Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Monogram Residential Trust, Inc. | a14-12965_18k.htm |

Exhibit 99.1

|

|

Behringer Harvard Multifamily REIT I, Inc. Q1 2014 Update Call May 20, 2014 Arpeggio at Victory Park– Dallas, TX (a joint venture owned community ) |

|

|

Forward-Looking Statements This presentation contains forward-looking statements, including discussion and analysis of the financial condition of Behringer Harvard Multifamily REIT I, Inc. (the “REIT”) and its subsidiaries and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of the REIT’s management based on their knowledge and understanding of the REIT’s business and industry. Words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should” and variations of these words and similar expressions are intended to identify forward-looking statements. We intend that such forward-looking statements be subject to the safe harbor provisions created by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution you not to place undue reliance on forward-looking statements, which reflect the REIT’s management's view only as of the date of this presentation. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions the occurrence of unanticipated events or changes to future operating results. |

|

|

Forward-Looking Statements Factors that could cause actual results to vary materially from any forward-looking statements made in this presentation include, but are not limited to: The forward looking statements should be read in light of these and other risk factors identified in the “Risk Factors” section of the REIT’s Annual Report on Form 10-K for the year ended December 31, 2013 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, as filed with the Securities and Exchange Commission. absence of a public market for the REIT’s securities; limited operating history; limited transferability and lack of liquidity; risks associated with lending activities; no assurance that distributions will continue to be made or that any particular rate of distribution will be maintained; until the proceeds from an offering are invested and generating cash flow from operating activities, some or all of the distributions will be paid from other sources, which may be deemed a return of capital, such as from the proceeds of an offering, cash advances by the advisor, cash resulting from a waiver of asset management fees, proceeds from the sales of assets, and borrowings in anticipation of future cash flow from operating activities, which could result in less proceeds to make investments in real estate; reliance on the program’s advisor; payment of significant fees to the advisor and their affiliates; potential conflicts of interest; lack of diversification in property holdings; market and economic challenges experienced by the U.S. economy or real estate industry as a whole and the local economic conditions in the markets in which our properties are located; the REIT’s ability to make accretive investments in a diversified portfolio of assets; availability of cash flow from operating activities for distribution; the REIT’s level of debt and the terms and limitations imposed on the REIT by its debt agreements; the availability of credit generally, and any failure to obtain debt financing at favorable terms or a failure to satisfy the conditions and requirements of that debt; the ability to secure resident leases at favorable rental rates; the ability to raise future capital through equity and debt security offerings and through joint venture arrangements; the ability to retain our executive officers and other key personnel of our advisor, our property manager and their affiliates; conflicts of interest arising out of our relationships with our advisor and its affiliates; the ability to successfully transition to a self-managed company; unfavorable changes in laws or regulations impacting our business, our assets or our key relationships; factors that could affect our ability to qualify as a real estate investment trust; potential development risks and construction delays; the potential inability to retain current tenants and attract new tenants due to a competitive real estate market; risk that a program’s operating results will be affected by economic and regulatory changes that have an adverse impact on a program’s investments; risks related to investments in distressed properties or debt include possible default under the original loan; unforeseen increases in operating and capital expenses; declines in real estate values; and, lack of availability of due diligence information. These risks may impact the REIT’s financial condition, operating results, returns to its shareholders, and ability to make distributions as stated in the REIT’s offering. Investment in securities of Behringer Harvard real estate programs is subject to substantial risks and may result in the loss of principal invested. Real Estate programs are not suitable for all investors. |

|

|

Questions? Live question and answer session after prepared remarks During the call, please e-mail questions to: bhreit@behringerharvard.com |

|

|

Today’s Presenters Robert S. Aisner Chief Executive Officer Mark T. Alfieri President and Chief Operating Officer Howard S. Garfield Chief Financial Officer |

|

|

Q1 2014 Highlights Rental revenue and net operating income improved compared with year-ago quarter Same store occupancy remained high at 95% and same store monthly rental rates improved by 3% Commenced leasing at two developments Sold community in Portland for gain of $16.2 million |

|

|

Economic Factors Affecting Multifamily Markets GDP growth in Q1 affected by weather Employment improved as weather improved: 298,000 jobs added in April Unemployment dropped to 6.3%, but participation rate also fell to 62.8% Economy sluggish but relatively stable Multifamily demand side factors con tinue to be favorable Supply increases affecting certain markets |

|

|

New Brand Effective at Self-Management Closing |

|

|

New Directors Appointed One vacant position filled, two positions added for a total of eight directors Murray J. McCabe Over 20 years of investment banking experience in real estate at JP Morgan including Managing Director and Co-Head of Real Estate and Lodging Investment Banking, North America, and Global Head of Real Estate and Lodging Investment Banking Currently Managing Partner of Blum Capital Behringer nominee David D. Fitch Former president, CEO and board member of Gables Residential Trust Independent director Mark T. Alfieri President and Chief Operating Officer of the REIT Will be appointed CEO at completion of transition Only executive officer appointed to board |

|

|

Other Transition Progress New headquarters location chosen Located in Legacy area of Plano, northern suburb of Dallas Build-out started, move in late June HR and Marketing executives hired Headquarters and property management personnel beginning transition to employees of the REIT IT infrastructure in implementation phase |

|

|

Geographic Distribution of Investments 54 Investments 33 Operating Properties 17 Developments 4 Mezzanine Loans Data is as of March 31, 2014. |

|

|

Rent vs. Job Growth by Market January 2014 Employment as % of Pre-Recession Peak 4Q13 Rent as % of Pre-Recession Peak Jobs recovered, rents not Jobs and rents recovered Neither jobs nor rents recovered Rents recovered, jobs not Note: Used with permission from Witten Advisors LLC. |

|

|

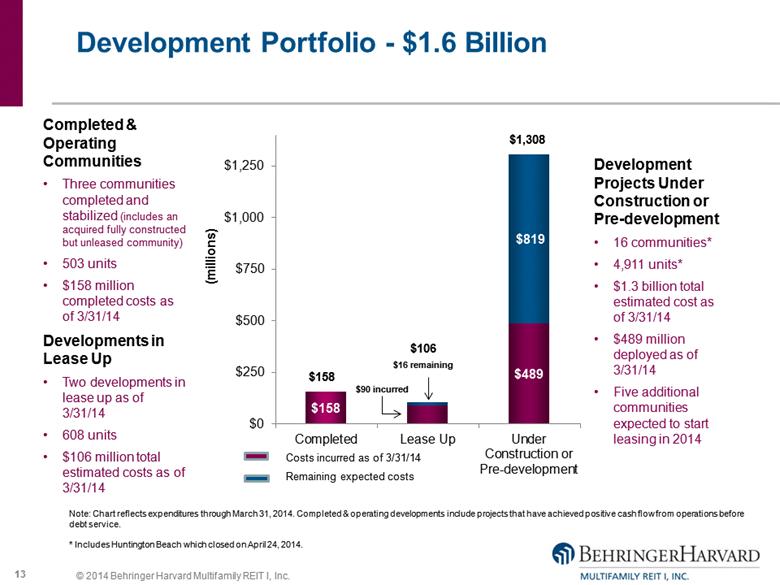

Development Portfolio - $1.6 Billion Completed & Operating Communities Three communities completed and stabilized (includes an acquired fully constructed but unleased community) 503 units $158 million completed costs as of 3/31/14 Developments in Lease Up Two developments in lease up as of 3/31/14 608 units $106 million total estimated costs as of 3/31/14 Development Projects Under Construction or Pre-development 16 communities* 4,911 units* $1.3 billion total estimated cost as of 3/31/14 $489 million deployed as of 3/31/14 Five additional communities expected to start leasing in 2014 Note: Chart reflects expenditures through March 31, 2014. Completed & operating developments include projects that have achieved positive cash flow from operations before debt service. * Includes Huntington Beach which closed on April 24, 2014. |

|

|

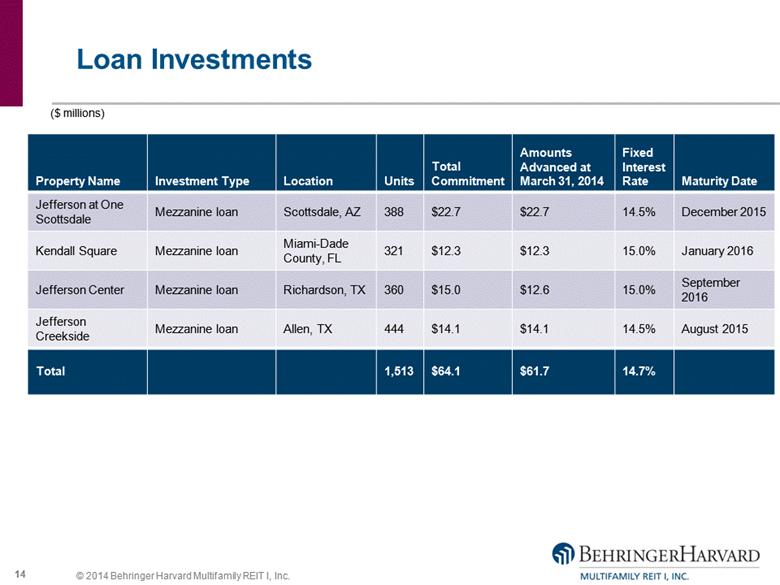

Loan Investments Property Name Investment Type Location Units Total Commitment Amounts Advanced at March 31, 2014 Fixed Interest Rate Maturity Date Jefferson at One Scottsdale Mezzanine loan Scottsdale, AZ 388 $22.7 $22.7 14.5% December 2015 Kendall Square Mezzanine loan Miami-Dade County, FL 321 $12.3 $12.3 15.0% January 2016 Jefferson Center Mezzanine loan Richardson, TX 360 $15.0 $12.6 15.0% September 2016 Jefferson Creekside Mezzanine loan Allen, TX 444 $14.1 $14.1 14.5% August 2015 Total 1,513 $64.1 $61.7 14.7% ($ millions) |

|

|

Same Store Rental Income Growth – 2013 vs 2014 Note: Same Store Properties as of January 1, 2013 |

|

|

Same Store Occupancy and Rental Rates There were 30 stabilized comparable properties in the 1st quarter year over year comparison. Monthly rental revenue per unit has been calculated based on the leases in effect as of March 31, 2014 and 2013 for the applicable comparable properties. Monthly rental revenue per unit only includes base rents for the occupied units, including affordable housing payments and subsidies, and does not include other charges for storage, parking, pets, cleaning, clubhouse or other miscellaneous amounts. |

|

|

*Reconciliations of Loss from continuing operations to same store Combined Net Operating Income can be found in the Current Report on Form 8-K filed on May 20, 2014 with the Securities and Exchange Commission. A copy of this filing is available at www.behringerinvestments.com. Same Store Net Operating Income* Trends There were 30 stabilized comparable properties in the 1st quarter year over year comparison. |

|

|

Performance Comparison with Exchange Listed Apartment REITs * Reflects AIMCO’s conventional same store change (excludes affordable component). Source: SNL Same Store Q1 2014 vs Q1 2013 Company Name Ticker SS Revenue Change (%) SS Expense Change (%) SS NOI Change (%) Associated Estates AEC 3.10 5.20 1.80 AIMCO* AIV 4.60 2.80 5.60 Avalon Bay AVB 3.70 6.50 2.60 Camden CPT 4.70 2.10 6.30 Equity Residential EQR 4.00 3.20 4.40 Essex ESS 7.20 4.60 8.30 Home Properties HME 2.80 8.90 -.80 Mid-America MAA 2.92 4.10 2.15 Post Properties PPS 2.40 3.70 1.60 UDR UDR 4.50 2.20 5.60 Lowest 2.40 2.10 -.80 Average 3.99 4.33 3.76 Highest 7.20 8.90 8.30 Behringer Harvard Multifamily REIT I 3.90 4.70 3.40 |

|

|

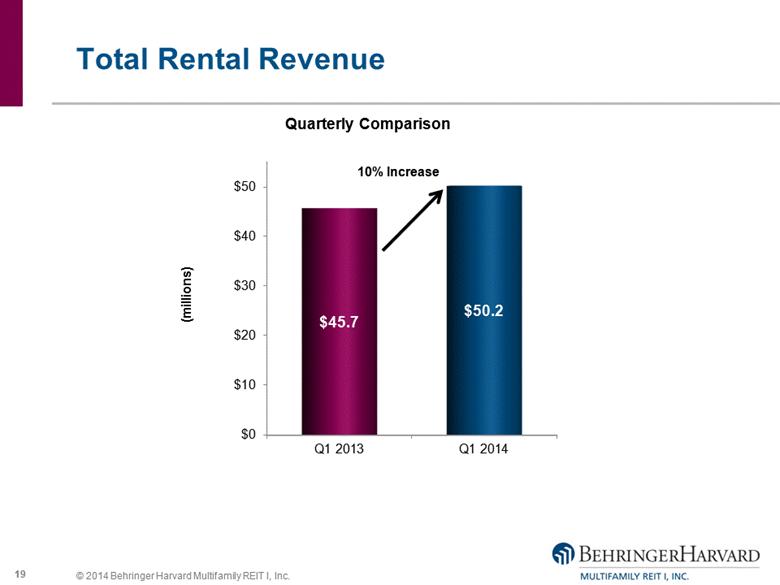

Total Rental Revenue |

|

|

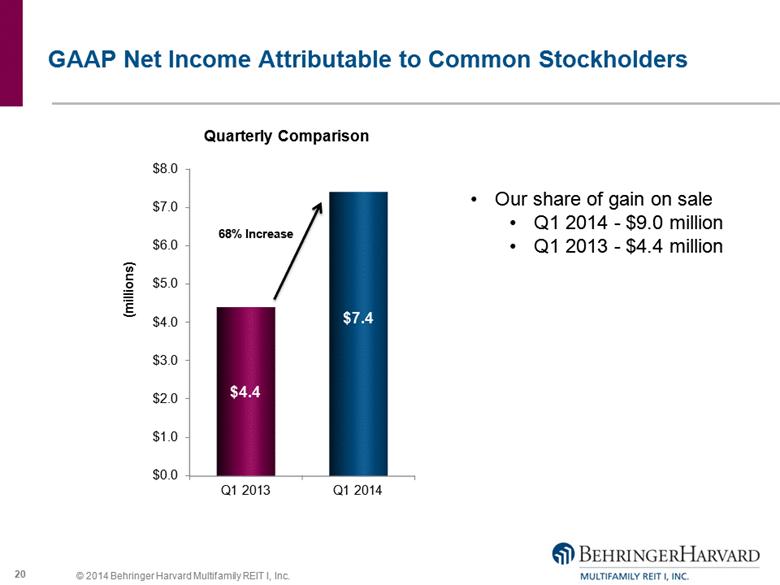

GAAP Net Income Attributable to Common Stockholders Our share of gain on sale Q1 2014 - $9.0 million Q1 2013 - $4.4 million |

|

|

MFFO* Trends *Reconciliations of Net Loss to FFO to MFFO can be found in the Current Report on Form 8-K filed on May 20, 2014 with the Securities and Exchange Commission. A copy of this filing is available at www.behringerinvestments.com. **Weighted average number of common shares outstanding were 168.7 million and 168.1 million for the quarters ended March 31, 2014 and 2013, respectively. |

|

|

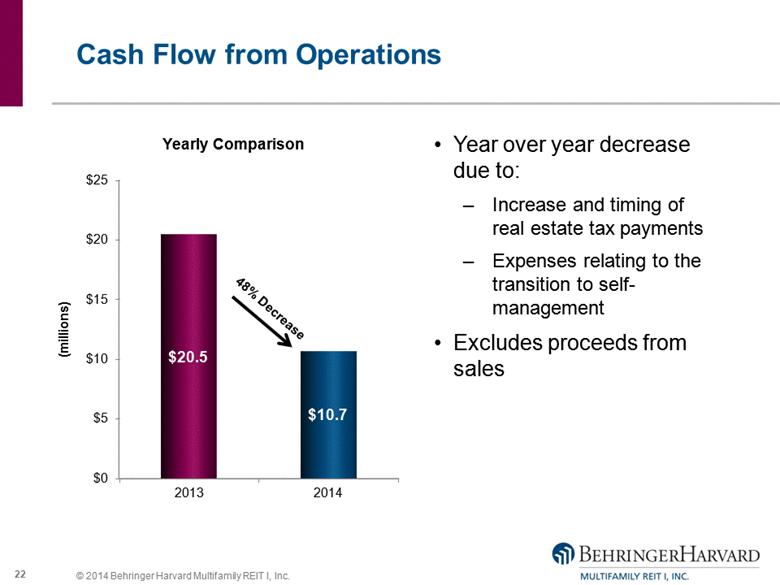

Cash Flow from Operations Year over year decrease due to: Increase and timing of real estate tax payments Expenses relating to the transition to self-management Excludes proceeds from sales 48% Decrease |

|

|

Debt Financing Obtained one construction loan for $28.5M with a variable interest rate of LIBOR + 195 bps As of 3/31/14, the weighted average interest rate was 3.7% Note: Includes 100% of property debt balances regardless of our ownership. |

|

|

Selected Investments Gallery Acappella – San Bruno, CA Fitzhugh Urban Flats – Dallas, TX The Reserve at La Vista Walk – Atlanta, GA Calypso Apartments and Lofts – Irvine, CA Acappella, La Vista and Allegro are wholly owned communities. Fitzhugh, Calypso and Skye 2905 Urban Flats are joint venture owned communities. Allegro– Addison, TX Skye 2905 Urban Flats– Denver, CO |

|

|

Our Strategy Grow revenues and NOI through proactive property management Continuing to optimize rents and occupancy to grow revenues and NOI Keep focus on reduction or containment of operating costs Deploy remaining available cash Institutional quality, coastal and urban in-fill focus locations Highly amenitized developments and newer operating properties, providing higher rents per unit Opportunistic acquisitions Cost effective, flexible financing to compliment our investment strategy Complete transition to self-management |

|

|

Questions? Press *1 to enter the queue Please ask one question and a follow-up question Re-enter the queue to ask further questions You may also e-mail questions to: bhreit@behringerharvard.com |

|

|

Playback Information Investors may dial toll free (888) 203-1112 and use conference ID 5123702 to access a playback of today’s call Representatives may log on to the password protected portion of the Behringer website (www.behringerinvestments.com) for a playback of today’s call Replays will be available until Friday, June 27. |