Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Cole Real Estate Investments, Inc. | d517482dex991.htm |

| 8-K - 8-K - Cole Real Estate Investments, Inc. | d517482d8k.htm |

A Highly

Attractive Real Estate Company and A Leading Real Estate Investment Manager

Exhibit 99.2 |

2

Disclaimer

This presentation may be deemed to be solicitation material in respect of the charter

amendments to be presented to Cole Credit Property

Trust

III,

Inc.’s

(“CCPT

III”)

stockholders

for

consideration

at

the

2013

annual

stockholders’

meeting

of

CCPT

III.

CCPT

III

has

filed a preliminary proxy statement and expects to file a definitive proxy statement with the

Securities and Exchange Commission (“SEC”)

in

connection

with

the

2013

annual

stockholders’

meeting.

STOCKHOLDERS

ARE

URGED

TO

READ

THE

DEFINITIVE

PROXY

STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE,

BECAUSE THEY WILL CONTAIN

IMPORTANT

INFORMATION.

You

may

obtain

a

free

copy

of

the

definitive

proxy

statement

and

other

relevant

documents

filed with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by

CCPT III with the SEC will be available free of

charge

by

directing

a

written

request

to

Cole

Credit

Property

Trust

III,

Inc.,

2325

East

Camelback

Road,

Suite

1100,

Phoenix,

Arizona 85016, Attention: Investor Relations.

CCPT III and its directors and executive officers and other members of management may be

deemed to be participants in the solicitation

of

proxies

in

respect

of

the

charter

amendments

to

be

considered

at

the

2013

annual

stockholders’

meeting

of

CCPT

III.

Information regarding the interests of CCPT III’s directors and executive officers in the

proxy solicitation will be included in CCPT III’s definitive proxy

statement. This

presentation

contains

a

description

of

certain

terms

of

the

merger

agreement

pursuant

to

which

CCPT

III

will

acquire

Cole

Holdings Corporation (“Cole Holdings”). A copy of the merger agreement has been

filed as an exhibit to a Form 8-K CCPT III filed with the SEC on March 8, 2013. The

description of the merger agreement contained in this presentation does not purport to be complete

and is qualified in its entirety by reference to the full text of the merger agreement.

|

3

Forward-Looking Statements

In addition to historical information, this presentation contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking

statements, which are based on current expectations, estimates and projections about the

industry and markets in which CCPT III operates, include beliefs of and assumptions

made by CCPT III’s management, and involve risks and uncertainties that could

significantly

affect

the

financial

results

of

CCPT

III.

Words

such

as

“may,”

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“projects,”

“seeks,”

“estimates,”

“would,”

“could”

and “should”

and variations of such words and similar expressions are intended to

identify such forward-looking statements, which generally are not historical in nature.

Such forward-looking statements include, but are not limited to, statements about

the benefits of the business combination transaction involving CCPT III and Cole Holdings,

future financial and operating results, and the combined company’s plans, objectives,

expectations and intentions. All statements that

address

operating

performance,

events

or

developments

that

we

expect

or

anticipate

will

occur

in

the

future

—

including

statements

relating

to

earnings

accretion,

cost

savings,

an

anticipated

NYSE

listing

and

increased

liquidity

—

are

forward-looking

statements. These statements are not guarantees of future performance and involve certain

risks, uncertainties and assumptions that are difficult to predict. Although we believe

the expectations reflected in any forward-looking statements are based on

reasonable assumptions, we can give no assurance that our expectations will be attained and

therefore, actual outcomes and results may differ materially from what is expressed or

forecasted in such forward-looking statements. Some of the factors that may affect

outcomes and results include, but are not limited to: (i) national, international, regional

and local economic climates, (ii) changes in financial markets, interest rates, credit

spreads, and foreign currency exchange rates, (iii) changes in the real estate markets, (iv)

continued ability to source new investments, (v) increased or unanticipated competition for

our properties, (vi) risks associated with acquisitions, (vii) maintenance of real

estate investment trust status, (viii) availability of financing and capital, (ix) changes in demand

for

developed

properties,

(x)

risks

associated

with

the

ability

to

consummate

the

CCPT

III

–

Cole

Holdings

transaction

and

the

timing

of the closing of the transaction, and (xi) those additional risks and factors discussed in

reports filed with the SEC by CCPT III from time to time. CCPT III does not make any

undertaking with respect to updating any forward-looking statements appearing in this

presentation. |

Key

Highlights The Special Committee of CCPT III has reviewed and considered the

unsolicited proposals from American Realty Capital Properties, Inc.

(“ARCP”) on March 27 and April 2 •

The Special Committee and its advisors have also had numerous follow-up

conversations with ARCP and its advisors to provide clarification on the

proposals •

Consistent with its fiduciary duties, the Special Committee has carefully reviewed

and considered the proposals The CCPT III Special Committee has concluded that

ARCP’s proposals are not in the best interests of CCPT III and its

stockholders for the following reasons: 1

2

3

4

5

6

7

8

9

ARCP’s Proposals Would Place the Company in the Hands of an External Manager

with a Mixed Track Record ARCP’s Proposals Would Create an Unattractive

Business Model ARCP Dividend Requires an Aggressive Acquisition and

Financing Strategy ARCP’s Aggressive Business Plan Generates Lower

Quality and Less Sustainable Earnings and Cash Flows ARCP Needs CCPT III to

Transform Itself, Not Vice Versa ARCP’s Proposals Represent Highly

Speculative Financial Engineering ARCP’s Unfunded Proposals Lack

Credibility ARCP’s Proposals Involve an Unsustainable and Excessive

Amount of Leverage ARCP’s Proposals Undervalue CCPT III on a Relative

and Absolute Basis 4 |

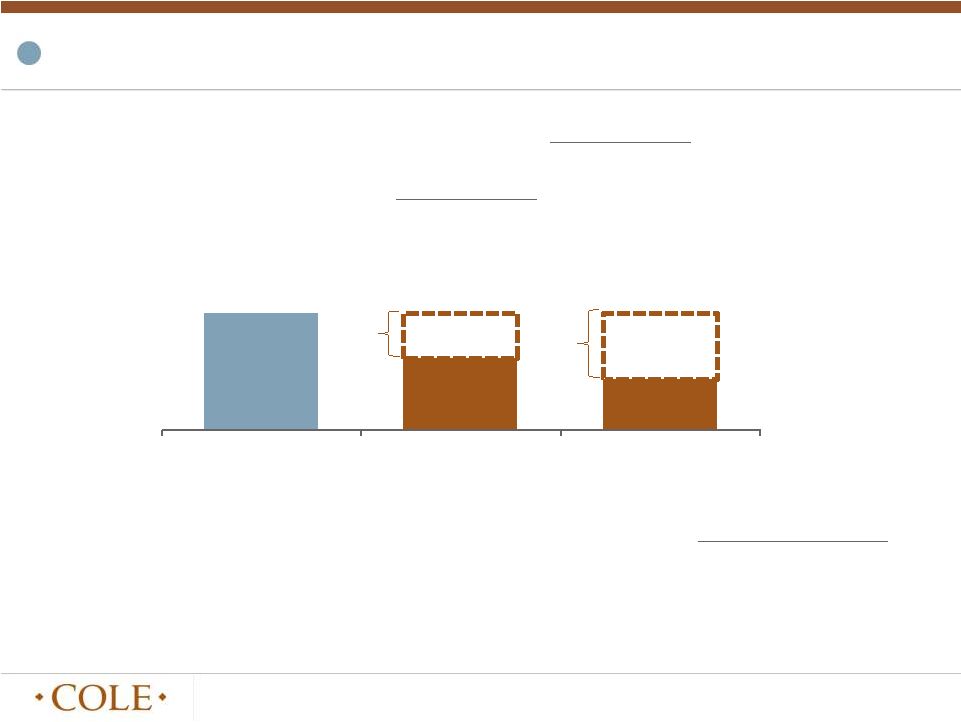

5

1

1. ARCP implied cap rate based on ARCP share price of $14.80 on April 4, 2013.

Assumes 2013E NOI of $172 million based on ARCP’s February 28, 2013 investor

presentation,

annualizing

NOI

for

all

acquisitions

under

contract

per

the

earnings

transcript

of

the

same

date.

ARCP

implied

cap

rate

applied

to

CCPT

III

2013E

real

estate

assets only, with non-real estate assets included at book value. Excludes the

impact of the Holdings acquisition. 2. Assumes a 100% stock election

scenario. 3. Cash value per share of ARCP’s proposal.

•

If one assumes CCPT III should be valued at ARCP’s current estimated implied

cap rate of 5.2%, then

the

notional

value

of

ARCP’s

proposal

represents

a

14%

DISCOUNT

to

the

implied

per

share

trading value of CCPT III

•

The

cash

offer

of

$12.50

represents

a

21%

DISCOUNT

to

CCPT

III’s

implied

per

share

trading

value

NOTIONAL VALUE OF ARCP'S

PROPOSAL IMPLIES A 14% DISCOUNT

TO CCPT III VALUE

VALUE OF ARCP'S CASH PROPOSAL

IMPLIES A 21% DISCOUNT

TO CCPT III VALUE

•

Current

ARCP

share

price

implies

CCPT

III

Stockholders

should

receive

an

exchange

ratio

>1.0x

compared to ARCP’s proposal of 0.8x

$15.78

(1)

$13.59

(2)

$12.50

(3)

CCPT III Trading Value at

ARCP’s Implied 5.2% Cap Rate

to Value Assets

ARCP's April 2, 2013

Notional Proposal Price

ARCP's April 2, 2013

Cash Proposal Price

ARCP’s Proposals Undervalue CCPT III on a Relative and Absolute

Basis |

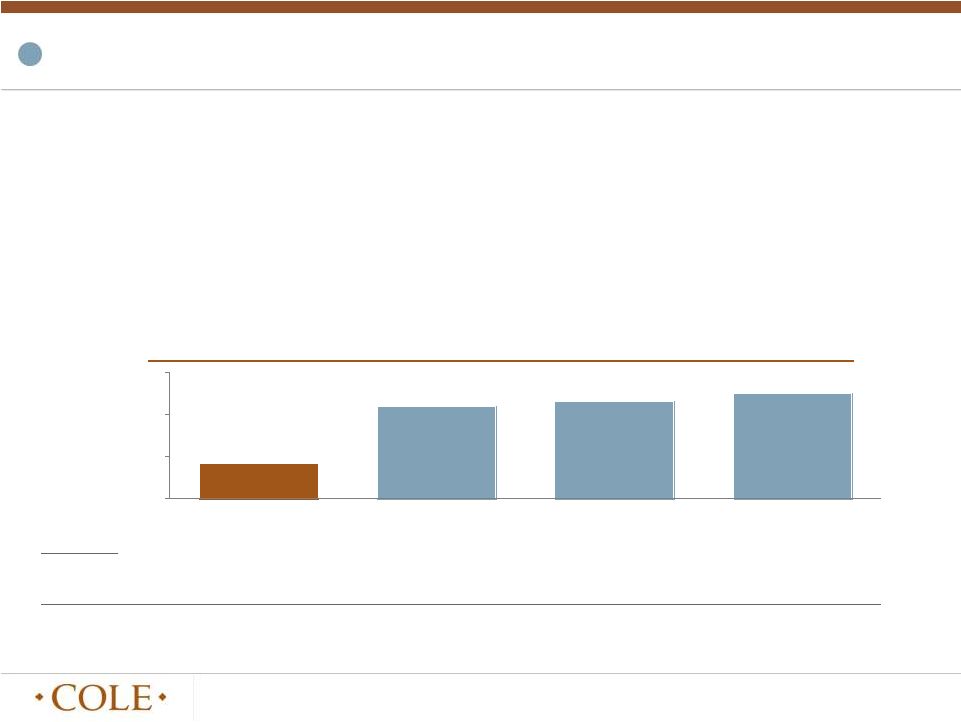

6

•

On

April

2,

2013,

ARCP

indicated

that

it

would

provide

up

to

60%

cash

consideration

at

$12.50

per

share

•

This

would

add

approximately

$3.8

billion

of

debt

to

the

balance

sheet

before

any

incremental

leverage

resulting

from

a

cash

“true-up”

mechanism

•

A

very

significant

amount

of

additional

cash

could

be

required

for

any

cash

“true-up”

to

achieve

ARCP’s

proposed “guarantee”

•

The result for equity owners would be a highly levered company with an unstable

capital structure •

Shares

would

be

burdened

with

a

large

overhang

and

would

require

substantially

dilutive

equity

offerings or asset sales to right size the balance sheet

1.

Net lease peers include O, NNN, EPR and LXP.

($ in millions)

Leverage Required for 60% Cash Component

$ 3,757

$ 3,757

$ 3,757

Additional Leverage Required for Cash True-Up

-

319

800

Total Additional Leverage

$ 3,757

$ 4,076

$ 4,557

Net Debt / 2013E EBITDA

2

5.4 x

10.8 x

11.3 x

12.0 x

2.0 x

6.0 x

10.0 x

14.0 x

Net Lease Peers (1)

ARCP Pro Forma 60% Cash

Election at $18.00 True-Up

ARCP Pro Forma 60% Cash

Election at $15.00 True-Up

ARCP Pro Forma 60% Cash

Election at $12.00 True-Up

ARCP’s Proposals Involve an Unsustainable and Excessive Amount of

Leverage |

7

ARCP’s Unfunded Proposals Lack Credibility

Where is the Money Coming From?

•

On

April

2,

2013,

ARCP

indicated

that

it

would

provide

up

to

60%

cash

consideration

at

$12.50 per share

•

This represents a cash requirement of approximately $3.8 billion

•

Potentially

more

cash

needed

to

fund

the

“guarantee”

via

“true-up”

mechanism

•

While ARCP’s financial advisors believe it can raise capital to fund the

transaction, ARCP does not have the necessary capital or evidence of

its ability to raise capital today •

ARCP would need to raise substantial additional debt and equity to fund the

transaction •

The pro-forma company’s equity would suffer significant dilution from

equity raises and/or asset sales to normalize pro forma leverage

How Can ARCP Bid to Acquire a Company with Funding it Does Not Have?

3 |

8

ARCP’s Proposals Represent Highly Speculative Financial Engineering

•

ARCP’s

proposals

contain

a

“guarantee”

that

involves

highly

complicated

financial

engineering

that

lacks

certainty

for

both

CCPT

III and ARCP stockholders

•

ARCP’s

proposals

referenced

a

“guarantee”

of

$13.59

of

notional

value

for

stockholders

electing

stock

but

did

not

provide

clarity

on the method of guarantee

•

ARCP’s

financial

advisors

verbally

indicated

that

such

“true-up”

could

come

via

additional

shares

to

CCPT

III

stockholders

and

/

or

additional

cash

in

the

scenario

that

ARCP

trades

below

$16.99

(vs.

$14.80

today¹)

•

ARCP’s

proposed

exchange

ratio

of

0.8x

applied

to

their

current

stock

price

of

$14.80

per

share

would

equate

to

an

$11.84

per

share

value

for

CCPT

III

shares,

resulting

in

a

$1.75

per

share

“true-up”

to

their

so-called

guaranteed

price

of

$13.59

•

Floating exchange ratio under a stock true-up scenario would substantially

dilute ARCP’s stockholders from an ownership and earnings

perspective •

ARCP stockholders will only achieve the proposed 0.8x exchange ratio if ARCP

trades up to $16.99, a 15% increase from current market value

•

ARCP’s proposals involve significant risk to both CCPT III and ARCP

stockholders under each approach by jeopardizing the financial stability of

both companies: Cash “True-up”

Stock “True-up”

•

Too much leverage on balance sheet

•

Lack of clarity around source of funding for proposal creates potential for

substantial earnings and ownership dilution to equity holders post-

transaction

•

ARCP stockholders may suffer significant dilution resulting in uncertainty

around their stockholder vote

•

CCPT III stockholders could own potentially up to 80% of pro forma

company in the form of a lower quality currency

Issues

4

1.

Based on ARCP’s closing stock price on April 4, 2013.

|

9

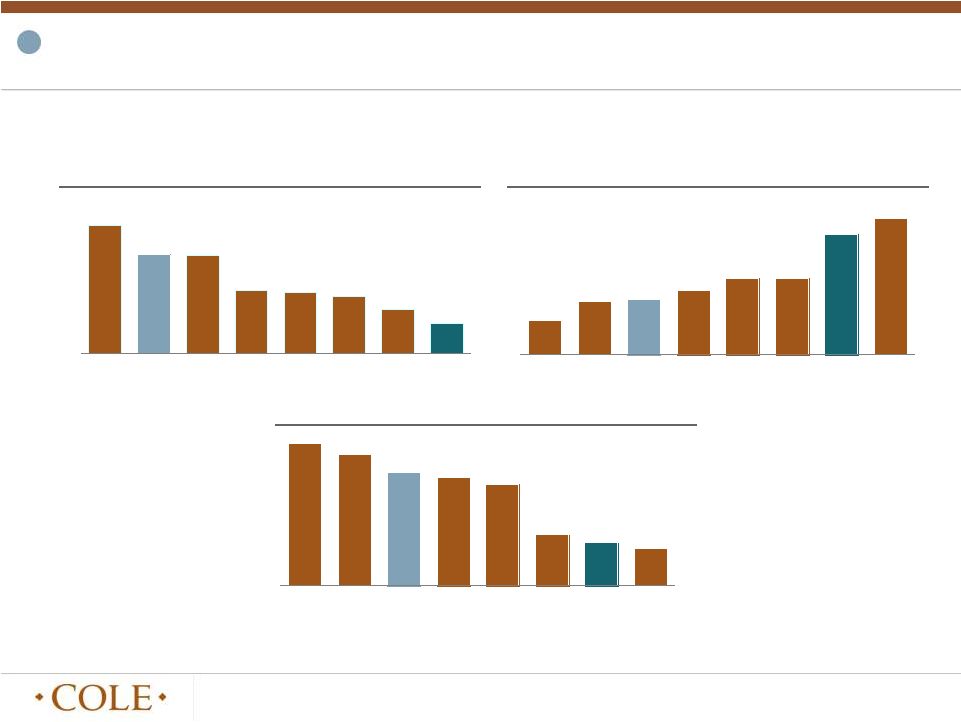

Square Footage (millions)

Gross Book Assets

1

($ in billions)

Diversification (% of Rent from Top 5 Tenants)

Source: Latest publicly available financials

1.

Gross book assets plus disclosed real estate depreciation.

2.

Spirit pro forma for CCPT II acquisition. SRC gross book assets represent the sum

of Spirit 3Q12 and CCPT II 3Q12 disclosed numbers. 3.

Based

on

straight-line

annualized

rental

revenue.

5

CCPT

III

is

already

a

premium

net

lease

REIT…

ARCP

is

trying

to

use

CCPT

III

to

transform

itself in the net lease space

$ 9.6

$ 7.4

$ 7.3

$ 4.7

$ 4.6

$ 4.3

$ 3.3

$ 2.2

O

CCPT III

SRC²

WPC

LXP

NNN

EPR

ARCP

13 %

20 %

21 %

24 %

29 %

29 %

46 %

52 %

LXP

O

CCPT III³

NNN

SRC

WPC

ARCP

EPR

54.3

>50

43.1

41.2

38.5

19.2

16.4

13.9

SRC

O

CCPT III

LXP

WPC

NNN

ARCP

EPR

ARCP Needs CCPT III to Transform Itself, Not Vice Versa |

10

ARCP’s Aggressive Business Plan Generates Lower Quality and Less

Sustainable Earnings and Cash Flows

6

•

ARCP uses a short duration, floating rate capital structure to drive earnings

accretion •

Strategy lacks predictability in long-term cash flows as business is

susceptible to interest rate and re-financing risk

•

ARCP’s external manager is motivated to grow assets under management

(“AUM”), not drive value

•

ARCP will increase AUM by more than one-third in 2013 under its current

business plan •

ARCP’s in place earnings are substantially below its year end guidance

Short-Term Floating Rate

Financing

Aggressive Acquisition

Strategy

Lower Quality Earnings

Short-Term Floating Rate

Financing

Aggressive Acquisition

Strategy

Lower Quality Earnings |

11

ARCP Dividend Requires an Aggressive Acquisition and Financing Strategy

•

ARCP is in a precarious position having guided dividend payout ratio to a level

that requires aggressive acquisitions

•

In-place earnings are significantly below year-end guidance

•

ARCP has guided to an AFFO that requires $1 billion of acquisitions (more than

one-third of its existing portfolio) after which it will still have an

excessive dividend payout ratio of 98% •

CCPT III’s pro forma dividend is well covered and positioned for sustainable

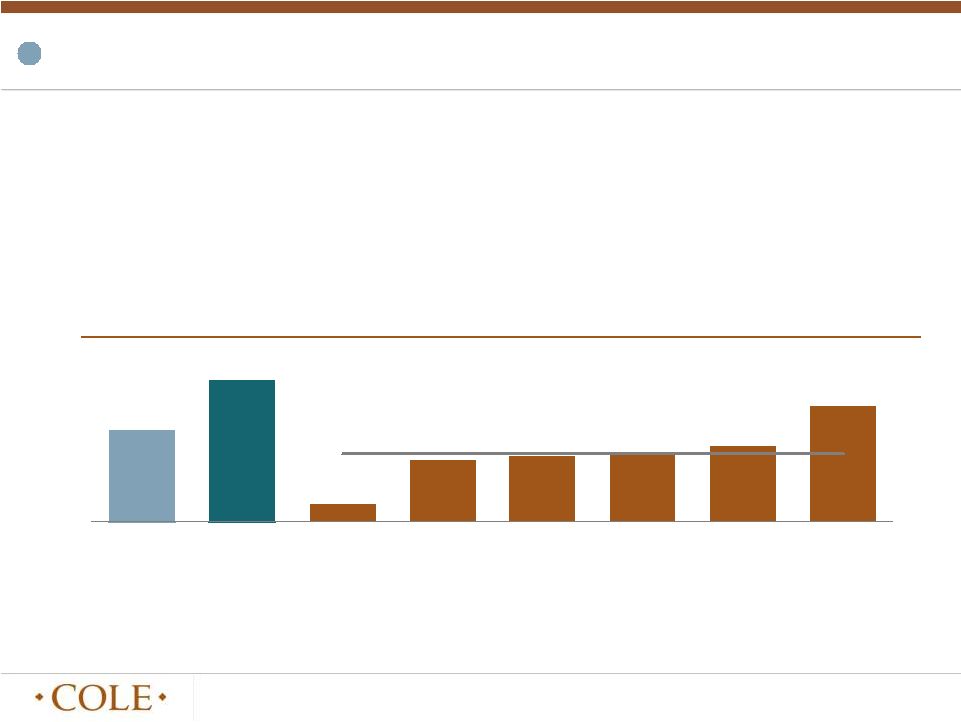

growth Net Lease Comparable Dividend Payout Ratio

7

Note: CCPT III and ARCP AFFO and Dividend estimates based on management guidance

from Investor Presentations dated 25-Mar-2013 and 28-Feb-2013, respectively.

Net Lease Comps estimates are sourced from IBES.

1. Pro forma for the Holdings transaction.

2. Estimates per 27-Mar-2013 Ladenburg Thalmann research.

2013E:

Dividend/Share

$ 0.70

$ 0.91

$ 0.61

$ 1.60

$ 3.30

$ 1.25

$ 3.16

$ 2.18

AFFO/Share

$ 0.80

$ 0.93

$ 0.83

$ 1.95

$ 3.98

$ 1.50

$ 3.73

$ 2.35

88.1 %

97.8 %

73.5 %

82.1 %

82.9 %

83.3 %

84.7 %

92.8 %

CCPT III¹

ARCP

LXP

NNN

WPC²

SRC

EPR

O

Peer Average: 83.2 % |

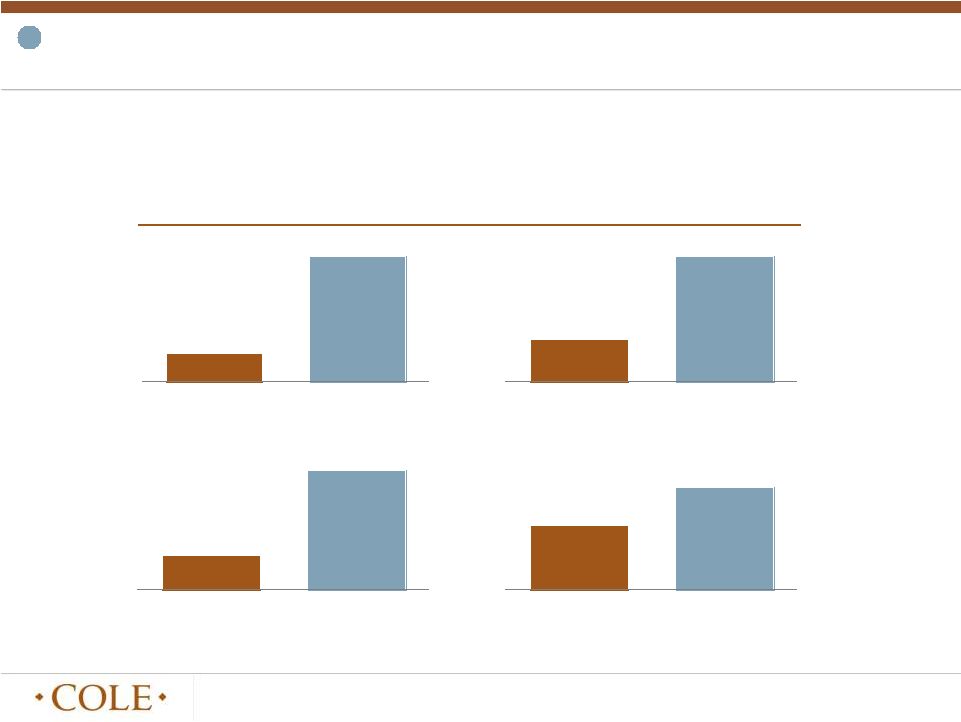

12

ARCP’s Proposals Would Create an Unattractive Business Model

External Management Structure for a Listed REIT

•

ARCP is currently externally managed by a private company. Many externally managed

publicly traded REITs have significantly underperformed their peers

•

External managers of publicly-traded companies are incented to grow assets under

management; not grow quality of earnings and net asset value

10-Year

Total

Return

(2003

–

2013)

Source: SNL, Bloomberg, as of 3-Apr-2013

8

Hospitality Properties

Trust

SNL US REIT

Hotel Index

128.9 %

137.2 %

CommonWealth

REIT

SNL US REIT

Office Index

55.5 %

132.4 %

Senior Housing

Properties Trust

SNL US REIT

Healthcare Index

348.0 %

544.5 %

Universal Health Realty

Income Trust

SNL US REIT

Healthcare Index

314.2 %

544.5 % |

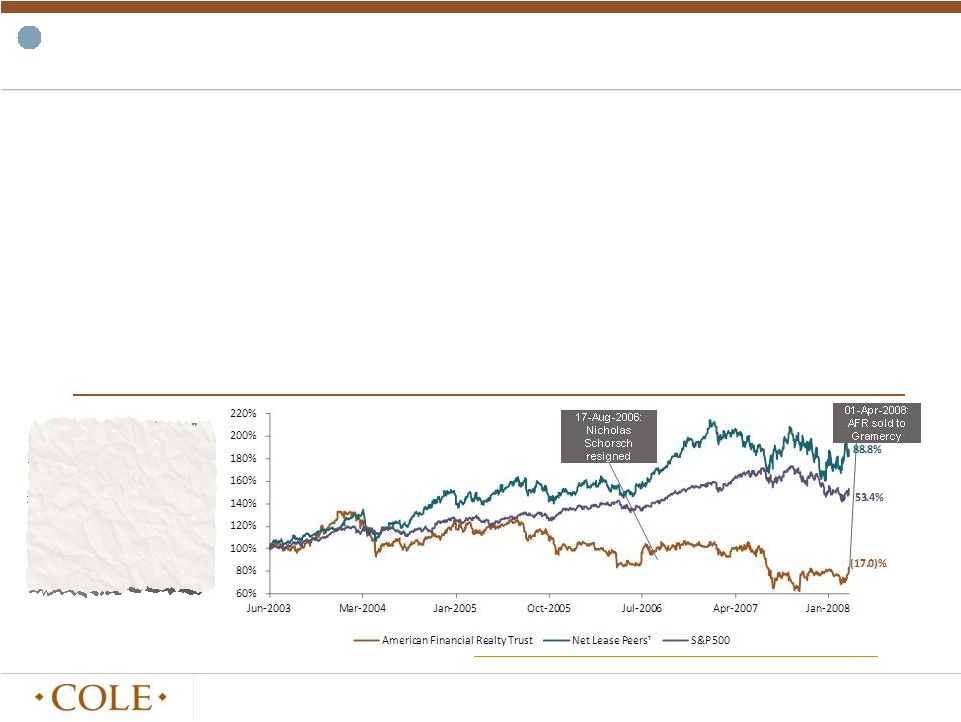

13

•

Nicholas Schorsch was the CEO, President and Chairman of American Financial Realty

Trust (“AFR”) since the REIT was formed in 2002 and till his

resignation in 2006 •

AFR materially underperformed net lease peers by 105.8% and the S&P 500 by

70.4% during the time it was public •

AFR’s underperformance was a result of its aggressive acquisitions, excessive

leverage and unsustainable dividend levels

•

In August 2006, the AFR Board accepted Nicholas Schorsch’s resignation as CEO

and replaced him with a new CEO who elaborated the necessity for a new

strategy, including: •

Aggressively pursue assets sales “for further debt reduction…to reach an

overall debt to total asset leverage of 60-65%”

•

Reduced quarterly dividend from $0.27 to $0.19 to “align its dividend payout

with its quarterly earnings from core operations”

•

Improve transparency in reporting to “conform its reporting of operating

results to more closely reflect industry standards”

AFR Indexed Total Return since IPO

ARCP’s Proposals Would Place the Company in the Hands of an External

Manager with a Mixed Track Record

Source:

Bloomberg,

Wall

Street

Research,

SEC

Filings,

company

press

release

available

at:

1

Net lease peer set includes O, NNN, LXP and EPR. Stock is equally weighted, WPC is

excluded as it was unlisted in 2003 and SRC is excluded due to interim transformational transactions.

9

“AFR's P/NAV discount

truly reflects poor

operating trends, higher

leverage, and growing

investor-agitation from

inconsistent performance

and communication..”

~(Wachovia, May 2, 2006) |

14

CCPT III’s Planned Acquisition of Cole Holdings is Expected to Yield

Substantial Financial Benefits to CCPT III Stockholders

•

Management expects approximately $29 million of 2013E pro forma EBITDA contribution

from Cole Holdings (excludes any

contribution

from

CCPT

II

and

CCPT

III)

(1)

•

In addition to acquiring a world class asset management business

with a 34-year track record:

•

CCPT III will achieve significant savings in overhead

•

Cole Holdings is forgoing 25% of its existing contractual promote

•

In most cases, the earn-out is payable on a 2-year trailing average

multiple of EBITDA only in excess of $25 million— Cole Holdings must

deliver results for future consideration •

Total

performance

must

meet

or

exceed

the

average

of

the

peer

group

for

full

payment

as

well

(2)

Note:

These metrics are among a number of factors considered by the Special Committee in

making its determination |

15

Near Term Liquidity Event and Pro Forma Company Business Plan

Represent a Compelling Opportunity for Stockholders

•

CCPT III Listing expected June 2013

•

CCPT III expects no

share lockups –

100% to be freely tradable on Day 1

•

Tender offer for shares to support liquidity upon listing is being considered by

CCPT III

•

CCPT III believes CCPT III stockholders will have significant value under the

current planned listing in a few months

•

CCPT III will be a well-positioned company that will drive sustainable,

long- term value |

Key

Highlights The Special Committee of CCPT III has reviewed and considered the

unsolicited proposals from American Realty Capital Properties, Inc.

(“ARCP”) on March 27 and April 2 •

The Special Committee and its advisors have also had numerous follow-up

conversations with ARCP and its advisors to provide clarification on the

proposals •

Consistent with its fiduciary duties, the Special Committee has carefully reviewed

and considered the proposals The CCPT III Special Committee has concluded that

ARCP’s proposals are not in the best interests of CCPT III and its

stockholders for the following reasons: 1

2

3

4

5

6

7

8

9

ARCP’s Proposals Would Place the Company in the Hands of an External Manager

with a Mixed Track Record ARCP’s Proposals Would Create an Unattractive

Business Model ARCP Dividend Requires an Aggressive Acquisition and

Financing Strategy ARCP’s Aggressive Business Plan Generates Lower

Quality and Less Sustainable Earnings and Cash Flows ARCP Needs CCPT III to

Transform Itself, Not Vice Versa ARCP’s Proposals Represent Highly

Speculative Financial Engineering ARCP’s Unfunded Proposals Lack

Credibility ARCP’s Proposals Involve an Unsustainable and Excessive

Amount of Leverage ARCP’s Proposals Undervalue CCPT III on a Relative

and Absolute Basis 16 |