Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TEXAS CAPITAL BANCSHARES INC/TX | d616649d8k.htm |

| EX-99.1 - EX-99.1 - TEXAS CAPITAL BANCSHARES INC/TX | d616649dex991.htm |

October 23, 2013

TCBI Q3 2013

Earnings

Exhibit 99.2 |

Certain

matters

discussed

on

this

call

may

contain

forward-looking

statements,

which

are

subject

to

risks

and

uncertainties

and

are

based on Texas Capital’s current estimates or expectations of future events or

future results. Texas Capital is under no obligation, and expressly

disclaims such obligation, to update, alter or revise its forward-looking statements, whether as a result of new

information, future events or otherwise. A number of factors, many of which are

beyond Texas Capital’s control, could cause actual

results

to

differ

materially

from

future

results

expressed

or

implied

by

such

forward-looking

statements.

These

risks

and

uncertainties include the risk of adverse impacts from general economic conditions,

competition, interest rate sensitivity and exposure

to

regulatory

and

legislative

changes.

These

and

other

factors

that

could

cause

results

to

differ

materially

from

those

described in the forward-looking statements can be found in the prospectus

supplements, the Annual Report on Form 10-K and other filings made by

Texas Capital with the Securities and Exchange Commission (SEC).

2 |

Opening Remarks

•

Strong

continued

core

earnings

growth,

with

provision

reflecting

another

quarter of significant growth in LHI

•

Continued improvement in NPAs

•

Continued strong growth in deposits, specifically DDAs

•

LHS levels down slightly as expected, with 2013 average to be

relatively flat as compared to 2012 average

3 |

Financial Review

Net Income and EPS

–

Increase in net income of 47% compared to Q2-2013, 23% compared to

Q2-2013 before non-recurring FDIC charge and

Q2-2013 charge of $7.7 million –

Increase in EPS compared to Q2-2013

–

Decrease in EPS compared to Q3-2012 due to preferred dividend in

Q3-2013 Operating Leverage, Core Earnings Power & NIM

–

Net Revenue

•

6% increase from Q2-2013

•

11% growth from Q3-2012

–

Exceptional growth in LHI average balances

•

Growth of 8% from Q2-2013

•

Growth of 22% from Q3-2012

–

Margin improved 2 bps from Q2-2013 to 4.21%

•

Strong LHI levels with favorable spreads; yields up slightly in LHI

and LHS •

Improved funding profile from growth in DDA and total deposits

–

Provision for loan losses directly related to strong quarterly growth

in LHI of $540.7 million –

$3.0 million of FDIC assessment ($0.05 per share) included in

non-interest expense in Q3-13 •

Relates

to

year-end

2011

and

2012

call

reports

which

were

amended

for

the

change

in

risk

weight

applicable to our mortgage finance loans

•

Disputing the charge as we believe it is unwarranted given the

circumstances; any recovery would be credited to a future

quarter 4 |

Financial Review

Loan Growth

–

Broad-based growth in LHI

•

Growth of $579.6 million, or 8%, from Q2-2013

•

Period end balance $319.4 million over average balance for the

quarter •

Averages increased 8% from Q2-2013 and 22% from Q3-2012

–

Average LHS balances down 2% from Q2-2013 and 3% from

Q3-2012 Funding

–

Funding profile optimal with exceptional DDA and total deposit

growth •

Average DDA increased 7% from Q2-2013 and 55% from

Q3-2012 •

Total average deposits increased 9% from Q2-2013 and 31% from

Q3-2012 –

Total deposit cost stable at 17 bps

Credit Costs

–

Total credit costs of $5.0 million for Q3-2013

–

Favorable trend in NPA ratio with $3.0 million (6%) decrease from

Q2-13, including 2% OREO reduction 5

•

Results remained well above industry trends in mortgage origination

and warehouse •

Provision of $5.0 million compared to $7.0 million in

Q2-2013 •

No OREO valuation cost in Q3-2013 compared to $382,000 in

Q2-2013 and $64,000 in Q3-2012 •

NCOs of $46,000 (0 bps) compared to $2.4 million (13 bps) in

Q2-2013 and 8 bps for Q3-2012 |

Income

Statement

-

Quarterly

6

Q3-13

Q2-13

Q1-13

Q4-12

Q3-12

Net interest income

$ 108,776

$ 101,220

$ 98,042

$ 101,155

$ 96,855

Non-interest income

10,431

11,128

11,281

12,836

10,552

Net revenue

119,207

112,348

109,323

113,991

107,407

Provision for credit losses

5,000

7,000

2,000

4,500

3,000

OREO valuation and write-down expense

-

382

71

955

64

Total provision and OREO valuation

5,000

7,382

2,071

5,455

3,064

Non-interest expense

62,009

68,352

55,629

59,119

53,457

Income before income taxes

52,198

36,614

51,623

49,417

50,886

Income tax expense

18,724

12,542

18,479

17,982

18,316

Net income

33,474

24,072

33,144

31,435

32,570

Preferred stock dividends

2,437

2,438

81

–

–

Net income available to common shareholders

$ 31,037

$ 21,634

$ 33,063

$ 31,435

$ 32,570

Diluted EPS

$ .74

$ .52

$ .80

$ .76

$ .80

Diluted EPS excluding charges

$ .79

$ .64

$ .80

$ .76

$ .80

Net interest margin

4.21%

4.19%

4.27%

4.27%

4.36%

ROA

1.25%

0.95%

1.38%

1.27%

1.40%

ROA excluding FDIC charge

1.32%

0.95%

1.38%

1.27%

1.40%

ROE

13.74%

9.94%

15.82%

15.35%

17.27%

ROE excluding FDIC charge

14.59%

9.94%

15.82%

15.35%

17.27%

Efficiency

(1)

52.0%

60.8%

50.9%

51.9%

49.8%

Efficiency excluding FDIC charge

(1)

49.2%

60.8%

50.9%

51.9%

49.8%

(1) Excludes OREO valuation charge

|

QTD Average Balances, Yields and Rates

7

(in thousands)

Q3 2013

Q2 2013

Q3 2012

Avg. Bal.

Yield Rate

Avg. Bal.

Yield Rate

Avg. Bal.

Yield Rate

Assets

Securities

$ 71,717

4.25%

$ 78,906

4.42%

$110,300

4.43%

Fed funds sold & liquidity investments

167,613

.19%

145,625

.20%

74,219

.30%

Loans held for sale

2,362,118

3.79%

2,406,246

3.74%

2,432,027

4.00%

Loans held for investment

7,731,901

4.72%

7,152,323

4.71%

6,313,263

4.81%

Total loans, net of reserve

10,014,468

4.53%

9,483,563

4.50%

8,672,917

4.63%

Total earning assets

10,253,798

4.46%

9,708,094

4.44%

8,857,436

4.59%

Total assets

$10,637,766

$10,110,992

$9,256,864

Liabilities

and

Stockholders’

Equity

Total interest bearing deposits

$ 5,612,874

.26%

$ 5,130,200

.25%

$4,649,823

.29%

Other borrowings

539,767

.20%

727,158

.20%

1,639,953

.21%

Subordinated notes

111,000

6.54%

111,000

6.61%

12,065

6.86%

Long-term debt

113,406

2.23%

113,406

2.24%

113,406

2.43%

Total interest bearing liabilities

6,377,047

.40%

6,081,764

.40%

6,415,247

.32%

Demand deposits

3,124,602

2,914,341

2,010,694

Stockholders’

equity

1,046,477

1,023,279

750,113

Total

liabilities

and

stockholders’

equity

$10,637,766

.24%

$10,110,992

.24%

$9,256,864

.22%

Net interest margin

4.21%

4.19%

4.36% |

Financial Summary

8

(in thousands)

QTD Averages

Q3 2013

Q2 2013

Q3 2012

Q3/Q2 %

Change

YOY %

Change

Total assets

$10,637,766

$10,110,992

$9,256,864

5%

15%

Loans held for investment

7,731,901

7,152,323

6,313,263

8%

22%

Loans held for sale

2,362,118

2,406,246

2,432,027

(2)%

(3)%

Total loans

10,094,019

9,558,569

8,745,290

6%

15%

Securities

71,717

78,906

110,300

(9)%

(35)%

Demand deposits

3,124,602

2,914,341

2,010,694

7%

55%

Total deposits

8,737,476

8,044,541

6,660,517

9%

31%

Stockholders’

equity

1,046,477

1,023,279

750,113

2%

40% |

Financial Summary

9

(in thousands)

Period End

Q3 2013

Q2 2013

Q3 2012

Q3/Q2 %

Change

YOY %

Change

Total assets

$10,797,448

$10,977,990

$9,881,362

(2)%

9%

Loans held for investment

8,051,328

7,510,662

6,549,089

7%

23%

Loans held for sale

2,262,085

2,838,234

2,818,622

(20)%

(20)%

Total loans

10,313,413

10,348,896

9,367,711

(0)%

10%

Securities

67,815

75,861

107,288

(11)%

(37)%

Demand deposits

3,242,060

2,928,735

2,114,279

11%

53%

Total deposits

8,957,081

7,980,598

6,717,579

12%

33%

Stockholders’

equity

1,066,629

1,034,955

802,406

3%

33% |

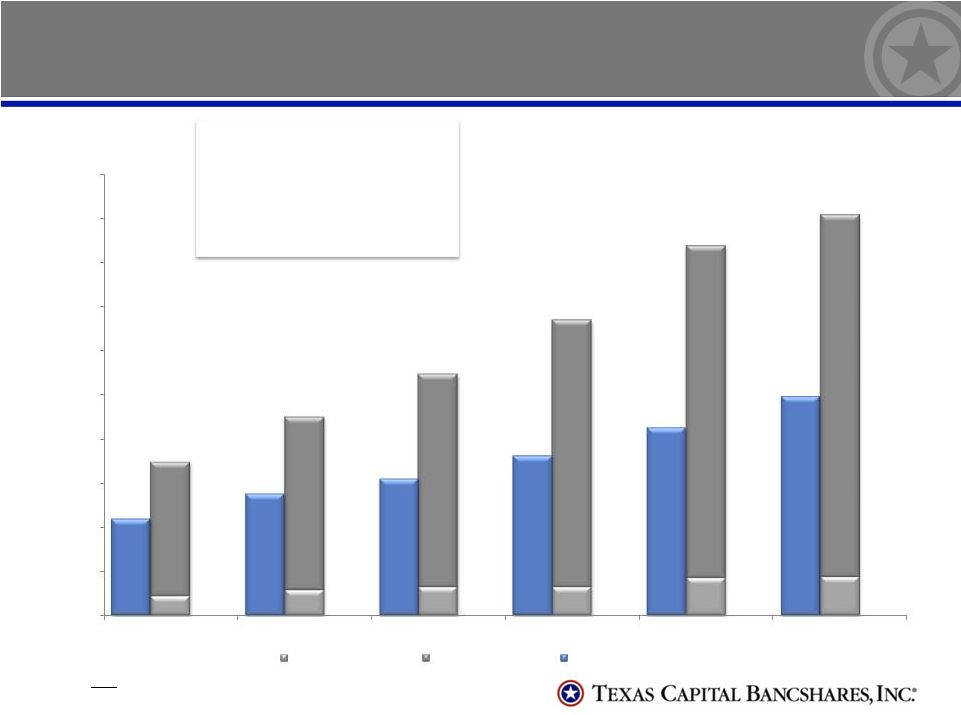

10

Revenue and Income Growth

($ in thousands)

$174,207

$225,951

$273,937

$335,169

$419,919

$454,504

109,651

137,733

154,985

181,403

212,961

247,948

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

500,000

2008

2009

2010

2011

2012

YTD Q3 2013

Non-interest Income

Net Interest Income

Non-interest Expense

Operating Revenue CAGR: 22%

Net Interest

Income CAGR:

23%

Non-interest Income CAGR: 15%

Non-interest Expense CAGR: 19%

Net Income CAGR: 40%

Excludes OREO valuation charge for YTD 2013, 2012, 2011 and 2010. YTD

Q3 2013 data is annualized. Note: |

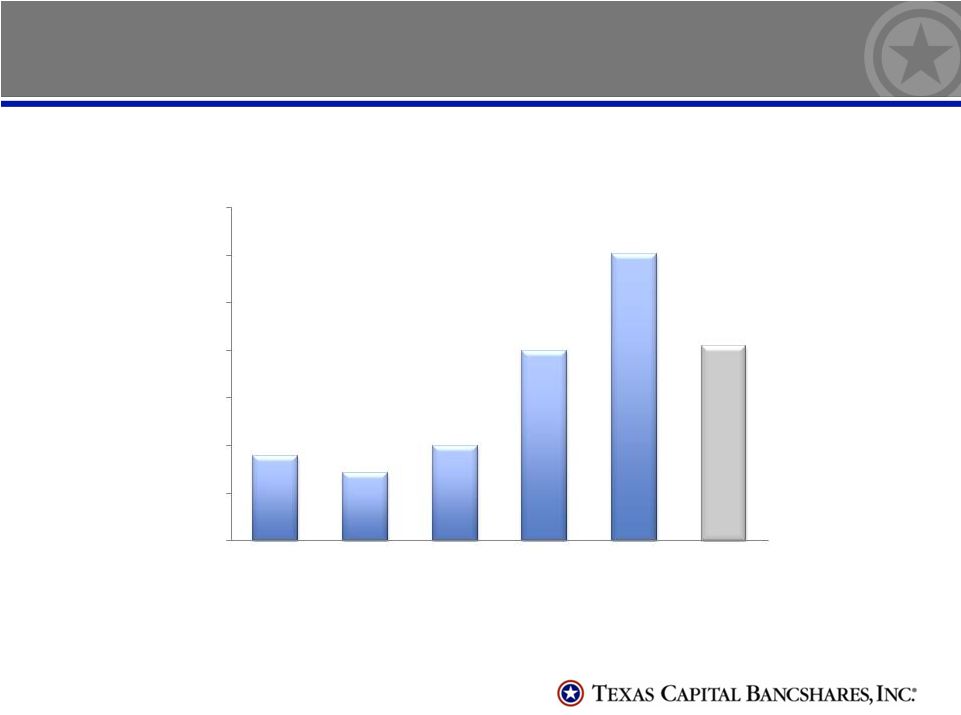

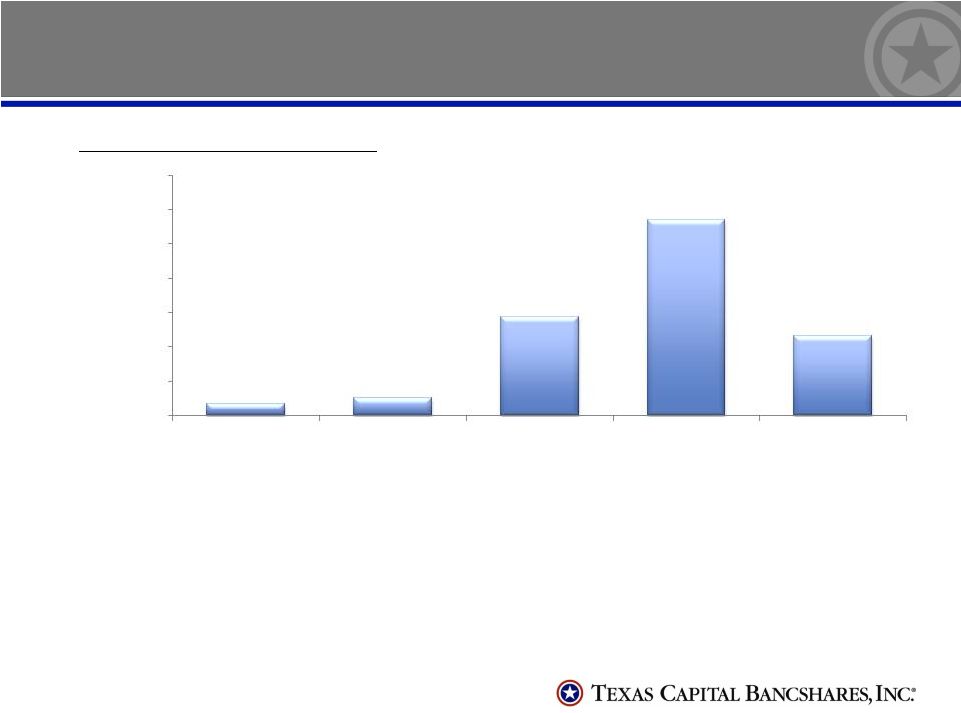

11

EPS Growth

2008

2009^

2010

2011

2012

5 Year EPS CAGR: 27%

Q3-2013

^Excludes $.15 effect of preferred TARP dividend during 2009. Reported

EPS was $0.56. $3.50

$3.00

$2.50

$2.00

$1.50

$1.00

$0.50

$0.00

$0.89

$0.71

$1.00

$1.99

3.01

$2.05 |

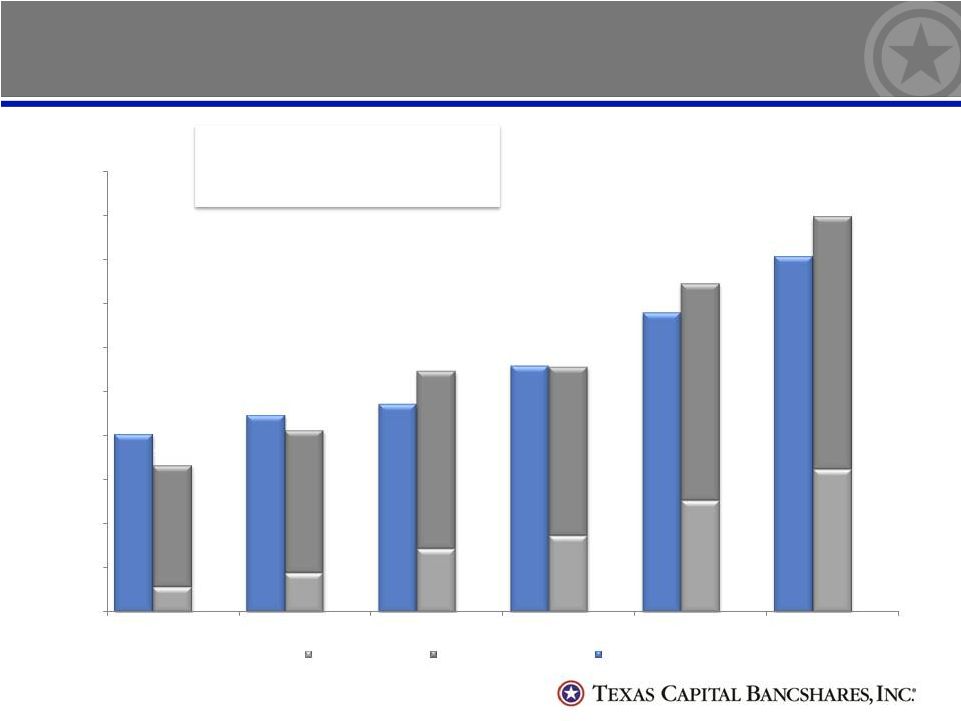

12

Deposit and Loan Growth

($ in millions)

Demand Deposit CAGR: 43%

Total Deposit CAGR: 23%

Loans Held for Investment CAGR: 16%

Demand Deposits

Intererst Bearing Deposits

Loans HFI

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

2008

2009

2010

2011

2012

2013

$4,028

$3,333

$4,457

$4,121

$4,711

$5,455

$5,572

$5,556

$6,786

$7,441

$8,051

$8,957 |

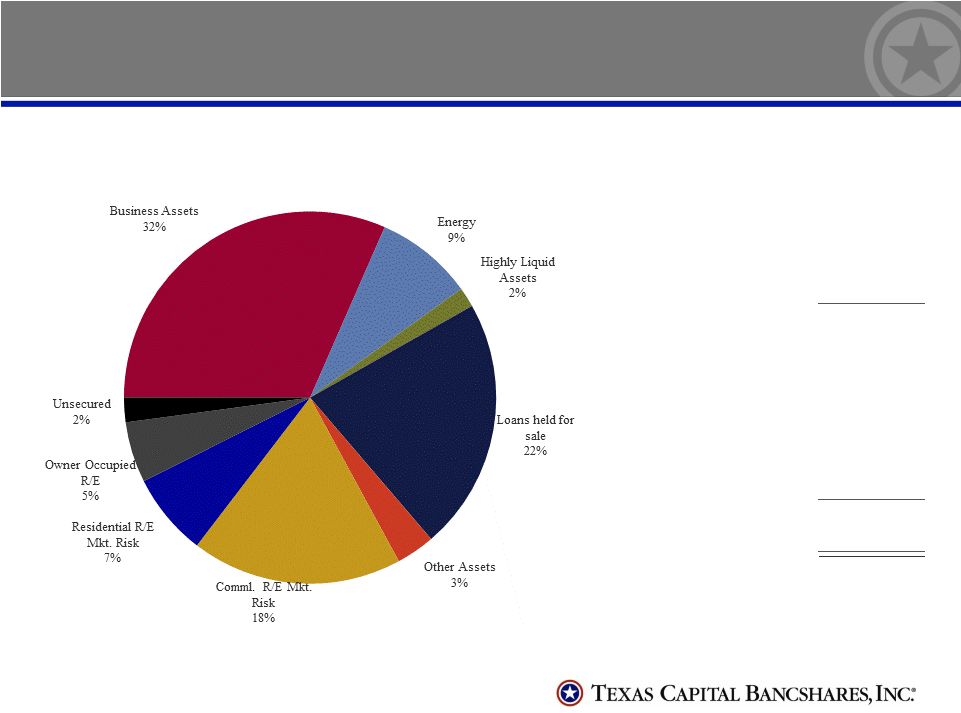

Loan Portfolio Statistics

13

Non-accrual loans

Commercial

$ 20,994

Construction

–

Real estate

14,616

Consumer

70

Equipment leases

57

Total non-accrual loans

35,737

Non-accrual loans as % of

loans held for investment

.44%

Non-accrual loans as % of

total loans

.35%

OREO

12,805

Total Non-accruals +

OREO

$ 48,542

Non-accrual loans + OREO

as % of loans held for

investment + OREO

.60%

Total Loans $10,313,413

All numbers in thousands.

Loan Collateral by Type 9/30/13 |

Credit Quality

Improved Credit Trends

–

Total credit cost of $5.0 million for Q3-2013, compared to $ 7.4

million in Q2-2013 and $3.1 million in Q3-2012

•

Provision of $5.0 million for Q3-2013 compared to $7.0 million for

Q2-2013 and $3.0 million in Q3-2012

•

NCOs $46,000 (0 bps) in Q3-2013 compared to 13 bps in Q2-2013

and 8 bps in Q3-2012; NCO ratio of 7 bps for YTD

•

No OREO valuation charge in Q3-2013 compared to $382,000 in

Q2-2013 and $64,000 in Q3-2012

–

NPA ratio continues to decline

•

Reduction of $3.0 million (6%) from Q2-2013 and $27.8 million

(36%) from Q3-2012 •

NPA ratio of .60% compared to .68% in Q2-2013 and 1.16% in

Q3-2012 •

NPLs at $35.7 million, down $2.5 million from Q2-2013 and down

$21.5 million from Q3-2012

•

NPL ratio at .35% of total loans and .44% of LHI

•

OREO reduction of $248,000 (2%) from Q2-2013 and $6.3 million

(33%) from Q3-2012 14 |

15

Credit Quality

Net Charge-offs / Average Loans

* Excludes loans held for sale.

Combined reserve /

Loans

*

1.10%

1.15%

1.31%

1.56%

1.59%

Non-accrual loans +

OREO to loans

*

+

OREO

.60%

1.06%

1.58%

3.25%

2.74%

Combined reserve to

non-accruals

2.4x

1.3x

1.3x

.6x

.7x

1.40%

1.20%

1.00%

0.80%

0.60%

0.40%

0.20%

0.00%

2013

2012

2011

2010

2009

0.07%

0.10%

0.58%

1.14%

0.46% |

Closing Comments

•

Strong

core

earnings

power,

profitability

and

growth

to

continue

in

2013

•

Credit continues positive trend

•

Strong LHI pipeline and new commitments present opportunity for growth

potential

•

LHS average balances to remain in line with expectations for flat

year- over-year averages

16 |

Q&A

17 |