Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STERLING FINANCIAL CORP /WA/ | sfc8-kreq3eranddividend.htm |

| EX-99.1 - RESULTS OF OPERATIONS AND FINANCIAL CONDITION - STERLING FINANCIAL CORP /WA/ | q32013earningsresults.htm |

Earnings Release Supplement For the Quarter Ended September 30, 2013 October 25, 2013

Important Information for Investors and Shareholders 2 . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Umpqua Holdings Corporation ("Umpqua") will file with the Securities and Exchange Commission ("SEC") a registration statement on Form S-4 containing a joint proxy statement/prospectus of Sterling Financial Corporation ("Sterling") and Umpqua, and Sterling and Umpqua will each file other documents with respect to the proposed merger. A definitive joint proxy statement/prospectus will be mailed to shareholders of Sterling and Umpqua. Investors and security holders of Sterling and Umpqua are urged to read the joint proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Sterling or Umpqua through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Sterling will be available free of charge on Sterling’s website at www.sterlingfinancialcorporation.com or by contacting Sterling’s Investor Relations Department at 509-358-8097. Copies of the documents filed with the SEC by Umpqua will be available free of charge on Umpqua’s website at www.umpquaholdingscorp.com or by contacting Umpqua’s Investor Relations Department at 503-268-6675. Sterling, Umpqua, their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Sterling is set forth in its Annual Report on Form 10-K for the year ended December 31, 2012, which was filed with the SEC on February 27, 2013, its proxy statement for its 2013 annual meeting of stockholders, which was filed with the SEC on March 15, 2013, and its Current Reports on Form 8-K or 8-K/A, which were filed with the SEC on January 28, 2013 (Item 1.01), March 4, 2013, May 2, 2013 (Item 5.07), May 10, 2013, June 20, 2013 and August 9, 2013, respectively. Information about the directors and executive officers of Umpqua is set forth in its Annual Report on Form 10-K for the year ended December 31, 2012, which was filed with the SEC on February 15, 2013, its Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2013 and June 30, 2013, which were filed with the SEC on May 2, 2013 and August 6, 2013, respectively, its proxy statement for its 2013 annual meeting of stockholders, which was filed with the SEC on February 25, 2013, and its Current Reports on Form 8-K, which were filed with the SEC on January 14, 2013, April 11, 2013 and April 22, 2013 (Item 5.07), respectively. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Cautionary Statement Regarding Forward-Looking Statements 3 This communication contains certain "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "anticipate," "may," "can," "believe," "expect," "project," "intend," "likely," "plan," "seek," "should," "would," "estimate" and similar expressions and any other statements that predict or indicate future events or trends or that are not statements of historical facts. These forward-looking statements include, but are not limited to, statements about Sterling’s plans, objectives, expectations, strategies and intentions and other statements contained in this release that are not historical facts and pertain to Sterling's future operating results and capital position, including Sterling's ability to reduce future loan losses, improve its deposit mix, execute its asset resolution initiatives, execute its lending initiatives, contain costs and potential liabilities, realize operating efficiencies, execute its business strategy, make dividend payments, compete in the marketplace and provide increased customer support and service. All forward-looking statements are subject to numerous risks and uncertainties. Actual results may differ materially from the results discussed in these forward-looking statements because such statements are inherently subject to significant assumptions, risks and uncertainties, many of which are difficult to predict and are generally beyond Sterling's and Umpqua's control. These risks and uncertainties include, but are not limited to, the following: changes in general economic conditions that may, among other things, increase default and delinquency risks in Sterling’s loan portfolios; shifts in market interest rates that may result in lower interest rate margins; shifts in the demand for Sterling's loan and other products; changes in the monetary and fiscal policies of the federal government; changes in laws, regulations or the competitive environment; exposure to material litigation; failure to obtain the approval of shareholders of Sterling or Umpqua in connection with the merger; the timing to consummate the proposed merger; the risk that a condition to closing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger, or lower-than-expected revenue or cost savings or other issues in connection with mergers and acquisitions generally; the parties’ ability to promptly and effectively integrate the businesses of Sterling and Umpqua; and the diversion of management time on issues related to the merger; the failure to consummate or delay in consummating the merger for other reasons. Sterling and Umpqua undertake no obligation (and expressly disclaim any such obligation) to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. For additional information concerning factors that could cause actual conditions, events or results to materially differ from those described in the forward-looking statements, please refer to the factors set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Sterling's and Umpqua's most recent Form 10-K and 10-Q reports and to Sterling's and Umpqua's most recent Form 8-K reports, which are available online at www.sec.gov. No assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of Sterling or Umpqua.

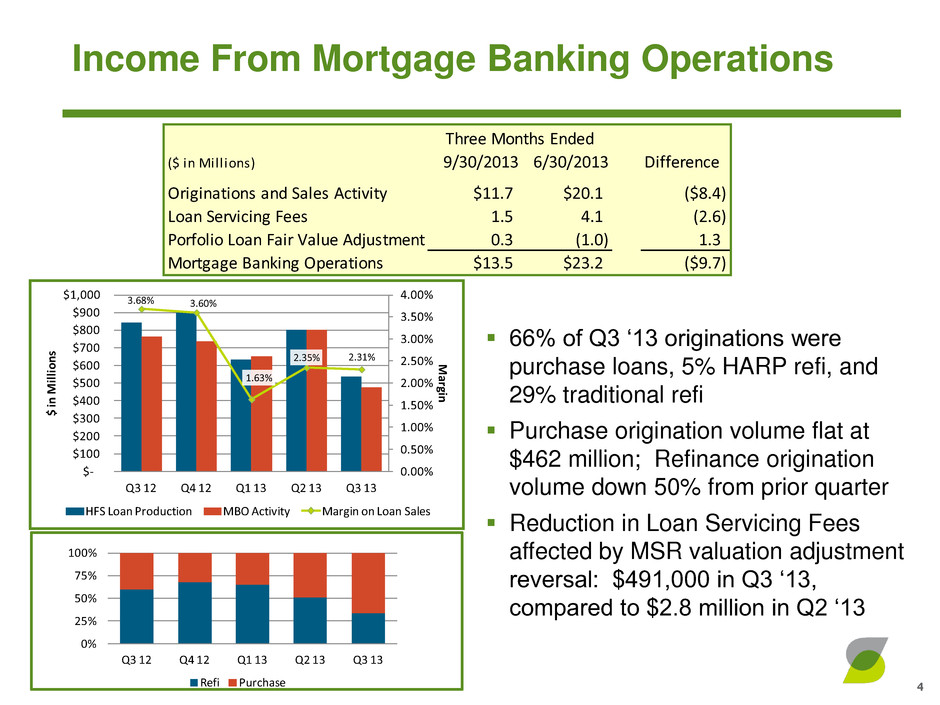

0% 25% 50% 75% 100% Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Refi Purchase Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Refi Purchase 3.68% 3.60% 1.63% 2.35% 2.31% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% $- $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 M argin $ i n M illi on s HFS Loan Production MBO Activity Margin on Loan Sales ($ in Millions) 9/30/2013 6/30/2013 Difference Originations and Sales Activity $11.7 $20.1 ($8.4) Loan Servicing Fees 1.5 4.1 (2.6) Porfolio Loan Fair Value Adjustment 0.3 (1.0) 1.3 Mortgage Banking Operations $13.5 $23.2 ($9.7) Three Months Ended Income From Mortgage Banking Operations 4 66% of Q3 ‘13 originations were purchase loans, 5% HARP refi, and 29% traditional refi Purchase origination volume flat at $462 million; Refinance origination volume down 50% from prior quarter Reduction in Loan Servicing Fees affected by MSR valuation adjustment reversal: $491,000 in Q3 ‘13, compared to $2.8 million in Q2 ‘13

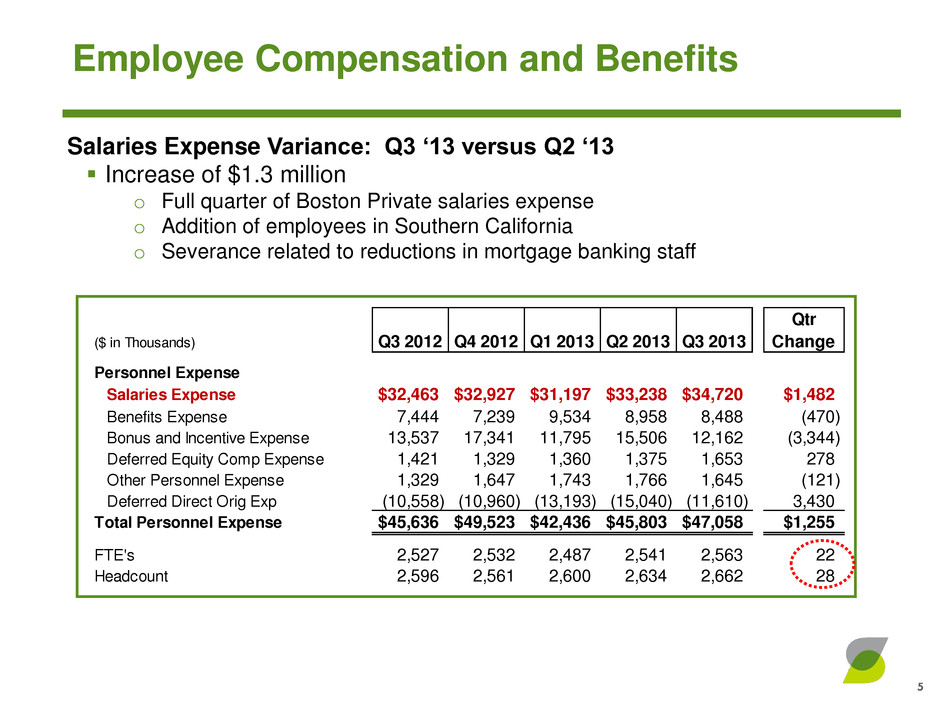

($ in Thousands) Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Qtr Change Personnel Expense Salaries Expense $32,463 $32,927 $31,197 $33,238 $34,720 $1,482 Benefits Expense 7,444 7,239 9,534 8,958 8,488 (470) Bonus and Incentive Expense 13,537 17,341 11,795 15,506 12,162 (3,344) Deferred Equity Comp Expense 1,421 1,329 1,360 1,375 1,653 278 Other Personnel Expense 1,329 1,647 1,743 1,766 1,645 (121) Deferred Direct Orig Exp (10,558) (10,960) (13,193) (15,040) (11,610) 3,430 Total Personnel Expense $45,636 $49,523 $42,436 $45,803 $47,058 $1,255 FTE's 2,527 2,532 2,487 2,541 2,563 22 Headcount 2,596 2,561 2,600 2,634 2,662 28 Salaries Expense Variance: Q3 ‘13 versus Q2 ‘13 Increase of $1.3 million o Full quarter of Boston Private salaries expense o Addition of employees in Southern California o Severance related to reductions in mortgage banking staff 5 Employee Compensation and Benefits

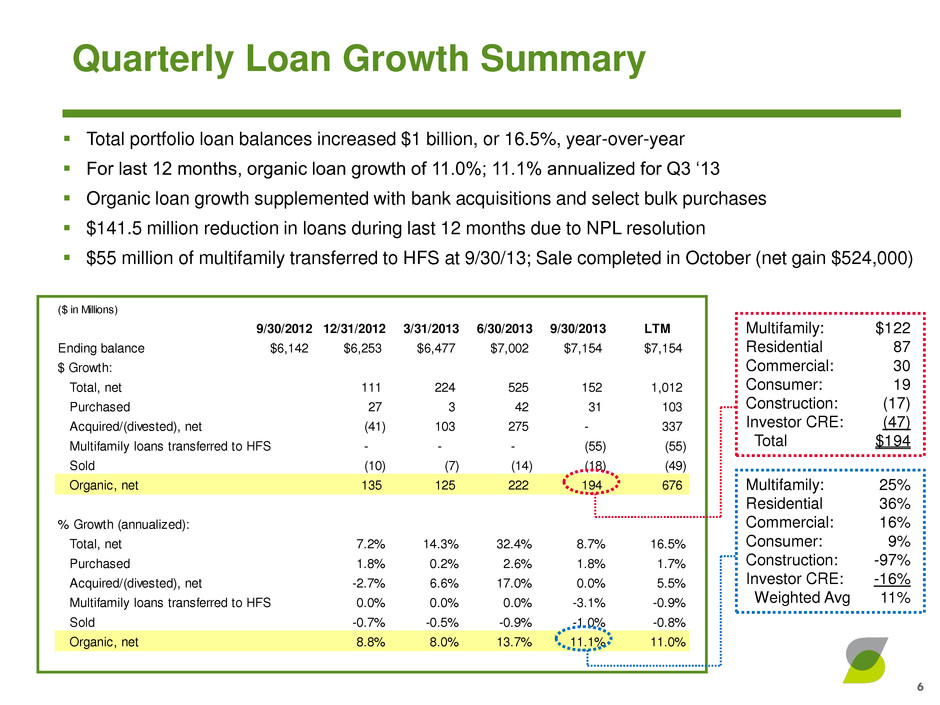

($ in Millions) 9/30/2012 12/31/2012 3/31/2013 6/30/2013 9/30/2013 LTM Ending balance $6,142 $6,253 $6,477 $7,002 $7,154 $7,154 $ Growth: Total, net 111 224 525 152 1,012 Purchased 27 3 42 31 103 Acquired/(divested), net (41) 103 275 - 337 Multifamily loans transferred to HFS - - - (55) (55) Sold (10) (7) (14) (18) (49) Organic, net 135 125 222 194 676 % Growth (annualized): Total, net 7.2% 14.3% 32.4% 8.7% 16.5% Purchased 1.8% 0.2% 2.6% 1.8% 1.7% Acquired/(divested), net -2.7% 6.6% 17.0% 0.0% 5.5% Multifamily loans transferred to HFS 0.0% 0.0% 0.0% -3.1% -0.9% Sold -0.7% -0.5% -0.9% -1.0% -0.8% Organic, net 8.8% 8.0% 13.7% 11.1% 11.0% Quarterly Loan Growth Summary Total portfolio loan balances increased $1 billion, or 16.5%, year-over-year For last 12 months, organic loan growth of 11.0%; 11.1% annualized for Q3 ‘13 Organic loan growth supplemented with bank acquisitions and select bulk purchases $141.5 million reduction in loans during last 12 months due to NPL resolution $55 million of multifamily transferred to HFS at 9/30/13; Sale completed in October (net gain $524,000) 6 Multifamily: $122 Residential 87 Commercial: 30 Consumer: 19 Construction: (17) Investor CRE: (47) Total $194 Multifamily: 25% Residential 36% Commercial: 16% Consumer: 9% Construction: -97% Investor CRE: -16% Weighted Avg 11%