Attached files

| file | filename |

|---|---|

| 8-K - Hill-Rom Holdings, Inc. | l191708k.htm |

| EX-99.2 - EXHIBIT 99.2 - Hill-Rom Holdings, Inc. | ex99_2.htm |

| EX-99.1 - EXHIBIT 99.1 - Hill-Rom Holdings, Inc. | ex99_1.htm |

Exhibit 99.3

Hill-Rom: Acquiring Mortara Instrument Complementary Combination Strengthens Clinical Focus on Diagnostic Cardiology and Patient Monitoring January 10, 2017

This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. All statements included herein that are not historical facts are forward-looking statements, including without limitation statements regarding the ability of Hill-Rom to achieve tax benefits associated with the acquisition of Mortara, the ability to expand our diagnostic cardiology franchise and expand the Welch Allyn business, the ability to retain key employees of Mortara, the achievement of projected financial synergies, the possibility that the closing of the transaction may be delayed, the ability to achieve any other anticipated benefits of the acquisition, and all other statements concerning future strategy, plans, objectives, projections, expectations and intentions. Such forward-looking statements involve a number of risks and uncertainties and are subject to change at any time. In the event such risks or uncertainties materialize, Hill-Rom’s results could be materially adversely affected. For a more in depth discussion of factors that could cause actual results to differ from those contained in forward-looking statements, see the discussions under the heading “Risk Factors” in the company's previously filed most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Hill-Rom assumes no obligation to update or revise any forward-looking statements. Forward Looking Statements

Table of Contents: Mortara Instrument Acquisition Compelling Strategic Rationale Mortara Overview Attractive Global Markets Complementary Portfolio Substantial Financial Benefits Transaction Summary Enhanced Capabilities

Supporting expansion of broader range of diagnostic technologies to further mission of improving patient outcomes Mortara Instrument: An Exciting Opportunity Strengthening clinical focus on diagnostic cardiology and patient monitoring across the combined portfolio Leveraging deep relationships in acute care, primary care and clinical research settings globally 1 2 3 Accelerating growth with highly attractive and immediately accretive acquisition 4

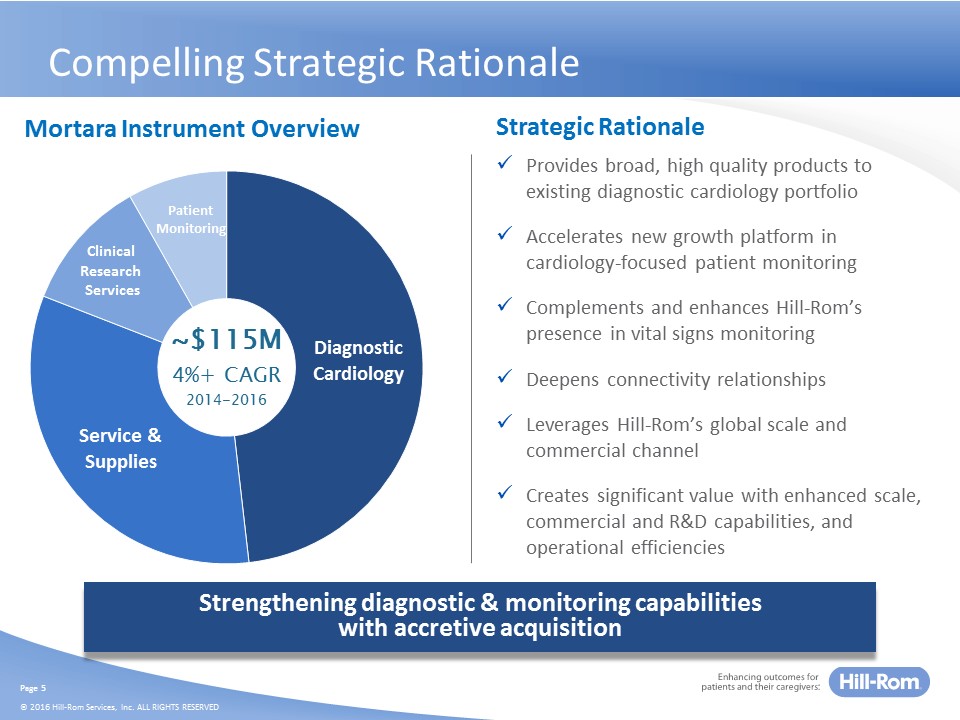

Strengthening diagnostic & monitoring capabilitieswith accretive acquisition Provides broad, high quality products to existing diagnostic cardiology portfolioAccelerates new growth platform in cardiology-focused patient monitoringComplements and enhances Hill-Rom’s presence in vital signs monitoringDeepens connectivity relationshipsLeverages Hill-Rom’s global scale and commercial channel Creates significant value with enhanced scale, commercial and R&D capabilities, and operational efficiencies Strategic Rationale Mortara Instrument Overview Compelling Strategic Rationale ~$115M4%+ CAGR2014-2016

Deal Structure & Consideration Hill-Rom to acquire Mortara Instrument for $330M in cash Deal valued at ~$290M including the net present value of tax benefitFinanced with cash on hand and borrowings under existing credit facilities Leadership Mortara Instrument CEO, Dr. Justin Mortara, joining Hill-Rom Mortara’s strong leadership and innovation culture will thrive as part of Hill-Rom Closing & Conditions Customary closing conditionsExpected to close in fiscal second quarter of 2017 Financial Benefits Accelerates revenue growth; accretive to gross and operating marginsModestly accretive to fiscal 2017 Adjusted EPSAnnual operational cost synergies of at least $10 million drive greater accretion beyond 2017Double-digit ROIC by year 3 Transaction Summary Accelerating growth with highly attractive and immediately accretive acquisition

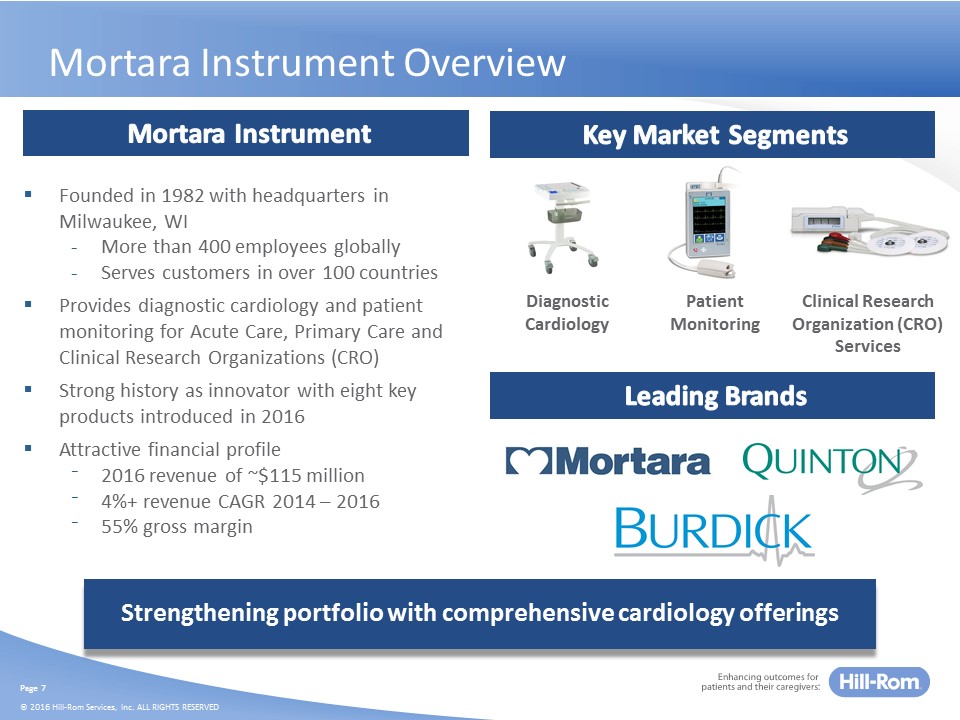

Mortara Instrument Overview Strengthening portfolio with comprehensive cardiology offerings DiagnosticCardiology Patient Monitoring Clinical Research Organization (CRO) Services Founded in 1982 with headquarters in Milwaukee, WIMore than 400 employees globallyServes customers in over 100 countries Provides diagnostic cardiology and patient monitoring for Acute Care, Primary Care and Clinical Research Organizations (CRO)Strong history as innovator with eight key products introduced in 2016Attractive financial profile2016 revenue of ~$115 million4%+ revenue CAGR 2014 – 201655% gross margin Mortara Instrument Key Market Segments Leading Brands

Attractive Global Markets Global Diagnostic Cardiology & Patient Monitoring Market US$ Billions 4% - 5%Market Growth CAGR Cardiovascular disease (CVD) is the #1 cause of death worldwideDiagnostic cardiology products are used in the non-invasive diagnosis of CVD across continuum of carePatient monitoring products incorporate electrocardiographic (ECG) and other monitoring parameters:Ambulatory TelemetryBedside MonitorsCentral StationsClinical IT Solutions Strong Foundation For Growth Significant opportunity to enhance patient outcomes Source: Markets and Markets global forecast

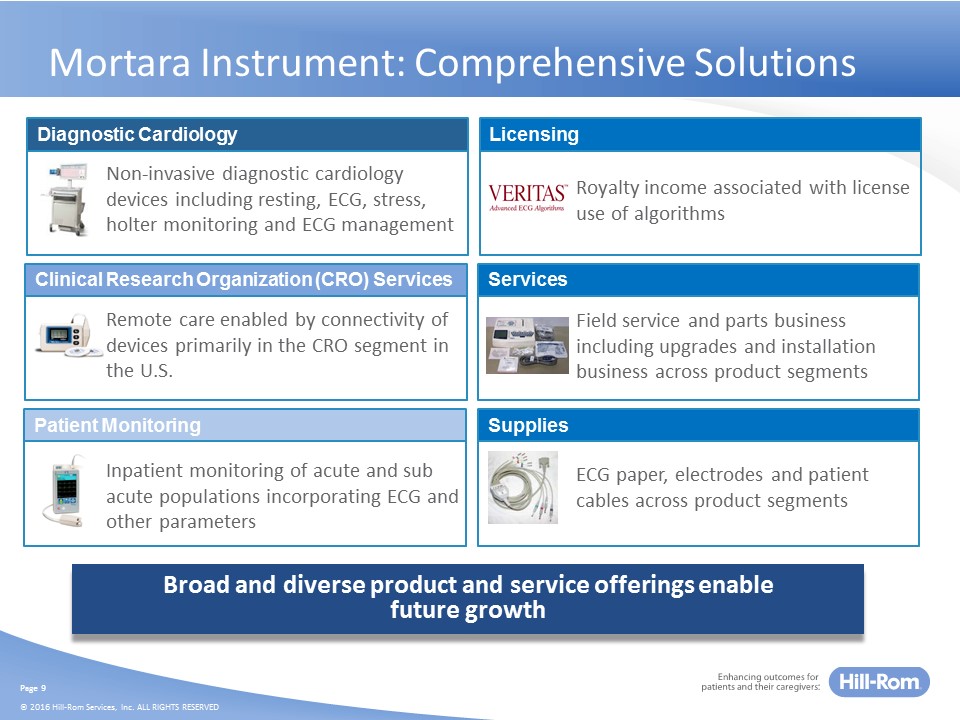

Supplies Services Licensing Clinical Research Organization (CRO) Services Patient Monitoring Diagnostic Cardiology Non-invasive diagnostic cardiology devices including resting, ECG, stress, holter monitoring and ECG management Inpatient monitoring of acute and sub acute populations incorporating ECG and other parameters Remote care enabled by connectivity of devices primarily in the CRO segment in the U.S. Royalty income associated with license use of algorithms Field service and parts business including upgrades and installation business across product segments Broad and diverse product and service offerings enablefuture growth Mortara Instrument: Comprehensive Solutions ECG paper, electrodes and patient cables across product segments

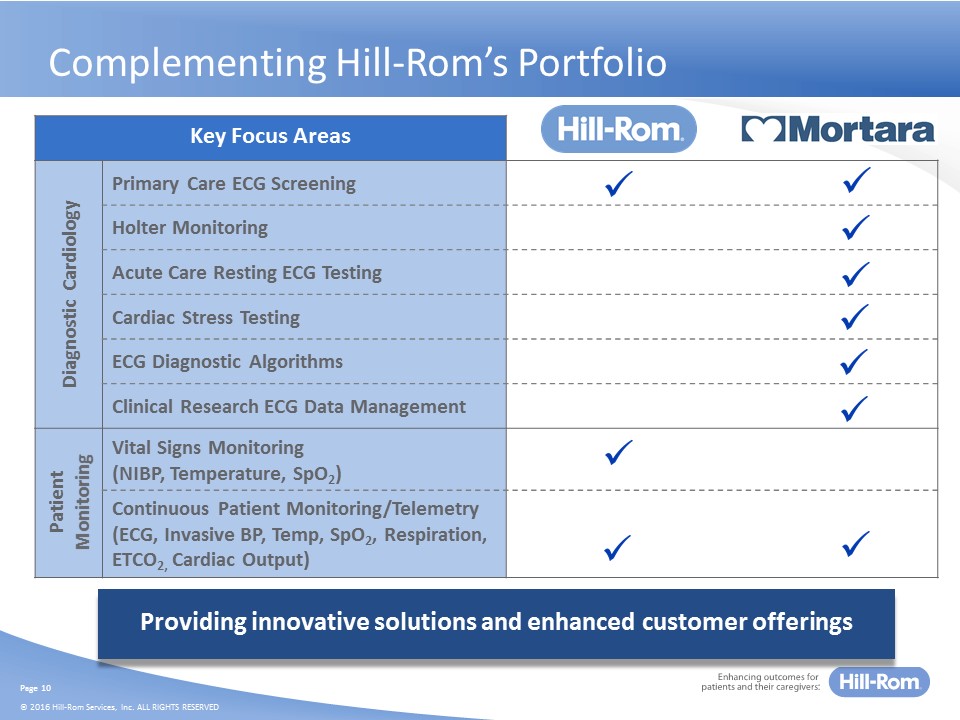

Key Focus Areas Diagnostic Cardiology Primary Care ECG Screening Holter Monitoring Acute Care Resting ECG Testing Cardiac Stress Testing ECG Diagnostic Algorithms Clinical Research ECG Data Management PatientMonitoring Vital Signs Monitoring(NIBP, Temperature, SpO2) Continuous Patient Monitoring/Telemetry(ECG, Invasive BP, Temp, SpO2, Respiration, ETCO2, Cardiac Output) Providing innovative solutions and enhanced customer offerings Complementing Hill-Rom’s Portfolio

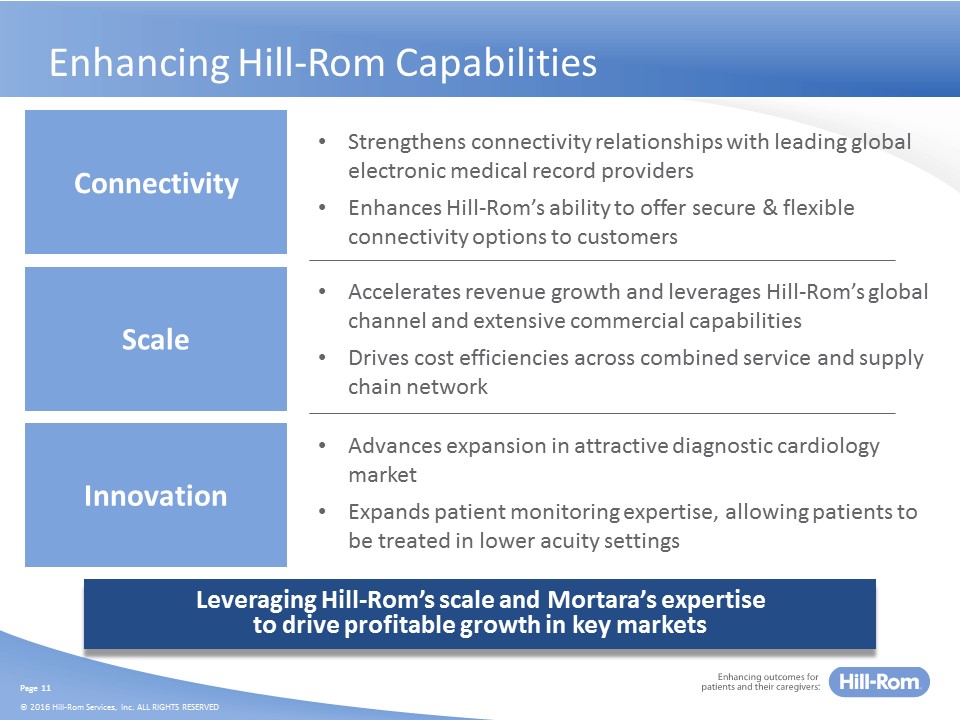

Leveraging Hill-Rom’s scale and Mortara’s expertise to drive profitable growth in key markets Strengthens connectivity relationships with leading global electronic medical record providersEnhances Hill-Rom’s ability to offer secure & flexible connectivity options to customers Enhancing Hill-Rom Capabilities Connectivity Scale Innovation Accelerates revenue growth and leverages Hill-Rom’s global channel and extensive commercial capabilitiesDrives cost efficiencies across combined service and supply chain network Advances expansion in attractive diagnostic cardiology marketExpands patient monitoring expertise, allowing patients to be treated in lower acuity settings

Substantial Financial Benefits And Returns Accelerates revenue growth in key marketsAccretive to gross and operating marginsModestly accretive to fiscal 2017 Adjusted EPS Annual operational cost synergies of at least $10 million drive greater accretion beyond 2017Double-digit ROIC by year 3 Historical Revenue Growth CAGR +4% 2016 Revenue ~$115M Adjusted Gross Margin 55% Accretive revenue and margin profile drives attractive returns

Supporting expansion of broader range of diagnostic technologies to further mission of improving patient outcomes Mortara Instrument: An Exciting Opportunity Strengthening clinical focus on diagnostic cardiology and patient monitoring across the combined portfolio Leveraging deep relationships in acute care, primary care and clinical research settings globally 1 2 3 Accelerating growth with highly attractive and immediately accretive acquisition 4

Hill-Rom: Acquiring Mortara Instrument Complementary Combination Strengthens Clinical Focus on Cardiac Diagnostics and Patient Monitoring January 10, 2017