Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDO HEALTH SOLUTIONS INC. | d622983d8k.htm |

| EX-99.1 - EX-99.1 - ENDO HEALTH SOLUTIONS INC. | d622983dex991.htm |

| EX-99.2 - EX-99.2 - ENDO HEALTH SOLUTIONS INC. | d622983dex992.htm |

Endo Health

Solutions 3Q 2013 Earnings Report

and

A Compelling Combination:

Endo Health Solutions

and

Paladin Labs

November 5, 2013

©2013 Endo Pharmaceuticals Inc. All rights reserved.

Exhibit 99.3 |

Offer Language

Disclosures ©2013 Endo Pharmaceuticals Inc. All rights

reserved. This

communication

is

not

intended

to

and

does

not

constitute

an

offer

to

sell

or

the

solicitation

of

an

offer

to subscribe for or buy or an invitation to purchase or subscribe for any securities or the

solicitation of any vote

or

approval

in

any

jurisdiction

pursuant

to

the

acquisition

or

otherwise,

nor

shall

there

be

any

sale,

issuance or transfer of securities in any jurisdiction in contravention of applicable law. No

offer of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as amended.

1 |

Endo Forward

Looking Statements; Non-GAAP Financial Measures

©2013 Endo Pharmaceuticals Inc. All rights reserved.

2

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Statements including words such as

“believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look

forward,” “intend,” “guidance,” “future” or similar

expressions are forward-looking statements. These forward-looking statements may

include, without limitation, statements regarding the completion of the proposed transaction

and other statements that are not historical facts. Although Endo and Paladin each

believe its forward-looking statements are reasonable, they are subject to important risks and

uncertainties. Those include, without limitation, the failure to receive, on a timely basis or

otherwise, the required approvals by Endo and Paladin shareholders, the Superior Court

of Québec and applicable government and regulatory authorities, the terms of those approvals,

the risk that a condition to closing contemplated by the arrangement agreement may not be

satisfied or waived, the inability to realize expected synergies or cost savings or

difficulties related to the integration of Endo and Paladin operations, the ability of the combined

company to retain and hire key personnel and maintain relationships with customers, suppliers

or other business partners, or other adverse events, changes in applicable laws or

regulations, competition from other pharmaceutical companies, and other risks disclosed in

Endo and Paladin's public filings, any or all of which could cause actual results to differ

materially from future results expressed, projected or implied by the

forward-looking statements. The forward-looking statements in this presentation are qualified by these risk factors. As a

result of these risks and uncertainties, the proposed transaction could be modified,

restructured or not be completed, and actual results and events may differ materially

from the results and events contemplated in these forward-looking statements and from historical

results. Neither Endo nor Paladin assumes any obligation to publicly update any

forward-looking statements, except as may be required under applicable securities

laws, or to comment on expectations of, or statements made by the other party or third parties in respect of

the proposed transaction. These forward-looking statements are not guarantees of

future performance, given that they involve risks and uncertainties. Investors

should not assume that any lack of update to previously issued forward-looking statement constitutes a

reaffirmation of that statement. Continued reliance on forward-looking statements is

at investors’ own risk.

This presentation may refer to non-GAAP financial measures, including adjusted diluted

EPS, that are not prepared in accordance with accounting principles generally accepted

in the United States and that may be different from non-GAAP financial measures used by other

companies. Investors are encouraged to review Endo’s current report on Form 8-K filed

with the SEC for Endo’s reasons for including thos non-GAAP financial measures

in this presentation. No reconciliation to GAAP amounts has been provided because the majority of the

amounts excluded from the comparable GAAP amounts are not currently possible to estimate with

a reasonable degree of accuracy. |

Today’s

Agenda Review of Third Quarter Accomplishments and 2013 Financial Results

Provide Updated 2013 Financial Guidance

Overview of Acquisition of Paladin Labs

•

Deal Rationale and Terms

•

Overview of Paladin Business

•

Endo Overview

•

New Endo Operating Model

•

Post Transaction Structure -

Domicile as an Irish plc

Q&A

©2013 Endo Pharmaceuticals Inc. All rights reserved.

3 |

Third Quarter

2013 Progress on Near-Term Priorities Enhance operational focus on organic growth

drivers Pursuing accretive, value-creating M&A opportunities

•

Announced $225M acquisition of Boca Pharmacal

•

Expected to be immediately accretive to adjusted diluted EPS upon close

•

Value creating

Exploring strategic alternatives for HealthTronics

Sharpen R&D focus on near-term opportunities

•

Aveed PDUFA date set for February 28, 2014

•

Completed interim analysis of BEMA Buprenorphine

Strengthen talent and organization

•

Announced new CFO and COO, Pharmaceuticals

©2013 Endo Pharmaceuticals Inc. All rights reserved.

4 |

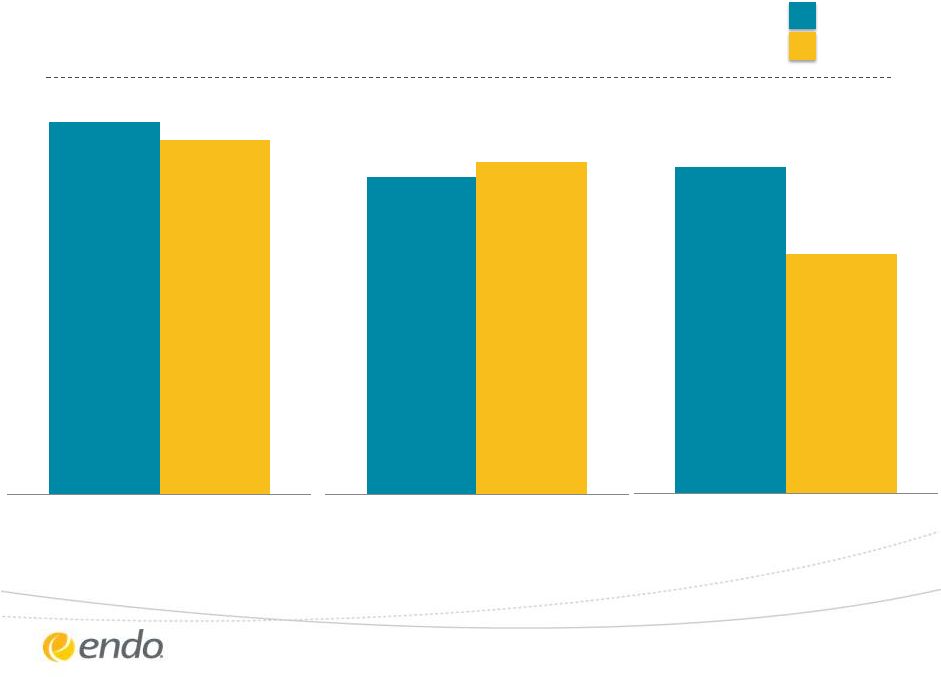

Q3 2013

Financial Performance ©2013 Endo Pharmaceuticals Inc. All rights

reserved. Q3 2012

Q3 2013

5

$1.28

$1.34

Adjusted Diluted EPS

$0.45

$0.33

Reported Diluted (GAAP) EPS

$750

$715

Revenues ($M) |

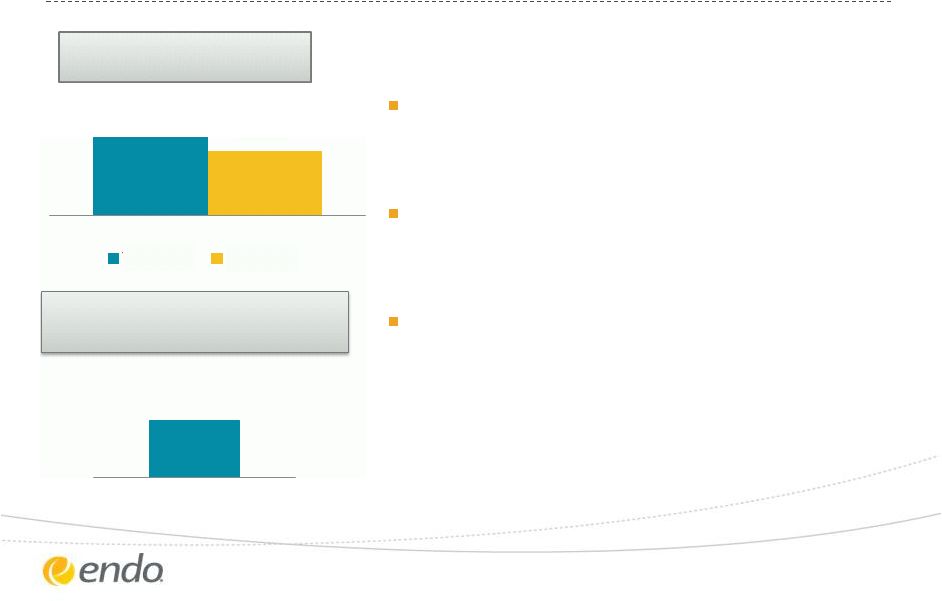

Drive Organic

Growth – Qualitest

©2013 Endo Pharmaceuticals Inc. All rights reserved.

6

13%

11%

Total Revenue Growth vs.

Same Period 2012

YTD 2013

Q3 2013

Contribution of New Products

to YTD Growth

On-track for double-digit growth for

full-year

Demand driven growth led by new

products and oral contraceptives

Planning for efficient integration of

Boca Pharmacal

60% |

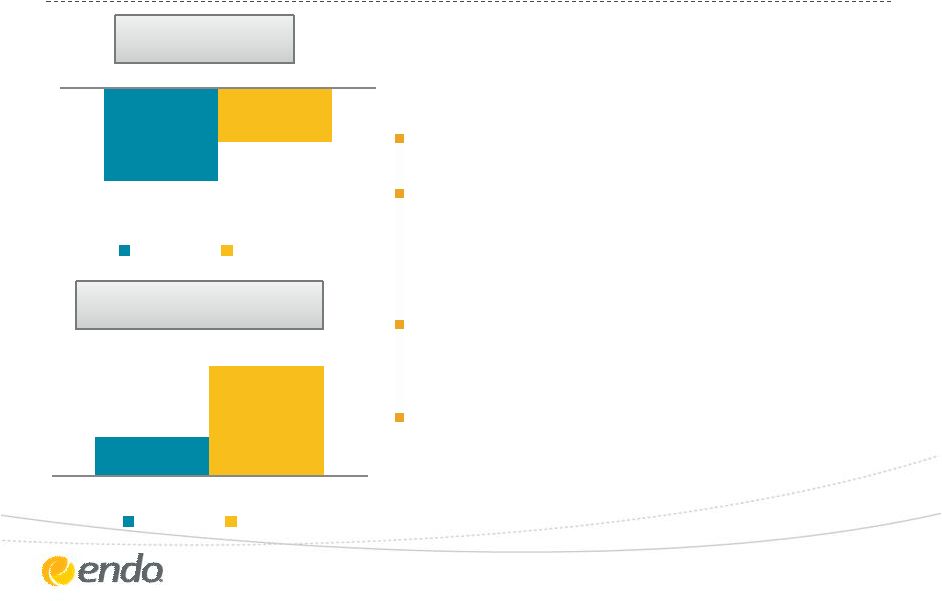

Drive Organic

Growth – Endo Pharmaceuticals

Managing LIDODERM

®

LOE

Continuing to support ADF

technologies and assert IP covering

OPANA

®

ER

Commercial support for OPANA

®

ER

through specialty promotion

Focused on driving performance of

growth assets: SUPPRELIN

®

LA,

Voltaren

®

Gel and FORTESTA

®

Gel

©2013 Endo Pharmaceuticals Inc. All rights reserved.

7

-12%

10%

All Products

All Products (ex -

LIDODERM/OPANA

ER/Actavis Royalty)

Q3 2013 Revenue Growth

vs. Q3 2012 |

Drive Organic

Growth – AMS

©2013 Endo Pharmaceuticals Inc. All rights reserved.

8

-3%

-2%

YTD 2013

Q3 2013

Total Revenue Growth

vs. Same Period 2012

1%

4%

YTD 2013

Q3 2013

Total (ex-WH) Revenue Growth

vs. Same Period 2012

Continued strength in Men’s Health

Continued strength in GreenLight

supported by medical education

focused on GOLIATH results

Managing impact of market decline in

Women’s Health

Launch of MiniArc

Pro Single-

Incision Sling System for Treatment of

Female Stress Urinary Incontinence

Key drivers of turnaround efforts:

TM

TM |

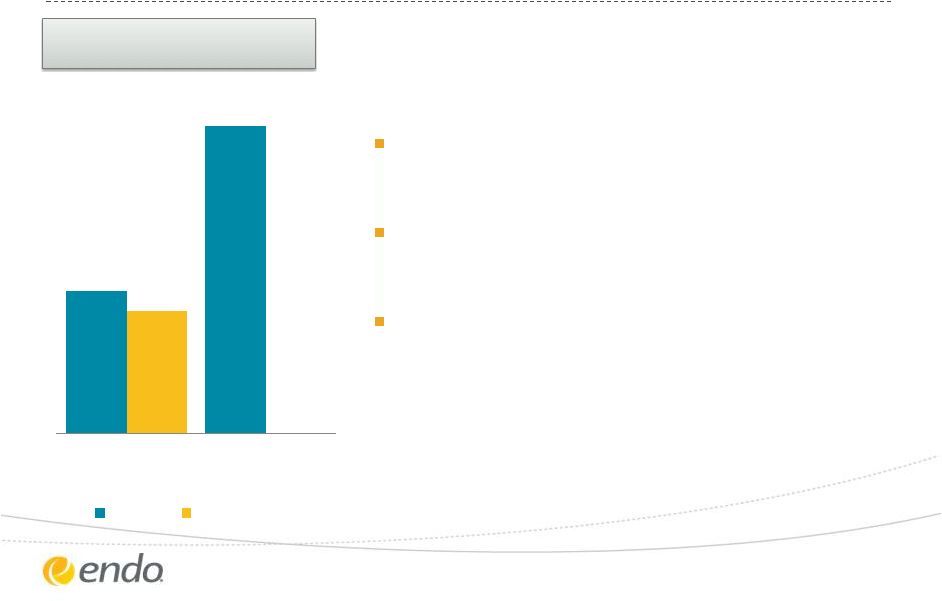

Implement

Lean

Operating

Model

–

Restructuring

Efforts

On-Track

Run-rate by mid-

2014E

2013E

©2013 Endo Pharmaceuticals Inc. All rights reserved.

9

$150

$325

$129

Target

Achieved to date

Reductions Announced Relative

to 2012A ($M)

Key actions taken:

All US headcount reductions

communicated on June 5

External spend reduction under

way

Ongoing focus on gaining

additional efficiencies |

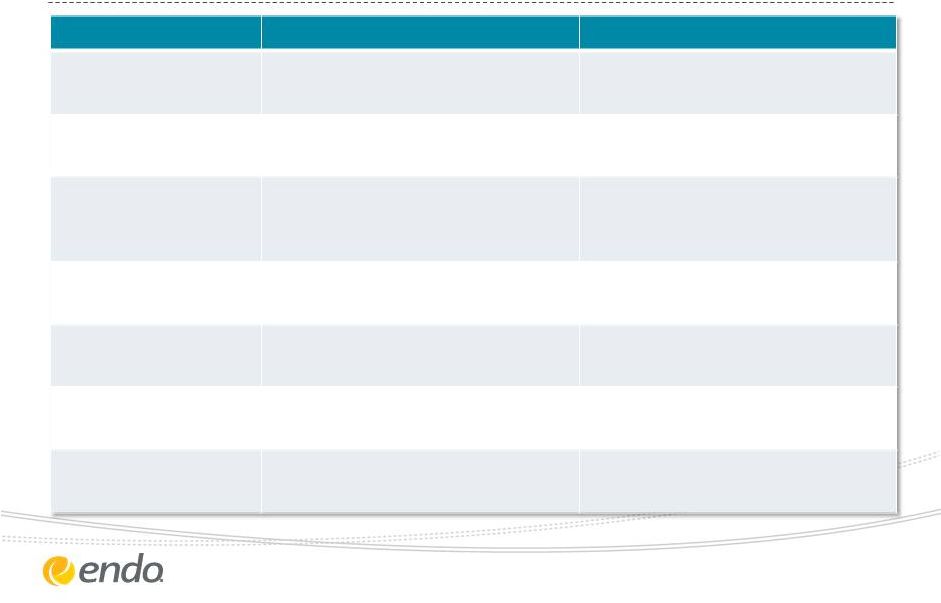

2013 Revised

Financial Guidance ©2013 Endo Pharmaceuticals Inc. All rights

reserved. 10

Measure

Previous 2013 Guidance

Revised 2013 Guidance

Revenues

$2.70B -

$2.80B

$2.75B -

$2.80B

Adjusted Gross

Margin

64% to

66%

Adjusted

Operating

Expenses

Adjusted Diluted EPS

$4.25 to $4.55

$4.60 to $4.75

Adjusted

Effective

Tax Rate

28.5% to 29.5%

28% to 28.5%

Diluted Shares

Outstanding

~117M

~118M

Capital Expenses

~$80M

~$80M

Reduced by approximately $150

million, which represents a 15%

decline versus 2012

Reduced by approximately $150

million, which represents a 15%

decline versus 2012

64% to 66% |

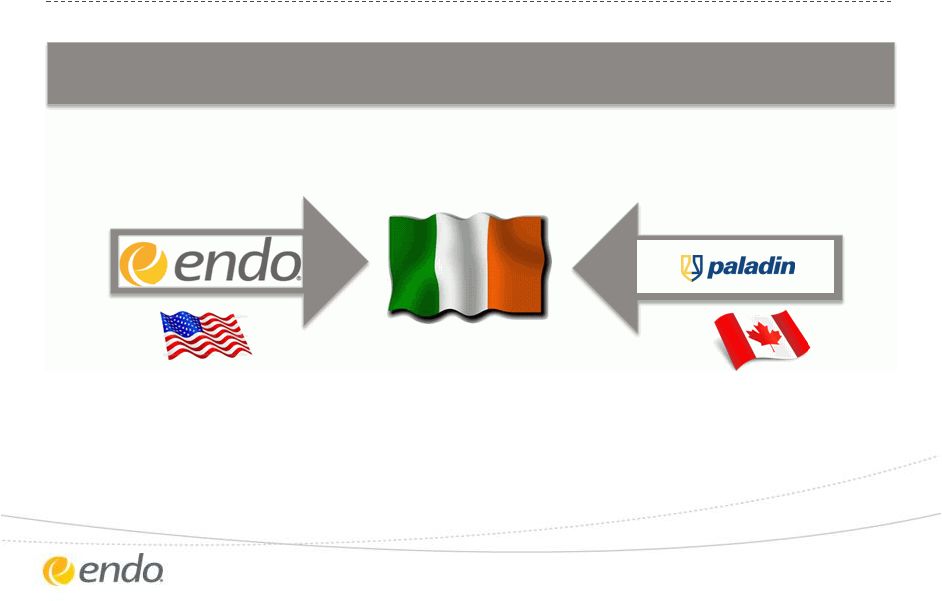

A Compelling

Combination: Endo Health Solutions

and

Paladin Labs

©2013 Endo Pharmaceuticals Inc. All rights reserved.

|

Transformational Opportunity

New Endo

©2013 Endo Pharmaceuticals Inc. All rights reserved.

12

Together creating a top tier specialty healthcare organization |

Accelerates

transformation into a leading specialty healthcare company •

Creates international specialty pharmaceutical business

•

Immediately accretive to adjusted diluted earnings per share

•

Enhances cash flow and earnings sustainability while further diversifying revenues in

pharmaceutical segment

•

Product portfolio and geography complementary across companies

•

Highly diversified revenue streams in Canada

•

Access

to

attractive

emerging

markets

–

South

Africa

and

Latin

America

Focused operating model to maximize organic growth potential and

cash flow

generation supplemented with an active M&A agenda

•

Net debt to adjusted EBITDA 2.4x upon close with rapid de-levering

•

Platform for organic growth with broader options for future M&A

•

Operational and tax synergies resulting in at least $75M after tax savings annually

•

Improved cash conversion leading to enhanced capital structure

Transaction Benefits

©2013 Endo Pharmaceuticals Inc. All rights reserved.

13

beneficial financial platform to facilitate future growth

Domicile as an Irish plc-- |

Combination

Creates Value Paladin shareholders and employees

•

Monetize outstanding track record of Paladin value creation

•

Direct access to U.S. market and opportunity to accelerate growth through a larger

platform

•

Retain Paladin name for Canadian business

Strategic value for Endo

•

Expanded geographic footprint

•

Diversify revenue base

•

Advantaged platform for growth with future acquisitions

Financially sound

•

Stable and growing cash flows

•

Immediately accretive to adjusted EPS

•

Enables inversion transaction

•

Combined company steady state tax rate of approximately 20%

©2013 Endo Pharmaceuticals Inc. All rights reserved.

14 |

Proposed

Transaction Terms $77

(CAD)

per

share

represents

a

20%

premium

to

Paladin

Labs’

closing

price

of

$63.91 as of

November 4, 2013 and values the transaction at approximately $1.6 billion (USD)

Paladin shareholders will receive:

•

1.6331 shares of New Endo for each share of Paladin Labs owned

•

$1.16 (CAD) in cash for each share of Paladin Labs Paladin owned

–

Cash consideration to be received by Paladin Labs shareholders will be

increased if Endo’s average share price declines more than 7% during a pre-

specified period

•

1 share of Knight Therapeutics for each share of Paladin Labs owned

Pro Forma ownership

•

Endo Shareholders to own 77.5% of New Endo

•

Paladin Shareholders to own 22.5% of New Endo

Endo has secured committed financing that will be used to refinance certain elements of the

company’s existing indebtedness and the early repurchase of our convertible notes

due April 2015, subject to market conditions

©2013 Endo Pharmaceuticals Inc. All rights reserved.

15 |

New Endo

Structure and Trading Endo management to lead combined company

•

Jonathan

Ross

Goodman

will

serve

as

an

advisor

to

the

Endo

Board

of

Directors

Existing management team will continue to operate Paladin

•

Mark Beaudet will continue as President, Paladin reporting to Rajiv De

Silva

New Endo will trade on NASDAQ

©2013 Endo Pharmaceuticals Inc. All rights reserved.

16 |

Overview of

Paladin Labs Paladin Labs is a specialty pharmaceutical company focused on acquiring or

in-licensing innovative pharmaceutical products for the Canadian and select

international markets

Strong diversified revenue growth

•

5 year revenue growth CAGR of 27%

•

Proven partner for the Canadian market

•

Demonstrated track record of profitable growth

•

Financial strength to drive expansion

Strong, near-term pipeline for growth

•

Solid late stage development pipeline including multiple products currently under

regulatory review

•

Zohydro

ER, Seralaxin

•

Over 15 products in development

©2013 Endo Pharmaceuticals Inc. All rights reserved.

17

TM |

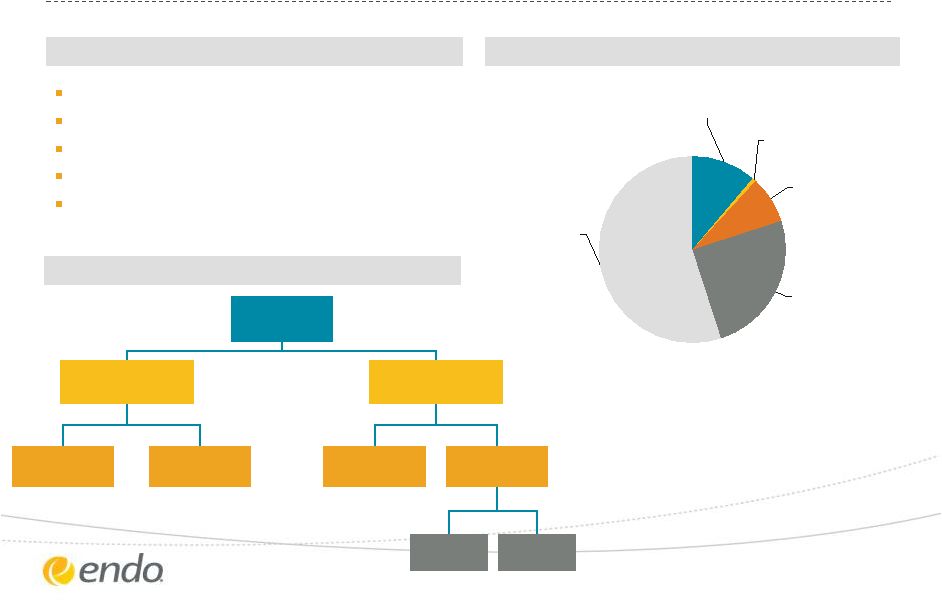

Paladin Labs

Structure Company Information

Structure

Adjusted Revenue Mix (prop. consolidation)

Canada Rx, 55%

Litha, 25%

Base Paladin Intl,

8%

Isodiagnostika,

1%

Canada OTC, 11%

1996

Montreal, Canada

Jonathan

Ross

Goodman

Mark Beaudet

127

©2013 Endo Pharmaceuticals Inc. All rights reserved.

18

Paladin

Labs

Base Paladin

International

platforms

Canada

Other

Litha

Latin

America

Mexico

Brazil

Founded:

Headquarters:

Chairman:

Interim CEO:

Employees:

Source: Paladin Labs Inc. management presentation |

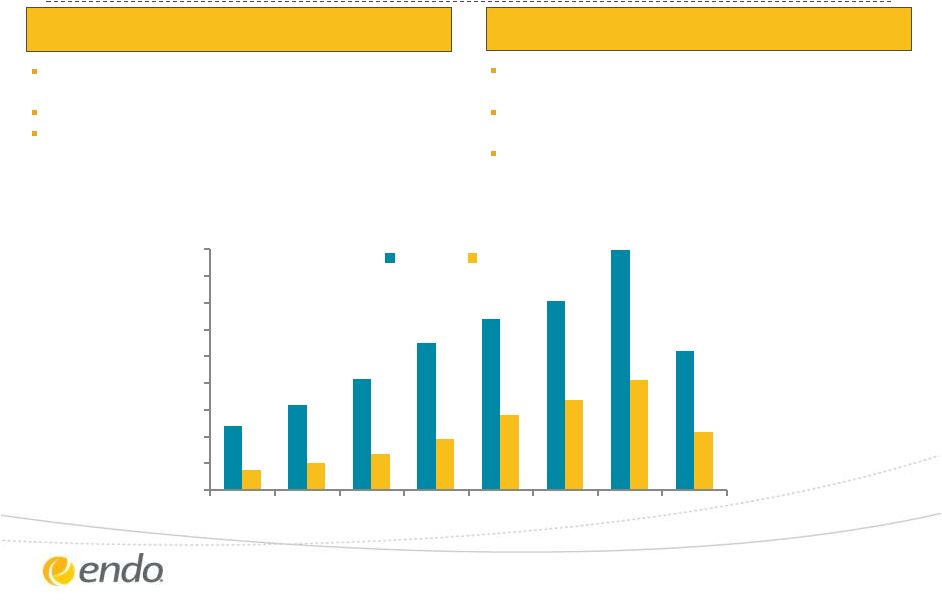

Paladin’s

Year-Over-Year Consecutive Growth ($ CAD) REVENUE

EBITDA

*Adjusted refers to the proportional consolidation of Litha’s results effective July 2,

2012 and Paladin Mexico’s results effective January 1, 2013 Source:

Paladin Labs Inc. Q2 2013 Investor Relations Presentation YTD

$M CAD

©2013 Endo Pharmaceuticals Inc. All rights reserved.

19

0

20

40

60

80

100

120

140

160

180

2006

2007

2008

2009

2010

2011

2012*

2013*

Revenue

EBITDA

Adjusted* revenue for 2012 of $179.0 million, up 27%

over 2011

Guidance for 2013 of $190 million adjusted* revenues

Adjusted* revenues for Q2 2013 of $52.3 million, up

41% versus Q2 2012

9 consecutive years of record EBITDA with EBITDA

representing 39% of revenues in 2012

Adjusted* EBITDA for 2012 of $79.0 million for 2012,

up 17% versus 2011

Adjusted* EBITDA for Q2 2013 of $22.7, up 32% versus

Q2 2012 |

Aspire to be

a leading specialty healthcare company Continue our commitment to serving our patients

and customers

Participate in specialty areas offering above average growth

and favorable margins

Transform our operating model to maximize growth

potential and cash flow generation

Endo Overview

©2013 Endo Pharmaceuticals Inc. All rights reserved.

20

Allows Endo to maximize shareholder value by adapting to market

dynamics and portfolio changes |

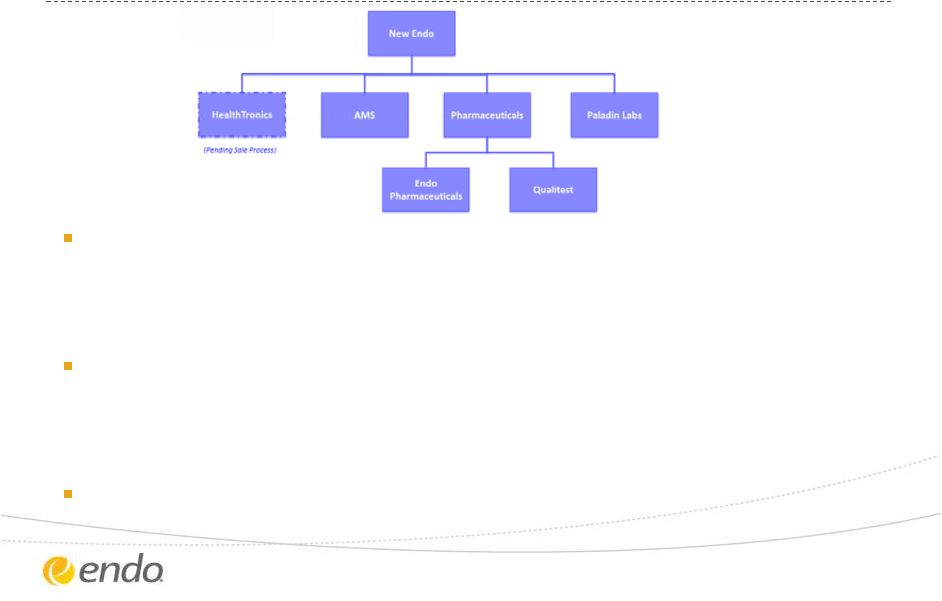

Recent Endo

Restructuring Actions ©2013 Endo Pharmaceuticals Inc. All rights

reserved. 21

•

Endo Pharmaceuticals

•

Qualitest

•

AMS

Drive organic growth through our core businesses

Implement lean operating model

Pursue accretive, value-creating acquisition opportunities

Explore strategic alternatives for HealthTronics

Sharpen R&D focus on near-term opportunities

Strengthen talent and organization |

New Endo

Operating Model Lean, efficient operating model

Focused, de-risked R&D

Streamlined and diversified organization with quick decision making

Performance metrics aligned with shareholder interests

Agnostic on therapeutic areas, but with focus in specialty areas

M&A as an important component of building and growing the business long term

©2013 Endo Pharmaceuticals Inc. All rights reserved.

22 |

New Endo

International Strategy Utilize new operating structure to drive international

expansion and growth

Focus on emerging markets with above average growth

characteristics

Invest in areas with growing healthcare infrastructure and

expanding economies

•

Proven local operators, competency in core business functions

•

International management expertise

Expand presence in markets with favorable reimbursement

environment or a large cash pay component

©2013 Endo Pharmaceuticals Inc. All rights reserved.

23 |

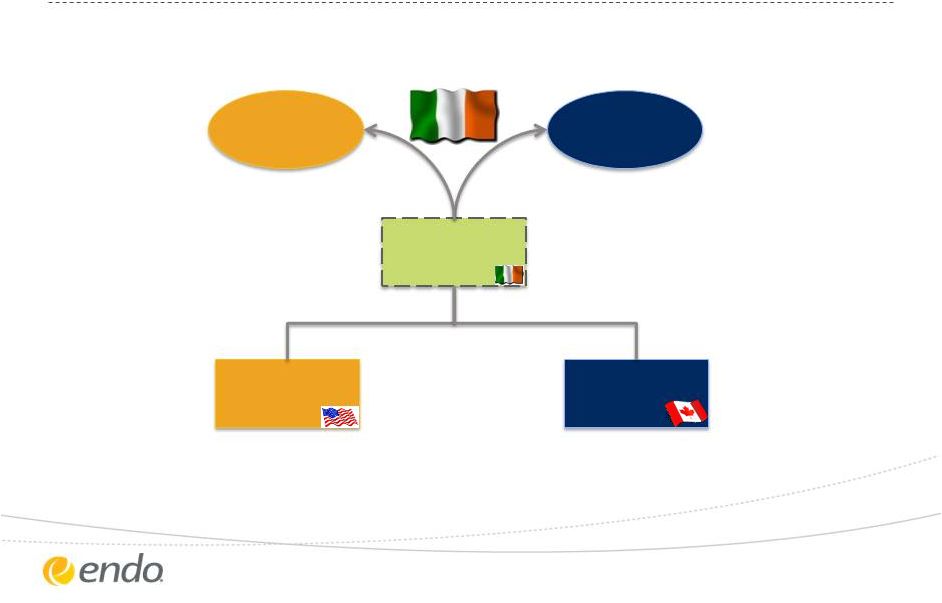

Corporate

Redomicile Endo

Shareholders

Paladin Labs

Shareholders

Paladin Labs

Shareholders

Endo

(& Subs)

Paladin Labs

(& Subs)

Paladin Labs

(& Subs)

Irish New Endo

77.5%

22.5%

24

©2013 Endo Pharmaceuticals Inc. All rights reserved.

|

New Endo

- Capital Structure

Proforma capital structure will continue to support the long

term strategy of Endo

Secured committed financing that will be used to refinance

certain elements of existing indebtedness and the early

repurchase of our convertible notes due April 2015

Proforma leverage ratio is expected to be in line with

current levels

Immediate accretion and improved cash flow conversion will

lead to rapid de-levering

©2013 Endo Pharmaceuticals Inc. All rights reserved.

25 |

Approvals and

Timing Standard U.S. merger process for Endo

•

Proxy/registration statement

•

Majority approval by Endo shareholders

2/3 vote required by Paladin Labs shareholders

•

Customary regulatory approvals, including Investment Canada

•

Shareholders representing 34% of Paladin Labs outstanding shares

have agreed to vote in favor of deal

Expected closing 1

st

half 2014

Transaction not currently expected to be taxable to U.S.

shareholders of Endo, as structured, but will be taxable for

shareholders of Paladin

©2013 Endo Pharmaceuticals Inc. All rights reserved.

26 |

Accelerates

transformation into a leading specialty healthcare company •

Creates international specialty pharmaceutical business

•

Immediately accretive to adjusted diluted earnings per share

•

Enhances cash flow and earnings sustainability while further diversifying revenues in

pharmaceutical segment

•

Product portfolio and geography complementary across companies

•

Highly diversified revenue streams in Canada

•

Access

to

attractive

emerging

markets

–

South

Africa

and

Latin

America

Focused operating model to maximize organic growth potential and

cash flow

generation supplemented with an active M&A agenda

•

Net debt to adjusted EBITDA 2.4x upon close with rapid de-levering

•

Platform for organic growth with broader options for future M&A

•

Operational and tax synergies resulting in at least $75M after tax savings annually

•

Improved cash conversion leading to enhanced capital structure

Transaction Benefits

©2013 Endo Pharmaceuticals Inc. All rights reserved

27

beneficial financial platform to facilitate future growth

Domicile as an Irish plc– |

Endo Health

Solutions 3Q 2013 Earnings Report

and

A Compelling Combination:

Endo Health Solutions

and

Paladin Labs

November 5, 2013

©2013 Endo Pharmaceuticals Inc. All rights reserved.

|

Appendix

29

©2013 Endo Pharmaceuticals Inc. All rights reserved.

|

Reconciliation

of Non-GAAP Measures ©2013 Endo Pharmaceuticals Inc. All

rights reserved. Three Months Ended September 30, 2013

(unaudited) Actual

Reported

(GAAP)

Adjustments

Non-GAAP

Adjusted

REVENUES

$

714,954

$

—

$

714,954

COSTS AND EXPENSES:

Cost of revenues

287,970

(46,105)

(1)

241,865

Selling, general and administrative

199,719

(30,069)

(2)

169,650

Research and development

38,080

(10,005)

(3)

28,075

Litigation-related and other contingencies

30,895

(30,895)

(4)

—

Asset impairment charges

38,807

(38,807)

(5)

—

Acquisition-related and integration items, net

2,207

(2,207)

(6)

—

OPERATING INCOME

$

117,276

$

158,088

$

275,364

INTEREST EXPENSE, NET

43,150

(5,704)

(7)

37,446

OTHER (INCOME) EXPENSE, NET

(17,292)

17,293

(8)

1

INCOME BEFORE INCOME TAX

$

91,418

$

146,499

$

237,917

INCOME TAX

36,803

26,008

(9)

62,811

CONSOLIDATED NET INCOME

$

54,615

$

120,491

$

175,106

Less: Net income attributable to noncontrolling interests

14,392

—

14,392

NET INCOME ATTRIBUTABLE TO ENDO HEALTH

SOLUTIONS INC.

$

40,223

$

120,491

$

160,714

DILUTED EARNINGS PER SHARE

$

0.33

$

1.34

DILUTED WEIGHTED AVERAGE SHARES

120,261

120,261

30

Notes to reconciliation of our GAAP statements of operations to our

adjusted statements of operations: (1) To exclude amortization of

commercial intangible assets related to marketed products of $44,105 and accruals for

milestone payments to partners of $2,000.

(2)

To exclude certain separation benefits and other costs incurred in

connection with continued efforts to enhance the company's

operations of $13,616, amortization of customer relationships of $2,748 and mesh litigation-related defense

costs of $13,705.

(3)

To exclude milestone payments to partners of $1,092 and certain

separation benefits and other costs incurred in connection with

continued efforts to enhance the company's operations of $8,913.

(4)

To exclude the net impact of accruals related to mesh -related

product liability. (5)

To exclude asset impairment charges.

(6)

To exclude integration costs of $2,144 and a loss of $63 recorded to

reflect the change in fair value of the contingent consideration

associated with the Qualitest acquisition. (7) To exclude additional interest

expense as a result of the prior adoption of ASC 470 -20.

(8)

To exclude $(14,628) related to patent litigation settlement income and

$(2,665) for a gain on sale of business. To reflect the

cash tax savings results from our acquisitions and the tax effect of the pre -tax adjustments above at applicable tax

rates.

|

Reconciliation

of Non-GAAP Measures 31

©2013 Endo Pharmaceuticals Inc. All rights reserved.

Three Months Ended September 30, 2012 (unaudited)

Actual

Reported

(GAAP)

Adjustments

Non

-GAAP

Adjusted

REVENUES

$

750,482

$

—

$

750,482

COSTS AND EXPENSES:

Cost of revenues

294,267

(52,762)

(1)

241,505

Selling, general and administrative

210,446

(10,480)

(2)

199,966

Research and development

48,952

(6,421)

(3)

42,531

Patent litigation settlement, net

(46,238)

46,238

(4)

—

Litigation-related and other contingencies

82,600

(82,600)

(5)

—

Asset impairment charges

11,163

(11,163)

(6)

—

Acquisition-related and integration items, net

5,776

(5,776

(7)

—

OPERATING INCOME

$

143,516

$

122,964

$

266,480

INTEREST EXPENSE, NET

45,505

(8)

40,296

LOSS ON EXTINGUISHMENT OF DEBT

1,789

(1,789)

(9)

—

OTHER INCOME, NET

(250)

—

(250)

INCOME BEFORE INCOME TAX

$

96,472

$

129,962

$

226,434

INCOME TAX

28,287

30,678

(10)

58,965

CONSOLIDATED NET INCOME

$

68,185

$

99,284

$

167,469

Less: Net income attributable to noncontrolling interests

14,376

—

14,376

NET INCOME ATTRIBUTABLE TO ENDO HEALTH

SOLUTIONS INC.

$

53,809

$

99,284

$

153,093

DILUTED EARNINGS PER SHARE

$

0.45

$

1.28

DILUTED WEIGHTED AVERAGE SHARES

119,579

119,579

Notes to reconciliation of our GAAP statements of operations to our

adjusted statements of operations: (1) To exclude amortization of

commercial intangible assets related to marketed products of $55,999, net

milestone payments and receipts of $1,440, an adjustment to the accrual

for the payment to Impax related to sales of OPANA ER of

$(6,000) and certain separation benefits and other costs incurred in connection

with continued efforts to enhance the company’s operations of

$1,323. (2)

To exclude certain separation benefits and other costs incurred in

connection with continued efforts to enhance the company’s

operations of $7,744 and amortization of customer relationships of $2,736.

(3)

To exclude milestone payments to partners of $3,898 and certain

separation benefits and other costs incurred in connection with

continued efforts to enhance the company’s operations of $2,523.

(4)

To exclude the net impact of the Actavis (Watson) litigation

settlement. (5)

To exclude the net impact of accruals for litigation-related and

other contingencies. (6)

To exclude asset impairment charges.

(7)

To exclude acquisition-related and integration costs of $5,680 and

a loss of $96 recorded to reflect the change in fair value of

the contingent consideration associated with the Qualitest Pharmaceuticals acquisition.

(8)

To exclude additional interest expense as a result of the prior

adoption of ASC 470-20.

(9)

To exclude the unamortized debt issuance costs written off and recorded

as a loss on extinguishment of debt upon our third quarter 2012

prepayments on our Term Loan indebtedness. (10) To reflect the cash tax savings

results from our acquisitions and the tax effect of the pre-tax adjustments above at

applicable tax rates.

(5,209) |

Reconciliation

of Non-GAAP Measures 32

©2013 Endo Pharmaceuticals Inc. All rights reserved.

Nine Months Ended September 30, 2013 (unaudited)

Actual

Reported

(GAAP)

Adjustments

Non

-GAAP

Adjusted

REVENUES

$

2,189,982

$

—

$

2,189,982

COSTS AND EXPENSES:

Cost of revenues

883,063

(149,045)

(1)

734,018

Selling, general and administrative

689,436

(117,485)

(2)

571,951

Research and development

113,740

(19,187)

(3)

94,553

Litigation-related and other contingencies

159,098

(159,098)

(4)

—

Asset

impairment charges

46,994

(46,994)

(5)

—

Acquisition-related and integration items, net

6,165

(6,165)

(6)

—

OPERATING INCOME

$

291,486

$

497,974

$

789,460

INTEREST EXPENSE, NET

129,939

(16,816)

(7)

113,123

LOSS ON EXTINGUISHMENT OF DEBT

11,312

(11,312)

(8)

—

OTHER (INCOME) EXPENSE, NET

(51,873)

54,113

(9)

2,240

INCOME BEFORE INCOME TAX

$

202,108

$

471,989

$

674,097

INCOME TAX

72,779

112,260

(10)

185,039

CONSOLIDATED NET INCOME

$

129,329

$

359,729

$

489,058

Less: Net income attributable to noncontrolling interests

38,758

—

38,758

NET INCOME ATTRIBUTABLE TO ENDO HEALTH

SOLUTIONS INC.

$

90,571

$

359,729

$

450,300

DILUTED EARNINGS PER SHARE

$

0.77

$

3.85

DILUTED WEIGHTED AVERAGE SHARES

116,890

116,890

Notes to reconciliation of our GAAP statements of operations to our

adjusted statements of operations: (1) To exclude amortization of

commercial intangible assets related to marketed products of $140,355, certain separation

benefits and other costs incurred in connection with continued efforts

to enhance the company's operations of $2,690 and accruals for

milestone payments to partners of $6,000. (2) To exclude certain separation

benefits and other costs incurred in connection with continued efforts to enhance the company's

operations of $74,363, amortization of customer relationships of

$8,251and mesh litigation-related defense costs of $34,871.

(3)

To exclude milestone payments to partners of $5,064 and certain

separation benefits and other costs incurred in connection with

continued efforts to enhance the company's operations of $14,123 .

(4)

To exclude the net impact of accruals primarily for mesh-related

product liability. (5)

To exclude asset impairment charges.

(6)

To exclude integration costs of $6,002 and a loss of $163

recorded to reflect the change in fair value of the contingent

consideration associated with the Qualitest acquisition.

(7)

To exclude additional interest expense as a result of the prior

adoption of ASC 470-20.

(8)

To exclude the unamortized debt issuance costs written off and recorded

as a loss on extinguishment of debt upon our March 2013

prepayment on our Term Loan indebtedness as well as upon the amendment and restatement of our existing credit

facility.

(9)

To exclude $(50,400) related to patent litigation settlement

income, $(2,665) for a gain on sale of business and other income

of $(1,048). To reflect the cash tax savings results

from our acquisitions and the tax effect of the pre-tax adjustments above at applicable tax rates. |

Reconciliation

of Non-GAAP Measures 33

©2013 Endo Pharmaceuticals Inc. All rights reserved.

Nine Months Ended September 30, 2012 (unaudited)

Actual

Reported

(GAAP)

Adjustments

Non

-GAAP

Adjusted

REVENUES

$

2,226,303

$

—

$

2,226,303

COSTS AND EXPENSES:

Cost of revenues

953,657

(272,857)

(1)

680,800

Selling, general and administrative

698,522

(30,044)

(2)

668,478

Research and development

183,067

(56,201)

(3)

126,866

Patent litigation settlement, net

85,123

(85,123)

(4)

—

Litigation-related and other contingencies

82,600

(82,600)

(5)

—

Asset impairment charges

54,163

(54,163)

(6)

—

Acquisition-related and integration items, net

16,580

(16,580)

(7)

—

OPERATING INCOME

$

152,591

$

597,568

$

750,159

INTEREST EXPENSE, NET

138,386

(15,354)

(8)

123,032

LOSS ON EXTINGUISHMENT OF DEBT

7,215

(7,215)

(9)

—

OTHER EXPENSE, NET

498

(300

(10)

198

INCOME BEFORE INCOME TAX

$

6,492

$

620,437

$

626,929

INCOME TAX

(9,263)

182,820

(11)

173,557

CONSOLIDATED NET INCOME

$

15,755

$

437,617

$

453,372

Less: Net income attributable to noncontrolling interests

39,826

—

39,826

NET (LOSS) INCOME ATTRIBUTABLE TO ENDO HEALTH

SOLUTIONS INC.

$

(24,071)

$

437,617

$

413,546

DILUTED (LOSS) EARNINGS PER SHARE

$

(0.21)

$

3.42

DILUTED WEIGHTED AVERAGE SHARES

116,688

121,083

Notes to reconciliation of our GAAP statements of operations to our

adjusted statements of operations: (1) To exclude amortization of

commercial intangible assets related to marketed products of $162,414, the impact of

inventory step-up recorded as part of acquisition accounting of

$880, the accrual for the payment to Impax related to sales of

OPANA ER of $104,000, net milestone payments to partners of $2,927 and certain separation benefits and other

costs incurred in connection with continued efforts to enhance the

company’s operations of $2,636. (2) To exclude certain separation

benefits and other costs incurred in connection with continued efforts to enhance the

company’s operations of $21,799 and amortization of customer

relationships of $8,245. (3)

To exclude milestone payments to partners of

$53,678 and certain separation benefits and other costs incurred in

connection with continued efforts to enhance the company’s

operations of $2,523. (4)

To exclude the net impact of the Actavis (Watson)

litigation settlement. (5)

To exclude the net impact of accruals for

litigation-related and other contingencies. (6) To exclude asset impairment

charges. (7)

To exclude acquisition-related and integration costs of $16,552

and a loss of $28 recorded to reflect the change in fair value

of the contingent consideration associated with the Qualitest Pharmaceuticals acquisition.

(8)

To exclude additional interest expense as a result of the prior

adoption of ASC 470-20.

(9)

To exclude the unamortized debt issuance costs written off and

recorded as a loss on extinguishment of debt upon our 2012

prepayments on our Term Loan indebtedness. (10) To exclude milestone and upfront

payments to partners. To reflect the cash tax savings results

from our acquisitions and the tax effect of the pre-tax adjustments above at applicable tax rates. |

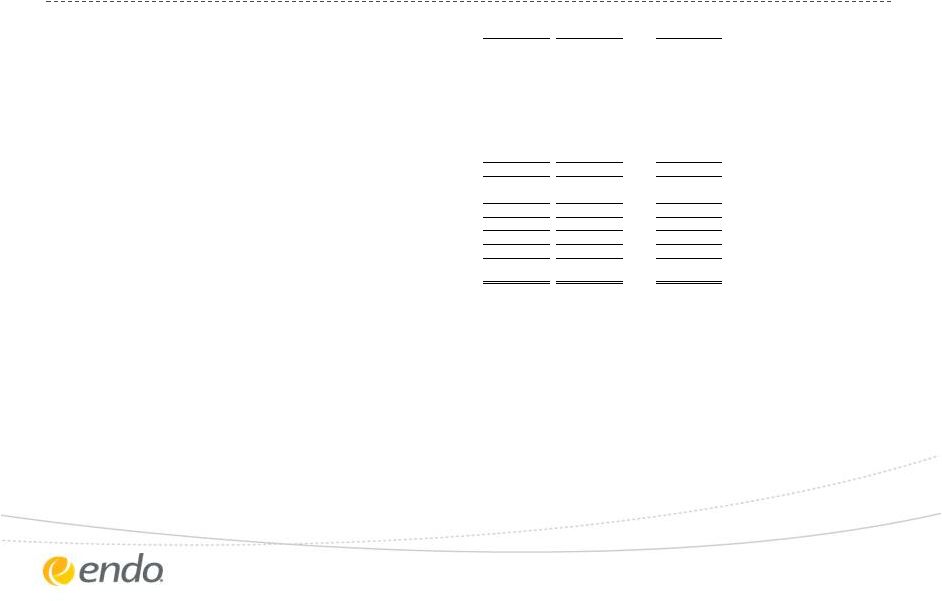

Reconciliation

of Non-GAAP Measures 34

©2013 Endo Pharmaceuticals Inc. All rights reserved.

Endo Health Solutions Inc. Net Revenues (unaudited) (in thousands)

Three Months Ended September 30,

Percent

Growth

Nine Months Ended September 30,

Percent

Growth

2013

2012

2013

2012

Endo Pharmaceuticals:

LIDODERM®

$

149,946

$

238,282

(37)%

$

566,626

$

676,302

(16)%

OPANA®

ER

59,936

62,232

(4)%

174,214

236,731

(26)%

Voltaren®

Gel

45,044

35,483

27%

123,937

79,173

57%

PERCOCET®

26,250

24,209

8%

78,818

73,413

7%

FROVA®

16,027

15,706

2%

44,116

45,352

(3)%

FORTESTA®

Gel

15,025

8,823

70%

47,156

21,526

119%

SUPPRELIN®

LA

14,105

14,534

(3)%

44,128

42,777

3%

VANTAS®

3,039

4,114

(26)%

10,013

12,352

(19)%

VALSTAR®

6,024

8,394

(28)%

16,327

20,717

(21)%

Other Branded Products

508

933

(46)%

1,833

1,788

3%

Royalty and Other

30,232

3,935

668%

32,204

12,874

150%

Total Endo Pharmaceuticals

$

366,136

$

416,645

(12)%

$

1,139,372

$

1,223,005

(7)%

Total Qualitest

$

183,939

$

166,070

11%

$

532,722

$

471,310

13%

American Medical Systems:

Men's Health

61,536

58,316

6%

197,185

192,728

2%

Women's Health

24,200

29,399

(18)%

80,470

95,763

(16)%

BPH Therapy

25,508

25,589

—%

82,212

83,110

(1)%

Total AMS

111,244

113,304

(2)%

359,867

371,601

(3)%

HealthTronics

53,635

54,463

(2)%

158,021

160,387

(1)%

Total Revenue

714,954

750,482

(5)%

2,189,982

2,226,303

(2)% |

Reconciliation

of Non-GAAP Measures For an explanation of Endo’s reasons for using non-GAAP

measures, see Endo’s Current Report on Form 8-K filed today with the

Securities and Exchange Commission Reconciliation of Projected GAAP Diluted Earnings Per

Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31,

2013 Lower End of Range

Upper End of Range

Projected GAAP diluted income per common share

$0.95

$1.10

Upfront and milestone-related payments to partners

$0.20

$0.20

Amortization of commercial intangible assets and inventory step-up

$1.64

$1.64

Integration and Restructuring Charges

$0.86

$0.86

Charges for Litigation and other legal matters

$1.79

$1.79

Asset Impairment Charges

$0.41

$0.41

Actavis (Watson) litigation settlement

($0.44)

($0.44)

Interest expense adjustment for ASC 470-20 and other treasury items

$0.29

$0.29

Tax effect of pre-tax adjustments at the applicable tax rates and certain

other expected cash tax savings as a result of recent acquisitions

($1.10)

($1.10)

Diluted adjusted income per common share guidance

$4.60

$4.75

The company's guidance is being issued based on certain assumptions including:

•Certain of the

above amounts are based on estimates and there can be no assurance that Endo will achieve these results

•Includes all

completed business development transactions as of November 5, 2013

35

©2013 Endo Pharmaceuticals Inc. All rights reserved.

|