Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Impax Laboratories, LLC | ipxl-08x09x2016x8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Impax Laboratories, LLC | ipxl-08x09x2016x8kxex991.htm |

1

Second Quarter 2016

Earnings Conference Call

August 9, 2016

2

Impax Cautionary Statement Regarding

Forward Looking Statements

"Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995:

To the extent any statements made in this presentation contain information that is not historical; these statements are forward-looking in nature

and express the beliefs and expectations of management. Such statements are based on current expectations and involve a number of known

and unknown risks and uncertainties that could cause the Company’s future results, performance, or achievements to differ significantly from

the results, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but

are not limited to: fluctuations in revenues and operating income; the Company’s ability to successfully develop and commercialize

pharmaceutical products in a timely manner; reductions or loss of business with any significant customer; the substantial portion of the

Company’s total revenues derived from sales of a limited number of products; the impact of consolidation of the Company’s customer base; the

impact of competition; the Company’s ability to sustain profitability and positive cash flows; any delays or unanticipated expenses in connection

with the operation of the Company’s manufacturing facilities; the effect of foreign economic, political, legal, and other risks on the Company’s

operations abroad; the uncertainty of patent litigation and other legal proceedings; the increased government scrutiny on the Company’s

agreements with brand pharmaceutical companies; product development risks and the difficulty of predicting FDA filings and approvals;

consumer acceptance and demand for new pharmaceutical products; the impact of market perceptions of the Company and the safety and

quality of the Company’s products; the Company’s determinations to discontinue the manufacture and distribution of certain products; the

Company’s ability to achieve returns on its investments in research and development activities; changes to FDA approval requirements ; the

Company’s ability to successfully conduct clinical trials; the Company’s reliance on third parties to conduct clinical trials and testing; the

Company’s lack of a license partner for commercialization of NUMIENT™ (IPX066) outside of the United States; impact of illegal distribution

and sale by third parties of counterfeits or stolen products; the availability of raw materials and impact of interruptions in the Company’s supply

chain; the Company’s policies regarding returns, allowances and chargebacks; the use of controlled substances in the Company’s products; the

effect of current economic conditions on the Company’s industry, business, results of operations and financial condition; disruptions or failures

in the Company’s information technology systems and network infrastructure caused by third party breaches or other events; the Company’s

reliance on alliance and collaboration agreements; the Company’s reliance on licenses to proprietary technologies; the Company’s dependence

on certain employees; the Company’s ability to comply with legal and regulatory requirements governing the healthcare industry; the regulatory

environment; the effect of certain provisions in the Company’s government contracts; the Company’s ability to protect its intellectual property;

exposure to product liability claims; risks relating to goodwill and intangibles; changes in tax regulations; the Company’s ability to manage

growth, including through potential acquisitions and investments; risks related to the Company’s acquisitions of or investments in technologies,

products or businesses; the restrictions imposed by the Company’s credit facility and indenture; the Company’s level of indebtedness and

liabilities and the potential impact on cash flow available for operations; uncertainties involved in the preparation of the Company’s financial

statements; the Company’s ability to maintain an effective system of internal control over financial reporting; the effect of terrorist attacks on the

Company’s business; the location of the Company’s manufacturing and research and development facilities near earthquake fault lines;

expansion of social media platforms and other risks described in the Company’s periodic reports filed with the Securities and Exchange

Commission. Forward-looking statements speak only as to the date on which they are made, and the Company undertakes no obligation to

update publicly or revise any forward-looking statement, regardless of whether new information becomes available, future developments occur

or otherwise.

Trademarks referenced herein are the property of their respective owners.

©2016 Impax Laboratories, Inc. All Rights Reserved.

3

Agenda

• 2Q16 Financial Results

• Business Update

Fred Wilkinson

President & CEO

• 2Q16 Financial Review

• 2016 Financial Guidance Update

Bryan Reasons

SVP & CFO

• Q&A Executive Team

4

2Q16 Results and

Business Update

Fred Wilkinson

President & Chief Executive Officer

5

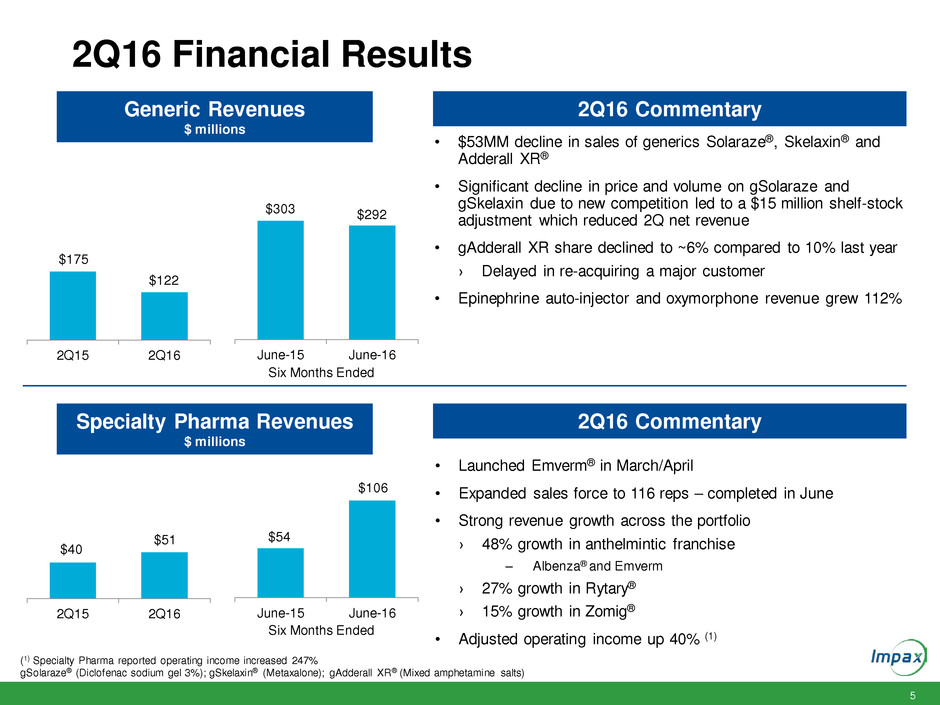

2Q16 Financial Results

$175

$122

2Q15 2Q16

Generic Revenues

$ millions

$40

$51

2Q15 2Q16

• $53MM decline in sales of generics Solaraze®, Skelaxin® and

Adderall XR®

• Significant decline in price and volume on gSolaraze and

gSkelaxin due to new competition led to a $15 million shelf-stock

adjustment which reduced 2Q net revenue

• gAdderall XR share declined to ~6% compared to 10% last year

› Delayed in re-acquiring a major customer

• Epinephrine auto-injector and oxymorphone revenue grew 112%

• Launched Emverm® in March/April

• Expanded sales force to 116 reps – completed in June

• Strong revenue growth across the portfolio

› 48% growth in anthelmintic franchise

‒ Albenza® and Emverm

› 27% growth in Rytary®

› 15% growth in Zomig®

• Adjusted operating income up 40% (1)

$303 $292

June-15 June-16

$54

$106

June-15 June-16

Specialty Pharma Revenues

$ millions

2Q16 Commentary

2Q16 Commentary

Six Months Ended

Six Months Ended

(1) Specialty Pharma reported operating income increased 247%

gSolaraze® (Diclofenac sodium gel 3%); gSkelaxin® (Metaxalone); gAdderall XR® (Mixed amphetamine salts)

6

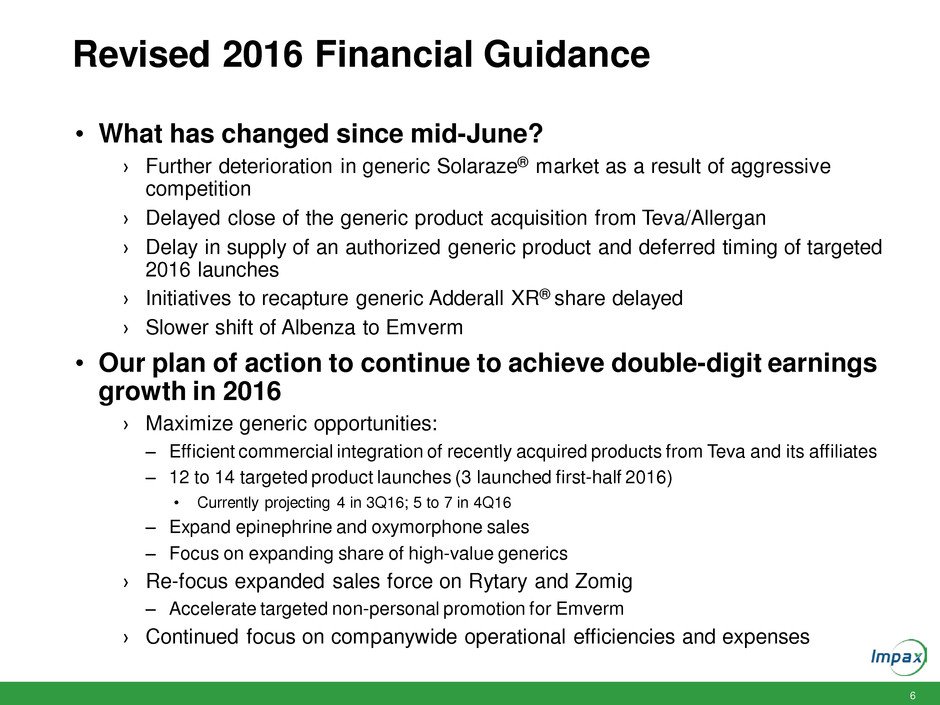

Revised 2016 Financial Guidance

• What has changed since mid-June?

› Further deterioration in generic Solaraze® market as a result of aggressive

competition

› Delayed close of the generic product acquisition from Teva/Allergan

› Delay in supply of an authorized generic product and deferred timing of targeted

2016 launches

› Initiatives to recapture generic Adderall XR® share delayed

› Slower shift of Albenza to Emverm

• Our plan of action to continue to achieve double-digit earnings

growth in 2016

› Maximize generic opportunities:

‒ Efficient commercial integration of recently acquired products from Teva and its affiliates

‒ 12 to 14 targeted product launches (3 launched first-half 2016)

• Currently projecting 4 in 3Q16; 5 to 7 in 4Q16

‒ Expand epinephrine and oxymorphone sales

‒ Focus on expanding share of high-value generics

› Re-focus expanded sales force on Rytary and Zomig

‒ Accelerate targeted non-personal promotion for Emverm

› Continued focus on companywide operational efficiencies and expenses

7

Rapid Market Change in Generic Solaraze®

(Diclofenac Sodium Gel 3%)

Impax Net Sales ($ in millions)

1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Impax Net Sales $11 $17 $33 $88 $50 $5

Sequential $ Change +$3 +$6 +$16 +$55 ($38) ($45)

Change in Sales Due to a Change in Volume and / or Price

Volume 100% 100% 100% 100% (76%) (60%)

Price 0% 0% 0% 0% (24%) (40%)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Market Share

Impax Sandoz AG Taro PNA Actavis

Jan

‘15

Feb

‘15

Mar

‘15

Apr

‘15

May

‘15

Jun

‘15

Jul

‘15

Aug

‘15

Sep

‘15

Oct

‘15

Nov

‘15

Dec

‘15

Jan

‘16

Feb

‘16

Mar

‘16

Apr

‘16

May

‘16

Jun

‘16

Source: IMS NPA Weekly

PNA = Pharmaceutica North America, Inc.

Sandoz AG

& Brand

Exit Market

Sandoz

Returns

Taro, Actavis

& PNA Launch

Price decline results in

$14.5MM shelf-stock

adjustment in 2Q

8

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

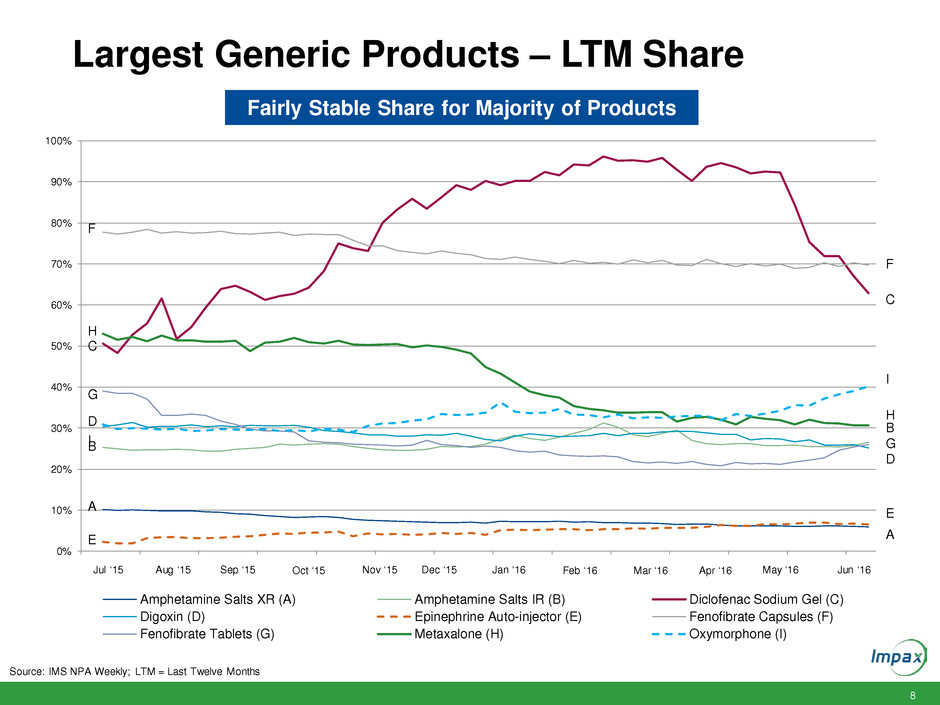

2015/07/24 2015/08/21 2015/09/18 2015/10/16 2015/11/13 2015/12/11 2016/01/08 2016/02/05 2016/03/04 2016/04/01 2016/04/29 2016/05/27 2016/06/24

Amphetamine Salts XR (A) Amphetamine Salts IR (B) Diclofenac Sodium Gel (C)

Digoxin (D) Epinephrine Auto-injector (E) Fenofibrate Capsules (F)

Fenofibrate Tablets (G) Metaxalone (H) Oxymorphone (I)

Largest Generic Products – LTM Share

C

F

I

E

G

D

H

A

B

F

C

E

A

B I

D

H

G

Source: IMS NPA Weekly; LTM = Last Twelve Months

Jul ‘15 Aug ‘15 Sep ‘15 Oct ‘15 Nov ‘15 Dec ‘15 Jan ‘16 Feb ‘16 Mar ‘16 Apr ‘16 May ‘16 Jun ‘16

Fairly Stable Share for Majority of Products

9

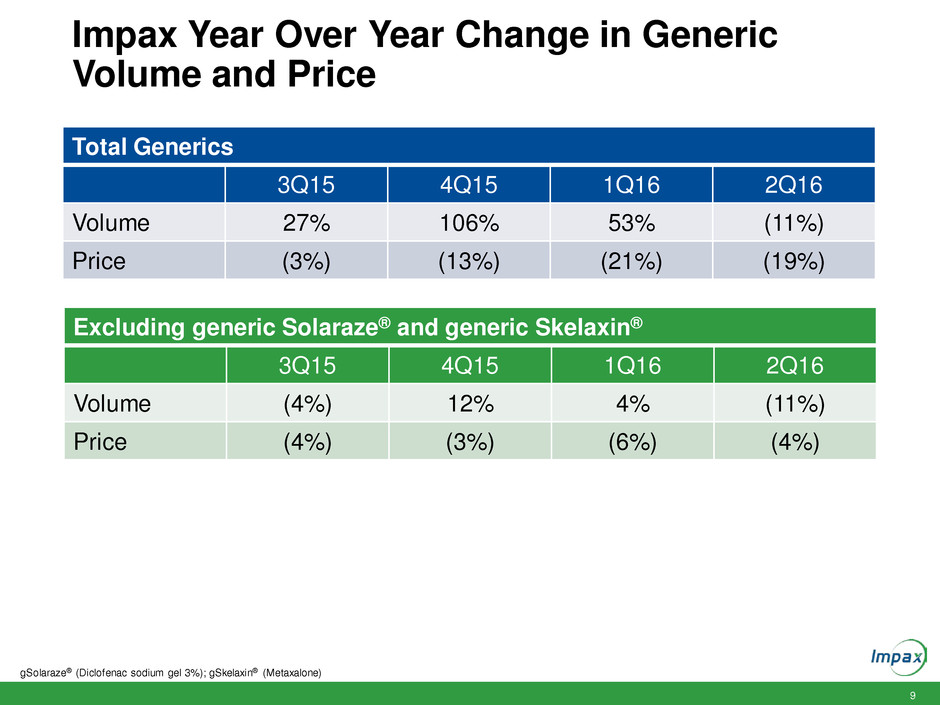

Impax Year Over Year Change in Generic

Volume and Price

Total Generics

3Q15 4Q15 1Q16 2Q16

Volume 27% 106% 53% (11%)

Price (3%) (13%) (21%) (19%)

gSolaraze® (Diclofenac sodium gel 3%); gSkelaxin® (Metaxalone)

Excluding generic Solaraze® and generic Skelaxin®

3Q15 4Q15 1Q16 2Q16

Volume (4%) 12% 4% (11%)

Price (4%) (3%) (6%) (4%)

10

Expanded Generic Portfolio Through Product Acquisition

Acquired 15 Marketed Products

Product Brand Strength Divested File

Acitretin capsules Soriatane® 10 mg,17.5 mg, 22.5 mg, 25 mg Allergan

Alendronate Sodium tablets Fosamax® 5mg, 10mg, 35 mg, 40 mg, 70 mg Teva

Budesonide inhalation suspension Pulmicort Respules® 0.25/2 mg/ml, 0.5/2 mg/ml Allergan

Buspirone HCl tablets Buspar® 5 mg, 10 mg, 15 mg Allergan

Desmopressin Acetate tablets DDAVP® 0.1 mg, 0.2 mg Teva

Dexmethylphenidate HCI extended release capsules Focalin XR® 5 mg, 10 mg, 15 mg, 20 mg, 30 mg Allergan

Epirubicin injection vial Ellence® 50 mg/25 ml, 200 mg/100 ml Teva

Glyburide/Metformin HCI tablets Glucovance® 1.25/250 mg, 2.5/500 mg, 5/500 mg Teva

Hydroxyzine Pamoate capsules Vistaril® 25mg, 50mg Allergan

Levalbuterol HCI inhalation solution Xopenex® 0.0103%, 0.0210%, 0.0420% Allergan

Metoclopramide HCI tablets Reglan® 5 mg, 10 mg Allergan

Mirtazapine ODT Remeron SolTab® 15 mg, 30 mg, 45 mg Teva

Nabumetone tablets Relafen® 500 mg, 750 mg Teva

Nitrofurantoin capsules (macrocrystals) Macrodantin® 50 mg, 100 mg Teva

Propranolol HCl tablets Inderal® 10 mg, 20 mg, 40 mg, 60 mg, 80 mg Teva

Pipeline Products

Aspirin/Dipyridamole capsules Aggrenox® 25/200 mg Allergan

Budesonide inhalation suspension Pulmicort Respules® 1 mg/2 ml Allergan

Dexmethylphenidate HCl extended release capsules Focalin XR® 25 mg, 35 mg Allergan

Fluocinonide cream (emulsified base) Lidex‐E® 0.05% Allergan

Methylphenidate HCl extended release tablets (1) Concerta® 18 mg, 27 mg,36 mg, 54 mg

One Undisclosed Under Development

(1) Reacquired full commercial rights to Impax’s pending ANDA, a product previously partnered with Teva

11

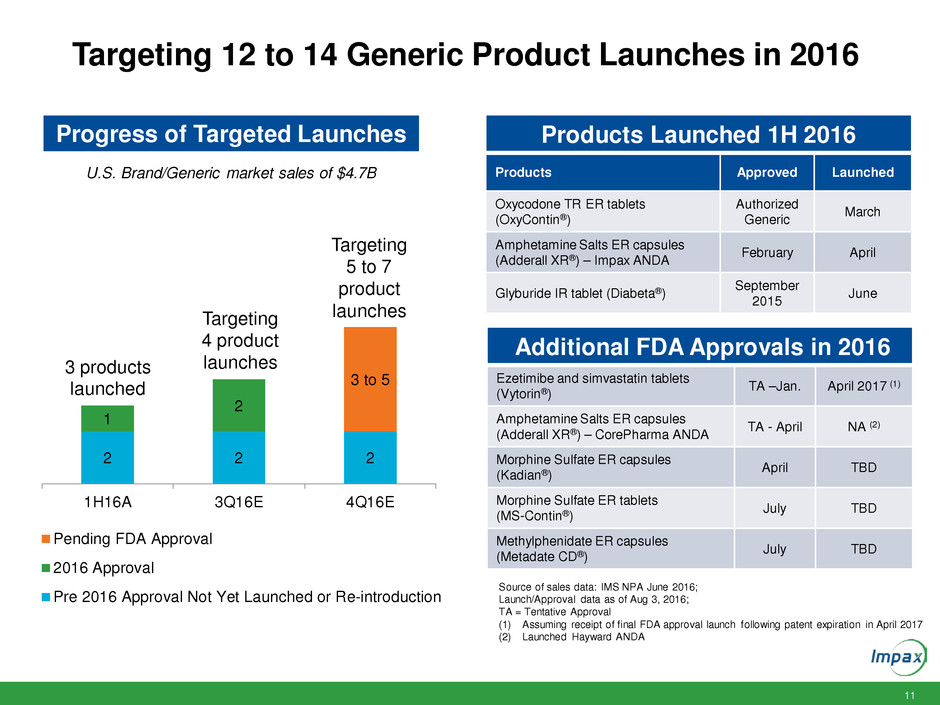

Targeting 12 to 14 Generic Product Launches in 2016

Source of sales data: IMS NPA June 2016;

Launch/Approval data as of Aug 3, 2016;

TA = Tentative Approval

(1) Assuming receipt of final FDA approval launch following patent expiration in April 2017

(2) Launched Hayward ANDA

U.S. Brand/Generic market sales of $4.7B

Progress of Targeted Launches Products Launched 1H 2016

Products Approved Launched

Oxycodone TR ER tablets

(OxyContin®)

Authorized

Generic March

Amphetamine Salts ER capsules

(Adderall XR®) – Impax ANDA February April

Glyburide IR tablet (Diabeta®) September 2015 June

Additional FDA Approvals in 2016

Ezetimibe and simvastatin tablets

(Vytorin®) TA –Jan. April 2017

(1)

Amphetamine Salts ER capsules

(Adderall XR®) – CorePharma ANDA TA - April NA

(2)

Morphine Sulfate ER capsules

(Kadian®) April TBD

Morphine Sulfate ER tablets

(MS-Contin®) July TBD

Methylphenidate ER capsules

(Metadate CD®) July TBD

2 2 2

1

2

3 to 5

1H16A 3Q16E 4Q16E

Pending FDA Approval

2016 Approval

Pre 2016 Approval Not Yet Launched or Re-introduction

3 products

launched

Targeting

4 product

launches

Targeting

5 to 7

product

launches

12

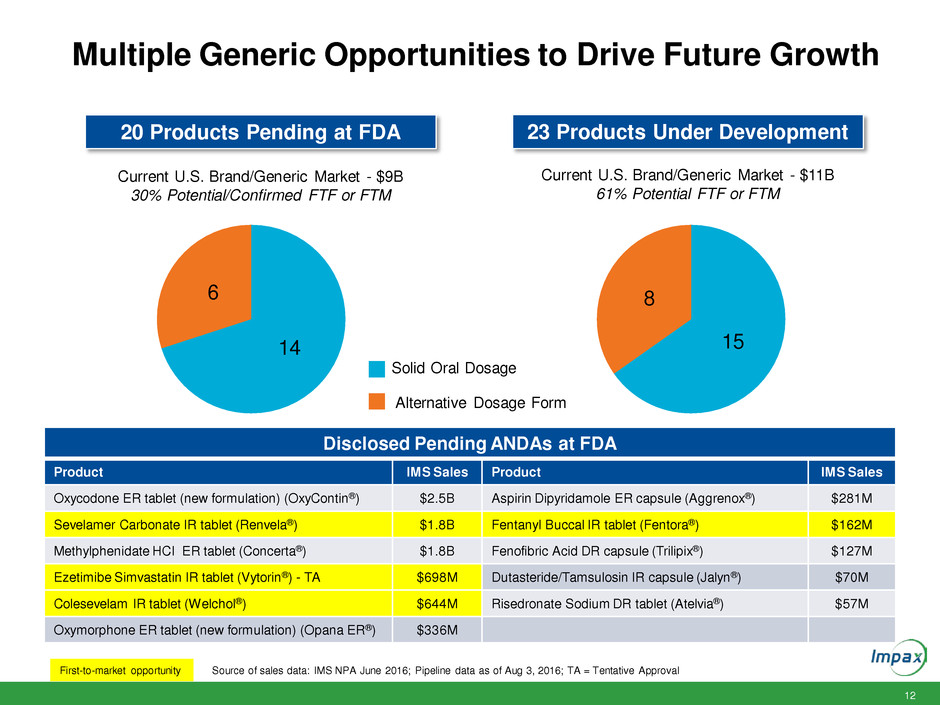

Multiple Generic Opportunities to Drive Future Growth

Solid Oral Dosage

Alternative Dosage Form

Current U.S. Brand/Generic Market - $9B

30% Potential/Confirmed FTF or FTM

Source of sales data: IMS NPA June 2016; Pipeline data as of Aug 3, 2016; TA = Tentative Approval

Current U.S. Brand/Generic Market - $11B

61% Potential FTF or FTM

14

6

20 Products Pending at FDA

15

8

23 Products Under Development

Disclosed Pending ANDAs at FDA

Product IMS Sales Product IMS Sales

Oxycodone ER tablet (new formulation) (OxyContin®) $2.5B Aspirin Dipyridamole ER capsule (Aggrenox®) $281M

Sevelamer Carbonate IR tablet (Renvela®) $1.8B Fentanyl Buccal IR tablet (Fentora®) $162M

Methylphenidate HCI ER tablet (Concerta®) $1.8B Fenofibric Acid DR capsule (Trilipix®) $127M

Ezetimibe Simvastatin IR tablet (Vytorin®) - TA $698M Dutasteride/Tamsulosin IR capsule (Jalyn®) $70M

Colesevelam IR tablet (Welchol®) $644M Risedronate Sodium DR tablet (Atelvia®) $57M

Oxymorphone ER tablet (new formulation) (Opana ER®) $336M

First-to-market opportunity

13

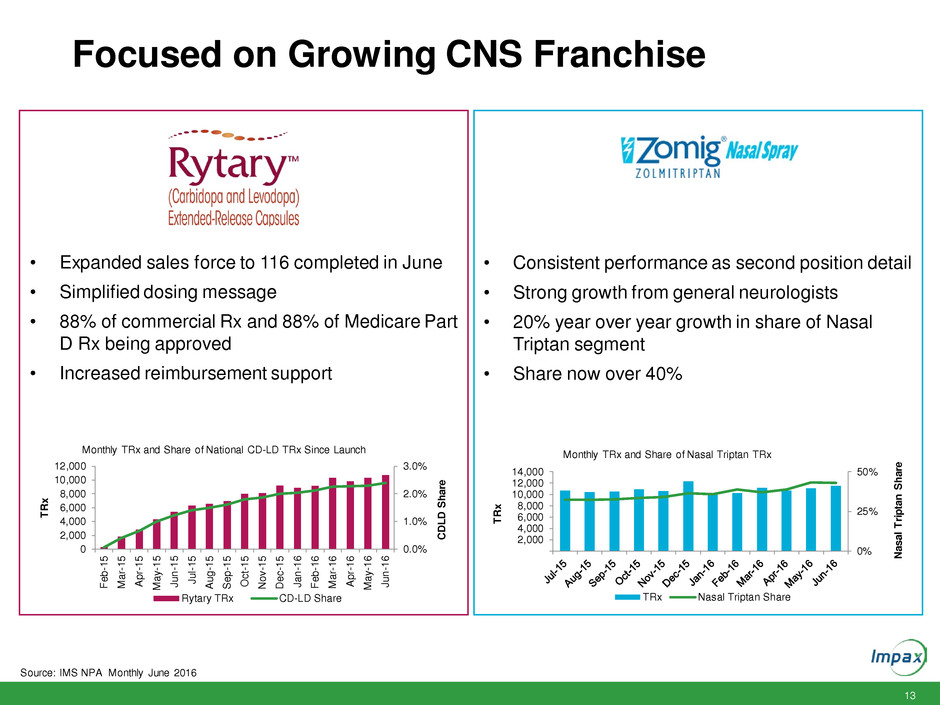

Focused on Growing CNS Franchise

0.0%

1.0%

2.0%

3.0%

0

2,000

4,000

6,000

8,000

10,000

12,000

F

eb

-1

5

M

ar

-1

5

A

pr

-1

5

M

ay

-1

5

Ju

n-

15

Ju

l-1

5

A

ug

-1

5

S

ep

-1

5

O

ct

-1

5

N

ov

-1

5

D

ec

-1

5

Ja

n-

16

F

eb

-1

6

M

ar

-1

6

A

pr

-1

6

M

ay

-1

6

Ju

n-

16

C

D

LD

S

ha

re

T

R

x

Monthly TRx and Share of National CD-LD TRx Since Launch

Rytary TRx CD-LD Share

0%

25%

50%

2,000

4,000

6,000

8,000

10,000

12,000

14,000

N

as

al

T

rip

ta

n

S

ha

re

T

R

x

Monthly TRx and Share of Nasal Triptan TRx

TRx Nasal Triptan Share

• Expanded sales force to 116 completed in June

• Simplified dosing message

• 88% of commercial Rx and 88% of Medicare Part

D Rx being approved

• Increased reimbursement support

• Consistent performance as second position detail

• Strong growth from general neurologists

• 20% year over year growth in share of Nasal

Triptan segment

• Share now over 40%

Source: IMS NPA Monthly June 2016

14

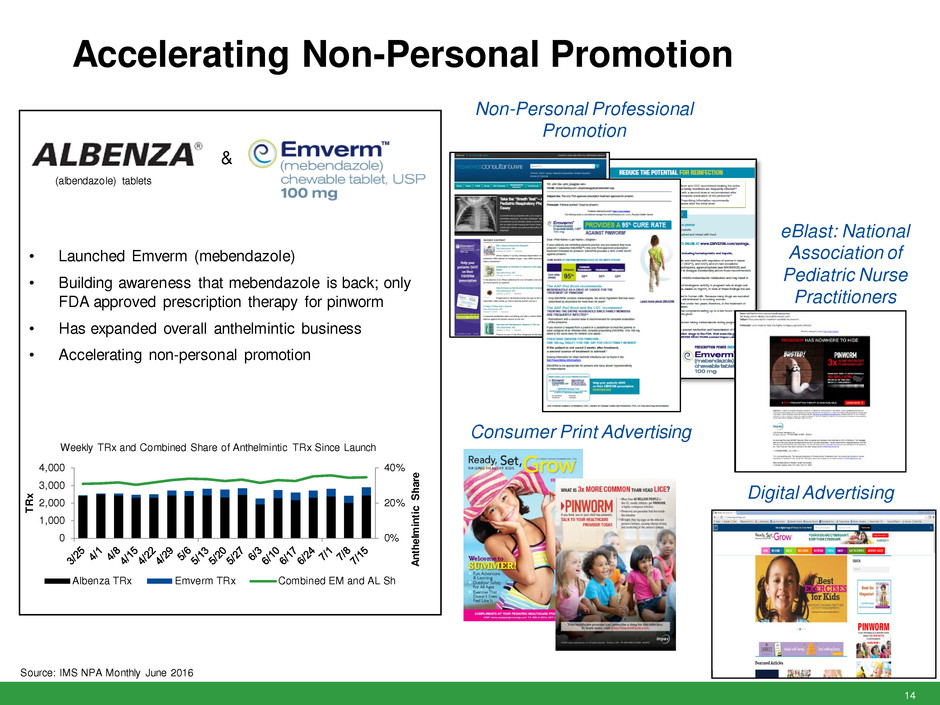

Accelerating Non-Personal Promotion

0%

20%

40%

0

1,000

2,000

3,000

4,000

A

nt

he

lm

in

ti

c

S

ha

re

T

R

x

Weekly TRx and Combined Share of Anthelmintic TRx Since Launch

Albenza TRx Emverm TRx Combined EM and AL Sh

(albendazole) tablets

&

• Launched Emverm (mebendazole)

• Building awareness that mebendazole is back; only

FDA approved prescription therapy for pinworm

• Has expanded overall anthelmintic business

• Accelerating non-personal promotion

Consumer Print Advertising

Digital Advertising

eBlast: National

Association of

Pediatric Nurse

Practitioners

Non-Personal Professional

Promotion

Source: IMS NPA Monthly June 2016

15

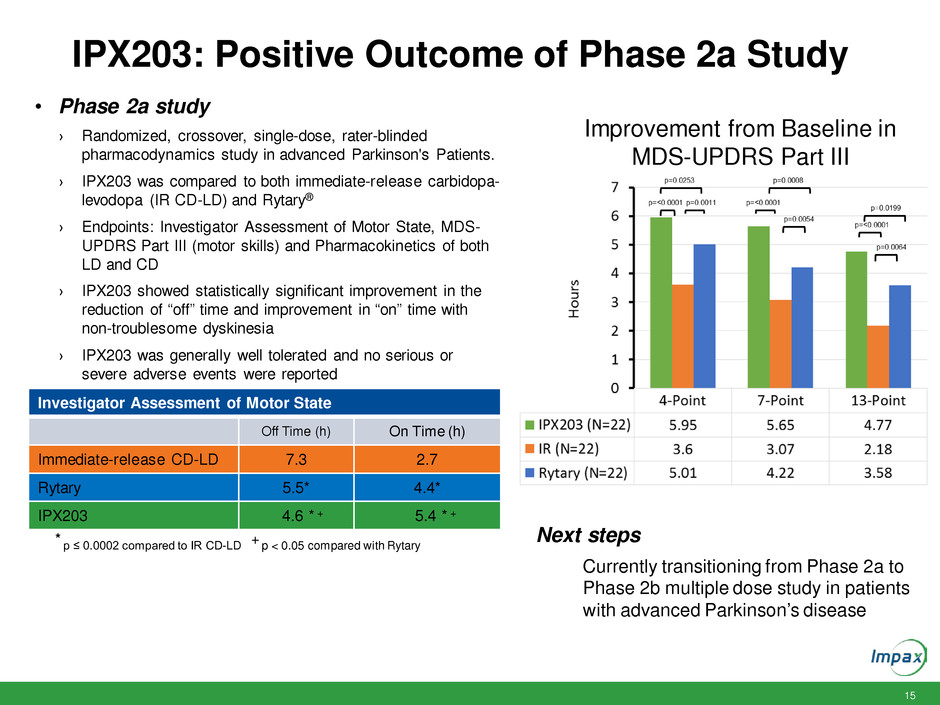

IPX203: Positive Outcome of Phase 2a Study

• Phase 2a study

› Randomized, crossover, single-dose, rater-blinded

pharmacodynamics study in advanced Parkinson's Patients.

› IPX203 was compared to both immediate-release carbidopa-

levodopa (IR CD-LD) and Rytary®

› Endpoints: Investigator Assessment of Motor State, MDS-

UPDRS Part III (motor skills) and Pharmacokinetics of both

LD and CD

› IPX203 showed statistically significant improvement in the

reduction of “off” time and improvement in “on” time with

non-troublesome dyskinesia

› IPX203 was generally well tolerated and no serious or

severe adverse events were reported

Investigator Assessment of Motor State

Off Time (h) On Time (h)

Immediate-release CD-LD 7.3 2.7

Rytary 5.5* 4.4*

IPX203 4.6 * + 5.4 * +

* p ≤ 0.0002 compared to IR CD-LD + p < 0.05 compared with Rytary

Improvement from Baseline in

MDS-UPDRS Part III

Next steps

Currently transitioning from Phase 2a to

Phase 2b multiple dose study in patients

with advanced Parkinson’s disease

16

2016 Priorities

• Maintain quality and compliance across all facilities / departments

• Sharpen focus on supply chain and cost efficiencies

• Improve conversion costs across global manufacturing network

Focus on Quality and Operations

• Optimize existing generic opportunities

• Launch up to 12 to 14 generic products

• Effectively utilize expanded Specialty Pharma sales force to drive growth

Maximize Dual Platform

• Successfully develop and bring to market new products

• Invest in sustainable generic and specialty pharma markets

Optimize R&D

• Execute on value enhancing business development and M&A

• Pursue generic and specialty pharma value creating opportunities

Business Development Acceleration

17

Financial Review and

2016 Financial Guidance

Bryan Reasons

Senior Vice President & Chief Financial Officer

18

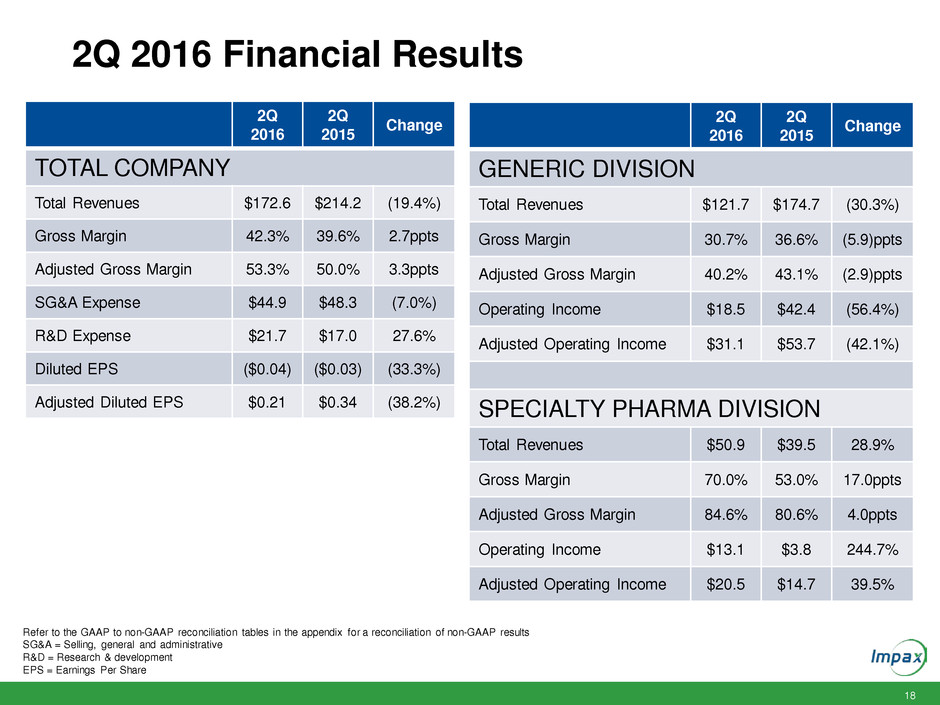

2Q 2016 Financial Results

2Q

2016

2Q

2015 Change

GENERIC DIVISION

Total Revenues $121.7 $174.7 (30.3%)

Gross Margin 30.7% 36.6% (5.9)ppts

Adjusted Gross Margin 40.2% 43.1% (2.9)ppts

Operating Income $18.5 $42.4 (56.4%)

Adjusted Operating Income $31.1 $53.7 (42.1%)

SPECIALTY PHARMA DIVISION

Total Revenues $50.9 $39.5 28.9%

Gross Margin 70.0% 53.0% 17.0ppts

Adjusted Gross Margin 84.6% 80.6% 4.0ppts

Operating Income $13.1 $3.8 244.7%

Adjusted Operating Income $20.5 $14.7 39.5%

2Q

2016

2Q

2015 Change

TOTAL COMPANY

Total Revenues $172.6 $214.2 (19.4%)

Gross Margin 42.3% 39.6% 2.7ppts

Adjusted Gross Margin 53.3% 50.0% 3.3ppts

SG&A Expense $44.9 $48.3 (7.0%)

R&D Expense $21.7 $17.0 27.6%

Diluted EPS ($0.04) ($0.03) (33.3%)

Adjusted Diluted EPS $0.21 $0.34 (38.2%)

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

SG&A = Selling, general and administrative

R&D = Research & development

EPS = Earnings Per Share

19

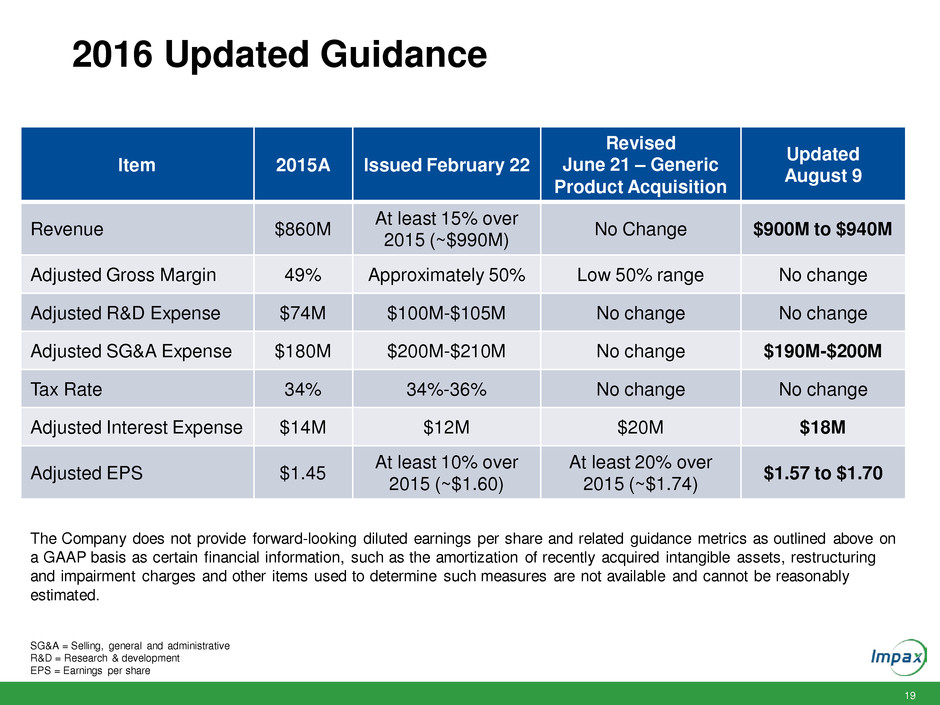

2016 Updated Guidance

Item 2015A Issued February 22

Revised

June 21 – Generic

Product Acquisition

Updated

August 9

Revenue $860M At least 15% over 2015 (~$990M) No Change $900M to $940M

Adjusted Gross Margin 49% Approximately 50% Low 50% range No change

Adjusted R&D Expense $74M $100M-$105M No change No change

Adjusted SG&A Expense $180M $200M-$210M No change $190M-$200M

Tax Rate 34% 34%-36% No change No change

Adjusted Interest Expense $14M $12M $20M $18M

Adjusted EPS $1.45 At least 10% over 2015 (~$1.60)

At least 20% over

2015 (~$1.74) $1.57 to $1.70

SG&A = Selling, general and administrative

R&D = Research & development

EPS = Earnings per share

The Company does not provide forward-looking diluted earnings per share and related guidance metrics as outlined above on

a GAAP basis as certain financial information, such as the amortization of recently acquired intangible assets, restructuring

and impairment charges and other items used to determine such measures are not available and cannot be reasonably

estimated.

20

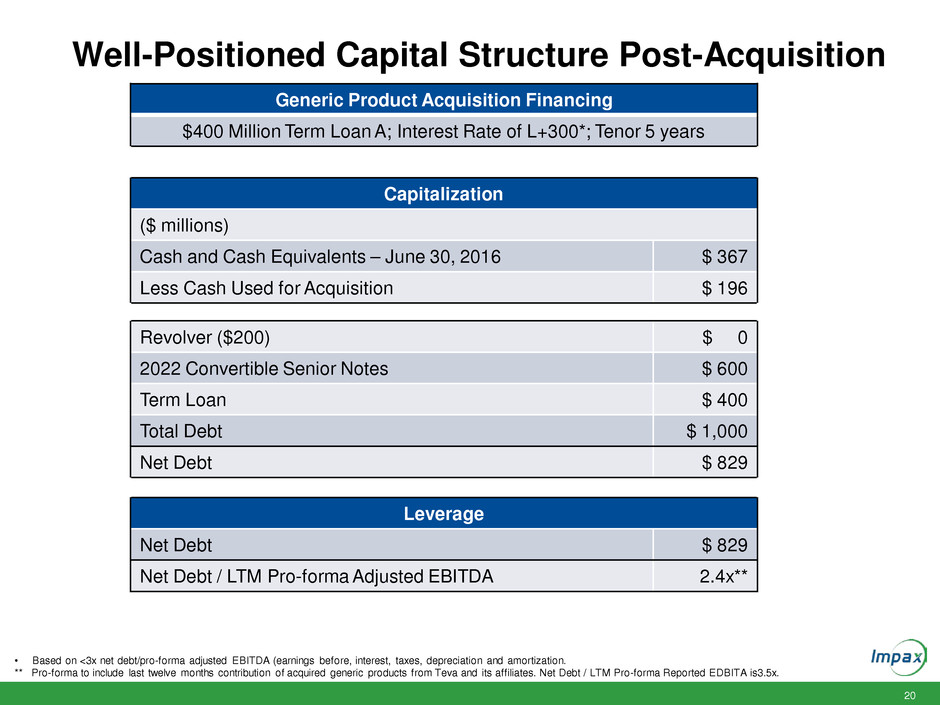

Well-Positioned Capital Structure Post-Acquisition

Generic Product Acquisition Financing

$400 Million Term Loan A; Interest Rate of L+300*; Tenor 5 years

Capitalization

($ millions)

Cash and Cash Equivalents – June 30, 2016 $ 367

Less Cash Used for Acquisition $ 196

Revolver ($200) $ 0

2022 Convertible Senior Notes $ 600

Term Loan $ 400

Total Debt $ 1,000

Net Debt $ 829

Leverage

Net Debt $ 829

Net Debt / LTM Pro-forma Adjusted EBITDA 2.4x**

• Based on <3x net debt/pro-forma adjusted EBITDA (earnings before, interest, taxes, depreciation and amortization.

** Pro-forma to include last twelve months contribution of acquired generic products from Teva and its affiliates. Net Debt / LTM Pro-forma Reported EDBITA is3.5x.

21

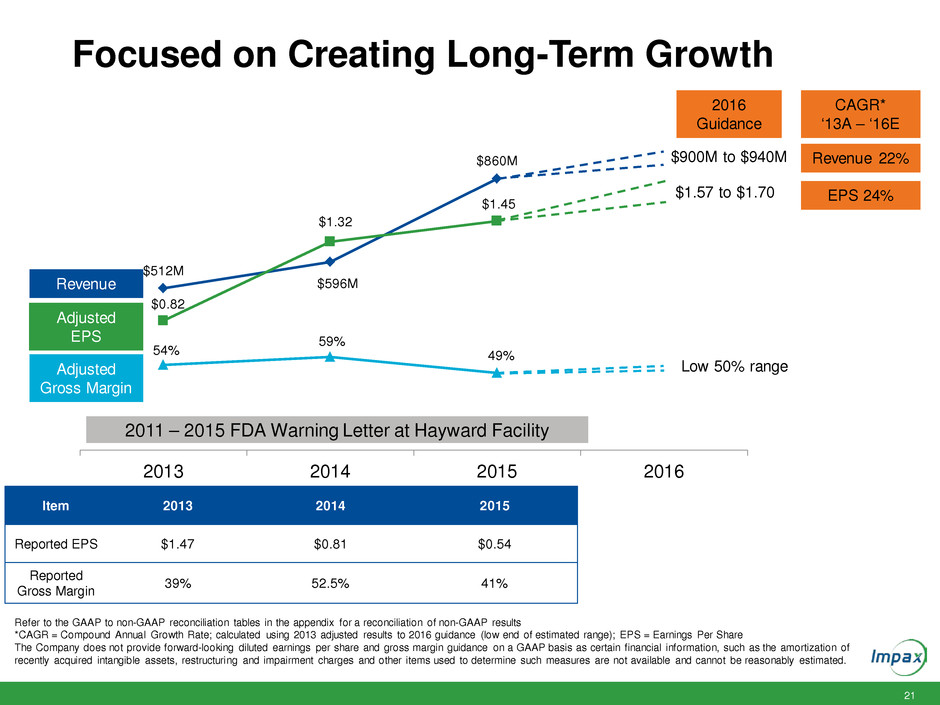

$512M

$596M

$860M

$0.82

$1.32

$1.45

54%

59%

49%

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

$1.80

$2.00

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2013 2014 2015 2016

Focused on Creating Long-Term Growth

2011 – 2015 FDA Warning Letter at Hayward Facility

$900M to $940M

$1.57 to $1.70

Low 50% range

Revenue

Adjusted

EPS

Adjusted

Gross Margin

CAGR*

‘13A – ‘16E

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

*CAGR = Compound Annual Growth Rate; calculated using 2013 adjusted results to 2016 guidance (low end of estimated range); EPS = Earnings Per Share

The Company does not provide forward-looking diluted earnings per share and gross margin guidance on a GAAP basis as certain financial information, such as the amortization of

recently acquired intangible assets, restructuring and impairment charges and other items used to determine such measures are not available and cannot be reasonably estimated.

Revenue 22%

EPS 24%

2016

Guidance

Item 2013 2014 2015

Reported EPS $1.47 $0.81 $0.54

Reported

Gross Margin 39% 52.5% 41%

22

Q&A

23

Appendix

24

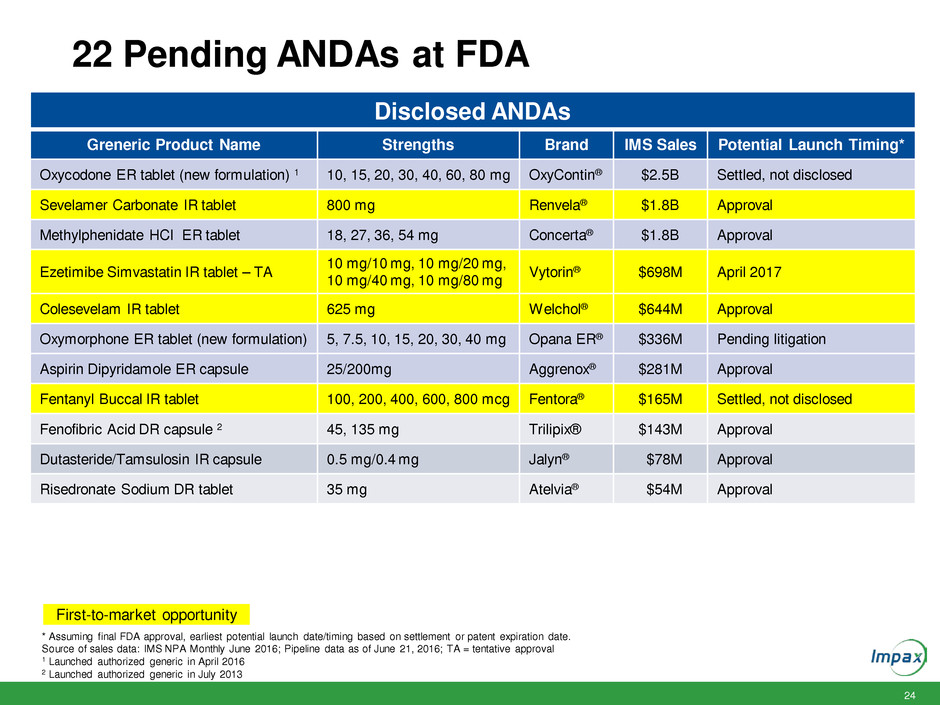

22 Pending ANDAs at FDA

* Assuming final FDA approval, earliest potential launch date/timing based on settlement or patent expiration date.

Source of sales data: IMS NPA Monthly June 2016; Pipeline data as of June 21, 2016; TA = tentative approval

1 Launched authorized generic in April 2016

2 Launched authorized generic in July 2013

First-to-market opportunity

Disclosed ANDAs

Greneric Product Name Strengths Brand IMS Sales Potential Launch Timing*

Oxycodone ER tablet (new formulation) 1 10, 15, 20, 30, 40, 60, 80 mg OxyContin® $2.5B Settled, not disclosed

Sevelamer Carbonate IR tablet 800 mg Renvela® $1.8B Approval

Methylphenidate HCI ER tablet 18, 27, 36, 54 mg Concerta® $1.8B Approval

Ezetimibe Simvastatin IR tablet – TA 10 mg/10 mg, 10 mg/20 mg, 10 mg/40 mg, 10 mg/80 mg Vytorin

® $698M April 2017

Colesevelam IR tablet 625 mg Welchol® $644M Approval

Oxymorphone ER tablet (new formulation) 5, 7.5, 10, 15, 20, 30, 40 mg Opana ER® $336M Pending litigation

Aspirin Dipyridamole ER capsule 25/200mg Aggrenox® $281M Approval

Fentanyl Buccal IR tablet 100, 200, 400, 600, 800 mcg Fentora® $165M Settled, not disclosed

Fenofibric Acid DR capsule 2 45, 135 mg Trilipix® $143M Approval

Dutasteride/Tamsulosin IR capsule 0.5 mg/0.4 mg Jalyn® $78M Approval

Risedronate Sodium DR tablet 35 mg Atelvia® $54M Approval

25

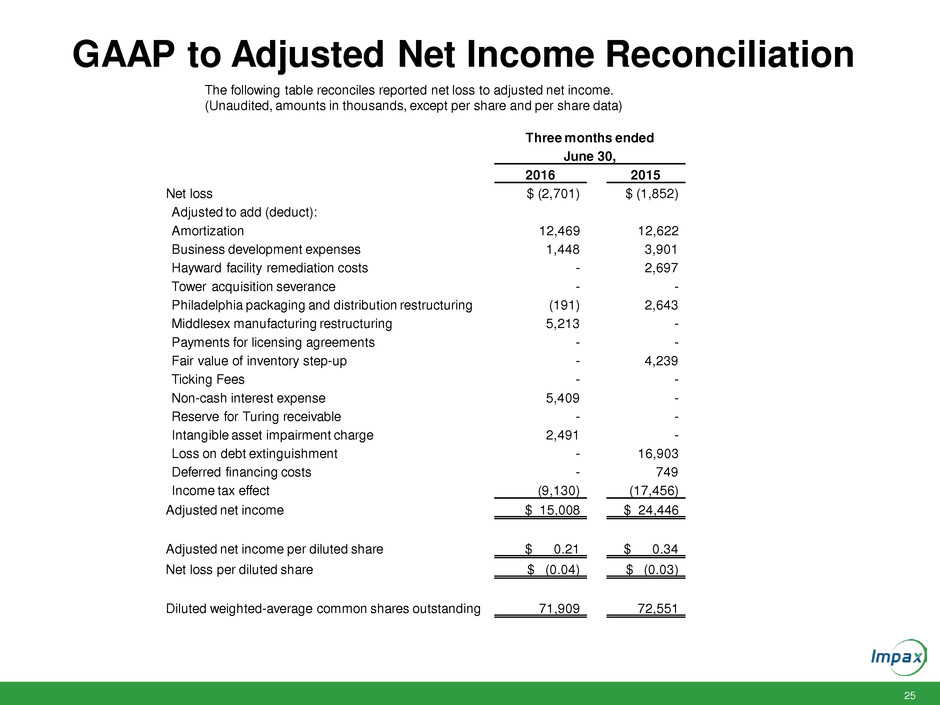

GAAP to Adjusted Net Income Reconciliation

The following table reconciles reported net loss to adjusted net income.

(Unaudited, amounts in thousands, except per share and per share data)

Three months ended

June 30,

2016 2015

Net loss $ (2,701) $ (1,852)

Adjusted to add (deduct):

Amortization 12,469 12,622

Business development expenses 1,448 3,901

Hayward facility remediation costs - 2,697

Tower acquisition severance - -

Philadelphia packaging and distribution restructuring (191) 2,643

Middlesex manufacturing restructuring 5,213 -

Payments for licensing agreements - -

Fair value of inventory step-up - 4,239

Ticking Fees - -

Non-cash interest expense 5,409 -

Reserve for Turing receivable - -

Intangible asset impairment charge 2,491 -

Loss on debt extinguishment - 16,903

Deferred financing costs - 749

Income tax effect (9,130) (17,456)

Adjusted net income $ 15,008 $ 24,446

Adjusted net income per diluted share $ 0.21 $ 0.34

Net loss per diluted share $ (0.04) $ (0.03)

Diluted weighted-average common shares outstanding 71,909 72,551

26

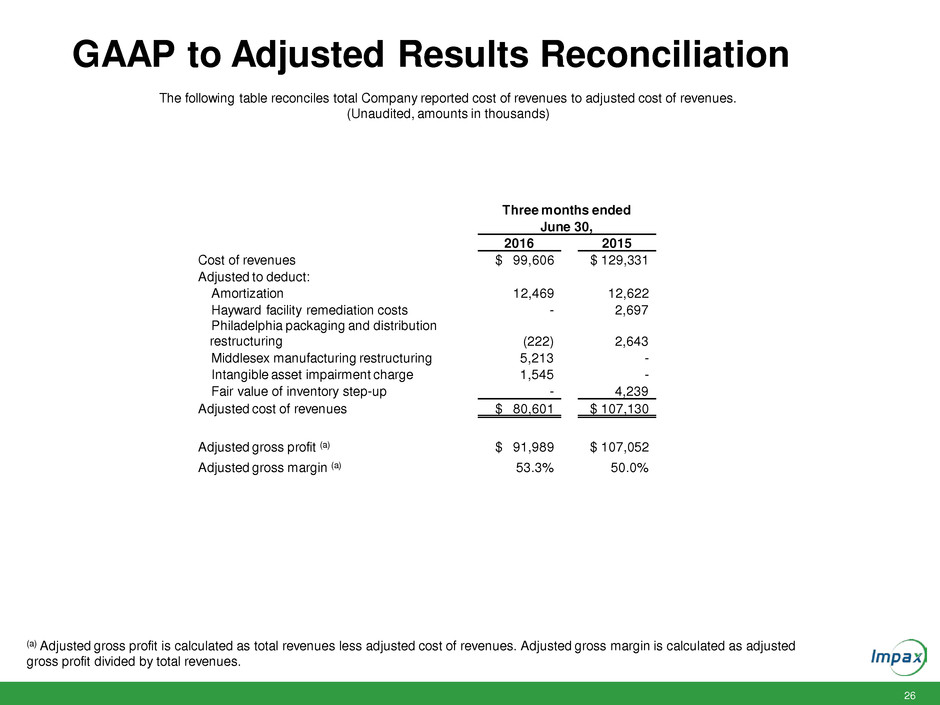

GAAP to Adjusted Results Reconciliation

The following table reconciles total Company reported cost of revenues to adjusted cost of revenues.

(Unaudited, amounts in thousands)

Three months ended

June 30,

2016 2015

Cost of revenues $ 99,606 $ 129,331

Adjusted to deduct:

Amortization 12,469 12,622

Hayward facility remediation costs - 2,697

Philadelphia packaging and distribution

restructuring (222) 2,643

Middlesex manufacturing restructuring 5,213 -

Intangible asset impairment charge 1,545 -

Fair value of inventory step-up - 4,239

Adjusted cost of revenues $ 80,601 $ 107,130

Adjusted gross profit (a) $ 91,989 $ 107,052

Adjusted gross margin (a) 53.3% 50.0%

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted

gross profit divided by total revenues.

27

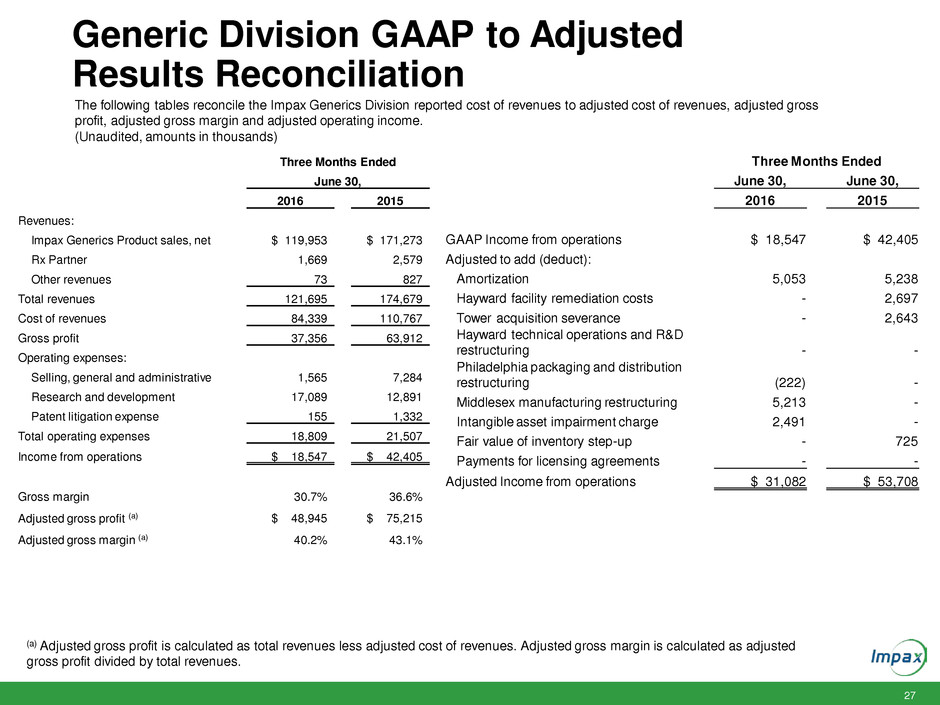

Generic Division GAAP to Adjusted

Results Reconciliation

The following tables reconcile the Impax Generics Division reported cost of revenues to adjusted cost of revenues, adjusted gross

profit, adjusted gross margin and adjusted operating income.

(Unaudited, amounts in thousands)

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted

gross profit divided by total revenues.

Three Months Ended

June 30,

2016 2015

Revenues:

Impax Generics Product sales, net $ 119,953 $ 171,273

Rx Partner 1,669 2,579

Other revenues 73 827

Total revenues 121,695 174,679

Cost of revenues 84,339 110,767

Gross profit 37,356 63,912

Operating expenses:

Selling, general and administrative 1,565 7,284

Research and development 17,089 12,891

Patent litigation expense 155 1,332

Total operating expenses 18,809 21,507

Income from operations $ 18,547 $ 42,405

Gross margin 30.7% 36.6%

Adjusted gross profit (a) $ 48,945 $ 75,215

Adjusted gross margin (a) 40.2% 43.1%

Three Months Ended

June 30, June 30,

2016 2015

GAAP Income from operations $ 18,547 $ 42,405

Adjusted to add (deduct):

Amortization 5,053 5,238

Hayward facility remediation costs - 2,697

Tower acquisition severance - 2,643

Hayward technical operations and R&D

restructuring - -

Philadelphia packaging and distribution

restructuring (222) -

Middlesex manufacturing restructuring 5,213 -

Intangible asset impairment charge 2,491 -

Fair value of inventory step-up - 725

Payments for licensing agreements - -

Adjusted Income from operations $ 31,082 $ 53,708

28

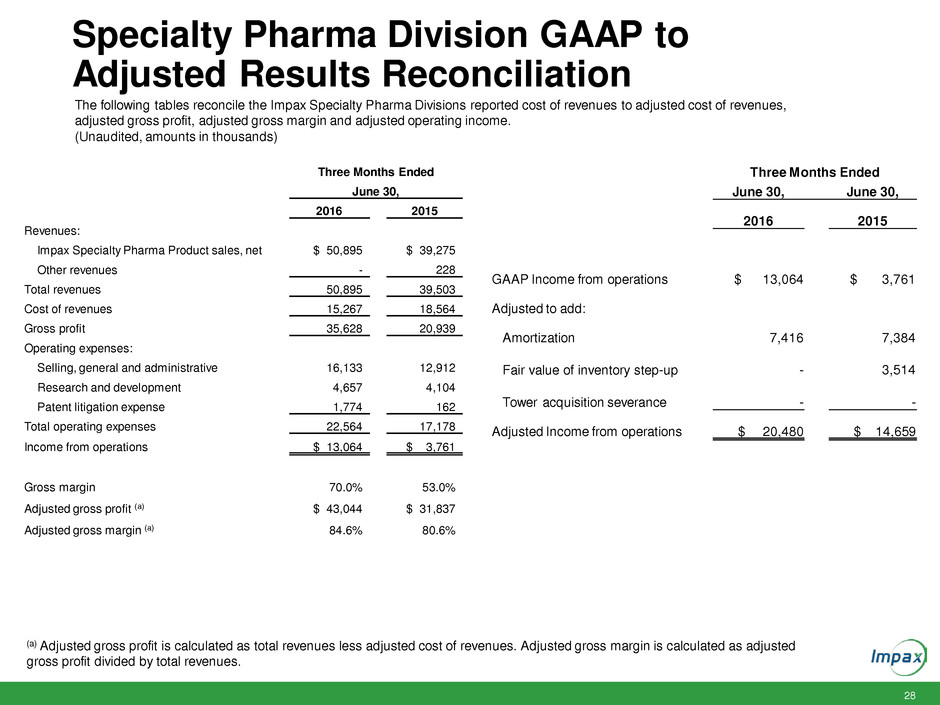

Specialty Pharma Division GAAP to

Adjusted Results Reconciliation

The following tables reconcile the Impax Specialty Pharma Divisions reported cost of revenues to adjusted cost of revenues,

adjusted gross profit, adjusted gross margin and adjusted operating income.

(Unaudited, amounts in thousands)

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted

gross profit divided by total revenues.

Three Months Ended

June 30,

2016 2015

Revenues:

Impax Specialty Pharma Product sales, net $ 50,895 $ 39,275

Other revenues - 228

Total revenues 50,895 39,503

Cost of revenues 15,267 18,564

Gross profit 35,628 20,939

Operating expenses:

Selling, general and administrative 16,133 12,912

Research and development 4,657 4,104

Patent litigation expense 1,774 162

Total operating expenses 22,564 17,178

Income from operations $ 13,064 $ 3,761

Gross margin 70.0% 53.0%

Adjusted gross profit (a) $ 43,044 $ 31,837

Adjusted gross margin (a) 84.6% 80.6%

Three Months Ended

June 30, June 30,

2016 2015

GAAP Income from operations $ 13,064 $ 3,761

Adjusted to add:

Amortization 7,416 7,384

Fair value of inventory step-up -

3,514

Tower acquisition severance -

-

Adjusted Income from operations $ 20,480 $ 14,659