Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RF MICRO DEVICES INC | d680952d8k.htm |

| EX-99.1 - EX-99.1 - RF MICRO DEVICES INC | d680952dex991.htm |

| EX-2.1 - EX-2.1 - RF MICRO DEVICES INC | d680952dex21.htm |

Creating a new leader in RF Solutions

1

Exhibit 99.2 |

2

•

All stock transaction in which post-closing RFMD and TriQuint

shareholders will each own approximately 50% of NewCo

•

TriQuint exchange ratio of 1.675x for new company shares

•

RFMD exchange ratio of 1.0x for new company shares

•

Tax free transaction

Pro Forma Ownership

Structure

•

8 of the 10 directors will be independent

Board of Directors

•

Robert Bruggeworth will serve as Chief Executive Officer

•

Steve Buhaly will serve as Chief Financial Officer

•

Dean Priddy will serve as Executive VP of Administration responsible

for integration and synergy value creation

Leadership

•

Expected to close in second half of 2014

•

Customary closing conditions include: Approval of RFMD and TriQuint

shareholders and regulatory approvals

Closing Conditions

& Timing

Terms of the deal

•

Ralph Quinsey will serve as Non-Executive Chairman

•

Board will be composed of 10 directors, with 5 each from the existing

boards of both companies |

Customers benefit from new scale advantages in manufacturing

and R&D, as well as an aggressive roadmap of new products and

technologies

Greatly improved financial model with performance improving to

best in class as synergies are realized

Drive innovation at the heart of the mobile data ecosystem –

from

base

station

to

mobile

device

–

to

deliver

the

industry’s

most comprehensive portfolio of critical RF technologies to

mobile and infrastructure customers

3

Strategic Rationale |

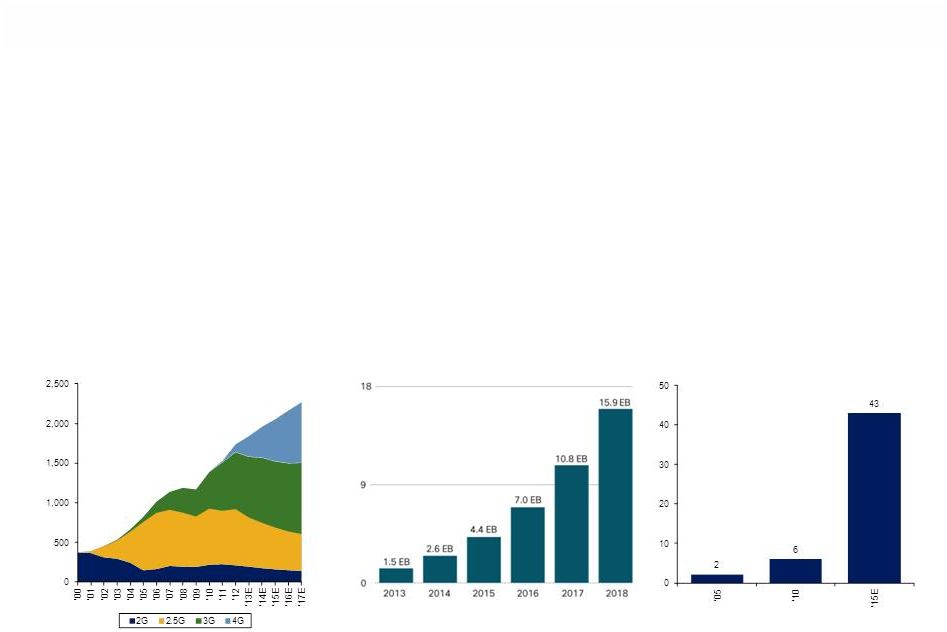

(1)

Source: IDC. Note: 2G consists of GSM and iDEN; 2.5G consists of CDMA 2000

1xRTT, EDGE and GPRS; 3G consists of CDMA 2000 1xEV-DO, TD-SCDMA,

UMTS/WCDMA and HSDPA/HSPA; 4G consists of LTE, TD-LTE and WiMAX.

(2)

Source: Cisco Visual Networking Index: Global Mobile Data Traffic

Forecast, 2014. (3)

Source: Management.

4

•

The world’s demand for mobile data is growing exponentially

•

The wireless industry is rapidly changing to meet this challenge

and

build the next generation of mobile devices and network

infrastructure

Mobile Device

Growth

Mobile Traffic

Growth

RF Complexity

Mobile Phone

Shipments (mm)(1)

Exabytes per

Month (2)

Total Frequency

Bands (3)

Mobile Industry Landscape |

5

•

Demand for network capacity and LTE deployments are

driving growth in the base station and optical transport

markets

•

Combined company will remain committed to the defense

market as a driver of innovative new technologies

•

GaN provides a disruptive growth opportunity within the

infrastructure and defense markets

Infrastructure & Defense Landscape |

Filters

GaAs

PA

Silicon

PA

Envelope

Tracking

SAW

TC-SAW

BAW

WLP

Switch

ASM

Antenna

Tuning

Mobile

Mobile

Mobile

GaN

Radar

Optical

Drivers

BTS

CATV

Wi-Fi

Foundry

GaN

PA

Standard

products

GaAs

SiGe

RX

TX

Amplifiers

PA

Filters

Infrastructure

Infrastructure

& Defense

& Defense

NewCo: Strength of Combined Portfolio

Power Amplifiers

Switch / Antenna

Wi-Fi |

7

* Non-GAAP Metrics; Assumes $150M in synergies across manufacturing costs

and operating expenses; no revenue synergies are assumed as part of the

transaction. Enhanced Financial Profile

•

Integration trends are creating larger

opportunities for broad based suppliers

•

New scale advantages

New growth

opportunities

•

$150M in annualized cost synergies

-

$75M exiting year one

Additional $75M exiting year two

Cost

Synergies

•

Accretive to EPS in first full fiscal year

following transaction close

EPS Accretion

- |

Metric

Target

Revenue Growth

Greater than the

Industry

Gross Margin

45%

Operating

Expenses

20%

Operating Margin

25%

8

* Non-GAAP Metrics; Assumes $150M in synergies across manufacturing costs

and operating expenses; no revenue synergies are assumed as part of the

transaction. Managing to a New Operating Model |

9

Creating a New Leader in

RF Solutions |

10

Forward-Looking Statements

This

communication

contains

forward-looking

statements,

including

but

not

limited

to

those

regarding

the

proposed

business

combination

between

RF

Micro

Devices,

Inc.

(“RFMD”)

and

TriQuint

Semiconductor,

Inc.

(“TriQuint”)

(the

“Business

Combination”)

and the transactions related thereto. These statements may discuss the

anticipated manner, terms and conditions upon which the Business

Combination

will

be

consummated,

the

future

performance

and

trends

of

the

combined

businesses,

the

synergies

expected

to

result

from

the

Business

Combination,

and

similar

statements.

Forward-looking

statements

may

contain

words

such

as

“expect,”

“believe,”

“may,”

“can,”

“should,”

“will,”

“forecast,”

“anticipate”

or

similar

expressions,

and

include

the

assumptions

that

underlie

such

statements.

These

statements

are

subject

to

known

and

unknown

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

those

expressed

or

implied

by

such

statements,

including

but

not

limited

to:

the

ability

of

the

parties

to

consummate

the

Business

Combination

in

a

timely

manner

or

at

all;

satisfaction

of

the

conditions

precedent

to

consummation

of

the

Business

Combination,

including

the

ability

to

secure

regulatory

approvals

in

a

timely

manner

or

at

all,

and

approval

by

RFMD’s

shareholders

and

TriQuint’s

stockholders;

the

possibility

of

litigation

(including

related

to

the

transaction itself);

RFMD and TriQuint’s ability to successfully integrate their operations,

product lines, technology and employees and realize synergies

from

the

Business

Combination;

unknown,

underestimated

or

undisclosed

commitments

or

liabilities;

the

level

of

demand

for

the

combined

companies’

products,

which

is

subject

to

many

factors,

including

uncertain

global

economic

and

industry

conditions,

demand

for

electronic

products

and

semiconductors,

and

customers’

new

technology

and

capacity

requirements;

RFMD’s

and

TriQuint’s

ability

to

(i)

develop,

deliver

and

support

a

broad

range

of

products,

expand

their

markets

and

develop

new

markets,

(ii)

timely

align

their

cost

structures

with

business

conditions,

and

(iii)

attract,

motivate

and

retain

key

employees;

and

other

risks

described

in

RFMD’s

and

TriQuint’s

Securities

and

Exchange

Commission

(“SEC”)

filings.

All

forward-looking

statements

are

based

on

management’s

estimates,

projections

and

assumptions

as

of

the

date

hereof.

Neither

RFMD

nor

TriQuint

undertakes

any

obligation

to

update

any

forward-looking

statements.

No Offer or Solicitation

This communication is for informational purposes only and is neither an offer to

purchase, nor a solicitation of an offer to sell, subscribe for or buy

any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or

otherwise,

nor

shall

there

be

any

sale,

issuance

or

transfer

of

securities

in

any

jurisdiction

in

contravention

of

applicable

law.

No

offer

of

securities

shall

be

made

except

by

means

of

a

prospectus

meeting

the

requirements

of

Section

10

of

the

Securities

Act

of

1933, as amended.

Additional Information and Where to Find It

In connection

with

the

proposed

Business

Combination,

a

newly-formed

holding

company

under

RFMD

(“HoldCo”)

will

file

with

the

SEC

a

Form

S-4

(the

“Registration/Joint

Proxy

Statement”)

which

will

include

a

registration

statement

and

prospectus

with

respect

to

HoldCo’s shares to be issued in the Business Combination and a joint proxy

statement of TriQuint and RFMD in connection with the Business

Combination. The definitive Registration/Joint Proxy Statement will contain important information about the proposed

Business Combination and related matters. SECURITY HOLDERS ARE URGED AND

ADVISED TO READ THE REGISTRATION/JOINT PROXY STATEMENT CAREFULLY WHEN IT

BECOMES AVAILABLE. The Registration/Joint Proxy Statement and other relevant materials

(when they become available) and any other documents filed by HoldCo, RFMD or

TriQuint with the SEC may be obtained free of charge at the SEC’s

website, at www.sec.gov. |

11

In addition, security holders of TriQuint will be able to obtain free copies of

the Registration/Joint Proxy Statement from TriQuint by contacting

Investor Relations by mail at TriQuint Semiconductor, Inc., 2300 N.E. Brookwood Parkway, Hillsboro, Oregon 97124, Attn:

Investor Relations Department, by telephone at (503) 615-9413, or by going

to TriQuint’s Investor Relations page on its corporate website at

www.triquint.com; and security holders of RFMD will be able to obtain free copies of the Registration/Joint Proxy

Statement from RFMD by contacting Investor Relations by mail at RF Micro

Devices, Inc., 7628 Thorndike Road Greensboro, North Carolina

27409-9421, Attn: Investor Relations Department, by telephone at (336) 678-7088, or by going to RFMD’s Investor

Relations page on its corporate web site at www.rfmd.com.

Participants in the Solicitation

RFMD, TriQuint and HoldCo and their respective directors, executive officers and

various other members of management and employees may be deemed to be

participants in the solicitation of proxies from RFMD’s shareholders in connection with the

proposed Business Combination. Information regarding the persons who may,

under the rules of the SEC, be deemed participants in the solicitation of

TriQuint or RFMD security holders in connection with the proposed Business Combination will be set forth in the

Registration/Joint Proxy Statement when it is filed with the SEC.

Information about TriQuint’s directors and executive officers is set

forth in TriQuint’s Proxy Statement on Schedule 14A for its 2013 Annual

Meeting of Shareholders, which was filed with the SEC on April 1, 2013,

and its Annual Report on Form 10-K for the fiscal year ended December 31, 2013, which was filed with the SEC on

February 21, 2014. These documents are available free of charge at the

SEC’s web site at www.sec.gov, and from TriQuint by contacting

Investor Relations by mail at TriQuint Semiconductor, Inc., 2300 N.E. Brookwood Parkway, Hillsboro, Oregon 97124, Attn:

Investor Relations Department, by telephone at (503) 615-9413, or by going

to TriQuint’s Investor Relations page on its corporate web site at

www.triquint.com. Information about RFMD’s directors and executive officers is set forth in RFMD’s Proxy Statement on

Schedule 14A for its 2013 Annual Meeting of Shareholders, which was filed with

the SEC on June 28, 2013, and its Annual Report on Form 10-K for the

fiscal year ended March 30, 2013, which was filed with the SEC on May 24, 2013. These documents are available

free of charge at the SEC’s web site at www.sec.gov, and from RFMD by

contacting Investor Relations by mail at RF Micro Devices, Inc., 7628

Thorndike Road Greensboro, North Carolina 27409-9421, Attn: Investor Relations Department, by telephone at (336)

678-7088, or by going to RFMD’s Investor Relations page on its

corporate web site at www.rfmd.com. Additional information

regarding the interests of these potential participants in the solicitation of

proxies in connection with the proposed Business Combination will be

included in the Registration/Joint Proxy Statement and the other relevant documents filed with the SEC when

they become available. |