Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE BANK FINANCIAL CORP | a8kcoverpage123116.htm |

| EX-99.1 - EXHIBIT 99.1 - STATE BANK FINANCIAL CORP | pressrelease123116.htm |

4th Quarter 2016

Earnings Presentation

Joe Evans, Chairman and CEO

Tom Wiley, Vice Chairman and President

Sheila Ray, EVP and Chief Financial Officer

David Black, EVP and Chief Credit Officer

January 26, 2017

State Bank Financial Corporation

2

Cautionary Note Regarding Forward-Looking

Statements

This presentation contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements, which are based on certain

assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “will,” “expect,” “should,” “anticipate,” “may,” and

“project,” as well as similar expressions. These forward-looking statements include, but are not limited to, statements regarding our acquisitions of NBG Bancorp (“NBG”) and

its subsidiary and S Bankshares and its subsidiary, including our belief that these acquisitions will provide entry into attractive new markets and the timing of each acquired

bank’s expected conversion date, statements regarding our focus on improving efficiency, including our target burden ratio and target efficiency ratio, and other statements

about expected developments or events, our future financial performance, and the execution of our strategic goals. Forward-looking statements are not guarantees of future

performance and are subject to risks, uncertainties and assumptions (“risk factor”) that are difficult to predict with regard to timing, extent, likelihood and degree. Therefore,

actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. We undertake no obligation to update, amend

or clarify forward-looking statements, whether as a result of new information, future events or otherwise. Risk factors including, without limitation, the following:

• the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to achieve than expected or may not be achieved in

their entirety as a result of unexpected factors or events;

• the integration of NBG’s and S Bankshares’ business and operations into ours may be more costly than anticipated or have unanticipated adverse results related to NBG’s,

S Bankshares’ or our existing businesses;

• our ability to achieve anticipated results from the transactions with NBG and S Bankshares will depend on the state of the economic and financial markets going forward;

• economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a

reduction in demand for credit and a decline in real estate values;

• a general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results;

• risk associated with income taxes including the potential for adverse adjustments and the inability to fully realize deferred tax benefits;

• increased cybersecurity risk, including potential network breaches, business disruptions or financial losses;

• restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals;

• legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us;

• competitive pressures among depository and other financial institutions may increase significantly;

• changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired;

• other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can;

• our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry;

• adverse changes may occur in the bond and equity markets;

• war or terrorist activities may cause deterioration in the economy or cause instability in credit markets; and

• economic, governmental or other factors may prevent the projected population, residential and commercial growth in the markets in which we operate.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently ended fiscal

year. These and other risk factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a forward-

looking statement.

3

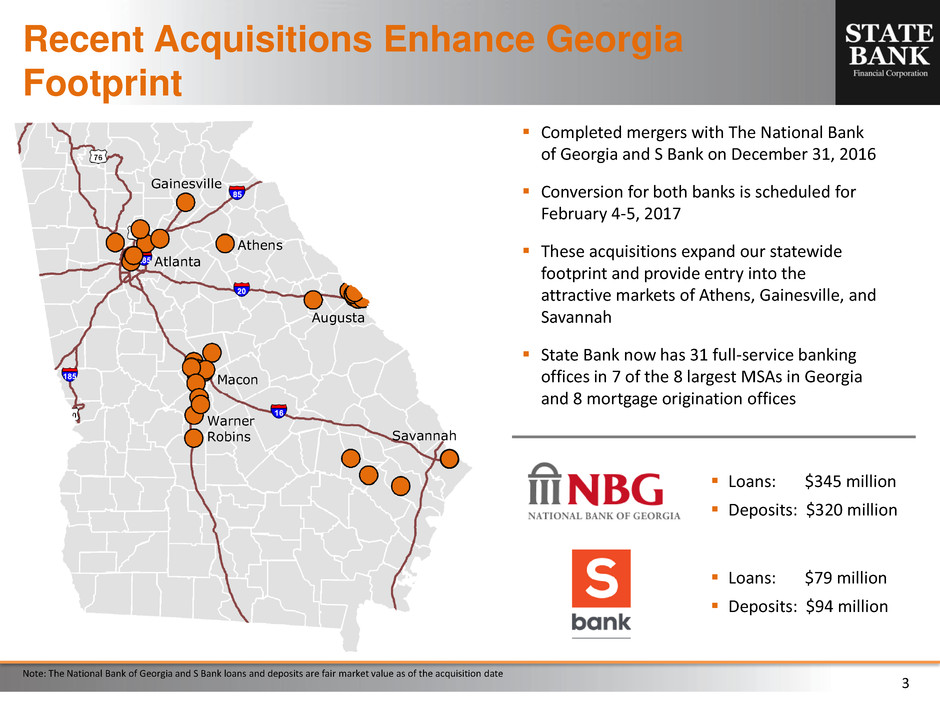

Recent Acquisitions Enhance Georgia

Footprint

Completed mergers with The National Bank

of Georgia and S Bank on December 31, 2016

Conversion for both banks is scheduled for

February 4-5, 2017

These acquisitions expand our statewide

footprint and provide entry into the

attractive markets of Athens, Gainesville, and

Savannah

State Bank now has 31 full-service banking

offices in 7 of the 8 largest MSAs in Georgia

and 8 mortgage origination offices

Loans: $345 million

Deposits: $320 million

Loans: $79 million

Deposits: $94 million

Atlanta

Macon

Warner

Robins

Augusta

Savannah

Athens

Gainesville

Note: The National Bank of Georgia and S Bank loans and deposits are fair market value as of the acquisition date

4

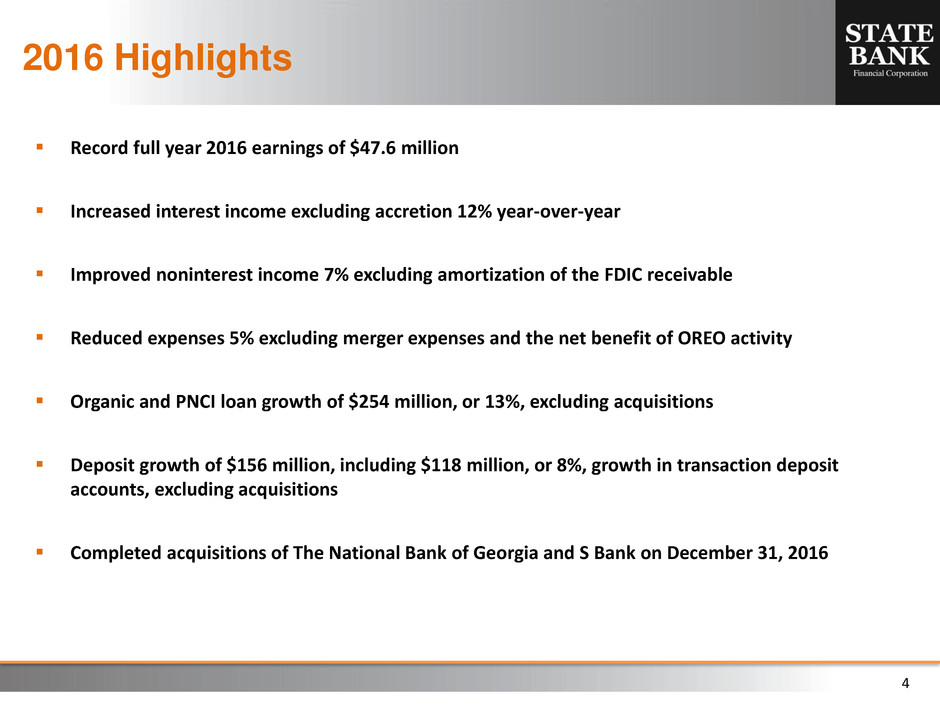

2016 Highlights

Record full year 2016 earnings of $47.6 million

Increased interest income excluding accretion 12% year-over-year

Improved noninterest income 7% excluding amortization of the FDIC receivable

Reduced expenses 5% excluding merger expenses and the net benefit of OREO activity

Organic and PNCI loan growth of $254 million, or 13%, excluding acquisitions

Deposit growth of $156 million, including $118 million, or 8%, growth in transaction deposit

accounts, excluding acquisitions

Completed acquisitions of The National Bank of Georgia and S Bank on December 31, 2016

5

Income Statement Highlights

($ in 000s, except per share data) 4Q16 3Q16 4Q15 FY 2016 FY 2015

Interest income on loans $26,696 $26,580 $24,250 $103,024 $92,938

Accretion income on loans 10,271 9,335 14,240 43,310 49,830

Interest income on invested funds 4,810 4,714 4,139 18,923 15,823

Total interest income 41,777 40,629 42,629 165,257 158,591

Interest expense 2,631 2,504 1,994 9,619 7,922

Net interest income 39,146 38,125 40,635 155,638 150,669

Provision for loan and lease losses 277 88 494 237 3,486

Net interest income after provision for loan losses 38,869 38,037 40,141 155,401 147,183

Total noninterest income 9,911 9,769 8,136 39,301 36,599

Amortization of FDIC receivable - - - - (16,488)

Total noninterest expense 32,875 28,480 29,562 120,927 123,422

Income before income taxes 15,905 19,326 18,715 73,775 43,872

Income tax expense 5,578 6,885 6,594 26,184 15,449

Net income $10,327 $12,441 $12,121 $47,591 $28,423

Diluted earnings per share .28 .34 .33 1.28 .77

Dividends per share .14 .14 .14

Tangible book value per share 13.48 13.99 13.22

Balance Sheet Highlights (period-end)

Total loans $2,814,572 $2,346,346 $2,160,217

Organic 2,090,564 2,030,457 1,774,332

Purchased non-credit impaired 563,362 189,053 240,310

Purchased credit impaired 160,646 126,836 145,575

Total assets 4,224,859 3,616,384 3,470,067

Noninterest-bearing deposits 984,419 890,588 826,216

Total deposits 3,431,165 2,959,292 2,861,962

Shareholders’ equity 613,633 561,134 536,490

4Q and Full Year 2016 Results Summary

1 Denotes a non-GAAP financial measure; for more information, refer to Table 8 of the 4Q16 earnings press release

Note: Consolidated financial results contained throughout this presentation are unaudited; numbers may not add due to rounding

2016 net income of $47.6

million, or $1.28 per

diluted share

4Q16 net income of $10.3

million, or $.28 per

diluted share

1

6

4Q 2016 Results

Net income of $10.3 million, or $.28 per diluted share in 4Q16

Interest income on loans and invested funds was 11% higher in 4Q16 compared to 4Q15

Noninterest income in 4Q16 increased 22% versus 4Q15

Noninterest expense in 4Q16 was impacted by the following items:

Merger-related expenses of $3.5 million, representing the majority of merger expenses we expect to incur

on our two most recent acquisitions (diluted EPS impact of $.06)

Increase in legal/professional fees of $638,000 related to consulting charge of $900,000 on a support

system project (diluted EPS impact of $.01)

Decrease in net gains on OREO of $714,000 compared to 3Q16 (diluted EPS impact of $.01)

1

7

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

2011 2012 2013 2014 2015 2016

Interest Income

1

Revenue Trends

Interest income (excluding accretion)

of $31.5mm in 4Q16 compared to

$28.4mm in 4Q15

Total interest income increased 4%

in 2016 compared to 2015, despite

a 13% decline in accretion income

Double digit growth in targeted fee

income lines of business led to a 7%

increase in 2016 noninterest income

($ i

n

000

s)

5,000

10,000

15,000

20,000

25,000

30,000

35,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Interest Income and Accretion

Interest Income Accretion

1 Excludes accretion income on loans

2 Excludes (amortization)/accretion of FDIC receivable

($ i

n

000

s)

($ i

n

000

s)

0

10,000

20,000

30,000

40,000

50,000

2011 2012 2013 2014 2015 2016

Noninterest Income

2

8

SBA income increased 31% in 4Q16 and 17% in FY

2016 compared to the same periods a year ago

Payroll fee income increased 17% in 4Q16 and 15% in

FY 2016 compared to the same periods a year ago

Revenue Trends

Mortgage banking income increased 25% in 4Q16 and 10%

in FY 2016 compared to the same periods a year ago

Total 4Q16 noninterest income of $9.9mm

($ i

n

000

s)

0

2,000

4,000

6,000

8,000

10,000

12,000

4Q15 1Q16 2Q16 3Q16 4Q16

Service Charge Other Mortgage Payroll SBA

0

50

100

150

200

0

1,000

2,000

3,000

4,000

4Q15 1Q16 2Q16 3Q16 4Q16

Pr

o

d

u

cti

o

n

($

in

m

m

)

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Production

1,000

1,050

1,100

1,150

1,200

0

250

500

750

1,000

1,250

1,500

4Q15 1Q16 2Q16 3Q16 4Q16

# o

f C

lien

ts

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Number of Clients

0

5

10

15

20

25

30

35

0

500

1,000

1,500

2,000

4Q15 1Q16 2Q16 3Q16 4Q16

Pr

o

d

u

cti

o

n

($

in

m

m

)

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Production

9

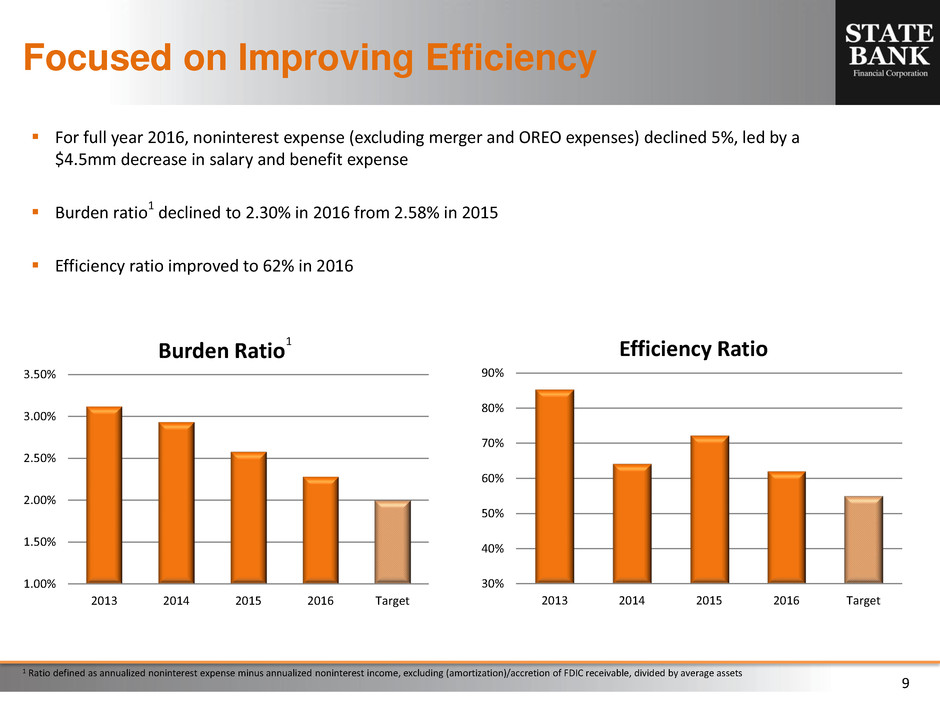

Focused on Improving Efficiency

For full year 2016, noninterest expense (excluding merger and OREO expenses) declined 5%, led by a

$4.5mm decrease in salary and benefit expense

Burden ratio1 declined to 2.30% in 2016 from 2.58% in 2015

Efficiency ratio improved to 62% in 2016

1 Ratio defined as annualized noninterest expense minus annualized noninterest income, excluding (amortization)/accretion of FDIC receivable, divided by average assets

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2013 2014 2015 2016 Target

Burden Ratio

1

30%

40%

50%

60%

70%

80%

90%

2013 2014 2015 2016 Target

Efficiency Ratio

10

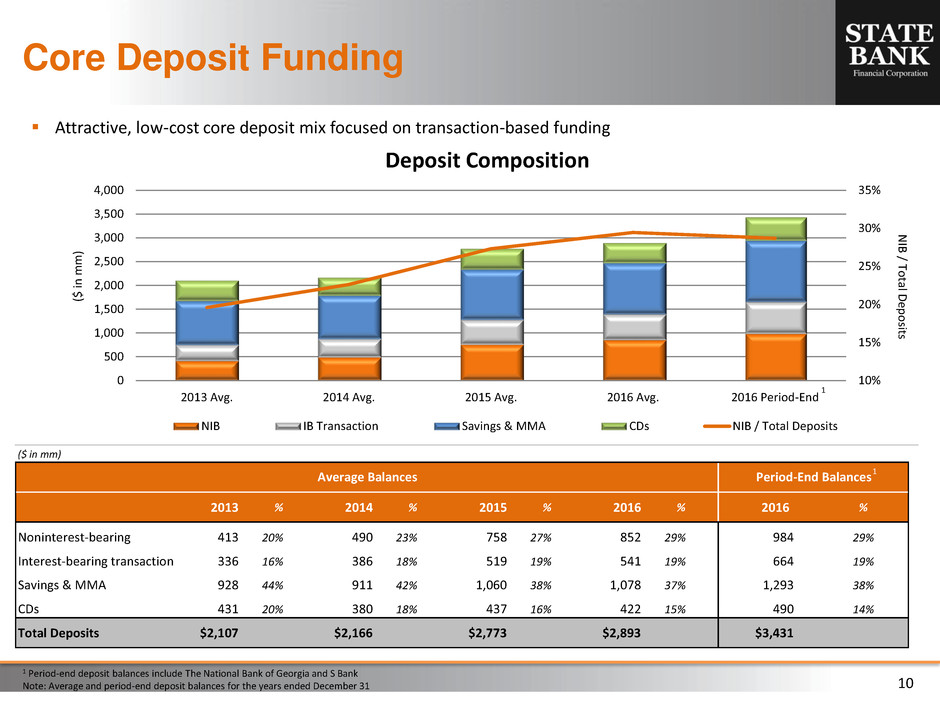

($ in mm)

2013 % 2014 % 2015 % 2016 % 2016 %

Noninterest-bearing 413 20% 490 23% 758 27% 852 29% 984 29%

Interest-bearing transaction 336 16% 386 18% 519 19% 541 19% 664 19%

Savings & MMA 928 44% 911 42% 1,060 38% 1,078 37% 1,293 38%

CDs 431 20% 380 18% 437 16% 422 15% 490 14%

Total Deposits $2,107 $2,166 $2,773 $2,893 $3,431

Period-End BalancesAverage Balances

Core Deposit Funding

($ i

n

m

m

)

N

IB

/ Tot

al D

ep

o

sit

s

Attractive, low-cost core deposit mix focused on transaction-based funding

1 Period-end deposit balances include The National Bank of Georgia and S Bank

Note: Average and period-end deposit balances for the years ended December 31

1

1

10%

15%

20%

25%

30%

35%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2013 Avg. 2014 Avg. 2015 Avg. 2016 Avg. 2016 Period-End

Deposit Composition

NIB IB Transaction Savings & MMA CDs NIB / Total Deposits

11

0

125

250

375

500

500

1,000

1,500

2,000

2,500

3,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16

Total Loan Portfolio

Organic PNCI PCI New Loan Fundings

Loan Portfolio

To

ta

l L

o

an

s

($

in

m

m

)

1 New loan fundings include new loans funded and net loan advances on existing commitments

Note: Period-end loan balances as of year-end 2016 include The National Bank of Georgia and S Bank

1

New loan originations in

excess of $400mm in 4Q16

Excluding the acquisitions,

organic and PNCI loans

increased $49mm in the

quarter and $254mm year-

over-year to end 4Q16 at

$2.27B

N

ew

Lo

an

Fu

n

d

in

gs ($ i

n

m

m

)

($ in mm)

Loan Composition (period-end) 2013 2014 2015

2016 Ex.

Acquisitions

2016 Inc.

Acquisitions

Construction, land & land development $251 $313 $501 $507 $551

Other commercial real estate 550 636 736 812 964

Total commercial real estate 802 949 1,236 1,319 1,516

Residential real estate 67 135 210 197 289

Owner-occupied real estate 175 212 281 306 372

C&I and Leases 71 123 267 409 435

Consumer 9 9 21 38 42

Total Organic & PNCI Loans 1,123 1,428 2,015 2,269 2,654

PCI Loans 257 206 146 122 161

Total Loans $1,381 $1,635 $2,160 $2,391 $2,815

12

Excluding the acquisitions,

purchased credit impaired loans

were down 16% year-over-year to

$121.8mm

OREO balances remain relatively

low at $10.9mm as of 4Q16

Asset Quality

($ i

n

m

m

)

Total organic NPAs of $6.5mm,

representing .31% of organic loans

and OREO

Average net charge-offs were .10%

in 4Q16

Past due organic loans of just .06%,

compared to .09% at 3Q16

Allowance to organic loans is 1.01%,

down from 1.07% last quarter, and

covers NPAs by 3.2 times

0.00%

0.50%

1.00%

1.50%

2.00%

0

5

10

15

20

2012 2013 2014 2015 2016

Nonperforming Loans

Organic PNCI NPLs / Organic Loans

0

10

20

30

40

50

0

100

200

300

400

500

2012 2013 2014 2015 2016

OR

EO

($ i

n

m

m

)

PCI

Lo

an

s ($

in

m

m

)

PCI Loans & OREO

1

PCI Loans OREO

1 Period-end PCI loans and OREO balances include The National Bank of Georgia and S Bank