Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNIVERSAL LOGISTICS HOLDINGS, INC. | d718716d8k.htm |

| EX-1.1 - EX-1.1 - UNIVERSAL LOGISTICS HOLDINGS, INC. | d718716dex11.htm |

| EX-99.2 - EX-99.2 - UNIVERSAL LOGISTICS HOLDINGS, INC. | d718716dex992.htm |

| EX-99.1 - EX-99.1 - UNIVERSAL LOGISTICS HOLDINGS, INC. | d718716dex991.htm |

Exhibit 5.1

May 2, 2014

Board of Directors

Universal Truckload Services, Inc.

12755 E. Nine Mile Road

Warren, Michigan 48089

| Re: | Offering of Common Stock |

Gentlemen:

We have acted as special counsel to Universal Truckload Services, Inc., a corporation organized under the laws of the state of Michigan (the “Company”), in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”), of the offer and sale of an aggregate of 1,900,000 shares of the Company’s common stock, no par value (the “Firm Shares”) (which includes 20,000 shares of common stock to be sold by the Company and 1,880,000 shares of common stock to be sold by the MJ Moroun 2012 Annuity Trust, dated April 30, 2012, and Manuel J. Moroun, an individual, as the “Selling Shareholders”). The Selling Shareholders also propose to sell to the Underwriter, at the option of the Underwriter, up to an additional 190,000 shares of Common Stock (the “Option Shares”). The Firm Shares and the Option Shares are hereinafter referred to as the “Shares.” The Shares are being offered pursuant to that certain Underwriting Agreement dated April 28, 2014 (the “Underwriting Agreement”), among the Company, the Selling Shareholders and Morgan Stanley & Co. LLC. The Shares are being offered and sold under a Registration Statement on Form S-3 under the Securities Act originally filed with the Securities and Exchange Commission (the “Commission”) on March 28, 2013 (Registration No. 333-187587) (such Registration Statement, as amended and supplemented, the “Registration Statement”), including a base prospectus dated May 22, 2013 (the “Base Prospectus”), a preliminary prospectus supplement dated April 28, 2014 (the “Preliminary Prospectus Supplement”), and a final prospectus supplement dated April 29, 2014 (the “Final Prospectus Supplement,” and together with the Base Prospectus and the Preliminary Prospectus Supplement, the “Prospectus”).

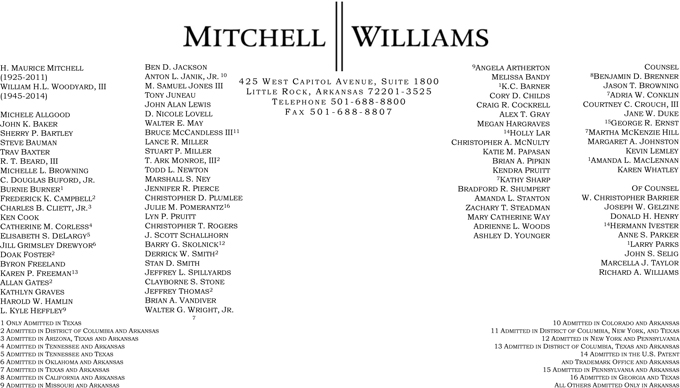

MITCHELL, WILLIAMS, SELIG, GATES & WOODYARD, P.L.L.C. | ATTORNEYS AT LAW

MITCHELLWILLIAMSLAW.COM

May 2, 2014

Page 2

With respect to the opinion set forth below, we have examined originals, certified copies, or copies otherwise identified to our satisfaction as being true copies of such documents, corporate records, certificates of public officials, and other instruments as we have deemed necessary for the purposes of rendering the opinion set forth herein.

For purposes of this opinion, we have assumed the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as copies, and the authenticity of the originals of all documents submitted to us as copies. We have also assumed the legal capacity of all natural persons, the genuineness of the signatures of persons signing all documents in connection with which this opinion is rendered, the authority of such persons signing on behalf of the parties thereto other than the Company, and the due authorization, execution, and delivery of all documents by the parties thereto other than the Company. We have not independently established or verified any facts relevant to the opinions expressed herein, but have relied upon statements and representations of officers and other representatives of the Company and the Selling Shareholders.

Based solely upon and subject to the foregoing, and subject to the assumptions, limitations, and qualifications stated herein, we are of the opinion that (A) the Shares to be sold by the Company have been duly authorized and, when issued, delivered, and paid for in accordance with the terms of the Underwriting Agreement, will be validly issued, fully paid, and nonassessable; and (B) the Shares to be sold by the Selling Shareholders have been validly issued and are fully paid and nonassessable.

This opinion letter is based as to matters of law solely on the Michigan Business Corporation Act, as amended, and the federal laws of the United States. We express no opinion herein as to any other laws, statutes, ordinances, rules or regulations.

Our opinion represents the reasoned judgment of Mitchell, Williams, Selig, Gates & Woodyard, P.L.L.C., as to certain matters of law based upon facts presented to us or assumed by us and should not be considered or construed as a guaranty. This opinion letter has been prepared for your use in connection with the filing of the Prospectus and speaks as of the date hereof. Our opinion is subject to future changes in law or fact, and we disclaim any obligation to advise you of or update this opinion for any changes of applicable law or facts that may affect matters or opinions set forth herein.

May 2, 2014

Page 3

We hereby consent to the filing of this opinion letter as Exhibit 5.1 to the Company’s Current Report on Form 8-K to be filed on May 2, 2014, and to the reference to this firm under the caption “Legal Matters” in the Prospectus constituting a part of the Registration Statement. In giving this consent, we do not admit that we are an expert within the meaning of the Securities Act.

| Very truly yours, |

| /s/ MITCHELL, WILLIAMS, SELIG, |

| GATES & WOODYARD, P.L.L.C.

MITCHELL, WILLIAMS, SELIG, GATES & WOODYARD, P.L.L.C. |