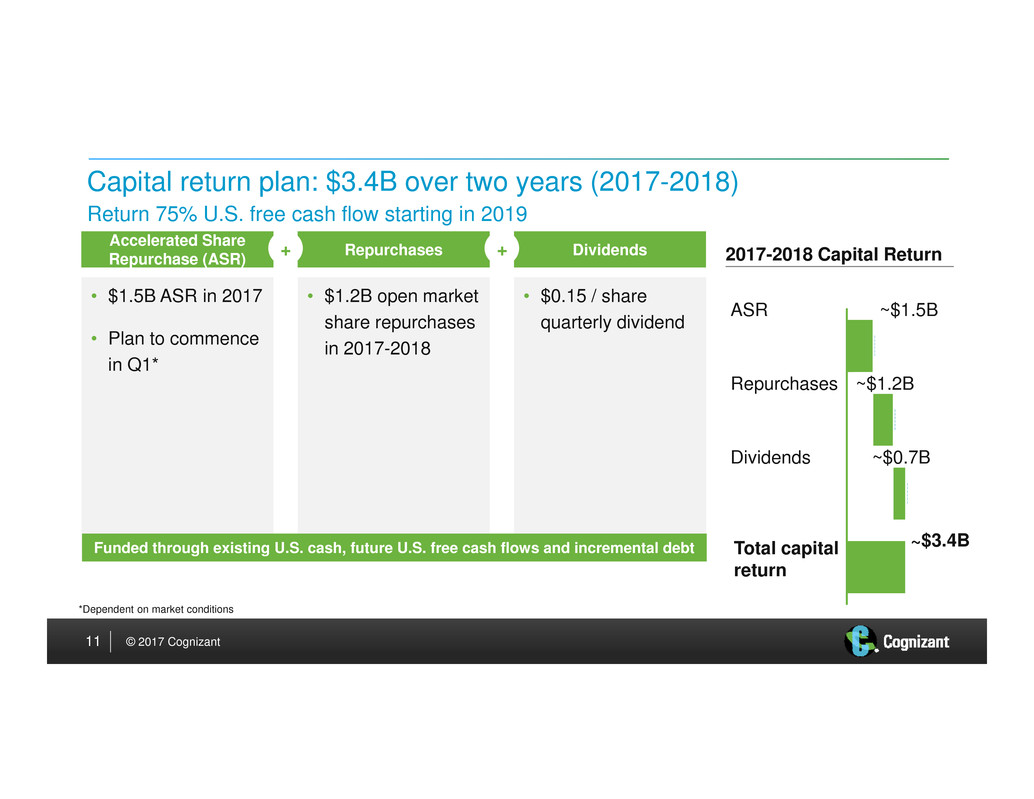

Capital return plan: $3.4B over two years (2017-2018)

• $1.5B ASR in 2017

• Plan to commence

in Q1*

Accelerated Share

Repurchase (ASR)

• $1.2B open market

share repurchases

in 2017-2018

Repurchases

• $0.15 / share

quarterly dividend

Dividends+ +

Return 75% U.S. free cash flow starting in 2019

ASR

Dividends ~$0.7B

~$3.4BTotal capital

return

~$1.2BRepurchases

~$1.5B

2017-2018 Capital Return

Funded through existing U.S. cash, future U.S. free cash flows and incremental debt

*Dependent on market conditions

11

© 2017 Cognizant

Best-in-class corporate governance

• Continuous improvement in corporate governance based on best-in-class industry standards

• Respond to shareholder input and concerns

• Continue to ensure executive compensation plan aligns with strategic objectives

• Ongoing board refreshment

• Two new independent directors joined the Board in the last two years

• Three new independent directors to be added in the next two years

• Two in connection with the 2017 Annual Meeting

• One in connection with the 2018 Annual Meeting

• Three existing Board members to rotate off the Board concurrently

• Cognizant’s Board will form a Financial Policy Committee

• Comprises three directors: CEO, an incumbent director with previous operational experience and one of the new

directors

• Committee charter will be to assist and advise on the Company’s operating plan and capital allocation strategy

12

© 2017 Cognizant 2017 ognizant13

Thank You