Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ESTERLINE TECHNOLOGIES CORP | d92436d8k.htm |

| EX-99.1 - EX-99.1 - ESTERLINE TECHNOLOGIES CORP | d92436dex991.htm |

Q4

2015 Supplemental Financial Information November 19, 2015

Exhibit 99.2 |

1 This presentation may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future

financial performance. In some cases, you can identify forward-looking statements

by terminology such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “should” or “will,” or the negative of such terms, or other

comparable terminology. These forward-looking statements are

only predictions based on the current intent and expectations of the

management of Esterline, are not guarantees of future performance or

actions, and involve risks and uncertainties that are difficult to predict and may

cause Esterline’s or its industry’s actual results,

performance or achievements to be materially different from any future

results, performance or achievements expressed or implied by the forward-looking statements. Esterline's actual results and the timing and outcome of events may differ materially

from those expressed in or implied by the forward-looking statements due to risks

detailed in Esterline's public filings with the Securities and Exchange

Commission including its most recent Annual Report on Form

10-K. This presentation may also contain references to non-GAAP financial information subject to Regulation G. The reconciliations of each non-GAAP financial measure to its comparable GAAP measure as

well as further information on management’s use of non-GAAP financial

measures are included in Esterline’s press release dated November

19, 2015, included as Exhibit 99.1 to Form 8-K filed with the SEC on

the same date, as well as in this presentation. Q4

2015 Supplemental Financial Information |

Q4

2015 Supplemental Financial Information Operational

Highlights •

Held eight Continuous Improvement Academies

– Over 220 leaders trained in 2015 • First facility-wide E3 transformation completed – ECCS (Korry) Everett site • Strategic sourcing initiative: – Wave 2 implementation stage – Wave 3 identification of addressable spend and savings 2 |

Q4

2015 Supplemental Financial Information Current Market

Conditions Commercial Aerospace

•

Solid fundamentals: Strong OE backlog, New airframe entry-into-service

in 2016+, Good airline profitability

•

Near term challenges from flat production on key programs, some new airframe

delays and customer inventory rationalization

Defense • No significant uptick except for production increases in F-35 and A400M Industrial • Challenging global market conditions, including low oil prices and weak European economy • Bright spots in niche markets such as high-end medical, human-machine interface and UK nuclear 3 |

Q4

2015 Supplemental Financial Information Q4 2015 Financial

Results* •

Sales of $350 million, up 12%

– Organic sales flat – Additional week in Q4-15 (9-week

vs 8-week stub period) – $20 million from DAT acquisition offset by $21 million FX impact • GAAP EPS of $0.69 – Adjusted EPS of $1.33** (excludes certain discrete items)

4 **See Page 1 regarding non-GAAP financial measures * Q4 2015 was a two month fiscal quarter ended October 2, 2015. Comparison is versus the two months ended September 26, 2014. |

Q4

2015 Supplemental Financial Information FY 2015 Financial

Results* •

Sales of $1.77 billion, down 1.5%

– Organic sales flat – $88 million from acquisition (primarily DAT) offset by $103 million FX impact • GAAP EPS of $3.10 – Adjusted EPS of $4.67** (excludes certain discrete items)

•

FY free cash flow** conversion 159% of net earnings

5 **See Page 1 regarding non-GAAP financial measures * FY 2015 was an eleven month fiscal year ended October 2, 2015. Comparison is versus the eleven months ended September 26, 2014. |

Q4

2015 Supplemental Financial Information 2015* Year-over-Year (YOY)

Summary 6

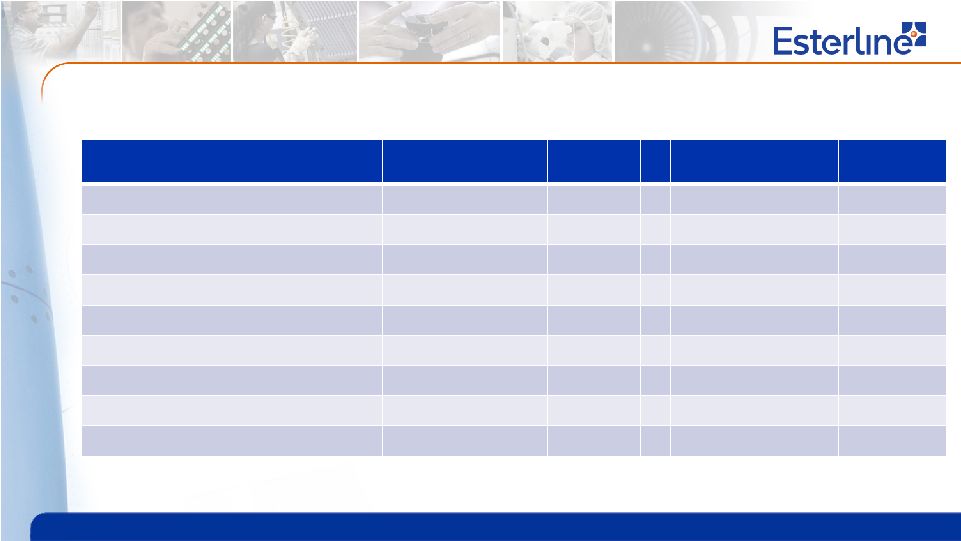

Dollars in millions, except EPS

Q4 2015 Q4 2014 Change FY 2015 FY 2014 Change Sales $ 350 $ 313 $ 37 $ 1,774 $ 1,801 ($27) Gross Margin $ 114 $ 102 $ 12 $ 589 $ 625 ($36) As a % of sales 32.7% 32.6% 0.1% 33.2% 34.7% (1.5%) Earnings from continuing operations $ 21 $ 20 $ 1 $ 97 $ 134 ($37) Earnings per diluted share (continuing ops) $0.69 $0.63 $ 0.06 $ 3.10 $ 4.12 ($1.02) * Q4 2015 was a two month fiscal quarter ended October 2, 2015. Fiscal 2015 was an eleven month year ended

October 2, 2015. Comparisons to 2014 are for the two months and eleven months

ended September 26, 2014. |

Q4

2015 Supplemental Financial Information 2015* Earnings

Adjustment 7

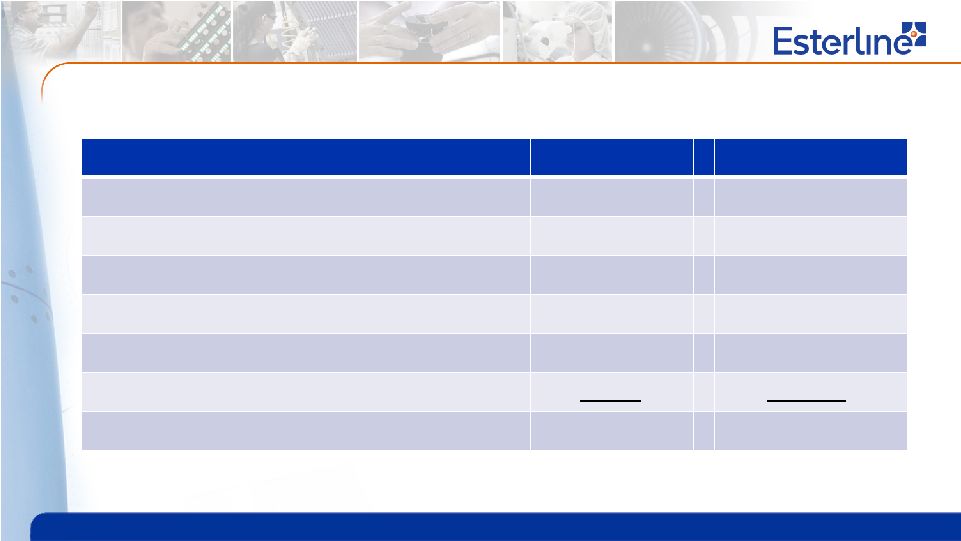

Dollars in millions, except EPS

EPS adjustments are net of tax

Q4 Earnings from Continuing Ops EPS FY Earnings from Continuing Ops EPS GAAP $ 21 $ 0.69 $ 97 $3.10 • Accelerated integration 2 0.05 10 0.31 • Incremental compliance 3 0.12 15 0.49 • DAT net loss and closing expenses 5 0.16 18 0.58 • Bond redemption costs 9 0.31 9 0.30 • Long-term contract adjustments - - 8 0.25 • Pension expense - - 2 0.08 • Non-income tax gain - - (13) (0.44) Adjusted ** $ 40 $ 1.33 $146 $4.67 **See Page 1 regarding non-GAAP financial measures * Q4 2015 was a two month fiscal quarter ended October 2, 2015. Fiscal 2015 was an eleven month year ended October 2, 2015.

|

Q4

2015 Supplemental Financial Information 2015* Sales Change

(YOY) Items

Q4 Sales FY Sales 2014* $ 313 $ 1,801 • Foreign currency translation (17) (84) • FX forward contract loss (4) (18) • Acquisitions (primarily DAT) 20 88 • Additional week in Q4-15 39 - • Sales volume (1) (13) 2015* $ 350 $ 1,774 Dollars in millions 8 * Q4 2015 was a two month fiscal quarter ended October 2, 2015. Fiscal 2015 was an eleven month year ended

October 2, 2015. Comparisons to 2014 are for the two months and eleven months

ended September 26, 2014. |

Q4

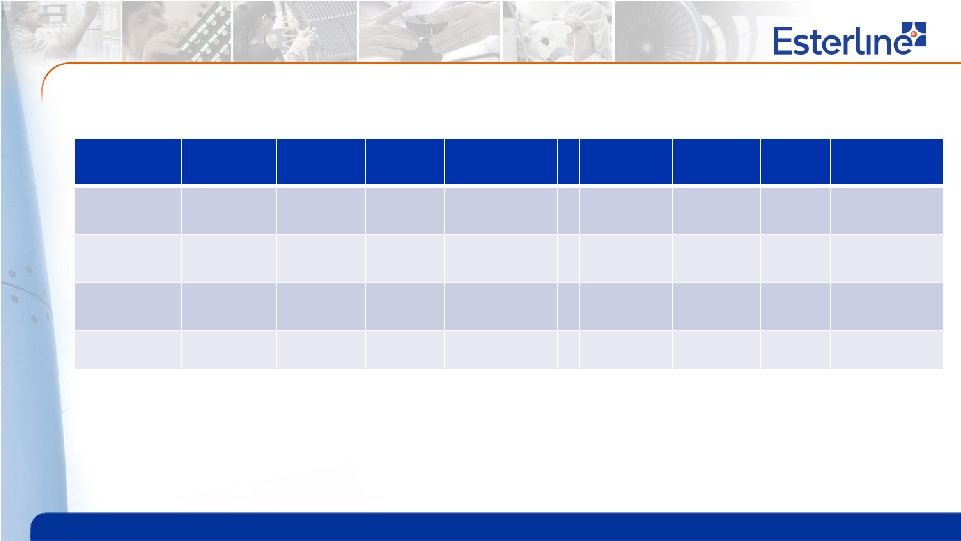

2015 Supplemental Financial Information 2015* Segment Sales Change

(YOY) Q4 Total

Change Q4 Organic¹

Q4 FX Q4 Acquisition FY Total Change FY Organic¹

FY FX FY Acquisition Avionics & Controls 34% 9% (5%) 18% 9% <(1%) (3%) 12% Sensors & Systems 6% 6% (12%) - (8%) 2% (11%) 1% Advanced Materials (10%) (21%) (2%) - (7%) (5%) (2%) - Total 12% <(1%) (7%) 6% (1%) <(1%) (6%) 5% ¹ Organic sales growth represents the total reported increase

within the company’s continuing operations less the impact of all foreign currency translation and hedging activities and acquisitions. 9 * Q4 2015 was a two month fiscal quarter ended October 2, 2015. Fiscal 2015 was an eleven month year ended

October 2, 2015. Comparisons to 2014 are for the two months and eleven months

ended September 26, 2014. |

Q4

2015 Supplemental Financial Information 2015* Gross Margin Change

(YOY) Items

Q4 Gross Margin FY Gross Margin 2014* $ 102 $ 625 • FX Impact (8) (27) • DAT acquisition (FY: $28 million from operations less $7 million purchase accounting) 1 21 • Sales volume / mix 5 (15) • Additional week in Q4-15 13 - • Higher mfg. costs / Inventory reserves / EAC / Other adjustments 1 (15) 2015* $ 114 $ 589 Dollars in millions 10 * Q4 2015 was a two month fiscal quarter ended October 2, 2015. Fiscal 2015 was an eleven month year ended

October 2, 2015. Comparisons to 2014 are for the two months and eleven months

ended September 26, 2014. |

Q4

2015 Supplemental Financial Information Adjusted Gross Margin and

EBIT See Appendix for supporting details

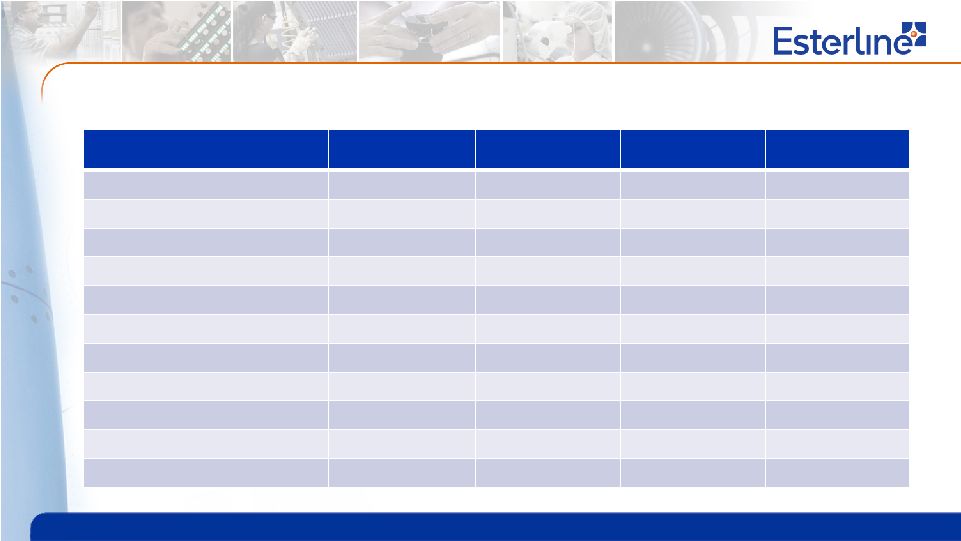

Avionics & Controls

Sensors & Systems Advanced Materials Total ESL Q4 2015 Gross Margin (Adjusted)* 36.0% 33.6% 33.7% 34.6% Q4 2014 Gross Margin (Adjusted)* 30.7% 34.8% 33.7% 33.0% FY 2015 Gross Margin (Adjusted)* 34.6% 35.6% 32.4% 34.5% FY 2014 Gross Margin (Adjusted)* 36.5% 34.1% 34.2% 35.0% Q4 2015 EBIT (Adjusted)* 16.0% 14.7% 18.6% 14.5% Q4 2014 EBIT (Adjusted)* 11.0% 12.0% 21.9% 11.0% FY 2015 EBIT (Adjusted)* 14.3% 12.5% 20.3% 12.2% FY 2014 EBIT (Adjusted)* 14.8% 12.0% 22.6% 12.5% 11 Q4 2015 was a two month fiscal quarter and FY 2015 was an eleven month period, both ended October 2, 2015. Comparisons are against the same

periods ended September 26, 2014. * See Page 1 regarding non-GAAP

financial measures |

Q4

2015 Supplemental Financial Information Free Cash Flow

Reconciliation FY 2015*

FY 2014* Net earnings attributable to Esterline $ 60 $ 74 • Depreciation ($45M) and amortization ($46M) 91 113 • Change in working capital (A/R, Inventory, A/P) (8) (45) • Other 1 20 Cash flow from operations $ 144 $ 162 • Capital expenditures (49) (40) Free cash flow** $ 95 $ 122 Cash conversion** 159% 164% Dollars in millions 12 * YTD 2015 and 2014 include 11 months of each fiscal year. **See Page 1 regarding non-GAAP financial measures |

Q4

2015 Supplemental Financial Information Share Repurchase

Update # Shares

In thousands $ Value In millions $ Authorization Remaining In millions • FY 2014 269 $ 30.3 • Q1 2015 850 92.6 • Q2 2015 312 34.7 • Q3 2015 1,400 132.2 • Q4 2015* 0 0 Total spend since inception** 2,831 $ 289.8 $110.2 * Q4 2015 includes the two months ended October 2, 2015 ** $400 million total authorization for share repurchase 13 |

Q4

2015 Supplemental Financial Information 2015 Income Statement (Restated for new fiscal calendar)

14 Dollars in millions, except EPS Q1 Q2 Q3 Q4 FY Sales $505 $447 $505 $545 $2,002 Gross Margin $180 $144 $169 $186 $679 Earnings from Continuing Ops $34 $29 $25 $40 $128 GAAP EPS (diluted, continuing ops) $1.06 $0.90 $0.79 $1.35 $4.11 # weeks 13 13 13 14* 53* * Fiscal 2016 has a 13-week fourth quarter and 52 weeks in the year. The following information is presented to assist with the analysis of future financial results using our new fiscal calendar.

This financial information reflects our fiscal 2015 actual results restated for the new

fiscal calendar (October 2014 – September 2015). Our new fiscal

calendar begins with the 2016 fiscal year starting on October 3, 2015. |

Q4

2015 Supplemental Financial Information 2016 Guidance

2016 Guidance Sales $2.03B - $2.08B GAAP EPS (diluted, continuing ops) $4.60 - $4.90 Adjusted EPS* (diluted, continuing ops) $5.50 - $5.80 *See Page 1 regarding non-GAAP financial measures 15 2016 Adjusted EPS GAAP EPS (diluted, continuing

ops) $4.60 -

$4.90 Accelerated Integration $0.11 Incremental Compliance $0.47 DAT Integration $0.32 Adjusted EPS* (diluted, continuing

ops) $5.50 -

$5.80 |

Q4

2015 Supplemental Financial Information Aerospace Growth and

Outlook 2015 Sales

Mix End Market 2015 Sales Growth* 2016 Sales Growth* Growth Drivers Beyond 2016 ~50% Commercial Aerospace Flat Low single digit Increased OE production rates: 737Max, A320Neo, 787, A350 Entry into service:, C919, E2, MRJ, C-Series Higher content: 777X ~30% Defense Flat Flat Increased OE production rates: F-35, A400M Entry into service: KC-390 ~80% Total Flat Low single digit ~10% Aftermarket (included in Commercial / Defense OE) Mid single digit Mid single digit Increased OE production rates Use Sensors aftermarket infrastructure for other ESL products 16 * Organic sales growth, excluding impacts from FX and acquisitions and adjusted for 11-month 2015 fiscal year.

|

Q4

2015 Supplemental Financial Information Adjacent Markets

Outlook 2015 Sales

Mix End Market 2016 Expectations ~14% Industrial Opportunity for sales growth in high-end medical markets and “human- machine interface” products. Overall economic growth pressure in European and emerging markets. ~4% Gaming Lower sales due to extremely strong 2015. Some uncertainty continues due to customer consolidation. ~2% Energy Overall flat to lower sales. Opportunities in UK nuclear market. Continued

pressure on sales into oil & gas end markets.

~20% Total Low single digit growth 17 |

Q4

2015 Supplemental Financial Information 2016 Guidance

Assumptions •

Interest expense ~ $30 million

– Annualized 2015 ~ $33 million – Fiscal 2016 starts with higher debt levels at lower interest rate • Tax rate ~ 21-22% (assumes expiration of the US R&D tax credit)

•

Average diluted shares outstanding ~ 29.6 million

18 |

Q4

2015 Supplemental Financial Information Company-Wide Efficiency

Initiatives Update Strategic Sourcing

Global Footprint INITIATIVE GOALS Achieve significant savings in material and services Implement standards and tools for sustainability • Remaining restructuring projects will complete in 2016 • Acquisition integrating well • Increasing competitive global presence • Savings ahead of plan • Savings tracker in place and automated • All commodities progressing well, executing to plan • Further projects being scoped and opportunities identified INITIATIVE GOALS Leverage global presence for growth Develop competitive cost structure Infrastructure supporting the Esterline Operating System 19 Ops Excellence • European launch for facility wide re-layout events • 8 Academies complete YTD – 224 leaders trained • Everett site “kaikaku” event complete INITIATIVE GOALS E3 transformation – entire facility New operating system deployed Leadership-driven, fully aligned operational improvements |

Q4

2015 Supplemental Financial Information E3 Transformation

– Everett

Facility 20 Kaikaku – Japanese for “radical change” • Re-layout of the entire manufacturing operation – Aligned fab. processes and physically linked them to main assembly lines • Key expected outcomes: – Double yearly revenue capacity – Reduce “days to manufacture” by 50% • Standard work makes process repeatable in other Esterline units • Part of a ~43-week process of transforming the entire value stream |

Q4

2015 Supplemental Financial Information DAT* Integration

Update 2015 Highlights

•

Integration progressing well with three areas of challenge:

– IT, Export Compliance, Facility relocation • FY gross margins ~ 32% (excludes purchase accounting)

2016 Update • Continued progress on integration and synergies – Focus on incremental top-line growth and cost savings • DAT results integrated into platforms within Avionics & Controls segment in fiscal Q2 2016 21 * Defense, Aerospace and Training display business (DAT), acquired from Barco N.V. in the second quarter of our fiscal 2015.

|

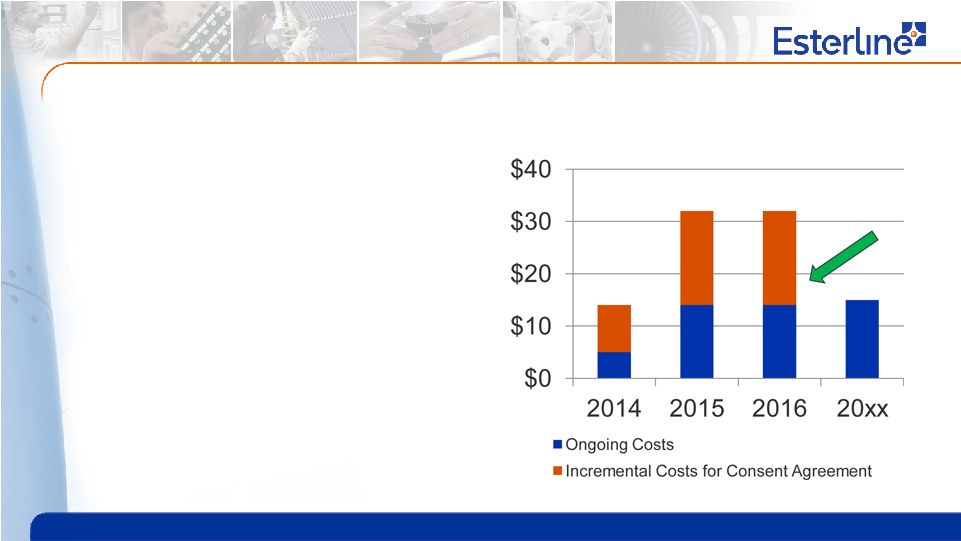

Q4

2015 Supplemental Financial Information Export Compliance

Update 22

• Mid-way through 3-year Consent Agreement (ends March 2017) • Enterprise-wide training, policies & procedures implemented • Next action: Internal audits Incremental costs will be $0 after consent agreement $ in millions |

Q4

2015 Supplemental Financial Information Appendix

23 |

Q4

2015 Supplemental Financial Information Q4 2015* Adjusted Gross Margin and

EBIT 24

* Q4 2015 was a two month fiscal period ended October 2, 2015.

In thousands

Avionics

Sensors

AM

ESL

GAAP Sales

151,086

$

117,835

$

80,706

$

349,627

$

DAT Sales

(20,029)

-

-

(20,029)

Adjusted Sales

131,057

$

117,835

$

80,706

$

329,598

$

GAAP Gross Margin

47,720

$

39,377

$

27,068

$

114,165

$

Accelerated Integration

-

199

133

332

DAT Gross Margin

(553)

-

-

(553)

Adjusted Gross Margin

47,167

$

39,576

$

27,201

$

113,944

$

In thousands

Avionics

Sensors

AM

Corporate

ESL

GAAP EBIT

15,230

$

16,296

$

14,802

$

(9,099)

$

37,229

$

Accelerated Integration

65

1,035

247

249

1,596

Incremental Compliance

-

-

-

3,320

3,320

DAT Net Loss

5,609

-

-

-

5,609

Adjusted EBIT

20,904

$

17,331

$

15,049

$

(5,530)

$

47,754

$

Adjusted GM as a % of Adjusted Sales

36.0%

33.6%

33.7%

-

34.6%

Adjusted EBIT as a % of Adjusted Sales

16.0%

14.7%

18.6%

-

14.5% |

Q4

2015 Supplemental Financial Information Q4 2014* Adjusted Gross Margin and

EBIT 25

* Q4 2014 was a two month fiscal period ended September 26, 2014.

In thousands

Avionics

Sensors

AM

ESL

GAAP Sales

112,412

$

110,719

$

90,069

$

313,200

$

GAAP Gross Margin

34,324

$

37,880

$

29,896

$

102,100

$

Accelerated Integration

209

651

446

1,306

Incremental Compliance

9

2

(27)

(16)

Adjusted Gross Margin

34,542

$

38,533

$

30,315

$

103,390

$

In thousands

Avionics

Sensors

AM

Corporate

ESL

GAAP EBIT

11,402

$

11,842

$

18,539

$

(11,934)

$

29,849

$

Accelerated Integration

705

1,255

976

194

3,130

Incremental Compliance

246

165

167

819

1,397

Adjusted EBIT

12,353

$

13,262

$

19,682

$

(10,921)

$

34,376

$

Adjusted GM as a % of Adjusted Sales

30.7%

34.8%

33.7%

-

33.0%

Adjusted EBIT as a % of Adjusted Sales

11.0%

12.0%

21.9%

-

11.0% |

Q4

2015 Supplemental Financial Information FY 2015* Adjusted Gross Margin and

EBIT 26

* FY 2015 was an eleven month fiscal year ended October 2, 2015.

In thousands

Avionics

Sensors

AM

ESL

GAAP Sales

727,801

$

633,446

$

413,202

$

1,774,449

$

DAT Sales

(82,525)

-

-

(82,525)

Adjusted Sales

645,276

$

633,446

$

413,202

$

1,691,924

$

GAAP Gross Margin

234,922

$

221,218

$

133,253

$

589,393

$

Accelerated Integration

-

4,322

761

5,083

Long-Term Contract Adjustments

7,814

-

-

7,814

DAT Gross Margin

(19,329)

-

-

(19,329)

Adjusted Gross Margin

223,407

$

225,540

$

134,014

$

582,961

$

In thousands

Avionics

Sensors

AM

Corporate

ESL

GAAP EBIT

65,910

$

87,443

$

80,951

$

(77,319)

$

156,985

$

Accelerated Integration

705

7,146

2,778

1,093

11,722

Incremental Compliance

-

-

-

18,291

18,291

DAT Net Loss & Closing Expenses

16,048

-

-

6,000

22,048

Long-Term Contract Adjustments

9,934

-

-

-

9,934

Pension Expense

-

-

-

3,000

3,000

Non-Income Tax Gain

-

(15,656)

-

-

(15,656)

Adjusted EBIT

92,597

$

78,933

$

83,729

$

(48,935)

$

206,324

$

Adjusted GM as a % of Adjusted Sales

34.6%

35.6%

32.4%

-

34.5%

Adjusted EBIT as a % of Adjusted Sales

14.3%

12.5%

20.3%

-

12.2% |

Q4

2015 Supplemental Financial Information FY 2014* Adjusted Gross Margin and

EBIT 27

* FY 2014 was an eleven month fiscal period ended September 26, 2015.

In thousands

Avionics

Sensors

AM

ESL

GAAP Sales

668,595

$

689,850

$

442,682

$

1,801,127

$

GAAP Gross Margin

241,826

$

232,446

$

150,442

$

624,714

$

Accelerated Integration

1,826

2,780

738

5,344

Incremental Compliance

315

298

64

677

Adjusted Gross Margin

243,967

$

235,524

$

151,244

$

630,735

$

In thousands

Avionics

Sensors

AM

Corporate

ESL

GAAP EBIT

92,227

$

73,653

$

94,450

$

(60,332)

$

199,998

$

Accelerated Integration

5,133

6,782

4,863

669

17,447

Incremental Compliance

1,435

2,672

744

3,451

8,302

Adjusted EBIT

98,795

$

83,107

$

100,057

$

(56,212)

$

225,747

$

Adjusted GM as a % of Adjusted Sales

36.5%

34.1%

34.2%

-

35.0%

Adjusted EBIT as a % of Adjusted Sales

14.8%

12.0%

22.6%

-

12.5% |