Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Voya Financial, Inc. | d693823d8k.htm |

| EX-99.1 - EX-99.1 - Voya Financial, Inc. | d693823dex991.htm |

March 2014

ING U.S. Follow-On Equity Offering

ING U.S.

America’s Retirement Company™

Exhibit 99.2

RETIREMENT •

INVESTMENTS •

INSURANCE

Making a secure financial future possible – one person, one family, one institution at a

time |

2

Note Regarding Forward-Looking Statements and Use

of Non-GAAP Financial Measures

This document contains forward-looking statements. Forward-looking

statements include statements relating to future developments in our

business or expectations for our future financial performance and any

statement not involving a historical fact. Forward-looking statements use words such as

“anticipate,”

“believe,”

“estimate,”

“expect,”

“intend,”

“plan,”

and other words and terms of similar

meaning in connection with a discussion of future operating or financial

performance. Actual results, performance

or

events

may

differ

materially

from

those

projected

in

any

forward-looking

statement

due to, among other things, (i) general economic conditions, particularly economic

conditions in our core markets, (ii) performance of financial markets,

including emerging markets, (iii) the frequency and severity of insured loss

events, (iv) mortality and morbidity levels, (v) persistency and lapse

levels, (vi) interest rates, (vii) currency exchange rates, (viii) general

competitive factors, (ix) changes in laws and regulations and (x) changes in

the policies of governments and/or regulatory authorities. Factors that may

cause actual results to differ from those in any forward-looking

statement

also

include

those

described

under

“Risk

Factors,”

“Management’s

Discussion

and

Analysis

of

Results

of

Operations

and

Financial

Condition—Trends

and

Uncertainties”

and

“Business—Closed Blocks—CBVA”

in ING U.S., Inc.’s registration statement on Form S-1 filed with

the SEC. ING U.S., Inc. assumes no obligation to update any forward-looking

information contained in this document.

Unless otherwise noted, the financial information included herein was determined in

accordance with U.S. GAAP. All dollar figures are presented in millions

unless otherwise noted. All references to “ROE”;

“ROC”

or

“Operating

ROE”

and

“Operating

ROC”

refer

to

Ongoing

Business

(which

excludes

Closed Blocks and Corporate), unless otherwise noted. “ROE”;

“ROC”; “Ongoing Business Operating ROE”; “Ongoing

Business Operating ROC”; “Ongoing Business Adjusted Operating

Earnings

Before

Interest

and

Income

Taxes”

and

“Financial

Leverage”

are

non-GAAP

financial

measures. The reconciliation of such measures to the most comparable GAAP measure

in accordance

with

Regulation

G

is

included

under

“Business

–

Operating

Return

on

Capital

Goal”

in

ING U.S., Inc.’s registration statement on Form S-1 filed with the SEC or

the Appendix hereto. 2

Retirement •

Investments •

Insurance |

Offering Summary

3

Company

ING U.S., Inc. (“ING U.S.”)

Exchange / Ticker

NYSE / VOYA

Selling Shareholder

ING Groep N.V.

Shares Offered

[33 –

36 million]

Primary / Secondary

100% Secondary

Underwriters’

Option

[15% Greenshoe (Secondary)]

Joint Global

Coordinators

Morgan

Stanley,

Goldman,

Sachs

&

Co.,

Citigroup,

Bank

of

America

Merrill

Lynch

Expected Pricing

Week of March 17

3

Retirement •

Investments •

Insurance |

Office

of the CEO Rod Martin

Chief Executive Officer

Alain Karaoglan

Chief Operating Officer

Ewout Steenbergen

Chief Financial Officer

More than 35 years of experience

in financial services. Former

chairman of AIG’s International

Life and Retirement Services

Previously held leadership

positions at AIG and American

General

More than 25 years of experience

in the financial services industry,

most recently with AIG as head of

divestitures

Previously held leadership

positions at AIG, Bank of America,

Deutsche Bank, and DLJ

More than 22 years of experience

in the financial services industry,

most recently as CFO and CRO

of ING Asia Pacific

Previously held leadership

positions at ING in Western

Europe, Central Europe, and

Asia/Pacific; and at Ten Pas

actuarial consultants (now part of

Mercer)

4

4

Retirement •

Investments •

Insurance |

ING

U.S. TODAY Focus on Execution, Driving Return on Equity Improvement

5

(1)

Pension & Investments, for the twelve months ended 9/30/13

(2)

See Appendix for explanatory note regarding Ongoing Business Adjusted Operating

Earnings Before Interest and Income Taxes Retirement •

Investments •

Insurance

#

1

Leading

franchise in

attractive

markets

publicly traded

Defined Contribution

recordkeeper with a

full array of retirement

capabilities

(1)

Strong track

record of

execution

12%

CAGR

in Ongoing Business

adjusted operating

earnings

(2)

2009-2013

Substantial

scope for

continuing

Return on

Equity (ROE)

improvement

400-500

bps

targeted increase in

Ongoing Business

operating ROE to

12-13% from 2012

to 2016 |

Customers

(3)

13M

Market cap

(1)

$9.3Bn

AUM / AUA

(2)

$511Bn

Points of Distribution

(4)

220,000

Retirement

Solutions

Investment

Management

Insurance

Solutions

26%

14%

60%

Diverse

Earnings

–

Three

Ongoing Businesses

(1)

As of market close, 3/14/14

(2)

As of 12/31/13; includes Closed Blocks

(3)

As of 12/31/13

(4)

Approximate as of 12/31/13; defined as independent producers

(5)

Approximate as of 12/31/13

(6)

Ongoing Business reflects Retirement, Annuities, Investment Management, Individual

Life, and Employee Benefits segments; adjustments include DAC/VOBA and other intangibles unlocking, the gain

74% of earnings from Retirement Solutions

and

Investment

Management

Employees

(5)

7,000

ING U.S. at a Glance

FY’13 Ongoing Business Adjusted Operating

Earnings Before Interest and Income Taxes: $1,212 million

(6)

6

Retirement •

Investments •

Insurance

(6)

associated

with

a

Lehman

Brothers

bankruptcy

settlement

(“Lehman

Recovery”),

and

losses

recognized

as

a

result

of

marking

low

income

housing

tax

credit

partnerships

(“LIHTC”)

to

the

sales

price

associated with their disposition |

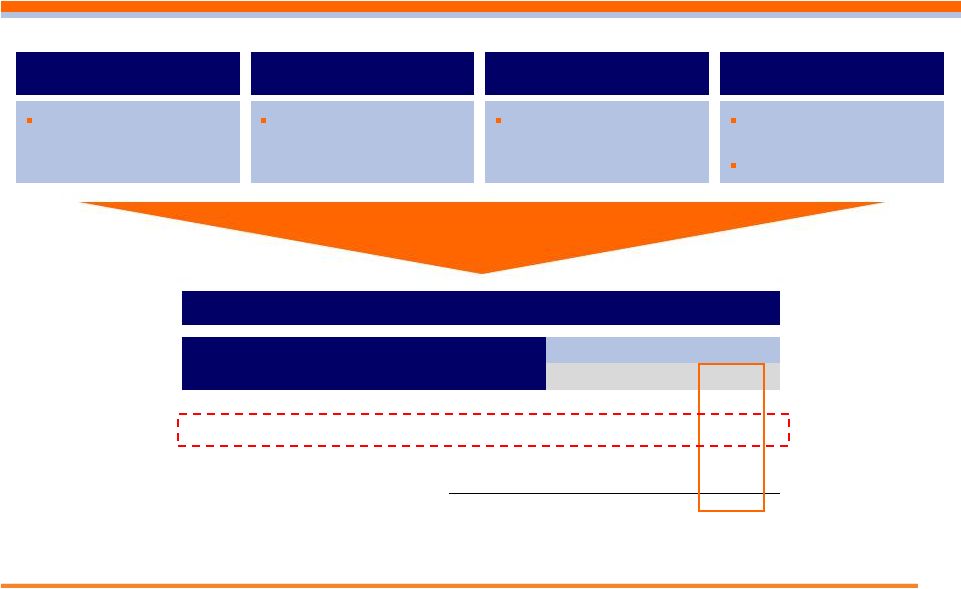

Three

Key Sources of Value Potential

CBVA Value

Tax Assets

Provide

Potential

Upside

Ongoing

Business

7

Retirement •

Investments •

Insurance |

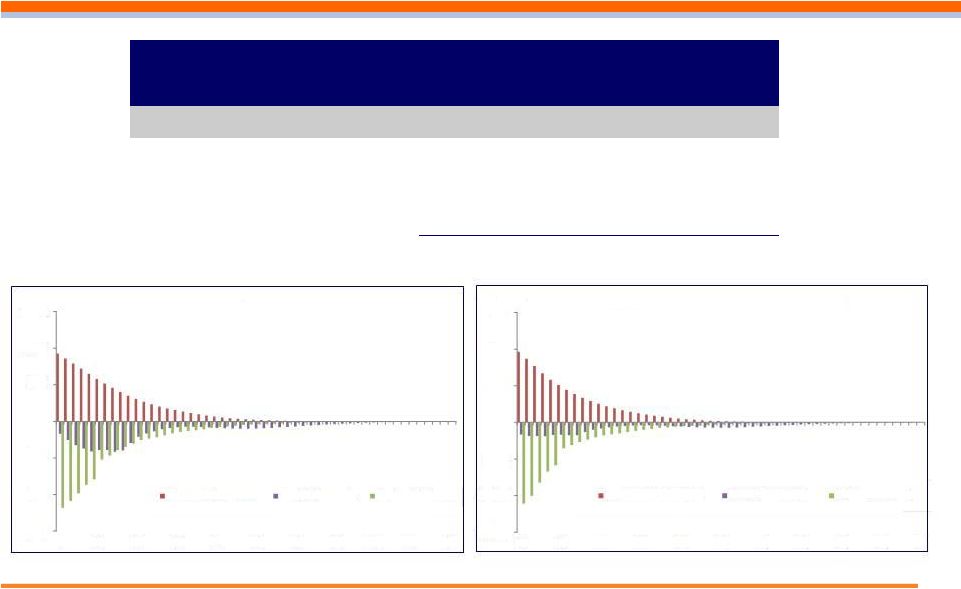

Continued Solid Execution since IPO, Supported by Favorable Markets

Markets

Forward Interest Rate Curve

Equity Market Levels (S&P 500)

At IPO (5/1/13)

Current (3/14/14)

Initial

Public

Offering:

Priced

our

IPO

on

May

1,

2013

Secondary Offering:

ING Group’s secondary offering

on October 23, 2013 reduced its ownership stake to

approximately 57%

Stock Performance:

Stock price increase of 80%

(from May 1, 2013 to December 31, 2013)

Completion

of

Recapitalization

Plan:

Primary

equity offering: $600 million in May 2013 and three

debt offerings: $1 billion in February 2013, $750

million in May 2013, and $400 million in July 2013,

which bolstered our balance sheet; reset negative

unassigned funds account at all subsidiaries to zero

Introduction of New Brand:

Introduction of Voya

Financial with full operational rebranding occurring in

2014

ROE

Improvement:

Adjusted

ROE

improved

by

200bps from 8.3% to 10.3% from 2012-2013

(1)(2)

Year in Review: 2013 Achievements

1,583

1,841

1

2

3

5

7

10

20

30

Current

(3/14/14)

At IPO

(5/1/13)

Retirement •

Investments •

Insurance

(1)

Excludes Closed Blocks and Corporate; excludes the impacts of DAC/VOBA and other intangible unlocking,

as well as the impact of 2012 portfolio restructuring and the gain associated with the Lehman

Recovery and losses recognized as a result of marking LIHTC partnerships to the sales price associated

with their disposition. See Appendix for explanatory note regarding adjusted operating earnings

(2)

We calculate Ongoing Business Adjusted Operating Return on Capital by dividing adjusted operating

earnings before interest and after income taxes (assuming a 35% effective tax rate) by average

capital allocated to the Ongoing Business. In order to translate anticipated Ongoing Business Operating

Return on Capital into Ongoing Business Operating Return on Equity, we divided projected

operating earnings after income taxes of our Ongoing Business by the projected average capital of our

Ongoing Business, after adjusting for projected interest expense and projected financial leverage of

the Ongoing Business. Operating Return on Equity assumes a 25% financial leverage-to-capital

ratio, a weighted average pre-tax interest rate of 5.5% on financial leverage for all periods prior to the third

quarter of 2013, when the Company completed its recapitalization initiatives, and the actual weighted

average pre-tax interest rate for all periods starting with the third quarter of 2013; see “Business—

Operating Return on Equity” and “Business—Operating Return on Capital Goal” in the

S-1 Registration Statement filed with the SEC for additional assumptions

8 |

9

Premier Franchise with Leading Positions in Attractive Markets

America’s Retirement Company

TM

Solid Foundation Based on a Re-Capitalized and De-Risked Balance Sheet

9

Retirement •

Investments •

Insurance

Experienced Management Team Executing a 400-500bps ROE Improvement Plan by 2016 |

Leveraging Three Strong Platforms

(1)

Pension & Investments, for the twelve months ended 9/30/13

(2)

Pensions & Investments Magazine, Defined Contribution Record Keepers Directory

published 3/4/13 with majority of company rankings based on data as of 9/30/12; based on number of DC plan sponsors

(3)

Investment News as of 12/31/12

(4)

ING U.S. Investment Management calculation as of 12/31/13

(5)

Pensions & Investments as of 12/31/12 (401(k), 403(b), 457, DB)

(6)

LIMRA as of 12/31/13

(7)

MyHealthGuide Newsletter News for the Self-Funded Community rankings as of

6/03/13 and does not include most managed healthcare providers 10

Retirement •

Investments •

Insurance

#1 publicly traded Defined

Contribution recordkeeper

with a full array of

retirement capabilities

(1)

#2 provider of defined

contribution plans

(2)

Top 10 independent

broker dealer

(3)

93% of fixed income

assets and 84% of equity

assets outperformed

benchmark returns on a 5-

year basis as of the end of

2013

(4)

Top 20 manager of

institutional assets

(5)

#13 provider of term life

insurance

(6)

#6 provider of stop loss

insurance

(7)

Retirement

Solutions

Investment

Management

Insurance

Solutions |

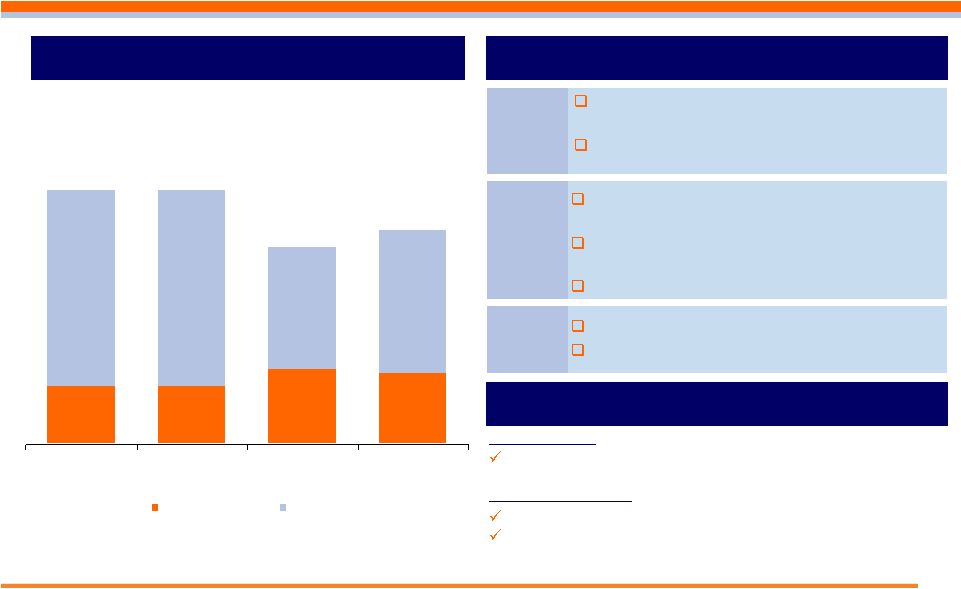

ING

U.S. Today: A Different Kind of Company Past: Top Line Focus

Today: Value Creation Focus

Market share

Growth

Acquisitions

Sales

Capital management

Profitable growth

Segment synergies

Operational efficiency

A

Cultural

Transformation

11

Retirement •

Investments •

Insurance

Our Metrics

Risk-adjusted returns

Distributable earnings

Sales at or above

target IRRs |

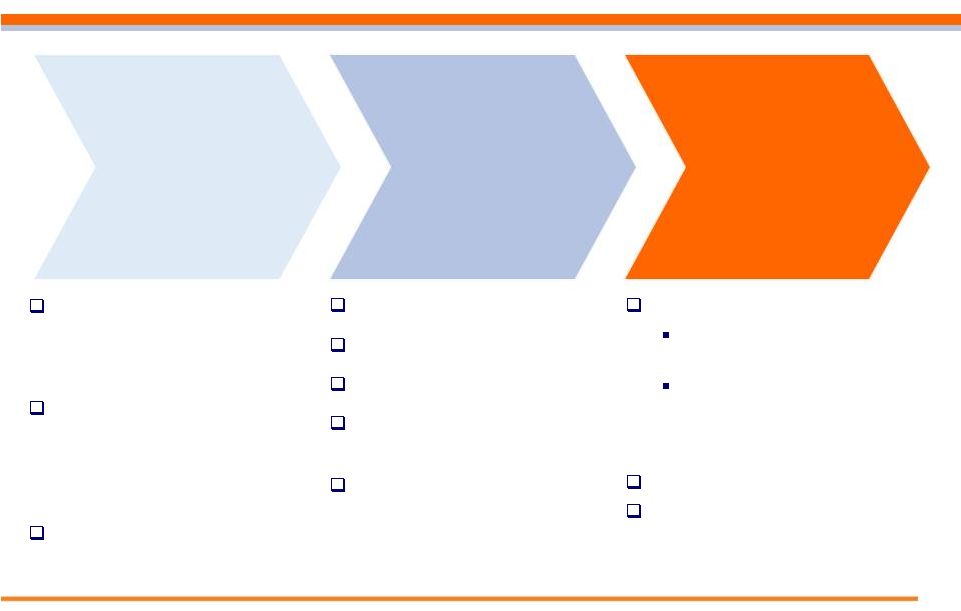

Solid foundation

Significant progress

repositioning the company

2

3

America’s

Retirement

Company™

The ING U.S. Investment Proposition

1

Premier franchise

Leveraging three platforms

Driving ROE improvement

On track to achieve 2016

targets

12

Focus on Execution, Driving ROE Improvement

Retirement •

Investments •

Insurance |

13

America’s Retirement Company

Premier Franchise with Leading Positions in Attractive Markets

Experienced Management Team Executing a 400-500bps ROE Improvement Plan by

2016 Solid Foundation Based on a Re-Capitalized and De-Risked Balance

Sheet 13

Retirement •

Investments •

Insurance

TM |

Comprehensive Plan with Clear Goals

Ongoing Business Adjusted Operating

ROC Goal

Ongoing Business Adjusted Operating

ROE Goal

(1)

(1)

(1)

(1)

14

Retirement •

Investments •

Insurance

8.3%

12-13%

2012 Ongoing Business

Adjusted

Operating ROE

2016 Target Ongoing

Business Adjusted

Operating ROE

7.2%

10-11%

2012 Ongoing Business

Adjusted

Operating ROC

2016 Target Ongoing

Business Adjusted

Operating ROC

(1)

Ongoing Business includes Retirement, Annuities, Investment Management, Individual Life, and Employee

Benefits segments and excludes Closed Blocks and Corporate; Ongoing Business adjusted operating

earnings is calculated by using the operating earnings (loss) before income taxes for the Ongoing Business, excluding the impacts of DAC/VOBA and other intangible unlocking, as well as the

impact of 2012 portfolio restructuring and the gain associated with the Lehman Recovery and losses

recognized as a result of marking LIHTC partnerships to the sales price associated with their

disposition. We calculate Ongoing Business Adjusted Operating Return on Capital by dividing

adjusted operating earnings before interest and after income taxes (assuming a 35% effective tax rate) by

average capital allocated to the Ongoing Business. In order to translate anticipated Ongoing Business

Operating Return on Capital into Ongoing Business Operating Return on Equity, we divided projected

operating earnings after income taxes of our Ongoing Business by the projected average capital of our

Ongoing Business, after adjusting for projected interest expense and projected financial leverage of

the Ongoing Business. Operating Return on Equity assumes a 25% financial leverage-to-capital

ratio a weighted average pre-tax interest rate of 5.5% on financial leverage for all periods prior to the third

quarter of 2013, when the Company completed its recapitalization initiatives, and the actual weighted

average pre-tax interest rate for all periods starting with the third quarter of 2013 see “Business—

Operating Return on Equity” and “Business—Operating Return on Capital Goal” in the

S-1 Registration Statement filed with the SEC for additional assumptions

400–500bps

300–400bps |

Notable items that might not recur contributed to the improvement in the Margin

category Ongoing Business Adjusted Operating ROC

(1)

(1)

Ongoing Business includes Retirement, Annuities, Investment Management, Individual

Life, and Employee Benefits segments and excludes Closed Blocks and Corporate. We calculate Ongoing Business

Adjusted Operating Return on Capital by dividing adjusted operating earnings before

interest and after income taxes (assuming a 35% effective tax rate) by average capital allocated to the Ongoing Business

15

Evidence Our Plan is Working

Retirement •

Investments •

Insurance |

(1)

Excludes Closed Blocks and Corporate; excludes the impacts of DAC/VOBA and other

intangible unlocking, as well as the impact of 2012 portfolio restructuring and the gain associated with the Lehman Recovery

and losses recognized as a result of marking LIHTC partnerships to the sales price

associated with their disposition. Investment Management target based on pre-tax operating margin range. Improvement figures

represent management’s best estimates

(2)

Without

the

annually

renewable

reinsurance

transaction

in

our

Employee

Benefits

segment,

which

lowers

the

required

capital

for

the

segment,

the

2016

operating

ROC

target

is

in

the

range

of

11%

to

13%

(3)

Cumulative estimated distributable capital from insurance companies in excess of

target statutory capital levels for Ongoing Business, net of new business strain and holding company expenses, that we estimate

would result from achievement of target ranges

(4)

Includes results from investment capital and excludes gain from Lehman

recovery (4)

16

Each Business Has Its Own ROC / ROE Target and Each

Contributed to ROE / ROC Improvement in 2013

Retirement •

Investments •

Insurance

2012

2013

2016 Target

Range

ROC by Segment:

Retirement

7.2%

8.9%

10.0

–

11.0%

Annuities

5.9%

7.3%

7.0

–

9.0%

Investment Management P/T Op. Margin

24.6%

27.7%

30.0

–

34.0%

Individual Life

4.3%

4.9%

6.0

–

8.0%

Employee Benefits

(2)

16.9%

18.8%

18.0

–

22.0%

Ongoing Business Adjusted Operating ROC

7.2%

8.6%

10.0

–

11.0%

Ongoing Business Adjusted Operating ROE

8.3%

10.3%

12.0

–

13.0%

Excess Capital Generation

(3)

More

$1.7Bn

Ongoing Business

Adjusted Operating ROE / ROCs

(1)

than |

Retirement

AUM Net

Flows

$1,445

$3,001

$3,466

$2,459

Retirement Solutions –

Leading Franchise Driving

Long-Term Growth and Returns

(1)

See Appendix for explanatory note regarding Ongoing Business Adjusted Operating

Earnings Before Interest and Income Taxes 17

($ millions)

Key Drivers of ROC Improvement

Margin

Adjusting crediting rates in response to changes

in the external rate environment

Increasing returns on Full Service business

Managing costs actively

Running off the Multi-Year Guarantee business

Examples of Execution

Retirement

Annuities

$309

$398

$474

$537

$125

$122

$200

$197

$434

$520

$674

$734

2010

2011

2012

2013

Retirement

Annuities

Ongoing Business Adjusted Operating Earnings

Before Interest and Income Taxes

Growing Individual Markets business

Ongoing sales momentum in Institutional Markets

Growing Mutual Fund Custodial sales

Growth

Executing reinsurance transactions

Running off less profitable business

Capital

Retirement •

Investments •

Insurance

$599 million in Mutual Fund Custodial net flows in 2013, up

from $461 million (+30%) in 2012

Allstate strategic partnership

Significant multi-employer engagement win in 3Q’13

(1) |

AUM

Net Flows

(2)

$(1,455)

$5,702

$9,846

$8,756

Key Drivers of Improvement

Investment Management –

Scalable Platform

Leveraging Strong Investment Performance

18

Ongoing Business Adjusted Operating Earnings

Before

Interest

and

Income

Taxes

&

Margin

(1)

Examples of Execution

93% of fixed income assets outperformed benchmark

returns on a 5-year basis as of 2013

84% of equity assets outperformed benchmark returns on a

5-year basis as of 2013

Third-party business AUM grew $19 billion in 2013 with

nominal increase in expenses

Improving sales force productivity

Reducing retail outflows

Margin

Increasing third-party business

Growing in higher-fee asset classes

Increasing capture of Defined Contribution

Investment Only (DCIO) mandates

Replacing underperforming non-ING U.S. mutual

fund sub-advisors

Growth

Margin Excluding Investment Capital Return

Retirement •

Investments •

Insurance

($ millions)

$50

$88

$132

$165

11%

16%

18%

25%

2010

2011

2012

2013

(1)

See Appendix for explanatory note regarding Ongoing Business Adjusted Operating Earnings Before

Interest and Income Taxes

(2)

Commercial net flows, excludes general account net flows, includes separate account and mutual fund net

flows reflected in other ING U.S. segments |

$84

$83

$109

$102

$286

$286

$178

$210

$370

$369

$287

$312

2010

2011

2012

2013

Employee Benefits

Individual Life

Insurance Solutions –

Repositioned Toward Capital

Efficient Products

(1)

See Appendix for explanatory note regarding Ongoing Business Adjusted Operating

Earnings Before Interest and Income Taxes 19

Ongoing Business Adjusted Operating Earnings

Before

Interest

and

Income

Taxes

(1)

Key Drivers of ROC Improvement

Examples of Execution

Individual Life

Continuing to manage expenses relative to

sales volume

Managing non-guaranteed elements of in-force

contracts

Margin

Increasing persistency and sales in the Group

business

Growing Stop Loss while retaining pricing

discipline

Expanding the Voluntary business

Growth

Shifting sales focus to indexed products

Executing capital efficient structures

Capital

Retirement •

Investments •

Insurance

($ millions)

Voluntary sales increased 11% in 2013

Loss ratios for both Stop Loss and Group Life remain within

expected ranges

Employee Benefits

Administrative expenses approximately 13% lower in 2013

vs. 2012 |

20

America’s Retirement Company

TM

Premier Franchise with Leading Positions in Attractive Markets

Experienced Management Team Executing a 400-500bps ROE Improvement Plan by

2016 Solid Foundation Based on a Re-Capitalized and De-Risked Balance

Sheet 20

Retirement •

Investments •

Insurance |

Ongoing Business

12% –13% ROE target by

2016

More than $1.7 billion in

excess capital expected to be

available, including for return

to shareholders

Potential CBVA value

Tax assets provide potential

upside

Financial Transformation Driving Value Creation

21

Significant

Improvement in

Profitability

Balance Sheet

Re-structuring

and De-risking

Valuable

Ongoing

Franchise and

Other Assets

Significantly reduced leverage

Improved capital position

De-risked investment portfolio

Termed out debt maturity

profile

24 months of holding company

liquidity

12% Ongoing Business

Adjusted Operating Earnings

Before Interest and Income

Taxes

(1)

CAGR (2009-2013)

11% increase in Ongoing

Business Adjusted Operating

Earnings Before Interest and

Income Taxes

(1)

from 2012 to

2013

Growth in capital efficient

business lines

(1)

See Appendix for explanatory note regarding Ongoing Business Adjusted Operating

Earnings Before Interest and Income Taxes Retirement •

Investments •

Insurance |

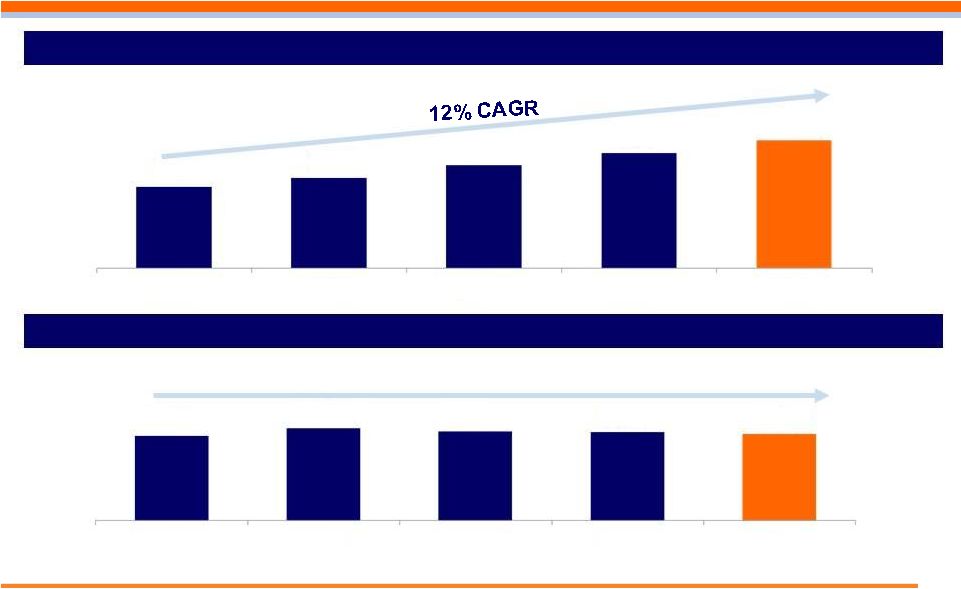

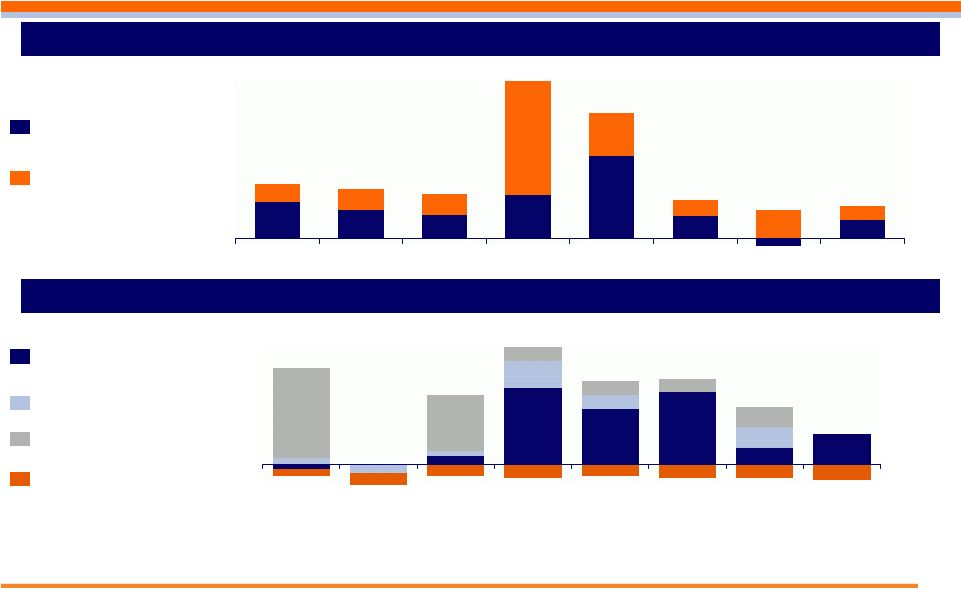

Solid

Improvement in Operating Earnings While Keeping Administrative Expenses

Flat (1)

See Appendix for explanatory note regarding Ongoing Business Adjusted Operating

Earnings Before Interest and Income Taxes 1% CAGR

22

Retirement •

Investments •

Insurance

($ millions)

($ millions)

Ongoing

Business

Adjusted

Operating

Earnings

Before

Interest

and

Income

Taxes

(1)

Ongoing Business Administrative Expenses

$767

$854

$976

$1,093

$1,212

$1,643

$1,669

$1,692

$1,749

$1,597

2009

2010

2011

2012

2009

2010

2011

2012

2013

2013 |

4Q’13 & 1Q’14 Operating Earnings Observations and

Seasonality

23

Retirement •

Investments •

Insurance

($

millions,

pre-tax

and

pre-DAC)

Lehman Recovery and LIHTC

$ 9.0

CB - ISP Prepayment Expense

(14.0)

Excess Pre-Payment Fee Income

7.0

Excess Alternative Investment Income

24.0

Excess Group Life Underwriting Income

8.0

DAC Unlocking

22.0

4Q'13 Non-Recurring and Variable Items

1Q’14 Observed Variances and

Anticipated Seasonality

Through the end of February, we had ~$2

million of prepayment fee income

compared to an average quarterly

prepayment fee income expectation of $15

million

Payroll taxes and other annual expenses

are concentrated in the first quarter,

typically adding ~$10 to $15 million to the

period’s operating expenses

Expect to achieve 2016 Ongoing Business Operating ROE goal of 12-13%

On track in 2014 to improving ROE towards that goal |

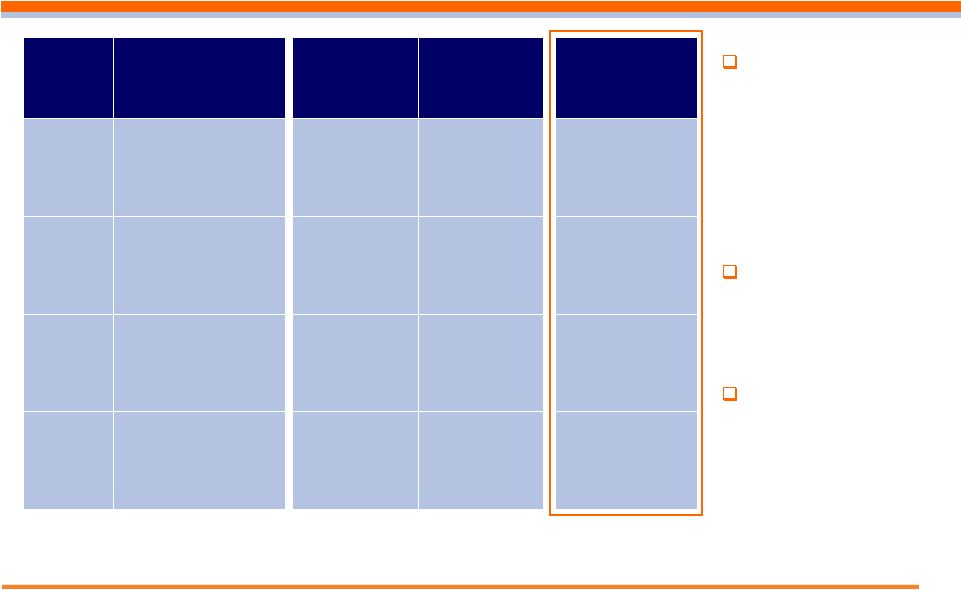

Continued Positive Net Flows

Stable Value Net Flows

Net Flows excl. Stable

Value

(1)

Excludes recordkeeping

(2)

Excludes General Account

(3)

Excludes VA

(4)

Total Closed Block Variable Annuity net outflows were $1,018 million in

2Q’13 Investment Management

Sourced

Affiliate Sourced

(3)

Sub-advisor

Replacements

Retirement

Net

Flows

(1)

Investment

Management

Third-Party

Net

Flows

(2)

$0.6

$0.6

$0.5

$1.8

$1.4

$0.4

Investment

Management VA

Outflows

(4)

$0.2

$0.4

24

Retirement •

Investments •

Insurance

($ billions)

($ billions)

$0.4

$0.4

$0.3

$0.5

$0.9

$0.2

($0.1)

$0.2

$0.2

$0.2

$0.2

$1.3

$0.5

$0.2

$0.3

$0.2

1Q'12

2Q'12

3Q'12

4Q'12

1Q'13

2Q'13

3Q'13

4Q'13

($0.2)

$0.3

$3.3

$2.4

$3.1

$0.7

$1.3

$0.3

($0.4)

$0.2

$1.2

$0.6

$0.9

$3.9

$2.4

$0.6

$0.6

$0.5

$0.9

($0.3)

($0.5)

($0.5)

($0.6)

($0.5)

($0.6)

($0.6)

($0.7)

$3.7

($0.8)

$2.5

$4.5

$3.2

$3.1

$1.8

$0.6

1Q'12

2Q'12

3Q'12

4Q'12

1Q'13

2Q'13

3Q'13

4Q'13 |

Active

Hedge Program in Closed Block Variable Annuity

(1)

Available resources include planned $150M movement from ING USA to SLDI in

2Q’14 (2)

Net flows represent products in deferred phase only. Net flows, in total, inclusive

of products in both deferred and payout phases, would be annualized 9.2% for the quarter

(3)

These sensitivities illustrate the estimated impact of the indicated shocks

beginning on the first market trading day following December 31, 2013, and give effect to dynamic rebalancing over the course of the shock event. This reflects the hedging we

had in place at the close of business on December 31, 2013 in light of our

determination of risk tolerance and available collateral at that time, which may change from time to time. The impact includes an equity effect on CARVM and change in cash

flow testing reserve, and excludes smoothing effect on risk based capital

(RBC). The estimates of equity market shocks reflect a shock to all equity markets, domestic and global, of the same magnitude. The primary focus of the hedge program is to

protect regulatory agency capital from equity market movements. Equity market and

interest rate changes and movements in other market variables that are not explicitly hedged may cause GAAP earnings volatility

(4)

Actual

results

will

differ

due

to

issues

such

as

basis

risk,

variance

in

market

volatility

versus

what

is

assumed,

combined

effects

of

interest

rates

and

equities,

rebalancing

of

hedges

in

the

future,

or

the

effects

of

time

and

other

variations

from

assumptions. Additionally, estimated sensitivities vary over time as the market and

closed book of business evolve or if assumptions or methodologies that affect sensitivities are refined

Preliminary

Impact

to

Regulatory

Capital

and

Earnings

(3)(4)

($ million)

$1.5

($0.5)

$1.0

$0.2

$1.2

$0.2

$1.0

$1.0

($1.4)

$0.4

($0.8)

($0.1)

($1.0)

($0.2)

($0.6)

($0.7)

1Q'12

2Q'12

3Q'12

4Q'12

1Q'13

2Q'13

3Q'13

4Q'13

Change in Statutory Reserves Relative to Hedge

($ billion)

Equity impacts (increase) decrease in stat reserve liability

Equity impacts increase (decrease) in hedge assets

Net Impact (increase / (decrease))

Equity Market (S&P 500)

Interest Rates

-25%

-15%

-5%

5%

15%

25%

-1%

1%

Regulatory Capital

-

-

50

200

250

300

50

(50)

U.S. GAAP Earnings Before Income Taxes

850

350

100

(150)

(450)

(650)

(300)

150

Available resources

of $4.3 billion

(1)

Guaranteed LB

Statutory reserves of

$2.4 billion

Living Benefit NAR

of $2.2 billion

Net Flows of ($1.1)

billion, annualized

10.2% of beginning

of period assets

(2)

4Q’13 Results

Net Impact ($ billion)

$0.1

($0.1)

$0.2

$0.1

$0.2

$0.0

$0.4

$0.3

25

Retirement •

Investments •

Insurance |

26

We switched to a

Present Value (PV)

methodology because

analysts and investors

are more familiar with

that approach and

peers also use this

approach

Year end 2012 time

zero equivalents

consistent with PV

approach

PV of Cash flows

projected over 50

years, discounted at

swap rates

Scenario

Assumptions

Time Zero

Equivalent

as of Year End

2012

(1)

PV of Cash Flows

as of Year End

2012

(2)

PV of Cash Flows

as of Year End

2013

(2)

Scenario 1

Equity return down 25%

in first year, then 0%

thereafter; Long term

interest rates constant;

Lapses down 10%

$(1.4)

$(1.4)

$(0.9)

Scenario 2

5% Equity returns;

Interest rates follow

forward swap curve;

current dynamic

assumptions

1.3)

1.3)

1.9)

Scenario 3

9% Equity returns;

Interest rates follow

forward swap curve;

current dynamic

assumptions

2.4)

2.2)

2.5)

Scenario 4

9% Equity returns;

Interest rates graded to

historical average;

current dynamic

assumptions

3.0)

2.9)

2.9)

($ billions)

Closed Block Variable Annuity Cash Flow

Scenarios Improved Over Past Year

Retirement •

Investments •

Insurance

Note: Capital Hedge Overlay impacts are estimated due to limited ability to estimate reserves / capital

in future; Rho hedge positions as of December 31, 2013 run-off over the projection; Cash Flows are projected over 50 years reflecting obligation of

guaranteed benefits. They are independent of any accounting regime, and are pre-tax. Discount rates

for GMIB claims approximated by interest rate assumption at time of annuitization in each scenario. Historical average swap rates grade in to 3.4% / 5.4%.

Actual results will vary from cash flows due to issues such as but not limited to, market volatility

over time, which would not be reflected in a single deterministic path; basis risk; potential changes in assumptions or methodology that affect reserves or hedge

targets; and additional impacts from rebalancing of hedges or effects of time.

(1) Illustrative amount of assets that could be removed or required at time zero to

ensure resources stay positive each year throughout the 50-year projection.

(2) PV of cash flows equal available resources less PV of benefit payments, PV of

fees net of expenses, and PV of Hedge Gains/Losses Available resources include planned $150M movement from ING USA to SLDI in 2Q’14

|

Nominal

NPV @ Valuation

DTA Value

Operating Loss Carry Forwards

(2)

$1,005

SLDI Related Deferred Losses

1,107

Life Subgroup Deferred Losses

575

Non-Life Subgroup Deferred Losses

(4)

264

Total

$2,951

$10,000

$438

618

353

85

$1,494

DTA That Could Be Realized

27

($ millions)

Significant NPV of Projected Tax Savings

Op. Loss Carry Forwards

Life Subgroup

Deferred Losses

Non-Life Subgroup

Deferred Losses

Losses incurred on VA

hedge program

Tax-based goodwill

amortization

Non-Life deferred losses

Non-Life federal net

operating loss carry

forwards

(1)

At

time

of

§382

event

–

likely

to

occur

with

the

offering

(2)

Factors in §382 tax exempt rate of 3.50% as of 12/31/13 and NOL expiration

schedule (3)

Of this amount, $385 million is not offset by a TVA

(4)

Factors in §382 tax exempt rate of 3.50% as of 12/31/13

SLDI Related

Deferred Losses

Losses incurred on VA

hedge program resident

in SLDI

(1)

$9,000

$418

618

353

76

$1,465

(3)

Retirement •

Investments •

Insurance

35% Federal Tax Rate

10% Discount Rate |

28

America’s Retirement Company

TM

Premier Franchise with Leading Positions in Attractive Markets

Solid Foundation Based on a Re-Capitalized and De-Risked Balance Sheet

28

Retirement •

Investments •

Insurance

Experienced Management Team Executing a 400-500bps ROE Improvement Plan by 2016

|

|

Appendix

30

Retirement •

Investments •

Insurance |

Profile of the Variable Annuity Closed Block

Account Value by

Benefit Type

($ millions)

$44.7 billion

as of December 31, 2013

(1)

Excludes $959 million of Payout, Policy Loan and Life Insurance business which is

included in consolidated account values (2)

Net amount at risk, net of external reinsurance. NAR for GMAB/GMWB and Guaranteed

Minimum Death Benefit (GMDB) is equal to the guaranteed values in excess of the

account value. NAR for GMIB and GMWBL is equal to the excess of the present value of

minimum guaranteed annuity payments over the account value. The NAR of DB and

LB are not additive

VA policies sold primarily between 2001 and 2010 offered living and / or death

benefit guarantees Majority of customer accounts were invested (at

customer’s discretion) in equities Equity market downturn depressed

account values Account

Value

(1)

Net Amount

at Risk

(2)

Benefit Type

Accumulation Benefit / Withdrawal Benefit

(GMAB/GMWB)

$943

$20

12%

Guaranteed Minimum Income Benefit

(GMIB)

15,909

1,682

62%

Guaranteed Min. Withdrawal Benefit for Life

(GMWBL)

16,537

452

24%

Death Benefit Only

11,351

-

-

Total

$44,740

$2,154

44%

% Contracts

In the Money

LB

LB

In addition, each policy has a Death Benefit, which can only be

obtained upon death of the policyholder. The DB NAR, which

assumes the simultaneous death of all policyholders, is $5,074 and

40% of the contracts are in the money.

31

Retirement •

Investments •

Insurance

GMAB/GMWB

2%

GMIB

36%

GMWBL

37%

Death

Benefit

Only

25% |

Year End 2012

Year End 2013

Change

Available Resources

7.5

4.3

(3.2)

32

Resources Needed

Year End

2012

Year End 2013

Change

Scenario 1

$8.9

$5.2

$(3.7)

Scenario 2

6.2

2.4

(3.8)

Scenario 3

5.3

1.8

(3.5)

Scenario 4

4.6

1.4

(3.2)

Available

Resources

have

been

reduced

as

fewer

assets

are

needed

due

to

improved

market

conditions

Resources Needed = PV Benefit Payments, less PV Fees Net of Expenses, less PV Hedge

Gain/Loss YE’12 PV

of

Cash

Flows

YE’13 PV

of

Cash

Flows

Scenario 1

$(1.4)

$(0.9)

Scenario 2

1.3)

1.9)

Scenario 3

2.2)

2.5)

Scenario 4

2.9)

2.9)

Resources Needed Have Declined Over the Past Year

Reflecting Lower Expected Benefit Payments

Retirement •

Investments •

Insurance

($ billions)

Note: Capital Hedge Overlay impacts are estimated due to limited ability to estimate reserves / capital

in future; Rho hedge positions as of December 31, 2013 run-off over the projection; Cash Flows are

projected over 50 years reflecting obligation of guaranteed benefits. They are independent of any

accounting regime, and are pre-tax. Discount rates for GMIB claims approximated by interest rate assumption

at time of annuitization in each scenario. Actual results will vary from cash flows due to issues such

as but not limited to, market volatility over time, which would not be reflected in a single deterministic path;

basis risk; potential changes in assumptions or methodology that affect reserves or hedge targets; and

additional impacts from rebalancing of hedges or effects of time.

Available resources include planned $150M movement from ING USA to SLDI in 2Q’14.

|

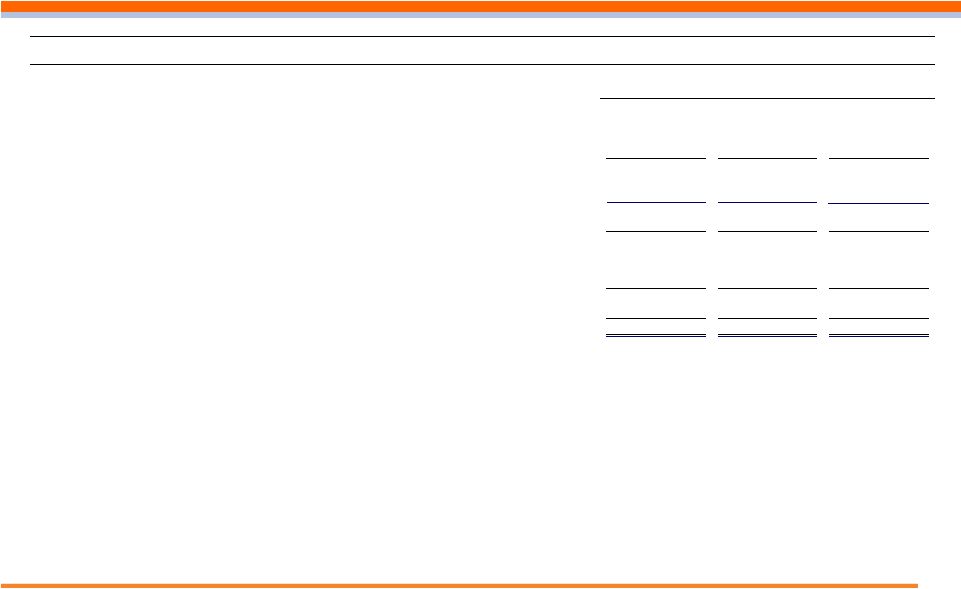

33

Scenario 3 –

Year End 2012

Scenario 3 –

Year End 2013

PV of Cash Flows: Scenario 3

($ billions)

Year End

2012

Year End

2013

(1)

Available Resources

$7.5)

$4.3)

PV of Fees Net of Expenses

7.4)

6.3)

PV of Benefit Payments

(4.6)

(2.1)

PV of Hedge Gain/Loss

(8.1)

(6.0)

PV of Cash Flows

2.2)

2.5)

(1)

Available resources include planned $150M movement from ING USA to SLDI in

2Q’14 CBVA Benefit Payments and Hedge Losses

Declined More than Fees Versus 2012

Retirement •

Investments •

Insurance

(1,500)

(1,000)

(500)

-

500

1,000

1,500

0

5

10

15

20

25

30

35

40

45

50

Fees net of expenses

Benefit Payments

Hedge Gain/Loss

($ million)

(1,500)

(1,000)

(500)

-

500

1,000

1,500

0

5

10

15

20

25

30

35

40

45

50

Fees net of expenses

Benefit Payments

Hedge Gain/Loss

($ million) |

Capital and Returns by Segment

Capital as of

December 31,

2013

Capital as % of

Consolidated

Capital

By Segment:

Retirement

4,007

27%

8.9%

Annuities

1,713

12%

7.3%

Investment Management

302

2%

35.4%

Individual Life

2,848

19%

4.9%

Employee Benefits

346

2%

18.8%

Ongoing Business

9,216

62%

8.6%

CBVA

3,119

21%

-

Corporate & Other Closed Blocks

2,603

17%

N/M

Consolidated

14,938

100%

5.5%

34

Retirement •

Investments •

Insurance

($ millions)

Adjusted

Operating Return

on Capital for the

Year Ended

December 31,

2013 |

Year ended

Year ended

Year ended

($ in millions)

December 31, 2013

December 31, 2012

December 31, 2011

Ongoing Business adjusted operating earnings before income taxes

1,211.8

$

1,093.2

$

975.8

$

DAC/VOBA and other intangibles unlocking

133.2

(77.0)

303.8

Lehman bankruptcy/LIHTC loss, net of

DAC 83.6

-

-

Impact of investment portfolio restructuring

-

(25.3)

-

Operating earnings before income taxes for Ongoing Business

1,428.6

990.9

1,279.6

Corporate

(210.6)

(182.3)

(230.2)

Closed Blocks Institutional Spread Products

and Other 50.6

109.7

70.2

Total operating

earnings before income taxes 1,268.6

918.3

1,119.6

Income taxes (based on an assumed tax rate of 35%)

(444.0)

(321.4)

(391.9)

Operating earnings, after-tax

824.6

596.9

727.7

Closed Block Variable Annuity,

after-tax (786.0)

(450.0)

(366.9)

Net investment gains (losses) and related

charges and adjustments, after-tax 137.9

296.0

46.7

Other,

after-tax 424.0

30.1

(495.6)

Net income (loss) available to ING U.S., Inc.'s

common shareholders 600.5

473.0

(88.1)

Net income (loss) attributable to

noncontrolling interest 190.1

138.2

190.9

Net income (loss)

790.6

$

611.2

$

102.8

$

ING U.S.

Reconciliation of Ongoing Business Adjusted Operating Earnings to Net Income (Loss)

35

Reconciliation of Adjusted Operating Earnings to Net

Income

Retirement •

Investments •

Insurance |

Ongoing Business Operating Earnings Before Interest and Income Taxes

Retirement

Annuities

Retirement Solutions

Investment Management

Individual Life

Employee Benefits

Insurance Solutions

Total Ongoing Business

Adjustments

1

Retirement

Annuities

Retirement Solutions

Investment Management

Individual Life

Employee Benefits

Insurance Solutions

Total Adjustments

Retirement

Annuities

Retirement Solutions

Investment Management

Individual Life

Employee Benefits

Insurance Solutions

Total Ongoing Business Adjusted Operating Earnings Before Interest and Income

Taxes Adjustments

Total Ongoing Business Operating Earnings Before Interest and Income Taxes

2009

358.3

48.7

407.0

44.4

301.1

37.2

338.3

789.7

67.2

6.0

73.2

0.0

(50.4)

0.0

(50.4)

22.8

291.1

42.7

333.8

44.4

351.5

37.2

388.7

766.9

22.8

789.7

2010

469.6

115.0

584.6

50.1

313.5

82.0

395.5

1,030.2

160.4

(10.2)

150.2

0.0

27.6

(2.0)

25.6

175.8

309.2

125.2

434.4

50.1

285.9

84.0

369.9

854.4

175.8

1,030.2

2011

441.9

387.6

829.5

87.5

279.3

83.3

362.6

1,279.6

44.2

266.0

310.2

0.0

(6.4)

0.0

(6.4)

303.8

397.7

121.6

519.3

87.5

285.7

83.3

369.0

975.8

303.8

1,279.6

1,093.2

2012

448.6

102.2

550.8

134.5

196.2

109.4

305.6

990.9

(25.5)

(97.4)

(122.9)

2.2

18.2

0.1

18.3

(102.4)

474.0

199.6

673.6

132.3

178.0

109.3

287.3

(102.4)

990.9

2013

595.8

293.8

889.6

178.1

254.8

106.1

360.9

1,428.6

$58.5

96.8

155.3

13.2

44.5

3.8

48.3

216.8

537.3

197.0

734.3

164.9

210.3

102.3

312.6

1,211.8

216.8

1,428.6

36

Retirement •

Investments •

Insurance

($ millions)

Explanatory Note: In connection with a portfolio restructuring in 2012, certain

alternative investments were sold. For comparability in measuring our progress toward our future operating ROC goal, Ongoing Business

Adjusted

Operating

Earnings

Before

Interest

and

Income

Taxes

for

2012

includes,

in

addition

to

adjustments

for

DAC

/

VOBA

and

other

intangibles

unlocking

and

for

the

net

loss

included

in

the

operating

earnings

from

the

sale

of

these

alternative

investments,

an

adjustment

for

the

investment

income

associated

with

the

assets

disposed

of

during

the

portfolio

restructuring.

Because

the

assets

disposed

of

in

our

2012

portfolio

restructuring

generated

income

for

prior

periods,

Ongoing

Business

Adjusted

Operating

Earnings

Before

Interest

and

Income

Taxes

for

2012

is

not

directly

comparable

to

Ongoing

Business

Adjusted

Operating

Earnings Before Interest and Income Taxes for prior periods in that it

excludes investment income associated with the assets disposed of during the portfolio restructuring. Ongoing Business reflects Retirement,

Annuities, Investment Management, Individual Life, and Employee Benefits segments;

adjustments include DAC/VOBA and other intangibles unlocking, the gain associated with a Lehman Brothers bankruptcy

settlement (“Lehman Recovery”), and losses recognized as a result of

marking low income housing tax credit partnerships (“LIHTC”) to the sales price associated with their disposition

Reconciliation of Ongoing Business Adjusted Operating

Earnings Before Interest and Income Taxes

Reconciliation of Ongoing Business Adjusted Operating Earnings Before Interest and Income Taxes

Ongoing Business Adjusted Operating Earnings Before Interest and Income Taxes |

37

Reconciliation of Adjusted Operating Return on Capital

and Return on Equity

Retirement •

Investments •

Insurance

(in millions USD, unless otherwise indicated)

Retirement

Annuities

Individual Life

Employee Benefits

Beginning Capital

(1)(2)

3,822

1,810

303

2,760

362

9,057

5,066

(150)

13,973

Ending Capital

(2)

4,007

1,713

302

2,848

346

9,216

3,119

2,603

14,938

Average Capital

(3)

3,915

1,762

303

2,804

354

9,137

4,092

1,226

14,456

Adjusted operating earnings before interest and after

income taxes

349.2

128.0

107.2

136.7

66.5

787.6

-

10.6

798.2

Adjusted Operating Return on Capital

8.9%

7.3%

35.4%

4.9%

18.8%

8.6%

-

N/M

5.5%

Adjusted Operating Return on Equity

(4)

10.3%

(in millions USD, unless otherwise indicated)

Retirement

Annuities

Individual Life

Employee Benefits

Beginning Capital

(2)

4,333

2,471

275

2,545

413

10,037

3,452

311

13,800

Ending Capital

(2)

4,284

1,949

303

2,858

429

9,823

3,262

888

13,973

Average Capital

(3)

4,308

2,210

289

2,702

421

9,930

3,357

599

13,886

Adjusted operating earnings before interest and after

income taxes

308.1

129.7

86.0

115.7

71.0

710.5

-

39.6

750.1

Adjusted Operating Return on Capital

7.2%

5.9%

29.8%

4.3%

16.9%

7.2%

-

6.6%

5.4%

Adjusted Operating Return on Equity

(4)

8.3%

(in millions USD, unless otherwise indicated)

Retirement

Annuities

Individual Life

Employee Benefits

Beginning Capital

(2)

4,087

2,288

336

2,172

408

9,291

3,010

1,076

13,377

Ending Capital

(2)

4,333

2,471

275

2,545

413

10,037

3,452

311

13,800

Average Capital

(3)

4,210

2,380

306

2,359

410

9,665

3,231

693

13,589

Adjusted operating earnings before interest and after

income taxes

258.5

79.1

56.9

185.7

54.1

634.3

-

61.5

695.8

Operating Return on Capital

6.1%

3.3%

18.6%

7.9%

13.2%

6.6%

-

8.9%

5.1%

Ongoing Business Operating Return on Equity

(4)

7.6%

(3)

(2)

(4)

(1)

Year Ended December 31, 2012

Retirement Solutions

Investment

Management

Insurance Solutions

Ongoing Business

Closed Block

Variable Annuity

Corporate and Other

Closed Blocks

Consolidated

Year Ended December 31, 2013

Retirement Solutions

Investment

Management

Insurance Solutions

Ongoing Business

Closed Block

Variable Annuity

Corporate and Other

Closed Blocks

Consolidated

Year Ended December 31, 2011

Retirement Solutions

Investment

Management

Insurance Solutions

Ongoing Business

Closed Block

Variable Annuity

Corporate and Other

Closed Blocks

Consolidated

Capital is allocated to each of our segments in proportion to each segment’s target statutory

capital, plus an allocation of the differences between statutory capital and total ING U.S., Inc.

shareholders' equity on a GAAP basis (excluding AOCI), based on each segment’s portion of these

differences. Statutory surplus in excess of target statutory capital and certain corporate assets

and liabilities, such as certain deferred tax assets and liabilities for unfunded pension plans, are

allocated to the Corporate segment. Capital excludes "operating leverage". See "Average Capital and

Financial Leverage" in the Statistical Supplement.

Calculated as Beginning Capital plus Ending Capital, divided by 2.

Assumes debt-to-capital ratio of 25% for all time periods presented, a weighted average

pre-tax interest rate of 5.5% for all periods prior to the third quarter of 2013, when the company completed

recapitalization, and the actual weighted average pre-tax interest rate for all periods starting

with the third quarter of 2013. The 1/1/13 beginning capital is different than the 12/31/12 ending capital at the segment level due to

certain reallocations of capital, primarily due to recapitalization activity (completed and anticipated).

|

38

Retirement •

Investments •

Insurance

Making a secure financial future possible – one person, one family, one institution at a time |