Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST INTERSTATE BANCSYSTEM INC | d765509d8k.htm |

Page 1

Keefe, Bruyette & Woods

15

th

Annual

Community

Bank

Investor

Conference

New York City,

NY July 29-30, 2014

Exhibit 99.1 |

First Interstate

BancSystem Safe Harbor

Page 2

This presentation contains “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section

21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that involve inherent

risks and uncertainties. Any statements about our plans, objectives, expectations, strategies,

beliefs, or future performance or events constitute forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other important factors that could cause

actual results to differ materially from any results, performance or events expressed or implied by

such forward-looking statements. Such forward-looking statements include but are not

limited to statements about revenues, income from the origination and sale of loans, net interest margin, quarterly provisions for

loan losses, non-interest expense, loan growth, non-performing assets and net charge-off

of loans, the benefits of the business combination transaction involving First Interstate

BancSystem, Inc. (FIBK) and Mountain West Financial Corp (MTWF), including future financial and operating results, the combined

company’s plans, objectives, expectations and intentions, and other statements that are not

historical facts. These forward-looking statements are subject to risks and uncertainties

that may cause actual results to differ materially from those projected, including but not limited to the following: the factors described in

our Form 10-K and subsequent filings with the Securities and Exchange Commission

(“SEC”), including under the sections entitled “Risk Factors,” the possibility

that the merger does not close when expected or at all because required regulatory, shareholder or

other approvals and other conditions to closing are not received or satisfied on a timely basis

or at all; the risk that the benefits from the transaction may not be fully realized or may take longer to realize than

expected, including as a result of changes in general economic and market conditions, interest and

exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of

competition in the geographic and business areas in which FIBK and MTWF operate; the ability to promptly and effectively

integrate the businesses of FIBK and MTWF; the reaction of the companies’ customers, employees

and counterparties to the transaction; and the diversion of management time on

merger-related issues. The risk factors described in Forms 10-K are not necessarily all of the important factors that could cause our actual

results, performance or achievements to differ materially from those expressed in or implied by any of

the forward-looking statement contained in this presentation. Other unknown or

unpredictable factors also could affect our results. All forward-looking statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by the cautionary statements set forth above. Forward-looking

statements speak only as of the date they are made and we do not undertake or assume any obligation to update publicly any of these

statements to reflect actual results, new information or future events, changes in assumptions or

changes in other factors affecting forward-looking statements, except to the extent

required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make

additional updates with respect to those or other forward-looking statements.

Additional Information About the Merger and Where to Find it

FIBK intends to file with the SEC a proxy statement/prospectus and other relevant materials in

connection with the merger, including the definitive merger agreement. The proxy

statement/prospectus will be mailed to the shareholders of MTWF. Investors are urged to read the proxy statement/prospectus and the

other relevant materials when they become available because they will contain important information

about MTWF, FIBK and the merger. The proxy statement/prospectus and other relevant materials (when they become available), and any

other documents filed by FIBK with the SEC, may be obtained free of charge at the SEC’s

web site at www.sec.gov. In addition, investors may obtain free copies of the documents filed by FIBK with the SEC by

contacting Amy Anderson, First Interstate BancSystem, Inc., 401 N. 31st Street, Billings, MT, 59101;

telephone 406-255-5390. |

First Interstate

BancSystem Long Term History with

Solid Performance Page 3

Company Snap Shot

Headquartered in Billings, MT with 74 branches across

Montana, Wyoming and western South Dakota

Total Assets of $7.7 Billion

Total Loans of $4.5 Billion

Regional bank offering retail and commercial banking,

along with wealth management, cash management, credit

card and mortgage services

NASDAQ: FIBK

Market Cap: $1.2B

Company Performance

2013 record earnings with net income of $86.1 million, or

$1.96 per share.

Q2 2014 net income to common shareholders of $21.1

million, earnings per share of $.47

Increased dividend per share to $.16

Continued improvement in credit quality trends |

|

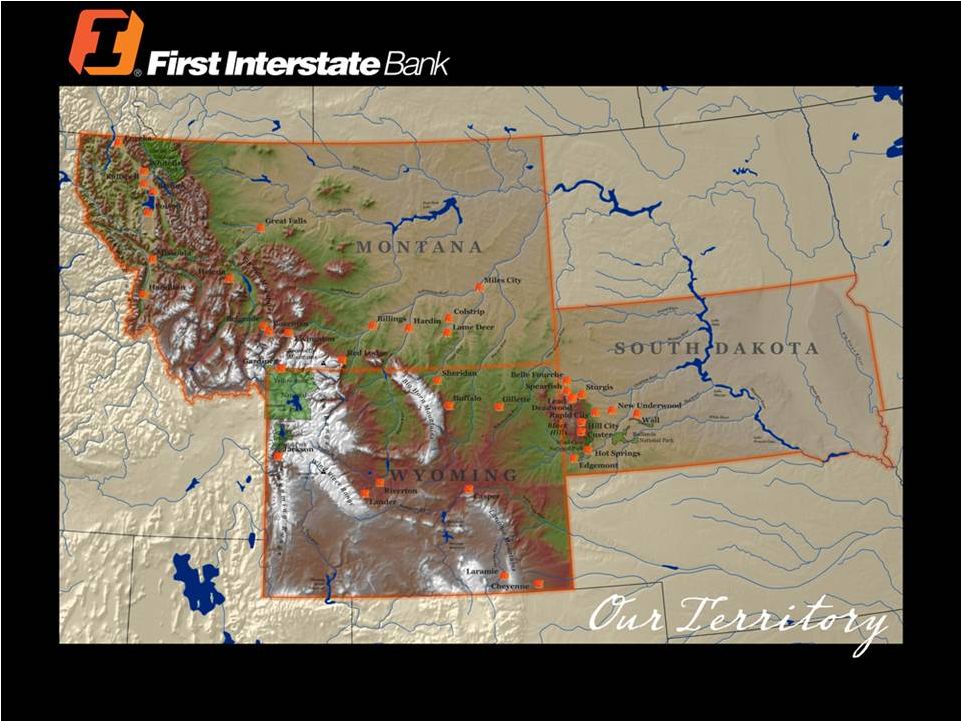

First Interstate

BancSystem Impressive Market

Shares Ranked #2 by market share in Montana and Wyoming, and #2 in the western South

Dakota markets we serve. -Data Per SNL Financial

(June 30, 2013)

MSAs

Market Share

Billings, MT

26%

Missoula, MT

31%

Casper, WY

27%

Rapid City, SD

20%

Jackson, WY-ID

16%

Gillette, WY

29%

Sheridan, WY

42%

Kalispell, MT

15%

Great Falls, MT

19%

Laramie, WY

52%

Bozeman, MT

12%

Riverton, WY

35%

Spearfish, SD

32%

Cheyenne, WY

11%

Helena, MT

6%

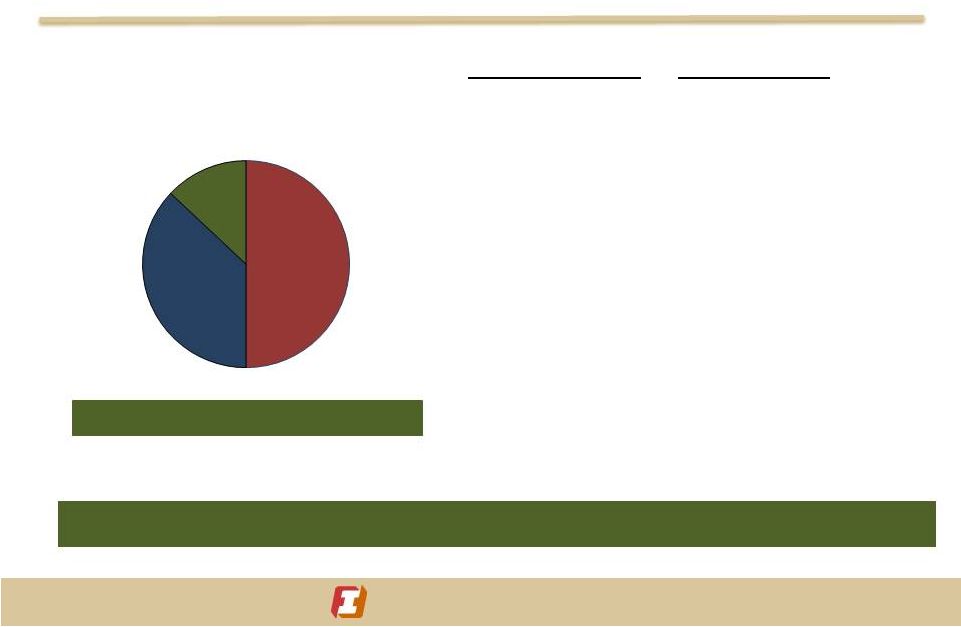

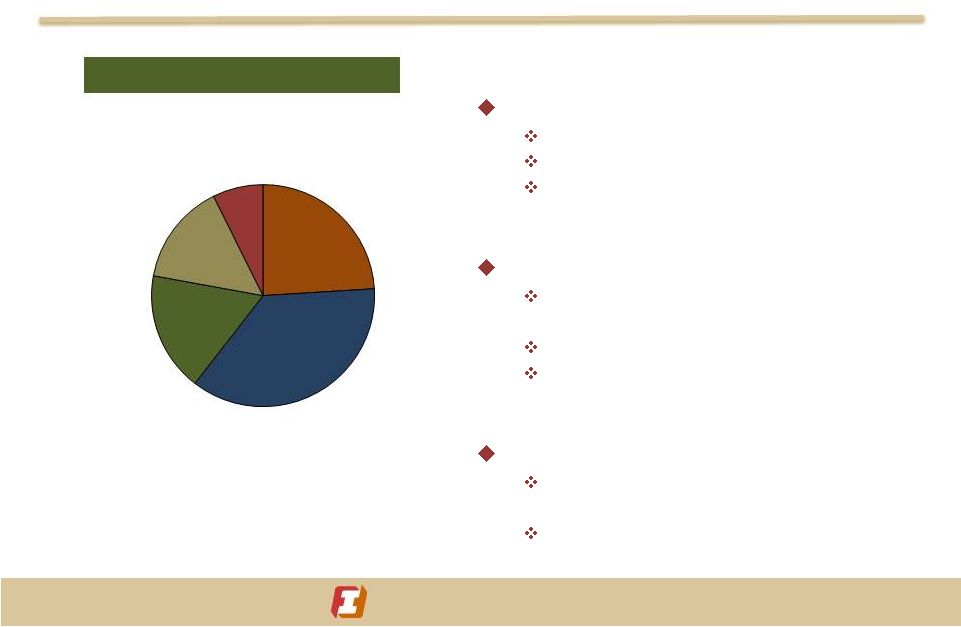

Page 5

South

Dakota

Wyoming

Montana

50%

38%

12%

Allocation of $6.2 Billion in Deposits

Allocation of $6.2 Billion in Deposits

(As

of

6/30/2014

) |

First Interstate

BancSystem Diversified

Industries Agriculture

Cattle

Crops

Page 6

Energy

Oil and Natural Gas

Greater Williston Basin Area

Bakken formation

Powder River Basin

Coal

MT Ranked #1 and WY ranked #3 in demonstrated Coal Reserves

WY Ranked #1 in Production

Wind

MT, WY and SD in the top 10 for potential wind energy development

MT has the fastest national growth rate for wind energy |

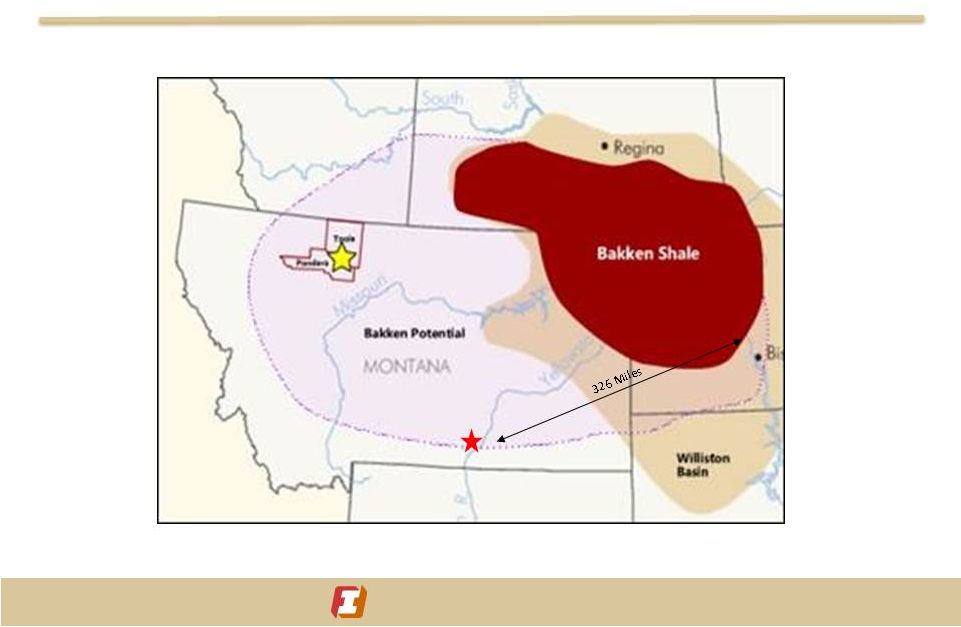

First Interstate

BancSystem Influence of the

Bakken Oil Field Page 7

North Dakota

South Dakota

Wyoming

Canada

Billings is the nearest trade

area to the Bakken Oil Fields |

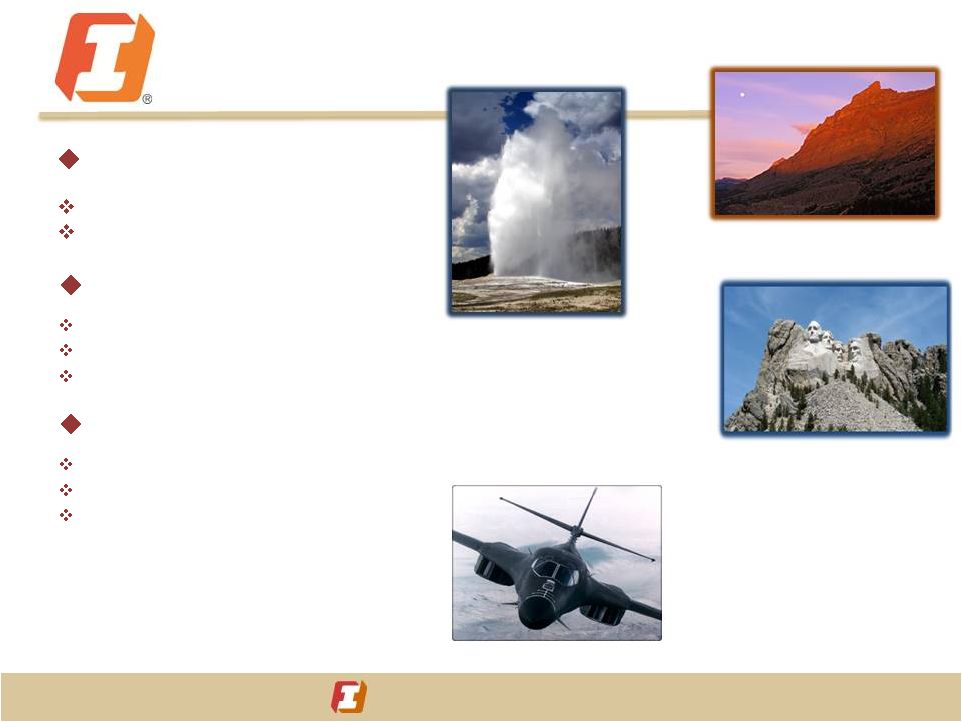

First Interstate

BancSystem Tourism

Glacier National Park, MT

Yellowstone National Park, WY

Major National Parks

Summer/Winter Opportunities

Mount Rushmore, SD

Page 8

Healthcare

Aging population base

Regional healthcare centers

Veterans Administration healthcare

Military /Government

Ellsworth Air Force Base, SD

Malmstrom Air Force Base, MT

F.E. Warren Air Force Base, WY

B1B Lancer,

Ellsworth Air Force Base

First Interstate

BancSystem |

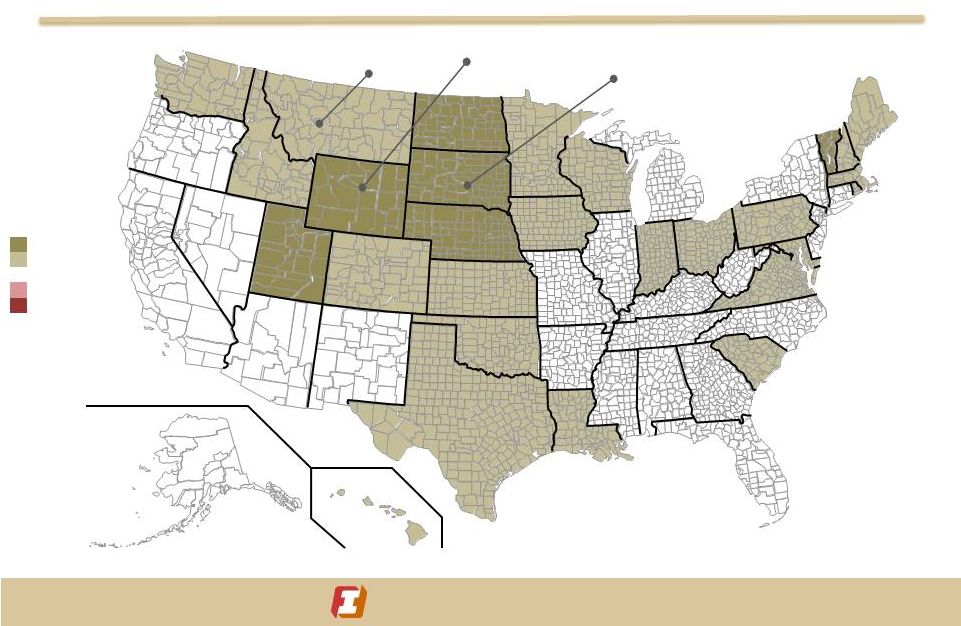

First Interstate

BancSystem Stable

Employment Page 9

MT 4.5%, Ranked 11th

WY 4%, Ranked 6th

SD 3.8%, Ranked 5th

0% to 4%

Best 5 Sates

4% to 6%

North Dakota 2.7%

6% to 8%

2

Nebraska 3.5%

8% to 10%

3

Utah 3.5%

10% or more

4

Vermont 3.5%

5

South Dakota 3.8%

Worst 5 States

50

Mississippi 7.9%

49

Nevada 7.7%

48

Michigan 7.5%

47

Kentucky 7.4%

46

Georgia 7.4%

Source: Bureau of Labour Statistics

Data as of: 6/30/2014

1 |

First Interstate

BancSystem Page 10

Balance Sheet

Asset Quality Trends

and Earnings

First Interstate

BancSystem |

First Interstate

BancSystem Page 11

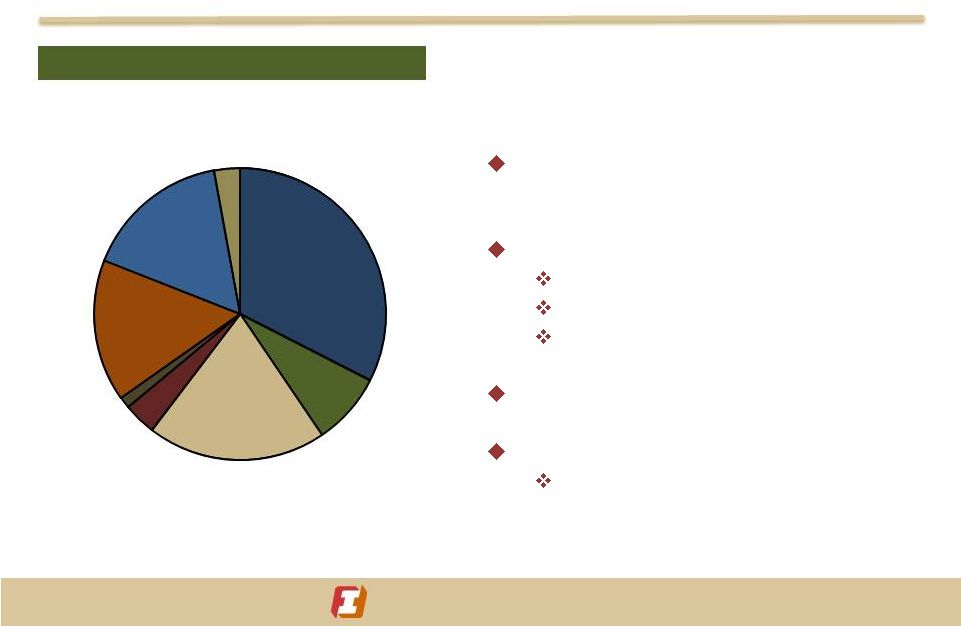

Diversified Loan Portfolio

$4.5 Billion in Loans

$4.5 Billion in Loans

Commercial

RE

32.5%

Construction

RE

8.0%

Residential RE

19.9%

Agriculture RE

3.6%

RE Held for

Sale

1.3%

Consumer

15.7%

Commercial

16.1%

Agricultural

2.9%

As of 6/30/2014)

(

Q2 loan growth of $142 million or 3.2%

over last quarter, 4.9% over June 30, 2013

Positive economic indicators

Increased Construction activity

Increased Commercial demand

Strong indirect lending network

Strengthening loan pipeline

Disciplined credit practices

In-house limit of $15 Million

Credit Opportunities |

First Interstate

BancSystem Investment

Portfolio Page 12

Investment Portfolio

$2.1 Billion

0%

20%

40%

60%

80%

100%

120%

Other

Municipal

MBS

CMO's

Agencies

Effective Duration of the

portfolio is 3.1 years

Average yield of the

portfolio is 1.73% (as of

6/30/14)

Strategy: Maintain short

duration with minimal

credit risk and an

emphasis on stable cash

flows and extension risk

mitigation. |

First Interstate

BancSystem Strong Core Deposit

Base Page 13

(as of 6/30/2014)

Low Cost of Funds

Q2 2014 -

0.27%

Demand Non-

Interest

Bearing

Demand

Interest

Bearing

Savings

Time Other

CDs >100k

24%

30%

8%

27%

11%

$6.2 Billion in Deposits |

First Interstate

BancSystem Strong

Non-Interest Income Revenue Streams Page 14

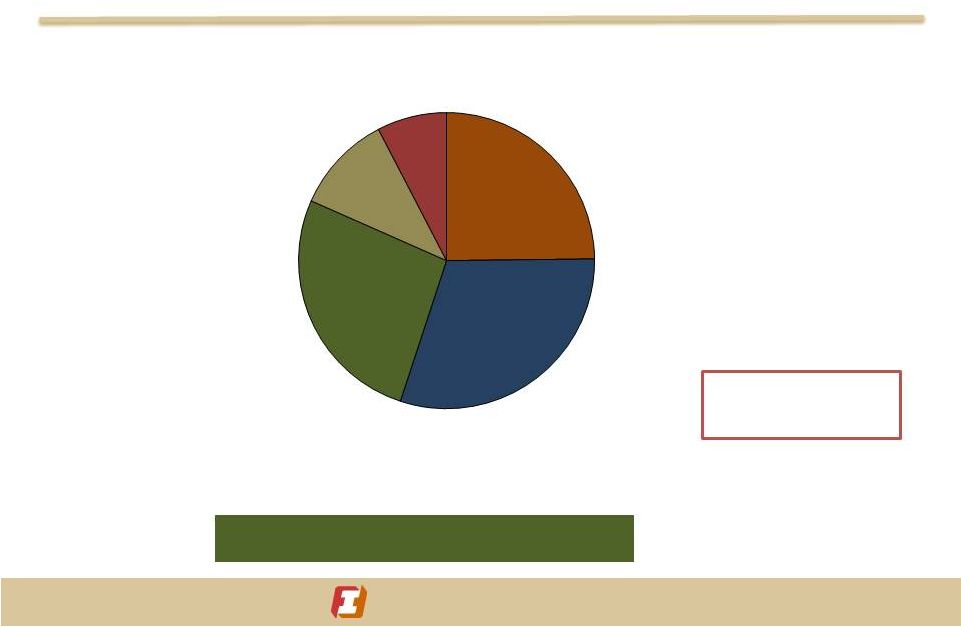

Non-Interest Income

Wealth Management

AUM -

$4+ Billion and growing

Bakken influence creating wealth

Wealth advisors positioned across our

footprint

Mortgage Lending

Strong purchase activity, particularly in

eastern Montana, our largest market

Ability to expand our market share

Seeing a more traditional residential real

estate cycle

Credit Card Activity

Focused strategy to increase business

card usage

Local reward program attracts personal

card usage

Home Loans

24%

Service

Charges

15%

Other

Income

7%

31% of Total Revenue

Wealth

Management

17%

Other Service Charges,

Commissions and Fees

37%

(Q2 2014) |

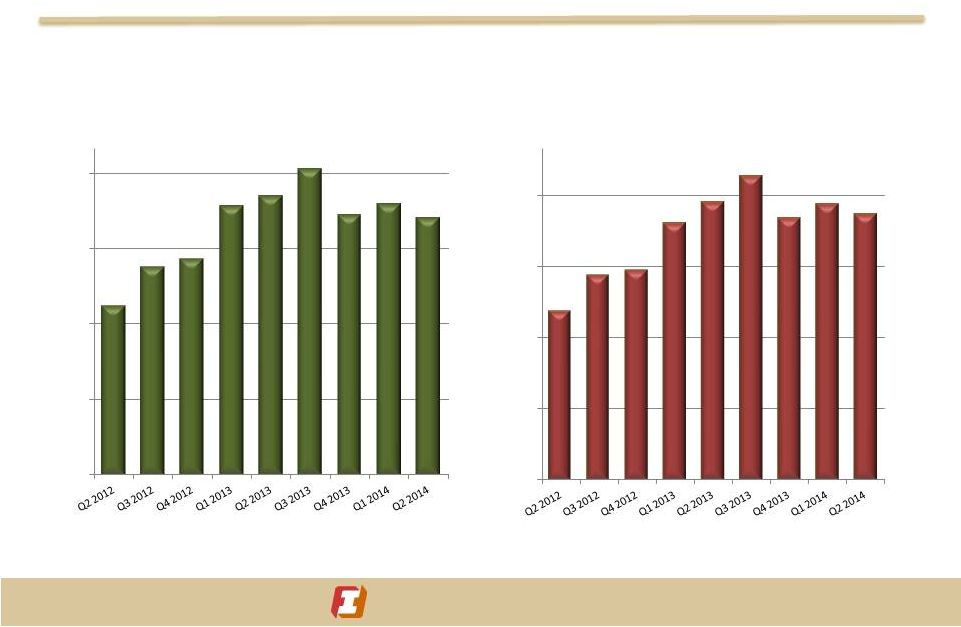

First Interstate

BancSystem Earnings

Improvement Page 15

$33,984

$27,863

$27,904

$30,378

$0

$4,000

$8,000

$12,000

$16,000

$20,000

$24,000

$28,000

$32,000

$36,000

Mortgage Revenue Impact

Stable Pre-Tax, Pre-Provision Earnings

$0.54

$0.47

$0.48

$0.47

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

Diluted Earnings Per Share

(in thousands) |

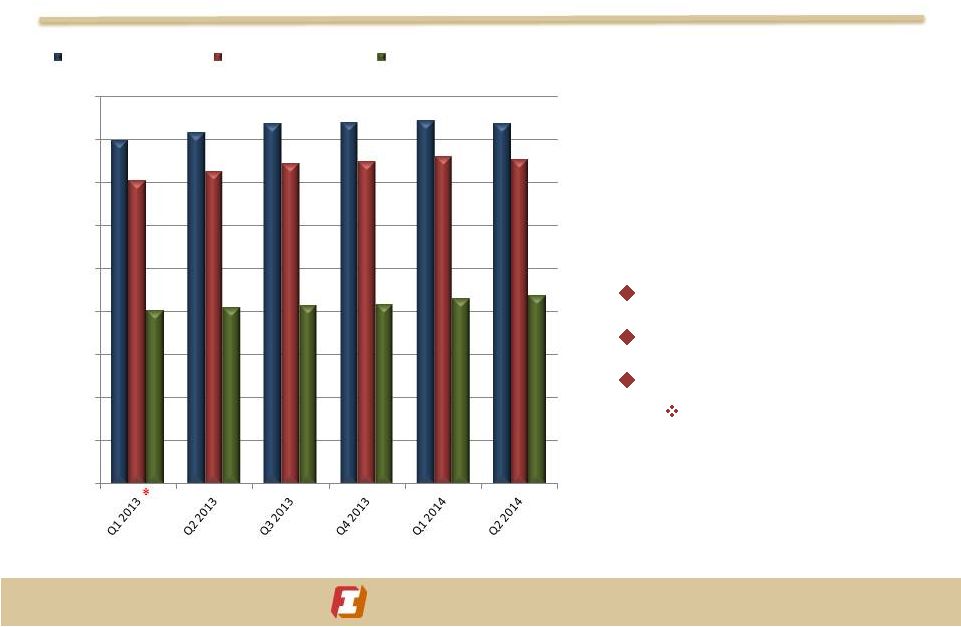

First Interstate

BancSystem Strong Capital

Ratios Page 16

* Redemption of $50 M Preferred Stock

Deploying capital to

maximize

shareholder return

Strong dividend

Stock repurchase plan

Mergers & Acquisitions

Mountain West

acquisition set to close

July 31, 2014

16.69%

15.02%

8.72%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

Total Risk Based Capital

Tier 1 Risk Based Capital

Tangible Common to Tangible Assets |

First Interstate

BancSystem Improved Earnings

Ratios Page 17

1.12%

0.00%

0.30%

0.60%

0.90%

1.20%

Annualized Return on Average Assets

10.18%

0.00%

3.00%

6.00%

9.00%

12.00%

Annualized Return on Average Common Equity |

First Interstate

BancSystem Improving Credit

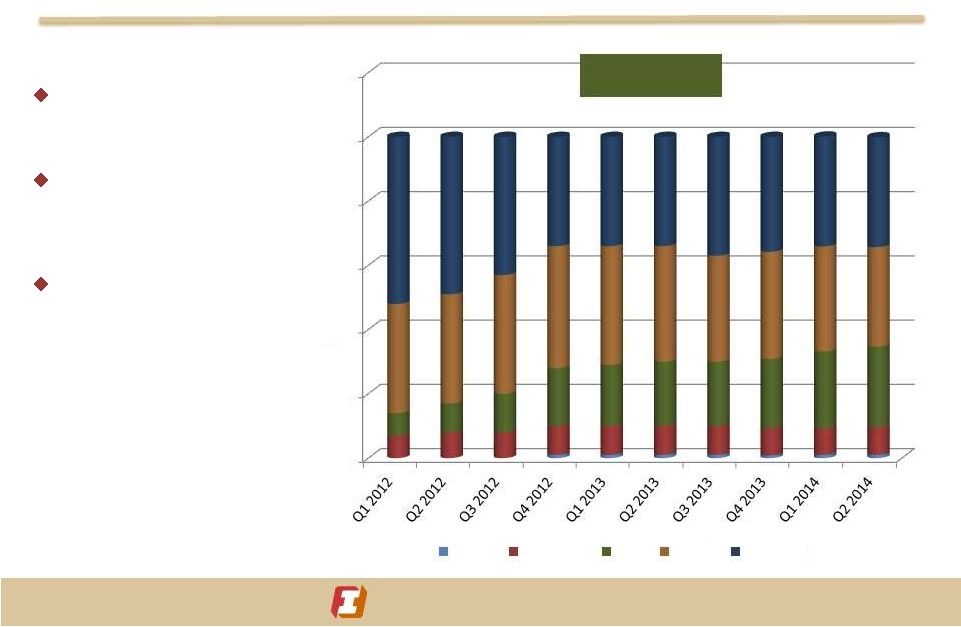

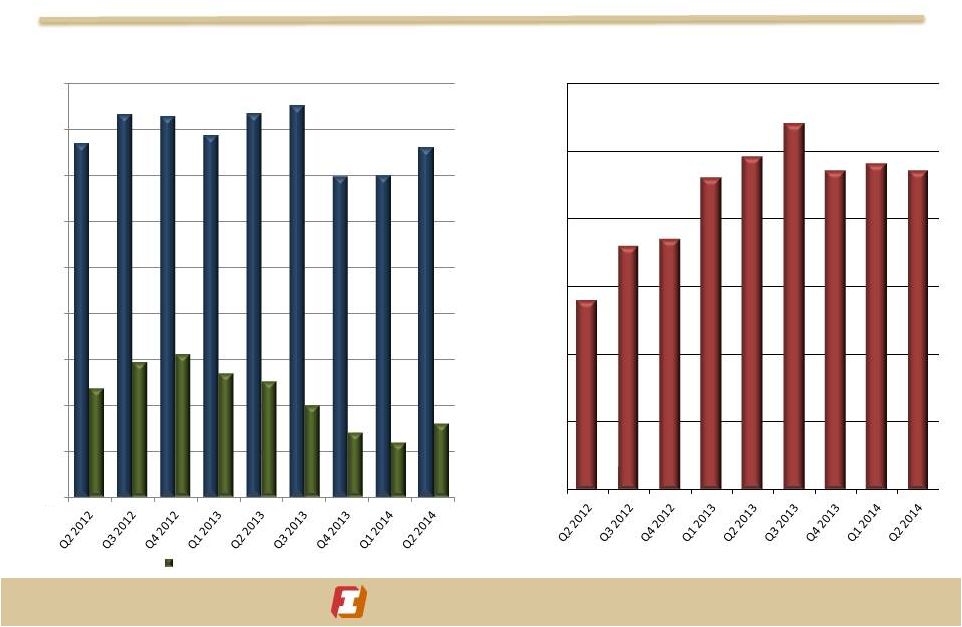

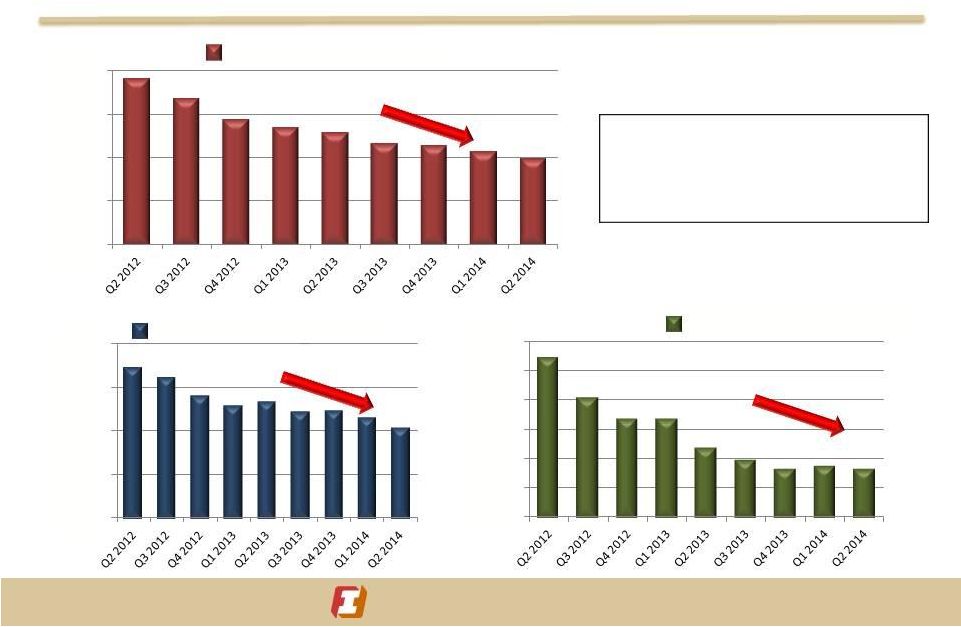

Quality Trends Page 18

(In millions)

70% reduction since peak in mid-2012

Earnings Improvement

driven by Improved Credit

Metrics

1.27% of Total Assets

$97

$-

$50

$100

$150

$200

Non-

$81

$-

$40

$80

$120

$160

Non-Performing Loans

$16

$-

$10

$20

$30

$40

$50

$60

OREO

Performing Assets |

First Interstate

BancSystem Page 19

First Interstate BancSystem

Merger with

Mountain West Financial Corp.

Announced February 10, 2014

First Interstate

BancSystem |

First Interstate

BancSystem Transaction

Highlights Page 20

Compelling

Strategic

Fit

Low Execution Risk

Enhances Shareholder

Value

Creates the #1 deposit market share franchise in the state of Montana

Meaningfully expands Helena presence while creating consolidation

opportunities in other market areas

Adds scale within existing footprint with no anticipated divestiture

required Adds strong customer base and talented people to FIBK

organization Comprehensive due diligence process completed

Knowledge of market area and similar business lines

Thoughtful and conservative approach to financial modeling

Meaningful cost savings opportunities

Immediately accretive to FIBK’s EPS

Modest dilution to tangible book value recaptured in approximately three

years

Anticipated IRR > 15% |

First Interstate

BancSystem Pro Forma

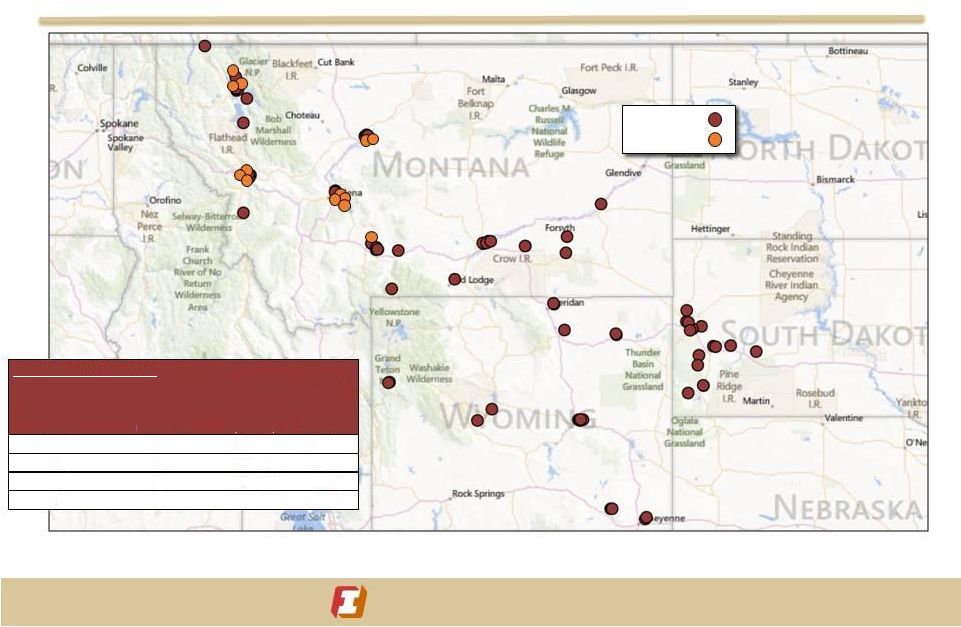

Branch Map Page 21

FIBK (76)

MTWF (13)

1)

Deposit data as of June 30, 2013

Source: SNL Financial; FDIC

Helena

Great

Falls

Missoula

Bozeman

Kalispell

Whitefish

Recently announced consolidation of 8 Mountain West branches

0.25

0.5

1

5

Branch Proximity Analysis¹

Distance from

Number of

Total MTWF

% of

FIBK Branch

MTWF

Deposits

Total

(mi.)

Branches

($000s)

Deposits

4

40,005

7.6

7

100,911

19.1

10

479,344

90.6

13

528,963

100.0

First Interstate

BancSystem |

First Interstate

BancSystem Top Market

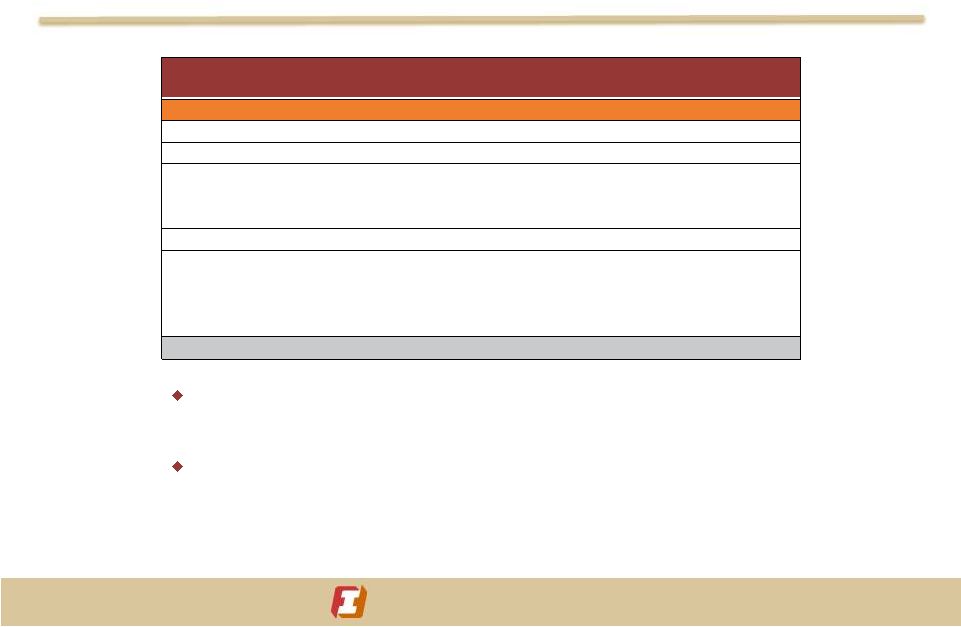

Share in Montana Page 22

Note: Deposit data as of June 30, 2013

Source: SNL Financial; FDIC

Pro

forma

FIBK

market

share

in

the

Helena

area

increases

from

#6

($70

million

in

deposits) to #1 ($317 million in deposits)

Pro forma FIBK market share in the Great Falls area increases from #3 ($258

million in deposits) to #1 ($397 million in deposits)

Total Deposits

Deposit

Number of

in Market

Market Share

Rank

Institution (St.)

Branches

($mm)

(%)

1

PRO FORMA

51

3,550.5

17.9

1

Glacier Bancorp Inc. (MT)

52

3,111.3

15.6

2

First Interstate BancSystem (MT)

38

3,021.5

15.2

3

Wells Fargo & Co. (CA)

44

2,371.3

11.9

4

U.S. Bancorp (MN)

25

2,218.1

11.2

5

Stockman Financial Corp. (MT)

31

1,815.7

9.1

6

Mountain West Financial Corp. (MT)

13

529.0

2.7

7

Inter-Mountain Bancorp. Inc. (MT)

8

519.8

2.6

8

Eagle Bancorp Montana, Inc. (MT)

13

418.3

2.1

9

Montana Security Inc. (MT)

5

397.8

2.0

10

Heartland Financial USA Inc. (IA)

10

367.7

1.8

Total in Market

402

$19,884 |

First Interstate

BancSystem Summary of Deal

Terms Page 23

Consideration

0.2552 FIBK shares of Class A Common Stock and $7.125 in cash in

exchange for each MTWF share

Outstanding and unexercised MTWF options will be cashed out at closing

Valuation

Based on FIBK closing stock price on February 10, 2014 of $24.77, per share

value to MTWF of $13.45 or $72.8 million in the aggregate in exchange for all

MTWF shareholder and optionholders

~124% of MTWF Tangible Book Value Per Share

~20x LTM EPS (excluding cost savings)

Approximately 47% stock, 53% cash consideration mix

Post-Merger Economic

Ownership

97.0% FIBK/3.0% MTWF

Anticipated Closing

July 31, 2014

Selected Closing

Conditions

Customary regulatory approvals received

MTWF shareholder approval received |

First Interstate

BancSystem Summary Financial

Assumptions and Impact Page 24

Cost Savings

Approximately 35% of MTWF noninterest expense base

One-time Deal Costs

Approximately $7.2 million pretax

Fair Market Value and

Accounting

Adjustments

Loan portfolio mark-to-market

~4.4% of gross loans

Core Deposit Intangible

1.50% amortized over 7 years

Fixed asset write-down of $10 to $11 million

Debt Redemption

$19.8 million Trust Preferred redeemed at closing at par

Impact to FIBK Shareholders

2015e EPS

6% to 7% EPS accretion (100% phase-in of cost savings)

TBVPS Impact

~3% dilutive to tangible book value per share at closing

Approximately 3 year earn-back

Internal Rate of Return

>15% |

Why invest in

First Interstate BancSystem? Long Track Record of Profitability

Leading Market Positions

Attractive and Healthy Footprint

Improving Credit Metrics

Low-Cost Core Deposit Base

Growth Opportunities

Increasing Shareholder Returns

First Interstate

BancSystem Page 25

|