Attached files

| file | filename |

|---|---|

| 8-K - ARIAD PHARMACEUTICALS, INC. 8-K - ARIAD PHARMACEUTICALS INC | a51018777.htm |

| EX-99.1 - EXHIBIT 99.1 - ARIAD PHARMACEUTICALS INC | a51018777ex99_1.htm |

Exhibit 99.2

Path to Value and

Profitability Elsa So Non-small cell lung cancer ARIAD clinical trial

patient Harvey J. Berger M.D. Chairman and Chief Executive Officer ARIAD

Pharmaceuticals, Inc.

Path to Value and

Profitability Elsa So Non-small cell lung cancer ARIAD clinical trial

patient Harvey J. Berger M.D. Chairman and Chief Executive Officer ARIAD

Pharmaceuticals, Inc.

01.14.2015 J.P.

Morgan Healthcare Conference Some of the statements in this presentation

constitute “forward looking statements” under the Private Securities

Litigation Reform Act of 1995. Such statements are subject to factors,

risks and uncertainties (such as those detailed in the Company’s

periodic filings with the SEC) that may cause actual results to differ

materially from those expressed or implied by such forward looking

statements.

01.14.2015 J.P.

Morgan Healthcare Conference Some of the statements in this presentation

constitute “forward looking statements” under the Private Securities

Litigation Reform Act of 1995. Such statements are subject to factors,

risks and uncertainties (such as those detailed in the Company’s

periodic filings with the SEC) that may cause actual results to differ

materially from those expressed or implied by such forward looking

statements.

01.14.2015 J.P.

Morgan Healthcare Conference ARIAD 2014: key areas of progress

Re-launched Iclusig in the U.S. with ~800 patients treated Successfully

completed EMA review - Iclusig indication statement unchanged Improved

understanding of benefit/risk profile of ponatinib Achieved positive P&R

outcomes in key European countries Concluded consultations with FDA and

EMA on Iclusig dose-ranging trial Secured experienced Japanese partner

for Iclusig Advanced brigatinib (AP26113) into pivotal trial and

designated as Breakthrough Therapy Nominated new development candidate

(AP32788)

01.14.2015 J.P.

Morgan Healthcare Conference ARIAD 2014: key areas of progress

Re-launched Iclusig in the U.S. with ~800 patients treated Successfully

completed EMA review - Iclusig indication statement unchanged Improved

understanding of benefit/risk profile of ponatinib Achieved positive P&R

outcomes in key European countries Concluded consultations with FDA and

EMA on Iclusig dose-ranging trial Secured experienced Japanese partner

for Iclusig Advanced brigatinib (AP26113) into pivotal trial and

designated as Breakthrough Therapy Nominated new development candidate

(AP32788)

01.14.2015 J.P.

Morgan Healthcare Conference 4 ARIAD 2015: our strategic focus Expand

the Iclusig global commercial opportunity Leverage existing commercial

infrastructure and investment Secure a broad partnership for brigatinib

Invest in randomized trials to advance Iclusig and brigatinib into

earlier lines of treatment, expand addressable market Achieve sustained

profitability in 2018 by reaching global product revenue of >$400M

01.14.2015 J.P.

Morgan Healthcare Conference 4 ARIAD 2015: our strategic focus Expand

the Iclusig global commercial opportunity Leverage existing commercial

infrastructure and investment Secure a broad partnership for brigatinib

Invest in randomized trials to advance Iclusig and brigatinib into

earlier lines of treatment, expand addressable market Achieve sustained

profitability in 2018 by reaching global product revenue of >$400M

01.14.2015 J.P.

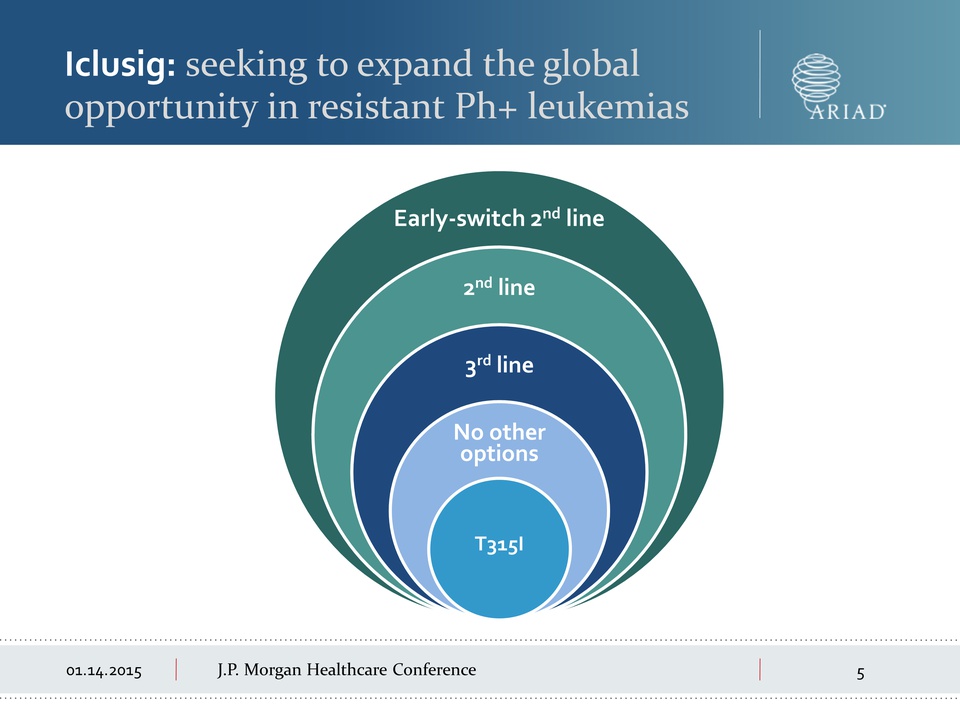

Morgan Healthcare Conference 5 Iclusig: seeking to expand the global

opportunity in resistant Ph+ leukemias Early-switch 2nd line 2nd line

3rd line No other options T315I

01.14.2015 J.P.

Morgan Healthcare Conference 5 Iclusig: seeking to expand the global

opportunity in resistant Ph+ leukemias Early-switch 2nd line 2nd line

3rd line No other options T315I

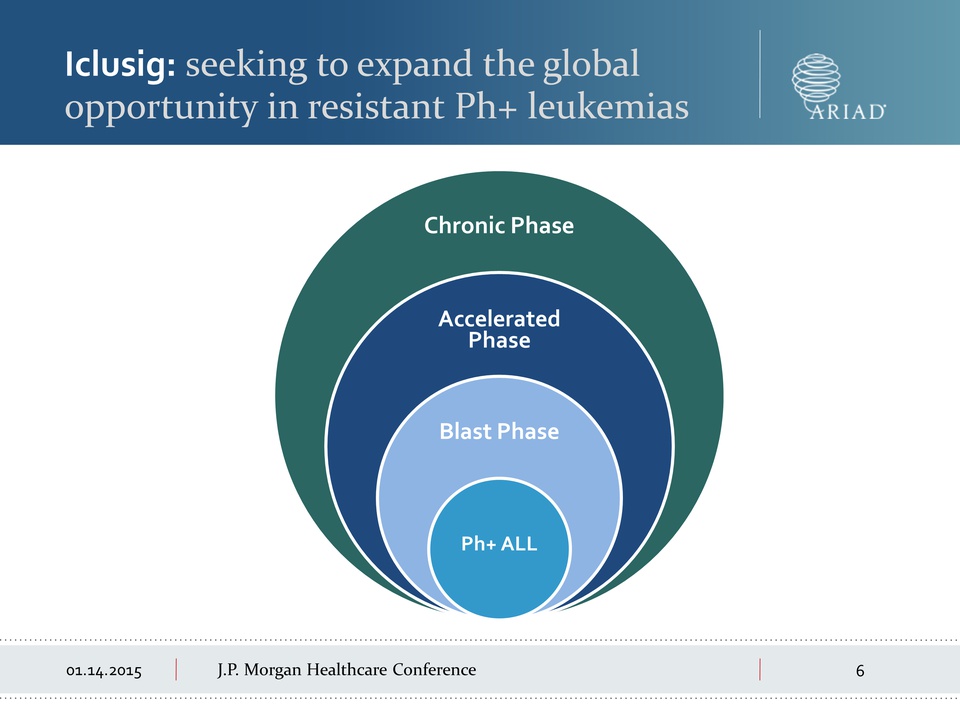

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: seeking to expand the global

opportunity in resistant Ph+ leukemias Chronic Phase Accelerated Phase

Blast Phase Ph+ ALL

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: seeking to expand the global

opportunity in resistant Ph+ leukemias Chronic Phase Accelerated Phase

Blast Phase Ph+ ALL

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: leverage existing infrastructure

and investment U.S. and Europe Further expand into chronic-phase disease

and earlier lines of therapy Advance to market leader in 3rd line

chronic-phase CML Continue launching throughout EU28 countries* Japan

Otsuka partnership in Japan and select Asian countries Commercial launch

expected in 2016 Rest of World Additional regional distribution

agreements in 2015 *Includes Central and Eastern Europe distributorship

with CSC Pharmaceuticals, a subsidiary of Angelini Pharma.

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: leverage existing infrastructure

and investment U.S. and Europe Further expand into chronic-phase disease

and earlier lines of therapy Advance to market leader in 3rd line

chronic-phase CML Continue launching throughout EU28 countries* Japan

Otsuka partnership in Japan and select Asian countries Commercial launch

expected in 2016 Rest of World Additional regional distribution

agreements in 2015 *Includes Central and Eastern Europe distributorship

with CSC Pharmaceuticals, a subsidiary of Angelini Pharma.

01.14.2015 J.P.

Morgan Healthcare Conference ARIAD and Otsuka: a strategic Iclusig

partnership in Japan and Asia Existing hematology sales force with CML

TKI experience Exclusive commercialization by Otsuka in ten Asian

countries Building major hematology/oncology business in Territory $77.5

million upfront, future milestones and substantial portion of net

product sales to ARIAD Joint development in Territory with Otsuka

funding additional agreed-upon clinical studies ARIAD rights to

co-promotion in Japan and China beginning in third year of

commercialization* Approval and launch of Iclusig in Japan expected in

2016 *ARIAD to bear its own cost for the co-promotion and receive a

higher share of incremental sales above a baseline forecast

01.14.2015 J.P.

Morgan Healthcare Conference ARIAD and Otsuka: a strategic Iclusig

partnership in Japan and Asia Existing hematology sales force with CML

TKI experience Exclusive commercialization by Otsuka in ten Asian

countries Building major hematology/oncology business in Territory $77.5

million upfront, future milestones and substantial portion of net

product sales to ARIAD Joint development in Territory with Otsuka

funding additional agreed-upon clinical studies ARIAD rights to

co-promotion in Japan and China beginning in third year of

commercialization* Approval and launch of Iclusig in Japan expected in

2016 *ARIAD to bear its own cost for the co-promotion and receive a

higher share of incremental sales above a baseline forecast

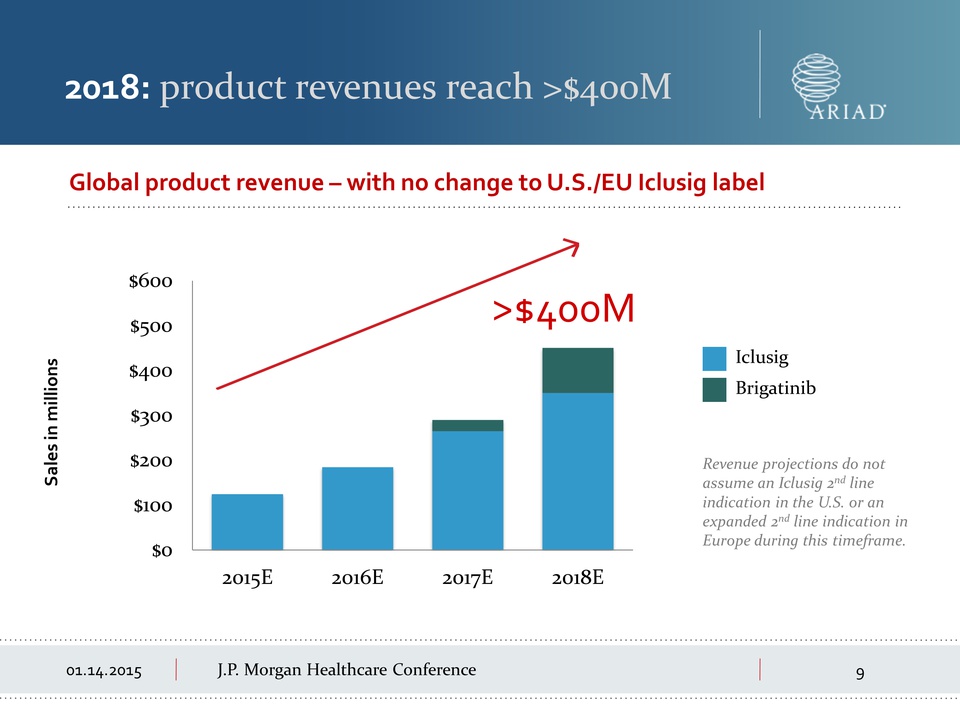

01.14.2015 J.P.

Morgan Healthcare Conference 2018: product revenues reach >$400M

Revenue projections do not assume an Iclusig 2nd line indication in the

U.S. or an expanded 2nd line indication in Europe during this timeframe.

Global product revenue – with no change to U.S./EU Iclusig label $0 $100

$200 $300 $400 $500 $600 2015E 2016E 2017E 2018E >$400M Sales in

millions Brigatinib Iclusig

01.14.2015 J.P.

Morgan Healthcare Conference 2018: product revenues reach >$400M

Revenue projections do not assume an Iclusig 2nd line indication in the

U.S. or an expanded 2nd line indication in Europe during this timeframe.

Global product revenue – with no change to U.S./EU Iclusig label $0 $100

$200 $300 $400 $500 $600 2015E 2016E 2017E 2018E >$400M Sales in

millions Brigatinib Iclusig

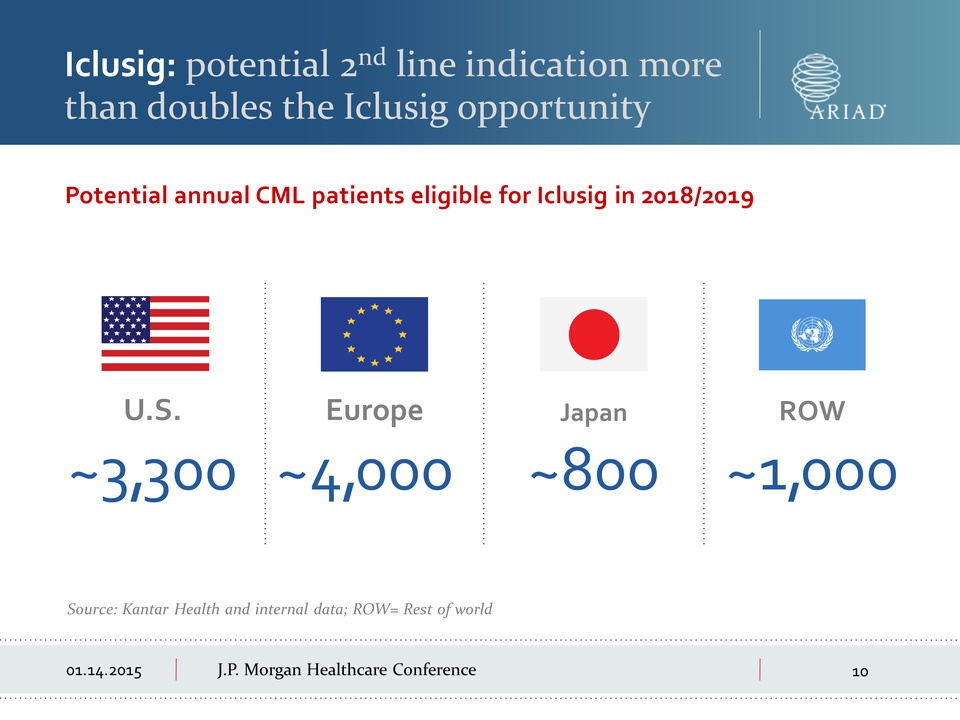

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: potential 2nd line indication more

than doubles the Iclusig opportunity Potential annual CML patients

eligible for Iclusig in 2018/2019 ~3,300 U.S. Source: Kantar Health and

internal data; ROW= Rest of world Europe ~4,000 Japan ~800 ROW ~1,000

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: potential 2nd line indication more

than doubles the Iclusig opportunity Potential annual CML patients

eligible for Iclusig in 2018/2019 ~3,300 U.S. Source: Kantar Health and

internal data; ROW= Rest of world Europe ~4,000 Japan ~800 ROW ~1,000

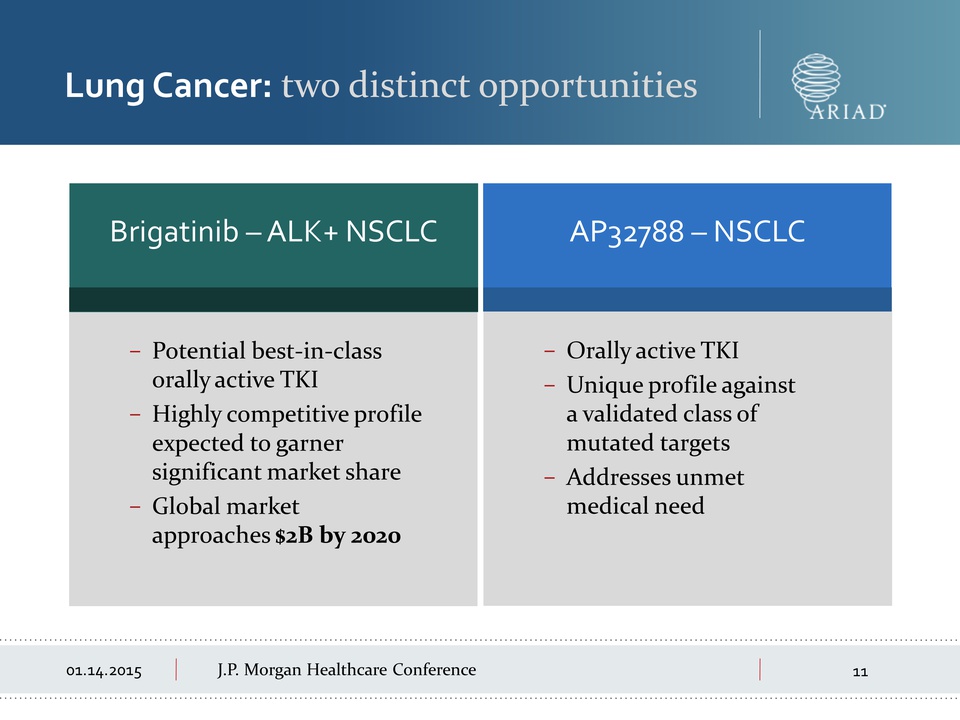

01.14.2015 J.P.

Morgan Healthcare Conference Brigatinib – ALK+ NSCLC AP32788 – NSCLC

Lung Cancer: two distinct opportunities - Potential best-in-class orally

active TKI - Highly competitive profile expected to garner significant

market share - Global market approaches $2B by 2020 - Orally active TKI

- Unique profile against a validated class of mutated targets -

Addresses unmet medical need

01.14.2015 J.P.

Morgan Healthcare Conference Brigatinib – ALK+ NSCLC AP32788 – NSCLC

Lung Cancer: two distinct opportunities - Potential best-in-class orally

active TKI - Highly competitive profile expected to garner significant

market share - Global market approaches $2B by 2020 - Orally active TKI

- Unique profile against a validated class of mutated targets -

Addresses unmet medical need

01.14.2015 J.P.

Morgan Healthcare Conference Brigatinib: maximizing the full value

Secure a broad partnership to co-develop and co-commercialize brigatinib

in 2015 - Leverage existing infrastructure and capabilities - Accelerate

randomized, 1st line trial against crizotinib - Explore new combination

therapies - Mitigate risk ALTA trial forms basis for initial approval;

filing expected mid-2016 Breakthrough therapy designation may accelerate

approval timeline

01.14.2015 J.P.

Morgan Healthcare Conference Brigatinib: maximizing the full value

Secure a broad partnership to co-develop and co-commercialize brigatinib

in 2015 - Leverage existing infrastructure and capabilities - Accelerate

randomized, 1st line trial against crizotinib - Explore new combination

therapies - Mitigate risk ALTA trial forms basis for initial approval;

filing expected mid-2016 Breakthrough therapy designation may accelerate

approval timeline

01.14.2015 J.P.

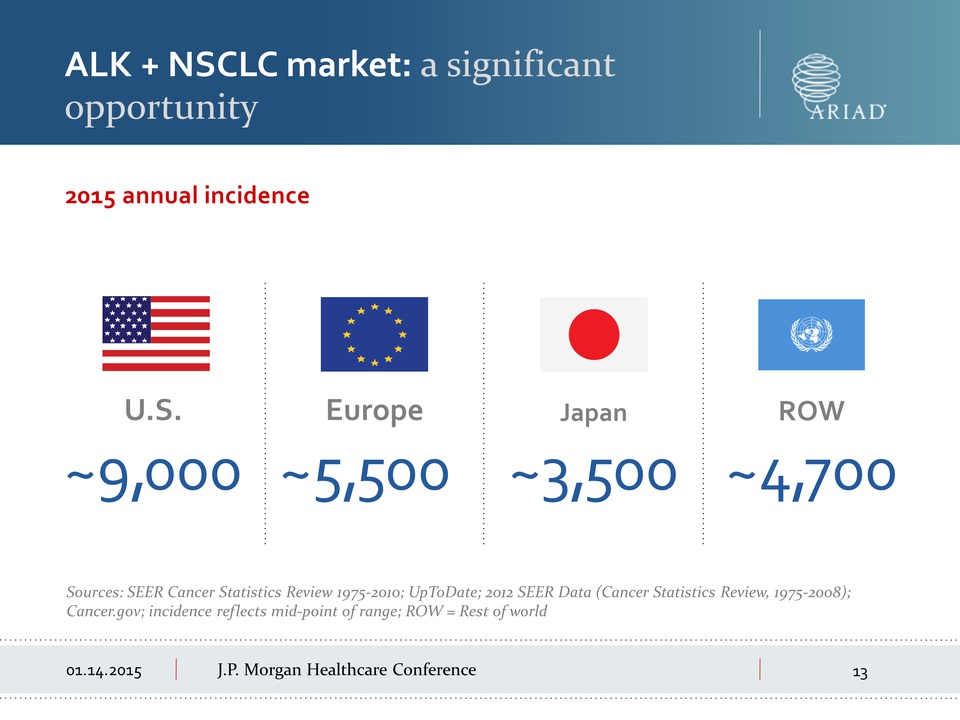

Morgan Healthcare Conference ALK + NSCLC market: a significant

opportunity 2015 annual incidence ~9,000 U.S. Europe ~5,500

Japan ~3,500 ROW ~4,700 Sources: SEER Cancer Statistics Review

1975-2010; UpToDate; 2012 SEER Data (Cancer Statistics Review,

1975-2008); Cancer.gov; incidence reflects mid-point of range; ROW =

Rest of world

01.14.2015 J.P.

Morgan Healthcare Conference ALK + NSCLC market: a significant

opportunity 2015 annual incidence ~9,000 U.S. Europe ~5,500

Japan ~3,500 ROW ~4,700 Sources: SEER Cancer Statistics Review

1975-2010; UpToDate; 2012 SEER Data (Cancer Statistics Review,

1975-2008); Cancer.gov; incidence reflects mid-point of range; ROW =

Rest of world

01.14.2015 J.P.

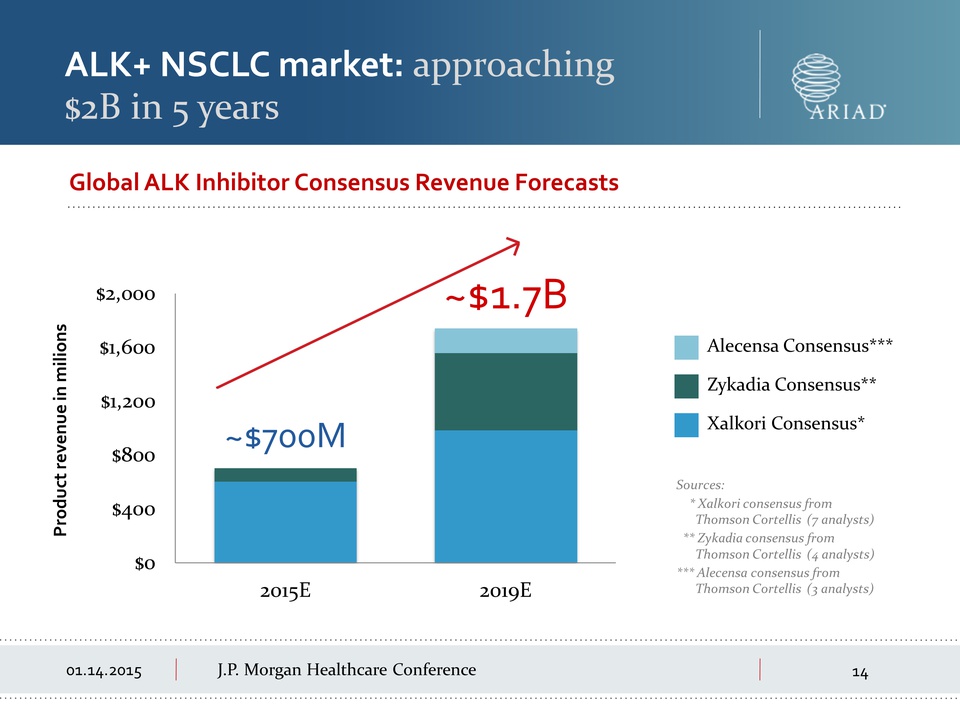

Morgan Healthcare Conference ALK+ NSCLC market: approaching $2B in 5

years Sources: * Xalkori consensus from Thomson Cortellis (7 analysts)

** Zykadia consensus from Thomson Cortellis (4 analysts) *** Alecensa

consensus from Thomson Cortellis (3 analysts) Global ALK Inhibitor

Consensus Revenue Forecasts $0 $400 $800 $1,200 $1,600 $2,000 2015E

2019E ~$700M ~$1.7B Product revenue in millions Alecensa Consensus***

Zykadia Consensus** Xalkori Consensus*

01.14.2015 J.P.

Morgan Healthcare Conference ALK+ NSCLC market: approaching $2B in 5

years Sources: * Xalkori consensus from Thomson Cortellis (7 analysts)

** Zykadia consensus from Thomson Cortellis (4 analysts) *** Alecensa

consensus from Thomson Cortellis (3 analysts) Global ALK Inhibitor

Consensus Revenue Forecasts $0 $400 $800 $1,200 $1,600 $2,000 2015E

2019E ~$700M ~$1.7B Product revenue in millions Alecensa Consensus***

Zykadia Consensus** Xalkori Consensus*

01.14.2015 J.P.

Morgan Healthcare Conference Research & Development Key Investments J.P.

01.14.2015 J.P.

Morgan Healthcare Conference Research & Development Key Investments J.P.

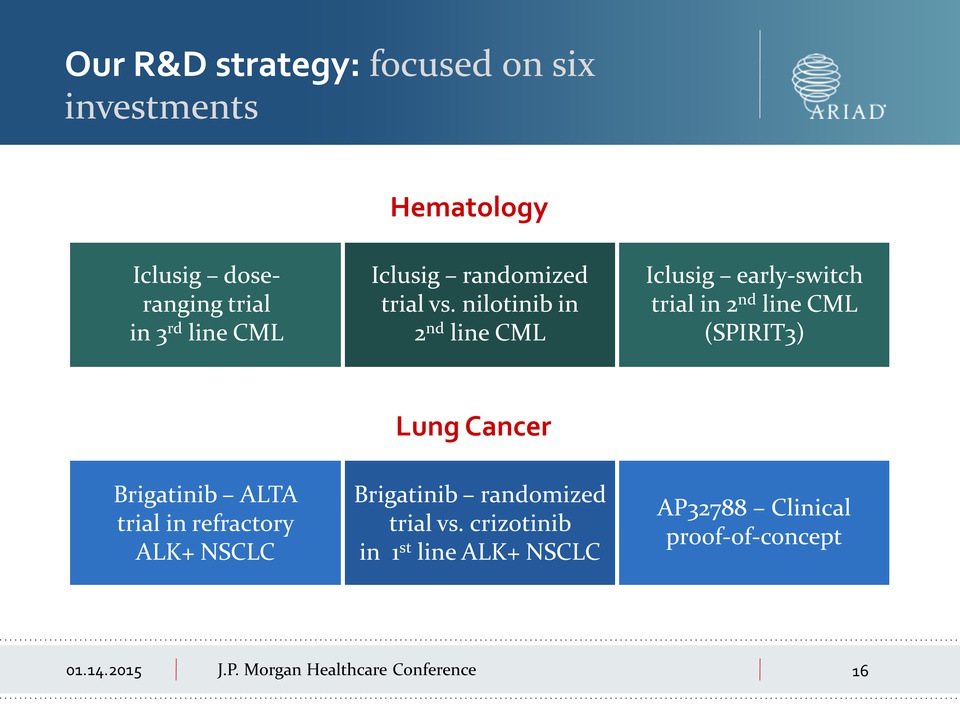

01.14.2015 Morgan

Healthcare Conference Iclusig – doseranging trial in 3rd line CML

Iclusig – randomized trial vs. nilotinib in 2nd line CML Iclusig –

early-switch trial in 2nd line CML (SPIRIT3) Brigatinib – ALTA trial in

refractory ALK+ NSCLC Brigatinib – randomized trial vs. crizotinib in

1st line ALK+ NSCLC AP32788 – Clinical proof-of-concept Hematology Lung

Cancer Our R&D strategy: focused on six investments

01.14.2015 Morgan

Healthcare Conference Iclusig – doseranging trial in 3rd line CML

Iclusig – randomized trial vs. nilotinib in 2nd line CML Iclusig –

early-switch trial in 2nd line CML (SPIRIT3) Brigatinib – ALTA trial in

refractory ALK+ NSCLC Brigatinib – randomized trial vs. crizotinib in

1st line ALK+ NSCLC AP32788 – Clinical proof-of-concept Hematology Lung

Cancer Our R&D strategy: focused on six investments

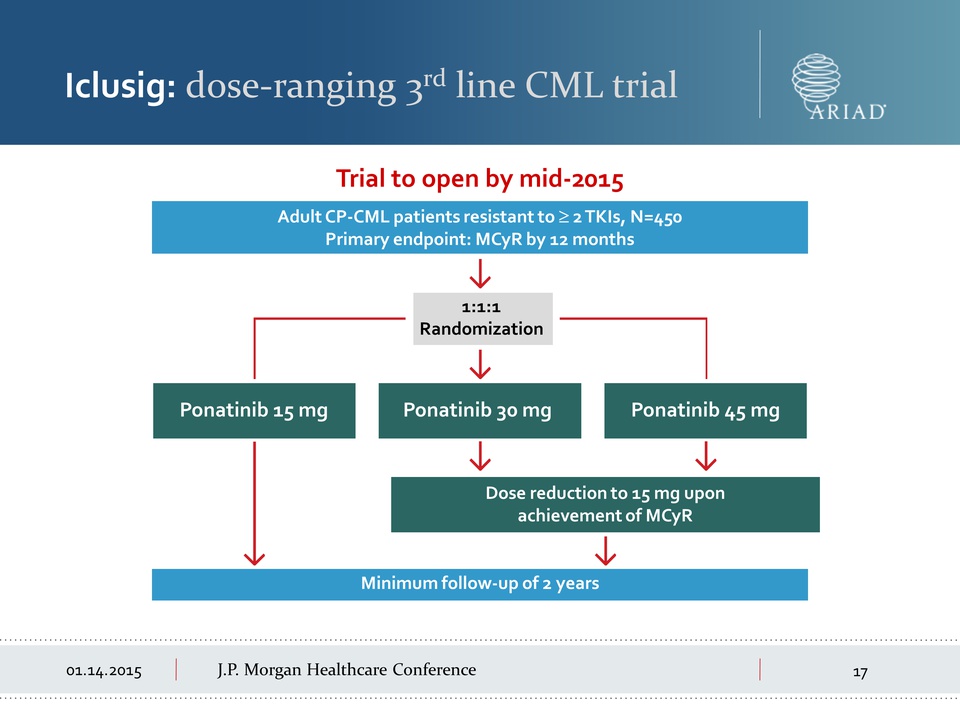

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: dose-ranging 3rd line CML trial

Trial to open by mid-2015 Adult CP-CML patients resistant to ≥ 2 TKIs,

N=450 Primary endpoint: MCyR by 12 months Minimum follow-up of 2 years

1:1:1 Randomization Dose reduction to 15 mg upon achievement of MCyR

Ponatinib 15 mg Ponatinib 30 mg Ponatinib 45 mg

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: dose-ranging 3rd line CML trial

Trial to open by mid-2015 Adult CP-CML patients resistant to ≥ 2 TKIs,

N=450 Primary endpoint: MCyR by 12 months Minimum follow-up of 2 years

1:1:1 Randomization Dose reduction to 15 mg upon achievement of MCyR

Ponatinib 15 mg Ponatinib 30 mg Ponatinib 45 mg

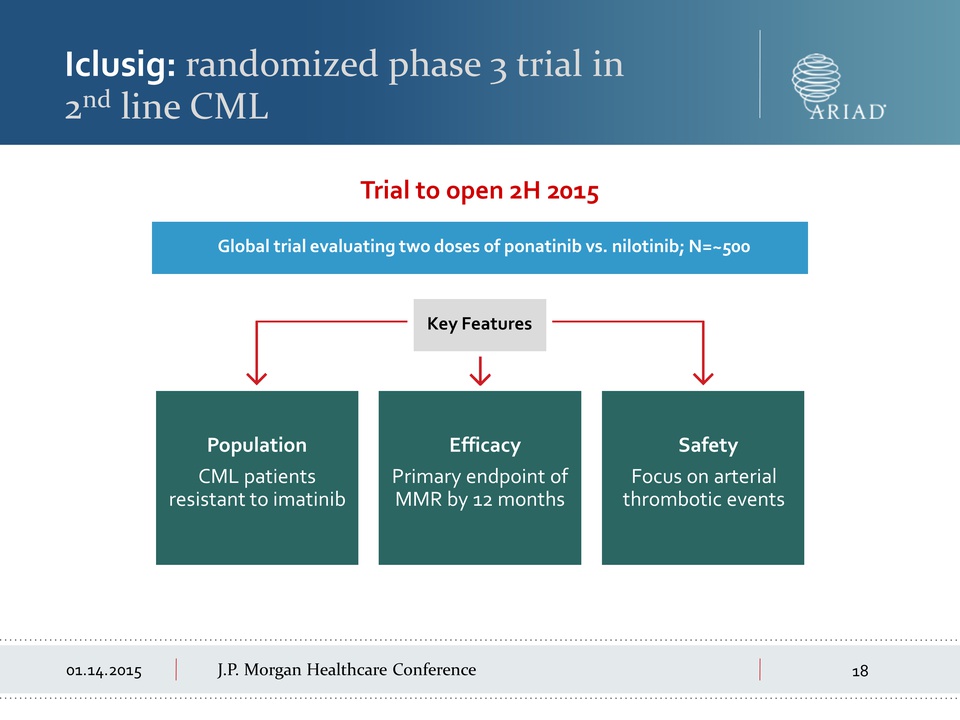

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: randomized phase 3 trial in 2nd

line CML Global trial evaluating two doses of ponatinib vs. nilotinib;

N=~500 Key Features CML patients resistant to imatinib Population

Primary endpoint of MMR by 12 months Efficacy Focus on arterial

thrombotic events Safety Trial to open 2H 2015

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: randomized phase 3 trial in 2nd

line CML Global trial evaluating two doses of ponatinib vs. nilotinib;

N=~500 Key Features CML patients resistant to imatinib Population

Primary endpoint of MMR by 12 months Efficacy Focus on arterial

thrombotic events Safety Trial to open 2H 2015

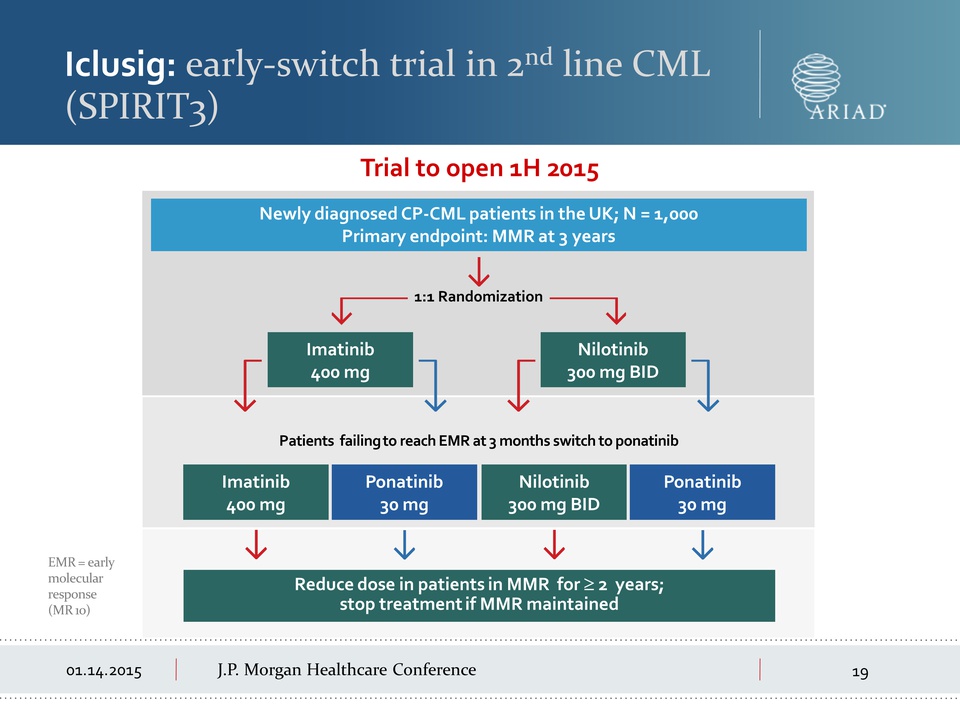

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: early-switch trial in 2nd line

CML (SPIRIT3) EMR = early molecular response (MR 10) Trial to open 1H

2015 Patients failing to reach EMR at 3 months switch to ponatinib

Reduce dose in patients in MMR for ≥ 2 years; stop treatment if MMR

maintained 1:1 Randomization Newly diagnosed CP-CML patients in the UK;

N = 1,000 Primary endpoint: MMR at 3 years Imatinib 400 mg Nilotinib 300

mg BID Imatinib 400 mg Ponatinib 30 mg Ponatinib 30 mg Nilotinib 300 mg

BID

01.14.2015 J.P.

Morgan Healthcare Conference Iclusig: early-switch trial in 2nd line

CML (SPIRIT3) EMR = early molecular response (MR 10) Trial to open 1H

2015 Patients failing to reach EMR at 3 months switch to ponatinib

Reduce dose in patients in MMR for ≥ 2 years; stop treatment if MMR

maintained 1:1 Randomization Newly diagnosed CP-CML patients in the UK;

N = 1,000 Primary endpoint: MMR at 3 years Imatinib 400 mg Nilotinib 300

mg BID Imatinib 400 mg Ponatinib 30 mg Ponatinib 30 mg Nilotinib 300 mg

BID

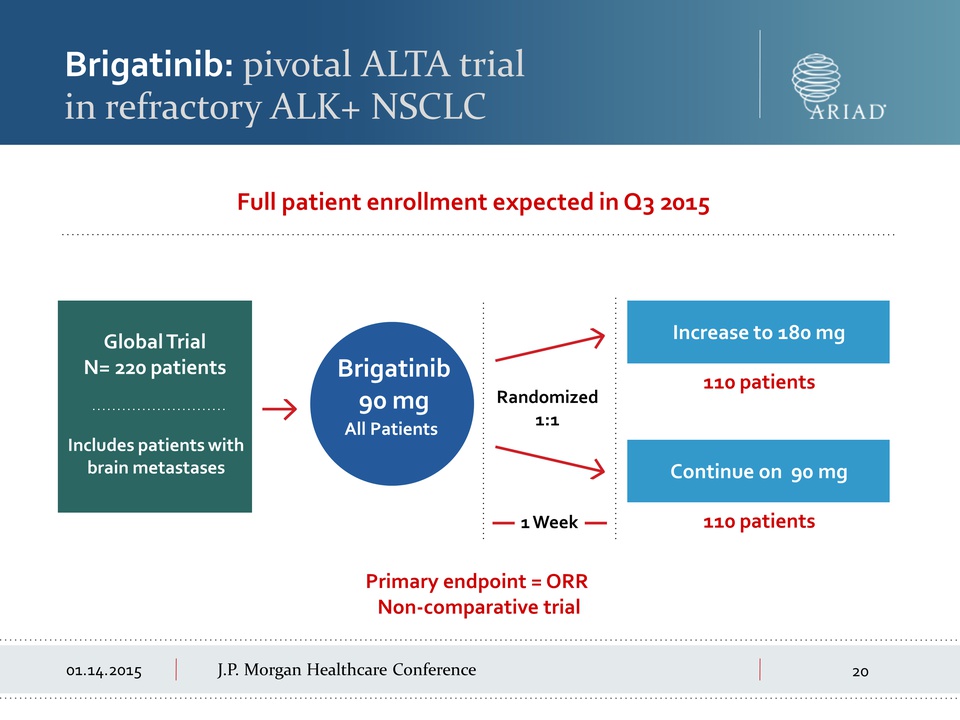

01.14.2015 J.P.

Morgan Healthcare Conference Brigatinib: pivotal ALTA trial in

refractory LK+ NSCLC Primary endpoint = ORR Non-comparative trial Full

patient enrollment expected in Q3 2015 Brigatinib 90 mg All Patients

Global Trial N= 220 patients Includes patients with brain metastases

Randomized 1:1 1 Week Continue on 90 mg 110 patients Increase to 180 mg

110 patients

01.14.2015 J.P.

Morgan Healthcare Conference Brigatinib: pivotal ALTA trial in

refractory LK+ NSCLC Primary endpoint = ORR Non-comparative trial Full

patient enrollment expected in Q3 2015 Brigatinib 90 mg All Patients

Global Trial N= 220 patients Includes patients with brain metastases

Randomized 1:1 1 Week Continue on 90 mg 110 patients Increase to 180 mg

110 patients

01.14.2015 J.P.

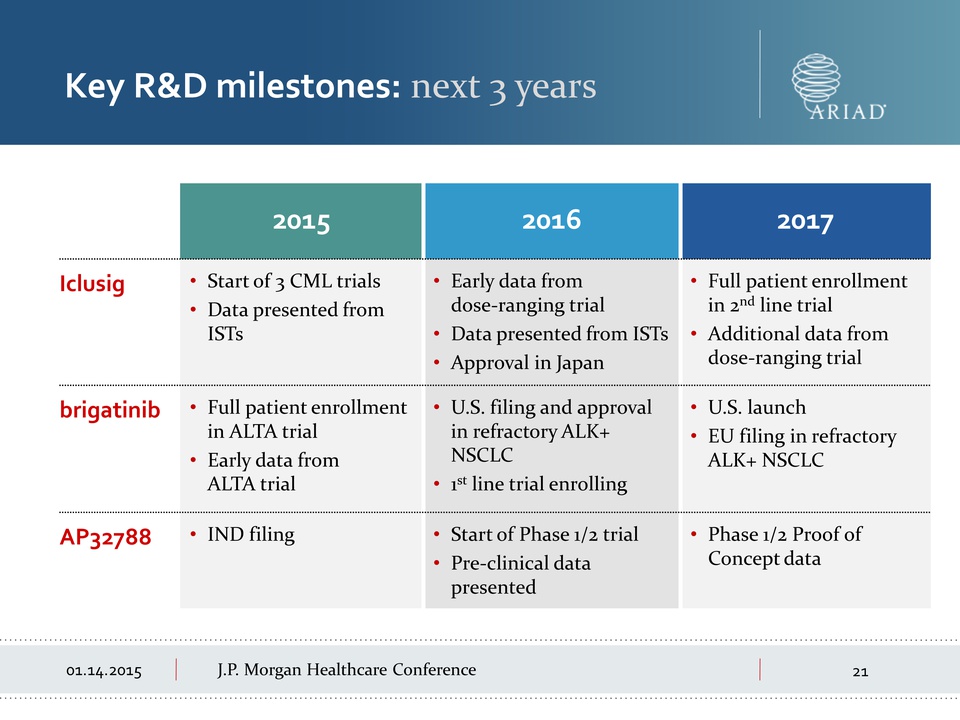

Morgan Healthcare Conference 2015 2016 2017 Iclusig • Start of 3 CML

trials • Data presented from ISTs • Early data from dose-ranging trial

Data presented from ISTs Approval in Japan Full patient enrollment in

2nd line trial Additional data from dose-ranging trial brigatinib Full

patient enrollment in ALTA trial Early data from ALTA trial U.S. filing

and approval in refractory ALK+ NSCLC 1st line trial enrolling U.S.

launch EU filing in refractory ALK+ NSCLC AP32788 IND filing Start of

Phase 1/2 trial Pre-clinical data presented Phase 1/2 Proof of Concept

data Key R&D milestones: next 3 years

01.14.2015 J.P.

Morgan Healthcare Conference 2015 2016 2017 Iclusig • Start of 3 CML

trials • Data presented from ISTs • Early data from dose-ranging trial

Data presented from ISTs Approval in Japan Full patient enrollment in

2nd line trial Additional data from dose-ranging trial brigatinib Full

patient enrollment in ALTA trial Early data from ALTA trial U.S. filing

and approval in refractory ALK+ NSCLC 1st line trial enrolling U.S.

launch EU filing in refractory ALK+ NSCLC AP32788 IND filing Start of

Phase 1/2 trial Pre-clinical data presented Phase 1/2 Proof of Concept

data Key R&D milestones: next 3 years

01.14.2015 J.P.

Morgan Healthcare Conference Marcele Wilson Chronic myeloid leukemia

ARIAD clinical trial patient Achieving Profitability in 2018

01.14.2015 J.P.

Morgan Healthcare Conference Marcele Wilson Chronic myeloid leukemia

ARIAD clinical trial patient Achieving Profitability in 2018

01.14.2015 J.P.

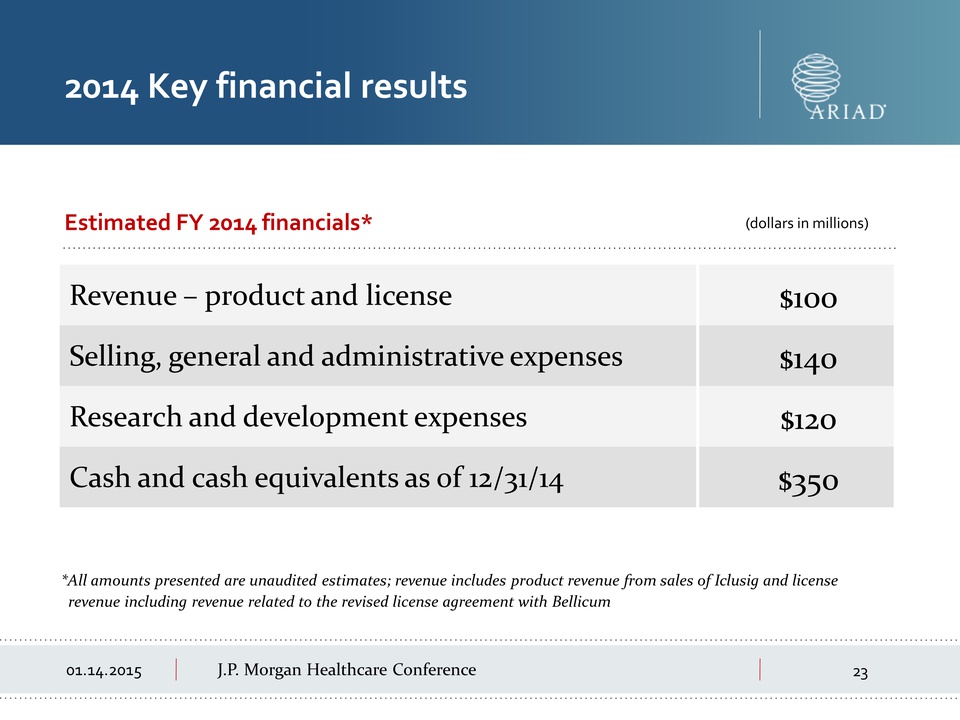

Morgan 01.14.2015 Healthcare Conference Revenue – product and license

$100 Selling, general and administrative expenses $140 Research and

development expenses $120 Cash and cash equivalents as of 12/31/14 $350

2014 Key financial results *All amounts presented are unaudited

estimates; revenue includes product revenue from sales of Iclusig and

license revenue including revenue related to the revised license

agreement with Bellicum Estimated FY 2014 financials* (dollars in

millions)

01.14.2015 J.P.

Morgan 01.14.2015 Healthcare Conference Revenue – product and license

$100 Selling, general and administrative expenses $140 Research and

development expenses $120 Cash and cash equivalents as of 12/31/14 $350

2014 Key financial results *All amounts presented are unaudited

estimates; revenue includes product revenue from sales of Iclusig and

license revenue including revenue related to the revised license

agreement with Bellicum Estimated FY 2014 financials* (dollars in

millions)

01.14.2015 J.P.

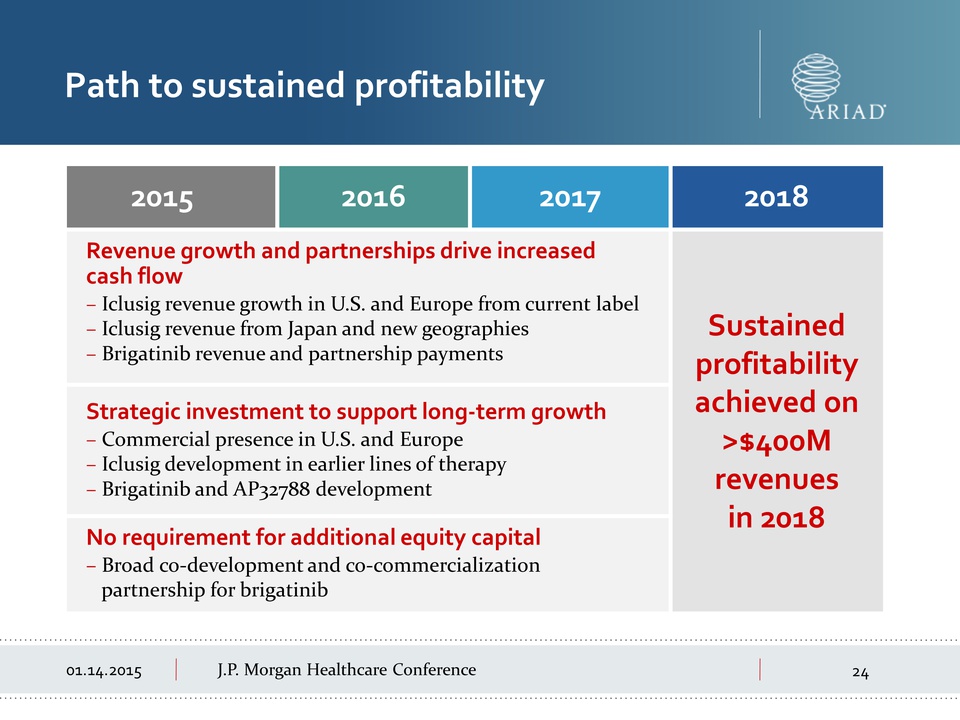

Morgan Healthcare Conference Path to sustained profitability 2015 2016

2017 2018 Revenue growth and partnerships drive increased cash flow

Iclusig revenue growth in U.S. and Europe from current label Iclusig

revenue from Japan and new geographies Brigatinib revenue and

partnership payments Sustained profitability achieved on >$400M revenues

in 2018 Strategic investment to support long-term growth Commercial

presence in U.S. and Europe Iclusig development in earlier lines of

therapy Brigatinib and AP32788 development No requirement for additional

equity capital Broad co-development and co-commercialization partnership

for brigatinib

01.14.2015 J.P.

Morgan Healthcare Conference Path to sustained profitability 2015 2016

2017 2018 Revenue growth and partnerships drive increased cash flow

Iclusig revenue growth in U.S. and Europe from current label Iclusig

revenue from Japan and new geographies Brigatinib revenue and

partnership payments Sustained profitability achieved on >$400M revenues

in 2018 Strategic investment to support long-term growth Commercial

presence in U.S. and Europe Iclusig development in earlier lines of

therapy Brigatinib and AP32788 development No requirement for additional

equity capital Broad co-development and co-commercialization partnership

for brigatinib

01.14.2015 J.P.

Morgan Healthcare Conference ARIAD 2015: key catalysts Accelerate

Iclusig sales in U.S. and Europe Initiate key Iclusig trials

Dose-ranging trial Randomized 2nd line trial vs. nilotinib Early- switch

2nd line trial (SPIRIT3) Secure broad partnership for brigatinib Present

early data from brigatinib pivotal ALTA trial File for approval of

Iclusig in Japan with Otsuka File IND for new development candidate

AP32788

01.14.2015 J.P.

Morgan Healthcare Conference ARIAD 2015: key catalysts Accelerate

Iclusig sales in U.S. and Europe Initiate key Iclusig trials

Dose-ranging trial Randomized 2nd line trial vs. nilotinib Early- switch

2nd line trial (SPIRIT3) Secure broad partnership for brigatinib Present

early data from brigatinib pivotal ALTA trial File for approval of

Iclusig in Japan with Otsuka File IND for new development candidate

AP32788

ARIAD®

ARIAD®