Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TALEN ENERGY SUPPLY, LLC | d937235dex991.htm |

| 8-K - FORM 8-K - TALEN ENERGY SUPPLY, LLC | d937235d8k.htm |

Talen Energy

June 2015 Investor Presentation

Creating Value from Day 1

We Generate Energy for a Brighter Tomorrow

Exhibit 99.2 |

©

Talen Energy Corporation 2015

2

Safe Harbor

Forward Looking Statements:

Any statements made in this presentation about future

operating results or other future events are forward-looking

statements under the Safe Harbor Provisions of the Private

Securities Litigation Reform Act of 1995. Actual results may

differ materially from such forward-looking statements. A

discussion of factors that could cause actual results or

events to vary is contained in the Supplemental Information

to this presentation and in the Company’s SEC filings,

including

the

factors

discussed

under

“Risk

Factors”

in

the

Company’s Registration Statement on Form S-1.

|

©

Talen Energy Corporation 2015

3

Agenda

Introduction to Talen Energy

Commercial & Operational Overview

Financial Overview

Key Investment Considerations

Q&A

P. Farr

P. Farr

J. McGuire

P. Farr |

©

Talen Energy Corporation 2015

4

Introduction to Talen Energy |

©

Talen Energy Corporation 2015

5

Talen in 20

Great Assets

Attractive Markets

Strong

Balance Sheet

Execution Track

Record

Focused on

Free Cash Flow

Poised for Growth

Significant |

©

Talen Energy Corporation 2015

6

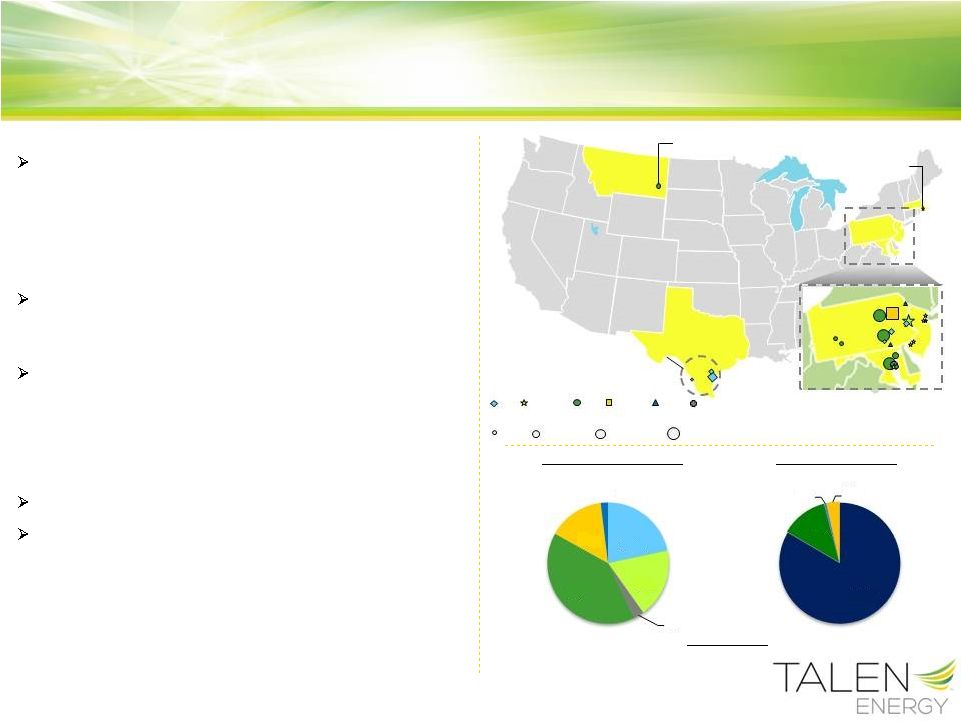

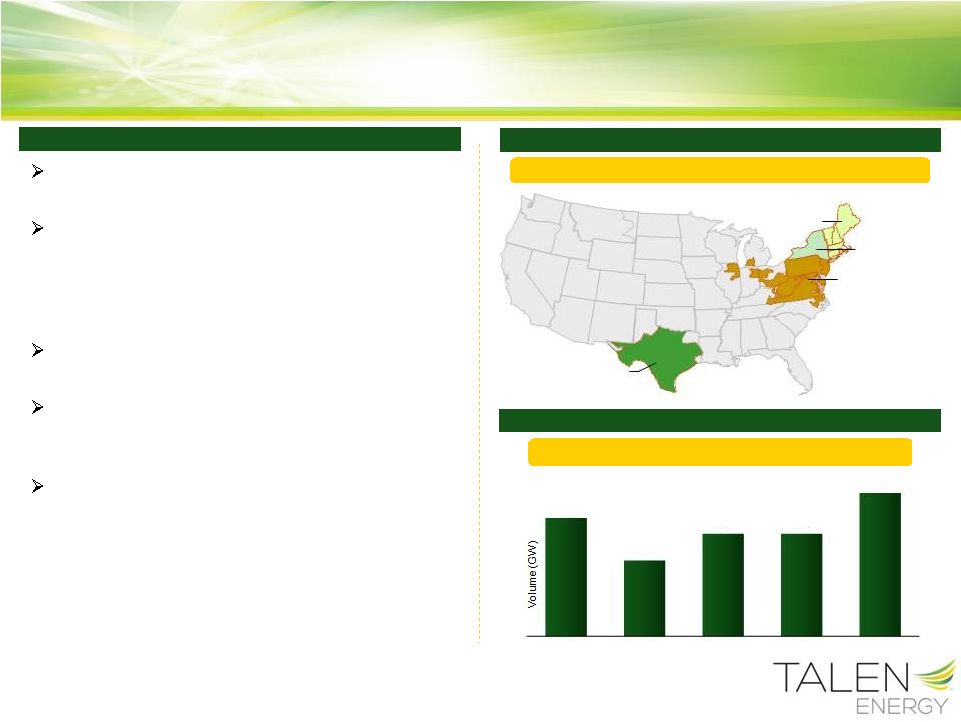

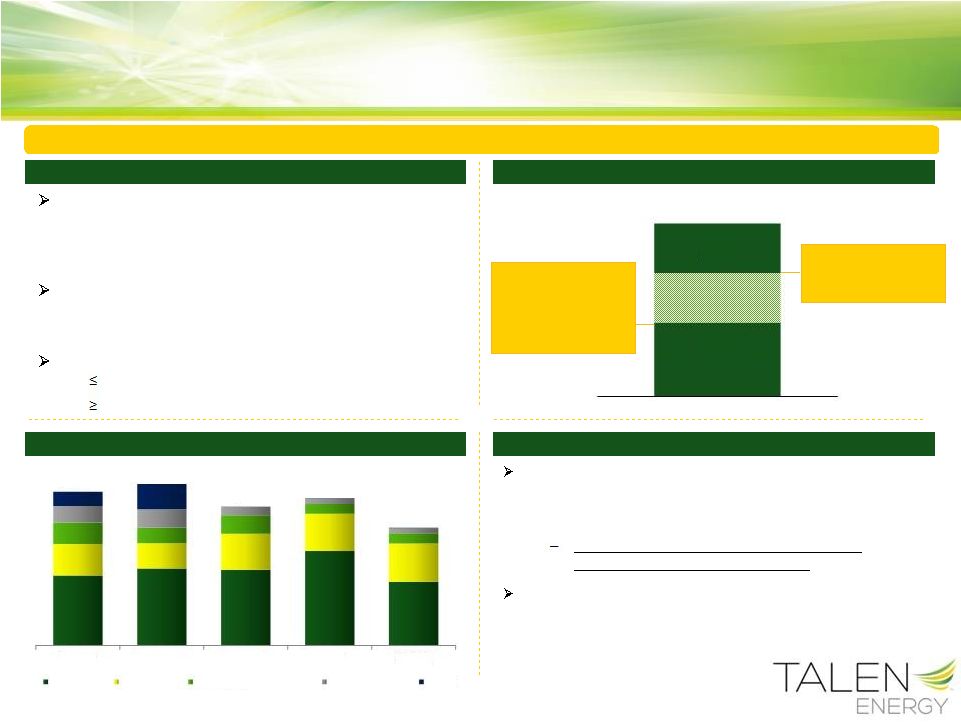

Re-Introducing Talen Energy

New independent power producer (“IPP”) formed by

the contemporaneous spin-off of PPL Energy Supply

(“Energy Supply”) and synergistic merger with RJS

Power Holdings (“RJS”), a portfolio company of

Riverstone Holdings that owned conventional

competitive power generation assets

Assets primarily located in two of the largest and

most liquid, competitive electricity markets in the

United States: PJM and ERCOT

A highly diverse fleet with multiple ways to capture

value including:

-

Flexible gas and highly efficient coal units

-

Significant carbon-free nuclear capacity

-

Portfolio optimizing dual-fuel capability

Strong balance sheet with superior growth prospects

Management team with extensive experience in

competitive power generation, a demonstrated track

record of strong operations, solid market calls and

ahead-of-the-curve strategic execution

Note: Does not reflect sale of approximately 1.3 GW of generating capacity that is

required to comply with the FERC Order MT

PA

TX

NJ

MD

530 MW ownership in

Colstrip facility

1,900 MW of flexible

CCGT and CT natural gas

generation in ERCOT

Over 12,500 MW of

PJM generation with

a diverse fuel mix

89 MW

Dartmouth

facility

MA

Capacity by Market

Capacity by Fuel Type

Gas

Dual

Fuel

Coal

Nuclear

Hydro

Fuel Type

Operating Capacity (MW)

< 300

300

–

750

750 –

1,000

> 1,000

15,079 MW

Oil

Hydro/Renewables

Natural Gas

Dual Fuel

Oil

Coal

Nuclear

WECC/MT

ISO-NE

PJM

ERCOT

83%

12%

1%

4%

22%

18%

3%

40%

15%

2% |

©

Talen Energy Corporation 2015

7

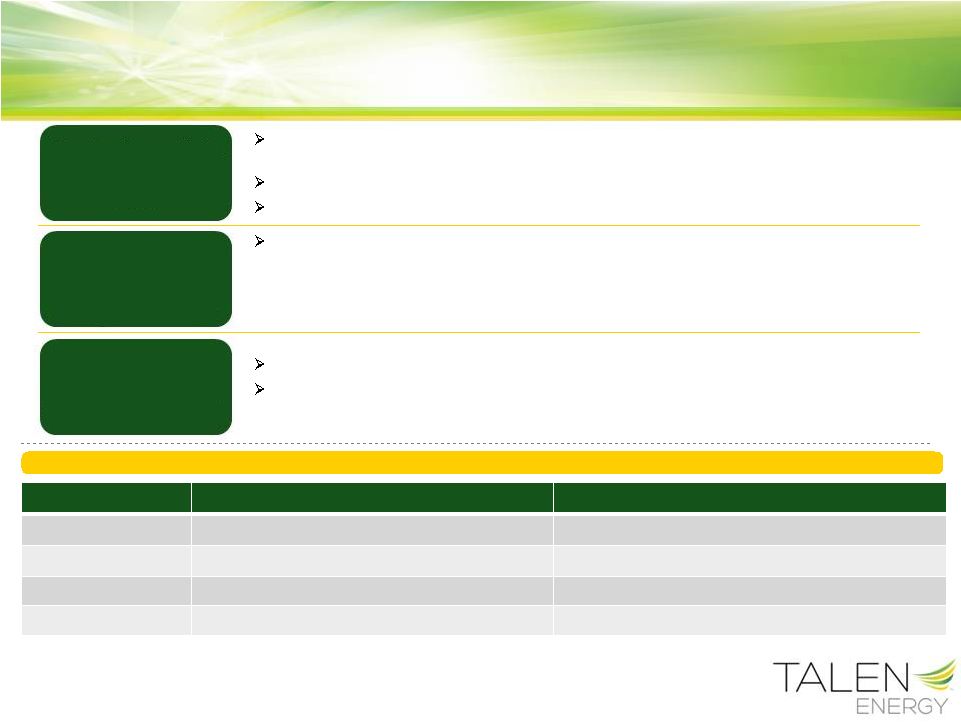

Merger with RJS creates a vibrant company with sufficient scale and asset

diversity to be an attractive and competitive IPP

Clear line-of-sight cost synergies and portfolio margin benefits

Valuation multiple expansion

Benefits derived from consolidation are an extremely powerful lever for value

creation Rate regulated utilities and competitive generation in the same

corporate structure does NOT optimize value

Freedom to pursue strategies as a pure-play IPP with respect to:

-

Hedging and portfolio management

-

Capital allocation

-

Growth

Creates Immediate

Shareowner

Value

Provides

Significant,

Sustainable

Long-Term Value

Formation of

Talen Energy

Validates the Thesis

Talen Energy Value Proposition

Then

Now

Value Creation

EPS / Decrease Volatility / Support Dividend

Cash Flow / Consolidation / Synergy Capture

Growth

Negative: Sell downs to raise capital

Significant: Talen Energy a result of consolidation

Asset Diversity

Fuel Only

Fuel + Markets

Liquidity & Hedging

Longer-term / Excess Liquidity / Ratings Driven

Shorter-term / Adequate Liquidity / Extrinsic Capture

A Complete Transformation |

©

Talen Energy Corporation 2015

8

Talen Energy’s Strategy

Safety is a core value

Value is built on a foundation of excellence in operations

Strong unit availability and performance during extreme load periods

The balance sheet is a strategic asset

Enhanced flexibility and capacity

Absorb volatility and pursue growth opportunities

Management incentives aligned with investors driven by EBITDA and free

cash flow

Cash generation fuels growth and investment opportunities

Investment for growth subject to rigorous returns-based analysis

Primary focus on delivering visibility 1-year forward

Manage and monetize intra-year volatility

Retail activities oriented to hedge the generation fleet in related markets

Safety &

Excellent Plant

Operations

Strategic Balance

Sheet Management

Strong Cash

Returns

Active Hedging &

Portfolio

Management

Growth Focus

Growth in value, not size alone

Right assets in the right markets

Not restricted by markets or fuel types |

©

Talen Energy Corporation 2015

9

ERCOT –

75 GW

Focus

on

Growth

in

Key,

Competitive

Markets

(1)

Key Growth Initiatives & Opportunities

Talen Energy’s Growth Prospects

Robust Competitive Power Asset Market

Focused on liquid, developed competitive

markets

Operating assets have a priority over

development opportunities

–

Immediate cash flow and EBITDA contribution

–

Synergies fit with existing portfolio value capture

and risk mitigation

Recent history reflects a very robust market for

competitive generation assets

Approximately 300

GW

(1)

of market-based

generation capacity in key markets; provides

significant opportunity for growth

Select development sites and repowering

opportunities within Talen Energy portfolio

currently being evaluated

Source: SNL

(1) Excludes generation capacity from principal competitive generators (CPN,

DYN, NRG, TLN and EXC) About 350 GW sold over past 5 years

PJM –

130 GW

NYISO –

60 GW

ISO-NE –

25 GW

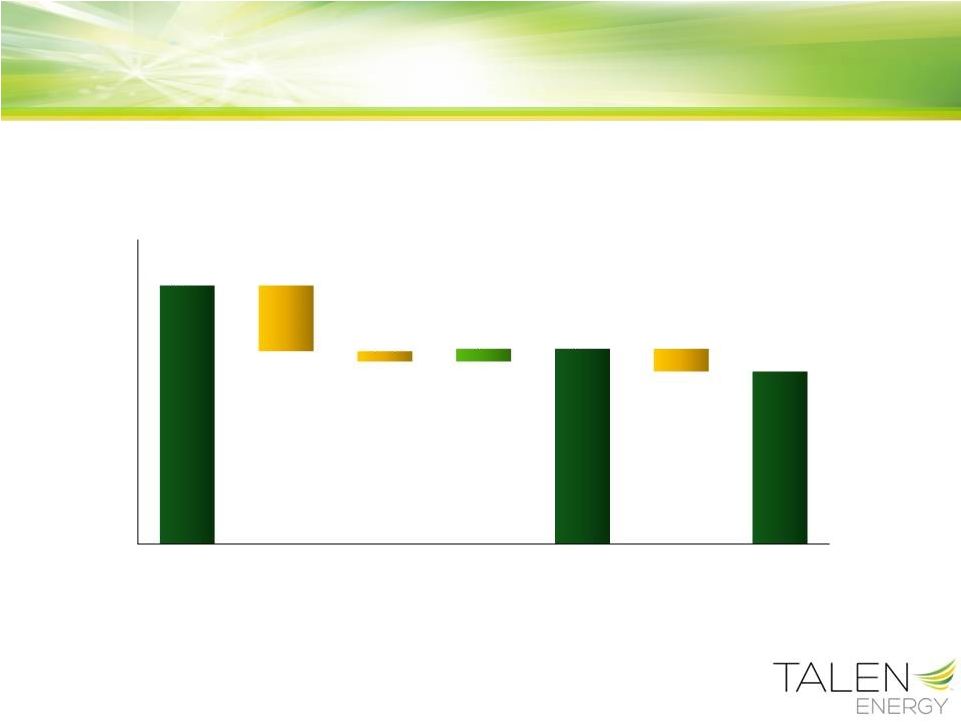

Substantial acquisition opportunity in key markets

75

48

65

65

91

2010

2011

2012

2013

2014 |

©

Talen Energy Corporation 2015

10

Talen Energy Measures of Success

Goals based on these

metrics form the

backbone of

management incentive

compensation

Operations

Focus

Execution

Key Metrics

Result

Growth

Sustainable

share price

appreciation

driven by

improvements in

EBITDA and Free

Cash Flow

Safety

O&M and Capex

efficiency

Availability

Beyond plan

synergies

Asset

commercialization

Disciplined strategic

acquisitions

Select “in inventory”

development and

repowering

opportunities

Employee lost time,

OSHA recordables,

Total Case Incidence

Rate (TCIR)

$/MW & $/MWh: G&A,

O&M, Totex

Commercial

Availability

IRR

Synergies

Cash flow accretion

Portfolio effects

Credit impacts |

©

Talen Energy Corporation 2015

11

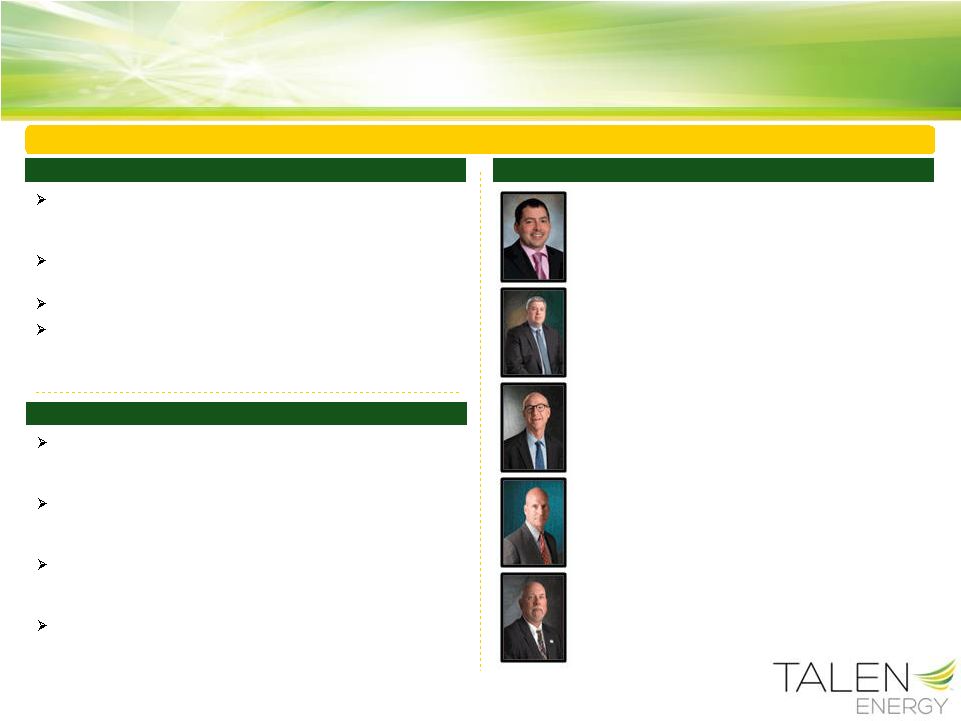

Seasoned leaders with the right experience to successfully execute Talen

Energy’s strategy Extensive Operational Experience

Management team has extensive experience in fossil and

nuclear power generation, commercial operations, strategy,

corporate finance and governance

Senior leadership team averages nearly 30 years of

experience in the power sector

Extensive public company experience

Strong Board comprised of individuals with competitive,

sector and technology-specific experience

Strong History of Strategic Execution

PPL’s cash acquisition of E.ON U.S. LLC, parent company of

Louisville Gas & Electric Company and Kentucky Utilities

Company, for $7.6 billion in 2010

PPL’s acquisition of Central Networks from E.ON UK plc for

$5.8 billion in cash and assumption of $800 million of existing

public debt in 2011

PPL’s acquisition of 660 MW Ironwood CCGT for a cash

purchase price of $85 million and $217 million of net project

debt in 2012

PPL’s sale of hydroelectric facilities in Montana to

NorthWestern Energy Corporation for $900 million in cash in

2014

Management Bios

Paul Farr

President, Chief Executive Officer and Director

•

Previously the President of PPL Energy Supply

•

Served as Executive Vice President and CFO of PPL for seven years

•

Five years leading PPL’s International Operations and Strategy

function

Jeremy McGuire

Senior Vice President and Chief Financial Officer

•

Previously the Vice President of PPL Strategic Development

•

Served as a Director in the Global Power & Utilities Group at Lehman

•

20 years of financial advisory and strategic and capital markets

execution experience

Russ Clelland

Vice President and Treasurer

•

Previously the Assistant Treasurer and VP at PPL

•

Has more than 35 years of experience in corporate finance

Joe Hopf

Senior Vice President and Chief Commercial Officer

•

Previously Senior VP -

Fossil and Hydro Generation at PPL

•

Has more than 30 years experience in the electricity generation and

marketing business, as well as expertise in risk management and

credit

Tim Rausch

Senior Vice President and Chief Nuclear Officer

•

Previously Senior VP -

Chief Nuclear Officer at PPL

•

Has 25 years of experience in virtually every discipline of the

nuclear power industry

Experienced Management Team |

©

Talen Energy Corporation 2015

12

Commercial & Operational Overview |

©

Talen Energy Corporation 2015

13

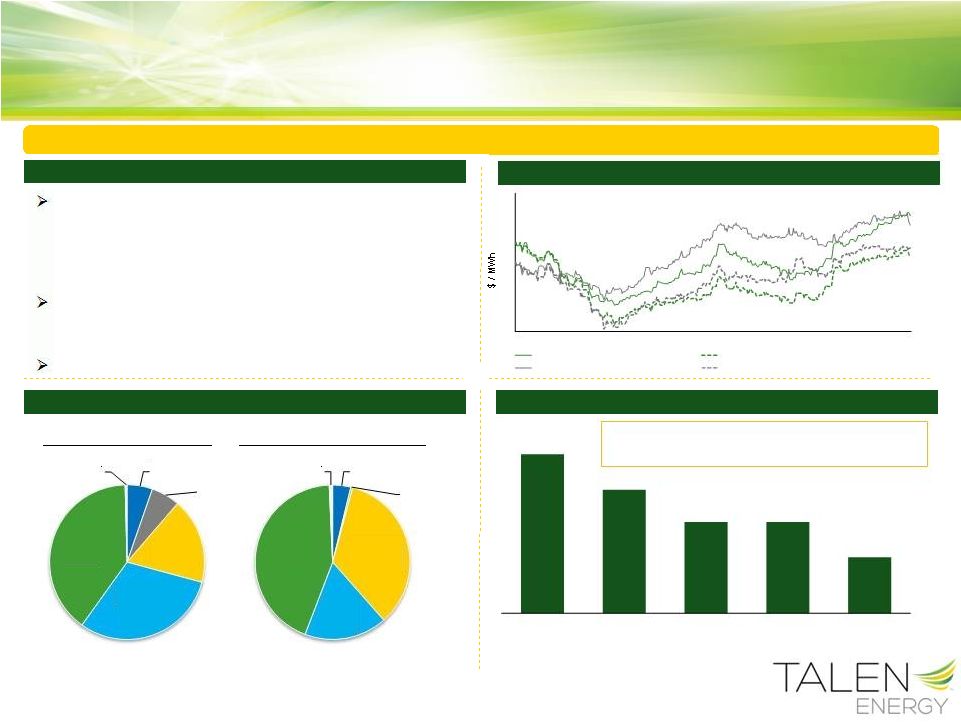

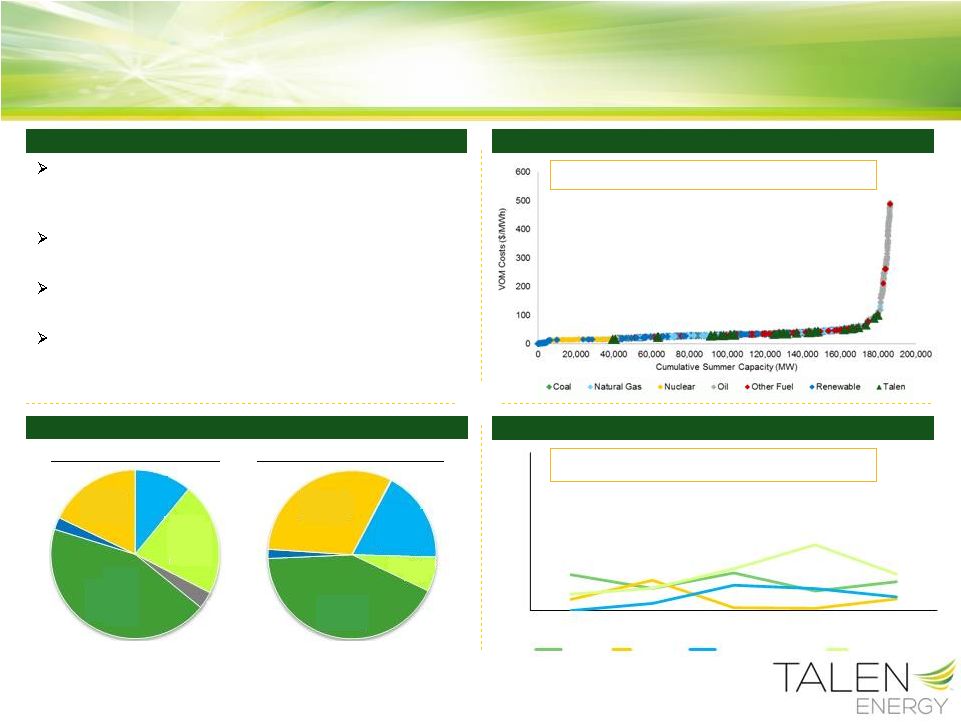

Source: Monitoring Analytics, LLC’s 2014 State of the Market Report for

PJM PJM Highlights

2014

PJM

Fuel

Mix

(1)

Strong capacity market, plant retirements and market reforms support long-term

fundamentals Supportive market fundamentals due to limited import

capacity, significant capacity retirements, improving

demand outlook, and a forward capacity market

providing cash flow certainty to generation asset

owners

Projected Decrease in Reserve Margins

Reserve margin decline driven by retirements of less-

efficient coal generators facing rising environmental costs

and challenged dark spreads

Source: PJM’s February 2, 2015 Forecasted Reserve Margin Graph

Capacity by Fuel Type

Generation by Fuel Type

(1)

Installed capacity as of December 31, 2014 and generation breakdown from January 1

to December 31, 2014 Exposure to Key Markets –

PJM

PJM Spark Spreads

16

22

24

26

5/1/14

6/1/14

7/1/14

8/1/14

9/1/14

10/1/14

11/1/14

12/1/14

1/1/15

2/1/15

3/1/15

4/1/15

18

20

PJM West Hub On-Peak vs Henry Hub -

2016

PJM West Hub On-Peak vs Henry Hub -

2017

PJM West Hub On-Peak vs TETCO M-3 -

2016

PJM West Hub On-Peak vs TETCO M-3 -

2017

21.4%

20.2%

19.1%

19.1%

17.9%

2015E

2016E

2017E

2018E

2019E

Renewables

5%

Oil

6%

Nuclear

18%

Natural Gas

31%

Coal

40%

Other

<1%

Renewables

4%

Oil

<1%

Nuclear

34%

Natural

Gas

17%

Coal

44%

Other

1%

PJM capacity performance product supports potential

capacity price increase, benefiting reliable generation

units

Increasing spark spreads due to lower gas prices |

©

Talen Energy Corporation 2015

14

(1)

Excludes EFORd for 354 MW of combustion turbines; EFORd: Equivalent Forced Outage

Rate demand (2)

Includes Ironwood and Lower Mount Bethel

(3)

Excludes statistics for 354 MW of combustion turbines

Diverse PJM Dispatch Capabilities

Talen Energy’s PJM Fuel Mix

PJM Fleet Highlights

Talen Energy’s assets are diverse in fuel and dispatch,

providing operational flexibility and reliable generation to

PJM under a variety of market conditions

Assets earn strong capacity revenues that provide

margin support and predictability

Assets positioned across various regions and serve as

natural hedges to basis risk from congestion constraints

Expansion and development capabilities provide

opportunities to enhance the portfolio

2011 –

2014 EFORd

(1)

The Right Assets in Key Markets –

PJM

Capacity by Fuel Type

Generation by Fuel Type

Strong unit availability an important factor in Capacity

Performance auction outcomes

12,553 MW

Well situated to serve retail and default supply load

0%

5%

10%

15%

20%

25%

2011

2012

2013

2014

Average

Coal

Nuclear

Natural Gas CCGT

Natural Gas/ Oil

(2)

(3)

Natural

Gas

11%

Dual

Fuel

22%

Oil

3%

Coal

44%

Hydro

2%

Nuclear

18%

Natural

Gas

18%

Dual Fuel

7%

Coal

42%

Hydro

2%

Nuclear

31%

Note: Does not reflect sale of approximately 1,300 MW of generating capacity

that is required to comply with the FERC Order or immaterial renewable capacity |

©

Talen Energy Corporation 2015

15

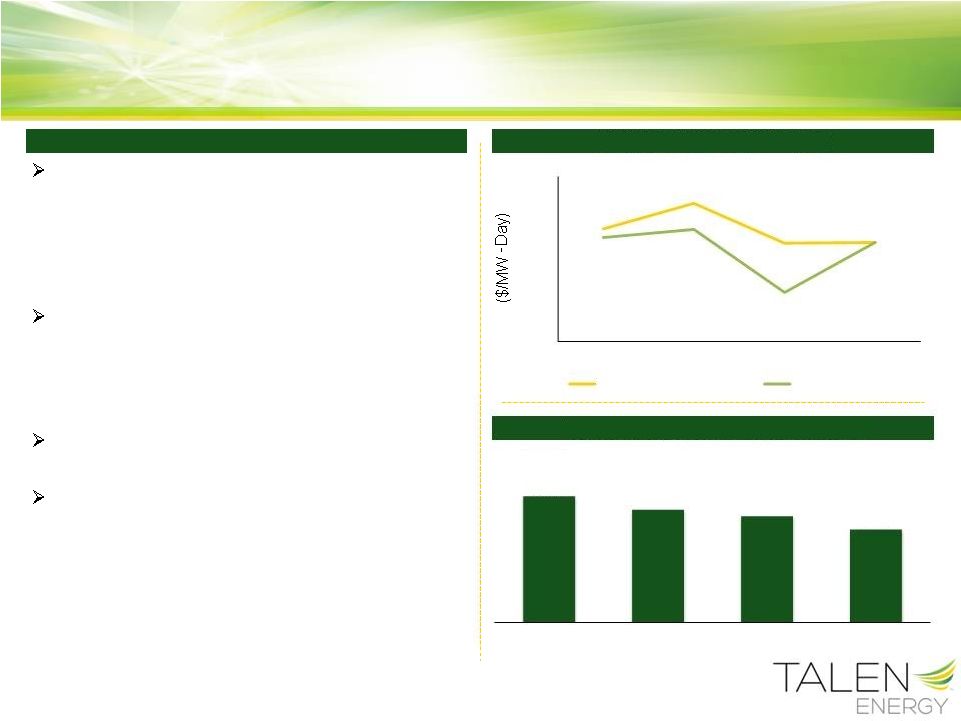

Historical Capacity Prices

PJM Capacity Performance (“CP”) Product

Proposal to add enhanced product to the

capacity market structure to provide additional

compensation for generators to make

necessary investments to maintain system

reliability in exchange for stronger performance

requirements

If approved by FERC, Capacity Performance is

expected to benefit generators like Talen

Energy that have demonstrated reliability

during peak load and extreme weather

conditions

Project 95% of fleet to be eligible to be bid in as

“CP”

under proposed rules

Fleet is substantially leveraged to PJM capacity

prices –

a $10/MW Day increase = a projected

~$45

million increase in potential capacity

revenues

Talen Energy Capacity Revenues

Leverage to PJM Capacity Prices

($ in millions)

$0

$25

$50

$75

$100

$125

$150

$175

$200

2014/2015

2015/2016

2016/2017

2017/2018

PJM MAAC & SWMAAC

PJM RTO

$733

$655

$618

$540

2014

2015E

2016E

2017E |

©

Talen Energy Corporation 2015

16

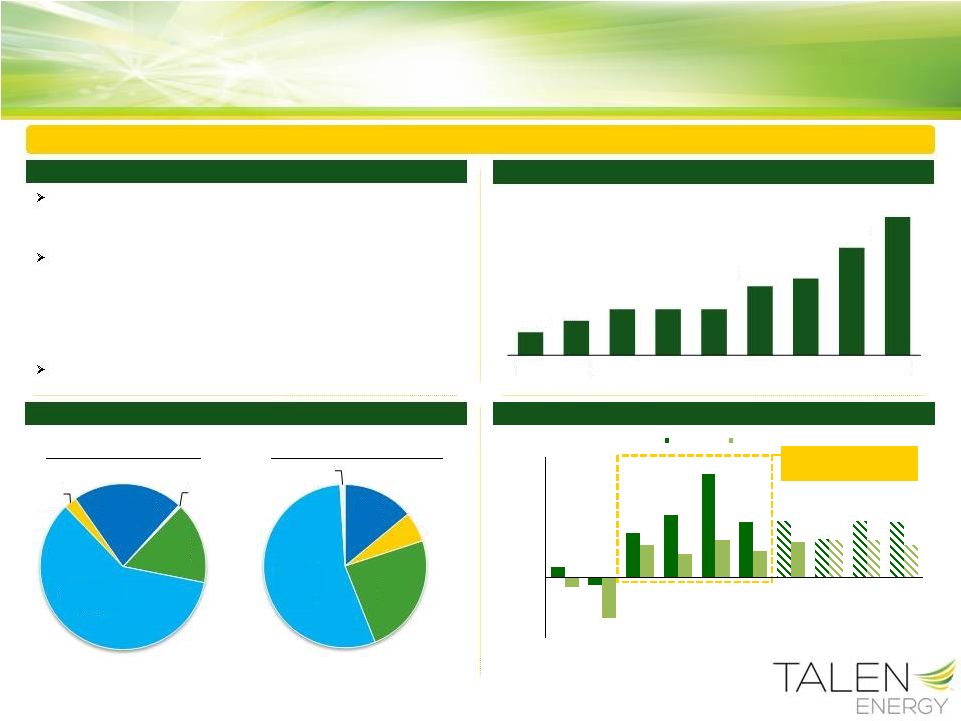

Above-average historical demand growth, increasing price caps

and an increasing reliance on flexible and quickly-dispatchable

natural gas-fired assets

ERCOT’s supply stack can provide significant margin opportunities

driven by unforeseen weather anomalies coupled with variability,

resulting in periods of extremely high power prices known as

“scarcity pricing”

-

Electricity prices are subject to a system-wide offer cap of

$9,000/MWh

The Texas population and gross state product (“GSP”) are growing

well above the national rate

ERCOT System-Wide Offer Cap ($/MWh)

2014 ERCOT Fuel Mix

Tracking double the

national average

Texas GSP / U.S. GDP Growth Rate

Sources: ERCOT, Bureau of Economic Analysis, Texas Office of

Comptroller and Federal Open Market Committee ERCOT Highlights

Capacity

by

Fuel

Type

Generation

by

Fuel

Type

Exposure to Key Markets –

ERCOT

0.7%

(0.5%)

3.0%

4.2%

6.9%

3.7%

3.8%

2.6%

3.8%

3.7%

(0.6%)

(2.7%)

2.2%

1.6%

2.5%

1.8%

2.4%

2.5%

2.5%

2.2%

(4.0%)

(2.0%)

0.0%

2.0%

4.0%

6.0%

8.0%

2008

2009

2010

2011

2012

2013

2014(E)

2015E

2016E

2017E

Texas GSP

U.S. GDP

$1,500

$2,250

$3,000

$3,000

$3,000

$4,500

$5,000

$7,000

$9,000

2007

2008

2009

2010

2011

2012

2013

2014

2015

Coal

16%

Natural Gas

60%

Nuclear

2%

Renewables

21%

Other

1%

Wind

14%

Nuclear

6%

Coal

24%

Natural

Gas

55%

Other

1%

Positive outlook due to strong demand growth and increased price caps |

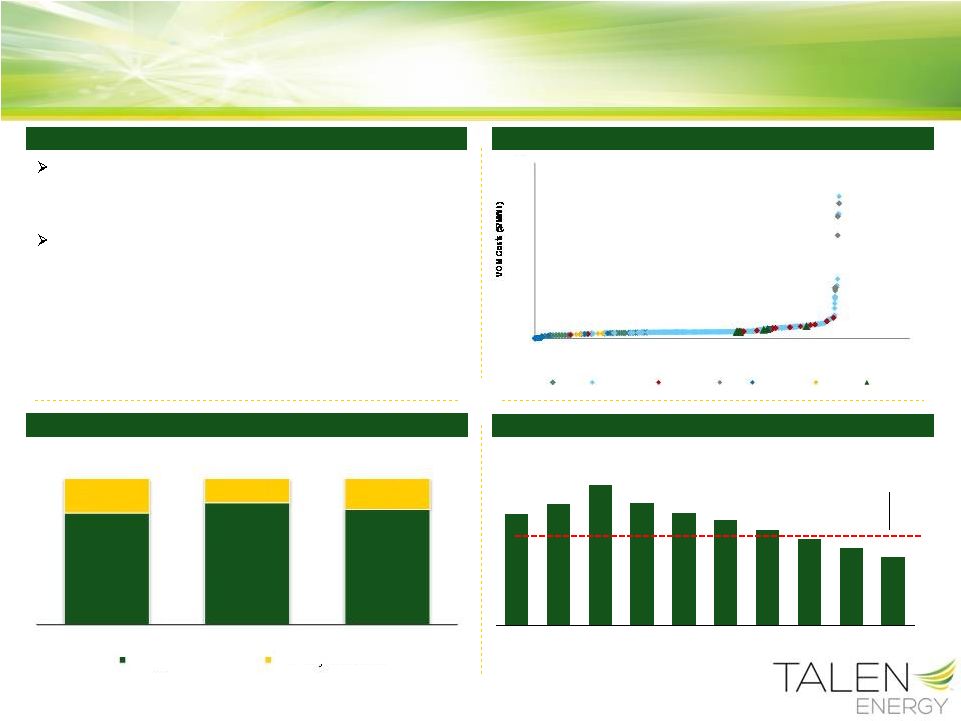

Highly reliable, flexible natural gas fleet designed to ramp

up quickly to support grid stability

-

Majority of units ramp up at 20 MW per minute

Opportunities to take advantage of higher scarcity pricing

in ERCOT due to weather variability, unplanned

transmission and generation outages, and potential coal

generation retirements resulting from upcoming EPA

regulations

-

Potential scarcity pricing benefits: a one hour

period at the $9,000/MWh cap equates to about

$20 million in revenue

Quick-Dispatch Assets Positioned for Scarcity

Supportive Ancillary Revenues

ERCOT Fleet Highlights

Declining Reserve Margins

The Right Assets in Key Markets –

ERCOT

(1)

Assumes all owned ERCOT generation is running and unhedged when prices hit

system-wide offer cap (1)

Source: SNL

Source: 5/4/15 ERCOT CDR Report

13.75% Target Reserve Margin

0

100

200

300

400

500

600

0

20,000

40,000

60,000

80,000

100,000

Coal

Natural Gas

Other Fuel

Oil

Renewable

Nuclear

Talen

76%

83%

79%

24%

17%

21%

2012

2013

2014

Energy Revenue

Ancillary Revenue

17

©

Talen Energy Corporation 2015

17.0%

18.5%

21.4%

18.7%

17.1%

16.1%

14.6%

13.2%

11.8%

10.4%

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

Cumulative Summer Capacity (MW) |

©

Talen Energy Corporation 2015

18

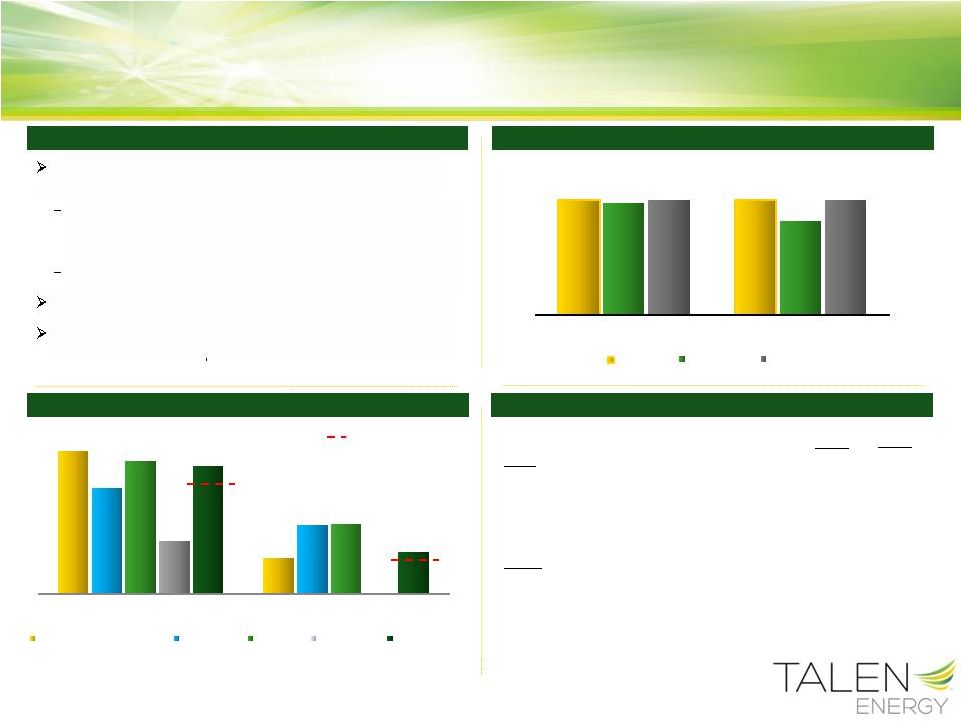

Hedging & Commercial Management Strategy

Note: As of March 31, 2015

Hedging & Commercial Strategy

Coal and Nuclear Fuel Hedge Levels

Portfolio Generation Hedge Position

Average Hedge Prices

Portfolio Targets

Focused on providing margin and cash flow visibility on a

one year forward basis

Lower level of financial leverage and strong liquidity

allow for greater resilience to operating cash flow

volatility enabling a shorter-term hedging program

Substantially reduces program costs

Execute strategies in both wholesale and retail markets

Utilize FTRs and basis swaps to reduce the risk of price

differentials between plants and hubs

75%

25%

2015

2016

East:

Power: Nuclear/Coal/Hydro ($/MWh)

$41-43

$44-46

Spark Spread ($/MWh)

$10-11

$8-9

Consumed Coal (Delivered $/ton)

$73-75

$72-74

West:

Power: Coal ($/MWh)

$40-42

$39-41

Spark Spread ($/MWh)

$14-15

-

Consumed Coal (Delivered $/ton)

$27-31

$27-33

100%

25%

74%

48%

93%

49%

37%

0%

90%

29%

2015

2016

East Nuclear, Coal & Hydro

East Gas/Oil

West Coal

West Gas/Oil

Total Portfolio

100%

100%

97%

81%

100%

100%

2015

2016

Nuclear

East Coal

West Coal

©

Talen Energy Corporation 2015

18 |

©

Talen Energy Corporation 2015

19

Turbine Blade Design Issues Resolved

Historical Equivalent Availability (“EQA”)

Historical Station Output

Lower EQA primarily driven

by turbine blade cracking

Turbine blade related outage

Set operational records in back-to-back

years prior to turbine blade cracking

Strong track-record of safety and performance

May 2011: First identified cracked blades on both units; first

instance for Siemens

2011 –

2014: 10 blade-related outages; first one lasted 38

days, more recent outages were as little as 12 days

Installation of monitoring gear allowed operations to proceed

within OEM specifications

2014: Installed new shorter last stage blade design on one

turbine

Seeing significantly reduced blade tip vibration

No evidence of root cracking

Plant efficiency unaffected

2015: Completed Root Cause Analysis confirming equipment

deficiencies and installed short blades on two Unit 2 turbines

during scheduled refueling outage

2016: Will install short blades on two additional Unit 1

turbines and perform validation inspections on short blades

installed in 2014 as part of the scheduled Unit 1 refueling

outage

Expect validation inspections to confirm short blade solution

efficacy

2017: Will install short blades on final Unit 2 turbine

Project ~89% EQA for

2015 –

highest in 6 years

No special turbine-related maintenance outages

are projected 2015 or thereafter

©

Talen Energy Corporation 2015

19

16.0

16.4

17.1

17.5

16.7

15.6

15.2

17.0

16.9

18.2

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

E

Susquehanna Nuclear Operations |

©

Talen Energy Corporation 2015

20

Financial Overview |

©

Talen Energy Corporation 2015

21

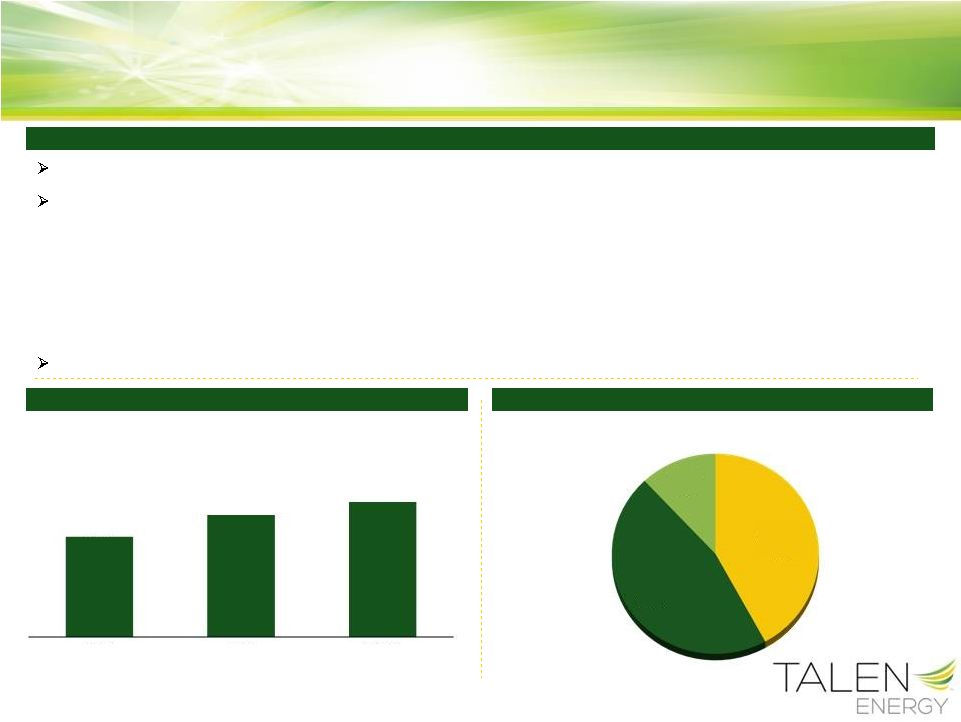

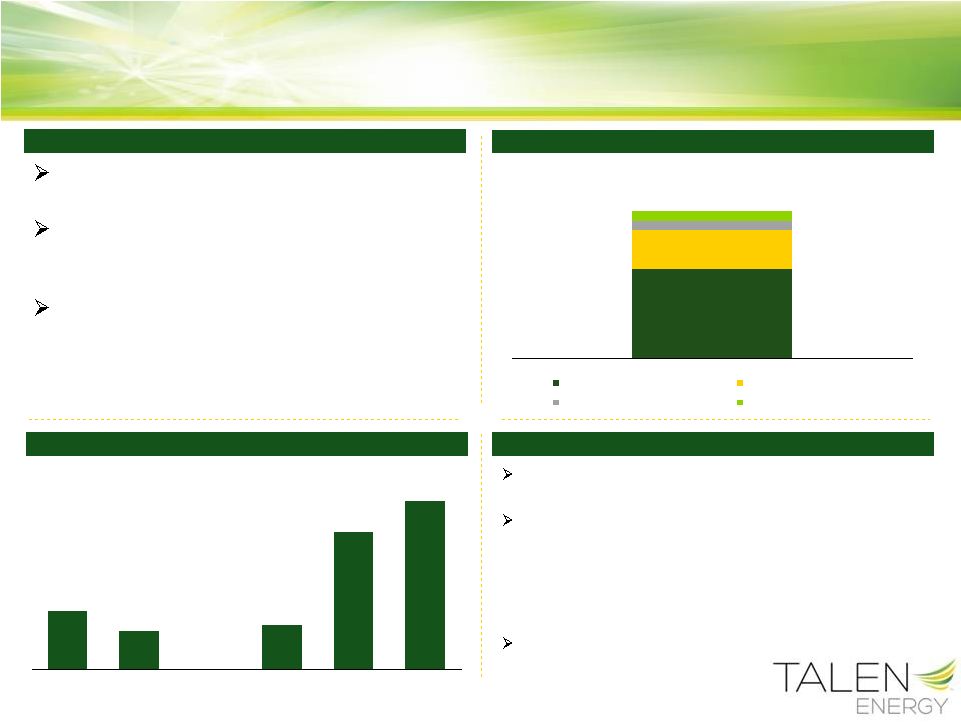

Expected Synergies

On track to deliver at least $155 million on an annual basis by 2017 as originally

forecasted Synergy attainment through multiple channels:

-

Overhead reductions

-

Asset focused commercial strategy

-

Streamlined operational workforce

-

Supply chain savings through greater discounts and enhanced inventory

management -

Margin

enhancement

through

improved

fuel

sourcing

and

commercial

management

-

Fleet-wide economies of scale

Infrastructure in place to add MWs in a cost-effective manner

Synergies

Projected Synergies

($ in millions)

Breakdown of Projected Synergies

$155 million

$115

$140

$155

2015

2016

2017

Operations

42%

Overhead

46%

Margin

12% |

©

Talen Energy Corporation 2015

22

Transition Support Costs

($ in millions)

Estimated TSA Costs by Category

Projected Range for TSA Cost

Category

% of Total Cost

Information Technology

84%

Business Support

(2)

16%

Transition Service Agreements (TSAs)

TSAs are temporary agreements put in place to

help facilitate Talen Energy’s transition to its new

operating model

Transition services are contractually available for

up to two years

-

Talen Energy expects to end TSAs by early 2017

The largest portions of service costs support the

development of reliable information technology

systems and infrastructure

(1)

TSA costs to begin June 1, 2015

(2)

Business Support includes Financial, Legal, Human Resources, Facilities, and

Commercial Services (1)

$30

$40

$10

$40

$50

$20

2015

2016

2017 |

©

Talen Energy Corporation 2015

23

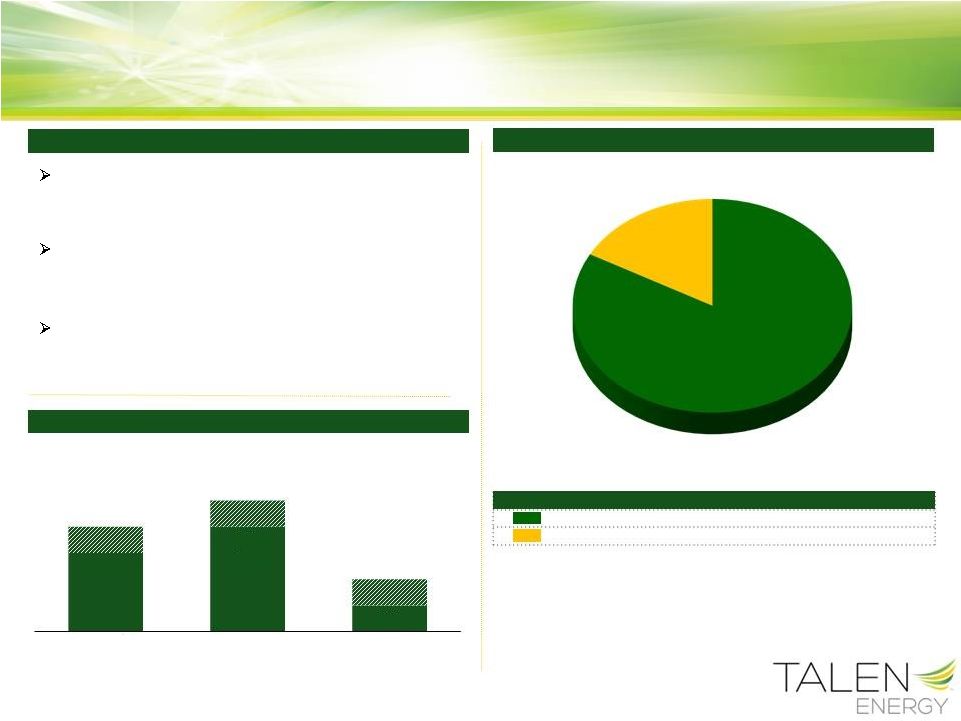

Notes: Does not reflect sale of approximately 1.3 GW of generating capacity

that is required to comply with the FERC Order 2015 Adjusted EBITDA

Expected transitional or

restructuring costs that will not be

experienced on a “run-rate basis”

(2)

(3)

(1)

($ millions)

Estimate provided at 6/9/2014

transaction announcement

$1,067

$1,010

$910

$25

($37)

($5)

($40)

($40)

($35)

($25)

$500

$600

$700

$800

$900

$1,000

$1,100

2015 Model

Year EBITDA

Margins

O&M & Other

Net ARO

Expense

Partial

Synergies

2015 Adjusted

EBITDA

Pre-spin PPL

Charges

TSA

Restructuring

Cost

2015 Adjusted

EBITDA,

including special

items (Midpoint)

(1)

Additional item identified as an adjustment to EBITDA, but was not adjusted in the

original $1,067 million model year EBITDA estimate. Net ARO expense means

ARO expense net of NDT income (2)

Synergies below full run-rate projection of $155 million per year

(3)

Reflects 3 months of Energy Supply actuals

Refer to “Supplemental Information – Regulation G Reconciliations” for reconciliation

of non-GAAP financial measures

|

©

Talen Energy Corporation 2015

24

2015 Guidance

($ in Millions)

Low

Mid

High

EBITDA:

Adjusted EBITDA

$935

$1,010

$1,085

Adjusted EBITDA, including special items

$835

$910

$985

Free Cash Flow:

Adjusted

Free

Cash

Flow

$265

$340

$415

Adjusted Free Cash Flow, including special items

$205

$280

$355

Projected Net Debt Outstanding at 12/31/2015

$3,700

Projected Net Debt / Adjusted EBITDA

3.7x

(1)(2)

(2)

(3)

(1)

(1)

Special items include pre-spin PPL charges, TSA costs and restructuring costs

(2)

Does not include growth capex of $48 million

(3)

Includes projection of $170 million in short-term debt outstanding

Notes: Does not reflect sale of approximately 1.3 GW of generating capacity that is required to

comply with the FERC Order

Refer to “Supplemental Information – Regulation G Reconciliations” for reconciliation

of non-GAAP financial measures |

©

Talen Energy Corporation 2015

25

2016 Adjusted EBITDA

($ millions)

$1,010

$885

$840

$25

($130)

($20)

($45)

$500

$600

$700

$800

$900

$1,000

$1,100

2015 Adjusted

EBITDA

Margins

O&M & Other

Partial

Synergies

2016 Adjusted

EBITDA

TSA

2016 Adjusted

EBITDA,

including special

items (Midpoint)

Notes: Does not reflect sale of approximately 1.3 GW of generating capacity that is required to

comply with the FERC Order

Refer to “Supplemental

Information – Regulation G Reconciliations” for reconciliation of non-GAAP financial measures

(1)

(1) Reflects year-over-year increase in expected synergies to

$140 million in 2016 from $115 million in 2015 |

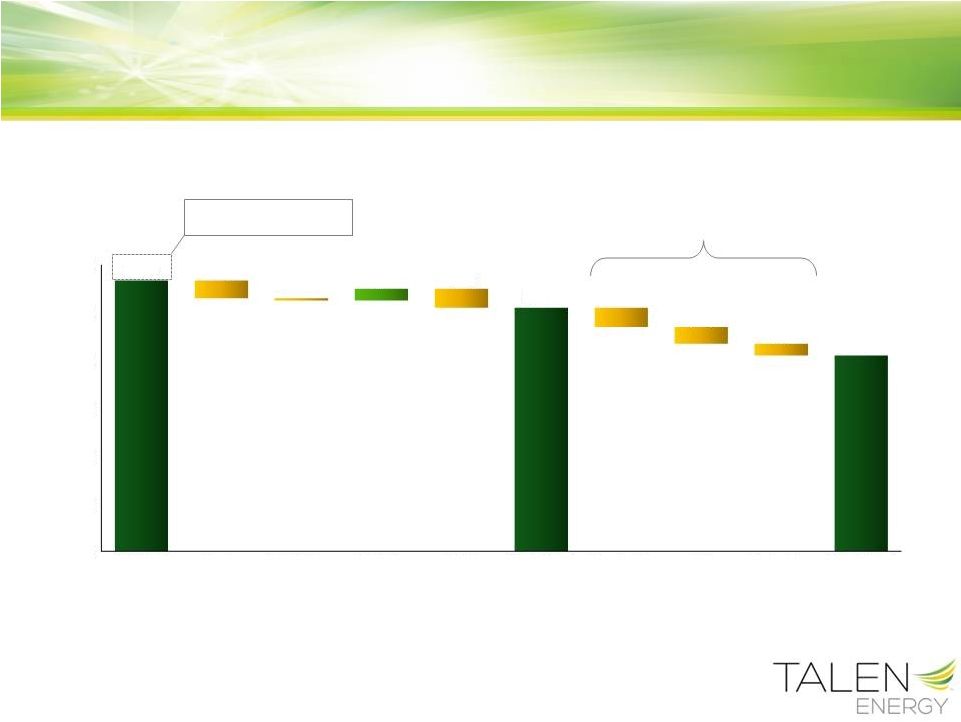

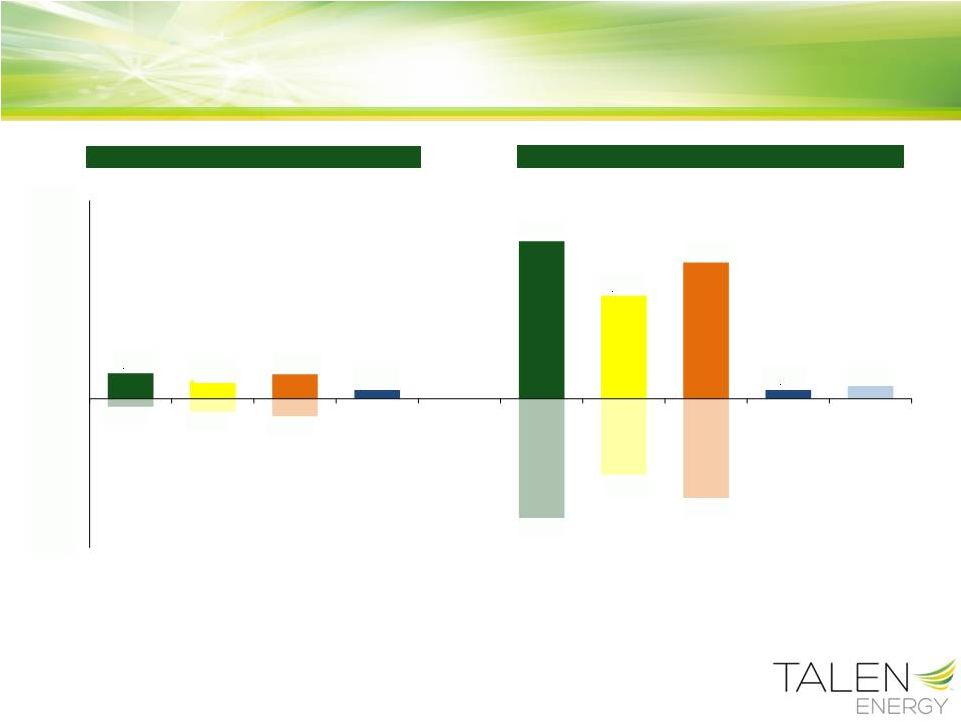

2015

Gas

+/-

$0.50/mmBtu

Heat Rate

+/-

1.0 mmBtu

Power

+/-

$5/MWh

ERCOT

1 hour

@

Offer Cap

2016

PJM

Capacity

+ $10/MW-Day

Margin Sensitivities

($ millions)

Gas

+/-

$0.50/mmBtu

Heat Rate

+/-

1.0 mmBtu

Power

+/-

$5/MWh

ERCOT

1 hour

@

Offer Cap

Notes: Does not reflect sale of approximately 1.3 GW of generating capacity

that is required to comply with the FERC Order Gas price sensitivity assumes

system heat rate is unchanged. Heat Rate sensitivity assumes power price moves and gas price is

unchanged. Power price sensitivity assumes gas price is unchanged.

©

Talen Energy Corporation 2015

26

$52

$37

$50

$18

$318

$208

$275

$18

$26

($16)

($26)

($35)

($240)

($153)

($200)

($300)

($200)

($100)

$0

$100

$200

$300

$400 |

©

Talen Energy Corporation 2015

27

Fully committed $1,850 million 5-year senior

secured revolving credit facility

$800 million secured trading facility, cash, and

bilateral agreements bring total liquidity sources

to $3.0 billion

Bilateral credit facilities are expected to be

effective in 2

nd

/3

rd

quarter 2015

Significant Liquidity Resources

($ in millions)

Liquidity Summary

Liquidity and Financing

Forecasted Long-Term Debt Maturities

Financing Highlights

Issued $600 million of 6.5% senior unsecured notes in

May 2015

Assumed $1,250 million of RJS senior unsecured

notes in connection with the transaction. The

covenants are now comparable to Energy Supply’s

senior unsecured notes covenants. Interest rate will

step down from 5.125% to 4.625% following next

interest payment in July 2015.

Plan to remarket $231 million of tax-exempt securities

in 3

rd

quarter 2015

$3,050

$1,850

$800

$200

$200

Syndicated Secured Credit Facility

Secured Trading Facility

Bilateral Credit Facilities

Cash on Hand

$533

$354

$4

$403

$1,254

$1,538

2015

2016

2017

2018

2019

Thereafter |

©

Talen Energy Corporation 2015

28

Leverage Lane

Capital decisions will be made on a cash returns basis

Capital Priorities

$2.4B of Projected Capital Spending

Capital Allocation

Modest Environmental Spending

Growth through strategic acquisitions

–

Accretive and supportive of long-term value proposition

–

Focus on synergy opportunities and portfolio

diversification

Growth through higher return asset development or

expansion

–

Brunner Island co-firing project

“Leverage

Lane”

of

3x

–

5x

Net

Debt/EBITDA

–

3x –

bias towards growth investment/capital return

–

5x –

bias towards debt retirement

Fleet substantially compliant with current regulations and

future environmental compliance-driven capital

expenditures projected at a modest $160 million from 2015

through 2019

Represents less than 10% of total capital

expenditures for the same period

Talen Energy is actively engaged with policy makers at the

state and federal levels to promote regulatory flexibility and

develop least-cost implementation scenarios, including

regional programs

Utilize balance sheet

for accretive growth

opportunities, asset

optimization projects

and return of capital

Rebalance capital

structure through

debt retirements

3.0 x

5.0 x

$516

$543

$466

$495

$395

2015

2016

2017

2018

2019

Sustenance

Nuclear Fuel

Environmental / Regulatory

Discretionary / I.T.

Growth |

©

Talen Energy Corporation 2015

Key Investment Considerations

29 |

©

Talen Energy Corporation 2015

30

Key Investment Considerations

Attractive fleet composition

High degree of strategic optionality across fuels, dispatch and markets Hedging strategy and balance sheet

construction harmonized to extract maximum value and positioned for growth opportunities Experienced management team with

demonstrated track record of delivering value through asset management and strong execution on

strategic initiatives

Management incentives tied directly to investors’ objectives: EBITDA and Free

Cash Flow |

©

Talen Energy Corporation 2015

31

Supplemental Information |

©

Talen Energy Corporation 2015

32

Asset

Location

Fuel Type

Ownership

Net Heat Rate (Btu / kWh)

Owned Capacity

COD

Region

East Assets

Brandon Shores

(2)

MD

Coal

100%

10,252

1,273

1984 -

1991

PJM-SWMAAC

Brunner Island

PA

Coal

100%

9,842

1,411

1961 -

1969

PJM-MAAC

C.P. Crane

(2)

MD

Coal

100%

10,616

399

1961 -

1967

PJM-SWMAAC

Conemaugh

PA

Coal

16%

9,700

278

1970 -

1971

PJM-RTO

Keystone

PA

Coal

12%

9,600

211

1967 -

1968

PJM-RTO

Montour

PA

Coal

100%

9,661

1,504

1972 -

1973

PJM-MAAC

H.A. Wagner

(2)

MD

Coal/NG/Oil

100%

10,663

976

1956 -

1972

PJM-SWMAAC

Eastern Hydro

(3)

PA

Hydro

100%

N/A

293

1910 -

1926

PJM-MAAC

Ironwood

PA

Natural Gas

100%

7,127

660

2001

PJM-MAAC

Lower Mt. Bethel

PA

Natural Gas

100%

7,170

538

2004

PJM-MAAC

York

(2)

PA

Natural Gas

100%

9,551

52

1989

PJM-MAAC

Bayonne

(2)

NJ

Natural Gas/Oil

100%

8,857

174

1988

PJM-PS North

Camden

(2)

NJ

Natural Gas/Oil

100%

8,675

151

1993

PJM-PSEG

Dartmouth

(2)

MA

Natural Gas/Oil

100%

8,715 (CCGT) / 11,326 (Peaker)

89

1996

ISO-NE

Elmwood Park

(2)

NJ

Natural Gas/Oil

100%

9,500

73

1989

PJM-PS North

Martins Creek 3&4

PA

Natural Gas/Oil

100%

11,744 (Gas) / 10,676 (Oil)

1,700

1975 -

1977

PJM-MAAC

Newark Bay

(2)

NJ

Natural Gas/Oil

100%

8,680

129

1993

PJM-PS North

Peakers

PA

Natural Gas/Oil

100%

Various

354

1967 -

1973

PJM

Pedricktown

(2)

NJ

Natural Gas/Oil

100%

8,455

132

1992

PJM-EMAAC

Susquehanna

PA

Nuclear

90%

N/A

2,245

1983 -

1985

PJM-MAAC

Renewables

(1)

NH, NJ, PA, VT

Renewables

100%

Various

25

Various

Various

Subtotal

12,667

West Assets

Colstrip 1 & 2

MT

Coal

50%

10,941

307

1975, 1976

WECC

Colstrip 3

MT

Coal

30%

10,660

222

1984

WECC

Barney Davis 1

(2)

TX

Natural Gas

100%

10,100

335

1974

ERCOT-South

Barney Davis 2

(2)

TX

Natural Gas

100%

7,100

674

2010

ERCOT-South

Laredo 4

(2)

TX

Natural Gas

100%

8,900

98

2008

ERCOT-South

Laredo 5

(2)

TX

Natural Gas

100%

8,900

98

2008

ERCOT-South

Nueces Bay 7

(2)

TX

Natural Gas

100%

7,100

678

2010

ERCOT-South

Subtotal

2,412

Total Talen Energy

15,079

Talen Energy Asset Overview

Note: Does not reflect sale of approximately 1.3 GW of generating capacity

that is required to comply with the FERC Order (1)Talen Energy is presently

considering divesting its renewables plants (2)Total net generating capacities

are based on average summer and winter capacity (3)Includes Holtwood and

Wallenpaupack |

©

Talen Energy Corporation 2015

33

Group 1

Mitigation Overview

PPL and RJS recognized possible FERC horizontal

market power concerns in PJM submarket 5004/5005 in

their FERC application for approval on July 15, 2014 and

proposed two divestiture options

Each divestiture option requires divestiture of one of two

proposed groups of approximately 1,300 MW of

generating capacity (based on summer ratings), with

some overlapping assets

On December 19, 2014, FERC conditionally approved

the transaction pending additional mitigation measures

-

Option 1: Divest all assets from one group while

limiting assets retained from other group to cost-based

rates

-

Option 2: Divest all 2,000 MW of capacity from both

groups

-

Option 3: Propose an alternative mitigation plan

PPL and RJS accepted Option 1 and told FERC they

would divest all assets from one group and bid the

retained assets at cost-based rates in the energy market

Decisions on which group of assets will be divested have

not been made

Group 2

(1)

Total net generating capacities are based on average summer and winter

capacity (2)

Pedricktown capacity includes capacity dedicated to serving landlord load (which

has historically averaged 9 MW) Facility

MW

Bayonne

0174

Camden

0151

Elmwood Park

0073

Newark Bay

0129

Pedricktown

0132

York

0052

Ironwood

0660

Total

1,371

Facility

MW

Bayonne

0174

Camden

0151

Elmwood Park

0073

Newark Bay

0129

Pedricktown

0132

York

0052

C.P. Crane

0399

Holtwood

0249

Wallenpaupack

0044

Total

1,403

FERC Required Mitigation

(1)

(2)

(2)

(1)

(1)

(1)

(1)

(1)

(1)

(1)

(1)

(1)

(1)

(1)

(1) |

©

Talen Energy Corporation 2015

34

Net Generation (GWh)

EAF

Capacity Factor

EFORd

2013

2014

2013

2014

2013

2014

2013

2014

East

Coal

24,191

22,580

80.6%

82.7%

48.3%

45.4%

5.9%

3.1%

Hydro

662

931

85.3%

88.5%

40.5%

36.3%

3.1%

1.8%

Nuclear

17,009

16,903

84.7%

84.1%

85.6%

85.6%

0.4%

0.3%

Natural Gas CCGT

8,794

9,411

82.0%

88.7%

83.9%

89.4%

4.0%

3.5%

Natural Gas/ Oil

2,283

3,822

91.8%

84.5%

11.8%

17.2%

6.4%

10.2%

Net Generation (GWh)

EAF

Capacity Factor

EFORd

2013

2014

2013

2014

2013

2014

2013

2014

West

Coal

3,502

3,449

81.0%

86.4%

76.0%

74.4%

15.6%

6.9%

Natural Gas

4,678

3,451

88.0%

84.0%

28.4%

21.1%

6.6%

7.8%

Operational Statistics

(1)

Includes Ironwood and Lower Mount Bethel

(2)

Excludes statistics for 354 MW of combustion turbines

(2)

(1) |

©

Talen Energy Corporation 2015

35

Asset

Unit

Low NOx

Burners

(Nox)

SCR/SNCR

(Nox)

Scrubbers

(SO )

Chemical Additive

(Mercury)

ESP/ Baghouse

(PM)

Dry Injection

(Acid Gases)

Closed-Cycle Cooling

Tower

Water Intake, 316(b)

Dry Handling/

Disposal/ Beneficial

Use

(CCRs)

Waste Water

Treatment

(Mainly Metals)

Brunner Island

Unit 1

NR

(1)

(3)

(6)

Unit 2

NR

(1)

(3)

(6)

Unit 3

NR

(1)

(3)

(6)

Montour

Unit 1

NR

(3)

(6)

Unit 2

NR

(3)

(6)

Colstrip

Units 1 & 2

(2)

(2)

(2)

(2)

NR

(3)

NR

(5)

Units 3 & 4

NR

NR

(3)

NR

(5)

Keystone

Units 1 & 2

(6)

Conemaugh

Units 1 & 2

(6)

Brandon Shores

Units 1

(6)

Units 2

(6)

Wagner

Unit 2

(7)

(7)

(4)

(4)

(1)

(6)

Unit 3

(4)

(4)

(1)

(6)

Crane

Unit 1

(7)

(7)

(4)

(4)

(1)

(6)

Unit 2

(7)

(7)

(4)

(4)

(1)

(6)

NR

= Not Required by Applicable Current or Proposed Regulations

= Installed

= Under Consideration/Construction

Environmental Controls

(1) 316(b)

regulations

finalized

in

2014

will

likely

require

intake

structure

modifications

for

some

sites,

particularly

those

with

once-through

cooling

water

systems.

If

needed,

Brunner

Island,

Crane

and Wagner will

install necessary equipment or make operational changes to comply

(2) New and pending NOx, SO2, and PM requirements will be met through boiler and

scrubber modifications; Talen Energy is appealing EPA's final Regional Haze FIP for Montana

(3) CCR regulations finalized in 2015 will likely require modifications to existing

operations or new controls at plants which utilize CCR disposal impoundments. Operation of the recently installed Wastewater Treatment

Plant at Brunner Island (which would replace the only remaining active disposal

impoundment) will commence following renewal of NPDES permit (4) Wagner

Unit

3

will

install

a

new

DSI

system,

Wagner

Unit

2

will

burn

a

low

chlorine

coal

(Adaro

from

Indonesia

or

Colorado)

and

they

will

average

emissions

with

Brandon

Shores

for

MATS

compliance.

Crane

burns

low-sulfur

PRB

(sub-bituminous)

coal

and

DSI

systems

will

also

be

installed

at

Crane

for

MATS

compliance.

Crane

and

Wagner

could

also

use

ultra-low

sulfur

Adaro

coal

to

comply

with

MATS,

or

if

needed,

to

meet

future

ambient

SO2

standards

(5) Colstrip

is

a

Zero-Liquid

Discharge

operation

and

therefore

does

not

have

discharge

permit

(6) Pending ELG revisions and NPDES permit renewals could require additional waste

water treatment (7) Crane is a cyclone boiler and is equipped with

over-fired air with SNCR for NOx control. MDE is developing new NOx requirements for MD coal plants which could require additional controls or operational changes

in 2020.

Wagner Unit 2, which has low NOx burners with SNCR for NOx control, could also be

required to install additional controls or make operational changes in 2020 as a result of MDE’s pending rule

2 |

©

Talen Energy Corporation 2015

36

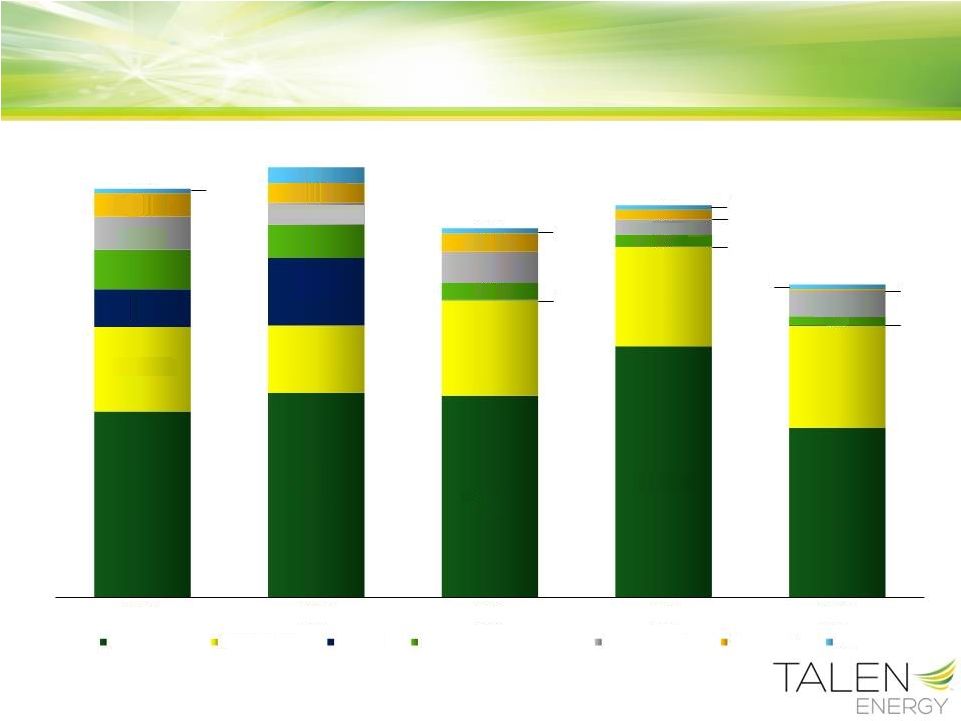

Projected Capital Expenditures

$107

$85

$120

$126

$129

$1

$1

$1

$29

$24

$23

$12

$2

$6

$20

$7

$6

$6

$516

$543

$466

$495

$395

2015

2016

2017

2018

2019

Sustenance

Nuclear Fuel

Growth

Information Technology

Environmental

Regulatory

Discretionary

$228

$42

$50

$48

$254

$28

$41

$85

$252

$39

$21

$307

$20

$15

$214

$32

$11 |

©

Talen Energy Corporation 2015

37

Long-term Debt Outstanding

(1)

Required

to

be

put

by

existing

holders

on

October

15,

2015

for

either

(a)

purchase

and

remarketing

by

a

designated

dealer

or

(b)

repurchase

by

Energy

Supply

(2)

As a result of meeting the “merger ratings event”, effective with the

interest period beginning July 15, 2015, the Senior Notes coupon will step down to 4.625%

(3)

Fair Market Value = $689 million

(4)

Put date September 2015

(5)

Amortizing Security; Fair Market Value = $47 million

Debt

Coupon

Maturity Date

Balance as of

5/31/2015

Senior Notes

5.700%

Oct 2035

(1)

$300

Senior Notes

6.200

May 2016

350

Senior Notes

6.500

May 2018

400

Senior Notes

5.125

Jul 2019

(2)

1,250

Senior Notes

4.600

Dec 2021

(3)

712

Senior Notes

6.000

Dec 2036

200

Senior Notes

6.500

May 2025

600

Muni Bonds

Various

Dec 2038

(4)

100

Muni Bonds

Various

Dec 2038

(4)

50

Muni Bonds

Various

Dec 2037

(4)

81

Secured Notes

8.857

Nov 2025

(5)

44

Total as of 5/31/2015

$4,086 |

©

Talen Energy Corporation 2015

38

Regulation G Reconciliations

Adjusted EBITDA

($ in Millions)

6/9/2014

(1)

–

2015E

(2)

Low –

2015E

(2)

Midpoint -

2015E

(2)

High -

2015E

(2)

Midpoint –

2016E

Net Income/(Loss)

$214

$55

$100

$145

$105

Income Taxes

143

23

53

83

56

Interest Expense

244

327

327

327

209

Depreciation & Amortization

439

410

410

410

422

EBITDA

1,040

815

890

965

792

Non-Cash Compensation

27

23

23

23

21

ARO

(3)

35

35

35

37

MTM losses (gains)

(28)

(28)

(28)

NDT losses (gains)

(10)

(10)

(10)

(10)

Adjusted EBITDA, including special items

1,067

835

910

985

840

Special items:

TSA costs and allocations

(4)

75

75

75

45

Other

(5)

25

25

25

Adjusted EBITDA

$1,067

$935

$1,010

$1,085

$885

(1) Estimate provided at 6/9/2014, the date of the

transaction announcement. (2)

RJS Power will be consolidated into Talen Energy’s financials as of June 1,

2015. Forecasted amounts include twelve months of performance from RJS Power, including the five-month period prior to

acquisition

with

respect

to

2015

estimates.

Low,

midpoint

and

high

forecast

2015

reflects

three

months

of

Energy

Supply

actuals.

Adjusted

EBITDA

from

RJS

Power

for

the

five-month

period

prior

to

acquisition is estimated at $41 million.

(3)

Additional item identified as an adjustment to EBITDA that was not included in the

original $1,067 model year Adjusted EBITDA estimate. (4)

Low, midpoint, and high 2015 amounts include $40 million of allocations from PPL and

$35 million of TSA costs that are not expected to continue in future periods.

(5)

Restructuring costs that are not expected to continue in future periods.

|

©

Talen Energy Corporation 2015

39

Regulation G Reconciliations

Adjusted Free Cash Flow

($ in Millions)

Low -

2015E

Midpoint –

2015E

High –

2015E

Cash from Operations

(1)

$752

$797

$842

Sustenance Capital Expenditures

(547)

(517)

(487)

Adjusted Free Cash Flow, including special items

205

280

355

Special items:

TSA costs & allocations (after tax)

(2)

45

45

45

Other (after tax)

(3)

15

15

15

Adjusted Free Cash Flow

$265

$340

$415

(1)

RJS Power will be consolidated into Talen Energy’s financials as of June 1,

2015. Forecasted amounts include twelve months of performance from RJS Power, including the five-

month period prior to acquisition with respect to 2015 estimates. Reflects three

months of Energy Supply actuals. Adjusted Free Cash Flow from RJS Power for the five-month

period prior to acquisition is estimated at $14 million.

(2) Includes $24 million of allocations from PPL and $21 million

of TSA costs that are not expected to continue in future periods.

(3) Restructuring costs that are not expected to continue in

future periods. |

©

Talen Energy Corporation 2015

40

Forward-Looking Information Statement

Statements contained in this presentation, including statements with respect to

future earnings, EBITDA results, cash flows, financing, regulation and

corporate strategy are "forward-looking statements" within the meaning of the federal

securities

laws.

Although

Talen

Energy

Corporation

believes

that

the

expectations

and

assumptions

reflected

in

these

forward-looking statements are reasonable, these statements are subject to a

number of risks and uncertainties, and actual results may differ materially

from the results discussed in the statements. The following are among the important

factors that could cause actual results to differ materially from the

forward-looking statements: market demand and prices for energy,

capacity and fuel; weather conditions affecting customer energy usage and operating costs; competition in

power markets; the effect of any business or industry restructuring; the

profitability and liquidity of Talen Energy Corporation

and

its

subsidiaries;

new

accounting

requirements

or

new

interpretations

or

applications

of

existing

requirements; operating performance of generating plants and other facilities; the

length of scheduled and unscheduled outages at our generating plants;

environmental conditions and requirements and the related costs of compliance,

including environmental capital expenditures and emission allowance and other

expenses; system conditions and operating costs; development of new

projects, markets and technologies; performance of new ventures; asset or

business acquisitions and dispositions; any impact of hurricanes

or other severe weather on our business, including any

impact on fuel prices; receipt of necessary government permits or approvals;

capital market conditions and decisions regarding capital structure; the

impact of state, federal or foreign investigations applicable to Talen Energy Corporation

and its subsidiaries; the outcome of litigation against Talen Energy Corporation

and its subsidiaries; stock price performance; the market prices of equity

securities and the impact on pension income and resultant cash funding

requirements for defined benefit pension plans; the securities and credit ratings

of Talen Energy Corporation and its subsidiaries; political, regulatory or

economic conditions in states, regions or countries where Talen Energy Corporation

or its subsidiaries conduct business, including any potential effects of threatened

or actual terrorism or war or other hostilities; foreign exchange rates; new

state, federal or foreign legislation, including new tax legislation; and the

commitments and liabilities of Talen Energy Corporation and its subsidiaries. Any

such forward-looking statements should be considered in light of such

important factors and in conjunction with Talen Energy Corporation's Registration

statement on Form S-1 and other reports on file with the Securities and

Exchange Commission. |

©

Talen Energy Corporation 2015

41

In this presentation the company presents EBITDA, Adjusted EBITDA and Adjusted

EBITDA, including special items, each of which are non-GAAP financial

measures. EBITDA represents net income (loss) before interest expense, income

taxes, depreciation and amortization. Adjusted EBITDA, represents EBITDA adjusted

for certain items as detailed in the reconciliation. Adjusted EBITDA,

including special items, is Adjusted EBITDA prior to adjustment for items management

considers special including TSA costs, pre-spin PPL charges and restructuring

costs. EBITDA, Adjusted EBITDA and Adjusted EBITDA, including special items,

are not intended to represent cash flows from operations or net income (loss)

as defined by U.S. GAAP as indicators of operating performance and are not

necessarily comparable to similarly-titled measures reported by other

companies. We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA, including special

items, are useful to investors and other users of our financial statements in

evaluating our operating performance because they provide additional tools

to compare business performance across companies and across periods. We

believe that EBITDA is widely used by investors to measure a company’s

operating performance without regard to such items as interest expense,

income taxes, depreciation and amortization, which can vary substantially from company to

company depending upon accounting methods and book value of assets, capital

structure and the method by which assets were acquired. Additionally, we

believe that investors commonly adjust EBITDA information to eliminate the effect

of restructuring and other expenses, which vary widely from company to company and

impair comparability. We adjust for these and other items as our management

believes that these items would distort their ability to efficiently view and

assess our core operating trends.

In summary, our management uses EBITDA, Adjusted EBITDA and Adjusted EBITDA,

including special items, as measures of operating performance to assist in

comparing performance from period to period on a consistent basis and to

readily view operating trends, as measures for planning and forecasting overall expectations and for evaluating actual

results against such expectations, and in communications with our Board of

Directors, shareholders, creditors, analysts and investors concerning our

financial performance. Definitions of Non-GAAP Financial

Measures |

©

Talen Energy Corporation 2015

42

Adjusted free cash flow is derived by deducting sustenance capital expenditures and

after-tax special items from cash flow from operations, while adjusted

free cash flow, including special items, is derived from adjusted free cash flow prior

to adjustment for after-tax special items. These two non-GAAP measures

should not be considered alternatives to cash flow from operations, which is

determined in accordance with GAAP. We believe that adjusted free cash flow and

adjusted free cash flow, including special items, although both non-GAAP

measures, are important measures to both management and investors as

indicators of the company’s ability to sustain operations and growth without additional

outside financing beyond the requirement to fund maturing debt obligations. These

measures are not necessarily comparable to similarly-titled measures

reported by other companies as they may be calculated differently.

Definitions of Non-GAAP Financial Measures |