Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FULTON FINANCIAL CORP | a8-k6x30x16.htm |

| EX-99.1 - PRESS RELEASE DATED JULY 19, 2016 - FULTON FINANCIAL CORP | exhibit9916-30x16.htm |

| EX-99.2 - SUPPLEMENTAL FINANCIAL INFORMATION FOR THE QUARTER ENDED JUNE 30, 2016 - FULTON FINANCIAL CORP | exhibit9926-30x16.htm |

D A T A A S O F J U N E 3 0 , 2 0 1 6

U N L E S S O T H E R W I S E N O T E D

2016 SECOND QUARTER RESULTS

NASDAQ: FULT

FORWARD-LOOKING STATEMENTS

This presentation may contain forward-looking statements with respect to Fulton Financial Corporation’s financial

condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking

statements can be identified by the use of words such as “may,” “should,” “will,” “could,” “estimates,” “predicts,”

“potential,” “continue,” “anticipates,” “believes,” “plans,” “expects,” “future,” “intends” and similar expressions which

are intended to identify forward-looking statements. Management’s “2016 Outlook” contained herein is comprised of

forward-looking statements.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, some

of which are beyond the Corporation’s control and ability to predict, that could cause actual results to differ materially

from those expressed in the forward-looking statements. The Corporation undertakes no obligation, other than as

required by law, to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise.

A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the

Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found

in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2015 and Quarterly

Report on Form 10-Q for the quarter ended March 31, 2016, which have been filed with the Securities and Exchange

Commission and are available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the

Securities and Exchange Commission’s website (www.sec.gov).

The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures

are reconciled to the most comparable GAAP measures at the end of this presentation.

2

SECOND QUARTER HIGHLIGHTS

Diluted Earnings Per Share: $0.23 in 2Q16, 4.5% increase from 1Q16 and 9.5% increase from 2Q15

Pre-Provision Net Revenue: $53.3 million, 4.9% increase from 1Q16 and 9.7% increase from 2Q15

Linked Quarter

Loan and Core Deposit Growth: 0.8% increase in average loans, while average core deposits increased 1.6%

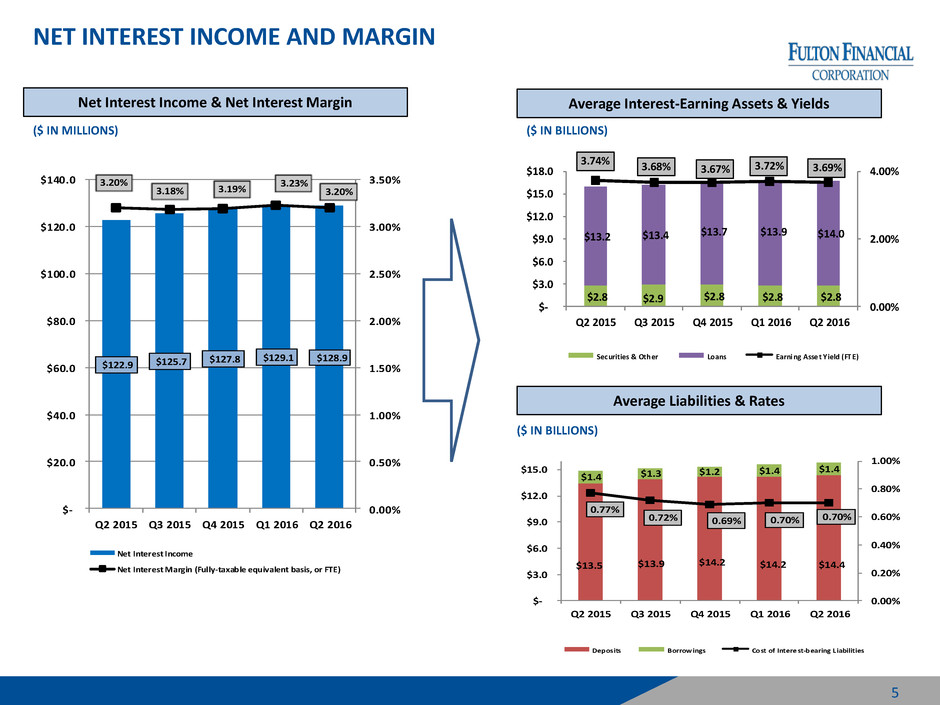

Net Interest Income & Margin: Net interest income was flat, reflecting a 3 basis point decrease in net

interest margin, offset by the impact of loan growth

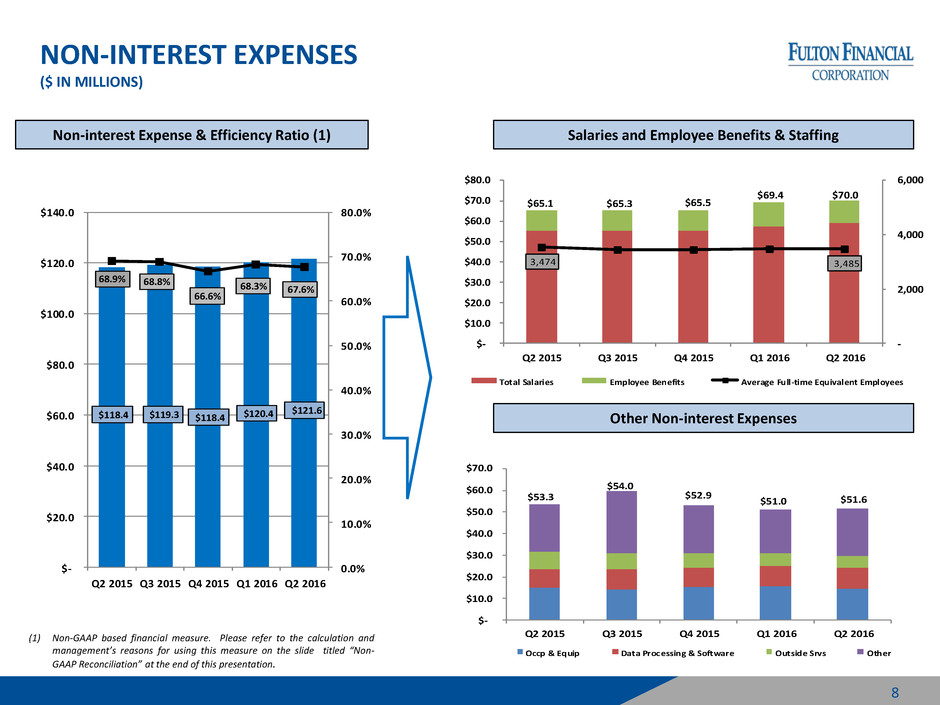

Non-Interest Income(1) & Non-Interest Expense: 9.2% increase in non-interest income and a 1.0% increase in

non-interest expense

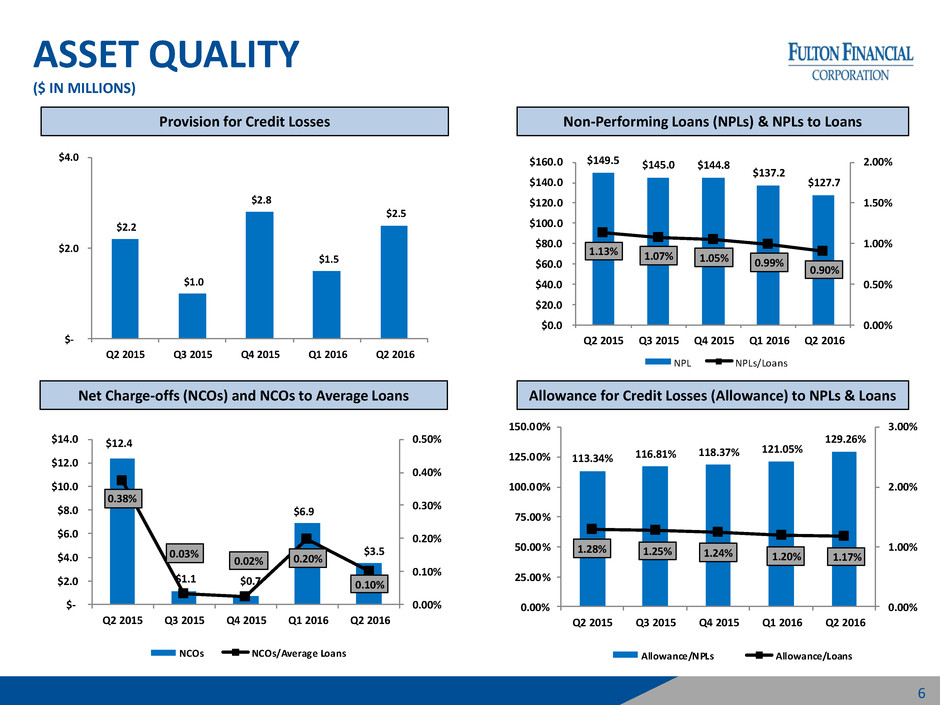

Asset Quality: $981,000 increase in provision for credit losses with improvement in all credit metrics.

Annualized net charge-off rate decreased from 20 basis points to 10 basis points.

Year-over-Year

Loan and Core Deposit Growth: 5.9% increase in average loans and 10.2% increase in average core deposits

Net Interest Income & Margin: 4.9% increase in net interest income and net interest margin unchanged

Non-Interest Income(1) & Non-Interest Expense: 4.5% increase in non-interest income and a 2.8% increase in

non-interest expense

Asset Quality: $311,000 increase in provision for credit losses. Improvement in all credit metrics.

3

(1) Excluding securities gains.

INCOME STATEMENT SUMMARY

Net Income of $39.8 million; a 3.9% increase from

1Q16 and an 8.4% increase from 2Q15. Earnings per

share increased 4.5% from 1Q16 and 9.5% from

2Q15.

Net Interest Income

From 1Q16: Flat, reflecting a 3 bp decrease in net interest

margin (NIM), offset by the impact of a 0.7% increase in

average earning assets

From 2Q15: Increase of 4.9% due to a 5.3% increase in average

earning assets

Loan Loss Provision

$2.5 million provision in 2Q16; Asset quality metrics continue

to improve

Non-Interest Income

From 1Q16 : Increase of 9.2% driven by increases in

commercial loan interest rate swap fees, merchant fees, life

insurance income, debit card fees, and gains on sales of SBA

loans

From 2Q15 : Increase of 4.5% due to increased commercial

loan interest rate swap fees, other service charges, and gains

on sales of SBA loans, partially offset by decrease in mortgage

banking income

Non-Interest Expenses

From 1Q16: Increase of 1.0% due to higher professional fees

and salaries and benefits, partially offset by net decreases in

outside services, equipment and occupancy expenses

From 2Q15: Increase of 2.8% due mainly to higher salaries and

benefits, professional fees, data processing and software,

partially offset by a decrease in expenses for outside services

4

(1) ROA is return an average assets determined by dividing net income for the period indicated by average assets.

(2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation.

2Q16 1Q16 2Q15

Net Interest Income 128,916$ (138)$ 5,996$

Provision for Credit Losses 2,511 981 311

Non-interest Income 46,061 3,871 1,987

Securities Gains 76 (871) (2,339)

Non-interest Expense 121,637 1,224 3,283

Income before Income Taxes 50,905 657 2,050

Income Taxes 11,155 (836) (1,020)

Net Income 39,750$ 1,493$ 3,070$

Earnings Per Share (Diluted) 0.23$ 0.01$ 0.02$

ROA (1) 0.88% 0.02% 0.02%

ROE (tangible) (2) 10.26% 0.19% 0.43%

Efficiency rati (2) 67.6% (0.7%) (1.4%)

(dollars in thousands, except per-share data)

Change from

NET INTEREST INCOME AND MARGIN

Net Interest Income & Net Interest Margin

~ $730

million

~ $610

million

$122.9 $125.7

$127.8 $129.1 $128.9

3.20%

3.18% 3.19%

3.23%

3.20%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Net Interest Income

Net Interest Margin (Fully-taxable equivalent basis, or FTE)

Average Interest-Earning Assets & Yields

Average Liabilities & Rates

$2.8 $2.9 $2.8 $2.8 $2.8

$13.2 $13.4 $13.7 $13.9 $14.0

3.74% 3.68% 3.67% 3.72% 3.69%

0.00%

2.00%

4.00%

$-

$3.0

$6.0

$9.0

$12.0

$15.0

$18.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Securities & Other Loans Earni ng Asse t Y ield (FT E)

$13.5 $13.9 $14.2 $14.2 $14.4

$1.4 $1.3

$1.2 $1.4 $1.4

0.77%

0.72% 0.69% 0.70% 0.70%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

$-

$3.0

$6.0

$9.0

$12.0

$15.

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Deposits Borrow ings Cost of Intere st-bearing Liabilities

($ IN MILLIONS) ($ IN BILLIONS)

($ IN BILLIONS)

5

ASSET QUALITY

($ IN MILLIONS)

6

Provision for Credit Losses Non-Performing Loans (NPLs) & NPLs to Loans

113.34% 116.81%

118.37% 121.05%

129.26%

1.28% 1.25% 1.24% 1.20% 1.17%

0.00%

1.00%

2.00%

3.00%

0.00%

25.00%

50.00%

75.00%

100.00%

125.00%

150.00%

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Allowance/NPLs Allowance/Loans

Net Charge-offs (NCOs) and NCOs to Average Loans Allowance for Credit Losses (Allowance) to NPLs & Loans

$12.4

$1.1 $0.7

$6.9

$3.5

0.38%

0.03%

0.02% 0.20%

0.10%

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

$-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

Q2 2015 Q3 2015 Q4 2015 1 6 2 2016

NCOs NCOs/Average Loans

$2.2

$1.0

$2.8

$1.5

$2.5

$-

$2.0

$4.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

$149.5 $145.0 $144.8

$137.2

$127.7

1.13% 1.07% 1.05% 0.99%

0.90%

0.00%

0.50%

1.00

1.50%

2.00%

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

NPL NPLs/Loans

NON-INTEREST INCOME

($ IN MILLIONS)

Non-interest Income, Excluding Securities Gains

~ $730

million

~ $610

million

$44.1

$43.0

$45.1

$42.2

$46.1

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

$50.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Mortgage Banking Income & Spreads

Other Non-interest Income

1.62%

1.17%

1.60%

1.28%

1.71%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

$(1.0)

$-

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016(2)

Gains on Sales Servicing Income Spread on Sales (1)

$5.3

$3.9

$4.3 $4.0

$3.9

$-

$5.0

$10.0

$15.0

$20.0

$25.

$30.0

$35.0

$40.0

$45.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Invt Mgmt & Trust Srvs Deposit Srv Chgs Oth Srv Chgs Other

$38.7 $39.2

$40.7

$38.2

$42.2

(1) Represents Gains on Sales divided by total new commitments to originate residential

mortgage loans for customers.

(2) Servicing income includes $1.7 million Mortgage Servicing Right (MSR) impairment charge

in Q2 2016.

7

Includes $1.7 MSR

impairment charge

NON-INTEREST EXPENSES

($ IN MILLIONS)

Non-interest Expense & Efficiency Ratio (1)

~ $730

million

~ $610

million

$118.4 $119.3 $118.4 $120.4

$121.6

68.9% 68.8%

66.6%

68.3% 67.6%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Salaries and Employee Benefits & Staffing

Other Non-interest Expenses

3,474 3,485

-

2,000

4,000

6,000

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Total Salaries Employee Benefits Average Full-time Equivalent Employees

$65.1 $65.3 $65.5

$69.4 $70.0

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Occp & Equip Data Processing & Software Outside Srvs Other

$53.3

$54.0

$52.9

$51.0 $51.6

(1) Non-GAAP based financial measure. Please refer to the calculation and

management’s reasons for using this measure on the slide titled “Non-

GAAP Reconciliation” at the end of this presentation.

8

$1.8 $2.1

$3.2

$4.3

$2.2

$4.6

$1.4

$8.2

$4.5

$2.1

$0.4

$1.4

$0.2

13

26

30

45

47

51

0

10

20

30

40

50

60

$-

$3.0

$6.0

$9.0

$12.0

2011 2012 2013 2014 2015 YTD 6/2016

Salaries & Benefits Expense Outside Consulting Services(1) Temporary Employee Expense Staffing

$0.8$0.1

COMPLIANCE & RISK MANAGEMENT

(1) Represents third-party consulting and legal services directly related to BSA/AML compliance program.

To

tal

E

xp

e

n

se

s,

in

m

ill

io

n

s

• Strengthening Risk Management and Compliance infrastructures

• Address deficiencies within BSA/AML compliance

• BSA/AML enforcement actions at the Corporation and banking subsidiaries

• Significant investments in personnel, outside services and systems

BSA/AML Compliance Program Expenses and Staffing

To

tal

N

u

m

b

e

r o

f Em

p

lo

ye

e

s at

Pe

rio

d

En

d

9

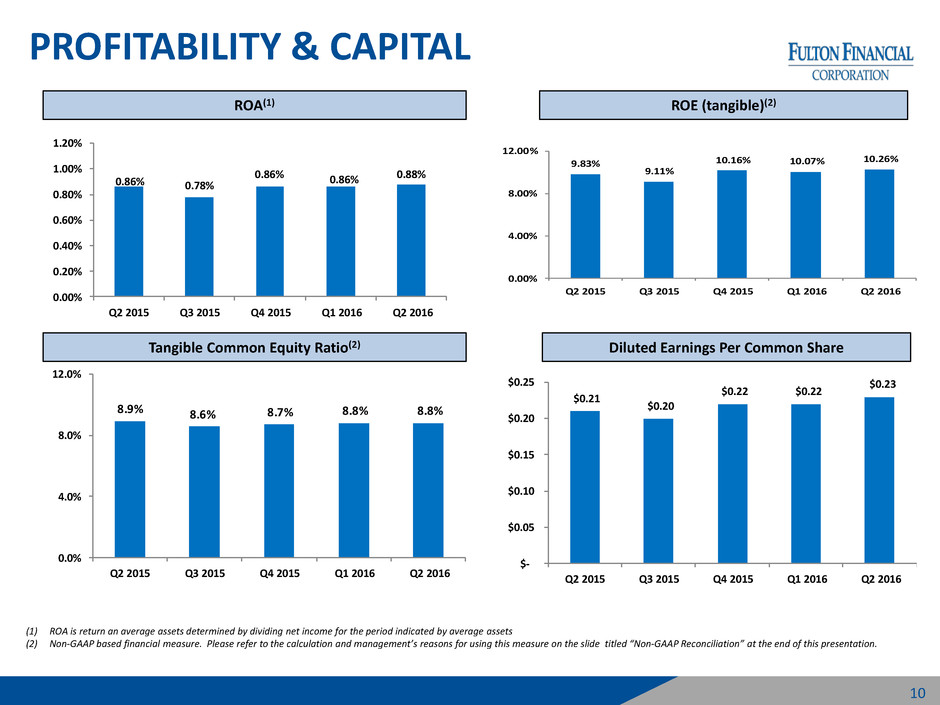

PROFITABILITY & CAPITAL

10

ROA(1) ROE (tangible)(2)

Tangible Common Equity Ratio(2) Diluted Earnings Per Common Share

9.83%

9.11%

10.16% 10.07% 10.26%

0.00%

4.00%

8.00%

12.00%

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

0.86% 0.78%

0.86% 0.86% 0.88%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

(1) ROA is return an average assets determined by dividing net income for the period indicated by average assets

(2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation.

8.9% 8.6% 8.7% 8.8% 8.8%

0.0%

4.

8.

12.0

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

$0.21

$0.20

$0.22 $0.22

$0.23

$-

$0.05

$0.10

$0.15

$0.20

$0.25

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

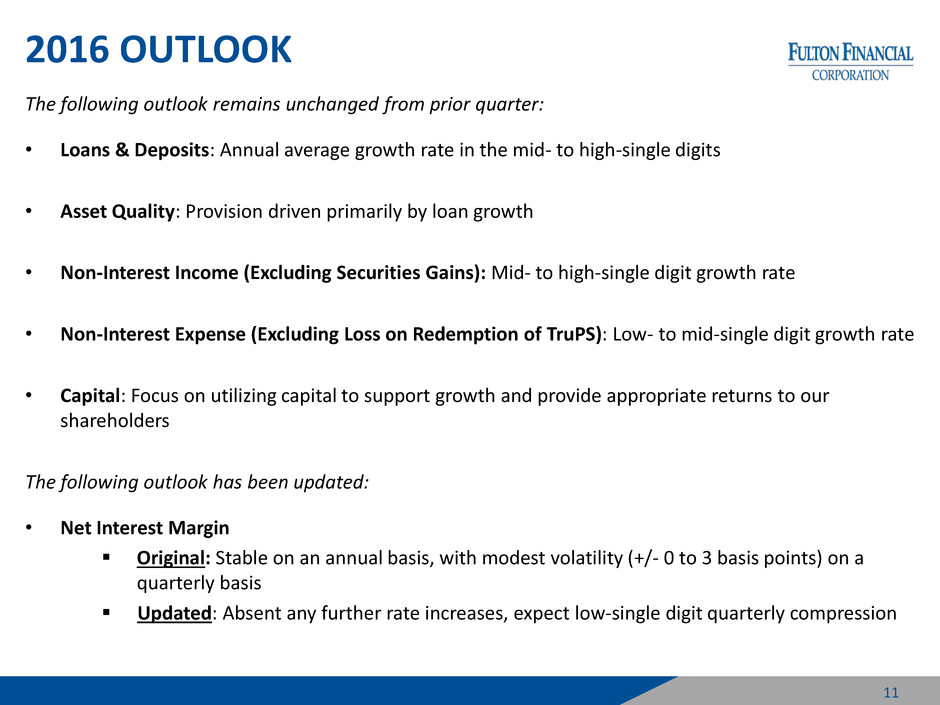

2016 OUTLOOK

The following outlook remains unchanged from prior quarter:

• Loans & Deposits: Annual average growth rate in the mid- to high-single digits

• Asset Quality: Provision driven primarily by loan growth

• Non-Interest Income (Excluding Securities Gains): Mid- to high-single digit growth rate

• Non-Interest Expense (Excluding Loss on Redemption of TruPS): Low- to mid-single digit growth rate

• Capital: Focus on utilizing capital to support growth and provide appropriate returns to our

shareholders

The following outlook has been updated:

• Net Interest Margin

Original: Stable on an annual basis, with modest volatility (+/- 0 to 3 basis points) on a

quarterly basis

Updated: Absent any further rate increases, expect low-single digit quarterly compression

11

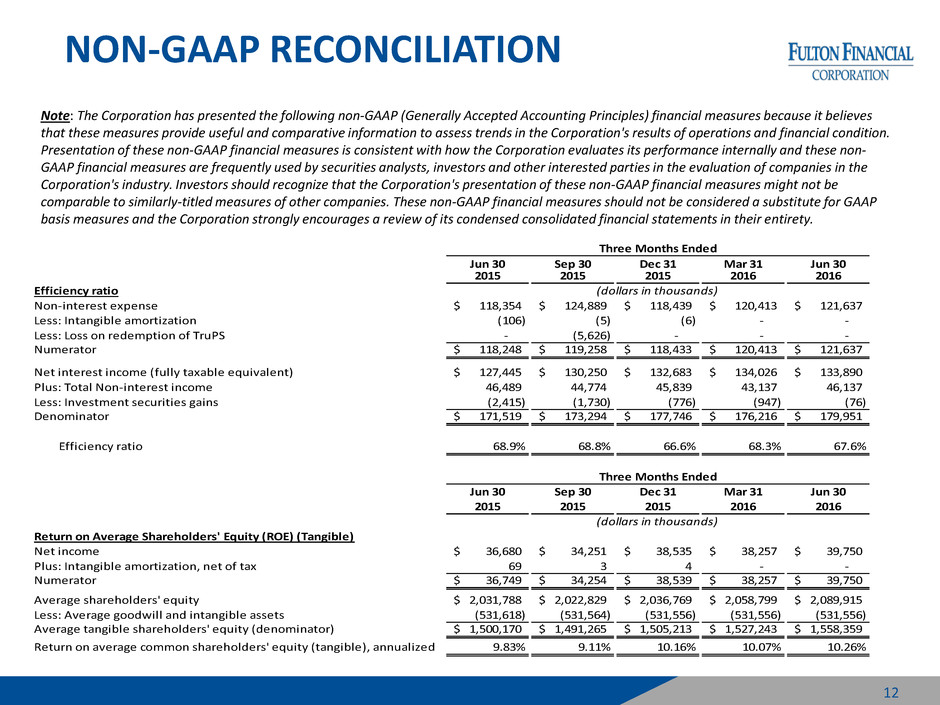

NON-GAAP RECONCILIATION

Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes

that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition.

Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non-

GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the

Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be

comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP

basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety.

12

Jun 30 Sep 30 Dec 31 Mar 31 Jun 30

2015 2015 2015 2016 2016

Efficiency ratio

Non-interest expense 118,354$ 124,889$ 118,439$ 120,413$ 121,637$

Less: Intangible amortization (106) (5) (6) - -

Less: Loss on redemption of TruPS - (5,626) - - -

Numerator 118,248$ 119,258$ 118,433$ 120,413$ 121,637$

Net interest income (fully taxable equivalent) 127,445$ 130,250$ 132,683$ 134,026$ 133,890$

Plus: Total Non-interest income 46,489 44,774 45,839 43,137 46,137

Less: Investment securities gains (2,415) (1,730) (776) (947) (76)

Denominator 171,519$ 173,294$ 177,746$ 176,216$ 179,951$

Efficiency ratio 68.9% 68.8% 66.6% 68.3% 67.6%

Jun 30 Sep 30 Dec 31 Mar 31 Jun 30

2015 2015 2015 2016 2016

Return on Average Shareholders' Equity (ROE) (Tangible)

Net income 36,680$ 34,251$ 38,535$ 38,257$ 39,750$

Plus: Inta g bl amortization, net of tax 69 3 4 - -

N m rator 36,749$ 34,254$ 38,539$ 38,257$ 39,750$

Average shareholders' equity 2,031,788$ 2,022,829$ 2,036,769$ 2,058,799$ 2,089,915$

Less: Average goodwill and intangible assets (531,618) (531,564) (531,556) (531,556) (531,556)

Average tangible shareholders' equity (denominator) 1,500,170$ 1,491,265$ 1,505,213$ 1,527,243$ 1,558,359$

Return on average common shareholders' equity (tangible), annualized 9.83% 9.11% 10.16% 10.07% 10.26%

Three Months Ended

Three Months Ended

(dollars in thousands)

(dollars in thousands)

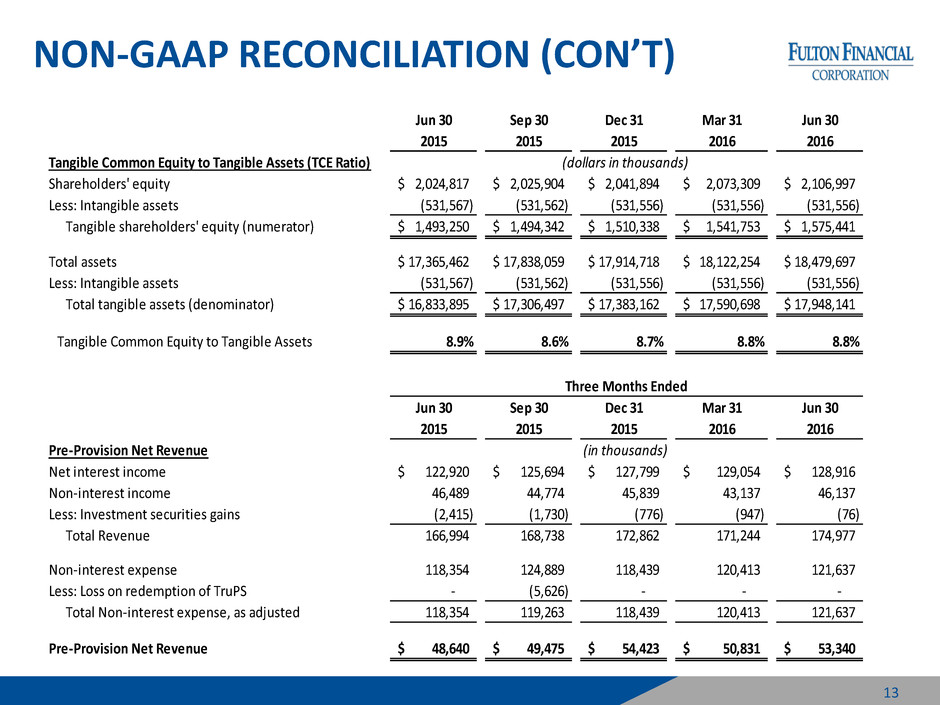

NON-GAAP RECONCILIATION (CON’T)

13

Jun 30 Sep 30 Dec 31 Mar 31 Jun 30

2015 2015 2015 2016 2016

Tangible Common Equity to Tangible Assets (TCE Ratio)

Shareholders' equity 2,024,817$ 2,025,904$ 2,041,894$ 2,073,309$ 2,106,997$

Less: Intangible assets (531,567) (531,562) (531,556) (531,556) (531,556)

Tangible shareholders' equity (numerator) 1,493,250$ 1,494,342$ 1,510,338$ 1,541,753$ 1,575,441$

Total assets 17,365,462$ 17,838,059$ 17,914,718$ 18,122,254$ 18,479,697$

Less: Intangible assets (531,567) (531,562) (531,556) (531,556) (531,556)

Total tangible assets (denominator) 16,833,895$ 17,306,497$ 17,383,162$ 17,590,698$ 17,948,141$

Tangible Common Equity to Tangible Assets 8.9% 8.6% 8.7% 8.8% 8.8%

Jun 30 Sep 30 Dec 31 Mar 31 Jun 30

2015 2015 2015 2016 2016

Pre-Provision Net Revenue

Net interest income 122,920$ 125,694$ 127,799$ 129,054$ 128,916$

Non-interest income 46,489 44,774 45,839 43,137 46,137

Less: Investment securities gains (2,415) (1,730) (776) (947) (76)

Total Revenue 166,994 168,738 172,862 171,244 174,977

on-interest expense 118,354 124,889 118,439 120,413 121,637

Less: Loss on redemption of TruPS - (5,626) - - -

Total Non-interest expense, as adjusted 118,354 119,263 118,439 120,413 121,637

Pre-Provision Net Revenue 48,640$ 49,475$ 54,423$ 50,831$ 53,340$

Three Months Ended

(dollars in thousands)

(in thousands)

www.fult.com