Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - USD Partners LP | exhibit231bdoconsent.htm |

| EX-99.3 - EXHIBIT 99.3 - USD Partners LP | exhibit993-usdpartnersprof.htm |

| EX-99.1 - CCR FINANCIAL STATEMENTS 9/30/2015 AND 2014 - USD Partners LP | ex991ccrllcc0915and14.htm |

| 8-K/A - 8-K/A FOR CCR ACQUISITION - USD Partners LP | ccrfinancials8-ka.htm |

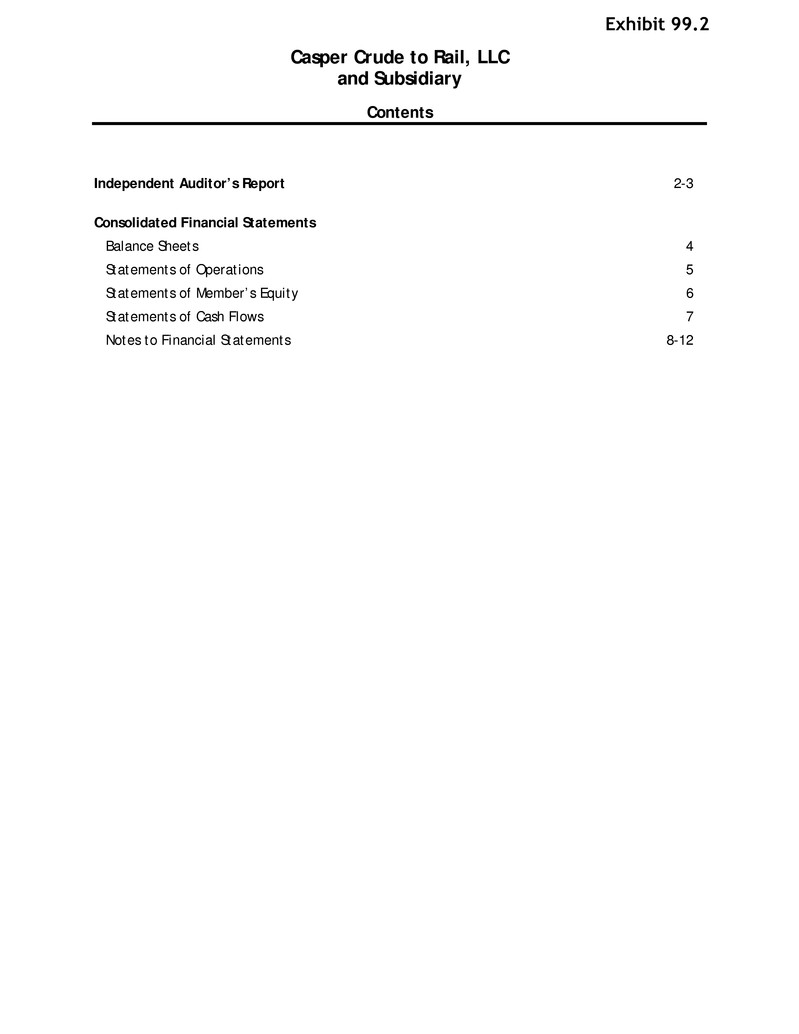

Casper Crude to Rail, LLC and Subsidiary Contents Independent Auditor’s Report 2-3 Consolidated Financial Statements Balance Sheets 4 Statements of Operations 5 Statements of Member’s Equity 6 Statements of Cash Flows 7 Notes to Financial Statements 8-12 Exhibit 99.2

Tel: 404-688-6841 Fax: 404-688-1075 www.bdo.com 1100 Peachtree Street NE, Suite 700 Atlanta, GA 30309 2 Independent Auditor’s Report Board of Directors Casper Crude to Rail, LLC and Subsidiary Casper, Wyoming We have audited the accompanying consolidated financial statements of Casper Crude to Rail, LLC and Subsidiary which comprise the consolidated balance sheets as of December 31, 2014 and 2013 and the related consolidated statements of operations, member’s equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms.

3 We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Casper Crude to Rail, LLC and Subsidiary as of December 31, 2014 and 2013, and the results of their operations and their cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. /S/ BDO USA, LLP Atlanta, Georgia October 8, 2015

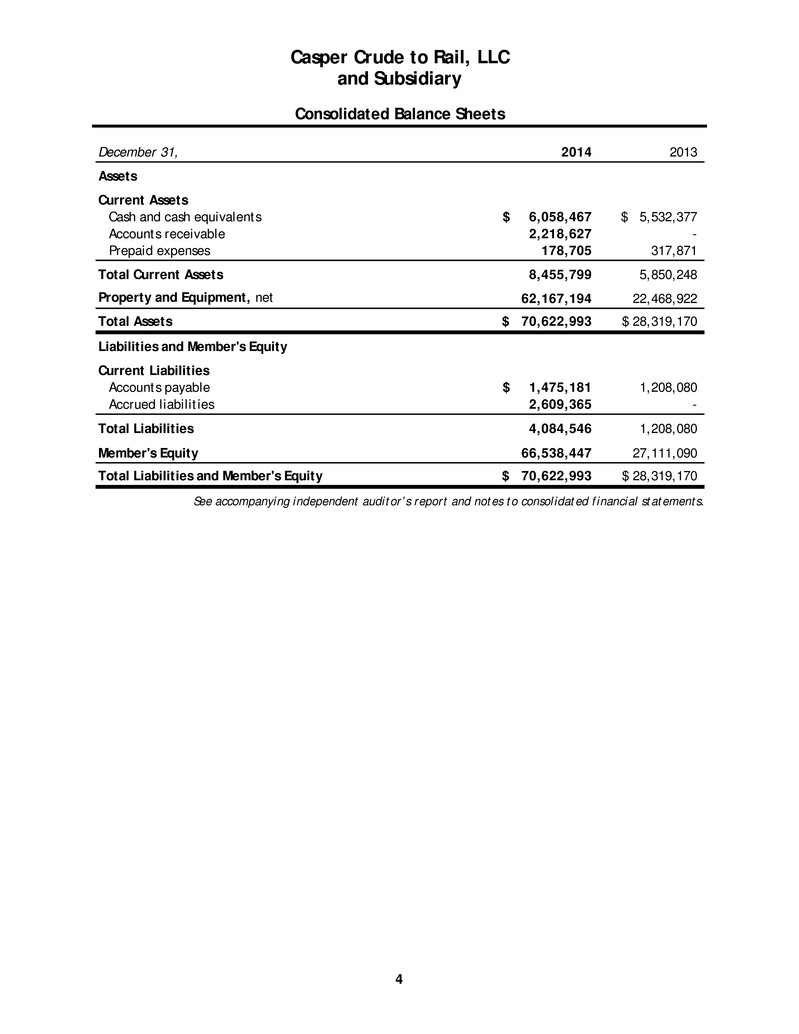

Casper Crude to Rail, LLC and Subsidiary Consolidated Balance Sheets 4 December 31, 2014 2013 Assets Current Assets Cash and cash equivalents 6,058,467$ 5,532,377$ Accounts receivable 2,218,627 - Prepaid expenses 178,705 317,871 Total Current Assets 8,455,799 5,850,248 Property and Equipment, net 62,167,194 22,468,922 Total Assets 70,622,993$ 28,319,170$ Liabilities and Member's Equity Current Liabilities Accounts payable 1,475,181$ 1,208,080 Accrued liabilities 2,609,365 - Total Liabilities 4,084,546 1,208,080 Member's Equity 66,538,447 27,111,090 Total Liabilities and Member's Equity 70,622,993$ 28,319,170$ See accompanying independent auditor’s report and notes to consolidated financial statements.

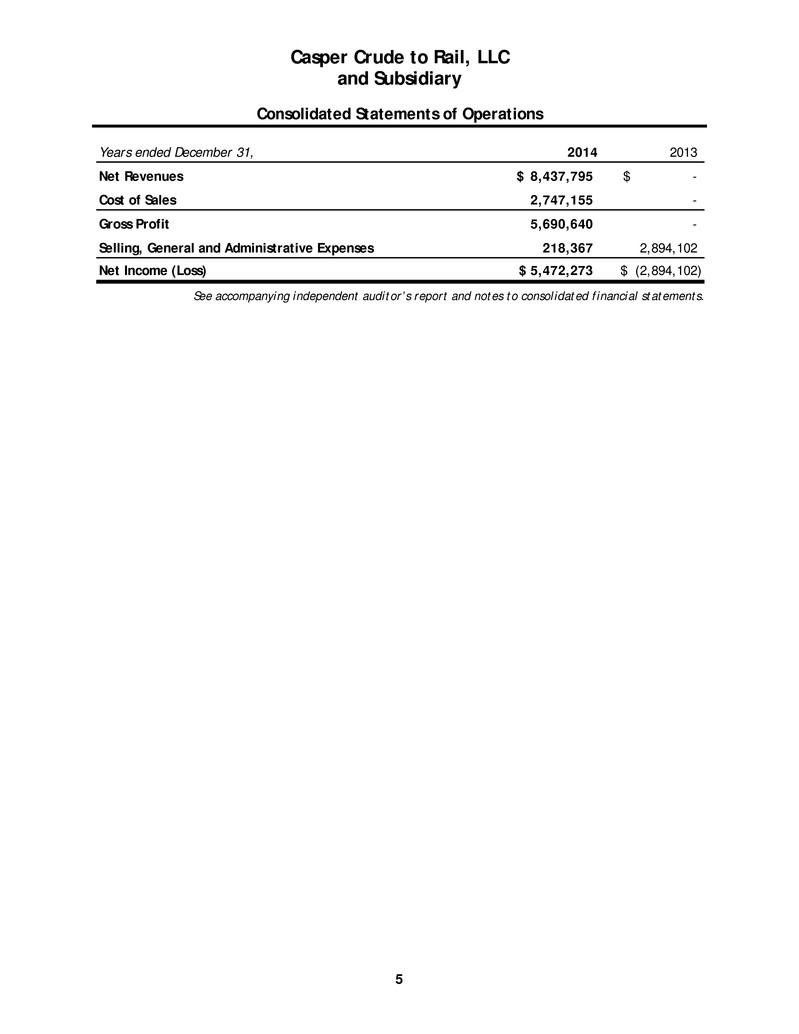

Casper Crude to Rail, LLC and Subsidiary Consolidated Statements of Operations 5 Years ended December 31, 2014 2013 Net Revenues 8,437,795$ -$ Cost of Sales 2,747,155 - Gross Profit 5,690,640 - Selling, General and Administrative Expenses 218,367 2,894,102 Net Income (Loss) 5,472,273$ (2,894,102)$ See accompanying independent auditor’s report and notes to consolidated financial statements.

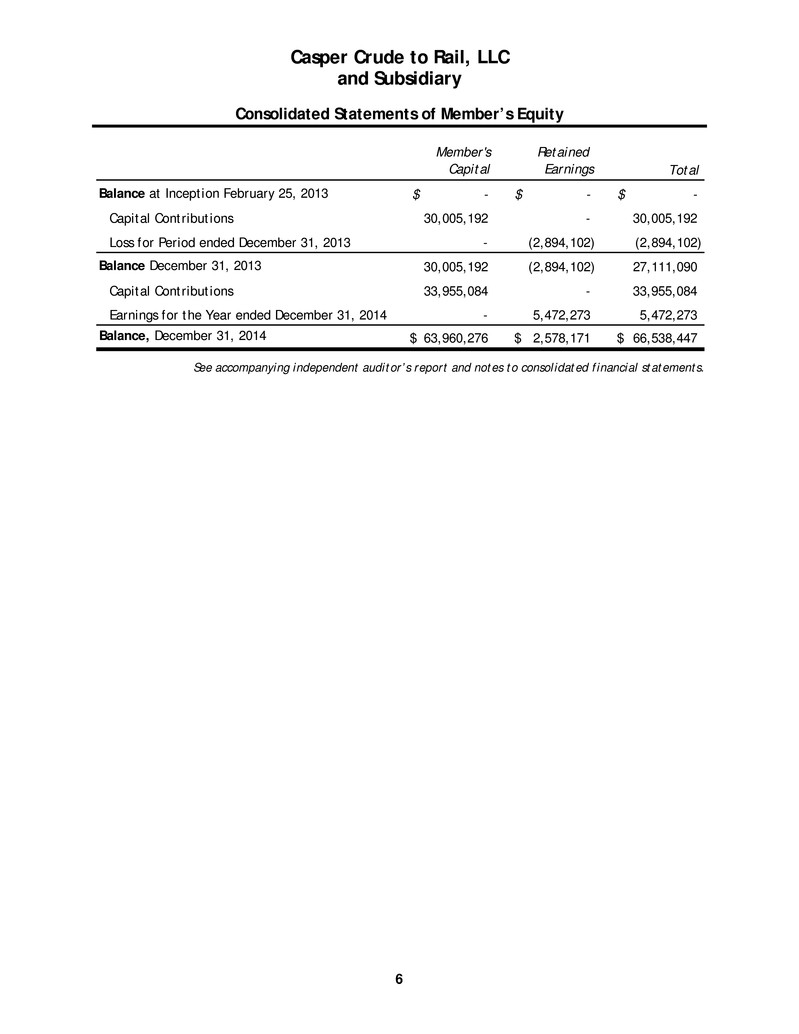

Casper Crude to Rail, LLC and Subsidiary Consolidated Statements of Member’s Equity 6 Member's Retained Capital Earnings Total Balance at Inception February 25, 2013 -$ -$ -$ Capital Contributions 30,005,192 - 30,005,192 Loss for Period ended December 31, 2013 - (2,894,102) (2,894,102) Balance December 31, 2013 30,005,192 (2,894,102) 27,111,090 Capital Contributions 33,955,084 - 33,955,084 Earnings for the Year ended December 31, 2014 - 5,472,273 5,472,273 Balance, December 31, 2014 63,960,276$ 2,578,171$ 66,538,447$ See accompanying independent auditor’s report and notes to consolidated financial statements.

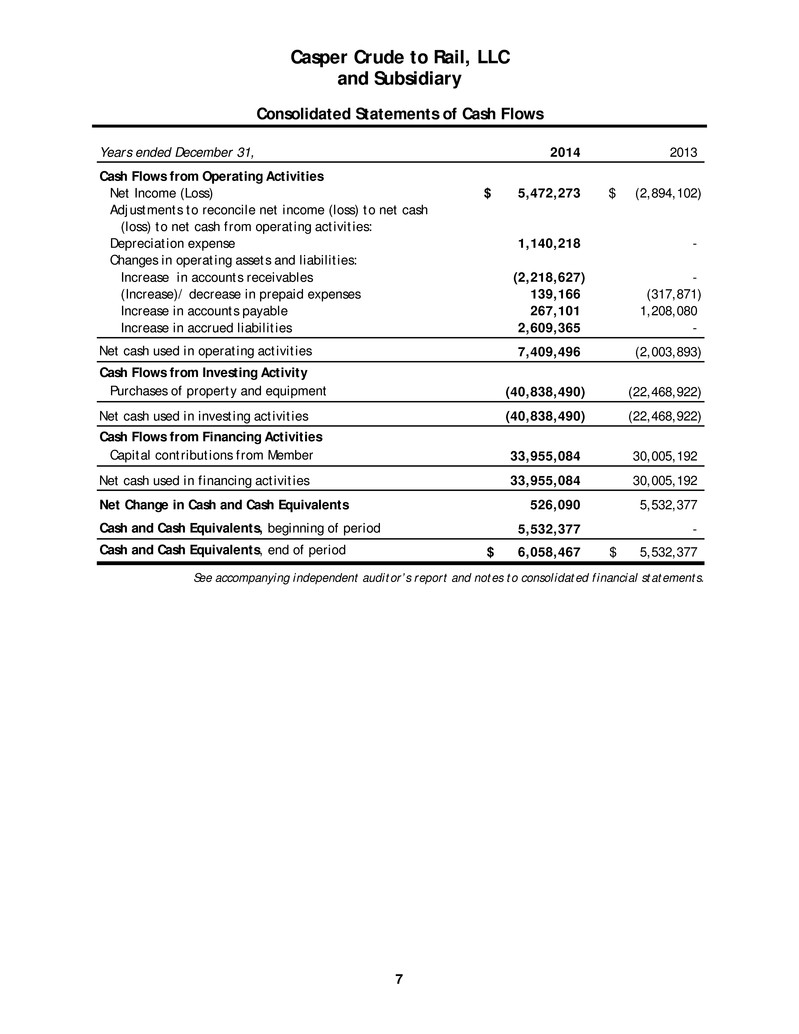

Casper Crude to Rail, LLC and Subsidiary Consolidated Statements of Cash Flows 7 Years ended December 31, 2014 2013 Cash Flows from Operating Activities Net Income (Loss) 5,472,273$ (2,894,102)$ Adjustments to reconcile net income (loss) to net cash (loss) to net cash from operating activities: Depreciation expense 1,140,218 - Changes in operating assets and liabilities: Increase in accounts receivables (2,218,627) - (Increase)/ decrease in prepaid expenses 139,166 (317,871) Increase in accounts payable 267,101 1,208,080 Increase in accrued liabilities 2,609,365 - Net cash used in operating activities 7,409,496 (2,003,893) Cash Flows from Investing Activity Purchases of property and equipment (40,838,490) (22,468,922) Net cash used in investing activities (40,838,490) (22,468,922) Cash Flows from Financing Activities Capital contributions from Member 33,955,084 30,005,192 Net cash used in financing activities 33,955,084 30,005,192 Net Change in Cash and Cash Equivalents 526,090 5,532,377 Cash and Cash Equivalents, beginning of period 5,532,377 - Cash and Cash Equivalents, end of period 6,058,467$ 5,532,377$ See accompanying independent auditor’s report and notes to consolidated financial statements.

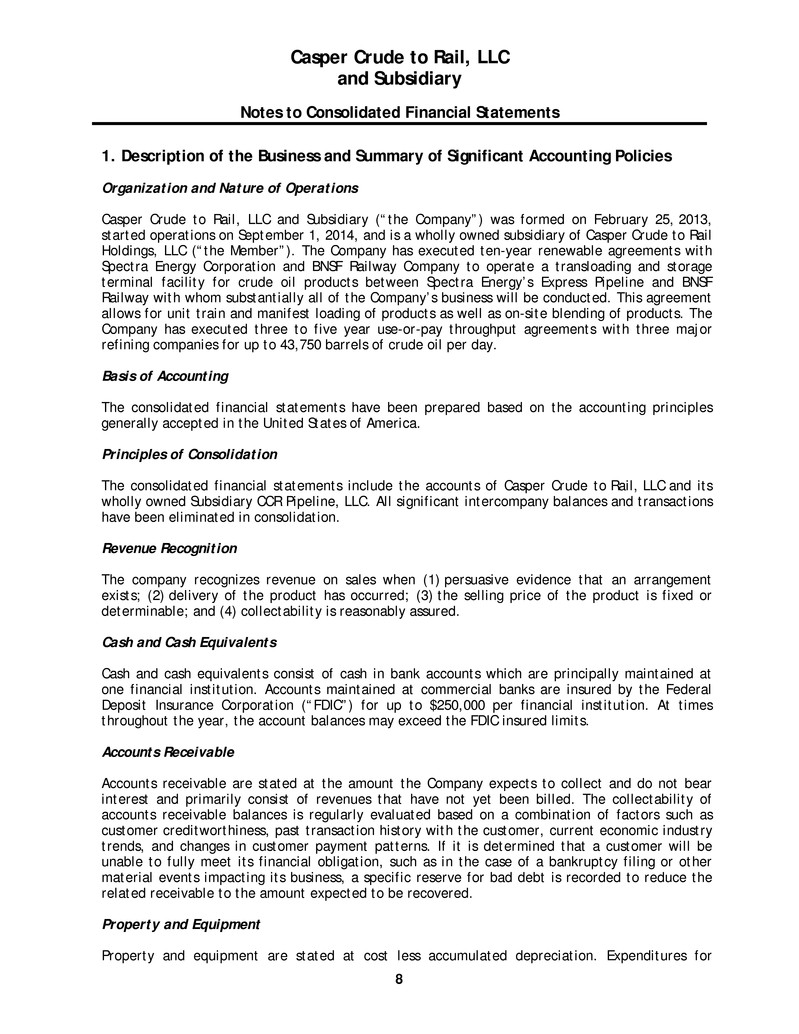

Casper Crude to Rail, LLC and Subsidiary Notes to Consolidated Financial Statements 8 1. Description of the Business and Summary of Significant Accounting Policies Organization and Nature of Operations Casper Crude to Rail, LLC and Subsidiary (“the Company”) was formed on February 25, 2013, started operations on September 1, 2014, and is a wholly owned subsidiary of Casper Crude to Rail Holdings, LLC (“the Member”). The Company has executed ten-year renewable agreements with Spectra Energy Corporation and BNSF Railway Company to operate a transloading and storage terminal facility for crude oil products between Spectra Energy’s Express Pipeline and BNSF Railway with whom substantially all of the Company’s business will be conducted. This agreement allows for unit train and manifest loading of products as well as on-site blending of products. The Company has executed three to five year use-or-pay throughput agreements with three major refining companies for up to 43,750 barrels of crude oil per day. Basis of Accounting The consolidated financial statements have been prepared based on the accounting principles generally accepted in the United States of America. Principles of Consolidation The consolidated financial statements include the accounts of Casper Crude to Rail, LLC and its wholly owned Subsidiary CCR Pipeline, LLC. All significant intercompany balances and transactions have been eliminated in consolidation. Revenue Recognition The company recognizes revenue on sales when (1) persuasive evidence that an arrangement exists; (2) delivery of the product has occurred; (3) the selling price of the product is fixed or determinable; and (4) collectability is reasonably assured. Cash and Cash Equivalents Cash and cash equivalents consist of cash in bank accounts which are principally maintained at one financial institution. Accounts maintained at commercial banks are insured by the Federal Deposit Insurance Corporation (“FDIC”) for up to $250,000 per financial institution. At times throughout the year, the account balances may exceed the FDIC insured limits. Accounts Receivable Accounts receivable are stated at the amount the Company expects to collect and do not bear interest and primarily consist of revenues that have not yet been billed. The collectability of accounts receivable balances is regularly evaluated based on a combination of factors such as customer creditworthiness, past transaction history with the customer, current economic industry trends, and changes in customer payment patterns. If it is determined that a customer will be unable to fully meet its financial obligation, such as in the case of a bankruptcy filing or other material events impacting its business, a specific reserve for bad debt is recorded to reduce the related receivable to the amount expected to be recovered. Property and Equipment Property and equipment are stated at cost less accumulated depreciation. Expenditures for

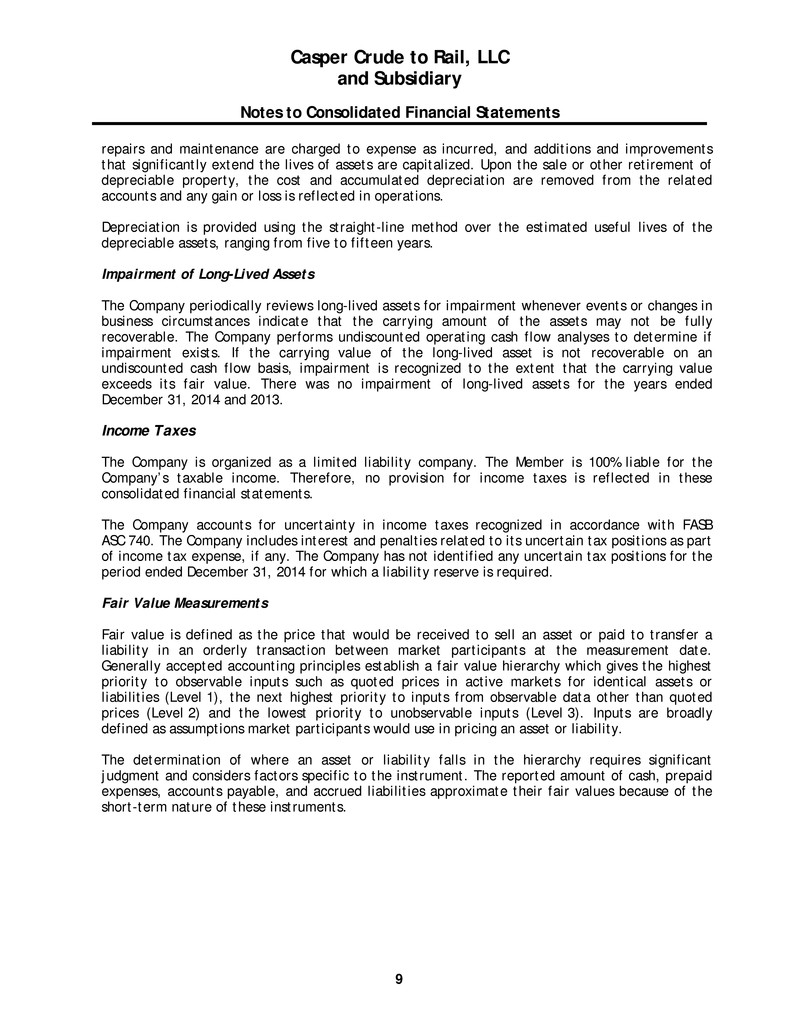

Casper Crude to Rail, LLC and Subsidiary Notes to Consolidated Financial Statements 9 repairs and maintenance are charged to expense as incurred, and additions and improvements that significantly extend the lives of assets are capitalized. Upon the sale or other retirement of depreciable property, the cost and accumulated depreciation are removed from the related accounts and any gain or loss is reflected in operations. Depreciation is provided using the straight-line method over the estimated useful lives of the depreciable assets, ranging from five to fifteen years. Impairment of Long-Lived Assets The Company periodically reviews long-lived assets for impairment whenever events or changes in business circumstances indicate that the carrying amount of the assets may not be fully recoverable. The Company performs undiscounted operating cash flow analyses to determine if impairment exists. If the carrying value of the long-lived asset is not recoverable on an undiscounted cash flow basis, impairment is recognized to the extent that the carrying value exceeds its fair value. There was no impairment of long-lived assets for the years ended December 31, 2014 and 2013. Income Taxes The Company is organized as a limited liability company. The Member is 100% liable for the Company’s taxable income. Therefore, no provision for income taxes is reflected in these consolidated financial statements. The Company accounts for uncertainty in income taxes recognized in accordance with FASB ASC 740. The Company includes interest and penalties related to its uncertain tax positions as part of income tax expense, if any. The Company has not identified any uncertain tax positions for the period ended December 31, 2014 for which a liability reserve is required. Fair Value Measurements Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Generally accepted accounting principles establish a fair value hierarchy which gives the highest priority to observable inputs such as quoted prices in active markets for identical assets or liabilities (Level 1), the next highest priority to inputs from observable data other than quoted prices (Level 2) and the lowest priority to unobservable inputs (Level 3). Inputs are broadly defined as assumptions market participants would use in pricing an asset or liability. The determination of where an asset or liability falls in the hierarchy requires significant judgment and considers factors specific to the instrument. The reported amount of cash, prepaid expenses, accounts payable, and accrued liabilities approximate their fair values because of the short-term nature of these instruments.

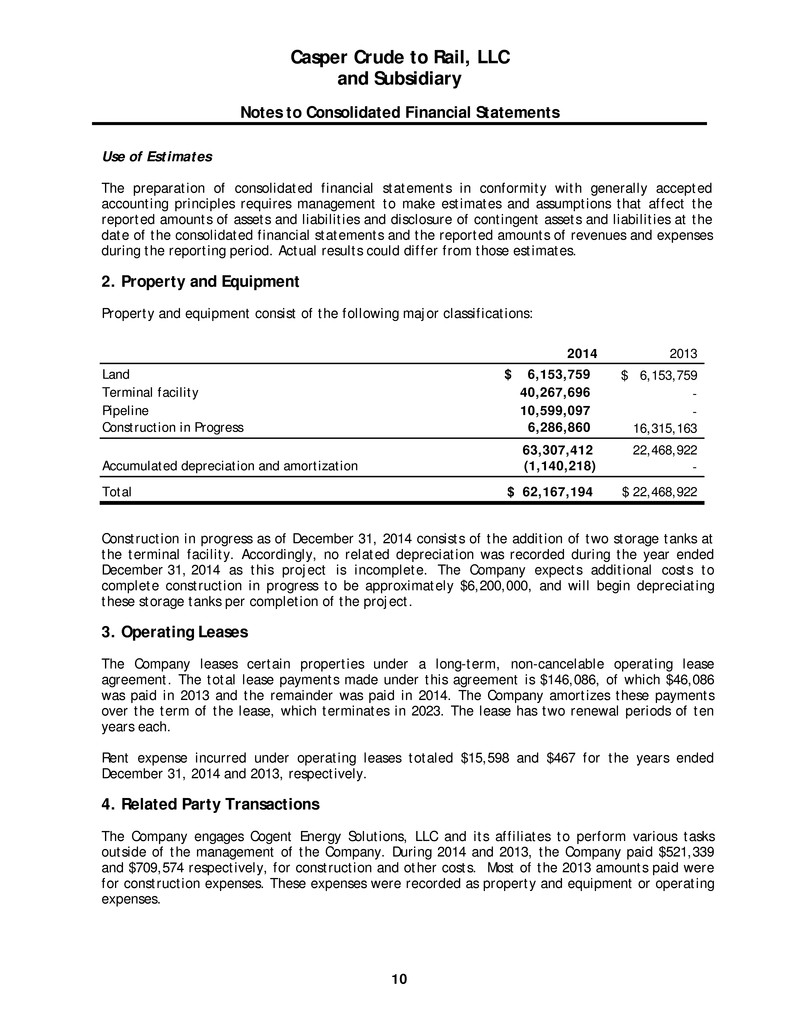

Casper Crude to Rail, LLC and Subsidiary Notes to Consolidated Financial Statements 10 Use of Estimates The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. 2. Property and Equipment Property and equipment consist of the following major classifications: 2014 2013 Land $ 6,153,759 6,153,759$ Terminal facility 40,267,696 - Pipeline 10,599,097 - Construction in Progress 6,286,860 16,315,163 63,307,412 22,468,922 Accumulated depreciation and amortization (1,140,218) - Total 62,167,194$ 22,468,922$ Construction in progress as of December 31, 2014 consists of the addition of two storage tanks at the terminal facility. Accordingly, no related depreciation was recorded during the year ended December 31, 2014 as this project is incomplete. The Company expects additional costs to complete construction in progress to be approximately $6,200,000, and will begin depreciating these storage tanks per completion of the project. 3. Operating Leases The Company leases certain properties under a long-term, non-cancelable operating lease agreement. The total lease payments made under this agreement is $146,086, of which $46,086 was paid in 2013 and the remainder was paid in 2014. The Company amortizes these payments over the term of the lease, which terminates in 2023. The lease has two renewal periods of ten years each. Rent expense incurred under operating leases totaled $15,598 and $467 for the years ended December 31, 2014 and 2013, respectively. 4. Related Party Transactions The Company engages Cogent Energy Solutions, LLC and its affiliates to perform various tasks outside of the management of the Company. During 2014 and 2013, the Company paid $521,339 and $709,574 respectively, for construction and other costs. Most of the 2013 amounts paid were for construction expenses. These expenses were recorded as property and equipment or operating expenses.

Casper Crude to Rail, LLC and Subsidiary Notes to Consolidated Financial Statements 11 During 2014 the Company paid $864 to affiliates of Stonepeak Advisors, LLC that were recorded as general and administrative costs. In 2013, the Company paid a one-time deal fee and expenses of $1,695,000 to Stonepeak Advisors, LLC as part of the organization of the Member which was charged to the Company. These deal fees and expenses have been recorded as general and administrative expenses. Stonepeak Advisors, LLC has an ownership interest in the Member. The Company engaged the services of various affiliates of CTRAN, LLC as part of the construction and operations of the terminal facility. During the years ended December 31, 2014 and 2013, the affiliated entities charged $6,170,977 and $2,710,357, respectively to the Company. These expenditures are recorded in property and equipment or cost of sales. CTRAN, LLC has an ownership interest in the Member. The Company acquired the land upon which to construct the facility from CTRAN, LLC during 2013.The cost to acquire the property was $6,003,183 and is recorded as property and equipment. Cogent Energy Solutions, LLC and CTRAN, LLC jointly own Wyoming Operating Company LLC. That entity operates the Company terminal under a management services agreement. During the year ended December 31, 2014, the Company paid Wyoming Operating Company LLC $858,932. These charges were recorded as cost of sales. Cogent Energy Solutions, LLC has an ownership interest in the Member. On a quarterly basis, at the commencement of commercial operations, the Company begin paying Stonepeak Advisors, LLC on be behalf of the Member, a management fee of one percent of quarterly EBITDA not to exceed $250,000 in the aggregate, during the year. There were no management fees incurred or paid during the years ended December 31, 2014 and 2013. The Company began paying these fees in 2015. 5. Member’s Equity Casper Crude to Rail, LLC was incorporated as a limited liability company on February 25, 2013 pursuant to the Wyoming Limited Liability Company Act. The Company was capitalized with an initial capital contribution from Casper Crude to Rail Holdings, LLC its sole Member. The Member has sole responsibility for management of the business and affairs of the Company. The Member is not personally liable for the debts, obligations or liabilities of the Company beyond such Member’s capital contributions, solely by reason of being a member or acting as a Manager. Allocation of Profit, Losses and Other Items All items of income, gain, loss and deduction of the Company’s operations shall be allocated 100% to the Member. Distribution Priorities The limited liability company agreement governs distribution priorities. Distributions include all payments made to the Member except for reimbursements made in the normal course of business. The Member is entitled to receive 100% of all distributions.

Casper Crude to Rail, LLC and Subsidiary Notes to Consolidated Financial Statements 12 Liquidation Rights The limited liability company agreement governs liquidation rights. Upon any liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, or any sale, the Company shall distribute additional amounts available after satisfying the Company’s debt and obligations. 6. Commitments and Contingencies The Company is subject to various claims and assessments in the ordinary course of business. Management believes that resolution of any such matters will not have a material effect on the Company’s financial position or results of operations. The Company is subject to various federal, state and local environmental laws and regulations in the normal course of conducting its business. The Company conducts an ongoing monitoring and compliance program and records provisions for expected environmental costs. Management is not aware of any environmental matters that it believes would have a material adverse effect on the consolidated financial condition of the Company. 7. Subsequent Events The following events took place after the balance sheet date of December 31, 2014: The Member contributed an additional $5,775,000 of additional capital in 2015. On February 28, 2015, The Certification of Operations Date was declared as required by the Member’s partnership agreement. On April 23, 2015, initial distributions of capital of $9,293,100 were made to the Member.