Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MOLEX INC | d524090dex991.htm |

| 8-K - 8-K - MOLEX INC | d524090d8k.htm |

April 23,

2013 Exhibit 99.2

FY13 Q3 Conference Call

|

Page

1 Page 1

Statements in this release that are not historical are forward-looking and are subject to various

risks and uncertainties that could cause actual results to vary materially from those

stated. Words such as “expect,” “anticipate,” “outlook,”

“forecast,” “could,” “project,” “intend,” “plan,” “continue,” “believe,” “seek,”

“estimate,” “should,” “may,” “assume,” “potential,”

variations of such words and similar expressions are intended to identify such

forward-looking statements. Forward-looking statements are based on currently

available information and include, among others, the discussion under “Outlook.” These

statements are not guarantees of future performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. Respective risks, uncertainties, and assumptions

that could affect the outcome or results of operations are described in Part 1, Item 1A of our

Annual Report on Form 10-K for the year ended June 30, 2012, and the Form 10-Q for the

quarters ended September 30, 2012 and December 31, 2012 which is incorporated by reference and

in other reports that Molex files or furnishes with the Securities and Exchange

Commission.

We have based our forward-looking statements on our management’s beliefs and assumptions

based on information available to management at the time the statements are made. We caution

you that actual outcomes and results may differ materially from what is expressed, implied, or

forecasted by our forward-looking statements. Reference is made in particular to

forward-looking statements regarding growth strategies, industry trends, global economic

conditions, success of customers, cost of raw materials, value of inventory, foreign currency

exchange rates, labor costs, protection of intellectual property, cost reduction initiatives,

acquisition synergies, manufacturing strategies, product development introduction and sales,

regulatory changes, competitive strengths, income tax fluctuations, natural disasters,

unauthorized access to data, government investigations and outcomes of legal proceedings.

Except as required under the federal securities laws, we do not have any intention or obligation to

update publicly any forward-looking statements after the distribution of this report,

whether as a result of new information, future events, changes in assumptions, or

otherwise.

Forward-Looking Statement |

Page

2 Page 2

In Molex Incorporated’s (“Molex” or the “Company”) conference call on

April 23, 2013 regarding the Company’s financial results for the third fiscal

quarter ended March 31, 2013 and the following slides, Molex may refer to non-GAAP

financial measures to describe earnings for such periods excluding the items

referenced in the relevant slides used during this conference call. This is in

addition to disclosing the most directly comparable measure for such periods

determined in accordance with generally accepted accounting principles, or

GAAP. Molex believes that these non-GAAP financial measures provide useful

information to investors because they provide information about the estimated

financial performance of Molex’s ongoing business and provide for greater

transparency of supplemental information used by management in its financial

and operational decision-making. These non-GAAP financial measures may be

different from non-GAAP financial measures used by other companies. Non-

GAAP financial measures should not be considered as a substitute for, or

superior to, measures of financial performance prepared in accordance with

GAAP.

Investors are encouraged to review the relevant slides reconciling the non-

GAAP financial measures intended to be used in the conference call to the most

comparable GAAP

measure.

Non-GAAP Financial Measures |

FY13 Q3

Summary Page 3

Page 3

Settled litigation with Mizuho Bank

Weaker than expected revenue from

mobile phones / tablets

Strong execution despite poor

operating environment

Solid balance sheet, liquidity and

cash flow potential supports

dividend increase |

Page

4 Page 4

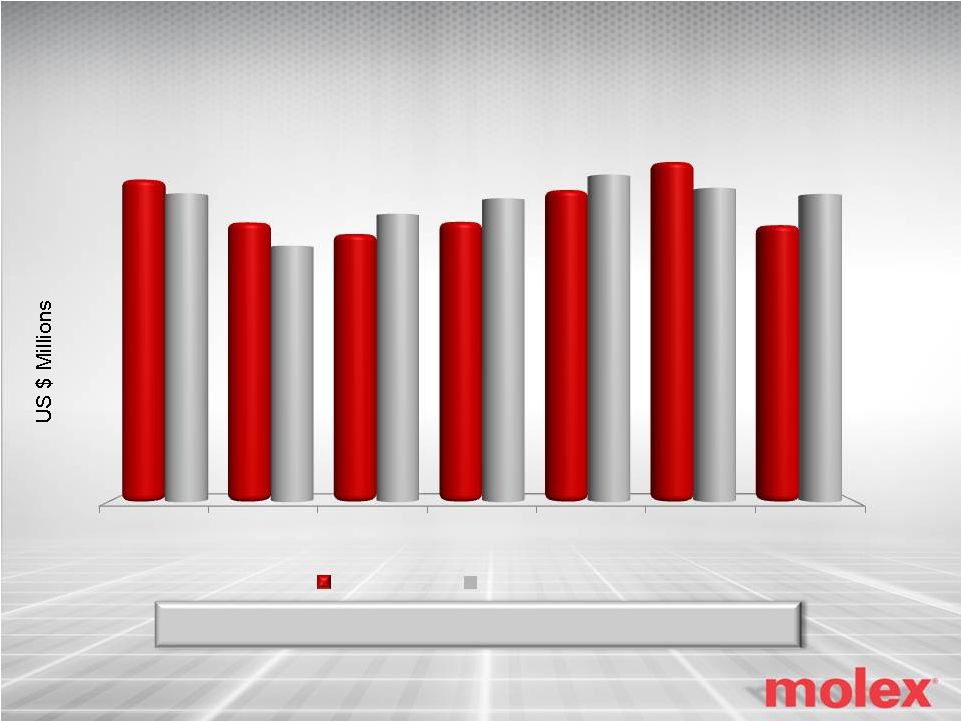

Revenue / Order Trend

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

Q2 13

Q3 13

$910

$815

$873

$901

$944

$920

$909

Revenue

Orders

$936

$858

$837

$859

$917

$968

$853

Q3 Book-to-Bill 1.07 to 1 |

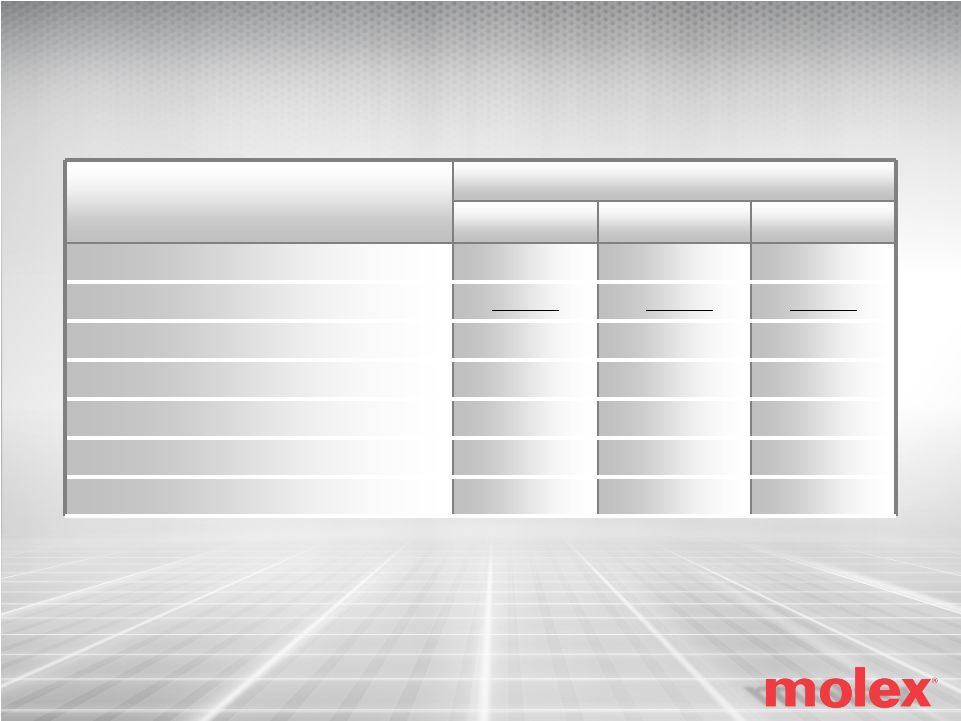

REVENUE

ORDERS

Sequential

Change

YOY

Change

%

Total

Sequential

Change

YOY

Change

%

Total

Automotive

10%

13%

20%

13%

14%

19%

Infotech

(6)%

(10)%

17%

2%

(7)%

17%

Telecom

(7)%

(9)%

13%

3%

(17)%

12%

Mobile Devices

(37)%

35%

19%

(19)%

56%

21%

Consumer

Elect.

(17)%

(19)%

13%

(6)%

(18)%

13%

Industrial

6%

(5)%

13%

18%

1%

14%

Medical /

Military

2%

35%

5%

(8)%

20%

4%

TOTAL

(12)%

2%

100%

(1)%

4%

100%

Page 5

Page 5

Change in Revenue / Orders

By Industry –

March Quarter |

Quarter

Ended Mar 2013

Dec 2012

Mar 2012

Net revenue

$852.9

$967.7

$837.1

Gross margin

29.1%

29.9%

30.5%

SG&A

$167.4

$181.0

$163.9

Unauthorized activities in Japan

$21.2

$1.6

$2.5

Income from operations

$59.9

$106.5

$88.8

Interest (expense) net

$(1.6)

$(1.1)

$(1.2)

Other (expense) income

$0.3

$(3.2)

$1.6

Effective tax rate

23.6%

31.1%

27.2%

Net income

$44.8

$70.4

$64.9

Earnings per diluted share

$0.25

$0.39

$0.36

(US$ in millions, except per-share data)

Page 6

Page 6

Financial Summary |

Quarter

Ended Mar 2013

Dec 2012

Mar 2012

Cash and marketable securities

$712.9

$716.8

$622.5

Total debt*

$399.8

$341.9

$252.2

Net cash

$313.1

$374.9

$370.3

Receivable days outstanding

70 Days

67 days

72 Days

Inventory days outstanding

89 Days

83 days

93 Days

Return on net assets**

18.6%

19.1%

20.1%

Research and development

$46.2

$47.9

$45.7

(US$ in millions)

*Total debt equals long-term debt plus current portion of long-term

debt and short-term loans, less current portion of capital leases

Page 7

Page 7

**See GAAP to non-GAAP reconciliation

Balance Sheet and Operating Metrics |

Page

8 Page 8

Q2 12

Q3 12

Q4 12

Q1 13

Q2 13

Q3 13

$141.0

$138.9

$143.3

$167.4

$87.2

$(20.1)

$(52.3)

$(54.4)

$(77.7)

$(69.4)

$(78.6)

$(55.9)

-

-

-

-

-

$182.8

Free Cash Flow (non-GAAP measure)

$88.7

$84.5

$65.6

$98.0

$8.6

$106.8

US $ in millions

*See unauthorized activities in Japan section

of our press release dated April 23, 2013

Free Cash Flow Trend

0

20

40

60

80

100

120

Q2 12

Q3 12

Q4 12

Q1 13

Q2 13

Q3 13

Free Cash Flow

Net Income

Cash Flow From Operations

Less: Capital Expenditures

Add: Japan Litigation Settlement* |

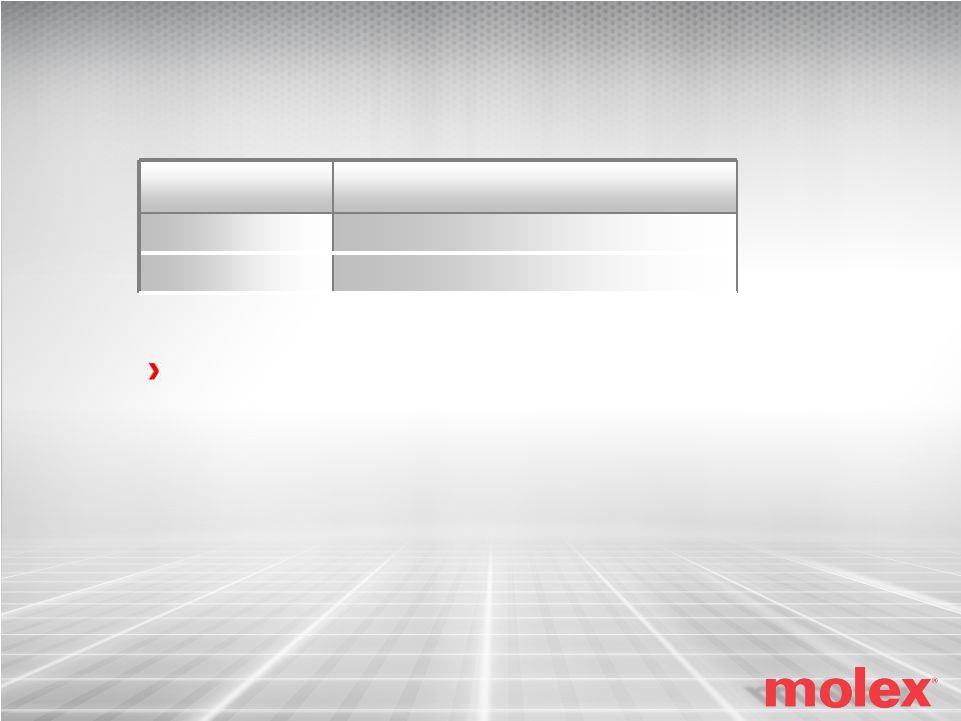

June Fiscal

Quarter Revenue

$870 to $910 million

EPS

$0.33 to $0.37

Assumes

–

30% to 32% effective tax rate

–

Constant foreign exchange rates and

commodity prices

Page 9

Page 9

Outlook

Outlook |

|

Quarter

Ended Mar

2013

Dec

2012

Sep

2012

Jun

2012

Mar

2012

Income from

operations

$59,938

$106,515

$102,735

$92,948

$88,802

Unauthorized

activities in Japan

21,210

1,627

2,561

3,093

2,521

Non-GAAP income

from operations

$81,148

$108,142

$105,296

$96,041

$91,323

(US$ in thousands)

Non-GAAP income from operations is a non-GAAP financial measure. We refer to

non-GAAP income from operations to describe income from operations excluding the

items referenced above. We believe that non- GAAP income from operations

provides useful information to investors because it provides information about the

estimated financial performance of Molex’s ongoing business. Non-GAAP income from operations is used

by management in its financial and operational decision-making and evaluation of overall

operating performance and segment level core operating performance. Non-GAAP

income from operations may be different from similar measures used by other

companies. Operating

income

excluding

restructuring

and

special

charges

Fixed

assets

+

Inventory

+

A/R

–

A/P

RONA =

Non-GAAP Measure |

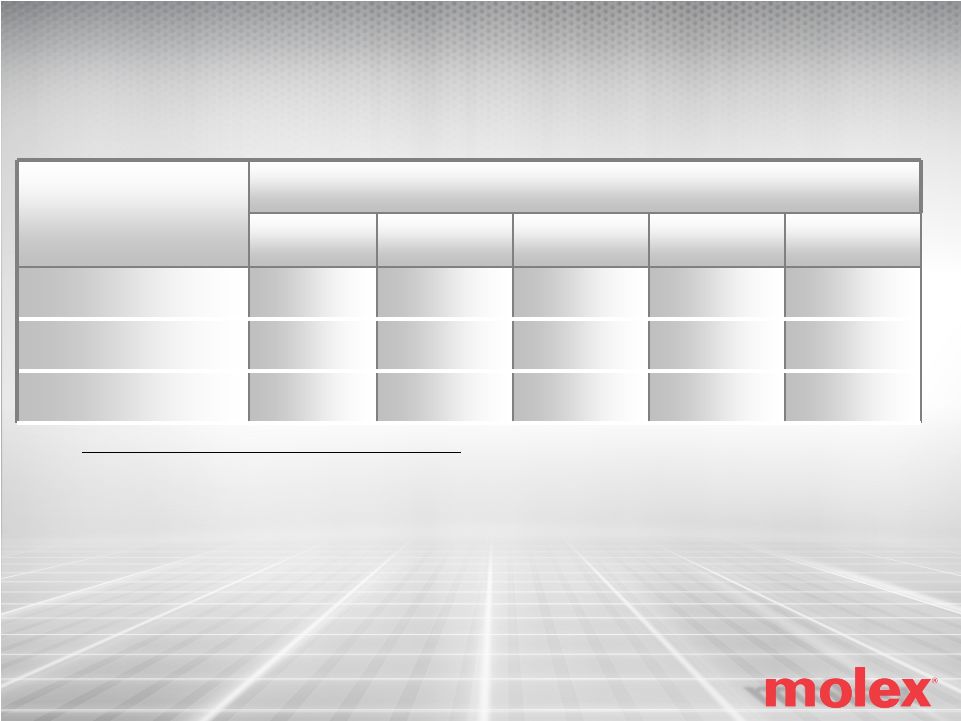

(US$ in

millions) Revenue

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Automotive

$143.2

$143.9

$135.3

$151.0

$150.0

$150.9

$155.5

$171.3

Infotech

168.4

163.1

159.9

156.5

162.0

154.9

150.8

141.5

Telecom

138.9

129.5

134.2

119.6

127.7

132.0

116.7

108.4

Mobile Devices

144.8

168.9

138.1

122.2

117.4

182.5

262.4

165.3

Consumer Elect.

155.3

177.8

154.6

140.6

149.6

149.9

137.2

114.1

Industrial

134.6

126.1

109.5

117.0

121.0

116.1

105.0

111.6

Medical/Military

28.5

26.7

26.0

30.2

30.8

30.6

40.1

40.7

Total

$913.7

$936.0

$857.6

$837.1

$858.5

$916.9

$967.7

$852.9

Orders

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Automotive

$134.9

$148.5

$133.1

$153.9

$149.1

$151.6

$155.8

$176.1

Infotech

172.2

155.7

151.9

163.5

158.4

149.9

149.3

151.7

Telecom

137.2

121.0

120.6

134.3

122.3

129.1

108.6

111.4

Mobile Devices

145.0

169.3

127.3

120.5

170.9

221.6

231.0

187.4

Consumer Elect.

155.4

175.5

146.8

146.1

149.9

150.6

127.4

119.9

Industrial

133.7

114.4

109.5

121.1

119.7

109.9

104.4

122.8

Medical/Military

27.6

25.6

26.1

33.2

30.7

31.2

43.2

39.9

Total

$906.0

$910.0

$815.3

$872.6

$901.0

$943.9

$919.7

$909.2

End Market Trend |